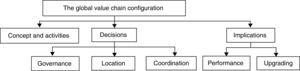

This paper reviews the literature on global value chain configuration, providing an overview of this topic. Specifically, we review the literature focusing on the concept of the global value chain and its activities, the decisions involved in its configuration, such as location, the governance modes chosen and the different ways of coordinating them. We also examine the outcomes of a global value chain configuration in terms of performance and upgrading. Our aim is to review the state of the art of these issues, identify research gaps and suggest new lines for future research that would advance our understanding of how firms are implementing new ways of organizing and managing activities on a global scale.

A vast amount of research has focused on different configurational aspects of firms’ activities worldwide. Specifically, an important part of the literature has focused on explaining the reasons and effects of locating individual activities in foreign countries (Lewin et al., 2009; Martínez-Noya and García-Canal, 2011; Rodríguez and Nieto, 2016; Schmeisser, 2013). Nevertheless, research has increasingly broadened this perspective to go beyond the analysis of specific activities and encompass the whole value chain. This has prompted the emergence of several lines of research examining different aspects of the global value chain configuration, including: governance types (Buckley and Strange, 2015; Gereffi et al., 2005), levels of disaggregation (Asmussen et al., 2007; Beugelsdijk et al., 2009), geographic scope (Los et al., 2015; Mudambi and Puck, 2016), and the upgrading processes of the firms involved (De Marchi et al., 2013; Humphrey and Schmitz, 2002; Lema et al., 2015).

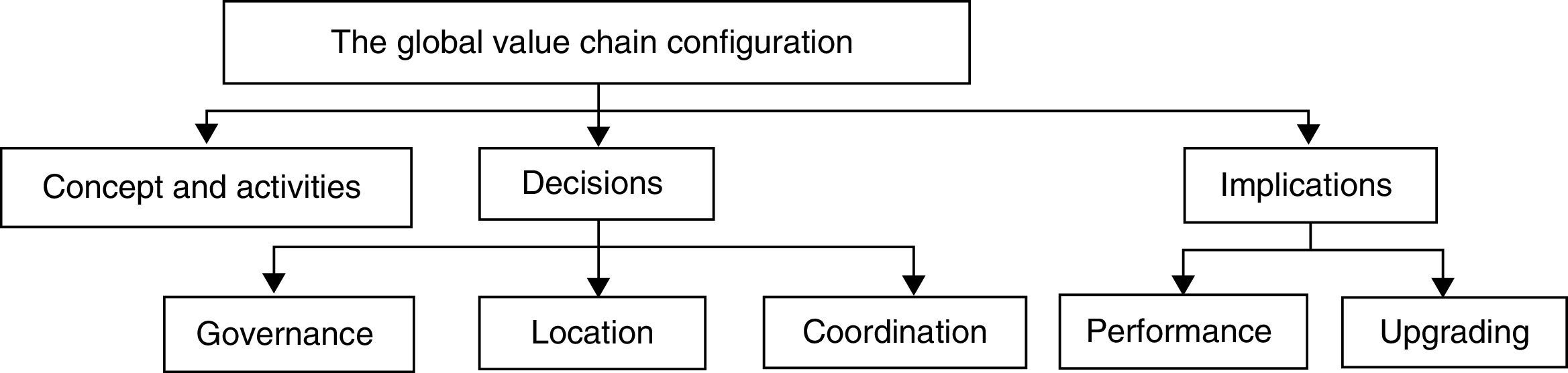

Recent studies have reviewed the literature that focuses on the different theoretical perspectives in global supply chain management (Connelly et al., 2013). However, a comprehensive review of the literature dealing with the state of the art of the global value chain configuration has not yet been carried out. Firms are constantly taking decisions in an interconnected world that not only affect their structures, capabilities and results, but also those of the other agents they interact with. It is thus necessary to clearly identify the decisions involved in a global value chain configuration that have been already examined and, from that, the aspects that remain unexplored. The purpose of this article is therefore to review the literature on global value chain configurations in order to systematize it and indicate avenues for future research (see Fig. 1).

The study contributes to global value chain literature in several ways. We believe that, traditionally, research has been focused on specific topics involved in its configuration such as decisions on location, governance and coordination. A review examining all of them allows us to better understand not only the characteristics of each decision but also the interdependencies between them. Additionally, it allows us to observe the complexity of a global value chain configuration that may be constantly evolving due to changes in countries, industries and firms. All in all, it allows us to identify the topics that remain unexplored and present those lines of research that, in our view, remain unanswered.

The rest of the paper is structured as follows. First, we explain the global value chain concept and the different activities composing it. Secondly, we describe how the literature has classified the different value chain configurations and the key decisions in designing the global value chain, namely governance, geographical scope and coordination of activities. Thirdly, we explore the outcomes related to global value chain configurations in terms of performance and upgrading. Finally, we suggest future lines of research and establish the conclusions that can be drawn from the study.

Global value chains: concept and activitiesOver the years, scholars have analyzed different terminology to define how firms organize activities such as commodity chains (Gereffi and Korzeniewicz, 1994; Selwyn, 2015), supply chains (Al-Mudimigh et al., 2004; Connelly et al., 2013; Priem and Swink, 2012), value networks (de Reuver and Bouwman, 2012; Stabell and Fjeldstad, 1998), etc., depending on the specific relationships that have emerged among firms and other agents within it (Gereffi et al., 2001). Commodity chains focus on examining industries and the authority and power relationships that have emerged within them to explain the role of a leading firm (Mahutga, 2012) – the firm which shapes, controls, coordinates and distributes the value along the chain (Azmeh and Nadvi, 2014). A distinction has thus been made between buyer-driven commodity chains – in which the leading corporation plays a central role as merchandiser and makes sure that all pieces of the business come together – and producer-driven commodity chains – in which the leading corporation plays a central role in production activities (Gereffi and Korzeniewicz, 1994). Other scholars have focused on the analysis of supply chains, where the supply chain concept explains the firms’ relationships with suppliers and customers to deliver product or services at less cost (Christopher, 2005). The value chain concept goes a step further, and explains that entities may be connected and create a value which is a source of competitive advantage (Al-Mudimigh et al., 2004; Stabell and Fjeldstad, 1998). This latter concept also takes into account the customers in a privileged position (Cox, 1999), understanding their needs and offering them value (Di Domenico et al., 2007), by examining value creation and its capture (Gereffi and Lee, 2012).

Moreover, when the value chain involves a constellation of organizational arrangements and firms that are interconnected through a global network, the global value chain concept emerges (De Marchi et al., 2014; Giroud and Mirza, 2015; Mudambi and Puck, 2016). Hence, the global value chain is defined as “the full range of activities that firms and workers perform to bring a product from its conception to end use and beyond”, that are carried out on a global scale and that can be undertaken by one or more firms (Gereffi and Fernandez-Stark, 2011, p. 4). Specifically, some scholars point toward a new system called the “global factory” (Buckley, 2011; Buckley and Ghauri, 2004), which entails the organization of activities in a complex configuration. This system describes how firms may reduce location and transaction costs by orchestrating the global value chain in such a way that all activities are linked by international flows of intermediate products that the MNC controls but does not necessarily own, and where knowledge is increasingly internalized (Buckley and Strange, 2015).

