This study investigates the strategic decisions of online platform retailers (OPRs) within government-regulated digital marketplaces, focusing on India’s Open Network for Digital Commerce (ONDC). The ONDC initiative, aimed at democratizing e-commerce, presents both challenges and opportunities for large and medium-sized OPRs accustomed to traditionally unregulated environments. Employing a Stackelberg game-theoretic model, the study analyzes three scenarios: (1) neither OPR joins ONDC, (2) only one OPR joins ONDC, and (3) both OPRs join ONDC. Each scenario evaluates key factors—pricing strategies, sales efforts, and supply chain profitability—to determine how regulatory frameworks impact competitive dynamics. The findings reveal a trade-off for OPRs between higher short-term profits when abstaining from ONDC and enhanced long-term value through ONDC participation. Specifically, participation in ONDC can facilitate market sustainability and growth for sellers, underscoring the transformative potential of regulated digital ecosystems. This study provides actionable insights for OPRs contemplating ONDC adoption, highlighting the strategic risks such as potential market share erosion and supply chain inefficiency. For policymakers, it emphasizes the importance of balancing the interests of OPRs and sellers to foster an inclusive, competitive digital marketplace. By examining the strategic adaptations of OPRs within a government-regulated digital marketplace, this study advances the understanding of regulatory impacts on competitive environments and offers a generalizable framework for decision-making in global digital economies.

The global retail sector is undergoing an unprecedented transformation driven by rapid digitalization and shifting consumer behaviors. This evolution has intensified competition, increased operational costs, and reduced profit margins across the industry. In India, the retail landscape presents a unique mix of challenges and opportunities, largely defined by the dominance of traditional mom-and-pop stores—known as Kiranas—which account for nearly 90% of the market share (Rai, 2021). These small, unorganized retailers have historically demonstrated resilience by maintaining close customer relationships and adapting to local preferences (Choudhary & Aithal, 2023). However, the growing presence of e-commerce giants and the widespread digitalization of the retail sector have introduced significant sustainability challenges for these businesses.

The Indian retail sector is poised for substantial growth, driven by an expanding middle class and the widespread use of smartphones for online commerce (Kalia & Paul, 2021). Projections suggest that the market will grow from $779 billion in 2019 to $1.8 trillion by 2030, highlighting strong potential and increasing consumer purchasing power (Indiaretailing Bureau, 2024). This growth is not confined to traditional retailing; it is significantly influenced by e-commerce platforms that have catalyzed a transformative shift in the retail landscape. Leading online platform retailers (OPRs), such as Amazon India and Walmart-owned Flipkart, have experienced exponential growth, drawing hundreds of millions of monthly visits (Pradhan & Jain, 2024). Alongside these giants, smaller and mid-sized online retailers—such as Myntra, Snapdeal, and Meesho—have also emerged as key players (Indian Retailer Bureau, 2024).

The COVID-19 pandemic severely disrupted the Indian retail industry, with government-mandated shutdowns particularly affecting local Kiranas. This disruption exacerbated their competitive challenges against large OPRs like Amazon India and Flipkart, pushing many Kiranas toward digital commerce—a transition fraught with difficulties due to limited resources. The dominance of Amazon India and Flipkart is evident in the market, with numerous complaints filed against these OPRs for allegedly engaging in predatory practices toward small-scale sellers. These practices include imposing high commission charges and multiple fees, significantly impacting the profitability and growth prospects of small retailers. They also create formidable barriers to market entry, stifling both competition and innovation (Kalra, 2021).

In response to these challenges, the Indian Department for Promotion of Industry and Internal Trade (DPIIT) recently launched the Open Network for Digital Commerce (ONDC)1. This groundbreaking initiative aims to democratize e-commerce by introducing an open protocol that creates a level playing field for all market participants. Despite ONDC’s potential to disrupt existing market structures (George & George, 2022), a significant gap remains in the literature concerning its impact on competitive pricing dynamics among OPRs of varying sizes. While existing studies have examined various aspects of e-commerce and digital marketplaces, the specific influence of ONDC on pricing strategies and the redistribution of market share among OPRs remains underexplored. This study aims to address this gap by analyzing how ONDC might reshape the competitive landscape, particularly within the Indian context.

To explore these dynamics, this study is guided by the following research questions:

- ■

RQ1: What is the impact of ONDC on the profitability of OPRs?

- ■

RQ2: How does the shift of customers from traditional OPRs to ONDC affect OPR profitability?

- ■

RQ3: Are major OPRs likely to adopt ONDC or continue operating through their proprietary platforms?

To address these questions, this study employs Stackelberg game-theoretical models to simulate the strategic interactions between two OPRs—one large and one medium-sized—and a single seller. The decision to examine OPRs of varying sizes reflects the real-world market scenario in India, where dominant players like Amazon India and Flipkart coexist with medium-sized platforms such as Snapdeal and Shopclues. By modeling these interactions, the study seeks to provide insights into how ONDC could impact competitive pricing, market share dynamics, and the strategic decisions of OPRs in an increasingly digitized retail environment.

Previous literature has examined how OPRs like Amazon India and Flipkart utilize commission-based fee structures to boost sales and profitability (Gupta & Sharma, 2022; Momaya, 2022). However, there remains a notable gap in understanding how these dynamics unfold among OPRs of varying sizes within the ONDC ecosystem. Furthermore, the existing literature lacks a comprehensive analysis of ONDC’s impact on the profit margins of both large and medium-sized OPRs across different scenarios—specifically, when one OPR joins ONDC, both OPRs join, or neither participates in the network.

To address this gap, this paper proposes a two-stage supply chain (SC) model in which sellers (i.e., manufacturers) act as Stackelberg leaders, while OPRs such as Amazon, Flipkart, and Snapdeal act as followers. The model analyzes commission fees and selling decisions under various scenarios within the ONDC framework. Unlike the traditional e-commerce model—where sellers pay commission fees to OPRs to list and sell products on their proprietary platforms—ONDC offers a unique opportunity for small and medium-sized retailers to expand their reach. It also enables large OPRs like Amazon India and Flipkart to expand their consumer base by joining the ONDC network. Furthermore, the current platform-centric e-commerce environment poses numerous obstacles to achieving widespread accessibility at a population scale.2 In the traditional e-commerce model, a single entity manages all operations, leading to centralized control. In contrast, the ONDC introduces an open network that enables buyers and sellers to interact without reliance on a central authority. Traditional e-commerce platforms often require sellers to operate across multiple platforms2 and pay high commissions, while transactions are limited to users within the same platform. ONDC, on the other hand, enables seamless connectivity between all buyers and sellers, eliminating monopolistic service charges and significantly reducing overall costs for sellers.3 As a result, the decision by large OPRs to join ONDC represents a strategic crossroads, with significant implications for their market positioning and profitability.

To explore these implications, this study developed analytical models to simulate the decision-making process, focusing on two competing OPRs—one large and one medium-sized—and a single seller. The study examines three scenarios: (1) Model B (Benchmarking Model), in which neither OPR joins ONDC; (2) Model E, where only the medium-sized OPR participates in ONDC; and (3) Model O, where both OPRs join ONDC and compete to sell the seller’s products through the platform.

The remainder of the paper is organized as follows. Section 2 presents a review of the relevant literature. Section 3 outlines the research problem and develops the mathematical models used in this study. Section 4 describes the data collection process and presents the results and discussion of the numerical experiments conducted. Section 5 provides a comprehensive sensitivity analysis, examining the effects of market share, advertising, commission fees, and customer shifts, along with the practical implications of these findings. Section 6 highlights the theoretical contributions of this research. Finally, Section 7 summarizes the key findings and explores promising directions for future research.

Literature reviewThis study builds on two distinct yet interrelated strands of literature: online retailing within supply chain management (SCM) and the competitive dynamics among retailers in the context of SCM. The following subsections offer a detailed review of the existing literature, highlight key gaps, and explain how this study aims to address them.

