This study investigates the relationship between green finance and environmental sustainability, with particular attention towards how these dynamics foster green economic growth within BRICS economies. Using a balanced panel dataset spanning 25 years, the research employs the Method of Moments Quantile Regression (MMQR), in order to obtain robust estimates. The results indicate that both green finance and green economic growth significantly enhance environmental sustainability by reducing carbon dioxide emissions and eventually mitigating climate change risks in the BRICS specific countries. Furthermore, the findings reveal that green finance stimulates green economic growth, while green economic growth positively moderates the relationship between green finance and environmental sustainability. Based on these results, the study puts forth a recommendation that BRICS nations strengthen the role of the banking sector and other financial institutions when it comes to advancing green financial initiatives. Greater emphasis on green finance and environmentally oriented and driven economic projects is essential for mitigating climate risks and achieving sustainable development.

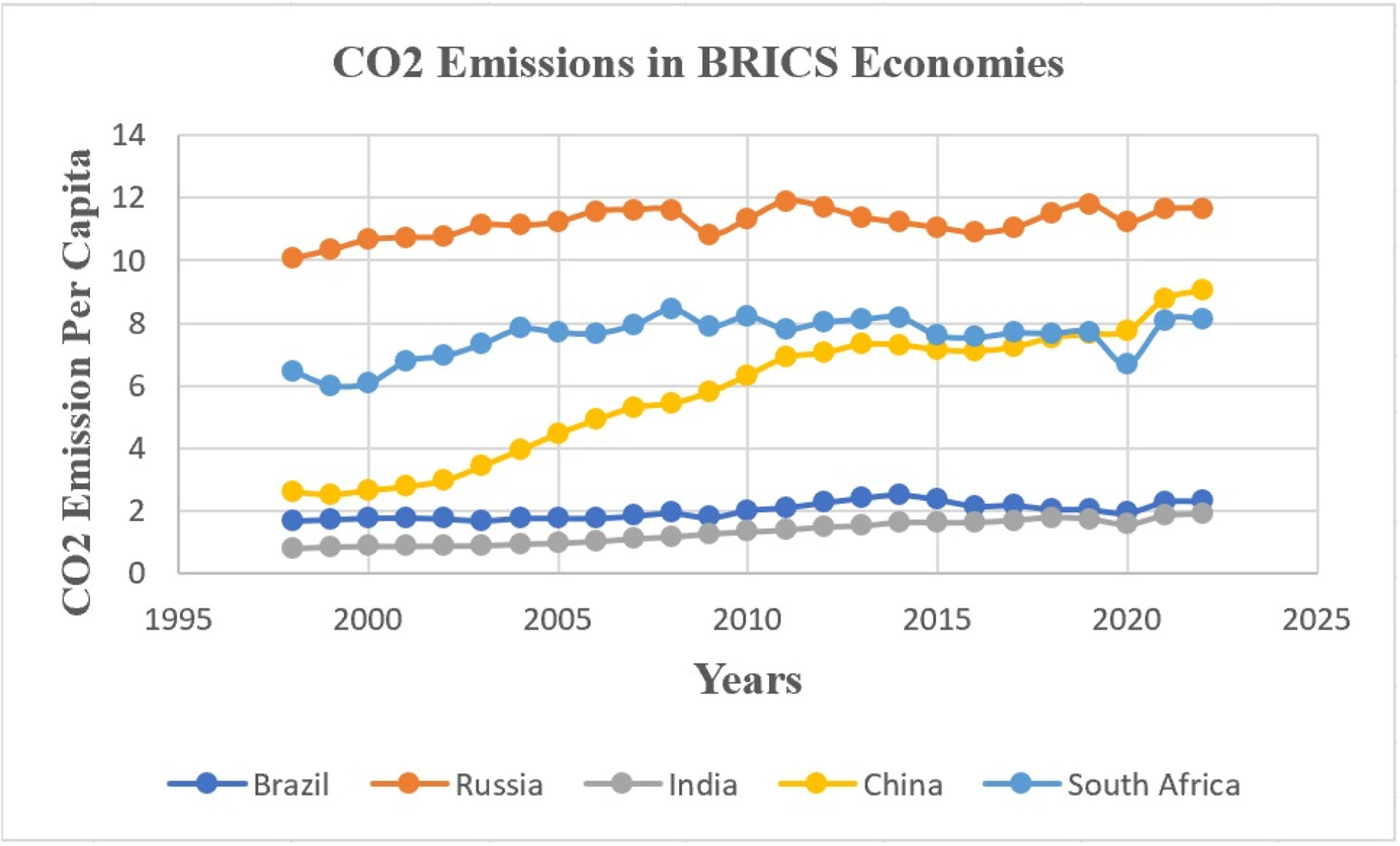

Over the last ten years, the environmental standards have faced a great dwindling fall worldwide, primarily due to the focus of the countries on hyper economic growth. The significant economic growth is rapidly contributing towards the enhancement of the Carbon Dioxide (CO2) emission levels in countries like China, Brazil, and India (Farooq, Ashfaq, Rustamovna & Al-Naimi, 2023). With a primary focus of these countries on production, employment, and economic growth, fossil fuels are being excessively supplied to the manufacturing industries in order to meet the rising energy needs (Shao, Wang, Zhou & Balogh, 2019). Rapid innovations in the realm of technology is also an active contributing factor that is uplifting CO2 emissions in BRICS economies (Su et al., 2021). These factors combined, the simultaneous goal of attaining environmental sustainability (ES) is greatly impacted and shattered, so to speak, because of this quest. The rising CO2 emissions and energy needs are increasingly triggering global issues such as environmental pollution, floods, and ozone depletion. Government authorities and stakeholders across the world are becoming more aware of these emerging challenges and are also keen to address the issues linked to environmental pollution resulting from the emission of CO2 (Esmaeil, Rjoub & Wong, 2020; Jahanger, Hossain, Usman & Onwe, 2023). Even with a considerable research focus on environmental issues in the recent years, there is much room available to further investigate the critical contributors of CO2 emission, in order to understand the magnitude of environmental hazards that we are, and would be faced with in the coming years (Agboola, Bekun & Joshua, 2021). Air pollution in countries like India and China significantly fosters cardiovascular and other pulmonary diseases. There are a few cities in China and India that are considered unsafe for human beings to populate, as the air pollution within and in the surrounding areas frequently reaches hazardous levels (Kumar, Sasidharan & Bagepally, 2023). As per IQAir (2023), India was in 8th place, and China was in 25th place, with an average of 53.3 (PM2.5 concentration in μg/m3) and 30.6 (PM2.5 concentration in μg/m3) per annum, respectively. Fig. 1 displays the level of CO2 emissions in the BRICS economies.