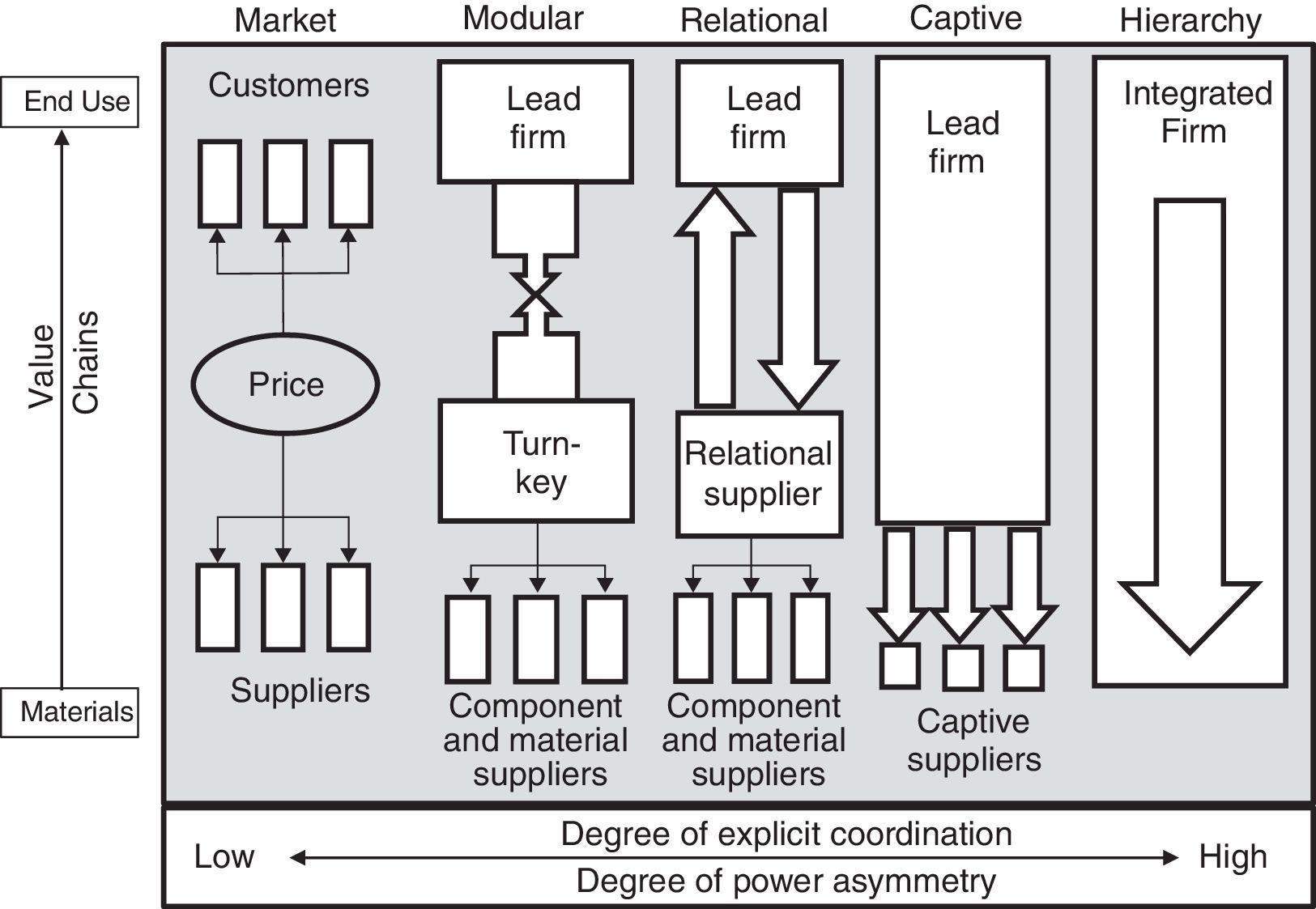

One of the crucial aspects of building an overview of global value chain configuration is therefore an examination of the activities involved, which can be grouped based on different criteria (see Table 1). Porter (1991) differentiates primary activities – those related to producing, delivering and marketing the product or service–from support activities. The latter are either related to creating and sourcing inputs or else to those factors that are integral to the firm and facilitate the work of primary activities, such as ensuring efficiency and effectiveness (Priem and Swink, 2012; Tansuchat et al., 2016). It is also possible to distinguish between upstream and downstream activities, based on their closeness to the exploitation of raw materials or to the manufacturing and customization of the product, respectively (Nicovich et al., 2007; Pananond, 2013; Singer and Donoso, 2008; Verbeke et al., 2016). Mudambi (2008) adds a third type called middle-end activities. Under this last approach, upstream activities are those that involve design and research, both basic and applied, and the commercialization of creative endeavors; downstream activities typically comprise marketing, advertising, brand management, and after-sales services; and middle-end activities are related to manufacturing, standardized service delivery and other repetitious processes in which commercialized prototypes are implemented on a mass scale. Activities may also be divided by distinguishing between those related to exploration from those related to exploitation, based on whether they are competence-creating activities – such as those that are technologically advanced – or competence-exploiting activities – such as those that imply local adaptation while deploying existing technologies (Cantwell and Mudambi, 2005; Cantwell and Piscitello, 2015; Ha and Giroud, 2015). Other classifications take into account activities’ importance in terms of the firm's competitive advantage and distinguish between core and non-core activities (Espino-Rodríguez and Rodríguez-Díaz, 2014; Gilley and Rasheed, 2000; McIvor, 2000) or between core, essential and non-core activities (Contractor et al., 2010; Quinn, 1999; Linares-Navarro et al., 2014). According to this latter view, core activities are those with high added-value, which are distinctive and crucial for competitive advantage, and are supposed to be the ones the firm performs better than any other company; essential activities are those needed for sustaining profitable operations that are complementary and important for competitive advantage; and non-core activities are those that can easily be outsourced.

