We analyse complementarity between different knowledge sources (internal, external and/or cooperation) employing a wide range of innovation performance measures (product, process, organizational, and commercial). The empirical study uses 2014 Spanish CIS data and studies complementarities by performing conditional complementarity/substitutability tests. The results show evidence of conditional complementarity in product innovation performance between external and internal knowledge sources in absence of cooperation and of conditional substitute relationship between external and cooperation knowledge sources in presence of internal source. In product and process innovation performance we found a conditional substitute relationship between internal and cooperation sources when external source is used and not used, respectively. This relationship turns to conditional complementarity in organisational innovation in absence of external knowledge source. Therefore, when designing innovation strategy, managers must consider their objectives on a priority basis, since not all the strategies have the same effects on innovation performance.

Companies have gradually abandoned the concept of knowledge generation as a purely internal process and tend to combine different sources in order to achieve all the capabilities needed to optimize their innovation activity (Teece, 1986; Hartung and MacPherson, 2000; Rigby and Zook, 2002). Although the idea that firms benefit from complementing internal with external knowledge sources is well accepted in the previous extensive literature on this topic (for example Cassiman and Veugelers, 2006; Schmiedeberg, 2008; Ballot et al., 2015), a closer look reveals that existing papers about complementarity on innovation knowledge sources have offered an incomplete view of the topic, generating inconsistent results (Krzeminska and Eckert, 2016), a fact that suggests the need of more research about this issue.

Firstly, and in spite of the potential benefits of R&D cooperation source on innovation performance, our literature review has identified only one paper (Cassiman and Veugelers, 2002) that analyses complementarity considering all the available knowledge sources for a firm: internal (the firm generates and integrates new knowledge on its own), external (the firm accesses external knowledge trough contractual arrangements in the market in order to gain knowledge unrelated to the firm's current areas of knowledge or to use knowledge that advances its existing technologies and products) and cooperation (the firm carries out innovation activities together with other partners). Consequently, a research gap exists regarding the analysis of complementary or substitute relationships considering all the three available knowledge sources for a firm. Secondly, although it is very difficult for a single measurement to capture all the complexity of innovation (Souitaris, 2002; Martinez-Sanchez et al., 2009), to date only few studies perform complementarity analysis of knowledge sources on more than one innovation performance measurement (Beneito, 2006; Schmiedeberg, 2008; Goedhuys and Veugelers, 2012; Ballot et al., 2015; Krzeminska and Eckert, 2016). Despite this scarcity in the variety of performance measurements, in some cases the opposite results reported in terms of complementarity (Schmiedeberg, 2008; Jirjahn and Kraft, 2006; Love and Roper, 1999, 2001) could be dependent on the type of performance measurement used, a factor that suggests the need for more research on the issue.

Given this situation the main objective of this paper is to study the existence of complementarity on innovation performance between the three innovation knowledge sources (internal, external and cooperation) employing different measures of innovation performance. We use data from Spanish companies collected by the Technology Innovation Panel (PITEC) as part of the Community Innovation survey (CIS) for the year 2014. The present work aims to provide a more comprehensive and integrated vision of this issue, contributing to existing literature along two directions. Firstly, the paper extends the analysis of complementary or substitutability relationships between internal and external knowledge sources to the R&D cooperation source. In our analysis, and in line with recent research (Ballot et al., 2015; Guisado-González et al., 2017), we adopt the supermodularity framework to directly study complementarities between more than two variables performing conditional complementarity tests. Secondly, the paper performs complementarity of knowledge sources incorporating a wider range of innovation performance measurements, some of them scarcely used in previous studies, such as those of organizational and commercial innovation, in order to investigate the possible effect of the performance variable on the results obtained in terms of complementarity or substitutability between knowledge sources.

In order to achieve our objectives, the next section of the paper deals with the review of literature on the subject. The third section presents a theoretical and methodological discussion of complementarity. The fourth section presents the data source and variables and fifth section presents the results, while the final section concludes.

Literature review on complementarity of innovation knowledge sourcesIn the literature analysing the relationship between knowledge sources and innovation outputs a significant strand has emerged focused of studying whether innovation knowledge sources are bound together by a complementarity o substitutability relationship (Catozzella and Vivarelli, 2014a), revealing the existence of various arguments and mixed empirical evidence in favour of the one or the other.

Beginning with the theoretical arguments supporting the complementarity nature between innovation knowledge sources – the simultaneous adoption of different sources being more valuable than the use of each of them separately –, a relevant factor is the existence of what Cohen and Levinthal (1990) called “absorptive capacity” within the Organization Industrial Theory. This concept shows that external knowledge source is more effective for the innovation process when the firm engages in its own R&D, which allows the firm to absorb, evaluate and use that external information (Cohen and Levinthal, 1990; Arora and Gambardella, 1994). Mowery and Rosenberg (1989), for their part, propose that cooperative research programs alone are insufficient, and firms also need the development of sufficient internal expertise to utilize the results of external research.

Along this line, Rigby and Zook (2002) argue that the ability to open innovation processes to external flows of knowledge – known as “open innovation” (Chesbrough, 2003a,b) – is a critical new source of competitive advantage, an approach shared from the perspective of Resource-Based View. The statement is based upon the argument that the combination of various sources for the development of innovation facilitates the construction of new organizational competencies (Teece, 1986). Companies with higher levels of absorptive capacity are more likely to generate competitive advantages, which may in turn positively reflect on the company's innovation performance (Damanpour et al., 2009).

These theoretical arguments are empirically supported in Veugelers and Cassiman (1999), Cassiman and Veugelers (2006), Hageedoorn and Wang (2012) and Catozzella and Vivarelli (2014a,b) for complementarity between internal and external knowledge sources, and in Cassiman and Veugelers (2002) for complementarity between internal R&D and cooperation. However, the empirical results in Berchicci (2013), suggest that the substitution effect is larger for firms with greater internal innovation capacity.

The literature has also shown arguments supporting the substitutability between innovation knowledge sources. Thus, the Transaction Costs Economics (TCE) has focused particularly on the choice between internal and external development, which is known as “Make or buy decision” (Veugelers and Cassiman, 1999). According to this theory, the choice of the innovation strategy, defined as a combination of one or more innovation knowledge sources, is determined for the costs and risks associated with each strategy. On the one hand, the external knowledge source allows firms to access to externally available specialist know-how, to attain the economies of scale associated with specialization (Veugelers and Cassiman, 1999) and to eliminate the costs and risks associated with internal development (Chen and Yuan, 2007), which are generally higher than those derived from acquisition (Beneito, 2003). On the other hand, the presence of high levels of complexity, specificity and uncertainty associated with R&D, and the possibility of opportunistic behavior in transactions – ‘ex ante’ in terms of search and negotiation and ‘ex post’ to execute and enforce the contract (Veugelers and Cassiman, 1999; Chen and Yuan, 2007) reduces the potential benefits of the external source, making the internal source more efficient (Williamson, 1985). Some authors suggest that firms with stronger innovation capabilities would be less likely to take from external sources (including cooperation) the knowledge needed for their innovative activities (Arora and Gambardella, 1994). Pisano (1990) and Schmiedeberg (2008) provided empirical evidence supporting that firms tend to use only in-house R&D when they have accumulated internal experience. This also finds empirical support in Love and Roper (1999, 2001). Finally, and regarding to cooperation, TCE suggests that firms engage in cooperative activities to achieve the best balance between cost and risks that are associated with the development of new products or processes (Jirjahn and Kraft, 2006). The theoretical arguments about the negative influence of the costs and risks on complementarity are supported by empirical evidence in Veugelers and Cassiman (1999) for the case of costs.

The Industrial Organization Theory also focuses in the effect of two types of spillovers (Belderbos et al., 2004b): incoming spillovers (external information flows to the firm that increase the interest of the cooperation for it) and outgoing spillovers (flows of information coming out of the company by imperfect protection mechanisms, thus limiting the suitability of the results of their innovation processes). Most theoretical models suggests that firms “manage” these flows of knowledge (Cassiman and Veugelers, 2002) to maximize input spillovers and minimize output spillovers (Cassiman et al., 2002; Amir et al., 2003; Belderbos et al., 2004a,b).

For what concerns the input spillovers the available evidence indicates that their existence reduces the use of internal sources in the receiving company, which may suggest that internal and external knowledge sources would substitute (Veugelers, 1997). Continuing with output spillovers, Industrial Organization literature posits that those companies that are not able to appropriate their innovation, either by ways of legal protection or the strategic protection (Veugelers and Cassiman, 1999, 2005; Lopez, 2008), tend to decrease the use of internal sources and therefore the internal, external and cooperation knowledge sources tend to be substitutes. However, Cassiman and Veugelers (2002, 2006) find that the effectiveness of the protection regime of innovations positively affects the complementarity between internal and external knowledge sources.

