This study utilizes panel data from 31 Chinese provinces over the period from 2011 to 2021. The entropy method is employed to calculate comprehensive indices. An index system is developed for assessing the development level of the innovation-driven digital economy and the resilience of industrial and supply chains. We subsequently construct a panel fixed-effects regression model that incorporates entrepreneurial activity as a moderating variable. This study empirically examines how the digital economy impacts the resilience of industrial and supply chains. We also apply a spatial Durbin model to explore spatial spillover effects and regional disparities in the influence of digital economy development on chain resilience. The results show that the digital economy significantly bolsters chain resilience through increased entrepreneurial activity. Furthermore, the level of the digital economy affects the resilience of the industrial and supply chains in neighboring provinces, indicating the presence of spatial spillover effects. Additionally, the impact of the digital economy on the resilience of industrial and supply chains exhibits regional heterogeneity.

Natural disasters and geopolitical conflicts frequently present vulnerabilities in global industrial and supply chain systems. Recent global shocks, such as the COVID-19 pandemic and the Russia–Ukraine conflict, have exacerbated cross-border supply chain risks and caused volatility spillovers across global financial and commodity markets (Hau et al., 2024, 2025; Liu et al., 2025; Zhai et al., 2024; Zhang et al., 2024; Zhang & Wang, 2022). This global supply chain vulnerability has gained worldwide attention because of cross-market commodity price volatility and liquidity risks (Ding et al., 2019; Ding & Zhang, 2020). In an era of globalization, economic ties between nations are tightening. Enhancing chain resilience can mitigate external shocks, ensuring economic stability. Current and future challenges compel a reevaluation of resilience and robustness in supply chain management.

Digital technologies are pervasive, and digital infrastructure is improving. The digital economy, a new model, is integral to the global economy. It is also transforming traditional industrial and supply chains. The digitalization of the supply chain (SC) has received extensive attention from practitioners and researchers (Nayal et al., 2022). Innovations and advances in the digital economy are pivotal in transitioning the real economy to the digital realm, bolstering chain resilience against disruptions. Examining the digital economy's impact on chain resilience is valuable for theory and practice. It aids in digital transformation, modernizes industry and supply chains, enhances resilience, and ensures economic stability. Existing studies often overlook both industrial and supply chains together. These chains are interconnected; thus, regression analysis between the digital economy and chain resilience lacks precision. We propose an integrated approach that treats both chains as a unified system. This approach emphasizes the importance of supply chain and full industrial chain factors.

From a global economic perspective, the intensification of Sino-American trade tensions has catalyzed a strategic recalibration in U.S. supply chain management through the implementation of "friend-shoring" policies—commonly referred to as the Anywhere But China (ABC) framework. This geopolitical realignment has been operationalized through a suite of restrictive measures targeting Chinese high-tech industries, including comprehensive embargoes on advanced semiconductor technologies and stringent export controls on photolithography equipment manufactured by ASML. In response, China has strategically leveraged its "Digital China" initiative to cultivate distinctive competitive advantages in terms of supply chain resilience and operational efficiency. Empirical evidence underscores this transformation. Huawei Technologies exemplifies this shift through its deployment of an intelligent operations center (IOC) integrated with over 300 predictive risk probes—a digital infrastructure that has demonstrably enhanced supply chain robustness. Quantitative analysis reveals that this technological intervention increased abnormal situation response efficiency by 31% while simultaneously improving end-to-end inventory turnover rates by 50%. Notably, during the COVID-19 pandemic (2020), this digitally enhanced supply chain architecture ensured 100% on-time delivery for critical components, effectively validating its operational resilience under extreme disruption scenarios. Similarly, DJI Innovations has pioneered supply chain optimization through proprietary digital solutions. The company's "7-day pick-up plan" combined with a just-in-time (JIT) production paradigm enabled DJI to maintain 95% order fulfillment accuracy during the global semiconductor shortage. This performance can be attributed to an integrated digital "immune system" that tripled inventory turnover efficiency while sustaining 95% supply continuity throughout the pandemic period.

On the basis of the above arguments, this paper raises the following questions: Does the development of the digital economy significantly affect the resilience of a country's industrial and supply chain? If the answer is yes and the effect is enhancing, is it a linear influence or a nonlinear and irregular influence? What mediators will regulate the effect of the digital economy on the resilience of a country's industrial and supply chains? What spatial characteristics will the resilience of a country's industrial and supply chains present under the influence of the digital economy?

Currently, the construction and measurement of digital economy indicators predominantly commence with the elucidation and evolution of the digital economy. This process entails identifying pertinent indicators to establish a comprehensive evaluation index system.

This paper uses 31 provinces in the underdeveloped regions of western China from 2011 to 2021 to study the impact of the digital economy on the sustainable development of the underdeveloped regions of western China. The digital economy is measured from both macro and micro perspectives. From the macro perspective, it includes digital infrastructure, telecommunication services, and internet development. From the micro perspective, it covers digital industrialization and the digitization of industry. Digital innovation indicators are also added, and the entropy method is used for measurement (Feng et al., 2025).

Considering the differences between China and Western countries, scholars have combined the actual situation of China to construct a measurement system of the digital economy mainly through the dimensions of digital infrastructure, digital industry development, the digital tool penetration rate and digital innovation ability and have selected indicators in different ways according to different research themes (Xin et al., 2023; Zeng et al., 2024). According to Li et al. (2024), the structure of supply chain relationships exerts a significant threshold effect on supply chain governance performance. Supplier concentration and customer concentration have differentiated nonlinear impacts across different governance dimensions. This finding offers theoretical support and practical guidance for optimizing corporate supply chain governance strategies. Teng and Lin (2024) explored the diversified development of new energy supply chain configurations. Their research revealed that the digital economy can significantly boost the diversified development of the new energy supply chain configuration, enhancing its resilience and security. Moreover, the digital economy has positive effects on supply chain transformation, upgrading, and risk prevention.

Chen et al. (2023) conducted a bibliometric analysis of 5000 articles from Web of Science and CNKI indexed journals, reviewing the digital economy measurement literature from 2010 to 2021. Cocitation network analysis revealed that scholars have focused on indicators such as intellectual property, innovation, digital IT, cryptocurrencies, blockchain, and e-commerce. The digital economy-level indicators should encompass various aspects and be quantified on the basis of regional specifics.

The factors for resilience assessment include the ability to recover from external adverse impacts, the capacity to prevent disruptions, and the ability to withstand shocks. In the field of economics, scholars often explore this topic from the perspective of economic resilience (Yu et al., 2023; Xu et al., 2024; Huang et al., 2024). Ma et al. (2023) proposed a comprehensive method to assess the resilience of the industrial chain from a global perspective, which not only takes into account the trade relationships and value added between countries but also captures the overall structural characteristics of the industrial chain through a complex network algorithm. Moosavi & Hosseini (2021) quantified the level of resilience by analyzing the change in a supply chain's performance under the risk of disruption.

A few studies have concurrently assessed the resilience of industrial chains and supply chains. Sun et al. (2024) analyzed the concept of industrial chain-supply chain ecology from a systemic perspective. The concept of industry chain ecology and the concept of supply chain ecology were explained, and value creation in the industry chain and supply chain ecosystem was presented through an innovation chain involving research, technology, products, systems and management to realize technological breakthroughs and improvements, which could indicate that this process requires close collaboration between each link of the industry chain and each subject of the supply chain. In light of this perspective, the resilience of these chains can be evaluated across dimensions such as their ability to withstand external shocks, adapt and recover, exercise autonomous control, and exhibit competitive leadership. As globalization intensifies and the digital landscape expands, the frequency of unforeseen incidents will continue to increase. Consequently, industrial and supply chains must adeptly navigate this uncertainty, maintain resilience, and ensure stability. Therefore, the evaluation of chain resilience should focus primarily on addressing the uncertainties stemming from external shocks.

Measuring the resilience of industrial and supply chains requires a deep understanding of the essence of supply chain resilience. With respect to the definition of supply chain resilience, Gonul & Nowicki (2018) summarized recent literature reviews on this topic, indicating inconsistencies in the terminology used to describe supply chain resilience.

