This article analyzes the impact of free-banking on the banking sector in Latin America in the 19th and early 20th centuries. I use data for seven countries to compare the entry of banks and the growth of bank output prior and after the enactment of free-banking laws to determine whether free-banking (by establishing general requirements for granting note-issuance rights) lowered barriers to entry. The results show that in most Latin American countries the adoption of free-banking laws did not cause in the short run an increase in bank entry and in bank output growth.

En este artículo se analiza el impacto de la banca libre para el sector bancario en Latinoamérica en el siglo XIX y principios del XX. Utilizando los datos de siete países, se compara la entrada de entidades bancarias y el crecimiento del producto bancario antes y después de la promulgación de leyes de banca libre para determinar si esta banca (a través del establecimiento de requisitos generales para garantizar derechos de emisión de billetes) redujo los obstáculos para la entrada. Los resultados revelan que, en la mayoría de países latinoamericanos, la adopción de leyes de banca libre no hizo aumentar a corto plazo la entrada de bancos ni el crecimiento del producto bancario.

Note issue is usually an important source of funding for banks in early stages of financial development. Cameron et al. (1967, p. 295) argue that “the right or privilege of note issue is one of the most effective means both of eliciting a rapid growth in the number of banks and of habituating the public to the utilization of financial intermediaries”. Similarly, Ng (1988, p. 878) indicates that in the U.S. prior to the Civil War the issuance of banknotes was the “major source of funds for banks”. Latin American banks also relied on note issue as a major source of funding, as indicated by the high values of the ratio note issue/deposits1. In Mexico, in 1890–1905 total banknotes represented 74% the total amount of deposits. In Brazil, in 1870–1895 total banknotes represented 34% of the total amount of deposits. In Argentina, the percentage in 1878–1891 was 72%.

If note issue was an important source of funding in Latin America the 19th and early 20th centuries, restrictions on note issue might have reduced the incentives to enter into the banking industry. Similarly, if note issue was an important source of funding, then the elimination of restrictions on note issue must have increased bank entry and the growth of bank output.

In a banking industry with no barriers to entry, perfect competition grants socially efficient number of banks and level of bank output2. Barriers to entry in the banking industry lead to a socially inefficient allocation of financial resources, and in particular to a small number of banks and a low level of output. The discretionary power of the government in granting note-issuance rights may constitute an important barrier to entry. Under a charter system, the government has discretion to grant or deny the right to issue banknotes. Note issue may be profitable, however. Note-issue profitability and government discretion to choose between different applicants may lead to corruption. In contrast, under a free-banking regime, the requirements for granting note-issuance rights are transparent. Any applicant who meets specified requirements is able to organize a bank of issue.

However, in some cases, free-banking may not reduce barriers to entry. Consider the scenario in which charter policies previous to the institution of free-banking are liberal and the government does not impose any major obstacle to the creation of banks of issue, or the case in which free-banking laws include high capital and specie requirements. In these cases, the adoption of free-banking may not have any effect on barriers to entry and therefore may not have any effect on bank entry and on the growth of bank output.

Therefore, free-banking may have alternative effects on the banking sector. It may promote the creation of banks and the growth of bank output if note issue was an important source of funding and if pre free-banking charter policies were restrictive (either to all banks or to some of them). Alternatively, it may not cause any change in bank entry and bank-output growth (or may actually reduce them) if charter policies were liberal and did not impose any effective restriction to note issue, or if free-banking laws imposed severe restrictions, including restrictions on capital or specie holdings.

The effect of free-banking laws on bank entry has been analyzed by several economists and historians in the United States and Europe. Some empirical studies for the U.S. indicate a positive impact of free-banking laws on the creation of banks prior to the Civil War (Sylla, 1969; Rockoff, 1974; Rolnick and Weber, 1993; Economopoulos and O’Neill, 1995). Ng (1988), however, argues that free-banking laws did not have a significant impact on bank entry3.

Some studies have analyzed the impact of free-banking on the banking sector in Latin America, especially in Mexico and Brazil. Haber (1991), for example, argues that restrictions on note issue hindered the creation of banks in Mexico during this period4. Legal and political factors had a significant role in accounting for the financial backwardness and the stunted process of industrialization in Mexico and Brazil5. Maurer (2002) also argues that the banking legislation in Mexico was severely restrictive and discouraged the formation of banks6.

This article analyzes the free-banking laws in seven Latin American countries and determines whether the enactment of free-banking lowered barriers to entry into the banking industry7. Using pre-1930 data for Mexico, Argentina, Brazil, Peru, Chile, Costa Rica and El Salvador, this article examines the evolution of bank entry and the growth of bank output prior to and after the enactment of free-banking laws to determine whether a significant change in the growth of the banking sector occurred soon after the passage of free-banking laws. If the passage of a free-banking law did not lead to an increase in the entry of banks and in the growth of bank output (controlling for other factors), then the enactment of such law did not effectively reduce barriers to entry. As Ng (1988, p. 881) argues, “if output did not increase after the institution of free banking, the lower barriers to entry theory can be rejected”.

The structure of this article is as follows. Section 1 describes the legislation in several Latin American countries during this period. Section 2 conducts a data analysis. Section 3 conducts an econometric data analysis to determine whether the passage of free-banking laws increased bank entry and the growth of bank output. Section 4 concludes the article.

2Free-banking lawsFor several decades after independence, most Latin American countries remained under charter systems in which their national governments had discretionary power to grant note issuance rights. Granting note issuance rights to only one bank or a few banks or simply prohibiting note issue may have reduced the incentives to create banks, also limiting the growth of bank output. Eventually, however, Latin American countries passed free-banking laws establishing general requirements for granting note-issuance rights. Those laws, however, varied across countries: some laws were much more liberal than others. Differences in free-banking laws referred to capital and specie requirements, government supervision, definition of exclusive territories, among other issues.

Mexico enacted a general banking law in 1897. Prior to the enactment of this law, the federal government chartered banks granting privileges to some of them, in particular to Banco Nacional de Mexico (Banamex). Maurer and Haber (2002, p. 25) argue that “since Mexico's Spanish traditions held that all economic activities undertaken without authorization from either a general law or a special concession were illegal, Mexico did not undergo a period of free-banking. Rather, bank charters were granted at the whim of the secretary of finance”. It seems that political connections were important in receiving a charter. In 1884, a group of Diaz’ supporters received a special charter to create Banamex. The government granted extraordinary privileges in note issue to this bank and restricted the formation of other banks.

The legislation changed in 1897, with the enactment of the General Law of Institutions of Credit. This law established general requirements for the establishment of banks. Banks of issue could be established in the states of the republic by meeting the requirements on that law, but they still required federal authorization. Capital requirements were half a million pesos (around a quarter million dollars). This requirement, however, existed prior to 1897: the commercial code of 1884 also established that banks required a minimum capital of half a million pesos. In addition, the law restricted competition within each state (creating state monopolies), by highly taxing the second bank of issue in each state, and prohibiting state banks to open offices out of their native states without federal authorization. Furthermore, Banamex and Bank of London maintained their special charters, and competition from state banks to these two banks was restricted by prohibiting state banks to redeem their notes in the federal district.

In the case of Brazil, from 1866 to 1888 banks did not have a right to issue banknotes, so that for more than two decades the Treasury had the monopoly in note issue. Then the law of banks of issue of 1888 established general requirements for the formation of banks of issue. These banks had to meet the requirements established in the incorporation law of 1882 for the establishment of corporations. In addition, banks had to maintain specie for 25% of their note issue8. In 1890 a new law established that banknotes were guaranteed by government bonds, and that banks could engage in every type of operation9. By the end of 1890, however, competition in note issue was restricted. In December of 1890 the government authorized the formation of the Banco da Republica dos Estados Unidos do Brasil10. According to this bank's charter, the government would not charter more banks of issue, and would not authorize further note issue to other banks of issue in operation11.

Argentina was subject to a charter system until 1887. The two largest banks were the Banco de Provincia de Buenos Aires and Banco Nacional. These two banks had note-issuance rights and had special links with the provincial government of Buenos Aires and with the national government, respectively. In 1887 the National Congress passed a free-banking law12, entitled Law of Guaranteed National Banks. According to this law, any corporate bank could issue banknotes guaranteed by national public funds (Piñero, 1921). Paid-in capital had to be at least 250,000 pesos (around U.S.$180,000 in 1887), and banknotes could not exceed 90% of paid-in capital. Banknotes were guaranteed by government bonds and were legal tender. Finally, banks had to maintain specie for at least 10% of their issue. The system of free-banking, however, ended in 1890, when the government created the Caja de Conversion, which was granted the monopoly right to issue. Although the law of 1887 probably increased banks’ profitability and made banking business more attractive, some indicate that the law promoted speculation, leading to the financial crisis of 1891. As result of this crisis, guaranteed banks could not redeem their notes, and most of them failed13.

Chile enacted the Law of Banks of Issue and Discount in 1860. This law established general requirements for the formation of banks of issue and discount14. Once a bank satisfied the legal requirements established by the law, it was authorized to operate. Banks did not have to raise a minimum capital to receive a license, and could engage in a variety of operations, such as issuing banknotes redeemable on demand, providing short- and long-term loans, receiving deposits, among others15. Banks could issue banknotes, but total note issue could not exceed 150% of its paid-in capital16.

In the case of Peru, banks could not issue banknotes from 1879 to 1913. Banks conducted other types of commercial operations, except note issue. In 1914 Congress enacted a free-banking law, establishing the right of banks to issue banknotes17. This law established general requirements for granting note issuance rights. Banks did not have to meet capital requirements. However, they had to maintain specie for at least 35% of its note issue. The other 75% of note specie was guaranteed by other banks’ assets, such as mortgage bonds and gold deposits in foreign financial institutions18. In addition, the Junta de Vigilancia was created to control the issue of banknotes and to centralize their gold guarantees.

