Customer retention is an imperative for competitiveness within organizations, with important reflexes in their profitability and income. Although studies of customer retention determinants have been conducted for at least three decades, the constructs employed in the elaboration of the models have gone through few changes throughout this time. In this sense, a new Theoretical Model has been developed and tested. Such model contemplates the constructs of Value Proposition, Operand Resources, Operant Resources, Value Facilitation, Value Co-creation and Value in use as determinants in the Customer Retention. The study was conducted via a survey, with a pooling of 273 clients of a banking institution. The result analysis used the Modeling of Structural Equation to analyze and understand the relations which make up the proposed Theoretical Model. The results show that the proposed Theoretical Model has shown satisfactory adjustment indexes, taking into account their originality.

A retenção de clientes é um imperativo para a competitividade das organizações, com reflexos importantes em sua lucratividade e rentabilidade. Embora estudos relacionados aos determinantes da retenção de clientes venham sendo realizados há pelo menos três décadas, os construtos utilizados na elaboração dos modelos teóricos analisados sofreram poucas alterações ao longo deste período. Neste sentido, foi desenvolvido e testado um Modelo Teórico que contempla os construtos Proposição de Valor, Recursos Operados, Recursos Operantes, Facilitação de Valor, Cocriação de Valor e Valor de Uso como determinantes da Retenção de Clientes. O estudo foi conduzido por meio de uma survey, realizada junto a uma amostra de 273 clientes de uma instituição financeira (Banco). A análise dos resultados utilizou a Modelagem de Equações Estruturais para analisar e compreender as relações que compõem o Modelo Teórico proposto. Os resultados apontaram que o Modelo Teórico proposto apresentou índices de ajuste satisfatórios, considerando sua originalidade.

Clients are vital to any organization, for, without them, there are no revenues, profit, profitability or market value (Gupta & Zeithaml, 2006). Logically, commercial relationships may vary in their intensity (Gremler & Gwinner, 2015, chap. 3) and have a positive repercussion in customer retention (Lin & Wu, 2011; Wu, 2011). However, clients will only establish a relationship with a specific supplier when they experience a sense of identity and perceive value in the relationship (Nikhashemi, Paim, Haque, Khatibi, & Tarofder, 2013). In the specific case of financial institutions, clients, in general, make a commitment in establishing, developing and keeping relationships with banks that offer higher value benefits, originating precisely from the continuity of the existing relationship (Liu, 2006).

Evidences suggest that the assessment clients make about the relationship value, as well as the following decision of keeping the service provider, is critically influenced by the dynamic of service experiences with said company (Bolton, Lemon, & Bramlett, 2006; Gupta & Zeithaml, 2006). Therefore, it is essential for companies to know in what way a service may be managed throughout time, so as to garner the highest possible value from each relationship with the clients (Aflaki & Popescu, 2013) and transform them into better outcomes for both parties (Kumar & Shah, 2015).

It follows then, that focusing on customer retention has relevant economical and financial implications. By retaining clients, companies are able to better service their current roster of clients, instead of spending resources to acquire new ones. Retained clients normally spend more, make positive remarks to third parties and are less costly in terms of service. Besides, they are less sensible to the competitors’ actions and respond better to cross-selling and up-selling efforts, resulting in increased revenues and bottom lines (Coussement, 2013).

Although countless papers have already been published, a consensus about customer retention determinants has not been established (Guo, Jian, & Tang, 2009; Kumar & Shah, 2015; Toufaily, Ricard, & Perrien, 2013). Therefore, this paper investigated the determinants of Customer retention, including the following constructs: Value Proposition, Operand Resources, Operant Resources, Value Facilitation, Value Co-creation and Value in use, starting from the proposal of a Theoretical Model, aiming at understanding the relation between a service provider and its clients.

The main contribution of this paper has been to fill a perceived theoretical void in marketing and service literature. Such literature is inherent to the proposal and validation of an original Theoretical Model, aimed at broadening the understanding of the value creation process from the client's point-of-view – the service user – and its relation to the proclivity of maintaining the relationship with the current service provider, resulting in a positive repercussion for customer retention. To achieve this, the central research question that guided this paper and that must be answered to fill the aforementioned theoretical void is as follows: what is the relation between the constructs of value proposition, resource configuration (operand and operant, value facilitation, value co-creation and value in use as customer retention determinants) in the context of financial services rendered to a retail bank?

Theoretical references and hypothesized relationsValue PropositionValue Proposition is acknowledged as an important element in the process of creating value in the area of client management, who have their needs, desires, expectations and demands. The process of value creation involves transforming the results of the organizational strategy into programs aimed at delivering value to the company clients (Payne & Frow, 2014a). It is important to highlight that the value the client gets from the company resides in the concept of the benefits that increase the supply to the clients, who may be integrated via a Value Proposition (Lanning & Michaels, 1988).

In most of the first discussions related to Value Proposition concepts, a goods-dominant logic – or G-D Logic – was implied, assuming the Value Propositions wouldn’t be co-produced, but pre-packaged and inputted into supplier-offered products, with focus on its trade value (Truong, Simmons, & Palmer, 2012). To Ballantyne, Frow, Varey, and Payne (2011), it becomes more and more clear that the historical emphasis in G-D Logic – associated to the emphasis on the market component management – limits the potential to create retention or client loyalty, as well as understanding the life cycle of relationship with them. To the authors, such G-D Logic predominance on marketing thinking eventually resulted in a reformist agenda, especially regarding service marketing. Out of the resulting theoretical contributions from this agenda, two alternative viewpoints to G-D Logic have been more productive in terms of publications and quotations and – because of these reasons – will be described next.

According to the purported perspective of the S-D Logic – Service-dominant Logic, companies cannot create value, but can only establish Value Propositions (Vargo & Lusch, 2004a). Such thesis has rekindled the long ongoing discussion among researchers about the nature of value in services. Service companies do not fill what they sell with any form of intrinsic value, as industrial companies usually see their own products. They, instead, make Value Propositions to their clients – which, may or may not be accomplished (Corvellec & Hultman, 2014). Vargo and Lusch (2008a) highlight that clients have the power to either accept or decline the Value Propositions, and that acquiring an offer is an explicit indication of acceptance of a Value Proposition. It represents that the anticipated Value in use, at least, meets the expectations that the sacrifices – financial or otherwise – done at the offer acquisition would be acceptable to the client. Clients experience and assess Value Propositions in an idiosyncratic way, that is, subjectively in each specific context of value integration. It is context that provides shape to the resource integration, and the latter are more valuable in some contexts than others (Chandler & Vargo, 2011).

