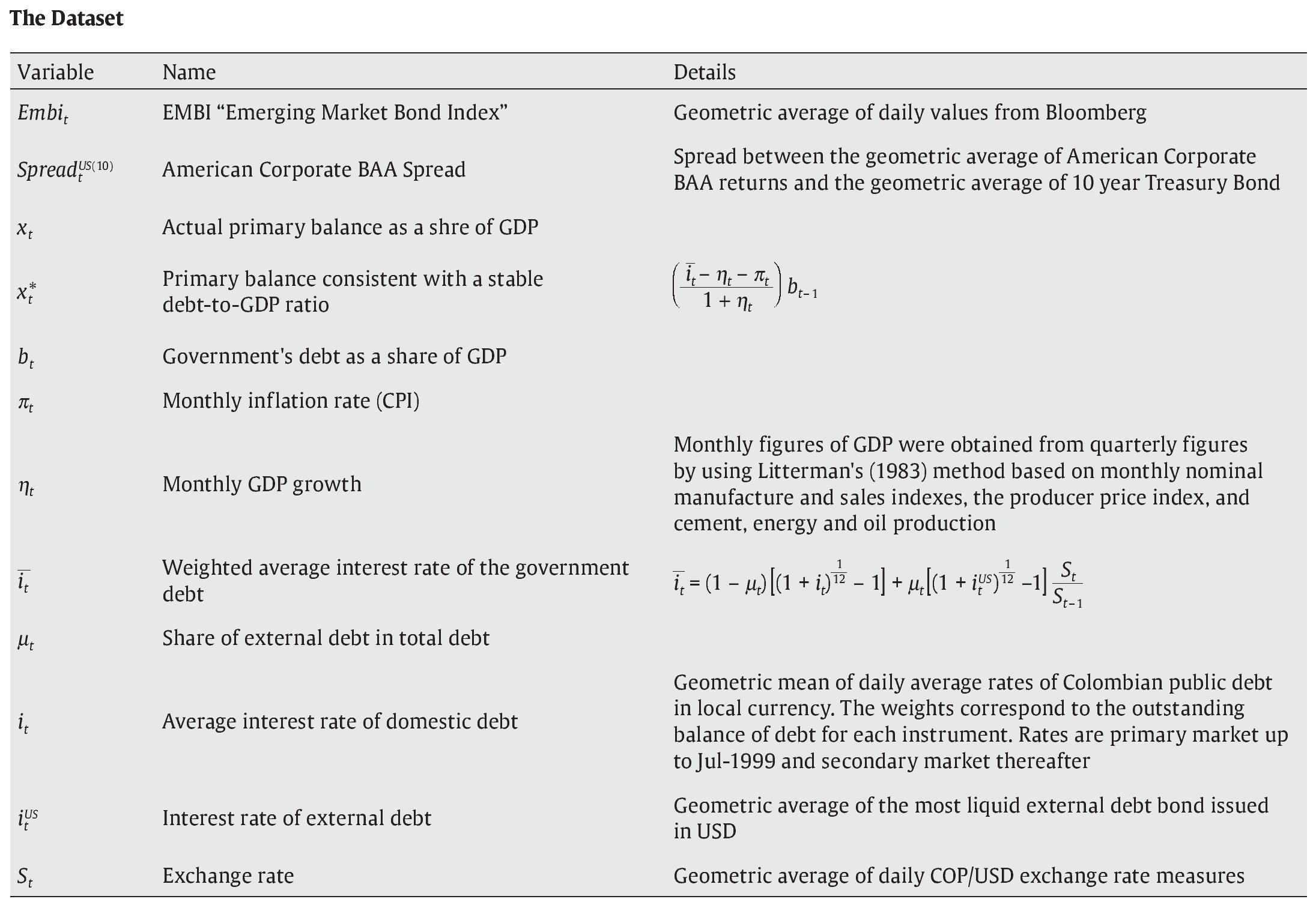

En el presente artículo se expone que el riesgo soberano de Colombia, el EMBI (por sus siglas en inglés, Emerging Markets Bond Index), es decir, el principal indicador del riesgo país, está determinado sobre todo por el apetito de riesgo del inversor internacional, cuya respuesta es no lineal y depende de la actitud fiscal gubernamental. También pone de relieve que la relación entre estas variables experimentó un importante cambio estructural en la segunda mitad del año 2000, en apariencia, asociada a la crisis económica mundial y a la mejora de los indicadores macroeconómicos locales. Las consecuencias de los hallazgos del presente estudio pueden ser de particular importancia para este país, ya que contribuirán a explicar tanto los menores costes financieros de la deuda pública como la menor incertidumbre del mercado local a las sacudidas y contratiempos externos, según se ha observado en los últimos años.

This paper shows that the Colombian sovereign risk (EMBI-Colombia) is mainly determined by international investors' risk appetite, whose response is non-linear and depends on the government fiscal stance. It is also shown that the relationship between these variables experienced an important structural break in the second half of the 2000's, apparently associated to the global financial crisis and the improvement in the local macro-fundamentals. The consequences of these findings might be particularly important for this country, as they help to explain both the lower financial costs of public debt as the local market less uncertainty to external shocks, which have been observed in recent times.

1. Introduction

The 2007 subprime financial collapse and its intense repercussions worldwide uncovered both the consolidation of the so-called macro fundamentals of the emerging economies and the frailty of the financial and productive sectors of the advanced economies. In fact, the recent global double dip outlook suggests that the governments of the most advanced Western economies will not be able to easily desist from the expansionary fiscal policies maintained for so many years and proven to be insufficient to revert or at least reduce the effects of the crisis. Moreover, the risk perception of emerging economies shifted after the crisis, which may have been reinforced by the stronger macro foundations they have been building up in the course of the last few decades.

The downgrade of American and some once deemed "risk free" European countries debt, is a bleak outlook for global investors regarding the future performance of these economies. The high level of indebtedness and the large public finance imbalance resulting from the financial crisis are an insolvency threat to several industrialized countries leading to a grim short-to-medium term performance for these economies. In contrast, emerging economies have learned to weather the international financial turmoil over the past few decades by improving their macro foundations and reducing their sensitivity to world economic shocks. The reform package addressed several key issues. In the fiscal front, for instance, Latin American emerging countries reduced their deficit to more acceptable levels, which resulted in more appropriate debt levels. Advances were also observed in inflation control, free-float exchange regime, and the strengthening of financial regulation. Moreover, increased labor market flexibility gave way to improvements in these countries' trading position. Having been acknowledged by financial markets, these improvements led to credit rating upgrades.

The most important measure of the investment risk in emerging economies is the sovereign risk spread, Emerging Market Bond Index (EMBI). The EMBI measures the spread of the return of fixed income U.S. dollar-denominated sovereign debt with respect to the return of American Treasuries1. Since the price of local assets is closely related to the price of sovereign bonds, the EMBI is the measure that foreign investors analyze when determining the performance of emerging economies like Colombia.