The cluster of some of the significant economic heavyweights of the world, like Brazil, Russia, India, China, and South Africa, more officially acknowledged as BRICS, are extensively recognized as industrialized nations (Chen, Ramzan, Hafeez & Ullah, 2023). The BRICS economies have around 25 % share of the world GDP, and nearly 50 % of the world's population also belongs to this region (Wei, Yue & Khan, 2024). Moreover, the BRICS region also greatly contributes towards the world’s environmental pollution. India, Brazil, and China are considered to be more manufacturing industrialized economies (Su et al., 2021). Whereas, on the other hand, South African and Russian economies are NTR-based, where the extraction of NTR is mainly responsible for the rise in CO2 emission (Shao et al., 2019; Wei et al., 2024). Furthermore, a consistent rise in CO2 emissions has been reported in BRICS economies over the years (Wei et al., 2024). Due to their sheer representation in the World’s population and GDP, environmental initiatives in BRICS economies can significantly help achieve a global sustainable environment by improving CO2 emission efficiency and moderation.

This study primarily examines the role of Green Finance (GFI) and Green Economic Growth (GEG) in promoting Environmental Sustainability (ENSUS) within the BRICS economies. Green Finance refers to financial instruments and investments that are designed to enhance environmental sustainability. It encompasses a range of mechanisms, including green credit, green securities, green insurance, green investment, and carbon finance. A key feature of GFI lies in its ability to channel capital toward energy-efficient and renewable energy development projects (Angeletopoulou et al., 2025; Zheng et al., 2025; Li et al., 2025). Through these mechanisms, green finance can actively facilitate sustainable economic growth by providing the essential funding for initiatives that are aimed and responsible towards environmental protection and restoration. Moreover, the expansion of green credit and other environmental factor oriented financial instruments, driven by Fintech innovation and the global energy transition, can foster substantial progress in developing sustainable infrastructure and environmental projects (Umar et al., 2024, 2025).

GFI can also help promote green projects, which include the likes of green infrastructure construction, green cities, green waste disposal, agricultural insurance, and renewable energy generation projects, so as to reduce CO2 emissions. Moreover, it can also help to secure investments from the private sector by promoting and enhancing the green reputation of the countries (Yu, Liu & Chen, 2023). It is commonly known that the BRICS economies are in a constantly pursuing their respective plans and strategies to accelerate their economic development. The quest for fast economic growth is one of the reasons which limit the focus, objective and critical evaluation of BRICS economies towards the environmental damage that is being unleashed by unprecedented growth (Chen, Ramzan, Hafeez & Ullah, 2023). There is no question that the advent of GFI initiatives can help BRICS economies attain economic development, without impeding or compromising on ecological standards. GFI can also promote green economic development which would include initiatives that would not contribute towards further harm to the environment.

In the Rio+20 conference, the United Nations projected the idea of GEG as a tool for sustainable development. The GEG growth essentially refers to the economic activities in both short and long-run achieving sustainability with respect to natural resources. (Ahmed, Kousar, Pervaiz & Shabbir, 2022). Likewise, Jacobs (2012) described green economic growth as a step towards the improvement of GDP without sacrificing environmental standards. The Organization for Economic Cooperation and Development also linked green economic growth with increased economic growth and development, without disturbing ecological standards. other than that, the World Bank (2012) also proposed the concept of green growth by connecting low pollution and efficient natural resource utilization with growth. Thus, eco-friendly economic transformation contextualizes the concept of GEG under sustainable development goals (SDGs). Nevertheless, SDG 13 of the United Nations outlined the necessity to fight against climate change challenges promptly.

Despite the growing attention that this area of study is receiving, existing studies tend to have a significant gap in depth that can be covered, and do not provide a comprehensive theoretical model incorporating GFI, GEG, and ENSUS. Most studies explore GEG and GFN as separate streams of academic research, without examining their joint relationship in promoting ENSUS. Furthermore, existing studies predominantly focused on GFI and the overall green growth nexus (Jiakui, Abbas, Najam, Liu & Abbas, 2023; Zhao et al., 2022), especially concerning GEG, remain largely underexplored. These studies are also extensively discussed in the corporate context, but their implications are overlooked at the national level. Moreover, several studies have found economic growth to be responsible for increasing CO2 emissions. In this regard, (Raihan et al., 2023; Zheng et al., 2017), identify that there is an urgent need for green economic growth to protect the environment from any further pollution. Adding onto these affirmations, Phadkantha and Tansuchat (2023) postulate that encouraging economic growth, investing into renewable energy sources, and energy efficiency could help reduce CO2 emissions, thus highlighting the importance of integrating GEG, GFI, and ENSUS. However, the relationship between GFI and ENSUS in the presence of GEG is an area of study that is still largely unexplored. This study aims to bridge these gaps in the current body of literature by making the following significant contributions.

