Smart networks, e.g., smart grids (SGs) as complex interconnected systems have become more complex and require greater processing and communication capabilities due to the growing use of renewable energy (RE). In addition to being a reliable method for collecting and managing information, wireless networks (WNs) are capable of enhancing the performance of RE management. As a result of wireless data transfer risks and centralized power trades, SGs using WNs are unable to provide the security of the electricity market or ensure a high level of RE utilization. Blockchains (BCs), which are new technologies that enable data sharing, are gaining popularity, and it is thought to be able to address these issues. A BC-based, reliable power-exchange scheme is presented for SGs using WNs in this study. Using the BC for recording power data obtained from the WNs allows the smart contract for making appropriate trades according to the information. Energy trading and RE consumption are more efficient in a dual-chain architecture that consists of local energy trade BCs and RE trade BCs. A BC-based RE incentive framework is designed to have greater stability and scale among RE producers. Overall, the proposed technique not only can provide higher security and reliability to the system but also can mitigate fraud, as well as providing less operation cost for the system. Ultimately, the 56-bus test feeder layout is used to validate the framework.

Wireless networks (WNs) are developing rapidly over the recent decade in a variety of areas (Saura, 2021). The effective transmission and collection procedures of WNs make wireless smart grid (SG) applications possible, including automatic meter reading, prices in real-time, and remotely read the meter, thereby adding novel technical capabilities for the growing energy market (Al-Turjman & Abujubbeh, 2019).

WNs have the capability of efficiently monitoring renewable energy (RE) production and delivering power trade data to electricity market consumers. The stability of the SGs depends on WN security. In the electrical power markets, the use of WNs offers a unique process of collecting and transmitting data. The SG utilizing WN still faces a number of difficulties in order to achieve effective energy management. The conventional electricity market manages power trade data through centralized data processing processes, and WNs are capable of accepting data from each consumer node in order to determine the market-clearing cost for electricity markets (Esapour, Moazzen, Karimi, Dabbaghjamanesh, & Kavousi‐Fard, 2022) and (Kim & Upneja, 2021). There might be several security concerns with such a centralized approach, including single points of failure or efficiency bottlenecks (Jafari, Kavousi-Fard, Dabbaghjamanesh, & Karimi, 2022). Despite the fact that various distributed methods utilize sensor nodes for storing and processing information, eliminating the security concerns associated with centralization (Hilmersson & Hilmersson, 2021) and (Wang, Dabbaghjamanesh, Kavousi-Fard, & Mehraeen, 2019), there is a lack of trust among users and producers that makes it difficult to implement distributed power trade in practical. It is impossible to develop an electricity market dominated by RE producers (REPs) in such conditions. SG and WNs are likely to exacerbate the issues mentioned previously in power trade (Liu, Wang, Wang, Wang, & Li, 2020). With the purpose of ensuring security in power trade and increasing trust between users and producers, a mechanism is needed for ensuring that RE has been effectively used (Razmjouei, Kavousi-Fard, Dabbaghjamanesh, Jin, & Su, 2022).

Currently, blockchain (BC) technologies are promoting investigation in a wide variety of areas (Li, Wu, Cao, Chen, Zhang, & Buyya, 2021) and offer viable solutions for these issues (Abou Chacra, Sireli, & Cali, 2021). BCs are distributed database technologies providing characteristics like non-tampering, traceability, decentralization, and transparency (Dwivedi, Roy, Karda, Agrawal, & Amin, 2021). Since it is capable of improving trading security, power trading systems can be constructed with it (Razmjouei, Kavousi-Fard, Dabbaghjamanesh, Jin, & Su, 2020). An innovative BC-enabled P2P power trade mechanism was discussed in ref (Xie, Tang, Huang, Yu, Xie, Liu, & Liu, 2019) to increase further possibilities for power flow.

BackgroundUsing BC to create a distributed power trading system may be a viable method of balancing the generation and utilization of energy in a local grid according to ref (Gbadegesin, Sun, & Nwulu, 2020). Nevertheless, such layouts are not succeeding in reducing entry obstacles into the conventional electric market, which has prevented retailers from entering. Furthermore, there is no processing procedure for total power trade.

To address these problems, the BC-based energy commerce procedure for SGs using WN is offered in this paper. The suggested approach has been based on the active distribution system (ADN) with a high infiltration amount of RE resources (RERs), and it can meet the optimum power flow (OPF) restrictions. The local energy trading BC (LETB) is introduced for recording and publishing data on the native power market, and the zonular RE trading BC (RETB) is used for recording REPs’ data. In a dual-chain frame made up of LETB and RETB, RE is consumed in various areas simultaneously to ensure trading security. As users triggered LETB and RETB smart contracts, distribution plans are generated according to their demands. As a result, the smart contract matches power trades and provides a distribution plan based on features like reliability, volume, and an offered price for each producer in the power network. Upon completion of power distribution, users can provide feedback to the BC according to its quality. By triggering a smart contract, a producer's reputation value is modified and the reward according to the feedback is paid.

ContributionsThe following are the major contributions of this study:

- 1)

a distributed energy commerce decision-making process is proposed in the SG. When BC and smart contracts are used to transfer information and make decisions in WNs, the reliability and security concerns associated with centralized power trading have been eliminated;

- 2)

A distributed power trading scheme is developed for reducing the cost of electricity to consumers and the burden on the grid;

- 3)

A BC-based incentive scheme is developed for the trading of RE power in order to motivate producers to increase production and improve quality. Based on the incentive algorithm, smart contracts allow for automatic and fair remuneration of REPs;

- 4)

The Ethereum BC and 56-bus trail feeders are applied for demonstrating how a BC-based distributed power trading model might work.

The remaining parts of the paper are as follows: Other relevant studies are introduced in the next part. Part III models the system and solves it based on OPF's limitations. The process is described in Part IV. Part V presents scenarios and outcomes of simulations. The final part provides a brief summary of the paper and outlines future directions.

