Start-ups, as small, new companies, suffer from liabilities of size and lack of experience when entering market competition. Research has suggested that relationships with other organisations might be a solution to balance such liabilities. While several studies underline the importance of relationships between start-ups and large organisations within an Innovation ecosystem, few still analyse the relevance of coopetitive relationships among start-ups. Coopetitive relationships describe “hybrid activity” of simultaneous cooperation and competition among firms while focusing on value creation within an innovation ecosystem. Moving from a case study review, we analyse how start-ups manage the balance between cooperation and competition among peers when belonging to an innovation ecosystem. We call this peer innovation. Our findings propose a framework for evidence about innovative start-ups' primary motivations, managerial mechanisms, and peer innovation strategy practices. Implications for theory define a novel paradigm that start-ups establish to cooperate and compete at the same time while being part of an incubator.

Innovative start-ups, often characterized as young, high-tech firms with significant growth potential (Passaro et al., 2020), represent pivotal actors in shaping the future landscape of economic activity. Paradoxically, they are also among the most vulnerable actors in any economy (Walsh & Cunningham, 2016). When start-ups navigate an environment characterized by uncertainty and instability, such as economic crises or global pandemics, they need to develop relationships to react promptly and adapt their business models in response to the evolving market dynamics and emergent consumer needs (Ahn et al., 2018; Cerchione et al., 2022). The knowledge required to solve a particular problem is often located outside a firm. The costs of tapping external knowledge digital technologies are rapidly declining (Konietzko et al., 2020; Pushpananthan & Elmquist, 2022; Yaghmaie & Vanhaverbeke, 2019).

Therefore, innovation ecosystems have emerged as desirable, or even necessary organisational forms. Jackson (2011, p. 2) defines an innovation ecosystem as consisting of “complex relationships formed between actors and entities whose functional goal is to enable technology development and innovation.” Other scholars defined innovation ecosystem as all the joint value creating activities performed by an evolving network of actors integrating their products and services on a digital technology platform (Dedehayir et al., 2018; Jacobides et al., 2018; Romano et al., 2014). Since innovation ecosystems’ central focus is value creation, efforts need to be made to understand what different players can bring in terms of complementary resources and capabilities, ensuring that everyone derives benefit from being part of that ecosystem (Yaghmaie & Vanhaverbeke, 2019). These phenomena are increasingly frequent, becoming the “normal” context in which companies and start-ups compete (Cerchione et al., 2022; Passaro et al., 2020; Romano et al., 2014).

Start-ups’ resilience and adaptability in this turbulent innovation ecosystem can be linked to the collective behaviours observed in flocks of birds in flight, a concept inspired by the pioneering studies of Craig Reynolds (1987). Reynolds emphasizes, in a flock, the direction of movement results from each bird slightly adjusting its position in response to nearby birds. No bird is the leader, and no bird is a follower. Each interacts with its nearest neighbours, and the entire group responds to those interactions. Thus, cooperation and competition become fundamental mechanisms for survival, a means to reduce the predatory risk posed by bigger and more powerful actors, much as smaller birds flock together to evade predators. This delicate balance between cooperation and competition offers an important lesson for innovative start-ups, which can benefit from strategic cooperation with other start-ups, while competing for resources and market opportunities despite their vulnerability due to their youth and size (Corvello et al., 2023; Inekwe, 2019; Margherita et al., 2020). This could be a promising opportunity for applying Open Innovation (OI) strategies to analyse collaborations organised between large companies and start-ups. Over the years, they have generated different types of programs such as accelerators, incubators, contamination Labs, innovation hubs, and the venture capital model (Giglio et al., 2023; Kohler, 2016; Rippa & Secundo, 2019; Steiber & Alänge, 2020; Secundo et al., 2020, 2021). These models are continuously evolving, giving rise to emerging types of (sustainable) innovation ecosystems (Ávila-Robinson et al., 2022).

Although several studies underline the importance of relationships between start-ups and large organisations within an innovation ecosystem, few studies still analyse the relevance of the coopetitive relationships among start-ups in the Innovation ecosystem. These are considered significant since they describe simultaneous cooperation and competition among start -ups while focusing on value creation (Secundo et al., 2019). Therefore, it thus becomes relevant to understand and analyse the factors that allow start-ups to be resilient and react in situations of uncertainty and instability, collaborating while maintaining their aim to be competitive even if they are part of the same innovation ecosystem.

Framed in the above premise, our research attempts to provide an answer to the following question: RQ: What motivations, managerial mechanisms, and practices allow start-ups to cooperate and compete at the same time, following an open innovation approach within an innovation ecosystem?

Adopting a qualitative research approach, specifically in a case study design as outlined by Yin (2017)), we propose a framework to demonstrate how start-ups manage the balance between cooperation and competition when establishing relationships among peers. In an innovation ecosystem context where an Incubator acts as orchestrator of innovation, we call this peer innovation. Findings will propose a framework to demonstrate innovative start-ups’ primary motivations, managerial mechanisms, and practices of a peer innovation strategy. Implications for theory defines a novel paradigm that start-ups establish to cooperate and compete at the same time while being part of an incubator.

The remainder of the paper is structured as follows. First, it will review the literature about cooperation and collaboration with a focus on start-ups. Then, Section 3 presents the research method; Section 4 and Section 5 describe findings and the novel conceptualisation of peer innovation as a suitable approach to OI for start-ups. Finally, section 6 concludes the paper with implications for theory and practice.