Classification of activities in the value chain.

| Criteria | Classification | Description | Studies |

|---|---|---|---|

| Degree of involvement in the production process | Primary activities | Those including creation, production, logistics, marketing and customer service. | Porter, 1991; Priem and Swink, 2012; Tansuchat et al., 2016 |

| Support activities | Those related to procurement, technology development, human resource management, and general infrastructure. | ||

| Function in the value chain | Upstream activities | Those close to the exploitation of natural resources and raw materials or those related to design, basic and applied research and the commercialization of creative endeavors. | Mudambi, 2008; Mudambi and Puck, 2016; Nicovich et al., 2007; Pananond, 2013; Singer and Donoso, 2008; Verbeke et al., 2016 |

| Middle-end activities | Those related to manufacturing and logistics. | ||

| Downstream activities | Those close to the ultimate consumer that add value to the product by manufacturing or customization. Those related to marketing, advertising, brand management, after-sales services, etc. | ||

| Potential for competence creation | Exploration-related activities | Those that create new areas of competence by extending the firm's capabilities and involving new combinations of resources. | Cantwell and Mudambi, 2005; Cantwell and Piscitello, 2015; Ha and Giroud, 2015 |

| Exploitation-related activities | Those based on the existing firm's capabilities. | ||

| Potential for being a source of competitive advantage | Core activities | Activities which are distinctive and crucial for competitive advantage. | Espino-Rodríguez and Rodríguez-Díaz, 2014; Gilley and Rasheed, 2000; Linares-Navarro et al., 2014; McIvor, 2000; Quinn, 1999 |

| Essential activities | Those activities which are complementary and important for competitive advantage. | ||

| Non-core activities | Those activities that give low added value to the firm. | ||

How firms configure this complex system of activities requires an analysis of different decisions, and we will examine these in the following sections.

Configuring a global value chainThe configuration of a global value chain has evolved in recent decades. Initially, activities were defined in large blocks ranging from low-end manufacturing and service activities to R&D, design and engineering. More recently, some scholars have pointed out that the value chain can no longer be seen as a set of traditional activities, as firms have engaged in a process of fine-slicing activities (Beugelsdijk et al., 2009; Contractor et al., 2010; Mudambi, 2008; Mudambi and Puck, 2016). This process of generating finer modules has several implications. On the one hand, firms have improved their learning about their own systems or about organizing activities in new ways and specifying connections among them; on the other, it has allowed firms to redefine their core and non-core activities, keeping the true core activities in-house and allocating more resources, time and effort to those activities they do best (Gilley and Rasheed, 2000; Linares-Navarro et al., 2014). It implies a process of modularization that takes large groups of activities – such as those related to R&D, production or marketing – and disaggregates them into sub-activities (Contractor et al., 2010). Indeed, specialization may give some firms the opportunity to develop superior capabilities that give them a competitive advantage (Jacobides and Winter, 2005). Firms thus have to decide: how to organize their activities – keep them in house, go to the market or use mixed modes such as alliances with other firms (Castañer et al., 2014; Gereffi et al., 2005), where to locate these activities (Jensen and Pedersen, 2011; Los et al., 2015; Mudambi and Puck, 2016), and how to coordinate them globally (Beugelsdijk et al., 2009; Hansen et al., 2009). Moreover, firms have to take into account that these choices may change and evolve over time depending on the circumstances, and must therefore review them continuously (Buckley, 2011; Buckley and Ghauri, 2004).

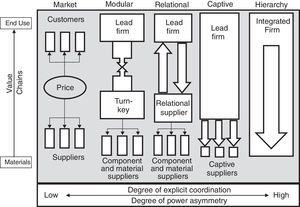

Governance structures of the global value chainGovernance refers to “authority and power relationships that determine how financial, material, and human resources are allocated and flow within a [value] chain” (Gereffi and Korzeniewicz, 1994, p. 97). In international business literature, two traditional governance modes have explained how firms operate abroad: based on hierarchy or on the market. In other words, firms have to deal with the make-or-buy decision enounced in the transaction cost theory (Coase, 1937; Williamson, 1975). However, it seems that explaining the global configuration of value chain activities merely through a hierarchical or a market structure (the two extremes) is far from the reality. As Jacobides and Billinger (2006) explain, firms can also use alliances and generate partial integration with mixed modes. When global value chains are analyzed, a range of governance options thus emerge (see Fig. 2).

Global value chain governance modes (Gereffi et al., 2005, p. 89).

At one end we find the market governance mode and at the other, the hierarchy mode. The former implies relatively simple transactions between the firms involved. Under this structure, buyers and suppliers along the value chain need little cooperation and the cost of switching to new partners is low for both. Price is the mechanism for reaching the deal (Gereffi and Fernandez-Stark, 2011). The tendency, however, is that firms within the global value chain are ever more connected, creating a network of independent firms orchestrated or coordinated by a leading firm, and providing a context of trust and power within volatile environments (Buckley, 2016). At the other end, we find the hierarchical governance mode, which implies vertical integration and managerial control within the lead firm. Although it is less and less common to find firms integrating the whole value chain, there is research that has focused on examining global value chain configurations based on foreign direct investment decisions (Hsu and Chen, 2009). This structure is more usual when products are complex, codification is difficult and competent suppliers are not easily found (Gereffi and Fernandez-Stark, 2011).

Between these two extremes, we find alternative governance structures that fit into the Gereffi et al. (2005) classification: modular, relational and captive governance structures. Although all of them are based on relationships with other firms, there are also differences between them. Modular governance implies that suppliers make products according to a lead firm's specifications, implying a high volume of codified information flow, while the lead firm concentrates on the creation, penetration and defense of markets for end products (Sturgeon, 2002). In a modular mode, suppliers tend to be highly competent, providing full-package services and taking responsibility for certain stages such as manufacturing through turn-key contracts (PingQing et al., 2007; Wad, 2008). For its part, relational governance is more likely when information is more complex, not easily transferred and when greater levels of interactions and knowledge-sharing based on mutual trust and social ties are needed (Altenburg, 2006). Relational governance implies that coordination is organized by social relationships and shared norms (Poppo and Zenger, 2002). It also allows lead firms and suppliers to quickly respond to changing conditions using norms of reciprocity for resolving conflicts (Sturgeon, 2002). Lastly, captive governance structure is the governance mode that entails greater dependence for suppliers, which operate under the lead firms’ conditions, with high degrees of monitoring and control from them (Gereffi et al., 2005). This implies that suppliers are in a worse position for bargaining for higher selling prices but a better position for receiving support from lead firms (Altenburg, 2006).

The configuration of the value chain in each of these governance structures may depend on several factors. First, external conditions, such as those in the industry, may affect the governance structures in the value chain configuration. Qian et al. (2012) relate the likelihood of internalizing value chain activities to the life cycle of the industry and whether the firm is an early mover or a late entrant. Indeed, governance modes may vary over time as the industry matures and evolves (Gereffi and Lee, 2012). The existence of entry barriers may also affect governance structures. Mahutga (2012) explains the existence of modular and relational value chains when entry barriers are high, captive and hierarchical value chains when entry barriers are intermediate, and quasi-market and modular value chains when entry barriers are low. As Buckley (2011) concludes, the dynamics of the industry and changes in the market, such as customer demand or technologies, also determine the structure of the global value chain under integrated or non-integrated structures.