Terms such as elasticity, robustness, reliability, agility, and flexibility may be used interchangeably. In this paper, supply chain resilience is further defined on the basis of the foundation of recovery, i.e., the ability of the supply chain system to recover from disruption back to its original state or move to a new, more ideal state (Christopher & Helen, 2004). The research findings show that both digital agility and digital adaptability have positive and direct effects on supply chain resilience. This finding indicates that organizations need to develop capabilities in both aspects simultaneously to better cope with the complex and changeable supply chain environment (Dubey et al., 2023).

Hosseini and Barker (2016) measured the infrastructure recovery capacity on the basis of the ability of the supply chain system to absorb, adapt, and recover from interruptions. Furthermore, some scholars have emphasized that considerations for supply chain resilience should also include the ability to forecast before disruptions occur or to resist disruptions when they happen.

Enhancing a supply chain company's ability to resist disturbances is a key proactive strategy that involves preventing fractures and withstanding impacts. IoT technology, through the collection and real-time transmission of data, can improve the visibility, flexibility, and collaborative capabilities of the supply chain. This enables companies to predict demand surges, promptly adapt to market changes, and make prior preparations to mitigate the impact of disruptions. Blockchain technology can establish a transparent, visible, and automated data exchange mechanism, thereby enhancing the supply chain's resilience and curbing the spread of disruptions. Big data analytics (BDA) can aid companies in predicting the occurrence of disruptions, formulating response strategies, and exercising real-time control, thus strengthening the supply chain's resilience (Iftikhar et al., 2024).

With the deepening of globalization and the development of the internet, the benefits brought by the digital economy have made high-tech capabilities such as the internet increasingly important in market competition. For example, digital technology empowers decision-makers to respond to disruptive events, consequently enhancing the resilience of the healthcare supply chain (Furstenau et al., 2022). Digital transformation can foster the diversification of the entire supply chain. By coordinating supply and demand, it can drive industrial restructuring (Cai et al., 2024). Moreover, it can reduce inventory transportation costs, thus enhancing the stability of the supply chain (Shi et al., 2024). The greater the degree of investment in technological innovation by companies is, the stronger their competitiveness in the market, enabling them to better maintain resilience and stability. Industrial chains link resource production, whereas supply chains expedite resource flow. They must support, depend on, and collaborate with each other. This paper explores the regional impact of the digital economy on chain resilience, considering indirect effects and spatial spillovers. It aims to offer a holistic view of the influence of the digital economy on chain resilience and to propose strategies for modernizing chains, fostering regional and digital economy development synergistically.

The contributions of this paper are as follows: First, it comprehensively examines the interplay between industrial and supply chains, devising a supply chain-centric resilience index system. It empirically investigates both the direct and indirect effects of the digital economy on chain resilience. Second, the spatial impact of the digital economy on industrial and supply chain resilience is commonly neglected. This study scrutinizes the spatial effects of the digital economy, considering both geographical and economic distances. Finally, this study explores regional disparities in how the digital economy affects industrial and supply chain resilience.

Theory and hypothesesDirect effects of the innovation-driven digital economy on the resilience of industrial and supply chainsLeveraging the innovation-driven digital economy, industry can accelerate digitalization and intelligent transformation, thereby enhancing the stability and competitiveness of industrial and supply chains (Cao et al., 2024). For example, the digital economy can optimize resource allocation, reduce various costs in production and supply processes, enhance efficiency in interenterprise collaboration (Xia, 2024; Nematollahi et al., 2025), and consequently impact the resilience of industrial chains and supply chains. It strengthens their ability to withstand various economic and financial risks, ensuring stable supply and sustainable development. Furthermore, the development of digital technology allows businesses to rapidly access, process, and analyze market information, thereby enhancing their adaptability and recovery capabilities. Particularly, the dual enhancement of short-term recovery and long-term resilience is achieved by integrating Adaptive Resilience (AR) and Transformative Resilience (TR) strategies (Abudu et al., 2025). Digital technology also gives rise to various business models, such as e-commerce and the sharing economy, promoting innovation and development within enterprises.

On this basis, the following hypothesis is proposed.

Hypothesis 1 An innovation-driven digital economy has a significantly positive effect on the resilience of industrial and supply chains.

Currently, a considerable body of research has focused on the impact of the digital economy on entrepreneurial activity. Wang et al. (2024) found that the digital economy has a significant positive effect on entrepreneurial activities. The innovation-driven digital economy can effectively reduce the financing costs of enterprises, stimulate innovative vitality and provide more development opportunities for entrepreneurs. An empirical analysis was conducted on the relationship between the digital economy and entrepreneurial activities. The results emphasized the significant influence of the digital economy in stimulating entrepreneurial activities (Wang et al., 2024). Supply chain resilience, as a key element of high-quality economic development, can also be further improved by the digital economy through stimulating entrepreneurial activities. The development of the digital economy has a positive effect on improving urban resilience, which can increase urban resilience through technological innovation and the intermediary role of entrepreneurship. Particularly, green technological innovation facilitates sustainable development, thereby enhancing the risk resistance capacity of industrial and supply chains (An et al., 2024).

On this basis, the following hypothesis is proposed.

Hypothesis 2 The digital economy indirectly strengthens the resilience of industrial and supply chains by driving entrepreneurial activity.

The innovation-driven digital economy can have spatial spillover effects in many different areas, such as technological innovation, the urban‒rural income gap, and industrial structure upgrading (Xia et al., 2024; Dian et al., 2024; Lu & Hu, 2024). By analyzing the digital economy in a way that simultaneously considers time and geospatial space, it is possible to better explain the key role played by the digital economy. With the continuous evolution of the digital economy, regions endowed with advanced digital industries and technological advantages exhibit heightened agglomeration effects. These effects subsequently propagate and impact neighboring regions, thereby augmenting regional economic resilience and risk mitigation. There is spatial dependence between urban entrepreneurial capacity and the digital economy, i.e., the impact of the innovation-driven digital economy on urban capacity clearly has nonlinear characteristics. Does this dependence also affect the resilience of industrial and supply chains?

On this basis, the following hypothesis is proposed.

Hypothesis 3 The innovation-driven digital economy impacts the resilience of industrial and supply chains in adjacent regions through spatial spillover effects.

The method of determining weights generally has two approaches: subjective weighting and objective weighting on the basis of actual data. According to Sun et al. (2021), subjective data weighting is biased and closely related to subjective perception. Therefore, data weights are often inaccurate. The entropy method is a comprehensive evaluation technique that relies on information entropy. It evaluates the significance of features in classification outcomes by calculating their information entropy values, thereby determining their importance and weights. Applying the entropy method to gauge the advancement of the digital economy and the resilience of the industrial chain supply chain enables a comprehensive assessment of the significance and impact of various factors. This approach effectively extracts information from multi-index evaluation data and offers scientific and dependable assessment support. Consequently, we employ the entropy method to assess both the development level of the digital economy and the resilience of industrial and supply chains. The specific steps involved are as follows:

Step 1: Standardize positive and negative indicators:

Step 2: Nonnegative shift, with 0.001 as the indicator shift magnitude:

Step 3: Calculate the weight of the jth indicator in the ith year:

Step 4: Calculate the information entropy value:

Step 5: Calculate the information entropy redundancy:

Step 6: Calculate the weight of each indicator:

Step 7: Calculate the comprehensive index:

Here, θ represents the year, i represents the province, j represents the measurement indicator, r represents the number of years, n represents the number of provinces, and m represents the number of indicators. The result is obtained from the above formula. The comprehensive index represents the measurement of province i in year θ, with values ranging from 0 to 1.

Construction of the indicator systemEvaluation index system for the development level of the digital economyThis paper constructs an evaluation indicator system for the development level of the innovation-driven digital economy: digital economic development carriers, the digital economic development environment, digital industrialization, and industrial digitalization. Seven primary indicators and 27 positive measurement indicators are selected. These indicators are employed to evaluate the comprehensive index of the digital economic development level for different provinces across various years, with the weights allocated using the entropy method. The specific indicator system is outlined in Table 1.

Evaluation system for the development level of the innovation-driven digital economy.

