The study analyses the individual and joint impact of family control and diversification on the performance of major Spanish corporations, considering the nature of the ultimate owner of non-family groups. The study uses a sample of ninety-nine Spanish corporations, each comprising a parent company listed on the stock exchange and a set of subsidiaries. Heckman's two-step correction is used to eliminate selection bias and the endogeneity of family ownership. Different models are contemplated in which we analyse the impact of both diversification and the family nature of a business on performance, established as Tobin's q-value. The results show how family control has a negative impact on Tobin's q-value, and that differences are greater between family groups and non-family groups controlled by banks and/or foreign agents. They also show how diversification does not affect the creation of value either individually or considering the possible moderating effect of family ownership.

In world economies, families are among the most important shareholders in business organisations (Aguilera & Crespi-Cladera, 2016; La Porta, Lopez-de-Silanes, & Shleifer, 1999). There are multiple definitions of a family business (Mazzi, 2011), although there appears to be consensus in that a firm is a family business when family members own a majority of shares, are involved in management, form part of the board of directors and wish to transmit the firm to subsequent generations (Mazzi, 2011).

The family nature of a business group determines strategies (Aguilera & Crespi-Cladera, 2016; Dawson & Mussolino, 2014), including diversification (Banalieva & Eddleston, 2011; Praet, 2013) and its subsequent impact on performance (Kang, 1999; Muñoz & Sánchez, 2011). Family members not only pursue financial targets, but also aim to maintain socio-emotional wealth (Cennamo, Berrone, Cruz, & Gomez-Mejia, 2012; Deephouse & Jaskiewicz, 2013; Gómez-Mejía, Makri, & Larraza, 2010). Family groups will thus prefer diversification strategies that are compatible with maintaining socio-emotional wealth that do not endanger survival, with an impact on performance.

Initially, the lack of socio-emotional wealth in non-family enterprises means that they aim to maximise performance. However, do all non-family groups act the same? In non-family groups where there is no shareholder of reference (who can exercise effective control), management has more discretionary power and tends to aim to satisfy its own needs instead of creating value for shareholders, with a negative impact on performance (Jensen, 1986). In this respect, managers can use diversification to improve their income and prestige, even if it has a negative impact on business performance (Jensen, 1986). The presence of a shareholder of reference in other non-family groups (banks, foreign firms) facilitates the goal of maximising performance, and thus the use of more appropriate diversification strategies.

Given the above characteristics of family holdings and the differences with non-family groups (primarily with groups “with no effective control”, where there is no shareholder of reference), there are two questions that this study attempts to answer. How does family control and degree of diversification affect performance, both individually and together? What are the differences in relation to different non-family businesses, specifically where there is no shareholder of reference?

A family can decide not to participate in new profitable businesses due to the need for new financial, human and material resources, and the possible loss of control derived from new shareholders, which would have a negative effect on socio-emotional wealth (Cennamo et al., 2012). In these cases, non-family groups have the advantage of not having to consider socio-emotional wealth in their utility function. The desire for a family firm's survival and transmission, however, generates a greater concern related to new medium and long-term profitable investments, as family members would carefully choose diversification projects that have a real positive impact on performance, thus revealing an advantage relative to non-family enterprises, where there is no desire to transmit ownership to subsequent generations. All these differences between family and non-family corporations would also be greater in relation to groups “with no effective control” due to the lack of a shareholder of reference and the difference between managers’ and shareholders’ interests.

Both family control and diversification are determinants of business performance, albeit with mixed conclusions in the literature (Benito, Guerras, & Zuñiga, 2012; Miller, Le Breton Miller, & Scholnick, 2008). There are few studies, however, that analyse the joint effect of family control and diversification on business performance, other than Kang (1999) and Muñoz and Sánchez (2011). The lack of homogeneity in the conclusions of previous research and the lack of studies considering the nature of the ultimate owner of non-family groups justify the need to delve deeper into the individual and joint impact of family control and diversification on performance.

This study also aims to advance in the analysis of the impact of diversification and family control on performance. The study has several objectives. The first is to analyse the individual impact on degree of diversification and family control on performance. The second is to establish differences in performance between family and non-family holdings, with the latter including the nature of the ultimate owner. In this case, the differences will be established relative to groups with no shareholder of reference (“without effective control”), rather than to family groups, although also considering groups controlled by banks and foreign agents. The third and final objective consists of determining the joint impact of family control and diversification on performance, thus determining whether family ownership, in which the preservation of socio-emotional wealth is key, can affect the use of more or less successful diversification strategies compared with non-family groups in general, and groups “without effective control” in particular.

We thus analyse a sample of 99 corporations, the parent companies of which were listed on the Spanish stock exchange during the 2000–2005 period. The Heckman two-step correction (1979) is used to test the established hypotheses, as it corrects the selection bias derived from diversification and the possible existence of endogeneity derived from family ownership (Demsetz & Lehn, 1985).

The study makes several contributions to the field of research. Firstly, the analytical unit is a business group, comprising a listed parent company and a set of subsidiaries. The activities of both the listed parent company and its subsidiaries provide a clearer idea of corporate strategy, and the market's evaluation of the parent company shows investor expectations not only regarding the company itself but also in relation to the entire group.

Secondly, when analysing the impact of the nature of the ultimate owner on performance, we compare businesses controlled by family members with non-family groups, with reference to groups with greater managerial discretionality and/or which do not have a shareholder of reference. The aim is to discover whether family ownership has a more positive impact on performance than other corporations with greater managerial discretionality (with a negative impact on performance). Following this analysis, we check for the existence of similarity of performance of family groups and groups controlled by banks and/or foreign agents, as managerial discretionality is more reduced in these cases, with a shareholder of reference.

