The immediate need for servitization and digital technologies like the Internet of Things (IoT), cloud computing and predictive analysis must be addressed in manufacturing industries. This research aims to analyze the impact of manufacturing services transformation management from traditional methods to technological innovation. This research approached the panel data of Chinese multinational equipment manufacturing industries for the analytical purpose from 2011 to 2017. The unit-root test has checked the stationarity of panel data and cointegration regression checked the long-term relationship among selected variables. The research results have confirmed a long-run and positive relationship between service transformation management of manufacturing enterprises and technological innovation. The positive upward trend among these two variables is because of increasing market demand-driven, open innovation network construction and increase in capital (intellectual, human & financial capital). The negative sign of values is declared the validity of an inverted “U-Shaped” analysis, which confirms the relationship's longevity. The adaptation of technological innovation has also indicated the growing performance trend in service management enterprises. As per the rule of inverted “U-Shaped” law, at a specific point, the manufacturing enterprises’ servitization management will start declining, and it will continue as a cyclic process. This research suggests that enterprises should prepare for the declining phase of servitization and sort out the other performance growth area, which will help to balance the performance of manufacturing enterprises wholesomely.

China has shifted from rapid economic growth to high-quality economic development and is in the critical period of ‘transforming development mode, optimizing economic structure and transforming growth momentum’. Expediting Manufacturing Service Transformation Management has already been the inevitable requirement of facilitating rapid economic growth and new and & old kinetic energy conversion. According to theoretical research and typical practical experience at home and abroad, there is a close correlation between Manufacturing Service Transformation Management and technological innovation. Manufacturing Service Transformation Management can push enterprises to upgrade technological innovation capability. Some traditional Electrical Companies like Philips, IBA and so on have all realized competitive edges remolding and technology advancement of enterprises through service transformation. With the most substantial innovation ability in the world, America has the service industry accounting for 80% of US GDP (Adedoyin et al., 2020). Some scholars consider it is excessive economic service that restrains technological innovation activities (Hall et al., 2020; Arora et al., 2020). Since the Obama administration began putting forward the strategic concept of ‘reindustrialization’, Trump has primarily propelled restoring America's manufacturing industry and accelerating manufacturing industry backflow subsequently. It directly strengthens America's substantive economy matters because it can indirectly reinforce the ‘Industrial Site’ effect, ensuring America's leadership in national innovation. It can be seen that the relationship between the degree of service of the manufacturing enterprise and technological innovation is not a merely simple linear relationship (Xing et al., 2023). Manufacturing Service Transformation Management probably has an optimum functional point on pushing for technological innovation. Before reaching the operating point, Manufacturing Service Transformation Management produces a positive effect. On the contrary, it will restrict technological innovation once exceeding the threshold. The paper will simulate unraveling the authentic existence of this relationship.

The significance of this research can be vindicated by its comprehensive nature and explore the current academic views on the effect of technological innovation on manufacturing service transformation that are still indeterminacy. This research provides a wide-scale framework to declare its focus and innovation to check the effect of manufacturing servitization and enterprises’ technological innovation. The selection of variables, focus of study, and leading technological innovation impact can fill the research gap because the previous literature only targets manufacturing servitization, companies’ performance, competitiveness, and so on. The empirical analysis also makes a difference because two methods are targeted to extract accurate results related to two different agerasia. The methods will cross-check the findings of each other, and the maximum accuracy level can be achieved. The study will lead toward the exact way to solve the discussing issues of manufacturing companies’ servitization and technological innovation. The data selection of A-shares is modeled Chinese equities’ return projections which show up to 10% over and above the current benchmark index. The return expectations of A-shares holders are comparatively due to their optimized portfolio nature with improved efficient frontier. This research justified its innovation and uniqueness from three different perspectives. Firstly, the conceptualization framework is built by adapting the enterprise's governance theory and systematically reviewing existing research. Secondly, check the relationship between technological innovation and manufacturing enterprises. The focused area of research is also making it different from the existing literature. Multinational manufacturing enterprises are issuing A-share, excluding companies issuing B and H-share shares and incorporating overseas companies. A-share issuing companies’ leading focus keeps this research near to accurate results and finds the authentic relationship. Thirdly & lastly the recommendations and suggestions will be made to enhance the performance of manufacturing enterprises.

This research is arranged as the first section of its introduction and the second section covers the theoretical analysis and research hypothesis. The third section is the research methodology, and the fourth section will cover the empirical results of this research. Lastly, the conclusive summary is presented, and makes suggestions & recommendations.

