The deep integration of the digital and real economies provides technological empowerment and strategic support for the innovative development of enterprises in China. This study employs the Latent Dirichlet Allocation model to quantify the balance of ambidextrous innovation by analyzing the textual content of analyst reports on listed companies. It examines how digital-real integration affects this balance, as well as the underlying mechanisms. Empirical results indicate that digital-real integration exerts a significant positive effect on promoting ambidextrous innovation balance in enterprises. This finding holds after addressing potential endogeneity issues and conducting a series of robustness tests. Mechanism analysis reveals that digital-real integration facilitates ambidextrous innovation balance by enhancing management efficiency and optimizing production factor allocation. Furthermore, heterogeneity analysis shows that the positive effect of digital-real integration is more pronounced in enterprises facing lower financial constraints, those operating in more competitive markets, and those located in regions with more advanced digital infrastructure. This study elucidates the mechanism through which digital-real integration influences ambidextrous innovation balance from both theoretical and practical perspectives, offering valuable insights for promoting the synergistic enhancement of corporate innovation capabilities.

China’s 14th Five-Year Plan for Digital Economy Development identifies “innovation-driven and integrated development” as the primary principle guiding digital economic growth. It emphasizes the integration of digital technologies across all socioeconomic sectors to establish a development paradigm in which technological innovation drives economic transformation. In turn, broad application across industries stimulates further technological progress. As vital players in the digital-real integration and innovation, enterprises need to pursue both short-term market performance and long-term competitiveness (Zhang & Li, 2025). Hence, firms must effectively balance exploratory and exploitative innovation to generate synergistic effects between the two modes and sustain enterprise growth in increasingly competitive markets.

The digital-real integration provides enterprises with strategic opportunities for technological empowerment and business model innovation. It effectively mitigates the inefficiencies inherent in traditional innovation paradigms such as uneven resource allocation and low innovation efficacy. Consequently, it promotes a virtuous cycle between technological advancement and market-oriented application. However, due to limited internal resources and external environmental uncertainty, firms often encounter the ambidexterity paradox (Ciarli et al., 2021), which manifests as overreliance on either exploratory or exploitative innovation. Overreliance on exploratory initiatives may result in sustained financial strain if unsuccessful. Alternatively, excessive emphasis on exploitation may gradually diminish core competitiveness and threaten innovation-driven productivity advancement. Accordingly, understanding how enterprises can leverage digital-real integration to achieve a dynamic balance of ambidextrous innovation has become a central concern for both academia and industry.

To ensure the rapid development of the digital economy, the deep integration of digital technologies and real economy is fundamentally redefining enterprises’ resource bases and capability boundaries. This integration fosters a distinctive experiential context that enables the strategic alignment and dynamic balance of ambidextrous innovation (Huang & Gao, 2023). Within this process, data elements functioning as novel production factors drive the convergence of the digital and real economy. The ubiquity of digital technologies and structural complexity of the real economy create a dynamic competitive environment, compelling enterprises to navigate through the dual imperatives of continuous technological iterations and adaptive market responsiveness simultaneously. Meanwhile, the cross-sectoral nature of digital-real integration enables enterprises to pursue heterogeneous innovation trajectories throughout the digital transformation process.

In this context, enterprises can achieve complementarity and dynamic co-evolution between digital and real economy technologies. Such synergy is accomplished by embedding digital solutions across the entire spectrum of research and development (R&D), production, and managerial activities within the real economy industrial domain (Tang et al., 2025). Digital technologies enhance technological innovation within real economy industries, while real economy industrial technologies absorb, adapt, and reconfigure digital innovations (Sun et al., 2024). This integration broadens the organizational knowledge scope, enhances innovation quality, and reinforces absorptive capacity and product competitiveness, ultimately catalyzing the advancement of ambidextrous innovation balance within enterprises through cross-industry knowledge recombination and technological synergy.

This study applies Latent Dirichlet Allocation (LDA) (Bellstam et al., 2021) to extract thematic structures from analyst reports. It develops a text-based dynamic measurement of ambidextrous innovation balance by constructing a dual-dimensional framework encompassing exploratory and exploitative innovation. Drawing on digital patent data from publicly listed firms, this study quantitatively assesses the extent of digital-real integration and examines its impact on ambidextrous innovation balance. The empirical results validate that digital-real integration significantly enhances ambidextrous innovation balance. Mechanism analysis further identifies two primary channels underlying this enhancement: improving managerial efficiency and optimizing production factor allocation. Collectively, these constitute a dual-path mechanism (managerial efficiency–factor allocation efficiency) that facilitates a dynamic equilibrium between exploration and exploitation. In addition, heterogeneity analysis based on firm-level financial constraints, industry-level competition intensity, and regional digital infrastructure indicates that digital-real integration has significantly heterogeneous effects on ambidextrous innovation balance.

This study makes several key theoretical contributions. First, it advances the measurement of ambidextrous innovation balance. Existing research predominantly uses static indicators, such as patents and R&D expenditure, to evaluate ambidextrous innovation balance; thus, it is unable to capture its dynamic complexity. In contrast, corporate analyst reports provide multidimensional insights into innovation strategies, technological trends, and market performance from a more dynamic and comprehensive perspective. By applying LDA topic modeling, this study extracts topic scores representing exploratory and exploitative innovation from the analyst reports, thus creating a new metric to measure ambidextrous innovation balance. This method leverages the cross-contextual applicability and transferability of LDA to help overcome the limitations of static indicators, thereby establishing a robust methodological foundation for cross-industry research.

Second, this study provides a conceptual articulation of the micro-foundations underlying digital-real economy integration and systematically examines how such integration affects ambidextrous innovation balance. By reframing the digital-real relationship as a bidirectional and co-evolutionary interaction, it expands the analytical lens of digital economy research and addresses the epistemological limitations of prior studies that view digital transformation as a unidirectional trajectory.

Third, this study elucidates the mechanisms through which digital-real integration enhances production factor allocation efficiency and managerial effectiveness. These mechanisms collectively shape the configuration of ambidextrous innovation balance at the firm level. This study establishes a process-oriented framework that links digital-real integration to the strategic balancing of exploration and exploitation. The findings provide actionable insights for firms aiming to optimize internal resource deployment via digital means, elevate innovation efficiency, promote balanced ambidextrous innovation, and strengthen long-term competitiveness in the digital economy era.

The remainder of this paper is organized as follows. Section 2 reviews the relevant literature on digital-real integration and ambidextrous innovation balance. Section 3 presents the theoretical framework and research hypotheses. Section 4 details the data, variables, and model. Section 5 presents the empirical results, robustness tests, and additional analysis. Section 6 discusses the findings while considering existing theories. Finally, Section 7 concludes the study, highlights the theoretical and managerial implications, and presents the study’s limitations and future research directions.

