The reasons for the strong rise in the securitization phenomenon up until the start of the “subprime crisis” need to be analysed. According to many authors, they mainly stem from its offering the possibility of generating fixed yield securities with the highest rating and a low risk premium, thanks to the issues being structured in differentiated bond series, so that certain series absorb most of the risk, thus facilitating the safer or “senior” tranches having a higher rating. Accordingly, this paper reviews the literature on the factors underlying the generation of differentiated tranches in this type of issues and regarding the determining factors of the yield offered by securitization issues. It concludes that the search for more complete markets, along with the reducing of problems associated to the moral hazard, are the main reasons for the multi-tranche structuring. And given the strong influence of the number of tranches on the yield offered by the issues, the paper likewise concludes that the multitranche structures has been an efficient tool to place securitization issues with more competitive yields.

Over two decades up until the onset of the subprime crisis, international financial markets witnessed a spectacular development of asset-backed securitization, both in terms of volume and methods, to the point that it became the most powerful and dynamic means of financial innovation. The relevance of securitization can be seen both from a quantitative and qualitative perspective. The immense majority of the securitization bonds thus received maximum ratings (AAA), not only during, but also after the period prior to the crisis. In the years in the run up to the crisis, securitization issues worldwide represented over two thirds of AAA issues overall (BCBS, 2011). It is precisely the opportunity offered by securitization to generate fixed-yield securities with the maximum rating (and, consequently, with a very low risk premium) which explains, to a great extent, its intensive use, and, to a lesser extent, why many agents, particularly credit institutions, continue to do.

There is, therefore, clearly no doubt about the social and economic relevance of securitization. Beyond the discussion regarding this mechanism's contribution to the triggering of the subprime crisis, from the point of view of the academic and scientific interest generated by its use, there is not a great deal of research that focuses on analysing the yield provided by the securities resulting from securitization, even though there are numerous studies that point to its characteristic as a means to obtain financing on good terms as the fundamental reason for its development. Moreover, to the best of our knowledge, none of those studies performed an exhaustive review of the related literature.

Given these gaps in the literature, we believe it to be appropriate to delve further into the aspects most closely related to the use of securitization: borrowing on advantageous terms and the factors that made it possible. In this regard, the generation of issues where the majority of the securitization bonds had maximum ratings was based on flexibility associated to this financial technique. This enabled the issues to be structured on various differentiated series of subordinated securities (tranches), meaning that certain subordinated tranches (or equity) absorb the majority of the risk and freeing their privileged tranches (or senior tranches), thus facilitating their higher rating. Precisely for that reason, the central purpose of this paper is to identify the factors underlying the generation of differentiated tranches in securitization issues (tranching) and the impact of these multi-tranche structures, and other relevant factors, on the primary yield offered by the securitization bonds. This will be carried out by a review of both the theoretical and empirical literature existing in that regard.

Consequently, this paper is structured in the following three sections. The next section reviews the factors that influence the generation of multi-tranche structures, considering both the financial theory approaches and the results of the empirical studies conducted in that regard. The factors are then analysed that, along with those structures, impact the primary yield of the securitization issues. The paper ends by setting out the main conclusions obtained.

2Generating multi-tranche structures: determinantsThe literature puts forward many reasons for using securitization. However, obtaining financing on attractive terms appears the most recurrent, if not the most relevant, of such reasons. This conclusion is not only reached based on quantitative studies (Agostino & Mazzuca, 2009; Bannier & Hänsel, 2008; Cardone-Riportella, Samaniego-Medina, & Trujillo-Ponce, 2010; Gorton & Metrick, 2012), but also on more qualitative approaches (BCBS, 2011). However, there are few papers that focus on analysing the yield offered by the securitization bonds; moreover, none of them perform an integral review of the different types of variables that may affect that yield, by linking them to the different financial theories.