Literature reviewThe manufacturing sector is rapidly adopting information technology and digital innovation which drives it's toward globalization as well as enhances the importance of it. Liu et al. (2022) analyzed the effect of Mobile Information Technology (MIT) on innovation services performance in manufacturing companies. A theoretical model is structured the mechanisms of this information technology and drives as hypothetical approach based on dynamic capability theory and invitation diffusion theory. By applying AMOS method at collection information 462 manufacturing companies, it's concluded that MIT indirectly effects on a firm's service innovation capabilities (SIC) and service innovation performance (SIP). In manufacturing service, first, Vandermerwe and Rada (1988) defined the concept of manufacturing service and considered those manufacturing enterprises which are converse from merely furnishing items or items accompanied by accessorial services to providing the form of ‘Goods + Service Package’. Reiskin et al. (1999) enriched the concept of manufacturing service, believing that input and output service are two connotation forms of manufacturing service. Input service means that service input is contained in manufacturing output. Output service refers to transformation manufacturing output from real entity to services. Szalavetz (2003) further concretized service definition and held that manufacturing service contains two implications: internal service and product-related service. Internal services refer to product development and design, human resource management, accounting and financial services and logistics, etc., which play an important role in enhancing the competitiveness of enterprises. Product-related services are mainly after-sale products, which are increasingly significant to enterprise development. Meanwhile, they also include product maintenance and management, transportation and installation, etc. There are few studies on the relationship between manufacturing services and enterprise technological innovation, most of which remain in theoretical analysis. Scholars believe that manufacturing service can directly promote the technological innovation effect of enterprises.

Schwrer and Tillmann (2013) and Amiti and Konings (2007) believe that the service-oriented manufacturing provides manufacturing enterprises with opportunities to learn comparative advantages and experience and technologies from service businesses, thus improving their human capital and innovation capacity. Grossman and Helpman (2002), (Kohtamäki et al., 2022) and Grossman and Rossi-Hansberg (2008) believe that service outsourcing is a form of manufacturing servitization. Service outsourcing reduces operating costs for enterprises, and at the same time brings "learning from doing" effect, which promotes the technological innovation ability of enterprises (Raddats et al., 2022). According to the endogenous growth theory, Ang (2010) found that capital is the endogenous variable of enterprises' technological innovation, and the improvement of financial capital will promote the improvement of enterprises' technological innovation effect. Financial service input provides a large amount of financial capital and superior financing environment for technological innovation of manufacturing enterprises, which will enhance the effect of technological innovation of enterprises. Bustinza et al. (2017) described that the conceptual foundation of servitization is finely established and target the manufacturing process with developed innovative service capabilities which enable it to compete with servitization. This research analysis divided into four thematic sections in the organizational transformation of product firms implementing services; 1) make-and-buy decision assessed 2) strategic approach is developed 3) digital technology and platforms are implemented and 4) pros & cons of findings-based contracts. These interconnected themes are assured of future development avenue. Opazo-Basáez et al. (2022) research extracted on literature at the servitization’ intersection, digital business models and supply chain management. This research also explored the digital disruption has affected interdependencies of B2B businesses. Dematerialization of physical products is transforming and repositioned by reduction of transport and production cost (Vendrell-Herrero et al., 2017; Sonntag, 2003). The new market conditions can empower downstream firms and the digital services help to track the upstream.

Theoretical analysis and research hypothesisThe effect of manufacturing servitization on technological innovation is mainly reflected in: the internal capital promotion and external environment promotion. The improvement of internal capital primary refers to the enhancement of internal interaction between manufacturing and service industry in the process of service-oriented transformation of the manufacturing industry and the positive promoting effect of manufacturing enterprises on technological innovation through service-oriented input and service-oriented output. The process of manufacturing service contains input service and output service. For one thing, the input service process refers to inputting services in the product production process, with research and development, business services, information and technology services and financial services involved. Research and development, commercial activities, information and technical services are technology-intensive industries, including a few high-quality talents with high technical levels and huge knowledge reserves. They are put into manufacturing as service elements, thus hoisting the accumulation of human capital and augmenting human capital and knowledge capital for technological innovation of enterprises (Schworer, 2013; Amiti, 2009). In addition, the input of financial services can provide grand-scale financing for the technological innovation of enterprises, which is an influential source of the technological innovation funds of enterprises, further triggering off the increase of financial capital for the technological innovation of enterprises. What's more, the capital market can disperse risks and share benefits for investors in technological innovation, providing stability and chronicity for technological innovation of enterprises.