Literature reviewDigital-real integrationA growing body of literature recognizes the digital economy as a novel economic paradigm, in which data serve as a core factor of production, digital technologies act as the principal driving force, and information networks form the foundational infrastructure for restructuring economic systems (Tapscott, 1996). Digital-real integration reflects a transformative process in which the real economy progressively incorporates data, digital technologies, and other elements of the digital economy. It acquires digital attributes and continually expands its internal logic and external boundaries (Huang & Gao, 2023). This process reflects a dynamic co-evolutionary relationship between digital and traditional sectors, marked by mutual reinforcement among heterogeneous technological domains. This convergence manifests through the sustained absorption and application of digital technologies within the innovation trajectories of traditional industrial sectors (Hong & Ren, 2023). The cross-domain fusion of heterogeneous technologies fosters the emergence of novel innovation frontiers and industrial transformation pathways. Considering their deep penetrability, strong enabling power, and low marginal replication costs, digital technologies rapidly diffuse across the upstream and downstream segments of industrial value chains (Goldfarb & Tucker, 2019).

Importantly, digital-real integration extends beyond the application of technologies and encompasses the strategic embedding of digital capabilities across all phases of enterprise operations. Two primary empirical approaches are used to evaluate firm-level integration. The first approach employs patent data to assess the degree and performance outcomes of integration. Micro-level studies identify a U-shaped relationship between integration intensity and firm performance (Srisathan et al., 2023; Lee, 2023), highlighting the nonlinear and dynamic nature of digital-real integration. The second approach utilizes survey data to evaluate integration across dimensions, such as extent, depth, effectiveness, and market reception (Gaglio et al., 2022). Despite these advancements, a significant empirical gap persists regarding the economic implications of enterprise-level digital-real integration. Most studies remain theoretical and discuss the impact on innovation and performance from the perspectives of supply chains dynamics and resource allocation efficiency (Li et al., 2025).

Ambidextrous innovation balanceInitially, March (1991) delineates two interdependent modes of organizational learning: exploration and exploitation. Many studies across multiple disciplines have since examined the inherent tensions between these activities and the conditions under which a dynamic equilibrium can be maintained. The concept of organizational ambidexterity has been extended to the innovation domain, resulting in the theory of ambidextrous innovation (Danneels, 2002). This framework categorizes innovation into two complementary dimensions: exploratory and exploitative. Exploratory innovation emphasizes radical transformation by pursuing novel knowledge, technologies, and business models. In contrast, exploitative innovation focuses on incremental improvements to enhance existing products and expand current markets, thereby addressing established customer needs (Wang et al., 2024). Because organizational resources are finite, reconciling these two distinct innovation logics becomes a challenge. Firms must simultaneously leverage existing capabilities and pursue new opportunities to sustain growth and achieve long-term competitiveness (Wu et al., 2024). Rooted in paradox theory, ambidextrous innovation hinges on managing tension and achieving synergy between exploration and exploitation (Wei et al., 2025).

Three primary approaches are used to measure ambidextrous innovation balance. First, absolute measures capture the magnitude of the imbalance between exploratory and exploitative efforts (Peng et al., 2022). Second, multiplicative or additive indices evaluate the aggregate intensity or joint effect of both innovation types (Zhao et al., 2021). Third, relative balance metrics adopt a configurational perspective to assess how well they are strategically aligned and organically integrated within a firm.

From a micro-level perspective, achieving ambidextrous innovation balance depends on both intrinsic innovation capabilities and a firm’s innovation culture. Innovation capabilities, which include R&D competence, technological endowments, and market insights, shape a firm’s ability to generate technological and business innovations, thereby serving as essential enablers of digital transformation (Kahn & Candi, 2021). Digital transformation, in turn, enhances innovation trajectories by strengthening ambidextrous capabilities, improving innovation quality, and enhancing sustainable competitiveness.

Innovation culture functions as a key internal soft asset, reflected in the organizational emphasis on innovation and well-designed incentive systems. Elements such as team efficacy and harmonious passion fulfill employees’ psychological needs and enhance their intrinsic motivation. Thus, these elements positively contribute to an ambidextrous innovation balance and enhance organizational performance (Cao et al., 2024). The urgency and prioritization of ambidextrous innovation vary across industries. High-tech sectors demand sustained engagement in technology-oriented and market-driven innovation to maintain competitive advantage and meet rapidly evolving consumer needs (Liu et al., 2025b).

However, three key research gaps exist. First, quantitative studies on the dynamic allocation of innovation resources are scarce. The prevailing measures of ambidextrous innovation balance, such as patent counts and R&D ratios (Xu et al., 2023), are predominantly static. Consequently, they fail to capture the evolving interactions between exploratory and exploitative innovation. Second, while many macro-level analyses examine digital-real integration (Colovic et al., 2025), only a few firm-level studies focus on digital transformation (Ranjan, 2024) and even fewer analyze how such integration reshapes internal ambidexterity mechanisms. Existing ambidexterity theory also overlooks key attributes of digital technologies, particularly the non-rivalrous nature of data and its effects on innovation balance. Third, there exists no coherent analytical framework that explains how digital-real integration influences ambidextrous innovation balance. Most studies rely on aggregate data (Zhao et al., 2025) and overlook core mechanisms, such as internal factor allocation and managerial efficiency, in shaping ambidextrous innovation balance dynamics.

Theoretical analysis and hypotheses developmentDigital-real integration and ambidextrous innovation balanceDynamic capabilities encompass opportunity sensing, opportunity seizing, and strategic transformation that enable firms to continuously build, renew, and reconfigure their resource portfolios in response to rapid and unpredictable environmental changes (Teece, 2007). This theoretical perspective provides a robust and integrative framework for understanding firm behavior in the context of the digital economy. It elucidates how firms leverage digital technologies to optimize operational processes, enhance efficiency, improve customer experiences, and catalyze business model innovation.

Moreover, data-driven decision-making paradigms have fundamentally reshaped both the epistemological foundation and functional enactment of dynamic capabilities. The informational basis of strategic decisions has shifted from reliance on internal experience and bounded rationality to reliance on strategic exploitation of high-dimensional externally sourced data ecosystems. Modern firms can access vast volumes of real-time granular data (Erevelles et al., 2016). When effectively mobilized through dynamic capabilities, these data resources strengthen the alignment between organizational routines and digital infrastructure.

The structure of decision-making has evolved from heuristic and intuition-based judgments toward analytically rigorous, data-augmented reasoning. This transformation enhances the accuracy, agility, and scalability of dynamic capabilities, particularly in complex and uncertain environments (Fosso et al., 2019). Firms constrained by limited resources must navigate the inherent tension between exploratory and exploitative innovation to achieve sustainable development (Jiao et al., 2025). They strive for resilience in increasingly volatile and fast-paced environments (Wang et al., 2025b). Further, they must not only explore new knowledge to adapt to future challenges but also leverage existing knowledge to sustain a competitive advantage and maintain organizational slack (Wu et al., 2022).