Drawing on previous research and the theoretical analysis presented earlier, this study develops an assessment framework for the resilience of industrial and supply chains, which includes four dimensions: adaptability resilience, self-control resilience, response resilience, and competitive leadership resilience. The framework consists of nine principal indicators and twenty-four measurement indicators, among which there are twenty-three positive measurement indicators and one negative measurement indicator. Employing the entropy method previously discussed, this system computes a comprehensive resilience index for both industrial and supply chains. The detailed indicator system is depicted in Table 2.

Evaluation index system for industrial and supply chain resilience.

To explore the direct impact of the digital economy on the resilience of industrial and supply chains, this paper constructs a foundational regression model for analysis. The specifics of this model are detailed in the subsequent sections.

Where:

Among these variables, Resili.t denotes the resilience of the industrial and supply chains in province i during period t,Digitali.t represents the level of digital economy development in province i during period t, and the vector Controli.t represents a series of control variables. If the individual fixed effect of province i remains constant over time, then the time fixed effect is controlled, representing a random perturbation term.

In addition, to explore the indirect effects of the digital economy on the resilience of industrial supply chains, this paper incorporates entrepreneurial activity as a mediating variable. To determine its potential mediating role, the following mediating effect model is constructed on the basis of the baseline regression model.

Where:

where Entre_arci.t represents the entrepreneurial activity in province i during period t, and the meanings of the other variables are consistent with those in Eq. (9).To delve into the spatial spillover effects of the digital economy on the resilience of industrial and supply chains, Eq. (9) is ultimately extended into a spatial econometric model:

where ρ is the spatial autoregressive coefficient, W is the spatial weight, and ∅1 and ∅care the regression coefficients of the digital economy level and the control variable with the spatial lag term, respectively. The meanings of the other variables remain consistent with Eq. (9).Variable descriptionDependent and independent variablesIn this study, the dependent variable is the resilience of industrial and supply chain systems, denoted as Resil.

The independent variable is the level of the digital economy, represented by Digital, which is quantified using the previously described evaluation indicator system and assessed via the entropy method.

Control variablesThe control variables selected in this study include the following:

- (1)

Logistic Level (Logis): As Song et al. (2022) elucidated, logistics capabilities play a pivotal role in bolstering supply chain resilience during the COVID-19 pandemic. These findings underscore the importance of logistics capability as a key driver of supply chain resilience (SCR). In this study, we measure the logistic level by the total freight volume.

- (2)

Urbanization Level (Urban): Urbanization is recognized for its capacity to stimulate income and industrial economic growth, which in turn positively impacts economic resilience. We operationalize the urbanization level by employing the ratio of the urban population to the total provincial population.

- (3)

Market Size (Size): A larger market size suggests a more extensive consumer base and more stable market demand, which in turn enhances the capacity to withstand supply chain risks. Accordingly, a correlation exists between market size and the resilience of industrial and supply chains, with larger markets indicating greater resilience. This study quantifies market size using the total retail sales of consumer goods.

- (4)

Financial Crisis (Gepu): The financial crisis is a systemic risk with a wide-reaching impact. As trade connections among countries become increasingly close, a financial or economic crisis in any country can spread rapidly to every other country, thus causing problems such as supply chain disruptions. This paper uses the World Economic Policy Uncertainty Index compiled by three scholars, Scott R. Baker, Nicholas Bloom, and Steven J. Davis, from Stanford University and the University of Chicago.

- (5)

Global GDP Growth Rate (Gegr): The global GDP growth rate reflects the overall health and development potential of the global economy. During different stages of GDP growth, market demand will be affected, which in turn impacts supply chain management. In this paper, it is measured by the annual GDP growth rate at market prices calculated in constant local currency, which is publicly available from the World Bank.

- (6)

Trade Friction (Tf): If trade friction occurs, for example, an increase in tariffs, procurement costs will increase, causing enterprises to face financial difficulties. As a result, firms will be unable to purchase raw materials and goods, increasing the risk of supply chain disruption. In this paper, Tf is measured by the degree of dependence on foreign trade, which is the ratio of the volume of import and export trade to the gross national product of the country.

Entrepreneurial Activity (Entre_act): In this study, entrepreneurial activity is conceptualized as a moderating variable, quantified by the number of private enterprises. The detailed definitions and measurements for each variable are delineated in Table 3.

Definitions and measurements of the various variables.

This paper presents an empirical analysis of 31 provinces and municipalities in China, spanning the period from 2011 to 2021, resulting in a panel dataset that encompasses 31 provinces over the decade. The dataset is derived primarily from authoritative sources, including the National Bureau of Statistics of China, the China Science and Technology Database, the annual statistical yearbooks of individual provinces, the "China Statistical Yearbook", the "Peking University Digital Inclusive Finance Index", and the "China Electronic Information Industry Statistical Yearbook". Complementary data were obtained from the EPS DATA database.

Empirical analysisDescriptive statisticsAnalysis of the measurement results of the innovation-driven digital economic development levelFig. 1 presents a three-dimensional graph depicting the comprehensive index of digital economic development levels across China from 2011 to 2021, which was calculated using the entropy method. The graph reveals an overall upward trend in China's digital economic development, with a consistent annual increase in the digital economic development levels of various provinces and regions. Notably, Beijing, Zhejiang, Guangdong, Shandong, Shanghai, and Jiangsu are at the forefront of digital economic development. For example, in 2021, Guangdong's comprehensive index of digital economic development reached 395.09, contrasting sharply with Qinghai's index of 18.07. This significant disparity underscores the substantial variation in digital economic development levels among provinces in China.

In alignment with the regional division method outlined in the 2015 "Government Work Report," this study classifies the 31 provinces and regions into eastern, central, western, and northeastern regions. Fig. 2's line chart visually represents the regional disparities in digital economic development levels. The eastern region is particularly prominent, with a relatively high level of digital economic development, establishing it as a vibrant epicenter for the digital economy. This can be attributed to the strong economic foundation of key economic zones such as the Beijing‒Tianjin‒Hebei region, the Pearl River Delta, and the Yangtze River Delta. Compared with the eastern region, the central region shows a marginally lower level of economic development, whereas the western and northeastern regions significantly trail behind, exhibiting substantial gaps compared with the eastern region. These discrepancies may be attributed to factors such as less advanced infrastructure and limited adoption of internet technology. Overall, from 2011 to 2021, China's digital economic development exhibited regional imbalances, with the eastern regions outpacing the western regions, thereby highlighting the presence of a 'digital divide' within China's digital economic landscape. Additionally, there are significant differences in the development and utilization of digital technology across various regions.

Analysis of the measurement results of the resilience of industrial and supply chainsThis paper presents a comprehensive index of the resilience of the industrial and supply chains in China, which is calculated using the entropy weight method over the period from 2011 to 2021, as depicted in Fig. 3. The graphical representation reveals a steady enhancement in China's industrial chain and supply chain resilience throughout the decade. Guangdong notably leads the nation annually, achieving a resilience index of 555.32 in 2021, with Jiangsu closely trailing at 432.56 for the same year. Conversely, Qinghai records the lowest resilience index at 13.93 in 2021, underscoring the pronounced disparities in resilience among China's provinces.

To delve deeper into regional disparities in the resilience of industrial and supply chains, this paper analyzes the four major regions as defined earlier and presents a line chart (Fig. 4). The eastern region demonstrates relatively stronger resilience, with most of its provinces exhibiting significantly higher comprehensive indices than the central, western, and northeastern regions do. This phenomenon could be attributed to the eastern region’s more mature economic development, intense market competition, and enterprises’ competitive advantages in adapting to economic changes. Moreover, both the government and enterprises in the eastern region prioritize environmental investment and technological innovation, enhancing their ability to respond to external environmental changes and bolstering industrial and supply chain resilience.

In contrast, the comprehensive indices of the other regions are relatively lower, possibly because of their lagging economic development, limited market elements, and inadequate attention from both the government and enterprises, resulting in a lower overall level of resilience. Notably, the northeastern region experienced significant fluctuations in resilience from 2014 to 2016, primarily due to issues such as low capacity utilization, high debt costs, and tight working capital, leading to a "single economic structure dilemma." With respect to the growth rates, the central region exhibits faster growth, indicating continuous improvement in the foundation for the development of industrial chains and supply chains in provinces within this region, with strong potential for the future.