Another thing that output service refers to is the additional services that manufacturing enterprises provide to customers after producing products, mainly including wholesale and retail services, transportation services, etc. The service object of output service differs from that of input service, which can be shown from the truth that in input service, manufacturing enterprises accept various services provided by the service industry as the object which is served, while the object of output service is to deliver product-based services directly to customers. Therefore, the output service behavior directly issues the contact and communication between manufacturing enterprises and customers and constructs the interactive relationship between them. Thereby increasing the degree of involvement of customers in the production process of the manufacturing center matures and providing conditions for the construction of the external connection of enterprises. The promotion function of the external environment primarily refers to the theory of employing the development of external relations. Manufacturing enterprises boost their technological innovation when manufacturing enterprises go on with service transmission. The external relationship of manufacturing enterprises mainly includes the relationships with customers and each enterprise. Traditional manufacturing enterprises have put more emphasis on the production and manufacturing of products, thereby ignoring the identification and response to customers’ requirements. In the process of service transformation, the manufacturing industry integrates customers’ behaviors and perceptions into the development and design of products and services and the manufacturing and delivery process. Customers’ demand is regarded as the core of production, and service becomes the bridge between manufacturers and customers. In the process of participation and experiencing, customers will put forward the shortcomings and areas required to be retrofitted from their perspective and give feedback on the feeling of using the product. As the market demand, the feedback and suggestions put forward by customers push ahead with the product improvement and technological innovation of manufacturing enterprises (Xing et al., 2023). The manufacturing enterprises have a promoting effect on the technological innovation effect of enterprises. Meanwhile, innovation is the arrangement and combination of stock knowledge and the creation and application of new knowledge (Chaithanapat et al., 2022; Lyu et al., 2022). The critical key to promoting innovation lies in the dissemination and application of knowledge. In the era of the knowledge economy, explicit knowledge is liable to acquire, while the capture of tacit knowledge is difficult. Tacit knowledge is the foundation of an enterprise's core competence, and its creation can be fulfilled only through close contact with customers. In face-to-face communication with customers, manufacturers shorten the distance between enterprises and customers. It promotes the capture and flow of tacit knowledge through frequent communication and learning, which provides vital, innovative expertise for enterprises. Furthermore, Zhou, Xue and Shang (2017). proposed the manufacturing enterprise servitization strategy provides an opportunity and motivation for the construction of an enterprise technological innovation network platform. Although the theoretical logic of the impact of manufacturing enterprise servitization on enterprise technological innovation. Ceschin (2013) elaborated significant extensive external network relations of the servitization demeanor of manufacturing enterprises. In manufacturing enterprise servitization, suppliers, service providers, manufacturers, distributors, customers etc., break the original enterprise boundaries and form modern manufacturing service networks. The process of innovation is the process of mutual communication and cooperation between individuals and organizations (Peng & Tao, 2022; Kang & Kang, 2009). The modern manufacturing service network members carry out the division of labor & collaboration, complementing each other's' advantages, sharing resources, and partaking risks in the network. It promotes the formation of an open innovation network of manufacturing enterprises and has confirmed technological innovation's positive effect on enterprises. See Fig. 1 for the internal mechanism of service-oriented transformation of the manufacturing industry promoting technological innovation. Based on this, the following hypotheses are further proposed in this paper.

Hypothesis 1 The technological innovation ability of enterprises will be enhanced according to the exaltation of the degree of servitization.

Some scholars also argue that many risks and costs accompany Manufacturing Service Transformation Management. Saavedra, Barquet and Rozenfeld (2013) propound that servitization has a high expense requirement for materials, talents, and capital. A high degree of servitization may cause trapping enterprises into a "servitization dilemma". This servitization dilemma triggers out the accretion of enterprises' production and management costs and reduces the input for innovation, which inhibits the technological innovation of enterprises. Industrial Commons refers to the multiple capabilities of enterprises, universities and other organizations. They jointly provide the basis for a series of industrial growth and technological innovation. They are the interwoven collection of various capabilities and element networks that sustain a series of industrial development and technological innovation in a country or region (Pisano & Shih, 2009; Ye et al., 2022). The loss of any link in the network will not only engender the decline of industrial Commons but also impair the industrial development and technological innovation of a country or region. The same is true for the development of the manufacturing industry. The same is true for the development of the manufacturing industry. Firstly, when the degree of servitization is exorbitant, the mode of "manufacturing + service" will be affected. Secondly, when the manufacturing link is entirely outsourced, the "industrial Commons" in manufacturing enterprises will be influenced, and the technological innovation effect enterprises to a certain extent. Based on the theoretical analysis, the following hypotheses are proposed:

Hypothesis 2 When the servitization of an enterprise achieves a certain level, technological innovation influences the enterprise.