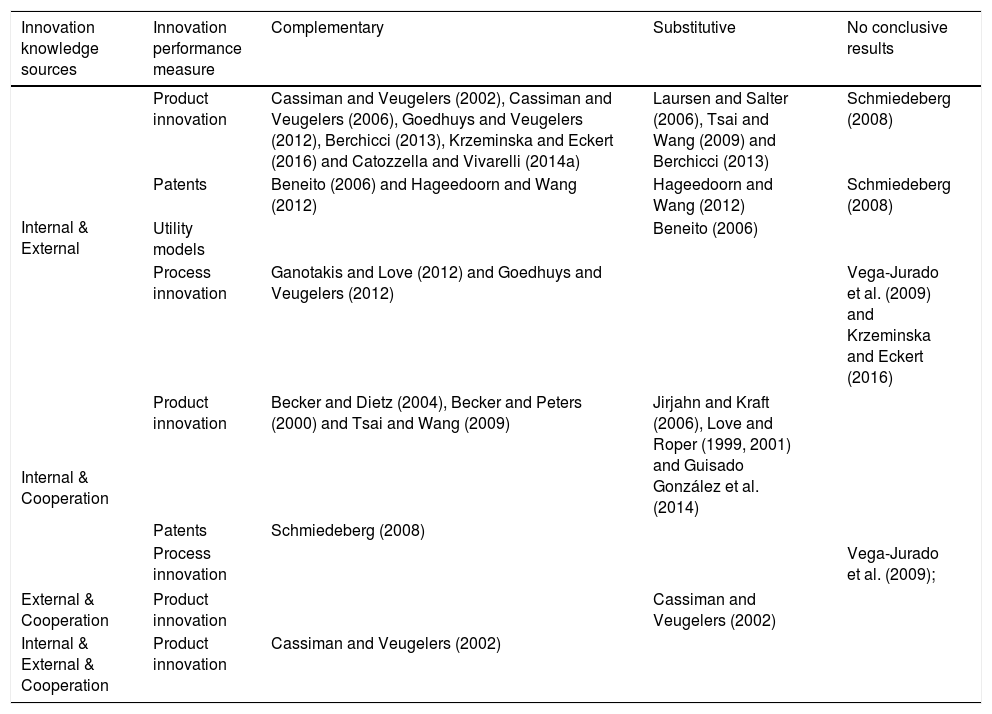

With regards to the empirical evidence available about complementarity of knowledge sources, our literature review, which is presented in Table 1, shows that it presents some limitations. Firstly, it provides an incomplete picture of the research problem. Thus, most studies have mainly focused on the complementarity between internal and external knowledge sources (Love and Roper, 1999, 2001; Becker and Peters, 2000; Becker and Dietz, 2004; Tsai and Wang, 2009; Vega-Jurado et al., 2009), with almost no papers (Cassiman and Veugelers, 2002) analysing the effects of the combined use of all the possible innovation knowledge sources available for a firm. Table 1 also reveals that the variety of performance measurements used in the studies of complementarity is limited, in line with a historical technological imperative on innovation research (Damanpour et al., 2009) more focused on a narrow definition of product and process innovations associated with R&D activities in manufacturing organizations. This fact has led to a majority of papers using performance measurements focused on product development (for example, Cassiman and Veugelers, 2002, 2006; Becker and Dietz, 2004; Jirjahn and Kraft, 2006; Laursen and Salter, 2006; Tsai and Wang, 2009; Guisado González et al., 2014). Less consideration is given to patents, utility models or process innovation (Beneito, 2006; Schmiedeberg, 2008; Hageedoorn and Wang, 2012) and a practically total absence of performance measurements exists in terms of organizational (Lam, 2005; Ballot et al., 2015) or marketing innovation. However, the relevance of these types of innovation has been identified from the seminal Schumpeterian definition of innovation (Schumpeter, 1934) and the socio-technical system theory (Damanpour and Evan, 1984; Trist and Murray, 1993), which argues that changes in both the technical and social system of the organization are necessary to optimize organizational outcome. For this reason, we have introduced in the study a wide range of measures in order to record all possible types of innovation performance (product, process, organizational and commercial).

Literature review on complementarity of innovation knowledge sources.

A second important limitation of the existing literature about complementarity is that it offers conflicting results. Thus, while some studies suggest the existence of complementary relationships between some of the knowledge sources, other studies have found them to be substitutes or even have found no conclusive empirical evidence (see Table 1).

Furthermore, there are new empirical evidence in the literature suggesting that instead of a clear-cut answer to the question of whether internal and external knowledge sources are complements or substitutes, there appears to be a contingent relationship between internal and external knowledge sources in shaping a firm's innovative output (Hageedoorn and Wang, 2012; Berchicci, 2013). On the one hand, Hageedoorn and Wang (2012) find that internal and external knowledge sources are complementary at higher levels of in-house R&D investments, whereas at lower levels of in-house R&D efforts, internal and external sources turn out to be substitutive options. On the other hand, Berchicci (2013) suggests that internal and external knowledge sources are complementary up to a point after which they are substitutes and that the substitution effect is larger for firms with greater internal innovation capacity.

Several factors could be explanatory reasons for these inconsistencies found in the empirical literature. Firstly, in some cases the opposite results obtained could be dependent on the type of performance measurement used. For example, complementarity between internal and external sources measured through patents turns into substitutability when the measure used are utility models (Beneito, 2006), or complementarity between internal and cooperation knowledge sources measured through patents (Schmiedeberg, 2008) becomes substitutability when the measure used is product innovation (Jirjahn and Kraft, 2006; Love and Roper, 1999, 2001; Guisado González et al., 2014). This aspect suggests the need to increase the number of innovation performance variables analysed in the studies in order to: (a) include variables related to organizational or commercial innovation performance and (b) confirm the effect of the performance variable used on the results obtained in terms of complementarity or substituibility between knowledge sources.

Secondly, Table 1 also reveals that in other cases, for example when the performance measure is product innovation, both complementarity and substitutability is confirmed between internal and external sources, on the one hand, and between internal and cooperation sources, on the other. This circumstance makes necessary to deepen in the research on complementarity of knowledge sources to confirm the theoretical arguments and empirical findings which are present in the literature on this issue.

Discussion of complementarityThe concept of complementarity implies that the innovation performance derived of using one innovation knowledge source is higher if the complementary source is present at the same time and vice versa. In other words, the concept of complementarity suggests that the benefit derived from the simultaneous combination of two or more activities is greater than the sum of the benefits to do just one or the other (Doran, 2012; Guisado-González et al., 2017).

From the standard analytical test of complementarity proposed in the seminal study by Milgrom and Roberts (1995), either an indirect (adoption) or a direct (productivity) empirical testing procedure have been developed (for an overview see Athey and Stern, 1998).

The “indirect approach” tests the implications of complementarity instead of complementarity in itself (Catozzella and Vivarelli, 2014a): if alternative individual knowledge sources are complements, it would be expected that firms adopt either both or none of them, in other words it would be expected the existence of a positive correlation between the adoption of these individual sources. However, common unobserved factors may have an influence on the sign and magnitude of the correlation, so it is necessary to control for exogenous factors, although the problem of further unobserved heterogeneity – firm and industry characteristics – still remains (Schmiedeberg, 2008). Arora and Gambardella (1994) solve this last problem by regressing separately each knowledge source on the assumed exogenous control variables: positive conditional correlation coefficients between the error terms of the regressions are a necessary condition for two inputs to be complementary. However, this procedure does not address the possibility of indirect effects acting through endogenous factors.

Alternatively, the “direct approach”, tests the existence of complementarities in performance by regressing a measure of innovation performance on the entire set of individual knowledge sources and their different combinations. The direct approach has been used in previous works for testing complementarities between internal and external or internal and cooperation (i.e. Cassiman and Veugelers, 2006; Schmiedeberg, 2008; Krzeminska and Eckert, 2016) as well as between internal, external and cooperation knowledge sources (Cassiman and Veugelers, 2002).

In order to avoid severe multicollinearity problems, this approach can only be tested introducing the innovation knowledge sources as discrete-choice variables (“yes” or “no”, instead of “how much”) and using them to create mutually exclusive categories identifying all the possible combinations of sources (Catozzella and Vivarelli, 2014a). However, using this interaction terms approach when analysing complementarities between more than two innovation knowledge sources makes interpretation based on the numerous interaction terms difficult (Ballot et al., 2015). Furthermore, as some authors point (Ai and Norton, 2003; Hoetker, 2007) in nonlinear models the sign of the interaction coefficient may not indicate the direction of the interaction effect and the significance cannot be determined by the significance of the interaction coefficient (Hoetker, 2007). In fact, the effect of the interaction is a function not only of the coefficient for the interaction but also can differ across observations (Huang and Shields, 2000).

To overcome this limitation, Mohnen and Roller (2005) suggest that the best approach to directly test the effect of complementarities is to investigate whether the innovation function is supermodular, and in doing so they developed tests for both super and submodularity.

Following this approach, this paper studies the existence of complementarities on innovation performance between innovation knowledge sources within the supermodularity framework proposed by Milgrom and Roberts (1990), and extended by Mohnen and Roller (2005) to study complementarities between more than two variables, as is the case of our paper. With regards to the analysis for both super and submodularity, and following Ballot et al. (2015) or Guisado-González et al. (2017) our focus is on conditional complementarity (substitutability) tests.

