It may be surprising that one of the most popular compensation schemes in business is so open to being hacked – to having managers cheat to win. We explore tournament theory to detail its vulnerabilities to various forms of cheating unilateral and multilateral. We identify who is most likely to be involved and under what conditions. We describe the costs to the victims, to the firm, and to society. We outline the possible strategic effects – in terms of firm performance. And, we discuss possible ways to address these vulnerabilities to the schemes we rely on to motivate managers to put in the right efforts, to take the right risks, and to lead the right way.

A firm's choice of its compensation scheme is strategic because it affects performance through how well the interests of its manager-agents align with those of its owner-principals. The structure of that compensation determines whether managers put in the optimal level of effort and take on the proper amount of smart risks (e.g., Bloom and Michel, 2002; Hvide, 2002; Tekleab et al., 2005). Compensation schemes vary in form, and in associated benefits, costs and risks. For example, when worker monitoring is free, an effort input-based scheme is efficient; however, outside of that often unrealistic ideal, alternative schemes may provide better results. One such alternative is the tournament compensation scheme, as described by Lazear and Rosen (1979), where managers compete for rank-order prizes and monitoring is minimized (i.e., only the relative outputs of the competitors are necessary to measure). Our research question in this paper focuses on as-yet-hidden flaws in that popular compensation system; specifically, we inquire as to whether tournament schemes are susceptible to fraud. We expose the vulnerabilities of tournaments to cheating – through both unilateral and bilateral deception – and describe the related impacts and implications to affected and relevant parties.

The analysis of such ‘hacking’ of compensation systems is important to do, especially for the tournament scheme. Tournament-style compensation is popular, especially in western economies – as seen in its application to business, sports, entertainment and other activities where ‘winning is everything’ (e.g., Frank and Cook, 2013; MacDonald, 1988; Rosen, 1981).1 It remains the standard compensation system for top management positions in Fortune 500 firms. It is an attractive system on paper for many reasons (e.g., Becker and Huselid, 1992; Kale et al., 2009; Lee et al., 2008; Pissaris et al., 2010): First, it is as efficient, theoretically (e.g., in expected value terms for all participants), as a perfectly monitored piece-rate scheme. Second, it requires much less information to implement, which is important when monitoring efforts are costly; it needs only one measure – that of the relative output of the competitors – to implement. Third, for real participants, it induces sufficiently more risk-taking from managers to benefit most firms. Fourth, in real labor markets, it tends to provide a advantageous self-selection effect to filter for more confident, talented and risk-taking managers who enjoy competition. Fifth, it is fairer to managers than alternative systems when the firm is exposed to significant external uncertainties. That said, it is also a compensation scheme that entails different costs than alternatives like the piece-rate system; for example, it is does not provide a ‘fair’ realized (versus expected) outcome under a ‘tie’, it leads to and rewards an unequal distribution of wealth, and it encourages competition over cooperation (e.g., Bloom, 1999; Fredrickson et al., 2010; Pfeffer and Langton, 1993).

The ‘regular’ benefits, costs and risks of the tournament are well-understood; as are some of the irregular vulnerabilities of this very popular compensation scheme used in most corporate settings. In this paper, we add to the literature on the latter in a focused way. We expose its many vulnerabilities to cheating scams – both unilateral and multi-lateral in nature – and describe what that means for users of this scheme, for firm performance, and for society more broadly.

While no other paper has analyzed the hacking of the tournament model in the specific way we do here, there exists significant related research. (Note that we do not deal with sabotage in tournaments – where one manager decreases the output of the other; for a good review of that literature see Chowdhury and Gürtler, 2015.) Other papers that consider cheating in the Lazear and Rosen model exist, such as Gilpatric's (2011) mathematical analysis of a very focused specification of cheating and of its deterrence (through auditing), which finds several unintuitive results that appear to be driven by the assumption that cheating entails no effort costs, only penalization costs (when discovered). However, this is not a true ‘hacking’ of the original tourney model, as add-on choices and actions are used to analyze scheme designs involving cheating-discovery mechanisms. Connelly and colleagues’ (2014) review of tournament theory does not consider unilateral cheating, only mentioning bi-lateral collusion as a possibility. The experimental studies of Harbring (2006) and Harbring and Irlenbusch (2003) consider only multi-lateral collusion, and only under repeated play (which is not an assumption of the original tourney model). The empirical studies of Hass and colleagues (2015) and Shi and colleagues (2016) correlate pay gaps with alleged frauds (e.g., lawsuits), indicating that cheating (in terms of managers misreporting results) occurs when stakes are higher, as with tournament-style compensation schemes. The case study of Backes-Gellner and Pull (2013) focuses on heterogeneity issues in the tournament participant pool that give rise to low efforts, but not to cheating. Several papers consider collusion among managers in tournaments, including repeated tournaments (e.g., Gürtler, 2010; Ishiguro, 2004; Mookherjee, 1984); we consider collusion among managers as well in the latter part of the paper to complete the analysis for our model.

So, there has been a strong interest in the vulnerabilities and in the potential negative effects of the tournament model, and we complement and add to that literature with a comprehensive analysis of how the original model can be hacked – one that reveals new vulnerabilities. Specifically, we do so by analyzing the impacts of an added assumption about a manager's access to output information prior to the firm's access to it. This type of analysis – one that goes off the equilibrium path and examines the harms of the successful cheating of institutionalized systems – is even more important now, especially in light of the growing unease about corruptive practices and the costs to industries and nations when their organizations use systems that allow cheaters not only to prosper with monetary rewards but with power as well. Analyzing how people (and collections of people) cheat what are thought to be reliable and fair systems of competition is important because of its effects: on business – in terms of where managers decide to put in efforts (e.g., in cheating or in fair play, with the former most often more harmful and long-term inefficient to society given it builds distrust and backbiting), and in terms of the costs to stakeholders when cheating firms are exposed (e.g., Enron, Worldcom, Arthur Andersen, Madoff, Theranos, and so on); on politics – relating to who wins elections and is able to make, change and implement laws that could pardon past wrongdoing or further harm victims; and, on society – in terms of our trust in each other and our institutions, especially as influencing our willingness to cooperate with and invest in each other's businesses (which are actions that produce the main synergies powering our economies). The more we know about these systems and their hackability, the better can understand what can go wrong and how to preempt and fix them.