First, it enhances the understanding of GEG, GFN, and ENSUS interplay by meticulously investigating the mechanisms and reasons that these elements use in order to influence ENSUS at the national level, particularly within the BRICS economies. This study also surpasses prior research by developing an exhaustive ENSUS index incorporating both CO2 emissions per capita and CO2 emissions kilotons, providing a more nuanced evaluation of environmental performance in BRICS nations. Second, this study differentiates itself from other studies by analyzing the effect of GEG on ENSUS at the national level among the BRICS nations. Third, the current study is evaluating the impact of GFN on GEG at the macro level, addressing a significant gap in the extant literature. Fourth, to our knowledge, the relationship between GEG and GFN in predicting ENSUS has not been comprehensively examined nationally across the BRICS nations, making our research a pioneering attempt in the domain. This research provides a distinctive contribution by examining the moderating influence of GEG on the link between GFN and ENSUS, bringing novel perspectives into the possible intricacies of these interactions. Fifth, the research has used an innovative method of moments quantile regression (MMQR) methodology to address the factor of heterogeneity. It must be noted that unlike the standard regression algorithms, MMQR can disperse conditional quantile heterogeneity connectivity at several levels (Chandio et al., 2023). Sixth, SDG 13, integral to the UN 2030 Agenda for Sustainable Development, emphasizes "Climate Action." Therefore, this objective addresses the pressing global challenge of climate change and its extensive repercussions. It substantially challenges emerging nations and is largely tied to BRICS countries. As one of its critical contributions, this analysis articulates relevant policy recommendations for BRICS that are consistent with UN SDGs.

The subsequent parts are structured as follows: Segment 2 discusses the literature review, and Segment 3 discusses the methodology and research design. Subsequently, segments 4 and 5 disclose estimation results, conclusions, and the recommendations.

Literature reviewTheoretical underpinningThis study has used stakeholder and growth theories to develop a theoretical framework for itself. The stakeholder theory (Clarkson, 1995; Freeman & McVea, 2005) assists in developing the theoretical framework that is needed for the relationship of GFI, GEG and ES to come into view. The advocates of the stakeholder theory propose that rather than focusing on shareholders, organizations that are actively contributing to significant levels of pollution in the environment should protect the interests of all stakeholders (Qian & Yu, 2024). In this regard, GFI promotes investment in energy-efficient and renewable energy projects (Huang et al., 2023), which can, as a consequence, also help to promote economic growth and environmental standards simultaneously (Nenavath & Mishra, 2023). This, as a result, can protect the interests of all the stakeholders. Secondly, the economic theory highlights the importance of an efficient and robust financial system for the growth of all the economies taken into consideration (Ahmed et al., 2022). A solid and efficient financial system can help to bridge savings with efficient and productive activities. The current literature links green growth with sustainable development (Fernando, Jabbour & Wah, 2019; Islam & Managi, 2019; Khoshnava et al., 2019), and studies also show that GFI can promote GEG at one end (D. Zhang, Mohsin, Rasheed, Chang & Taghizadeh-Hesary, 2021). Therefore, it can be concurred that GEG has the ability to improve social sustainability, economic performance and environmental performance as well (Gazzola, Del Campo & Onyango, 2019).

Empirical literature and hypothesis developmentSince the last few decades, the creation of renewable energy is among the top priorities encapsulating the intent and interest of the whole world. In the wake of this, green financing by firms and corporations can help with the increase in renewable energy generation. It is essential to recognize that the supply of renewable energy can be increased through financial literacy, which may eventually reduce the excessive use of fossil fuels(Fareed et al., 2022). Following this trend, this will ultimately promote the ENSUS by reducing CO2 emissions (Bei & Wang, 2023). Al Mamun, Boubaker and Nguyen (2022) also studied the relationship between GFI and CO2 emission using the dataset of 46 countries and concluded that green bonds could encourage the usage of renewable energy to condense environmental pollution. Similarly, W. Zhang, Hong, Li and Li (2021) concluded that green credit, a vital component of GFI, has helped to reduce the CO2 emission intensity in 30 cities in China. It must be noted that one of the leading challenges of BRICS economies is attaining sustainable economic growth – and typically, such growth is not expected to hamper ecological standards. Therefore, it can be affirmed that GFI can help develop a more sustainable financial structure to promote economic growth and maintain environmental quality simultaneously (Nenavath & Mishra, 2023). In developing and applying green and sustainable projects, the availability of funds for such projects is crucial. Green credit, green investment, green insurance, green securities, carbon finance, and other related GFI products can ideally fund green and sustainable projects. Such funding is a critical gateway to attaining sustainable environmental targets for countries in the foreseeable future (Lazaro, Grangeia, Santos & Giatti, 2023). Furthermore, Wei et al. (2024) also disclosed that implementing green projects can help reduce energy consumption to promote ENSUS. Hence, based on aforementioned discussion, the following hypothesis have been stated;

H1 GFI significantly affects ENSUS in the BRICS economies.

H2 GEG significantly affects the ENSUS of the BRICS Economies.

The biggest challenge of the 21st century is to control the growing energy demand, so as to reduce CO2 emissions, that too without hampering economic activities (Liang, Umar, Ma & Huynh, 2022; Romanello et al., 2021). As said by Umar, Gubareva, Tran and Teplova (2021) the energy industry is the main contributor to CO2 emissions, which nearly accounts for two-thirds of global emissions. The concentration of greenhouse gas (GHG) experiences an incline mainly due to burning the fossil fuels in industries. Furthermore, economic development also steadily enlarges social and economic activities, increasing energy consumption and greenhouse gas emissions. Therefore, ensuring smooth economic growth without disturbing ecological standards is among the primary climate targets that must be given due importance. Similarly, in the same context, (Zheng et al., 2017) recognized that economic growth can be considered to be a factor that is responsible for increasing CO2 emissions. According to X. Li and Ullah (2022), the economies of the world largely consume fossil fuels to increase the production of goods and services, in order to fulfil the demand of the growing population around the world. As a result, economic expansion leads to higher levels of CO2 emissions. In the framework of Malaysia, Raihan et al. (2023) studied the relationship among economic growth, resource sources, health spending, and CO2 emission. Empirical evidence confirmed that economic growth deteriorates environmental sustainability by increasing CO2 emissions. Furthermore, Phadkantha and Tansuchat (2023) also revealed a twofold relationship between economic growth and CO2 emission. On one side, economic growth increases CO2 emissions; whereas on the other side, economic growth can also encourage investment in renewable energy and energy-efficient projects that can be used to condense CO2 emissions in developing countries. This argument contradicts the previous findings and opens a debate to determine the role of GEG for the ENSUS.