Costa Rica had a charter system in the 19th century. The government could charter banks and grant them special privileges. In 1884 the government granted monopoly rights in note issue to Banco de la Unión19. Banco de la Unión maintained those monopoly rights until the turn of the century. In 1900 Costa Rica passed a free-banking law, establishing general requirements for the creation of banks. The law required banks of issue to have a minimum capital of one million colons (near half a million dollars). In addition, note issue could not exceed 75% of paid-in capital and had to be backed by specie by no less than 40%20.

El Salvador was subject to a charter system until the end of the 19th century. Under this system, the government chartered a few banks of issue. Congress enacted the Law of Institutions of Credit in 189821. This law regulated the formation and operations of banks of issue22. The law required banks of issue to be corporations with a capital of at least one million colons (around half a million dollars), and with no less than seven shareholders23. In addition, note issue could not be more than twice the paid-in capital, and could not be more than twice the specie holdings. The law also established some restrictions on lending24. The banking law was repealed one year later, when the Law of Banks of Issue was enacted25. However, this law maintained the same requirements for banks of issue26.

In summary, Latin American countries adopted different types of free-banking laws and for different periods of time. Some laws such as the Argentine law of 1887 or the Brazilian law of 1888 were very liberal, but also lasted a very short period of time. In other cases, like Costa Rica and El Salvador, free-banking laws lasted longer but were more restrictive. Free-banking laws were not necessarily liberal laws, and therefore the impact of free-banking on bank entry may have not been the same across countries.

3Data analysisDiscretion on granting note-issuance rights may have constituted a barrier to entry into the banking industry. If it was a barrier to entry, then one might expect that several banks entered into the banking system and bank output increased faster as soon as free-banking laws were enacted, especially in the cases in which free-banking laws were liberal and did not include severe restrictions on capital, specie or other restrictions27. I then compare the net entry of banks and the growth bank output before and after the institution of free-banking28.

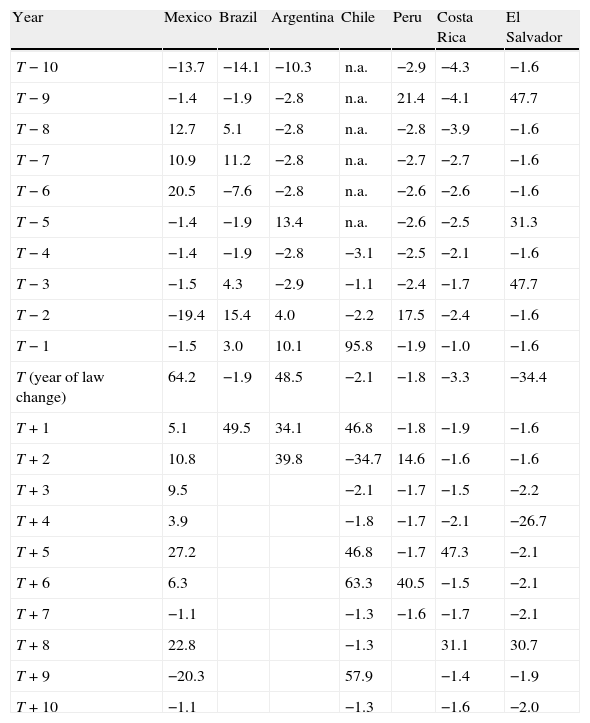

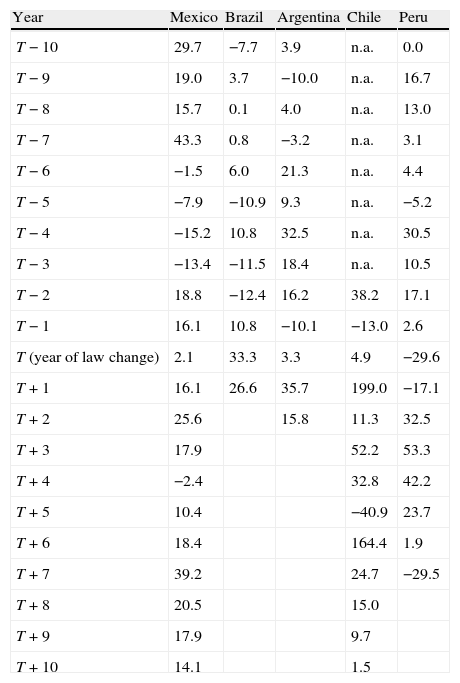

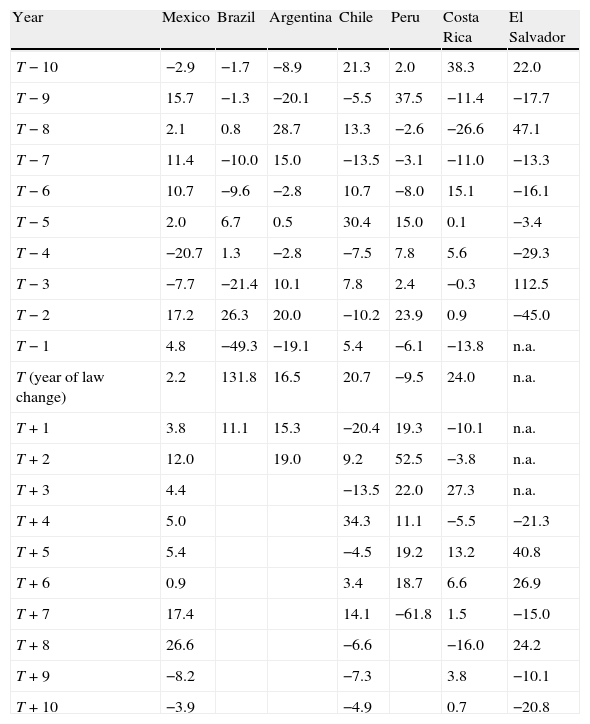

Data on number of banks and bank output have been calculated using a large number of sources. The Appendix describes those sources. I measure bank output as the sum of deposits and banknotes. I have been able to calculate figures on banking output for Mexico, Brazil, Argentina and Peru. Tables 1 and 2 report the growth rates of the number of banks per-capita and bank output per-capita prior to and after the adoption of free-banking. Table 3 reports the growth rate of exports per-capita.

Growth rate of the number of banks per-capita (%).

| Year | Mexico | Brazil | Argentina | Chile | Peru | Costa Rica | El Salvador |

| T−10 | −13.7 | −14.1 | −10.3 | n.a. | −2.9 | −4.3 | −1.6 |

| T−9 | −1.4 | −1.9 | −2.8 | n.a. | 21.4 | −4.1 | 47.7 |

| T−8 | 12.7 | 5.1 | −2.8 | n.a. | −2.8 | −3.9 | −1.6 |

| T−7 | 10.9 | 11.2 | −2.8 | n.a. | −2.7 | −2.7 | −1.6 |

| T−6 | 20.5 | −7.6 | −2.8 | n.a. | −2.6 | −2.6 | −1.6 |

| T−5 | −1.4 | −1.9 | 13.4 | n.a. | −2.6 | −2.5 | 31.3 |

| T−4 | −1.4 | −1.9 | −2.8 | −3.1 | −2.5 | −2.1 | −1.6 |

| T−3 | −1.5 | 4.3 | −2.9 | −1.1 | −2.4 | −1.7 | 47.7 |

| T−2 | −19.4 | 15.4 | 4.0 | −2.2 | 17.5 | −2.4 | −1.6 |

| T−1 | −1.5 | 3.0 | 10.1 | 95.8 | −1.9 | −1.0 | −1.6 |

| T (year of law change) | 64.2 | −1.9 | 48.5 | −2.1 | −1.8 | −3.3 | −34.4 |

| T+1 | 5.1 | 49.5 | 34.1 | 46.8 | −1.8 | −1.9 | −1.6 |

| T+2 | 10.8 | 39.8 | −34.7 | 14.6 | −1.6 | −1.6 | |

| T+3 | 9.5 | −2.1 | −1.7 | −1.5 | −2.2 | ||

| T+4 | 3.9 | −1.8 | −1.7 | −2.1 | −26.7 | ||

| T+5 | 27.2 | 46.8 | −1.7 | 47.3 | −2.1 | ||

| T+6 | 6.3 | 63.3 | 40.5 | −1.5 | −2.1 | ||

| T+7 | −1.1 | −1.3 | −1.6 | −1.7 | −2.1 | ||

| T+8 | 22.8 | −1.3 | 31.1 | 30.7 | |||

| T+9 | −20.3 | 57.9 | −1.4 | −1.9 | |||

| T+10 | −1.1 | −1.3 | −1.6 | −2.0 |

Notes and sources: see data appendix.

T corresponds to the year of law change (1897 for Mexico, 1888 for Brazil, 1887 for Argentina, 1860 for Chile, 1914 for Peru, 1900 for Costa Rica and 1898 for El Salvador).

Growth rate of bank output per-capita (%).

| Year | Mexico | Brazil | Argentina | Chile | Peru |

| T−10 | 29.7 | −7.7 | 3.9 | n.a. | 0.0 |

| T−9 | 19.0 | 3.7 | −10.0 | n.a. | 16.7 |

| T−8 | 15.7 | 0.1 | 4.0 | n.a. | 13.0 |

| T−7 | 43.3 | 0.8 | −3.2 | n.a. | 3.1 |

| T−6 | −1.5 | 6.0 | 21.3 | n.a. | 4.4 |

| T−5 | −7.9 | −10.9 | 9.3 | n.a. | −5.2 |

| T−4 | −15.2 | 10.8 | 32.5 | n.a. | 30.5 |

| T−3 | −13.4 | −11.5 | 18.4 | n.a. | 10.5 |

| T−2 | 18.8 | −12.4 | 16.2 | 38.2 | 17.1 |

| T−1 | 16.1 | 10.8 | −10.1 | −13.0 | 2.6 |

| T (year of law change) | 2.1 | 33.3 | 3.3 | 4.9 | −29.6 |

| T+1 | 16.1 | 26.6 | 35.7 | 199.0 | −17.1 |

| T+2 | 25.6 | 15.8 | 11.3 | 32.5 | |

| T+3 | 17.9 | 52.2 | 53.3 | ||

| T+4 | −2.4 | 32.8 | 42.2 | ||

| T+5 | 10.4 | −40.9 | 23.7 | ||

| T+6 | 18.4 | 164.4 | 1.9 | ||

| T+7 | 39.2 | 24.7 | −29.5 | ||

| T+8 | 20.5 | 15.0 | |||

| T+9 | 17.9 | 9.7 | |||

| T+10 | 14.1 | 1.5 |

Notes and sources: see data appendix.

