This study investigates the moderating influence of R&D intensity on the relationships between family management and firm performance in private firms. The results confirm that R&D intensity reinforces the negative effect of family management on firm performance. More specifically, we obtain that R&D intensity is a statistically significant moderator for those firms having large levels of R&D investment relative to one's industry peers. Likewise, we find that only when taking into account the total effect of R&D, including internal and external R&D, does its interaction with family management has a detrimental effect on firm performance.

In a complex world, firms are more and more driven to identify and exploit their specific resources and competencies to obtain an improved performance (Habbershon et al., 2003). Particularly, management capabilities have been confirmed to have influence on innovation performance in technology-based firms (Ruiz-Jiménez and Fuentes-Fuentes, 2016), boosting these firms’ growth and success (Barbero et al., 2011).

In that sense, family firms must decide whether nonfamily members are hired to occupy top positions in the firm management. Given that family management is considered as a unique resource (Habbershon and Williams, 1999) and it is an expression of the family ability to influence performance (De Massis et al., 2014), many researchers have analyzed the relationship between the involvement of family members in the firm management and performance. Family business literature has confirmed that this topic has been particularly popular and controversial (Basco, 2013; Mazzi, 2011) and in attempting to reconcile conflicting conclusions some relevant meta-analyses of performance of the family firm have been conducted (O’Boyle et al., 2012; Wagner et al., 2015). We define family management as the active involvement of the controlling family in firm management for all firms that are family owned. Thus, we define a family-managed firm as one in which one or more members of the owner-family occupy managerial positions. This definition allows us to capture the family's influence and involvement in the management of the firm (Fernández and Nieto, 2005).

Existing research on the influence of family management on firm performance have mainly been focused on public firms. Likewise, the scarce previous literature addressing the influence of family management on firm performance in private firms has obtained mixed findings. Some authors could not confirm significant differences between family and not family-managed firms (Westhead and Howorth, 2006; Blanco-Mazagatos et al., 2007), whereas Sciascia and Mazzola (2008) showed an inferior performance of family-managed firms. More recently, Sciascia et al. (2014) and Gallucci et al. (2015) have found that the presence of family members in the management enhances firm performance. Consequently we argue that the question of whether private family-managed firms differ from other firms in their performance, remains unsolved. Our intention is to contribute to this academic discussion in the present manuscript.

Family firm literature is tackling how distinct family firms differ regarding their strategic choices and firm performance (Miller et al., 2011; Schulze et al., 2003a). But, in comparison to the copious empirical literature on public firms, the research on private family businesses is substantially less abundant and lacks findings regarding the strategic and economic repercussions of family members holding firm management (Carney et al., 2015).

A significant gap persists in our understanding of how strategic decision-making moderates the interplay between family management and firm performance. As we have indicated previously, a limited number of studies have analyzed the influence of family management on firm performance in private firms. Moreover, some studies have addressed the relationships between family management and a crucial strategic decision, namely R&D intensity (Duran et al., 2016; Nieto et al., 2015). However, to the best of our knowledge, no studies have empirically investigated the moderating role that R&D strategy exerts on the family management–firm performance relationship. Hence, we respond to the call for further research on the family firms’ innovative behaviour considering their heterogeneity in terms of management. Drawing on Oslo Manual (OECD, 2005, p. 92), R&D “comprises creative work undertaken on a systematic basis in order to increase the stock of knowledge, including knowledge of man, culture and society, and the use of this stock of knowledge to devise new applications”.

We aim to cover the abovementioned gap in literature. Prior research has confirmed that R&D investments are crucial for innovation since they improve firm ability to make the most of existing information (Block, 2010), leading to long-term benefits by facilitating strategic adjustment in very dynamic markets (García-Manjón and Romero-Merino, 2012) and firm's viability (David et al., 2001). However, we argue that R&D investments may have a moderating effect rather than a direct effect on the relationship between family management and firm performance. In that sense, we discuss, mainly from the agency and socioemotional wealth point of view, that this type of investments may improve/worsen the family management influence on firm performance. R&D expenses, being consistent with long-term perspective (Miller and Le Breton-Miller, 2005b, 2006), may contribute to align economic and non-economic goals and enhance stakeholders’ relationships with the firm (Anderson and Reeb, 2003), enhancing firm performance. However, these types of investment may also clarify and show the lack of merit, expertise or talent in family-managed businesses (Lubatkin et al., 2005) or further complicate existing complex conflicts among family managers (Dyer, 2006), damaging firm performance.

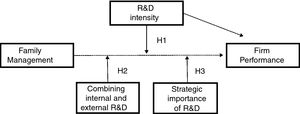

Therefore, our research examines the following research question. Is the family management-firm performance relationship moderated by R&D intensity? Likewise, a further in-depth analysis is implemented regarding the moderating role of R&D intensity, exploring the effect of factors such as the innovative behaviour–internal vs. external R&D – and the strategic importance of R&D – below/above the industry median value of R&D effort – on that moderating role. In this sense, we consider internal R&D as “the creative work undertaken on a systematic basis within the enterprise in order to increase the stock of knowledge and use it to devise new applications”, while external R&D are the “same activities as intramural R&D, but purchased from public or private research organizations or from other enterprises” (OECD, 2005, p. 97). The strategic importance of innovation to the firm is measured using the R&D intensity of the firm relative to others in its industry (O’Brien, 2003).

To shed light on this topic and answer in depth the above question, the analysis is empirically examined using a panel data sample of 510 Spanish private manufacturing firms from 2000 to 2012. To test the hypotheses developed in this article, we obtain data from the Survey on Business Strategies.

The results of this study have several theoretical contributions. Firstly, the study goes beyond the conceptual frame analysing the direct family involvement effect on firm performance (e.g. Bammens et al., 2011). By introducing R&D intensity as a moderator of this relationship, we analyze how family management interacts with a specific firm strategy, namely R&D investment, in influencing firm performance, helping to untangle the contradictory findings of research on the direct effect of family management on firm performance. Secondly, this article shows that the negative impact of family management on firm performance is reinforced when R&D increases. Particularly, our findings emphasize that the effect of family management on firm performance differs depending on whether a business invests in R&D below or above the industry median. Thirdly, this paper offers a further in-depth theoretical analysis of the moderating role of R&D intensity, highlighting that only when considering the total effect of R&D, combining internal and external R&D, does it significantly contribute to reinforce the negative effect of family management on firm performance. Fourthly, by focusing on private firms, a very common organizational form among family firms (Astrachan and Shanker, 2003) where managerial discretion of family management is often higher than in publicly traded firms, we extend and contribute to research that focuses on family management-firm performance relationships.