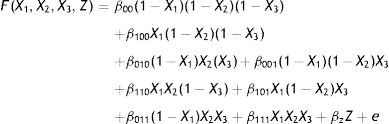

First, this approach requires to establish an objective function. In this case X1, X2 and X3 are three innovation knowledge sources, Z is a vector of exogenous variables and e is the error term. Assume that X1, X2 and X3 are dichotomous choices that take value 1 if they are adopted by the firm and value 0 if they are not:

In order to estimate the effect of the mutually exclusive combination of knowledge sources on our innovation performance measures – Prodinno, Procinno, Orginno and Markinno – the methodology has been based on a probit regression model. We regress the four innovation performance measures on the set of state dummies identifying all the mutually exclusive innovation strategies as well as on a set of both general and innovation firm characteristics.1

Second, after regressing the eight combinations of exclusive knowledge sources on our innovation performance measures, the estimated coefficients of these combinations can be used to perform the complementarity (substitutability) tests, based upon the supermodularity methodology. In doing so, as Ballot et al. (2015) propose, it is possible to test first for unconditional complementarity for each pair of innovation knowledge sources, and then for conditional complementarity.

Beginning with the unconditional complementarities, each pair of variables (internal and external, internal and external and external and cooperation) need to be tested for a pair of inequality restrictions (Ballot et al., 2015). In other words, if there are k variables, the number of non-trivial inequalities to be tested will be 2k−2∑i=1k−1i (Topkis, 1978). Since we have three variables in our analysis, the number of restrictions to be tested will be six.

The strict supermodularity conditions to be tested are:

If the two restrictions for each pair of variables are simultaneously accepted the performance function is supermodular in those variables, and then we can say that they are unconditional complements, thus the complementarity occurs independently of the absence or presence of the third variable. The inequalities of submodularity are easily obtained by replacing ‘>’ with ‘<’.

In order to test for strict supermodularity Wald tests and the methodology by Kodde and Palm (1986) must be applied. They compute lower and upper bound critical values for this test. However, since unconditional tests are often inconclusive, as in Leiponen (2005), Love and Roper (2009), Strube and Resende (2009), Doran (2012) or Ballot et al. (2015), Ballot et al. (2015) propose testing conditional complementarity, an approach that might be more informative, especially when studying complementarity between more than two variables as in the present paper. Then, we focus on conditional tests as Ballot et al. (2015) or Guisado-González et al. (2017).

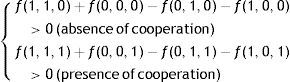

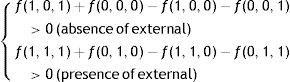

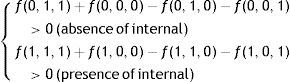

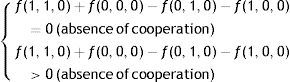

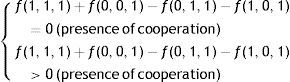

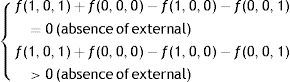

This conditional complementarity procedure implies testing separately pair wise complementarities conditional on the absence of the third innovation knowledge source, and then on the presence of this third source. The empirical conditions for complementarity between internal and external innovation knowledge sources are:

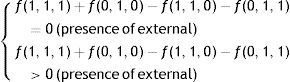

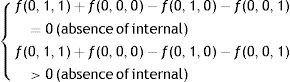

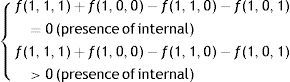

for internal and cooperation:and for external and cooperation:Following Guisado-González et al. (2017) for each pair of variables it is checked first whether the two types of innovation knowledge sources of innovation analyzed have a relationship between them. If the test indicates that the relationship is statistically significant, then we perform a second test in order to confirm whether this relationship is complementary or substitutive.

Data source and variablesData sourceOur empirical analysis has been conducted based on data from the Survey of Innovation Technology Companies for 2014, available in the Technology Innovation Panel (PITEC). The Survey is part of the Community Innovation Survey (CIS) and was carried out according to the methodological guidelines set out in the Oslo Manual (OECD, 1997, 2005).

The number of companies in the Survey amounts to 12,843. Of these, 4885 can be classified as innovators, and it is this group that constitutes the sample used in the empirical study. Innovators are identified by the answer to the questions regarding whether they introduced a product, process, organizational and/or a marketing innovation in the previous two years.

VariablesDependent variablesWe have selected measures of innovation performance in terms of results according to the Third Edition of the Oslo Manual, which expands their measurement framework including organizational innovation and marketing innovation in addition to traditional product innovation and process innovation. This is reflected in CIS surveys after this moment allowing the inclusion, for the first time, of these variables in research studies.

Accordingly we have constructed four dummy variables depending upon whether the company has introduced a product innovation (Prodinno), a process innovation (Procinno), an organizational innovation (Orginno), or a marketing innovation (Markinno). These variables are measured similar to those used in Chang (2003) and Vega-Jurado et al. (2009).

Independent variablesThe independent variables represent three innovation knowledge sources – internal, external and cooperation – and all their exclusive combinations that are used for the development of innovation activities by companies. In relation to the internal knowledge source, the PITEC posed four questions (0 no, 1 yes). In more concrete terms companies are asked if during the period of analysis they carried out internal R&D activities, internal training for innovation activities, developed internally activities in order to introduce innovations to the market or design other improvements to production or distribution (not including R&D) with the aim of developing or improving their products or processes. In relation to the external knowledge source, the PITEC posed five questions (0 no, 1 yes): whether the firm purchased R&D, acquired machinery, equipment, hardware or software and buildings, acquired other external knowledge for innovation, external training for innovation activities, or developed externally activities in order to introduce innovations to the market. In both cases if the answer to at least one of the questions was affirmative we considered that the company used the internal or external knowledge source for the development of innovation activities, respectively. Finally, in relation to the cooperation knowledge source, the PITEC posed one question (0 no, 1 yes): whether the firm had cooperated with any other companies or entities in order to develop innovation activities. For the estimations the following 8 exclusive knowledge source strategies are included in the model: Only Internal (1,0,0), Only External (0,1,0), Only Cooperation (0,0,1), Internal & External (1,1,0), Internal & Cooperation (1,0,1), External & Cooperation (0,1,1), Internal & External & Cooperation (1,1,1), and Neither (0,0,0).

Control variablesAs previous authors suggested (e.g. Cassiman and Veugelers, 2006; Schmiedeberg, 2008; Catozzella and Vivarelli, 2014a) the innovative process is likely to be affected by both general and innovation firm characteristics.

Beginning with the “general firm characteristics” these variables are: Size, Industry dummies, Export intensity and Group.

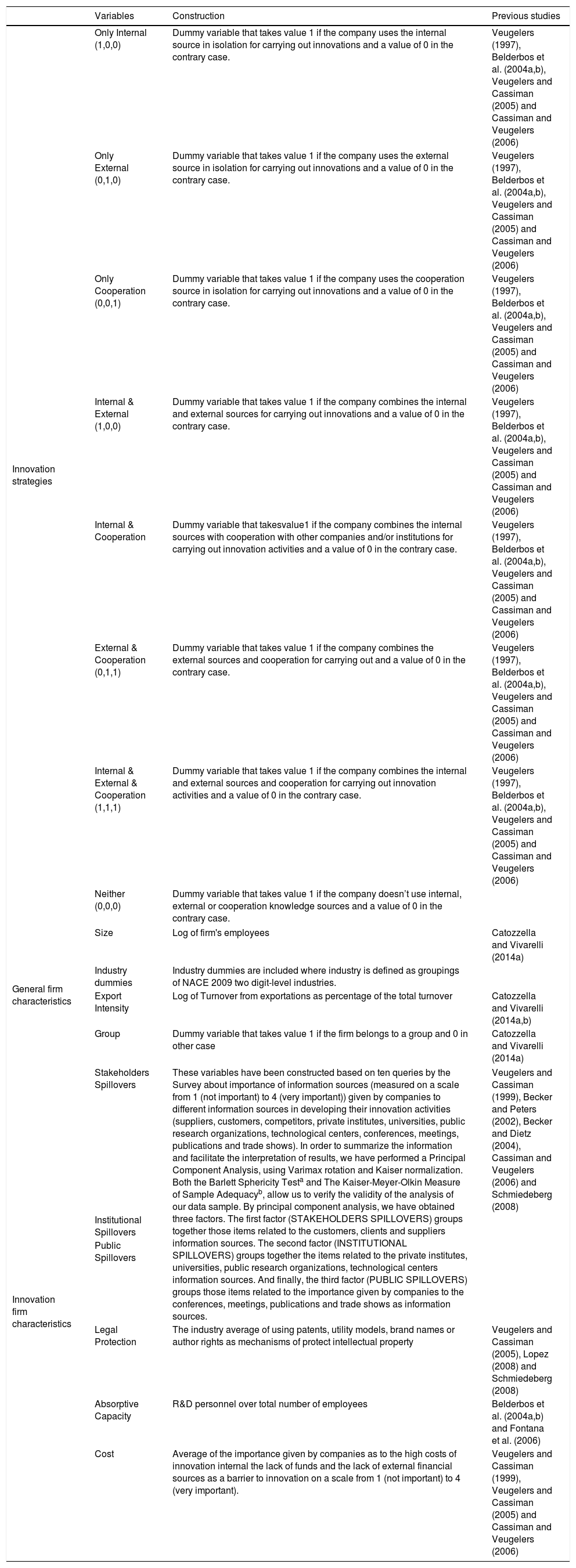

Following with the “innovation firm characteristics” the selected variables are key factors identified by previous literature that could explain complementarity, such as Stakeholder Spillovers, Institutional Spillovers, Public Spillovers, Legal Protection, Absorptive Capacity and Cost. The information about independent and control variables is summarized in Table 2.