Online retailing in the supply chainRetailing involves the sale of goods and services directly to consumers through various channels, including brick-and-mortar stores, online platforms, and e-commerce. Extensive research has examined the dynamics of online retailing, focusing on different selling formats, consumer behavior, and the integration of online and offline channels (Laudon & Traver, 2020). For instance, Ryan et al. (2012) and Chen and Chen (2017) have explored the impact of various selling formats—such as online marketplaces and dual-channel models—on retailer profitability. These studies highlight the importance of aligning online and offline strategies to enhance overall performance in an increasingly digital retail environment.

Tian et al. (2018) and Lu et al. (2018) further investigated the decision-making processes involved in selecting intermediary selling formats within competitive SCs, highlighting how factors such as fulfillment costs and the intensity of competition significantly influence retail format choices. Building on these insights, Yan et al. (2018) and Yan et al. (2019) explored manufacturers’ preferences for integrating online sales channels and the impact of spillover effects on downstream SCs. Collectively, these studies underscore the complexity of managing hybrid retail models and highlight the critical role of commission fees—as discussed by Wang et al. (2021)—in balancing operational flexibility with the challenges of contract management. Research by Adivar et al. (2019) and Sun et al. (2020) has further expanded the understanding of omnichannel retailing, emphasizing the importance of quality decisions and channel strategies in sustaining a competitive advantage. However, these studies do not directly address the emerging challenges posed by new platforms like ONDC. While they touch on the dynamics of online and offline integration, they do not explore the implications of an open-access platform like ONDC on pricing structures and market share distribution among OPRs of varying sizes.

The rise of online retail platforms has prompted analyses of hybrid retailing scenarios and the impact of commission fees (Chen et al., 2018). Wang et al. (2021) examined a hybrid model in which a manufacturer sells through both an online retailer and an intermediary, finding that while this approach offers flexibility, it also complicates contract management. Similarly, Li et al. (2021) highlighted that consumer showrooming tends to benefit manufacturers but poses challenges for online retailers in dual-channel SCs. Salari et al. (2022) proposed a data-driven framework for real-time delivery forecasting, demonstrating superior performance compared to traditional models. Chen et al. (2023) analyzed sellers’ decision-making within an OPR, comparing participation through a marketplace versus a reselling model. Their findings suggest that when faced with this choice, suppliers should opt for the marketplace model with the lowest minimum quantity contract.

Although previous research has explored various aspects of online retailing, a significant gap remains in understanding how ONDC influences pricing decisions by OPRs, particularly regarding its impact on small-scale organizations. Furthermore, the decision of OPRs to join ONDC and its potential effects on industry dynamics have not been thoroughly examined. These areas warrant further investigation due to their implications for the competitive landscape and the ability of small-scale organizations to compete on a global scale.

Competition between channels in retailingRetail competition across various sales channels has been extensively studied, particularly the phenomenon of showrooming, where customers test products in offline stores but purchase them online at lower prices. This behavior has had a significant impact on pricing strategies and customer retention (Balakrishnan et al., 2014; Jena & Meena, 2022). Cavallo (2018) further explored how online competition, driven by algorithmic pricing and the transparency of the internet, influences pricing behavior among large retailers. This has led to greater pricing uniformity across locations, reducing disparities.

Despite a considerable body of research on online marketplaces, the complexities of competition between retailers within these platforms remain underexplored. Much of the existing literature has focused on traditional competition between manufacturers and retailers, leaving a gap in understanding how competition unfolds among retailers within online marketplaces. For instance, some studies suggest that cooperation between retailers often leads to higher profits than direct competition, indicating that strategic alliances could be more advantageous under certain market conditions (Wang et al., 2024).

In the context of dual-channel strategies, research has highlighted the challenges retailers face in balancing online and offline channels to avoid intra-cannibalization, which can erode profit margins. Kim and Chun (2018) emphasized the importance of managing these dual channels effectively. At the same time, Wu et al. (2018) found that customer switching behavior can reduce price competition between retailers, leading to mutual benefits and potentially higher collective profits. Recent literature has also explored the feasibility of the Buy Online, Pick Up In-Store (BOPS) model, particularly regarding its impact on pricing strategies and inventory management. Studies have identified both the advantages and challenges of implementing BOPS, noting that while it can enhance customer convenience and loyalty, careful management is essential to avoid stockouts (Jiang & Wu, 2022; Shin et al., 2024; Wang et al., 2023).

Despite advancements in understanding retail competition, particularly in online and dual-channel contexts, significant gaps remain—especially regarding the impact of the ONDC on OPRs’ strategic decisions. The ONDC initiative, which aims to democratize digital commerce, has the potential to disrupt existing power structures and reshape competitive strategies. However, its effects on pricing, quality decisions, and SC coordination have not been thoroughly investigated.

This study builds on existing research on retail competition by examining the strategic choices of OPRs within the ONDC framework. It explores how ONDC could disrupt established power structures and influence competitive strategies, particularly in terms of pricing, quality decisions, and SC coordination. By analyzing the optimal competitive strategies for channel selection between two OPRs, this study contributes to a deeper understanding of the evolving dynamics of retail competition in the digital era.

The problem descriptionThis study investigates the dynamics of a two-stage SC, where a seller (or manufacturer) sells its products through two OPRs. The first OPR represents a large market share, exemplified by major players like Amazon India or Flipkart, while the second OPR holds a medium market share, akin to platforms such as Snapdeal and IndiaMart. These OPRs compete to attract customers, primarily through investments in marketing and delivery efforts—common competitive strategies in the Indian e-commerce landscape (Zhang et al., 2020).

Model assumptionsSeveral key assumptions have been made to ensure that the model is relevant and applicable to real-world scenarios. First, the model assumes that OPRs charge a per-unit commission fee rather than a percentage of total sales. This reflects standard practices in the Indian market, where platforms often impose a fixed fee per item sold, enabling small and medium-sized enterprises (SMEs) to predict costs and set prices more effectively. Second, the model presumes that product demand is influenced by both pricing and the sales efforts of OPRs. This assumption is grounded in empirical studies that suggest customers respond to price changes and perceive higher sales efforts—such as faster delivery and better customer service—as added value (Huang & Swaminathan, 2009; Li et al., 2013).

Thirdly, OPR 1 and OPR 2 collectively serve the entire market, so the total market size, α, is fully split between them: OPR 1 captures a fraction, ρα, while OPR 2 serves (1−ρ) (Jena & Meena, 2022; Li & Zhou, 2019; Wu et al., 2018). Fourth, the inclusion of one large and one medium-sized OPR reflects India’s competitive landscape, where dominant players coexist with smaller—yet significant—competitors. This structure is crucial for understanding how platforms of varying sizes respond to initiatives like the ONDC. Lastly, the model introduces the variable t, which represents the number of customers shifting from traditional OPR websites to ONDC. While this variable simplifies the complex nature of customer behavior, it effectively captures the potential impact of ONDC on consumer preferences, considering various factors such as seller marketing strategies, customer loyalty, and the perceived value of ONDC.

Scenarios and strategic decisionsThe study examines three distinct scenarios (see Fig. 1) to capture the potential strategic decisions of OPRs regarding their participation in ONDC. The first scenario, Model B, assumes that neither OPR joins ONDC, allowing both OPRs to continue operating independently by leveraging their established market presence and customer bases. This scenario serves as a benchmark, representing the status quo, where ONDC has no direct influence on market dynamics.

The second scenario, Model E, suggests that the medium-sized OPR joins ONDC while the larger OPR does not. In this case, the medium-sized OPR may gain a competitive edge by leveraging the ONDC network, potentially attracting sellers and customers who are drawn to the lower commission fees and broader market reach offered by ONDC.