This article selects A-share listed multinational equipment manufacturing enterprises in Shenzhen and Shanghai, China, as the initial research samples from 2011 to 2017. This periodic selection is due to Chinese industries' adaptation mechanism of Industry 4.0. In this period, Chinese manufacturing companies' growing scale was going upward, and technological innovation was getting space and status in the industrial sector. However, it's an initial stage, and leading this sector toward global competition is impactful. This research intends to construct the panel data for empirical research. The initial data were screened under the following principles:(1) excluding the companies issuing B and H shares simultaneously and listed incorporation overseas. (2) The service transformation of the manufacturing industry, which will lead by western developed countries, will damage interests in multinational manufacturing enterprises in our country. The foreign environment affects these manufacturing industries, which will carry on the service transformation antecedent to other domestic enterprises. Relative to the domestic later-transformation mode of manufacturing enterprises, its "manufacturing + services" business model is more mature. According to the definition, " the enterprises with branches and subsidiaries erected all over the world go by the name of multinational enterprises" the international manufacturing enterprises with overseas subsidiaries are screened out; (3) To ensure the availability of data, select out the manufacturers listed before 2011; (4) Eliminate enterprises with missing data; after preliminary screening, 118 enterprises meet the requirements. The data mainly originate from the "Flush" stock financial database, enterprise annual reports and National Intellectual Property Network. We have supplemented and verified individual missing data by combining sample enterprise websites and annual reports.

Variable measurementThe servitization degree of manufacturing industryAs for the research for the degree of service in the manufacturing industry (Ser), according to the literature review, there are primarily three methods to measure the degree of servitization. The first method was introduced by Neely (2008). He measured the degree of servitization by using the number of enterprise service projects. The second method is that from the industry perspective, input-output table to calculate the proportion of service input to calculate the degree of servitization, giving priority to Huang (2014). The third method was presented by Xiao Ting (2017). The empirical method denotes primarily selecting "other business income" or "external major business income" in the enterprise's financial statements as the service income and then calculating the proportion with the total revenue to measure the degree of the enterprise servitization. By employing the above research method, the scholars select the "other business income" or "external main business income" in the financial statements of enterprises. As scholars' enterprise service income method is in the majority, corresponding with the actual circumstance that this topic uses micro-enterprise data as samples. The ratio-gravity of "other business income" and the gross revenue of enterprises have been used to measure the degree of enterprise servitization. A non-linear relationship is expected between the degree of manufacturing servitization and technological innovation. Consequently, the quadratic term (Ser2) of the degree of manufacturing servitization is also introduced into the model.

Technological innovation effectIn the existing literature research, the measurement of the technological innovation effect mainly contains innovation input and output. Innovation input is primarily measured by research input index, while innovation output is mainly metered by the quantity of patents and sales revenue of new products. Li and Han (2018) perceive that innovation input can reflect the enthusiasm of enterprises for technological innovation to a certain extent, but only the patents that have been examined and authorized have the basis for technological innovation evaluation. Ma et al. (2001) hold the point that the concept that the index of innovation output is measured by the number and sales revenue of innovative products is susceptible to the influence of market factors and financial operations of the company. The patent is an important indicator of the innovation ability of an enterprise. The number of core patents owned by an enterprise can mirror its position and prospect in market competition to a certain degree. Therefore, most studies take the total number of patent applications or patents of an enterprise as the measurement of the innovation output of enterprises (Chen, He & Zhang, 2018). Also, this article measures the innovation performance through the quantity of patents. Hall et al. (2011) selected the number of patents obtained by enterprises to stand for innovation accomplishments; While studying the correlation between the reverse investment of China to developed countries and independent innovation, Wu and Mi (2009) measured autonomous innovation capability with the number of patent grants as well. The measuring capability of this research is Considering that the relative index is more stable than the absolute index. It takes a logarithm adopting the per capita patent authorization number of enterprises, referring to the proportion of patent authorization number and employees of enterprises.