The ongoing debate in the financial literature demonstrates GFI as a critical factor for GEG. In this regard, Wu (2019) used the idea of green investment to measure GFI and determined that GFI can help polluting enterprises develop green industrial structures that can be used to enhance green economic development. Likewise, the reported outcomes from the research of Soundarrajan and Vivek (2016) also concluded the catalytic effect of GFI on the GEG of the Indian region. Furthermore, the researchers also found that GFI complements socioeconomic development with a low-carbon economy. The empirical findings of Cowan (1999) presented a positive effect of green investment on the quality of the environment. Moreover, Wara (2007) claims that a low carbon economy, through GFI, will also attain more significant development. Sachs, Woo, Yoshino and Taghizadeh-Hesary (2019) also highlighted the need to develop more environmentally friendly financial products through GFI. In the words of Tan, Su and Wang (2023), GEG is a phenomenon that is flourished by GFI. In the same realm of study, Zhou et al. (2022) identified that GFI, through green investment and green credit, can promote environmental standards in the case of China. Tan et al. (2023) also found GFI to be a viable economic growth element. Du, Zhao, Tao and Lin (2019)) illustrated GFI as a key driver for more dynamic GEG. Furthermore, a number of recent studies also highlighted the importance of GFI for the upward growth of economies around the world. Literature reflects that GFI positively influences the GEG of the countries. In the post-COVID-19 era, a study by Zhao et al. (2022) illustrated a positive relationship between financing policies of green bonds and economic growth. Likewise, Wang, Zhao, Jiang and Li (2022) also suggested that countries with a lack of funds for green projects can use GFI to establish and flourish their sustainable economic growth. In the same regard, H. Zhang, Geng and Wei (2022) highlighted the significance of GFI for environment-friendly projects in order to gain higher per capita income and employment rates. Moreover, Jiakui et al. (2023) also found GFI to be a driving force in promoting green total factor productivity, green technological innovation, and GEG.

Keeping the work of this academia in the frame, we propose the following hypothesis based on the above discussion in the literature.

H3 GFI significantly affects the GEG of the BRICS Economies.

H4 GEG significantly moderates the relationship between GFI and ENSUS of the BRICS Economies.

In this study, a quantitative approach has been used. Secondary data has been used to study the relationship between GFI, GEG, and ENSUS. The study sample consists of five economies, more formally known as Brazil, Russia, India, China, and South Africa (BRICS). The data considered for the study consists of 25 years spanning from January 1, 1998, to December 31, 2022 mainly for two reasons. First, it covers the impact of the global financial crises of 2008–2009, and second, it also covers the impact of the COVID-19 and the era surrounding it. The required data for ENSUS, GFI, GEG, GDP, Natural Resource Rent, GDPPC, Energy Efficiency, Government Intervention, and Foreign Direct Investment has been obtained from the World Development Indicators (WDI) (Udeagha & Ngepah, 2023; Wei et al., 2024). The data for the missing years has been calculated through the linear interpolation method (Danisman & Tarazi, 2020). Furthermore, The GFI index and ENSUS index are calculated through the Principal Components Analysis (PCA), which distinguishes our study from the previous research in the discipline (Hung, 2023; Musah et al., 2022; Wei et al., 2024). Additionally, in order to ensure the reliability of the studied variables, the natural log was taken into consideration. As all the variables have unlike measurements, the natural log helps to make them homogenous in nature (Wei et al., 2024).

Description of variablesTable 1 displays the detailed description, conceptualization and calculation of the variables considered in this study. The dependent variable of the study is ENSUS, and it is measured through CO2 emission per capita (Wei et al., 2024). The alternative proxy to measure environmental sustainability is CO2 emission kiloton (Udeagha & Ngepah, 2023). However, the present study deployed both proxies for the construction of the ENSUS index for more comprehensive estimates. The independent variable of the study is GFI, and it is measured through diverse proxies. The GFI index is calculated through green credit, green securities (Wei et al., 2024), green investment (Hung, 2023), and carbon finance (H. Zhang et al., 2022). This study has incorporated GEG as a variable that acts as a moderator in the relationship between green finance and CO2 emission. The GEG is calculated the studies undertaken by Ahmed et al. (2022); Degbedji, Akpa, Chabossou and Osabohien, (2024). Furthermore, the study has used several control variables in order to determine the true impact of GFI and GEG on the ENSUS of BRICS countries. The control variables include GDP square, per capita GDP (Udeagha & Ngepah, 2023), foreign direct investment (Yue, Zou & Hu, 2015), government intervention, energy efficiency (W. Li & Fan, 2023), and natural resource rent (Udeagha & Ngepah, 2023).

Variable’s description.