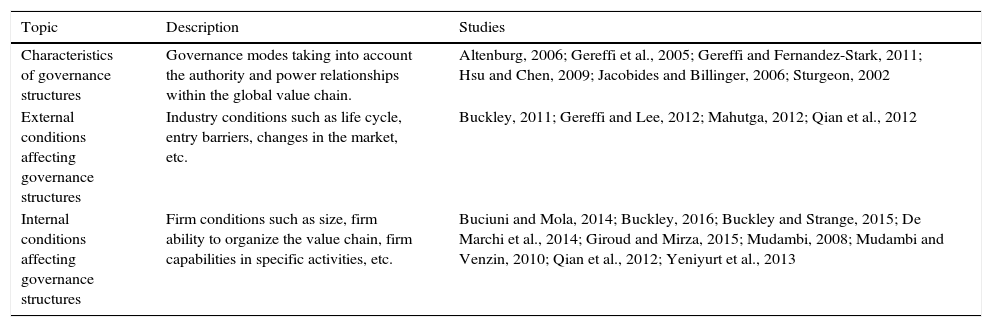

Second, there are other relevant internal conditions within the firms that can affect the governance mode. De Marchi et al. (2014) point out that the position of the lead firm in buyer-driven and producer-driven commodity chains is different, implying different governance structures. Studies have also considered firm factors such as the size of the firm to explain governance structures (Buciuni and Mola, 2014; Roza et al., 2011). The choice of one governance structure or another may also depend on whether or not the firm has the specific capabilities required to integrate activities along the value chain. Internalizing activities requires capabilities related to coordinating, organizing and managing affiliates (Qian et al., 2012), so vertical integration is attractive for firms with the capabilities that help them to stimulate cross-activity coordination, learning and innovation (Mudambi, 2008). Alternative modes require other capacities, such as relational and networking abilities (Giroud and Mirza, 2015). Specifically, firms trying to implement a global strategy through partnerships need to possess the skills and capabilities that allow them to manage them effectively and efficiently, such as the ability to share information and the ability to develop global and local responsiveness (the ability to initiate actions based on knowledge generated and disseminated across the organization) to suppliers (Yeniyurt et al., 2013). Additionally, firms may choose different governance modes depending on the capabilities they have in certain activities. As Mudambi and Venzin (2010) explain, firms are more prone to maintain control over the value chain if they have stronger competencies in manufacturing or standardized service delivery, and may link them to more knowledge-intensive activities in R&D, design and marketing. On the other hand, specialization and focus on controlling certain activities is more likely in companies with stronger dynamic competencies in internal knowledge-intensive activities but weaker competencies in linking standardized and specialized activities. Table 2 offers an overview of the studies analyzing different aspects of governance structures in a global value chain configuration.

Studies of the governance structures of global value chains.

| Topic | Description | Studies |

|---|---|---|

| Characteristics of governance structures | Governance modes taking into account the authority and power relationships within the global value chain. | Altenburg, 2006; Gereffi et al., 2005; Gereffi and Fernandez-Stark, 2011; Hsu and Chen, 2009; Jacobides and Billinger, 2006; Sturgeon, 2002 |

| External conditions affecting governance structures | Industry conditions such as life cycle, entry barriers, changes in the market, etc. | Buckley, 2011; Gereffi and Lee, 2012; Mahutga, 2012; Qian et al., 2012 |

| Internal conditions affecting governance structures | Firm conditions such as size, firm ability to organize the value chain, firm capabilities in specific activities, etc. | Buciuni and Mola, 2014; Buckley, 2016; Buckley and Strange, 2015; De Marchi et al., 2014; Giroud and Mirza, 2015; Mudambi, 2008; Mudambi and Venzin, 2010; Qian et al., 2012; Yeniyurt et al., 2013 |

Despite the amount of research on this topic, we can finish this subsection by suggesting some lines for future research. Existing research has examined firm features to explain governance decisions in the global value chain, but opportunities for broadening our understanding still remain. On the one hand, firm's factors affecting global value chain configuration may be related to the ownership type of leading firms. Some scholars point to this aspect as a future line of research in which, for example, family and non-family firms are compared (Fernández and Nieto, 2014). It would also be interesting to test empirically the implications of the different governance modes described in the literature. Scholars have traditionally focused on comparing different governance modes for specific activities (Castañer et al., 2014; Nieto and Rodríguez, 2011; Rodríguez and Nieto, 2016) and only scant research has considered the global value chain as the unit of analysis (Buciuni and Mola, 2014). Additionally, as we have seen in this review, most of the studies adopt a static perspective when examining the governance decisions around the configuration of the global value chain. Nevertheless, as technologies evolve, the comparative advantages of countries change, new specialized suppliers appear, and activities become more standardized. The options for modularizing and fine-slicing activities may thus increase. Firms may therefore reconfigure their value chains in new ways. Scholars have to recognize these changes and movements in order to explain the evolution of decisions related to the governance structure of the global value chain and explain the dynamics that emerge within it over time.

Geographic scope of the global value chainThe fragmentation of the value chain has also entailed a dispersion of activities around the globe. Thus, management literature has used the term “global value chain” for those cases in which some functions are located in other countries. However, limitations exist in this literature for different reasons. First, some studies examining the geographical scope of firms’ activities claim that we cannot talk about global but only about a regional distribution of them (Rugman et al., 2009). Some scholars explain that production occurs in regional blocks that can be grouped into three “Factories”: Factory Asia, Factory North America and Factory Europe (Baldwin and Lopez-Gonzalez, 2015). MNEs managing global networks are increasingly inclined to work with fewer, larger and more capable suppliers, operating in a reduced number of strategic locations around the world, and favoring regionalization (Gereffi and Fernandez-Stark, 2011). Los et al. (2015) explain, however, that this trend does not reflect reality and that regional effects could be explained by the fact that some studies examine trade in terms of intermediate inputs instead of the value added, thus overestimating the internal regional trade in downstream inputs.

Second, strategic management literature has explained that firms should disperse their activities globally and choose the best locations for them to obtain a competitive advantage (Gupta and Govindarajan, 2001). Nevertheless, the research has focused on the analysis of specific activities and how there should be a match between them and the characteristics of the host country (Demirbag and Glaister, 2010; Hsu and Chen, 2009; Jensen and Pedersen, 2011; among others). Although these studies show the reasons for locating different activities in specific countries and the benefits thus obtained, they do not show the geographical scope of a value chain, nor take into account the complexity of today's business world or the broader range of the firm's strategic choices (Wiersema and Bowen, 2011). The key is therefore to examine these components as a whole (Mudambi and Puck, 2016). Otherwise, it would be impossible to take into consideration several factors that are necessary for evaluating the effects of a global value chain configuration. Some research is adopting this perspective of including the whole system, in order to explore the “degree of globalness” of the value chain (Verbeke and Asmussen, 2016). Similarly, Asmussen et al. (2007) identify three types of value chain configurations by taking into account the MNEs’ geographical scope – international, multi-domestic and global value chains. This vision, however, focuses on the examination of MNEs as the unit of analysis, which may hide the existence of global value chains that include externalized and internalized activities. Mudambi and Puck (2016) conclude that the footprint of MNEs is global when a value-chain based approach is used which also incorporates all the externalized activities. More studies are therefore needed to explain this issue.