Independent and control variables used in the empirical study.

| Variables | Construction | Previous studies | |

|---|---|---|---|

| Innovation strategies | Only Internal (1,0,0) | Dummy variable that takes value 1 if the company uses the internal source in isolation for carrying out innovations and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) |

| Only External (0,1,0) | Dummy variable that takes value 1 if the company uses the external source in isolation for carrying out innovations and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| Only Cooperation (0,0,1) | Dummy variable that takes value 1 if the company uses the cooperation source in isolation for carrying out innovations and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| Internal & External (1,0,0) | Dummy variable that takes value 1 if the company combines the internal and external sources for carrying out innovations and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| Internal & Cooperation | Dummy variable that takesvalue1 if the company combines the internal sources with cooperation with other companies and/or institutions for carrying out innovation activities and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| External & Cooperation (0,1,1) | Dummy variable that takes value 1 if the company combines the external sources and cooperation for carrying out and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| Internal & External & Cooperation (1,1,1) | Dummy variable that takes value 1 if the company combines the internal and external sources and cooperation for carrying out innovation activities and a value of 0 in the contrary case. | Veugelers (1997), Belderbos et al. (2004a,b), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

| Neither (0,0,0) | Dummy variable that takes value 1 if the company doesn’t use internal, external or cooperation knowledge sources and a value of 0 in the contrary case. | ||

| General firm characteristics | Size | Log of firm's employees | Catozzella and Vivarelli (2014a) |

| Industry dummies | Industry dummies are included where industry is defined as groupings of NACE 2009 two digit-level industries. | ||

| Export Intensity | Log of Turnover from exportations as percentage of the total turnover | Catozzella and Vivarelli (2014a,b) | |

| Group | Dummy variable that takes value 1 if the firm belongs to a group and 0 in other case | Catozzella and Vivarelli (2014a) | |

| Innovation firm characteristics | Stakeholders Spillovers | These variables have been constructed based on ten queries by the Survey about importance of information sources (measured on a scale from 1 (not important) to 4 (very important)) given by companies to different information sources in developing their innovation activities (suppliers, customers, competitors, private institutes, universities, public research organizations, technological centers, conferences, meetings, publications and trade shows). In order to summarize the information and facilitate the interpretation of results, we have performed a Principal Component Analysis, using Varimax rotation and Kaiser normalization. Both the Barlett Sphericity Testa and The Kaiser-Meyer-Olkin Measure of Sample Adequacyb, allow us to verify the validity of the analysis of our data sample. By principal component analysis, we have obtained three factors. The first factor (STAKEHOLDERS SPILLOVERS) groups together those items related to the customers, clients and suppliers information sources. The second factor (INSTITUTIONAL SPILLOVERS) groups together the items related to the private institutes, universities, public research organizations, technological centers information sources. And finally, the third factor (PUBLIC SPILLOVERS) groups those items related to the importance given by companies to the conferences, meetings, publications and trade shows as information sources. | Veugelers and Cassiman (1999), Becker and Peters (2002), Becker and Dietz (2004), Cassiman and Veugelers (2006) and Schmiedeberg (2008) |

| Institutional Spillovers | |||

| Public Spillovers | |||

| Legal Protection | The industry average of using patents, utility models, brand names or author rights as mechanisms of protect intellectual property | Veugelers and Cassiman (2005), Lopez (2008) and Schmiedeberg (2008) | |

| Absorptive Capacity | R&D personnel over total number of employees | Belderbos et al. (2004a,b) and Fontana et al. (2006) | |

| Cost | Average of the importance given by companies as to the high costs of innovation internal the lack of funds and the lack of external financial sources as a barrier to innovation on a scale from 1 (not important) to 4 (very important). | Veugelers and Cassiman (1999), Veugelers and Cassiman (2005) and Cassiman and Veugelers (2006) | |

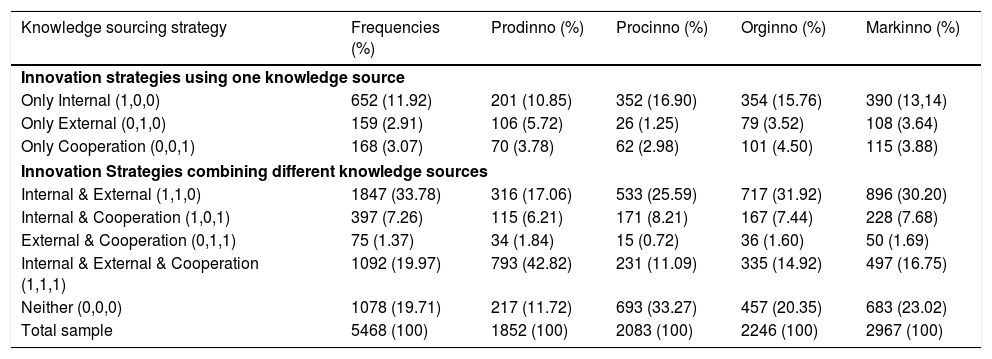

We begin this section by commenting on the exclusive knowledge sourcing strategies chosen by Spanish companies, based on the frequency analysis of the companies in our sample (Table 3).

Frequencies and innovation performance conditional on knowledge sourcing strategies.

| Knowledge sourcing strategy | Frequencies (%) | Prodinno (%) | Procinno (%) | Orginno (%) | Markinno (%) |

|---|---|---|---|---|---|

| Innovation strategies using one knowledge source | |||||

| Only Internal (1,0,0) | 652 (11.92) | 201 (10.85) | 352 (16.90) | 354 (15.76) | 390 (13,14) |

| Only External (0,1,0) | 159 (2.91) | 106 (5.72) | 26 (1.25) | 79 (3.52) | 108 (3.64) |

| Only Cooperation (0,0,1) | 168 (3.07) | 70 (3.78) | 62 (2.98) | 101 (4.50) | 115 (3.88) |

| Innovation Strategies combining different knowledge sources | |||||

| Internal & External (1,1,0) | 1847 (33.78) | 316 (17.06) | 533 (25.59) | 717 (31.92) | 896 (30.20) |

| Internal & Cooperation (1,0,1) | 397 (7.26) | 115 (6.21) | 171 (8.21) | 167 (7.44) | 228 (7.68) |

| External & Cooperation (0,1,1) | 75 (1.37) | 34 (1.84) | 15 (0.72) | 36 (1.60) | 50 (1.69) |

| Internal & External & Cooperation (1,1,1) | 1092 (19.97) | 793 (42.82) | 231 (11.09) | 335 (14.92) | 497 (16.75) |

| Neither (0,0,0) | 1078 (19.71) | 217 (11.72) | 693 (33.27) | 457 (20.35) | 683 (23.02) |

| Total sample | 5468 (100) | 1852 (100) | 2083 (100) | 2246 (100) | 2967 (100) |

The majority of the firms in our sample (62.38%) develop innovation strategies that combine different innovation knowledge sources. Regarding the strategies combining different sources, the most used combination is Internal & External (33.78% of our total sample) followed by Internal & External & Cooperation (19.97%), and Internal & Cooperation (7.26%).

Table 3 also shows the innovation performance in terms of product, process, organizational and commercial innovation conditional on the firm's chosen knowledge sourcing strategy. These preliminary results suggest that, regardless the performance measurement considered, firms relying on both internal and external knowledge sources are more successful than those relying exclusively on innovation strategies that use only one individual knowledge source. The same occurs for the combination of internal, external and cooperation for the case of product and marketing innovation, and the combination of internal and cooperation knowledge sources, with the exception of only internal.

These preliminary results would be in line with the suggestions of some authors (Rosenbusch et al., 2011) regarding the idea that innovative orientation may facilitate the development of relevant innovations by enabling the company to benefit from access to a diverse range of sources of ideas that allows the integration of different knowledge bases, behaviors and routines (Pittaway et al., 2004). Therefore, from this argument it could be expected that the combination of a large number of sources has a positive effect on the development of all types of relevant innovations, as confirmed by our study.