Other relevant studiesThe following part reviews recent research on electrical power markets, and energy commerce strategies, and concisely describes BCs.

Conventional methodsA centralized framework was implemented at the start of the construction of the electricity market because of the greater efficiencies of the allocation of resources. In a centralized framework, data from every participant can be accessed, such as the features of consumer demand, the features of producer supply, as well as any external and internal limitations. Accordingly, centralized power trading will optimize public welfare when regulators with the adequate capability of calculating and analyzing have the ability to make decisions. A branch-enabled wireless sensor network is developed in ref (Faheem & Gungor, 2018) and (Dabbous & Tarhini, 2021), in that the information on the power consumption of users could be effectively collected in a centralized power trading without conflicting because of smart meters' time synchronization. Electricity markets based on centralized power trade are common, however, the centralized framework leads to centralization concerns, including a single point of failure. Further, the use of WNs will increase the previous security risks when it comes to transferring data.

The last few years have witnessed a rapid rise in interest in distributed power trading that has been briefly examined (Mujeeb, Hong, & Wang, 2019). Distributed market structures are better suited for SGs that utilize a great deal of RE, and in combination with WNs could more effectively utilize RE. A multi-level layout in combination with energy storage systems is employed in ref (Kayalvizhi & DM, 2018). The average-market cost as the pricing method of the suggested P2P commerce is examined in ref (Anoh, Maharjan, Ikpehai, Zhang, & Adebisi, 2019) and the canonical coalition game framework is presented as a way for ensuring honest producers make consistent profits. Specifically, the schemes fail to address the current cost obstacles in the market, and distrust among users and producers makes such distributed power trading schemes challenging to implement.

BC and related methodsBC and smart contractThe Bitcoin project was initially based on the distributed database technology known as BC (Nakamoto, 2008). Blocks store data on the BC. Block bodies are the parts that store data, and block headers are the parts that store the time stamp, the block body's hash (HA), the HA of the prior block, and so on. Entire ties in the network store datum in the BC, and such nodes agree on a BC via a consensus method. The prior block's HA is a kind of pointer. By using the pointers, a chain from the back to the front is formed by the blocks. It is hard for an attacker to change data saved in a block without changing all the blocks following the block. A node in the BC could trace the data based on the chain framework as well (Sedghi, Ahmadian, & Aliakbar-Golkar, 2015). Different access methods are used to categorize BCs: public, consortium, and private. Any node is able to access the public BC; it is fully decentralized and highly secure. Several authority nodes, which are highly influential and have greater BC transaction throughput, maintain the consortium BC. The private BC typically stores data distributed between trustworthy nodes of an organization.

The development of smart contracts significantly increased the capabilities of BC technology (Dabbaghjamanesh, Wang, Mehraeen, Zhang, & Kavousi-Fard, 2019). The intelligent agreement is the code's segment that runs on the BC. The nodes of the Ethereum BC frame, which developed the smart contracts, must use an Ethereum virtual machine (EVM) (Thomas, Long, Burnap, Wu, & Jenkins, 2017). Every tie runs the program in its own EVM and uses the consensus mechanism for producing a reliable outcome whenever a BC node calls the smart contract. Smart contracts use Turing's comprehensive smart contract language to create increasingly complicated algorithm functions and have a wide range of applications in power trading cases.

Formulating the problemThe suggested operation layout of ADS, a BC-based distributed power trading scheme, and the design objectives are presented in the following part.

Operation layoutThe entities of the suggested operation layout are as follows: regulated power plants, distributed RE generators, batteries, uncontrollable, and controllable loads. The following are their particular descriptions, in which, the distribution network bus criteria are shown byi, the time period is represented byt , represents the minimum amount of the tie voltage meeting the electrical network's standards is shown by Vi,min, and the maximum amount of the tie voltage meeting the electrical network's standards are represented by Vi,max.

Adjusted power plantsThe adjusted power plants have been mostly controlled power generation tie-tune G consisting of the fuel cell, gas turbine, and small thermal power agent. For both reactive and active power, the following restrictions need to be met:

For i∈G at t are investigated to have quadratic cost functions as Ci,t(PGi,t)=αi,tPGi,t2+βi,tPGi,t+γi,t. Here, PGi,t shows the active power of production tie i at epoch t. QGi,t represents the reactive power of production tie i at epoch t. Node i should satisfy the restrictions in Eqs. 1 and 2 for ensuring the quality of power and safety of power supply conditions.Distributed REThe present study focuses on photovoltaic (PV) generation as a RER.

The active power from the PV at tie i at epoch t meets the prior restrictions, in which, PDGi,max shows the upper limit of PV power output and PDGi,min represents the lower limit of PV power output.Controllable loadElectric vehicles (EVs) are the major controllable loads in the electric grid. The controllable loads are defined as Si,t=Pi,t+jQi,t for i∈CL. For instance, the EV from devices with flexible power specifications but constant energy demands Ei,demand in 24 hours. The controllable load can be represented mathematically as follows:

Here, the time-horizon's epoch has been shown by T and the time interval is represented by Δt . Si,t=0, for t=1,…,ti,start,ti,end,…,T.Uncontrollable loadsThe majority of uncontrollable loads are street lightings, medical organizations and anything else that does not shut down or limit its power. Here is the static mathematical formula:

Here, VN represents the rated voltage, PN represents the active power at the rated voltage and QN shows the reactive power at the rated voltage. Based on the actual voltage static features, the coefficients are calculated using the least square process.According to Eqs. 5 and 6, reactive and active power of uncontrollable loads have been included 3 components, one of which is proportionate to the voltage square and defines the power required for the firm impedance, the next is proportionate to the voltage and shows the power associated with the firm current load.Energy storage systemsSystems for storing and releasing energy are called energy storage systems (ESS). System reliability and power quality are greatly impacted by them.