Finally, we aim to provide new evidence for Spain considering the moderating effect of family ownership on the diversification/creation of value ratio.

This paper is structured as follows: we first establish the theoretical framework in which our hypotheses regarding the impact of diversification and family control on performance are formulated. We then describe the database, the variables and the methodology used to test said hypotheses. Thirdly, we present and analyse the results of the econometric models. Finally, we summarise the study's main conclusions, its limitations and future lines of research.

2Theoretical frameworkThe decision to diversify forms a fundamental part of the strategic behaviour of corporations (Hitt, Hoskisson, & Ireland, 1994), and plays a key role in enhancing their performance (Hull & Lee, 1999). Diversification involves participating in new business or markets by launching new products (Ansoff, 1976). By performing new activities, firms can make us of surplus resources and capabilities (Chatterjee & Wernerfelt, 1991), generating synergies between activities and making the most of the opportunities to invest in businesses that favour the creation of value (Martin & Sayrak, 2003). Diversification, however, increases coordination costs and information asymmetries (Denis, Denis, & Yost, 2002), with which the firm's inflexibility costs grow (Porter, 1985) and its ability to react to market changes diminishes. The literature often refers to diversification discount, which anticipates a negative impact of diversification on performance (Villalonga, 2004).

From an agency theory perspective, diversification is the result of greater managerial discretionality; by increasing the size of the company, managers seek higher salaries, a reduction in personal risk, secure job positions and greater power (Amihud & Lev, 1981; Jensen & Murphy, 1990). New investments are not to maximise value for shareholders, but to satisfy managers’ particular interests; they have a negative impact on performance and increase agency costs (Jensen & Murphy, 1990). Furthermore, the greater the degree of diversification, the easier it is for managers to access capital by the use of cross subsidies (Meyer, Estrin, Bhaumik, & Peng, 2009), producing inefficient resource allocation that reduces the firm's value (Berger & Ofek, 1995).

The negative impact of diversification on performance, however, is not only due to the conflict between shareholders and managers, but can also derive from conflicts between majority and minority shareholders. If concentration of ownership is high, part of the wealth of minority shareholders can be expropriated by majority shareholders (Lins & Servaes, 2002). Said expropriation is easier through diversification, with tunnelling practices reducing the company's value (Johnson, La Porta, Lopez-de-Silanes, & Shleifer, 2000). Majority shareholders prefer new activities that do not aim to maximise performance, but to favour their own interests (Johnson et al., 2000). Diversification enables tunnelling practices, where assets or results are transferred out of the firm in favour of the majority shareholders, or cash flow is transferred from one firm to another (Johnson et al., 2000; Lins & Servaes, 2002), all of which has a negative impact on the corporation's performance.

Therefore, the first hypothesis is:H1 Business group's diversification has a negative impact on performance.

The impact of family control on performance is a major line of research in the literature, and there is no consensus regarding the relationship between the two variables (Anderson & Reeb, 2003; Miller et al., 2008; Sacristán, Gómez, & Cabeza, 2011). The impact of family ownership on performance depends on the relationship between pros and cons; if the advantages exceed the disadvantages there will be a positive relationship between family ownership and performance (Dyer, 2006).

Family ownership and control can have a positive effect on performance (Anderson & Reeb, 2003; Sraer & Thesmar, 2007). Family business has high ownership concentration values, with family members involved in the firm's management, with incentives to supervise managers (Fama & Jensen, 1983), minimising the principal-agent problem and agency costs (Demsetz & Lehn, 1985). The presence of family executives leads to better performance (Anderson & Reeb, 2003; Kowalewski, Talavera, & Stetsyuk, 2010). Family control, however, can also have a negative effect (Fama & Jensen, 1983; Morck, Wolfenzon, & Yeung, 2005), as a high concentration of ownership in family firms can generate an agency problem between family members and other investors (minority shareholders) (Chrisman, Chua, Pearson, & Barnett, 2012; Zahra, 2007). The family can present an opportunistic conduct satisfying its private needs (Jara, López, & López, 2008; Shleifer & Vishny, 1997), taking part of the wealth belonging to minority shareholders (Demsetz & Lehn, 1985; Villalonga & Amit, 2006) and thus having a negative effect on the creation of value (Bloom & Van Reenen, 2007).

Gomez-Mejia, Haynes, Nuñez, Jacobson, and Moyano (2007), propose a model in which family enterprises are adverse to socio-emotional wealth loss. According to Cennamo et al. (2012), socio-emotional wealth includes elements such as the desire to maintain family control, the family's identification with the company, the presence of emotional links and the desire to ensure the firm's survival. The family's utility function thus maximises both socio-emotional wealth and financial performance (Gómez-Mejía et al., 2010). The desire to maintain control of the firm and to preserve family links leads to priority being given to socio-emotional wealth versus financial performance (providing that the firm's survival is not at risk), and families are willing to sacrifice greater profits for the same of socio-emotional wealth. A negative relationship is therefore expected between control and performance. According to the socio-emotional wealth model, we establish the second hypothesis:H2 Family control has a negative impact on business group's performance.