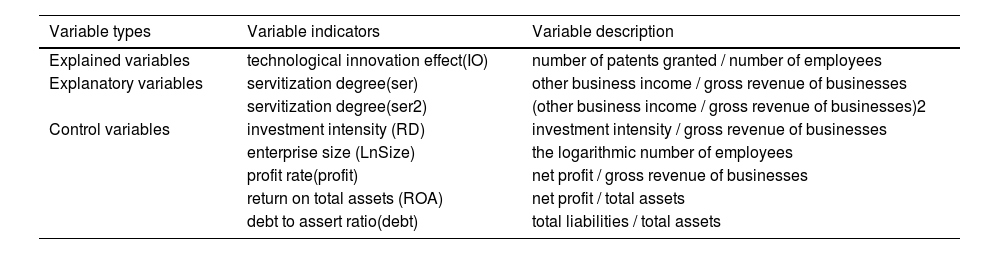

Control variablesReferring to the existing literature of Peng and Zhou(2017), the influencing factors of technological innovation effect are selected as control variables in this paper: (1) investment intensity (RD), which is one of the critical ingredients affecting enterprise the technological innovation. Feng and Wen (2008), Dai and Cheng (2013) all adopt the proportion of R&D investment to sales to measure the R&D investment. Therefore, this paper takes the ratio as a proxy variable of the R&D investment intensity of enterprises. (2) Enterprise size: there is a positive influence mechanism between enterprise size and innovation performance, so enterprise size should be controlled. From the perspective of research methods, indicators that can be applied to measuring the enterprise size include sales revenue, total assets and the quantity of employees, which have both advantages and disadvantages respectively (Scherer, 1965). The number of personnel assigned by an enterprise is the scale indicator recognized and adopted by most researchers. Similarly, this paper also adopts this measurement method and takes the natural logarithm to carry out the analysis. (3) Profit rate, which is measured by the ratio of the net profit to the main business income of enterprises (4) return on total assets (ROA), which denotes the ratio of net profit to total assets. (5) Debt to assets ratio, the ratio of total liabilities to total assets. The details of variables are presented in Table 1.

Variable description.

(In section: Control Variables).

This article discusses the correlation between technological innovation's effect and the degree of service-oriented transformation of enterprises. Through the concerning theoretical analysis, it can be concluded that the relationship between the impact of technological innovation and the degree of service-oriented transformation is more than a simple linear relationship. Therefore, the nonlinear model this article will build is as follows:

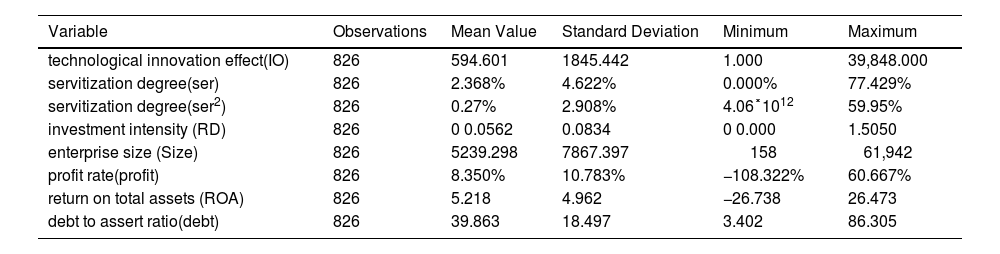

where t represents each year, variable subscript i represents the corresponding enterprise, βn (n = 0, 1, 2, 3, 4, 5, 6, 7) is the parameter corresponding to each explanatory variable, and p is the random error term. Ser,Ser2 are the servitization degree and the square terms of the servitization degree of the enterprise. RD, Size, Profit, ROA and Debt refer to the R&D investment, scale, profit margin, return on total assets and the enterprise's asset-liability ratio, which are introduced into the model as the control of face-changing.Empirical analysisDescriptive statistics and correlation analysisDescriptive statistical results of variables based on all samples are shown in Table 2. It can be discovered from the figures in the table that the service income of listed companies in equipment manufacturing industries in China accounts for the highest proportion of the total operating income of 77.42%, which indicates that some equipment manufacturing industries have vigorously promoted the strategy of manufacturing service transformation. Nevertheless, sample enterprises' average level of servitization ratio is merely 2.39%, which is comparatively low. Thus, the strategy of Manufacturing Service Transformation Management of Chinese manufacturing enterprises has begun to be carried forward. Moreover, some enterprises have made significant progress. However, the strategy must be further expedited from the overall level, and the application scope and depth of servitization in manufacturing enterprises remain elevated.

Descriptive analysis.

(In section: Empirical Analysis).