The relationship between the sovereign risk (EMBI) and the emerging economies fundamentals has been the subject of many studies. In fact, there is clear evidence that a weak fiscal stance affects investors' risk appetite and, therefore, country risk as well. Since country risk affects the exchange rate and inflation expectations, a weak fiscal situation might lead to a monetary policy tightening as a tool to control the inflation rate. The resulting higher interest rates translate into a weakening of the government's fiscal health and, consequently it could set up a vicious circle of fiscal dominance.

Motivated by the well-known role of sovereign risk in the macroeconomic context, this paper provides empirical evidence on its determinants in an emerging economy like Colombian. In particular we conclude that the EMBI-Colombia is determined by the global appetite for risk, that its response is non-linear and it depends on the Government's fiscal stance. It is also shown that the relationship between these variables suffered an important break in the second half of the 2000's decade, apparently associated with the world's financial crisis and its global aftershocks and better domestic macro-fundamentals. More specifically, after the trend break that took place in the first quarter of 2007, the EMBI's response to global appetite for risk was significantly reduced.

The consequences of the results found in this paper could be extremely important for this country, as they help to explain both the lower financial costs of public debt as the local market less uncertainty to external shocks which have been observed in recent years. Needless to mention that the exercises developed in this paper have not been done previously for Colombia. However, it should be noted that empirical relationship between sovereign risk and other macro variables, such as devaluation, inflation expectations and monetary policy response, are beyond the scope of this paper. Therefore empirical assessment on eventual fiscal dominance episodes in Colombia remains as matters for future research.

The document is organized as follows. Section 2 comprises the literature review concerning the country risk determinants and the channels of transmission of this risk to the economy. Section 3 describes the benchmark model and the existence of the structural break between global risk appetite and country risk leading to a modified model for Colombia. Section 4 contains the results, and section 5 offers some final remarks.

2. Literature Review

Sovereign risk determinants are broadly classified into two types: Those that are foreign or global—which, by definition, escape from the control of local authorities—, and those that are internal and have to do with the government's debt repayment. Calvo (2002) and Calvo et al. (1993) emphasized the role of global factors2. In particular, these authors find that global appetite for risk is the fundamental variable explaining the sovereign risk of emerging economies, and that local fundamentals, once global factors are included, have a limited role in explaining the sovereign risk3.

Özatay et al. (2009) offer a wider explanation on the way global factors affect the country spread. These authors suggest that global financial liquidity, global appetite for risk and U.S. macroeconomic news play a key role explaining the long-run evolution of EMBI. However, these authors have also found that domestic macro fundamentals affect the default probability and, therefore, financing costs. Under this background and once global factors have been discounted, Hilscher and Nosbusch (2010) analyze the terms of trade effect while others like Favero and Giavazzi (2004), Blanchard (2004), and Baldacci et al. (2008) emphasize the role of fiscal policy.

The terms of trade and the state of the fiscal policy are indicators of the country's debt repayment capability. In Bulow and Rogoff (1989), for instance, the terms of trade affect the government's ability to generate revenues and, in turn, this affects the government's foreign debt payment capability. Moreover, the volatility of the terms of trade impacts the capability to pay the debt through its impact on the long term cyclic growth of the economy, Mendoza (1995 and 1997). The estate of the fiscal policy, in turn, relates to the expected debt payment capability of the government, related not only to the terms of trade but on a wider scope, as the ability to generate revenue to pay the debt.

For the case of Brazil, Favero and Giavazzi (2004) found that the response of the EMBI spread to the global appetite for risk is non-linear and depends on the spread of the fiscal balance with respect to the balance that keeps the debt/GDP ratio constant. Their results suggest that the fiscal policy may intertwine with monetary policy in an inflation-targeting system, which may lead to a dominant fiscal policy. These results are in line with Uribe (2002), who suggests that under particular fiscal-monetary set ups, inflation targeting is not compatible with government solvency.

Baldacci et al. (2008) do also emphasize the role of fiscal policy in the explanation of country spreads. They find that countries with a high level of debt and/or fiscal deficits have a higher probability of default. In the same way, these authors suggest that the response of the sovereign debt to fiscal factors is non-symmetric and has a higher impact on countries having already experienced defaults. Another approach in the literature explores the transmission channels from country risk to economic activity and monetary policy. The key link in these transmissions seems to be the exchange rate through its interaction with capital flows4. In this way, an unexpected increase in the risk premium in an emerging economy implies a sudden capital outflow and, under a flotation system, a real exchange rate ("RER") depreciation. The effects of this depreciation may affect the rest of the economy at least through two channels.

On the one hand, the debt as a part of the GDP increases, depending on the share of external debt in the total. Therefore, the fiscal balance deteriorates due to the debt increase in local currency and the interest flow over that debt increase. In turn, the RER depreciation might shift inflation expectations, which may affect the workings of monetary policy under inflation targeting. In fact, Basci et al. (2008) argue that, under certain circumstances, credit and aggregate demand channels of monetary policy might not work properly.

More specifically, an unexpected increase in the risk premium that depreciates local currency and increases inflation expectations, and thus policy rates would require the primary surplus to adjust in order to keep the debt-GDP ratio stable. Although the local rate increment may increase the inflow of funds into the country, if the fiscal stance is not sufficient to keep the debt/GDP ratio constant, then a vicious circle might be created between country risk perception, depreciation, debt deterioration, and fiscal unsustainability expectations, which would limit the scope of monetary policy to control inflation. Thus, might be configured a different fiscal dominance mechanism, which is new compared to what is recognized by traditional literature.

3. The EMBI and the Government's Fiscal Stance

3.1. The Benchmark Model .

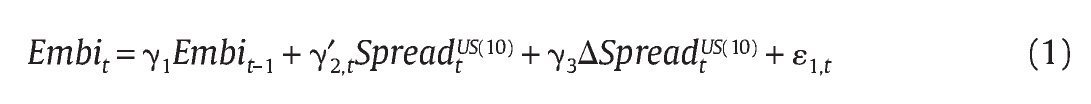

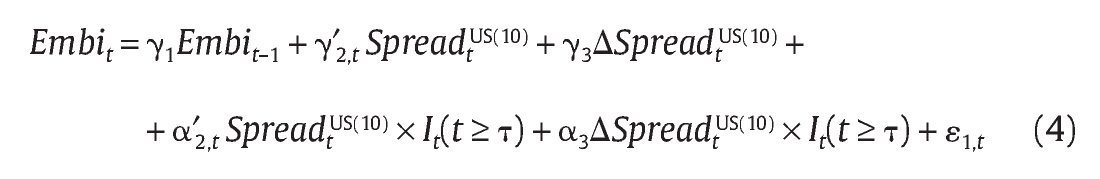

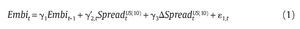

In this section we consider Favero and Giavazzi (2004) as our benchmark model, which comprises the ideas of previous works. In this model, Brazil country risk (EMBI-Brazil), is determined by investors' appetite for risk (or the lack of it) in international markets, and its response depends non-linearly on the government's fiscal policy stance. More specifically, the model for the country risk of an emerging country is suggested in the following reduced form5:

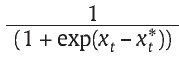

where Embit is the country risk, SpreadtUS(10) is the American corporate BAA spread with respect to the ten-year treasury bond usually regarded as global risk appetite, ΔSpreadtUS(10) captures the jumps of the appetite for risk, and γ′2,t determines the response of the country risk to global appetite, which depends on the fiscal policy stance, according to the equation:

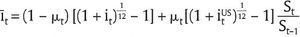

Where Xt is the primary balance as a share of GDP, and χt* is the primary balance consistent with a constant debt-GDP ratio. Following Burnside (2005), we define χt* as:

Where b is the debt as a share of GDP, π is the inflation rate, nt is the real growth of the economy, ¿ is the average interest rate of the government's debt,

where μt is the share of external debt, it is the interest rate of internal debt, itUS is the interest rate of external debt in US dollars, and St is the nominal exchange rate. It is important to note that equation (3) contains the factors that explain the government's ability to pay its debt. In terms of equation (2), these factors correspond to the macro-fundamentals that could affect the behavior of the sovereign risk.

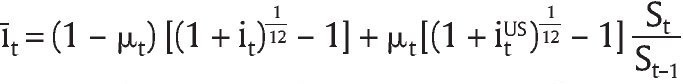

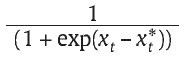

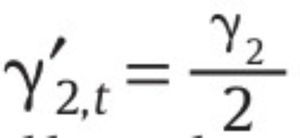

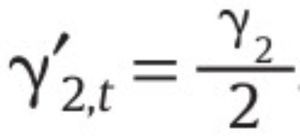

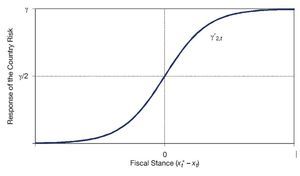

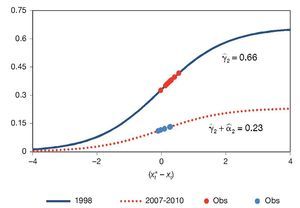

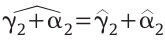

From equation (2) it follows that when the fiscal position is balanced, χt = χt*, the response of the country risk becomes

,and increases when this fiscal position is unbalanced, χt smaller thanχt*. Therefore, this term gives a similar response to LSTAR models (see Tong, 1983). Two extreme situations arise from this equation. The first one offers a favorable fiscal stance occurring when the primary balance, χt, is significantly higher than the one that keeps the debt constant as a GDP percentage, χt*. In this case the response of the country spread to risk appetite becomes γ;′2,t = 0. The second situation reflects a highly unsustainable or deteriorated fiscal position, where the response is γ;′2,t = γ;2.

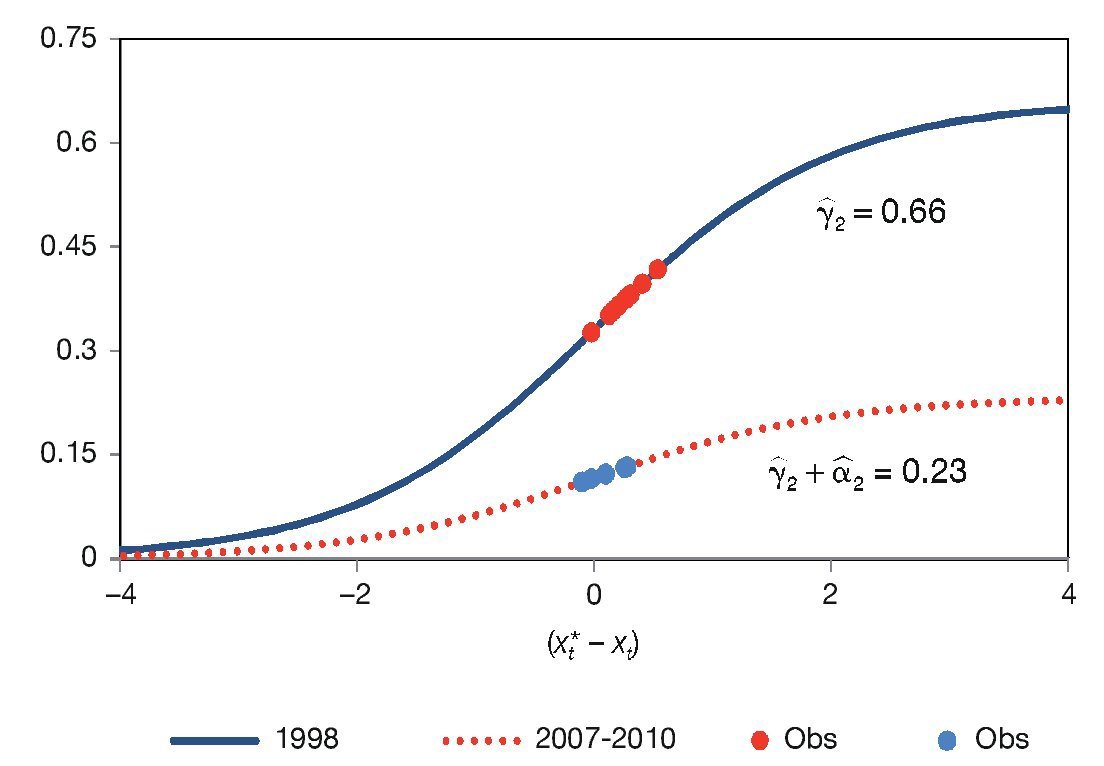

Figure 1 depicts the two extreme situations described above and the smooth transition between them. A highly unbalanced fiscal position arises when χt* - χt is positive and the response of the country risk converges to γ;′2,t = γ;2. In the same way, a favorable fiscal stance arises when χt* - χt is negative and the response of the country risk converges to zero. A balanced fiscal position, χt = χt*, lies midway between these extremes, which leads to

.Figure 1. Response of the EMBI to investors' risk appetite as a fiscal stance function. Source: Author's calculations.