T corresponds to the year of law change (1897 for Mexico, 1888 for Brazil, 1887 for Argentina, 1860 for Chile, 1914 for Peru, 1900 for Costa Rica and 1898 for El Salvador).

Growth rate of exports per-capita (%).

| Year | Mexico | Brazil | Argentina | Chile | Peru | Costa Rica | El Salvador |

| T−10 | −2.9 | −1.7 | −8.9 | 21.3 | 2.0 | 38.3 | 22.0 |

| T−9 | 15.7 | −1.3 | −20.1 | −5.5 | 37.5 | −11.4 | −17.7 |

| T−8 | 2.1 | 0.8 | 28.7 | 13.3 | −2.6 | −26.6 | 47.1 |

| T−7 | 11.4 | −10.0 | 15.0 | −13.5 | −3.1 | −11.0 | −13.3 |

| T−6 | 10.7 | −9.6 | −2.8 | 10.7 | −8.0 | 15.1 | −16.1 |

| T−5 | 2.0 | 6.7 | 0.5 | 30.4 | 15.0 | 0.1 | −3.4 |

| T−4 | −20.7 | 1.3 | −2.8 | −7.5 | 7.8 | 5.6 | −29.3 |

| T−3 | −7.7 | −21.4 | 10.1 | 7.8 | 2.4 | −0.3 | 112.5 |

| T−2 | 17.2 | 26.3 | 20.0 | −10.2 | 23.9 | 0.9 | −45.0 |

| T−1 | 4.8 | −49.3 | −19.1 | 5.4 | −6.1 | −13.8 | n.a. |

| T (year of law change) | 2.2 | 131.8 | 16.5 | 20.7 | −9.5 | 24.0 | n.a. |

| T+1 | 3.8 | 11.1 | 15.3 | −20.4 | 19.3 | −10.1 | n.a. |

| T+2 | 12.0 | 19.0 | 9.2 | 52.5 | −3.8 | n.a. | |

| T+3 | 4.4 | −13.5 | 22.0 | 27.3 | n.a. | ||

| T+4 | 5.0 | 34.3 | 11.1 | −5.5 | −21.3 | ||

| T+5 | 5.4 | −4.5 | 19.2 | 13.2 | 40.8 | ||

| T+6 | 0.9 | 3.4 | 18.7 | 6.6 | 26.9 | ||

| T+7 | 17.4 | 14.1 | −61.8 | 1.5 | −15.0 | ||

| T+8 | 26.6 | −6.6 | −16.0 | 24.2 | |||

| T+9 | −8.2 | −7.3 | 3.8 | −10.1 | |||

| T+10 | −3.9 | −4.9 | 0.7 | −20.8 |

Notes and sources: see data appendix.

T corresponds to the year of law change (1897 for Mexico, 1888 for Brazil, 1887 for Argentina, 1860 for Chile, 1914 for Peru, 1900 for Costa Rica and 1898 for El Salvador).

In Mexico, in the 1880s and 1890s, barriers to entry into the banking sector were significant. Haber (1991) and Maurer (2002) have argued that charter policies were very restrictive and hindered the supply of formal credit. Banco Nacional de México (Banamex) enjoyed a number of privileges on note issue. Banking concentration was high: in the 1880s and 1890s, the Banamex accounted for more than 50% of total bank output in all of Mexico. Very few banks were created in the 1890s. In per-capita terms, the number of banks fell in every single year from 1891 to 1895. Bank output per-capita fell in 1892, 1893 and 1894, although then recovered in 1895 and 1896.

The law of 1897 lowered barriers to entry. In practise, this legislation eliminated the monopoly power in note issue of the Banamex, although competition in note issue was far from perfect. Soon after the enactment of the law of 1897, Mexico witnessed a large increase in bank entry, unlike what occurred in the years prior to the passage of the law: the number of banks increased by only three in 1887–1896, by six in 1897, and by 21 in 1897–1907. Bank output also rose following the enactment of the law of 1897. Bank output per-capita grew by more than 15% in 1898, 1899 and 1900. Although it fell in 1901, bank output per-capita grew again by more than 10% in each of the following six years. The law of 1897 did not lead to a perfectly competitive banking industry. However, considering how restrictive the system was prior to 1897, it is not surprising that several state banks opened soon after the new legislation was passed.

It is possible, however, that the rapid increase in bank entry and in the growth of bank output was partially caused by a faster growth of economy (and the consequent growth of the demand for financial intermediation). For example, exports per-capita fell by 20% in 1893, and fell again in 1894, but then steadily grew from 1895 to 1906. This change in the trend of exports coincides with the change in the trend of bank entry and growth of bank output. The larger number of new banks and the faster growth of bank output following the enactment of the law of 1897 may then obey to the faster growth of the economy29.

In the case of Argentina, the enactment of the Law of National Guaranteed Banks of 1887 preceded the creation of a large number of banks throughout the country. Prior to the law, the number of banks per-capita fell in 1883 and 1884, and then grew by 4% in 1885 and 10% in 1886. Following the change in the legislation, however, growth rates increased substantially. The number of banks per-capita increased by 49% in 1887, 34% in 1888 and 40% in 1889. Our estimates indicate that ten banks were created in 1887, and other ten banks in 1888 and 17 new banks were created in 1889. Bank output also increased more rapidly soon after the enactment of the free-banking law of 1887. Bank output per-capita grew by 3.3% in 1887, 35% in 1888 and 15% in 1889.

The large effect of free-banking may reflect the entrance of new banks due to speculation and excessive borrowing. One of the main ingredients of the rapid growth of banking was the creation of provincial banks of issue. During 1888 and the early months of 1889 13 new banks of issue were organized; eight of them were established by the provincial governments of poor provinces. Specie for these provincial banks was borrowed in Europe, where investors had never heard of those banks. As Quintero (1965), indicates, since loans were obtained to buy national securities (and meet the specie requirement to issue banknotes), creditors probably considered those loans as being made indirectly to the national government and not to the provincial banks. Borrowing by provincial banks created a problem since, according to Piñero (1921), the borrowing provinces lacked the financial capacity to meet their obligations and pay the debt. Privately owned banks followed the same practise conducted by provincial banks. In the meantime, the national government ran continuous large deficits from 1885, leading to a growing external debt: public debt increased from 117 million gold pesos in 1886 to 355 million three years later30. With the expansion of liquidity, several businesses appeared and flourished, at least for a few months. Several new banks (not only banks of issue) were then created in Buenos Aires and in other provinces. Speculation and excessive lending made the financial sector and other sectors grow.

This expansion of the financial sector lasted only a few years. In 1890 the financial bubble exploded. As Quintero (1965, p. 95) indicates, “the real estate and stock markets experienced a sudden crash in that year. The price of a meter of land went down from 10 pesos to less than 10 centavos. No one honored his obligations… The velocity of circulation of money decreased sharply, for people began to hoard in a big way. Banks were reluctant to discount letters, no matter how solvent the prospective borrower was”. In the midst of the crisis, the government created the Caja de Conversión and banks lost the right to issue. The crisis, however, was not avoided: several banks, including the large Banco de la Provincia and Banco Nacional suspended the payment of their obligations.

In the case of Brazil, the law of 1888 established general requirements for granting note-issuance rights, but the free-banking period only lasted until 1890. The number of banks increased rapidly soon after the passage of the free-banking law in 1888: seventeen new banks were created in 1888–1889, whereas only ten banks had been created from 1880 to 1887. The level of bank output per-capita grew very fast soon after the adoption of free-banking in 1888: the growth rate was 33% in 1888 and 26% in 1889.

However, the evolution of bank entry and bank output may obey to the growth of the economy and not necessarily to the legislation. Unfavorable economic conditions, for example, may explain the slow growth of banking from 1880 to 1887. Exports per-capita fell 10% in 1881, 10% in 1882, grew by only 6% in 1883 and 1% in 1884, and fell again 1885 and 1887. In contrast, a faster growth of the economy may have led to a faster growth of banking under the free-banking period. In fact, exports per-capita grew by 132% in 1888 and 11% in 1889. Then, bank entry and the growth of bank output increased in 1888–1889, at a time of the expansion of the export economy.

When looking at the growth of banking in the early 1890s, it is clearer that economic conditions probably mattered more than the adoption of free-banking seems. After the government repealed the free-banking law in 1890 by granting monopoly privileges on note issue to Banco da Republica, and in spite of the restrictions on note issue to other banks, the banking sector continued in expansion. Twenty-five new banks were created in 1890 and other 19 banks entered the industry in 1891, probably as a result as the expansion of the economy: exports per-capita grew from 9.9 dollars in 1889 to 10.5 dollars in 1890 and 11.9 dollars in 1892.

In the case of Peru, the free-banking system lasted between 1914 and 1921. The evidence suggests that the enactment of the 1914 law did not influence bank entry. In 1909–1914 only one bank was created, and in 1914–1919 also only one bank was created. On the other hand, bank output grew faster during the free-banking period, but the increase the growth rate occurred only after two years. The growth rates of bank output per-capita were −30% in 1914, −17% in 1915, 32% in 1916 and 53% in 1917. Bank output certainly grew fast in the late 1910s, but the Peruvian economy also grew fast during those years. Prior to the enactment of the law of 1914, exports per-capita fell in 1913–1914, and then grew 52% in 1915 and kept growing in 1916–1919. It is then possible that the expansion of bank output (especially bank deposits) responded to the greater availability of funds from the boom in exports.