Since panel data contains features of both cross-sectional and time-series data, to avoid the phenomenon of "pseudo-regression" in empirical analysis, the stationarity test of each variable is carried out first. this article uses the LLC test (applicable to the same root) and the IPS test (applicable to no root) to test the unit root of variables. As the results show, all variables are first-order integration sequences, passing the significance examination after the first-order difference. this article uses the Kao test to test the co-integration relationship between variables. The co-integration test shows that the statistic p-value is 0.0124. The examination indicates that there is a long-term stable equilibrium relationship between variables.

Analysis of model estimation resultsIn this article, mixed regression, fixed effect and random effect are analyzed respectively, after which the F and Hausman tests are used to select the models. After the model's mixed regression and fixed effect assay, the P-value of 0.0000 in the fixed effect analysis passes the test significantly. In contrast, the fixed effect should be selected rather than the mixed regression results. Afterwards, whether the model applies to fixed-effect or random effect is determined. Employing the Hausman test, the p-value passed the test prominently as well. Overturning the null hypothesis, the model was suitable for the fixed effect model.

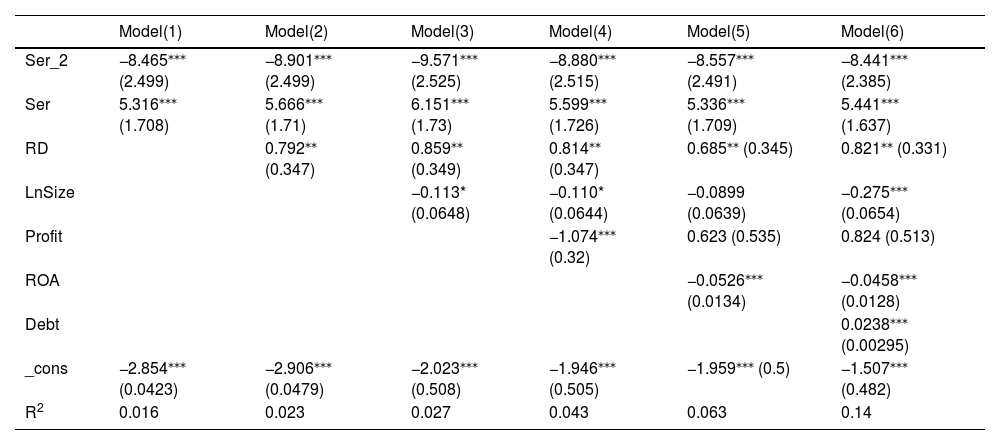

Table 3 shows the results of stepwise regression of the fixed-effect model. The servitization degree of core explanatory variables and the second-order items both pass the significance test, certifying that the quadratic curve relationship between the manufacturing service level and enterprise technological innovation effect exists. Moreover, the coefficient of the second-order items is negative, appearing inverted "U" type trend. It means that with the ascension of the manufacturing service level, the technological innovation effect of enterprises is supposed to be enhanced first and then have a tendency to descend after reaching a certain level, following the hypothesis of this article. In the initial stage of manufacturing servitization, the input of service elements increases the knowledge, technology and human capital of manufacturing enterprises, providing a factor basis for the technological innovation of enterprises.

Regression analysis of servitization on enterprise technological innovation.

| Model(1) | Model(2) | Model(3) | Model(4) | Model(5) | Model(6) | |

|---|---|---|---|---|---|---|

| Ser_2 | −8.465⁎⁎⁎ (2.499) | −8.901⁎⁎⁎ (2.499) | −9.571⁎⁎⁎ (2.525) | −8.880⁎⁎⁎ (2.515) | −8.557⁎⁎⁎ (2.491) | −8.441⁎⁎⁎ (2.385) |

| Ser | 5.316⁎⁎⁎ (1.708) | 5.666⁎⁎⁎ (1.71) | 6.151⁎⁎⁎ (1.73) | 5.599⁎⁎⁎ (1.726) | 5.336⁎⁎⁎ (1.709) | 5.441⁎⁎⁎ (1.637) |

| RD | 0.792⁎⁎ (0.347) | 0.859⁎⁎ (0.349) | 0.814⁎⁎ (0.347) | 0.685⁎⁎ (0.345) | 0.821⁎⁎ (0.331) | |

| LnSize | −0.113* (0.0648) | −0.110* (0.0644) | −0.0899 (0.0639) | −0.275⁎⁎⁎ (0.0654) | ||

| Profit | −1.074⁎⁎⁎ (0.32) | 0.623 (0.535) | 0.824 (0.513) | |||

| ROA | −0.0526⁎⁎⁎ (0.0134) | −0.0458⁎⁎⁎ (0.0128) | ||||

| Debt | 0.0238⁎⁎⁎ (0.00295) | |||||

| _cons | −2.854⁎⁎⁎ (0.0423) | −2.906⁎⁎⁎ (0.0479) | −2.023⁎⁎⁎ (0.508) | −1.946⁎⁎⁎ (0.505) | −1.959⁎⁎⁎ (0.5) | −1.507⁎⁎⁎ (0.482) |

| R2 | 0.016 | 0.023 | 0.027 | 0.043 | 0.063 | 0.14 |

Note: Values in brackets for variables are standard errors.

