This paper analyzes opportunity entrepreneurship through the interplay between formal and informal institutions. It seems evident that not all entrepreneurial initiatives have the same quality, thus the goal of a society should be to encourage the activities that best contribute to innovation and value generation. We theorize that informal institutions are contingent to the formal institutional environment where the new ventures operate. Our empirical results, using GEM data, confirm that, in countries with a more individualistic orientation, the relationship between formal institutions and opportunity entrepreneurship is more intense, as happens in societies with lower levels of uncertainty avoidance.

Entrepreneurship has become a phenomenon of paramount importance that is receiving increasing attention in recent years (Acs, 2006; Wennekers et al., 2005; Barba-Sánchez and Atienza-Sahuquillo, 2017). Given its relationship to economic growth and wealth (Minniti, 2008), it has attracted the interest of scholars and policy makers alike to identify both the factors that encourage entrepreneurship and the type of entrepreneurship that generates higher externalities for society (Baumol, 1990; Sobel 2008).

Extant empirical evidence, mainly from reports and monographs, shows that the level of entrepreneurship varies greatly across countries. The explanation of these differences has evolved from works that analyze the levels of entrepreneurship across countries in an undifferentiated way (i.e. evaluating the differences in absolute terms) to the most recent stream that introduces the idea that not all types of entrepreneurship are equally desirable, suggesting that a more granular analysis is needed. Therefore, it seems convenient to go one step further when explaining country differences paying attention not only to entrepreneurship levels but also to the type of entrepreneurship that characterizes a specific region (Baumol, 1990).

To increase our knowledge of the differences in entrepreneurship levels among countries, the literature has incorporated the institutional component as a factor that either enables or hinders entrepreneurial activity (Belitski et al., 2016; Aidis et al., 2012; Stenholm et al., 2013; Minh and Hjortsø, 2015; Aparicio et al., 2016). However, despite the growing body of studies examining the influence of institutions on different types of entrepreneurial initiatives, several gaps are still underexplored.

One of the most important calls made by the literature is that these studies should incorporate a more fine-grained analysis that integrates formal and informal institutions (Aidis et al., 2008). This is because firms, when analyzing the institutional landscape, face not only the formal dimension but also the informal one, as well as to consider the potential interdependences that could take place between them (Peng et al., 2009). Thus, our understanding of the institutional context is that it works as a multidimensional, complex and interdependent system (Hutzschenreuter et al., 2016).

Some studies have started to address this problem empirically. For instance, Li and Zahra (2012), in a paper that analyzes the variance of venture capital activity depending on both different levels of formal institutions and different cultural settings, suggest that, in the study of the quality of entrepreneurship, it is necessary to adopt an institutional perspective that takes these two dimensions into account. Similarly, Estrin et al. (2013a) explain entrepreneurial growth aspirations across individuals and institutional contexts, suggesting that higher levels of corruption, weaker property rights and greater government activity significantly constrain entrepreneurial employment growth aspirations. At the same time, they argue that local social networks mitigate the effects of some of these institutional deficiencies.

This joint analysis of formal and informal institutions when explaining the type of entrepreneurship constitutes our first contribution. Theoretically, we follow the idea that formal institutions are embedded within a broader context represented by informal institutions, that is, informal institutions operate at a deeper level than formal ones (DiMaggio, 1988; North, 1990). These authors maintain that the development of formal institutions may reinforce or constrain the effects of informal ones. This means, for instance, that the latter become predominant when the former fail (Helmke and Levitsky, 2004; Peng et al., 2009). Accordingly, our work will consider that the relationship between the development of formal institutions and opportunity entrepreneurship is contingent to the cultural characteristics of the country. We specifically focus on the two cultural dimensions that have been more clearly connected with entrepreneurship, namely, the individualistic character of a society and uncertainty avoidance (Mueller and Thomas, 2001; Tiessen, 1997; Li and Zahra, 2012). Our hypotheses suggest that these distinctive dimensions of the informal institutional environment moderate the relation between formal institutions and opportunity entrepreneurship.

Our research also contributes to the literature by focusing on opportunity entrepreneurship. Previous research has begun to study the relationship between institutions and opportunity entrepreneurship, postulating, for instance, that a country’s institutional environment influences the extent to which entrepreneurial effort is directed toward high-growth activities (Bowen and De Clercq, 2008), or analyzing the effect of the regulatory burden and rule of law on strategic and non-strategic entrepreneurship entry rates (Levie and Autio, 2011). We should notice here that we define opportunity entrepreneurship as one that identifies good business opportunities, expects ventures to provide more new jobs and has a strong correlation with high growth firms (Wennekers et al., 2005; Hechavarria and Reynolds, 2009). According to Reynolds et al. (2002), we can differentiate between opportunity and necessity entrepreneurship. The former, in which a new venture starts to pursue an attractive business opportunity, leads to greater employment growth, higher exports and sometimes creates new market niches. By contrast, necessity entrepreneurship, where individuals are pushed into entrepreneurship by circumstances, usually has a more modest impact on economic development (Acs, 2006). Because of the purpose of this work, we will use a broad concept of opportunity entrepreneur and consider terms such as productive, high quality, strategic or high growth entrepreneurship as synonymous.

Our analysis is close to Estrin et al. (2013a) in the sense that we also analyze the interaction between formal and informal institutions and its effect on entrepreneurship and that we focus on high-growth entrepreneurship. However, it differs from Estrin et al. (2013a) and related research in several points. First, we contribute to the literature by approaching informal institutions (culture) in a substantially different way. Culture is a complex phenomenon and we consider two moderating variables that have been deemed especially important in the entrepreneurship literature, namely, individualism and uncertainty avoidance. Second, our time horizon is much longer than that considered by Estrin et al. (2013a). While Estrin et al. (2013a) use data for a five-year period (2001–2005), our analysis is from 14 years (2002–2015). Third, our sample includes a greater number of countries (84 instead of 42), and, what is more important, our analysis is less biased toward developed countries because many developing countries have started to participate in the GEM project in recent years.1

This international dimension and the presence of countries from different economic environments provide us with enough variability in the institutional dimensions, which is strongly recommended in studies analyzing the influence of the institutional context (Franke and Richey, 2010). The use of a common methodology facilitates comparisons and gives credibility to the results obtained in an international scenario. Furthermore, GEM identifies several types of entrepreneurship, which will be useful to operationalize our dependent variable that is also different to the one use by Estrin et al. (2013a).

Literature review: institutions and entrepreneurshipExtant literature has proved that an appropriate institutional environment provides the necessary conditions for individuals to identify market opportunities, start new activities, introduce innovations and new products or services and generate employment (Verheul et al., 2002; El-Namaki, 1988; Baumol, 2002). Likewise, the quality of the institutional context influences the allocation of the different types of entrepreneurship (Baumol, 1990).

To determine the relevant institutions for entrepreneurship dynamics, it is necessary to precisely define the term institution.North (1990) defines institutions as the rules of the game that guide the behavior of individuals and provide the structure of incentives to the agents, reducing transaction problems. In this sense, institutions can facilitate economic, political and social interactions, creating incentives for different courses of action and guiding the election of the economic actors (Boettke and Coyne, 2009). When these rules are well defined, opportunism decreases, trust increases and so does the enforcement of long-term contracts, reducing transaction costs and leading to an efficient institutional structure (Arias and Caballero, 2006). On the contrary, “poor quality institutions reduce the incentive to invest and prevent resources being allocated to their most productive end” (Knowles and Weatherson, 2006, p.10).

In a broad sense, the literature usually distinguishes between formal and informal institutions (North, 1990). Generally speaking, the first can be understood as a set of political, economic and regulatory rules that facilitate exchanges. The second are rules that have not been designed consciously but come from the information that has been socially transmitted through what we call culture (North, 1990).

There is a growing body of literature that tries to link institutions with entrepreneurship. Factors like governance (Dau and Cuervo-Cazurra, 2014), economic freedom (McMullen et al., 2008), property rights and financial capital (Bowen and De Clercq, 2008; Desai et al., 2003), regulation of entry (Klapper et al., 2006) and control of corruption (Anokhin and Schulze, 2009) are some of the key formal institutional factors considered. McMullen et al. (2008) show how the institutional context influences opportunity and necessity entrepreneurship in different ways. Bowen and De Clercq (2008) demonstrate that the allocation of entrepreneurial resources toward high-growth activities is positively related to financing and education and negatively to the level of corruption in a country. In the same way, Anokhin and Schulze (2009) show that the control of corruption increases the trust of individuals in government and encourages entrepreneurial activities and innovation. Recent research supports the idea that higher levels of corruption, weaker property rights and a greater government activity reduce entrepreneurs’ aspirations of growth (Estrin et al., 2013a).

