Setting research and development (R&D) investment targets is a significant approach for governments to implement innovation-driven strategies. Based on data from Chinese A-share listed firms from 2004 to 2022, this study uses a staggered difference-in-differences model to explore the impact of R&D investment target setting on enterprise innovation strategies. The results demonstrate that R&D investment target setting can promote enterprise innovation, with a stronger effect on symbolic innovation than substantive innovation. Heterogeneity analysis reveals that R&D investment target setting can enhance innovation in mature- and decline-stage enterprises but not growth-stage enterprises. In addition, labor- and capital-intensive enterprises tend toward symbolic innovation, whereas technology-intensive enterprises avoid substantive innovation. Mechanism analysis reveals that R&D investment target-setting drives enterprise innovation by empowering human capital, expanding financing scale, and promoting strategic alliances. Furthermore, economic growth targets are found to strengthen the innovation effect of R&D investment target setting, but only substantive innovation contributes to enterprise growth. These findings are crucial for optimizing government target management and enterprise innovation activities to construct an innovation-driven country.

Since China’s reform and opening-up, the nation’s GDP has surged from 367.9 billion yuan in 1978 to 134.9 trillion yuan in 2024, achieving an 8.9 % average annual growth rate and establishing the globally acclaimed “Chinese miracle” (Deng et al., 2023). However, the GDP-oriented extensive economic development model has exposed deep-seated contradictions such as insufficient factor supply, excess production capacity, and imbalanced industrial structure (Niu et al., 2023), severely constraining high-quality development (Wang & Zhen, 2025). In response, the 18th National Congress of the Communist Party of China explicitly proposed the implementation of an innovation-driven development strategy, emphasizing scientific and technological innovation as a strategic pillar for enhancing social productivity and comprehensive national strength, and must occupy a central position in the nation’s development agenda (Song & Wen, 2023). Under the national strategic orientation, some cities have incorporated the proportion of research and development (R&D) expenditure to GDP into government work reports, aiming to achieve a systemic transition from factor-driven to innovation-driven growth. Enterprises are the fundamental units of economic activity and primary entities of technological innovation (Wang & He, 2024) and have a decisive influence on promoting the realization of R&D investment targets and influencing the effectiveness of innovation-driven strategies (Liu et al., 2024). Therefore, clarifying how R&D investment target-setting impacts enterprise innovation strategies has significant practical importance for deepening innovation-driven development and building an innovation-oriented nation.

According to market failure theory, market mechanisms cannot effectively address the undersupply of public goods and externalities, necessitating government intervention to correct resource misallocation (Mazzucato, 2023). Institutional theory further posits that corporate behavior is shaped by formal and informal institutional frameworks (Zhang et al., 2025), wherein government target management exerts legitimacy pressure on enterprises to innovate in response to regulatory demands and societal expectations (Cui et al., 2025). Building on these theoretical foundations, previous studies have empirically examined the innovation effects of government target management. Some scholars have argued that setting economic growth targets can expand bank risk exposure (Liang et al., 2024; Ren et al., 2023a), drive urban expansion (Zhang et al., 2022), and stimulate economic growth (Yu et al., 2023) and technological innovation (Li & Qiu, 2024). However, some studies have found that economic growth targets may reduce corporate social responsibility (Long et al., 2025), distort investment structures (Ren et al., 2023b; Zhong et al., 2022), and ultimately crowd out R&D expenditure while inhibiting green innovation (Liu et al., 2020; Shen et al., 2021; Zhang et al., 2023b). Regarding environmental protection targets, studies have demonstrated that such targets reduce total pollution emissions (Pan et al., 2022) and improve energy efficiency (Ge et al., 2023a) while driving energy transitions (Wang et al., 2023) and green technological innovation (Zhang & Lin, 2025; Wang et al., 2024b). Notably, while these findings provide indirect insights into the nexus between R&D investment targets and enterprise innovation strategies, few studies have directly integrated both into a unified analytical framework.

Contingency theory posits that organizations need to be capable of flexibly adjusting strategies based on internal and external environments, which implies that enterprises under government target management might adopt differentiated innovation strategies (Ge et al., 2025). Lamperti et al. (2025) and Liu et al. (2023) suggest that organizations facing uncertainty tend to adopt symbolic rather than substantive actions to gain legitimacy, resulting in the “innovation theater” phenomenon (Chiesa & Frattini, 2011; Granados et al., 2024). However, symbolic actions may damage organizations’ reputations, diminish innovation capabilities, and negatively affect corporate performance (Höflinger et al., 2018; Truong et al., 2021). Consequently, sometimes organizations may prefer substantive actions to gain a comparative advantage (Ren et al., 2025). For example, Zhang et al. (2024b) found that environmental, social, and governance (ESG) ratings can facilitate green innovations’ transition from symbolic to substantive manifestations, as the latter can generate stronger performance outcomes and lower risk perceptions (Wang & Tang, 2024; Tray et al., 2025). Although previous studies have noted strategic variations among enterprises, existing literature has largely assumed homogeneous innovation responses under government target management (Sun & Yang, 2024; Zhao & Zhao, 2025) and lacks scientific explanations for corporate decision-making logic.

In response, this study fills the knowledge gap by constructing and validating a series of hypotheses to thoroughly investigate the effects and mechanisms through which R&D investment target-setting influences enterprise innovation strategies. The research focuses on four key areas. (1) The nexus between R&D investment target setting and enterprise innovation strategies. Specifically, whether R&D investment target setting can promote enterprise innovation, and if so, whether enterprises prefer substantive or symbolic innovation. (2) The heterogeneous characteristics of enterprise innovation strategies under R&D investment target setting. (3) The mechanisms through which R&D investment target-setting affects enterprise innovation. (4) The interactive effects between economic growth targets and R&D investment targets as well as the economic consequences of substantive versus symbolic innovations.