In this context, digital-real integration is pivotal for balancing exploratory and exploitative innovation. The deep interaction between digital technologies and the real economy creates conditions for an ambidextrous innovation balance. Digital technologies enable real-time data acquisition and analytical capabilities that allow firms to transcend traditional knowledge boundaries, identify emerging opportunities, and enhance the efficiency and precision of exploratory innovation (Wang et al., 2025a). The digital reconfiguration of real assets, combined with algorithm-driven intelligent optimization, strengthens the capacity to integrate existing knowledge systems and facilitates exploitative innovation through more efficient technological upgrading and process refinement (Fang & Liu, 2024).

Furthermore, through the synergistic co-evolution of technological and entity resources, digital-real integration reduces the trial-and-error costs often associated with exploration and the path dependence inherent in exploitation. This enables the development of a flexible and adaptive resource orchestration model consistent with the dynamic capabilities view. Additionally, emerging technologies, such as digital twins and blockchain, support the construction of risk-controllable, virtual-physical collaborative innovation environments that allow technological exploration and commercial validation to be pursued simultaneously. They foster a synergistic and sustainable balance between exploratory and exploitative innovation at the organizational level. Therefore, the following hypothesis is proposed:

H1 Digital-real integration positively affects ambidextrous innovation balance.

According to dynamic capabilities theory, digital-real integration fosters a synergistic co-evolution between digital technologies and real economy operations, generating a triadic empowerment effect that encompasses resources, organizational processes, and knowledge. This mechanism enhances management efficiency, enabling firms to balance exploratory and exploitative innovation dynamically (Xue et al., 2025). From a resource allocation perspective, digital-real integration improves the efficiency and effectiveness of resource deployment by streamlining data-driven managerial decision-making. This integration facilitates the real-time acquisition and analysis of internal and external data, thereby enhancing the accuracy and timeliness of information processing. Consequently, firms are better equipped to provide targeted resource support for exploratory and exploitative innovation (Zhang et al., 2025a).

In terms of organizational outcomes, digital-real integration enhances organizational flexibility and adaptability through improved management efficiency, thereby supporting ambidextrous innovation balance (Clauss et al., 2021). Specifically, digital technologies enable the dynamic restructuring of organizational architecture and business processes. This allows firms to respond swiftly to changing market conditions, effectively transition between innovation modes, and become less reliant on a single innovation approach. From the knowledge synergy perspective, digital-real integration contributes to ambidextrous innovation by strengthening knowledge-sharing and organizational learning. Deploying digital technologies embedded in digital-real integration facilitates the development of open, transparent, and dynamic knowledge-management systems. This enhances the ability to integrate diverse knowledge sources and promotes the coordinated development of exploratory and exploitative innovation. Therefore, the following hypothesis is proposed:

H2 Digital-real integration positively affects ambidextrous innovation balance by enhancing management efficiency.

Digital-real integration improves the efficiency, precision, and synergy of production factor allocation. According to resource allocation theory, such improvement promotes a more effective balance in ambidextrous innovation. Through deep digital technology integration, firms can achieve precise allocation and dynamic adjustment of production inputs. By leveraging big data analytics and artificial intelligence algorithms, firms can monitor real-time supply and demand conditions and accurately forecast resource requirements. This establishes a stable and responsive resource base that supports exploratory innovation.

Additionally, digital-real integration promotes the collaborative and networked configuration of production resources. Through digital platforms, firms can integrate internal and external factor markets (Li et al., 2024), thus facilitating the efficient flow, coordination, and sharing of resources. This not only shortens innovation cycles but also enhances resource utilization efficiency, accelerating the realization and application of exploitative innovation outcomes. Furthermore, data-driven intelligent management enables the development of dynamic factor allocation systems. These systems enhance organizational flexibility and adaptability under shifting market conditions and are essential for sustaining a long-term balance between exploration and exploitation.

Moreover, efficient production factor allocation enables firms to reinvest the resulting gains in innovation activities, forming a virtuous “allocation–innovation” cycle that increases ambidextrous innovation (Shao et al., 2024). Conversely, resource misallocation may lead to an “allocation lock-in” trap, where an overemphasis on short-term cost control constrains innovation input, ultimately eroding a firm’s long-term innovation capacity. Therefore, the following hypothesis is proposed:

H3 Digital-real integration positively affects ambidextrous innovation balance by optimizing production factor allocation.

Fig. 1 illustrates the conceptual model.

MethodologySample dataAs digital technologies become increasingly integrated into the real economy, China’s A-share listed enterprises have developed a distinct practical paradigm characterized by pilot demonstrations followed by collaborative diffusion. This digital-real integration provides a distinctive empirical setting for investigating the dynamic mechanisms through which integration drives ambidextrous innovation balance. Accordingly, this study selects China’s A-share listed companies as the research sample. The observation period spans from 2007 to 2023. The year 2007 is chosen as the start of the sample period because it marks the implementation of new corporate accounting standards in China, ensuring data comparability and consistency. The year 2023 is set as the endpoint based on data availability.

Data collection comprises three primary components:

- (1)

Patent data: The study focuses on invention patents filed by firms with the China National Intellectual Property Administration (CNIPA). The dataset includes application numbers, publication numbers, and International Patent Classification (IPC) codes. The sample was restricted to patents representing substantive technological advancements and excluded utility models and design patents to ensure measurement accuracy.

- (2)

Analyst report data: Analyst research reports are sourced from the China Stock Market & Accounting Research (CSMAR) database, covering approximately 310,000 reports issued between 2007 and 2023. After removing duplicate and incomplete records, 220,000 valid reports are retained. These reports serve as a key channel of market information, providing valuable textual content and quantitative indicators that serve as proxy variables for external perceptions and market expectations of the firms.

- (3)

Firm-specific and financial data: Information such as company fundamentals, financial ratios, and other supplementary data related to China's A-share listed companies are obtained from the CSMAR database.

The initial sample is refined by: (1) excluding firms in the financial industry; (2) excluding ST-designated firms (those subject to special treatment due to financial irregularities); (3) standardizing variables; and (4) winsorizing all continuous firm-level variables at the 1st and 99th percentiles. The final unbalanced panel dataset includes 53,309 firm-year observations.

The empirical analysis employs the LDA text-mining technique to overcome the limitations of traditional IPC-based innovation classification methods. LDA enables a more granular identification of ambidextrous innovation types based on the distributional characteristics of the derived topics.