3.2. The Structural Break

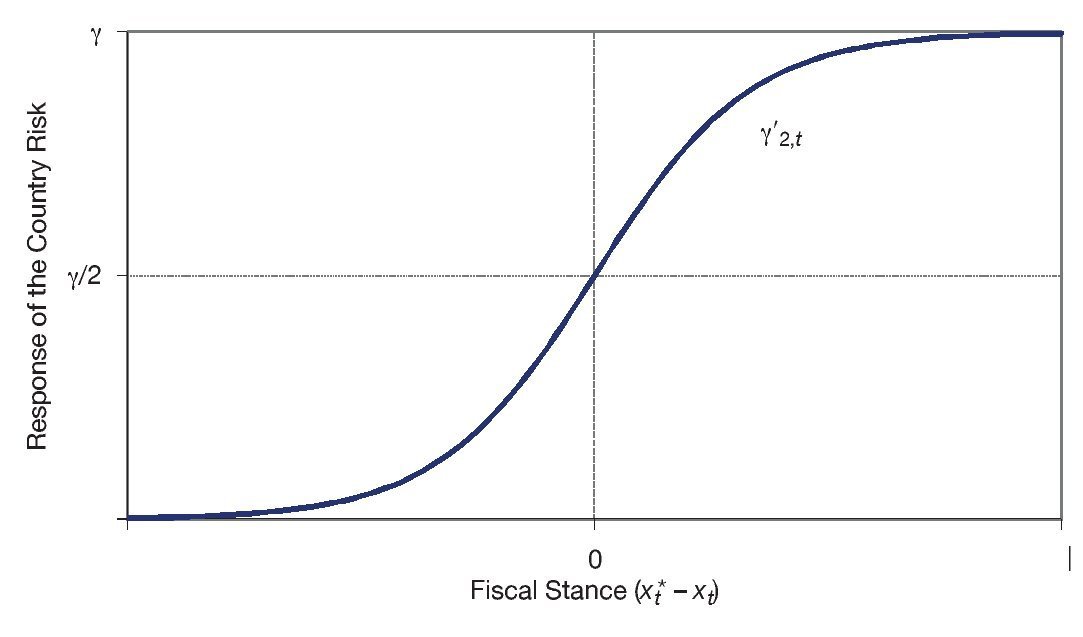

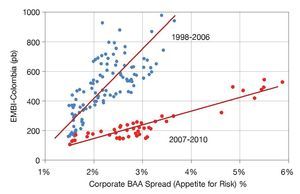

Historical data of the Colombia's EMBI spread and global risk appetite (measured as the American corporate BAA spread) suggest that an important structural break took place in the second half of the 2000's decade. This break might be related with the recent emerging countries' performance and the international environment after the crises. During the 2000's decade, Latin American economies enjoyed a period of economic expansion coinciding with sounder macro-fundamentals, as seen in Izquierdo et al. (2008) and Ocampo (2010). More specifically, between 2004 and 2007, Colombia attained a growth rate of 5.9% slightly higher than the region's 5.7% average. This may be explained, among other reasons, by rising commodities prices, international trade growth, improved financing conditions, and a significant increase in remittances. Although some of these circumstances shifted back during the 2008 crisis, the countries in the region had the chance to implement counter-cyclical monetary and fiscal policies and were soon able to resume their positive growth path.

Macro fundamentals improvement, the management of the 2008 financial crisis, a subsequent credit expansion, and the 2009's commodity price recovery eased access to international financing. Ocampo (2010) highlights two factors that facilitated the implementation of countercyclical measures to counteract the effects of the 2008 financial crisis, like a stronger reliance on local bond markets to finance public spending and subsequent reduction of the government's external debt level. In this way, along with these policies, the expansionary cycle helped consolidate the fiscal adjustment process initiated in Colombia by the turn of the decade.

Figure 2 shows evidence of the structural break in the relationship between the Colombian country risk and the corporate BAA spread. This figure shows two clearly defined clouds of points, each one lying on a clearly defined straight line, whose break took place sometime between 2006 and 2007. The lower cloud, which corresponds to the latest period, is less spread around the corresponding line than the upper cloud, in spite of its lower slope. In fact, the correlation between the two series during 2007-2010 is 0.92, and 0.74 for the 1998-2006 period6.

Figure 2. EMBI-Colombia and American corporate BAA spread. Source: Bloomberg and Federal Reserve Economic Data (FRED).

3.3. The Extended Model

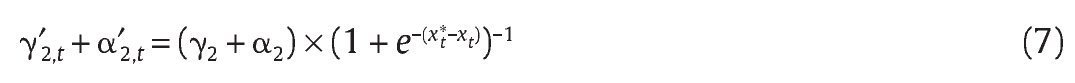

The shift in the response of Embit to the investors' risk appetite can be tested and its effects estimated by extending equation (1) as follows:

whereα′2,tSpreadtUS(10) × It(t ≥ t) determines the shift in the response of Embit for the second (2007-2010) sub-period, with respect to the first, and α3ΔSpreadtUS(10)× It(t ≥ τ) is the shift in the Embit response to SpreadtUS(10) jumps between the two sub-periods. In equation (4), It(t ≥ τ) is a dummy variable for the second sub-period:

where t is the unknown shift date and α′2,t is determined by

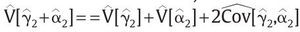

Under these circumstances, the response of the country risk to the appetite for risk is still non-linear, depending on the fiscal policy stance. However, during the first sub-period, 1998 to t, the response is γ;′2,t while for the second one, t to 2010, the response is given by:

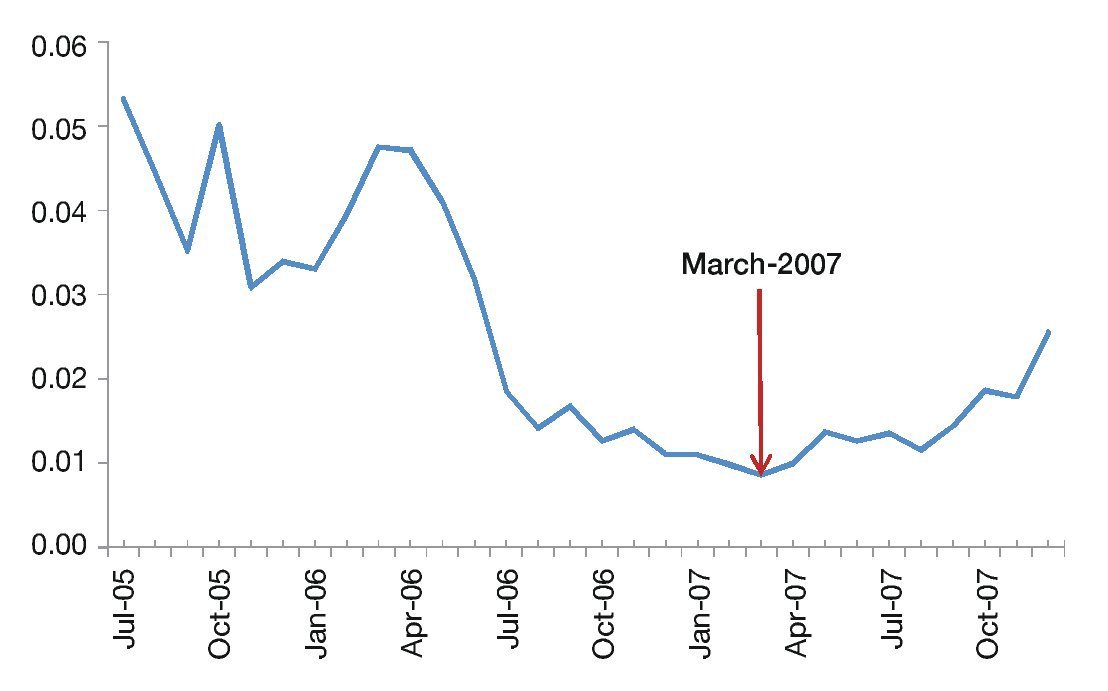

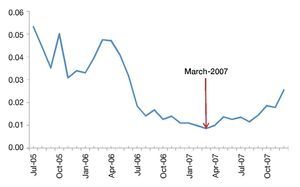

In order to determine the break date, recursive estimation of equation (4) was performed by GMM in a window of likely values for t, the breaking date. In this estimation the lagged regressor and endogenous variables were used as instruments7. For the chosen window, the coefficient estimates had the expected signs and magnitudes; particularly, γ;2 was positive and statistically significant while a2 was statistically significant and negative, and smaller than γ;2. Therefore, γ;2 + α2 was also statistically positive and significantly different from γ;2. Figure 3 depicts the p¿value for α2, for the window of likely slope break. This result suggests that τ is more likely March 2007, when this p¿value minimizes8. It is worth mentioning, that the date of the break coincides with the beginning of the global financial crisis.

Figure 3. P-Value of a . Source: Author's calculations.

4. Results and Discussion

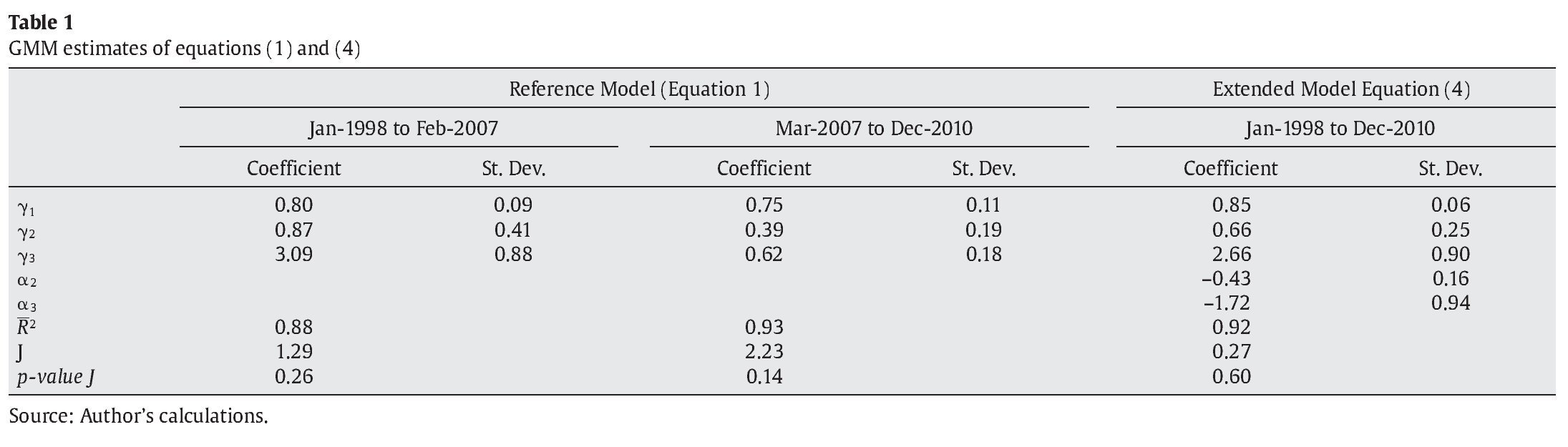

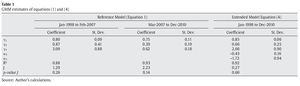

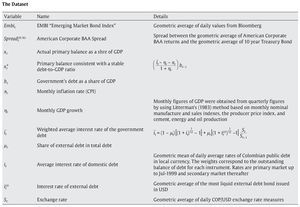

The dataset under analysis comprises monthly information from Jan-1998 to Dec-2010 on the variables described in the Appendix. This Appendix also describes in detail the treatment of data prior to their analysis, and the source. Table 1 contains the estimation results of equation (1) for the sub-periods Jan-1998 to Feb-2007 and Mar-2007 to Dec-2010 separately, as well as the estimation results for equation (4) using the whole sample, for τ = Mar-2007 obtained above. This table contains the estimated coefficients, standard errors, the adjusted coefficients of determination,

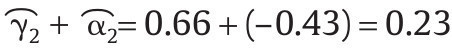

and the over-identification J test along with its corresponding p-value.The estimates of the coefficients for the three samples considered have the expected signs and magnitudes, and are significantly different from zero. The coefficient that determines the response of Embit to the appetite for risk of investors, γ;2, is 0.87 using the data for the first sub-period and model (1), and 0.66 using the whole sample and equation (4). The results for the first sub-period are similar to those of Favero and Gavazzi (2004) for the case of Brazil (between Aug-1999 and Apr-2004), who find an estimate 0.88.

However, the estimate of this coefficient is substantially lower for the second sub-period in equations (1) and (4). For the second sub-period using equation (1), the coefficient is 0.39, and 0.23 for the whole sample using equation (4). The last result arises from

.Moreover, the estimated standard error for

is 0.099, which shows that γ;2 + α2 is significantly different from zero; and since a2 is significantly different from zero, γ;2 + α2 is also significantly different from γ;29.

The estimated autoregressive coefficient, γ;1, falls into the interval [0.75, 0.85] for both sub-periods and the whole sample, suggesting a strong persistence of the country risk. However, the coefficient of the shift of the effect of jumps between the two sub-periods, α3, is not significantly different from zero, suggesting that this component does not change in a significant way between both. In addition, the adjusted coefficients of determination for the three samples are higher than 0.88, and the p¿values of the J tests for over-identified restrictions do not reject the null of model adequacy. In the same way, the results of Table 1 are robust to filtrations of χt and χt*. In fact, the coefficient estimates as well as their standard deviations change very slightly when they are modified by seasonally adjusted series deriving from an X12 procedure, its trend cycle, or a long-run trend deriving from a Hodrick and Prescott (1997) filter10.

