We investigate the impact of credit market deepening on innovation, considering the role of investment risk and investment potential in the context of Russian regions, analysing the panel time series data extracted from the Federal Statistics Department of the Russian Federation and using the method of moments quantile regression. Our baseline findings demonstrate that credit market development spurs innovation in the sample regions in all quantiles (q10–q90), and the credit market has a positive impact on innovation, regardless of whether investment risk is lower or higher. In addition, we reveal a U-shaped relationship between innovation and regional economic growth in Russian regions. We also observe reductions in imports and exports and a boosting effect of increased employment on innovation. We propose several potential policy measures and practical conclusions based on our findings.

A competitive economy requires a sound financial market for stable economic growth. Financial market development occurs when the efficacy of financial products, markets and market participants improves in terms of information asymmetry, legal enforcement and the cost of transactions. Although stock market development functions as the key driver for financial development in advanced economies, the banking sector still has a pivotal role in credit market development in developing countries such as the Russian Federation. As an emerging economy, Russia is primarily reliant on the hydrocarbon market and remains vulnerable to external shocks; therefore, establishing a non-resource-dependent sustainable economic landscape through promoting the private sector, economic diversification and innovation is among the key national development agendas. Previous studies suggest that innovation can promote long-term economic growth but follows a long, complicated and idiosyncratic path and promoting them often entails the risk of uncertainty. However, financial markets often develop prudential regulations or tools to minimise risk when financing innovation projects. Existing studies confirm that financial deepening promotes innovation by facilitating cost-efficient loans and advancing risk management and resource optimisation (King & Levine 1993; Beck & Levine 2004; Hsu et al., 2014). The Russian banking sector has a paramount role in the context of realising the national development policy for innovation promotion and economic diversification. The Federal State Statistics Service (2022) indicates that the Russian banking sector disburses a considerable amount of short- and long-term loans to various private firms to elevate technological innovation in the region. However, previous research suggests that financial institutes have sceptical perspectives when investing in capital-intensive innovation projects due to the uncertainty of obtaining desired outcomes and financial viability (Pástor & Veronesi, 2009; Rajan, 2012; Law et al. 2018). Given the contradictory findings regarding the role of financial development in spurring innovation, we are motivated to assess the impact of credit disbursement on the growth of innovation in Russian regions based on several distinct features.

Our motivation for investigating the effectiveness of credit market development in promoting innovation in Russian regions is inspired by a few strands of research propositions. First, scholarly inquiry regarding the role of financial development in promoting innovation dates back to the seminal 1911 study of Schumpeter (King & Levine, 1993). Schumpeter (1911) proposes that a developed financial sector effectively allocates financial resources and fosters innovation, which eventually propels economic growth and satisfies market demand. Following the influential work of Schumpeter (1911), multiple studies have examined the role of finance in innovation promotion (Robinson 1952; Solow 1957; Romer 1990; Grossman & Helpman 1994; Rajan & Zingales 1998). Previous literature offers two different propositions regarding the innovation–finance nexus. The first proposition claims that the financial market development significantly promotes innovation. Financial sector development fosters innovation by removing capital constraints for innovative projects and encouraging research and development financing (Hicks 1969; King & Levine 1993; Beck & Levine 2004; Brown et al. 2009). A well-developed credit market advances innovation by providing industries with the necessary finances for adopting and developing new technologies with which production efficiency improves (Aghion, Howitt, & Mayer-Foulkes, 2005). Additionally, financial development reduces investors’ credit monitoring costs, which mitigates agency and moral hazard challenges when issuing credit (De La Fuente & Marín, 1996; Aghion et al., 2009). In contrast, the second proposition of finance and innovation dynamics asserts that financial development discourages innovation (Stiglitz 1985; Hellwig 1991; Morck & Nakamura, 1999). Proponents of this perspective argue that credit markets are risk-averse and extend finances to established companies rather than new, risky and innovative businesses. Credit markets suppress innovation by eliciting information rent and shielding wealthy companies. Influential financial institutions have access to businesses’ private information and are able to extract information rents and a bulk proportion of the profits from such businesses, which eventually diminishes firms’ ability to invest in long-term innovative ventures (Hellwig 1991; Rajan 1992). Thus, existing theories focusing on the finance and innovation nexus are contradictory, motivating us to explore the influence of the credit market on innovation in Russian regions to investigate these seminal contributions.