This article presents the following structure: first, the relevant literature is outlined and hypotheses are formulated; the research methods follow and thereafter results are disclosed; finally, the paper comes to an end with the discussion and conclusions.

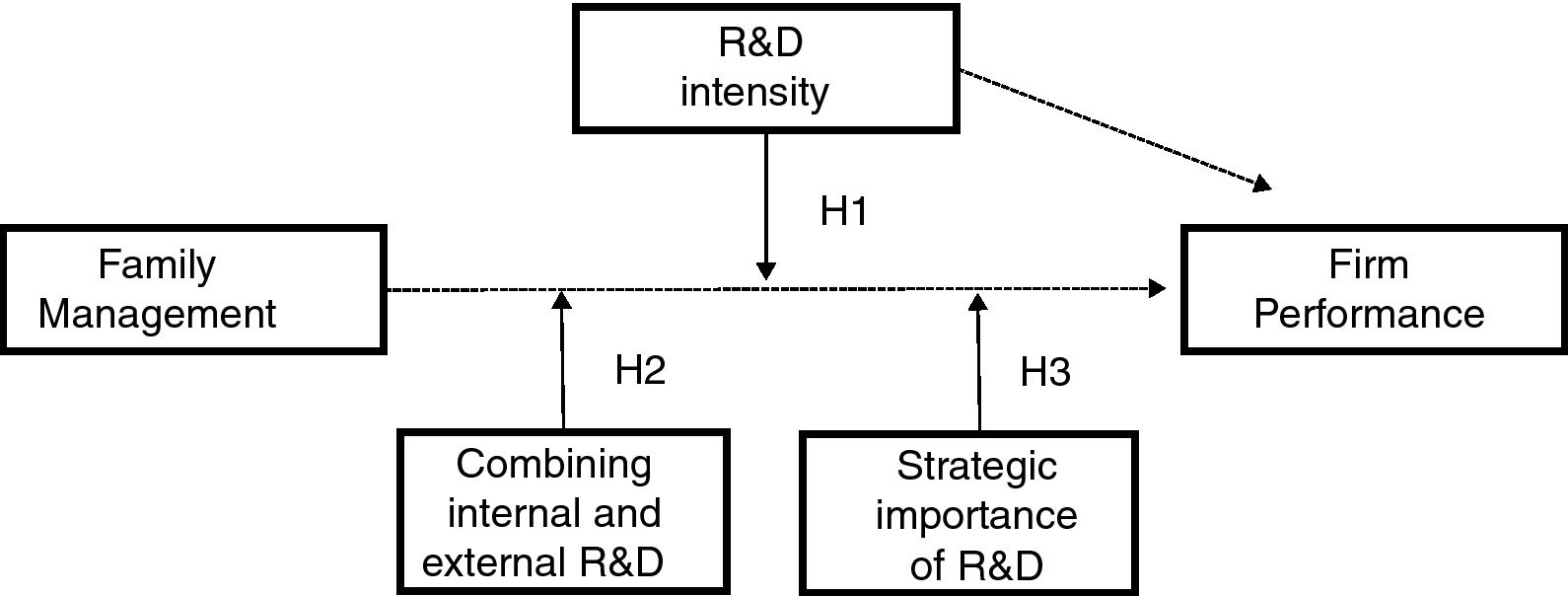

Review of literature and hypothesesThe moderating influence of R&D intensity (Fig. 1)Since the direct incidence of family management on firm performance in private firms is complex and casualty is not evident, in this manuscript, we argue that R&D intensity may be a moderating element of the former relationship.

Prior research reveals that R&D investment is a fundamental influence on competitiveness and national development (Conner, 1991; Tidd et al., 2001) and may result in superior performance and growth (Amit and Zott, 2001; Deng et al., 1999; Lee et al., 2000; Sirmon and Hitt, 2003; Zahra et al., 2000a). Hence, research shows that R&D spending has a favourable and significant impact on the growth of firm's productivity (Wakelin, 2001) and long-term performance (Ettlie, 1998; Hitt et al., 1997).

Family management is usually associated with long-term perspective and some authors argued that family managers make quintessentially farsighted investments, such as those in R&D, in order to increase firm performance over their foreseeable long career (Miller and Le Breton-Miller, 2006). A higher commitment of resources in R&D may help family managers to improve the ultimate health of the business (Laverty, 1996), enhancing competitiveness and sustainable performance (Block et al., 2013).

Stakeholders, who are usually fully aware of the family-managed firm determination for R&D, may be likely to maintain and enhance their relationships with the firm (Anderson and Reeb, 2003), which in turn may increase firm performance. Furthermore, as family-managed firms may excel in developing social capital (Schulze and Gedajlovic, 2010), they may dispose of their higher R&D to increase their already strong inter-organizational networks (Le Breton Miller and Miller, 2006). Particularly, greater technological acquisitions may better support family-managed firms’ relationships with external partners to keep ahead of competency and market, improving firm performance (Miller et al., 2009).

Moreover, investing in R&D is consistent with the long-term perspective of family-managed firms, concerned about the preservation and development of its unique and particular competitive advantages. Thus, R&D collaborates to maintain and stimulate the business for the benefit of following generations (Chrisman and Patel, 2012). As a consequence, R&D may also be considered as a source of SEW, that might contribute to align non-economic and economic goals in family managed-firms, increasing the involvement and commitment of family managers and consequently firm performance.

Yet, R&D is a priori uncertain, from a technical and commercial point of view (Kline and Rosenberg, 1986). Furthermore, R&D usually requires increasing debt level or increasing equity, given that internal financing is insufficient (Piga and Vivarelli, 2004). The entrance of this new financing may lead to family members renouncing control in favour of external capital (Mishra and McConaughy, 1999). Both, the inherent uncertainty and the probable loss of control associated to this line of expense may endanger the SEW of the family firm (Duran et al., 2016; Gómez-Mejía et al., 2007). Moreover, failed R&D attempts may damage family reputation and investments in R&D are sunk costs that have a longer payoff horizon and imply substantial risk that might result in firm failure (Chrisman and Patel, 2012). As R&D increases, the likelihood of firm failure will be higher and there will be a misalignment between economic and non-economic goals for family managers (Habbershon and Williams, 1999; Hay and Morris, 1984), which may weaken firm performance.