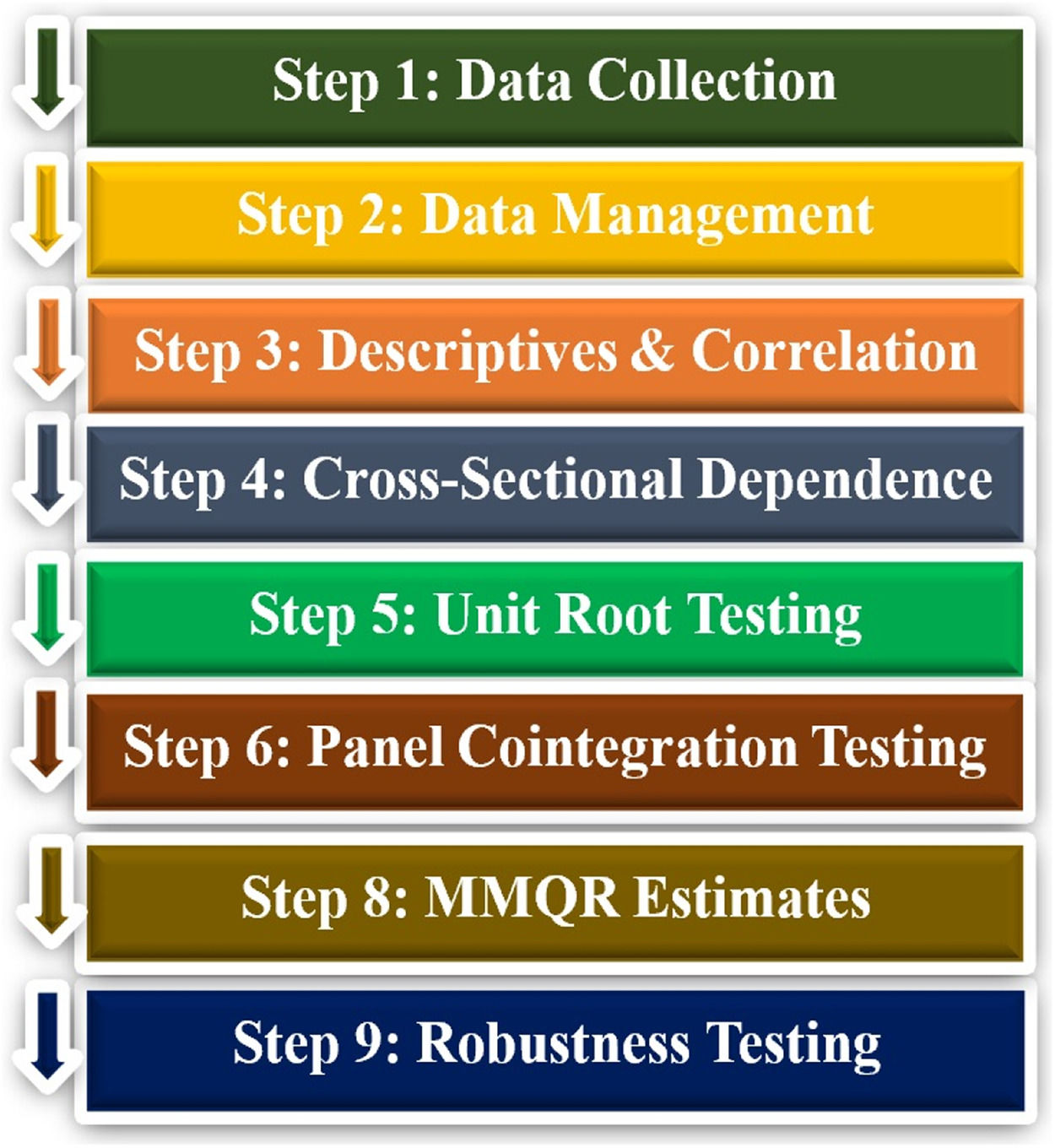

This study has mainly used two explanatory variables, one exploratory variable, and one moderating variable, along with the control variables. The conceptual framework of the variables has already been discussed above. Fig. 2 displays the methodological flowchart of this article. The econometric models below were used for the estimation through MMQR.

Model 1 is used to study the interplay among GFI and ENSUS along with the control variables.

Model 2 is used to study the interplay between GEG and ENSUS along with the control variables.

Model 3 is used to study the interplay between GFI and GEG along with the control variables.

Model 4 is used to study the interplay between GFI and ENSUS in the presence of GEG and the control variables.

Where, ENSUSi, t represents the environmental sustainability index (CO2 emissions) of country ‘i’ at time‘t’, LnFGI i, t represents green finance index of country ‘i’ at time‘t’, LnGEG i, t represents green economic growth of country ‘i’ at time‘t’ LnGFI*LnGEG i,t refer to interaction term of country ‘i’ at time ‘t’, X i,t represent country-specific control variables and ε i, t refer to the error term. The methodological flowchart is illustrated as figure-02Descriptive statistics and correlation analysisThe dataset's normal distribution is analyzed through the descriptive statistics analysis, while Pearson's correlation analysis explores the direction of the variable’s relationship. The J-B test statistics confirm that the variables are not normally distributed.

Diagnostic testingThe study conducted several diagnostic tests to identify cross-sectional dependence, unit root, data stationarity, and panel co-integration among the considered datasets. The Pesaran, Frees, and Friedman tests were used to determine cross-sectional dependence, followed by CIPS and CADF tests for unit root and data stationarity. Furthermore, the study also used (Westerlund, 2007) co-integration test to identify co-integration in the dataset.

Method of moments quantile regressionThe MMQR is an appropriate estimation approach that is used to handle any outliers, skewness, and heteroskedasticity (Wei et al., 2024). In this study, it also tackles the individual fixed effects to mitigate any endogeneity issues (Liu et al., 2025). Additionally, heterogeneity also tends to be a persistent cause of concern and issue for scholars while dealing with secondary data. The existence of heterogeneity in the panel dataset makes the outcomes dubious and biased. However, conventional estimation techniques are unreliable when it comes to capturing heterogeneity and produce biased outcomes (Wei et al., 2024). Therefore, in order to deal with the potential heterogeneity problem, this research has used a quantile-based estimation technique. In quantile-based regression techniques, the linkages are developed through quantiles, which helps to address heterogeneity problems in a more efficient manner (Wei et al., 2024). The quantile-based estimations are based on the OLS estimation framework, the outcomes are considerably comprehensive due to the development of quantiles. Besides, quantile-based techniques are also capable of being shielded against outliers. It is noteworthy that the outcomes generated through quantile-based estimation techniques are superior to conventional regression techniques. Conventional estimation techniques account for averages to generate results, unlike quantile-based estimation techniques (Binder & Coad, 2011).