The third scenario, Model O, explores a situation where both OPRs join ONDC, intensifying competition within the ONDC framework. In this scenario, both platforms must adjust their strategies to align with ONDC’s rules and conditions, thereby examining the implications of a fully integrated digital commerce environment.

Analytical model and decision variablesTable 1 outlines the notation used in our analytical models. The model aims to determine the optimal pricing p1(p2)and sales effort e1(e2)levels for the OPRs to maximize their profits. These decisions are crucial as they directly influence product demand and overall SC performance. Consistent with previous findings (Huang & Swaminathan, 2009; Li et al., 2013), we assume that self-price, cross-price, sales effort, and cross-sales effort have a linear impact on product demand.

Notations in models.

The term “sales effort” refers to the overall quality of service that OPRs provide to sellers, including factors such as advertising, feedback collection, packaging, and delivery. Higher sales effort typically leads to increased customer awareness and higher immediate purchases (Cachon, 2003; Jena & Meena, 2022; Li et al., 2013; Ofek et al., 2011).

Model justificationThe model’s structure and assumptions are carefully designed to reflect real-world scenarios in the Indian digital commerce market. The selection of OPRs, the focus on commission fees, and the modeling of seller shifts align with the current trends and challenges faced by online retailers in India. By examining these specific scenarios, the model offers valuable insights into how ONDC could reshape market dynamics, influence pricing strategies, and impact the overall performance of the SC.

Although the model is rooted in the Indian context, its implications extend beyond this market. Similar government-led digital initiatives are emerging globally, making this study relevant for understanding the potential worldwide impact of such frameworks on online retailing. Future research could adapt this model to different markets, exploring how variations in market structure and consumer behavior might influence outcomes.

Case1: Model L (Benchmarking model)In this scenario, both OPRs compete on price and sales efforts to sell products without participating in the ONDC. These OPRs enable sellers to offer their products to customers through their platforms, as illustrated in Fig. 1. The OPRs charge varying commission fees based on the number of units sold and their sales efforts. Product demand is influenced by the pricing and sales efforts made by the OPRs, as described by the following equations:

where, Diand pi(i=1,2) represent the product demand and unit sale price for OPRs 1 and 2, respectively. The notation αdenotes the market size for OPRs 1 and 2, while ρ defines the market share of OPR 1. Therefore, ρα represents the sales potential for OPR 1, and (1-ρ)α represents that for OPR 2. The parameter β represents the price elasticity of demand for the products, and γ denotes the cross-price elasticity between the two products. The notation ei represents the sales efforts of the OPRs, with θ being the coefficient of effort for selling products, and ν representing the cross-effort observed by the OPRs.The profit of the OPR 1 is as follows:

The profit of the OPR 2 can be written as:

The seller’s profit can be expressed as:

We solve the two-stage SC game using backward induction. In this model, the seller maximizes profits by investing in an appropriate display level, which depends on OPR 1 and OPR 2′s sales efforts. The first-order condition of Eqn. (3) yields the seller’s reaction function, given the effort e1.

Given the concave nature of πR1 (as proven in Appendix A), the optimal solution is derived by solving the first-order condition, which gives:

Similarly, the optimal effort level for OPR 2 is:

The seller’s reaction function is then obtained by applying the first-order condition of Eqn. (5), using the values of e1Lande2L:

Appendix B demonstrates that the functionπsL is concave. By substituting Eqs. (7), (8) into Eq. (9), we derive the seller’s equilibrium selling prices through the first-order conditions for the profit maximization problems of OPRs 1 and 2:

By solving Eqs. (7), (8), (10), and (11) simultaneously, we obtain the optimal equilibrium solution (p1L*,p2L*,e1L*,ande2L*) as shown in Appendix B.

Proposition 1 With an increase in market share, OPR 1 and OPR 2 sell their products at higher prices when their respective commission fees are:τ1≤2βθ2andτ2≥2βθ2. (Proof in Appendices)

According to Proposition 1, there is a positive correlation between a product’s selling price and its market share. This relationship exists because organized players (OPRs) generate revenue through commission fees. When OPRs sell a product at a lower price—thereby increasing demand—or at a higher price—potentially decreasing demand—their revenue adjusts accordingly. The product’s selling price tends to rise if competitive sales efforts positively influence market size, thereby helping to balance supply and demand dynamics. Moreover, OPRs leverage customers’ sensitivity to both product quality and price by using effective sales strategies that encourage customers to prioritize product value over pricing concerns. OPRs typically adopt a pricing strategy based on market share—initially offering uniform prices but adjusting them as market share expands, often accompanied by changes in commission structures (Duan et al., 2022).

Moreover, as market size expands, the resulting increase in demand prompts OPRs to adjust product prices to match supply and demand (Li, 2020). This approach helps maximize profits while simultaneously incentivizing members of the sales force. OPRs also employ various strategies, such as offering product discounts to encourage continued customer loyalty. Additionally, they actively monitor customer feedback and make necessary adjustments to product quality and pricing. This iterative process not only strengthens customer loyalty but also fosters a positive brand image. As a result, OPRs can maintain a competitive advantage and ensure high levels of customer satisfaction.

Case2: Model EIn this scenario, OPR 2 agrees to join the ONDC, while OPR 1 declines, opting instead to review ONDC’s retail environment before making a decision. Despite this, OPR 1 and OPR 2 remain competitors. The seller continues to offer products through both OPR 1′s proprietary platform and OPR 2′s ONDC-integrated platform. The formulation of the product demand functions takes into account the sales prices and sales efforts provided by the respective OPRs, and is expressed as follows:

Linear demand functions are widely adopted in economics and SC management research (Wu et al., 2018). In this context, tz is a random variable representing the uncertain number of customers who may shift from OPR 1 to OPR 2 (i.e., the ONDC platform), primarily due to OPR 2′s lower commission fees (Duan et al., 2022). Specifically, the variable z follows a uniform distribution over [A,] (with A>0 and B>A), capturing the unpredictability of how many customers ultimately transition to OPR 2′s channel.

Moreover, traditional web and third-party services often fail to adequately protect users’ personal information from misuse (Gupta & Sharma, 2022). In contrast, ONDC is considered more secure, offering enhanced privacy protections (Mahesh et al., 2022; Salkever et al., 2022). Given that OPR 1′s independent platform is perceived as less secure than ONDC, some customers may prefer purchasing from OPR 2 via the ONDC platform, further reinforcing the random nature of tz.

The game sequence begins with the seller setting the product’s sales price. The OPR then decides whether to promote the product on its platform and sets the commission fee accordingly. With OPR 2 joining the ONDC and offering a lower commission fee, we apply backward induction to determine the optimal selling price and sales efforts. The profit function for OPR 1 under Model E in the SC is expressed as follows:

Due to the concavity of the objective function (∂2πR1E∂e12=−2<0), the first-order condition can be used to determine the optimal product prices on both platforms.

Similarly, the profit function for OPR 2 is as follows:

The optimal value of the effort for OPR 2 is derived as follows:

The profit function of the seller, considering the sales efforts of their OPRs in the SC is given by:

By substituting Eqs. (14) and (16) into the profit functions, we derive the equilibrium selling prices:

where =2αρ+2(β−γ)w−(2γ+θν)k2andL=(−2tμ+2T1θν+wθ(−θ+ν)+2α(−1+ρ))η2.By solving Eqs. (14), (16), (18), and (19) simultaneously, the optimal equilibrium solution (p1E*,p2E*,e1E*,ande2E*) can be obtained (see Appendix C).

Proposition 2 With an increase in market share, OPR 2 sells its products at higher prices under Model E compared to Model B when(2β−θ2τ2)(2β−θ2η2)>0.