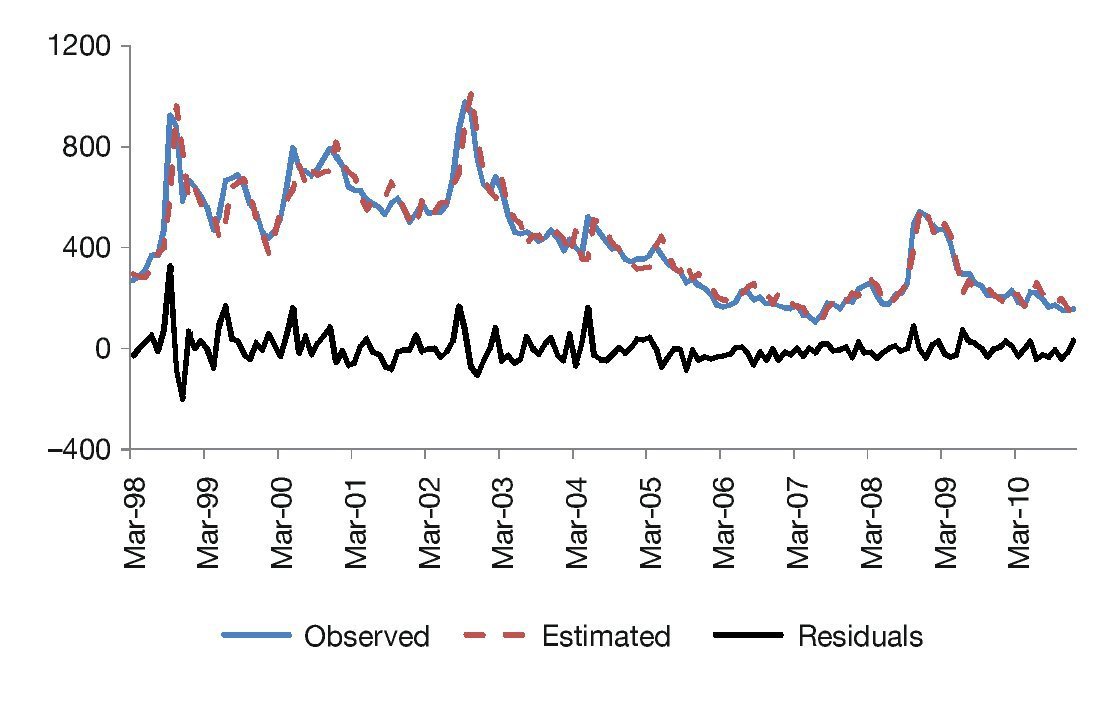

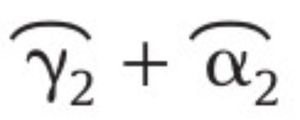

In order to further check model adequacy, Figure 4 shows the observed, adjusted and residual series from estimating equation (4). This figure displays a good fit for the model, which agrees with a high

of 0.92. However, residuals present during the first sub-period are bigger than in the second one, in this way suggesting a fit for the second period better than for the first11.Figure 4. Observed and estimated EMBI and residuals of the extended model. Source: Author's calculations.

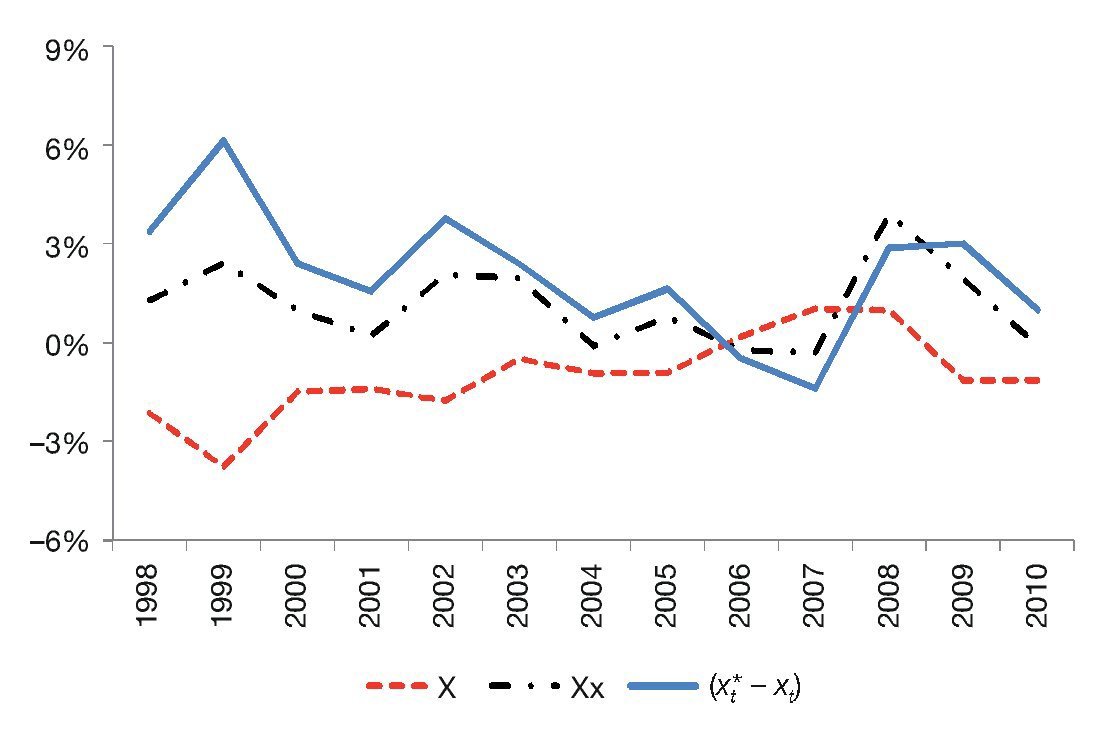

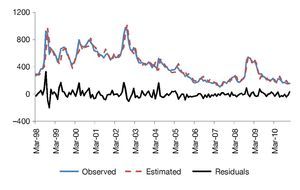

Figure 5 depicts the evolution of the observed primary balance, χt, the balance consistent with a stable debt-GDP ratio, χt*, and the gap between them, (χt* - χt). The Colombian government shifted slowly from a weak stance at the end of the 1990's to a more balanced one between 2006 and 2007, when this gap closes. It is worth noticing at this point that the best fiscal results are observed more during the period of time within which the break is more likely, i.e. 2006-2007. However, the fiscal stance deteriorates in 2008-2009 as a result of the crisis, and improves back in 2010.

Figure 5. Primary balance of the Colombian government (share of GDP). Source: Author's calculations.