BackgroundCooperation and collaboration among start-ups within innovation ecosystemsA start-up is a small business at an embryonic stage of its life cycle that foresees achievement of profits through a promising innovative capability (Scott & Bruce, 1987). Start-ups are an essential engine of economic systems’ industrial change and growth and a strategic source of job creation and technological innovation (Davidsson et al., 1994). The creation of a start-up is not a single event but a process that can take many years to occur. It can be divided into phases: birth (pre-seed and seed), early stage and growth, expansion and exit (or decline). This life cycle only results in success (Passaro et al., 2020) for few start-ups. While many start-ups do not survive beyond their first few years (globally, more than 60 % of start-ups fail in their early stages) (Mukti et al., 2019), others continue to grow, although only a few of them become the great companies of the future. In addition to having limited access to the resources needed to grow and expand (i.e. capital, physical assets, capabilities, and technology), start-ups in the early development stage lack credibility and visibility. They encounter difficulties in acquiring customers and scaling rapidly (Larkin & O'Halloran, 2018). Start-ups are inherently agile, innovative, and flexible, with the ability to change by demonstrating resilience and business agility (Margherita et al., 2020).

Scholars note that start-ups, more than other forms of organisations, by definition need to open their innovation processes to incorporate knowledge flows. These may originate from or be co-produced with external stakeholders who interact in specific social, economic, and cultural contexts (Chesbrough & Bogers, 2014; Huizingh, 2011) to develop new solutions and prototypes.

Within a competitive paradigm (Porter, 1985, 1980), companies focus on maximizing their interests and outperforming other market players at their expense (Bengtsson & Kock, 2000). Value chain activities are considered the cost drivers that can influence the firm's relative cost position, hence the potential of a competitive advantage. In the transaction cost theory, Williamson (1985) assumed that the mechanism of competition reduces transaction costs between parties. Barney (1991) explained that firms’ performance depends on their resource-base and that the accumulation of rare, valuable, non-substitutable, and hard-to imitate resources is the basis of the competitive advantage.

In the global competitive scenario, collaboration or cooperation, such as alliances, joint ventures, networks, and buyer-supplier relationships, are crucial in enhancing a company's performance (Bouncken et al., 2021). Working together can either enhance or diminish the capabilities necessary for global competitiveness (Hamel, 1991) Engaging in collaborative endeavours, such as strategic alliances with external partners, offers an opportunity to assimilate external knowledge and expertise. Khanna et al. (1998) introduced a comprehensive framework that simultaneously encompasses both competitive and cooperative behaviours exhibited by companies. Collaboration among rivals serves as a means to gain access to novel technologies and skills, share expenses and risks, and swiftly regain competitiveness with moderate effort (Hamel et al., 1989). Despite the potential benefits of collaborating with competitors, firms face the challenge of balancing the transfer of knowledge, skills and competencies derived from the relationship (Hamel et al., 1989). Disadvantages deriving from collaboration or cooperation can be ascribed to partners’ diverging or misaligned interests (Gulati et al., 2012). To reduce the opportunism of self-interest, formal and relational governance structures are proposed as remedies to control collaboration/cooperation risks.

The collaboration/cooperation strategy presents many advantages and benefits as well as disadvantages and risks. It starts from the four principles summarized by Hamel et al. (1989) (Collaboration is a competition in a different form; Harmony is not the most important measure of success; Cooperation has limits, companies must defend against competitive compromise; Learning from partners is paramount). Accordingly, Brandenburger and Nalebuff (1997) opened the door to a new concept of cooperation between competitors: the coopetition strategy.

Start-ups’ coopetition strategy for value creation within innovation ecosystemsThe coopetition strategy (Bengtsson & Kock, 2014) is an emerging strategy that simultaneously addresses cooperative and competitive elements. Coopetition can be considered a crucial pillar for start-ups’ competitive advantage (Morris et al., 2007). Furthermore, the simultaneous conditions of competition and cooperation can offer a new way of sharing ideas, integrating external capabilities, or combining complementary resources (Gast et al., 2019). The role of the social dimension of creativity is particularly relevant; it reflects the production of new ideas, approaches, or actions of a group of actors involved in the OI process through exchanging, sharing, generating, and combining knowledge (Westlund et al., 2014).

Start-ups are typically included in an innovation ecosystem where knowledge management flows among firms affect the start-up company's internal strategic decisions. The benefits of belonging to an innovation ecosystem become more evident when the market changes at an unprecedented rate and large companies respond slowly to environmental changes (Prashantham & Kumar, 2019). With complementary characteristics, start-ups are characterized by limited financial, organisational, and human resource availability (Inekwe, 2019).

One valuable aspect of the ecosystem perspective is the focus on optimisation of value created and distributed among several participants (Ritala et al., 2013). Researchers typically distinguish between value creation and value capture (Lepak et al., 2007). Value creation is linked to collaboration, sharing, and creativity, while value capture is related to competition, closeness, and control. In the innovation ecosystem, according to the OI perspective, the value firms generate is divided by pecuniary and non-pecuniary, in line with the organisation's business model (Chesbrough & Bogers, 2014). This is based on the presence or absence of financial resources (Dahlander & Gann, 2010). OI processes are instrumental in network relationships (West & Gallagher, 2006), both for the acquisition of resources (Soetanto & van Geenhuizen, 2015) and for introduction of new products in the market (Lundberg, 2013).