A large body of research also discusses the informal institutional dimension and its relationship with entrepreneurship. Previous work has focused on issues such as entrepreneurial traits or characteristics of the entrepreneur (Mueller and Thomas, 2001; Thomas and Mueller, 2000), entrepreneurial intention (Entrialgo and Iglesias, 2016), the formation rates of new firms at the regional or national level (Davidsson and Wiklund, 1997), entrepreneurial orientation (Lee and Peterson, 2000; Tiessen, 1997), innovation (Shane 1992, 1993) and the social dimension of entrepreneurship (Estrin et al., 2013b; Stephan et al., 2015). Kreiser et al. (2010) argue that national culture has an impact on the willingness of firms to display risk taking and proactive behaviors, two key dimensions of entrepreneurial orientation. Levie and Hunt (2004) analyze the role of culture in entrepreneurship and conclude that there is a positive relationship between new business activity-related beliefs and the level of new business activity, but they do not find empirical evidence for the direct association between cultural values and entrepreneurship. Autio et al. (2013) analyze the influence of national culture on aspects such as entry behaviors and post-entry aspirations. In the same way, Liñán and Fernández-Serrano (2014) and Hechavarria and Reynolds (2009) show that culture is a significant factor in predicting entrepreneurship rates at the country level. More recent studies find a positive relationship between the potential entrepreneurs’ perception of approval and support from their families and closest environments and entrepreneurial attitude and how entrepreneurial education moderates this relationship (Entrialgo and Iglesias, 2016). Dheer (2017) suggests that individualism positively moderates the effects of political freedom and education, and negatively moderates the effect of corruption, on the rate of entrepreneurial activity across nations.

To sum up, the previous literature review reveals that the relationship between both formal and informal institutions and entrepreneurship is well documented. However, there are still significant gaps with respect to the possible relationships between the two types of institutions that are necessary to fill in order to provide a more accurate picture of their relation with entrepreneurship. This study is an attempt to advance in the understanding of the joint effect of the two types of institutions on entrepreneurship and, more specifically, in the moderating effect of informal institutions on the relationship between formal institutions and entrepreneurship. In the following section, we elaborate on this.

HypothesesThe relation between formal institutions and opportunity entrepreneurshipFormal institutions are a multidimensional concept that includes aspects such as political, economic and legislative systems (Pejovich, 1999). These dimensions define the nature of the political processes, decrease uncertainty, facilitate the necessary managerial efforts to acquire resources at the start of a new venture (Busenitz et al., 2000), increase the availability of financial resources (Holmes et al., 2013) and are the basis or infrastructure which makes development possible (De Soto, 2000). In general, formal institutions provide the framework of trust that the entrepreneur needs when starting up a business. They also facilitate the perception of business opportunities and influence their number and characteristics (Verheul et al., 2002). This will result in an increase in the level of entrepreneurial activity, as well as in the aspirations of growth, in the size of the new companies (Levie and Autio, 2008) and in the proportion of registered businesses in comparison to those that takes place outside the official economy (De Soto 1989, 2000).

Accordingly, an environment with a transparent legal system and clearly defined property rights mitigates the risks taken by the agents who provide funds for entrepreneurs (Estrin et al., 2013a). This facilitates access to financing, usually a key factor for the creation and growth of new businesses (Rajan and Zingales 1998). As a consequence, more developed formal institutions promote, for example, the investment of venture capital (Sobel, 2008; Li and Zahra, 2012), an especially relevant alternative for financing projects in contexts of high uncertainty but high potential growth (Bowen and De Clercq, 2008). Other factors, such as the protection of property rights, have also been positively related to innovation (Dau and Cuervo-Cazurra, 2014), growth aspirations (Autio and Acs, 2010), the size of new companies (Kumar et al., 1999), and the reinvestment of profits (Johnson et al., 2002). It has also been demonstrated that the control of corruption increases trust in institutions and markets and makes it more likely for entrepreneurs to appropriate a portion of the rewards that can be earned by encouraging entrepreneurship and innovation (Anokhin and Schulze, 2009).

On the contrary, weak formal institutions can constitute an important limitation for entrepreneurship and, in particular, for the growth and quality of business initiatives (Krasniqi and Desai, 2016). For example, an excess of entry regulation increases the profits necessary to compensate for the opportunity costs of other investment alternatives, discouraging opportunity entrepreneurship (Ho and Wong, 2007) and reorienting marginal businesses to the shadow – unproductive, in the Baumolian terminology – economy (De Soto 1989, 2000; Jiménez et al., 2015). Similarly, the absence of property rights protection discourages entrepreneurship and productivity because individuals are skeptical about realizing the gains of their productive efforts (Williamson and Mathers, 2011). Furthermore, financial constraints limit investments in high growth projects (Beck et al., 2005). In general, regulatory complexity discourages job creation and, in some cases, limits the growth aspirations of quality entrepreneurship (Verheul et al., 2002).

Furthermore, a weak formal institutional structure not only limits opportunity, high-impact activities but also leads to an increase in low-impact ones (Mehlum et al., 2006). It has been observed that when tax rates or corruption levels are high or there are market restrictions, economic activity moves from formal to informal economy (Johnson et al., 1998; Schneider and Enste, 2000). In line with this argument, Coyne and Leeson (2004) argue that political and legal instability lead to the non-performance of contracts because it is easier to ignore the laws than to keep them, increasing the level of corruption and the informal economy. In the same way, “the lack of an effective court system limits the expansion of one’s network of clients, lenders or suppliers and makes it extremely difficult for entrepreneurs to extend their network beyond a few close friends and neighbors whom they know well” (Coyne and Leeson 2004, p. 242).

To sum up, the existence of institutional structures that guarantee the safety of property rights and a fair judicial system that allows the correct enforcement of contracts makes individuals more likely to take part in the generation of wealth through opportunity entrepreneurship. Accordingly, our first hypothesis is formulated in the following way:H1 The greater the development of formal institutions, the higher the level of opportunity entrepreneurship.

The previous section has argued that the existence of sound formal institutions leads to an environment that encourages opportunity entrepreneurship (McMullen et al., 2008). However, the evidence suggests that the same formal institutions show different effects in different societies (North, 1990; Acs, 2006) or that they even interact with the informal ones (De Soto, 2006). This can be due, at least partially, to the fact that formal institutions coexist with informal ones and that both, as well as their interdependences, have to be considered for the correct interpretation of the institutional dimension (Helmke and Levitsky, 2004; Williamson, 2000). In this sense, North’s (1990) institutional theory explains that formal institutions are the result of the crystallization of the informal component and that they co-evolve through organizations. Formal institutions are subordinated to informal ones in that the former are the means used to structure the interactions of the society in accordance with the norms and values that the latter represent.

Informal institutions are self-regulating but “where the formal institutions do not reflect the underlying informal norms, formal institutions will be costly to enforce because the formal rules governing society will be at odds with the underlying belief systems” (Boettke and Coyne 2009, p. 142). In contrast, where formal norms are in line with informal ones, the cost of implementing the former will be relatively low and they will be accepted, supported and developed over time (Weingast, 1995). More importantly, institutions are often context dependent and it is not easy to transplant them from one context to another due to what Boettke et al. (2008) define as institutional stickiness.

Following the above reasoning, Garretsen et al. (2004) develop a cluster analysis to identify patterns of behavior in accordance with social and legal norms and demonstrate that sociocultural variables allow legal institutions to better achieve their objectives. Licht et al. (2001) reach similar conclusions when relating the rights of investors and cultural factors. They demonstrate that cultural factors determine what types of legal systems can be perceived and accepted as legitimate in a country. Similarly, Li and Zahra (2012, p. 96) suggest that “formal institutions are important for venture capital activity but the effects of formal institutions depend also on the cultural settings”.

In accordance with these arguments, we can conclude that when informal institutions (understood as the value system of a group or society), improve the social desire toward entrepreneurship as a choice of occupation (Stenholm et al., 2013), individuals are more receptive to the incentives offered by formal institutions. As a consequence, formal institutions cannot be analyzed in isolation, given that informal ones (culture) moderate their effect on entrepreneurship.