On the other hand, although the law of 1914 facilitated the issue of banknotes, this law established some restrictions on note issue. Banks could issue banknotes from 1914, but they had to maintain at least specie for at least 35% of their issue. In addition, as Quiroz (1993) indicates, the government created the Junta de Vigilancia to control the issue of banknotes and centralize the bank gold guarantees in order to avoid an excessive issue and the depreciation of the banknotes. The government also imposed maximum limits on the amount of authorized banknotes, reducing the probability of speculation. Also, this period of free-banking was accompanied by the expansion of fiscal revenues31. Fiscal prosperity implied that the government did not request funds to banks, which contributed to a moderate growth of the banking sector (unlike the speculative growth in Argentina) and the stability of the financial sector.

Chile enacted a free-banking law in 1860. The banking sector did not respond immediately to the change in the legislation. Only one bank (Banco McClaure y Cia) was created in the period 1860–186532, although other ten banks were created from 1866 to 1870. The law of 1860 did not establish high barriers to entry. There were no capital requirements, for example. It is possible then that charter policies in the 1850s did not restrict entry. It is also possible that Chile only had a few banks because there was no much demand for financial intermediation.

Costa Rica was under a charter system in the 19th century. Since 1884 the government granted monopoly in note issue to one bank, the Banco de Costa Rica.33 Costa Rica then enacted a free-banking law in 1900, which established general requirements for the creation of banks34. Bank entry increased in the years following the enactment of the 1900 law. No bank had opened in the ten years prior to 1900. In contrast, one bank (Banco Comercial) opened in the five years that followed the enactment of the law of 1900, so the number of banks increased from two in 1900 to three in 190535; and another bank (Banco Mercantil) opened in 1908, increasing the number of banks to three36. The two new banks, however, did not receive the authorization to issue immediately. Since they did not meet the capital requirements, they were only authorized to conduct all types of commercial operations, except the issue of banknotes37. On the other hand, even considering the creation of these banks, the total number of banks did not grow as fast as in Mexico, Brazil or Argentina. High capital requirements of near half a million dollars (higher than capital requirements in Mexico and the United States) in a small country of 300,000 inhabitants may explain the slow response of the banking sector.

In the case of El Salvador38, the enactment of the law of 1898 law was not followed by an increase bank entry. Only one bank (Banco National de El Salvador) opened in the ten years that followed the enactment of the law, whereas five banks opened in the ten previous years39. The law of 1898 (replaced by a similar law in 1899) was then associated with a reduction in bank entry. One possible explanation for the decline in bank entry is the level of capital requirements. Banks of issue required to have at least half a million dollars to start to operate. This level of capital was higher than in Mexico and the United States. In addition, it is also possible that charter policies (at least in the late 19th century) had not been restrictive, so bank entry was not constrained. In 1896, for example, El Salvador had almost eight banks per million inhabitants, whereas Costa Rica had seven banks per million inhabitants and Brazil had less than three. On a per-capita basis, El Salvador had more banks than Costa Rica and Brazil, even though exports per-capita in El Salvador were less than five dollars, whereas exports per-capita were near 20 dollars in Costa Rica and almost ten dollars in Brazil.

Therefore, in some countries, the enactment of free-banking laws preceded an increase in the creation of banks and in the growth of bank output. This was the case of Argentina in 1887, Mexico in 1897 and Brazil in 1888. In Costa Rica, bank entry increased but a lower rate than in Argentina, Mexico and Brazil. Moreover, reducing restrictions on note issue not always promoted bank entry. In Peru, for example, bank entry did not increase after the enactment of a free-banking law; and in El Salvador bank entry declined.

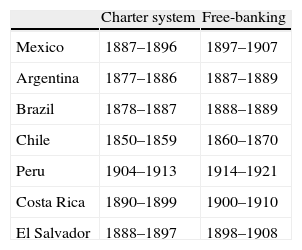

4Econometric analysisIn this section I conduct a multivariate analysis to determine whether controlling for other variables the enactment of free-banking laws caused an increase in the growth of the number of banks and of bank output. I use data for seven Latin American countries that adopted a free-banking law at some point in time in the period 1860–1930. Table 4 reports the countries and the periods included in the sample. The countries included in the sample are Mexico, Argentina, Brazil, Peru, Chile, Costa Rica and El Salvador. Following Economopoulos and O’Neill (1995) and Ng (1988), I analyze the evolution of bank entry and the growth of bank output around the enactment of free-banking in order to test the impact of free-banking on barriers to entry. If free-banking lowered barriers to entry, the entry of banks and the growth of bank output must have been larger in the years following the change in the legislation than in the years prior to the law change. In particular, I use data for a period of up to 21 years for each country: the ten years prior to the adoption of free-banking, the year in which free-banking was adopted, and up to ten years following the passage of free-banking laws. In the cases of Mexico, Chile, Costa Rica and El Salvador, I included the ten years that followed the enactment of their free-banking laws. In the cases of Argentina, Brazil and Peru, I select less than ten years following the enactment of their free-banking laws, simply because free-banking in those countries lasted less than ten years.

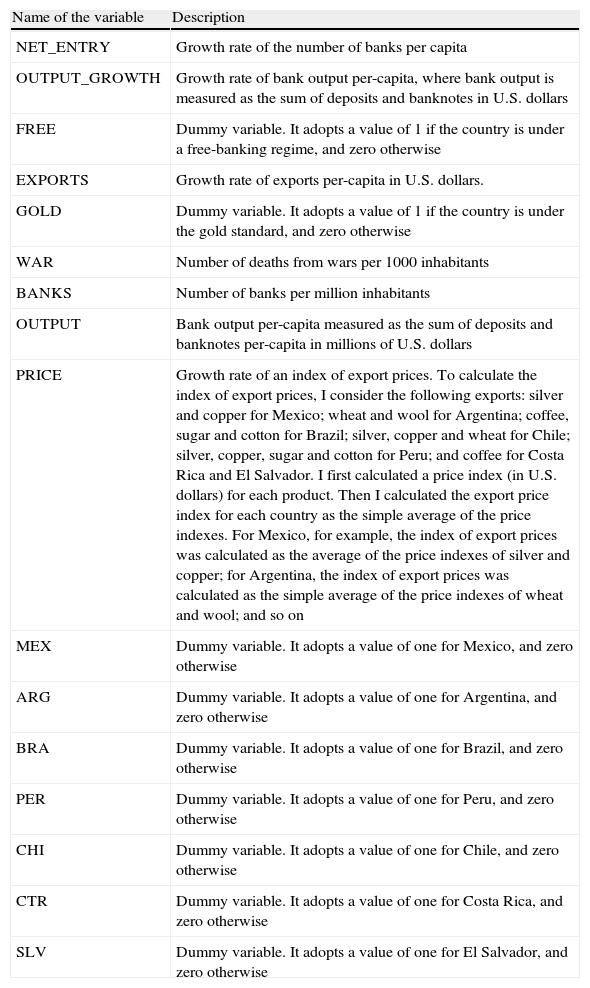

Table 5 lists the variables included in the econometric model, and Table 6 shows the main descriptive statistics of the variables. The model has two alternative dependent variables. The first dependent variable measures the net entry of banks (NET_ENTRY), calculated as the growth rate of the number of banks per-capita. The second dependent variable measures the growth rate of bank output per-capita (OUTPUT_GROWTH), where bank output is measured as the sum of bank deposits and banknotes in U.S. dollars40. The dependent variables are defined in per-capita terms.

Variables included in the econometric models.

| Name of the variable | Description |

| NET_ENTRY | Growth rate of the number of banks per capita |

| OUTPUT_GROWTH | Growth rate of bank output per-capita, where bank output is measured as the sum of deposits and banknotes in U.S. dollars |

| FREE | Dummy variable. It adopts a value of 1 if the country is under a free-banking regime, and zero otherwise |

| EXPORTS | Growth rate of exports per-capita in U.S. dollars. |

| GOLD | Dummy variable. It adopts a value of 1 if the country is under the gold standard, and zero otherwise |

| WAR | Number of deaths from wars per 1000 inhabitants |

| BANKS | Number of banks per million inhabitants |

| OUTPUT | Bank output per-capita measured as the sum of deposits and banknotes per-capita in millions of U.S. dollars |

| PRICE | Growth rate of an index of export prices. To calculate the index of export prices, I consider the following exports: silver and copper for Mexico; wheat and wool for Argentina; coffee, sugar and cotton for Brazil; silver, copper and wheat for Chile; silver, copper, sugar and cotton for Peru; and coffee for Costa Rica and El Salvador. I first calculated a price index (in U.S. dollars) for each product. Then I calculated the export price index for each country as the simple average of the price indexes. For Mexico, for example, the index of export prices was calculated as the average of the price indexes of silver and copper; for Argentina, the index of export prices was calculated as the simple average of the price indexes of wheat and wool; and so on |

| MEX | Dummy variable. It adopts a value of one for Mexico, and zero otherwise |

| ARG | Dummy variable. It adopts a value of one for Argentina, and zero otherwise |

| BRA | Dummy variable. It adopts a value of one for Brazil, and zero otherwise |

| PER | Dummy variable. It adopts a value of one for Peru, and zero otherwise |

| CHI | Dummy variable. It adopts a value of one for Chile, and zero otherwise |

| CTR | Dummy variable. It adopts a value of one for Costa Rica, and zero otherwise |

| SLV | Dummy variable. It adopts a value of one for El Salvador, and zero otherwise |

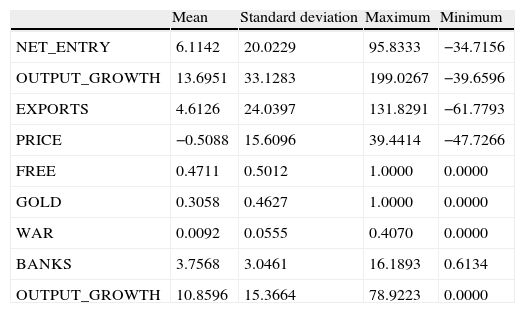

Descriptive statistics.

| Mean | Standard deviation | Maximum | Minimum | |

| NET_ENTRY | 6.1142 | 20.0229 | 95.8333 | −34.7156 |

| OUTPUT_GROWTH | 13.6951 | 33.1283 | 199.0267 | −39.6596 |

| EXPORTS | 4.6126 | 24.0397 | 131.8291 | −61.7793 |

| PRICE | −0.5088 | 15.6096 | 39.4414 | −47.7266 |

| FREE | 0.4711 | 0.5012 | 1.0000 | 0.0000 |

| GOLD | 0.3058 | 0.4627 | 1.0000 | 0.0000 |

| WAR | 0.0092 | 0.0555 | 0.4070 | 0.0000 |

| BANKS | 3.7568 | 3.0461 | 16.1893 | 0.6134 |

| OUTPUT_GROWTH | 10.8596 | 15.3664 | 78.9223 | 0.0000 |

One of the explanatory variables is FREE. This variable is a dummy, and adopts a value of one if the country was under a free-banking and zero otherwise. If free-banking lowered barriers to entry then the effect of FREE on NET_ENTRY and on OUTPUT_GROWTH must be positive. I also include country free-banking dummies by multiplying FREE with country dummies. The country dummies are MEX, ARG, BRA, CHI, PER, CTR and SLV. The inclusion of these country free-banking dummies is important, since free-banking laws varied across countries.

