Digital transformation is widely acknowledged as a pivotal factor in reducing banks’ marginal costs and enhancing the efficiency of credit risk management. Concurrently, it allows banks greater flexibility to adapt to shifts in market conditions, thereby optimizing adjustments to credit scale and structure. Despite these recognized benefits, the extant literature has yet to comprehensively analyze the specific mechanisms through which digital transformation impacts banks’ credit operations. This study addresses this research gap by examining how digital transformation dynamically affects the supply of bank credit, with the objective of offering valuable insights to bank management and policymakers. This study utilizes panel data from commercial banks and employs a nonlinear difference-in-differences (DID) approach to analyze the mechanisms and determinants of how digital transformation affects the credit supply scale and structure. The findings indicate that while digital transformation via policy guarantees does not significantly alter the overall credit scale, it significantly influences the credit structure, encouraging banks to enhance credit provision to small and micro-enterprises (SMEs). These findings are robust to various tests. This study reveals that the digital transformation mechanism introduces novel data elements for policy guarantees, facilitates the digitalization of banking operations, reduces costs, and improves risk management, thereby steering the credit structure toward SMEs. The impact of digital transformation is not uniform across banks; differences in management and information-screening capabilities lead to heterogeneous effects on credit structures. Notably, the impact of policy-guaranteed digital transformation on credit structure is more pronounced in non-local commercial banks with regional operations. To validate these conclusions, this study examines 2061 loan records from 42 banks, confirming that digital transformation effectively redirects commercial banks’ credit supply towards enterprises and the real economy. This research offers theoretical insights for refining policy guarantee frameworks, accelerating the digital transformation of commercial banks, and bolstering their credit support for SMEs.

According to the White Paper on the Development of China's Digital Economy (2022), the scale of China's digital economy in 2021 reached 45.5 trillion yuan, accounting for 39.8% of its GDP, ranking second in the world. The development of the digital economy has created conditions for the digital transformation of commercial banks. Commercial banks share information and interoperate with different departments through digital transformation, thereby reducing information acquisition costs (Ding & Zhou, 2024). Financial technology enables banks to obtain more operational and financial information about physical enterprises, making it easier for innovative enterprises to obtain loans (Damian & Manea, 2019). From a micro perspective, credit rationing leads to financing constraints for some enterprises—especially small and micro enterprises (SMEs) and technology-based enterprises—which, in turn, limits their innovation activities and scale expansion, affecting the improvement of total factor productivity (Nicolas, 2022; Bakhtiari et al., 2020). Therefore, if banks’ digital transformation effectively increases their proportion of credit supply to innovative enterprises such as SMEs, it means an improvement in their innovative credit structure.

In December 2015, the Chinese government designated Taizhou as the “Small and Micro Enterprise Financial Service Reform and Innovation Pilot Zone,” the only national-level pilot zone in the country. Taizhou has comprehensively formed a “Taizhou model” that focuses on the real economy and supports SMEs by building a diversified financial service pattern and organizational system that includes state-owned banks serving large and medium-sized enterprises, joint-stock banks serving small and medium-sized enterprises, urban commercial banks, and small and micro financial specialized institutions serving SMEs. Taizhou is continuously optimizing the financial ecosystem of government enterprise bank linkage, playing a role in transforming the efficiency of government services and implementing the “government bank linkage” project. Cooperation between the credit information-sharing platform in Taizhou City, Zhejiang Province, and policy financing-guarantee institutions is a typical case of the combination of digital and real economies, providing empirical evidence for the digital transformation of credit for small and medium-sized enterprises in commercial banks.

Credit rationing leads not only to insufficient credit for some enterprises but also to excessive credit for some enterprises, as well as a decrease in the overall financing efficiency of the whole society. Analyzing policy financing-guarantee institutions is of great significance in improving SMEs and technology-based enterprises, optimizing credit resource allocation, and improving the conditions and mechanisms of credit market welfare. Therefore, contemporary development theories increasingly emphasize the importance of credit availability. Research on the digital profession has mainly focused on issues such as bank profitability and financial risk, while little discussion has addressed whether digital transformation can optimize bank credit structure (Cheng & Qu, 2020; Hu et al., 2022; Wang et al., 2021).

Owing to the participation of the Taizhou Credit Information Sharing Platform, Taizhou's policy guarantees not only the role of government guarantees but also the digital transformation of cooperative banks. This study uses panel data from 42 commercial banks from 2012 to 2019 to empirically test the mechanism and influencing factors of banks’ digital transformation on the scale and structure of credit supply using the nonlinear interleaved DID model proposed by Wooldridge (2021). It leverages government big data to quantify the extent and directionality of the influence across diverse scales of banking institutions that banks’ credit structures exert on their cooperation with policy guarantee initiatives. This study provides a theoretical reference for improving the policy guarantee system, promoting the digital transformation of commercial banks, and strengthening credit support for SMEs.

The remainder of this paper is organized as follows. Section 2 reviews the literature on banks’ credit supply. Section 3 describes the methodology, data, and variables used in this study. Sections 4 and 5 report the estimation results and robustness checks, respectively. Finally, Section 6 presents the concluding remarks.

Literature reviewCommercial banks’ digital transformation has attracted considerable scholarly attention, and various methodologies have been employed to measure its impact. A common approach involves the use of panel data and indices that capture multiple dimensions of digitalization, including cognition, organization, and product innovation. Chen et al. (2023) and Khattak et al. (2023) utilized panel data from listed banks to analyze the effects of digital transformation on risk-taking and stability. Jia and Liu (2024) focused on systemic risks, reflecting a comprehensive interest in the diverse implications of digital banking. Measures of digital transformation often rely on indices that account for technological adoption, digital product innovation, and organizational change. Zhu and Jin (2023) and Shanti et al. (2023) used a regression analysis of fixed effects to measure the impact of digital transformation on bank efficiency and profitability, suggesting that advancements in digital services, customer engagement, and internal processes are quantified through a composite index. Factors such as executive leadership, innovation awareness, and technical background significantly influence the success of digital transformation in banks (Zhu & Jin, 2023). Additionally, the level of competition within the banking sector and broader business environment affects how digital transformation reduces firms’ reliance on bank credit, as noted by Chen (2024). The impact of digital transformation on corporate credit is a critical area of inquiry, with Chen (2024) finding a significant negative correlation between a firm's digital transformation and its dependence on bank credit; this indicates that digital advancements can alleviate financing constraints and information asymmetry for businesses. This finding is supported by Hou and Yang (2024), who established a bidirectional relationship between digital transformation and liquidity mismatch, suggesting that digitalization can enhance banks’ credit risk management capabilities. Studies on bank digital transformation have employed diverse methodologies, focusing on panel data and composite indices to measure its multifaceted impacts. Influencing factors such as leadership and market competition significantly shape the outcomes of digital initiatives. Moreover, transformation positively affects corporate credit by reducing reliance on traditional banking services, thereby promoting financial inclusion and stability.

Commercial banks’ digital transformation is a result of integrating digital technology and financial innovation. As public guarantee schemes are based on government support, the digital innovation of governments’ public service platforms will also promote the passive digital transformation of commercial banks. Existing academic discourse has underscored the transformative impact of digital innovation on the banking sector, with a particular focus on its capacity to enhance operational efficacy, reduce cost structures, and expand credit accessibility. Governments have implemented measures aimed at increasing the probability of start-ups securing bank credit, albeit without significantly deterring borrowing tendencies. Empirical evidence from Chile suggests that policy-backed loans are primarily directed toward financing working capital, which has been instrumental in enhancing credit accessibility for SMEs without affecting loan interest rates (Cowan et al., 2015). Similar patterns have been observed in Argentina, where such guarantees have been correlated with employment growth and higher wage levels, particularly in the context of product innovation (Castillo et al., 2013). In Spain, policy guarantees have positively influenced business efficiency across the economic, financial, and operational spheres, although these advantages have not uniformly translated into reduced financial costs (Garcia-Tabuenca & Crespo-Espert, 2008). Furthermore, policy guarantees have demonstrated their utility as a countercyclical tool, effectively easing credit constraints during economic downturns (Martin Garcia & Santor, 2019). A case study from South Korea indicates that policy guarantees positively impact SMEs’ R&D investments (Heshmati, 2014). However, potential risks have been identified, such as in Italy, where guarantees may lead banks to relax borrower screening and monitoring, increasing the risks of moral hazard and adverse selection (de Blasio et al., 2018). Comparatively, bank-guaranteed loans have been found to carry a higher default risk than those counter-guaranteed by mutual guarantee institutions (MGIs) (Caselli et al., 2021). Studies on Japan's government loan guarantee program have suggested that this may prompt banks to adopt riskier lending strategies attributed to the mitigation of credit risk (Wilcox & Yukihiro, 2018). Despite concerns of loan guarantee programs crowding out unsecured loans, empirical evidence points to a complementary relationship between secured and unsecured loans.