Therefore, we aim to delve further into the factors that justify the development of securitization as a mechanism to obtain low-cost financing, with a special emphasis on the internal structure of the securitization funds, an essential factor that distinguishes this type of issues from other financing mechanisms.

The fact that a single asset pool acts as collateral or guarantee to a structure or set of a series of bonds (tranches), with a predetermined order of precedence and, therefore, with different risk profiles, allows the needs of investors with different profiles to be met, which results in a lower overall return requirement by investors. Consequently, the design of the number and size of the tranches seeks to minimise the weighted sum of the yields offered by the series of bonds into which each securitization issue or demand is divided (Childs, Ott, & Riddiough, 1996; Franke & Weber, 2009).

Firla-Cuchra (2005) and Firla-Cuchra and Jenkinson (2006) highlight three main reasons to explain the multi-tranche structuring (tranching) and its impact on the yield of the issues: (i) the sophistication of the investors, (ii) the segmentation of the markets and (iii) the existence of asymmetric information. However, the influence of those three factors cannot be perfectly defined and each one of them will be considered separately below.

2.1Sophistication of the markets and of investorsOne of the circumstances associated to the greater complexity of the structuring of the securitization operations is the degree of sophistication of the markets and of the investors involved. Both the improved risk analysis techniques and the advances in information technology are two of the main factors that have explained the growth of securitization (European Commission, 2004) and the greater sophistication of the investors were placed among the six most important factors.

Plantin (2004) indicates that the growing sophistication of the investors should be associated to the generation of issues structured on a greater number of tranches and with greater differentiation of the roles performed by the participating agents. In this regard, the model proposed by this author propounds that the issuers should be interested in generating at least two different types of bonds: on the one hand, the relatively high yield generators, whose associated cash flows are information sensitive; they would be aimed at sophisticated agents and “scrutineers”, with a greater yield compensating those analysis and supervision endeavours; and, on the other hand, high quality bonds, close to safe-haven assets, whose cash flows are not information sensitive, that is, which do not depend (or only to a minimum degree) on the management by the issuers themselves; those securities would be aimed at risk adverse and not very sophisticated investors.

Cumming, Schwienbacher, and McCahery (2011), in a worldwide study of securitization issues underwritten by syndicated loans, consider the generation of tranches as a core element for the efficient legal configuration of this type of issues. They propose (and verify) that the investor protection and legal differences, by countries, are decisive in the multi-tranche structuring. On the contrary, Haselmann, Pistor, and Vig (2010) believe that the regulation of financial systems is irrelevant in this regard, as the high sophistication of the investors – or at least part of them – enable agreements to be designed that cover the legal differences existing between countries by means of contractual clauses. This would support the hypothesis that multi-tranche structuring is independent from the existing legal framework for high sophisticated investors, but not to no-sophisticated ones.

Some studies show the aforementioned relation between the sophistication of the markets and the complexity of the securitization structures. For the Spanish case, Peña-Cerezo (2014) observes a clearly positive relation between the degree of sophistication of the investors and of the securitization markets (measured by the number, volume and types of funds set up) and the number of tranches per issue. The European Commission (2004) came to similar conclusions using a more qualitative approach (focus group).

2.2Segmentation and search for complete marketsThe fact that financial markets are incomplete, that is, that they do not offer an exhaustive range of securities able to meet all the needs of the investors, is a reason for the multi-tranche structuring of the securitization issues (Franke & Weber, 2009). If the markets are incomplete, the generation of new securities that cover the needs not covered by the existing ones will be beneficial (Firla-Cuchra, 2005), as it helps to “complete” the markets, that is, to extend the range of investment opportunities.