Culture has been approached in several ways but, probably, the framework most frequently used by the literature is the one proposed by Hofstede (2001) and Hofstede et al. (2010). Among the six dimensions this author develops (power distance, individualism or collectivism, masculinity vs femininity, uncertainty avoidance, long-term orientation and indulgence vs restriction), our analysis will focus on the two more clearly linked to entrepreneurship and its typology (see, for example, Thomas and Mueller, 2000; Li and Zahra, 2012; Mueller and Thomas, 2001, or Levie and Hunt, 2004): individualism and uncertainty avoidance. Greenfield (2000, p. 230) highlights the importance of “individualism and collectivism as a universal deep structure of cultural differentiation”, where “particular cultures are therefore surface forms of one or the other of these basic cultural frameworks” (Greenfield, 2000, p. 223). Thomas and Mueller (2000) show that dimensions such as motivation to the achievement and the pursuit of personal goals, internal locus of control, risk taking and innovativeness (Mueller and Thomas, 2001; Shane 1993) are significantly related to the profile of the entrepreneur and are usually linked to individualism. For instance, Mueller and Thomas (2001) found that cultures with higher levels of individualism and lower levels of uncertainty avoidance are more supportive of entrepreneurship and innovation than cultures that are collectivist and more risk averse. McGrath et al. (1992) reach similar conclusions when they compare entrepreneurs and non-entrepreneurs. Other studies, such as that of Levie and Hunt (2004), investigate the role of culture for opportunity and necessity entrepreneurs. They found that countries with low individualism have more necessity entrepreneurs, while there is no correlation between individualism and opportunity entrepreneurship or total entrepreneurial activity. Finally, Li and Zahra (2012) found that higher levels of uncertainty avoidance and collectivism weaken the positive relationship between formal institutions and the level of venture capital activity in a country. Similarly, other authors, such as Baughn and Neupert (2003, p. 327), suggest that “These two dimensions help predict financial, regulatory, and legal structures favoring new business start-ups”. To sum up, individualism and uncertainty avoidance seem to be the two cultural dimensions more closely related to the decision to become an entrepreneur. As a consequence, in what follows, we will elaborate on their interplay with formal institutions.

Individualism vs collectivismIndividualism is one of the most representative dimensions of culture (Autio et al., 2013) and it is considered to be a key element when it comes to describing changes in behavior, attitudes, norms, values, goals and family structures (Triandis 1996). At the same time, individualism has frequently been associated with studies on entrepreneurship (Cullen et al., 2013).

Individualism cannot be defined independently but must be understood as part of a continuum in which individualism and collectivism are located at opposite ends (Hofstede, 2001). In individualistic cultures, individuals are more motivated by their own personal interest and the achievement of personal goals than by group achievements (Triandis, 1993), thus making it more difficult to identify collective targets. By contrast, in collectivist societies, individuals are considered to be a part of a group from birth and are motivated to achieve rewards at group level (Triandis et al., 1988).

It is important to emphasize that, in these individualistic environments, where communication is low and collective punishment does not exist for the breaching of contracts, trust lies in contractual safety (Tiessen, 1997; Steensma et al., 2000). In these societies, collective actions, exchanges and the enforcement of contracts and norms are obtained through the development of specialized formal institutions (Greif, 1994). Therefore, formal institutions in those cultures play “a central role in enforcing contracts, mitigating transaction cost problems and providing the proper incentive structure for economic transactions” (Li and Zahra, 2012, p. 99). These arguments are in line with those offered by Gorodnichenko and Roland (2010) who conclude that individualism encourages and strengthens the enforcement of norms and formal regulations.

On the contrary, in collectivist societies, individuals interact at the social and economic level with the members of family groups and the fulfillment of contracts is obtained through informal economic and social institutions. In these countries, “the employment of informal relationships to tackle transaction problems may not help with the development of formal institutions” (Li and Zahra, 2012, p. 99), these being less necessary since the government of the country relies on loyalty to the group and power hierarchy (Gaygisiz, 2013). Based on the above, we argue that individualistic societies, that encourage the discovery of opportunities, creativity and innovation, and have a greater acceptance of entrepreneurship at a social level, strengthen the effect of formal institutions in their attempt to encouraging opportunity entrepreneurship.H2 The more individualism, the stronger the positive relationship between formal institutional development and the level of opportunity entrepreneurship.

Another important dimension that influences entrepreneurship is uncertainty avoidance (Autio et al., 2013; Mueller and Thomas, 2001; Wennekers et al., 2007). Uncertainty is a central concept when speaking about entrepreneurship and, particularly, or start-up entrepreneurs who are unable to calculate the expected profits of new ventures (Wennekers et al., 2007). Uncertainty avoidance, unlike risk aversion, which pertains to individuals, shows a wide within-group dispersion and can be insured against, is usually understood as a group or country attribute (Wennekers et al., 2007). According to Hofstede (2001), uncertainty refers to the level of tolerance of societies to ambiguity and the extent to which they feel threatened by unknown, uncertain and new situations. Uncertainty implies, therefore, differences in how individuals perceive the opportunities and threats of the environment and how they react to them (Schneider and De Meyer, 1991). In societies with greater uncertainty avoidance, there is less tolerance of ambiguity, fear of failure is greater and willingness to take risks is lower (Hofstede, 1980). On the other hand, low uncertainty avoidance is associated with optimism and a positive evaluation of uncertain situations (Schneider and De Meyer, 1991), with the subsequent search for opportunities and the assumption of greater risks (Palich and Bagby, 1995).

Uncertainty avoidance influences the way in which other variables affect business undertaking (Wennekers et al., 2007). We have previously argued a positive relationship between formal institutions and opportunity entrepreneurship. However, this relationship is contingent to the level of uncertainty avoidance. For low levels of this societal trait, individuals are more likely to participate in activities with uncertain outcomes, becoming more innovative, more proactive and more open to new norms and laws (Yan and Hunt, 2005). In this context, sound formal institutions are particularly important because they provide the framework to develop economic activity. On the contrary, when formal institutions are weak, new firms are created in a much more uncertain context, thus reducing the incentives to start the ventures.

When uncertainty avoidance is high, individuals are less willing to take risks and entrepreneurs will concentrate on activities with less uncertain outcomes. Given that inefficient institutions increase the ambiguity about the link between entrepreneurs' decisions and their outcomes (Li and Zahra, 2012), this ambiguity is less important when the variance of the expected outcome is low, thus increasing the relative entrepreneurship rates when formal institutions do not work properly. High uncertainty avoidance reduces the number of projects undertaken, especially high quality-high risk ventures, and the institutional framework becomes less important. This line of reasoning is similar to that of Li and Zahra (2012) who analyze the decisions taken by venture capitalists to invest in new projects, and show how venture capitalists are less responsive to incentives offered by formal institutions in societies with greater uncertainty avoidance.

Based on the above arguments, we expect that, in societies with low uncertainty avoidance, where fear of failure is small and willingness to take risks is high, the incentives offered by formal institutions can be understood as an opportunity associated with the creation of new businesses, thus stimulating opportunity entrepreneurship.H3 The lower uncertainty avoidance, the stronger the positive relationship between formal institutional development and the level of opportunity entrepreneurship.

The proposed model will be tested using an unbalanced panel data set of 84 countries that have taken part in the Global Entrepreneurship Monitor (GEM) project between 2002 and 2015. GEM is an international research project that started in 1999 and whose main objective is to assess “entrepreneurial activity, aspirations and attitudes of individuals across a wide range of countries” (http://www.gemconsortium.org). It initially started with 10 participants but coverage rapidly increased as a number of countries joined the project. In any case, it is important to note that most countries have not been part of the sample throughout the whole period. There are two main reasons for this. The first one is that some nations joined the project several years after 2002. The second is that a number of countries participated only in specific years. Therefore, our sample finally includes an unbalanced panel data with a total of 84 countries with 586 observations.2

One of the main reasons we believe that the GEM observatory is a good laboratory to test our hypotheses is that it presents enough heterogeneity in various areas that are crucial to our study, including the level of economic development, the legal and governmental structures and the social and cultural norms that prevail between the different countries. In other words, the “variance” of the institutional dimension is guaranteed. It is important to recall that this variability is a necessary condition in works where institutions play a relevant role, given that no absolute conclusions should be inferred if only a few countries take part in the study (Franke and Richey, 2010).

Dependent variableOur dependent variable is opportunity entrepreneurship (Reynolds et al., 2002). Alvarez and Busenitz (2001) understand opportunity as a central element of quality entrepreneurship and the initiatives that derive from it arise as a result of the desire for income, wealth and achievement (Hessels et al., 2008; Shane et al., 1991; McClelland, 1961).

In this context, GEM seems to be particularly recommended for our purposes. Besides identifying the entrepreneurship rate in each country (defined as the percentage of population aged between 18 and 64 that is involved in a business activity), it breaks it down into opportunity and necessity entrepreneurship. The first one is linked to the identification of good business opportunities while, in the second, firms are created because of the lack of better job opportunities and not because of identifying a clear market niche. Accordingly, our proxy for the level of opportunity entrepreneurship is the ratio between opportunity entrepreneurship and the total of population aged between 18 and 64 that is involved in a business activity (opportunity plus necessity).