This study employs R&D investment target setting as a quasi-natural experiment, using a staggered DID model based on a matched-sample dataset of Chinese A-share listed companies and manually collected R&D investment target data. The findings indicate that R&D investment target setting significantly promotes enterprise innovation, with a stronger enhancement effect on symbolic innovation than substantive innovation. Heterogeneity analysis reveals differentiated innovation strategies across enterprises under R&D investment target setting, wherein mature- and decline-stage enterprises engage in technological innovation and growth-stage enterprises do not, and labor- and capital-intensive enterprises tend toward symbolic innovation, whereas technology-intensive enterprises refrain from substantive innovation. Mechanism analysis demonstrates that R&D investment target-setting drives enterprise innovation by empowering human capital, expanding financing scale, and facilitating strategic alliances. Additional analysis demonstrates that economic growth targets amplify the innovation-inducing effects of R&D investment target setting, but only substantive innovation contributes to enterprise growth.

The marginal contributions of this study are fourfold. First, while existing research has predominantly focused on enterprise innovation under government target management, few studies have examined the differences in innovation strategies across enterprises. By dividing technological innovation into substantive and symbolic categories based on distinct innovation motivations and exploring the impact of R&D investment target setting on enterprise innovation strategies, this study advances theories related to enterprise innovation and broadens the research perspective on government management objectives. Second, considering enterprise and industry characteristics, we investigate the heterogeneous effects of R&D investment target setting on enterprise innovation strategies from the perspectives of life cycle stages and factor intensity, providing empirical evidence for strategically tailoring policies to better guide enterprise innovation. Third, this study reveals the mechanisms through which R&D investment target setting operates—human capital empowerment, financing scale expansion, and strategic alliance facilitation, offering decision-making insights for amplifying innovation effects. Fourth, by analyzing the moderating effects of economic growth targets and the differing impacts of enterprise innovation strategies, we clarify the interactive effects between economic growth targets and R&D investment target setting and the economic consequences of substantive versus symbolic innovation, providing critical implications for refining government target management and optimizing enterprise innovation decisions.

The remainder of this paper is organized as follows. Section 2 presents the study’s theoretical analysis and research hypotheses. Section 3 introduces the model specifications, variable definitions, and data sources. Section 4 reports and interprets the empirical results. Section 5 summarizes the research conclusions and proposed policy recommendations.

Theoretical analysis and hypotheses developmentImpact effectsR&D investment target-setting reflects national expectations for technological development and is accompanied by a series of supportive policies. First, governments can guide enterprise innovation by formulating industrial development plans and releasing key technology catalogs, enabling enterprises to accurately understand market demands and technological trends by strategically intensifying technological innovation (Tang et al., 2025b). Furthermore, governments implement incentive measures to reduce R&D costs and enhance innovation motivation such as tax incentives, R&D subsidies, and innovation rewards (Jin & Wang, 2024). Second, R&D investment target-setting facilitates innovation ecosystem improvement and innovation resource aggregation. Governments encourage collaboration between innovation entities to form synergistic alliances, enabling enterprises to efficiently access innovation resources and accelerate technological breakthroughs. Finally, R&D investment targets amplify enterprises’ market competition and survival pressure. In a globalized context, enterprises must continuously upgrade technological capabilities and innovation capacities to remain competitive (Abbas, 2024). These targets can act as a “threshold”—only by meeting or exceeding this threshold can enterprises maintain sustained comparative advantages in the market. Moreover, R&D investment target-setting attracts broad societal attention, elevating public demand for technological innovation, which stimulates enterprises’ innovation motivation and drives increased investment in technological innovation.

Enterprises can engage in two distinct innovation pathways—substantive or symbolic innovation. The former achieves technological monopolies and cultivates new market demand through breakthrough technological advancements, but requires substantial R&D investment and long-term technical accumulation, and entails high risk of failure. The latter focuses on enhancing competitiveness through nontechnical approaches such as business model adaptation, market positioning refinement, and organizational restructuring, characterized by shorter cycles, controllable costs, and rapid market responsiveness to establish a temporary competitive edge, although such innovations are more susceptible to competitor imitation. Under R&D investment target-setting regimes, enterprises face multiple considerations such as efficient resource use, rapidly responding to policy mandates, and maximizing self-interest (Gu & Mo, 2025). This encourages enterprises to prefer symbolic innovation over substantive innovation in their strategic choices. First, government intervention influences enterprise innovation practices, and R&D subsidies and tax incentives are primary policy instruments to spur enterprise innovation (Jiang & Xu, 2023; Wu & Zheng, 2025). After enterprises obtain R&D subsidies, governments typically require them to meet specific innovation quantity standards, using quantitative indicators such as patent counts and R&D investment ratios as evaluation criteria (Yang & Wang, 2024). This incentivizes enterprises to prioritize short-cycle projects such as process optimization or cosmetic improvements over foundational research and original technology development requiring long-term commitment in pursuit of additional resource support. Concurrently, while governments set R&D investment targets, they often do not delineate the legal boundaries between substantive and symbolic innovation, enabling enterprises to achieve superficial compliance by adjusting accounting categories or declaring low-risk incremental projects (Luo et al., 2024). Second, enterprises must balance R&D return cycles with survival pressure in competitive markets (Fang & Liu, 2025). Substantive innovation demands prolonged investment with high failure risks, and symbolic innovation enables rapid product launches and market share capture through marginal technical iterations. Furthermore, uneven resource allocation exacerbates enterprise differentiation as industry leaders with financial and talent advantages can sustain long-term R&D, whereas small and medium-sized enterprises (SMEs) constrained by financing limitations lean toward low-cost symbolic innovation. Finally, enterprise innovation decisions inherently involve risk–reward tradeoffs (Zhao & Zhu, 2025). While government subsidies mitigate some risks, substantive innovation still incurs uncertainties such as technological barriers and low market acceptance. In contrast, symbolic innovation builds on validated technical pathways with lower failure probability (Wang & Tang, 2024). Particularly, when imitation costs are low and legal enforcement costs are high, the short-term gains of symbolic innovation may outweigh the long-term risks of substantive innovation, introducing an innovation strategy distortion of “bad money driving out good.” Therefore, we propose Hypothesis 1:

H1: R&D investment target-setting promotes overall enterprise innovation but induces a stronger preference for symbolic innovation over substantive innovation.