Among numerous alternatives of quantile fraternity, the study has used the novel Method Of Moments Quantile Regression (MMQR), as proposed by Machado and Silva, (2019). While also dealing with heterogeneity and outliers issues (Canay, 2011; Koenker, 2004), MMQR presents robust estimates even if significant strikes occur due to fixed effects. However, the present study used MMQR methodology to examine the interconnectedness between GEG, GFI, and ENSUS within BRICS economies.

Results and discussionDescriptive statistics and correlation matrixTable 2 displays the descriptive statistics of the variables. Additionally, it presents the J-B test statistics, which confirm the non-normal distribution of all the variables. It endorses the legitimacy of applying the MMQR methodology. Table 3 illustrates that the inter-relationship among variables does not present high values; hence, it can be concurred that the relationship among variables is not overstated due to a high correlation factor.

Descriptive statistics.

Correlation metrix.

The present study has utilized various pre-diagnostic tests to validate the usage of MMQR. Table 4 reports the outcomes of the cross-sectional dependence (CD) test. In cross-section panel studies, if CD is not determined, the results are assumed to be doubtful and ambiguous. The hypothesis of the CD test proposes that the significant values confirm the existence of CD, and insignificant results confirm the nonexistence of CD. However, in the case of this study, the CD test confirms that the data is cross-sectionally dependent. Furthermore, the stationarity of data has also been assessed through a cross-sectional IPS (CIPS) test. The CIPS test is also capable of capturing the factor for heterogeneity (Phillips & Hansen, 1990; Raza & Shah, 2017). The significant outcomes of the CIPS test depict the data’s stationarity, while the insignificant result depicts the presence of the unit root. In compliance with the reported outcomes in Table 5, the data is seen to be stationary at first difference. Additionally, the assessment of the data’s stationarity is further validated through the CADF test. The outcomes of the CADF test complement the findings of CIPS and endorse that the data is stationary at first difference.

Cross-sectional dependence test results.

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

Unit root and data stationarity test.

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

The results of the CADF test also been summarized in Table 5. The cointegration among the variables has been assessed through Westerlund (2007). The Westerlund (2007) test is a second-generation test, and it is considered to be more legitimate for the assessment of cointegration as compared to the Pedroni (2004) test. This test also assesses cointegration from a group perspective and panel perspective. In Table 6, the outcome of the Westerlund (2007) confirms cointegration among the variables from both perspectives. Notably, the present study has deployed MMQR by satisfying all the initial requirements to examine the interconnectedness between GEG, GFI, and ENSUS. The dependent variable, the ENSUS index (CO2 emissions), is predicted by GFI, GEG, and other control variables. The reported outcomes have revealed positive and negative relationships among variables based on their respective nature.

WesterLund (2007) Co-Integration Analysis.

| Statistics | Gt | Ga | Pt | Pa | Decision |

|---|---|---|---|---|---|

| Value | −5.119 | −26.879 | −6.629 | −15.644 | Cointegration Exist |

| Z-value | −7.694 | −5.036 | −2.218 | −2.505 | |

| p-value | 0.000*** | 0.000*** | 0.013** | 0.006*** |

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

Table 7 displays the empirical estimates of models 1, 2, 3, and 4 through the MMQR estimation technique. First, the influence of GFI on the ENSUS index (CO2 emissions) in the BRICS economies is examined using model 1. It can be observed that across all quantiles, GFI negatively influences CO2 emission at different statistical significance levels. In the first quantile, the relationship was insignificant, while in the second quantile, the relationship was significant at 5 %. Apart from these findings, it can also be concurred that the relationship is statistically significant at 1 % from the third quantile to the ninth quantile. The empirical estimates revealed that a 1 % increase in GFI reduces CO2 emissions by −0.078, −0.111, −0.124, −0.137, −0.155, −0.188, −0.203, and −0.238 in second to ninth quantiles respectively. The negative nature of the relationship illustrates the complementary role of GFI in reducing CO2 emissions to enhance ENSUS. These reported outcomes are consistent with H1. The emphasis of the BRICS economies on GFI as a potential solution to CO2 emissions could be a possible reason for the difference in significance level. Even though GFI is one of the available solutions for reducing CO2 emissions. The flow of green funds through GFI can serve as a key tool to push organizations to invest in energy-efficient projects in order to reduce CO2 emissions in the BRICS economies. The findings of this research are supported by the prior studies. For instance, the outcomes are in line with Xu, Chen, Zhang, Liu and Li (2023), who explored the GFI and ES nexus in China and concluded that GFI can facilitate the promotion of renewable energy generation levels and can play a vital role in accomplishing a sustainable environment goal. Likewise, Ma, Zhu, Liu and Huang (2023) disclosed that GFI helps to develop renewable energy sources and can improve energy efficiency to maintain the ecological standards of G-20 countries. The findings are also consistent with the current study and conclude that GFI helps to enhance environmental sustainability by reducing CO2 emissions in the BRICS economies (Wei et al., 2024). The impact of control variables, such as natural resource rent, GDP per capita, and government intervention, was found to be negative at a statistically significant level of 1 % across all the quantiles. Furthermore, the impact of control variables such as GDP square and energy efficiency was found to be positive and statistically significant at different levels across all the quantiles. Nonetheless, the impact of FDI is found to be positive and significant in the 1st to 5th quantiles.

Panel estimates through MMQR.