Variable definitionsDependent variable: ambidextrous innovation balanceUtilizing Bellstam et al.’s (2021) methodology, which integrates text mining and machine learning techniques to construct innovation metrics, the LDA model is used to extract thematic structures from analyst reports that contain information about firms’ exploratory and exploitative innovation activities. Building on this framework, the relative entropy method is applied to identify and filter keywords related to ambidextrous innovation and construct a textual metric reflecting the degree of balance between exploratory and exploitative innovation. The main steps of this process are as follows:

First, tokenization is applied to each document in the text corpus to generate relevant word-frequency data. Themes related to ambidextrous innovation are identified and categorized into three groups: exploratory innovation keywords, exploitative innovation keywords, and combined ambidextrous innovation keywords. The third category encompasses a range of concepts, including breakthrough thinking, and new product development (from an exploratory perspective), as well as improvement of existing products, and cost control (from an exploitative perspective). The number of latent topics is predefined as n, based on topic-word distributions algorithmically generated from the article lexicon, and the probability of each topic appearing in each analyst report is computed.

Second, ambidextrous innovation themes within the latent topics are identified. The word probability distributions of each latent topic are compared with a benchmark text that is representative of ambidextrous innovation. A similarity score is then computed to identify the topic most closely aligned with the reference. Guo et al.’s (2024) relative entropy approach is adopted as the measure of similarity to enhance the accuracy of textual theme detection. The specific model applied in this context is detailed in Model (1):

where Dkl(P|Q) denotes the extent of disparity in the probability distribution of P relative to that of Q (i.e., the scatter of the Kullback–Leibler divergence). X signifies the set of distributions of Q, P denotes the distribution of ambidextrous innovation topic words, and Q represents the distribution of words in standard texts.Finally, analyst reports that exhibit a positive sentiment tone are selected. Zhou et al.’s (2019) sentiment tone measurement approach, in which the word frequencies of positive and negative tone expressions are calculated, is adopted. The sentiment score of each analyst report is computed by dividing the difference between the number of positive and negative words by the total word count of the report. This method not only captures the directional nature of sentiments but also enhances the objectivity and reliability of the screening process. Building upon the initial construction of the analyst report–topic probability distribution matrix, reports with positive sentiment are further filtered and aggregated at the firm-year level. This aggregation enables the creation of a firm-year-level textual innovation indicator, thereby supporting a more accurate assessment of innovation capabilities and annual performance, as shown in Model (2):

where sentiment denotes the sentiment measure of analyst reports; positive and negative denote the number of positive and negative words in analyst reports, respectively; and total_words represents the total number of words in analyst reports. For sentiment, larger values indicate that analysts’ sentiments are more positive; thus, their evaluation of corporate innovation is more positive.The relative entropy distance method (Kullback–Leibler divergence) is used to select relevant innovation themes. A comprehensive screening is conducted following Bellstam et al. (2021), who use Innovation Management, Innovation and Entrepreneurship, and the Oxford Handbook of Innovation as benchmark texts. The top ten innovation-related terms in textbooks and journal abstracts are identified and quantified. This multi-source approach enables the Kullback–Leibler divergence to be calculated for each theme, mitigating the potential bias arising from reliance on a single benchmark text.

Subsequently, innovation themes are classified as either exploratory or exploitative. Terms including “R&D,” “design,” and “intelligence” are classified as exploratory innovation, while those including “business” and “production capacity” are categorized as exploitative innovation. These thematic categories are then quantified using the LDA model to generate independent measures for both innovation types.

Cao et al.’s (2009) and Peng et al.’s (2022) portfolio perspective is adopted to evaluate ambidextrous innovation balance. This method measures balance through the product of exploratory and exploitative innovation scores, emphasizing the synergistic effect that enhances firm performance and reflects the interdependence between the two innovation dimensions. The balance metric is recalculated using the sum of both innovation types as an alternative independent variable in the latter part of the analysis for robustness testing.

Independent variable: digital-real integrationThis study follows Tao et al. (2023), who develop a three-tier mapping system—Digital Economy Core Industry Classification (DEIC), National Economy Industry Classification (SIC4), and Patent Classification (IPC)—by integrating the Statistical Classification of the Digital Economy and its Core Industries issued by the National Bureau of Statistics (NBS) in 2021. This system overcomes the limitations of traditional single-category frameworks by accurately capturing the integration interface between the digital economy and traditional industries. Consequently, this method enables the technological domains of digital innovations to be accurately identified along with their corresponding IPC codes. Based on this classification system, the identified digital technology invention patents are further disaggregated along the dual dimensions of enterprise and year to construct a firm-level digital-real integration index.

Control variablesA set of micro-level control variables (ContVars) is introduced to account for the influence of other potential factors on the empirical results:

- (1)

Return on assets (ROA): ratio of net profit to total assets;

- (2)

Return on equity (ROE): ratio of net profit to shareholder equity;

- (3)

Asset turnover ratio (ATO): ratio of operating revenue to average total assets;

- (4)

Board size (Board): proxied by the natural logarithm of the number of directors on the board;

- (5)

Ownership concentration (Top1): proportion of shares held by the largest shareholder;

- (6)

Top ten shareholding ratio (Top10): ratio of shares held by the top ten shareholders to the total outstanding shares;

- (7)

Cash flow ratio (Cashflow): ratio of net cash flow from operating activities to total assets;

- (8)

Revenue growth rate (Growth): annual growth rate of operating revenue;

- (9)

Administrative expense ratio (Mfee): ratio of administrative expenses to operating revenue;

- (10)

Capital occupied by major shareholders (Occupy): ratio of other receivables to total assets.

Table 1 describes the variables in more detail.

Variable meanings and descriptions.

Model (3) is constructed to test the effect of digital-real integration on ambidextrous innovation balance:

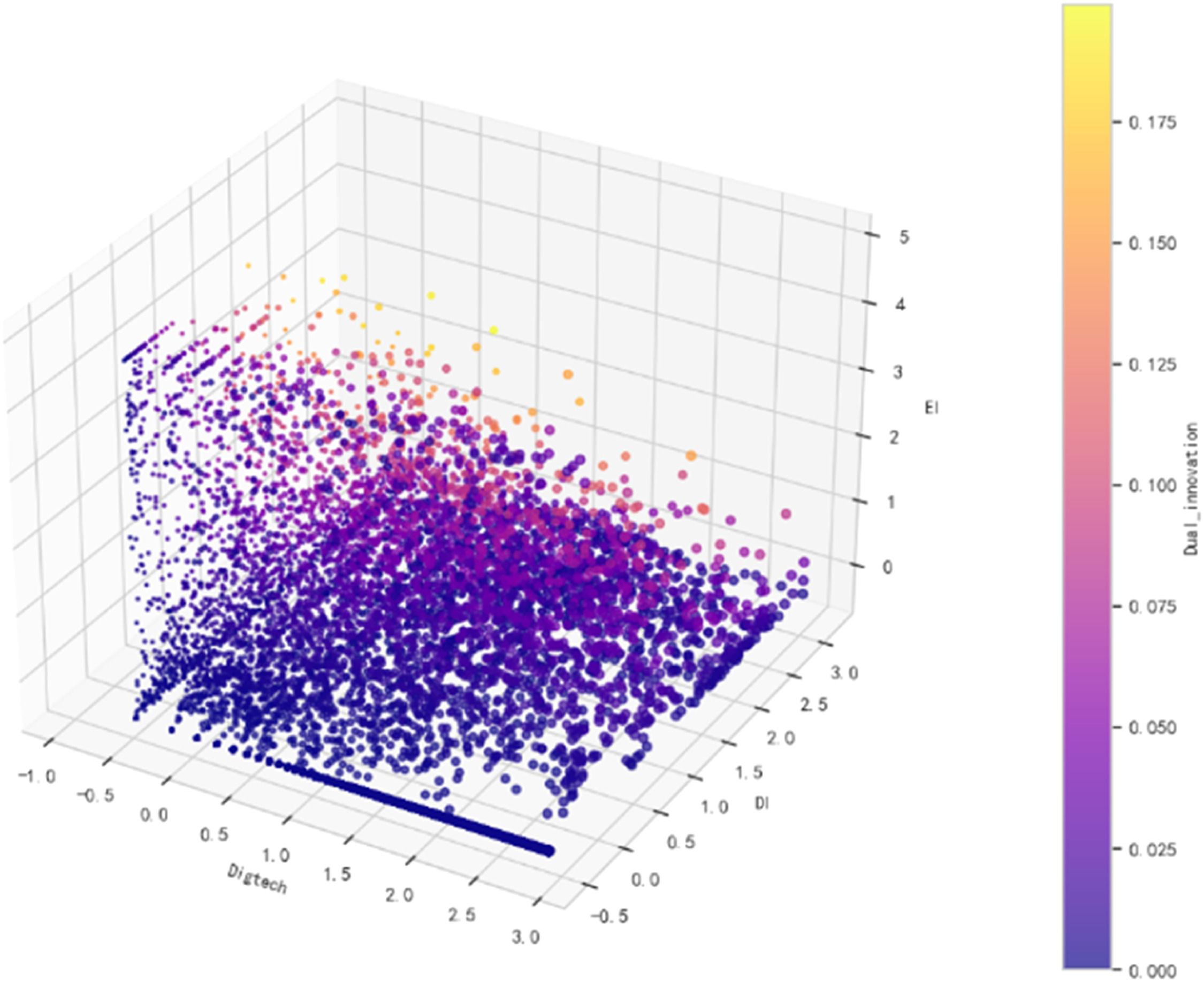

where subscripts i,t denote firm and year, respectively, Dual_innovationit denotes the ambidextrous innovation balance of firm i in year t, and Digtechit denotes the digital-real integration of firm i in year t. ContVarsit denotes the set of control variables of firm i in year t, μi denotes the firm fixed effect, and γt denotes the year fixed effect. If the coefficient α₁ is both statistically significant and positive, it indicates that digital-real integration facilitates ambidextrous innovation balance.Result analysisDescriptive statisticsTable 2 presents descriptive statistics for the dependent, independent, and control variables. After standardization, the distribution of ambidextrous innovation balance (Dual_innovation) appears more concentrated. The considerable gap between the maximum (10.06) and minimum (−0.38) values suggests substantial heterogeneity in ambidextrous innovation capabilities. The distribution of digital-real integration (Digtech) ranges from −0.95 to 2.92, indicating an asymmetrical pattern in digital-real integration across firms. Fig. 2 presents a three-dimensional diagram of the variables.

Descriptive statistics.

Table 3 presents the benchmark regression results. Columns (1)-(4) present the stepwise regression analysis results. The sequence begins with the independent variable only. Then control variables, the year fixed effects, and the year and firm two-way fixed effects are incorporated. The degree of digital-real integration (Digtech) has a significant and positive impact on ambidextrous innovation balance, which is consistent with Hypothesis 1. These results provide robust evidence that digital-real integration significantly enhances firms’ ability to achieve balanced development between exploratory and exploitative innovation.

Benchmark regression results.

The regression results may be subject to endogeneity concerns, particularly reverse causality. Thus, to mitigate potential endogeneity, we refer to the literature (e.g., Huang & Gao, 2023) and construct instrumental variables (IVs) using average values from other firms in the same year and size group. Specifically, firms are classified into deciles based on their total assets each year. For each firm, the IV (AvgDigtech) is calculated as the average level of digital-real integration among other firms within the same size–year group, excluding the focal firm. This grouping strategy is implemented alongside the firm fixed effects in the model, helping to eliminate the potential confounding effects of firm size on the relationship between digital-real integration and ambidextrous innovation. Consequently, the constructed IV can better meet the relevance and exclusion criteria required for valid instrumentation.

The IV strategy is implemented using two-stage least squares (2SLS) estimation. Columns (1) and (2) of Table 4 report the regression results for the first and second stages, respectively. In the first stage, the endogenous independent variable is regressed on the IV to generate its predicted values. The first-stage regression results show the strength and direction of this relationship, confirming the instrument’s predictive power. In the second stage, these predicted values are used instead of the original endogenous variables to estimate the causal impact on the dependent variable. The second-stage regression results reflect the net effect of digital-real integration on ambidextrous innovation balance, which is free from endogeneity bias.

Endogeneity test.

The IV diagnostics further support the validity of this approach. The LM test rejects the null hypothesis of under-identification at the 1 % level (p < 0.01). The first-stage regression (column 1) shows that the instrument is significantly and positively associated with the endogenous variable, confirming instrument relevance. In the second-stage regression (column 2), the coefficient of the predicted variable (Digtech) is positive and significant at the 1 % level, suggesting that the core findings remain robust even after addressing endogeneity.

In summary, the 2SLS results indicate that the integration of digital and real economies emerges as a critical driver of the ability to achieve a balanced innovation strategy.

PSM-DID methodConsidering the continuity of technological innovation behavior, the timing and decisions of different firms to initiate technological integration across various real-world industries can be treated as a quasi-natural experiment. Referring to Wu et al. (2021), propensity score matching (PSM) is used to ensure that the key industry characteristics between the treatment and control groups remain comparable both before and after the innovation decision. In this context, firms that have implemented digital-real integration more than once are categorized as the treatment group, whereas those with no instances are classified as the control group. Model (4) is constructed to test for potential endogeneity:

The dummy variable Treat is assigned a value of 1 for firms in the treatment group, and 0 otherwise. Post is a time dummy variable indicating the implementation period of the policy. It takes a value of 1 for the year in which digital-real integration first occurred in a treatment firm and for all subsequent years, and 0 otherwise. Propensity scores for the full sample are first estimated for the year of digital-real integration initiation. Firms in the treatment group that experienced their first instance of digital-real integration during the sample period are matched 1:1 with control firms using nearest-neighbor matching within a 0.1 standard deviation caliper, again without replacement.