Here, the energy storage placed at tie i at epoch t is shown by Ei,t.Ei,cSoCmax and Ei,cSoCmin represnt upper and lower limits as the charging performance and discharge performance, Ei,c shows the rated volume, SoCmin and SoCmax∈(0,1] represnt the lowest and highest charging state preventing the batteries from over-discharging/charging. Pi,maxcha and Pi,maxdis represent the utmost power charging and discharging, respectively.System losses of distribution networksThe branch active power i,j is defined:

Here, Gij+jBij represents the branch entrance. Thus, the branch active power losses is defined:As δ is typically relatively small, cosδij=−δij2/2. This is substituted into Eq. 14 to get:Since the voltage amplitude cannot be affected by variations in the injected active power, it is considered constant. Due to this, the changing section of system losses can just be attributed to node active power injection, that is:System LayoutA BC-based distributed power commerce scheme in the electricity distribution market is proposed. In the suggested layout, participants have been divided into 4 types: the user, the local producer, the REP, and the grid. Here is a description of each type:

- •

User is responsible for power requisition in the market and would buy electricity from native producers, REPs, and the system, such as the controllable/uncontrollable loads, and ESSs suggested in the grid layout.

- •

Native producers have the same geographic region as the user, generate power via rooftop PVs, and sell the power saved in ESS.

- •

REP is specifically the distributed PV power plants and supplies power for the electricity markets.

- •

Grid includes large power plants as well as regulated power plants, enabling consumers to access power whenever other producers are unable to provide it.

As part of the suggested layout, participants are linked to a BC network and can apply BC function. Assuming that all participants are rational and won't act against their own interests, in other words, consumers are motivated to find the cheapest power and the best quality power. Additionally, local producers and REPs won't impose excessive electricity costs.

Design objectivesThis study aims at addressing the issue of combining BC with distributed power trading in order to achieve the OPF. The energy balance equation is proposed, and the operation layout suggested in subpart A is converted to the 2nd-order conic coding.

For every bus i, Si=Pi+jQi is tie i′s genuine intricate power injection. Power balance is met by the suggested ADS.

Here, the injected power of the load is shown byPi,tload, the active power losses of the system is represented byPtloss, Ptcha indicates the ESS's charging power in the grid at epoch t, Ptdis refers to the ESS's discharge power at epoch t, Pi,tDG indicates the PV production in the grid at epoch t, PtSI refers to the slack-bus injected active power in the network at epoch t.Eq. 1 to Eq. 17 are non-linear programming (NLP) problems. On the other hand, since the power flow formula is nonconvex, finding the global optimum solution can be challenging. In this way, the original problem can be transformed into a convex optimization by the second-order relaxation.

Here, Uj,t shows the voltage of node j at time t, Pij represents the active power transferred via line (i;j) at time t, rij and xij represent the resistance and reactance of line (i;j), Pj,tload and Qj,tload indicate the active and reactive power transferred via line (i;j) at epoch t, respectively. vj shows the subset of tie set J. Here is how the original problem can be turned to the 2nd-order conic coding. The use of universally employed mercantile solvers like CPLEX, and could rapidly discover the global optimum solution.An objective function would be the OPF layout of an open power market with the lowest active power buy price set at the marker bright expense:The objective function was determined by meeting OPF restrictions. CMPC.∑i=1nPDG,i defines the cost of active power buy based on the market-clearing cost (the active power market clear cost is shown byCMPC ), along with thermal losses, which have been depicted via Closs.Cstor.∑i=1nPstor,i shows the cost of local energy storage. In the suggested trading scheme, thus, users' electricity prices must satisfy the limitations of the Eq. 24.Furthermore, the suggested trading scheme aims to conduct effective distributed electricity commerce in the distributed power market and incentivize REPs to increase their production scale and offer steady power.

MethodThe following part introduces the power trading scheme of the BC-based distributed electricity market. 3 steps are included in the suggested method: initialization, local power trading, and RE trading. Initialization would involve the establishment of the LETB and RETB BC networks in different areas and the joining of the entities to the relevant BC during this step. Following the local power trading step, which involves publicizing users' requisition and volume in the LETB, the intelligent agreement will be able to decide how power is distributed in a reasonable manner. Following the completion of local power distribution, each producer's reputation value will be modified according to consumer feedback and incentives will be provided. In addition, the method moves into the RE trading step if local power distribution is unable to satisfy users' needs. The power distribution plan is completed when the REPs match smart contracts for completing the rest of the power.

Initialization stepDuring the following step, users and producers with the same geographic areas create a LETB network using the consortium BC and choose a few entities with good reputations as the trusted nodes for maintaining the LETB. Meantime, RETB networks are being established by REPs and users. As a result, users have joined LETBs and RETBs in their neighborhood, producers have joined LETBs in their neighborhood, and producers of RE have joined RETBs in their neighborhood. For registration, several identity data are published in such BCs. A reputation amount rp is assigned by the smart contract to every registered entity that changes by progressing the trading.

Next, the locational marginal price (LMP) would be determined by the nodes. Using LMP as a price limitation, power trading cannot take place if the offered cost of the producer exceeds the LMP. According to the theory of real-time electricity pricing, the objectives and limitations are used to form the Lagrangian function, in which the Lagrangian restriction ratio for tie infusion power equivalence can be the related final cost of the tie infusion power.

Hence, the smart contracts are called by the BC nodes to compute LMP based on the next formula.

Here, pi and qi indicate the node injected power, the node injected power-limited Lagrange multiplier has been shown by λpi, the generator set active power-restricted Lagrange has been represented byη and the Lagrange multiplier of the generator reactive power limitation has been shown byξ . As a final step, retail investors would use LMP for determining the cost of RE in the suggested distributed power trade. To emphasize the economic impact, the price needs to exceed the feed-in tariff.Local power trading stepLETB's smart contracts guide local producers as they supply power to users during this step. The local producer is denoted by p, below is some specific information.