According to Proposition 2, an increase in a product’s market share leads to a corresponding rise in its selling price, aimed at balancing demand with supply. This pricing trend can be attributed to intensified competition, a stronger brand reputation, and increased demand for the product on the ONDC platform.4 OPRs are more likely to join ONDC when product pricing has a greater impact on demand and profit than sales efforts—or when pricing negatively influences demand more than sales effort and commission fees. Upon joining ONDC, OPRs are required to accept lower commission fees while allocating more resources toward advertising and delivery to ensure faster service (Mahesh et al., 2022; Barik, 2022; Salkever et al., 2022). Typically, OPRs price their products higher on their portals than on ONDC when the market size is relatively small.

Moreover, privacy and security threats are not confined to the retail industry alone but are widespread across e-commerce (Duan et al., 2022; Kummer & Schulte, 2019). Traditional websites and third-party services often fail to provide adequate protection against the misuse of personal information (Gupta & Sharma, 2022). In contrast, the ONDC is perceived as a more secure platform, offering enhanced privacy protection for customers (Mahesh et al., 2022; Salkever et al., 2022). As a result of these privacy concerns, customers increasingly prefer purchasing products through OPRs on the ONDC rather than on the OPRs’ independent platforms. Consequently, sellers adjust their pricing in Model E, increasing it relative to Model B to accommodate rising customer demand.

Case 3: Model OIn this scenario, both OPRs (i.e., OPR 1 and OPR 2) actively join the ONDC and compete to sell their products through the platform. This strategy enables them to increase sales and expand their customer base by reaching consumers who might otherwise be unaware of their offerings. In the era of online shopping, platform preferences play a significant role in shaping consumers’ purchasing intentions (Chen & Yang, 2021). As the ONDC network expands, customers’ channel preferences continue to evolve, influencing their final purchase decisions. By joining ONDC, both OPR 1 and OPR 2 gain access to a new segment of customers who place greater trust in a government-backed platform. ONDC offers a crucial opportunity for small and micro businesses to attract local customers through a single, reliable network.

To model the impact of sales prices and sales efforts employed by both OPRs within the ONDC, we adopt a linear demand approach consistent with previous research (Jena & Meena, 2022; Li & Shan, 2023). We define the product demand functions as follows: D1O=ρα−βp1+γp2+θe1−νe2+t1z1for and D2O=(1−ρ)α−βp2+γp1+θe2−νe1+t2z2 for OPR2.

In this model, ti and zi jointly represent the potential influx of newly migrating customers who were previously purchasing exclusively from other standalone platforms (Mahesh et al., 2022; Salkever et al., 2022). Specifically:

- ■

zi represents the portion of additional customers discovering ONDC. Consistent with prior assumptions, z can be treated as a random variable (e.g., uniformly distributed) to capture the uncertainty surrounding how many new consumers are effectively reachable.

- ■

ti serves as a scaling factor, indicating the fraction of these newly reachable consumers who adopt each OPR’s offering once on ONDC.

For simplicity, we assume an equal split of these new customers between the two OPRs, such that t1z1=t2z2=tz. OPR 1 and OPR 2 therefore operate under symmetrical conditions when both join ONDC—facing identical fee structures, having comparable access to the ONDC buyer pool, and possessing equal potential to attract migrating consumers.

Accordingly, we express the final demand functions as follows, where both OPRs experience the same upward shift tz:

We aim to explore how ONDC affects OPRs and SC profits. To maintain simplicity in the model and focus on local business players, we assume both OPRs have equal exposure to a common pool of new customers utilizing the ONDC platform. The profit for OPR 1 can be calculated as:

Since the objective function is concave (∂2πR1O∂e12=−2<0), we determine the optimal prices of the product on the two platforms using the first-order condition:

Similarly, the optimal value of effort for OPR 2 is given by:

The profit functions of the seller, considering OPRs in the SC, are defined as follows:

where τ1>η1, τ2>η2and T1>k1.where 2(wβ−wγ+tμ+αρ)=G.where (2γ+θν)=C.By solving Eqs. (23), (24), (26), and (27) simultaneously, the optimal equilibrium solution (p1o*,p2o*,e1o*,ande2o*) can be derived (see Appendix D).

Proposition 3 OPR 1 can sell its products at a higher price than OPR 2 when a greater number of customers shift (t) from the e-commerce platform to ONDC, andβ∈(θ2η22,θ2η12).(Proof in the Appendices)

According to Proposition 3, OPR 1 sells its products at a higher price than OPR 2 when more customers shift to the ONDC platform. Additionally, OPR 1 imposes a higher commission fee on sellers for each unit sold but compensates for this by ensuring on-time delivery and leveraging advanced analytics to understand customer behavior and retailer sales performance. This strategy enables OPR 1 to capture brand-sensitive customers and maximize commission revenue, thereby justifying the higher selling prices. Although this approach may negatively impact demand, OPRs prioritize serving customers who seek personalized experiences and place a high value on quality and timely delivery.

Due to higher commission fees, OPR 1 can allocate more resources to advanced analytics, allowing it to capture brand and advertising sensitivity and gain deeper insights into customer behavior (Salari et al., 2022; Wang et al., 2021). Furthermore, OPR 1 ensures on-time delivery through a well-coordinated process designed to meet customer requirements. Price-sensitive customers may still choose to purchase products exclusively available on OPR 1′s platform, especially when it is the sole provider of those items.

Data collection and numerical experimentTo rigorously model the dynamics of the Indian retail sector within the ONDC framework, a comprehensive data collection process was conducted between April 3, 2022, and August 31, 2022. This process integrated data from both primary and secondary sources to establish a solid foundation for the analytical models used in this study. The research is grounded in established theoretical frameworks in SC coordination and platform economics, which informed both the data collection strategy and the subsequent numerical modeling approach.

The data sources included detailed information extracted from the official websites of leading OPRs, such as Amazon India, Flipkart, and Snapdeal. This data encompassed critical aspects of their operations, including pricing mechanisms, commission structures, service levels, and broader strategic approaches. These elements are crucial for understanding their competitive behavior in the market. Additionally, in-depth consultations were conducted with industry experts—including marketing directors, a sales chief, and an academic specializing in marketing—each possessing over a decade of experience. These experts provided valuable qualitative insights into current market trends, prevailing pricing strategies, and the anticipated impact of ONDC on the broader retail ecosystem. Moreover, macro-level data was sourced from the Commerce and Industry Department of India (CIDI), a government body that offers a comprehensive overview of the ONDC initiative and relevant industry metrics. This government data served as “secondary data,” situating the ONDC’s impact within a larger economic context and complementing the granular operational data gathered from OPR websites.

Additionally, we reviewed existing academic literature, industry reports, and white papers, which provided a solid theoretical foundation for the study. These sources offered essential background on digital commerce, platform economics, and the expected effects of the ONDC initiative. Media reports were also examined to capture the ongoing discourse and public sentiment regarding the ONDC’s implementation, offering supplementary context to the data collected from primary sources. Moreover, we could not obtain certain parameter values (e.g., for cross-price elasticity or cross-effort elasticity) from reports and websites. For these parameters, we used hypothetical data based on company reports and e-commerce website information, consistent with assumptions made in similar analytical research.

This extensive data collection process yielded several critical observations regarding the ONDC. The network operates on an adapted version of the Beckn Protocol, a global open-source standard developed in India. It facilitates retail commerce and extends its application to sectors such as mobility and healthcare (Salkever et al., 2022). ONDC is designed to establish a comprehensive digital infrastructure for commerce, encompassing inventory management, logistics, and dispute resolution, with an ambitious plan for nationwide rollout. Additionally, ONDC envisions a flexible fee structure, starting at 1.5 percent per transaction, which may decrease to 0.1–0.2 percent as the network scales. This fee structure is embedded in consumer prices (Salkever et al., 2022).