Non-family corporations can be controlled by foreign agents, banks or the State, etc. From the agency theory perspective, however, the principal-agent problem is greater in groups where ownership is more disperse and no single shareholder has effective control of the firm; managers aim to satisfy their own needs, which are not the same as those of the other shareholders (Jensen & Meckling, 1976). In these groups (with no effective control), agency costs will be higher and have a more negative effect on performance (Amihud & Lev, 1981).

When comparing corporations considering the nature of the ultimate owner, the greatest differences are expected to be found between groups “with no effective control” and family enterprises, where family control leads to a reduction in agency costs. Family groups thus perform better than firms with disperse ownership or no shareholder of reference (Wang, 2006). This leads to our third hypothesis:H3 Family business groups perform better than groups where there is no controlling shareholder (groups “with no effective control”).

After analysing the individual impact of diversification and family control on performance, the following question arises. Could the impact of diversification on performance be conditioned by family control? In other words, does family control ensure a more or less successful diversification process, having a positive or negative moderating effect on performance compared to non-family groups?

There are very few studies in the literature that answer these questions. A first approximation was provided by Kang (1999). For a set of listed textile companies, it was found that family ownership favours a positive impact of diversification on performance. According to Kang (1999), although family enterprises are more reluctant to diversify, when they do decide to do so, they invest in activities that have a more positive effect on performance, with a view to ensuring the firm's survival and transmission to subsequent generations. Family firms thus do not diversify for reasons derived from managerial discretionary power, more common in non-family firms that aim to maximise managers’ utility function (Jensen, 1986), with a negative impact on performance.

The study conducted by Muñoz and Sánchez (2011) from a group of European firms from 27 countries showed that family firms are more profitable than non-family enterprises when diversifying both by product and internationally, although there are no differences if diversification only affects product. According to Muñoz and Sánchez (2011), family firms are more reluctant to accept the change involved in diversification, given that their goal is to preserve family values and maintain control of the company. They do not diversify, therefore until they have the experience and know-how required to ensure the best possible performance. The family will diversify when it has the required know-how, making use of existing synergies and reducing dependence on a single firm's income and/or a single country, increasing the likelihood of survival and the preservation of its assets (Gómez-Mejía et al., 2010).

From a theoretical perspective, family firms seek survival (Casson, 1999), preferring diversification strategies that create value without harming socio-emotional wealth. So although family firms are more reluctant to diversify than others (Goranova, Alessandri, Brandes, & Dharwadkar, 2007; May, 1995), when they do decide to participate in new businesses they have to satisfy their particular objectives without reducing socio-emotional wealth. When comparing family and other enterprises, then, diversification is expected to have a positive impact on the former's performance.

However, a “principal-principal” agency problem may arise (Zahra, 2007), in which case diversification strategies facilitate the expropriation of the wealth of minority shareholders in favour of the family, with a negative impact on performance. Diversification enables the use of tunnelling practices (Johnson et al., 2000), with which the family can expropriate part of the wealth of minority shareholders by transferring assets elsewhere, or by transferring cash flow between firms in favour of family interests (Lins & Servaes, 2002). Diversification also enables family members to work in the corporation's different companies (nepotism), with a negative effect on performance (Faccio, Lang, & Young, 2001). Given these arguments, it is difficult to quantify whether tunnelling practices have a more negative impact on the effect of diversification on performance, compared to diversification processes in non-family groups, where they depend on more or less managerial discretionality. Two hypotheses are therefore considered:H4a Family control has a positive moderating effect on the relationship between degree of diversification and performance. Family control does not have a moderating effect on the relationship between degree of diversification and performance.

The greatest differences related to family control are found between family groups and enterprises “with no effective control”. In the latter, diversification is the result of the pursuit of satisfaction of managers’ private interests, choosing strategies that can have a negative impact on given the greater agency costs (Denis, Denis, & Sarin, 1997). Yet although family firms are more reluctant to diversify, and the preservation of socio-emotional wealth can lead to less performance than non-family groups, when a family form decides to perform new activities, which are not derived from a principal-principal agency problem, the goal of creating value would have a positive impact on the interaction between family ownership and diversification (Kang, 1999). Our final hypothesis, therefore, is:H5 Family control has a positive moderating effect on the relationship between degree of diversification and performance relative to groups with no controlling shareholder (group “with no effective control”).

The study sample comprises business groups in which the parent company was listed on the Spanish stock market in each year of the 2000–2005 period. We have excluded groups in which the parent company belongs to the financial and/or energy sectors, as they have specific legal and accounting standards. The sample finally consists of 99 corporations (99 listed companies that head business groups). Two databases were fundamentally used: the National Stock Market Commission website (www.cnmv.es) and the SABI-Informa database. With regard to the former, we used the account reports available to obtain the economic-financial information used in the study, and to identify all the firms included in the business groups. The CNMV website provides information about significant shareholdings, identifying the nature of the ultimate owner of the corporation.

Secondly, we also used the SABI-Informa database, which identifies the ultimate owner and its nature, enabling us to estimate the corporation's degree of diversification, with access not only to the economic-financial information of the parent company, but also to accounting information pertaining to its subsidiaries.

Fifty (50) of the 99 listed parent company are under family control; this is the largest group, showing the importance of families on the Spanish stock exchange (Sacristán et al., 2011; Santana & Aguiar, 2006). There are also 13 groups “without effective control”; these groups do not have a single owner (or group of similar owners) with effective control of the organisation. There are also 10 groups controlled by banks and 6 by foreign agents. The ultimate owner varied in 20 groups during the analysed period. Although they are included in the subsequent analyses, they are not subject to a detailed study, as creation of value will be affected by the nature of the ultimate owners each year, and it would be difficult to determine their net effect on Tobin's q-value.