Tournament theory primerWe begin the analysis of cheating in the tournament system by describing ‘tournament theory’ in its most basic form as laid out by Lazear and Rosen (1979); that basic form provides a solid foundation for the rest of the analysis. So, we start with an economics-based, mathematical, formal model and then shift to less-formal, descriptive logic to analyze the cheating possible in the modified basic model. We do so because the economic model's formality efficiently and clearly sets up the basic system and its main variables, including the ones we focus on (e.g., the level of uncertainty as measured by the variance in managerial outputs) that allow the analysis of cheating when the new, realistic assumptions are added to the base model. This exposition style is both fair to the original material (i.e., by summarizing it in its own language) and appropriate for the business audience (i.e., by explaining the main analysis in less formal, more descriptive and realistic terms once they have been introduced to the that original material2).

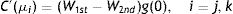

We start with the Lazear and Rosen (1979) paper because it provides a simple-but-generalizable model that focuses attention on the most important factors and issues. In this model, there are two managers vying for first and second prize in the tournament being held at the focal firm. There is one main period of action in which they make decisions – a period that is preceded by the firm choosing the two tournament prize levels, and followed by the firm choosing the winner and awarding the prizes. The actions of the two managers involve mainly the choice of their effort-investment that they each voluntarily make in the tournament, but may also include other items like posting a bond to enter the tournament (e.g., depending on the prize levels chosen). Each manager j produces output qj based on their effort-investment level μj and an uncontrolled random factor ɛj such that:

Each manager's effort investment is produced at an increasing cost C(μ), where C′, C″>0. The random factor is drawn from a probability distribution with mean of zero and variance of σ2. It is assumed that a manager's productivity risk is personally non-diversifiable, and that ɛj is independently and identically distributed (iid) across managers. (This allows firms to diversify risk across managers through pooling.) A simple production function is assumed – firm production is based only on manager outputs, where those outputs are additively separable. It is assumed that the managers act independently, as maximizers of expected-value (with risk-neutrality as the base case). It is further assumed that there exists free entry into the competitive output market of the firm, a scenario that sets the value at ‘V’ per output-unit of each manager.

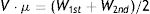

For comparison we can consider the piece-rate compensation scheme under free monitoring costs. In that case, the outcome is efficient. Firm output settles at the point where societal marginal benefits just equal manager marginal costs (and firm-owners make no profits in the competitive market), so that:

With the comparison outcome set, we can now return to the tournament outcome illustrated with our (generalizable) two-player competition over two prizes – W1st and W2nd. Manager output remains as described in equation (1), with the winner identified by the largest q produced, regardless of the margin of victory. The optimal tournament scheme involves setting the two prize levels, upon which the managers choose effort levels to maximize their expected utilities, and where the firm is held to the zero-profit condition (due to the competitive market assumed). Given the firm's setting of W1st and W2nd, each manager tries to maximize expected utility as defined by the risk-neutral benefits less costs equation:

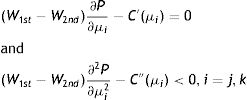

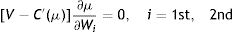

where P denotes the probability of the manager winning.where γɛj−ɛk, γ∼g(γ), G(·) is the cumulative distribution function of γ, E(γ)=0, and E(γ2)=2σ2 (because ɛj and ɛk are assumed iid).Each manager chooses effort to maximize expected utility, and with an interior solution assumed,3 this gives:

We assume Nash–Cournot optimization where each manager optimizes against the optimum choice of his opponent, which leads to the reaction function for manager j as:

The assumed symmetry of opponent actions under a Nash solution gives μj=μk and P=G(0)=½, implying that the outcome is purely random in equilibrium even though each manager provides positive effort.

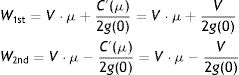

Substituting equal effort into Eq. (5) gives:

which describes an outcome where effort levels depend on the spread of the prizes.The firm's revenue is (qj+qk)·V and its costs are W1st+W2nd. Given the assumption that market competition drives out profits, these must equate. Further, given that firm-level equality result and the equality of managerial efforts result, and the assumption that the mean of the random effects are zero, the zero-profit condition indicates that the expected prize equals the expected value of the output:

Now, substituting (7) into (2) and setting P=½ in equilibrium gives the manager's expected utility in equilibrium as:

The firm sets the equilibrium prize levels to optimize (8), and that guarantees marginal benefits equal marginal costs:

Some additional manipulation of the equilibrium conditions identifies the prize levels as:

To illustrate further, assuming a Normal distribution of the random factor, equation (10) describes how the optimal prize spread settings vary directly with V and σ2 – i.e., with the output's value and with the variance of the distribution of the random effect of ‘managerial talent’. (Note that ‘managerial talent’ here is simply a term used for the random effect of external influences on output, ɛj. Although it is included in his ‘talent’ in terms of his actual production function of output-from-effort, it is not predictable or controllable by him, and so may not really be ‘talent’ but more accurately personal ‘luck’.) That concludes the outline of the basic tournament model. Note that: (i) a tournament has the same expected efficiency as the piece-rate scheme in the ‘ideal’ case – each scheme provides the same managerial effort level; but, (ii) in the one-shot scenario, it is highly unlikely that the outcome of a tournament is ‘fair’ (i.e., it is unlikely that the firm's revenues equal its costs, or that the either manager is rewarded at the piece-rate level for his efforts ex post – and this is due to the effects of randomness on a scheme that magnifies the effects of small differences for any one play; of course, in expectation – over many plays – the scheme will be ‘fair’, but by then the losing manager may have left the firm).