The assumptions underpinning our numerical model were carefully chosen based on established empirical studies and theoretical frameworks in SCM and platform economics. For example, the use of a linear demand function is supported by literature (Jena & Meena, 2022; Salkever et al., 2022), which demonstrates its effectiveness in modeling competitive pricing strategies in multi-channel retail environments. Similarly, the decision to model commission fees on a per-unit basis aligns with findings from studies that identify this pricing structure as common in the Indian market (Jena & Meena, 2022; Salkever et al., 2022). These assumptions provide a solid foundation for the subsequent analysis and ensure that our model accurately reflects the real-world dynamics of the Indian retail sector.

Utilizing the collected data, a series of numerical experiments were conducted to validate and apply the analytical models. These experiments were carefully designed to explore the strategic implications of ONDC participation for both large and medium-sized OPRs, with a focus on pricing strategies, commission fees, and market competitiveness. Table 2 presents the parameters used in our numerical experiments along with their respective values.

Numerical parameter values.

The numerical experiment assessed three distinct scenarios to identify the optimal strategic responses of OPRs within the ONDC framework. The first scenario (Model B) considered a situation where neither OPR joined the ONDC, allowing each to operate independently. The second scenario (Model E) explored the strategic implications of only the medium-sized OPR (OPR 2) joining the ONDC, potentially gaining a competitive advantage over the larger OPR (OPR 1). The third scenario (Model O) examined the outcomes when both OPRs joined the ONDC, resulting in a balanced and competitive market environment. These scenarios were rigorously analyzed to determine the optimal pricing strategies, sales efforts, and overall profitability for both OPRs and sellers. The results provide valuable insights into how ONDC participation may alter market dynamics and influence the long-term strategic decisions of OPRs.

Results and discussionsThis section presents the outcomes of our numerical experiments and offers a comprehensive discussion of their implications for the strategic decision-making of OPRs within the ONDC framework. The primary focus is to understand how the different scenarios—represented by Model B, Model E, and Model O—affect profitability, selling prices, demand, and advertising efforts for both OPRs and sellers. The numerical results obtained from these three models are summarized in Table 3.

In Model B, the results indicate that OPR 1, benefiting from its larger market share and stronger brand recognition, sets higher selling prices and invests more in advertising compared to OPR 2. This strategy leads to increased product demand for OPR 1, enabling it to achieve higher individual profitability. However, it is important to note that this advantage is based on certain assumptions—such as moderate price sensitivity, favorable cross-price effects, and the perceived added value of OPR 1′s service levels. For instance, if customers were highly price-sensitive, OPR 1 might struggle to maintain premium prices while still capturing strong demand.

Despite OPR 1′s relative success, the total SC profit under Model B is the lowest among all three scenarios. This outcome suggests that the absence of ONDC participation limits overall market efficiency and potential gains, restricting the SC’s ability to optimize performance and realize the broader benefits that could have emerged from a more integrated digital environment.

The dynamics shift in Model E, where only the medium-sized OPR (OPR 2) joins the ONDC. In this scenario, OPR 2 experiences increased product demand and can set higher selling prices, with these benefits further amplified by the reduced commission fees within the ONDC framework. Conversely, OPR 1 faces a reduction in both selling prices and advertising efforts as it loses market share to OPR 2. While OPR 2 gains a competitive edge, OPR 1′s profitability declines as a result. Nevertheless, the overall SC profit in this model exceeds that of Model B, highlighting the potential advantages of ONDC participation for medium-sized OPRs and the sellers who partner with them.

Model O represents the scenario in which both OPRs actively participate in the ONDC, creating a highly competitive and balanced market environment. In this model, OPR 1 and OPR 2 set identical selling prices, sales efforts, and product demand, highlighting that the ONDC framework promotes a more equitable competitive landscape. As a result, this scenario generates the highest profitability for the seller, driven by increased product demand and optimized pricing strategies. Furthermore, the total profit of the SC is highest in this model, emphasizing the efficiency and effectiveness of a fully integrated digital commerce environment within the ONDC.

Interestingly, the findings show that both OPRs achieve higher individual profits in Model B, where they do not participate in the ONDC. This outcome is primarily due to their ability to charge higher commission fees and maintain elevated selling prices without the competitive pressures introduced by the ONDC. However, in Models O and E, the seller attains greater profitability due to reduced commission fees and enhanced product demand within the ONDC framework. This result underscores the significant benefits for sellers who partner with OPRs involved in the ONDC, which aligns with previous research (Duan et al., 2022; Johnson, 2013).

While large OPRs may initially enjoy higher profits outside the ONDC, the long-term benefits of increased market access, customer trust, and sustained growth through ONDC participation should not be overlooked. Large OPRs must carefully weigh the short-term gains from higher profits against the risks of long-term market share erosion and decreased SC efficiency if they choose to remain outside the ONDC. The intensified competition fostered by the ONDC allows sellers of various sizes to market and sell their goods and services more effectively. However, this competitive environment also reduces profits for OPR 2 in Model E, as the seller pays a lower commission fee to OPR 2 compared to OPR 1. As a result, both OPRs must strategically adjust their pricing and sales efforts to succeed in this competitive landscape.

Overall, Model O demonstrates the potential for the ONDC to enhance overall SC efficiency by fostering a collaborative network between OPRs and sellers. This finding challenges previous studies (Duan et al., 2022; Esteves & Resende, 2019), suggesting that while large OPRs may see higher immediate profits outside the ONDC, the broader collaborative benefits within the ONDC framework could lead to more sustainable and equitable growth for all stakeholders. The results also indicate that OPR 1′s optimal strategy might involve not participating in the ONDC for price-sensitive segments. In this case, lower selling prices and commission fees could drive increased demand and allow for more tailored advertising strategies. However, the collaborative advantages offered by the ONDC—such as broader market access and enhanced customer trust—should be considered integral to the long-term strategic planning of OPRs.

Sensitivity analysis and managerial implicationsThis section presents a comprehensive sensitivity analysis to assess the robustness of our models and derive actionable insights for OPRs and sellers operating within the ONDC framework. The study examines how key parameters influence the model outcomes, with a particular focus on their implications for profitability and strategic decision-making.

Effect of market shareMarket share analysis provides critical insights into OPR profitability across different models. Our findings show that OPR 1′s profit increases across all models as market share (ρ) expands, as illustrated in Fig. 2. In Model B, where neither OPR joins the ONDC, profits for both OPRs and overall SC profitability are higher compared to the other models, especially as market share (ρ) increases. This rise in profitability in Model B can be attributed to the absence of ONDC’s regulatory constraints, which allows OPRs to charge higher commission fees and impose additional charges for operations such as packaging and delivery. OPRs, particularly those with significant market share, can more fully exploit their monopolistic advantages in this model. For these OPRs, it is crucial to strategically set commission fees and additional charges to optimize profitability while maintaining competitive pricing to attract both sellers and consumers.

Moreover, OPRs typically allocate substantial resources to advertising efforts to attract a broader customer base, which leads to higher product selling prices. While this strategy benefits OPRs, it reduces sellers’ profits. This trade-off underscores the inherent tension between OPR-driven pricing strategies and seller profitability. OPRs must carefully balance advertising expenditures with their effects on product prices and demand. Although aggressive advertising can stimulate demand, the resulting higher product prices must not deter consumers.

The dominance of leading OPRs like Amazon and Flipkart in the Indian market allows them to attract greater demand, ultimately leading to higher profits. These OPRs can leverage their established brand reputation and extensive logistics networks to negotiate better terms with sellers and offer value-added services that justify higher commission fees, ensuring sustained profitability even as market conditions evolve. However, OPRs must also acknowledge the potential trade-offs when participating in ONDC. While their market share may increase, their profits could decline due to reduced commission fees and heightened competition from retailers of various sizes, including local Kiranas. Nevertheless, in large markets, it becomes advantageous for OPRs to sell products on the ONDC platform.