Likewise, family managers may have competing goals and values (Dyer, 2006) and, therefore, different opinions regarding the appropriate level of R&D and its consequences on SEW. Decisions concerning R&D may augment the likelihood of turning the family firm into a battlefield where family managers may come into conflict with one another. Therefore, higher expenses in R&D may further increase difficulties and complexities to the family business conflicts (Sorenson, 1999). Greater levels of R&D might escalate emotional family issues and conflict (Kellermanns and Eddleston, 2004), reduce nonfamily managers’ discretion and freedom to act (Zahra, 2005) and to influence on strategy (Block et al., 2013), making R&D investments fruitless and finally harming firm performance.

Family-managed firms have to deal with agency problems such as self-control problems, nepotism, shirking, and free riding (Schulze et al., 2001), which may result in contracting unskilled relatives for management posts (Lubatkin et al., 2005) and in generating a decrease in firm performance (Chrisman et al., 2004; Schulze et al., 2001, 2003a). However, the expertise and skills of individuals and the training of critical human resources are essential for developing and managing R&D (Carrasco Hernández et al., 2014; Helble and Chong, 2004). Therefore, the inefficiencies of family-managed firms may be more evident as R&D grows, being detrimental to firm performance. Hiring nonfamily managers and non-family skilled workers with the required technical education and experience may be necessary to solve this problem (Daellenbach et al., 1999; Sirmon and Hitt, 2003; Smith and Warner, 1979). But, hiring non-family managers would imply conceding control to external managers over the firm decision-making and contracting only non-family employees may produce new family conflicts, which may also harm firm performance.

In short, family-managed firms may face a dilemma. More R&D might improve firm-managed social capital, the commitment of family managers and the likelihood of firm sustainability and survival through future generations, increasing business performance. Yet, family manager's ability to generate firm performance may diminish due to the misalignment between economic and non-economic goals, the intensification of complex conflicts and the lack of expertise to deal with the complex process linked to R&D. Thus the extent to which R&D influences on the family management-firm performance relationship depends on the balance between two competing forces. Hence we postulate a non-directional hypothesis as follows:Hypothesis 1 For private firms, the family management-firm performance relation is moderated by R&D intensity.

Firms can carry out both internal R&D and external R&D to augment their incomes (Christensen et al., 2004). Yet, the simultaneous utilization of external and internal R&D may generate the objection of internal R&D to use external R&D, because of the – ‘not invented here’ syndrome – (Veugelers and Cassiman, 1999). In this sense, the combination of internal and external R&D may harm a family-managed firm’ integrative capabilities to utilize and build upon the acquired knowledge (Weigelt, 2009) and may ease leakages of valuable technology and knowhow (Kessler et al., 2000). Furthermore, combining both types of R&D usually require high levels of managerial diligence and attention (Ocasio, 1997), which is often lacking in family managed firms (Schulze et al., 2003b). Consequently, this strategic option can undermine the capacity of family management to enhance firm performance.

However, external R&D may supply the firm with resources that are not available internally (Weigelt, 2009) and internal R&D may become more important when they cooperate with external R&D (DeSarbo et al., 2005), improving the unique systemic conditions of family-managed firms (Habbershon and Williams, 1999) and enhancing their large number of unique resources and capabilities (Chua et al., 1999). Hence, complementing internal with external R&D may contribute to improve the ability of family management to better firm performance.

As the impact of this specific innovative behaviour depends on the balance between two competitive forces, we again form a non-directional hypothesis:Hypothesis 2 For private firms, the family management-firm performance relation is moderated by the innovative behaviour consistent on combining both internal and external R&D.

The strategic relevance of innovation to the business will show itself not in absolute R&D intensity of the firm, but rather in the R&D relative to others in the same sector. Thus, when a firm has a large R&D intensity relative to one's industry competitors, then the business is making an effort for being an innovator (O’Brien, 2003). In this vein, we argue in this section that the relationship between family management and firm performance might be contingent upon the firm's innovation strategy.

If a family managed firm is competing on the basis of innovation, it may confront a dilemma. Investing in R&D above industry competitors may make family-managed firms to exploit even more their significant expert knowledge and social capital within and outside the organizational community (Miller et al., 2009), becoming more competitive and overperforming (Aghion and Howitt, 1992). Therefore, we may predict that there will be positive performance implications for family-managed firms that are trying to be innovative.

Nevertheless, a strong innovation strategy requires a dedicated and motivated workforce (Lee and Miller, 1999) including highly educated scientists and technicians with know-how in relevant areas (Pike et al., 2005). In this vein, most related research suggest that family-managed firms have a limited pool of human capital (Dyer, 2006; Llach and Nordqvist, 2010) and bear specific agency costs that increase conflicts and decrease the quality of the labour pool which serves them (Schulze et al., 2001). Therefore, we may also predict a negative interaction between the importance of innovation to the firm's strategy and family management with regard to their impact on firm performance. As a consequence, and finally, we formulate the following third hypothesis:Hypothesis 3 The relationship between family management and firm performance depends on the importance of R&D to firm's strategy.

The study sample includes Spanish manufacturing firms whose data is found in the Survey on Business Strategies (ESEE). We selected ESEE database because this paper is particularly interested in analysing private manufacturing firms. Particularly, this type of firm has more innovative activities due to their products suffering a high degree of obsolescence (Kotlar et al., 2014). This dataset is an annual survey published by the Ministry of Industry of the Spanish Government. According to the arguments of Dorling and Simpson (1999), considering the data originates from a public agency, guarantees the quality of the information (high level of participation, high response rate and representation of the population). Additionally, the procedure followed by the ESEE database to obtain data and the validation of the information collected, ensures the quality of this survey. We first collected the information from the ESEE database, which includes a sample of 5304 firms (in the survey of 2012). This specific sample only included information of the ESEE database until 2012 because we used some variables throughout the course of the research process that only are collected every four years. The ESEE database only has complete data for an average of 1800 firms per year, due to the fact that some firms disappear, because they go bankrupt or for other reasons, and other firms enter the survey in order to maintain the representativeness of the sample regarding the population. The survey question regarding whether the firm is publicly listed allowed us to identify private firms. We then eliminate those firms with missing data, and take accounting and innovation data from the other 510 private firms over a thirteen-year period, resulting in a final sample of 6630 observations (510 firm×13 years –2000/2012–). In order to assure the representativeness of the sample, we calculate the maximum error for a finite population. The maximum error is small (e=4.13%), this is why we can assert that the final sample represents the population under study.