Independently from the value strategy, the virtuous processes of knowledge exchange and transfer occurring in an innovation ecosystem through the collaboration of different actors require integration of diverse perspectives, experiences, competencies, and technologies of internal and external partners who are motivated to contribute to the development of novel ideas, concepts, and technologies (Enkel et al., 2009).

These aspects are clearly evident when start-ups are included in a business incubator. There, the incubator's intermediation role acts as a catalyst and orchestrator of the innovation ecosystem for the incubates. An incubator's primary purpose is to support start-ups in their early stages with different strategies and managerial practices (Grimaldi & Grandi, 2005; Mian et al., 2016). Business models adopted by incubators supporting incubates’ growth are varied and may oscillate based on the incubator's focus: specialisation vs. generalisation (Mian et al., 2016). Specialist incubators may focus on start-ups in specific technological domains, while generalists are more encompassing and include a variety of technological fields.

The ecosystem perspective of OI is opposed to the firm-centric approach (Chesbrough, 2003), which has dominated the OI field (Bogers et al., 2017). An ecosystem perspective highlights the innovation process as involving cross-boundary interactions between a diverse set of actors (Bogers et al., 2017). One valuable aspect of the ecosystem perspective is the focus on optimisation of the value created and distributed among multiple participants (Ritala et al., 2013). A typical academic differentiation involves distinguishing between value generation and retention (Lepak et al., 2007). The former is associated with elements like innovation, cooperation, and sharing, while the latter pertains to control, exclusivity, and competitive behaviours. In OI ecosystems, these two different logics must be addressed and maintained over time (Chesbrough et al., 2018), even if they are challenging to manage simultaneously (Remneland Wikhamn, 2020).

Research gapThe complexity and interrelationships among these factors raise critical questions about start-ups’ opportunities when collaborating and interacting with other start-ups to share and transfer their experiences, technological and intangible assets, knowledge and expertise. Until now, many studies have investigated collaboration and cooperation strategies between small and large firms, neglecting collaboration among start-ups (Giglio et al., 2023). In addition to limited access to the resources needed to grow and expand (i.e. capital, physical assets, capabilities, technology, etc.), start-ups in early development stages lack credibility and visibility, encountering difficulties in acquiring customers and scaling rapidly (Larkin and O'Halloran, 2018). For facing these difficulties, start-ups choose to involved within an incubator of technology-intensive companies. Therefore it becomes pivotal to effectively understanding the motivations of start-ups for their participation in the incubator, how knowledge moves across the boundaries created by specialized knowledge domains characterizing each start-up (Carlile & Rebentisch, 2003) and which managerial systems behind such processes are activated to allow start-ups to cooperate and compete at the same time to create a suitable environment for innovative start-ups (Zobel, 2017). This represent the research gap behind our study.

Research methodTo understand the motivations, managerial mechanisms, and practices that allow start-ups to cooperate and compete at the same time, following an open innovation approach while belonging to an innovation ecosystem, we decided to use an exploratory methodology based on a case study design outlined by Yin (2017)). This methodology moves from the reasons behind and the methods employed by start-ups when embracing OI, making the case study an ideal choice for exploring the “how” and “why” aspects (Yin, 2017). Furthermore, case studies serve as a valuable means of empirical inquiry, allowing researchers to examine a contemporary phenomenon within its real-life context (Yin, 2017, p. 13). They offer a platform for theory building (Eisenhardt & Graebner, 2007) and enable in-depth investigations into complex subjects, offering rich and detailed insights (Miles & Huberman, 1994). While a single-case study is inherently linked to its specific context, it remains a well-established method for providing in-depth, theoretical insights into exploratory phenomena (Flyvbjerg, 2006), such as the emerging field of OI (Remneland Wikhamn & Styhre, 2023).