Government initiatives to alleviate financing challenges for SMEs have been ongoing, with economic indicators reflecting the success of these policies (Beck et al., 2010; Cressy & Aernoudt, 2000; Merton & Bodie, 1992). However, field surveys have revealed that the actual perception of obtaining credit is weak, and the financing environment for these enterprises may have further deteriorated (Beck et al., 2010; Martín-García & Santor, 2019). The structural economics perspective posits that the banking structure's misalignment with regional industrial and enterprise-scale structures is a contributing factor. Resolving the financing constraints of SMEs necessitates an optimized banking structure that leverages the strengths of small and medium-sized banks in microcredit and aligns the banking structure with the scale structure of enterprises (Udell & Berger, 2002). The credit insurance fund for SMEs enhances the creditworthiness of these businesses and mitigates the credit risk faced by lending banks through lower-cost guarantee credit enhancement (Baltensperger, 1978; Guiso, 1998). However, the credit-enhancement effect varies among suppliers of different sizes owing to the heterogeneity of credit supply sides. According to credit theory, all risks must be compensated for, and a business’ profitability is a determinant of its repayment capacity (McGuinness & Hogan, 2014). Poor profitability necessitates alternative risk-compensation methods for lending banks, such as collateral provision or third-party guarantees and credit enhancements, including guarantee institutions, corporate pooling, and relationship lending. Different credit-granting models across bank sizes result in structural matching between various enterprise types and corresponding bank models.

The literature on the impact of policy financing guarantees on commercial banks’ credit structures is predominantly theoretical owing to data limitations. Wilcox and Yukihiro (2019) theoretically established the mechanism by which policy financing guarantees influence bank risk-taking, revealing a credit-enhancement effect on both guaranteed and non-guaranteed loans. Other studies, such as those by Nicola (2021), Foreman-Peck (2013), Hennecke et al. (2019), Ono et al. (2013), and Uesugi et al. (2010), have used survey data to discuss the relationship between policy financing guarantees and banks’ credit decisions, with less emphasis on banks’ borrower selection beyond guarantee status.

As the banking sector continues to evolve, further research is necessary to explore the long-term sustainability and systemic implications of digital transformation. This study distinguishes itself by leveraging government big data to quantify the extent and directionality of the influence across diverse scales of banking institutions regarding their credit structures’ impact on cooperation with policy-guarantee initiatives, providing a nuanced set of indicators for policy refinement. It incorporates data from 2061 loan records across 607 branches of 42 commercial banks, including state-owned, joint-stock, and urban commercial banks, enhancing the generalizability of the findings.

Methodology and dataData resource and variables selectionOwing to the impact of COVID-19, the data from 2020 to 2022 fluctuate greatly from the previous data. The impact of such sudden changes causes significant deviations in the model conclusions, which cannot explain real-world problems. Therefore, this study uses data collected before 2019. It utilizes Taizhou data because Taizhou City is China's first demonstration zone for small and micro financial enterprises and has implemented a policy guarantee and enterprise credit information-sharing platform. Taizhou City's bank credit data demonstrate how policy guarantees can promote the digital transformation of commercial banks and their credit-structure adjustment. The study of this sample also provides data support for promoting the policy, which is the significance of this study.

The enterprise-level data used in this study come from the Taizhou Credit Information Sharing Platform, Taizhou Credit Insurance Fund Guarantee Ledger, and are voluntarily disclosed by the Torch High-tech Industry Development Center of the Ministry of Science and Technology, Zhejiang Provincial Department of Science and Technology, and Taizhou Municipal Bureau of Science and Technology. The sample period is from 2012 to 2019. This study focuses on technology-based enterprises registered in Taizhou City and operating continuously within the timeframe of data statistics. National-, provincial-, and municipal-level technology-based enterprises are recognized based on the list of high-tech enterprises announced by the Torch High-tech Industry Development Center of the Ministry of Science and Technology of China, the Department of Science and Technology of Zhejiang Province, and the Science and Technology Bureau of Taizhou City before 2017. The list of technology-based enterprises is matched with the credit information-sharing platform data of the People's Bank of Taizhou City and the shared ledger data of the Taizhou Credit Insurance Fund. After excluding enterprises with many missing values, the data include 136,135 enterprise credit data, with panel data on the credit structure of 607 branches of 42 commercial banks.

The raw data employed in our study are monthly data, which report information on new credit loans granted to each enterprise by each bank every month. The statistical time is determined by the starting time of the new credit granted. However, the update of data on variables related to enterprise operations is relatively irregular; thus, differences may be observed between the actual occurrence time of covariates and dependent variables at the monthly level. To eliminate the impact of such bias, the dataset is summarized annually, and empirical analysis is conducted using annual data. Specifically, the empirical research in this study is based on the changes in the scale and structure of bank credit supply before and after their participation in policy financing guarantees (i.e., average treatment effects on treated, ATT) to evaluate the implementation effect of these guarantees under the cooperation of “government-bank-guarantee.”

The explained variables include two dimensions: the scale of bank credit granting and the number of credit-granting enterprises. The credit scale refers to the total amount of credit granted by a bank to a certain type of enterprise in the current year, and the number of credit-granting enterprises refers to the number of enterprises that have obtained credit from the bank in the current year. It should be noted that one enterprise may obtain credit from multiple enterprises at the same time. PostTreatit is the key explanatory variable indicating whether the commercial bank is a cooperative bank of policy financing guarantee. If the commercial bank i joins in the cooperative banks in year t, PostTreatit=1, when T≥t. μi and λt refer to fixed effect and annual time effects of banks. xit are control variables, including the number of local outlets, registered capital, whether it is a listed company, ownership, and annual sales revenue. We use bank-level clustering with a robust standard error to calculate the standard deviation of the error term.