In the S-D Logic related approaches, companies can only make Value Propositions (Vargo & Lusch, 2004a, 2008b). However, from the Service Logic (SL) point-of-view, this is not the case. This is an understanding still derived from the G-D Logic, according to which, companies are not involved in the consumption and value creation processes of their clients. Meanwhile, a fundamental characteristic of services is precisely that companies can actively influence the way Value Propositions are done through the value creation processes of clients. As per the SL, companies are not restricted to making Value Propositions, but have the opportunity to leverage the realization – or delivery – of value (Grönroos, 2008).

According to the SL perspective, clients employ resources made available by service providers or their usage processes in a way which the usage of such resources adds value to the clients. Not only service activities, but goods (products) are also considered service distribution mechanisms (Grönroos, 2011a). Such observations coincide with some aspects of the fundamental premises of the S-D Logic (Vargo & Lusch, 2004a). Companies, therefore, by developing Value Proposition for their clients, aim at delivering offers that integrate to the many practices and processes of their clients. By thinking this way, service is redefined in the way offers are put to use as to support value creation by the clients and, consequently, all organizations are service organizations (Grönroos, 2011b).

Resources, resource integration and their relation to Value PropositionResources are defined as anything with the potential to add value to the acting or benefited parties. Resources are deemed a “will-be”, that is, resources have potential resources, but value is only added when they are integrated and operated – or employed. This dynamic view of resources has been long acknowledged in literature (Wetter-Edman et al., 2014). According to Wetter-Edman et al. (2014), Zimmermann, in his 1951 work, pointed out that resources “aren’t”, but rather, “become”. On its own, resource integration refers to incorporating and applying resources from an organization in tandem with resources from the clients (Moeller, 2008). Lusch, Vargo, and Tanniru (2010) suggest that companies exist to integrate and transform micro-specialized competencies into more complex proposals, which must have market potential. Therefore, Mele, Spena, and Colurcio (2010) highlight that resources do not have any inherent worth, but have an important potential value, depending on how they are integrated and operated, in specific contexts with specific intentions.

To make a point regarding value creation Vargo, Maglio, and Akaka (2008) set a distinction between two resource categories: Operant Resources and Operand Resources. While the latter are typically physical entities – raw materials, equipment and facilities -, the former are basically people: clients and company employees – as well as their knowledge, skills and motivations. The initial concept of Operant Resources, by Constantin and Lusch (1994), consider competencies, abilities and dynamic skills as Operant Resources (Madhavaram & Badrinarayanan, 2014).

Grönroos and Gummerus (2014) underscore that interaction plays a crucial role in understanding service perspective. Interaction establishes that companies, as service providers and through their actions and interactions with their client, support everyday processes of the clients to facilitate and contribute to create value. To the authors, interactions may be divided as direct and indirect. Indirect interactions are those in which a client interacts with standardized systems or products, comparable to Operand Resources according to S-D Logic definition. Also, the provider of such resources cannot actively influence the value creation from the client's part. Direct interactions, on the other hand, are collective processes in which actions from two or more parties merge in a collaborative and dialogic process. The parties may be persons or intelligent products and systems, comparable to the Operant Resources by the S-D Logic definition. They become resources by the interaction of the service provider, the service user and the context: the requirements for the everyday practices of the clients (Grönroos & Gummerus, 2014; Kowalkowski, 2015, chap. 3; Raddats, Burton, & Ashman, 2015).

Applying and using resources represent the source of value for clients, forcing companies to become apt to offer Value Propositions through a combination of different resources in tandem with each client's specificity.

Using both the Value Proposition and modifications to resource configuration drives client value. These integrated resources are classified as operational and Operand Resources. Operant Resources represent specialized skills and knowledge, while Operand Resources are tangible resources, often employed by the Operant Resources. Service providers and service users are linked by the Value Proposition. The users create value through the combination of available resource of Value Propositions with their own resources (Pfisterer & Roth, 2015). Therefore, the following research hypotheses can be formulated:H1 The Value Proposition has a meaningful, positive impact in the configuration of Operand Resources. The Value Proposition has a meaningful, positive impact in the configuration of Operant Resources.

Marketing has inherited from Economics the view that value (usefulness) was inseparable from tangible goods (products). One of the first debates in the area of marketing revolved around the following question: If value is something added to goods, would marketing make any contribution to value? Although the general concept of usefulness has been broadly accepted by marketing, its meaning has been interpreted in many different ways (Vargo & Lusch, 2004a). The nature of value has been discussed and debated since Aristotle, and part of its lack of definition results from divergent or transversal meanings, which have been incorporated to the fundamentals of economics and market exchanges. More specifically, two predominant meanings about value concept, value exchange and value usage, which reflect different ways to think about value and its creation (Vargo et al., 2008).

The nature of exchange value is a usefulness, based on the value incorporated either to a resource or to an output of a labor process. It exists as a unique entity at a given point in time and it may be exchanged for other uses, or by something the client is willing to pay. Value in use may be considered the benchmark which measures whether a client feels comfortable (positive value) or uncomfortable (negative value) as a result of consumption-related experiences or the use of any specific product and/or service. Therefore, value is accumulated throughout time, from experiences during the usage of said product and/or service. However, value, as value usage, cannot exist before being created or emerge from the usage process, when value accumulation takes place and, therefore, cannot be assessed before its use (Corvellec & Hultman, 2014; Grönroos & Voima, 2013; Holttinen, 2014).

As it was previously discussed, Grönroos and Gummerus (2014) conceptualize indirect interactions as the ones in which an agent (client) interacts with a standardized system or product (Operand Resources), and that takes place within the client's sphere. Pfisterer and Roth (2015) reinforce this aspect, claiming that the client's sphere focuses the client interaction with the Operand Resources of the service provider. In this case, the service provider is considered only a value facilitator, supplying the resources required by the client. The interaction is considered indirect because no dialogical or collaborative process takes place and the resource provider cannot actively influence the value creation on behalf of the client. Operand Resources, therefore, are the ones upon which an agent acts to obtain support to the value creation process, making it possible – or, at least, easier – for the necessary interactions to take place (Lusch & Nambisan, 2015). Based on this premise, a third hypothesis comes about:H3 The Operand Resources configuration has an impact both relevant and positive to the Value Facilitation.