Formal institutionsFormal institutions will be proxied through the six governance dimensions developed by Kaufmann, Kraay and Mastruzzi for the World Bank (WGI, Worldwide Governance Indicators) (2009). Governance indicators have previously been used in the literature with very similar purposes (Aidis et al., 2008; Dau and Cuervo-Cazurra, 2014) because they cover a wide range of countries and have been proven to be very accurate (Thomas, 2010). Kaufmann et al. (2010) define governance as “the traditions and institutions by which authority in a country is exercised” and they proxy it through a set of six indicators that “include the process by which governments are selected, monitored and replaced, the capacity of the government to effectively formulate and implement sound policies and the respect of citizens and the state for the institutions that govern economic and social interactions among them” (Kaufmann et al., 2010, p. 4). These indicators have been developed for 215 countries for the period between 1996 and 2016. All of them range between −2.5 and 2.5, with the higher scores corresponding to better outcomes of institutions and vice versa (Kaufmann et al., 2010).

Given the high correlation between these six dimensions, with values ranging from 0.74 to 0.96, our research uses principal component analysis to elaborate a composite score of the formal institutional environment (Garrido et al., 2014). The six indicators were reduced to one factor, with factor loadings between 0.83 and 0.98.3 This allows us to capture the formal institutional dimension in a single variable and we avoid the multicollinearity problems that derive from the high correlation between these dimensions. As a consequence, we will use the factor resulting from the previous principal component analysis to measure formal institutions.

Informal institutions: cultureMost of the entrepreneurship research that considers cultural variables is based on the theory of Hofstede (1980, 2001) that shows how the culture of societies and organizations is influenced by different features deep-rooted in the traditions of the different territories. Initially, Hofstede (2001) established cultural differences through four dimensions: power distance, uncertainty avoidance, individualism vs collectivism and masculinity vs femininity. Recently, Hofstede et al. (2010) added two new dimensions to their cultural model: long-term orientation and indulgence vs restriction. These indexes usually take values from 0 to 100 (although they can exceptionally surpass this threshold), where higher scores correspond to cultures with greater power distance, more individualists, more masculine, with high uncertainty avoidance, more based on a long term approach and where relatively free gratification of basic and natural human desires related to enjoying life and having fun is.

When including the informal institutional component and as we have previously argued, our study considers the two dimensions of Hofstede that are more closely related to entrepreneurship: Individualism vs collectivism and uncertainty avoidance (Mueller and Thomas, 2001; Thomas and Mueller, 2000).

Control variablesOur study also includes several control variables that take into account economic and demographic characteristics of the countries that constitute our sample and that have previously been considered in entrepreneurship studies. The first is the degree of economic activity, proxied through GDP growth. There are a number of studies that document the existence of a positive relationship between economic growth and entrepreneurship and, in particular, between economic growth and quality entrepreneurship (see, for instance, Carree et al., 2007). Our analysis also takes into account GDP per capita, usually positively associated with entrepreneurship (Desai et al., 2003). The existence of a suitable financial supply is also incorporated into the model since it facilitates the mobilization of resources to finance projects, with the resulting improvement of innovative activity and economic growth (King and Levine, 1993). It has been observed that exploitation of opportunities is frequently associated with a greater access to financial capital (Hurst and Lusardi, 2004) and that more developed financial markets promote the entry and growth of new companies (Guiso et al., 2004). Consequently, the model includes the variable financial freedom from the Index of Economic Freedom (Holmes et al., 2008), as a proxy of the financial supply. Moreover, the literature has shown that men are more active in entrepreneurship than women (Minniti et al., 2005; Adachi and Hisada, 2017) and that men obtain better performance and create more jobs (Bosma et al., 2004). To take into account this circumstance, we control for the female rate of population in the country. Previous studies also show that some religions are more conductive to entrepreneurship than others (Audretsch et al., 2007), so we include dummies for the main religions in the world (Christianity, Judaism, Islam and Buddhism). These dummies take a value of 1 for the religion that is dominant in a country and 0 otherwise, being Judaism treated as the reference category. To alleviate multicollinearity problems, all the variables are standardized to have a mean of 0 and standard deviation of 1 and, to mitigate simultaneity, all the explanatory variables are lagged one year (Cornett et al., 2007).

The variables used in our empirical model and the data sources are summarized in Table 1.

Description of the variables used in the study.

| Dimension | Variable | Description | Source |

|---|---|---|---|

| Level of opportunity entrepreneurship | Opportunity TEA/Opportunity TEA + Necessity TEA | Ratio of the adult population that claims to be involved in a business because of the identification of a market opportunity over the population (aged between 18 and 64) who had initiated a venture in the last 42 months (opportunity plus necessity). | GEM |

| Formal institutions | Voice and Accountability | Ability of the citizens to participate in selecting their government, as well as freedom of expression, freedom of association, and free media. | WGI |

| Political Stability | Likelihood that the government will be destabilized or overthrown by unconstitutional or violent means, including politically-motivated violence and terrorism. | WGI | |

| Government Effectiveness | Quality of public services, the quality of the civil service and the degree of its independence from political pressures, the quality of policy formulation and implementation, and the credibility of the government’s commitment to such policies. | WGI | |

| Regulatory Quality | Ability of the government to formulate and implement sound policies and regulations which permit and promote private sector development. | WGI | |

| Rule of Law | Confidence of the agents in and abidance by the rules of society, and in particular the quality of contract enforcement, property rights, the police and the courts, as well as the likelihood of crime and violence. | WGI | |

| Control of Corruption | Extent to which public power is exercised for private gain, including both petty and grand forms of corruption, as well as "capture" of the state by elites and private interests. | WGI | |

| Informal institutions | Individualism/ Collectivism | Extent to which individuals prefer to act and feel recognized as individual versus being part of a group or collective. | Hofstede |

| Uncertainty Avoidance | Extent to which members of a society accept uncertainty and ambiguity. | Hofstede | |

| Control variables | GDP Growth | Annual percentage growth rate of GDP (local currency). | WB |

| Financial freedom | Banking efficiency as well as a measure of independence from government control and interference in the financial sector. | IEF | |

| Population female | Percentage of female population in the country. | WB | |

| GDP per capita | GDP per capita is gross domestic product divided by midyear population. | WB | |

| Christianity | Dummy variable that equals 1 if Christianity is the dominant religion in the country. | ARDA | |

| Buddhism | Dummy variable that equals 1 if Buddhism is the dominant religion in the country. | ARDA | |

| Islam | Dummy variable that equals 1 if Islam is the dominant religion in the country. | ARDA | |

GEM = Global Entrepreneurship Monitor (Reynolds et al., 2002).

WGI = Worldwide Governance Indicators of World Bank (Kaufmann et al., 2009).

IEF = Index Economic Freedom (Holmes et al., 2008).

Hofstede: see Hofstede (1980, 2001).

ARDA = World Bank and Association of religion data archives (http://www.thearda.com/).

WB = World Bank.

Descriptive statistics and correlations between our variables are shown in Table 2. As can be observed, the ratio that approach opportunity entrepreneurship takes a value of 0.76.

descriptive statistics and correlation matrix (N = 583).

| Variable | Mean | Std. Dev. | Min | Max | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Level of opportunity entrepreneurship | 0.76 | 0.11 | 0.42 | 0.97 | 1 | ||||||||||

| Formal institutions | 0.39 | 0.95 | −1.78 | 1.85 | 0.61* | 1 | |||||||||

| Individualism | 47.33 | 24.11 | 6.00 | 91 | 0.42* | 0.68* | 1 | ||||||||

| Uncertainty avoidance | 66.02 | 23.04 | 8.00 | 100 | −0.21* | −0.21* | −0.26* | 1 | |||||||

| GDP growth | 3.03 | 3.81 | −14.33 | 22.59 | −0.10* | −0.28* | −0.23* | −0.09* | 1 | ||||||

| Financial freedom | 60.50 | 18.38 | 10.00 | 90.00 | 0.45* | 0.69* | 0.54* | −0.27* | −0.25* | 1 | |||||

| GDP per capita | 24240.7 | 21470.8 | 354.85 | 119172.7 | 0.60* | 0.78* | 0.62* | −0.24* | −0.28* | 0.51* | 1 | ||||

| Female rate | 50.55 | 2.22 | 25.50 | 54.21 | −0.08* | 0.09* | 0.19* | 0.11* | −0.11* | 0.17* | −0.06 | 1 | |||

| Christianity | 0.79 | 0.40 | 0.00 | 1.00 | 0.17* | 0.32* | 0.36* | 0.17* | −0.22* | 0.37* | 0.21* | 0.35* | 1 | ||

| Buddhism | 0.09 | 0.29 | 0.00 | 1.00 | −0.12* | −0.05 | −0.27* | −0.18* | 0.15* | −0.14* | −0.05 | −0.04 | −0.63* | 1 | |

| Islam | 0.09 | 0.29 | 0.00 | 1.00 | -0.11* | −0.37* | −0.23* | −0.08 | 0.15* | −0.36* | −0.25* | −0.43* | −0.65* | −0.08* | 1 |

The mean value of the indicator that proxies formal institutions is 0.39. The range of values of this variable, between −1.78 and 1.85, means that the average country in our sample shows a reasonable level of institutional development. The standard deviation is also high, indicating that our sample covers a wide range of countries with very different institutional contexts. Regarding informal institutions, the mean values of individualism and uncertainty avoidance are, respectively, 47.33 and 66.02, with moderate to high variation among the different observations. When we analyze the correlation matrix, we observe that opportunity entrepreneurship is positively correlated with formal institutions, individualism, financial freedom, GDP per capita and Christianity. On the other hand, the correlation is negative between opportunity entrepreneurship and uncertainty avoidance, GDP growth, female rate, Buddhism and Islam.