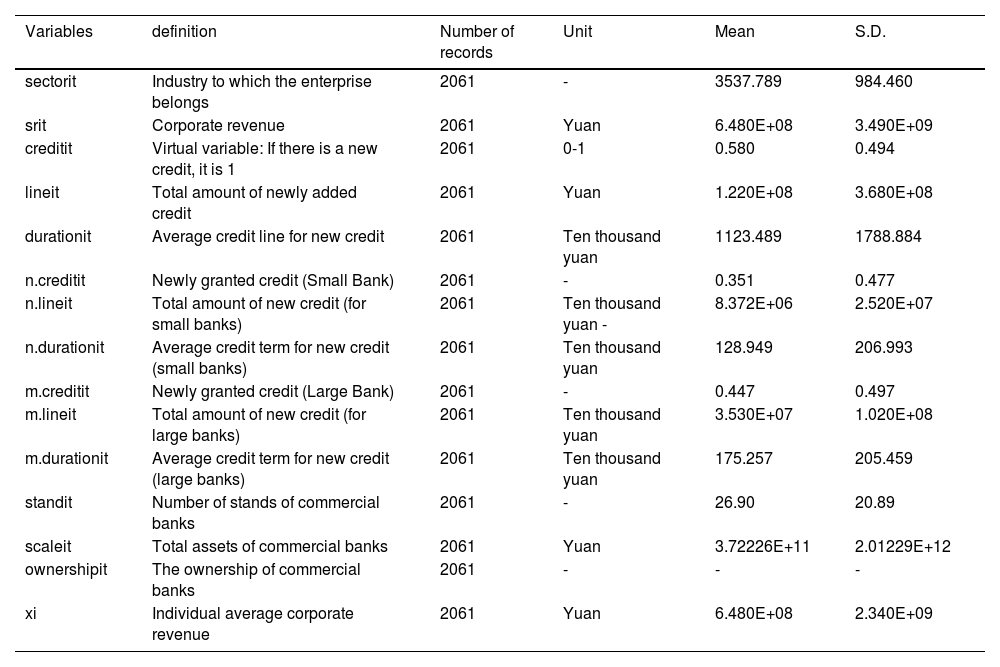

Data and descriptive statisticsOur analysis is built on the datasets from credit information-sharing platforms in Taizhou, China. This dataset includes various indicators of all enterprises registered in Taizhou and is updated by every government department and central bank in Taizhou. The dataset contains detailed information on the commercial banks of Taizhou (i.e., registered capital, whether it is a listed company, ownership, and annual sales revenue) and operation-related variables. Start-ups are usually defined as enterprises with 2–10 employees (Andersson & Xiao, 2016). However, since the indicators reflecting the number of employees are not included in the data source, we define the firms under five years old as start-ups. The identification of start-ups is based on their registered names and date of establishment. To reveal the role that digitalizing initiated by policy financing guarantees plays in credit availability and performance growth, we take whether an enterprise is granted with bank credit as the first-response variable. If an enterprise is granted this, we label it as 1; otherwise, we label it as 0. As performance growth is closely related to the development of industry, we introduce a dummy variable to eliminate industrial difference. If an enterprise achieves sales growth rate higher than the average level of its industry, we label it as 1, or 0 otherwise. Table 1 presents the descriptive statistics of the main variables in raw data.

Descriptive statistics of main variables in raw data.

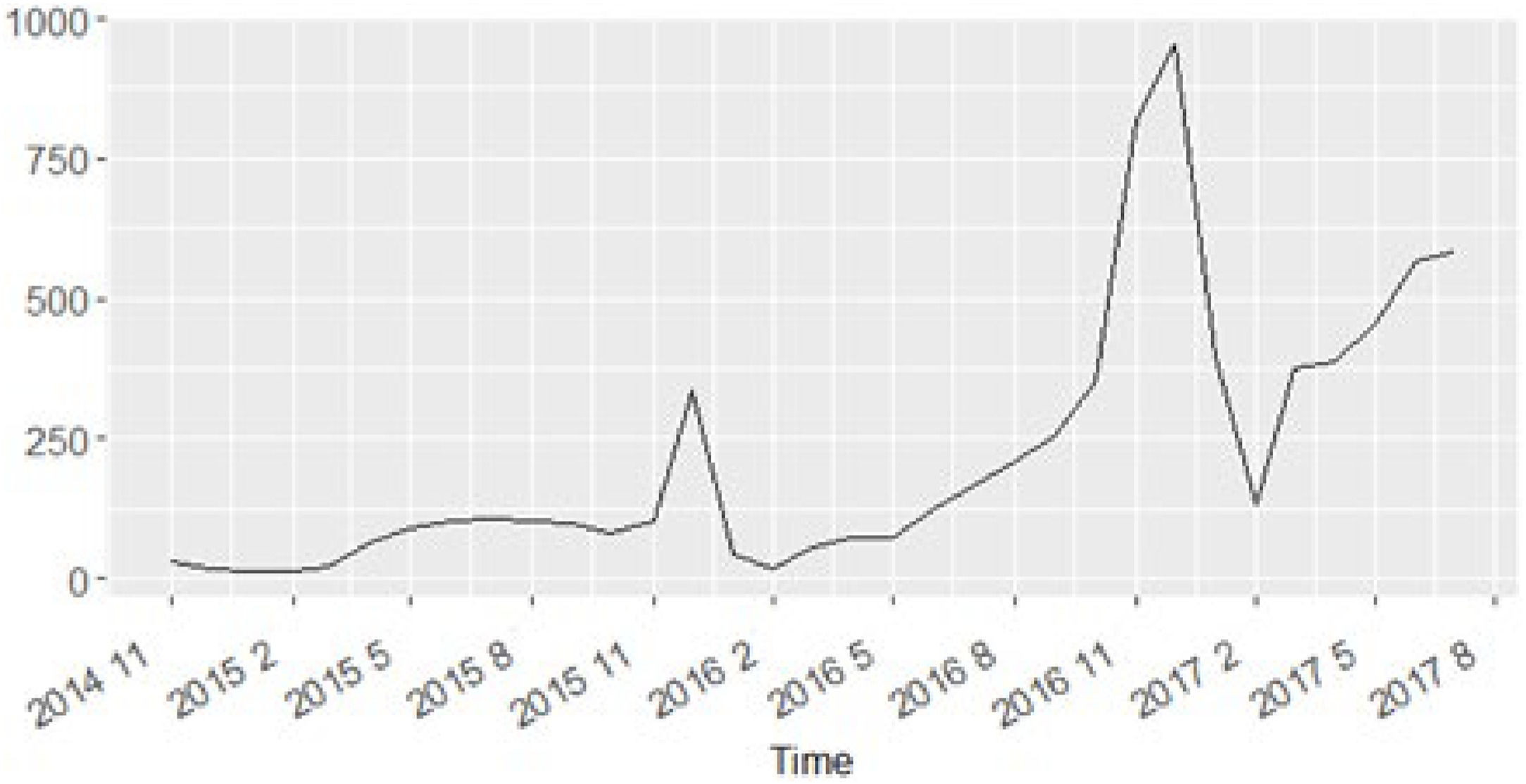

Taizhou's policy guarantees were established in November 2014 and a credit information-sharing platform was set up in the same year. However, data shows that only three companies received policy financing guarantees that year, and a large number of companies only received guarantees from Taizhou's policy guarantees scheme after 2015. Therefore, when using an original DID model to estimate the impact of bank digital transformation on bank credit supply, this article chooses 2015 as the starting point of policy implementation. Fig. 1 shows the number of enterprises that have received policy financing guarantees every month since the establishment of Taizhou's policy guarantees. It suggests that the policy effectiveness of bank digital transformation is gradually realized at the enterprise level.

Commercial banks have achieved digital transformation by participating in policy guarantees, resulting in a significant increase in the number of enterprises obtaining bank credit through guarantees, as well as an increase in credit lines and durations. However, Fig. 1 shows that in the early stages of the establishment of the credit information-sharing platform in Taizhou City, there was a short-term slight increase in the bank's credit supply, but then a significant decrease followed, which led to a gradual recovery after 2016. Therefore, the impact of digital transformation on the credit of banks exhibits significant heterogeneity over time.

Empirical modelsIn this study, the dependent variables, the scale of bank credit supply is a non-negative variable, and the structure of credit supply is a proportional variable. Therefore, we adopt the nonlinear staggered DID proposed by Wooldridge (2021), constructing an equivalent regression model for the TWFE model using the TWM model and using Quasi Maxim Likelihood to estimate model parameters.