(In section: Empirical Analysis).

Meanwhile, the frequent communication between manufacturing enterprises and customers, as well as the innovation network jointly constructed with other enterprises generate the knowledge spillover effect, promoting the generation and dissemination of innovative knowledge, and subsequently expediting the technological innovation effect of enterprises. As the degree of servitization of enterprises is strengthened, that the costs accrete and enterprises make a hole in resources will increase the pressure of enterprises and thereby reduce the investment available for innovation. The further deepening of the degree of servitization will affect the technological innovation effect of enterprises, having a restraining effect. As for the control variables, the r&d investment is positively correlated with the technological innovation effect. The more the r&d investment, the greater the technological innovation effect. Similarly, the profitability and debt ratio of an enterprise are also in direct proportion to the technological effect of technological innovation. The greater the profit of an enterprise, the more sufficient the capital invested in r&d, and the greater the technological innovation effect of enterprises. As for the debt ratio of an enterprise, the higher the debt ratio of an enterprise is, the more capital the enterprise holds. Just like the profit rate, the more sufficient the capital for R&D investment, the greater the technological innovation effect.

Heterogeneity testThis article empirically analyzes the impact of the degree of servitization in each area on the effect of technological innovation. The empirical results are shown in Table 4, from which it can be seen that the empirical results in the eastern region are consistent with the results of the principal regression. The degree of manufacturing servitization and its quadratic terms have passed the test, and the negative quadratic coefficient shows an inverted "U-shaped" trend. From the regression results of the central region, even though the quadratic term of servitization does not pass the test, its coefficient sign is compatible with that of the primary regression. The quadratic coefficient of the degree of servitization is insignificant because compared to that in eastern China, the degree of servitization of manufacturing enterprises in central China is lower, and enterprises have not yet been admitted to the stage of "servitization dilemma". Therefore, the inhibition influence of excessive servitization on the effect of technological innovation of enterprises has been manifest, for which it fails to pass the test. According to the results of the western region, the degree of servitization doesn't traverse the test, which lies in that the data in the west area are relatively few, and the trend is inconspicuous. Secondly, the degree of servitization of manufacturing enterprises in the western region is lower than that in the eastern and central areas. The transformation has not even begun, causing the model to fail the test. Generally, the empirical results in the central and east regions consist of the main regression results. Therefore, the practical model in this article is comparatively robust.

Empirical regression results of regional heterogeneity.

| Model (7) East | Model (8) Central Region | Model (9) West | |

|---|---|---|---|

| Ser_2 | −9.093⁎⁎⁎ (2.565) | −121.6 (80.3) | 710 (543.5) |

| Ser | 5.866⁎⁎⁎ (1.768) | 18.32* (10.95) | −61.55 (38.69) |

| RD | 0.558 (0.441) | 7.012* (3.893) | −0.3 (0.642) |

| Size | −0.205⁎⁎⁎ (0.068) | 0.416* (0.241 | 0.896⁎⁎ (0.358) |

| Profit | 0.919* (0.495) | 0.158 (1.575) | 0.472 (2.445) |

| ROA | −0.0173* (0.0104) | −0.033 (0.0457) | −0.087 (0.0645) |

| Debt | −0.00174 (0.00165) | 0.0194* (0.00999) | −0.00208 (0.0147) |

| _cons | −1.192⁎⁎ (0.535) | −7.241⁎⁎⁎ (1.966) | −9.084⁎⁎⁎ (2.989) |

| N | 672 | 98 | 56 |

| R2 | 0.047 | 0.209 | 0.202 |

Note: Values in brackets for variables are standard errors.

(In section: Empirical Analysis).