3.2VariablesWhen analysing the relationship between diversification, family ownership and performance, it is very common in the literature to use Tobin's q-value as a dependent variable (Miller, Le Breton-Miller, Lester, & Canella, 2007; Thomsen & Pedersen, 2000; Villalonga & Amit, 2006). Tobin's q is a measure of profitability in market terms. It reflects the parent company's expectations for future profits, and hence the holding's evaluation by investors. Tobin's q-value is calculated as the ratio between the parent company's market value and total assets (book value). The market value is the sum of the market value of its equity and the book value of its debt (Demsetz & Villalonga, 2001; Martínez, Stohr, & Quiroga, 2007). The market value of its equity was estimated by multiplying share value at the end of each year (31 December) by the total number of listed shares.

As independent variables, when defining corporation, it is established as the listed parent company plus all subsidiaries, according to the criterion established by the Spanish General Accounting Plan of 2007, firms where the parent company has the majority of the voting rights and/or the ability to appoint or dismiss most of the members of the board of directors. Companies that form part of a business group are identified in the annual report published by the listed parent company.

A firm is considered to have an ultimate owner when its leading shareholder directly or indirectly has 10 per cent or more of the voting rights (La Porta et al., 1999). The ultimate owner is identified by control chains. When a firm's shares are held by another company, the voting rights of the latter are analysed, identifying its main shareholder, and so on as far as the ultimate owner of the voting rights.

A group is considered to be a family enterprise when family members represent the majority owners (directly and indirectly) of the parent company and one or several family members are in key positions as managers or members of the board of directors; the group is a family concern throughout the study period (Miller & Le Breton-Miller, 2006). Family members share a surname or are connected by marriage. This definition of family firm is based on the proposals of the European Commission (http://ec.europa.eu/growth/smes/promoting-entrepreneurship/we-work-for/family-business/index_en.htm) and Instituto de Empresa Familiar (http://www.iefamiliar.com/web/es/ief.html).

Groups are therefore classified as:

- a)

Family groups (FAM): groups in which the ultimate owners are Spanish family members throughout the study period.

- b)

Foreign group (FOR): groups in which the ultimate owners are firms or individuals not residing in Spain.

- c)

Financial groups (FINAN): groups in which the ultimate owners are banks or investment funds throughout the study period.

- d)

Groups without effective control (NEC): groups in which there is not a single owner (or group of similar owners) with effective control of the organisation throughout the study period.

- e)

Groups with changes in ultimate owners (CUO): groups in which the nature of the ultimate owner changed during the study period.

Degree of diversification (TOTAL DIV) is established considering all the activities performed in the business group, both by the parent company and by the pyramid of subsidiaries. Primary activity and turnover are identified for all the firms in the group (parent and subsidiaries). Considering group activities measures diversification more objectively, as a study of only the parent company's activities would ignore those of the subsidiaries, which also form part of the corporation's global strategy (Chen & Yu, 2011). Degree of diversification is measured by the entropy index (Jacquemin & Berry, 1979; Palepu, 1985).

According to prior research concerning creation of value, diversification and family ownership (Anderson & Reeb, 2003; Chen & Yu, 2011; Ducassy & Prevot, 2010; Gómez-Mejía et al., 2010; Kang, 1999; Maury & Pajuste, 2005), the following control variables are considered: (i) Capital in the hands of the parent company's five main shareholders (% 5 SHARE), which is established as a measure of concentration of ownership; (ii) size of listed parent company (LN ASSETS), measured as the parent company's total assets expressed as logarithms; (iii) age (LN AGE), measured as the logarithm of the difference between two thousand and the year of establishment of the listed parent company; (iv) indebtedness (DEBT), measured as the ratio between the listed parent company's total liabilities and total assets; (v) capital intensity (CAP INT), measured as the ratio between the sum of tangible and non-tangible assets and the number of employees of the listed parent company; (vi) non-tangible investment (NO TANG), the listed parent company's investment in the new technologies, measured by the ratio between intangible assets and total assets; (vii) structural change in parent company (SCH), a dummy variable with a value of 1 when there has been a structural change in the listed parent company and 0 otherwise.

3.3MethodologyIn the results (see Section 4), we first present a descriptive analysis of the model's different variables, considering the family and non-family ownership of the different business groups, estimating the possible mean differences according to the nature of the ultimate owner. We first estimate the Student's t-values to test the mean differences between family and non-family groups, then apply the Brown-Forsythe and Kruskal–Wallis tests, which test the mean differences between family groups and each of the different types of non-family group (foreign, financial and “with no effective control”).

Heckman's two-step correction (1979) is used to test the five hypotheses. This method is regularly used in the literature when analysing the relationship between performance, diversification and family control (Gomez-Mejia et al., 2007; Kang, 1999; Maury, 2006; Miller et al., 2007). The Heckman two-step method corrects the selection bias derived from diversification (Kang, 1999), and considers the effect of the possible endogeneity derived from the business group's family ownership (Demsetz & Lehn, 1985).

A Probit model is used in the first stem, in which the endogenous variable is a dummy variable of diversification (value is 1 if the group diversifies and 0 otherwise), and the exogenous variables are used in the model (nature of ultimate owner, diversification, concentration of ownership and control variables). A new variable is added in this first step, the annual growth rate of sales, in order to prevent possible multicollinearity problems when applying Heckman. Finally, the inverse Mills ratio that corresponds to the decision to diversify (λdiv) is calculated.