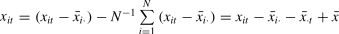

The equivalent model method for TWFE regression based on TWM regression is as follows. For longitude variables {xit}, iϵ{1,⋯,N}, tϵ{1,⋯,T}, define xiẗ as

If ∑i=tN∑t=1Txiẗ′xiẗ is nonsingular matrix, the estimated results of the TWFE model are equal to those of the TWM model, and the TWFE model is given as below:

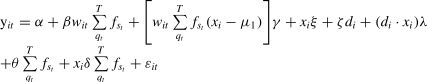

in which x¯i· represents the individually average value of the covariate, and x¯·t represents the timely average value of the covariate. Wooldridge (2021) confirmed that if the variance in a typical random-effect model is known, the equivalence is established. Therefore, under the standard random effect hypothesis, at this time, the Mixed Ordinal Least Square (POLS) estimation is the best linear unbiased. To control the time effect, a dummy variable of time is added to the covariant {fst:t=2,3,⋯T}. Only when s=t, fst=1, if s≠t, fst=0. In this estimation result, the coefficient of fst is the fixed effect at time t. To eliminate the individual effects and time effects that cannot be estimated in the model (1), the following changes are made, and we obtain a mixed panel model (2): in which wit=di·pt=PostTreatit, and di is a dummy variable of the processing group. If the enterprise belongs to the processing group, that is, it ultimately obtains a policy financing guarantee, then di=1, otherwise di=0; pt is a dummy variable of time, which equals 1 if t is the time after the treatment. Thus, if the treatment time is the q-th period, pt=∑qtTfst and the coefficient of wit is the estimated value of ATT. μ1=E(xi|di=1) is the mean vector of covariates of treated group. Since wit=wit·pt=wit·∑qtTfst, formula (2) can be rewritten as formula (3):Model (4) does not include incalculable individual and time effects, and the coefficients can be estimated by pooled ordinal least square (POLS). Finally, we obtain the equivalent model of Model (1). However, the dependent variable yit is not a restricted and independent, identically distributed continuous variable; thus, yit∈(−∞,+∞). The dependent variables used to evaluate the financial support effect of digitalizing initiated by policy financing guarantees do not meet the assumptions of the dependent variables in Model (1). The commercial bank credit scale is a non-negative variable, and the variables of credit structure distribute between 0 and 1. Thus, we should change Model (3) to apply the data of which the dependent variables are non-negative or limited-distributed. In the existing literature, a generalized linear model has commonly been used for such dependent variables, using the Canonical Link Function to project a linear function into the interval of the dependent variable's distribution. According to the same research idea, the equivalent regression model for constructing a nonlinear TWFE model is as follows. The Link function G(·) is strictly increasing, continuously differentiable, by which the linear part on the right side of Model (3) is project into the distribution interval of yit.

Using bank credit scale and credit structure as dependent variables, we construct two generalized linear TWM regression models:

By the dummy variables of time and treatment, Model (6) and (7) are translated into Model (3). Model (6) is the Logit model.

Explained Variable yit1 is the credit scale of bank i in year t satisfying binomial distribution, and the link function G1(zit1)=exp(zit1)/1+exp(zit1). Model (7) is a Poisson regression model, in which yit2 is the credit structure of bank i in year t satisfying Poisson distribution, and the link function G2(zit2)=exp(zit2).

PostTreatit is the explanatory variable. The annual statistical data for this empirical study is from 2013 to 2019, and t∈{1,2,⋯,7}, t=1 if year = 2013. If the establishment time of the policy financing guarantee is taken as the policy implementation time point for discussion, according to the previous analysis, the year 2015 (rather than the actual establishment year 2014) must be taken as the time point for the processing factor to occur—in other words, q=3. For the dummy variables of time {fst}={fs2,fs3,⋯,fs7}, only when s=t, fst=1. di is the dummy variable of treated group, which equals 1 if the commercial bank is the co-operative bank of policy financing guarantee agency. pt is the dummy variable of treatment time, which equals 1 only if t≥3. Additionally, according to the definition of pt, pt=∑qtTfst. wit=di·pt=PostTreatit, and the marginal effect of wit is the estimated value of the credit-enhancement effect (ATT) of the policy financing guarantee.

The control variables at the enterprise level encompass the duration of continuous operation (measured in years), total operating revenue from the previous year, enterprise type, and total export volume from the previous year. The selection of these control variables was informed by the relevant literature (Cheng & Lin, 2015; He et al., 2012; Nguyen & Canh, 2021; Nicolas, 2022; Moro et al, 2020; Sheng & Fan, 2020;), which has primarily focused on factors associated with the transparency of information within technology-based enterprises. Additionally, the study incorporates the “three qualities and three forms” principle of loans from small corporate banks in Taizhou (Liu, 2014; Zhang, 2002). Owing to constraints in data availability, the final control variables utilized in this study are business operation duration (in years), the previous year's total revenue, the enterprise type, and the previous year's total export value.xi is the vector of the control variables at the bank level that does not change over time. Non-time-varying variables can be directly incorporated into the model, while time-varying variables follow the treatment method of Wooldridge (2021), incorporating their enterprise level mean values into the model as non-time-varying variables.

μ1=E(xi|di=1) is the vector of the treated group's mean value. The coefficients of models are estimated by Quasi-MLE.