Therefore, according to this approach, the main virtue associated to tranching lies in the order of precedence of the different tranches. Thus, the simultaneous generation of particularly protected tranches (senior) and subordinated tranches (known as junior, mezzanine or – if they refer to those assuming the first losses – equity) is effective to complete the market and, consequently, to minimise the mean yield linked to the issue overall (Franke & Weber, 2009). In fact, if there are incomplete markets and diverse investors as regards yield-risk preferences, availability of private information or capacity to assess investments, the creation of multiple tranches with distinct characteristics (different degrees of sensitivity to information, risk and yield) may have the goal of adjusting the performance of the securitization issues to the different investor profiles, thus completing the market (Boot & Thakor, 1993; Gaur, Seshadri, & Subrahmanyam, 2004; Iacobucci & Winter, 2005; Plantin, 2004; Riddiough, 1997). Thus, the most risk adverse investors, or those that find it difficult to understand all the characteristics of this type of investments, may prefer protected or senior tranche bonds. On the other hand, the specialist investors may be more inclined to obtain an additional yield by acquiring more specific and information-sensitive financial assets, but also with greater risks. This reasoning is consolidated in settings with a lack of liquidity, where it is not possible to carry out a perfect arbitration between assets with different characteristics (Firla-Cuchra & Jenkinson, 2006; Gaur et al., 2004).

Therefore, investors with little capacity to analyse and manage risks, or those that act as mere intermediaries (banks, conventional investment funds, etc.) would opt to acquire safe-haven tranches, with a maximum rating, but little yield. Furthermore, certain institutional investors are required, legally or statutorily, to limit their portfolio to financial assets rated over a certain rating and, at times, may only acquire securities with the maximum rating. On the contrary, professional investors with a greater risk management and analysis capacity (hedge funds, funds managed by insurers, re-insurers, etc.) would prefer to invest in tranches with a lower rating and greater yields (Plantin, 2004). In this regard, Franke and Weber (2009) establish a positive relation between the degree of heterogeneity of the investors and the generation of a greater number of tranches, thus increasing the complexity of the markets, where, in turn, the increase in the number of tranches is related to a reduction in the requirement average yield.

On the other hand, the advantage arising from adjusting a large number of securitization bonds series to a greater diversity of investors should offset the loss of liquidity from issuing smaller volumes (DeMarzo, 2005; DeMarzo & Duffie, 1999). Thus, the larger issues are the ones that best offset this loss of liquidity, while there would be less incentive for the smaller ones to be structured in a high number of series (DeMarzo, 2005; Mitchell, 2004). Schaber (2008) suggests that the existence of a segmented market, with non-homogeneous investors in terms of their preferences or needs, must generate issues with a greater number of tranches, to attract a more extensive investor base. Precisely, Firla-Cuchra and Jenkinson (2006) use the size of the issue as proxy associated to the effects of segmenting the market, propounding – and verifying, in the same way as Schaber (2008) and Franke and Weber (2009) subsequently did – a positive relation between the size of the issue and the number of tranches placed on the primary market.

However, Firla-Cuchra and Jenkinson (2006) observe that the largest issues certainly generate a large number of tranches (market classes), but not necessarily a larger number of tranches with different ratings (rating classes). In fact, the relation between size and number of tranches is stronger, when the market classes (the series generated, regardless of their rating) are taken into account rather than the rating classes (the series generated with distinct ratings). This evidence strengthens the ideas of the tranching associated to the market segmentation, even at the cost of ex post loss of liquidity.

In short, from the perspective of the issuer, the generation of a greater number of tranches enables a trade-off between: (i) the benefits arising from covering the needs of the different market segments, and (ii) the ex post liquidity and transaction costs arising from the existence of smaller tranches.