For the remainder of this paper, we keep the model at this level of description, even though tournament theory has been developed and been further complicated to reveal other interesting effects, like that such schemes attract managers who are less risk-averse and better endowed, and that it is a preferred scheme when certain types of measurement errors exist in the economy. This present level is sufficient to make our points about this scheme being vulnerable to cheating in a simple and generalizable way. From here on we switch from formal economics language to a more descriptive argumentation because we will not be talking about standard economic equilibria analyses, but instead examining off-equilibrium paths where deception can occur, where the implications are meant more for a business rather than an economics audience.

Hackability and its effectsTournament-style compensation schemes involve higher stakes than the piece-rate one because there are disproportionate rewards for the tournament winner. So, the question then is not about whether there is a motivation to cheat but whether there is any opportunity to do so in the tournament scheme. Once such opportunities are identified, the follow-up question about what impacts such fraudulent activity produce can be addressed.

Hacking the ideal modelTo begin our analysis of the opportunities to cheat, we consider the original base model, as described above, under the ideal assumptions stated. We can confirm that it is robust – there are no rational opportunities to cheat (in equilibrium). That is expected under the Nash–Cournot equilibrium based on the relevant assumptions of the model: when the available options to alter output have been presumed considered (i.e., the standard effort-to-output option has been considered); and, when the manager cannot sabotage the work of others, collude with rival managers, or bribe the firm. Under these ideal assumptions, the manager has only one factor to manipulate to alter his output and that is his effort level, but he would not rationally increase his effort because the model equilibrium settles at the optimum point where marginal benefits just equal marginal costs for the effort level of each manager.

However, what if there were other ways to boost output – options not considered in the base model? For example, the manager could seek to boost his own output by obtaining output from others (a practice not uncommon in business, for example, when managers take credit for the output of underlings). Consider the benchmark case when he pays the market price V per unit and applies it to his own total output prior to that q being measured by the firm (assuming that the firm does not have monitoring to stop this). But, because the marginal benefit is composed of the increase in the chances of winning and the decrease in the chances at losing at the zero-difference-point in the distribution g(0) – which is given by the right-hand side of Eq. (6) – and this is equal to the model's equilibrium marginal cost on the left-hand side, which is equal to V in Eq. (9), and that is price for additional output here, the idea of cheating in this manner is also unattractive.

Now consider that there may be other ways to boost a manager's output, some possibly having a marginal cost below the V-level marginal benefit. (To be clear, in the cases of cheating, we are speaking about a marginal cost that accounts for the expected costs of cheating – including the product of the probability of being caught and the penalty from being caught.) We expect that if the manager could overstate his output, or access a method or tool that increases his output-to-effort ratio at a low marginal cost, then he will cheat even in the original model. So, let's describe those main possibilities to boost output through cheating: First, there is the premature logging of anticipated future output as current output. This is often done in terms of sales as output; Xerox found trouble doing this decades ago. Second, there is straight deceptive reporting of performance as was seen at the firm-level in accounting scandals, such as at Enron, and in testing scandals, such as at VW. Third, there is pyramiding where performance returns are subsidized with new subscription fees (e.g., Madoff). Fourth, there is corner-cutting that increases the effort-to-output function, where quality and safety controls that are costly to efforts are avoided (e.g., in the BP Gulf Oil disaster). Fifth, there is the use of rule-breaking equipment to gain a competitive advantage over rivals (e.g., using PEDs, corked bats, enriched fuel, and so on). Sixth, there is rule-breaking behavior at the margins (e.g., Maradona's ‘hand of god’ in the World Cup, using enforcers to injure rival star players in hockey, screaming during tennis shot-making, and so on).

Such possibilities have all occurred in the real world, even under the ‘reasonable’ levels of monitoring that occur in sports tournaments and tournament-like rivalries between firms. Within a firm, where monitoring is lower because it is costly and, hence, a good place to use a tournament scheme, such possible cheating is obviously possible as well, in addition to being harmful. If the cheating is successful – i.e., the cheating manager wins when he would have not otherwise – then there are victims. There is the cheated rival manager, and there are likely other victims as well, such as the firm and others who did not promote the best manager or who were put in unsafe conditions due to corners being cut, and so on. Given that harmful cheating is possible even in the base case, it is worth investigating in more realistic cases and across all of the main variations of cheating by the parties involved; and we do so, all in one place, as a contribution to the literature, below. We refer to the same base model, the same main methods of boosting output, the same manipulatable factors (e.g., effort) in doing so, but with one main addition in the assumption of who knows what when, an assumption we argue is realistic in most business contexts.

Hacking a more realistic tournament modelWe now consider cheating in a more realistic version of the tournament, beginning with the simplest case, a case that does not involve a conspiracy with an involved party. We add one assumption to the original model to make it more realistic and more aligned with the cheating opportunities available in tournament-style compensation schemes. We assume that the cheater observes his own output level, q, prior to it being measured by the firm and with sufficient lead time to boost his output through the available means.4 This is a reasonable assumption; first, because it is not ruled out in the original study and, second, because cheaters do monitor their own output more closely and with less information asymmetries than outsiders. Recall that we assume monitoring is expensive when tournament systems are used in business and so is ‘poorly done’ from the firm's perspective. The manager has arguably the most expertise in his own output, is the most proximate to it, and has the most incentive to check it; therefore, it is likely he can do it prior to the firm measuring it at the end of the contest. (Examples of rogue managers [e.g., Leeson at Baring's Bank; Kerviel at Société Général] knowing what the firm does not appear to repeat in business history. Even when superficial output monitoring is at a high level – as in cycling – cheaters like Armstrong could monitor his own ‘enhanced’ effort-to-output ratio and adjust it prior to officials noticing.)5