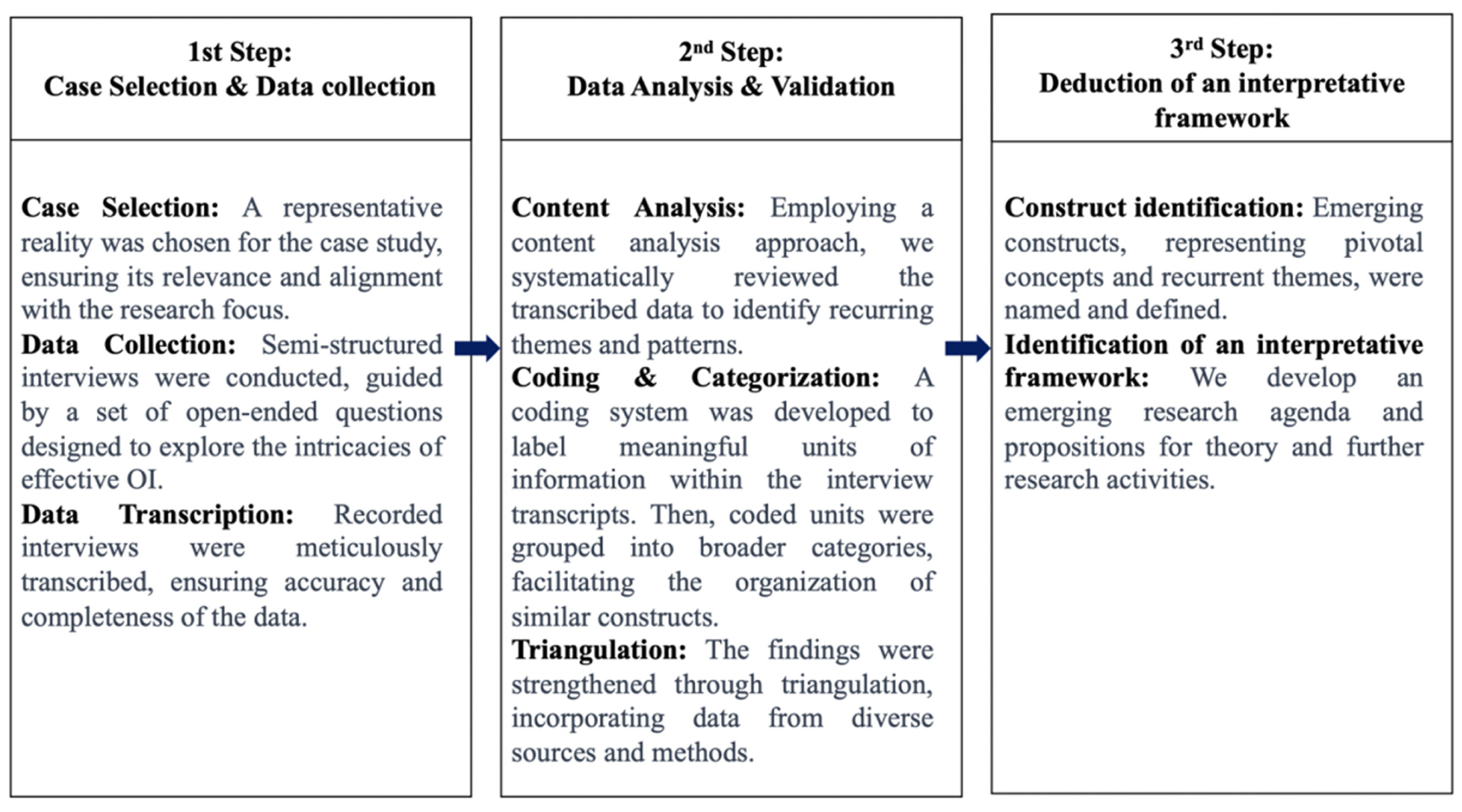

Once we defined the scope of our research based on the relevant academic literature at the intersection of OI and start-ups, we adopted a research protocol for collecting, analysing, and validating data that allowed us to deduce an interpretative theoretical framework of peer innovation. Fig. 1 provides an overview of the research steps.

Case selection & data collectionFor the case selection, we adhered to the principles outlined by Flyvbjerg (2006) regarding information-oriented selection. This method is aimed at maximizing the utility of information derived from small samples and single cases. Our case selection process aligns with critical cases where the overarching goal is to obtain information that allows for logical deductions of the type, “If this is (not) valid for this case, then it applies to all (no) cases.” (Flyvbjerg, 2006, p. 230).

In this regard, we selected the incubator “012 Factory” as a representative case study; it holds exceptional informational value due to its unique characteristics among incubators. Indeed, 012 Factory is among the 45 Italian incubators certified as innovative by the Italian Ministry of Economic Development.1 It recently announced three important facts: 1) the creation of a consortium by the incubates, 2) market stock entry, and finally 3) acquisition of the benefits deriving from the company title.

These distinctive features position 012 Factory as a critical case, where insights drawn from its operations can have broader implications and permit logical deductions applicable not only to this specific situation but potentially to all cases within the domain of start-up and OI.

The data collection process then consists of two key steps:

- •

Step 1: Interviewing Incubator Managers. In the initial step, we conducted in-depth semi-structured interviews with the managers of 012 Factory, who are the primary architects behind the consortium's formation. These interviews collectively spanned approximately two hours. All researchers engaged in the analysis participated in these interviews, and a diverse range of questions was posed. The interviews took place in a conducive and confidential setting within the premises of 012 Factory. The interview questions covered a wide array of topics, including the historical evolution of the incubator, its transformation from an entrepreneurship academy to a business incubator, the rationale behind creating the consortium, and the specific steps taken to establish it. These semi-structured interviews aimed to elicit comprehensive insights into the incubator's journey, motivations, and strategies related to formation of the consortium. After the interviews, the recorded files were meticulously transcribed. This was executed with utmost care and attention to detail to ensure the data's accuracy and completeness. Each interview was transcribed verbatim, capturing not only the spoken words but also non-verbal cues that may hold valuable insights.

- •

Step 2: Data Collection from Consortium Members. In the second step, we shifted our focus to the consortium's founding members, collecting pertinent information. To achieve this, we administered a web survey to these members. The survey aimed to gather insights about motivations and expectations that drive start-ups to become consortium members. Additionally, we sought to acquire data that would enable us to investigate the managerial mechanisms and OI practices adopted by the consortium.

The rich data collected over the four-year period required a structured data analysis process. In the pursuit of a rigorous data analysis process, we implemented a collaborative approach to coding and categorisation. Each author embarked on individual coding endeavours, generating suggested categorisations based on their interpretation of the transcribed interview data.