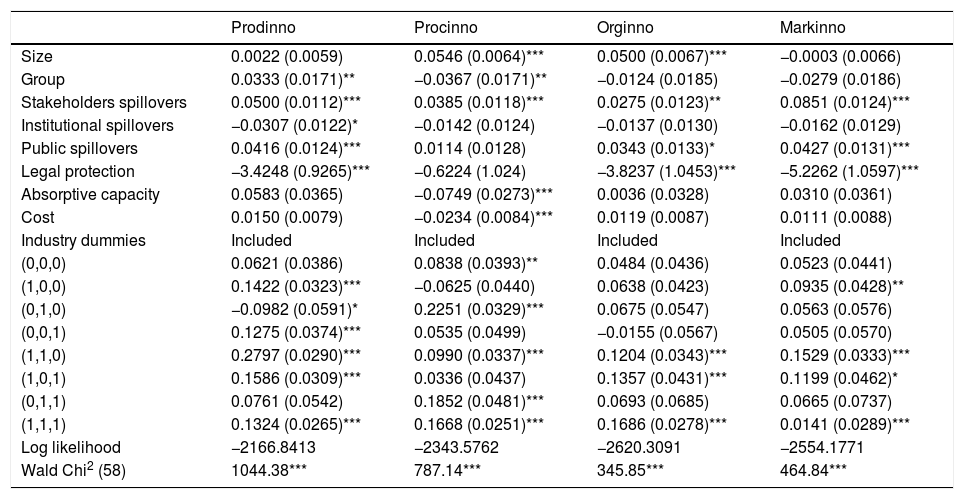

Following with the supermodularity (submodularity) tests for the analysis of complementarities between innovation knowledge sources, Table 4 allows us to observe the effect of both general and innovation firm characteristics on performance.

Estimates on innovation performance (marginal effects).

| Prodinno | Procinno | Orginno | Markinno | |

|---|---|---|---|---|

| Size | 0.0022 (0.0059) | 0.0546 (0.0064)*** | 0.0500 (0.0067)*** | −0.0003 (0.0066) |

| Group | 0.0333 (0.0171)** | −0.0367 (0.0171)** | −0.0124 (0.0185) | −0.0279 (0.0186) |

| Stakeholders spillovers | 0.0500 (0.0112)*** | 0.0385 (0.0118)*** | 0.0275 (0.0123)** | 0.0851 (0.0124)*** |

| Institutional spillovers | −0.0307 (0.0122)* | −0.0142 (0.0124) | −0.0137 (0.0130) | −0.0162 (0.0129) |

| Public spillovers | 0.0416 (0.0124)*** | 0.0114 (0.0128) | 0.0343 (0.0133)* | 0.0427 (0.0131)*** |

| Legal protection | −3.4248 (0.9265)*** | −0.6224 (1.024) | −3.8237 (1.0453)*** | −5.2262 (1.0597)*** |

| Absorptive capacity | 0.0583 (0.0365) | −0.0749 (0.0273)*** | 0.0036 (0.0328) | 0.0310 (0.0361) |

| Cost | 0.0150 (0.0079) | −0.0234 (0.0084)*** | 0.0119 (0.0087) | 0.0111 (0.0088) |

| Industry dummies | Included | Included | Included | Included |

| (0,0,0) | 0.0621 (0.0386) | 0.0838 (0.0393)** | 0.0484 (0.0436) | 0.0523 (0.0441) |

| (1,0,0) | 0.1422 (0.0323)*** | −0.0625 (0.0440) | 0.0638 (0.0423) | 0.0935 (0.0428)** |

| (0,1,0) | −0.0982 (0.0591)* | 0.2251 (0.0329)*** | 0.0675 (0.0547) | 0.0563 (0.0576) |

| (0,0,1) | 0.1275 (0.0374)*** | 0.0535 (0.0499) | −0.0155 (0.0567) | 0.0505 (0.0570) |

| (1,1,0) | 0.2797 (0.0290)*** | 0.0990 (0.0337)*** | 0.1204 (0.0343)*** | 0.1529 (0.0333)*** |

| (1,0,1) | 0.1586 (0.0309)*** | 0.0336 (0.0437) | 0.1357 (0.0431)*** | 0.1199 (0.0462)* |

| (0,1,1) | 0.0761 (0.0542) | 0.1852 (0.0481)*** | 0.0693 (0.0685) | 0.0665 (0.0737) |

| (1,1,1) | 0.1324 (0.0265)*** | 0.1668 (0.0251)*** | 0.1686 (0.0278)*** | 0.0141 (0.0289)*** |

| Log likelihood | −2166.8413 | −2343.5762 | −2620.3091 | −2554.1771 |

| Wald Chi2 (58) | 1044.38*** | 787.14*** | 345.85*** | 464.84*** |

Statistical significance: at *** 1%, ** 5% and * 10%.

Starting with general firm characteristics, company size confirms a positive effect, in line with previous studies (Camison-Zornoza et al., 2004), in the case of process and organizational innovation performance. As for the membership of a group it confirms a positive effect only on product innovation. However, our results show a significant and negative influence of this variable in terms of process innovation performance and no significant effect in the rest of the cases. These results support the idea that belonging to a group of companies doesn’t facilitate access to the knowledge of other companies within the same group. For the case of Spanish companies these networks don’t seem to be playing an important role in knowledge transmission and innovation, as different authors suggested in other contexts (Castellani and Zanfei, 2006; Frenz and Ietto-Gillies, 2009).

As far as the innovation firm characteristics are concerned, the results demonstrate a positive and significant effect of stakeholders and public spillovers on all the innovation performance measures used. The only exception is for public spillovers and process innovation. A negative and significant effect of institutional spillovers is found for product innovations, and no effect on the rest of innovation performance measures. These results indicate that the effect of these control variables is quite consistent regardless the measurement of innovation performance used in each case. Regarding legal protection, a negative and significant effect is found in all the cases except for process innovation. Finally, and regarding absorptive capacity and cost, in both cases these factors show a significant, and negative, effect when innovation performance is measured in terms of process innovation, losing its significance on the rest of innovation performance measures.

Turning to the main focus of the paper, the study of complementarities between innovation knowledge sources, the estimation of the objective function is needed in order to perform complementarity/substitutability tests in the post-estimation phase, and therefore is not an objective but an instrument. For this reason, and following Guisado-González et al. (2017) we make no comment on the significance of the eight possible innovation strategies on innovation performance.