- •

Stage 1 includes uploading native generator data.

The native generator p has triggered the intelligent agreement for uploading its data (esp;vp) to LETB, in which es shows the marketable native storage, the native ESS tender fee is shown byv . The smart contract executes a sorting algorithm when a producer has uploaded data for ordering whole producers based on their bidding cost.

- •

Stage 2 includes uploading power solicitation.

The users’ power solicitation have triggered the intelligent agreement in LETB for uploading user data for local trade. Particularly, the consumer has uploaded (m;rt) to LETB, where m shows the user's power solicitation and the reliability threshold amount of native generators has been shown byrt . The smart contract calculates the outcomes of the trading according to the power demand of the user. The intelligent agreement selects several local producers satisfying rp≥rt based on the arranging of tender fee from low to high, till the aggregate of esp of whole the chosen producers meets the user's requisition, or whole generators are chosen. Eventually, the power trading outcomes are published on the BC.

- •

Stage 3 includes distributing the power.

Based on the outcomes of the smart contract in the prior stage, BC conveys the data to the transmission and distribution network operator (TDNO) for completing the distribution process. The stage assumes that generators won't annul the trade, and the smart meter would provide accurate data about power trading. On the other hand, TDNO and the electricity commerce BC system proceed for checking and confirming the data to make sure that every power trading is carried out properly.

- •

Stage 4 includes returning trading feedback.

The user returns feedback to LETB once power distribution is complete and pays the electricity costs. The smart meter device has been assumed to complete the procedure automatically, making cheating unachievable. As soon as the feedback is received, the intelligent agreement on LETB will adjust the reliability amount of the corresponding generators. Those producers whose power distribution plan is completed effectively would have a greater reputation amount, and they would be at a competitive benefit in the following power distribution process. As a result, producers with low-quality power would lose their reputations. In addition, the related producers would receive the electricity cost.

RE trading stepOnce the local power trade is complete, when the users do not meet their power needs, the method moves to the RE trade step. The BC allows users to trade with REPs for meeting the demand. Below is some certain steps.

- •

Stage 1 including uploading REP data.

In the same way as stage 1 in the previous phase, REP in the electricity market has uploaded its data d(ΔTd;md;Cd;td) to the BC network, in which ΔTd shows the predicted steady production period of RE, md represents the current power supply capacity, Cd shows the new energy producer's predictions electricity cost, the sum of supply time of new energy production has been shown bytd . As a means of improving the precision of the power distribution process, it is critical that consumers' data continues to be enriched.

- •

Stage 2 includes trading RE on RETB.

It is typical that local energy storage cannot satisfy the power demands of users, therefore, power shortage Δm can occur following the local energy storage and residual power trading phases. Distributed generation of RE will solve the power shortage. Power shortages are uploaded to the RETB by the user, and the RETB's smart contract is triggered by Δm. The RE power generation node d would be identified using OPF, based on the data in RETB. If the user's demand period TD should fall within the steady production period Td of REPs and the user's electricity demand Δm falls lower compared to the REP's generation capacity md , the RETB network will match the user with the proper production node.

- •

Stage 3 includes distributing the power.

In the same way as the prior stage of the electricity distribution method, TDNO will complete the distribution process among REPs and users according to the outcome of the intelligent agreement.

- •

Stage 4 includes returning feedback and implementing incentive.

As REPs complete their distribution plans, the consumer provides feedback via the BC. Based on the feedback, the intelligent agreement on the RETB will give a motivation to REP tie d, which will complete the distribution plans, and the predicted power cost of tie d can be expressed below:

Here, Cd shows the electricity cost following the incentive, CREG represents the present main electricity cost of RE, k shows the difficulty regulation ratio, x refers to the general variable formula of the power supply agent that can be described as x+P.td+s. In there, P shows the power production's scale, s shows the tie's power production stability within the ΔT length, td≥0 shows the aggregated steady production time of REP. REPs’ incentive function will aim at encouraging producers of power to enhance the installation and investiture of REPs. Meantime, steady power production efficiency and extended cumulative power production time result in greater economic gains. Incentives I=Cd−CREG show tokens that producers receive, and government agencies or grid operators realize such incentives economically.In the event that the power supply continues to be inadequate, the AND obtains power from nearby regional grids, and then completes the distribution process.

Blockchain technologyIn this paper, blockchain technology has been used to not only provide higher security and reliability for the system but also mitigate fraud, as well as provide less operation cost. At each hour, several generation units can provide different levels of energy. So, at each hour, active generation units send their capability to other active members, along with the requested price. Active members decide to purchase power from cheaper units. This process will lead to generating a block at each hour along with a hash address (HA). For the next hour, a new HA will be the generation that can connect to the previous blocks using the past HA. Indeed, at any time interval, each block contains two HA including both current and past addresses.

HA's are unbreakable for outside active members; which means more security and reliability for the system. Also, there is no central node for the system; which means less operation cost and mitigating potential fraud. The main disadvantages of the blockchain (BC) technique are storage problems and reviving missing data that can be addressed by using advanced techniques like the directed acyclic graph (DAG) technique.

AssessmentThe on-chain part efficiency and the off-chain part efficiency are analyzed in order to show the effectiveness of the scheme in the following part.

Experiment environmentThe SCE 56 bus trial (Kashani, Mobarrez, & Bhattacharya, 2018) is used for building the distribution system. This is a low load distribution feeder for rural areas. A PV power station of 1 MW and 0.8 MW is integrated into the distribution network. The changes to the 56-bus trial feeder are depicted in Fig. 1.

ESSs and Rooftop PV install on home consumers on the 56-bus trial feeder based on Fig. 2. A one MW PV power center has been placed on node 53, and the 800 kW PV power center is located on node 19.