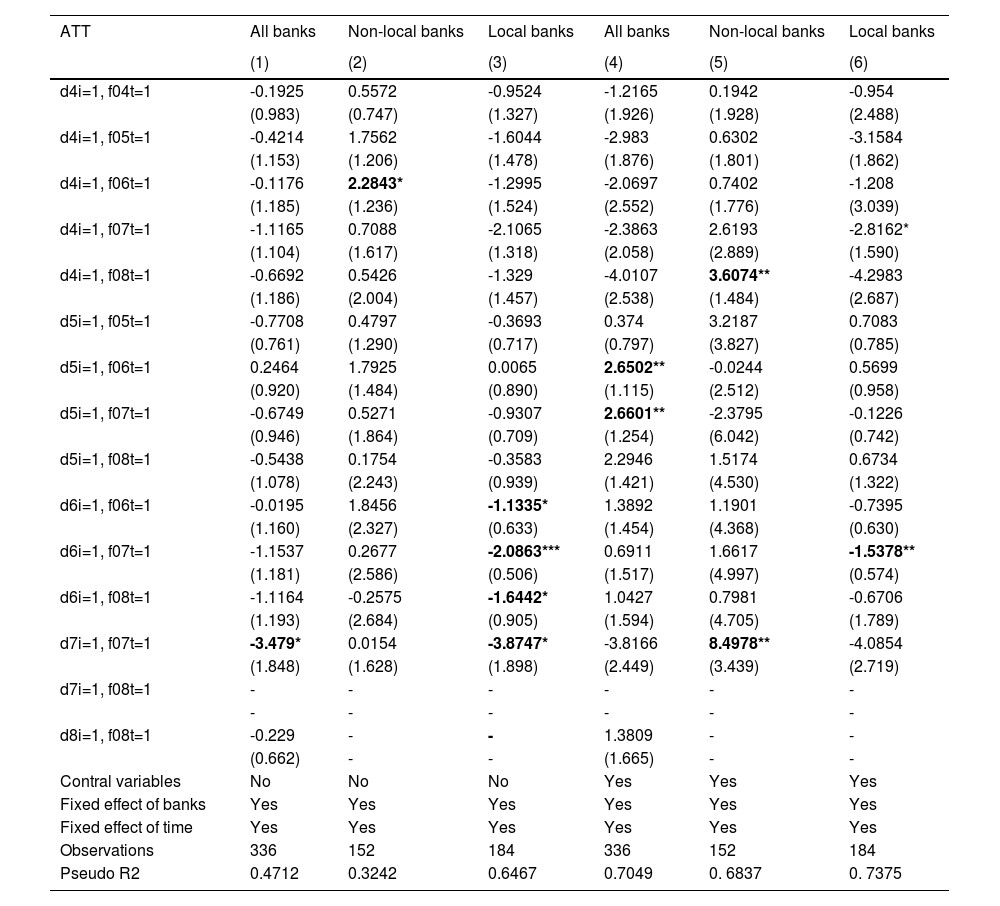

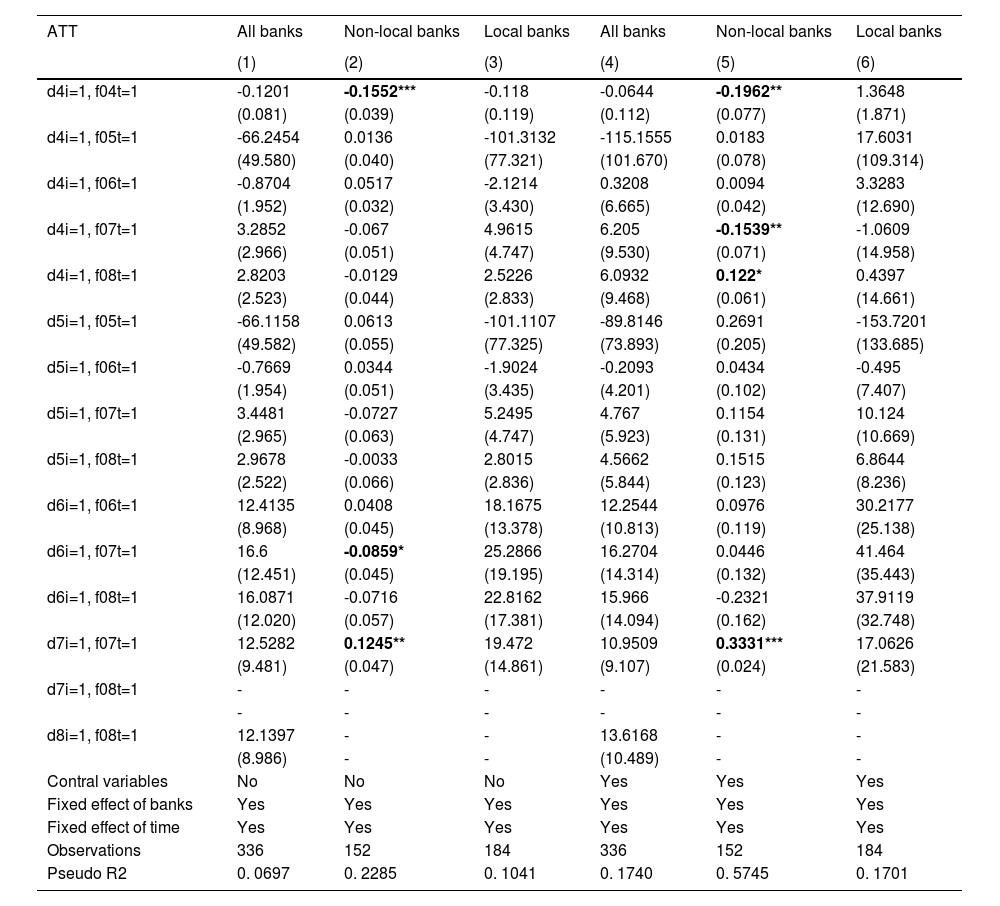

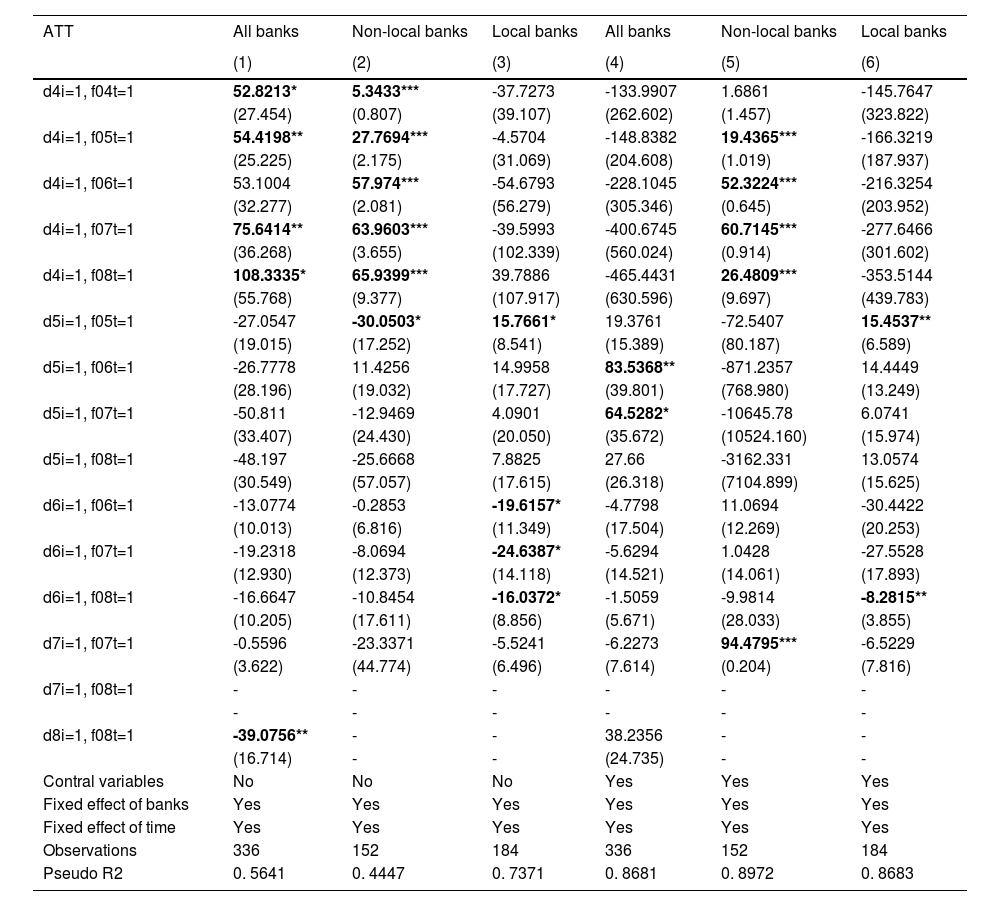

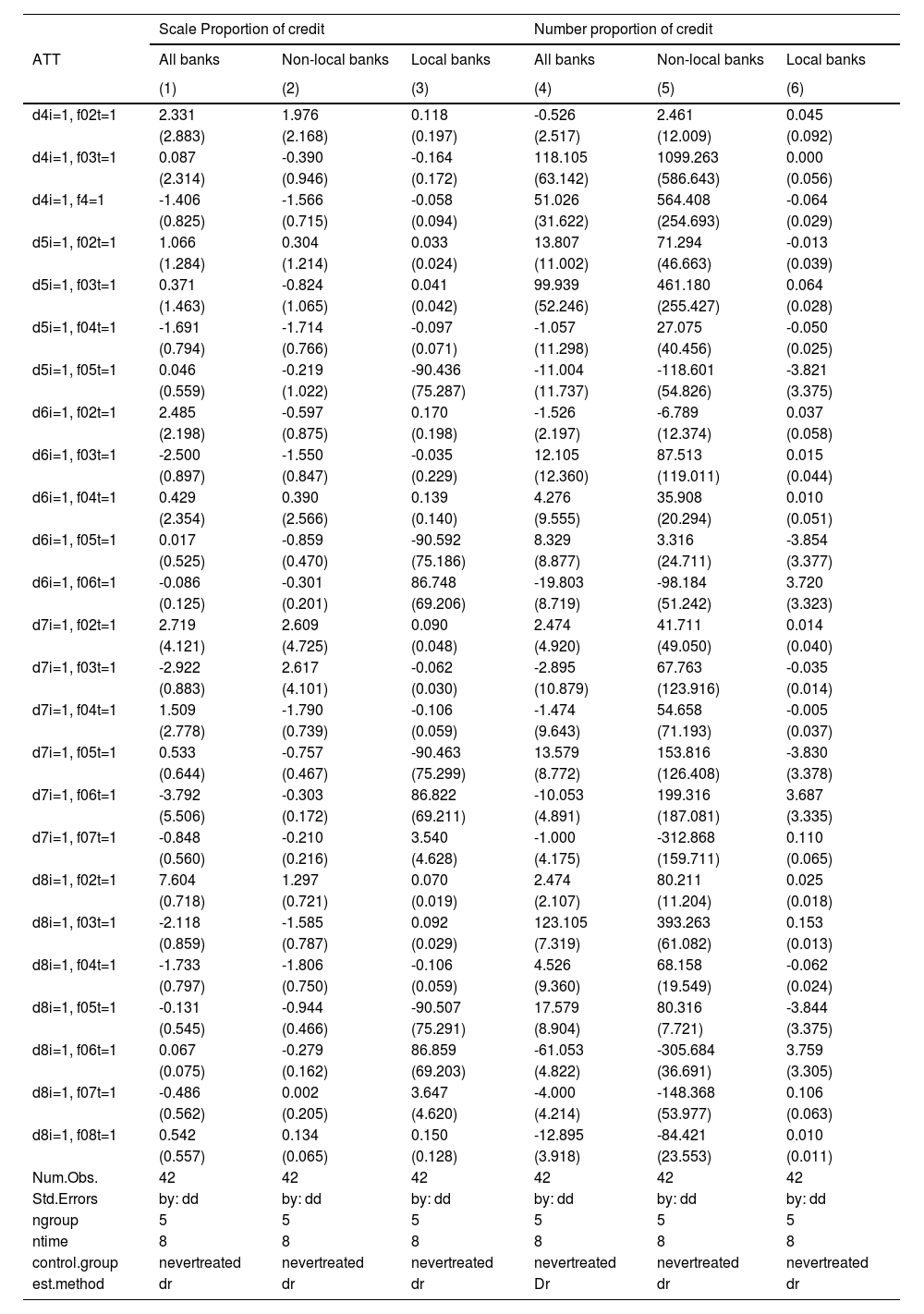

Empirical results and discussionsEmpirical resultsTables 2–5 report the number of credit-granting enterprises and the credit scales by commercial banks. Tables 2 and 4 are calculated in absolute terms, while Tables 3 and 5 are calculated in proportion terms. In terms of bank credit scale, without considering the control variables, the results for all banks in the seventh period (year 2019) are significant and negative, which indicates that the digitalizing initiated by policy financing guarantees have reduced the credit supply of technological enterprises. However, under the control of covariates, the digitalizing initiated by policy financing guarantees has a positive impact on the credit supply of technological enterprises in some periods. The impact of local and non-local banks is in the