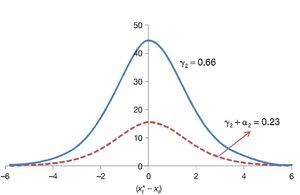

Figure 6 displays the response of the EMBI-Colombia to investors' risk appetite. The analysis concentrates on the component that, according to equation (4), depends on the government's fiscal stance of the (χt* - χt). The solid line represents the response for the first sub-period, while the dashed line shows the response for the second. The dots indicate the estimated response to the observed yearly average balance spreads (χt* - χt) during the two sub-periods.

Figure 6. Estimated response of EMBI to the global appetite for risk as a function of the government's fiscal stance. Source: Author's calculations.

From this figure is clear that the response of the country risk to the appetite for risk, which lies between 0.3 and 0.45 during the first sub-period, is significantly higher than the response during the second sub-period, which falls between 0.10 and 0.13. More specifically, notice that the average response of the country risk to the appetite for risk during the first sub-period was 0.37. Thus, an increase 100 bp (basic points) in the corporate BAA spread increase the country risk in 37 bp. Moreover, if we take into account that the appetite for risk ranged between 68 bp y 343 bp in the first sub-period, the average response of the country risk was 25 bp, and reached a maximum of 128 bp. For the second sub-period this response reduces to 8 bp, with a maximum of 42 bp.

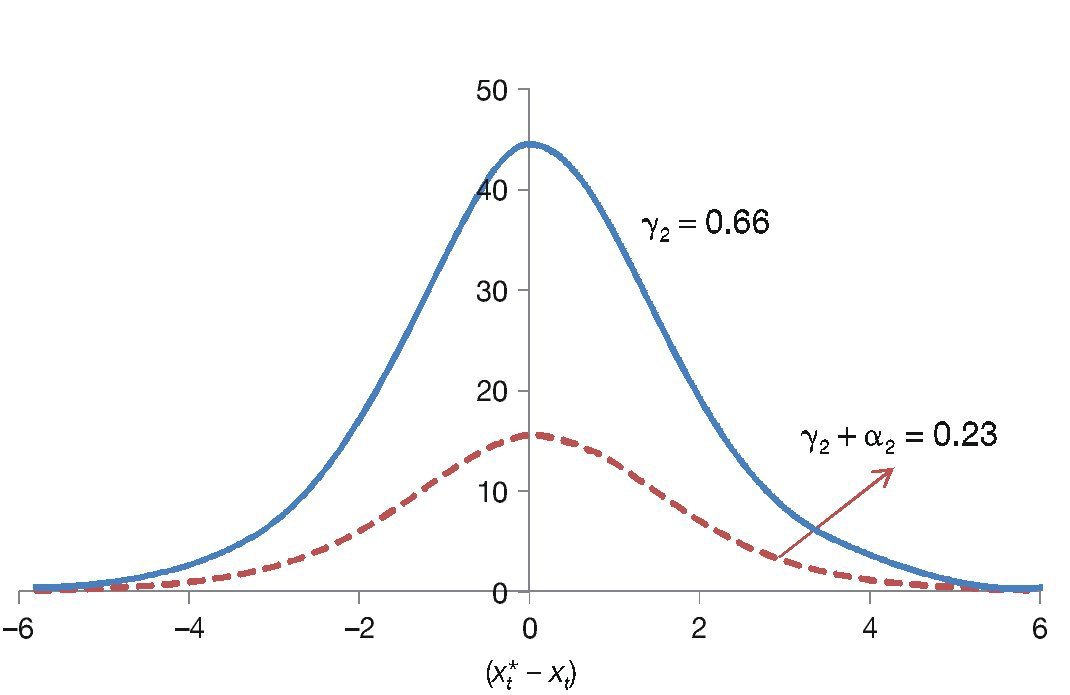

Figure 7, in turn, describes the direct response of the EMBI spread to changes in the balance spread, for a given level of the appetite for risk. The solid line describes the response for the first sub-period while the dashed one describes the second sub-period. In each case, the highest sensitivity is reached around the fiscal equilibrium, that is, when the balance spread is close to zero. In the same way, the lowest sensitivity is reached under extreme fiscal stances. For instance, a marginal loss in the fiscal stance of the government from equilibrium implies an increase of the country risk close to 44 bp during the first sub-period and of 15 pb during the second. However, if the balance spread had reached an extreme of +4 bp of GDP, these sensitivities would be reduced to 3.5 bp and 1.2 bp, respectively. This result could be explained by the fact that in a difficult (or very favorable) fiscal situation, a further deterioration in the deficit (or an improvement in the surplus) has less impact on the EMBI, in relation to observed changes when fiscal balance is close to the equilibrium.

Figure 7. Estimated response of the EMBI to the fiscal stance of the government. Source: Author's calculations.

5. Concluding Remarks

This paper has shown that Colombia country risk is determined by global appetite for risk among investors, measured as the American BAA corporate spread. However, this response depends on the government's fiscal stance measured as the spread between the observed primary balance and the balance that keeps the debt to GDP ratio constant. It was also found that the relationship between these variables was subject to a structural break in March-2007, which seems to be related to improved macro fundamentals in Colombia and the international financial crisis and its global aftermath. The country spread sensitivity to risk appetite was significantly reduced in the second half of the sample, with important positive effects on the financial costs of public debt and the country's vulnerability to external shocks.

The estimated coefficient determining the country risk response to appetite for risk was 0.67 for the period Jan-1998 to Feb-2007. This coefficient is close to that obtained by Favero y Gavazzi (2004) for the case of Brazil of 0.88. However, the estimated coefficient is reduced to 0.23 for the second sub-sample, Mar-2007 to Dec-2010, suggesting a more favorable perception of international investors on the Colombian economy during these years.

Likewise, the smaller EMBI-Colombia sensitivity to global risk appetite found for the last few years has important implications for the economy. From a fiscal point of view, it may imply a reduction in the financial costs of debt as well as increased access to debt financing in the future. Moreover, it might mean lower financial market vulnerability to external shocks. In cost of capital terms, these results may have a positive effect on the interest rate in the long run, by reducing, in turn, the financial cost of investment. Finally, the lower EMBI sensitivity may revert, however, depending on the world economic outlook.

Acknowledgements

The authors acknowledge Hernando Vargas, one anonymous referee, and to the attendants to Banco de la Republica's Economic Seminar for their valuable remarks and suggestions on a previous version of this paper. They would also like to thank Nestor Espinosa and Sergio Restrepo-Angel from the Colombian Central Bank's Economic Studies Department for providing information. The opinions expressed here are those of the authors and do not necessarily reflect the views of Banco de la República, its Board of Directors or the National University of Colombia.