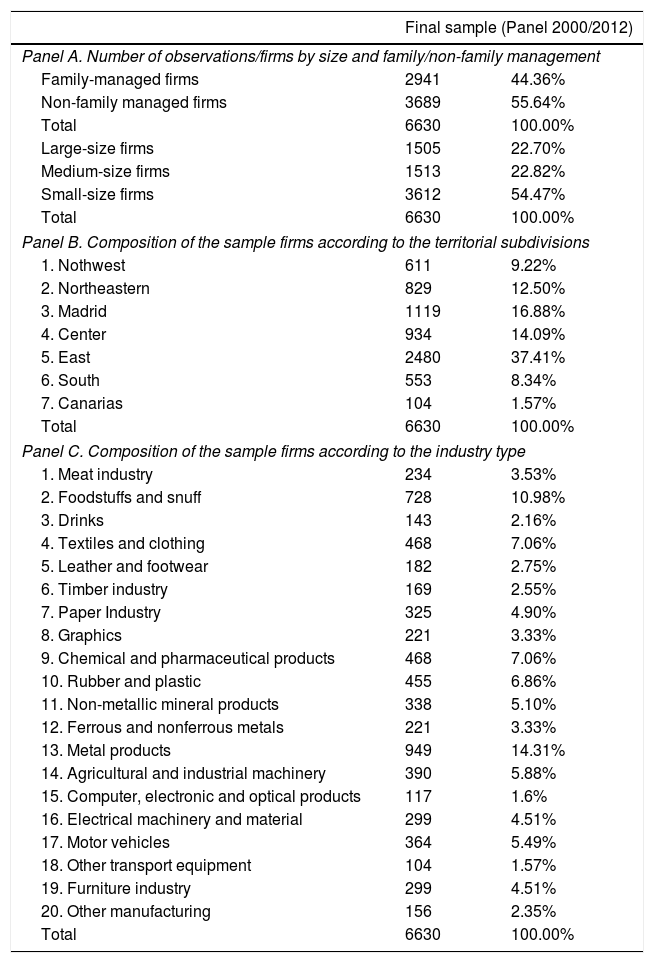

Regarding the characteristics of the sample, slightly more than 44% are family-managed firms. Table 1 shows details of size, territorial localization and industry breakdown for the firms in our final sample. In summary, firms of different sizes (large, medium or small) and territorial localization are represented in the sample. More than 50% are small-size firms and more than 35% are firms located geographically in the east of Spain. Regarding industries, most of the sample firms develop activities in metal products (14.31%) and foodstuffs and snuff industry (10.98%).

Distribution of firms on the sample by size and family/non-family management.

| Final sample (Panel 2000/2012) | ||

|---|---|---|

| Panel A. Number of observations/firms by size and family/non-family management | ||

| Family-managed firms | 2941 | 44.36% |

| Non-family managed firms | 3689 | 55.64% |

| Total | 6630 | 100.00% |

| Large-size firms | 1505 | 22.70% |

| Medium-size firms | 1513 | 22.82% |

| Small-size firms | 3612 | 54.47% |

| Total | 6630 | 100.00% |

| Panel B. Composition of the sample firms according to the territorial subdivisions | ||

| 1. Nothwest | 611 | 9.22% |

| 2. Northeastern | 829 | 12.50% |

| 3. Madrid | 1119 | 16.88% |

| 4. Center | 934 | 14.09% |

| 5. East | 2480 | 37.41% |

| 6. South | 553 | 8.34% |

| 7. Canarias | 104 | 1.57% |

| Total | 6630 | 100.00% |

| Panel C. Composition of the sample firms according to the industry type | ||

| 1. Meat industry | 234 | 3.53% |

| 2. Foodstuffs and snuff | 728 | 10.98% |

| 3. Drinks | 143 | 2.16% |

| 4. Textiles and clothing | 468 | 7.06% |

| 5. Leather and footwear | 182 | 2.75% |

| 6. Timber industry | 169 | 2.55% |

| 7. Paper Industry | 325 | 4.90% |

| 8. Graphics | 221 | 3.33% |

| 9. Chemical and pharmaceutical products | 468 | 7.06% |

| 10. Rubber and plastic | 455 | 6.86% |

| 11. Non-metallic mineral products | 338 | 5.10% |

| 12. Ferrous and nonferrous metals | 221 | 3.33% |

| 13. Metal products | 949 | 14.31% |

| 14. Agricultural and industrial machinery | 390 | 5.88% |

| 15. Computer, electronic and optical products | 117 | 1.6% |

| 16. Electrical machinery and material | 299 | 4.51% |

| 17. Motor vehicles | 364 | 5.49% |

| 18. Other transport equipment | 104 | 1.57% |

| 19. Furniture industry | 299 | 4.51% |

| 20. Other manufacturing | 156 | 2.35% |

| Total | 6630 | 100.00% |

(1) Small, medium and large firms have been classified following the criteria of European Commission (2003/361/CE, 6th may). Specifically, we consider a large-size firm, those with a volume of total assets greater than 43 millions of euros, a turnover greater than 50 millions of euros and a number of employees greater or equal to 250; Medium-sized firms, those with a volume of total assets lower or equal to 43 millions of euros, a turnover lower o equal to 50 millions of euros and less than 250 employees; Small-sized firms, those with a volume of total assets lower or equal to 10 millions of euros, a turnover lower o equal to 10 millions of euros and less than 50 employees.

We follow prior empirical studies and measure firm performance as the return on asset ratio (earnings before interest and tax to total assets). This is the most commonly used performance indicator when studying family businesses (see among others Zahra et al., 2000a).