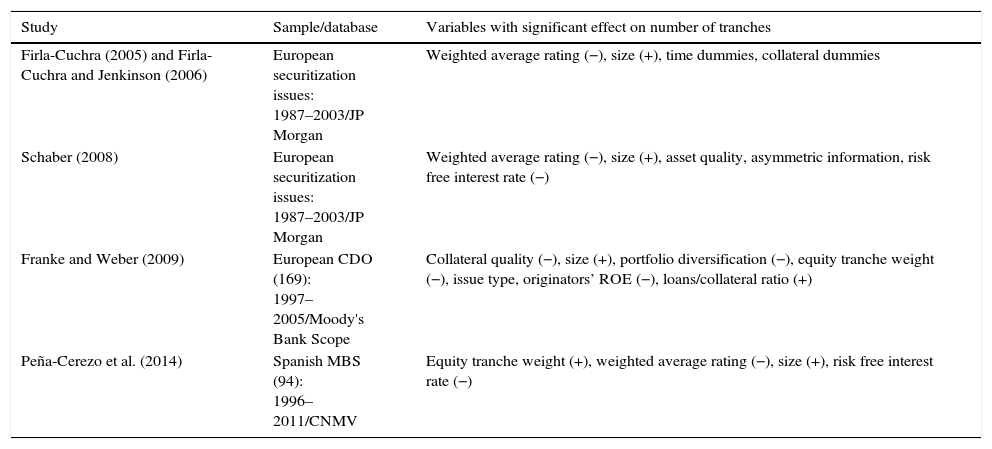

On balance, the approaches associated to the segmentation of the markets imply the existence of a positive relation between the size and number of tranches. Reviewing the empirical papers in that respect (Table 1) confirms that relation, both for the Spanish market (Peña-Cerezo, Rodríguez-Castellanos, & Ibáñez-Hernández, 2014), and for European cases (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Franke & Weber, 2009).

Literature review: explanatory variables of the number of tranches in securitization issues.

| Study | Sample/database | Variables with significant effect on number of tranches |

|---|---|---|

| Firla-Cuchra (2005) and Firla-Cuchra and Jenkinson (2006) | European securitization issues: 1987–2003/JP Morgan | Weighted average rating (−), size (+), time dummies, collateral dummies |

| Schaber (2008) | European securitization issues: 1987–2003/JP Morgan | Weighted average rating (−), size (+), asset quality, asymmetric information, risk free interest rate (−) |

| Franke and Weber (2009) | European CDO (169): 1997–2005/Moody's Bank Scope | Collateral quality (−), size (+), portfolio diversification (−), equity tranche weight (−), issue type, originators’ ROE (−), loans/collateral ratio (+) |

| Peña-Cerezo et al. (2014) | Spanish MBS (94): 1996–2011/CNMV | Equity tranche weight (+), weighted average rating (−), size (+), risk free interest rate (−) |

+/−: the variable has a positive/negative and relevant influence on the number of tranches.

After the multi-tranche structuring, motivations can also be found relating to the problem solving arising from the existence of information asymmetries among the originators–issuers (and including the brokers) and the final investors. This is due to the originators of the assets being much more aware of their quality than the potential investors at which the securitization issues are targeted. In turn, the pooling of a high number of assets in a single portfolio, given that it hinders the scrutiny of the quality of those credits and their monitoring, can worsen the problems associated to the asymmetric information.

Therefore, the investors may suspect that they are being offered “lemons” instead of good securities, and they will therefore be reluctant to take them up (“adverse selection”). Yet the information asymmetries not only come from the different degree of knowledge about the quality of the assets, but also from the difficulty that the originators face to get across to investors their work of ex post correctly monitoring compliance of the obligations of the transferees (“moral hazard”).

Consequently, the yield sought by the market can incorporate a penalty for the problems arising both from the adverse selection and from the moral hazard. Therefore, the granting of external or internal guarantees is necessary on imperfect capital markets to eliminate, or at least minimise, this problem. The “internal guarantees” include multi-tranche structuring, as will be seen below.