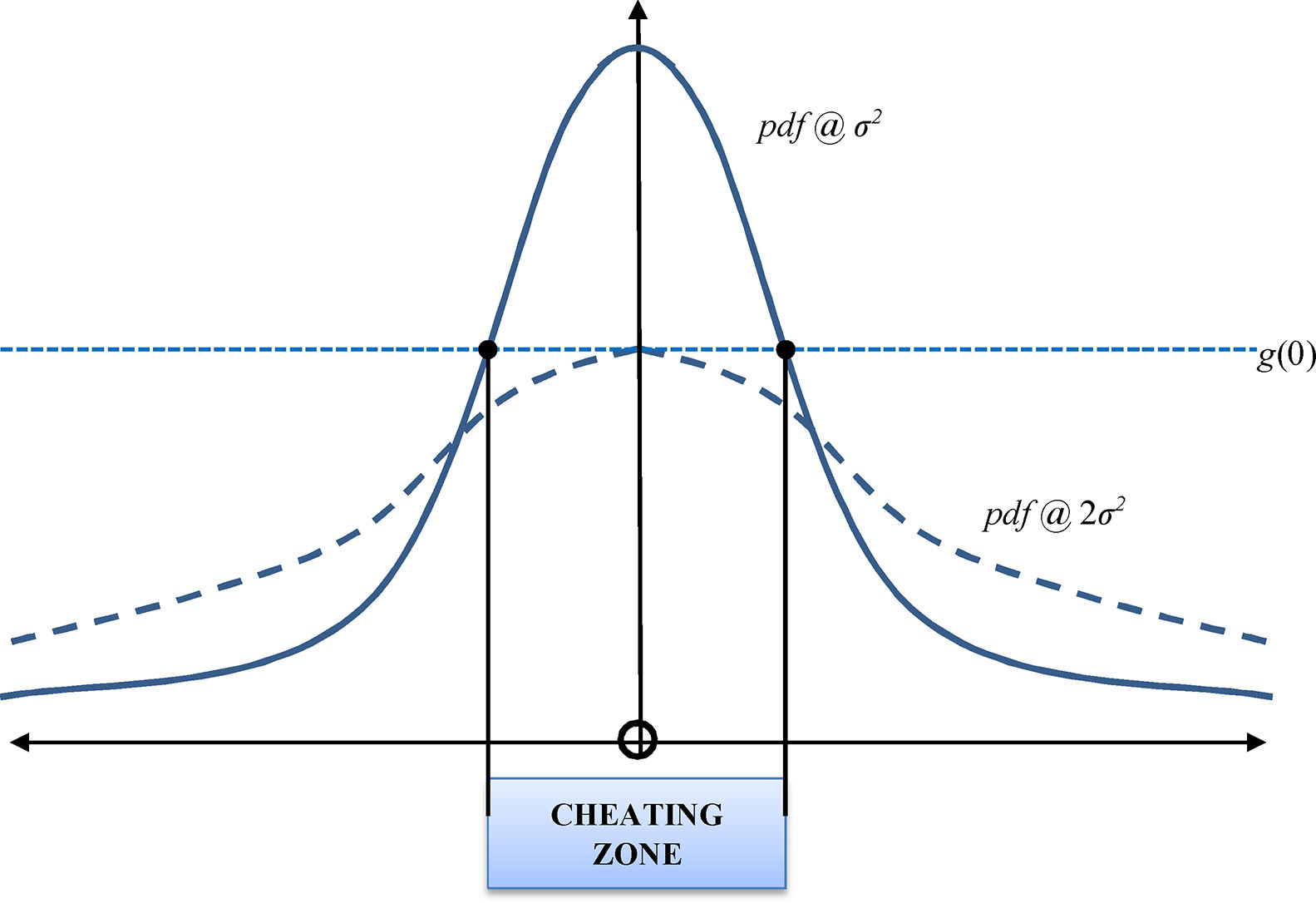

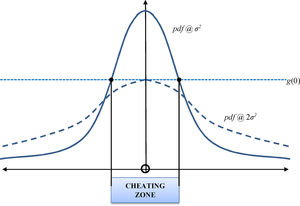

This new assumption – where the cheater observes his own output level prior to it being judged by the firm – is important because it alters the probability distribution driving the marginal benefits of cheating, g(·). Specifically, the mean remains the same – at zero – but the variance is halved at the time that cheating can occur. In the base tournament model, the relevant variance is 2σ2 at the time each manager chooses his effort, but here, after observing his own output and prior to choosing to cheat, it now is halved to σ2 because the only unknown at play is the random factor affecting the rival manager's output. Note that under this lowered variance, the marginal benefit of cheating changes, while the marginal cost remains the same (i.e., at V per unit purchased). For symmetrical distributions, the maximum of the partial distribution function (pdf) occurs at the mean, which is at zero here – i.e., so it occurs at g(0). Recall that this is the pdf value that affects optimal managerial effort according to Eq. (6). Note that when the variance of a symmetrical pdf is reduced then its maximum increases. Thus, it must follow that there is a range of values around the (zero) mean for a lower-variance pdf that lie at or above the higher-variance pdf's value at that mean. Here, that realization implies that there exists a range of values around zero where the marginal benefits of cheating exceed the marginal costs of cheating. Recall that the marginal benefits are defined by the right-hand side of Eq. (6) – but with cheating the g(·) is now defined by a pdf with half that variance; so while the higher-variance pdf was maximized in the original model, the relevant pdf is not in the cheating model.

The prospect of higher marginal benefits opens up many possibilities for boosting output because the marginal costs of such can be at the level of V or higher. (The manager could even boost own effort, but with C′ and C″>0, he is likely to hit any acceptable higher cost level faster than with other options; that said, it is likely this action will not be ‘seen’ as cheating by itself. Because our focus here is on cheating in its regular forms, we base our analysis on a more representative option.) For the sake of simplicity, in order to provide a detailed analysis of a representative way of output boosting, we assume that this is done by purchasing output on the open market at cost V (i.e., consider this output boosting method as exemplar for all boosting possibilities listed above). Given the marginal costs of V, there is now room to cheat as marginal benefits can increase above that original g(0) value – given the same prize level spread – because the cheater knows his own q and has effectively altered the pdf in his favor. Thus, cheating will occur – i.e., the manager will purchase units at price V until the marginal costs just equal the marginal benefits of increasing his probability of winning and decreasing that of losing.