Analysis of the relationship between the innovation-driven digital economy and the industrial chain supply chainFig. 5 illustrates the correlation between the digital economy and the resilience of industrial and supply chains. Upon examining the trend line in the scatter plot, a clear positive correlation emerges: as the level of the digital economy increases, so does the resilience of industrial and supply chains. This suggests that the advancement of the digital economy plays a beneficial role in bolstering the resilience of these chains, enabling them to better cope with various changes.

Analysis of the impact of the innovation-driven digital economy on the resilience of industrial and supply chainsBaseline regression resultsThe baseline regression analysis examining the impact of the innovation-driven digital economy on the resilience of industrial and supply chains, employing fixed effects, is detailed in Table 4. Column (1) presents the regression outcomes with the digital economy as the sole explanatory variable, excluding the control variables. Columns (2) to (5) gradually incorporate control variables such as the logistics level, market size, and urbanization level into the regression model.

Benchmark regression results.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | Resil | Resil | Resil | Resil | Resil | Resil |

| Digital | 0.575*** | 0.533*** | 0.414*** | 0.450*** | 0.433*** | 0.221*** |

| (27.318) | (25.645) | (15.386) | (15.283) | (14.748) | (6.920) | |

| Logis | 0.214*** | 0.142*** | 0.139*** | 0.139*** | 0.055* | |

| (6.446) | (4.280) | (4.240) | (4.322) | (1.941) | ||

| Size | 0.202*** | 0.175*** | 0.154*** | 0.183*** | ||

| (6.414) | (5.356) | (4.718) | (6.583) | |||

| Urban | 0.157*** | 0.250*** | 0.371*** | |||

| (2.858) | (4.135) | (7.058) | ||||

| Tf | -0.107*** | -0.132*** | ||||

| (-3.410) | (-4.955) | |||||

| Gepu | -0.277*** | -0.315*** | ||||

| (-5.765) | (-7.687) | |||||

| Gegr | -0.006 | -0.017** | ||||

| (-0.805) | (-2.446) | |||||

| Digital×Tf | 0.474*** | |||||

| (10.687) | ||||||

| Constant | -0.279*** | -0.077 | -0.092* | -0.039 | -0.135*** | -0.092** |

| (-6.105) | (-1.440) | (-1.835) | (-0.735) | (-2.706) | (-2.159) | |

| N | 341 | 341 | 341 | 341 | 341 | 341 |

| R2 | 0.988 | 0.989 | 0.991 | 0.991 | 0.991 | 0.994 |

| Fixed province | YES | YES | YES | YES | YES | YES |

| Fixed time | YES | YES | YES | YES | YES | YES |

| Note: (1) t statistics are in parentheses; (2) *, ** and *** indicate significance at the 10%, 5% and 1% significance levels, respectively; (3) the following takes the same treatment. | ||||||

The results of the Hausman test reveal that the regression coefficient for the effect of DE on ISCR is 0.433, which is statistically significant at the 1% level. This implies that for every 1% increase in DE, ISCR can be expected to increase by 0.433%. This finding underscores the significant role of the digital economy in enhancing the resilience of these chains. The rationale behind this relationship is that the evolution of internet technology, a key driver of the digital economy, accelerates business communication and connectivity, enhances market transparency and responsiveness, and fosters greater interaction opportunities among supply chain partners. Consequently, these factors collectively contribute to the enhancement of industrial and supply chain resilience.

For the control variables, the regression coefficients for logistics level, market size, and urbanization level are all positive and statistically significant at the 1% level. This finding indicates that the logistics level, market size, and urbanization level contribute to improving the resilience of industrial and supply chains. In recent years, as digital technology has advanced, logistics levels have improved, and logistics organizations have expanded services globally. The enhancement of logistics service quality has increased the stability, response speed, and risk resilience within the supply chain, significantly contributing to the improvement of the resilience of the industrial chain and supply chain. Furthermore, with the widespread development of the digital economy, market sizes have expanded rapidly. Larger market sizes mean clearer supply and demand relationships, market diversification, and increased market competition. This provides supply chains and industrial chains with a broader market for services and technological applications, enhancing their ability to adapt to market changes and withstand risks, thus increasing their resilience. Additionally, the growth in urbanization levels promotes industrial upgrading and optimization of the industrial structure, leading to increased information exchange between businesses and society. This has strengthened public services in logistics and warehousing management, enhancing the resilience of industrial and supply chains.

The regression coefficients of trade frictions and economic uncertainty are both negative and statistically significant at the 1% significance level. This indicates that the occurrence of trade frictions undermines China's investment environment, increases import and export costs, heightens the risk of economic uncertainty, leads to a decline in the autonomous control of the supply chain, and ultimately reduces supply chain resilience. In Column (6), we added the interaction term of the variables "digital" and "Tf" to analyze their interaction with the digital economy. The results show that after the interaction term is added, the main effects of the variables "digital" and "Tf" remain significant. Notably, the regression coefficient of the interaction term is 0.474 > 0 and is significant at the 1% confidence level. That is, the impacts of "digital" and "Tf" reinforce each other. With a higher degree of external dependence, for example, when the tariffs between two trading countries are reduced and the level of the digital economy is greater, the effect of enhancing the resilience of industrial and supply chains becomes more obvious.

Tesla has emerged as a trailblazer in integrating digital economy principles into the automotive sector. Early in its development, the company leveraged its proprietary battery management system (BMS)—a sophisticated integration of hardware and software—to achieve what industry experts initially considered "impossible": the series-parallel configuration of 18650 lithium-ion batteries into high-performance battery packs. This technological breakthrough not only redefined EV architecture but also catalyzed a paradigm shift across the automotive industry, driving sustained reductions in production costs and accelerating the adoption of sustainable mobility solutions.

After the signing of the first-phase China–U.S. trade agreement in December 2019, tariffs on select automotive components were reduced from 25% to 7.5%. Tesla further mitigated tariff-related costs through strategic localized procurement and utilization of free trade zone bonded policies. The alleviation of trade frictions fostered a more conducive supply chain environment, defined by reduced external costs and expanded market opportunities. Concurrently, the digital economy amplified these structural advantages by leveraging technological empowerment and efficiency enhancements, thereby translating policy-driven benefits into measurable operational resilience.

However, since Trump came to power in 2025, a series of tariff-increasing policies have severely impacted Tesla, with electronics, machinery, and automotive components being key sectors hit by these tariffs. The U.S. has imposed a 25% tariff on imported vehicles not produced domestically since April 3, 2025, and plans to levy tariffs on automotive components starting May 3, 2025, covering nearly $600 billion in annual imports of vehicles and parts. According to research institutions, nearly 40% of Tesla's EV battery material suppliers are Chinese companies, with China accounting for the largest share across all subcategories of lithium-ion battery materials. Overall, U.S. companies make up 22% of Tesla's total suppliers, whereas Chinese companies account for 17%, highlighting Tesla's dependence on Chinese partners. On March 31, 2025, Tesla reported its worst quarterly production and sales data in nearly three years: global deliveries in the first quarter of 2025 were only 336,700 vehicles, a year-on-year decline of 13%, far below market expectations of 360,000–390,000, leading multiple agencies to downgrade their 2025 sales forecasts for Tesla.

These short-term tariff shocks demonstrate that escalating trade friction can undermine the improvements in resilience caused by the combined effects of reduced trade friction and an enhanced digital economy. Even with digital economy-driven productivity gains and cost reductions, the negative impacts of increased trade friction appear to inhibit the promoting role of the digital economy. In contrast, Zhang (2025) illustrates with the case of Comprehensive Pilot Zones for Cross-border E-commerce (CPZCEs) that mitigating the adverse impacts of trade frictions by reducing corporate costs can enhance supply chain redundancy and innovation capacity.