Gorton and Pennacchi (1990) argue that the costs associated to the existence of information asymmetries may be mitigated by designing securities that segregate the cash flows generated by the underlying assets. The generation of differentiated securities would prevent, or would limit, such information asymmetries being used by sophisticated institutions to achieve a brokerage benefit at the cost of non-sophisticated investors. That is, the generation of information non-sensitive and safe securitization bonds – at the cost of generating one or more subordinate tranches, that are information sensitive – should prevent the agents with more information benefitting at the cost of the less informed. This risk reduction, achieved by the senior bonds at the cost of the junior (or subordinate) ones, would help to reduce the average differential requires for the securitization issues overall. The conclusion reached, both by means of theoretical modelling and by empirical comparisons, is in this same line: the optimum level of tranching is greater with information-sensitive assets (Boot & Thakor, 1993; Firla-Cuchra & Jenkinson, 2006; Riddiough, 1997).

On the other hand, DeMarzo and Duffie (1999) and DeMarzo (2005) analyse the two opposing effects of the asset pooling: the beneficial diversification of the risk and the harmful destruction of information. They conclude that: (i) the originators will opt for the pooled transfer of assets, given that the benefit arising from the diversification and the ensuing reduction of the information asymmetries is greater than their associated costs (information destruction due to not transferring the credits individually), and (ii) in sufficiently large portfolios, tranching can reduce the problems associated to the information destruction arising from pooling.

However, the information problems associated to the issuer–investor relations can be reproduced as many times as brokers acting on those markets. In this regard, not only is an adverse selection problem generated associated to the mistrust existing between the investors and the brokers–bond issuers, but also there is a moral hazard issue linked to the possible misalignment of incentives generated throughout the securitization chain.

Those problems may arise at source, if there are credit institutions with excessively expansive and unwise credit policies (Otero, Ezcurra, Lado, & Durán, 2015; Otero, Ezcurra, Martorell, & Mulet, 2013). In turn, the brokers, whose business may simply be based on the volume of securities traded, and on monitoring and analysing their quality, may also adopt decisions that are not optimum in this regard. Finally, the institutional investor, acting as the agent of the private saver, may also incur this type of inefficiencies if they do not act with due diligence.

The moral hazard problems also arise from the logical mistrust that the investors may feel regarding the possibility that the originators have incentives to transfer lower quality assets to the securitization fund, by keeping the relatively safer credits on their balance sheets (Plantin, 2004). Furthermore, with respect to the consequences arising from more lax (or non-existent) supervision by the originator on the assets transferred, these will be more serious according to the more uncertain the cash flows arising of those assets are, which is inversely related to the quality of those credits. Ashcraft and Schuermann (2008) detail the frictions associated to information asymmetries in the securitization chain, indicating that, according to Moody's, the quality of the management carried out by the fund managers may influence up to 10% of the real level of the losses.

Therefore, it is logical to expect that, the lower the quality of the pool of transferred assets, the greater the potential costs will be associated to the moral hazard that the originator may incur, taken as being the possibility that it may carry out ex post actions contrary to the interests of the bondholders: changes in behaviour, absence of due diligence, etc. Following this reasoning, if the lower quality of the portfolio of transferred assets makes the consequences of the moral hazard more probable and/or more intense, the securitization structures will have to offer more guarantees to offset that, particularly to the senior bondholders. Given that the number of tranches, along with the relative weight of the equity tranche, is the main protective measures of the senior tranches, it must be concluded that a lower quality of the transferred credit portfolio will lead to a greater number of tranches.

In short, taking the moral hazard in perspective, the lower the global quality of the asset pool is, the issue will be divided into more tranches, as compensation for the senior bondholders for taking part in an issue underpinned by worse quality assets. A negative relation is therefore to be expected between the quality of the pool of transferred assets and the number of tranches per issue (Firla-Cuchra & Jenkinson, 2006; Franke & Weber, 2009; Schaber, 2008).