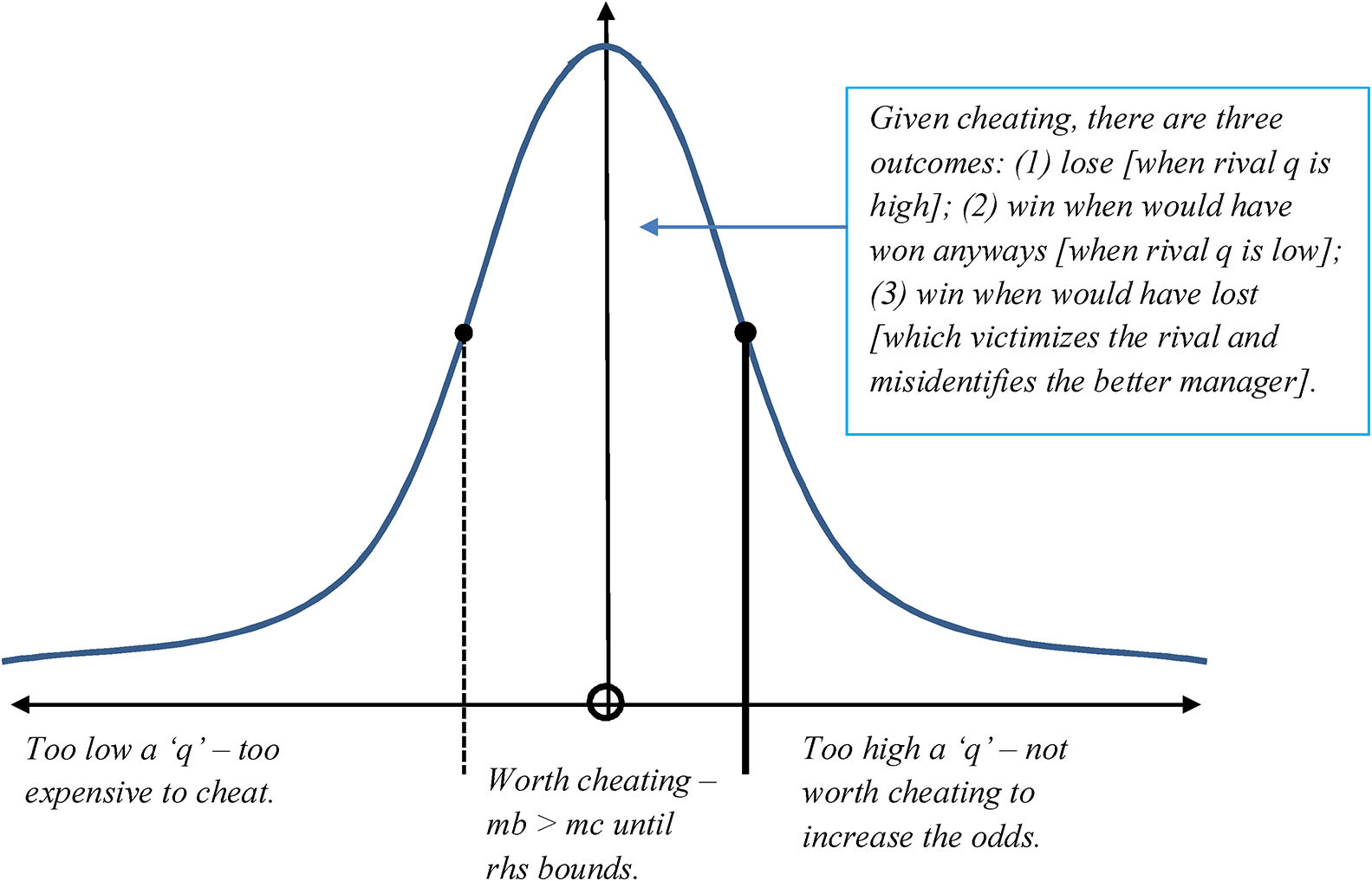

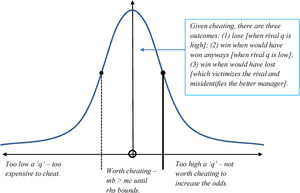

Fig. 1 illustrates the band of cheating activity expected for a symmetrical pdf. The limits of the band are defined by the original – higher-variance – g(0) value. The cheating manager buys outside units until he hits the right-hand band limit. Outside that band's range, there is no cheating: If the manager observes too low an output, he expects to lose, and trying to inflate his output is not worth the cost. If the manager observes too high an output, he expects to win, and so further inflating his output is wasteful. Fig. 2 depicts the choices of cheating and the likely outcomes. When the manager does choose to cheat, he can win when he would have anyways, he can win when he would not have, and he can lose regardless (i.e., when the rival's output is very high, at a level above the right-hand band limit).

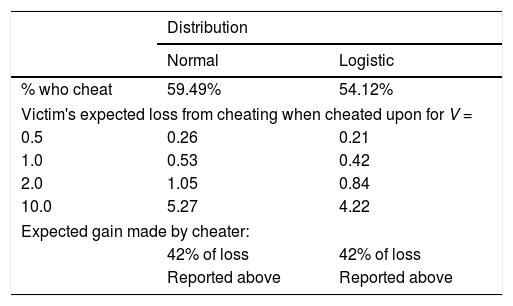

We have established that with a small change in assumptions the opportunity for cheating exists for a typical pdf – one with an increasing ‘value at the mean’ under lower variance – and that the cheating range will increase with pdfs that are more sensitive to changes in variance. That is a significant new result. We can now consider the impacts of cheating. We do so using the Normal distribution as the example pdf – an illustrative technique used in the original study (note we could do so algebraically given a specific pdf form, or do so propositionally in generalities, but the numbers seem to be sufficient for illustration here). Under that condition, the following descriptive statistics can be calculated:

- •

59.5% of managers will cheat, and, of those:

- ∘

20.3% will lose regardless;

- ∘

79.7% will win, made up of:

- •

50% who would have won anyways; and,

- •

29.7% who would have lost.