According to enterprise life cycle theory, enterprises at different stages have distinct strategic priorities and resource endowments (Qin et al., 2025; Xing et al., 2025) that may shape the innovation-stimulating effects of R&D investment target setting. From a strategic objective perspective, mature-stage enterprises face challenges such as intensified market competition and shrinking profit margins, which drive their strategic focus toward technological barrier construction and product iteration upgrades. R&D investment target setting can alleviate funding pressure during transitions and promote increased innovation investment through policy tools such as tax incentives and specialized subsidies. Decline-stage enterprises urgently require technological substitution to delay product life cycle decay, and the policies accompanying R&D investment targets accelerate strategic transformation by sharing innovation risks, redirecting resources from phasing out inefficient capacities to emerging technology R&D. Growth-stage enterprises confront dual pressures of market share acquisition and capacity expansion, prioritizing resource allocation to short-cycle return domains such as channel development and brand promotion. From an innovation pressure perspective, mature-stage enterprises leverage robust risk management systems and technological reserves, while decline-stage enterprises face survival-driven “innovate-or-perish” imperatives, and R&D investment targets may incentivize both to amplify innovation commitments. Conversely, growth-stage enterprises often emphasize operational efficiency in managerial frameworks and lack specialized R&D management systems, rendering them less capable of converting policy support into tangible innovation outputs even when assistance is provided.

According to factor endowment theory, enterprises with varying factor intensities adopt differing innovation pathways due to distinct demands for technological innovation (Cheng & Zhao, 2025; Wang et al., 2024a), implying that the innovation effects of R&D investment target setting may diverge across factor intensities. Labor-intensive enterprises rely on the competitive advantages of low labor costs, where the marginal benefits of R&D investment are dominated by those of labor force expansion. To maintain profit margins under R&D investment target setting, firms typically opt for symbolic innovation methods to achieve policy compliance such as adjusting accounting categories or filing design patents rather than substantive technological upgrades. Capital-intensive enterprises, characterized by asset-heavy operations and asset preservation needs, tend to prioritize process optimization under R&D investment targets to enhance equipment use and avoid asset devaluation risks from disruptive innovation. Despite strong R&D management capabilities, technology-intensive enterprises face dual pressures of meeting government R&D metrics and addressing downstream client demands, resulting in “short-chain” innovation strategies. In addition, cross-departmental collaboration and long-cycle incentive mechanisms required for basic R&D conflict with existing key performance indicator systems, further eroding substantive innovation incentives. Therefore, we propose Hypothesis 2:

H2: R&D investment target setting can stimulate mature- and decline-stage enterprises’ innovation but does not promote growth-stage enterprises’ innovation, and labor- and capital-intensive enterprises tend to engage in symbolic innovation and technology-intensive enterprises concentrate on symbolic innovation.

Human capital theory posits that individual capabilities acquired through education and training are core determinants of innovation, directly impacting enterprises’ technological breakthrough capabilities. As a critical innovation policy instrument, R&D investment target-setting stimulates enterprises’ innovative dynamism and enhances innovation capabilities by optimizing human capital structures. First, R&D investment target setting can alter enterprises’ human resource evaluation criteria, prompting reassessment of existing human capital structures and resource reallocation from traditional production domains to innovation-oriented R&D. For example, enterprises may optimize the technical composition of human capital by recruiting R&D personnel with cutting-edge expertise to establish talent foundations for innovation or integrating innovation performance metrics into existing position evaluation systems to incentivize employees to proactively update their knowledge and enhance professional skills (Zhao et al., 2025a). Second, R&D investment target setting can drive enterprises to establish sustained human capital investment mechanisms. Enterprises can institutionalize individual knowledge into organizational assets through internal knowledge-sharing platforms such as building technological innovation case repositories or hosting technical workshops while expanding employees’ innovation capabilities via external learning activities like industry forums and professional certifications (Goto, 2023). Finally, the evaluation pressure of R&D investment targets compels enterprises to develop incentive systems that are more tightly associated with innovation performance. Enterprises may strengthen economic motivations for skill upgrading and innovation participation by directly linking R&D outcomes to compensation and financial incentives, while fostering supportive organizational climates that recognize exemplary innovation and tolerate trial failures to unlock employees’ innovative potential and achieve policy objectives (Cantoni et al., 2024; Wang et al., 2025).

According to financing constraints theory, financing difficulties elevate innovation costs, resulting in more cautious approaches to R&D investment. R&D investment target setting can provide sustained financial safeguards for innovation that reshape enterprises’ financing structures and environments. R&D investment target setting generates significant signaling effects, reducing information asymmetry between enterprises and investors (Ge et al., 2023b). This enhances enterprises’ credit ratings, lowers financing costs, facilitates the development of innovative financing instruments, and expands funding channels such as R&D-specific bonds and intellectual property pledge loans. Furthermore, R&D investment targets synergize with other supportive innovation policies to collectively improve enterprises’ innovation financing opportunities (Tang et al., 2025a). In terms of fiscal policy synergy, enterprises’ increased actual expenditures to meet R&D investment targets qualify for higher super-deductions, tax credits, or R&D subsidies, reducing innovation costs (Liu & Li, 2025). Regarding financial policy synergy, commercial banks may relax credit approval criteria for compliant enterprises, while government-backed guarantors amplify support for innovation projects, creating a policy synergy effect. Additionally, the binding nature of R&D investment targets can optimize capital allocation through budgetary systems to improve innovation fund utilization efficiency, and such continuity may cultivate stable innovation investment expectations via risk-compensation mechanisms that reshape financing practices.