Another explanatory variable is the growth rate of exports per-capita (EXPORTS). I include this variable to test the impact of the level of economic activity on the development of banking. I use exports per-capita rather than GDP per-capita as indicator of economic activity simply because information about GDP per-capita for the 19th century is unavailable for most countries in the sample. Since Latin American countries were largely exporting economies, variation in exports per-capita may be a good indicator of variation in income per-capita. I expect this variable to have a positive effect on the dependent variables.

One problem of using an indicator of economic activity as explanatory variable of NET_ENTRY or OUTPUT_GROWTH is that it may be endogenous. In the case of EXPORTS, the endogeneity problem may be an issue. A higher growth in the number of banks and a higher growth of bank output (calculated as the sum of deposits and note issue) may have been associated with a higher level of credit to businesses, including exporting firms, which therefore may have been able to expand their production. However, it is also possible that the export sector was largely driven by external factors, and not by the development of the domestic banking sector. In this case, EXPORTS was not endogenous to the development of banking. I then estimate the model in two stages (two state-least squares) using PRICE as instrument for EXPORTS, where PRICE is the growth rate of an index of export prices. To calculate the index of export prices, I consider the following exports: silver and copper for Mexico; wheat and wool for Argentina; coffee, sugar and cotton for Brazil; silver, copper and wheat for Chile; silver, copper, sugar and cotton for Peru; and coffee for Costa Rica and El Salvador. I first calculated a price index for each product (1900=100). Then I calculated the export price index for each country as the simple average of the price indexes. For Mexico, for example, the index of export prices was calculated as the average of the price indexes of silver and copper; for Argentina, the index of export prices was calculated as the simple average of the price indexes of wheat and wool; and so on. International prices of commodities may be exogenous to the banking systems of these countries, so PRICE may be exogenous to EXPORTS.

Other two explanatory variables control for the effects of monetary policies and war. One of those variables is the dummy variable GOLD, which controls for the effect of the gold-standard41. This variable adopts a value of one if the country is under the gold standard and zero otherwise. Countries under a gold standard probably had lower inflation and lower risk of devaluation, attracting foreign banking. The effect on domestic banks (and on the total number of banks) is, however, ambiguous. Under gold standard, inflation may be lower, which may attract entry of domestic banks. However, the entry of foreign banks (for the reduction in devaluation risks) may hinder the creation of domestic banks. If foreign banks have access to a lower cost of capital than domestic banks, foreign banks may tend to be much larger. In this case, the entry of foreign banks may actually substantially reduce the number of domestic banks. The effect on NET_ENTRY and OUTPUT_GROWTH is then ambiguous.

I also include the variable WAR to control for the effects of war-related instability on the growth of the banking sector42. This variable is equal to the total number of deaths in wars per 1000 inhabitants. The effect of WAR on the dependent variables is expected to be negative.

Considering that the growth rate of one variable may be negatively correlated with its initial level, I include one lag of BANKS in the regressions of NET_ENTRY and one lag of OUTPUT in the regressions of OUTPUT_GROWTH.

Finally, I include country fixed-effects to control for relevant omitted variables which remain constant over time. If those omitted variables are correlated with the explanatory variables, the estimates will be inconsistent and biased if fixed effects are not included in the regressions.

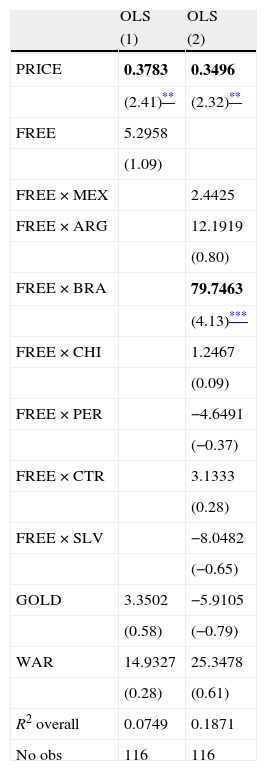

Table 7 reports first-stage OLS estimates. The dependent variable is EXPORTS. In column 1 the explanatory variables are PRICE, FREE, GOLD and WAR. In column 2 I include the country-specific free-banking dummies instead of FREE. Country fixed-effects are included in both columns. In both columns the estimator for PRICE is positive and statistically significant at a 5% level. Since PRICE may be exogenous to EXPORTS and it has a statistically significant effect on EXPORTS, then PRICE is a valid instrument for EXPORTS.

Dependent variable: EXPORTS.

| OLS | OLS | |

| (1) | (2) | |

| PRICE | 0.3783 | 0.3496 |

| (2.41)** | (2.32)** | |

| FREE | 5.2958 | |

| (1.09) | ||

| FREE×MEX | 2.4425 | |

| FREE×ARG | 12.1919 | |

| (0.80) | ||

| FREE×BRA | 79.7463 | |

| (4.13)*** | ||

| FREE×CHI | 1.2467 | |

| (0.09) | ||

| FREE×PER | −4.6491 | |

| (−0.37) | ||

| FREE×CTR | 3.1333 | |

| (0.28) | ||

| FREE×SLV | −8.0482 | |

| (−0.65) | ||

| GOLD | 3.3502 | −5.9105 |

| (0.58) | (−0.79) | |

| WAR | 14.9327 | 25.3478 |

| (0.28) | (0.61) | |

| R2 overall | 0.0749 | 0.1871 |

| No obs | 116 | 116 |

Notes: The table reports OLS estimates for EXPORTS as dependent variable. The table also reports t-statistics in parentheses. All equations include country fixed-effects. Bold figures are statistically significant at a 10% level.

*Significant at 10%.

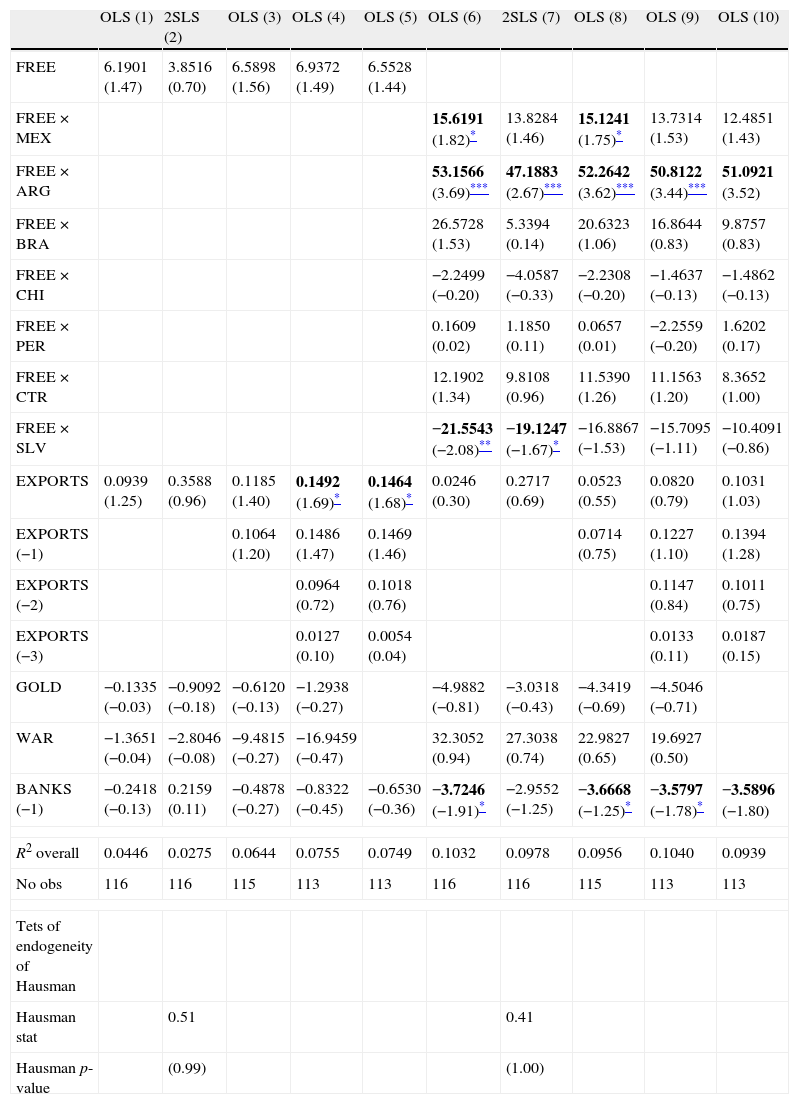

Table 8 reports OLS and 2SLS estimates for NET_ENTRY as dependent variable. All specifications include country fixed-effects. Columns 1–5 include FREE and the control variables EXPORTS, GOLD, WAR and one lag of BANKS. Columns 6–10 include the country-specific free-banking dummies instead of FREE. Columns 3–5 and 8–10 add up to three lags for EXPORTS. Adding lags for EXPORTS is important since it is possible that the growth of the economy and the export sector had a lagged effect on the growth of the banking sector. Columns 5 and 10 estimate the regressions excluding GOLD and WAR from the model. Columns 2 and 7 report 2SLS estimates using PRICE as instrument for EXPORTS.