Direct interactions, on the other hand, are joint processes in which actions of two or more agents merge into one single collaborative and dialogical process, which takes place in the joint sphere, establishing a platform of co-creation. A co-creation platform allows only direct interactions. These agents could be either humans or intelligent systems and products (Grönroos & Gummerus, 2014; Grönroos & Voima, 2013). The most fundamental operating resources are knowledge and the technology this knowledge promotes (Lusch & Nambisan, 2015). Pfisterer and Roth (2015) conceptualize this joint sphere – which includes usage processes in which the service provider and the client create value jointly, via direct interactions. The agents do not interact only via usage of Operand Resources, but also interact directly and dialogically during the usage process. From this perspective, a fourth hypothesis arises.H4 The Operant Resources configuration has a relevant and positive impact in Value Co-creation.

On the other hand, a new perspective has been gaining ground, the C-D Logic (Customer Dominant Logic). According to this perspective, both the G-D Logic and the S-D Logic are understood as centered around the service provider. The new proposal suggests, then, the discussion on value concept should be extended beyond interaction and consumption, because instead of being restricted to value co-creation or value facilitation in client-company interactions, value also emerges exclusively in the client's sphere. In this sense, there is a lack of deep investigations about how value emerges in the client's sphere, without emphasizing the service provider perspective (Heinonen, Strandvik, & Voima, 2013).

Pfisterer and Roth (2015) conceptualize what is called client usage process. Under such conceptualization, client usage processes in which clients integrate their resources and combine them with resources from third parties are the central element of value creation to the client. To the authors, this dimension of the value creation process is hard to be assessed and managed by the resource providers, since these processes are usually performed without direct interactions between the clients and the service providers, resulting in some form of “flight recorder”. Medberg and Heinonen (2014) refer to this process as the invisible formation of value. The value formation that occurs outside the visibility line where services meet. To the authors, the client context has been neglected by marketing literature, especially in the area of banking services, since their process focus and service results are more centered on the perspective of the service provider.

The client's perception of Value in use creation – either by co-creation or by value facilitation – may occur after experiencing the service and integrating resources. Some researches suggest that previous experiences of utility or Value in use are the basis for the future repetition of such experiences with a pre-determined service provider. It establishes the rational criteria for the decisions of repurchases, turning past experiences of value co-creation and value facilitation into the benchmark of future expectations of Value in use creation or perception regarding Value Proposition (Kleinaltenkamp, 2015, chap. 15).

The following hypothesis were formulated – based on the possibility of Value in use creation within the client's sphere, without interactions between service providers and the client:H5 Value Proposition has a positive and significant impact on Value Facilitation. Value Proposition has a positive and significant impact on Value Co-creation.

Since companies supply clients resources to be used, they can be seen as value base co-creators, via a process of value facilitation. By using such resources – whether they are tangible (goods) or intangible (services) – and adding other resources (goods, services and information) and skills, clients convert the value of potential usage into real potential usage. However, clients also bring a value base to the game and, in case they do not have the necessary abilities to use the given resources by the service provider, or if they do not have the required additional resources, the Value in use does not become concrete, or it becomes less than its potential. The clients’ abilities and the access to other necessary resources for the consumption process (or usage) in the form of self-service configurate the clients’ value base (Grönroos, 2008; Grönroos & Gummerus, 2014; Grönroos & Voima, 2013).

This model of value creation, in which the company's role is solely of value facilitator, is called value facilitation model. In it, the service provider develops the Value Proposition, which represents the value base that the client will use. If the clients accept the Value Proposition during consumption as the value basis, they add their own skills and resources required to the process of value generation as to reach value effectiveness in the form of Value in use (Grönroos, 2006). Therefore, under the marketing point-of-view, the company is restricted to only performing Value Propositions (Grönroos, 2008). In some cases, direct interaction with the service provider is impossible, unnecessary and could possibly be counterproductive regarding value creation (Pfisterer & Roth, 2015), as in the case of a banking operation done at an ATM.

In a service provider–client relationship, value facilitation can be considered a pre-requisite or basis for value creation and, as a result, is also a reason for clients to seek out a relation with a supplier. Companies facilitate value creation whenever they supply the clients of goods in their value creation processes. The service provider is a resource producer that the client integrates to its value creation process (Grönroos & Ravald, 2009). In other words, a company produces resources as entries for the consumption process or value generation of their clients. Because resource provision is a basic requirement for value creation by the clients, it may be called value facilitation (of usage).

This is the point where the possibilities of influencing value creation end for a supplier without direct interactions with clients (Grönroos & Ravald, 2009). It is relevant to keep in mind that indirect interactions take place between clients and resources or standardized systems (Grönroos, 2011b). These resources and systems are used and/or operated autonomously by the clients themselves, and value creation depends solely on the clients’ skills of using (and creating value) these entry resources during the usage of the service (Grönroos & Ravald, 2009). In the value facilitation model, the client's goal is to combine the integrated available resources by the service provider in order to make the Value in use emerge (Pfisterer & Roth, 2015). The seventh research hypothesis, thus, emerges:H7 Value Facilitation has a significant and positive impact on Value in use creation. The challenge service providers face consists in developing competitive Value Propositions and the necessary set of resources to co-create value, which, in turn, results in attractive consumption experiences. In this manner, the success potential of a Value Proposition is reliant on the ability of understanding value creation by the client – Value in use (Edvardsson, Kristensson, Magnusson, & Sudström, 2012). Lusch et al. (2010) claim the most valuable resources are the ones based on competencies, relationships and information, and the biggest challenge for organizations is to establish a better alignment among its competencies to create, build and maintain relationships between clients (the sources of revenues) and suppliers (the sources of entry resources). The company that develops the most attractive Value Proposition, that offers an adequate connection between competencies and relationships, will have the best performance. Since clients are an asset in the value chain, they must be integrated to the service supplying process in order to make possible the creation of attractive Value in use (Edvardsson et al., 2012).