Family managementConsistent with the theoretical arguments previously discussed, Family management is considered as an independent variable. Following previous researchers (Cruz and Nordqvist, 2012; Fernández and Nieto, 2005; Nieto et al., 2015; Sirmon et al., 2008), the influence of family members on decision-making is an objective measure of family impact on firm. This paper uses the ESEE information to including both, family ownership and family management as indicators of family firms influence on decision making (Cruz and Nordqvist, 2012; Fernández and Nieto, 2005; Nieto et al., 2015; Sirmon et al., 2008). We have defined family management as the active involvement of the controlling family for all those firms that are family owned. Firstly, for considering whether a company is a family firm or not, we used a question from the survey regarding whether the firm is controlled or not by a family. Secondly, and according to aforementioned, Family management is measured as a dummy variable. Specifically, the variable family management is operationalized as a dichotomous variable, which takes value 1 when one or more members of the owner-family occupy managerial posts and 0 otherwise. Family management is usually linked to a specific family vision and goals (Chrisman and Patel, 2012). We argue that family presence in the management influences the investment decisions, the specific knowledge of the firm and investment horizons (Stein, 1989). In line with the above arguments, we adopt a specific measure of family management, which has been currently used by recent literature relating family firm and innovation (Diéguez-Soto et al., 2017; Kotlar et al., 2014; Nieto et al., 2015).

R&D intensityFollowing previous studies (see among others Liang et al., 2013), R&D intensity is defined as a firm's R&D expenditures divided by total sales. Internal R&D intensity is measured as the ratio between internal R&D expenditures and total sales, while external R&D intensity is measured as the ratio of external R&D spending to total sales (Gomez and Vargas, 2009). We also distinguish two firm subgroups depending on the relative R&D intensity of the firm is above or below the specific industry median. First, we compute R&D intensity median for every industry. Next, we compare the R&D intensity of each sector to all business competing in the same industry.

In the field of innovation research, previous studies have used other proxies of economic and technological value of innovation (innovation quality), such as patents or patents citation (see among others Hall et al., 2005). Due to limitations of patents as a proxy of innovation – some businesses generally do not file patents for the fear of failure in their ideas (Deng et al., 2013) or they cannot afford the expenses of the process (Kalantaridis and Pheby, 1999), we use R&D intensity as a proxy of technological effort of the firm. Then, following previous studies, we used a lagged expression of the variable for a two-year period. R&D investments are essential for firms as they bestow the experience necessary upon businesses to turn research projects into successes (Hambrick and Macmillan, 1985), building long-term benefits for the firm and contributing to achieve higher firm performance (Zahra et al., 2000a). In addition, it captures the capability of the firm to innovate. Therefore, as we described previously, we expect that R&D intensity exerts a moderating role on the relationship between family management and firm performance.

Control variablesFour different variables are used to control other determinants of the firm performance. Due to organizations with greater financial resources having higher levels of financial slack to achieve greater profitability and greater levels of R&D investment, we controlled for leverage, computed as total debt divided by total assets (Bah and Dumontier, 2001; Kotlar et al., 2013). Firm size was the second control variable. Since large firms have advantages compared to small firms (financial and economic resources, internal knowledge or market power among others), which are expected to increase the level of innovation investment and performance, we control for firm size (Cohen and Klepper, 1996). We measure firm size as the log of total assets. The third control variable was Industry effect. Due to business sectors can have different degrees of innovation propensity and profitability, the specific industry characteristics are included in our models as a group of dummy variables representative of each activity sector (see Table 1 to a better description of each activity sector). Finally, we included the geographical localization effect. Technological progress depends on the capacity and the effort of firms to innovate. According to Camagni and Capello (2013), the territorial specificities may explain the willingness to invest in R&D and develop technological innovation outcomes. Thus, geographical localization is considered as a control variable, to capture the effect of the geographical opportunities to invest and develop innovation. We use dummy variables representatives of seven Spanish territorial subdivisions (NUTS1, Nomenclature des Unités Territoriales Statistiques)1 distinguishing 7 areas: 1. Northwest; 2. Northeastern; 3. Madrid; 4. Center; 5. East; 6. South; and, 7. Canarias (see Table 1).

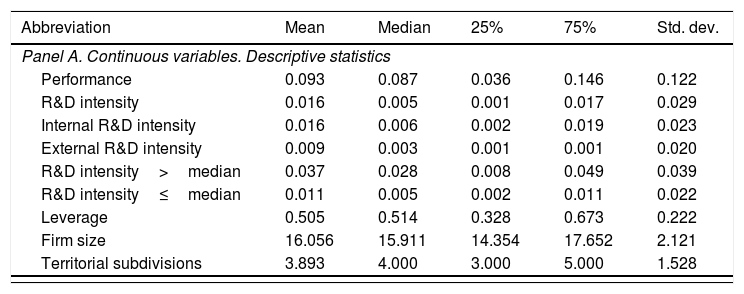

Descriptive analysisTable 2 shows the mean and another descriptive statistics and bivariate correlations of the variables. In terms of the dependent variable, the average of performance is 9.3% (see Table 2, Panel A). Regarding moderator, R&D expenses reach a mean of 1.6% of the sales. In terms of the family management involvement, a 44.36% of the sample are considered family-managed firms against the 55.64% of non-family-managed firms for the period (see Table 2, Panel B).

Descriptive statistics and correlation matrix.

| Abbreviation | Mean | Median | 25% | 75% | Std. dev. |

|---|---|---|---|---|---|

| Panel A. Continuous variables. Descriptive statistics | |||||

| Performance | 0.093 | 0.087 | 0.036 | 0.146 | 0.122 |

| R&D intensity | 0.016 | 0.005 | 0.001 | 0.017 | 0.029 |

| Internal R&D intensity | 0.016 | 0.006 | 0.002 | 0.019 | 0.023 |

| External R&D intensity | 0.009 | 0.003 | 0.001 | 0.001 | 0.020 |

| R&D intensity>median | 0.037 | 0.028 | 0.008 | 0.049 | 0.039 |

| R&D intensity≤median | 0.011 | 0.005 | 0.002 | 0.011 | 0.022 |

| Leverage | 0.505 | 0.514 | 0.328 | 0.673 | 0.222 |

| Firm size | 16.056 | 15.911 | 14.354 | 17.652 | 2.121 |

| Territorial subdivisions | 3.893 | 4.000 | 3.000 | 5.000 | 1.528 |

| Value/number of observations | 0 | 1 | Total | |||

|---|---|---|---|---|---|---|

| N | % | N | % | N | % | |

| Panel B. Categorical variables. Frequency | ||||||

| Family management | 3689 | 55.64% | 2941 | 44.36% | 6630 | 100.00% |

| 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|

| Panel C. Correlations | |||||

| 1. Performance | 1 | ||||

| 2. Family management | −0.070*** | 1 | |||

| 3. R&D intensity | −0.009 | −0.073*** | 1 | ||

| 4. Leverage | −0.099*** | 0.057*** | 0.018 | 1 | |

| 5. Firm size | 0.165*** | −0.419*** | 0.146*** | −0.003 | 1 |

| 6. Territorial subdivisions | 0.052*** | 0.127*** | −0.041*** | −0.028** | −0.059*** |

**p<0.01; ***p<0.001.

Table 2 Panel C provides the bivariate correlations between the variables. Although there are significant correlations, all are below 0.45 (Tabachnick and Fidell, 1996), results that allow us to assert that multicollinearity is not a significant concern. Also, the size of the sample (6630 observations) is large, contributing to the reduction of the standard errors.