As shown in Column (3) of Table 4, the empirical findings remain robust after accounting for potential omitted variables and addressing concerns related to sample selection bias. This indicates that the promotion effect of digital-real integration on ambidextrous innovation balance within firms remains significant after mitigating endogeneity, thus enhancing the credibility and reliability of this study’s conclusions.

Robustness testsReplacement of the independent variable measuresThe method of Tao et al. (2023) is used to identify patent technological domains using IPC classification codes. A digital-real integration event occurs when the patent’s main IPC code corresponds to a real economy industry technology and at least one secondary IPC code belongs to a digital industry. Based on this definition, the number of digital-real integration events is calculated at the firm-year level and used to replace the independent variable for robustness testing. The classification criteria are based on the Statistical Classification of the Digital Economy and its Core Industries (2023) issued by the NBS. Table 5 presents the robustness test results. Column (1) shows that the regression coefficient of Digtech is positive and significant at the 1 % level, consistent with the benchmark results. These results suggest that the frequency of digital-real integration events positively contributes to ambidextrous innovation balance within firms.

Robustness test results.

In this robustness test, the original measure of the dependent variable is replaced with the sum of the exploratory and exploitative innovation levels. Column (2) of Table 5 shows that the regression coefficient of the independent variable is significantly positive, aligning with the baseline results. These findings further support the conclusion that digital-real integration behavior plays a significant role in fostering ambidextrous innovation balance.

Replacement with lagged independent variableIn this robustness test, the potential time lags in the effect of digital-real integration on ambidextrous innovation is addressed by replacing the current independent variable with its one-period lagged values. Column (3) of Table 5 shows that the regression coefficient of Digtech remains positive and significant at the 1 % level, consistent with the benchmark results. These results indicate that the lagged effect of digital-real integration continues to significantly promote ambidextrous innovation balance.

Mechanism analysisA mediation effect test is used to examine the mechanism underlying the impact of digital-real integration on ambidextrous innovation balance. Building on the proposed theoretical framework, the test identifies management efficiency and production factor allocation as key mediating variables. The independent variable influences these mediators, subsequently affecting ambidextrous innovation balance. Accordingly, building on Model (3), Model (5) is developed to empirically test the mediating effects:

The explanatory and control variables are defined and measured in the same manner as in the baseline regression; Mediation is the mediating variable, which includes the indicators of corporate management efficiency and production factor allocation.

Management efficiencyThe theoretical framework posits that digital-real integration enhances management efficiency by optimizing information flows and resource allocation while reducing decision-making costs. These improvements facilitate a more balanced approach to ambidextrous innovation. Digital integration is a pivotal manifestation of the deep convergence between the digital and real economies. It reconfigures information transmission mechanisms and resource allocation models by applying digital technologies such as big data, artificial intelligence, and cloud computing to improve the operational efficiency and scientific rigor of decision-making processes.

Accordingly, this study adopts Liu and Cao’s (2025) management efficiency measurement approach, which uses the ratio of operating revenue to the sum of administrative and selling expenses as a proxy for enterprise management efficiency. A higher ratio indicates stronger output per unit of management cost and superior resource allocation and cost management capabilities. Conversely, a lower ratio suggests potential inefficiencies and room for managerial improvement.

The regression results in column (1) of Table 6 show that the coefficient of Digtech is positive and significant at the 1 % level, indicating that enterprise digital-real integration behavior significantly enhances management efficiency. This finding aligns with theoretical expectations that digital-real integration fosters efficient internal information flow, mitigates information asymmetry, and supports the balanced development of ambidextrous innovation capabilities.

Mechanism test results.

Theoretically, enterprises can achieve a balance between short-term operational efficiency and long-term adaptability in innovation by optimizing production factor allocation. The effective distribution of resources between exploratory and exploitative innovation is fundamental to ambidextrous innovation balance. Production factor allocation directly influences decision making and the optimization of innovation inputs as the core mechanism through which enterprises integrate and utilize their resources. This study uses labor productivity as a proxy for production factor allocation efficiency (Dai et al., 2025). Labor productivity, measured as the ratio of operating revenue to the total number of employees, comprehensively reflects the input–output efficiency of labor resources, thereby overcoming the limitations of single-factor indicators.

Column (2) of Table 6 shows that the coefficient of Digtech is positive and significant at the 1 % level, indicating that digital-real integration significantly promotes production factor allocation optimization. That is, digital-real integration helps enterprises strike a dynamic balance between exploratory and exploitative innovation, ultimately facilitating the realization of ambidextrous innovation balance.

Heterogeneity analysisFinancial constraintsFirms that face financial constraints often have limited access to external financing and insufficient internal resources, which may restrict their engagement in digital-real integration activities and hinder their ability to invest fully in digital technology R&D and application. Consequently, these firms contribute less to achieving balanced ambidextrous innovation (Livdan et al., 2009). In other words, these constraints prevent firms from capitalizing on the positive effects of digital-real integration on ambidextrous innovation balance.

This hypothesis is tested by constructing a financial constraint dummy variable (WW) and employing the WW index to quantify financial constraint levels. Firms with WW index values above the sample mean are classified as financially constrained (WW = 1), whereas those firms with values below the mean are classified as unconstrained (WW = 0). As shown in Fig. 3 and Column (1) of Table 7, the interaction term Digtech × WW is negative and significant at the 1 % level. This indicates that the positive effect of digital-real integration on ambidextrous innovation balance is significantly stronger among firms with low financial constraints. In contrast, firms with high financial constraints have fewer benefits from digital-real integration because of their limited resources and higher risk aversion. Consequently, resource-rich firms are better positioned to enhance innovation synergy and dynamic adaptability through digital-real integration.

Heterogeneity test results.

A highly competitive market environment stimulates firms’ proactive adoption and application of digital intelligence technologies. This promotes a more balanced approach to ambidextrous innovation. Therefore, the positive effect of digital-real integration on ambidextrous innovation balance is expected to be stronger in industries characterized by high competition. The Herfindahl–Hirschman Index (HHI) is introduced as a dummy variable representing the level of industry competition. Specifically, HHI is used to measure market concentration. Industries with HHI values below the median are classified as highly competitive (HHI = 1), whereas those with values above the median are considered less competitive (HHI = 0). Fig. 4 and Column (2) of Table 7 show that the interaction term Digtech × HHI is significant and positive. This implies that the positive impact of digital intelligence technologies on ambidextrous innovation balance is more pronounced in highly competitive industries. Firms in highly competitive environments face intensified market pressure and uncertainty, which compel them to optimize resource allocation strategically through digital technologies, thereby balancing exploration and exploitation to enhance ambidextrous innovation outcomes.