Another Probit model is also estimated in order to analyse the endogenous nature of family ownership, in which the dependent variable is the group's family ownership, and the explanatory variables are sectoral dummies, firm size and cost of debt. This estimates the inverse Mills ratio that corresponds to family ownership (λfam).

In the second step of the Heckman model, we estimate an ordinary least squares regression analysing the impact of the exogenous variables (nature of ultimate owner, diversification, concentration of ownership and control variables) on Tobin's q-value, including the previously analysed inverse Mills ratios (λdiv and λfam), correcting the possible selection bias due to diversification and the endogeneity of family ownership.

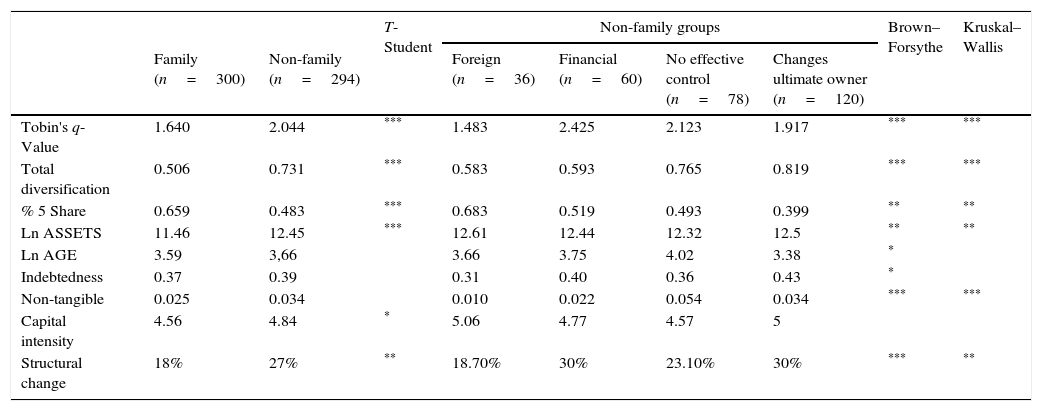

4Results4.1Descriptive analysisTable 1 shows the mean values of the model's variables and the existence of differences according to the nature of the ultimate owner. When comparing the family with the non-family groups, the results show that the former present a lower mean Tobin's q-value (Cronqvist & Nilsson, 2003; Thomsen & Pedersen, 2000): 1.640 for family groups and 2.044 for non-family groups. There is also a lower mean degree of diversification in family groups (0.506 versus 0.731 for non-family enterprises), similar to the results obtained by Anderson and Reeb (2003) and Miller, Le Bretton Miller, and Lester (2010).

Mean differences in study variables, according to the nature of the corporation's ultimate owner.

| T-Student | Non-family groups | Brown–Forsythe | Kruskal–Wallis | ||||||

|---|---|---|---|---|---|---|---|---|---|

| Family (n=300) | Non-family (n=294) | Foreign (n=36) | Financial (n=60) | No effective control (n=78) | Changes ultimate owner (n=120) | ||||

| Tobin's q-Value | 1.640 | 2.044 | *** | 1.483 | 2.425 | 2.123 | 1.917 | *** | *** |

| Total diversification | 0.506 | 0.731 | *** | 0.583 | 0.593 | 0.765 | 0.819 | *** | *** |

| % 5 Share | 0.659 | 0.483 | *** | 0.683 | 0.519 | 0.493 | 0.399 | ** | ** |

| Ln ASSETS | 11.46 | 12.45 | *** | 12.61 | 12.44 | 12.32 | 12.5 | ** | ** |

| Ln AGE | 3.59 | 3,66 | 3.66 | 3.75 | 4.02 | 3.38 | * | ||

| Indebtedness | 0.37 | 0.39 | 0.31 | 0.40 | 0.36 | 0.43 | * | ||

| Non-tangible | 0.025 | 0.034 | 0.010 | 0.022 | 0.054 | 0.034 | *** | *** | |

| Capital intensity | 4.56 | 4.84 | * | 5.06 | 4.77 | 4.57 | 5 | ||

| Structural change | 18% | 27% | ** | 18.70% | 30% | 23.10% | 30% | *** | ** |

In greater detail, considering the nature of the ultimate owner of non-family groups, family enterprises present a lower Tobin's q-value (except foreign groups). As shown in Table 1, financial groups present the highest mean Tobin's q-value (2.425), followed by groups “with no effective control” (mean Tobin's q-value=2.123), family groups (mean Tobin's q-value=1.640) and foreign groups (1.483). Similarly, family groups are characterised by a lower degree of diversification, with the greatest differences between family groups and groups “with no effective control” (the mean degree of diversification in family groups is 0.506 versus 0.765 in groups “with no effective control”).