The rooftop PV's panels will be used to charge their energy storage batteries throughout the day, and the user's energy demand will not exceed the battery energy storage. Furthermore, Ethereum Geth client is used for building the specific BC and the consortium BC for simulating and RETB and LTEB, respectively.

OutcomesAs a demonstration of the benefits of the suggested system's function and the efficiency of the algorithm, the consumption of gas, electricity cost, and grid load during the experiment are tested.

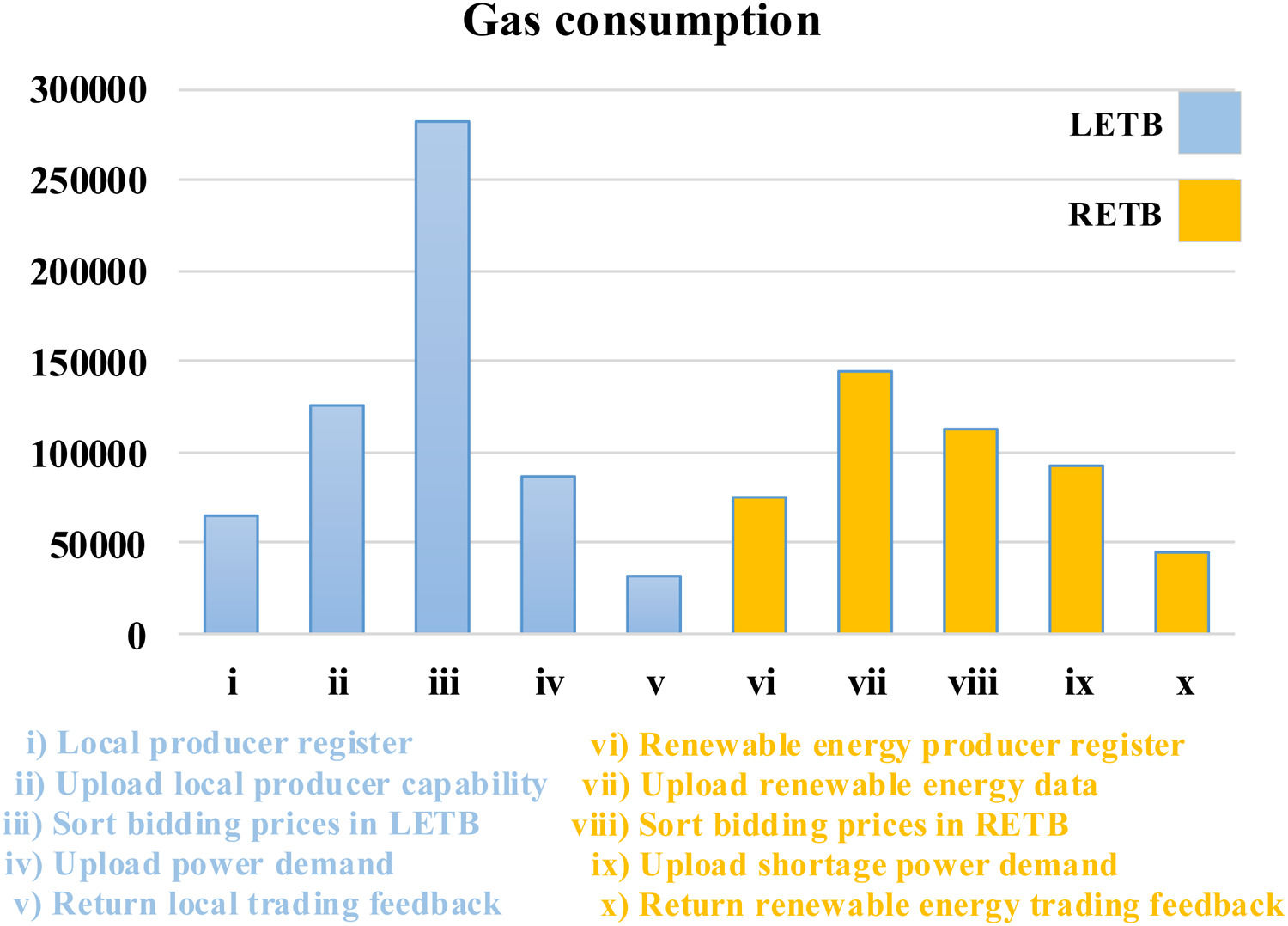

Gas consumptionEthereum smart contracts require a specific amount of gas for each operation, thus the gas consumption reflects the overhead associated with running operations on the BC. Gas consumption for the major operations on the BC in the suggested layout is shown in Fig. 3. Local producers and REPs perform operationsa,b,c in LETB and f,g,h in RETB, respectively, and the users perform the remaining operations. The majority of gas is consumed by sorting the producer's bidding cost. Furthermore, since LETB has many producers, operation c uses approximately 280,000 units of gas. Conversely, RETB has fewer REPs compared to LETB, which consumes approximately 110,000 units of gas. Other operations include storing data on the BC, and their gas consumption is no more than 150,000 that can be accepted by any node.