Co-creation is intimately linked to the joint development of value in the relation client-service provider – and other agents – whenever necessary. Such joint development presupposes the creation of experiences and the solving of problems. In this case, the focus changes from the value chain to the interaction point between client and service provider (Santos-Vijande, Gonzáles-Mieres, & López-Sánchez, 2013). Therefore, Vargo and Lusch (2008b) think that the involved parties of a commercial relationship must make a joint effort – which consists in value co-creation – by integrating resources and providing services.

It is relevant to acknowledge that, in order to add value to their offers, companies must be capable of using resources that surpass the internal limits of the organization, integrating and combining resources that belong to the clients’ sphere and to the business partners’ network. There are evidences that broadening the client's participation in developing solutions contributes to raising the customer retention rate, which, in turn, elevates their commitment to co-creation, as well as the value perception associated to the company offers (Durugbo & Pawar, 2014; Vega-Vazquez, Revilla-Camacho, & Cossío-Silva, 2013).

The co-creation opportunities companies have are strategic options for value creation (Payne, Storbacka, & Frow, 2008). The interactions involving value co-creation are dialogical, that is, both parties influence the perception and actions of one another (Ballantyne & Varey, 2006). Because the client is ultimately responsible for the creation of Value in use, without direct interactions, the supplier or service provider do not have available co-creation opportunities. Value co-creation is a joint process of value creation, which requires the simultaneous presence of client and supplier. Whenever they are isolated from each other, the supplier facilitates the creation of Value in use, while the client, as an individual value creator, creates Value in use. In this context, co-creation means that two (or more) parts, in tandem and interactively, influence the emergence of Value in use (Grönroos, 2011a).

Therefore, value co-creation has relevance in a value co-creation platform. It involves a service provider and a client, where the provision process or delivery service and its usage process, by the client, merge into a direct interaction process. During this process, the service provider may take part in the client's value creation and, through co-creation actions, influence the creation of Value in use that takes place in the client's sphere (Durugbo & Pawar, 2014; Grönroos & Gummerus, 2014; Ramaswamy, 2009). Based on such premises, the eight research hypothesis emerges:H8 Value co-creation has a significant and positive impact in the creation of Value in use.

Fornell and Wernerfelt (1987) describe customer retention as a defensive marketing strategy, vis-à-vis the offensive strategy (communication) – the most popular in literature and marketing practice. Customer retention may be defined as the continuation of a relationship between a client and a corporation (Keiningham, Cooil, Aksoy, Andreassen, & Weiner, 2007). Therefore, it is associated to the longevity of the client's relationship to a certain company (Menon & O’Connor, 2007), having a positive repercussion in the economical-financial development (Sun, Wilcox, & Zhu, 2007).

In the specific case of retail banking, employing strategies to increase retention rates is considered relevant, in part, due to the difficulty to differentiate based on service offers – in Brazil, specifically, it is a highly regulated sector. There is a caveat that clients sense few differences in the services offered by retail banks, and any new offer is quickly emulated by the competition (Coskun & Frohlich, 1992; Devlin, Ennew, & Mirza, 1995). Thus, retail banking, like other service companies, has discovered that increasing customer retention rates may cause a substantial impact in their bottom line and income (Levesque & McDougall, 1996).

Despite attempts by the banks to increase client satisfaction levels, the sector has gone through a decrease of customer retention and loyalty in recent years. Demand fragmentation and intensification of competition levels have been forcing banks toward price competition, cost reduction and changes in the levels of on-site personal client services (Jagersma, 2006). Amid this growing competition, the conventional ways of establishing possible competitive advantages seem inefficient and of little sustainability. Based on this viewpoint, developing Value in use by the clients seems to be a new way to differentiate service offers from the ones the competition offers (Strandberg, Wahlberg, & Öhman, 2012).

Generating Value in use comprehends taking into account the client's life context. Doing so involves taking a look at seemingly irrelevant relations to the specific operation that is being carried out to in order to identify the ones that grant opportunities to broaden client interaction and relationship. However, the existing knowledge level regarding the necessary development of service-centered logic so as to co-create value in the client's value creation process and, through it, generate retention, is still generally low (Lähteenmäki & Nätti, 2013).

Researchers have suggested that it is necessary to take into account the client's personality traits to determine the nature of their relationship with the companies (Lin, 2010; Ponsignon, Klaus, & Maull, 2015; Vazquez-Carrasco & Foxall, 2006). This argument revolves around the idea that clients could choose a service provider since the latter expresses the client's personality or social position, that is, they satisfy specific psychological needs. The perception that promises are being kept by filling those psychological gaps – or Value in use – would strongly contribute toward the intention of staying in the relationship with said service provider (Al-Hawari, Ward, & Newby, 2009; Al-Hawari, 2015). Based on such arguments, the ninth research hypothesis arises:H9 Value in use has a significant and positive impact in customer retention.