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

Secondly, the influence of GEG on ENSUS (CO2 emissions) in BRICS economies is investigated using model 2. It was noted that across all quantiles, GEG negatively influences CO2 emission at different statistical significance levels. In the first quantile, the relationship was found to be significant at 1 %, while in the second quantile, the relationship was found to be significant at 5 %. Apart from these outcomes, the relationship is statistically significant at 1 % from the third quantile to the ninth quantile. Moreover, the coefficient values categorically exhibit that a 1 % increase in GEG reduces CO2 emissions by −0078, −0.111, −0.124, −0.137, −0.155, −0.188, −0.203, and −0.238 from 2nd to 9th quantiles, respectively. These reported outcomes are consistent with H2. The negative nature of the relationship demonstrates the complementary role of GEG in reducing CO2 emissions, in order to maintain ecological standards. It must be noted though that GEG is one of the available solutions for reducing CO2 emissions. GEG can ensure that green economic practices accelerate economic growth, reduce CO2 emissions, and help achieve sustainable economic growth in a simultaneous manner. There is limited empirical evidence, and the role of GEG in reducing CO2 emissions is inconclusive. Nonetheless, the study's findings have initiated a new debate on the role of GEG in achieving CO2 emission neutrality. However, the reported empirical evidence of this research is in line with the argument that economic growth can reduce CO2 emissions by encouraging investment in renewable and energy-efficient projects in developing economies (Phadkantha & Tansuchat, 2023). It can be concluded that the impact of control variables, such as GDP square and energy efficiency, is positive and statistically significant at 1 % in all the quantiles. The impact of control variables that pertain to natural resource rent and government intervention is negative and statistically significant at 1 % across all the quantiles. FDI was found to be insignificant in this analysis.

Thirdly, the influence of GFI on the GEG of the BRICS economies has been inspected using model 3. Across all quantiles it has been observed that GFI positively influences GEG at a 1 % statistical significance level. The positive nature of the relationship illustrates the complementing role of GFI in promoting the GEG of the BRICS economies. The coefficient values suggest that a 1 % increase in GFI fosters GEG by 0.412, 0.396, 0.383, 0.371, 0.360, 0.344, 0.330, 0.313, and 0.284 from the 1st to the 9th quantiles respectively. The reported outcomes are consistent with H3. Hence, GFI is one of the critical factors that can accelerate GEG. The environmental stringency index appears to be positively and negatively significant in the 10th-40th and 50th-90th quantiles, respectively in BRICST (Li et al., 2022). According to Tan et al. (2023) GFI can help industries to develop environment-friendly projects by providing green credit, and as a result it can also accelerate GEG. The reported findings are also consistent with a prior study touching upon the same areas of discipline (Soundarrajan & Vivek, 2016). Furthermore, the impact of the control variables, natural resource rent, GDP per capita, and government intervention, was positive and statistically significant across all the quantiles that were taken into consideration. Also, the control variable energy efficiency was negative and statistically significant at 1 % across all the quantiles, whereas FDI was insignificant.

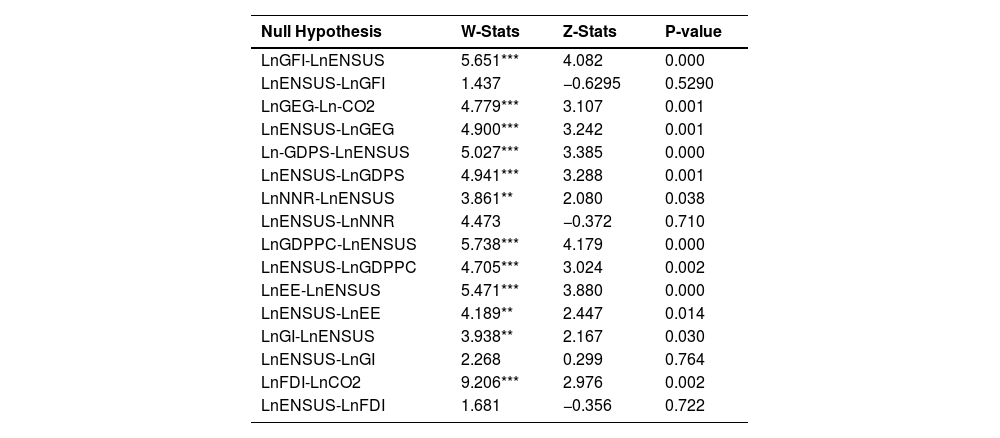

Fourthly, the impact of GFI on ENSUS (CO2 emissions) of the BRICS economies is examined by incorporating GEG as a moderator in model 4. Across all quantiles, GEG significantly and positively moderates the association between GFI and CO2 emission at 1 % statistical significance levels. The reported outcomes are consistent with H4. Al Mamun et al. (2022) claimed that GFI can help mitigate environmental risk and develop a low-carbon economy through a properly developed institutional environment. The negative nature of the GEG and CO2 emission relationship can encourage investments in clean energy, energy efficiency, and other environmentally friendly projects (Phadkantha & Tansuchat, 2023). This can help to reduce CO2 emissions and also strengthen the impact of green finance on environmental sustainability. Furthermore, by integrating GFI into the framework of GEG, BRICS economies can achieve a more sustainable and low-carbon development path. This, in turn, can lead to a win-win situation where economic growth is achieved while also addressing environmental challenges simultaneously. Therefore, in light of the empirical outcomes, this study concludes that GEG can significantly moderate the relationship between GFI and ENSUS. The impact of the control variables, such as natural resource rent, GDP per capita, and energy efficiency, is positive and statistically significant at 1 % across all the quantiles. Whereas control variables pertaining to government intervention, and FDI, are found to be insignificant in this regard. Table 8 reports the test results of (Dumitrescu & Hurlin, 2012) test to depict the causality among the independent, control, and the dependent variables. The outcomes have revealed bidirectional causality among CO2 emission, GEG, GDP square, per capita GDP, and energy efficiency. They also revealed a one-way relationship between CO2 emission, GFI, natural resource revenue, government intervention, and FDI.

Dumitrescu hurlin panel causality tests.

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

By following the methodology proposed by (Gowanda Research), the robustness of the results has been checked through the second-generation regression using the Driscoll-Kraay, the standard errors method (DK). Table 9 reports the results of the DK standard error robustness in order to run this check.

Regression with Driscoll-Kraay standard errors method.

Note:(s) *, ** & *** is level of significance at 10 %, 5 % and 1 %. The dependent variable of the study is ENSUS index measured through CO2 emissions per capita and CO2 emissions kiloton.