Facing the new normality of economic development, it has become a significant trend of the economic development of China and the world to actively pullulate manufacturing service industry and promote the servitization innovation of manufacturing industry. Turning to the perspectives of service-oriented manufacturing and technological innovation, this paper analyzes the technological innovation effect of service-oriented transformation of China's multinational manufacturing enterprises on the basis of existing literature researches:

- (1)

This paper analyzes the internal and external effects of the servitization transformation of manufacturing enterprises on technological innovation. Internally, manufacturing enterprises servitization reform includes input servitization and output servitization. Input servitization means that service elements are invested into manufacturing industry. Research and development, business services, information and technology services and financial services triggered the increment of knowledge capital, human capital and financial capital for manufacturing enterprises. Output service provides prerequisites for establishing the relationship between manufacturing enterprises and customers, allowing manufacturing enterprises to push for the technological innovation effect of manufacturing enterprises through the development of external relations such as the relations with customers and inter-enterprise relations.

- (2)

Transnational enterprises manufacturing accouterments in our country based on the listed companies as research samples, manufacturing service level as the core variables, this article verifies the inverted "U" relationship between the degree of service and manufacturing enterprise technological innovation effect, meaning that as the degree of enterprise servitization deepens, enterprise technological innovation effect will increase while when manufacturing enterprise service levels reaches a certain stage, the technological innovation effect of enterprises will decrease. Based on the above test results of the degree of manufacturing servitization and the effect of enterprise technological innovation, as well as the existing research results at home and abroad, the following suggestions are put forward for the transformation and upgrading of China's manufacturing industry:

This paper has validated that the service-oriented transformation of manufacturing industry can improve the technological innovation of enterprises. Studies at home and abroad have also confirmed that manufacturing servitization will be advantageous to enterprise performance and enhancing manufacturing competitiveness. Nevertheless, from the perspective of time horizon, the number of enterprises that is willing or able to implement servitization transformation strategy allows of no optimistic. The average service-oriented degree of China's enterprises manufacturing equipment is merely 2.37%. Relevant scholars point out that this strategic behavior is still not accepted by most companies due to the lack of knowledge relevant to the implementation of manufacturing enterprise servitization (Chiu et al., 2015). Therefore, it is necessary to strengthen the research on how enterprises promote servitization behavior and encourage manufacturing enterprises to carry out servitization transformation.

Traditional output services such as wholesale and retail services and transportation services can improve the output of manufacturing enterprises to a certain extent, but have little influence on the technological level of enterprises, while the input of high-end services, such as information technology services and financial services, can bring knowledge, technology and human capital to enterprises, thus enormously giving impetus to the technological innovation effect of enterprises. As a result, manufacturing enterprises should lay emphasis on improving the quality and efficiency of traditional services and dominating the cost of traditional services in the process of service-oriented transformation, on the basis of which, more attention should be paid to the input of high-quality service elements such as information technology and finance, so as to improve the technological innovation effect and technological level of enterprises.

Customer participation is a significant feature of service-oriented manufacturing transformation. The communication between customers and manufacturers will generate knowledge concerning innovation, which has a positive promoting effect on enterprise innovation. Therefore, in the process of service transformation, manufacturing enterprises should converse the concept and mode of innovation and attach greater importance to customer satisfaction. Especially, enterprises are supposed to value the communication and exchange with customers, which means regarding customers as the partners of innovation and establishing and improving the process and mechanism for customers to get involved in the production of enterprises. At the same time, pay attention to capturing the effective information furnished by customer, upgrading the information capture ability and sensitivity of relevant employees, which makes it possible that they can capture the key information of customer needs by apace and accurately, thus providing knowledge sources for the technological innovation of enterprises. Extensive external network relationships are the characteristics of manufacturing servitization. In the process of service transformation, manufacturing enterprises should pay attention to establishing cooperative relations rather than competitive relations with upstream and downstream enterprises, governments and universities. Moreover, enterprises ought to maintain the long-term and amicable friendly cooperation with partners and learn the required technology and knowledge from enterprises with technology of higher level, so as to realize complementary advantages. Confronted with uncertainties in the external environment, establishing cooperative relations with relevant enterprises makes it possible to share risks, reduce losses, and enhance the ability of enterprises to fight against risks and dynamic responses. Strengthen the communication and exchange between partners, promote the generation and dissemination of innovative knowledge, and enhance the effect of technological innovation of enterprises.

FundingThis work was supported by National Social Science Foundation of China Project [Grant Numbers: NO.18BJY105], Philosophy and Sciences Excellent Innovation Team of Jiangsu Province [Grant Numbers: No. SJSZ2020-20] and Qing Lan Project of Jiangsu Province [Grant Numbers: No. SJS2020-10].