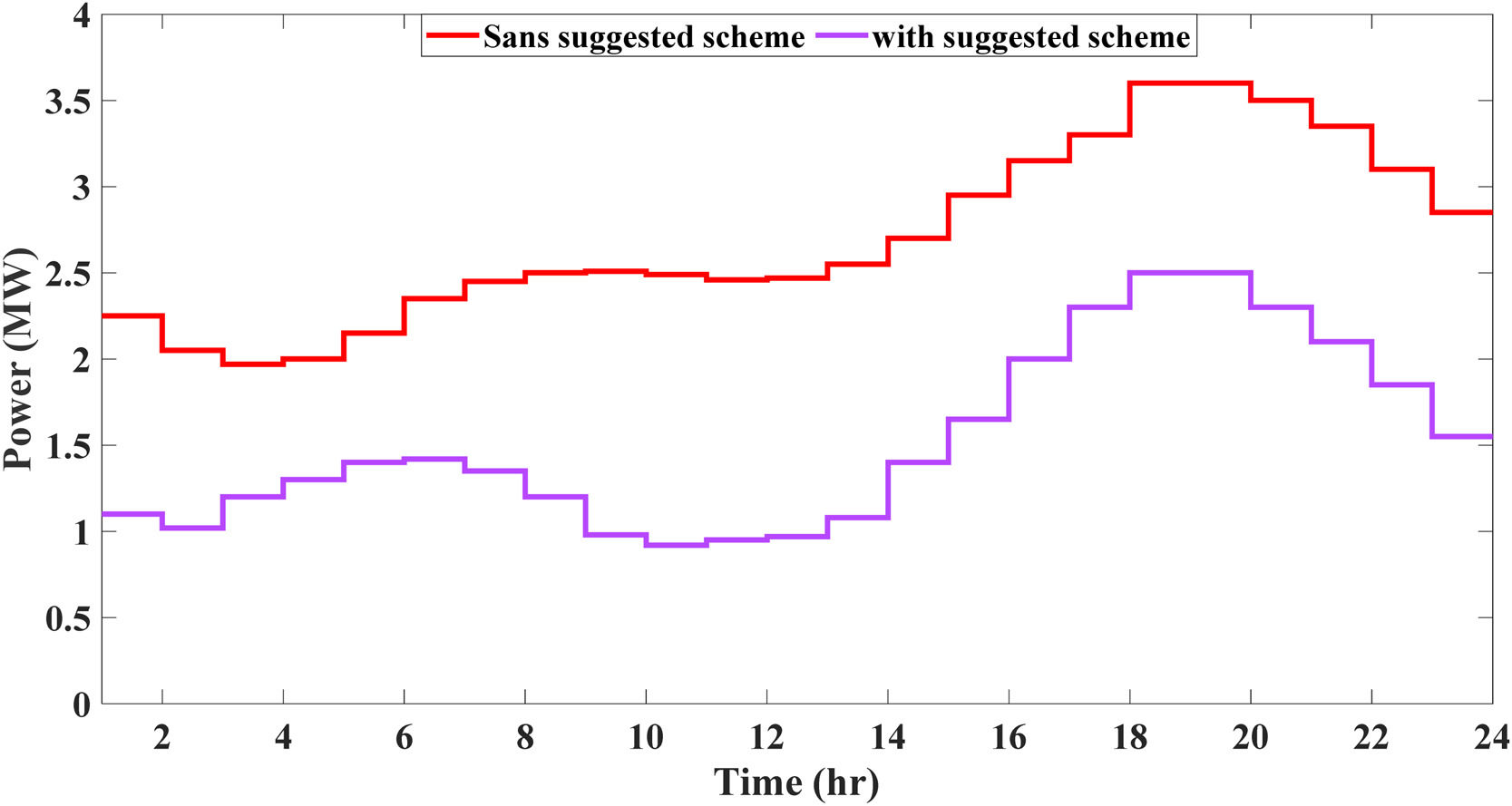

Load analysisThis experiment tests the efficiency of the suggested method based on various grid loads in diverse cases. A comparison is made between the power modifications of the 56-bus feeder prior to and following BC-based electricity commerce, based on the present market condition.