However, the consideration of the adverse selection leads to a different approach. In fact, the generation of senior securitization bond tranches, that are overprotected and aimed at investors that demand safe securities, may reduce the undervaluation and the lower liquidity that affect assets on a “market of lemons”. Given that the issuers with better quality assets are more impacted by the costs arising from the possible adverse selection of the investors, a positive relation between the quality of the transferred assets and the number of tranches is to be expected, so that those issuers manage to avoid or reduce the incentives for the adverse selected by providing the investors with a broad and differentiated range of investment opportunities, even if that means the greater costs associated to that more complex structure (Agarwal, Chang, & Yavas, 2012; An, Deng, & Gabriel, 2011; Franke, Herrmann, & Weber, 2007; Iacobucci & Winter, 2005).

The empirical evidence found (Table 1) shows a negative relation between the quality of the issue and the number of tranches (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Franke & Weber, 2009; Peña-Cerezo et al., 2014; Schaber, 2008), thus validating the models previously propounded by Boot and Thakor (1993) and Riddiough (1997), based on the moral hazard, and therefore contrary to what is argued by authors such as An et al. (2011) or Agarwal et al. (2012). In short, the use of more complex multi-tranche structure seems to be linked basically to the moral hazard problem and not to the adverse selection one.

3Yield of the securitization issues: determinantsAs has been indicated in the previous section, the multitranche structuring may not only foster the placing the senior tranches on the market on the best terms, but it could also generate a reduction of the weighted average risk premium sought by the investors for the tranches overall. In fact, this second consequence would be what, if verified, would consolidate the real effectiveness of this risk stratification techniques as a net value generator, beyond the internal risk transfer of some tranches (protected) to others (subordinated). Therefore, the effect of the tranching, along with other variables, both on the yield sought for the senior tranches, and for the weighted average yield of the issue, is a key research area.

The main explanatory variables considered in the studies aimed at analysing the primary yield of the securitization issues are now analysed.

First, a variable whose presence is very frequent in the rating granted to the securities issued, even when the complexity of the issues is high (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Vink & Fabozzi, 2009; Vink & Thibeault, 2008a, 2008b). Furthermore, it is interesting to compare the information value provided by the average rating compared to other proxy variables of the quality of the securitization bonds, such as the weight of poorer quality tranches (mezzanine and equity) with regard to the total volume of the issue (Franke & Weber, 2009; Schaber, 2008; Vink & Thibeault, 2008a, 2008b).

Thus, the number of credit rating agencies for each issue has been considered as a possible quality measurement of the rating awarded (Vink & Thibeault, 2008a, 2008b): the larger the number of agencies implied, the lower the risk arising from the rating shopping, taken to be choosing the agency that offers a more favourable rating (Dittrich, 2007; Peña-Cerezo, Rodríguez-Castellanos, & Ibáñez-Hernández, 2013). Consequently, the expected value of the coefficient is negative, given that the greater the number of agencies involved in rating the securitization issues, the more reliable that rating will be and, therefore, the lower the margin offered.

The size of the issue is another of the variables considered (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Franke & Weber, 2009; Schaber, 2008; Vink & Thibeault, 2008a, 2008b). Therefore, it is reasonable to suppose the larger the pool of securitized assets, the greater the degree of diversification that will be achieved (geographically, by sectors, by income levels, etc.). Therefore the sign of the relation existing between this variable (size) and the weighted average yield of the bonds is expected to be negative. In turn, the liquidity premium sought for smaller issuers will result in a negative expected relation between the size and the yield offered by the senior bond tranches, which are more traded on the markets.

As regards the multitranche structuring, it is considered an effective measure to increase the rating of specific tranches of bonds because, as has already been indicated, it is possible to use that mechanism to resize the risk assumed by those tranches. The sign of the expected relation between the number of tranches and the primary yield of the bonds (particularly in the senior tranches) is negative, while the strategy to create tranches with differentiated risk and yield characteristics is assumed to be effective and, therefore, to create value. The empirical studies usually also include other indicative variables of the multitranche structuring, such as the size of the tranches, the order of precedence of each tranche, the tranches retained, and the weight of certain types of tranches.