Joining the ONDC offers an opportunity to expand market reach and access a broader customer base. However, OPRs must carefully assess the impact of lower commission fees and increased competition on their overall profitability. To balance the benefits of expanded market reach through ONDC participation with potential reductions in commission fees, strategies could include optimizing operational efficiencies and leveraging data analytics to tailor offerings more precisely.

The entry of various retailers, including smaller Kiranas, onto the ONDC platform increases competition, prompting OPRs to strengthen their value propositions by offering superior logistics and customer service. To succeed in this competitive ONDC environment, OPRs should focus on differentiating themselves through unique value propositions, such as faster delivery times, exclusive product ranges, and exceptional customer experiences.

Effect of advertising effort elasticityThe elasticity of advertising effort (θ) plays a critical role in influencing OPR profitability across different models. As shown in Fig. 3, in Models O and E, SC profits initially increase with higher values of θ, but eventually stabilize. This trend indicates that increased advertising efforts positively impact profitability by attracting more customers and driving higher sales up to a certain point. Beyond this threshold, the marginal benefits of additional advertising diminish, resulting in steady profits. Therefore, OPRs need to determine an optimal level of advertising effort that maximizes returns without overspending.

Notably, OPR 1 achieves lower profits in Model O compared to Models B and E. This outcome results from reduced advertising efforts and higher selling prices in Model O, which deter customers and reduce demand. In contrast, OPR 1 can adopt more aggressive advertising strategies in Models B and E, attracting a larger customer base and maintaining higher profits. This finding suggests that larger OPRs should strategically balance their advertising efforts with competitive pricing to attract and retain customers. Overly aggressive advertising without corresponding competitive pricing can discourage potential customers, leading to a decrease in both demand and profitability.

Interestingly, sellers benefit from higher profits as more customers flock to purchase their products. The relatively high prices that OPRs charge for targeted advertisements in traditional models drive both customers and sellers toward the ONDC platform. Here, lower advertising costs and a broader reach create a more favorable environment for sales. This outcome underscores the potential of ONDC to level the playing field for smaller sellers, allowing them to compete more effectively with larger OPRs.

Effect of the commission feeThe impact of the commission fee (τ) on OPR profitability is a critical factor in shaping their strategic decisions. As shown in Fig. 4, SC profits increase across all three models as commission fees rise. This trend indicates that higher commission fees boost profitability by enabling OPRs to generate more revenue from each transaction.

In Model B, OPRs achieve higher profitability due to intense competition among them for sellers’ products. This competition drives OPRs to offer better services and attract more sellers, thereby increasing revenues. Additionally, a traditional e-commerce platform operates as a single-entity channel. When customers enter this channel, they often purchase more products in bundles to take advantage of reduced shipping costs. This model is particularly advantageous for OPRs with significant market share, as they can impose higher fees without significantly losing their customer base. The intense competition motivates OPRs to optimize their service offerings, which enhances both seller and customer satisfaction, ultimately boosting profits.

In Model E, when the commission fee drops below 0.1, it generates higher profits than Model B. This outcome is primarily due to reduced demand and a larger market. Lower commission fees attract more sellers to the platform, which expands the market size and increases overall transactions. This model proves advantageous for OPRs operating in markets where lower fees can stimulate demand and attract a broader base of sellers. By reducing commission fees, OPRs can create a more inclusive and appealing platform for sellers, thereby enhancing market diversity and reach.

As the commission price (η1) increases under the ONDC process, the price of OPRs decreases in Model B. However, it is important to note that in Model O, OPRs generate higher profits than in Model B, especially when the value of η₁ exceeds 0.12, as shown in Fig. 5. These findings suggest that increasing the commission fee does not necessarily lead to a decrease in OPRs’ profits, as the outcome depends on the specific model used. In Model O, higher commission fees, combined with ONDC’s broader market reach and lower operational costs, can lead to increased profitability.

In response to an increase in commission fees and a corresponding decline in product demand, sellers may opt to raise their product prices to offset the revenue loss. This adjustment can impact overall market dynamics and OPR profitability. Consequently, OPRs are likely to generate more profit by joining ONDC than by remaining outside it. The ONDC platform provides a broader market reach and lower operational costs, which can help compensate for the higher commission fees.

Furthermore, it is important to note that Indian customers demonstrate greater confidence in and derive more benefits from ONDC. This suggests that the market size for products under ONDC may expand in the future. The growing consumer trust in ONDC is likely to drive higher demand, benefiting both OPRs and sellers. This trend highlights the significance of strategic participation in ONDC to capitalize on its expanding market potential and boost profitability.