Mediation effect analysisTo investigate the impact of digital transformation on industrial supply chain resilience (ISCR), we employed a moderated regression framework with entrepreneurial activity (Entre_act) as the moderating variable. The analytical results are systematically presented in Table 5. Column (1) represents the main effect model, which shows the direct effect of the digital economy on industrial supply chain resilience (ISCR). The results indicate a significant promoting effect. Column (2) represents the relationship between the digital economy and the mediating variables, examining whether the digital economy has an impact on the mediating variables. Column (3) displays the regression outcomes after the mediating variables are incorporated. The findings indicate that the regression coefficients for the digital economy's effect on industrial and supply chain resilience are significantly positive at the 1% level. Compared with the coefficients presented in Eq. (11), these results maintain their consistency and statistical significance. Notably, the regression coefficient modestly decreases from 0.417 to 0.345, suggesting that entrepreneurial activity exerts a partial mediating effect on the relationship between the digital economy and the resilience of industrial and supply chains. This implies that the digital economy can bolster the resilience of industrial and supply chains by fostering increased entrepreneurial activity.

Mediation effect test results.

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

|---|---|---|---|---|---|---|---|

| Variable | Resil | Entre_act | Resil | Entre_act2 | Resil | Ti | Resil |

| Digital | 0.433*** | 0.871*** | 0.348*** | 1.209*** | 0.120*** | 0.727*** | 0.229*** |

| (14.748) | (10.229) | (10.588) | (14.289) | (4.708) | (8.883) | (11.103) | |

| Logis | 0.139*** | 0.169* | 0.122*** | 0.410*** | 0.033 | 0.189** | 0.086*** |

| (4.322) | (1.815) | (3.940) | (4.431) | (1.473) | (2.114) | (4.244) | |

| Size | 0.154*** | 0.439*** | 0.111*** | 0.059 | 0.139*** | 0.121 | 0.120*** |

| (4.718) | (4.642) | (3.414) | (0.630) | (6.368) | (1.334) | (5.874) | |

| Urban | 0.250*** | 0.549*** | 0.196*** | -0.377** | 0.347*** | 0.485*** | 0.113*** |

| (4.135) | (3.139) | (3.320) | (-2.169) | (8.564) | (2.885) | (2.969) | |

| Tf | -0.107*** | 0.211** | -0.127*** | -0.307*** | -0.027 | -0.443*** | 0.018 |

| (-3.410) | (2.322) | (-4.202) | (-3.405) | (-1.278) | (-5.082) | (0.871) | |

| Gepu | -0.277*** | -0.391*** | -0.238*** | -0.092 | -0.253*** | -0.728*** | -0.072** |

| (-5.765) | (-2.808) | (-5.103) | (-0.664) | (-7.899) | (-5.448) | (-2.296) | |

| Gegr | -0.006 | -0.032 | -0.003 | 0.024 | -0.013** | -0.067*** | 0.012** |

| (-0.805) | (-1.374) | (-0.430) | (1.033) | (-2.360) | (-3.020) | (2.459) | |

| Entre_act | 0.098*** | ||||||

| (5.098) | |||||||

| Entre_act2 | 0.259*** | ||||||

| (19.232) | |||||||

| Ti | 0.281*** | ||||||

| (21.546) | |||||||

| Constant | -0.135*** | 0.461*** | -0.180*** | 0.575*** | -0.284*** | 0.286** | -0.215*** |

| (-2.706) | (3.192) | (-3.702) | (4.003) | (-8.319) | (2.059) | (-6.872) | |

| Sobel z | 4.563*** | 11.470*** | 8.212*** | ||||

| N | 341 | 341 | 341 | 341 | 341 | 341 | 341 |

| R2 | 0.991 | 0.925 | 0.992 | 0.926 | 0.996 | 0.931 | 0.997 |

| Fixed time | YES | YES | YES | YES | YES | YES | YES |

| Fixed province | YES | YES | YES | YES | YES | YES | YES |

Similarly, Columns (4) and (5) employ the number of high-tech enterprises (Entre_act2) as a mediating variable to further examine the mediating role of innovation-intensive entrepreneurial activities. Following the same analytical procedure applied in Columns (2) and (3), the results remain statistically significant. Furthermore, Columns (6) and (7) extend the analysis by investigating the influence mechanism with technological innovation (Ti) as the mediating variable. The findings reveal that all three mediating variables have significant mediating effects. Using Sobel’s mediation effect decomposition method, the Sobel Z values (4.563, 11.47, and 8.212) presented in Table 5 all surpass the critical threshold at the 1% significance level; the corresponding mediating effects account for 19.8% (0.871 × 0.098/0.433), 72.3% (1.209 × 0.259/0.433), and 47.1% (0.727 × 0.281/0.433) of the total effects, respectively. These results confirm that entrepreneurial activities serve as a critical transmission channel through which the digital economy enhances supply chain resilience.

These findings also provide additional insights. First, the mediating effect of general entrepreneurial activities accounts for only 19.8% of supply chain resilience, whereas high-innovation entrepreneurial activities (Entre_act2) constitute 72.3% of supply chain resilience. This stark contrast highlights the pivotal role of technological sophistication in entrepreneurial ventures, as the depth of their impact on supply chain resilience is largely determined by their technological intensity. In essence, enhancing supply chain resilience requires a paradigm shift—from prioritizing the quantity of entrepreneurship to fostering the quality of entrepreneurial innovation. This underscores the need to cultivate a technology-intensive entrepreneurial ecosystem. For instance, policymakers could establish dedicated innovation-driven entrepreneurship funds to incentivize high-tech ventures and amplify their contribution to resilient supply chains.

Second, not all entrepreneurial activities contribute equally to enhancing supply chain resilience. Only high-innovation entrepreneurial activities—typically embodied by high-tech enterprises—function as resilience converters for technological innovation. Their core value lies in transforming abstract technological innovations (e.g., patents, algorithms) into tangible supply chain management advancements (e.g., intelligent systems, digital platforms) while amplifying technological spillovers through cluster effects. This transformation enables a critical leap from technological advantages to resilience advantages. These findings carry significant policy implications: policymakers should prioritize support for technology‒entrepreneurship composite enterprises (e.g., high-tech firms) over generalized entrepreneurial initiatives to maximize the digital economy’s impact on supply‒chain resilience. Such targeted support ensures that technological innovation is effectively channeled into resilient supply chain practices.

Finally, technological innovation (Ti) serves as a fundamental enabler in the process by which the digital economy enhances supply chain resilience. The digital economy fosters technological innovation through three primary mechanisms: resource agglomeration, demand guidance, and efficiency improvement. For example, digital platforms such as the Alibaba Cloud Developer Platform integrate data from national research institutions, thereby enhancing enterprise R&D efficiency. Additionally, the digital economy leverages big data analytics—such as consumption data from Taobao and Meituan—to clarify technological innovation directions, effectively creating technological demand. A notable example is Meituan’s response to the surge in demand for contactless delivery during the COVID-19 pandemic in 2020. This has spurred the development of patents for intelligent delivery technologies, addressing critical bottlenecks in core technologies and bolstering autonomous control resilience. The mediating effect, accounting for 47.1% of the total effect, underscores that technological innovation is the core driver through which the digital economy exerts its influence. This finding provides a supply chain-centric interpretation of the innovation-driven development strategy, emphasizing its practical relevance.

To illustrate the theoretical implications, we present Pinduoduo's innovative supply chain model for western China's agricultural sector. As a representative digital platform (founded by Colin Huang in 2015), Pinduoduo's “social viral diffusion” strategy enabled it to surpass Taobao in monthly active users by 2020, becoming the world's largest e-commerce platform by customer base. Field data demonstrate Pinduoduo's model's efficacy. In Xinping County, Yunnan Province, the integration of "direct-from-origin dispatch" and AI-driven product selection reduced the unsold rock sugar orange inventory from 35% to 3% in 2023, concomitantly increasing farmers' incomes by 400%. The Agricultural Cloud Initiative has achieved nationwide penetration across 10 provinces, facilitating digital market access for over 2,000 agricultural merchants. Behind this model lies Pinduoduo's continuous and concentrated exposure of products through tools such as the "Hundred Billion Subsidy" program and "group buying" initiatives. The platform also leverages full-channel promotion, connects with infrastructure such as warehousing and cold chains, and optimizes logistics routes through algorithms. This enables fully digitalized management of the supply chain, from direct dispatch from the origin to consumers' tables. More importantly, a key feature of this model is the comprehensive support provided to local new merchants and live streamers. It encourages the local young population to actively participate in e-commerce entrepreneurial activities. In essence, this model significantly enhances the resilience of the agricultural product supply chain through the synergy of digital empowerment and entrepreneurial activities.