Level of regional digital infrastructure developmentDigital infrastructure development helps shape the technical capacity and resource accessibility of firms engaged in digital-real integration. Firms operating in regions with more advanced digital infrastructure presumably achieve a stronger synergistic balance between exploratory and exploitative innovation, realized through effective digital-real integration. Hence, the ratio of Internet broadband subscribers to the local residential population at year-end (Net_level) is used to quantify regional digital infrastructure levels. Regions in which this ratio exceeds the sample median are designated as having a high level of digital infrastructure (Net_level = 1), whereas the others are assigned a value of 0. Fig. 5 and Column (3) of Table 7 show that the interaction term Digtech × Net_level is significant and positive, indicating that firms in regions with well-developed digital infrastructure can better utilize digital-real integration for exploratory and exploitative innovation. These findings support the hypothesis that digital infrastructure is a key facilitator of ambidextrous innovation balance at the regional level.

DiscussionThe integration of digital capabilities with the real economy is critical for resolving the exploration-exploitation innovation paradox (Ciarli et al., 2021; Kim & Jin, 2024). This study contributes to the discourse on sustainable development by addressing how firms can achieve ambidextrous innovation balance within the context of digital-real integration. The findings systematically illustrate the intrinsic value of digital-real integration in reconciling innovation tensions and emphasize the study’s theoretical contributions and managerial relevance.

First, prior studies confirm that digital transformation significantly drives corporate innovation (Chen et al., 2024). This study extends the research by examining how digital-real integration facilitates dynamic equilibrium between exploratory and exploitative innovation. Digital transformation typically involves unidirectional restructuring of internal processes, business models, and value chains. Meanwhile, digital-real integration fosters bidirectional synergy and value co-creation between digital technologies and real economy, which is essential for balancing innovation types. From this perspective, Wu et al. (2023) demonstrate the positive effects of the digital economy on various stages of innovation. Consistent with this view, this study extends the discussion by demonstrating how digital-real integration addresses challenges related to innovation resource allocation. Specifically, it shows that this integration helps firms pursue exploratory and exploitative innovation simultaneously. Establishing a collaborative ecosystem between digital technologies and the real economy provides a strategic avenue for alleviating resource constraints. Therefore, firms should leverage digital-real integration to enhance resource allocation efficiency and support balanced ambidextrous innovation.

Second, prior research suggests that supply chain transparency amplifies the innovation benefits of digital transformation (Li et al., 2025). The study’s findings indicate that digital-real integration enhances supply chain transparency, thereby improving management efficiency and supporting more balanced innovation outcomes. From a resource allocation perspective, mechanism analysis shows that this integration facilitates the optimal allocation of production factors, echoing the conclusions of Shao et al. (2024). When digital technologies are embedded within the real economy, firms can leverage intelligent decision-making systems to dynamically adjust the distribution of innovation resources. Hence, through improved management efficiency and more effective resource allocation, digital-real integration substantially strengthens firms’ ambidextrous innovation capabilities.

Third, heterogeneity analysis shows that firms facing high financing constraints encounter greater challenges in fully leveraging the benefits of digital-real integration for innovation balance, consistent with the findings of Fang and Liu (2024). Similarly, Li et al. (2024) report that the impact of digitalization on innovation is more pronounced in high-tech firms. This study finds that firms located in regions with well-developed digital infrastructure are better positioned to utilize digital-real integration to coordinate exploratory and exploitative innovation, thereby achieving a more balanced innovation portfolio. These findings highlight the need for firms to adapt their ambidextrous innovation balance strategies according to their financing capacity, competitive environment, and level of digital maturity. Such adaptation facilitates the dynamic reallocation of innovation resources to sustain ambidextrous innovation under varying conditions.

Finally, this study builds on the approaches of the extant literature (Bellstam et al., 2021; Mahdikhani & Meena, 2024; Tian et al., 2024; Zhang et al., 2025b) and uses the LDA model to examine analyst reports and constructs innovation indicators. Extending the work of Bellstam et al. (2021), this study leverages topic features, extracted using the LDA model, to differentiate between exploratory and exploitative innovation, thereby enriching the text-based analysis of innovation heterogeneity. Specifically, topic terms related to both types of innovation are extracted from analyst reports using the LDA model. The terms associated with ambidexterity are identified using a relative entropy-based screening method. Relative to traditional static index systems, this dynamic content-driven approach offers a more nuanced and responsive method for capturing the complexity and diversity of corporate innovation.

Conclusions and implicationsConclusionsThis study investigates the textual content of analyst reports on publicly listed companies in China using the LDA model and quantifies ambidextrous innovation balance by developing novel text-based indicators. Furthermore, it examines how digital-real integration affects this balance and explores the underlying mechanisms driving this relationship. The empirical results show that digital-real integration has a significant positive effect on ambidextrous innovation balance. The findings remain robust after controlling for potential endogeneity using IV techniques and PSM. The findings are further supported by multiple robustness checks, including alternative variable specifications. Mechanism analysis reveals that digital-real integration improves management efficiency and optimizes production factor allocation, facilitating a better ambidextrous innovation balance. Moreover, digital technologies streamline information flow, reduce decision-making costs, and enhance internal coordination. Simultaneously, by enabling more accurate allocation of production inputs, digital-real integration shortens innovation cycles and increases resource utilization, thereby supporting balanced innovation strategies.

Heterogeneity analysis reveals that the effects of digital-real integration on ambidextrous innovation balance are significantly moderated by contextual conditions, including financial constraints, industry competition intensity, and regional digital infrastructure. Firms facing high financing constraints benefit less from digital-real integration because of resource limitations and their inability to absorb the high costs of technological transformation. Conversely, the impact is more pronounced in industries with greater competitive intensity because firms are under greater pressure to optimize resource allocation across innovation activities. Furthermore, firms in regions with advanced digital infrastructure benefit more from digital-real integration. This advanced infrastructure facilitates technology diffusion and interfirm knowledge sharing, thereby amplifying the positive impact of digital transformation on innovation balance.

Theoretical implicationsThis study makes three theoretical contributions to the literature. First, it develops a novel measurement system for dynamic ambidextrous innovation balance. Traditional studies predominantly rely on static indicators, such as patent counts and R&D expenditure. However, these measures fail to capture the dynamic evolution and inherent complexity of ambidextrous innovation balance (Wu et al., 2023). To address this limitation, this study employs the LDA model based on text mining and topic modeling techniques. Exploratory and exploitative innovation theme scores are extracted from corporate analyst reports to construct a comprehensive ambidextrous innovation balance measurement index. The framework developed in this study is effectively applied in the context of A-share listed companies in China. The findings also demonstrate its potential for cross-context applicability, facilitating the expansion of related research.