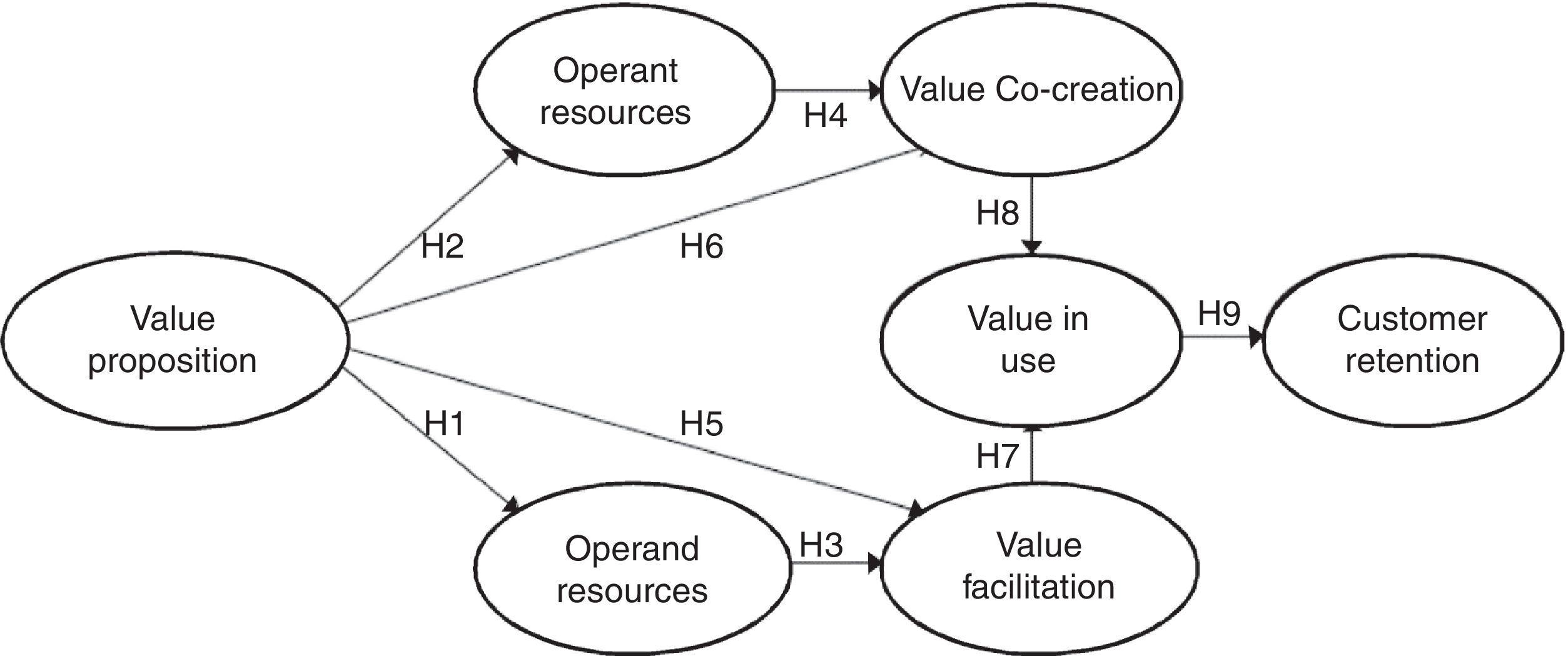

To facilitate the understanding of the proposed Theoretical Model and the respective hypothetical relations, Picture 1 has been developed.

Research methodThis paper is a research of quantitative nature and a descriptive quality. It aims at investigating the existing connections between the analyzed constructs. It was implemented via a single transversal cut survey (Fink, 2013; Malhotra, Birks, & Wills, 2012). Moreover, the recommendations to employ the Structural Equations Modeling – MEE in Portuguese – technique were followed (Byrne, 2016; Hair, Black, Babin, Anderson, & Tatham, 2009; Kline, 2011; Malhotra et al., 2012). This technique is used to assess the intrinsic relations of the proposed Theoretical Model.

Research ambience and target populationThe chosen target population for this paper encompassed people – since the other possible targets were corporations – who were clients of a multinational retail bank, henceforth known as Alpha Bank, classified as Premium per the enterprise itself, whose classification criteria include a minimum income of R$ 4000.00. Choosing Premium category clients is justified because of the nature of the constructs themselves that were assessed – mainly value co-creation – which demand a greater volume of direct interactions between client, the service user, and the service provider, the bank, in which the client can be deemed an operating resource.

The sampling choice was non-probabilistic by convenience (Malhotra et al., 2012). The participants were chosen because of their access and their interest in participating in the study, as well as the participants’ adequacy to the criteria of the financial institution. For the sample definition, since the MEE has been employed, the Hu and Bentler (1999) criteria were adopted. This criterion makes the argument that a minimum sampling of 250 cases is necessary to perform adequate analyses. Thus, a minimum amount of 250 valid case samples was used in this paper.

Construct operationalization and creation of the data collection instrumentThe data was gathered via a questionnaire, created based on the contemplated constructs of the proposed Theoretical Model. For the construct Value Proposition a scale with six items (PROP_VL_1 to 6) was employed. The items PROP_VL_1 to 5 were adapted from Lindic and Da Silva (2011), while the item PROP_VL_6, from Payne and Frow (2014a). For Operand Resources, a one-to-six scale was employed (REC_OPD_1 to 6), adapted from Zhu, Wymen, and Chen (2002). For Operant Resources, a five-items scale was employed (REC_OPT_5). The items REC_OPT_1 and 2 were adapted from Barnes (1997); items REC_OPT_3 and 4, from Hennig-Thurau (2004) and item REC_OPT_5 from Jamal and Naser (2002). For Value Facilitation, a four-items scale (FAC_VL_1 to 4) was employed, developed by Zhu et al. (2002). For Value Co-Creation, a five-items scale was employed (COC_VL_1 to 5), adapted from Ngo and O’Cass (2009). For Value in use, a five-items scale (VL_USO_1 to 5) was adopted. Item VL_USO_1 was adapted from Zhu et al. (2002), while items VL_USO_2 to 5 were adapted from Wang et al., 2004. Finally, for Customer retention, the scale was made up of five items (RETEN_1 to 5), adapted from Zeithaml, Berry, and Parasuraman (1996).

For all the constructs, a seven-point Likert-like scale was employed, since it is a scale commonly used whenever interviewees fill the questionnaires up themselves (Wakita, Ueshima, & Noguchi, 2012), which was the procedure adopted in this paper. On the extremes, the scale had the labels “1. Completely Agree” to “7. Completely Disagree”.

Validation of the data collection instrumentThe data collection instrument has been subjected to a content validation process. In order to do so, the questionnaire was submitted to an assessment by three experts in the field – all three PhDs in Marketing – and also by two Public Relations Managers who work at financial institutions and are familiar with the target-clients. After the content validation, the pre-test takes place: it was applied to thirty people – financial institutions clients who have a similar profile to the required one for the final gathering. The necessary time to fill all the questionnaire was analyzed – it hovered around 10min – and also possible doubts regarding the terminology or language used as well as the coherence in question order to facilitate the understanding. Based on the pre-test, slight alterations were done in two questions that gave leeway to interpretation misunderstandings. Such questionnaires were not incorporated into the final sampling.

Gathering and processing dataThe questionnaires were made available to the interviewees online, as a secondary step from an initial e-mail contact, and they answered by themselves. The polling was done by making the questionnaire link available by e-mail. The mailing list was created from staff contacts from three companies that use the Alpha Bank as the financial institution in city in the Rio Grande do Sul northeast.

The treatment of the gathered data was done via a set of statistical procedures. Initially, two categories of raw data analyses are recommended (Hair et al., 2009; Tabachnick & Fidell, 2012) before the application of multivariate analysis techniques: missing data – called missings – and atypical observations – outliers; and analyses related to data distribution and variable relation, checking if normality, linearity, multi-co-linearity and homo-cedasticity (Kline, 2011; Malhotra et al., 2012) that result are satisfactory.