Appendix

1. The EMBI spread was introduced by J.P. Morgan in 1992 and it included Brady bonds, loans and Eurobonds. Successive improvements to the coverage of USD denominated external sovereign debt were made with the introduction of EMBI+ and EMBI-Global indexes. The EMBI+ extended the coverage of fixed income USD dominated sovereign debt under very strict trading liquidity conditions, and the EMBI global relaxed these liquidity requirements. We use EMBI Global in our empirical analysis.

2. Some other authors like Diaz and Gemmill (2006), Garcia-Herrero and Ortiz (2006), Longstaff et al. (2007), and González-Rosada and Levy (2008) obtained similar results.

3. Global risk appetite is measured as the spread between the returns of American corporate BAA bonds and Treasuries, as in Favero and Giavazzi (2004).

4. Özel and Sarikaya (2008), for instance, argue that economy in emerging countries is determined by the exchange rate, which affects the growth and inflation dynamics.

5. Therefore, this analysis is not free of the Lucas critique.

6. The strength and linearity of this relationship is robust to different measures of global risk like the Chicago Board of Trade VIX Index.

7. See Hansen (1982), Mátyás (1998) and Hall (2005) for a good exposition on GMM.

8. The KPSS unit root test was performed before and after the break on both, EMBI and

.The null of stationarity is not rejected for the regressor before and after the break, and after the break only for the regressand. Before the break the null is rejected for EMBI with a suspicious p-value between 1% and 5%. Therefore (1) and (4) are stationary after the break and the residuals of (1) must be non stationary before the break. Further analysis of these residuals (see the next section), sheds light on EMBI 's apparent unit root behavior before the break.

9. A consistent estimator of γ;+ α is directly obtained from the estimated GMM coefficients as

.Moreover, from the estimated variance-covariance matrix of the GMM, a HAC (heteroskedasticity and autocorrelation consistent) estimator of its standard error may be similarly calculated as

.10. The rationale behind these filtrations arises from the fact that these series show an important seasonal component as they are calculated as ratios of highly seasonal series.

11. The KPSS unit root test on the residuals does not reject the null of stationarity, suggesting that the apparent unit root before the break, found above, has to do with temporary short term effects as suspected. This result matches nicely the fact that the residuals in Figure 4 are bigger before than after the break.

INFORMACIÓN DEL ARTÍCULO

Historia del artículo:

Received on June 28, 2013

Accepted on October 16, 2013

*The opinions expressed here are those of the authors and do not necessarily reflect the views of Banco de la Republica, its Board of Directors or the National Univer sity of Colombia.

* Correspondingauthor.

E¿mail address:jjulioro@banrep.gov.co (J.M. Julio).

References

Baldacci, E., Gupta, S., Mati, A., 2008. Is it (Still) Mostly Fiscal? Determinants of Sovereign Spreads in Emerging Markets. IMF Working Paper WP/08/259.

Basci, E., Özel, Ö., Sarikaya C., 2008. The Monetary Transmission Mechanism in Turkey: New Developments'. BIS Papers. Bank for International Settlements 35.

Blanchard, O., 2004. Fiscal Dominance and Inflation Targeting: Lessons from Brazil. NBER working paper 10389. National Bureau of Economic Research.

Bulow, J., Rogoff, K., 1989. Sovereign Debt: Is to Forgive to Forget? The American Economic Review 79 (1), 43-50.

Burnside, C., 2005. Fiscal Sustainability in Theory and Practice, A Handbook. The World Bank, Washington D.C.

Calvo, G., Leiderman, L., Reinhart, C., 1993. Capital Inflows and Real Exchange Rate Appreciation in Latin America: The Role of External Factors. IMF Staff Papers 40 (1), 108-151.

Calvo, G., 2002. Globalization Hazard and Delayed Reform in Emerging Markets. Economía 2 (2): 1-29.

Diaz, W.D., Gemmil, G., 2006. What drives credit risk in emerging markets? The roles of country fundamentals and market co-movements. Journal of International Money and Finance 25 (3), 476-502.

Favero, C.A., Giavazzi, F., 2004. Inflation Targeting and Debt: Lessons from Brazil. NBER Working Paper 10390. National Bureau of Economic Research.

Garcia-Herrero, A., Ortiz, A., 2006. The Role of Global Risk Aversion in Explaining Sovereign Spreads. Economía 7 (1), 125-155.

Gonzáles-Rozada, M., Levy, E., 2008. Global Factors and Emerging Market spreads. The Economic Journal 118 (533), 1917-1936.

Hall, A.R., 2005. Generalized Method of Moments. Oxford University Press, Oxford.

Hansen, L.P., 1982. Large Sample Properties of Generalized Method of Moments Estimators. Econometrica 50, 1029-1054.

Hilscher, J., Nosbusch, Y., 2010. Determinants of Sovereign Risk: Macroeconomic Fundamentals and the Pricing of Sovereign Debt. Review of Finance 14 (2), 235-262.

Hodrick, R.J., Prescott E.C., 1997. Postwar U.S. Business Cycles: An Empirical Investigation. Journal of Money, Credit and Banking 29 (1), 1-16.

Izquierdo, A., Romero, R., Talvi, E., 2008. Booms and Busts in Latin America: The Role of External Factors. Inter-American Development Bank, Research Department, Working Paper No. 631.

Kamin, S.B., Kleist, K., 1999. The Evolution and Determinants of Emerging Market

Credit Spreads in the 1900s. BIS Working Papers. Bank for International Settlements. Monetary and Economic Department, Basel, Switzerland. Longstaff, F., Mithal, S., Neis, E., 2007. Corporate Yield Spreads: Default Risk or

Liquidity? New Evidence from the Credit Default Swap Market. Journal of Finance 60 (5), 2213-2253.

Litterman, R., 1983. A Random Walk, Markov Model for the Distribution of Time Series. Journal Bussiness and Economic Statistics 1 (2), 169-173.

Mátyás, L., 1998. Generalized Method of Moments Estimation. Cambridge University Press, Cambridge, UK.

Mendoza, E., 1995. The terms of trade, the real exchange rate, and economic fluctuations. International Economic Review 36 (1), 101-137.

Mendoza, E., 1997. Terms-of-trade Uncertainty and Economic Growth. Journal of Development Economics 54 (2), 323-356.

Ocampo, J.A., 2010. How well has Latin America Fared during the Global Financial crisis? Paper of the James A. Baker III Institute for Public Policy of Rice University.

Özatay, F., Özmen, E., Sahinbeyoglu, G., 2009. Emerging Market Sovereign Spreads, Global Financial Conditions and U.S. Macroeconomic News. Economic Modelling 26 (2), 526-531.

Tong, H., 1983. Threshold models in non-linear time series analysis. Springer-Verlag, Berlin, New York.

Uribe, M., 2002. A Fiscal Theory of Sovereign Risk, NBER Working Paper Series. Working Paper 9221. National Bureau of Economic Research.