According to the resource-based view, strategic alliances can integrate innovation resources, disperse R&D risks, facilitate knowledge flow, and enhance enterprises’ innovation efficiency. R&D investment target setting can drive enterprise innovation activities by promoting strategic alliances. First, as a mandatory constraint, R&D investment target-setting elevates the strategic significance of innovation resources, compelling enterprises to forge external resource collaborations, expand innovation networks, and establish alliances with partners possessing complementary advantages. Second, as a policy signal, R&D investment target setting can reduce information asymmetry to establish reliable policy expectations for potential partners and lower search costs, and enhance cooperative trust through government endorsement, mitigating opportunism risks in alliance governance (Ge et al., 2024). Concurrently, ancillary policy tools such as tax incentives, specialized subsidies, and joint application requirements reduce the costs of cooperative alliances and provide ready-made collaborative frameworks. Finally, due to high-risk characteristics, the normative foundations developed through industry associations and expert teams in interpreting innovation strategies can encourage enterprises to adopt strategic alliances as the optimal implementation mechanism. This approach can reduce failure probabilities and potential loss through risk-sharing and avoid redundant investments or technological lock-ins via information exchange. Notably, when alliance models pioneered by leading enterprises in policy compliance demonstrate significant success, such models are emulated by others, triggering chain reactions that accelerate technology diffusion and stimulate secondary innovations (Zuo et al., 2025). Accordingly, we propose Hypothesis 3:

H3: R&D investment target-setting drives enterprise innovation by empowering human capital, expanding financing scale, and promoting strategic alliances.

Based on the preceding analysis, our conceptual framework is illustrated in Fig. 1.

Research designModel specificationTo implement the innovation-driven development strategy, some cities, e.g., Shanghai, Tianjin, and Suzhou have successively set R&D investment targets in their government work reports. Considering the heterogeneity and temporal differences in local governments’ responsiveness to policy mandates, we treat R&D investment target setting as a quasi-natural experiment and employ a staggered difference-in-differences (DID) model for empirical analysis. Compared with traditional policy evaluation methods, the staggered DID model makes estimations more scientific and accurate by reducing selection bias and endogeneity concerns, and has become the most widely applied causal inference method. The model specification is as follows:

where EI denotes enterprise innovation, encompassing substantive and symbolic innovation. RIT is a dummy variable that represents R&D investment target setting, and X denotes a vector of control variables. u and v represent respective firm and year fixed effects (FEs), and ε is the random error term.Variable definitionsDependent variablesThe dependent variable is EI. To mitigate the time-lag effect of patent grants, we use the number of patent applications to quantify enterprises’ innovation. Referencing Granados et al. (2024), we divide enterprise innovation into substantive (SUI) and symbolic (SYI) innovation. As noted previously, substantive innovation refers to technology-driven advancement activities, which is proxied by the total number of invention patent applications, and symbolic innovation refers to quantity-oriented innovation practices intended to pursue numerical targets or ancillary benefits, which we measure using the aggregate applications for utility models and industrial designs.

Independent variableThe independent variable is R&D investment target setting (RIT). Drawing on Zheng et al. (2023), we treat R&D investment target setting as a quasi-natural experiment. Specifically, we designate enterprises in cities that set R&D investment targets for at least three consecutive years following their initial implementation as the treatment group, and enterprises in other cities serve as the control group. The National Innovation-Driven Development Strategy Outline issued in May 2016 marked the formal establishment and comprehensive implementation of China’s innovation-driven development strategy; therefore, we designate 2017 as the policy shock year.

Mediating variablesBased on our theoretical analysis, R&D investment target setting may drive enterprise innovation by empowering human capital, expanding financing scale, and promoting strategic alliances. Referencing Jin et al. (2020), we quantify human capital scale using the number of R&D personnel (DP) and human capital quality by the number of employees with college degrees or higher (CD). Drawing on Han and Gu (2021), we operationalize financing scale using equity financing (EF), measured by the logarithm of the sum of share capital and capital reserves, and government subsidies (SU), measured by the logarithm of government subsidies recognized in current profit and loss. For strategic alliances (AE), this study quantifies alliance intensity using the number of strategic alliance entities noted in the main text of listed companies’ public disclosures or media analytics.

Control variablesReferencing Hao et al. (2022), Sun et al. (2025), and Xie and Wang (2025), we introduce the following control variables. Firm-level controls include (1) firm age (FA), using the logarithm of years since listing; (2) firm size (FS), measured by the logarithm of total assets at year-end; (3) cash flow (CF), quantified by the ratio of net cash flow from operating activities to total assets; (4) debt-to-asset ratio (DR), using total liabilities divided by total assets; (5) return on assets (RA), measured by net profit divided by total assets; (6) ownership concentration (OC), quantified by the largest shareholder’s shareholding ratio at year-end; and (7) board size (BO), measured by the logarithm of the number of board members. City-level controls include (1) economic development (ED), measured by the logarithm of regional GDP per capita to account for regional economic disparities; (2) industrial structure (IS), using the proportion of secondary and tertiary industries’ value-added to regional GDP; (3) foreign investment (FI), quantified by the ratio of actually used foreign capital to regional GDP; (4) financial development (FD), measured by the ratio of year-end financial institution loan balances to regional GDP; and (5) education expenditure (EE), using the proportion of education spending in general government fiscal expenditure.

Data sourcesThis study uses Chinese A-share listed companies from 2004 to 2022 as the research sample. Firm-level data are sourced from the China Stock Market & Accounting Research database, and city-level data are obtained from municipal statistical yearbooks and government work reports. The sample processing follows four steps. (1) excluding ST and *ST companies, (2) removing financial enterprises, (3) eliminating enterprises with fewer than three years of data, and (4) winsorizing continuous variables at the top and bottom 1 % to mitigate extreme value effects. After implementing these procedures, the final dataset comprises 15,327 firm–year observations.