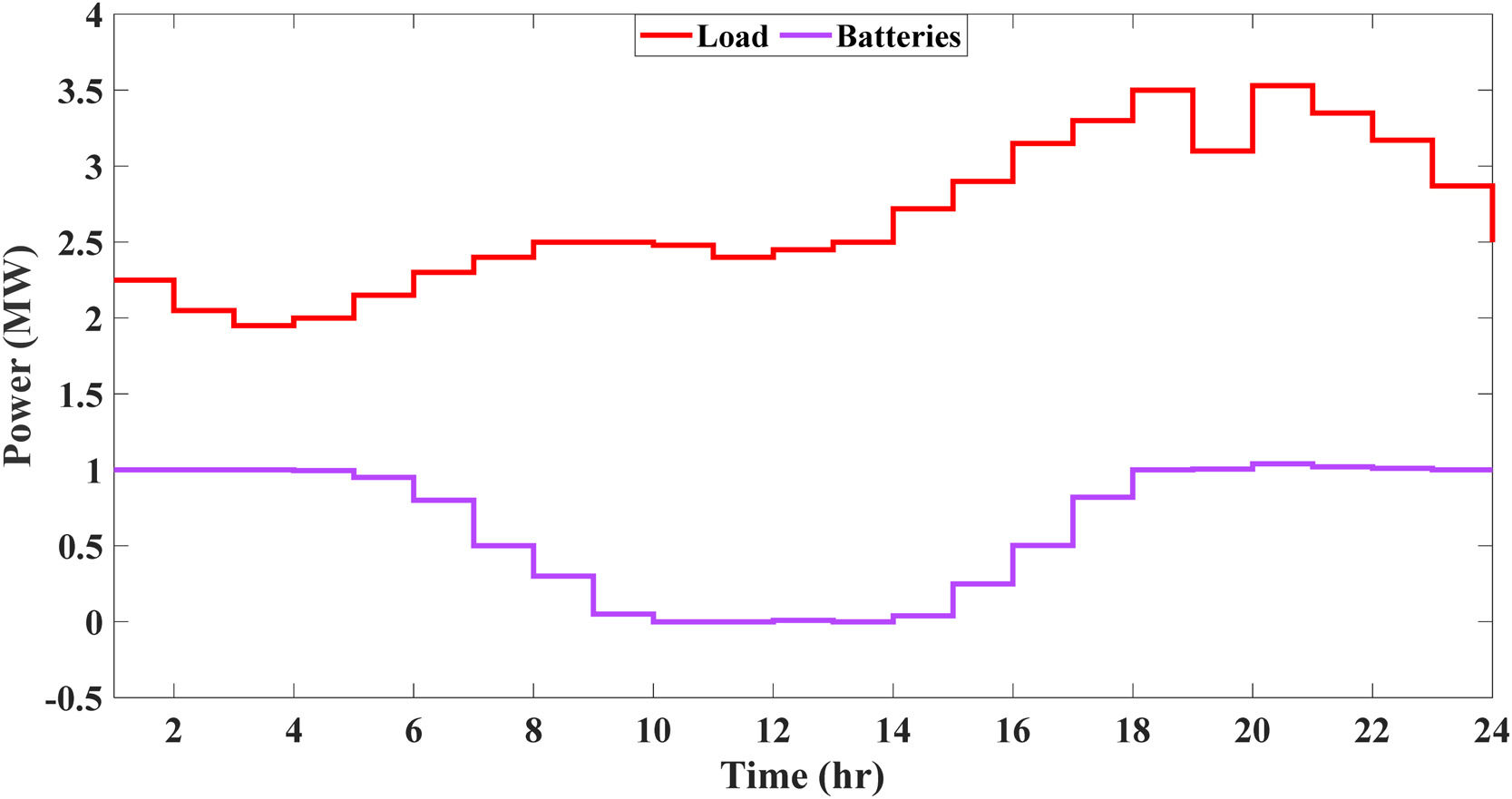

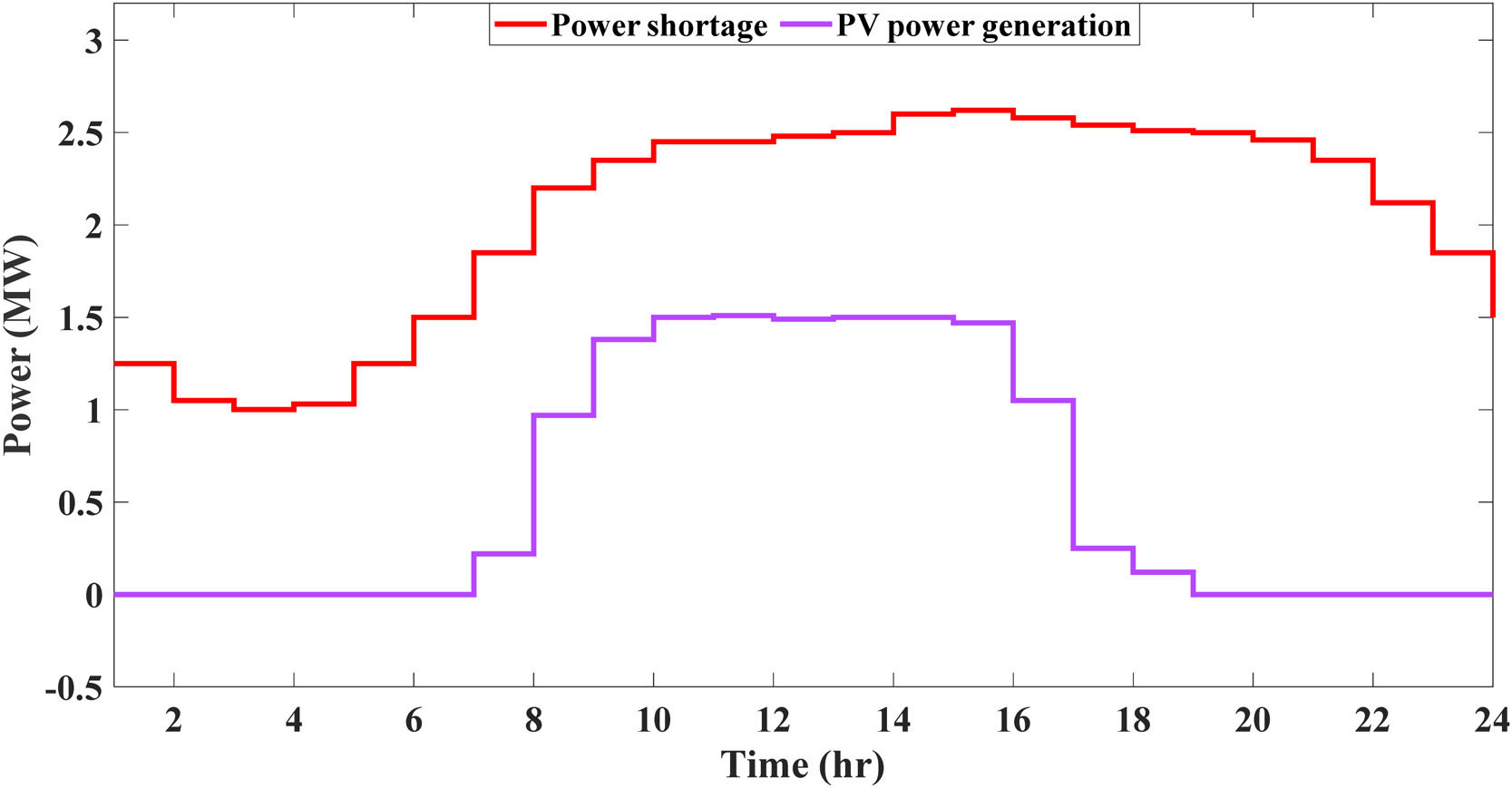

The variation in loads and native ESS during a day is described in Fig. 4. There are two peaks in the power utilization of the loads at 8:00 and 20:00. respectively. From 8 PM to 5 AM the next day, local energy storage supplies more electrical power. According to Fig. 4, the batteries of the local producer supply power for users at 5 a.m. the following day. Because of the constraints of present battery hardware, the entire power from native ESS remains inadequate for the grid. The modifications in the user's power deficiency and REP's PV power production in various time lengths following the final of native energy commerce are shown in Fig. 5. The production of RE slowly rises from 8:00, and can reach the maximum from 10:00 till 16:00. At these times, REPs supply a lot of electricity. Thus, if PV production functions normally, the scheme greatly alleviates the power deficiency from 10:00 to 16:00.