Second, empirical studies related to the finance–innovation nexus propose that credit markets foster innovation by providing vital financial services. Credit markets facilitate information acquisition and manage risk to reduce transaction costs, which eventually benefits risky but lucrative innovative businesses (Levine, 1997). Innovation is pivotal to scaling up the firms’ growth (Cuevas-Vargas et al., 2022), and the financial sector can ensure the optimum capital accumulation for firms to reach a steady-state of innovation-led productivity (Zhang et al., 2019).

Financial market development shapes the innovation landscape and is therefore intimately connected to determining a country's innovation capacity (Meierrieks, 2014). A weak financial sector misallocates capital among innovative and unproductive entrepreneurs. Consequently, solvent but ineffective entrepreneurs receive funding on a priority basis, while innovative entrepreneurs relying on external funding experience delayed access to capital (Buera et al., 2011). Hyytinen & Toivanen (2005) find that deficiencies in the financial sector can hinder innovation and eventually block firm growth. He et al. (2021) also argue that bank credit is critical for advancing innovation in developing economies and financial vulnerability restricts the smooth flow of credit, ultimately hindering innovation. Conversely, ample studies demonstrate a negative correlation between financial development and innovation. For example, Brown et al. (2009) document that excessive financial development provokes monopolistic competition in the market, thereby discouraging innovation. Pástor and Veronesi (2009) find that financial sectors exhibit reluctance in encouraging innovation based on the perceived uncertain outcomes of innovative ventures. Law et al. (2018) argue that regions with weak regulatory frameworks incur the risk of breach of contract and default; therefore, credit market deepening may not significantly influence innovation. Our empirical findings indicate that there are linear and nonlinear relationships between innovation and credit market deepening, and the findings vary according to the economic, geopolitical and demographic standing of the cross-sections. As Russian regions exhibit a high level of economic and social disparity, we investigate the role of credit markets in promoting innovation in these regions with such inequalities.

Third, Russia has transformed from a command economy to a market economy paradigm over the past three decades; however, excessive dependence on natural wealth and lack of sufficient privatisation and economic diversity are among the major contemporary economic challenges (Sohag et al., 2022). Amidst this backdrop, Russia concentrates on fostering innovation to advance economic diversity and gain competitive advantage. Mariev & Savin (2010) contend that innovation has a crucial role in the total economic growth of Russia. The Russian public sector provides nearly 70% of the total innovation financing in the country (Semke & Kazachenko, 2015). Russia managed to improve its position from 45th to 43rd place on the Global Competitiveness Index in 2016, reducing the gap with the innovation leaders for 12 of the 41 relevant indicators (Davidson et al. 2018). The effectiveness of several initiatives undertaken by the Russian banking sector to promote innovation remains under-researched. This research gap motivates us to examine the impacts of credit market development on innovation referencing underlying economic theories.

We contribute to the body of literature that stresses the credit market deepening and innovation nexus in three notable ways. First, to the best of our knowledge, we are the first to investigate the effect of credit market deepening on innovation in the context of Russian regions. In this regard, we exclusively consider data for the number of innovations and bank credit extended to individual and legal business entities of Russian regions. Our panel-based approach captures both time series and cross-sectional dynamics between credit deepening and innovation, generating robust empirical findings. Second, we apply the method of moments quantile regression (MMQR) proposed by Machado and Silva (2019) which can address regional heterogeneity and potential endogeneity issues in the innovation–credit nexus. Determining quantiles via the MMQR reveals robust results by considering location and scale quantile distributions. Third, our empirical study generates fresh insights into the dynamics of innovation and credit market development, addressing regional heterogeneity. Our baseline findings demonstrate that credit deepening significantly spurs innovation in Russian regions; however, we find that credit development alone is inadequate for promoting innovation. A favourable investment climate with low business risk is crucial for attracting more innovation financing in Russian regions.