Subsequently, we convened for intensive discussions and deliberations, bringing together the individual coding outputs. These discussions served as a platform for refining and integrating the diverse coding perspectives into a unified categorisation framework. This collaborative effort was instrumental in harmonizing individual interpretations and ensuring the categorisation system's cohesiveness.

Through this iterative and collaborative process, we arrived at a final categorisation structure that encapsulated the essence of the recurring themes and patterns identified within the qualitative dataset.

Deduction of an interpretative frameworkIn the final phase of our research methodology, we engaged in the deductive process of constructing a novel innovation model. “Innovation models” are conceptual frameworks which provide a stylised representation of the way innovation is generated. They describe the reality ‘out there’ and act as lenses to view and interpret this reality. When they are widely shared they play a performative role (Joly et al., 2010).

To begin, we undertook the systematic task of construct identification. This process involved recognizing and naming emerging constructs within the qualitative dataset. These constructs represented pivotal concepts and recurrent themes that surfaced during the data analysis phase. Thus, building upon the identified constructs, we developed an interpretative framework where our research findings are organized and contextualized. Within this framework, we synthesized the emerging constructs into a cohesive structure, facilitating the integration of multifaceted insights.

Furthermore, we formulated an emerging research agenda as part of our contribution. This agenda delineated key areas warranting further scholarly exploration and investigation within the context of OI practices and start-up incubation. Additionally, we generated propositions for theory development, offering conjectural statements with the potential to advance theoretical understanding in the field.

FindingsThe case study: incubator “012 factory”012 Factory is among the 45 incubators recognized as “certified” by Italian law. The incubator started acting as an entrepreneurship education academy about ten years ago, devoted to inspiring and educating people to start new businesses.

The academy concept turned into a business incubator about 7 years ago, aiming to support new companies (also born thanks to the academy by offering consultancy services, facilities, and know-how). The growth of the incubator and the success obtained by the incubates prompted the managers to plan to strategically create a consortium of start-ups. The idea is founded on the incubator managers’ ability to catch an opportunity. Incubates faced a huge amount of difficulties in searching for new customers and benefitting from local and international financial opportunities. The decision to start the consortium resulted from the idea to build a new form of organisation upon this opportunity. Nine start-ups decided to accept this challenge and become founding consortium members. The consortium established an egalitarian set of rules where all the start-ups collaborate and cooperate to increase the market power. The relations between the Consortium members must be based on loyalty and correctness.

There are three different kinds of members within the consortium: level A is the founders’ partners; level B is constituted by ordinary members who can access the consortium upon admission request. Finally, level C represents the supporting members (they finance the consortium through donations). The consortium is currently composed of nine start-ups admitted into the consortium as level A members.

A central part of the consortium's regulation is customer acquisition. The customer is managed on behalf of the consortium, even if the acquisition results from a single company's effort. The customer acquired through the Consortium will be entrusted to the Consortium companies through a Project Manager appointed by the Board of Directors. They will assign a customer's project to Consortium members more suitable for the regulatory conditions concerning the project as well as for the competencies and resources needed.

The consortium acts with a wide hi-tech services portfolio, operating with a business-to-business (B2B) model serving national and international markets by providing digital transformation and digital services solutions for a wide range of companies in every sector.

Table 1 reports the identikit of the 9 start-ups involved within the 012 consortium.

General Information about the nine start-ups that participate in the consortium.

Stage = PS (Pre-seed), Seed (S), ES (Early stage), G (Growth), E (Expansion).

Position = CEO (executive), F (finance), O (operations), T (technology), M (marketing and communications), I (innovation).

In this section, based on the research questions guiding the analysis, we explore the motivations, managerial mechanisms, and practices that allow start-ups to be part of the innovation ecosystem (the consortium) while at the same time cooperating in the consortium and competing in the market.

MotivationsA typical problem that start-ups are called to solve every day is the search for the combination of knowledge in a search space (Knudsen & Srikanth, 2014). Technological domains, industry classifications or scientific fields can represent knowledge categories. Being part of a consortium helps start-ups overcome the liability of newness and scarcity of resources (typical of start-ups) and open engaging search scenarios for local knowledge in the proximity of the firm's current knowledge. Companies belonging to the same technological domain (software and IT) and industry classification (consultancy) find the right motivation to participate in the OI process in the consortium. On the other side, searching for external knowledge is a complex task to be pursued by a single start-up. Distant search entails knowledge recombination (Fleming & Sorenson, 2004) that helps companies identify disruptive innovations to achieve a competitive advantage. The consortium, on the whole, empowers each single knowledge domain of the start-ups, enriching the internal knowledge domain and opening to solutions unrelated to the firms’ current knowledge base.

As the CEO of the 012 Consortium mentioned, “We observed, after several years of professional activities supporting new businesses, how start-uppers declared difficulties with entering a new market with new products, .” From the start-up side, the main problem is that they “do not have much power to negotiate. We need a wider portfolio of products to be competitive.” After that, incubator managers observed how every single start-up owned a little piece of knowledge and competencies that together could have opened new market opportunities.” One start-upper declared, “There were a lot of hurdles in finding new clients. Talking with other incubates at that time, we discovered that some clients were searching for IT solutions we were able to solve. We observed how we could acquire new clients by searching in the internal domain of clients already acquired by start-ups operating in the same physical domain of 012 Factory.”