Lastly, the change in the entire load prior to and following the implementation of the BC-based power trading scheme is depicted in Fig. 6. In the figure, the area below the line represents the amount of power the consumer is consuming from the grid. Clearly, as a result of the suggested method, the user's power demand on the grid is lower compared to what it would have been if the method were not applied. In the figure, the orange portion represents the reduction in power consumption.

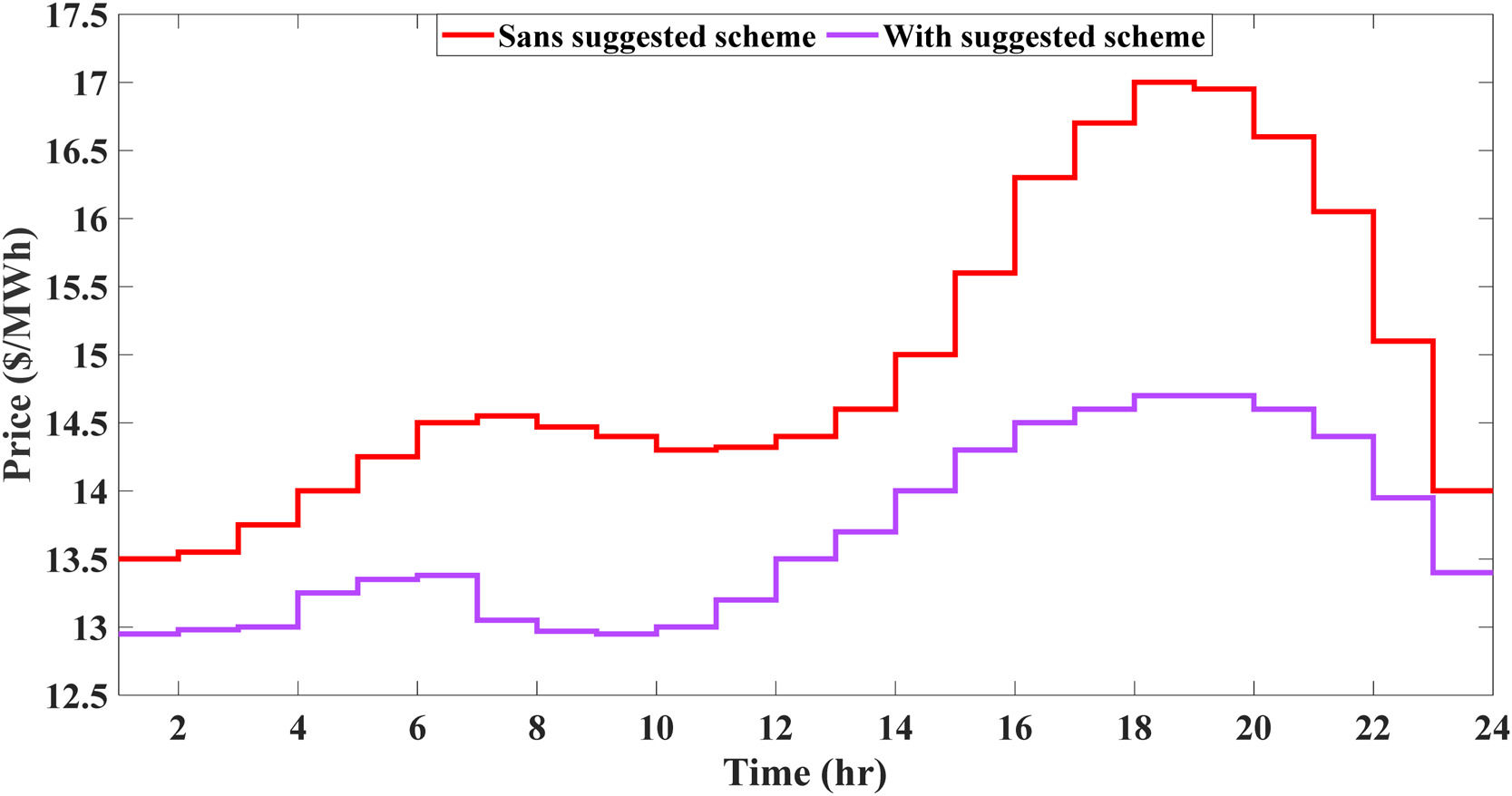

Electricity costThe suggested scheme is tested and compared to the variations in costs over time prior to and following implementation to demonstrate the effects it has on the electricity cost bought via users. Fig. 7 shows that the electricity cost that user must pay at all times has been reduced compared to the original electricity cost when utilizing the suggested power trade scheme. The suggested scheme can be most noticeable at the peak time of power cost at 20:00. Consequently, users' power costs are decreased since they buy power from native generators and zonular REPs at the tender cost below the mean cost for the system, thereby lowering users' electricity costs. Thus, according to the outcomes, the suggested scheme effectively reduces the power buy costs of users and smooths the power curve in order to decrease the grid's load.

ConclusionIn this research study, we investigate a new security BC-based power trade scheme for SGs using WNs techniques. Through the introduction of BC technology, concerns like data transfer and single points of failure in the electricity market can be addressed, which will improve WN security. An authorized distributed trade scheme could be implemented among users and producers with no centralized authorized party by the suggested scheme. LETB and RETB, a dual chain framework, take maximum advantage of native ESS and RE in distributed energy commerce and meet user requisition with OPF limitations, which decreases electricity cost and reduces grid burdens. With the incentive scheme according to smart contracts, producers could be efficiently encouraged to increase generation capacity and enhance quality of power. The efficiency of the suggested scheme is also demonstrated by simulation tests using real scenarios.

This work is fully supported by the National Social Science Foundation of China (No. 21BTQ058): Research on User Privacy Security of Electronic Token Authentication for Big Data in Emerging Public Events.