opposite direction. Regardless of whether the covariate is controlled or not, the significant impact of the digitalizing initiated by policy financing guarantees on non-local commercial banks is positive, while that on local commercial banks is positive.

ATT of the credit scales of commercial banks.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * *indicating significant differences at the 10%, 5%, and 1% level, respectively; control variables at the enterprise and industry levels have been controlled in the table.

ATT of the credit scales structure of commercial banks.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * *indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table.

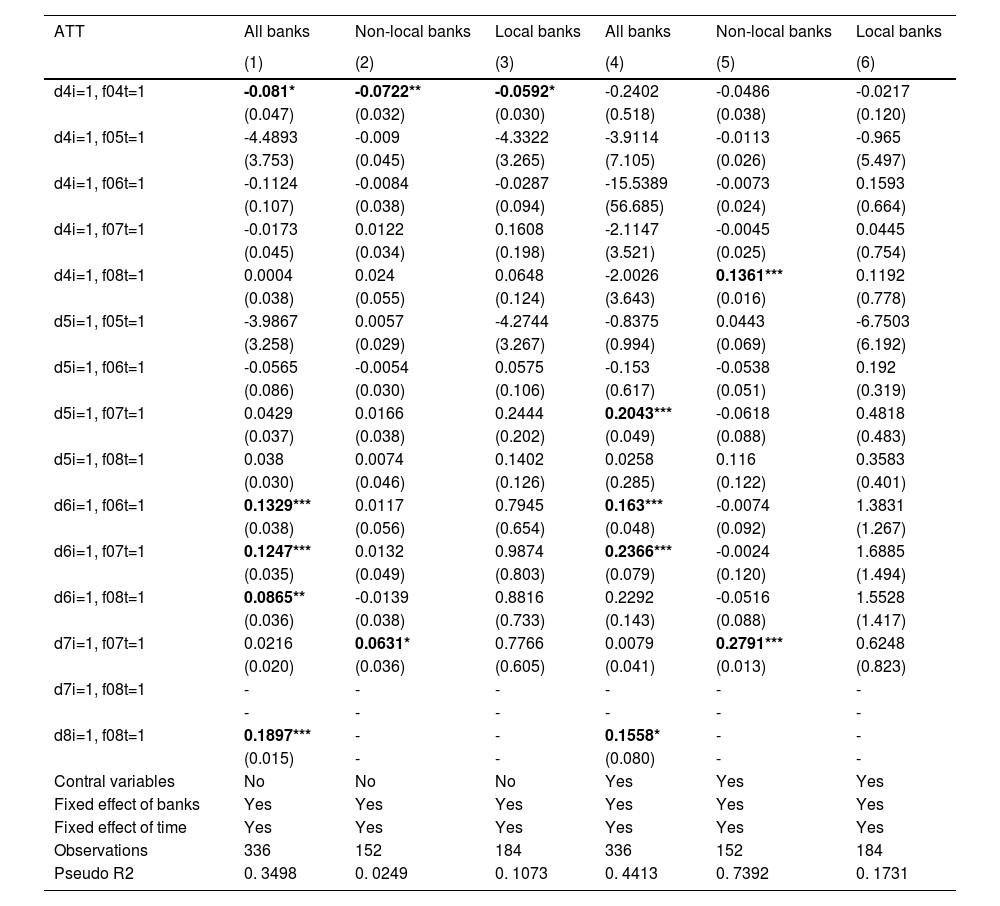

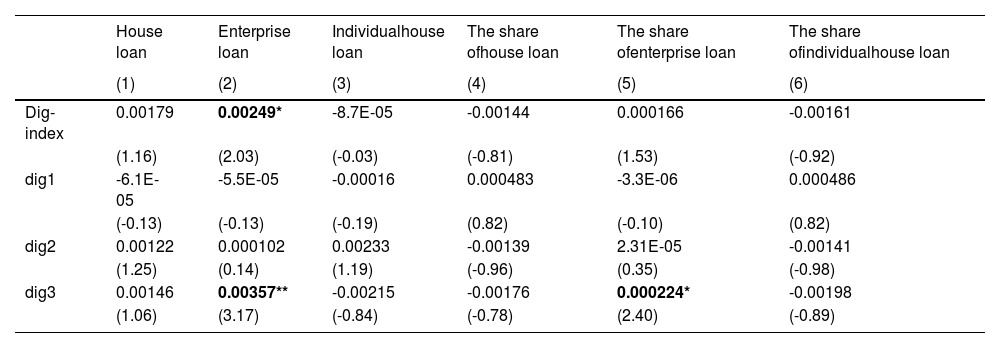

ATT of the number of enterprises granted credit by commercial banks.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * * indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table.