MethodSince evidence in previous literature shows that most profitable firms are those that invest more in innovation (Amit and Zott, 2001; Deng et al., 1999; Lee et al., 2000; Sirmon and Hitt, 2003; Zahra et al., 2000b), it is necessary to consider the impact of previous value of investment in innovation into the family management-firm performance relationship. Also, according to previous literature on technology innovation, it is expected that previous investment in R&D has a positive effect on current technological innovation (Kyriakopoulos and De Ruyter, 2004), considering the innovation process as a continuous process throughout time (Diéguez-Soto et al., 2016). Accordingly, we use a pooled regression with fixed effect controlling by heteroscedasticity and autocorrelation problems. Particularly, we use an AR (autoregressive process) including lagged values of the dependent variable as regressors. That methodology reduces the potential serial correlation of the errors and control for the possible endogeneity problems (Cameron and Trivedi, 1998).

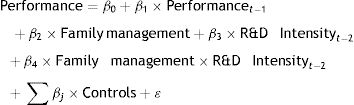

According to those arguments we estimate different models based on the Eq. (1):

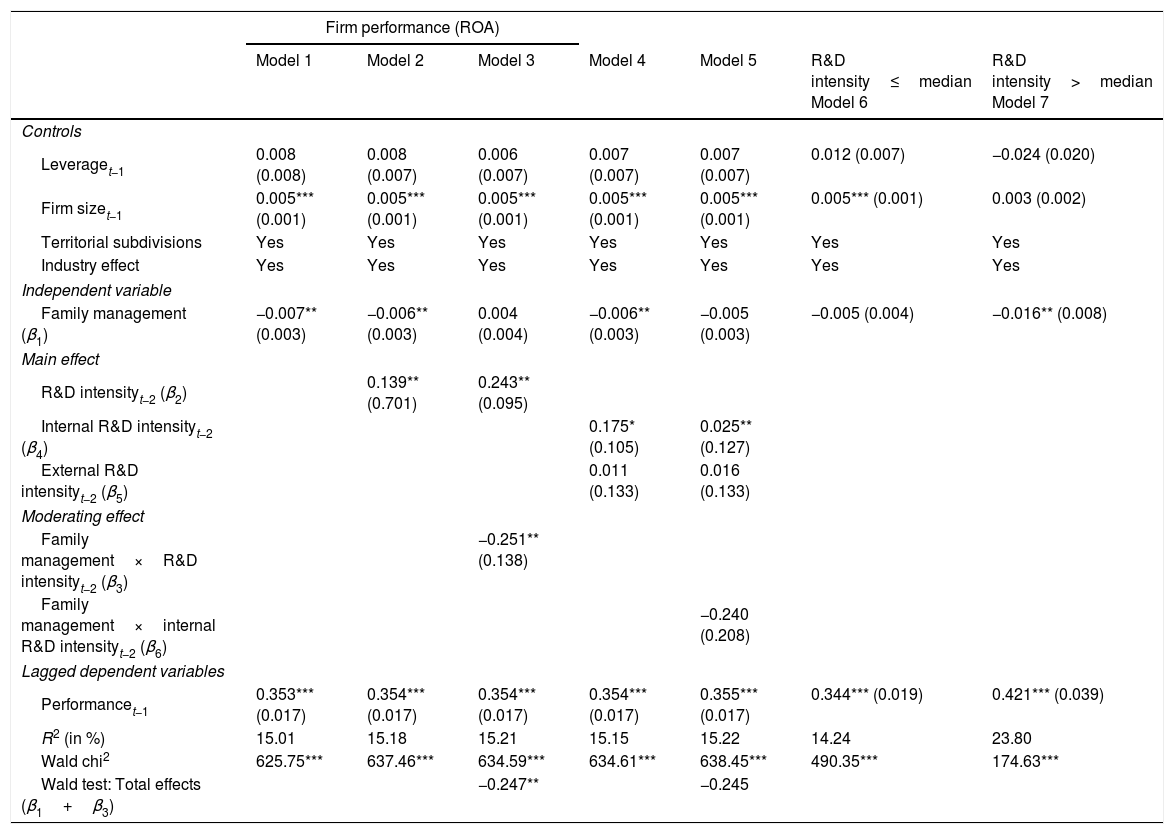

In order to measure the moderating role of R&D intensity on the relationship between family management and firm performance, a step-wise manner is followed as reported in Table 3 and is explained in the following lines.

Results of autoregressive panel data models.

| Firm performance (ROA) | |||||||

|---|---|---|---|---|---|---|---|

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | R&D intensity≤median Model 6 | R&D intensity>median Model 7 | |

| Controls | |||||||

| Leveraget−1 | 0.008 (0.008) | 0.008 (0.007) | 0.006 (0.007) | 0.007 (0.007) | 0.007 (0.007) | 0.012 (0.007) | −0.024 (0.020) |

| Firm sizet−1 | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) | 0.005*** (0.001) | 0.003 (0.002) |

| Territorial subdivisions | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Industry effect | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Independent variable | |||||||

| Family management (β1) | −0.007** (0.003) | −0.006** (0.003) | 0.004 (0.004) | −0.006** (0.003) | −0.005 (0.003) | −0.005 (0.004) | −0.016** (0.008) |

| Main effect | |||||||

| R&D intensityt−2 (β2) | 0.139** (0.701) | 0.243** (0.095) | |||||

| Internal R&D intensityt−2 (β4) | 0.175* (0.105) | 0.025** (0.127) | |||||

| External R&D intensityt−2 (β5) | 0.011 (0.133) | 0.016 (0.133) | |||||

| Moderating effect | |||||||

| Family management×R&D intensityt−2 (β3) | −0.251** (0.138) | ||||||

| Family management×internal R&D intensityt−2 (β6) | −0.240 (0.208) | ||||||

| Lagged dependent variables | |||||||

| Performancet−1 | 0.353*** (0.017) | 0.354*** (0.017) | 0.354*** (0.017) | 0.354*** (0.017) | 0.355*** (0.017) | 0.344*** (0.019) | 0.421*** (0.039) |

| R2 (in %) | 15.01 | 15.18 | 15.21 | 15.15 | 15.22 | 14.24 | 23.80 |

| Wald chi2 | 625.75*** | 637.46*** | 634.59*** | 634.61*** | 638.45*** | 490.35*** | 174.63*** |

| Wald test: Total effects (β1+β3) | −0.247** | −0.245 | |||||

*p<0.05; **p<0.01; ***p<0.001. Standardized coefficients are presented with standard error in parentheses.