Table 3 complements the information provided by Table 2. First, it allows us to verify the variability within the institutional dimensions (a necessary condition to address a study of these characteristics). Second, it offers some relevant details about the exact position of the countries of our sample both in relationship to the dependent variable and in the variables that capture the effect of institutions. The first aspect that attracts our attention in Table 3 (listed from biggest to smallest values of the dependent variable) is that countries with higher levels of opportunity entrepreneurship are usually those where formal institutions are more developed: the top positions in both rankings are held by countries like Denmark, Iceland, Norway, Luxembourg and Sweden. This preliminary evidence is consistent with the arguments outlined in our Hypothesis 1. A less clear pattern is observed in the relationship between opportunity entrepreneurship and the individualistic character or uncertainty avoidance in a society. This lack of a clear relationship would be in line with previous evidence that does not identify a direct impact of the informal institutional dimension on entrepreneurship. Therefore, this evidence could suggest a moderation effect between formal and informal institutions.

Average institutional features by country.

| Country | Level of opportunity entrepreneurship | Formal institutions | Individualism | Uncertainty |

|---|---|---|---|---|

| Denmark | 0.94 | 1.74 | 74 | 23 |

| Iceland | 0.92 | 1.58 | 60 | 50 |

| Norway | 0.92 | 1.61 | 69 | 50 |

| Luxembourg | 0.90 | 1.07 | 60 | 70 |

| Sweden | 0.90 | 1.66 | 71 | 29 |

| Saudi Arabia | 0.89 | −0.62 | 25 | 80 |

| The Netherlands | 0.89 | 1.56 | 80 | 53 |

| Austria | 0.89 | 1.46 | 55 | 70 |

| New Zealand | 0.88 | 1.65 | 79 | 49 |

| United Arab Emirates | 0.88 | 0.25 | 25 | 80 |

| Surinam | 0.88 | −0.21 | 47 | 92 |

| Switzerland | 0.87 | 1.63 | 68 | 58 |

| Trinidad and Tobago | 0.86 | −0.11 | 16 | 55 |

| Singapore | 0.86 | 1.27 | 20 | 8 |

| Malaysia | 0.85 | 0.05 | 26 | 36 |

| Canada | 0.85 | 1.49 | 80 | 48 |

| Australia | 0.85 | 1.47 | 90 | 51 |

| Belgium | 0.85 | 1.17 | 75 | 94 |

| United Kingdom | 0.84 | 1.29 | 89 | 35 |

| Slovenia | 0.84 | 0.75 | 27 | 88 |

| Italy | 0.84 | 0.36 | 76 | 75 |

| Finland | 0.84 | 1.77 | 63 | 59 |

| Estonia | 0.84 | 0.96 | 60 | 60 |

| United States | 0.82 | 1.11 | 91 | 46 |

| Mexico | 0.82 | −0.47 | 30 | 82 |

| Indonesia | 0.80 | −0.62 | 14 | 48 |

| Spain | 0.80 | 0.73 | 51 | 86 |

| Ireland | 0.80 | 1.36 | 70 | 35 |

| Ethiopia | 0.80 | −1.31 | 20 | 55 |

| Portugal | 0.79 | 0.82 | 27 | 99 |

| Latvia | 0.78 | 0.44 | 70 | 63 |

| Thailand | 0.78 | −0.61 | 20 | 64 |

| Israel | 0.77 | 0.39 | 54 | 81 |

| Lebanon | 0.77 | −1.09 | 40 | 50 |

| Jordan | 0.76 | −0.28 | 30 | 65 |

| Uruguay | 0.76 | 0.57 | 36 | 99 |

| Japan | 0.76 | 1.04 | 46 | 92 |

| France | 0.76 | 1.06 | 71 | 86 |

| Lithuania | 0.76 | 0.60 | 60 | 65 |

| Costa Rica | 0.75 | 0.48 | 15 | 86 |

| Burkina Faso | 0.75 | −0.78 | 15 | 55 |

| Chile | 0.75 | 0.99 | 23 | 86 |

| Peru | 0.74 | −0.59 | 16 | 87 |

| Germany | 0.74 | 1.34 | 67 | 65 |

| Greece | 0.74 | 0.27 | 35 | 100 |

| Czech Republic | 0.73 | 0.68 | 58 | 74 |

| Morocco | 0.73 | −0.65 | 46 | 68 |

| Panama | 0.73 | −0.10 | 11 | 86 |

| Bangladesh | 0.73 | −1.23 | 20 | 60 |

| Senegal | 0.73 | −0.35 | 25 | 55 |

| India | 0.72 | −0.48 | 48 | 40 |

| Romania | 0.72 | −0.03 | 30 | 90 |

| Hungary | 0.71 | 0.53 | 80 | 82 |

| Hong Kong | 0.71 | 1.30 | 25 | 29 |

| Venezuela | 0.71 | −1.60 | 12 | 76 |

| Vietnam | 0.69 | −1.00 | 20 | 30 |

| Nigeria | 0.69 | −1.54 | 30 | 55 |

| Russia | 0.69 | −1.13 | 39 | 95 |

| Ecuador | 0.69 | −1.06 | 8 | 67 |

| Angola | 0.69 | −1.47 | 18 | 60 |

| Dominican Republic | 0.68 | −0.74 | 30 | 45 |

| Colombia | 0.68 | −0.66 | 13 | 80 |

| Ghana | 0.67 | −0.22 | 15 | 65 |

| Bulgaria | 0.66 | −0.07 | 30 | 85 |

| South Africa | 0.66 | 0.05 | 65 | 49 |

| Guatemala | 0.66 | −0.95 | 6 | 99 |

| Slovakia | 0.66 | 0.59 | 52 | 51 |

| Argentina | 0.66 | −0.62 | 46 | 86 |

| El Salvador | 0.66 | −0.30 | 19 | 94 |

| Zambia | 0.65 | −0.63 | 35 | 50 |

| Turkey | 0.64 | −0.34 | 37 | 85 |

| Namibia | 0.64 | 0.06 | 30 | 45 |

| The Philippines | 0.64 | −0.56 | 32 | 44 |

| Brazil | 0.62 | −0.30 | 38 | 76 |

| South Korea | 0.62 | 0.54 | 18 | 85 |

| Jamaica | 0.61 | −0.28 | 39 | 13 |

| Croatia | 0.61 | 0.13 | 33 | 80 |

| Iran | 0.60 | −1.57 | 41 | 59 |

| Egypt | 0.60 | −1.04 | 25 | 80 |

| Poland | 0.59 | 0.61 | 60 | 93 |

| China | 0.59 | −0.95 | 20 | 30 |

| Malawi | 0.57 | −0.73 | 30 | 50 |

| Serbia | 0.57 | −0.60 | 25 | 92 |

| Pakistan | 0.51 | −1.56 | 14 | 70 |

| Mean | 0.76 | 0.39 | 47.33 | 66.02 |

| Standard deviation | 0.11 | 0.94 | 24.11 | 23.04 |

A second feature that deserves our attention is the distribution of the sample. In spite of the wide range of variation of our variables (which is a key feature to test our hypotheses), there seems to be a slight over-presence of countries in which the development of formal institutions is high. This is evidenced by the fact that the average value of formal institutions is above zero (0.39). This is not the case with the cultural dimensions, whose means and variances are more evenly distributed. The variable individualism has an average almost in the center of the range of the variable (do not forget that it usually ranges between 0 and 100) and a standard deviation of 24.11. The values for uncertainty avoidance are somewhat more skewed, with an average of 66.02 and a standard deviation of 23.04.

ResultsTo take the nature of our dependent variable into account, which is a ratio that lies between 0 and 1, we estimate a two-limit tobit model (Long, 1997) with panel data.4Table 4 presents the results of our estimations. All of them are robust to heteroskedasticity and autocorrelation (HAC). To test our hypotheses, we estimate five models where the variables that proxy formal institutions and their interactions with informal ones are introduced in a nested way. Model 1 only considers the influence of the control variables. Model 2 introduces the direct effect of formal institutions on the level of opportunity entrepreneurship (Hypothesis 1). Models 3 and 4 add, respectively, the interaction between formal institutions and individualism (Hypothesis 2), and between formal institutions and uncertainty avoidance (Hypothesis 3). Finally, Model 5 is the full model that incorporates all the interactions.