Descriptive statisticsTable 1 presents the descriptive statistics of our key variables. The mean value of SUI is 15.2096 with a standard deviation (SD) of 32.7530, indicating significant heterogeneity in substantive innovation across enterprises. The mean SYI value of 24.0502 exceeds that of SUI, indicating enterprises’ preference for pursuing symbolic innovation characterized by “quantity over quality” (Hu et al., 2023). The mean RIT value of 0.3404 reveals that 34.04 % of sampled enterprises belong to cities that maintained R&D investment targets for at least three consecutive years following initial implementation. Control variables exhibit distributions consistent with previous literature, affirming sample validity (Hou et al., 2022; Jiang & Bai, 2022).

Descriptive statistics.

Table 2 presents our baseline results. Columns (1)–(3) include only firm-level controls, and Columns (4)–(6) introduce city-level controls. Columns (1) and (4) reveal that RIT coefficients are significantly positive with the coefficients of determination (R2) exceeding 0.7, indicating that R&D investment target setting significantly enhances enterprise innovation. These results are consistent with those of An et al. (2025), Huang and Ma (2024), and Zhang et al. (2024a). R&D investment target setting typically aligns with supportive policies such as increased deduction ratios for R&D expenses and value-added tax credit refunds, subsequently reducing innovation costs (Huang et al., 2024). Furthermore, RIT drives financial institutions to allocate targeted loans to innovative sectors, alleviating R&D financing constraints (Chen et al., 2024). In addition, continuous government R&D investment targets incentivize enterprises to develop sustainable innovation strategies that can mitigate short-termism and foster industry–university–research collaboration networks, amplifying R&D investment and accelerating technology commercialization (Xi & Jia, 2025).

Baseline results.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

Columns (5) and (6) in Table 2 reveal that the R2 values are higher than 0.6, indicating high explanatory power. RIT coefficients are 4.0236 and 7.9910, respectively, demonstrating that R&D investment target-setting promotes substantive and symbolic innovation. The standardized coefficient neutralizes measurement units and scale disparities, enabling direct comparison between variables, and it is obtained by multiplying the original coefficient by the independent variable’s SD, then dividing by the dependent variable’s SD. The standardized respective RIT coefficients in Columns (5) and (6) of 0.0582 (4.0236 × 0.4739 / 32.7530) and 0.0754 (7.9910 × 0.4739 / 50.2311) indicate enterprises’ stronger preference for symbolic over substantive innovation under target-driven mechanisms, aligning with Li et al. (2025), who found that pilot policies integrating technology and finance primarily boost symbolic innovation. Similarly, Zhang et al. (2023a) found that green acquisition enhanced innovation quantity over quality. Quantitative evaluation metrics such as funding scale and patent counts embedded in R&D targets can incentivize enterprises to prioritize low-value patents and incremental improvements. Annual innovation assessments in government work reports exacerbate short-termism, pressuring enterprises to engage in easily quantifiable symbolic innovations. In addition, adverse selection effects and the lack of error-tolerance mechanisms channel subsidies toward low-risk mature projects, reinforcing symbolic innovation preferences (Zhang et al., 2024c). Therefore, R&D investment target setting significantly elevates enterprise innovation, with stronger effects on symbolic than substantive innovation, validating H1.

Robustness testsParallel trends testThe prerequisite for using the DID model is that treatment and control groups exhibit consistent pre-treatment trends. Therefore, we conduct a parallel trend test using the event study approach, presenting the results in Figs. 2 and 3. The findings demonstrate that SUI and SYI trends between the treatment and control groups were largely parallel before the policy shock, indicating no significant differences. Following policy implementation, SUI and SYI show substantial increases for the treatment group, confirming that R&D investment target setting significantly enhances enterprise innovation. These results satisfy the parallel trend assumption required for DID analysis.

Propensity score matching-DID testLocal governments’ decisions to set R&D investment targets may stem from comprehensive considerations including national policy guidance and regional economic development, potentially introducing sample selection bias into our baseline estimates. Therefore, we employ the propensity score matching (PSM)-DID approach for causal inference. Specifically, we conduct a logit model analysis using control variables as matching covariates and adopt 1:1 nearest-neighbor matching to identify optimally matched control enterprises for treatment enterprises under. The results presented in Columns (1) and (2) of Table 3 reveal that the RIT coefficient is significantly positive, with larger standardized coefficients when SYI is the dependent variable. This confirms that R&D investment target-setting promotes enterprise innovation with stronger effects on symbolic than substantive innovation. Therefore, our baseline results remain robust after considering potential selection bias.

Robustness tests.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

The 2008 global financial crisis and the 2015 Chinese stock market crash disrupted enterprises’ funding chains and adversely affected innovation (Conyon et al., 2011; Sui et al., 2023). Therefore, we re-estimate the models after excluding samples from 2008 to 2015, presenting results shown in Columns (3) and (4) of Table 3. The RIT coefficients remain significantly positive, confirming that R&D investment target setting effectively stimulates enterprise innovation. Moreover, larger standardized RIT coefficients for the SYI dependent variable indicate enterprises’ stronger inclination toward symbolic innovation under target-driven mechanisms. These findings further validate the robustness of our baseline results.