The remainder of our paper is organised as follows. In section 2, we examine the existing literature and present our research hypotheses regarding the impact of bank credit on innovation promotion in Russian regions. Section 3 describes the dataset, model selection and econometric estimation processes applied. In sections 4 and 5, we present our results and subsequent discussion regarding the results. We conclude by proposing some policy measures and future research potential in section 6.

Hypotheses developmentIn this section, we establish three testable hypotheses with which credit deepening potentially influences innovation based on different economic theories and empirical studies. First, we observe whether credit deepening spurs innovation. Second, we assess whether investment risk has any link to promoting innovation through credit deepening. Third, we examine whether the investment potential has any link to promoting innovation through credit deepening.

Innovation and financial deepeningThe proposition that bank credit spurs innovation has received significant academic attention. Schumpeter (1911) establishes the theoretical basis for further studies on this issue. The author argues that a well-developed financial market promotes innovation through extending credit. Following Schumpeter, several economists investigated the finance–innovation nexus, stressing the role of finance in promoting innovation-led economic growth. For example, Gurley and Shaw (1955), Solow (1957), Hicks (1969), Goldsmith (1969) and McKinnon (1973) argue that financial development advances innovative businesses’ capital formation through savings mobilisation, risk sharing and financial advocacy. The economic performance of these businesses ultimately impacts the aggregate growth of the national economy. Several theories also signify the role of finance in innovation promotion. For example, the pecking order theory of finance suggests that firms resort to the credit market to seek financing for new ventures (Myers, 1984), arguing that businesses usually invest in projects with internal financing (i.e., retained earnings). However, as ventures begin to grow, firms require additional financing to maintain working capital and continuously diversify business with new projects. At this stage, firms approach finance companies (particularly banks) to obtain additional capital. Laeven et al. (2015) find that a stable financial market channels funds to productive industry segments, which positively influences innovation. Loutskina & Strahan (2015) claim that the banking sector development is the prime indicator of a nation's economic strength. In the event of digitalisation, to maximise economic gain, countries must foster economic diversity and innovation influences the extent of a nation's economic diversity (Snowball et al., 2022). However, innovation is complicated and always associated with financial constraint (Magri, 2009). Demyanyk et al., (2007) propose that by amplifying credit supply and adopting stringent credit assessment mechanisms, the banking industry can stimulate innovation. Lucas (1988) and Romer (1990) argue that in the new growth theory, R&D is treated as the key determinant of innovation; therefore, the extent of R&D investment shows the prospect of innovative efforts in a region. Beck & Levine, (2004) find that financial markets have a major influence in encouraging innovation by channelling funds towards productive economic sectors. Biancone et al., (2022) state that advanced economies accumulate innovation capital and attain growth through innovation channels which include research institutions, the manufacturing industry, international and regional trade connectivity, policymakers and finance companies. Eventually, the development of the credit market favourably impacts innovation; however, underdeveloped countries encounter restricted access to the global innovation–finance ecosystem due to a lack of channels. This limitation may restrain the impact of financial development on innovation in such countries (Singh et al., 2022). Nanda & Nicholas (2014) show that turmoil in the banking sector at the time of the Great Depression significantly decreased the number of patents, indicating the influence of the credit market on innovation.