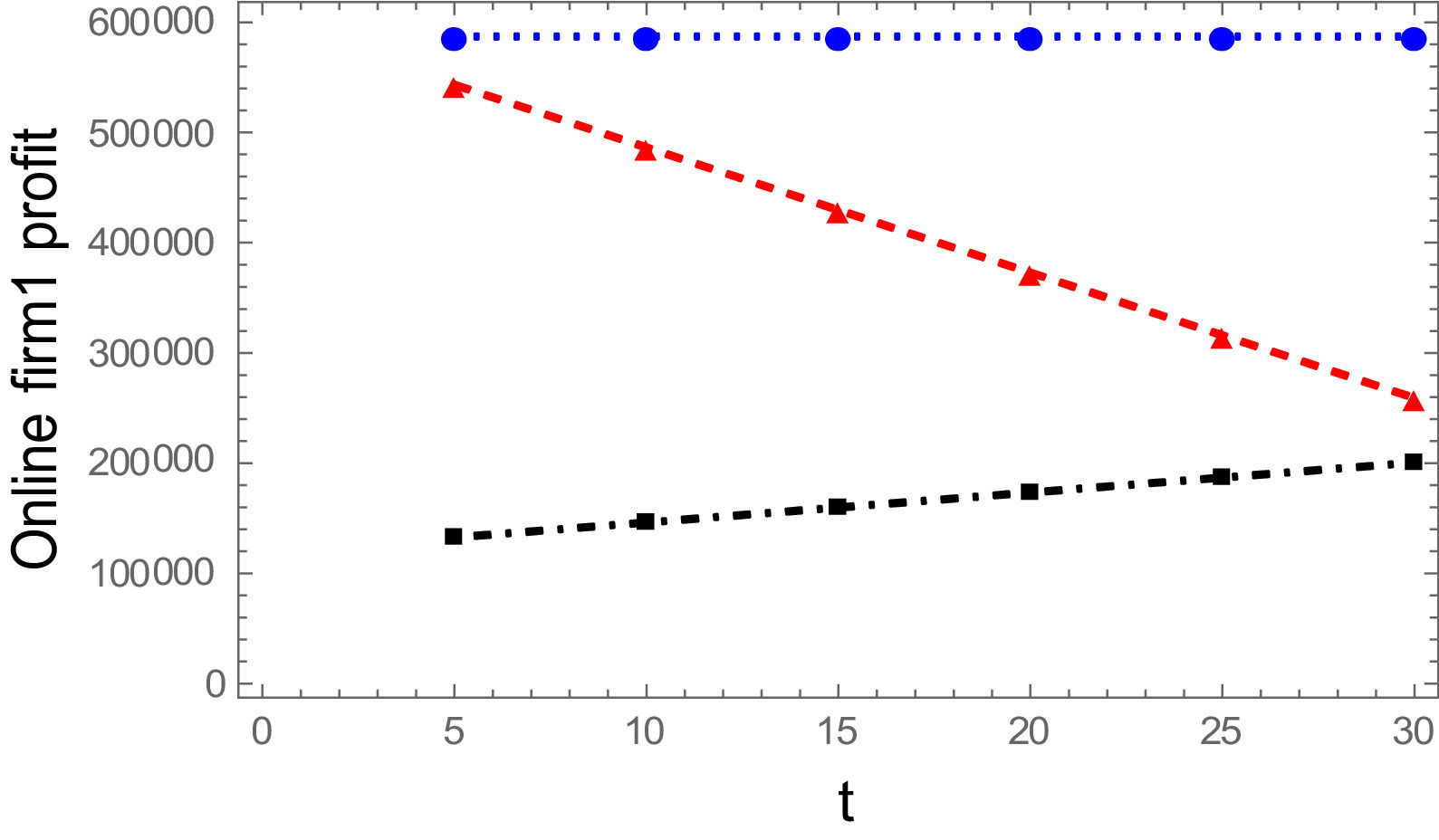

Effect of customer shifts from individual OPR to ONDCThe profitability of OPRs is significantly influenced by the migration of a random number of customers from individual e-commerce platforms to the ONDC, as shown in Fig. 6. The findings indicate that OPRs experience increased profits as more customers transition from individual retailer platforms to the ONDC. This upward trend in profits can be attributed to the ONDC’s lower commission fees and higher customer demand, which together make it a more financially rewarding platform for selling products. Additionally, the ONDC’s inclusive nature allows customers to shop from any retailer, providing OPRs with access to a larger customer base and, in turn, boosting profits.

However, the benefits of the ONDC platform are not universal. For example, when a large OPR joins ONDC while a medium-sized OPR continues to sell products through its platform, OPR 1 experiences a gradual decline in profits over time. This decline is driven by shifting consumer preferences toward the ONDC platform and the loss of exclusivity for OPR 1. This scenario highlights the need for strategic decision-making by OPRs when considering their participation in the ONDC.

The preference for ONDC over large OPRs can be attributed to the relatively higher commission fees charged by the OPRs, which prompt sellers to raise their prices. As a result, OPR 2 and the sellers experience increased profitability. Large OPRs only achieve higher profits when fewer than 30 customers transition to the ONDC. However, they face reduced profits when a significantly larger number of customers shift to ONDC.

Therefore, it is crucial for large OPRs to strategically assess their options and carefully consider joining ONDC when a significant number of customers migrate from their platforms. This move will help ensure sustained profitability and secure their market position. Large OPRs must also develop innovative pricing strategies that strike a balance between profitability and customer satisfaction to remain competitive. By integrating their operations with ONDC, they can take advantage of the platform’s benefits while preserving their brand identity and customer loyalty. This hybrid approach—maintaining their platforms while participating in ONDC—enables them to reach a broader audience and sustain profitability.

Theoretical and managerial implicationsThis section discusses the broader theoretical contributions of our study to SCM and regulated digital marketplaces, while also offering practical guidance for managers considering participation in ONDC in the following subsections.

Theoretical implicationsThis study makes several important contributions to the literature on SCM, competitive dynamics among OPRs, and digital commerce ecosystems, especially in the context of government-led initiatives such as the ONDC. By integrating game-theoretical models with a focus on the ONDC, this research advances existing theories in several key areas.

The first contribution of this study is its extension of SCM theory into the realm of digital platforms and decentralized networks. While traditional SCM theories have primarily focused on linear and hierarchical SCs (Adivar et al., 2019), this study addresses the complexity of a multi-stakeholder environment like the ONDC. Building on the work of Ryan et al. (2012) and Chen and Chen (2017), who examined competition and coordination in online marketplaces, this study explores how digital networks influence SC decisions in a non-linear and decentralized context. The findings provide new insights into the management of SCs operating within open, government-regulated platforms, thereby broadening the scope of SCM theory to encompass modern digital ecosystems.

The second contribution lies in advancing competitive dynamics theory among OPRs. Previous research has primarily focused on competition between online and offline retailers, as well as the strategic introduction of online channels (Wang et al., 2021; Yan et al., 2019). However, this study explicitly examines how regulatory frameworks, such as ONDC, alter competitive behaviors among OPRs of different sizes. By integrating the strategic choices of OPRs within a game-theoretical model, this research expands on the findings of Yan et al. (2018) and Wu et al. (2018), offering a more nuanced understanding of how competition is reshaped in a regulated digital marketplace. This adds a critical dimension to the literature on platform competition, highlighting the pivotal role of regulation in shaping competitive strategies and market outcomes.

This study also makes a significant contribution to the literature on digital platform theory, particularly in the context of multi-sided markets. The ONDC initiative, as examined in this research, challenges traditional platform economics by introducing a government-led, inclusive platform that disrupts established market dynamics (Lu et al., 2018; Tian et al., 2018). The findings illustrate how regulatory interventions can democratize access to digital markets, thus extending Lu et al. (2018) work on strategic pricing models in distribution channels. Additionally, this research complements Adivar et al. (2019) work by providing a quantitative analysis of how platform regulation affects the competitive landscape and operational efficiency of OPRs, thereby contributing to a more comprehensive understanding of digital platform economics.

The fourth theoretical contribution of this study is its integration of game theory with digital commerce regulation. While game theory has been widely applied to traditional markets (Chen et al., 2018; Salari et al., 2022), its application to regulated digital platforms remains less explored. This research advances the literature (Wang et al., 2021; Wu et al., 2018) by applying game-theoretical models to analyze the strategic decisions of OPRs within the ONDC framework. The results demonstrate how OPRs adjust their pricing, commission fees, and sales efforts in response to regulatory changes. This study offers a novel analytical tool for understanding strategic decision-making in regulated digital marketplaces. The integration of game theory with digital commerce regulation provides a new perspective for analyzing and understanding the impacts of government-led platforms.

This study expands the concept of digital commerce ecosystems by examining the role of an open, government-regulated platform in shaping market dynamics. The ONDC model, as analyzed in this research, provides a theoretical foundation for understanding how such ecosystems can foster greater competition and inclusivity, challenging existing paradigms that favor large, established platforms (Cavallo, 2018; Shin et al., 2024). Additionally, this work builds on the findings of Chen et al. (2018) by illustrating how open networks can enhance SC efficiency and market accessibility, contributing to the broader discourse on digital commerce and platform economics. The study’s findings offer valuable theoretical insights into how open digital platforms can serve as tools for economic democratization, potentially reshaping the future of global digital commerce.

Managerial implicationsBuilding on insights from the three scenario-based results (Models B, E, and O) and the sensitivity analyses (market share, advertising elasticity, commission fees, and customer shifts), several strategic implications emerge for managers considering whether, how, and when to integrate with the ONDC framework. The results suggest that remaining outside the ONDC (Model B) may yield higher short-term profits for OPRs with substantial market share, due to the ability to charge elevated commission fees. However, this strategy limits overall SC efficiency and may lead to long-term market share erosion, as medium-sized competitors or local Kiranas take advantage of ONDC’s lower fees to attract both sellers and buyers. In contrast, joining ONDC (Models E and O) generally enhances seller profitability and improves overall SC performance. This indicates that large OPRs, though initially hesitant, should weigh short-term margin benefits against the longer-term risks of losing market access and facing intensified competition.

In scenarios with reduced ONDC commission fees (Model E), medium-sized OPRs can profit by setting higher retail prices while still attracting sellers drawn to the platform’s lower costs. However, large OPRs in this environment must exercise caution. While heavy advertising can maintain brand visibility, it may also inflate selling prices, which could suppress consumer demand. Managers should, therefore, align advertising budgets with realistic expectations of price sensitivity, recognizing that if both sellers and buyers favor ONDC for its cost savings, aggressive promotion outside the platform may yield diminishing returns. Additionally, sensitivity analyses show that a moderate increase in commission fees can boost revenue when consumer loyalty or brand appeal is strong. However, excessive fees may risk driving cost-sensitive customers away.