Endogeneity testTo address potential endogeneity arising from reverse causality between R&D investment target setting and enterprise innovation, we employ the proportion of cities within the same province that set R&D investment targets as an instrumental variable (IV). Government competition theory suggests that local governments frequently adopt symbolic responses to rivals’ actions to fulfill performance evaluations and achieve official promotions (Wu et al., 2020), implying that a city’s R&D investment target setting may be influenced by peer governments’ behaviors. Enterprises typically develop innovation strategies based on internal development needs and market competition dynamics rather than being affected by R&D investment target policies in other cities within the same province, satisfying the exclusion restriction. The results are presented in Table 4. Column (1) reports the first-stage results, where the IV coefficient is significantly positive. The Cragg–Donald Wald F-statistic exceeds the 10 % critical value, rejecting weak IV concerns. Columns (2) and (3) present second-stage results, revealing that RIT coefficients are significantly positive, confirming that R&D investment target-setting boosts substantive and symbolic innovation. Therefore, our baseline findings remain robust after addressing endogeneity concerns.

Endogeneity test.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

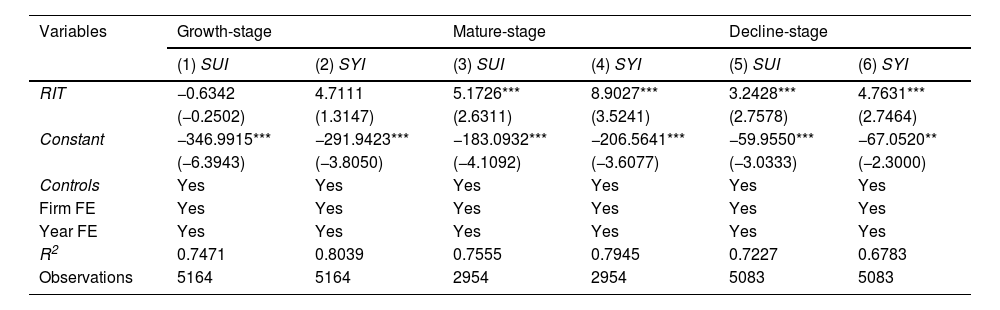

Enterprises at different life cycle stages exhibit significant variations in resource acquisition, technological capabilities, and market demand, potentially resulting in heterogeneous responses to R&D investment target setting. To investigate this heterogeneity, we categorize enterprises into growth-, mature-, and decline-stage groups based on the deviation between earnings-per-share growth and industry average growth rates for regression analyses. The results are presented in Table 5.

Life cycle heterogeneity.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

Columns (1) and (2) reveal insignificant RIT coefficients, indicating ineffective innovation inducement for growth-stage enterprises. Possible explanations are that growth-stage enterprises prioritize allocating limited resources toward short-term profit projects over long-cycle, high-risk R&D owing to cash flow constraints and market competition pressure, coupled with technological immaturity and R&D talent shortages that hinder complex innovation (Lv et al., 2021; Gao et al., 2025). Columns (3) and (4) reveal standardized RIT coefficients of 0.0748 and 0.0840, indicating that R&D investment target setting effectively promotes mature-stage enterprises’ innovation with greater emphasis on symbolic over substantive innovation. This aligns with Jia et al. (2024), who observed stronger technological commitments in mature-stage enterprises. Mature-stage enterprises can leverage stable cash flow to implement symbolic innovation for low-risk policy compliance while maintaining existing profitable models through technological inertia. Columns (5) and (6) reveal standardized coefficients of 0.0469 and 0.0449, demonstrating that R&D investment target-setting drives decline-stage enterprises’ innovation with stronger substantive innovation effects. Facing market share erosion and cash flow crises (Xie & Wu, 2024), decline-stage enterprises will prioritize breakthrough technologies over symbolic gestures. Per growth options theory, substantive innovation is a future growth option that enables technological leadership despite potential short-term loss (Cheng et al., 2024). Therefore, the innovation effect of R&D investment target-setting varies depending on the life cycle, which preliminarily verifies H2.

Factor intensity heterogeneityEnterprises with varying factor intensities exhibit variations in R&D requirements and innovation capabilities, resulting in heterogeneous effects of R&D investment target setting on enterprises’ innovation. Referencing Qiao et al. (2025), we categorize samples into labor-, capital-, and technology-intensive enterprises for subgroup analyses, presenting the results in Table 6.

Factor intensity heterogeneity.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

Columns (1)–(4) demonstrate significantly positive RIT coefficients and larger standardized coefficients when SYI is the dependent variable, indicating that R&D investment target-setting stimulates labor- and capital-intensive enterprises’ innovation, prioritizing symbolic over substantive innovation. Constrained by narrow profit margins (Yang et al., 2023), labor-intensive enterprises prefer market-proven incremental improvements over substantive innovation that requires long-term commitments and faces uncertain demand to ensure short-term revenue stability. Capital-intensive enterprises, bound by asset-heavy operation models, align innovation activities with existing capacity use (Wang et al., 2024a), opting for symbolic innovation to meet R&D requirements without risking large-scale production line restructuring. Columns (5) and (6) reveal an insignificant RIT coefficient for substantive innovation but a significant RIT coefficient for symbolic innovation in technology-intensive enterprises. As such enterprises have already established technological barriers and competitive advantages in specific domains (Liu et al., 2025), they tend to allocate R&D resources toward extending existing technological frameworks rather than exploring disruptive alternatives under R&D investment target pressure. In summary, the innovation effects of R&D investment target-setting exhibit differentiated characteristics based on factor intensity, validating H2.

Mechanism analysisTable 7 presents the mechanism analysis results. Columns (1) and (2) reveal that RIT coefficients are significantly positive, indicating that R&D investment target-setting promotes increases in R&D personnel and highly educated employees, which enhances human capital scale and quality to drive enterprise innovation. Under R&D investment target policies, governments use fiscal incentives to encourage enterprises to optimize R&D teams and upgrade innovation models (Song & Wen, 2023), e.g., recruiting high-level talent, enhancing employee skill training, improving talent incentive mechanisms, and establishing specialized R&D centers to meet policy assessment requirements and secure sustained support. Furthermore, R&D investment target-setting guides regional innovation ecosystem development, strengthening industry–university–research collaboration. This facilitates knowledge flow and compels enterprises to establish human resource management systems that encourage open innovation (Zhou et al., 2025). For example, interviews with employees across finance, insurance, and utilities industries have revealed that human capital is the micro foundation of enterprises’ innovation, translating individual foresight into organizational knowledge, which requires a supportive innovation culture and organizational learning to unlock its potential (Innes, 2024).