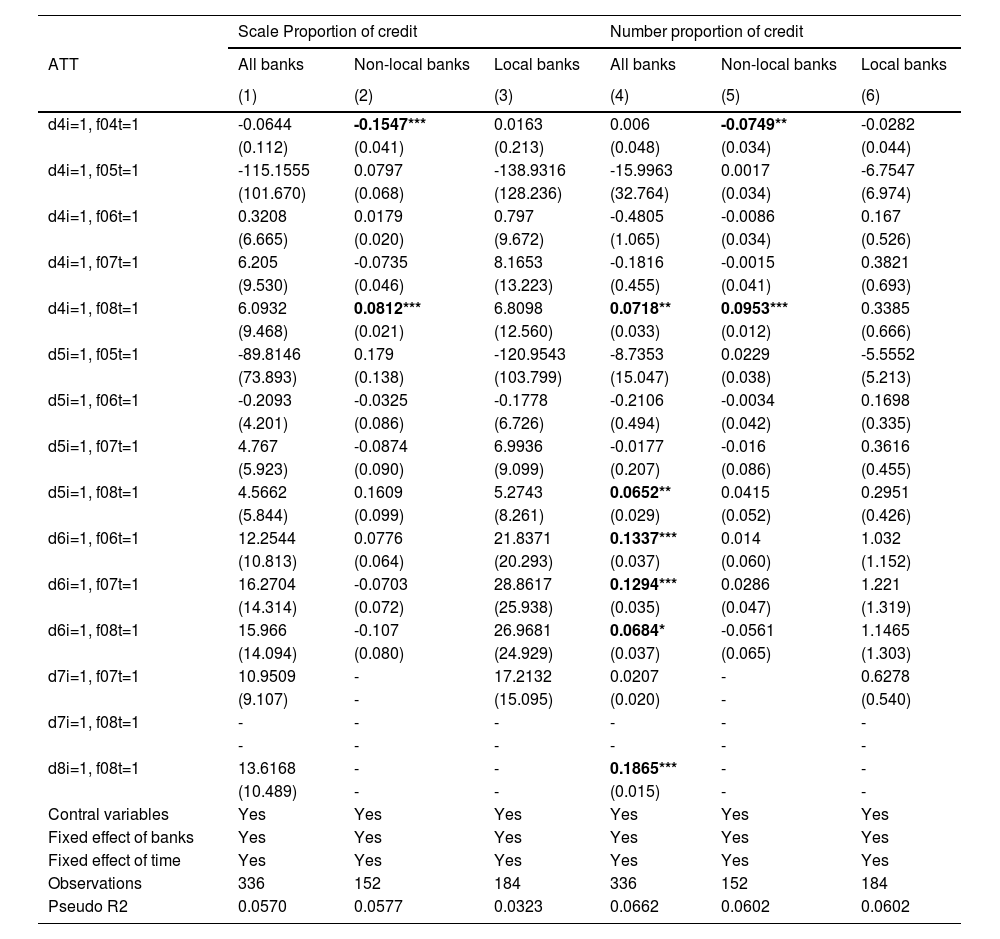

ATT of proportion of enterprises granting credit by commercial banks.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * * indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table.

The 1st to 3rd columns in Table 2 are the estimated results of the regression model without control variables, while the 4th to 6th columns are the estimated results of the regression model with control variables included.

However, the proportion of credit supply for high-tech enterprises in the credit supply of various banks has not been positively affected by policy guarantees. In most periods, the impact of digitalizing initiated by policy financing guarantees on the scale of credit supply to high-tech enterprises is not significant. Regardless of whether the covariate is controlled or not, the impact of policy guarantees on the proportion of credit supply scale of high-tech enterprises in the credit supply of all commercial banks in the city is not significant. The same is true for the processing effect of local commercial banks. However, the credit structure of non-local commercial banks is similarly affected. Although Table 2 shows that the credit supply of technological enterprises has increased, the proportion of credit supply of technological enterprises in the total credit supply of various banks has declined; this decline mainly occurred in the early stage of the establishment of policy guarantees (year 2016). In the near future (year 2019), policy guarantees would have a positive impact on the proportion of credit supply scale for technological enterprises.

Unlike the calculated results of credit scale, the number of high-tech enterprises granting credit has been significantly affected by the digitalizing initiated by policy financing guarantees. Regardless of the enterprises’ geographical differences, for all banks in the city, cooperation with policy financing guarantee institutions can significantly increase the number of high-tech enterprises that receive bank credit. When the policy financing guarantee fund was first established, cooperation between nonlocal banks and the policy financing guarantee fund can significantly increase the number of technological enterprises that have obtained their credit. However, this conclusion is not valid for local commercial banks. Conversely, cooperation with policy financing guarantee institutions in 2018 has actually reduced the number of technological enterprises granted credit by local commercial banks.

The result of the proportion of enterprises is completely different from the absolute value of the number of enterprises. When the Credit Insurance Fund was first established, the cooperation with the policy guarantee fund reduced the proportion of the number of high-tech enterprises granting credit in the total number of credit enterprises of each bank, whether local or nonlocal banks. However, it is optimistic that over time, the impact of cooperation with policy guarantee funds on the proportion of high-tech enterprises has become positive, especially for nonlocal banks. The cooperation between local banks and the digitalizing initiated by policy financing guarantees will not affect the proportion of high-tech enterprises that receive their credit.

Robustness test(1) Robustness test of changing model settings

In the basic analysis, we use three variables as the control variables of the bank, namely, the number of bank outlets, registered capital, and ownership nature. To verify the robustness of the empirical results, we only use the number of bank outlets as a single covariate to estimate the processing effect of the digitalizing initiated by policy financing guarantees. Table 6 shows the estimated results after changing the control variables. The results are similar to the previous results. When setting up a policy financing guarantee fund, the impact of the cooperation between banks and policy financing guarantee funds on the credit scale and the proportion of high-tech credit-granting enterprises is either not significant or significantly negative. Over time, the impact of cooperation with policy guarantee funds on the proportion of high-tech enterprises has become positive, especially for nonlocal banks. The cooperation between local banks and the digitalizing initiated by policy financing guarantees will not affect the proportion of high-tech enterprises that receive their credit.

Robustness test of changing model settings.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * * indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table.

(2) Parallel trend test

The prerequisite for using the double difference method is that parallel trends are established, that is, before policy implementation, the development trends of the control and treatment groups are consistent, and no systematic differences will be observed over time. If the parallel trend is not established, a significant difference exists between the control and treatment groups before and after the policy financing guarantee, and the double difference cannot estimate the actual treatment effect of the policy. By calculating the marginal effect of the interaction term between the pre-guarantee time point and the processing group in the multi-timepoint DID model, we estimate whether a difference exists between guaranteed and unguaranteed enterprises before obtaining the digitalizing initiated by policy financing guarantees. If the estimated marginal effect is significantly nonzero, the null hypothesis of parallel trend formation is rejected; conversely, if the estimation result is not significant and nonzero, the null hypothesis that parallel trends hold is accepted.

Table 7 reports the parallel trend test of the multi-timepoint DID model. The results indicate that before the digitalizing initiated by policy financing guarantees is obtained, no significant statistical difference exists in the bank credit limit and credit term between the treatment and control groups, and the parallel trend hypothesis is valid. The previous estimation of the credit-enhancement effect of the digitalizing initiated by policy financing guarantees indicates that this digitalizing is conducive to promoting the increase of credit limits for banks to technology enterprises. This conclusion effectively proves that the double difference model satisfies the parallel trend assumption, and the estimated value of the ATT model can effectively reflect the impact of digital transformation on banks’ credit structure.

Common trend test.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * * indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table.

(3) Placebo test

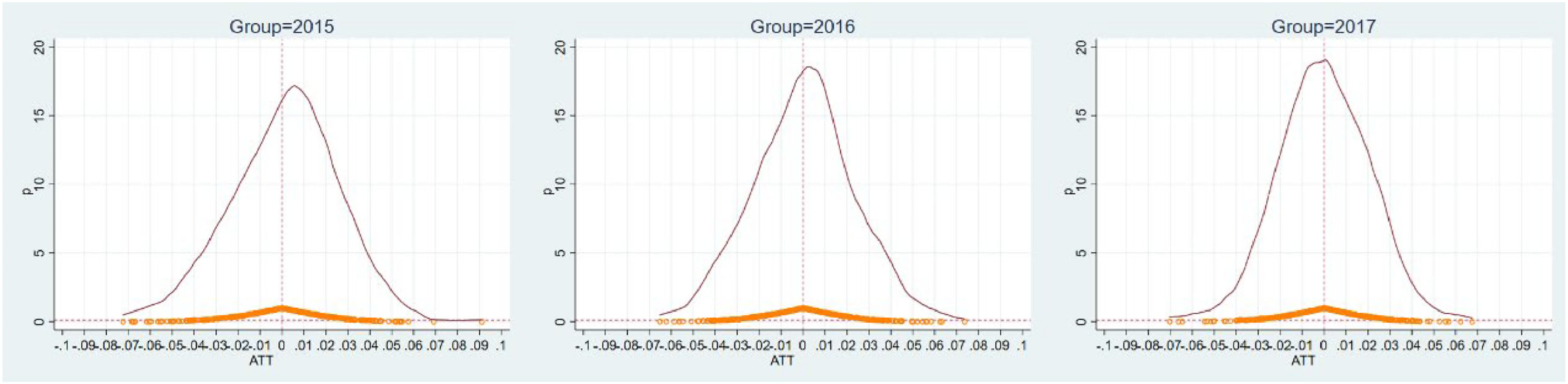

The placebo test is a counterfactual test conducted by changing the implementation time of policies. The data are grouped by banks, and one year is randomly selected from each bank as the time when it obtained policy financing guarantees. The test is repeated 500 times, and TWM regression is performed after each group is sampled. A graph of the estimated counterfactual values and corresponding P-values for digital transformation is drawn as shown in Fig. 2. The focus here is on the significance of the counterfactual processing effect. If the estimated result is significantly nonzero, this indicates that the credit-enhancement effect in this article is not caused by the digital transformation of commercial banks’ policy guarantees; conversely, it confirms the reliability of the previous research conclusions.