Moreover, another important issue to consider when activities are globally dispersed is how firms may need to adapt to local market differences while at the same time needing to exploit economies of scale and scope and maximize knowledge transfers across locations (Gupta and Govindarajan, 2001). Configuring a global value chain may imply managing heterogeneous languages, cultures, regulations, etc. The capabilities required in each market usually differ, and this pushes firms to implement higher levels of monitoring and control (Gereffi et al., 2005). Firms may balance their internal embeddedness with the external embeddedness in each host country (Meyer et al., 2011). Moreover, capabilities and the learning effect needed to manage different locations may be different depending on the type of value chain activity considered (Verbeke et al., 2016). More research is therefore needed in order to explain how firms solve the challenges they encounter when faced with a diversity of institutions and discover which aspects firms may change in order to smooth potential negative impacts.

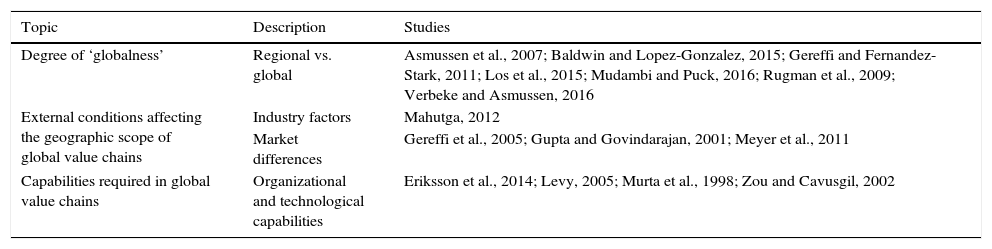

Lastly, the literature has explained that there are contingencies that affect firms in their options for geographically configuring a global value chain. Some scholars note that the type of industry is a factor to consider as some industries are restricted by entry barriers that make it more difficult to configure value chains on a global level. Mahutga (2012) argues that the likelihood of global value chains existing is greater in industries that have low entry barriers to manufacturing, such as the garment industry, as there are more options for externalizing and finding suppliers globally. From a firm perspective, it is important that firms have a global orientation (Zou and Cavusgil, 2002). When firms configure a global strategy they need to have a global mindset (Murta et al., 1998) and some capabilities, such as cultural awareness or locational flexibility, are critical factors for success when configuring a global value chain (Eriksson et al., 2014). Additionally, firms having greater organizational and technological capabilities for coordinating a dispersed set of economic activities may more easily reach a global configuration (Levy, 2005). Nevertheless, future research may explain how firms may change the ‘globalness’ of their value chains. There are firms that are born with a global mandate and configure a global value chain from the very beginning. There are also, however, firms that develop a restructuring process in order to make their value chains global or simply because agents in the value chain change their location decisions. Differences between them, their decision-making processes and their implications would be an interesting line of investigation. To summarize, Table 3 offers an overview of the studies analyzing the location decisions of a global value chain configuration.

Studies considering the geographic scope of global value chains.

| Topic | Description | Studies |

|---|---|---|

| Degree of ‘globalness’ | Regional vs. global | Asmussen et al., 2007; Baldwin and Lopez-Gonzalez, 2015; Gereffi and Fernandez-Stark, 2011; Los et al., 2015; Mudambi and Puck, 2016; Rugman et al., 2009; Verbeke and Asmussen, 2016 |

| External conditions affecting the geographic scope of global value chains | Industry factors | Mahutga, 2012 |

| Market differences | Gereffi et al., 2005; Gupta and Govindarajan, 2001; Meyer et al., 2011 | |

| Capabilities required in global value chains | Organizational and technological capabilities | Eriksson et al., 2014; Levy, 2005; Murta et al., 1998; Zou and Cavusgil, 2002 |

Considering the mix of activities together with their governance and location decisions, a global value chain configuration requires decisions to be taken about the coordination between actors at different functional positions (Ponte and Gibbon, 2005). In this regard, one of the key issues in the global value chain literature is the role of the lead firm. Moreover, the need for coordination also arises from the necessity to simultaneously combine different operation modes in their value chains (Benito et al., 2011, 2012). Specifically, firms may combine governance modes in the different activities of the value chain in a foreign market, or combine mode packages for an activity in one or more countries (Benito et al., 2009). A situation like this implies that firms need to find a balance between the benefits of an optimal governance structure and the costs derived from greater organizational complexity (Benito et al., 2011). Moreover, they have to coordinate governance modes supporting the firm's objectives (Petersen and Welch, 2002), while at the same time taking into account that each mode of operation requires a different combination of skills (Casillas and Moreno-Menéndez, 2014).

Another interesting line of research explains how managers combine modes, apply and evaluate different mode packages (Benito et al., 2009). As Asmussen et al. (2009) highlight, companies involved in a global strategy require that spatially dispersed activities are tightly coordinated. Managing a global value chain implies taking governance decisions across different host countries and activities that cannot be considered independently because there are interdependencies between them, in terms of strategic control and learning (Hashai et al., 2010). Challenges then emerge as, in most cases, firms have to manage not only their internal networks but also the external ones. Having connections with several suppliers along the value chain may increase confusion and information overload (Chiu, 2014). Future research should consider this pattern, examining interdependencies between governance and location decisions and the factors that could facilitate global value chain coordination.

Moreover, these coordination activities require a dynamic perspective to explain how and why firms change operation modes (Benito et al., 2012). Literature shows that firms have to be constantly reexamining the global redistribution of capabilities (Lema et al., 2015). Specifically, the lead firm has to take into account changes in other firms in the global value chain and their evolution, because these can modify the capabilities of those other firms and thus affect the coordination of activities and markets in the value chain (De Marchi et al., 2014). A combination of decisions might thus be optimal at a given point in time, but not in the future (Gupta and Govindarajan, 2001). Firms have to be aware of the possibility of changing their decisions. Future research could empirically examine the evolution and challenges that the different firms involved in the global value chain may encounter.