To test the moderating effect of R&D intensity in the relationship between family management and performance, we first analyzed the impact of family management (independent variable) on performance (dependent variable) (Model 1, Table 3). The results showed that those firms managed for family members had lower performance (β=−0.007; p<0.01). Compared to previous studies, this result was consistent with Cucculelli and Micucci (2008) findings, which revealed that positive family characteristics such as firm-specific investments, decrease in agency costs, stewardship, and long-term perspective (Davis et al., 1997; Maury, 2006; Miller and Le Breton-Miller, 2005a) appear to be reduced in family-managed firms. Thus, they confirmed that inherited management within a family weaken the family firm performance (Cucculelli and Micucci, 2008). Sciascia and Mazzola (2008) also found a negative non-linear relationship between family management and firm performance – a U-shaped function – arguing that the reduction is more noticeable at greater levels of family management. These authors justified these results explaining that family management decreases both the competencies and the social capital of the business, restricting the available resources and their efficient use.

Second, we ran a regression model to examine the direct influence of the independent variable R&D investment on the dependent variable (performance) (see Model 2, Table 3). In order to avoid endogeneity problems between performance and R&D investment, and due to the use of autoregressive models, we lagged the R&D investment variable two-year period. As shown in Model 2, Table 3, the R&D intensityt−2 was positively and significantly associated to performance (β=0.139; p<0.01). These results, indicating that firms investing more in R&D were likely to over-perform those businesses devoting less money into innovation, agreed with Sirmon and Hitt (2003) findings, among others. In addition, the results showed that when R&D investment was added, the direct impact of family management on firm performance continued significant (β=−0.006; p<0.01). Finally, we added to the Model 2 the interaction term of family management×R&D intensityt−2. The results of Model 3 showed that the interaction term (family management×R&D intensityt−2) had a strong significant effect on firm performance (β=−0.251; p<0.01), suggesting that the negative family management involvement–performance relationship was stronger when increasing R&D investment. Results support our Hypothesis 1.

To further examine the moderating role of R&D intensity, we questioned whether the innovative behaviour had an effect on the moderating role of R&D investment on the relationship between family management and firm performance. Firstly, and according to previous research, economic results depend on the internal and external R&D activities (see among others Blanes and Busom, 2004; Busom, 2000; Czarnitzki, 2006; Czarnitzki and Licht, 2006; Duguet and Monjon, 2004). In order to test whether innovativeness behaviour influenced our above results, we split the variable R&D investment into internal R&D and external R&D (see Model 4, Table 3). Splitting internal R&D and external R&D showed that greater investment into internal R&D influenced positively and significantly (β=0.175; p<0.05) into firm performance. However, external R&D was not significant, although positive. Therefore, our results suggested that the main impact of R&D investment into performance came from internal R&D, consistent with the results of Tsai and Wang (2008) and Jones et al. (2001). To understand whether internal R&D moderated the relationship between family management and firm performance in private firms, we ran Model 5. Our results showed that the coefficient of the interaction is negative but not significant (β=−0.240; p>0.10), suggesting that the negative effect of the interaction between R&D investments and family management on firm performance was only revealed when the total effect of R&D was considered, including internal and external R&D. Results supported our Hypothesis 2.

Secondly, we also questioned whether the moderating role of R&D investment on the relationship between family management and firm performance depended on the level of investment. In order to give an answer to this question, the sample was split into high and low R&D level of investment according to the median of the activity sector (see Miller, 1991; Chen et al., 2010) (Models 6 and 7, Table 3). The results showed that family management had a negative and significant effect on firm performance in the higher R&D intensity subgroup, but it was insignificant in the lower R&D intensity subgroup. Additionally, the coefficient of family management variable was lower in the higher R&D intensity subgroup (β=−0.016; p<0.01) than that of the lower R&D intensity subgroup (β=−0.005; p>0.10), indicating that family management was more negatively associated to performance in the higher R&D intensity subgroup. In other words, the results supported that the relationship between family management and firm performance depends on the importance of R&D to the firm's strategy (Hypothesis 3). Specifically, R&D intensity above industry median strengthened the negative effect of family management on firm performance in private firms.

The results for the control variables were similar across Models 1–7. Regarding Size variable, the coefficient is positive and significant in models 1–6, showing that larger firms have greater performance. The variable is not significant in model 7. The relative standard deviation, calculated as the ratio of the absolute standard deviation to the mean, may provide an explanation to this result. The range of values for the variable Size in the sample which includes those firms with R&D intensity above the industry median is lower (relative standard deviation=0.10) than the range for the sample which includes firms with R&D intensity below the industry median (relative standard deviation=0.14). Consequently, the relative dispersion for the first sample is lower and the variable Size is not significant to distinguish performance differences among those firms with higher R&D intensity than the industry median.

Finally, in order to give robustness to our result, we included a control variable of the economic cycle (2000–2007 vs. 2008–2012) and used different lags for the dependent variables. After running the same regressions with these new variables, the results did not differ much from those found in the regressions of Models 1–7. The results of these latest models are available from the authors on request.

DiscussionOur results manifest that R&D intensity reinforces the negative effect of family management on firm performance. More specifically, the moderating effect of R&D on the family management-firm performance interplay turns out to be statistically negative when we split the sample used and are only focusing on the firms whose level of R&D is superior to the percentile 50. In other words, we obtain that R&D is a statistically significant moderator only for those firms having higher levels of R&D. Therefore, the findings of the moderating model show that family-managed firms that belong to the higher R&D intensity subgroup are more negatively associated to firm performance. Furthermore, we find that the moderating impact of R&D on family management-firm performance interplay is only significant when considering both internal and external R&D simultaneously through a measure of the whole R&D effect.