Dependent variable: NET_ENTRY.

| OLS (1) | 2SLS (2) | OLS (3) | OLS (4) | OLS (5) | OLS (6) | 2SLS (7) | OLS (8) | OLS (9) | OLS (10) | |

| FREE | 6.1901 (1.47) | 3.8516 (0.70) | 6.5898 (1.56) | 6.9372 (1.49) | 6.5528 (1.44) | |||||

| FREE×MEX | 15.6191 (1.82)* | 13.8284 (1.46) | 15.1241 (1.75)* | 13.7314 (1.53) | 12.4851 (1.43) | |||||

| FREE×ARG | 53.1566 (3.69)*** | 47.1883 (2.67)*** | 52.2642 (3.62)*** | 50.8122 (3.44)*** | 51.0921 (3.52) | |||||

| FREE×BRA | 26.5728 (1.53) | 5.3394 (0.14) | 20.6323 (1.06) | 16.8644 (0.83) | 9.8757 (0.83) | |||||

| FREE×CHI | −2.2499 (−0.20) | −4.0587 (−0.33) | −2.2308 (−0.20) | −1.4637 (−0.13) | −1.4862 (−0.13) | |||||

| FREE×PER | 0.1609 (0.02) | 1.1850 (0.11) | 0.0657 (0.01) | −2.2559 (−0.20) | 1.6202 (0.17) | |||||

| FREE×CTR | 12.1902 (1.34) | 9.8108 (0.96) | 11.5390 (1.26) | 11.1563 (1.20) | 8.3652 (1.00) | |||||

| FREE×SLV | −21.5543 (−2.08)** | −19.1247 (−1.67)* | −16.8867 (−1.53) | −15.7095 (−1.11) | −10.4091 (−0.86) | |||||

| EXPORTS | 0.0939 (1.25) | 0.3588 (0.96) | 0.1185 (1.40) | 0.1492 (1.69)* | 0.1464 (1.68)* | 0.0246 (0.30) | 0.2717 (0.69) | 0.0523 (0.55) | 0.0820 (0.79) | 0.1031 (1.03) |

| EXPORTS (−1) | 0.1064 (1.20) | 0.1486 (1.47) | 0.1469 (1.46) | 0.0714 (0.75) | 0.1227 (1.10) | 0.1394 (1.28) | ||||

| EXPORTS (−2) | 0.0964 (0.72) | 0.1018 (0.76) | 0.1147 (0.84) | 0.1011 (0.75) | ||||||

| EXPORTS (−3) | 0.0127 (0.10) | 0.0054 (0.04) | 0.0133 (0.11) | 0.0187 (0.15) | ||||||

| GOLD | −0.1335 (−0.03) | −0.9092 (−0.18) | −0.6120 (−0.13) | −1.2938 (−0.27) | −4.9882 (−0.81) | −3.0318 (−0.43) | −4.3419 (−0.69) | −4.5046 (−0.71) | ||

| WAR | −1.3651 (−0.04) | −2.8046 (−0.08) | −9.4815 (−0.27) | −16.9459 (−0.47) | 32.3052 (0.94) | 27.3038 (0.74) | 22.9827 (0.65) | 19.6927 (0.50) | ||

| BANKS (−1) | −0.2418 (−0.13) | 0.2159 (0.11) | −0.4878 (−0.27) | −0.8322 (−0.45) | −0.6530 (−0.36) | −3.7246 (−1.91)* | −2.9552 (−1.25) | −3.6668 (−1.25)* | −3.5797 (−1.78)* | −3.5896 (−1.80) |

| R2 overall | 0.0446 | 0.0275 | 0.0644 | 0.0755 | 0.0749 | 0.1032 | 0.0978 | 0.0956 | 0.1040 | 0.0939 |

| No obs | 116 | 116 | 115 | 113 | 113 | 116 | 116 | 115 | 113 | 113 |

| Tets of endogeneity of Hausman | ||||||||||

| Hausman stat | 0.51 | 0.41 | ||||||||

| Hausman p-value | (0.99) | (1.00) | ||||||||

Notes: the table reports OLS and 2SLS estimates for NET_ENTRY as dependent variable. The table also reports t-statistics (OLS equations) and Z-statistics (2SLS equations) in parentheses. PRICE is the instrument for EXPORTS in columns 2 and 7. The table also reports Hausman statistics and p-values. All equations include country fixed-effects. Bold figures are statistically significant at a 10% level.

I conduct a Hausman test to determine whether EXPORTS is endogenous to NET_ENTRY. The null hypothesis is that OLS and 2SLS estimates are consistent, and the alternative hypothesis is that only 2SLS estimates are consistent. If the null hypothesis is accepted then we can conclude that OLS estimates are consistent, so EXPORTS is not endogenous to NET_ENTRY. Columns 2 and 7 report the Hausman statistics. The Hausman test in column 2 compares the OLS estimates from column 1 and the 2SLS estimates from column 2, whereas the Hausman test in column 7 compares the OLS estimates in column 6 and the 2SLS estimates in column 7. At a 5% level I cannot reject the null hypothesis, so EXPORTS is exogenous to NET_ENTRY and OLS estimates are consistent. Since the OLS estimates are consistent and efficient, it is more appropriate to rely on OLS estimates to withdraw conclusions about the determinants of NET_ENTRY.

Column 1 includes FREE as explanatory variable, assuming that the effect of free-banking was the same across countries. The estimate for FREE is positive but is not significant. This result cannot be interpreted as that the adoption of free-banking did not lead to a faster net entry of banks in any country: the effect of free-banking may vary across countries. The results in column 6 indicate that free-banking in Argentina and Mexico increased bank entry, whereas free-banking in Brazil, Peru, Chile and Costa Rica did not affect bank entry. The result for Argentina is robust to including lags for EXPORTS and to excluding GOLD and WAR from the regressions: in columns 8–10, the estimate for FREE×ARG is still positive and significant at a 1% level. The results for Brazil, Peru, Chile and Costa Rica are also robust to changes in the specification (columns 8–10). In the case of Mexico, however, the result is not robust to including three lags for EXPORTS: in columns 9 and 10, the estimate for FREE×MEX is positive, but is not significant at a 10% level. Meanwhile, the estimator for FREE×SLV suggests that free-banking in El Salvador reduced bank entry. This result, however, is not robust to including lags for EXPORTS and to the exclusion of GOLD and WAR from the model (columns 8–10).

The results in columns 6, 8–10 suggest that the enactment of free-banking in Argentina increased the growth of the number of banks per-capita by at least 50 percentage points. This effect is very large. The estimate for FREE×MEX in column 6 is 0.15, which suggests that the enactment of free-banking in Mexico led to an increase in the growth of the number of banks per-capita by 15 percentage points, a much smaller impact than that of free-banking in Argentina. As indicated, however, this result is not robust: columns 9 and 10 indicate that free-banking in Mexico did not cause a change in bank entry.

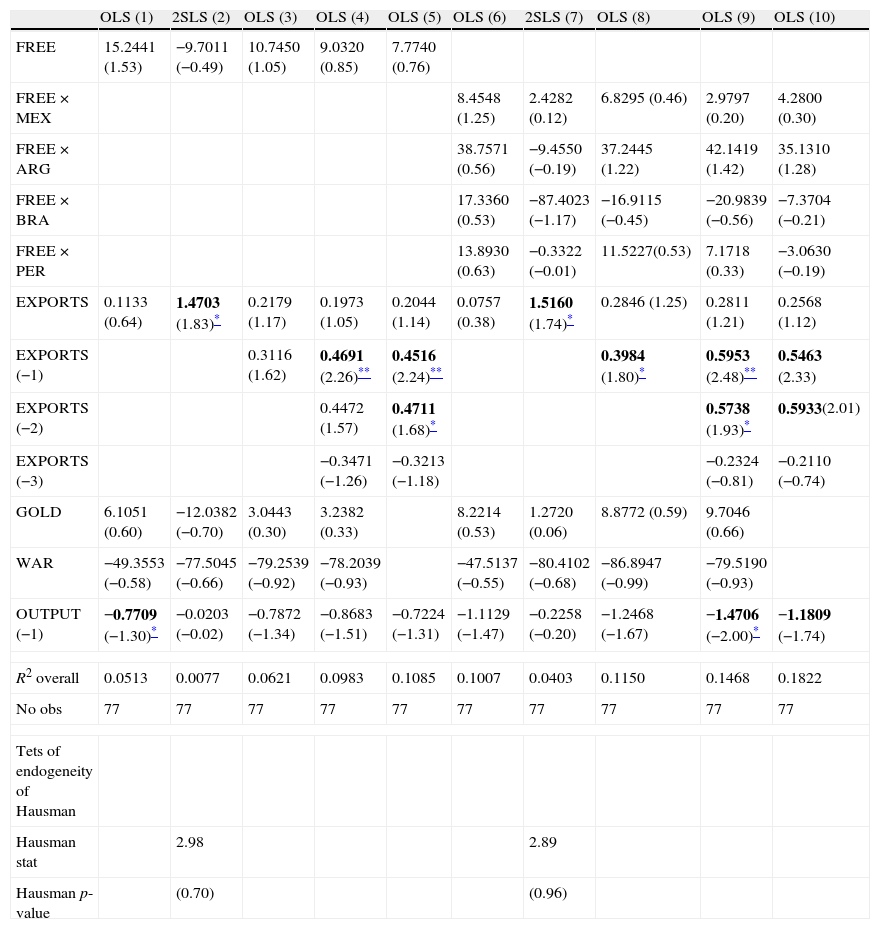

Let us now analyze the effect of free-banking on OUTPUT_GROWTH. Data for bank output is available for Mexico, Argentina, Brazil and Peru. Table 9 reports OLS and 2SLS estimates for OUTPUT_GROWTH as dependent variable. All specifications include country fixed-effects. Columns 1–5 include the variable FREE to measure the impact of free-banking, as well as the control variables EXPORTS, GOLD, WAR and one lag of OUTPUT. Columns 6–10 include country-specific free-banking dummies rather than FREE. Columns 3–5 and 8–10 add up to three lags for EXPORTS. Columns 2 and 7 report 2SLS estimates using PRICE as instrument for EXPORTS.