- •

- ∘

In other words, by cheating, the manager increases his chances of winning by about 30%.6

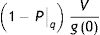

The act of cheating generates several inefficiencies and unjust effects: The victimized manager loses an expected amount of ‘V/2g(0)’ about 30% of the time when the other manager cheats (which is about 60% of the time). The loss to the victim is increasing in product value (output value) and in effort-to-output variance (‘talent spread’). (Notice that the cheater also ‘loses’ – or commits to inefficiencies – when he: cheats and wins when he would have won anyways; and, when he cheats and loses.)

The cheating manager increases his expected income by the amount of about ‘(0.221)· V’, which is increasing in the value of the production output. That increase represents a rent-shift from the victim to the cheater. To put this all in perspective, these levels can be related to the total gross value from of firm of two managers of expected size ‘2Vμ’, where μ is set by the condition that V=C′(μ). So, for quickly-rising effort costs (and lower stakes), the rent-shift is a larger proportion of the economic transaction size. Table 1 provides several illustrative outcomes for two example distributions, four example V-levels, and three example cost functions.7

Illustrating the outcomes.

| Distribution | ||

|---|---|---|

| Normal | Logistic | |

| % who cheat | 59.49% | 54.12% |

| Victim's expected loss from cheating when cheated upon for V = | ||

| 0.5 | 0.26 | 0.21 |

| 1.0 | 0.53 | 0.42 |

| 2.0 | 1.05 | 0.84 |

| 10.0 | 5.27 | 4.22 |

| Expected gain made by cheater: | ||

| 42% of loss | 42% of loss | |

| Reported above | Reported above | |

| V | Net economic gain produced under V, C(x) | ||

|---|---|---|---|

| C(x)=x2 | C(x)=2x2 | C(x)=x3 | |

| 0.5 | 0.13 | 0.06 | 0.27 |

| 1.0 | 0.50 | 0.25 | 0.77 |

| 2.0 | 2.00 | 1.00 | 2.18 |

| 10.0 | 50.00 | 25.00 | 24.34 |

We have described how a realistic (i.e., slightly altered in assumptions) tournament model can be cheated unilaterally. We now consider bilateral cheating opportunities, where two parties collude to cheat a third. There are two types of bilateral cheating, each with variants: (1) where the cheating manager and the firm conspire to cheat the other manager; and, (2) where the two managers conspire to cheat the firm.

Case 1a – Bilateral cheating agreed to ex ante: Here, the cheating manager and the firm conspire after the victim-to-be manager has signed up to compete in the tournament but before the cheating manager does any work. The scam here involves agreeing to split the expected difference between the victim-manager's output and his ‘fixed’ losing prize. In this case, the cheating manager sells off his output in the free market and does not take the winning prize (leaving it to the firm), while the firm tells the victimized manager that he lost the tournament. In this case, because each conspiring party is ‘guaranteed’ an expected benefit, 100% of managers and of firms have the motivation to cheat in this manner. (Nash-type bargaining, based on the numbers of alternative cheaters available, should determine the split of the expected rent-shifted gain from the victim of the amount ‘V/2g(0)’.) This case requires the added assumption that the victimized manager has no way to verify that the firm's choice of a winner is actually rewarded the higher prize and has no way to check the other manager's output; in some cases, these are not unrealistic assumptions as those are transactions completed between private parties who may have no legal obligation under the contract to provide such information. One example of such bilateral deception is when a firm puts out a phony request for proposal to get useful information about a project for free, with no intention of awarding the work to any firm that submitted a bid.

Case 1b – Bilateral cheating agreed to ex post: Here, the cheating manager and the firm conspire only after the work has been done by both managers but prior to the awarding of the prizes. The cheating manager approaches the firm with his verifiable output with an offer to award him the winning prize in return for a side payment. We assume at that point neither party knows the other manager's output. For simplicity, we further assume that the cheating manager cannot adjust his output prior to presenting his offer to firm.8 The possible benefit to the cheating manager emerges from being guaranteed the winning prize, while the cost to do so is the size of the side payment made to the firm. Thus, the expected increase in gross benefit to the cheating manager is:

where his probability of winning pre-conspiring, P, is evaluated at his verifiable output, q.Several observations from this condition and case can be noted: For any level of the cheating manager's output, q, he has the motivation to make a conspiratory offer to the firm for the winning prize. That offer will decrease with q, increase with the per-unit output value, V, and increase as the pdf's ‘spread’ (i.e., its uniformity, or non-peakedness, that drives g(0) downwards). For any output level below the expected mean level, the firm has more bargaining power as it expects to have ex post losses. Regardless of the bargaining outcome, again both conspiring parties are motivated to cheat as each can increase their benefits at the time of the offer and decision to cheat.

Cases 2a and 2b – Bilateral managerial cheating agreed to ex ante: In these cases, the two managers collude to cheat the firm. As before, we assume that neither manager can verify the other's output prior to it being verified by the firm (because it is private information that is costly to monitor and, therefore, to verify). We also assume that the offer to cheat is made prior to work being done by either manager. There are two cases to consider – (a) when managers cannot sell their excess output on the open market without being observed by the firm; and, (b) when they can.

In Case 2a, there exists an instability when such collusion is attempted without contracted (e.g., bonded) side-payments. That instability results in the original solution where no cheating actually occurs, as each manager will do incrementally more to win regardless of the ‘cheap talk’ agreement made prior to competing. However, when managers can collude with a contracted side-payment,9 so that each is guaranteed the average of the two prizes, then neither will do any work (as there is no benefit from working to win) and the firm loses (i.e., the firm is victimized by a rent-shift of the expected work done of the amount ‘2Vμ’).