Based on the interviews analysed by the authors, we deduced a set of reasons that led the companies to participate in establishment of the consortium:

- •

Market expansion: in a coopetition strategy, start-ups can enter new markets or expand their customer base more quickly and efficiently. Collaborating with other start-ups who have presence or expertise in a specific market can be a strategic advantage.

- •

Visibility: Collaborative efforts can increase the visibility of all participating start-ups. Joint marketing campaigns, partnerships, and shared events can draw more attention from customers, investors, and the media.

- •

Economy of scale: Combining forces with other start-ups can lead to economies of scale, reducing the per-unit costs of production or operation. This can make products or services more affordable and competitive in the market.

- •

Access to complementary expertise: Start-ups may not have all the necessary expertise in-house. Partnering with other start-ups can provide access to complementary skills, knowledge, and experience. This can lead to the developing more innovative and competitive products or services.

- •

Risk mitigation: Start-ups face high levels of uncertainty and risk. By cooperating with other start-ups, they can spread and share risks associated with research and development, market entry, or new product launches. This shared risk can make it easier to weather challenges and setbacks.

- •

Access to funding: Investors may be more willing to support start-ups engaged in coopetition because they see the potential for synergy and market advantage. Coopetition can also facilitate access to larger funding opportunities for joint projects.

A mechanism adopted in the consortium is oriented to balance the local-distance search space of knowledge. When searching for the local domain, a specific technology need is satisfied. However, going distant through boundary spanning helps to identify new ways to solve problems (Rosenkopf & Nerkar, 2001). The boundary spanning mechanism enables information processing, interpretation and translation of knowledge, and negotiation of common meanings among heterogeneous parties. In this consortium, unlike situations where innovation intermediaries such as Innocentive (www.innocentive.com) act as catalysers of boundary spanning processes, start-ups go outbound as a unique organisation, sharing knowledge and technologies for external technological solutions and new market opportunities. As the consortium members mentioned, the main reason to enter the consortium is for “collaborative purposes.” Analysing the documents and the acts of the consortium, and also the transcript of the interviews with the incubators’ managers, we can derive the following managerial mechanisms of the consortium typical of an innovation ecosystem:

- •

Strategical alliances: Start-ups can create formal partnerships where they outline specific objectives, roles, and responsibilities, often with the intent of jointly entering new markets or offering integrated solutions.

- •

Intellectual property and legal agreement: Start-ups can license each other's intellectual property, patents, or proprietary technologies to enhance their offerings or reduce development time. Establishing legal agreements and contracts that outline the terms of coopetition, including dispute resolution mechanisms, can help start-ups avoid misunderstandings and conflicts.

- •

Knowledge sharing: Creating mechanisms for sharing knowledge, best practices, and industry insights can help start-ups learn from each other and innovate more effectively.

A coopetition strategy involves collaborating with start-ups or small companies to foster innovation, share knowledge, and develop new products or services jointly. This approach can lead to faster innovation cycles and reduced costs. The main reason behind the consortium's creation lies in the difficulties young enterprises encounter when entering the market and searching for new technological opportunities.

As the Consortium CEO states, “the start-ups decide to be part of the consortium to share their knowledge and intangible assets with their peers, to identify complementary areas of collaboration. In some cases, they feel like competitors with references to the external market, while within the consortium, they can share the knowledge assets and operate in strict collaboration.”

In the case study analysis, practices that start-ups employed to promote peer innovation were:

- •

Joint market initiatives: Start-ups in the same industry or related niches can collaborate in marketing campaigns, co-host webinars, or run joint social media promotions. This can help start-ups reach a wider audience and share the costs associated with marketing efforts.

- •

Co-design, Co-development, Co-funding: Start-ups can pool their resources and expertise to co-develop products or solutions that benefit both parties. This can be particularly useful when tackling complex challenges that require diverse skill sets. Start-ups can co-fund initiatives, such as industry conferences or research projects. They can also jointly approach investors or venture capitalists to secure funding for mutual projects.

- •

Data sharing: Start-ups can exchange non-sensitive data to improve their products or services. For instance, sharing anonymized user data can help both parties gain insights into customer behaviour and preferences.

- •

Cross promotion: Start-ups can promote each other's products or services to their customer bases. This cross-promotion can introduce each start-up to a new set of potential customers.

The case study revealed several triggers that instigated the emergence of novel strategy of Open innovation involving start-ups when part of an innovation ecosystem led by a keystone organisation such as an Incubator: the first trigger is related to start-ups’ motivations to take part in an innovation ecosystem; the second refers to the managerial and organisational mechanism coordinating all the actors while competing and cooperating at the same time; the third factor is focused on the practices that create a novel form of coopetition strategy within the ecosystem. These triggers are discussed in the next sections.

Motivations for open innovation among start-upsThe first was the need for resources and competence that motivated the firm to engage in several alliances. By leveraging the coopetition strategy, the Consortium of start-ups plans to implement a significant shift in its value creation and culture through creation of an Open Innovation platform working as a hub and acting as a bridge between the company and the external environment. This approach reinforces the Jacobides et al. (2018, p. 2264) definition according to which “an ecosystem comprises a set of actors with varying degrees of multilateral, non-generic complementarities that are not fully hierarchically controlled.” Start-ups’ motivations to be part of the Consortium led by the 012 Factory Incubator are based on the following principles: a) To be effective as a consortium of start-ups, a central actor will engage all the start-ups as the Incubator. Its participation is in addition to their existing workload, so the platform must be compelling and rewarding. b) To maximize effectiveness, the peer innovation strategy must be easily customisable to conform to start-ups processes with the established systems of review and communication. c) Beyond generation of ideas, a key component of innovation success for each start-up is the right balance between the simultaneous competition and collaboration strategy.