Dependent variable: OUTPUT_GROWTH.

| OLS (1) | 2SLS (2) | OLS (3) | OLS (4) | OLS (5) | OLS (6) | 2SLS (7) | OLS (8) | OLS (9) | OLS (10) | |

| FREE | 15.2441 (1.53) | −9.7011 (−0.49) | 10.7450 (1.05) | 9.0320 (0.85) | 7.7740 (0.76) | |||||

| FREE×MEX | 8.4548 (1.25) | 2.4282 (0.12) | 6.8295 (0.46) | 2.9797 (0.20) | 4.2800 (0.30) | |||||

| FREE×ARG | 38.7571 (0.56) | −9.4550 (−0.19) | 37.2445 (1.22) | 42.1419 (1.42) | 35.1310 (1.28) | |||||

| FREE×BRA | 17.3360 (0.53) | −87.4023 (−1.17) | −16.9115 (−0.45) | −20.9839 (−0.56) | −7.3704 (−0.21) | |||||

| FREE×PER | 13.8930 (0.63) | −0.3322 (−0.01) | 11.5227(0.53) | 7.1718 (0.33) | −3.0630 (−0.19) | |||||

| EXPORTS | 0.1133 (0.64) | 1.4703 (1.83)* | 0.2179 (1.17) | 0.1973 (1.05) | 0.2044 (1.14) | 0.0757 (0.38) | 1.5160 (1.74)* | 0.2846 (1.25) | 0.2811 (1.21) | 0.2568 (1.12) |

| EXPORTS (−1) | 0.3116 (1.62) | 0.4691 (2.26)** | 0.4516 (2.24)** | 0.3984 (1.80)* | 0.5953 (2.48)** | 0.5463 (2.33) | ||||

| EXPORTS (−2) | 0.4472 (1.57) | 0.4711 (1.68)* | 0.5738 (1.93)* | 0.5933(2.01) | ||||||

| EXPORTS (−3) | −0.3471 (−1.26) | −0.3213 (−1.18) | −0.2324 (−0.81) | −0.2110 (−0.74) | ||||||

| GOLD | 6.1051 (0.60) | −12.0382 (−0.70) | 3.0443 (0.30) | 3.2382 (0.33) | 8.2214 (0.53) | 1.2720 (0.06) | 8.8772 (0.59) | 9.7046 (0.66) | ||

| WAR | −49.3553 (−0.58) | −77.5045 (−0.66) | −79.2539 (−0.92) | −78.2039 (−0.93) | −47.5137 (−0.55) | −80.4102 (−0.68) | −86.8947 (−0.99) | −79.5190 (−0.93) | ||

| OUTPUT (−1) | −0.7709 (−1.30)* | −0.0203 (−0.02) | −0.7872 (−1.34) | −0.8683 (−1.51) | −0.7224 (−1.31) | −1.1129 (−1.47) | −0.2258 (−0.20) | −1.2468 (−1.67) | −1.4706 (−2.00)* | −1.1809 (−1.74) |

| R2 overall | 0.0513 | 0.0077 | 0.0621 | 0.0983 | 0.1085 | 0.1007 | 0.0403 | 0.1150 | 0.1468 | 0.1822 |

| No obs | 77 | 77 | 77 | 77 | 77 | 77 | 77 | 77 | 77 | 77 |

| Tets of endogeneity of Hausman | ||||||||||

| Hausman stat | 2.98 | 2.89 | ||||||||

| Hausman p-value | (0.70) | (0.96) | ||||||||

Notes: The table reports OLS and 2SLS estimates for OUTPUT_GROWTH as dependent variable. The table also reports t-statistics (OLS equations) and Z-statistics (2SLS equations) in parentheses. PRICE is the instrument for EXPORTS in columns 2 and 7. The table also reports Hausman statistics and p-values. All equations include country fixed-effects. Bold figures are statistically significant at a 10% level.

I conduct a Hausman test to determine whether EXPORTS is endogenous to OUTPUT_GROWTH. The null hypothesis is that OLS and 2SLS estimates are consistent, and the alternative hypothesis is that only 2SLS estimates are consistent. The results indicate that at a 5% level I cannot reject the null hypothesis. The interpretation of this result is that EXPORTS is exogenous to OUTPUT_GROWTH, which is consistent with the results in Table 8. Since the OLS estimates are consistent and efficient, it is more appropriate to rely on OLS estimates to withdraw conclusions about the determinants of OUTPUT_GROWTH.

The estimator for FREE in column 1 is not significant. This result may be interpreted as that the adoption of free-banking in Mexico, Argentina, Brazil and Peru did not change the annual growth rate of bank output. The effect of free-banking on bank output growth, however, was probably not the same across countries. The specifications in columns 6–10 allow for a differentiated effect. The results in these columns indicate that free-banking did not increase the growth rate of bank output in any country. The estimators for all free-banking country dummies are positive, but they are not significant at a 10% level. The larger estimate is that for Argentina: in column 6, for example, the estimator for FREE×ARG is 38, much greater than for any other country. Even for Argentina, however, the estimator is not significant. The growth of exports seems to be a better explanatory variable of the growth of bank output than the enactment of free-banking laws. As the estimates in columns 3–5 and 8–10 indicate, the first and second lags of EXPORTS are significant at a 5% level. Excluding GOLD and WAR does not change the main qualitative results.

The econometric results indicate that the adoption of free-banking laws did not have the same effects on all Latin American countries. Controlling for the growth of the export sector (which may be related to the growth of the demand for banking intermediation), the adoption of gold standard, war-related instability and country fixed-effects, the results indicate that Argentina was the only country with a positive and robust impact of free-banking on the growth of the number of banks. In all other countries, the impact of free-banking on the growth in the number of banks is not significant or is not robust to changes in the specification. On the other hand, the evidence also shows that the impact of free-banking on the growth of bank output was never significant. The growth of exports (including its lags) is actually more important than the adoption of free-banking for explaining the growth of bank output.

We must be very careful in the interpretation of these results, especially for Argentina. In this case, the results indicate that the adoption of free-banking was followed by a significant increase in the growth of the number of banks. This result, however, only corresponded to 1887–1889, since free-banking only lasted until 1889. As I mentioned previously, this result may simply reflect the creation of banks due to speculation and excessive borrowing43. In other countries, the evidence suggests that free-banking did not lower barriers to entry, either because free-banking laws established important barriers to entry or because charter policies were not restrictive. In the cases of Costa Rica and El Salvador, for example, capital requirements were too high; in Mexico, several restrictions prevented the banking industry from being very competitive; and in Peru capital and specie requirements were not high, but government control and healthy fiscal finances prevented speculation from happening. In Chile and Brazil, it is possible that charter policies were not very restrictive, so that the enactment of free-banking laws did not make much of a difference.

5ConclusionsIn theory, the adoption of free-banking could potentially promote the entry of banks and the growth of bank output if note issue was an important source of funding for banks and charter policies were restrictive and granted note-issuance rights to only a few banks. However, if pre free-banking charter policies were liberal, or if free-banking laws imposed some severe restrictions on capital or specie (or other restrictions), then free-banking probably did not have any effect on the banking industry.

The econometric analysis shows that in average bank entry and the growth of bank output was not influenced by the enactment of free-banking laws. The inclusion of country-specific free-banking dummies indicates that in the case of Argentina bank entry increased but bank output did not grow faster. In the seven countries in the sample, the adoption of free-banking did not lead to a significant increase in the growth of bank output. In the case of Argentina, it seems that the large response of the banking industry was partially caused by speculation and excessive borrowing by provincial and national governments. In other countries, free-banking did not increase the growth of banking because either free-banking laws established severe restrictions on entry or charter policies (prior to the free-banking period) were already very liberal.

That free-banking did not change the incentives to create banks in the short run in several countries certainly does not imply that in the long run free-banking laws could not make a difference. It is possible that growth rates of the number of banks and bank output were greater in the long run under free-banking. However, in the short run, it seems that charter policies for most of our sample were not a binding constraint for the growth of the banking sector.

The effects of banking laws in Latin America certainly deserve more attention from the literature. There much research to be done. The effect of free-banking on financial stability, for example, is an important issue. Since free-banking laws did not lead to many more banks in the short run, it is important to know whether those laws increased financial instability. If free-banking laws did not make the system more competitive but made it more unstable, then it is clear that the adoption of free-banking was not socially desirable.

FundingFinancial support was provided by Kenneth Sokoloff, the UCLA Department of Economics, the Economic History Association, the All-UC Economic History Group, the Latin American and Caribbean Economic Association-LACEA, the UCLA-Latin American Center, the UCLA-Global Fellows Program, and the Institute for Humane Studies.

I thank the comments and advise of Professors Kenneth Sokoloff, Jean-Laurent Rosenthal and Naomi Lamoreaux.

I am also grateful to the four anonymous referees who evaluated this article for their suggestions and recommendations.

I used a large number of primary and secondary sources to obtain information on bank laws and to calculate series on the number of banks, bank deposits, banknotes, exports and export prices.

Information about bank laws in the sample comes from several sources. For Mexico, the main source was Ludlow and Salmerón-Castro (1997). For Brazil, I relied on the Senate's website. For Argentina, I relied on Piñero (1921) and Quesada (1908). For Chile, I used Santelices (1893), Subercaseaux (1922) and Mamalakis (1985). For Peru, I relied on information from the website of the National Congress, which apparently contains every law from 1822. For Costa Rica, the sources were Gil-Pacheco (1958, 1988) and Villalobos (1981). Finally, for El Salvador, I relied on Rochac (1984) and Silva (1979).

I constructed series of number of banks based on information about the year of creation and liquidation of all banks. Data on bank deposits and banknotes was obtained from a number of sources. For Mexico, I calculated the number of banks using Ramírez (1985) and McCaleb (1920). I relied on the Instituto Nacional de Estadística, Geografía e Informática (1985) to obtain bank deposits and banknotes. For Brazil, I calculated the number of banks using Imperial decrees4444 These decrees are available in the Senate's website.