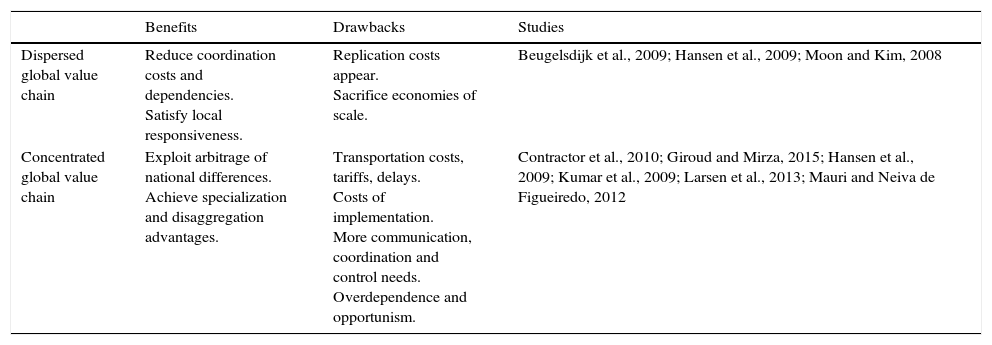

Another interesting topic is related to the way firms coordinate these activities worldwide and considers the degree of replication of activities in different locations. Specifically, some scholars distinguish between dispersed and concentrated global value chains (Hansen et al., 2009). A dispersed global value chain implies the replication of activities country by country, making multinational units operate independently. This matches one of the types of value chains identified by Yip (1989, p. 31), the multi-domestic firm configuration, in which foreign subsidiaries are autonomous units with “all or most of the value chain reproduced in every country”. This configuration implies the existence of affiliates operating independently with lower levels of coordination needs and more focus on satisfying local responsiveness (Hansen et al., 2009). However, it sacrifices the potential benefits of scale economies (Beugelsdijk et al., 2009) and at the same time incurs costs derived from replicating subsidiaries, lack of standardization, etc., which are the pros of the global strategy (Moon and Kim, 2008).

A concentrated global value chain, conversely, implies the creation of highly specialized affiliates, each with a geographic scope that transcends a local market (Frost et al., 2002), which operate with other affiliates in a network. In an extreme case, each value chain activity takes place in a different country. This would allow firms to benefit from the various advantages derived from the disaggregation and modularization of the value chain into independent units (Beugelsdijk et al., 2009). This configuration is considered to define a pure global firm (Asmussen et al., 2007; Roth et al., 1991; Yip, 1989). Nevertheless, it involves a global distribution of work with geographic and time gaps between work locations, which may generate problems. First, it may imply costs related to transportation, tariffs, delays, or to dependencies on a specific location (Giroud and Mirza, 2015). Second, unexpected costs may emerge that derive from the greater complexity of implementing the offshoring of functions (Larsen et al., 2013). Third, dispersion and disaggregation may also imply management and communication efforts and control difficulties due to the significant number of activities divided into discrete slices. These additional efforts and difficulties may, at some point, exceed the potential benefits (Contractor et al., 2010; Kumar et al., 2009). Lastly, costs related to opportunism are significant, especially in concentrated value chains that use partners and do not internalize activities (Hansen et al., 2009). Firms operating within this type of configuration have fewer redundancies but at the same time are more risk-exposed because of the lower margin for errors and greater exposure to unforeseen outcomes (Mauri and Neiva de Figueiredo, 2012). This configuration thus requires organizational design mechanisms, such as network structures, modularization, delegation, electronic communication infrastructures and standardizing interfaces (Pedersen et al., 2014; Ponte and Gibbon, 2005; Srikanth and Puranam, 2011). Additionally, offshoring experience and a strong orientation toward an overall system of structures and processes have been considered to be factors that allow firms to anticipate the costs of the dispersion of activities and avoid its negative effects (Larsen et al., 2013). Table 4 summarizes the benefits and drawbacks of each type of coordination.

Benefits and drawbacks of dispersed and concentrated global value chains.

| Benefits | Drawbacks | Studies | |

|---|---|---|---|

| Dispersed global value chain | Reduce coordination costs and dependencies. Satisfy local responsiveness. | Replication costs appear. Sacrifice economies of scale. | Beugelsdijk et al., 2009; Hansen et al., 2009; Moon and Kim, 2008 |

| Concentrated global value chain | Exploit arbitrage of national differences. Achieve specialization and disaggregation advantages. | Transportation costs, tariffs, delays. Costs of implementation. More communication, coordination and control needs. Overdependence and opportunism. | Contractor et al., 2010; Giroud and Mirza, 2015; Hansen et al., 2009; Kumar et al., 2009; Larsen et al., 2013; Mauri and Neiva de Figueiredo, 2012 |

Nevertheless, many other aspects remain underexplored. An interesting line of research in this area may be to examine these coordination structures by considering different firm factors such as size. Traditionally, global value chain configuration has mainly been explored through the study of large firms. They have been considered to have more of the resources and capabilities that enable them to design integrated structures. A dispersed or concentrated value chain may, however, imply different challenges and opportunities for SMEs. Other factors such as the value chain's ownership structure and country of origin, the dynamism of the industry, etc., may also be relevant.

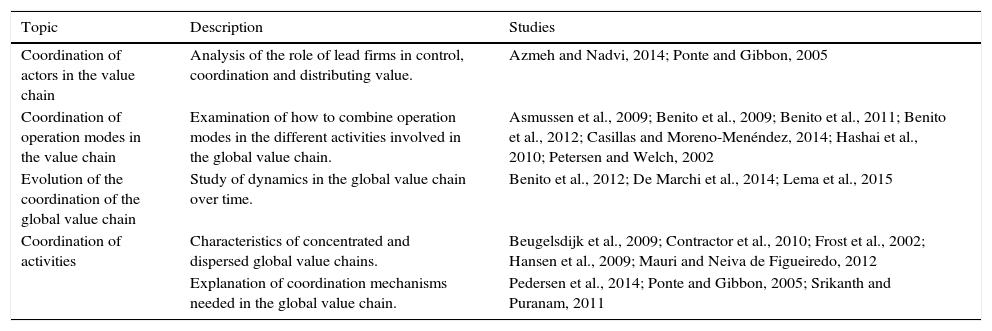

All in all, in order to systematize all the aspects covered above, we created Table 5 to provide an overview of the studies analyzing how the activities of global value chains are coordinated.