In model 1, the empirical results obtained through the DK standard error method confirmed a negative relationship between GFI and CO2 emissions at a 5 % statistical significance level. While in model 2, the outcomes confirmed a negative association between GEG and CO2 emissions at 1 % statistical significance levels in the BRICS economies. Moreover, in model 3, the empirical evidence also discloses a positive relationship between GFI and GEG at a 5 % statistical significance level. Lastly in model 4, the outcomes confirm that GEG significantly and positively moderates the GFI and CO2 emissions nexus at 10 % statistical significance level. These findings align with the primary findings of the study and complement the findings of MMQR. However, the magnitude of the coefficient values is observed to be heterogenous.

Conclusion and recommendationsSustainable development is among the top priorities of all countries across the globe. It is a phenomenon that is essential to determine the key factors that can promote economic growth and also reduce CO2 emissions simultaneously. However, the current environmental status is deemed to be precarious, which is damaging ecological standards all over the world. Regardless of the notable initiatives by the countries to reduce CO2 emissions, there is a dire need to promote more sustainable and empirical practices that can provide respite to the environment. It must be noted that the world is still facing challenges such as shortage of food, lack of drinking water, and air pollution (Lee, Gibson, Brown, Habtewold & Murphy, 2023). The mere commitment of the countries when it comes to the environmental protection has brought little change, while a few countries are parting their ways from climate deals altogether (Sun, Gao, Deng & Wang, 2022). This can and to an extent has put poorer countries in severe danger of an environmental crisis. Meanwhile, this is also a very potent problem for developing and developed countries as well (Farooq et al., 2023). It can slow down the pace of economic growth, and as a result, become a host to several novel economic problems. Therefore, developing dynamic and meaningful environmental protection and sustainability policies is one of the critical concerns of leaders and academic scholars around the world (Kumar et al., 2023). The cluster of some of the world's big economies, formally known as BRICS, is also greatly concerned about environmental degradation. The level of CO2 emissions coming from two industrialized countries such as China and India is at a staggering stage due to high levels of growth (Farooq et al., 2023). In line with SDG 13 of the UN, with the urgent need to fight against climate change, the present study research primarily focuses on BRICS economies to identify the key root causes and to suggest preventative measures and remedies related to ecological protection, to the biggest polluters of the world.

This study examines the impact of GFI and GEG on ENSUS (CO2 emissions) through a novel MMQR estimation technique and has been concluded as follows:

- •

GFI helps facilitate the smooth flow of funds within the financial industry in order to develop sustainable and green projects. It is noteworthy that green investment, securities, credit, insurance, carbon finance, and environmental protection products are important elements of GFI. The empirical evidence of the study determined GFI to be a driving force in reducing CO2 emissions in the BRICS economies. Moreover, GFI can help increase renewable energy usage by channeling funds to energy-efficient projects. All the critical aspects of GFI can be utilized as a guiding force to maintain ecological standards for the BRICS economies.

- •

Secondly, this research enriches financial literature by examining the impact of GEG on the CO2 emissions. Based on the outcomes, this study concludes that GEG negatively influences the level of CO2 emissions and can help to maintain ENSUS. Thirdly, the relationship between GFI and GEG is studied in the context of BRICS economies.

- •

Based on the reported outcomes of the study, it can be affirmed that GFI can help accelerate GEG in the BRICS economies. Hence, this study also concludes that GFI plays a positive role and can foster the establishment of GEG in BRICS economies. In turn, GEG can ensure green economic practices that accelerate economic growth, reduce CO2 emissions, and help achieve sustainable economic growth simultaneously.

- •

Fourthly, this research explored the relationship between GFI and CO2 emission by incorporating GEG as a moderating variable. The outcome of this analysis found GEG to be a significant factor in the relationship between GFI and CO2 emission. Hence, it is concluded that GEG significantly and positively moderates the relationship between GFI and CO2 emission in the context of BRICS economies.

- •

Furthermore, the Dumitrescu and Hurlin (2012)) test reports the causality among the independent, control, and the dependent variables. The outcomes revealed bidirectional and unidirectional causality among the variables taken into consideration. Lastly, the reported outcomes of the robustness check through DK regression have been observed to be consistent with the baseline findings, thus confirming the outcomes' reliability and validity.

- 1.

In light of the findings of this study, this research suggests that GFI can be used as an effective tool to promote green projects, renewable energy projects, and energy-efficient projects. In this way, the risk imposed by conventional finance on BRICS economies can be mitigated.

- 2.

Furthermore, GEG can also flourish and encourage investors to invest in energy-efficient projects. As a result, this will help to reduce CO2 emissions, and the goal of sustainable development of the UN can also be achieved as a pragmatic goal. Therefore, it is recommended that BRICS economies provide all the essential means to facilitate sustainable economic development.

- 3.

It is also recommended that governments ensure an efficient, effective and smooth transition towards energy-efficient and green projects, primarily by offering credits on favorable terms. Furthermore, the governments of BRICS economies should also incentivize green initiatives and projects, as to make them more attractive than the conventional ones. The notion of GEG can be a game changer in accomplishing the sustainable economic development goals of the BRICS economies.

As revealed earlier, the novel MMQR estimation technique has been used in this study for cross-country analysis. Whereas the QARDL and NARDL can also be used in future studies. Moreover, along with GFI and GEG, future studies can incorporate several other aspects, such as economic policy uncertainty, human capital, usage of renewable energy, government effectiveness, and economic freedom for more insightful outcomes.

CRediT authorship contribution statementJiuhong Yu: Software, Methodology, Conceptualization. Hai Long: Visualization, Project administration, Funding acquisition, Conceptualization. Imran Shahzad: Writing – original draft, Project administration, Formal analysis, Conceptualization. Jinyu wang: Writing – review & editing, Writing – original draft, Software, Investigation, Conceptualization.

There is no conflict of interest between authors.

The study is supported by Project number (2820240204), Ningbo University of Finance and Economics: Research on the Mechanism and Digitization of Pension Development.