Since the research was answered electronically and it was mandatory to answer all questions, there were no identified missings in the 275 received forms. To identify the outliers, the Z Scores – or single-variation outliers – and the Distance of Mahalanobis – or multi-variation outliers – were calculated (Byrne, 2016; Hair et al., 2009). After the analyses, two samples were ruled out, resulting in a final total sampling of 273. The software SPSS 20 was used to process data. The software Amos 20 was used to validate the Model.

Research resultsCharacteristics of the research participantsOut of the 273 participants, 138 – or 50.55% – are women and 135 – 49.45% are men. The age ranges from 27 to 75, and the largest concentration is between the ages of 32 and 39 years – 124 people, or 45.42%. In terms of education, 138 respondents – 50.50% – have graduated University, while the remainder – 135 people or 49.50% – have an ongoing or concluded post-graduation course – Master's or PhD. As for the monthly income level, 187 of the respondents – 68.50% – earn between 5 and 10 minimum wages; 68 of them – 24.90% – between 10 and 20 minimum wages and the remaining 18 – 6.60% – above 20 minimum wages. How long they have been a client of the bank varies between 1 and 30 years. However, the greatest concentration is between 5 and 11 years – 67.40% – making it obvious that the vast majority of surveyed bank clients have good experience with the service provider. In terms of service usage, 21 – 7.70% – predominantly use agency services; 88 – 32.20% – use mostly the ATMs; 75 – 27.50% – use mostly the Internet; and 89 – 32.60% – use either the agencies or any other platform.

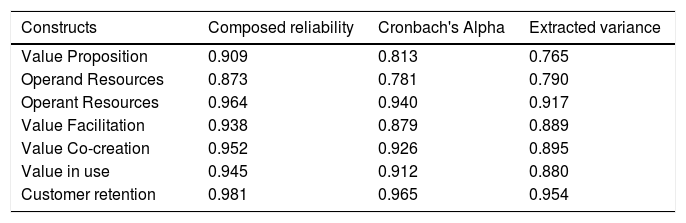

Individual construct validationBefore validating the model, it is highly recommended to do the individual validation of constructs. Such measure demonstrates how much measuring the set of variables represents the underlying construct (Byrne, 2016; Garver & Mentzer, 1999). Afterwards, the unidimensionality, reliability, converging validity and discriminating validity (Byrne, 2016; Kline, 2011). Composed reliability and Alpha of Cronbach were employed to measure reliability. The results pointed to acceptable numbers – above .70 – as well as for the extracted variance – above .50 – as per the books (Hair et al., 2009; Malhotra et al., 2012; Tabachnick & Fidell, 2012). Table 1 represents such results.

Reliability and variance extracted from the constructs.

| Constructs | Composed reliability | Cronbach's Alpha | Extracted variance |

|---|---|---|---|

| Value Proposition | 0.909 | 0.813 | 0.765 |

| Operand Resources | 0.873 | 0.781 | 0.790 |

| Operant Resources | 0.964 | 0.940 | 0.917 |

| Value Facilitation | 0.938 | 0.879 | 0.889 |

| Value Co-creation | 0.952 | 0.926 | 0.895 |

| Value in use | 0.945 | 0.912 | 0.880 |

| Customer retention | 0.981 | 0.965 | 0.954 |

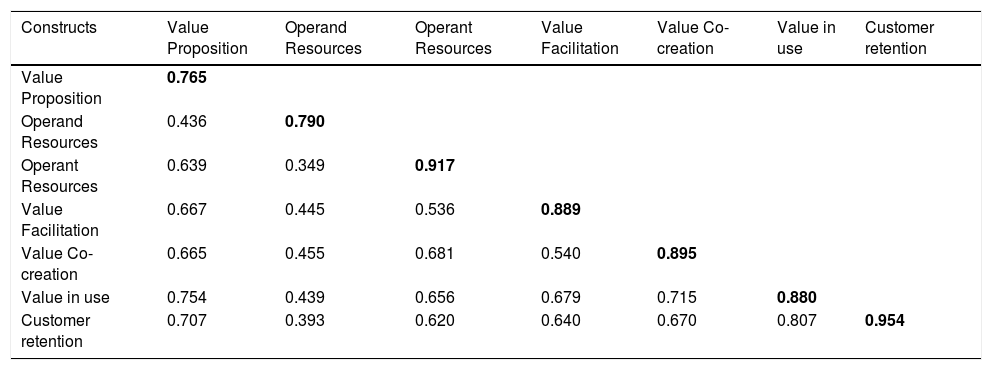

To assess the converging validity, two processes were employed: the analysis of the significance of the variable factorial loads, based on the t-values of each construct indicators, with a p<0.05 significance (Garver & Mentzer, 1999); and the Confirmatory Factorial Analysis, with the measuring of the indicator loads of their respective constructs, the measurement error for each indicator and the variance estimates between factors and constructs (Kline, 2011). All the results were satisfactory. As for the discriminating validity, the extracted variances were compared to the shared variances and, then, they were calculated by the correlation between the constructs taken to the square power. As a result, it became obvious when the constructs present extracted variances superior to the shared variances with the remaining constructs (Fornell & Larcker, 1981). The results in Table 2 confirm the discriminating validity amidst constructs.

Discriminating validity.

| Constructs | Value Proposition | Operand Resources | Operant Resources | Value Facilitation | Value Co-creation | Value in use | Customer retention |

|---|---|---|---|---|---|---|---|

| Value Proposition | 0.765 | ||||||

| Operand Resources | 0.436 | 0.790 | |||||

| Operant Resources | 0.639 | 0.349 | 0.917 | ||||

| Value Facilitation | 0.667 | 0.445 | 0.536 | 0.889 | |||

| Value Co-creation | 0.665 | 0.455 | 0.681 | 0.540 | 0.895 | ||

| Value in use | 0.754 | 0.439 | 0.656 | 0.679 | 0.715 | 0.880 | |

| Customer retention | 0.707 | 0.393 | 0.620 | 0.640 | 0.670 | 0.807 | 0.954 |

Obs.: The figures in bold show the extracted variances and the remaining figures are the shared variances.