Second, this study clarifies the connotation of digital-real integration behaviors at the micro level and the related mechanism driving the ambidextrous innovation balance. Accordingly, it expands the research perspective on enterprises’ ambidextrous innovation balance in the digital economy. Current research paradigms are predominantly confined to meso–macro analytical dimensions, often simplifying corporate digital transformation into a unidimensional economic output effect. However, deconstructive studies on the micro-level mechanisms of digital-real integration are scarce (Hao et al., 2024; Chen et al., 2024). Therefore, based on ambidextrous innovation balance theory, this study elucidates the essence of micro-level digital-real integration behaviors and their role in achieving ambidextrous innovation balance, providing a better understanding of technology-integration-driven ambidextrous innovation balance in the digital economy. Furthermore, this study transcends the application boundaries of ambidextrous innovation balance theory in the digital context, providing theoretical foundations for enterprises to achieve synergistic equilibrium between exploitative and exploratory innovation in the era of digital-real integration.

Third, this study systematically reveals the dynamic transmission mechanism between digital-real integration and ambidextrous innovation balance. Prior research focuses on the effects of single innovation models (Liu et al., 2025a); it does not delve into path dependence and dynamic interactions in the ambidextrous innovation balance under digital-real integration. Based on dynamic capability theory, this study examines exploratory and exploitative innovation from management efficiency and production factor allocation perspectives. It elucidates how these two approaches achieve synergistic evolution in the digital-real integration process and explains how dynamic equilibrium is established through resource complementarity and capability iteration. Furthermore, from a dynamic capability perspective, this study demonstrates that management efficiency enhances organizational adaptability through optimized decision-making and responsiveness. Simultaneously, production factor allocation promotes innovation coordination through resource restructuring and capability redistribution. Collectively, these mechanisms drive the integration and reconfiguration of internal and external resources within enterprises, ultimately advancing ambidextrous innovation balance.

Practical implicationsAs global digitalization accelerates, digital-real integration has become vital for enterprises to promote high-quality economic development. However, many firms struggle to balance exploratory and exploitative innovation. The study’s findings offer a practical framework for resolving the innovation allocation paradox.

First, governments should increase targeted support for digital-real integration. Such support may include subsidies and tax incentives to help firms overcome their resource and technological constraints. Firms should strengthen their investments in digital R&D and build open innovation ecosystems that foster collaboration among industries, academia, and research institutions. Moreover, advancing data-sharing frameworks and standardizing integration practices can address technological fragmentation and data silos. Embedding digital technologies across business operations, including smart production, decision systems, and lifecycle platforms, enables firms to achieve a dynamic balance between short-term efficiency and long-term innovation capacity.

Second, this study offers significant theoretical and practical implications for economies at different digital maturity stages. In economies with advanced digitalization, enterprises can leverage robust digital infrastructure and dynamic data ecosystems. This enables them to synergize digital technologies across exploratory and exploitative innovation, optimizing resource allocation, while enhancing dynamic innovation capabilities. For economies in the early or developing stages of digitalization, the research reveals how digital-real integration promotes ambidextrous innovation balance dynamics. This emphasizes that enterprises can effectively achieve a dynamic equilibrium between exploratory and exploitative innovation by improving management efficiency and optimizing production factor allocation.

Third, although economies vary in technological foundations, institutional frameworks, and market characteristics, the inherent mechanism of digital-real integration remains universally applicable. This mechanism promotes ambidextrous innovation balance by enhancing innovation efficiency, reducing trial-and-error costs, and strengthening organizational adaptability. Therefore, the study’s findings can help countries at different stages of the digitalization process design effective strategies for digital transformation and innovation support tailored to their specific context. Furthermore, from a policy coordination perspective, both the EU’s “Digital Europe Programme” and China's “Digital Economy Framework” drive the deep integration of digital technologies with the real economy. This study proposes a “policy guidance—technology empowerment—innovation coordination” approach that offers a replicable practical framework for other countries. This demonstrates that the role of digital-real integration in driving the ambidextrous innovation balance follows universal principles aligned with global industrial transformation trends.

Limitations and future researchThis study has several limitations that can be explored in future research. First, this study adopts a linear perspective centered on single-factor effects and thus fails to systematically consider the nonlinear or interactive effects among organizational, technological, and environmental factors. In the digital-real integration context, capturing the complex mechanisms of multi-factor coupling and their differential effects on exploratory versus exploitative innovation pathways is a challenge. Future research could use fuzzy-set qualitative comparative analysis to reveal nonlinear and collaborative mechanisms across multiple factors. At the conditional variable level, systematic deconstruction should be strengthened for core independent variables, including digital technology investment, resource constraints, and talent supply. Regarding outcome variables, introducing systematic and hierarchical dependent variables such as innovation quality, innovation sustainability, and innovation ecosystem synergy would allow for the multi-dimensional effects of digital-real integration on ambidextrous innovation balance to be captured more comprehensively.

Second, this study relies on data from A-share listed companies in China and does not include data from other economic systems or market environments. This may limit the generalizability of the findings. Future research should conduct comparative analyses across industries, regions, and national contexts to understand how digital-real integration produces heterogeneous effects on enterprises’ ambidextrous innovation balance under varying institutional constraints, market structures, and digital economy development levels. This would provide targeted empirical evidence and theoretical support for optimizing the adaptability of enterprises’ ambidextrous innovation balance strategies across diverse contexts.

Third, this study focuses on the impact of digital-real integration on the balance of enterprise ambidextrous innovation without exploring broader economic consequences, such as high-quality economic development, improvements in total factor productivity, or shifts in corporate competitiveness in product markets. Future research could integrate the value creation potential of digital technology, information, and knowledge into the research framework. It can explore how digital-real integration promotes high-quality economic development, enhances total factor productivity, and strengthens product market competitiveness, while considering both the multiplier effect of digitalization on foundational production factors and its incremental contributions.

FundingThis work was supported by Youth Foundation Project of the Ministry of Education of China for Humanities and Social Sciences Research [grant numbers 24YJCZH249].

CRediT authorship contribution statementQianqian Shi: Writing – review & editing, Writing – original draft, Visualization, Validation, Supervision, Investigation, Funding acquisition, Formal analysis, Conceptualization. Yuanlei Deng: Writing – original draft, Visualization, Software, Formal analysis, Data curation. Tingli Liu: Writing – review & editing, Supervision, Investigation, Formal analysis. Xiaojun Liu: Writing – review & editing, Investigation, Funding acquisition, Formal analysis.

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.