Data on exports mostly come from a variety of sources. For Mexico, Argentina, Brazil, Peru and El Salvador, I relied on Mitchell (1998). For Chile I used Braun et al. (2000). For Costa Rica I used Soley (1926). For some countries, exports figures are expressed in domestic currencies. In those cases, I converted the export figures to U.S. dollars.

I constructed export price indexes using data for the following commodities: silver, copper, sugar, cotton, coffee, wheat and wool. For the price of silver, I used data on prices of a bar of silver in London from the NBER's website www.nber.org. For copper, I used New York prices from Braun et al. (2000) For coffee, prices were from San Francisco (Berry, 1984) until 1899 and New York (NBER's website) from 1900. Sugar prices refer to San Francisco until 1899 (Berry, 1984) and New York from 1900 (NBER's website). Cotton prices refer to New York and come from U.S. Department of Commerce (1975). Wheat prices are wholesale prices in London and come from NBER's website. Wool prices are for Boston (until 1890) and Ohio (from 1891) from U.S. Department of Commerce (1975).

In most cases, exports are expressed in domestic currencies. I then used exchange rates between domestic currencies and U.S. dollars to convert exports into U.S. dollars. Data on exchange rates between the domestic currencies and the U.S. dollar comes from a variety of sources. When it was possible, I used official or secondary sources. In other cases, I estimated the exchange rate by using the specie content of the domestic currency and U.S. dollar. For Mexico, data on exchange rates between the peso and U.S. dollar come from Estadísticas Históricas de México (1985). For Brazil, the exchange rate between the Brazilian milreis and the U.S. dollar was obtained from Normano (1935). For Argentina, the exchange rate between the Argentine gold peso and the U.S. dollar was estimated using the specie content of those currencies. On the other hand, the exchange rate between Argentine paper pesos and the U.S. dollar came from Vásquez-Presedo (1988). For Peru, exchange rates between the sol and U.S. dollar were obtained from Extracto Estadístico 1927. For Chile, the exchange rate between the Chilean peso and U.S. dollar was obtained from Braun et al. (2000). In the case of Costa Rica, this country had four different currencies in this period: silver peso, gold peso, gold colon, and silver colon. I estimated the exchange rates between the first three currencies and the U.S. dollar, using the specie content of those currencies. I obtained the exchange rate between the silver colon and the U.S. dollar from Soley (1926). For El Salvador, I used the specie content of the peso, colon and U.S. dollar to estimate implicit exchange rates between the peso and dollar (until 1900) and between the colon and dollar (from 1901).

The sources for this data are reported in the appendix.

Early banks provided several financial services. Among their main services, banks received deposits, issued banknotes and made loans. Therefore, banks provided a medium of exchange and a store of value, and acted as intermediaries between savers and borrowers.

He argues that due to competition to attract investment, charter states also liberalize their charter policies while some states enact free-banking laws.

Haber (1991), however, does not only focus on restrictions on note issue.

Haber argues that legal financial constraints in Mexico and Brazil dramatically reduced the supply of credit below what it otherwise would have been, and therefore yielded less industrial production and greater industrial concentration in those countries than occurred in the United States. In the case of Mexico, the Mexican ruler Porfirio Diaz (1877–1911) “relied on financial and political support of a small in-group of powerful financial capitalists, who were able to use their political power to erect legal barriers to entry in the banking industry”.

In a study for Mexico, Maurer (2002) analyzes the response of banks to competition in note issue. He tests whether a greater number of banks of issue increased the proportion of earning assets with respect to total assets. The lack of balance-sheets data for a large number of Latin American countries does not allow us to extend such analysis to a sample of several countries.

There are certainly several interesting areas of research about the banking sector in Latin America. This article only refers to the relationship between free-banking and bank entry.

Decree 3403, November 24, 1888.

Decree 165, January 17, 1890.

In December 7, 1890, the government authorized the merger of Banco Nacional and Banco dos Estados Unidos do Brasil into the Banco da Republica.

Two years later, the government authorized the formation of Banco da Republica do Brasil, and granted this bank monopoly rights in note issue. In 1896 the government eliminated all concessions, and ten years later it chartered the fourth Banco do Brasil, which took over Banco da Republica.

November 3, 1887.

Even the official banks Banco de la Provincia and Banco Nacional had to shut down. The government then took financial responsibility for the guaranteed banks’ debts.

This law was enacted in July 28, 1860.

Information about this law was obtained from Subercaseaux (1922).

The 1860 law increased transparency for the formation of banks of issue; but they (as any corporation) still required a specific Executive decree to operate.

Those banknotes were called cheques circulares.

Those banknotes had legal course.

No other bank could issue banknotes. Banco Nacional de Costa Rica and Banco Anglo Costarricense were then prohibited to issue banknotes.

Banknotes were not of legal tender.

This law was passed on January 4, 1898 by the National Assembly of El Salvador and published eleven days later. Rochac (1984) and Silva (1979) provide information on this law.

The law actually mentioned mortgage banks as a type of institution of credit. However, it did not regulate their formation or operations. The law rather established that mortgage banks would be regulated by another law. Other types of banks were ruled by the general legislation or by their charters.

Bank owners could be individuals or companies, but every bank ought to operate as a corporation.

Banks could not discount notes without two signatures, or without collateral, and could not make mortgage loans.

May 4, 1899.

For example, banks needed to be corporations with a minimum capital of a million colons, and seven shareholders. Requirements on specie were also the same as those in the law of 1898. Banks of issue needed to meet the requirements from the commercial legislation which contained the requirements for the incorporation of companies and the law of banks of issue; whereas other commercial banks were only subject to this commercial code. For example, the incorporation of the Banco Nacional of El Salvador in 1906 was subject to the law of banks of issue, whereas the authorization of the Commercial Bank of Spanish America to open a branch in El Salvador in 1924 was subject to the commercial code (Rochac, 1984, p. 327).

This analysis of the short-term effects of the institution of free-banking may be more appropriate than the analysis of long-term effects to determine whether the lack of free-banking legislation was a binding constraint for entry or for the reduction in production costs. The idea of a “binding constraint” has received much attention lately in the literature of competitiveness for the analysis of the factors that are binding constraints (obstacles) for the growth of the economies.

This methodology has similarities with the methods employed by Economopoulos and O’Neill (1995), Ng (1988) and Sylla (1969) in their testing of the effects of free-banking on US bank entry. Ng (1988) uses a similar time period for a comparison of the effects of free-banking in the United States, whereas Sylla (1969) compares the growth of banking assets before and after the passage of free-banking laws.

New York prices of copper, for example, remained around 70 dollars per pound in 1892–1897 and barely increased by 0.4% per year during this period; but then went up by 25% per year in 1897–1899.

Quintero (1963). All these factors created a bubble that exploded in 1890.

Fiscal revenues increased from 33 million soles in 1915 to 83 million soles in 1921.

However, seven new banks entered in 1866–1870.

Prior to 1884 the government allowed several banks of issue to compete. By 1880 four banks were in operation: Banco Nacional, Banco Anglo Costarricense, Banco de la Unión and Banco Herediano. Banco Nacional was chartered in 1877, Banco Anglo Costarricense was created in 1863, Banco de la Unión was created in 1877 and Banco Herediano was created in 1879. All of them could issue banknotes. No law restricted competition in note issue. However, in 1884 the government granted Banco de la Union (later in 1890 called Banco de Costa Rica) the monopoly in note issue. The contract between the Ministry of Hacienda and the General Manager of this bank established that this bank would be the only bank authorized to issue banknotes and in exchange the government would receive credit from this bank. Until then, other banks had been issuing banknotes. In fact, Banco Nacional de Costa Rica was seriously affected by the new legislation, leading to the failure of that bank in 1884. By 1900 two banks operated in Costa Rica: Banco de Costa Rica and Banco Anglo Costarricense. Banco Costa de Rica had the monopoly in note issue and Banco Anglo Costarricense conducted other commercial banking operations (Gil-Pacheco, 1958).

But the law was not extremely liberal: the law established minimum capital and specie requirements, and Banco de Costa Rica remained as the administrator of fiscal funds.

Two banks opened in the following five years (1906–1910). These were Banco Comercial and Banco Mercantil. Those banks opened in 1905 and 1908.

In addition, Banco Anglo Costarricense, in operation from 1863 and which did not have the right to issue banknotes, started to issue banknotes from 1900.

Both banks started operations with a subscribed capital of only half million colones or a quarter million dollars, whereas the capital requirement to issue was twice that amount.

Rochac (1984) and Silva (1979) provide information on bank charters. All banks that operated in El Salvador in the 19th century received privileges from the government, which suggest that having privileges on note issue, tax exemption, among others, influenced the decision of entry. The first bank of El Salvador, Banco Internacional de El Salvador, was chartered by the government in 1880. One privilege of this bank was the monopoly in note issue for twenty-five years. In addition, those notes were accepted in public offices, the bank's operations were exempted of some taxes, and the bank enjoyed the same privileges as the government in judiciary procedures. However, the monopoly in note issue only lasted five years, because in 1885 the government chartered another bank of issue, the Banco Particular de El Salvador. The charter of this bank granted similar privileges, such as acceptance of its notes in public offices, exemption of some taxes, among others. The other five banks created in the 19th century received similar privileges. The other five banks were Banco Occidental, Banco Industrial de El Salvador and Banco Agrícola Comercial, a branch of Banco de Nicaragua, and a branch of London Bank of Central America. These five banks started operations prior to the enactment of the Law of Institutions of Credit of 1898.

These were Banco Industrial, Banco Agricola Comercial, London Bank of America.

Data for bank output (as measured in this article) is more scattered than data for number of banks. Data for deposits and banknotes is available for Mexico, Argentina, Brazil and Peru.

The variable GOLD in the regressions is a dummy variable, equal to one if the country was under the gold standard and zero otherwise. The source was Officer (2008).

Information on wars comes from the Correlated of War Project, www.correlatesofwar.org/.

If the free-banking period had lasted more than only three years and the crisis of 1891 had occurred under free-banking, then the growth rates of the number of banks under free-banking would have not been necessarily higher than prior to 1887.