Furthermore, the originators and the managers of the securitization funds have a potential wide battery of external tools for credit enhancement – that is, granted by financial entities outside the originator of the credits granted to the fund-, aimed at improving the levels of liquidity, risk, etc. perceived by the potential investors. Special mention should be made of surety guarantee. A negative relation is, then, expected between surety granting and the yield offered by the guaranteed bonds.

The term or the maturity of securitization bonds is likewise variables that are frequently included in this type of analysis (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Vink & Thibeault, 2008a, 2008b). The expected sign of the relation between the maturity and the yield premium is positive, given that the rational aspect in a scenario with a temporary structure of rising interest rates is that the longer the maturity of the financial assets, the greater the yield they offer. In any event, the influence of the maturity both on the yield of the senior bonds and on the average yield of the issue is clearly conditioned by the type of credit given – mortgage, company, consumer, etc.–, given their different terms. In this regard, the maturity will have an explanatory capacity if the representative variables of the type of assets transferred have not discounted the information relating to their maturity.

Different studies (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Vink & Fabozzi, 2009; Vink & Thibeault, 2008a) have included time control variables. On the one hand, the introductory stage of this mode of financing on each market is usually considered, as it is expected that during that stage, the market requires an extraordinary yield as a result of the relative complexity of the product and the lack of knowledge of it by the investors. On the other hand, for the studies that include the subprime crisis and the subsequent period, it cannot be ignored that that crisis has generated negative effects on the appraisal and perception of the risk of those assets, such as the lack of confidence of the investors in the rating awarded by the rating agencies or the lack of liquidity on the securitization markets. These circumstances have had a significant effect on the premiums required for the securitization bonds. Therefore, the expected effect on the yield of the bonds is positive in both cases (“adaptation” and “crisis”).

As regards the specific variables of the financial markets more widely used in the literature to contextualise the behaviour of the primary yield of the securitization bonds, the level of the interest rates of the market should be noted. In this regard, either because the government bonds and the majority of the securitization issues (those that have an AAA rating or equivalent to the sovereign risk) can be considered to be substitute financial products, or because the yield on the government bonds is a benchmark for the fixed yield issues overall of a country, a significant and positive relation has to be supposed between this variable and the primary yield of the securitization issues.

When summarising the results obtained in the empirical studies (Table 2), a significant and negative influence of the number of tranches on the yield can be seen, thus defending the effectiveness of generating multitranche structure to reduce the yield offered by the senior tranches – “weak” effectiveness (Franke & Weber, 2009; Peña-Cerezo et al., 2014), and even, by the issue overall – “strong” effectiveness – (Peña-Cerezo et al., 2014). In turn, it can also be seen that the size of the issue negatively influences the yield premium (Firla-Cuchra, 2005; Firla-Cuchra & Jenkinson, 2006; Peña-Cerezo et al., 2014; Schaber, 2008), either due to the greater diversification of the risks in larger asset pools, or because of the lower liquidity premium required of these issues. Other variables such as the average rating awarded to the issue, the yield of the no-risk asset (Peña-Cerezo et al., 2014; Schaber, 2008; Vink & Thibeault, 2008b), the number of agencies that rate the issue (Peña-Cerezo et al., 2013; Vink & Thibeault, 2008b), the existence of credit enhancements (Schaber, 2008; Vink & Fabozzi, 2009; Vink & Thibeault, 2008a, 2008b) or the maturity (Vink & Thibeault, 2008a, 2008b) also have a significant influence on the yield of the securitization issues, in the meaning expected by the literature.