We found this principle in line with the literature in which an innovation ecosystem enables the actors to access resources and complementary assets. These are beyond the scope and capabilities of a single firm (Adner & Kapoor, 2010; Gawer & Cusumano, 2014; Iansiti & Levien, 2004).

Managerial mechanisms for open innovation among start-upsFindings reveal that the Incubator 012 factory adopts specific organisational mechanisms to guarantee the presence of start-ups that could be competitors and collaborators simultaneously to improve their performance, thus overcoming difficulties generated by the lack of resources. The selective promotion of actors and definition of specific roles and procedures for the start-ups highlights the Incubator 012 Factory’s position as the keystone and orchestrator in the emerging innovation ecosystem. We therefore conclude that Incubator 012 Factory’s ability to orchestrate the network of actors is indicative of an emerging innovation ecosystem. This is coherent with the ecosystem literature that acknowledges the importance of a keystone firm to coordinate activities and ensure the ecosystem's overall health (Iansiti & Levien, 2004; Jacobides et al., 2018). The presence of the 012 Factory Incubator also highlights the importance of certain actors for the overall ecosystem, and the need (for a keystone firm) to promote these key actors (Rietveld & Eggers, 2018; Rietveld et al., 2019). Clarysse et al. (2014, p. 1166) suggest that the “keystone firms create platforms such as services, tools, or technologies, which are open for other players in an ecosystem to enhance their own performance.” Moreover, a keystone firm is responsible for the ecosystem's overall ‘health’ and ensures that value is shared amongst the ecosystem participants (Adner, 2017; Clarysse et al., 2014; Corvello et al., 2023; Iansiti & Levien, 2004; Jacobides et al., 2018; Williamson & De Meyer, 2012). Finally, the Incubator's role confirms that in an innovation ecosystem, the entry and exit of actors is coordinated by a keystone organisation, which decides what actors can enter the network (Pushpananthan & Elmquist, 2022) to sustain the value creation process.

Practices for open innovation among start-upsPromoting the Consortium activities as led by the 012 Factory incubator was vital for the start-ups belonging to the ecosystems, thanks to the collaborative value creation processes that allowed a competitive advantage. This is in line with previous work on ecosystems.

Findings revealed that in this ecosystem, Internet-based platforms could also serve as intermediaries or network orchestrators linking start-uppers among them or connecting start-ups with potential funders. Peer Innovation, unlike open innovation, primarily relies on the “wisdom of the crowd.” In some cases the competition strategy arises, while in other situations, cooperation strategy happens in screening new start-ups offering complementary capabilities, technologies, and IP. New ventures and start-ups face difficulties exploiting in-house capabilities in an effective and efficient way to create revenue streams and manage cost structures. They face the same difficulties when exploring new innovations to overcome the exponential development of new technology and the short life cycle of many technology products and services (Hughes et al., 2020; Rippa et al., 2019; Secundo et al., 2019). The peer innovation approach can help start-ups overcome the difficulties of acting with an innovation ambidexterity strategy (Voss et al., 2008; Voss & Voss, 2013), defined as the high-quality, simultaneous balance of exploration and exploitation activities.

Defining the peer innovation strategy for coopetition strategy among start-upsThe Ecosystem Effectuation model (Radziwon et al., 2022) affirms that the ecosystem orchestrator identifies the best next step by assessing the available resources that could help to achieve the ecosystem's goal. Hence, we refer to this strategy as a peer innovation approach requiring specific strategic decisions that a neutral organisation, the incubator, should orchestrate and coordinate. Adopting this approach requires specific action by the orchestrator. All the motivations, managerial mechanisms and practices revealed during the case study lead to deducing a novel open innovation strategy that we named peer innovation. It is interpreted as a relevant strategy aimed at improving the coopetition and collaboration of the start-ups belonging to an innovation ecosystem to overcome complex business dynamics, high uncertainty, aggressive market competition, lack of funds and needs for complementary resources. Peer innovation describes the strategy of the start-ups that are in the simultaneous condition of competition and cooperation when belonging to an innovation ecosystem where an incubator acts as catalyst, offering novel way of sharing ideas, integrating external capabilities, or combining complementary resources. Start-uppers use peer innovations individually, or in combination, to exploit opportunities they identify but for which traditional resources and technologies are not readily available. This is especially true due to the continuous compression of the technology life cycle (Phillips et al., 1999) and to the increasing costs to develop complementary products and services requiring a single start-up to develop these complementarities.

A summary overview of the concept of peer innovation is depicted in Fig. 2.