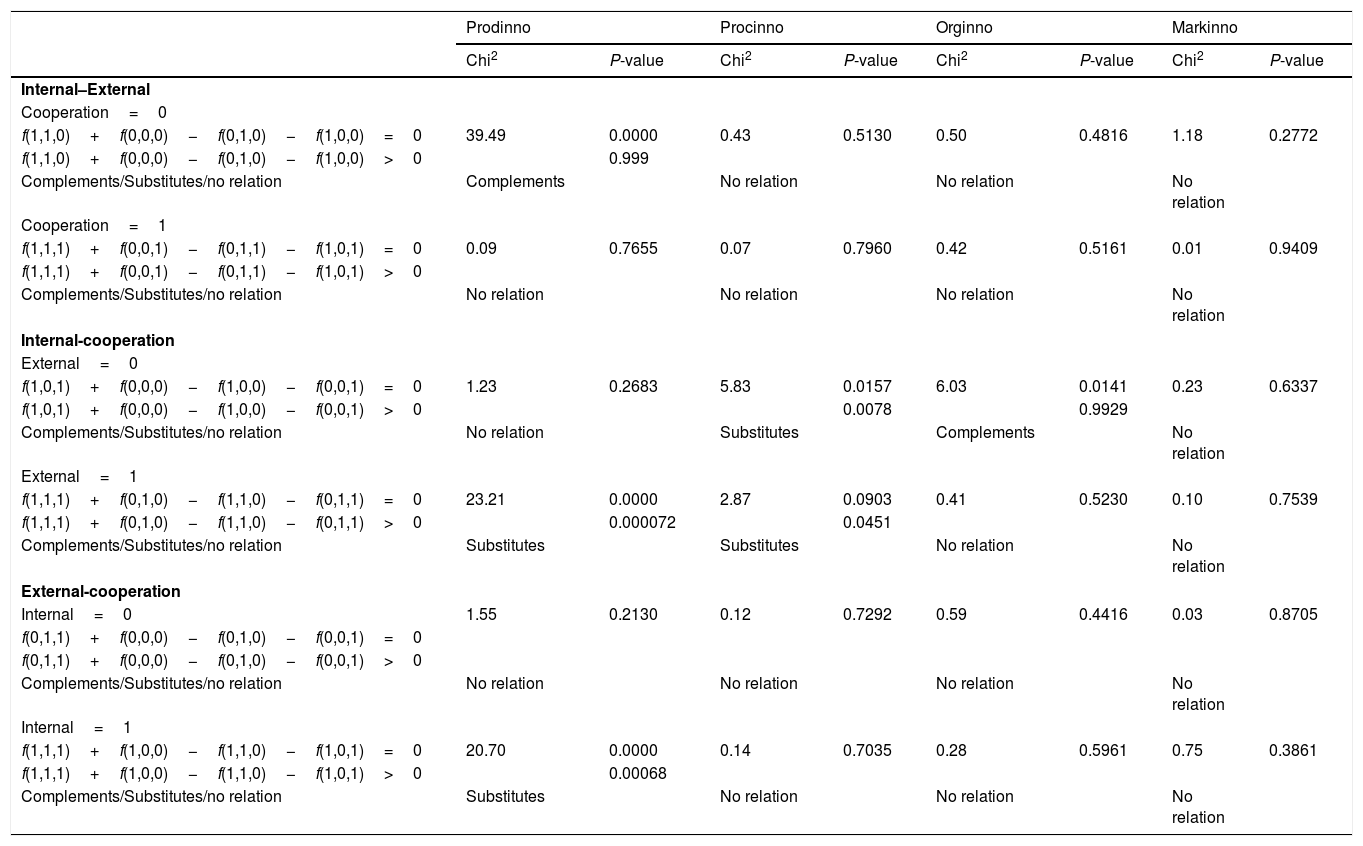

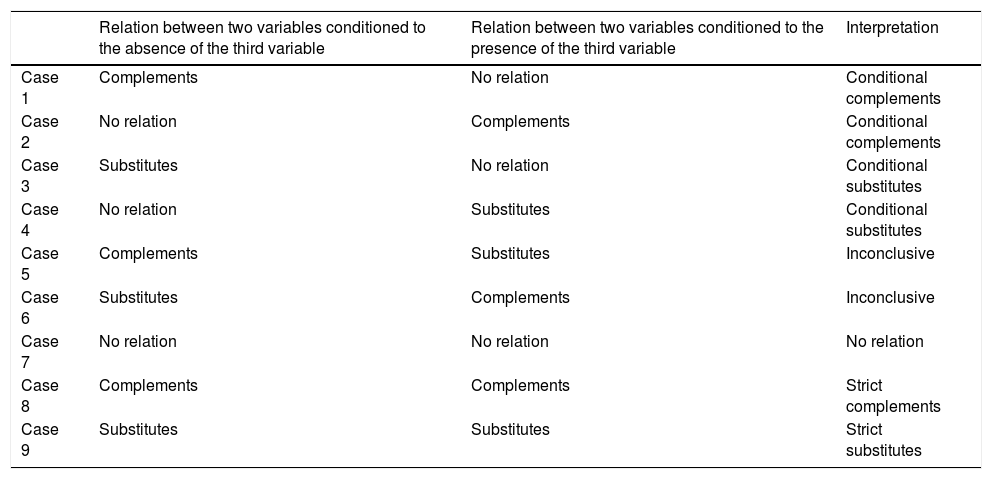

The main results of the complementarity/substitutability tests are summarized in Table 5. For the interpretation of these results Table 6 summarizes the nine possible cases of interpretation we can find.

Complementarity/substitutability tests between innovation knowledge sources.

| Prodinno | Procinno | Orginno | Markinno | |||||

|---|---|---|---|---|---|---|---|---|

| Chi2 | P-value | Chi2 | P-value | Chi2 | P-value | Chi2 | P-value | |

| Internal–External | ||||||||

| Cooperation=0 | ||||||||

| f(1,1,0)+f(0,0,0)−f(0,1,0)−f(1,0,0)=0 | 39.49 | 0.0000 | 0.43 | 0.5130 | 0.50 | 0.4816 | 1.18 | 0.2772 |

| f(1,1,0)+f(0,0,0)−f(0,1,0)−f(1,0,0)>0 | 0.999 | |||||||

| Complements/Substitutes/no relation | Complements | No relation | No relation | No relation | ||||

| Cooperation=1 | ||||||||

| f(1,1,1)+f(0,0,1)−f(0,1,1)−f(1,0,1)=0 | 0.09 | 0.7655 | 0.07 | 0.7960 | 0.42 | 0.5161 | 0.01 | 0.9409 |

| f(1,1,1)+f(0,0,1)−f(0,1,1)−f(1,0,1)>0 | ||||||||

| Complements/Substitutes/no relation | No relation | No relation | No relation | No relation | ||||

| Internal-cooperation | ||||||||

| External=0 | ||||||||

| f(1,0,1)+f(0,0,0)−f(1,0,0)−f(0,0,1)=0 | 1.23 | 0.2683 | 5.83 | 0.0157 | 6.03 | 0.0141 | 0.23 | 0.6337 |

| f(1,0,1)+f(0,0,0)−f(1,0,0)−f(0,0,1)>0 | 0.0078 | 0.9929 | ||||||

| Complements/Substitutes/no relation | No relation | Substitutes | Complements | No relation | ||||

| External=1 | ||||||||

| f(1,1,1)+f(0,1,0)−f(1,1,0)−f(0,1,1)=0 | 23.21 | 0.0000 | 2.87 | 0.0903 | 0.41 | 0.5230 | 0.10 | 0.7539 |

| f(1,1,1)+f(0,1,0)−f(1,1,0)−f(0,1,1)>0 | 0.000072 | 0.0451 | ||||||

| Complements/Substitutes/no relation | Substitutes | Substitutes | No relation | No relation | ||||

| External-cooperation | ||||||||

| Internal=0 | 1.55 | 0.2130 | 0.12 | 0.7292 | 0.59 | 0.4416 | 0.03 | 0.8705 |

| f(0,1,1)+f(0,0,0)−f(0,1,0)−f(0,0,1)=0 | ||||||||

| f(0,1,1)+f(0,0,0)−f(0,1,0)−f(0,0,1)>0 | ||||||||

| Complements/Substitutes/no relation | No relation | No relation | No relation | No relation | ||||

| Internal=1 | ||||||||

| f(1,1,1)+f(1,0,0)−f(1,1,0)−f(1,0,1)=0 | 20.70 | 0.0000 | 0.14 | 0.7035 | 0.28 | 0.5961 | 0.75 | 0.3861 |

| f(1,1,1)+f(1,0,0)−f(1,1,0)−f(1,0,1)>0 | 0.00068 | |||||||

| Complements/Substitutes/no relation | Substitutes | No relation | No relation | No relation | ||||

Possible cases of interpretation of complementarity tests.

| Relation between two variables conditioned to the absence of the third variable | Relation between two variables conditioned to the presence of the third variable | Interpretation | |