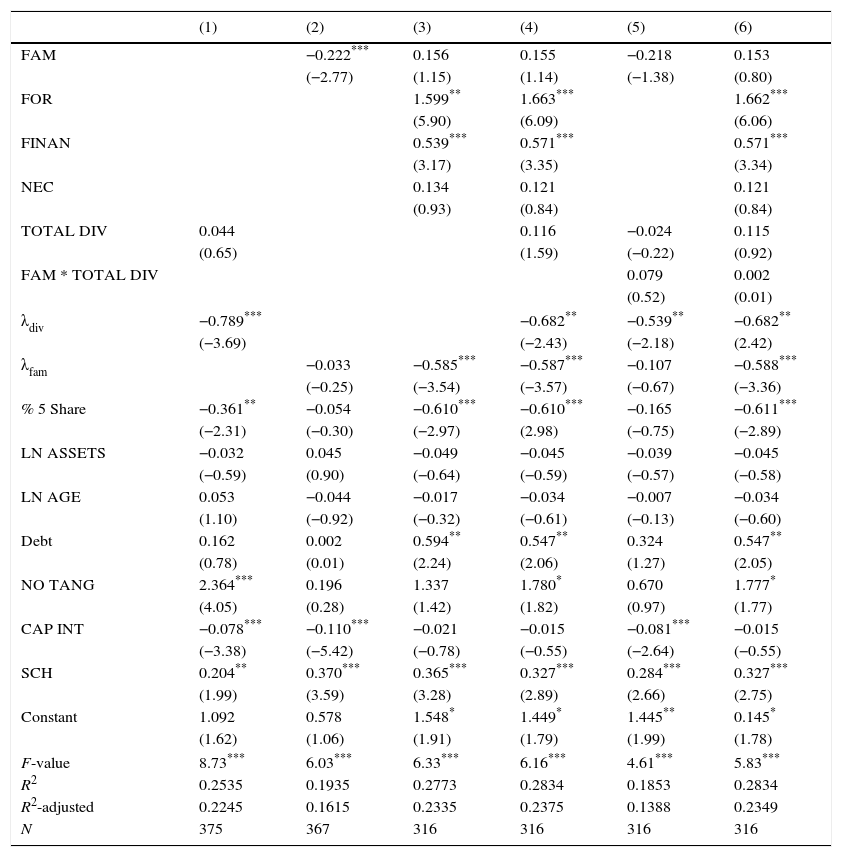

4.2Econometric analysisTable 2 analyses the impact of diversification and family ownership on Tobin's q-value. The results correspond to the second step of Heckman's two-step correction, including the inverse Mills ratios relative to diversification (λdiv) and to family ownership (λfam).

Individual and joint impact of degree of diversification and nature of last owner on Tobin's q-value (second step of the Heckman correction).

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| FAM | −0.222*** | 0.156 | 0.155 | −0.218 | 0.153 | |