Mechanism analysis.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

Columns (3) and (4) of Table 7 reveal that respective RIT coefficients are significantly 0.0272 and 0.3163, demonstrating that R&D investment target-setting enhances enterprise innovation by expanding equity financing and government subsidies. Financing constraints are critical barriers to enterprise innovation (Liu & Gao, 2024; Wang, 2025). When R&D investment targets are set, governments amplify R&D subsidies to stimulate innovation and achieve preset targets, which alleviates financial constraints and attracts external investors through signaling effects, boosting equity financing (Shao & Wang, 2023). Interviews with corporate beneficiaries revealed that deeply integrating innovation subsidy projects into business strategies; for example, by investing in equipment upgrades and employee skill development, can effectively enhance enterprises’ innovation potential (Koniewski et al., 2024).

Column (5) of Table 7 exhibits a significantly positive RIT coefficient, revealing that R&D investment target-setting fosters enterprise innovation through strategic alliances. Mandated innovation goals may exceed enterprises’ resource capacities, compelling them to integrate innovation elements such as laboratory equipment and data platforms through alliances that enable technology sharing and resource complementarity (Jin & Wang, 2021). Strategic alliances reduce individual enterprises’ risk exposure via R&D cost-sharing mechanisms while accelerating knowledge transfer and technology commercialization through collaborative platforms (Weidenfeld & Clifton, 2025; Zhou et al., 2024). Garlet et al. (2025) conducted interviews with professionals involved in the Brazilian solar panel value chain, finding that enterprises engaging in strategic alliances leverage synergies through resource integration and knowledge sharing, which drives technological advancement.

Based on in-depth interviews with auditors, consultants, and medium-sized enterprises in Europe, Johnstone, and Hallberg (2020) determined that when confronting institutional pressure such as government legislative mandates and licensing requirements, enterprises primarily meet compliance through token adoption of the ISO 14,001 standard, which is exemplified by preparing scripted responses or pursuing certification for legitimacy. However, driven by the standard’s improvement mechanisms, managers’ sustainability values and organizational efficiency demands, enterprises can transition from ceremonial conformity to substantive management reforms. In summary, R&D investment target-setting drives enterprise innovation by empowering human capital, expanding financing scale, and fostering strategic alliances, validating H3.

Further analysisModerating effect of economic growth targetsAs a core component of government work reports, economic growth targets (EGT) serve as an inherent requirement of China’s high-quality development stage and a policy pivot to coordinate multiple objectives. To investigate the moderating influence of economic growth targets between R&D investment target setting and enterprise innovation strategies, this study employs the economic growth rates set in government work reports to measure EGT and introduces its interaction term (EGT×RIT) with RIT into the model. The results are presented in Table 8. Columns (1) and (2) reveal significantly positive EGT coefficients, indicating that economic growth targets enhance substantive and symbolic innovation. Columns (3) and (4) reveal standardized coefficients of EGT×RIT as 0.0534 and 0.0745, both of which are statistically significant, indicating that economic growth targets amplify the innovation effects of R&D investment target setting, with stronger positive moderating effects on symbolic innovation than substantive innovation. Under China’s multi-objective assessment system, local governments’ resource allocation tends to exhibit short-term performance-oriented characteristics, prioritizing resource allocation toward easily quantifiable and quick-result domains (Ge et al., 2023b). This implies that local governments allocate limited resources to achieve higher priority economic growth targets, which incentivizes enterprises to favor symbolic innovations that generate rapid outcomes (Chai et al., 2021; Kratochvil, 2025).

Moderating effect of economic growth targets.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

Enterprise growth is a gauge of enterprises’ vitality and a core driver of sustainable development. To identify the differing impacts of innovation strategies on enterprise growth, we use the proportion of intangible assets to measure enterprise growth (EG), presenting the results in Table 9. Columns (1) and (2) reveal that SUI and SYI are significantly positive, with respective standardized coefficients of 0.0466 and 0.0429. The results indicate that substantive and symbolic innovation enhance enterprise growth, although the former demonstrates significantly greater efficacy. Columns (3) and (4) reveal a significantly positive coefficient for the RIT×SUI interaction term but an insignificant result for RIT×SYI, indicating that R&D investment target setting positively moderates the growth–enhancing effect of substantive innovation but not symbolic innovation. This finding provides indirect support for existing literature that has highlighted the differing impacts of innovation strategies (Zhu et al., 2025). Bi et al. (2024) found that new environmental protection laws prompted enterprises to adopt instrumental green innovation rather than substantive green innovation, failing to significantly enhance corporate value. Wang and Tang (2024) demonstrated that substantive innovation curbs enterprises’ greenwashing and symbolic innovation does not. Zhao et al. (2025b) revealed that substantive innovation (but not symbolic innovation) enables enterprises to maintain competitive investment strategies while adapting to environmental policies. Therefore, technology-driven substantive innovation is a foundation of enterprise sustainability, whereas policy-oriented symbolic innovation fails to contribute to long-term enterprise sustainability, despite potential short-term gains.

Economic consequences of enterprise innovation strategies.

Note: t-statistics are in parentheses; *p < 0.1, **p < 0.05, ***p < 0.01.