|---|---|---|---|

| Case 1 | Complements | No relation | Conditional complements |

| Case 2 | No relation | Complements | Conditional complements |

| Case 3 | Substitutes | No relation | Conditional substitutes |

| Case 4 | No relation | Substitutes | Conditional substitutes |

| Case 5 | Complements | Substitutes | Inconclusive |

| Case 6 | Substitutes | Complements | Inconclusive |

| Case 7 | No relation | No relation | No relation |

| Case 8 | Complements | Complements | Strict complements |

| Case 9 | Substitutes | Substitutes | Strict substitutes |

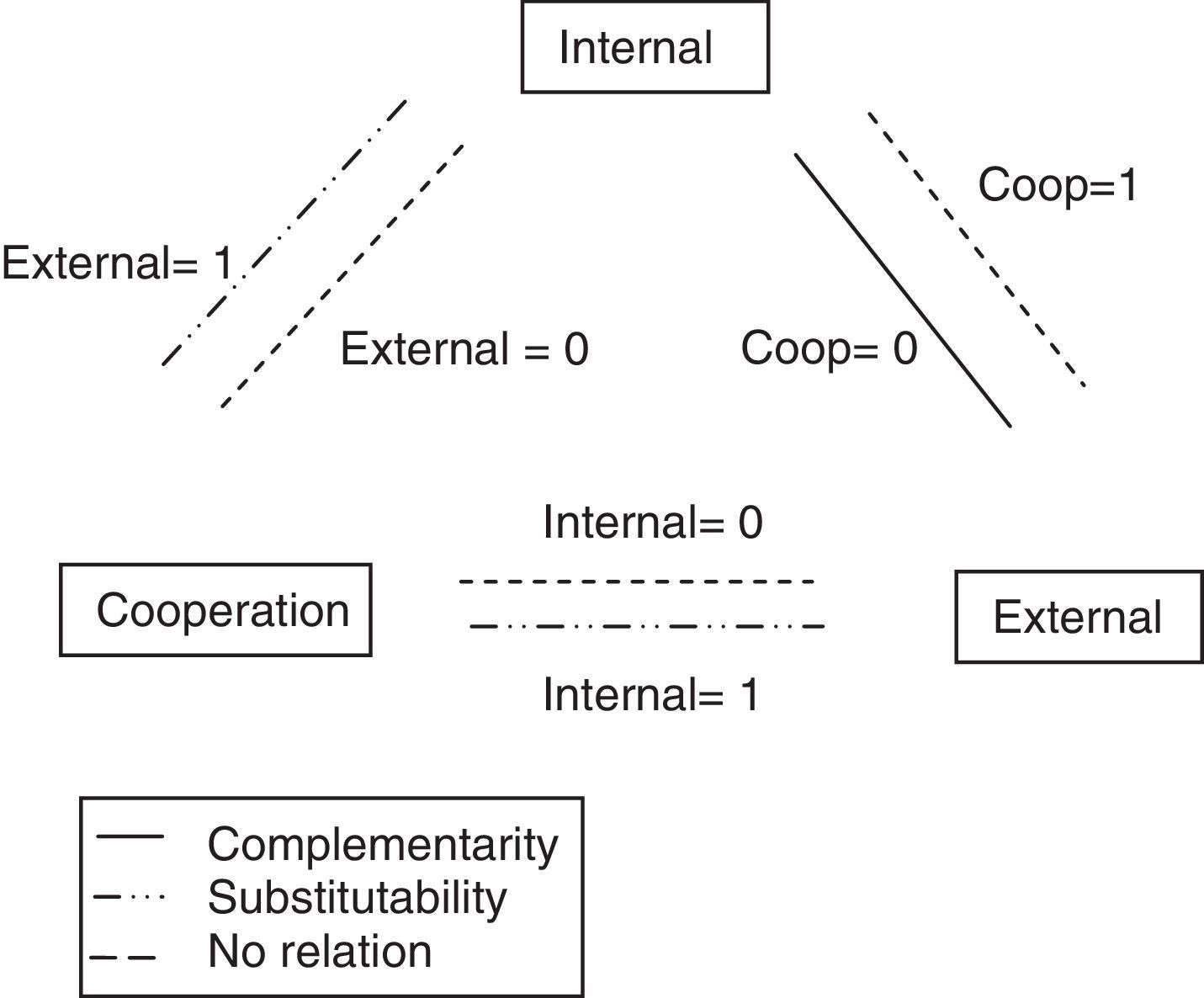

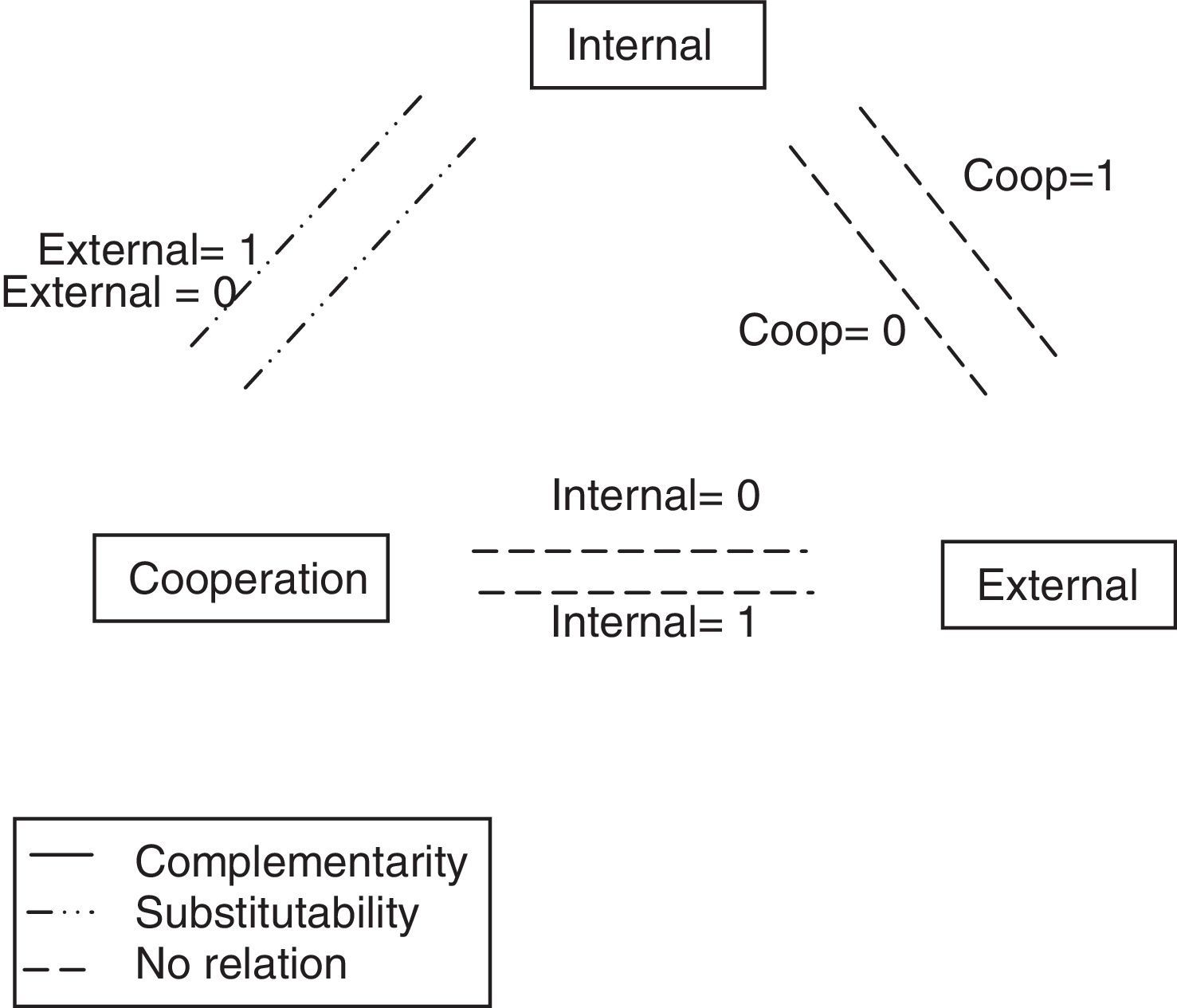

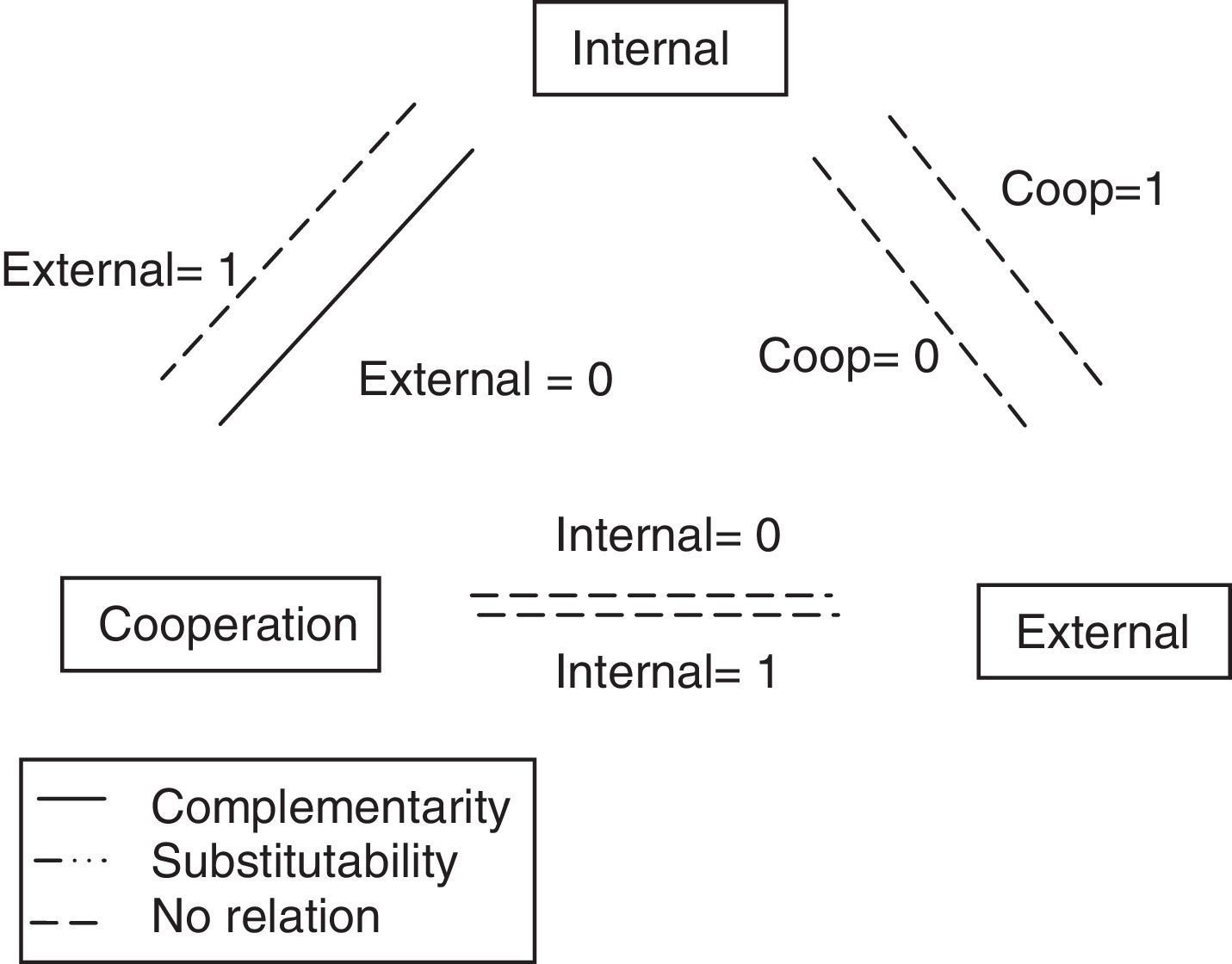

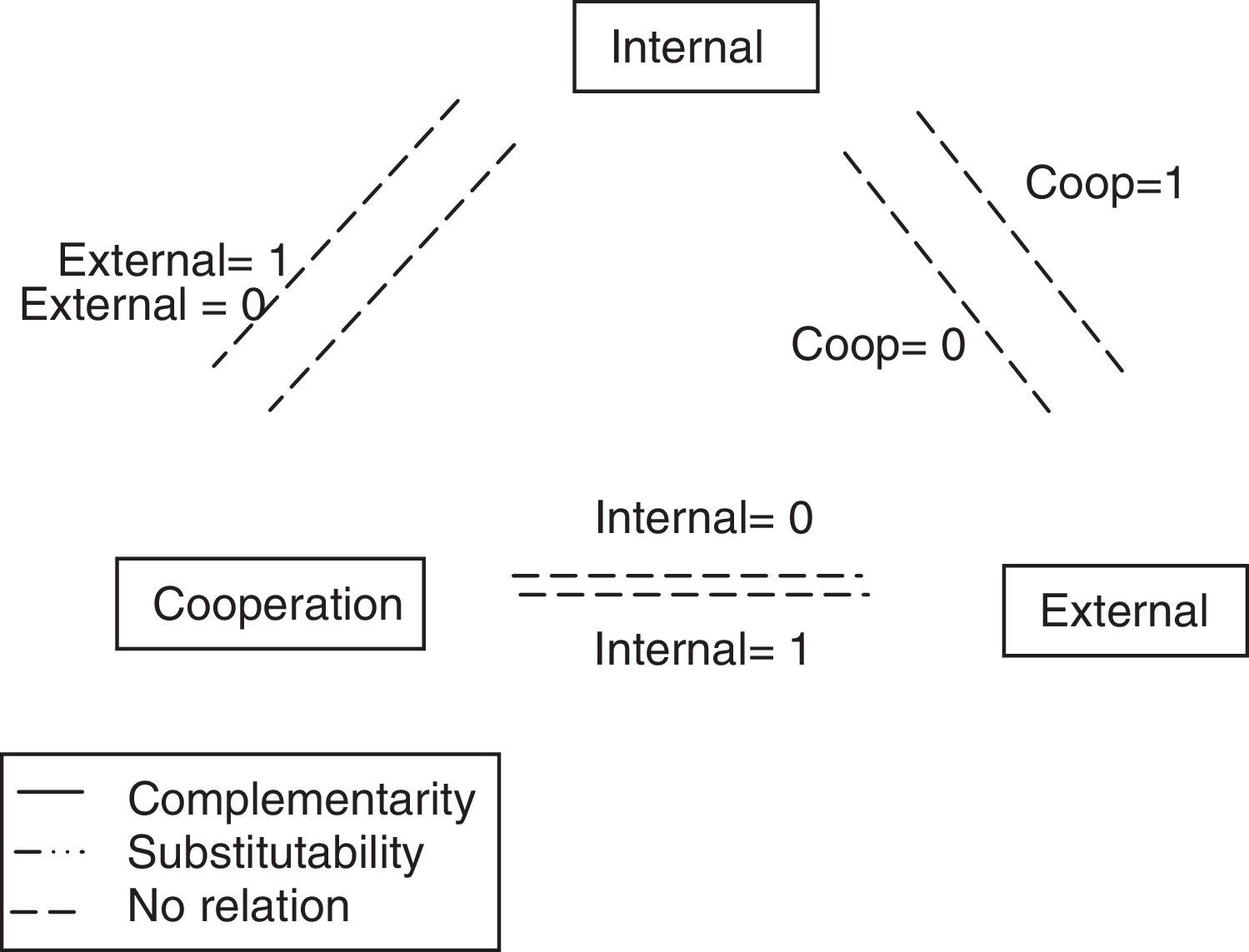

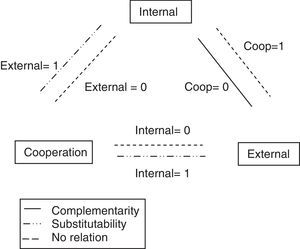

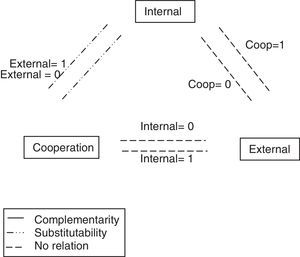

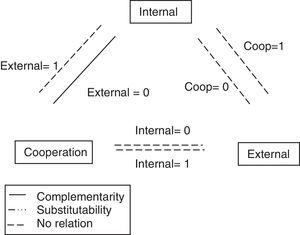

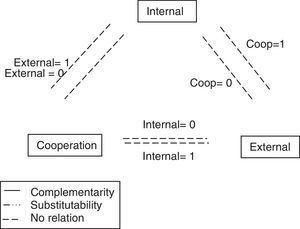

Tests conducted on the relationship between internal and external innovation knowledge sources show evidence of conditional complementarity in product innovation performance between both sources if (and only if) cooperation is not used. However, no relationship is found for internal and external knowledge sources when innovation performance is measured in terms of process, organisational or marketing innovation. Following with the relationship between internal and cooperation knowledge sources, different results can be found depending on the innovation performance measured. Regarding product and process innovation, internal and cooperation are conditional substitutes if external is used and not used, respectively. This relationship turns to conditional complementarity in organisational innovation performance in absence of external knowledge source. For marketing innovation no relationship is found between internal and cooperation knowledge sources. Finally, with regards to external and cooperation sources the results suggest a conditional substitute relationship only for product innovation and for firms using internal innovation knowledge sources. These results are also summarized in Figs. 1–4 (similar to Ballot et al., 2015).

ConclusionsThe aim of this paper has been to extend previous literature about complementarity on knowledge innovation sources along two directions in order to offer a more comprehensive and integrated vision of the issue: first, we extend the analysis of complementary or substitute relationships between internal and external knowledge innovation sources to the cooperation knowledge source; second, we incorporate a wider range of innovation performance measurements, some of them scarcely used in previous studies, such as those of organizational and commercial innovation.

Beginning with the extension of the analysis of complementary or substitute relationships to the cooperation knowledge source the results of the tests for conditional complementarities confirm that the relationship between cooperation and internal knowledge sources changes depending on the innovation performance used (substitutes for product and process innovation, and complements for organizational innovation). As far as the relationship between external and cooperation, the results are more independent on the innovation performance measure, and only for product innovation performance a (conditional) substitutive relationship is found.