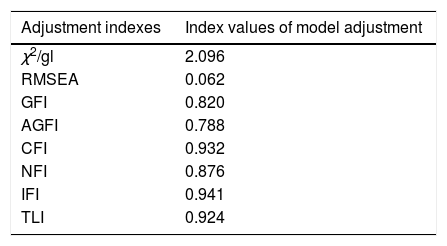

The Theoretical Model validation was done through the analysis of the adjustment model indexes. According to Table 3, theχ2/gl (2.096), with lower-than-3 value (Byrne, 2016), and the RMSEA (0.062), with values between 0.05 and 0.08, meet the recommendation (Byrne, 2016; Hair et al., 2009; Kline, 2011). The GFI (0.820), AGFI (0.788) and NFI (0.876) values were less than recommended by the literature – values of, or above, 0.90 (Byrne, 2016; Hair et al., 2009; Kline, 2011). By the way, Bagozzi and Yi (2012) underscore that no commonly accepted cutting-off criteria have been proposed for the GFI and the AGFI, since both are reliant on the size of the sample. Also, simulations demonstrate that they do not behave so well as the remaining adjustment indexes. As a result, the remaining indexes of criteria are more solid to be used with model variation with MEE. However, the CFI (0.932), IFI (0.941) and the TLI (0.924), with values equal to, or above, 0.90 (Byrne, 2016; Hair et al., 2009; Kline, 2011), present satisfying levels.

Theoretical Model adjustment indexes.

| Adjustment indexes | Index values of model adjustment |

|---|---|

| χ2/gl | 2.096 |

| RMSEA | 0.062 |

| GFI | 0.820 |

| AGFI | 0.788 |

| CFI | 0.932 |

| NFI | 0.876 |

| IFI | 0.941 |

| TLI | 0.924 |

Notes: χ2/gl, chi-square/degrees of freedom; RMSEA, root mean square error of approximation; GFI, goodness-of-fit index; AGFI, adjusted goodness-of-fit index; CFI, comparative fit index; NFI, normed fit index; IFI, incremental fit index; TLI, tucker-lewis index

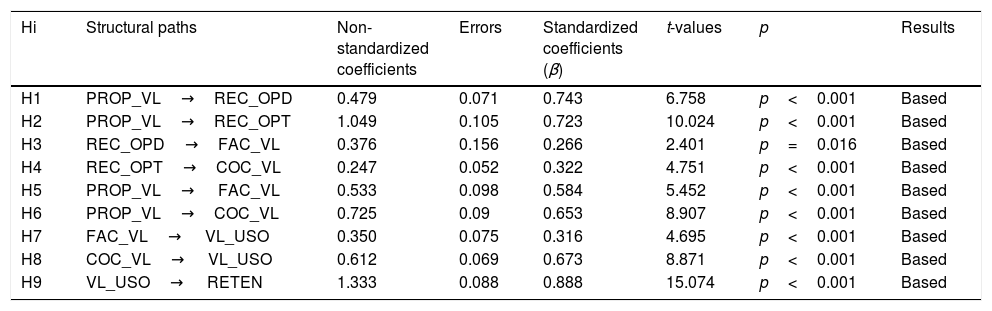

In order to provide continuity to the validation model, the hypothesis test was employed. Both the significance and the magnitude of the estimated regression coefficients were examined. They measure the amount of expected change in the dependent variable for each unit of change of the independent variable. The signal of this coefficient indicates the direction of the correlation: either positive or negative (Hair et al., 2009). When the regression coefficient is meaningful, the relation between the two variables is empirically proved (Byrne, 2016; Kline, 2011). Table 4 explains this quite clearly.

Hypotheses tests.

| Hi | Structural paths | Non-standardized coefficients | Errors | Standardized coefficients (β) | t-values | p | Results |

|---|---|---|---|---|---|---|---|

| H1 | PROP_VL→REC_OPD | 0.479 | 0.071 | 0.743 | 6.758 | p<0.001 | Based |

| H2 | PROP_VL→REC_OPT | 1.049 | 0.105 | 0.723 | 10.024 | p<0.001 | Based |

| H3 | REC_OPD→FAC_VL | 0.376 | 0.156 | 0.266 | 2.401 | p=0.016 | Based |

| H4 | REC_OPT→COC_VL | 0.247 | 0.052 | 0.322 | 4.751 | p<0.001 | Based |

| H5 | PROP_VL→ FAC_VL | 0.533 | 0.098 | 0.584 | 5.452 | p<0.001 | Based |

| H6 | PROP_VL→COC_VL | 0.725 | 0.09 | 0.653 | 8.907 | p<0.001 | Based |

| H7 | FAC_VL→ VL_USO | 0.350 | 0.075 | 0.316 | 4.695 | p<0.001 | Based |

| H8 | COC_VL→ VL_USO | 0.612 | 0.069 | 0.673 | 8.871 | p<0.001 | Based |

| H9 | VL_USO→ RETEN | 1.333 | 0.088 | 0.888 | 15.074 | p<0.001 | Based |

Based on the obtained results, all hypotheses had statistical basis. That is: H1 (the value proposition has a significant and positive impact in the configuration of Operand Resources, β=0.743, p<0.001); H2 (the value proposition has a significant and positive impact in the configuration of operating resources, β=0.723, p<0.001); H3 (the configuration of Operand Resources has a significant and positive impact in the value facilitation, β=0.266, p=0.016); H4 (the configuration of operating resources has a significant and positive impact in value co-creation, β=0.322, p<0.001); H5 (the value proposition has a significant and positive impact in the value facilitation, β=0.584, p<0.001); H6 (the value proposition has a significant and positive impact in value co-creation, β=0.653, p<0.001); H7 (value facilitation has a significant and positive impact in Value in use, β=0.316, p<0.001); H8 (value co-creation has a significant and positive impact in Value in use, β=0.666, p<0.001); and H9 (Value in use has a significant and positive impact in customer retention, β=0.882, p<0.001).

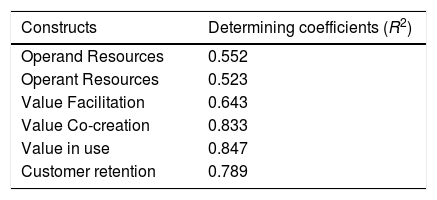

On the other hand, measuring the determining coefficient (R2) helps to confirm the hypotheses test and model validation, establishing the variability proportion of a dependent variable which is explained by the independent variables (Hair et al., 2009; Tabachnick & Fidell, 2012). On Table 5, the resulting determining coefficients (R2) are presented.