Analysis of spatial spillover effectsAs previously stated, this study employs the Queen-type adjacency method to construct a binary (0–1) matrix that delineates the adjacency relationships among the 31 provinces, utilizing it as the spatial weight matrix. Table 6 presents the global Moran's I statistics for both the digital economy and the resilience of industrial and supply chains. The findings reveal that the Moran's I values for both variables are positive and statistically significant at the 5% level. This positive spatial correlation suggests that provinces with more advanced digital economies are likely to have greater resilience in their industrial and supply chains.

Global Moran's I values of the digital economy and the resilience of industrial and supply chains.

Fig. 6 shows a Moran scatterplot depicting the resilience of the industrial and supply chains in 2021. The scatterplot is divided into four quadrants, with the first quadrant representing high values in both the province itself and its neighboring provinces, indicating a cluster of high values. Conversely, the third quadrant represents low values in both the province itself and its surrounding provinces, indicating a cluster of low values. Prior to conducting spatial econometric regression, LM tests and Hausman tests were conducted. The results suggested that the fixed-effects model was the most appropriate choice. A comparison of individual fixed, time fixed, and two-way fixed models revealed that the two-way fixed model yielded the best fit. Furthermore, an LR test was performed to assess whether the spatial Durbin model (SDM) could degrade into a spatial autoregressive model (SAR) or spatial error model (SEM). The results rejected the degradation hypothesis, leading to the selection of the SDM as the spatial econometric model. To ensure robustness, a spatial autoregressive model was also employed for comparison.

The regression results, as detailed in Table 7, reveal that the coefficient of the spatial lag term for the digital economy is positive and statistically significant. This finding indicates that the level of the digital economy influences the resilience of neighboring provinces' industrial and supply chains, underscoring the existence of spatial spillover effects.

Regression results of the spatial model of the digital economy on the resilience of industrial and supply chains.

Table 7 further illustrates both the direct and indirect effects to assess the impact of the local region and variables in other regions. Notably, the digital economy has a significant indirect effect on the resilience of industrial and supply chains. This suggests that the digital economy can positively influence the resilience of neighboring provinces' industrial and supply chains through spatial spillover effects, highlighting the interdependence of regional economic development and supply chain resilience.

Further expansion: analysis of regional heterogeneityAs mentioned in previous research, the digital economy has been found to promote the enhancement of the resilience of industrial and supply chains. However, there are substantial variations in the levels of digital economic development and the resilience of industrial and supply chains across different regions. To explore whether these variations result in differing impacts of the digital economy on the resilience of the industrial and supply chains in different regions, this study conducts a regression analysis of regional heterogeneity on the basis of the four major regions defined earlier. The results of this analysis are presented in Table 8.

Regional heterogeneity analysis results.

| (1) | (2) | (3) | (4) | |

|---|---|---|---|---|

| Variable | Eastern China | Central China | Western China | Northeast China |

| Digital | 0.432*** | 0.192 | 0.219*** | -0.125 |

| (9.224) | (1.543) | (5.564) | (-0.737) | |

| Logis | 0.097 | 0.016 | -0.011 | -0.014 |

| (1.456) | (0.427) | (-0.300) | (-0.097) | |

| Size | 0.216*** | 0.174** | 0.191*** | -0.691** |

| (3.044) | (2.428) | (5.317) | (-2.141) | |

| Urban | 0.520*** | -0.322 | 0.040 | -0.278 |

| (3.797) | (-1.617) | (0.641) | (-0.472) | |

| Tf | -0.245*** | -0.512** | 0.086** | -0.212 |

| (-3.614) | (-2.203) | (2.515) | (-1.153) | |

| Gepu | -0.516*** | 0.425*** | -0.016 | 0.245 |

| (-5.640) | (2.716) | (-0.304) | (0.751) | |

| Gegr | -0.013 | 0.080*** | 0.012 | 0.058 |

| (-0.757) | (3.574) | (1.589) | (1.427) | |

| Constant | 0.714*** | -0.935*** | -0.291*** | -1.241*** |

| (4.148) | (-5.650) | (-3.871) | (-4.368) | |

| N | 110 | 66 | 132 | 33 |

| R2 | 0.991 | 0.981 | 0.987 | 0.976 |

| Fixed time | YES | YES | YES | YES |

| Fixed province | YES | YES | YES | YES |

The results in Table 8 indicate that the digital economy has a positive effect on all four major regions. It has a significant effect on the eastern and western regions, but it is not significant for the central and northeastern regions. This outcome may be attributed to the fact that the eastern region, as an economic development hub of the nation, experiences rapid development in the digital economy, with a high degree of digital application . This has also widened the gap in entrepreneurial activities across different urban areas—a phenomenon akin to the “Matthew Effect” (Zhao & Weng, 2024). Additionally, this region boasts clear advantages in terms of high technology and the service industry. The continuous application and innovation of new technologies such as the internet, the Internet of Things, and cloud computing contribute to enhancing the resilience of the industrial and supply chains in the eastern region.

In Eastern China, the Alibaba Group serves as an exemplary case. Founded by Jack Ma in 1999, Alibaba has revolutionized China's consumption patterns and propelled the digital transformation of the retail industry through its e-commerce platforms, such as Taobao and Tmall. Cainiao Network, a subsidiary of Alibaba, has constructed a global intelligent logistics backbone network, achieving digital management across the entire supply chain, including order processing, warehousing, and delivery. During the COVID-19 outbreak in Wuhan in 2020, Cainiao Network coordinated with over 400 logistics enterprises. By leveraging intelligent scheduling and dynamic route optimization, it managed to reduce the delivery time of medical supplies to within 24 h, thereby significantly enhancing the efficiency of emergency logistics operations.

Additionally, as Tesla's first overseas manufacturing facility, the Shanghai Gigafactory began production in 2019, exemplifying the "China speed" by achieving the remarkable feat of commencing operations and delivering vehicles within the same year. By 2023, the factory's annual production capacity reached 950,000 vehicles, accounting for 52.5% of Tesla's global deliveries. During the COVID-19 outbreak in Shanghai in 2022, the factory resumed full-capacity production after only one month of shutdown, owing to closed-loop management and digital scheduling. This highlights the ability of digital technologies to mitigate supply chain disruption risks. Behind this success lies the adoption of an industrial internet platform by the Shanghai Gigafactory, which enables real-time data collaboration from component procurement to vehicle manufacturing. The data indicate that the foundation of the factory's resilient digital production system is its proprietary manufacturing operating system (MOS). This system covers the entire production process, including vehicle assembly, battery workshops, and motor workshops. It achieves a defect detection accuracy rate of 99.9% through AI-powered visual quality inspection and supports real-time monitoring of critical process parameters. For example, the lower body casting workshop employs a 6000-ton press, which simplifies the welding process of 70 parts into a single casting operation. This reduces the production cycle from several hours to just 30 s, exemplifying the efficiency gains enabled by advanced digital and manufacturing technologies.

In the western region, which is strategically supported by the national government, the development of the digital economy has been bolstered by dedicated policies and resource allocation. This has led to the emergence of various innovative industries, thereby significantly enhancing the impact of the digital economy on the resilience of the industrial and supply chains in this region.

Conversely, the central and northeastern regions have experienced slower progress in the realm of the digital economy, resulting in less stable resilience of their industrial and supply chains. Consequently, the influence of the digital economy on the resilience of the industrial and supply chains in these regions is not as pronounced as that in the eastern and western regions.

As China's old industrial base, Northeast China faces a dual challenge: on the one hand, the competitiveness of its traditional advantageous industries has decreased significantly during the nearly 20-year revitalization period, according to data from the National Bureau of Statistics. On the other hand, the added value of core digital economy industries in Northeast China (such as software and information technology services) accounted for only 5.2% of GDP in 2021. In 2022, Northeast China showed weak competitiveness in strategic emerging industries such as integrated circuits, mobile communication handsets, information technology services, and software business, with their product output or operating income accounting for extremely low proportions of the national total: 0.35%, 0.01%, 1.60%, and 2.44%, respectively. This dual dilemma—declining competitiveness in traditional industries and lagging cultivation of emerging industries—has made digital transformation extremely difficult in Northeast China.