Formal institutions, informal institutions and the level of opportunity entrepreneurship.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | |

|---|---|---|---|---|---|

| Formal institutions | 0.364*** | 0.461*** | 0.389*** | 0.469*** | |

| (6.19) | (7.04) | (6.58) | (7.18) | ||

| Formal institutions × individualism | 0.116*** | 0.099** | |||

| (2.82) | (2.34) | ||||

| Formal institutions × uncertainty | −0.088*** | −0.072** | |||

| (−2.67) | (−2.16) | ||||

| Individualism | −0.131*** | −0.117** | |||

| (−2.80) | (−2.45) | ||||

| Uncertainty avoidance | 0.014 | 0.011 | |||

| (0.43) | (0.32) | ||||

| GDP Growth | 0.108*** | 0.115*** | 0.097*** | 0.105*** | 0.090** |

| (2.93) | (3.23) | (2.70) | (2.90) | (2.49) | |

| Female rate | −0.087* | −0.107** | −0.073 | −0.113** | −0.081 |

| (−1.67) | (−2.11) | (−1.41) | (−2.23) | (−1.56) | |

| Financial freedom | 0.222*** | 0.084* | 0.051 | 0.045 | 0.025 |

| (5.54) | (1.87) | (1.09) | (0.96) | (0.52) | |

| GDP per capita | 0.471*** | 0.281*** | 0.250*** | 0.249*** | 0.229*** |

| (13.62) | (6.18) | (5.02) | (5.33) | (4.55) | |

| Christianity | 0.031 | −0.007 | −0.045 | −0.031 | −0.058 |

| (0.31) | (−0.08) | (−0.45) | (−0.31) | (−0.59) | |

| Buddhism | −0.056 | −0.086 | −0.111* | −0.094 | −0.115* |

| (−0.91) | (−1.44) | (−1.85) | (−1.56) | (−1.88) | |

| Islam | 0.100 | 0.104 | 0.092 | 0.081 | 0.074 |

| (0.99) | (1.06) | (0.94) | (0.82) | (0.76) | |

| Constant | −0.104*** | −0.124*** | −0.200*** | −0.133*** | −0.196*** |

| (−3.09) | (−3.78) | (−4.77) | (−4.04) | (−4.61) | |

| N | 586 | 586 | 586 | 586 | 586 |

| R2 | 0.19 | 0.22 | 0.22 | 0.22 | 0.23 |

| F-Test vs. 1 | 38.34*** | 24.92*** | 23.16*** | 18.30*** | |

| F-Test vs. 2 | 7.98*** | 7.13*** | 5.72*** | ||

| F-Test vs. 3 | 4.66** | ||||

| F-Test vs. 4 | 5.49** | ||||

| VIF mean | 3.63 | 3.89 | 3.86 | 3.52 | 3.53 |

Standard errors in parentheses.

It is important to note that several of our models include interaction terms, which implies that some multicollinearity problems may arise. To assess their importance, we calculate the variance inflation factors (VIFs). In the models no variable has a VIF above the usual threshold of 10, which suggests there are not multicollinearity problems (see VIF mean in Table 4).

Focusing our analysis on the results of the model that only includes the control variables, we observe that GDP growth has a positive and significant effect on the level of opportunity entrepreneurship. This may indicate that higher economic growth is related to the availability of better business opportunities, and something similar happens with GDP per capita. It is also important to note that these variables maintain their sign and significance across the five models. The female rate is negative and significant in models 1, 2 and 4 so, the higher the rate of females in a given country, the lower the level of opportunity entrepreneurship. The other variables we consider (financial freedom and religion) usually present the expected signs, although their coefficients are not statistically significant, with the exceptions of financial freedom, which is positive and significant in models 1 and 2, and Buddhism, which is negative and significant in models 3 and 5.

Although our theoretical predictions analyze the impact of informal institutions from a contingent perspective, we comment on the direct effect of the two variables that capture the informal component of the institutions, namely, uncertainty avoidance and individualism. As we can observe, individualism is negative and significant and uncertainty avoidance is positive but not significant in any model.

Formal institutions show a positive and significant relationship (β = 0.36, p < 0.01) with the level of opportunity entrepreneurship (Model 2), suggesting that, in countries where formal institutions are more developed, entrepreneurship is, in general, of higher quality. This result provides support for Hypothesis 1.

The interaction term between formal institutions and individualism (Model 3) is also positive and significant (β = 0.11, p < 0.01) while the interaction with uncertainty avoidance (Model 4) takes the expected negative sign (β = −0.08, p < 0.01), suggesting that, in countries with higher individualism, the relationship between the development of formal institutions and opportunity entrepreneurship is more intense while, in countries with lower uncertainty avoidance, the relation is also negatively reinforced. Model 5 includes all the explanatory variables and, according to the F-tests shown at the end of Table 4, it is the model that best fits our data.

All the relevant variables maintain their sign and remain statistically significant, so our previous conclusions hold. Overall, the results of Model 5 give support to our Hypotheses 1, 2 and 3.

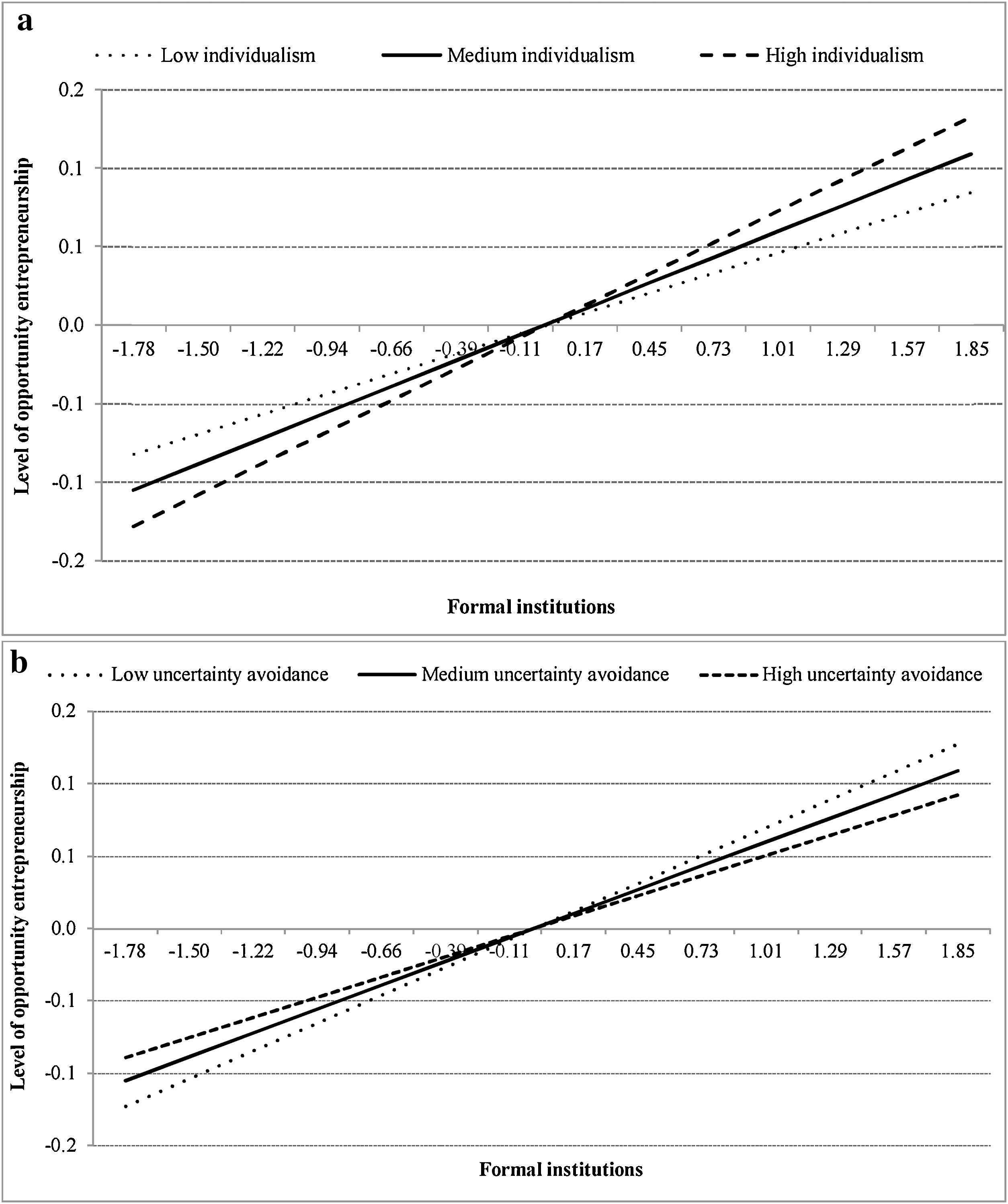

Fig. 1a and b presents a graphical illustration of our results with the aim of providing a more nuanced analysis of the moderating effect of the informal dimension on the relation between formal institutions and the level of opportunity entrepreneurship. Fig. 1a shows the moderating effect of individualism (Hypothesis 2). Using coefficient estimates from the fully specified model in Table 4 and considering the average of the other moderating variable (uncertainty avoidance) of 66.02, we analyze the effect of formal institutions on the level of opportunity entrepreneurship when individualism is low (one standard deviation below the mean), when it is equal to the mean, and when it is high (one standard deviation above the mean). We observe that for a medium formal institutional development (values of the formal institutions variable close to zero), differences in the levels of individualism in a country hardly lead to significant variations in the levels of opportunity entrepreneurship. However, these differences become more pronounced as the formal institutions development move further away from values around 0. Therefore, for high values of formal institutions, the individualistic character of a society improves the relation between formal institutions and the level of opportunity entrepreneurship. However, where formal institutions are less developed, a collectivistic culture favors their relation with quality entrepreneurship.