R&D investment target setting has become a core instrument for driving enterprise innovation and establishing a technology powerhouse through policy guidance and resource coordination. Using data from Chinese A-share listed firms spanning 2004–2022, we investigate the effects and mechanisms of R&D investment target setting on enterprise innovation. The findings reveal that R&D investment target setting effectively promotes enterprise innovation, with a stronger effect on symbolic innovation than substantive innovation. Heterogeneity analysis reveals that R&D investment target-setting enhances mature- and decline-stage enterprises’ innovation but does not stimulate growth-stage enterprises, and labor- and capital-intensive enterprises tend to adopt symbolic innovation whereas technology-intensive enterprises avoid substantive innovation. Mechanism analysis demonstrates that R&D investment target-setting drives enterprise innovation by empowering human capital, expanding financing scale, and fostering strategic alliances. Further analysis indicates that economic growth targets amplify the innovation–enhancing effects of R&D investment target setting; however, only substantive innovation contributes to enterprise growth.

Based on these findings, we propose the following policy recommendations. Firstly, the central government should encourage local governments to establish R&D investment targets and refine target management systems. Since the mid-20th century, approximately 49 economies have implemented government target management systems. However, even in China, which is considered to be a relatively successful country, only 23 % of local governments had set R&D investment targets by 2022. This indicates that the innovation potential of such target-setting remains substantially underexploited; therefore, the central government should promote localized implementation through tiered strategies. For example, developed regions could appropriately elevate mandatory targets with evaluation requirements to identify original achievements, while underdeveloped regions could establish flexible targets for annual growth rates of technological upgrade investments. In addition, governments should improve incentive–constraint mechanisms. Exemplary measures could include establishing target–resource matching mechanisms that prioritize land allocation and providing preferential R&D loans to target-achieving enterprises as well as constructing a quality coefficient assessment system that incorporates patent quality and commercialization indicators into evaluations to substantially enhance R&D quality. For example, governments can adopt an industry–university–research collaboration model similar to Germany’s Industry 4.0 to closely align R&D investment targets with industrial upgrading requirements and implement targeted funding through intermediary organizations such as the German Federation of Industrial Research Associations. Concurrently, by emulating Japan’s procurement mechanism that prioritizes purchasing domestically developed innovative technologies with market potential, governments can effectively incentivize enterprises to conduct high-quality innovation activities.

Secondly, governments should implement strategically targeted policies and associated incentives based on the heterogeneous influence of R&D investment target setting on innovation across enterprises. We recommend establishing dynamic R&D target systems. For example, tiered target management could be applied that requires mature-stage enterprises to set baseline R&D intensity based on revenue scale and offers tax credits for exceeding these targets. For decline-stage enterprises, mechanisms that compel transformation could be implemented by linking R&D investment to industry exit compensation or mandating capacity reductions proportional to unmet annual R&D targets. Flexible evaluation systems could be adopted for growth-stage enterprises such as innovation uncertainty tolerance allowances, R&D loan linkage mechanisms, and incorporating R&D compliance into science and technology finance evaluation frameworks. Furthermore, it is advisable to develop a multidimensional innovation quality assessment system. For labor- and capital-intensive enterprises, an innovation efficiency index could be adopted with tiered rewards provided to enterprises that meet the standards. Innovation authenticity audits could be implemented for technology-intensive firms, involving R&D process data verification, third-party certifications, and extended tax incentives for substantive innovation projects. Additionally, enterprises engaging solely in symbolic innovation for three consecutive years could be added to an innovation quality “blacklist”, disqualifying them from obtaining government subsidies and mandating compliance training.

Thirdly, governments should refine the channels of R&D investment target setting to fully leverage its innovation-inducing effects. First, human capital enhancement systems can be established by allocating specialized talent training subsidies for enterprises that meet R&D targets, incorporating R&D contributions into professional title evaluation systems, and mandating enterprises to assign R&D personnel to upstream and downstream enterprises in industrial chains. Second, innovative R&D financing models can be developed to incentivize commercial banks to determine credit lines based on corporate R&D targets while establishing R&D loan risk compensation funds to absorb nonperforming loan losses. Governments should support enterprises’ conversion of R&D-generated patents into equity stakes and pilot R&D revenue rights securitization to enable specialized R&D bond issuance. Third, strategic alliance coordination mechanisms can be deepened by establishing industrial innovation consortia such as jointly funded technology alliances combining government-guided capital and private investments for generic technology development. Furthermore, governance mechanisms for strategic alliances could be enhanced such as promoting R&D performance-based agreements to align risk-sharing and benefit distribution between participating institutions according to R&D contributions, in addition to blacklisting underperforming enterprises from innovation alliances to stimulate effective engagement. In addition, human capital conversion rates, financing utilization efficiency, and alliance contributions should be included in innovation effectiveness evaluation systems.

Although this study thoroughly investigates the impact of R&D investment target setting on enterprise innovation strategies, four areas warrant further exploration. First, our empirical analysis of Chinese A-share listed enterprises does not consider differing innovation activities and policy responsiveness between nonlisted enterprises and SMEs. Therefore, future studies could expand the research scope to identify policy effects across enterprise types more comprehensively. Second, simplifying innovation strategies into substantive and symbolic innovation may overlook certain innovative practices. Subsequent research could develop more nuanced categories to better capture enterprise innovation dynamics such as classifying strategies by innovation purposes and approaches. Third, while focusing on the impact of target setting, this study did not consider the numerical variations of preset targets, leaving room for future investigations into the nonlinear impact of heterogeneous R&D investment targets. Fourth, significant disparities in innovation ecosystems and policy frameworks exist between countries. Therefore, cross-cultural and cross-national comparative studies could assess the effectiveness and applicability of R&D investment target setting across diverse contexts.

CRediT authorship contribution statementTao Ge: Writing – review & editing, Writing – original draft, Funding acquisition, Formal analysis, Conceptualization. Mengke Wang: Writing – original draft, Methodology, Formal analysis, Data curation. Dongyu Dai: Writing – review & editing, Writing – original draft, Supervision.

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

This study was supported by the National Social Science Fund of China (No. 21CJL016) and Postgraduate Research & Practice Innovation Program of Jiangsu Province (No. KYCX25_3602).