Studies considering coordination decisions of global value chains.

| Topic | Description | Studies |

|---|---|---|

| Coordination of actors in the value chain | Analysis of the role of lead firms in control, coordination and distributing value. | Azmeh and Nadvi, 2014; Ponte and Gibbon, 2005 |

| Coordination of operation modes in the value chain | Examination of how to combine operation modes in the different activities involved in the global value chain. | Asmussen et al., 2009; Benito et al., 2009; Benito et al., 2011; Benito et al., 2012; Casillas and Moreno-Menéndez, 2014; Hashai et al., 2010; Petersen and Welch, 2002 |

| Evolution of the coordination of the global value chain | Study of dynamics in the global value chain over time. | Benito et al., 2012; De Marchi et al., 2014; Lema et al., 2015 |

| Coordination of activities | Characteristics of concentrated and dispersed global value chains. | Beugelsdijk et al., 2009; Contractor et al., 2010; Frost et al., 2002; Hansen et al., 2009; Mauri and Neiva de Figueiredo, 2012 |

| Explanation of coordination mechanisms needed in the global value chain. | Pedersen et al., 2014; Ponte and Gibbon, 2005; Srikanth and Puranam, 2011 |

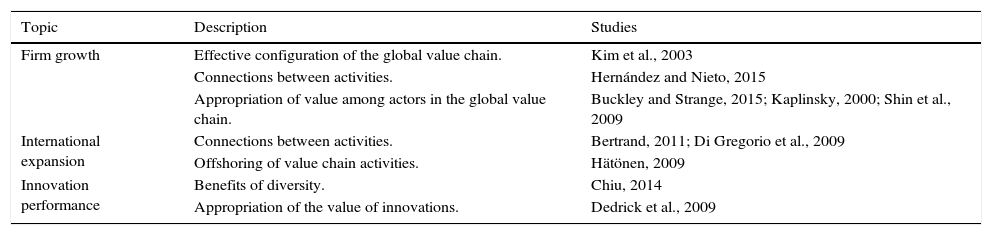

The literature has also explained some of the outcomes from global value chain configurations. Specifically, scholars have posited that an effective global value chain configuration may have a positive impact on business performance (Kim et al., 2003). Similarly, some literature examining inward-outward connections explains the positive effects on firm growth resulting from the connections between international activities in the upstream and downstream parts of the value chain (Hernández and Nieto, 2015). Other performance measures have also been examined. Some scholars have highlighted the fact that activities related to the upstream side of the value chain may generate advantages for activities related to the downstream side of the value chain, such as international sales (Bertrand, 2011; Di Gregorio et al., 2009; Hätönen, 2009). These studies are common when the firm is examined as the unit of analysis. Less research exists, however, into how different firms within a global value chain, generate their performance or how the value is appropriated between the different agents. An exception is the study by Kaplinsky (2000) which, from a macro-level perspective, explains that some parties gain and other lose in the global value chain and suggests some movements that could be made by the economic actors to reverse that situation. Other research goes beyond performance generation and explains mechanisms that enable value appropriation. Specifically, it has been argued that if lead firms are able to leverage power over their suppliers they may appropriate the value generated, since they may increase flexibility and take advantage of external competencies in terms of better quality or lower costs (Buckley and Strange, 2015).

Another important issue explored in the literature about the implications of value chain activities is related to innovation performance. Chiu (2014) posits that supplier diversity allows firms to enable new skills and technologies, improve their assimilative power, and broaden perspectives, and all this helps firms to track new discoveries and advances. Additionally, one important topic in this area is also related to the appropriation of the value generated by innovations within a global value chain model. Hence, Dedrick et al. (2009) describe differences related to how the control of key elements enables some firms to capture supernormal returns on innovation. From a different perspective, focused on the complementary assets of lead firms for making innovations a commercial success, Shin et al. (2009) argue that these firms may capture more benefits from innovations even when they are developed by non-lead firms.

Table 6 offers an overview of the literature examining the different performance implications of a global value chain configuration. Despite the research we have reviewed, we consider that more literature is especially needed that examines the performance outcomes of a global value chain configuration from a strategic management perspective. Specifically, more studies are needed that analyze how the different global value chain configurations (which differ in terms of governance, geographic scope and levels of coordination), may affect lead firms’ performance and the outcomes of the rest of the agents in the global value chain. Moreover, it is necessary to shed light on the way each agent contributes to financial profit or other outcomes and how changes in market conditions may affect their distribution (Contractor and Reuer, 2014).

Studies explaining the performance implications of global value chain configurations.

| Topic | Description | Studies |

|---|---|---|

| Firm growth | Effective configuration of the global value chain. | Kim et al., 2003 |

| Connections between activities. | Hernández and Nieto, 2015 | |

| Appropriation of value among actors in the global value chain. | Buckley and Strange, 2015; Kaplinsky, 2000; Shin et al., 2009 | |

| International expansion | Connections between activities. | Bertrand, 2011; Di Gregorio et al., 2009 |

| Offshoring of value chain activities. | Hätönen, 2009 | |

| Innovation performance | Benefits of diversity. | Chiu, 2014 |

| Appropriation of the value of innovations. | Dedrick et al., 2009 |

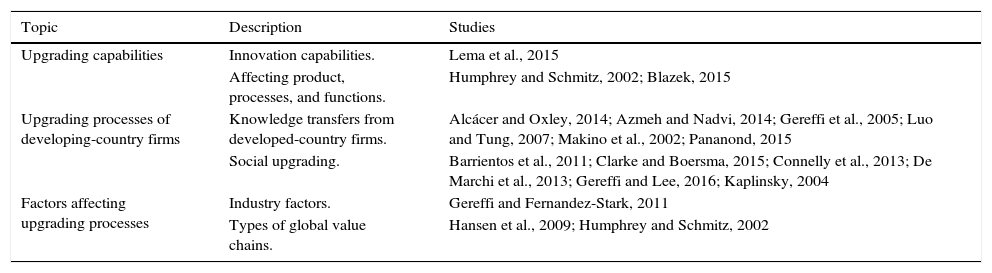

Another line of research, which is related to the innovation aspect we explained before, is focused on analyzing the improvement in innovation capabilities. Some scholars posit that these capabilities may appear in lead firms, but also in subsidiaries and independent suppliers in foreign countries (Lema et al., 2015). This topic connects with those studies that have examined upgrading processes derived from global value chain configurations. Gereffi et al. (2005) define upgrading as “the process by which economic actors – nations, firms and workers – move from low-value to relatively high-value activities in global production networks” (p. 171). Both lead and supplier firms can upgrade their capabilities as a consequence of a global value chain configuration. And they can upgrade in several ways: product, process, functional and inter-chain upgrading (Humphrey and Schmitz, 2002; Blazek, 2015). But special emphasis has been given to the upgrading process for local producers that can learn from global buyers.

Some scholars point out, indeed, that it is the lead firms that are the ones that can affect the upgrading potential of the rest of the actors on that value chain (Azmeh and Nadvi, 2014). Also related to this, entities from developing countries can really experience an upgrading process and move from developing low-value added activities to high-value added ones (Pananond, 2013). These firms have gained access to global markets (Gereffi et al., 2005). Indeed, some literature focuses on how this upgrading process has allowed emerging market firms to undertake outward internationalization as a result of the knowledge acquired from the inward internationalization carried out by Western countries in developing nations (Luo and Tung, 2007). As a result, firms from emerging countries are becoming more and more important players in the international arena and their countries are not just the recipients of activities from developed-country firms. This process has also implied that firms from emerging and developed countries have different motivations and ways of configuring global value chains. Firms from emerging countries may locate their R&D and marketing activities in advanced economies in order to develop capabilities which allow them to catch up with their rivals from developed countries and are necessary to compete there (Luo and Tung, 2007; Makino et al., 2002). Moreover, this is a way of then counter-attacking their global rivals in their own domains and a way of overcoming their latecomer disadvantage, especially in aspects related to consumer base, brand recognition and technological leadership (Pananond, 2015). Nevertheless, some research has explained that factors such internal capabilities as well as to whom you supply, impact the degree of learning achieved (Alcácer and Oxley, 2014).