Population outflow is another critical factor. According to the statistical yearbooks of the three northeastern provinces, in 2011, the permanent populations of Heilongjiang and Jilin decreased sharply, by 510,000 and 213,000 people, respectively. Liaoning fared slightly better but barely maintained population growth, with a slight increase of only 10,000 people. Collectively, the three provinces experienced a net population decrease of 713,000 in 2011, marking the start of more than a decade of negative population growth. Over the past decade, the total population of Northeast China has decreased by over 11 million, a scale larger than that of Harbin, the most populous city in the region (whose permanent population has now dropped below 10 million). The dual loss of labor and innovative elements has led to a 40% gap in interdisciplinary talent who understand both industrial processes and data analysis.

Robustness testingInstrumental variable methodIn practice, a variable is often subject to the influence of multiple other variables, making it impractical to enumerate each factor affecting the resilience of the industrial supply chain. This can lead to omissions in variable specification and potential endogeneity issues, such as bidirectional causality. To bolster the robustness of our findings and address estimation biases stemming from endogeneity, we employ the instrumental variable (IV) approach to ameliorate this concern. Generally, the lagged value of the digital economy in the previous period is positively correlated with the current period's digital economy level, whereas its relationship with the resilience of the industrial supply chain is comparatively minor. Thus, this arrangement satisfies the criteria for relevance and exogeneity. In this analysis, the lagged value of the digital economy serves as the instrumental variable, and a two-stage least squares regression (2SLS) is conducted. The outcomes are displayed in Table 9, Columns (1) to (2). These results indicate a significant positive correlation between the digital economy and the resilience of the industrial supply chain, which aligns with the findings of the baseline regression model. Consequently, the conclusions drawn from the baseline regression are deemed robust.

2SLS regression results.

| (1) | (2) | |

|---|---|---|

| Variable | Digital | Resil |

| L1_digital | 1.072*** | |

| (62.384) | ||

| Digital | 0.471*** | |

| (12.695) | ||

| Logis | -0.006 | 0.016 |

| (-0.662) | (0.770) | |

| Size | 0.015 | 0.368*** |

| (0.869) | (8.840) | |

| Urban | -0.002 | -0.073*** |

| (-0.242) | (-3.572) | |

| Tf | 0.014 | 0.321*** |

| (1.528) | (15.431) | |

| Gepu | -0.014** | -0.053*** |

| (-2.226) | (-3.620) | |

| Gegr | -0.017*** | 0.003 |

| (-2.945) | (0.197) | |

| Constant | 0.113*** | -0.008 |

| (18.859) | (-0.623) | |

| Identifiability test (p values) | 287.677*** | |

| Weak instrumental variables test | 3891.800***(>16.380) | |

| N | 310 | 310 |

| R2 | 0.948 | 0.948 |

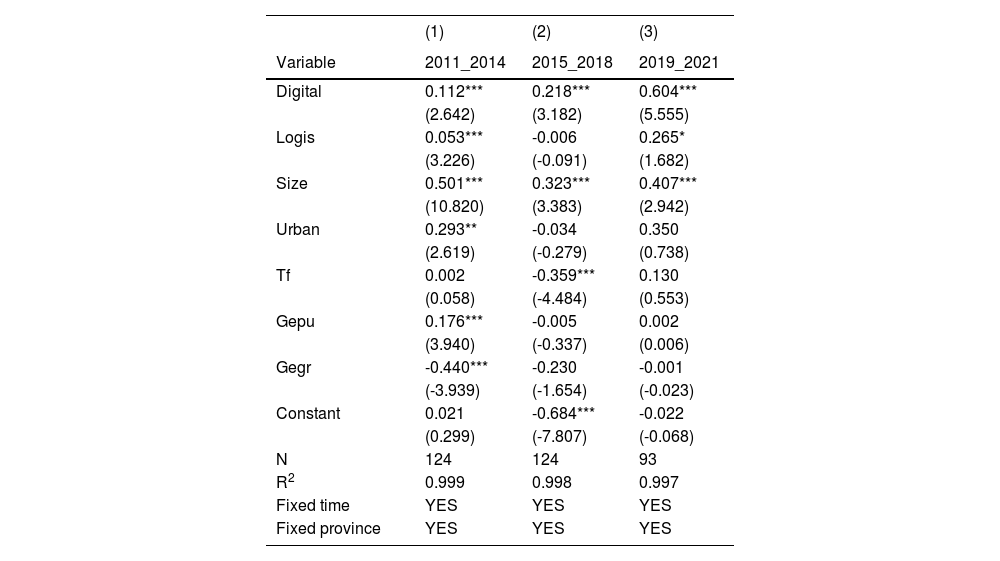

From 2015 to 2018, the Chinese government implemented a series of measures to conduct supply-side reforms aimed at promoting industrial upgrading. However, since 2018, escalating trade tensions with the United States and the impact of the 2020 public health crisis have significantly affected China's economy. Taking these factors into account, the time windows were shortened, dividing the periods into 2011–2014, 2015–2018, and 2018–2021 for regression analysis to determine whether the level of the digital economy continues to have a significant effect on the resilience of industrial and supply chains.

The findings, as presented in Table 10, demonstrate that even within these truncated time frames, the level of the digital economy has a significant effect on the resilience of industrial and supply chains. Nevertheless, the magnitude of the impact coefficients fluctuates across the different time periods. In the early stages, when digital elements were initially integrated into various sectors and the digital economy was in its infancy, its influence on industrial and supply chain resilience was comparatively limited. As the mid-term phase unfolded, government policies promoting digitalization in industries were introduced, incrementally enhancing the positive impact on industrial and supply chain resilience. Despite the external shocks experienced between 2018 and 2021, the digital economy's level continued to rise, with its beneficial influence on industrial and supply chain resilience progressively increasing due to judicious government policies.

Regression results for the shortened time window.

| (1) | (2) | (3) | |

|---|---|---|---|

| Variable | 2011_2014 | 2015_2018 | 2019_2021 |

| Digital | 0.112*** | 0.218*** | 0.604*** |

| (2.642) | (3.182) | (5.555) | |

| Logis | 0.053*** | -0.006 | 0.265* |

| (3.226) | (-0.091) | (1.682) | |

| Size | 0.501*** | 0.323*** | 0.407*** |

| (10.820) | (3.383) | (2.942) | |

| Urban | 0.293** | -0.034 | 0.350 |

| (2.619) | (-0.279) | (0.738) | |

| Tf | 0.002 | -0.359*** | 0.130 |

| (0.058) | (-4.484) | (0.553) | |

| Gepu | 0.176*** | -0.005 | 0.002 |

| (3.940) | (-0.337) | (0.006) | |

| Gegr | -0.440*** | -0.230 | -0.001 |

| (-3.939) | (-1.654) | (-0.023) | |

| Constant | 0.021 | -0.684*** | -0.022 |

| (0.299) | (-7.807) | (-0.068) | |

| N | 124 | 124 | 93 |

| R2 | 0.999 | 0.998 | 0.997 |

| Fixed time | YES | YES | YES |

| Fixed province | YES | YES | YES |

Given the construction of a composite indicator system comprising over 50 secondary indicators for assessing digital economy development and supply chain resilience, significant regional disparities in China—particularly in underdeveloped areas—have resulted in severe historical data gaps. In prior research, we utilized data from 2011 to 2021 to mitigate these limitations. However, to enhance methodological rigor and capitalize on the approximate linear temporal trends observed in our variables, we employed log-linear interpolation to impute missing observations, ultimately generating balanced panel data of 31 provinces in China from 2005 to 2024.