In Case 2b, where managers can sell their excess output on the open market undetected, they put in efficient efforts and then choose whether to sell their excess depending on seeing their own output level, q, prior to its verification by the firm. The choice to sell the excess depends on the marginal benefit from retaining excess output relative to the marginal benefit from selling it on the open market at V per unit. The marginal benefit for retention is g*(ɛ)[V/g(0)], where ɛ>0, and g*(·) indicates the pdf at half the original variance. This trade-off is the same as the one for the unilateral cheating case (but where the cheating manager was buying output at V per unit). Thus, the same outcomes apply: At very low q – to the left of the ‘cheating bracket range’ – the manager sells his output and obtains the low prize, as it is not attractive to compete for the high prize. At very high q – to the right of the ‘cheating bracket range’ – the manager sells almost all of his excess output and expects to obtain the high prize, as it is not attractive to retain excess output. Within the bracket range, the manager retains all his output and hopes to win the high prize. Thus, inside the brackets, there is no cheating (in the bilateral case) and the tournament remains efficient; however, if either manager has an output outside the brackets, he shifts rents from the firm to himself (in the form of the excess output sold).

DiscussionWe have proven and detailed that under limited and realistic additional assumptions to the base model – involving self-awareness and imperfections in monitoring – that unilateral and bilateral cheating is likely to occur in a tournament. Our results are important because they constitute a new revelation that exposes potentially significant costs arising from a common business compensation system. Such a revelation appears to feed the sense of injustice at many workplaces, and then in society more widely, regarding the questionable division of economic classes often based on small and possibly even fraudulent differences in actual talent and effort. If significant opportunities for cheating can occur in this relatively simple model, then what does that entail for real, complex, poorly overseen compensation and tournament systems used in businesses, governments and other institutions? What does it mean especially when so many of these rank-based systems entail no oversight other than verifying that the process ‘looks right’ in terms of having the expected process steps, when no actual checks are done on whether those processes are hackable – e.g., that garbage in is not producing garbage out.10 It may mean that the wrong people and firms are winning, that the right people and firms are losing. It may also mean that competitive advantage may arise from either being a hacker or by being able to design unhackable systems, including those controlling compensation.

Regardless, the hacking of trusted reward systems is an important phenomenon that deserves further investigation. We have witnessed cheating under various compensation schemes, including tournaments, from high-stakes sports (e.g., cycling, soccer, baseball, racing, and so on) to high-stakes business (e.g., VW, Enron, Xerox, Theranos, Wells Fargo, Bre-X, Siemens, HealthSouth). Readers have probably even suspected it when participating in their organization's own tournament compensation schemes (e.g., seeing corner-cutting, misreporting, overzealous projections, taking credit for underlings’ work, sabotage of rivals, and other activities that boost output in dangerous ways). These behaviors are harmful to organizations, to the economy and to society. So, it is important to understand the range of such behaviors (and their effects) that constitute cheating in any commonly applied system, as we have done so here for tournament-style compensation schemes. With that understanding, we can better decide on which reward system is better (accounting for its vulnerabilities) and make informed decisions on how to mitigate the deviant behaviors (e.g., by being able to more accurately trade off the costs and benefits of increased monitoring; by being able to more accurately target the likely times and people involved in cheating; and, so on).

Our analysis has contributed to the understanding of compensation systems by adding to concerns focused on the vulnerabilities of such systems to hacking. We illustrated this using tournament theory. Our analysis has identified the likely cheaters (i.e.,. mid-tier-quality managers), and the damages cheating can cause – which can be significant under specific levels of output value, effort-cost, and random effect variance (or ‘talent spread’). We have described the limits where the tournament is relatively ‘cheat-proof’. We have identified the main types of cheating that are likely to occur – i.e., where there is the opportunity and motivation to do so. We have described the main statics of the relevant conditions – e.g., where cheating is expected to increase with output value and noise (i.e., the variance in luck). We have provided illustrations of the costs to the victims, to the firms, and to society when cheating occurs. We note two more related concerns now to round out the more realistic effects of such fraud: (1) that the wrong winner is identified and may then move forward in the next round of competition, adding a further inefficiency to the system; and, (2) that the wrong message is sent to the firm and society that in fact cheaters do prosper, feeding a possible vicious cycle in such destructive actions (e.g., think about the steroids era in sports).

The natural question that then arises is whether such fraud can be stopped, especially in situations where monitoring is normally too costly, or is practically or legally impossible. The answer is that maybe it can be mitigated with a penalty system of big fines based on spot-checks, whistle-blowing, and focusing on unusual patterns of managerial behavior, to increase the probability of getting caught. Our analysis has identified whom to target and the conditions for when to check, based on factor conditions like output value, luck (or ‘talent spread’), and so on. Also, recall that every cheating action leaves a paper trail – e.g., in the purchase of outside output, in the bonds entered into, and so on – a trail that theoretically could be used as evidence. So, in theory, there may be less of a need to monitor what ‘regular’ efforts are being made by a manager, and more of a need to investigate what ‘unusual’ actions he may be partaking in (and with whom) that would allow cheating to occur – i.e., actions that allow him to alter his output without putting in the effort by exploiting transactions with those who could use or produce such outputs. In other words, monitoring manager network use and the timing of that use may be a better choice than spot-checking day-to-day efforts and outputs; firms doing so should outperform their rivals.

There are many avenues for future work that could be pursued based on the analysis in our research. We advocate field work on identifying and testing cheating in tournaments – in cases and in lab experiments – to see how and when it is done and to what effect. Field work may also be helpful in determining the counter-measures being deployed by firms and to what extent these are effective under which conditions, and when they lead to better profits. Such findings should be publicized so that more hack-proof compensation schemes can be devised and deployed, and so that the dangers of hackable ones can be made more widely known. We also advocate further analysis into other common compensation schemes to identify whether and how these alternatives can be hacked and what that means for strategic decisions and outcomes.