A similar assessment can be carried out when we analyze the effect of formal institutions on the level of opportunity entrepreneurship for different values of uncertainty avoidance. With this aim in mind, again from the full model (Model 5) and considering an average value for individualism of 47.33, we analyze the effect of formal institutions when uncertainty avoidance takes low, medium and high scores. Fig. 1b shows that the moderating effect of uncertainty avoidance on the relation between formal institutional development and the level of opportunity entrepreneurship increases when formal institutions shifts away from zero. In other words, the degree of uncertainty avoidance has a limited effect on entrepreneurial rates when formal institutions have a medium level of development. However, the picture changes dramatically for high (low) levels of development of formal institutions. In this case, a lower (greater) aversion can potentiate (reduce) the level of opportunity entrepreneurship.

Further analysisAlthough we have previously argued that individualism and uncertainty avoidance are the two more salient Hofstede dimensions analyzed in the context of entrepreneurial activity (Thomas and Mueller, 2000; Li and Zahra, 2012; Mueller and Thomas, 2001, Levie and Hunt, 2004), the Hofstede model of national culture consists of six dimensions: power distance, individualism or collectivism, masculinity vs femininity, uncertainty avoidance, long-term orientation and indulgence vs restriction. Table 5 offers definitions of all of them.

Description of the Hofstede dimensions.

| Dimension | Description |

|---|---|

| Power distance | The degree to which the less powerful members of a society accept and expect that power is distributed unequally |

| Individualism/Collectivism | Individualism can be defined as a preference for a loosely-knit social framework in which individuals are expected to take care of only themselves and their immediate families. Collectivism represents a preference for a tightly-knit framework in society in which individuals can expect their relatives or members of a particular in-group to look after them in exchange for unquestioning loyalty. |

| Masculinity/Femininity | The Masculinity side of this dimension represents a preference in society for achievement, heroism, assertiveness, and material rewards for success. Femininity stands for a preference for cooperation, modesty, caring for the weak and quality of life. Society at large is more consensus-oriented. |

| Uncertainty Avoidance | The degree to which the members of a society feel uncomfortable with uncertainty and ambiguity |

| Long term orientation/Short term orientation | Societies who score low on this dimension, for example, prefer to maintain time-honoured traditions and norms while viewing societal change with suspicion.T hose with a culture which scores high, on the other hand, take a more pragmatic approach: they encourage thrift and efforts in modern education as a way to prepare for the future. |

| Indulgence/Restrain | Indulgence stands for a society that allows relatively free gratification of basic and natural human drives related to enjoying life and having fun. Restraint stands for a society that suppresses gratification of needs and regulates it by means of strict social norms. |

In Table 6, we offer additional empirical evidence on the contingent impact of informal institutions on the level of opportunity entrepreneurship. We estimate six different models, taking into account the six Hofstede dimensions just defined. Given the multicollinearity problems that arise when all the dimensions are included in the same model (the VIF is substantially above the usual threshold of 10), we present their effects one by one. It is important to note that we include the same control variables as in previous models. All of them remain qualitatively the same. Accordingly, we focus our comments on both the direct and moderating impacts of Hofstede dimensions.

Formal institutions and the six dimensions of Hofstede.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Formal institutions | 0.453*** | 0.373*** | 0.375*** | 0.306*** | 0.391*** | 0.384*** |

| (0.066) | (0.063) | (0.0640) | (0.062) | (0.064) | (0.063) | |

| Formal institutions × individualism | 0.163*** | |||||

| (0.048) | ||||||

| Individualism | −0.189*** | |||||

| (0.054) | ||||||

| Formal institutions × uncertainty | −0.063* | |||||

| (0.037) | ||||||

| Uncertainty avoidance | −0.021 | |||||

| (0.043) | ||||||

| Formal institutions × power distance | −0.120*** | |||||

| (0.042) | ||||||

| Power distance | 0.055 | |||||

| (0.054) | ||||||

| Formal institutions × masculinity | −0.052 | |||||

| (0.035) | ||||||

| Masculinity | −0.075* | |||||

| (0.041) | ||||||

| Formal institutions × long term orientation | 0.001 | |||||

| (0.032) | ||||||

| Long term orientation | −0.108*** | |||||

| (0.039) | ||||||

| Formal institutions × indulgence | 0.015 | |||||

| (0.036) | ||||||

| Indulgence | 0.210*** | |||||

| (0.043) | ||||||

| GDP growth | 0.072* | 0.077** | 0.076** | 0.081** | 0.088** | 0.084** |

| (0.037) | (0.038) | (0.037) | (0.036) | (0.037) | (0.036) | |

| Female rate | −0.023 | −0.184* | −0.148 | −0.158 | −0.0817 | 0.117 |

| (0.114) | (0.110) | (0.107) | (0.114) | (0.113) | (0.124) | |

| Financial freedom | 0.075 | 0.069 | 0.098** | 0.135*** | 0.096** | 0.064 |

| (0.048) | (0.049) | (0.046) | (0.045) | (0.046) | (0.046) | |

| GDP per capita | 0.238*** | 0.233*** | 0.215*** | 0.262*** | 0.275*** | 0.244*** |

| (0.050) | (0.048) | (0.050) | (0.045) | (0.047) | (0.046) | |

| Christianity | −0.004 | −0.039 | −0.036 | −0.038 | −0.101 | −0.171 |

| (0.188) | (0.190) | (0.189) | (0.186) | (0.190) | (0.188) | |

| Buddhism | −0.089 | −0.108 | −0.089 | −0.076 | −0.095 | −0.117 |

| (0.106) | (0.107) | (0.107) | (0.105) | (0.107) | (0.105) | |

| Islam | 0.169 | 0.083 | 0.098 | 0.104 | 0.060 | 0.091 |

| (0.171) | (0.172) | (0.172) | (0.169) | (0.173) | (0.169) | |

| Constant | −0.202*** | −0.094** | −0.161*** | −0.098** | −0.115*** | −0.148*** |

| (0.050) | (0.037) | (0.045) | (0.039) | (0.040) | (0.039) | |

| N | 532 | 532 | 532 | 532 | 532 | 532 |

| R2 | 0.23 | 0.22 | 0.22 | 0.23 | 0.22 | 0.23 |

Standard errors in parentheses.

Models 1 and 2 consider the moderating impact of individualism and uncertainty avoidance on the level of opportunity entrepreneurship. As can be observed, these models coincide with Models 3 and 4 already commented in Table 4. It can be seen that there is a difference in terms of the number of observations (586 vs 532), which comes from the fact that not all the Hofstede dimensions are equally available for the same number of countries.5 For comparative purposes, we have kept the number of observations equal among models. For our sample, indulgency is the dimension with the fewest observations. This is why the number of observations is slightly reduced. In any case, the interpretation of Models 1 and 2, where individualism and uncertainty avoidance are introduced, is the same as we have previously offered.

Model 3 shows that the direct effect of power distance is not significant, while the interactions with formal institutions is negative and significant (β = −0.120, p < 0.01). This means that countries where power distance is high, that is, that people accept a hierarchical order in which everybody has a place, negatively moderates the relationships between formal institutions and the level of opportunity entrepreneurship. Model 4 provides empirical evidence on the negative relationship between masculinity and the level of opportunity entrepreneurship, but, in this case, the interaction with formal institutions is not significant. Similarly, Model 5 shows that only the direct effect of long-term orientation is negative and significant, but not the interaction term. Finally, Model 6 presents the relationship between indulgence and the level of opportunity entrepreneurship. Results show that the direct effect of this dimension is positive and significant, but the moderating effect with formal institutions is not.

This empirical evidence on the impact of additional Hofstede dimensions, shown in Table 6, gives us the possibility to elaborate on the interplay between formal institutions and other dimensions of the informal component of institutions. Further research should theoretically explore these relationships.