A global value chain configuration can have additional implications related to other upgrading processes. Firms from developing countries may also achieve social upgrading1 (Barrientos et al., 2011). In fact, these aspects have implied a broad range of questions in recent literature within different areas. From a human resources management perspective, scholars are increasingly worried about explaining the implications for working conditions and rights (Clarke and Boersma, 2015); from the point of view of corporate social responsibility management, scholars are exploring the implications for the level of awareness that lead firms have about the practices along the whole value chain (De Marchi et al., 2013); from an institutional point of view, studies are exploring the possible evolution and upgrading of host country institutions (Connelly et al., 2013; Kaplinsky, 2004). All in all, this social upgrading process is driven by different factors, requires different mechanisms and different actors are involved in it (Gereffi and Lee, 2016).

Upgrading processes may be affected by other factors. The literature has considered that upgrading paths depend on the industry and the input–output structure. Some industries require linear upgrading activity by activity, whereas others, especially those related to services, present non-linear upgrading paths (Gereffi and Fernandez-Stark, 2011). Similarly, different types of global value chains may also affect upgrading. Humphrey and Schmitz (2002) explain that quasi-hierarchical chains offer better conditions for process and product upgrading but worse for functional upgrading. For their part, Hansen et al. (2009) conclude that there are differences between firms implementing dispersed versus concentrated value chain configurations in terms of the likelihood of upgrading local partners from developing countries. And it is this upgrading which may most profoundly affect local partners. Table 7 offers an overview of the studies explaining the upgrading outcomes of a global value chain configuration.

Studies explaining upgrading implications of global value chain configurations.

| Topic | Description | Studies |

|---|---|---|

| Upgrading capabilities | Innovation capabilities. | Lema et al., 2015 |

| Affecting product, processes, and functions. | Humphrey and Schmitz, 2002; Blazek, 2015 | |

| Upgrading processes of developing-country firms | Knowledge transfers from developed-country firms. | Alcácer and Oxley, 2014; Azmeh and Nadvi, 2014; Gereffi et al., 2005; Luo and Tung, 2007; Makino et al., 2002; Pananond, 2015 |

| Social upgrading. | Barrientos et al., 2011; Clarke and Boersma, 2015; Connelly et al., 2013; De Marchi et al., 2013; Gereffi and Lee, 2016; Kaplinsky, 2004 | |

| Factors affecting upgrading processes | Industry factors. | Gereffi and Fernandez-Stark, 2011 |

| Types of global value chains. | Hansen et al., 2009; Humphrey and Schmitz, 2002 |

All in all, more research could extend this line of literature. Upgrading has been mainly explored from the viewpoint of how emerging-country firms have participated in the global value chains of Western firms and have upgraded their positions within these value chains (Buckley and Strange, 2015). Future research could also explore how this process may also imply that these firms could develop their own global value chains and how the transformation arises. Another topic that is interesting and remains underexplored is the case of downgrading, which means that firms may voluntarily or involuntarily move toward the production of simpler goods or focus on lower or smaller segments (Barrientos et al., 2011; Blazek, 2015). Future research may examine the mechanisms needed for avoiding this process or for recognizing it as the optimal strategy.

Discussion and an agenda for future researchTo summarize, the purpose of this study was to revise the literature around global value chain configurations. To do so, we have focused on three areas. Firstly, we have reviewed the literature that defines the concept of the global value chain and the different types of activities examined on it. Secondly, we have reviewed the literature that examines the different decisions necessary to configure a global value chain: governance structure, geographic scope and coordination scheme. Thirdly, we have taken into account the research covering the implications of a global value chain configuration, both in terms of firm performance and upgrading effects.

Throughout the paper, we have not only examined the literature, we have also suggested the opportunities for developing this literature. These are summarized below.

- •

Regarding decisions related to global value chain configuration, future research may explore firm factors that could affect the way firms in the global value chain make their decisions. Aspects such as the impact of size or type of ownership remain underexplored, especially in respect of governance and coordination decisions. Moreover, decisions may differ depending on whether the firm is global from its outset or it is a firm following a traditional path of internationalization. The latter type of firm has to reconfigure the way it operates in the value chain, especially regarding the location decision and the geographic scope of the value chain. An important aspect of governance, location and coordination decisions is related to the dynamics that may emerge over time. Thus, more research is needed that scrutinizes how firms change their global value chain configurations, including the factors determining these changes.

- •

The performance effects of different types of value chains in terms of governance, their geographical scope or their level of coordination remain underexplored. Scholars could also focus on contingencies that could help firms to identify which decisions may benefit them more.

- •

A third line of research is related to the effects on upgrading capabilities. A global value chain configuration may imply transformation processes that could affect the way firms develop their capabilities or allow them to deteriorate. Future research could also explore the mechanisms by which firms may avoid downgrading processes.

Moreover, there are two additional aspects that future research on global value chain configuration should take into account:

- •

There should be more quantitative studies analyzing the global value chain configuration. Many scholars describe the global value chain configuration from a theoretical or a qualitative perspective. Future research should therefore include more quantitative studies into the factors that affect the different decisions behind a global value chain configuration.

- •

An examination of the global value chain may be conducted from a multilevel perspective. Specifically, the different decisions involved in the global value chain configuration could be examined by considering the possible interdependencies between the different transactions and/or activities and that affect the whole of the value chain.

Configuring the global value chain is one of the most important topics in today's literature. The goal of the present work is to review the literature related to global value chain configuration in order to give a clear vision of the state of the art in this field. A more connected world in which change is more rapid implies that firms are changing their structures in order to remain competitive. Accessing resources and markets globally is, increasingly, a necessary condition but not sufficient per se. Firms have to combine locations and modes of governance in order to define their value chains, and must accept that they have to coordinate them within a network in which other agents also interact. We believe that the analysis of the global value chain configuration, its concept, the decisions involved and the consequences or outcomes resulting from its management not only provide the basis for understanding this phenomenon but also introduce new topics and questions that remain unexplored and need further research.

This study has been partially supported by financial aid from the Spanish Ministry of Economy and Competitiveness (Projects ECO2012-36160 and ECO2015-67296-R (MINECO/FEDER, UE)) and from the Project INNCOMCON-CM S2015/HUM-3417 (cofinanced by the Communtiy of Madrid and European Social Fund).