Further, the market share analysis indicates that a growing ρ correlates with higher OPR profits in Model B. However, once a significant proportion of consumers (t) migrates to ONDC, even a dominant OPR experiences a decline in profit potential outside the open network. In such cases, adopting a hybrid approach—continuing to serve loyal or specialized segments through proprietary channels while also integrating with ONDC—can help mitigate revenue losses and protect brand reputation.

When advertising elasticity (θ) is high, as observed in Models O and E, OPRs can boost profitability through increased promotional and service efforts—up to a certain threshold. Beyond that point, marginal returns begin to plateau. Managers should identify an optimal level of advertising effort that achieves brand differentiation without overspending. Additionally, they can differentiate their service offerings (e.g., premium delivery, personalized recommendations) to attract customers, especially if the ONDC environment results in more head-to-head comparisons.

Finally, the analysis of customer migration (t) suggests that large OPRs remaining outside ONDC may face sustained profit declines if many customers are attracted to the open platform due to lower fees or stronger security. To retain customers on proprietary channels, OPRs should consider innovative pricing strategies (e.g., bundle discounts and loyalty perks) and enhance data security measures. At the same time, integrating with ONDC allows them to capture new consumer segments without compromising brand identity.

These insights suggest that participation in ONDC is not a binary choice but rather a strategic continuum. Large OPRs may opt for phased integration, maintaining key proprietary advantages while leveraging ONDC’s broader reach, whereas medium-sized OPRs can take advantage of competitive fee structures and increased visibility to narrow the gap with incumbents. Ultimately, managers must balance short-term profitability with long-term market positioning, ensuring that decisions on commission levels, advertising intensity, and service differentiation align with shifting consumer preferences and the evolving competitive landscape introduced by ONDC.

Conclusions and limitationsThis study provides a comprehensive analysis of the ONDC’s impact on the strategic behaviors and profitability of OPRs within India’s dynamic retail landscape. Using a game-theoretic approach, we examined three key scenarios: (1) neither OPR joins the ONDC, (2) only the medium-sized OPR joins the ONDC, and (3) both OPRs join the ONDC. The primary objective was to understand how these scenarios influence key variables—pricing strategies, sales efforts, and overall SC profitability—thereby addressing the research questions posed in this study.

Our findings reveal that OPR participation in the ONDC framework leads to significant shifts in competitive dynamics. Specifically, larger OPRs may initially maintain higher profitability by opting out of ONDC, as they can set higher commission fees and selling prices. However, this strategy carries the risk of long-term market share erosion, as smaller competitors capitalize on ONDC’s advantages—namely, lower fees and more transparent access to sellers and customers (addressing RQ1). Conversely, medium-sized OPRs that join ONDC gain a competitive edge by attracting more sellers and customers through lower commission fees, but they face the challenge of intensified competition and reduced profit margins.

Furthermore, our results indicate that OPRs generate higher profits when customers switch to ONDC platforms, primarily due to increased visibility, reduced commission fees, and lower operational barriers within the open network (addressing RQ2). Additionally, our analysis of advertising-effort elasticity shows that while increased advertising can boost profits up to a certain point, excessive spending without a corresponding increase in demand can lead to diminishing returns. This highlights the need for a careful balance in advertising expenditures to maximize returns.

These insights highlight the transformative potential of ONDC in creating a more balanced and competitive market, particularly benefiting smaller and medium-sized OPRs and sellers who might otherwise struggle to compete against established giants. The study also emphasizes the importance of strategic decision-making for OPRs, where participation in ONDC must be carefully evaluated in the context of market conditions, competitive pressures, and long-term profitability goals.

This study contributes to the growing body of literature on digital commerce and SCM by deepening the theoretical understanding of platform competition in a regulated environment, particularly through government-led initiatives like ONDC, which are reshaping traditional market dynamics. By examining the integration of ONDC into the Indian e-commerce sector, the research highlights the significant impact of regulatory frameworks on market outcomes. Additionally, the study offers valuable insights into pricing strategies within multi-channel retail environments, demonstrating how regulatory interventions influence pricing decisions. It also provides a nuanced perspective on how OPRs can strategically navigate competitive pressures alongside regulatory mandates. Furthermore, the research enhances the understanding of advertising and promotional strategies in digital commerce, revealing the importance of balancing increased advertising efforts with pricing strategies in regulated markets like ONDC. This contributes to the broader discourse on effective advertising in digital platforms.

From a managerial perspective, the study highlights that while the immediate financial benefits of staying outside the ONDC can be appealing—especially for large OPRs—the long-term advantages of integration, such as expanded market access and increased consumer trust, are substantial (addressing RQ3). OPRs must carefully weigh the benefits of maintaining higher prices and commission fees against the potential for market share erosion and reduced SC efficiency. Moreover, the study highlights the need for OPRs to innovate in their service offerings, particularly in enhancing customer experience and logistics, to remain competitive in a market increasingly shaped by ONDC. It suggests that ONDC provides a valuable opportunity to level the playing field for smaller retailers and traditional Kiranas. By lowering entry barriers and reducing costs associated with digital commerce, the platform can empower these retailers to compete more effectively with larger players, thereby fostering a more inclusive digital marketplace.

Despite the comprehensive nature of this study, certain limitations remain. Our assumptions regarding customer migration patterns to ONDC, fixed commission fees, advertising efforts, wholesale price, and static market conditions may not fully capture the complexity of real-world markets. Future research could address these gaps by examining variable commission structures, evolving consumer behavior, and fluctuating market dynamics. Extending the analysis to other emerging markets would also shed light on the broader global implications of digital commerce frameworks such as ONDC. Additionally, empirical validation through case studies or longitudinal data would enhance the robustness and applicability of our findings. This study primarily examines how SC and firm profit are impacted when large and medium online retailers join ONDC in a competitive environment. We consider three scenarios: (1) neither retailer joins ONDC (the benchmarking model), (2) only one retailer joins ONDC, and (3) both retailers join ONDC. Future work might explore more complex settings, including multiple retailer competition or varying government policies (e.g., taxation or subsidies), to gain deeper insights into the strategic decisions of OPRs. Furthermore, we did not include a time factor to capture how quickly buyers might migrate from OPR 1 to OPR 2 or how OPR 1 could eventually join ONDC. Future research could integrate dynamic or temporal decision variables, reflecting government promotion and shifting consumer preferences, to evaluate whether—and how rapidly—OPR 1 might opt to adopt ONDC under real‐world conditions.

CRediT authorship contribution statementSarat Kumar Jena: Writing – original draft, Methodology, Investigation, Conceptualization. Purushottam Meena: Writing – review & editing, Supervision, Investigation.

∂p1B∂ρ=α2β−θ2τ1 and ∂p2B∂ρ=α−2β+θ2τ2

α2β−θ2τ1>0if τ1<2βθ2 and α−2β+θ2τ2>0,ifτ2>2βθ2. Because α>0,β>0,τ1,τ2>∼0,θ>0.

In Model B, ∂p2B∂ρ=α−2β+θ2τ2. Whereas, in Model E, when OPRs join ONDC, ∂p2E∂ρ=α−2β+θ2η2.

∂p2E∂ρ−∂p2B∂ρ=(2β−θ2τ)(2β−θ2η2)>0, as α>0,β>0,τ1>∼0,θ>0,η2<τ2.

It was assumed that the commission fee in the ONDC is lower than without ONDC.

∂p1O∂t=μ2β−θ2η1 and ∂p2O∂t=μ2β−θ2η2

∂p1O∂t−∂p2O∂t=μ(2β−θ2η1)(2β−θ2η2)>0, as α>0,β>0,1>∼η1,η2>∼0,θ>0.

https://ondc-static-website-media.s3.ap-south-1.amazonaws.com/res/daea2fs3n/image/upload/ondc-website/files/ONDCStrategyPaper_ucvfjm/1659889490.pdf