Literature review: explanatory variables of the securitization bonds yield.

| Study | Sample/database | Variables with significant effect on securitization bonds yield |

|---|---|---|

| Firla-Cuchra (2005) and Firla-Cuchra and Jenkinson (2006) | European securitization issues: 1987–2003/JP Morgan | Rating (−), size (−), geographical and market dummies, creditor's rights dummies, time dummies, collateral dummies |

| Schaber (2008) | European securitization issues: 1987–2003/JP Morgan | Rating (−), size (−), risk free interest rate (+), credit enhancements (−) |

| Vink and Thibeault (2008a) | 765 non-US ABS issues: 1999–2005/Structured Finance International Magazine (Euromoney Inst. Investor Plc.) | Rating (−), LTV (−), geographical and market dummies, time dummies, collateral dummies, currency risk (+), external enhancement (−), maturity (+), collateral type |

| Vink and Thibeault (2008b) | non-US ABS (765), MBS (760) and CDO (514) issues: 1999–2005/Structured Finance International Magazine (Euromoney Institutional Investor Plc.) | Rating (−), LTV (−),issue type (ABS, MBS, CDO), geographical and market dummies, time dummies, collateral dummies, currency risk (+), credit enhancement (+), external enhancement (−), maturity (+), collateral type, loans size (+), originator type (bank, corporate, finance house, insurance company, public entity, sovereign), number of ratings (−), fixed interest rate loans (+), currency risk (+) |

| Vink and Fabozzi (2009) | Non-US ABS (186 issues): 1999–2006/Structured Finance International Magazine (Euromoney Inst. Inv. Plc.) | Rating (−), external enhancement (−), geographical origin of the loans, originator default risk (+), nature of assets |

| Franke and Weber (2009) | European CDO (169): 1997–2005/Moody's Bank Scope | Number or tranches (−), number of subordinated tranches (−) |

| Gorton and Metrick (2012) | US and non-US asset classes and others: 2007–2008/Dealers banks (Goldman Sachs, Morgan Stanley, Lehman Brothers, Merrill Lynch and Bear Stearns) | LIBOR-OIS (overnight index swap): interbank minus confidence (+), Interbank market haircut (+), rating (−), collateral dummies, issue type |

| Peña-Cerezo et al. (2014) | Spanish MBS (94): 1996–2011/CNMV | Number of tranches (−), subordinated tranches weight (+), rating (−), time dummies, risk free interest rate (+) |

+/−: the variable has a positive/negative and relevant influence on securitization bond yield.

The capacity of securitization to generate fixed yield securities with the maximum rating and, consequently, with a very low risk premium are among the factors that justify the extensive use of the mechanism, particularly in the period prior to the subprime crisis. When reviewing the literature linked to the explanatory factors of yield offered by the securitization issues, a characteristic element of financial securitization emerges: the possibility that it offers to preferably generate securities with maximum ratings, by means of dividing the bond issues into different tranches, with a determined order of precedence.

The effectiveness of generating multiple tranches in the reduction of the risk premium linked to securitization issues can be taken at two levels. On the one hand, the “weak effectiveness” concept can be present if a large number of tranches is related to a lower risk premium sought for senior or AAA tranches. On the other hand, for a greater strictness of requirements, we would define the “strong effectiveness” if a large number of tranches help to reduce the yield sought from the bonds issued overall. Both effects have been found, even though the second of them less frequently, in the securitization issues.

In addition, the generation of multiple tranches can also help to solve the serious asymmetric information problems associated to financial securitization. However, the review of the empirical papers in that regards shows a stronger link of the multitranche structure to the reduction of the moral hazard problems than those associated to adverse selection.

To conclude, we consider that more comprehensive empirical studies (including a greater number of securitization types, a greater number of markets, and a longer time line) should be carried out that will allow to verify in a more integral and global manner the validity of the theoretical approaches set out here, by observing the differences that may exist on the different financial markets, according to the different degree of complexity of the securitization structures used or the existing legislative differences.

In any event, despite the criticism of this mechanism as the possible trigger of the subprime crisis, we believe that, with appropriate regulation and supervision, it will continue to be a useful instrument, particularly for financial entities, to obtain financing in attractive conditions.