Although such analyses may be distasteful to some who believe that most people adhere to ethics and laws, it remains worthwhile to discuss the ways in which our systems may be hacked and when they are likely to be hacked – i.e., where there is opportunity, motivation and rationalization to do so (e.g., Cressey, 1973; Howe and Malgwi, 2006). That type of analysis is, of course, pursued with ‘better labeling’ in the agency literature – where people are expected to act with guile in their own self-interests (Williamson, 1975). The point is similar here; we need to design systems that produce the results we want, rather the results we do not when they are hacked. Only by taking a hard look at our systems will we be able to protect our firms, economies and values, and that is certainly worth the attention of our own cunning.

However, such a competitive approach has been associated with significant negative outcomes, such as the recent widening gaps between rich and poor (e.g., Piketty, 2014), and an unfriendly win-at-all-costs mentality in what were previously considered respectful arenas of fair-play (e.g., Kräkel, 2000; Main et al., 1993; Messersmith et al., 2011).

We do not think that keeping the economics-based formality is appropriate for the entire paper. One reason is that standard economics analyses require calculating equilibria when no party is deceived (i.e., all parties are aware of any cheating when it occurs and they adjust correspondingly) and that is simply not applicable for the main analysis in this paper. Here, we are interested in exploring the cases and harms when successful deception and cheating occur by at least one party in the compensation system – because it happens in real business settings. Thus, this cannot be a standard economics paper and so it is not written as such; instead, it is written for a different purpose – to describe off-equilibrium outcomes for business academics, policy-makers and practitioners.

Lazear and Rosen (1979) provide the explanation justifying the traditional interior solution assumption and describe the conditions when an interior solution does not occur.

The timing of the manager's checking on his output is important. If it does not increase over the span of the contest, the manager would rather wait as long as possible to check the output in order to remove as much of the randomness in the effort-to-output function as possible. That way, he has the most accurate reading of the final output level without cheating – a level he can then use to best decide if and how much he should cheat. If we assume that the randomness effect is uniformly distributed across time, as is the manager's main effort, then waiting until very close to the contest's end is optimal timing.

To be clear, we are assuming that the manager can only observe his own output and not that of his rival. We assume the focal manager's costs to monitor a different manager are at least as high as the firm's, and so here it is not done. Besides such information being private between two other parties, firms using tournaments usually take measures to ensure such spying does not occur. Even if the argument could be made some expertise and familiarity could exist between rival managers, it is unlikely the spying would be tolerated. To hit home, consider how little most Faculty know of the outputs of Administrative peers, even in public Universities.

These statistics were calculated by using the Normal distribution, comparing its pdf under a mean (μ) and variance (2σ2) with a pdf under the same mean (μ) but with half the variance (σ2); for example, the cheating range is located from the two intercepts of these pdfs, then the cdf between the two intercepts provides the percent of the total within that range. Similar calculations can be done for a distribution based on the range identified [e.g., outside that range to the right is where the rival would win despite the cheating actions of a cheating rival].

We have only considered the case of one of the two managers cheating thus far, as it was the simplest case. What happens when they both cheat? If neither knows that the other is cheating, then the one-manager case that we have outlined predicts when each will cheat but not who will win nor who gains and who loses. It terms of expected values, both managers will lose in costly output boosting investments that cancel each other out (on average) with the firm gaining from the added outputs. If both managers know that the other can cheat then neither will put in any initial effort, and then they will make the least cost investments in output boosting (i.e., cheating) up until marginal costs equal marginal benefits, and depending on their then-known random effect level under the new pdf. Assuming symmetry in expectation, neither manager will gain and both may lose by making investments (as these are likely to exceed base model effort levels, but with unspecified cost functions), but the firm is likely to gain because the tighter variance should increase outputs. Of course, if both managers know the other is cheating, then it is likely that the firm does as well. And, when all parties know that cheating is likely then a new contract will be generated based on that shared knowledge and the reduced variance. It is likely to produce an efficient outcome much like the original base model.

There are several sub-variants of bilateral cheating that can occur, for example, where parties have access to private information that can be used to manipulate the co-conspirator. Such cases require further assumptions and further complexities for the model. We present the simplest case here because our point in this research paper is to reveal that cheating is possible, both unilaterally and bilaterally; the purpose is not to depict the every possible variant of the main types of cheating for a tournament compensation scheme. We leave the latter exercise as future work.

The content of the contracted side-payment could consist of each manager posting a bond of half the difference between the two rewards, where the deemed winner (assumed verifiable by a third party) then must transfer the bond to the deemed loser (with the deemed loser retaining their own bond). This would be enforceable because it is not illegal (as it does not violate the standard terms of the tournament contract or of criminal law), and the trigger is verifiable. (The contract does not need to include bonding, but it does ensure a smooth transaction of payment between colluding parties.) An example of such a side-payment scheme between two agent parties who are supposed to be competing for a prize from a principal but who instead collude to cheat that principal occurs in bids for road projects (and in other procurement auctions) in the US (e.g., Bajari and Summers, 2002; Bajari and Ye, 2001). The first firm pays the second to submit a non-competitive bid in exchange for a side payment; the first firm wins the bid at a sufficient profit margin to pay off the second firm and still enjoy high profits itself, while the government agency (and taxpayers) lose. Such side payments may be in the form of a contract or ‘bonded’ by reciprocation over time among the ‘competing’ firms. Such a scheme is akin to the one described in this paper where two competing managers collude through contracted side-payments to cheat the tournament holding firm (by reducing their efforts for the firm).

Of course, we need not look far to see how such systems have been violated in our business school rankings, our publication processes and our accreditations – COPE, AACSB, Princeton Review and other oversight agencies do not actually conduct any investigations into cheating, although they provide ‘cover’ for their members to the naïve public that everything is fine when it may not be.