Discussion and conclusionsThe main objective of this research has been to provide a more detailed picture of the relationship between institutions and the level of opportunity entrepreneurship. We build on the well-established distinction between formal and informal institutions proposed by North (1990) and we acknowledge that, although previous literature has frequently addressed these two institutional components separately, our proposal suggests that they should be jointly considered for a better understanding of their impact on entrepreneurship.

Within this context, our contention is that not all the initiatives have the same positive effects on wealth creation. We argue that opportunity entrepreneurs are especially motivated to start and develop larger and more valuable firms and that these firms have clear implications on economic growth and innovation (Wong et al., 2005). As a consequence, we elaborate on the relationship between opportunity entrepreneurship and institutions. Our main findings confirm our assumptions and, although it is true that the highest opportunity entrepreneurship rates are observed in countries where the rules of the game (formal institutions) are well defined, culture and society values (informal institutions) greatly affect the process of business creation through their moderating effect on formal institutions. Particularly, in more individualistic-oriented countries the relation between formal institutions and the level of opportunity entrepreneurship is more intense. This relationship is also strengthened when uncertainty avoidance is lower. Nevertheless, there are some countries whose values in these dimensions deserve our attention. Germany, for example, has a relatively low presence of opportunity entrepreneurship, in spite of its strong formal institutions, a relatively high individualism and an average level of uncertainty avoidance. Belgium, one of the countries with the highest uncertainty avoidance, shows an impressive level of opportunity entrepreneurship based on highly developed formal institutions combined with a very individualistic society. These figures contrast with those observed in Poland, with similar uncertainty avoidance and a not very different level of individualism; however, the limited development of formal institution in this country results in a very low level of opportunity entrepreneurship. There are also countries that present high levels of opportunity entrepreneurship although their formal institutions are underdeveloped, for example, Saudi Arabia, Trinidad and Tobago and Mexico.

Our analysis has contributed to the existing literature both from a theoretical and an empirical point of view. The discussion initiated by Baumol (1990), where productive and unproductive entrepreneurship are dependent on the prevailing rules of the game, has opened a prolific stream of research. Some previous studies, including Sobel (2008), have contributed to empirically testing Baumol’s postulates and further literature has called for the consideration of not only the number of new ventures but also their quality (Li and Zahra, 2012). However, most previous research only provides a limited approach to this analysis. Some studies analyze the type of entrepreneurship but they do not take into account the institutional component (Acs, 2006; Block and Sandner, 2009). Other scholars include formal institutions in their analyses of the type of entrepreneurship but they omit the role played by informal institutions (Sobel, 2008). Finally, additional work analyzes the different dimensions of culture and their impact on the type of entrepreneurial activity (Hechavarria and Reynolds, 2009). Our work contributes to fill this gap by proposing that the approach to institutions should be more granular and consider formal institutions, as well as their interactions with informal ones, as key factors that determine opportunity entrepreneurship. Existing research shows very mixed results on the relationship between dimensions such as individualism and uncertainty avoidance and new venture creation (Stephan and Uhlaner, 2010; Wennekers et al., 2007). In our paper, we show that, to better understand the impact of informal institutions on entrepreneurship, they need to be contextualized. The interplay between formal and informal institutions provides a more nuanced picture on how institutions affect entrepreneurial behavior. Our research also contributes to the literature by isolating opportunity entrepreneurship, which has traditionally been considered of higher quality. It increases economic growth and employment to a greater extent, thus generating higher externalities for society. As a consequence, its separate analysis facilitates the adoption of better managerial and policy decisions.

Policy implicationsThe paper has relevant implications from a public policy point of view. Despite the growing adoption of measures to encourage the creation of new ventures, it is imperative to take into account that not all the initiatives have the same impact on value creation and economic growth. As Sobel (2008) argues, it is not uncommon to identify entrepreneurial projects that simply receive public funds through subsidies and grants, but with a doubtful contribution to value creation (zero-sum economic activities). For this reason, the stimuli provided by governments should essentially focus on allocating resources to initiatives with a greater innovative component or with high potential growth.

Another implication from a public policy perspective is the importance of strengthening formal institutions, particularly in less developed countries where the rules of the game are usually less clear. Policymakers in these countries should be conscious of the positive effects in terms of development and wealth creation of giving sufficient attention to reinforcing the regulatory framework. In any case, formal institutions should not be managed in isolation; they are contingent on informal ones. It is important to be aware that similar formal institutions may have different effects on new business creation depending on the informal institutions (Li and Zahra, 2012; Rodrik, 2007). Unfortunately, it is not easy to establish a clear causal relationship between policymakers’ actions and society values. Thus, the effect of the decisions adopted with respect to these variables is difficult to identify, given that they are only perceived in the long run. It is true that governments are frequently conditioned by short-term outcomes but they should be conscious of the positive consequences of the efforts that derive from this type of decisions. As a consequence, public authorities should promote measures, such as improving the social recognition of the entrepreneur and highlighting the long-term consequences of the quality of entrepreneurship, aimed at sensitizing citizens to developing their entrepreneurial spirit. The inclusion of issues related to entrepreneurship at different educational levels and raising awareness of the importance of entrepreneurs in society are only some of the challenges facing governments in the promotion of opportunity entrepreneurship.

Limitations and future researchOur results also leave several questions unanswered that will deserve further attention in the future. First, we have proxied formal institutions through an aggregate index, which tries to measure objective perceptions about the quality of formal institutions in different countries. Undoubtedly, perceptions may often be as important as objective differences in institutions across countries (Kaufmann et al., 1999, p. 2) but it would be of interest if future work provides a more disaggregated analysis of formal institutions, including dimensions such as economic freedom, political stability, the quality and independence of public services, ease of access to finance, the control of corruption or legal security. It cannot be discarded that the interaction between these factors and informal institutions would be heterogeneous. As the moderating effect of informal institutions would be contingent to each (or some) of these dimensions, our knowledge would be enriched by identifying adequate variables that measure and assess them separately.

Second, our analysis does not distinguish between formal and informal (non-registered) entrepreneurship. It seems to be clear that their characteristics are completely different and that the ventures that take place outside the official economy are more often necessity-driven and would be of lower quality. By way of example, the literature has shown that an improvement of the quality of formal institutions leads to an increase in the level of formal compared to informal entrepreneurship (Autio and Fu, 2015; Dau and Cuervo-Cazurra, 2014) and that the level of informal entrepreneurship is dependent on industry conditions (Siqueira et al., 2016). Nevertheless, a deeper analysis of their differences would increase our comprehension of opportunity entrepreneurship.

Third, our empirical analysis has been performed through the use of GEM data. This has the advantage of providing us with a wide variety of cultural contexts, which is the exception in studies that relate entrepreneurship and institutional theory (Bruton et al., 2010). However, GEM data are not free from criticism. For example, GEM coverage – at least at the beginning of the project – is slightly biased toward developed countries, which might limit the variability of our independent variables. It is true that the sample has been widened in recent years so we can expect a more homogeneous representativeness in the near future. Our hope is that entrepreneurship scholarship will develop and test more complex measures that improve the accuracy of the findings.

Fourth, culture is assumed to be a construct that is extremely stable over time. Hofstede (1980, 2001) gathered the information used to develop his first set of indicators in the late 70s and revised it in the late 90s. However, it can be argued that, in a highly dynamic world, cultural patterns may evolve over time (Inglehart and Baker, 2000), which raises concerns about whether the indices collected by Hofstede a few decades ago are still relevant (Jones, 2007). As a consequence, future research should make additional efforts to update (or complete) these indicators with the aim of taking new cultural patterns into account in a landscape that is becoming more and more global.

Fifth, we analyze culture at the national level to predict rates of opportunity entrepreneurship also at national level. However, culture is a multi-level construct that ranges from the macro to the individual level (Erez and Gati, 2004). The effects of culture at the individual level remain largely understudied. Subsequent analysis should explore the role of culture at the individual level as a possible moderator between formal institutions and opportunity entrepreneurship. Similarly, our macro-level analysis is centered on the institutional side. However, there are probably other macro dimensions that may influence the propensity toward opportunity entrepreneurship; thus, future research would benefit from identifying new, potentially relevant, variables.

Finally, although our work considers a moderating relationship between formal and informal institutions and we find strong empirical evidence that confirms this relationship, we do not investigate whether formal institutions mediate the relationship between culture and opportunity entrepreneurship. Exploring mediation relationships would be a promising area for future research (Holmes et al., 2013).

We acknowledge financial support from the Spanish Ministry of Economy and Competitiveness and FEDER (project ECO2014-53904-R) and the Regional Government of Aragón and European Social Fund (project S09). Fuentelsaz also acknowledges support from Salvador de Madariaga program (Grant PRX15/00142). We also thank Elisabet Garrido and Martín Larraza and Tomasz Mickiewicz for their insightful comments as well as seminar audiences at Aston University and XXIV ACEDE Conference. Any errors remain our sole responsibility.