Second, as far as the inclusion of a wider range of performance measurements, our results show that the results differ depending on the innovation performance analysed. The more robust results are those regarding the relationship between internal and external and external and cooperation, where no relation is found in the majority of the cases. The only exception is for product innovation performance, where conditional complementarity between internal and external knowledge sources and conditional substitutability for external and cooperation sources were found. As far as the relationship between internal and cooperation sources, it is much more dependent on the innovation performance measure used. Internal and external sources are (conditional) substitutes for product innovation, (strictly) substitutes for process innovation, (conditional) complements for organisational innovation and no relation is found for commercial innovation performance.

The main implication of this study is that the dilemma of what the best strategy is for implementing innovation cannot be viewed solely in terms of a discussion as to whether the different knowledge sources are complementary or substitutive, given that the strategy used most often by the firms (Internal & External, 33.78% of the total sample) doesn’t have a complementary effect on innovation performance, except for product innovation. This results would seem to confirm that the innovation sourcing strategy of a company needs to be designed according to the specific aims pursued – for example efficacy versus efficiency –, as well as taking into account the type of indicator used for follow-up and control of these objectives. In this sense, the results of this study may be an important guide in this selection process. However, the empirical evidence available to date is still scarce, and should be broadened in future research.

Another recommendation that could be made to companies is that they should take into account the type of result they wish to achieve in each case. First, companies seeking improvements in product innovation should combine in their innovation strategies internal and external knowledge sources, while internal and cooperation and external and cooperation innovation knowledge sources would be substitutes in presence of the third innovation knowledge source. Secondly, for process innovation performance firms should substitute internal and cooperation knowledge sources. Thirdly, in the case of firms seeking improvements in organizational innovation performance, they should combine internal and cooperation knowledge sources in absence of external source. Finally, firms oriented towards marketing innovation must know that there is no evidence of relationship among the different sources.

The use of cross section data is a limitation of the paper, on the one hand. First, the fact that the dependent variable is measured in the same year as the independent ones could be improved in future research by considering its lag, due to the fact that innovation activities tend to make its effects more effective in subsequent periods. Second, the interpretation of our results is limited by the possibility of endogeneity bias. Third, the existence of heterogeneous components could have made the estimation results partially biased. On the other hand, the kind of data available has conditioned the construction of some of the variables. Finally, as far as future research is concerned, it would be useful to deepen into the identification and analysis of the variables that may help to explain our results.