Fig. 2 represents the estimated values of the policy guarantee digital transformation of the guaranteed enterprises in 2015, 2016, and 2017, respectively, based on the counterfactual data. The dashed line perpendicular to the X-axis is x = 0, and the dashed line parallel to the X-axis is y = 0.1. The results show that the estimated ATT values are generally distributed at (-0.07, 0.07), and the P-values are also generally distributed above 0.1. The credit-enhancement effect of the counterfactual is not significant but nonzero, confirming the reliability of the previous research conclusions. The credit structure-adjustment effect estimated by the model is caused by digital transformation.

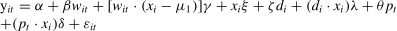

Further discussionSince that the data samples of benchmark models are only from banks in Taizhou, the generalizability of the research conclusions is insufficient. We also used imbalanced panel data on credit from 42 commercial banks nationwide from 2010 to 2021, including state-owned commercial banks, joint-stock commercial banks, urban commercial banks, rural commercial banks, private banks, and foreign-funded banks. The data on bank loans came from the annual reports, information disclosure reports, and audit reports of various commercial banks, which indicates that bank loans are invested in different industries. The Digital Transformation Index of Banks was sourced from the Digital Transformation Index of China Commercial Bank at Peking University (Xie & Wang, 2022). Additionally, we manually collected data on banks’ electronic channel business and external fintech cooperation using information disclosed in commercial bank annual reports and official websites. The financial data of banks mainly came from the Wind database and CSMAR database, and we supplemented missing data by manually querying many commercial bank annual reports. This study measured the credit allocation of banks based on four dimensions: Total Loan (TLoan), Real Loan (RLoan), Financial Loan (FLOan), and Nonzero Financial Loan (NZFLOan). Finally, to eliminate the interference of outliers, all continuous bank financial variables were truncated at the upper and lower 1% levels.

This further discussion incorporates a series of important control variables at the bank level that affect credit allocation into the model: Asset Size (SIZE), using the natural logarithm of total assets, with total assets in millions of RMB; Profit level (ROA), using the bank's average return on total assets; Liquidity level (LDR), using the bank loan to deposit ratio, which is the ratio of total loans to total deposits; loan quality (NPL), which adopts the bank's non-performing loan ratio; the Capital Adequacy Level (CAR), using the bank's capital adequacy ratio; and the leverage level (Equity), which is calculated by comparing the bank's equity assets to the total assets.

Table 8 reports the impact of digital transformation on the total scale and proportion of various types of loans. Owing to the lack of policy guarantee data at the national level, this part uses the Digital Index of Commercial Banks measured by Xie and Wang (2022) to replace the digital transformation level of various commercial banks. dig1 is strategic digitalization; dig2 is business digitalization; dig3 is management digitalization, and the dig-index is the total digital index. Models (1) and (4) in Table 8 show the impact of digital transformation on the scale and proportion of real estate loans. Models (2) and (5) show the impact of digital transformation on the scale and proportion of real economy loans. Models (3) and (6) show the impact of digital transformation on the scale and proportion of personal housing loans. The results show that, overall, the digitalization index has indeed effectively increased the scale of credit in the real economy, but its impact on the proportion of various types of loans is not significant. From different dimensions of digital transformation, managing digitalization can not only improve the credit of the real economy. This conclusion is consistent with the conclusion that Taizhou Credit Insurance Fund promotes banks’ digital transformation.

The impact of digital transformation on the nationwide credit structure of businesses.

The standard errors reported in parentheses are bank-level clustering, with *, * *, and * * * indicating significant differences at the 10%, 5%, and 1% levels, respectively; control variables at the enterprise and industry levels have been controlled in the table. To control the length, the estimated results of covariates are not displayed in the table.

This study employed panel data from 42 commercial banks and the nonlinear staggered DID to empirically test the mechanism and influencing factors of banks’ digital transformation on the scale and structure of credit supply. Empirical results showed that digital transformation achieved through policy guarantees does not have a significant impact on the credit scale of commercial banks, but it can optimize and adjust their credit structure, allowing them to increase credit support for SMEs. This conclusion is supported by a series of robustness tests. The mechanism of action provides new data elements for policy guarantees, accelerates the digitalization of management and business of commercial banks, reduces management costs, improves risk compensation, and promotes the tilt of bank credit structure toward SMEs. Furthermore, the impact of digital transformation is not homogeneous among all banks. Owing to the different management methods of various commercial banks, information-screening capabilities show significant differences, and the impact of policy guarantees on credit structure is also heterogeneous. Compared to the commercial banks headquartered locally, the digital transformation of policy guarantees has a more significant impact on the credit structure of nonlocal commercial whose businesses operate across regions. To further verify the universality of the conclusion, we used nationwide credit data from 42 commercial banks to confirm that digital transformation can effectively increase their credit supply to tilt toward SMEs and the real economy.

This study provided an in-depth empirical analysis of how digital transformation, facilitated by policy guarantees, affects the credit supply structure of commercial banks. It specifically examined the shift in credit support toward SMEs, which is a critical area of focus given the relevant role that SMEs play in economic development. The use of the nonlinear staggered DID approach to assess the causal impact of digital transformation on credit supply is methodologically rigorous and offers new insights into the dynamics of credit allocation following digital initiatives. The study highlighted the role of policy guarantees in not only influencing the credit scale but, more importantly, optimizing banks’ credit structure. This finding contributes to the policy debate on how to effectively use policy guarantees to steer financial resources toward SMEs. Our study recognizes the heterogeneity in the impact of digital transformation across different types of banks, offering a nuanced understanding of how local versus nonlocal banks may respond differently to digital initiatives. The robustness of the findings was thoroughly tested through a series of robustness checks and placebo tests that strengthen the credibility of our conclusions. The conclusion of this study is consistent with the risk-based analysis by Chen et al. (2023) and Khattak et al. (2023), and further emphasizes the positive impact of digital transformation on the credit structure of non-local large commercial banks.

Despite its contributions, this study also has a few limitations worth noting. It focused on commercial banks, which may limit the generalizability of the findings to other types of financial institutions. Additionally, the focus on Taizhou—and later on the national level within China—may not capture the global diversity in banking practices and regulatory environments. Moreover, the reliance on panel data from a specific timeframe (2012–2019) might not fully capture the long-term effects of digital transformation, especially given the rapid pace of technological change in the financial sector. While this paper provides a robust empirical analysis, it could benefit from a more extensive theoretical framework that integrates existing theories of financial intermediation and digital innovation.

For future research, several avenues could be explored to build on our findings. First, investigating the impact of digital transformation on credit supply in banks across different countries could provide a more comprehensive understanding of the global implications of such transformations. Second, longitudinal studies that track the impact of digital transformation over a more extended period could offer insights into the sustainability of the effects observed. Third, future studies could incorporate a broader range of digital innovations, such as blockchain and artificial intelligence, to assess their impact on credit supply and financial inclusion. Fourth, research could examine the implications of digital transformation on financial stability by considering both the potential benefits and risks associated with the rapid adoption of digital technologies in banking. Last, further research could explore how regulatory policies can effectively promote digital transformation in banking while mitigating associated risks, ensuring a balanced approach to innovation and stability.

FundingPlease add: “This research received no external funding”.

CRediT authorship contribution statementJingwen Yang: Validation, Supervision, Methodology, Formal analysis, Conceptualization. Xiaohui Chen: Software, Data curation.