Peer innovation can be an opportunity that allows start-ups to acquire new necessary knowledge to speed up the innovation process. The incubator adopts the mechanisms to share each start-up's knowledge and competencies in the whole innovation ecosystem. The knowledge is transferred smoothly from one start-up to another, allowing the consortium to collaborate faster and more efficiently. Intangible assets such as competencies, trademarks, and IP Intellectual Property are shared to support each firm's innovation process, providing a suitable ecosystem for the start-ups to prosper. In this way, the OI mechanisms developed within the Innovative ecosystem are based on support and collaboration among peers that receive a number of relevant services to increase the innovation practices. Furthermore, some scholars state that the emergence of an ecosystem can take place in multiple ways (Romano et al., 2014; Thomas et al., 2014). This is in line with the traditional literature model related to the emergence phases of an innovation ecosystem. According to Dedehayir et al. (2018), it may involve activities related to acquiring resources, developing a technology, implementing rules of engagement and framing regulations. Extant literature somewhat explains the conditions (such as a new technology, changes in regulations or shifting customer behaviours) that prevail during the pre-formation phases of innovation ecosystems.

CONCLUSION and implicationsHow start-ups approach collaboration strategies and OI approaches in innovation ecosystem is still an open question (Spender et al., 2017). Several academic studies have proposed partnerships between large companies and start-ups as a means to mitigate the dilemmas of both parties (Giglio et al., 2023; Kurpjuweit & Wagner, 2020; Prashantham & Kumar, 2019; Weiblen & Chesbrough, 2015). For the same reason, start-ups face the risk of misappropriation of innovation results, requiring adoption of effective knowledge protection mechanisms (Fierro & Pérez, 2018). In this paper, we propose peer innovation as an open innovation approach to realize a coopetitive strategy while start-ups take part in an innovation ecosystem. A peer innovation approach can be activated by start-ups under certain conditions of simultaneous competition and collaboration within an innovation ecosystem to improve their performance in terms of competitive advantage.

Implications for theory and practicesFirstly, this study contributes to the literature about OI for start-ups, developing a novel approach called peer innovation interpreted as a relevant strategy aimed at improving the coopetition and collaboration of start-ups belonging to an innovation ecosystem. This enables them to overcome complex business dynamics, high uncertainty, aggressive market competition, lack of funds and needs for complementary resources. Here, the concept of peer innovation pertains to the approach adopted by start-ups that are involved in simultaneously competitive and cooperative engagements. These start-ups operate within an innovation ecosystem that facilitates the sharing of novel ideas, integrates external capabilities, and combines complementary resources with an incubator that acts as a catalyst.

Secondly, this study contributes to the literature about the evolving phase of an innovation ecosystem where peer innovation processes happen among start-ups. This is based on the idea that integrating internal and external sources of knowledge creates a combination of activities that allow start-ups in an incubator to collaborate and compete simultaneously while maintaining their uniqueness and innovation capabilities. The joint introduction of internal and external sources of knowledge forms synergistic and complex interrelationships that are challenging to imitate. They thus contribute to improving a firm's competitive advantage, recognized in the resource base view, producing an inimitable system that improves itself, and creating a unique configuration that sustains and develops start-ups’ innovation capabilities (Peteraf et al., 2013; Stieglitz & Heine, 2007).

Thirdly, this study provides insights for policymakers. To best capture innovation in start-ups, policymakers need to be aware of the differing types of innovators among start-ups; heterogeneity is a crucial aspect. All the start-ups belonging to an incubator have the final aim to become more innovative in their industries. The critical point is how start-ups innovate differently, developing distinct internal and external activities. One-size-fits-all policies for stimulating start-up innovation do not consider the distinct array of innovation typologies and the associated collaboration activities. Product and process innovation, separately, require different knowledge assets, knowledge sharing, tools and initiatives for each innovation strategy. Overall, the specific activities, both internal and external, that each start-up can successfully implement are of great importance for policymakers. Product-oriented innovators that carry out R&D and rely on knowledge from markets can be stimulated with R&D voucher funds to create an R&D activity for market intelligence, whereas equipment renewal may be useless. On the contrary, process-oriented innovators basically require equipment renewal to access embodied knowledge, while scientific-based incentives for R&D or access to scientific sources are useless due to their low internal capabilities to innovate.

Fourthly, for scholars, the study of OI requires a more complete understanding of the complex taxonomy of start-ups belonging to an incubator heterogeneity, introducing innovation typologies. Thus, studying start-ups requires considering complex interrelationships among internal sources, as well as external ones and technological innovation types. The start-up innovation map from our results may provide a better orientation to pursue research questions more comprehensively, avoiding fragmentation and generalisation of biased empirical designs. Put differently, start-ups studied as SMEs should not be conceptualized or approached using a one-size-fits-all perspective, but recognizing their heterogeneity, as recent studies have just started to do (De Marco et al., 2020; Leckel et al., 2020).

Limitations and future research. This paper is not without its limitations. First of all, the sample is limited to Italy and to a small sample of start-ups incubated within an Incubator. For future studies, a more in-depth analysis of the differing types of innovation strategies in Italy should be conducted by explicitly comparing more countries within Europe, thus evaluating the generalisation of this study's results.

This research has been financed within the framework of the PRIN – PNRR 2022 Project INSPIRE: Digital INnovation EcoSystem DeveloPment for the CIRcular Economy: the startups' perspective, Project's CODE E53D23016450001. SH1_9 Industrial organisation; entrepreneurship; R&D and innovation.

The concept of certified incubator was introduced by Article 25, paragraph 5 of Law Decree 179/2012 and is defined in detail by the Ministerial Decree of December 22, 2016. Companies meeting the requirements can access certified incubator status through self-certification by the legal representative and enjoy the related benefits by registering in the dedicated special section of the Business Register at the Chambers of Commerce throughout the national territory.