Consequently, it has been verified that 78.9% of the variation of Customer retention is explained by its independent variables: Value in use, Value Co-Creation, Value Facilitation, Operating Resources, Operand Resources and Value Proposition. 84.7% of Value in use variability is explained by Value Co-Creation, Value Facilitation, Operant Resources, Operand Resources and Value Proposition. 83.3% of Value Co-Creation variability is explained by Operating Resources and Value Proposition. 64.3% of Value Facilitation variability is explained by Operand Resources and Value Proposition. 52.3% of Operant Resources variability is explained by Value Proposition. 55.2% of Operand Resources variability is explained by Value Proposition. As it is obvious, the presented results suggest a high explanatory power of Customer retention in the aspect of determining constructs inserted in the proposed Theoretical Model.

Closing remarksBecause Value Proposition plays a central role in business strategy (Payne & Frow, 2014b), it was chosen as the initial construct for the proposed Theoretical Model – essential in service relationships. Also, its relation to two other constructs was established: Operand Resources and Operating Resources (Vargo et al., 2008). The evidenced results make it possible to name the three constructs as the determining ones in Customer retention, validating hypotheses H1 and H2, by establishing that Value Proposition has a significant and positive impact in the configuration of both Operand Resources and Operating Resources.

A series of theoretical proposals relates the configuration of organizational resources to the superior value creation to the clients (Lusch et al., 2010; Moeller, 2008; Vargo & Lusch, 2008b). Specifically, Vargo et al. (2008) as well as Grönroos and Gummerus (2014) defend a direct connection between Operand Resources and Value Facilitation as well as another direct connection between Operand Resources and Value Co-Creation, although there is no empirical evidence of the existence of such connections. In this paper, such connections were hypothesized (H3 and H4), tested and validated. It has been observed that both Operand Resources and Operant Resources have the potential to create value, and that they contribute to create value, whenever made available in the form of either direct or indirect client interactions (Grönroos & Gummerus, 2014), that is, when value is created cooperatively (Value Co-Creation) through Operating Resources, or autonomously (Value Facilitation) through Operand Resources (Kowalkowski, 2015, chap. 3).

Value creation, within the client's sphere, does not always happen via interactions in the providing dichotomy of services-client through resource integration between the two agents, be it direct or indirect interactions (Heinonen et al., 2010). H5 and H6 hypotheses, however, create empirical evidences regarding this proposal, demonstrating that there are significant and positive relations amidst Value Proposition, Value Facilitation and Value Co-Creation. Such relations are based on previous client's experiences with the service provider or the relationship with other agents involved in value creation process, which is the case of clients, friends and family members, to create expectations related to value creation.

By taking into consideration another construct – Value in use – it has been theoretically determined as an outcome of both Value Co-Creation and Value Facilitation, thus creating the hypotheses that Value Facilitation has a positive and significant impact on Value in use (H7) and that Value Co-Creation has a positive and significant on Value in use (H8); which were supported. Value in use has been included into the model to replace the Perceived Value, which has been employed in studies related to Customer retention, since it is considered more adequate to the service context. This happens because, since it is defined as a service experience assessment, the individual judgment of the sum of all client's functional and emotional experiences, which cannot be pre-defined by the service provider, but only by the client himself during or after the service usage (Sandström, Edvardsson, Kristensson, & Magnusson, 2008). Vargo and Lusch (2008b) state that Value in use is the value subjectively determined by the clients whenever they use products and/or services. Authors emphasize the distinction between exchange value – related to the client perceived value –, which represents the nominal sum through which something can be exchanged – vis-à-vis benefits versus sacrifices –, and Value in use, which represents the derivative value by integration and usage, or application, of an available resource (Akaka, Vargo, & Schau, 2015).

Another theoretical contribution that results from establishing the hypothesis that Value in use has a significant and positive impact in Customer retention (H9) was the proposal of Value in use as a determining construct of Customer retention. Such hypothesis has been formulated by the realization that Value in use creation is the most important concept for the service providers (Corvellec & Hultman, 2014; Grönroos, 2008; Holttinen, 2014). Value in use is the real value for the service user. Also, it is created by the former during the usage of available resources: operated and operating (Grönroos & Gummerus, 2014). Besides, the perception of fulfillment of promises – which meets clients’ expectations, noticed by Value in use – contribute toward the intention of staying in the relationship with the service provider (Al-Hawari et al., 2009; Al-Hawari, 2015).

The hypothesis that deems Value in use as a positive and significant influence upon Customer retention (H9) was supported statistically, making it obvious a strong connection between the two constructs (β=0.888). Although there aren’t any studies that have laid the connection so results could be compared, some important theoretical contributions can be inferred from such realization. The first contribution is the hypothesis validation itself, which may allow further theoretical understanding to broaden the understanding of the connection. Under a different view, it reinforces the theoretical proposals that Value in use represents a more adequate approach in service contexts than the perceived value, due to the connective and experimental characteristic of services (Grönroos, Strandvik, & Heinonen, 2015, chap. 4; Sandström et al., 2008). From the service user's perspective, the only effective value is the Value in use (Grönroos & Voima, 2013) and Customer retention is related to the maintenance of a lasting relationship between a service provider and their clients. It is reasonable to suppose, then, that the greater the obtained value by the service user – Value in use -, the greater its proclivity to remain engaged in the relationship, adding potential to its retention. From the service provider's perspective however, the development of Value in use by clients may represent a new way to differentiate service offers from the ones the competition offers (Strandberg et al., 2012).

Finally, it is possible to consider the main theoretical contribution of this study the proposal, test and validation of an original Theoretical Model regarding the Customer retention determinants in a service environment. As previously stated, the predominant view in marketing literature considers the guiding factors of service performance similar to the ones postulated for tangible goods. Some authors, such as Ordanini and Parasuraman (2011), who suggest that some traditional guiding factors in manufacturing and product contexts may have little relevance in service context, have questioned this position. The proposal and validation of the previously mentioned model, by employing constructs from theoretical streams, such as S-D Logic and SL – the latter can be considered a result from the Nordic School – represents a step forward to provide empirical evidences of its main suppositions.

Conflicts of interestThe authors declare no conflicts of interest.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.