Theoretical implicationsOur study provides several contributions to previous literature. Firstly, the direct effect of family involvement on firm performance has resulted inconsistent in the literature reviewed (De Massis et al., 2012; Yu et al., 2012). Thus, the proposal of this research of introducing a moderating factor may well be helpful to explain the contradictory results. Moreover, this study has confirmed the relevant lack of previous research on analyzing specific firm strategy factors to moderate the relationship between family management and its consequences on firm performance level in private firms. Therefore, this paper has also gone beyond traditional input–output statistical analysis by studying the indirect effect of the intensity in R&D effort to moderate the relationship between family management and financial behaviour in private firms. Thus, we contribute to advance the understanding on how, when and why family management influences on firm performance, introducing a firm strategy factor into the academic conversation. This is indeed opportune given that family management influences the way strategy is planned and realized (Upton et al., 2001).

Secondly, we argue that R&D intensity reinforces the negative effect of family management on firm performance, due to greater and more complex conflicts originated from the heterogeneity of family managers’ views regarding the proper quantity of R&D investments (Kellermanns and Eddleston, 2004). The former influence is also explained by the incompetence of human capital of family-managed firms, which is more obvious and manifest when dealing with investments that usually require higher intricacy (Lubatkin et al., 2005), and by the intrinsic uncertainty and loss of control often attached to R&D investments that do contribute to disjoin economic and non-economic goals (Duran et al., 2016). These disadvantages are able to overcome the expected benefits of R&D investments derived from their long-term effect and their contribution to preserve SEW and from better relationships with stakeholders and consequently improved social capital (Anderson and Reeb, 2003). Hence, our study, analyzing the dysfunctional consequences at firm performance level of investing in R&D below/above the industry median, provides theoretical and empirical evidence on when and why family management decisions related to R&D investments may lead to family-managed firms having a better or worse firm performance. Particularly, we discover that when R&D spending is above the median, the inconveniences of R&D investments are able to supersede significantly the bright aspects of R&D expenses on family management–firm performance relationship. However, when R&D spending is below the median, disadvantages of R&D effort seem to be compensated by their positive consequences on family management-firm performance interplay and incremental R&D spending does not exert a significant effect on the abovementioned relationship.

Thirdly, this paper offers a further in-depth theoretical analysis regarding the moderating role of R&D intensity, highlighting that the combination of internal and external R&D significantly contributes to reinforce the negative effect of family management on firm performance. This finding, in accordance to research suggesting no complementarity between internal and external R&D (Blonigen and Taylor, 2000; Fernandez-Bagues, 2004), confirms that the combination of both types of R&D is not always conducive to higher performance. It seems that the troubles of this specific strategy are especially severe when interacting with family management. The combination of external and internal R&D can lead to the dilution of the business's resource base, making it less unique and easier for competitors to imitate (Grimpe and Kaiser, 2010) and the deterioration of integrative capabilities (Weigelt, 2009). This specific strategy usually requires significant management attention which is a limited resource itself (Ocasio, 1997). These weaknesses, likely attached to the combination of external and internal R&D, appear to be specially made worse with family management. Family management can result in the development of unique resources and capabilities (Habbershon and Williams, 1999), which generate sustained competitive advantage to family firms (Barney, 1991; Barney et al., 2001). These unique resources and capabilities may be endangered when internal and external R&D are combined. Likewise, the unskilled staff usually linked to family-managed firms are likely to be unable to appropriately integrate external and internal R&D. Therefore, our results suggest that when interacting with family management, the downsides of the specific strategy bringing together internal and external R&D excel its expected benefits (i.e. reduction of costs), being detrimental to firm performance.

Fourthly, there is a scarce number of studies analysing family management-firm performance focused on privately held family firms, despite findings to date have been conflicting and puzzling (Sciascia et al., 2014). The evidence concerning to the performance of privately held firms is scant (Sharma and Carney, 2012) and distinct family firms differ regarding their strategic choices and relative performance (Miller et al., 2011; Schulze et al., 2003a). Thus, this manuscript also contributes to develop and infer how to interact family management and strategic decisions to generate financial consequences in a context of private firms.

Managerial/practical implicationsThe moderating role of R&D intensity on family management-firm performance relationship demonstrates that those family-managed firms that belong to the higher R&D intensity subgroup are more negatively associated to performance, since the disadvantages associated with investments of this nature at this level surpassed its gains. Thus, it is definitely important to know which level and composition of R&D is adequate to achieve the best performance. Family managers should be aware that the combination of internal and external R&D may become disadvantageous if firms do not examine thoroughly the firm's internal resource base before external R&D is acquired and analyze how internal and external resources should be redeployed to achieve a better combination than a firm's competitors. Likewise, family managers should plan ahead to enhance management attention in the procedure of resource assignment, which should drive to improve their unique and particular resources and capabilities (Grimpe and Kaiser, 2010).

Limitations and future researchEven with the new results obtained through our analysis we recognize that our research presents some limitations and, at the same time, opens new lines of research. We have considered family-managed firms as a particular group but we have not taken into account the heterogeneity that exits among them (Diéguez-Soto et al., 2016). Further research may investigate, for instance, if the moderating effect of R&D on family firm performance operates in the same way when the firm changes from the founder to future generations in the family (Sciascia et al., 2014). As we have concluded above, it could also be interesting to investigate the maximum R&D investment level and the composition of internal and external R&D that allow optimizing performance on a family-managed firm.

ConclusionThis study uses a different theoretical lens to investigate the role played by R&D intensity in the family management-firm performance interplay. The results show that the negative influence of family management on firm performance is reinforced when R&D spending increases. This study also finds that the particular combination of internal and external R&D becomes detrimental, when interacting with family management, for firm performance. Although our research extends the theoretical contributions of recent literature (Chrisman and Patel, 2012; Duran et al., 2016; Diéguez-Soto et al., 2016), further research is needed to comprehend the great dispersion in the performance among family firms and comparatively with that of non-family firms.

See Eurostat NUTS: http://ec.europa.eu/eurostat/ramon/nomenclatures/index.cfm?TargetUrl=LST_CLS_DLD&StrNom=NUTS_2013L&StrLanguageCode=EN&StrLayoutCode=HIERARCHIC (Accessed 2 of October of 2015).