| (−2.77) | (1.15) | (1.14) | (−1.38) | (0.80) | ||

| FOR | 1.599** | 1.663*** | 1.662*** | |||

| (5.90) | (6.09) | (6.06) | ||||

| FINAN | 0.539*** | 0.571*** | 0.571*** | |||

| (3.17) | (3.35) | (3.34) | ||||

| NEC | 0.134 | 0.121 | 0.121 | |||

| (0.93) | (0.84) | (0.84) | ||||

| TOTAL DIV | 0.044 | 0.116 | −0.024 | 0.115 | ||

| (0.65) | (1.59) | (−0.22) | (0.92) | |||

| FAM * TOTAL DIV | 0.079 | 0.002 | ||||

| (0.52) | (0.01) | |||||

| λdiv | −0.789*** | −0.682** | −0.539** | −0.682** | ||

| (−3.69) | (−2.43) | (−2.18) | (2.42) | |||

| λfam | −0.033 | −0.585*** | −0.587*** | −0.107 | −0.588*** | |

| (−0.25) | (−3.54) | (−3.57) | (−0.67) | (−3.36) | ||

| % 5 Share | −0.361** | −0.054 | −0.610*** | −0.610*** | −0.165 | −0.611*** |

| (−2.31) | (−0.30) | (−2.97) | (2.98) | (−0.75) | (−2.89) | |

| LN ASSETS | −0.032 | 0.045 | −0.049 | −0.045 | −0.039 | −0.045 |

| (−0.59) | (0.90) | (−0.64) | (−0.59) | (−0.57) | (−0.58) | |

| LN AGE | 0.053 | −0.044 | −0.017 | −0.034 | −0.007 | −0.034 |

| (1.10) | (−0.92) | (−0.32) | (−0.61) | (−0.13) | (−0.60) | |

| Debt | 0.162 | 0.002 | 0.594** | 0.547** | 0.324 | 0.547** |

| (0.78) | (0.01) | (2.24) | (2.06) | (1.27) | (2.05) | |

| NO TANG | 2.364*** | 0.196 | 1.337 | 1.780* | 0.670 | 1.777* |

| (4.05) | (0.28) | (1.42) | (1.82) | (0.97) | (1.77) | |

| CAP INT | −0.078*** | −0.110*** | −0.021 | −0.015 | −0.081*** | −0.015 |

| (−3.38) | (−5.42) | (−0.78) | (−0.55) | (−2.64) | (−0.55) | |

| SCH | 0.204** | 0.370*** | 0.365*** | 0.327*** | 0.284*** | 0.327*** |

| (1.99) | (3.59) | (3.28) | (2.89) | (2.66) | (2.75) | |

| Constant | 1.092 | 0.578 | 1.548* | 1.449* | 1.445** | 0.145* |

| (1.62) | (1.06) | (1.91) | (1.79) | (1.99) | (1.78) | |

| F-value | 8.73*** | 6.03*** | 6.33*** | 6.16*** | 4.61*** | 5.83*** |

| R2 | 0.2535 | 0.1935 | 0.2773 | 0.2834 | 0.1853 | 0.2834 |

| R2-adjusted | 0.2245 | 0.1615 | 0.2335 | 0.2375 | 0.1388 | 0.2349 |

| N | 375 | 367 | 316 | 316 | 316 | 316 |

Model 1 in Table 2 shows how the business group's degree of diversification (β=0.044, ρ>0.10) does not affect Tobin's q-value, meaning that an increase in the number of new activities performed by the group has no impact on performance (rejecting H1). These results are similar to those obtained by Delios and Beamish (1999), Graham, Lemmon, and Wolf (2002), and Muñoz and Sánchez (2011). There is therefore no diversification discount (Berger & Ofek, 1995; Villalonga, 2004), as a greater degree of diversification does not affect performance, measured by Tobin's q-value. One possible explanation lies in the fact that the increase in costs derived from greater diversification is compensated by the synergies derived from new activities (Palepu, 1985), so that the negative effect of the former is compensated by the positive effect of the latter. Also, as mentioned by Campa and Kedia (2002), diversification can occur due to the poor performance of the original business, in which case degree of diversification is the result of a process aimed at maximising shareholder returns. Indeed, firms obtain a poor performance before the diversification process, so it does not necessarily determine the diversification discount (Campa & Kedia, 2002).

Model 2 shows how family control has a negative impact on Tobin's q-value (β=−0.222, ρ<0.01). In other words, market evaluation of family groups is lower than that of non-family enterprises, confirming hypothesis H2 (Cronqvist & Nilsson, 2003; Morck, Shleifer, & Vishny, 1998). The goal to maintain socio-emotional wealth (keeping control of the business, preserve family connections, transfer the business to subsequent generations, etc.) makes families give greater importance to it than to financial performance (Gómez-Mejía et al., 2010), providing that it does not endanger the family business’ survival (Cennamo et al., 2012).

In greater detail, model 3 shows that the differences between family and other groups largely lie in the greater creation of value (measured by Tobin's q-value) in groups controlled by financial enterprises (β=0.539, ρ<0.01) and foreign agents (β=1.599, ρ<0.05) than in others, including family groups (β=0.156, ρ>0.10) (rejection of H3). There is a difference in the impact of the type of ultimate owner on performance, which is positive in financial groups and foreign enterprises, and zero in family groups and groups “with no effective control”. The results show that the preservation of socio-emotional wealth in family groups decreases financial performance, which is not the priority (Gomez-Mejia et al., 2007; Gómez-Mejía et al., 2010). However, even considering this circumstance, family groups were expected to show a better performance than groups “with no effective control”, where it is reduced by managerial discretionary power. Therefore, the results obtained show that the effect of the preservation of socio-emotional wealth on performance is similar to the effect of the lack of a shareholder of reference, and no differences are found between the two groups. However, compared with financial and foreign groups, the latter do obtain a better performance, as they have shareholders of reference and socio-emotional wealth is not part of their utility functions, which focus on maximising profits.

Model 4 includes diversification and family control in the same regression, with reference to groups “with no effective control”. The inclusion of diversification relative to model 3 does not affect performance, and financial groups (β=0.571, ρ<0.01) and foreign enterprises (β=1.663, ρ<0.01) obtain a better market evaluation than groups with no effective control, and family groups (β=0.155, ρ>0.10) (rejection of hypothesis H3). This confirms the results obtained in model 3, enabling it to distinguish between family and “no effective control” groups on the one hand, and foreign and financial groups on the other, where the nature of the latter increases Tobin's q-value.

Finally, models 5 and 6 consider the interaction of family control and degree of diversification, establishing a comparison between family and non-family groups (model 5) and between family groups and groups “with no effective control” (model 6). This tests the possible moderating effect of family control on the relationship between degree of diversification and performance (Kang, 1999; Muñoz & Sánchez, 2011). Both models show that family control does not affect the impact of diversification on Tobin's q-value (in model 5, β=−0.218, ρ>0.10, and in model 6, β=0.153, ρ>0.10). In other words, family control does not have a moderating effect on the relationship between diversification and performance, similar to non-family enterprises in general (Muñoz & Sánchez, 2011) or if we compare with groups “with no effective control” in particular. This confirms hypothesis H4b, rejecting hypotheses H4a and H5.

The above results show that the family nature of a business group does not affect the impact of diversification on performance. Although the goal to maintain socio-emotional wealth favours investments that increase performance (Muñoz & Sánchez, 2011), a principal-principal agency problem (between the family and non-family shareholders) (Zahra, 2007) can lead to investments in new businesses that do not maximise profits, which would explain the results obtained. Another possibility to be considered is that a family business diversifies but lacks the know-how or skills required in the new businesses (Schulze, Lubatkin, & Dino, 2002), which would hinder the use of synergies and reduce the positive impact of diversification on performance.

5Conclusions, limitations and future lines of researchThis paper represents a contribution to the fields of family business, diversification strategies and performance, providing new evidence about the individual and joint impact of family control and degree of diversification on market evaluation, considering business groups as the analytical unit, and classifying non-family groups according to the nature of their ultimate owner. After analysing a sample of business groups in which the parent company is listed, the results confirm that there is a relationship between family control and performance, and that family control has little impact on the effect of diversification on performance, measured by Tobin's q-value.

In a first approximation, we find that family groups are characterised by a worse market evaluation than non-family enterprises (Cronqvist & Nilsson, 2003; Thomsen & Pedersen, 2000), and that the differences are greater relative to groups controlled by financial concerns and groups “with no effective control”. Family businesses also show a smaller degree of diversification than non-family firms (Anderson & Reeb, 2003; Miller, Le-Bretton Miller and Lester, 2010), and the differences are greater relative to groups with no shareholder of reference. The family's involvement in management aligns its interests with those of other shareholders, leading to a smaller degree of diversification in family groups relative to those where managers have greater discretionality (Goranova et al., 2007). The aim to preserve socio-emotional wealth also generated less interest in new activities, as this could lead to loss of control of the company (Gomez-Mejia et al., 2007; Gómez-Mejía et al., 2010).