As shown in Table 11, the regression results in the first column correspond to the analysis conducted using data spanning from 2005 to 2024. These results reveal that the core explanatory variable "digital" has a significant positive influence on the resilience of industrial and supply chains, with a coefficient of 0.262. The second and third columns present the grouped regression analyses for the periods 2005–2010 and 2011–2024, respectively. The findings indicate that the regression results for the period 2005–2010 are statistically insignificant, whereas those for the period 2011–2024 are significant. This divergence in results underscores the developmental trajectory of digital technology in China. During the period from 2005 to 2010, despite some progress in digital technology, the construction of digital infrastructure was uneven, and the overall development remained in its nascent stage. Notably, technologies such as big data and artificial intelligence, which are now widely employed to increase the resilience of industrial and supply chains, were not yet mature. Their application scenarios and scopes were limited, thereby precluding a significant impact on the resilience of industrial and supply chains.

Expanded regression results in terms of the time dimension.

| (1) | (2) | (3) | (4) | (5) | (6) | |

|---|---|---|---|---|---|---|

| Variable | 2005_2024 | 2005_2010 | 2011_2024 | 2005_2024 | 2005_2010 | 2011_2024 |

| Digital | 0.262*** | -0.026 | 0.347*** | 0.280*** | 0.203*** | 0.602*** |

| (10.019) | (-0.512) | (9.295) | (15.925) | (11.679) | (13.623) | |

| Urban | 0.013 | -0.034 | -0.079 | -0.077 | -0.090 | -0.031 |

| (0.209) | (-0.264) | (-0.874) | (-1.560) | (-1.482) | (-0.364) | |

| Logis | 0.141*** | 0.013 | 0.181*** | -0.074** | -0.147** | 0.037 |

| (5.336) | (0.221) | (4.783) | (-2.010) | (-2.560) | (0.674) | |

| Size | 0.499*** | 0.898*** | 0.437*** | 0.506*** | 0.356*** | 0.287*** |

| (16.808) | (7.329) | (11.276) | (17.851) | (3.482) | (7.456) | |

| Gegr | 0.079* | -0.135 | -0.004 | 1.756* | -0.001 | 0.043 |

| (1.779) | (-0.384) | (-0.135) | (1.861) | (-0.002) | (0.792) | |

| Gepu | 0.203** | 0.136 | -0.160 | -1.586** | -0.056 | -0.509*** |

| (2.143) | (0.471) | (-1.301) | (-1.992) | (-0.398) | (-2.684) | |

| Tf | 0.032 | 0.033 | 0.028 | 0.009 | -0.057 | -0.027 |

| (1.224) | (1.112) | (0.525) | (0.288) | (-1.159) | (-0.453) | |

| Constant | -0.249* | -0.063 | 0.007 | 1.717* | -0.347 | -0.239* |

| (-1.733) | (-0.555) | (0.081) | (1.872) | (-0.710) | (-1.887) | |

| N | 620 | 186 | 434 | 620 | 186 | 434 |

| R2 | 0.967 | 0.985 | 0.974 | 0.934 | 0.946 | 0.968 |

| Fixed time | YES | YES | YES | YES | YES | YES |

| Fixed province | YES | YES | YES | YES | YES | YES |

Another explanation could be that the interpolation method assumes linear trends in variables, whereas actual data may exhibit nonlinear fluctuations, leading to insignificant results. To address this rigorously, we employed an optimal polynomial fitting model, which fits polynomial models for all variables in each province and selects the best nonlinear fitting curve through cross-validation to predict missing data. As shown in Table 11, the regression results in Columns 4 to 6 correspond to analyses using data from 2005–2024, 2005–2010, and 2011–2024, respectively. These results indicate that the core explanatory variable "digital" has a significant positive effect on the resilience of industrial and supply chains, with coefficients of 0.280, 0.203, and 0.602, respectively. In terms of regression coefficients, the period from 2011–2024 had the strongest effect of the digital economy on enhancing supply chain resilience, three times that of 2005–2010. This validates the earlier inference: although China witnessed some development in digital technology from 2005–2010, the construction of digital infrastructure remained uneven, and overall development was still in its infancy. In recent years, however, China has vigorously promoted the digital economy, deepened the integration of digital technology with the real economy, advanced digital industrialization and industrial digitalization, and significantly strengthened the resilience of industrial chains and supply chains.

Conclusions and recommendationsResearch conclusionsOn the basis of existing research, this study utilized panel data from 2011 to 2021 at the provincial level to establish an evaluation index system for assessing the development level of the digital economy and the resilience of industrial and supply chains. By employing the entropy value method to score various indicators, composite indices were derived. Subsequently, panel fixed effects regression models, moderation effect models, and spatial Durbin models were employed to delve into the regional heterogeneity in how digital economic development influences the resilience of industrial and supply chains. The following conclusions were drawn:

First, both macro- and provincial-level analyses in China reveal a positive correlation between the level of innovation-driven digital economy development and the resilience of industrial and supply chains, although significant regional disparities exist. The eastern region leads in digital economic development and demonstrates the strongest resilience in its industrial and supply chains. The central region closely follows in terms of digital economic development and resilience, albeit with a more rapid growth rate. In contrast, the western and northeastern regions show slower growth in digital economy development, resulting in lagging resilience in their industrial and supply chains, markedly divergent from the eastern region.

Second, the innovation-driven digital economy significantly and directly contributes to enhancing industrial and supply chain resilience. Through moderation effects, the digital economy indirectly strengthens China's industrial and supply chain resilience by stimulating entrepreneurial activities. Entrepreneurial activity, which acts as a moderating variable between the digital economy and industrial and supply chain resilience, highlights the positive impact of the digital economy in bolstering China's industrial and supply chain resilience, offering valuable insights for future economic development.

Third, the innovation-driven digital economy exerts a substantial influence on the resilience of industrial and supply chains through spatial spillover effects. The widespread adoption of digital technologies facilitates the expansion of both supply chain and industrial dimensions. Specifically, the digital economy enables the rapid diffusion of advanced technologies across regions. For example, the adoption of cloud computing, big data analytics, and Internet of Things (IoT) technologies in one region can spill over to neighboring areas through knowledge sharing and collaborative efforts. This process enhances the overall digital infrastructure and capabilities, thereby improving supply chain resilience in adjacent regions. Moreover, the digital economy often leads to the clustering of industries in specific regions, generating agglomeration economies. These clusters attract talent, investment, and innovation, which can positively impact neighboring regions through supply chain linkages and shared infrastructure. For example, the development of digital industrial parks in China's coastal regions has increased the resilience of supply chains in nearby provinces by providing better access to digital services and technologies. This regional spillover effect underscores the importance of spatial dynamics in shaping the resilience of industrial and supply chains within the digital economy.

Finally, regional heterogeneity characterizes the digital economy's impact on industrial and supply chain resilience. The eastern region, which has experienced rapid digital economic development, has experienced significant improvements in industrial and supply chain resilience. The western region, supported by national policies and resources, benefits from governmental support, leading to positive impacts on industrial and supply chain resilience. In contrast, the central and northeastern regions exhibit slower digital economic growth, resulting in less stable industrial and supply chain resilience than the eastern and western regions do.

Policy recommendationsOn the basis of the research findings, the following three policy recommendations are proposed to further promote the development of China's digital economy and enhance the resilience of its industrial and supply chains:

First, an innovation-driven digital economy should be fostered and regional disparities should be reduced. It is recommended that the government intensify efforts to develop an innovation-driven digital economy and bridge regional disparities. This can be achieved by increasing support for enterprises within the digital economy, improving the business environment to attract digital economy firms to various regions, and fostering collaboration between the digital economy and traditional industry enterprises through policy incentives and standardized cooperation models. Additionally, the development of the digital economy should emphasize differentiated and coordinated growth, leveraging regional strengths and characteristics to expedite digital economic progress and bolster the resilience of industrial and supply chains.

Second, a dedicated fund should be established to bolster digital infrastructure in underdeveloped regions. This fund could be financed through a combination of public budgetary allocations and private-sector investments, ensuring sustainable capital inflows. Such an initiative would accelerate the deployment of digital infrastructure, thereby mitigating the digital divide and enhancing the resilience of industrial and supply chains in these regions. Furthermore, governments could implement supportive measures, including innovation incubators, rental subsidies, and legal assistance for entrepreneurs, to cultivate a thriving ecosystem for digital innovation and entrepreneurship. These interventions would not only stimulate technological advancement but also foster inclusive economic growth within the digital economy.