When analysing the effect of degree of diversification on a business group's performance, the results show that there is zero impact (Chen & Yu, 2011; Graham et al., 2002; Muñoz & Sánchez, 2011); in other words, there is no diversification discount (Villalonga, 2004). This could be because Spanish groups are characterised by high levels of concentration of ownership (Santana & Aguiar, 2006), which enable the alignment of shareholder and manager interests, thus preventing new activities that could harm the group's performance (Berger & Ofek, 1995). The selection bias of diversification was corrected in the models, studying the possible endogeneity between diversification and performance (Graham et al., 2002), which can affect the results obtained (Sacristán et al., 2011).

When comparing the impact of type of group on the creation of value, we find that family control has a negative impact on performance (Cronqvist & Nilsson, 2003; Morck et al., 2005; Thomsen & Pedersen, 2000). The desire to maintain socio-emotional wealth (Gomez-Mejia et al., 2007; Gómez-Mejía et al., 2010) means that families are more willing to renounce part of their business profits in order to ensure control of the company and maintain all emotional connections. These results show how markets anticipate that problems derived from family control exceed its advantages. Although family groups seek the survival of the business (Casson, 1999) and have a longer-term perspective, a high concentration of shares owned by family members can give rise to problems between majority and minority shareholders (Zahra, 2007), causing internal conflicts and opportunistic behaviour by the family relative to other investors (Astrachan, 2010).

Finally, when considering the joint effect of family control and diversification on performance, we find that family control does not have a positive moderating effect on the relationship between diversification and performance (Muñoz & Sánchez, 2011). When considering nature of the ultimate owner, family groups and groups “with no effective control” are similar, and Tobin's q-value is not affected. The performance of new activities by family enterprises is seen by investors in the same way as for non-family groups, as the market does not positively evaluate that a family's diversification could increase the company's value. On the other hand, Tobin's q-value is positively affected when the business group is controlled by foreign agents or financial institutions. These results could show that investors prefer groups where financial objectives and the creation of value are more evident (financial groups and groups controlled by foreign agents who invest in Spain based on ROI criteria) rather than in groups “with no effective control” or family enterprises where creation of value can be compromised (either due to managerial discretionality in the former or to problems derived from family control in the latter).

Finally, several contributions are made relative to previous research. For Spain, the study provides new evidence regarding the impact of family control and diversification on performance. It specifically considers major Spanish corporations with listed parent companies, so that the measure of diversification refers to the entire group (parent company and subsidiaries). The use of Tobin's q-value as a measure of performance also shows investors’ expectations not only in relation to the listed parent company, but also in relation to the entire business group. Comparisons are also made between family groups and different types of non-family corporations according to the nature of the ultimate owner, and the moderating effect of family control on the relationship between diversification and performance, an aspect hardly considered in family business literature, is also studied.

The research has several limitations. Firstly, the results obtained correspond to a period before the economic crisis (2000–2005). It would be a good idea to update the database in order to replicate the study for the years of economic recession. We could then see whether the economic crisis affected degree of diversification (resulting from readjustments and the sale of unprofitable businesses), the nature of the ultimate owner (possible changes in the number of groups controlled by families, financial or foreign institutions or “with no effective control”) and performance (reduced as a result of the economic crisis). It could also be studied whether there have been changes in the joint effect of diversification and family control on performance.

A second limitation of the study is that the results are valid for business groups with listed parent companies, and cannot be generalised to unlisted enterprises. The following questions also arise. Why are their family groups with listed parent companies and others with unlisted parent firms? Do they not meet the requirements of the Spanish stock markets, or do they prefer not to be listed? What could the reasons be, to preserve socio-emotional wealth or others? The answers to these questions, together with a study of unlisted corporations, could lead to new lines of research.

A third limitation is that only the nature of the group's main shareholder is considered. Other shareholders often play a relevant role regarding strategy, an aspect not analysed here. It would therefore be interesting to analyse the ownership structure of family groups in greater detail, controlling the presence of other important shareholders that could affect strategic decision-making (Jara et al., 2008; Sacristán et al., 2011), with an impact on both degree of diversification and performance. The characteristics of the board of directors and firm management, the presence of independent external executives and the greater or smaller presence of family board members (Minichilli, Corbetta, & Macmillan, 2010) are factors that can affect diversification strategies, and should be controlled in future research.

Finally, the results of the study show how control by financial institutions and foreign agents improves performance, while it is not affected by family firms and groups “with no effective control”. There is therefore a need to study the differences between family, foreign and financial groups. However, from the perspective of agency theory and socio-emotional wealth, if there is a clear difference between family firms and groups “with no effective control”, why are there differences between family, financial and foreign groups? In all three cases there is an ultimate owner who can exercise effective control. However, the objectives established by financial and foreign groups are different, as family groups give priority to the preservation of socio-emotional wealth. There is therefore a need to discover the reasons for said differences, and how they can affect both diversification and performance.

We acknowledge financial support from research projects ECO2013-48496-C4-3-R, funded by the Spanish Ministerio de Economía y Competitividad, and CREVALOR, funded by the Diputación General de Aragón (DGA) and the European Social Fund.