Some studies argue that small and innovative businesses fail to provide adequate information when applying for loans (Khavarinezhad et al., 2022). The majority of small businesses are innovation-based start-ups, including e-commerce, fintech and the health tech (Sukumar et al., 2022). These businesses are heavily reliant on external financing for product development, marketing and working capital management (Onjewu et al., 2022); however, information inadequacy from these businesses makes it difficult for financiers to assess creditworthiness. Eventually, these credit providers fail to reach equilibrium in terms of price and transaction efficiency (Stiglitz, 2000). Information asymmetry from borrowers leads to adverse selection and moral hazard issues which affects agency costs. Wellalage & Locke (2020) state that agency costs constrain the credit market when fund providers indiscriminately disapprove credit to both high- and low-risk projects by failing to assess the borrowers’ risk criteria. Moreover, innovation projects are usually adopted for a longer duration than typical projects and carry higher risks; therefore, firms seeking funding for such projects confront difficulties raising capital through external financing (Giebel & Kraft, 2020).

Other studies find that credit development and innovation carry a diminishing relationship. For example, Zhu et al. (2020) argue that credit market development diminishes innovation and slows down economic growth. The authors assert that too much available credit makes innovation ineffective in propelling economic development. Trinugroho et al. (2021) claim that during the expansion of credit markets, banks tend to discourage firms from risky innovation projects, only opening opportunities to raise financing for typical projects. The authors conclude that fewer innovation projects yield a prolonged return, reducing possible contributions to innovation-led growth.

In contrast, Chen et al. (2010) argues that the formal financial sector facilitates firms’ innovation through cost-effective long-term loans. Xu et al. (2021) finds that a developed financial system encourages innovation by offering low-cost capital to innovative businesses with which firms reduce production costs and enhance productivity. Rothwell (1992) asserts that a longer repayment time helps innovative firms engage in designing, testing and implementing new products related to firm innovations. The credit development literature suggests that one of the prime objectives of financial markets is to address adverse selection and moral hazard issues. Overcoming these two challenges can reduce firm expenditures related to securing external financing. Rajan & Zingales (1998) show that credit markets promote economic growth by providing low-cost financing to businesses that need external funding. Hicks (1969) argues that undertaking innovative projects requires long-term illiquid capital investment and financial markets provide those investments by establishing liquidity facilities for investors. Aghion et al. (2005) find that a dearth of credit supply adversely affects innovation and consequently distresses economic growth. Giebel & Kraft, (2020) contend that the availability of bank financing may influence firms’ decisions to undertake new and innovative projects because of special features such as timespan, objectives and financing needs and characteristics such as goals, external financing requirements and asymmetric information bias. Therefore, the progress of innovation in any region relies on the extent of its financial sector's capital mobilisation efficiency. These arguments suggest that financial sector development has influenced both innovation and economic growth. The above discussion leads to our first hypothesis.

Hypothesis 1 Credit deepening promotes innovation in Russian regions.

Financial markets assist market participants with risk diversification, which nurtures innovation (King & Levine, 1993). However, innovative firms spend a significant amount of time designing and developing new products with the application of modern technology. Because of long-term R&D processes and uncertain outcomes, innovative projects are considered riskier than regular projects (Schäfer et al., 2004). The extent of riskiness can be beyond precise description and cannot be defined using mere mean-variance analysis (Hall & Lerner, 2010). Subsequently, innovative projects usually entail more risk than typical projects. Hsu et al. (2014) argue that credit markets remain sceptical about financing innovative companies for two reasons. First, the credit market lacks the ‘feedback effects’ observed in ‘noisy rational expectation equilibrium’. Rajan (1994) proposes that banks may continue to finance enterprises with negative returns in the absence of price indicators. Consequently, the banking sector may impede the effective flow of innovation financing (Beck & Levine, 2002). Second, most innovative businesses generate irregular and inadequate revenue to serve the loans (Hall, 2002); therefore, bank loans are perceived to be an unfavourable financing option for highly risky innovative companies (Carpenter & Petersen, 2002). Stiglitz (1985) argues that the risk aversion of banks bars enterprises from investing in risky innovative projects adequately. Additionally, investing in innovation can cause agency problems when managers become shareholders; therefore, banks tend to avoid approving loans to innovative businesses based on managers’ and shareholders’ fear of overinvestment.

Another strand of literature finds that financial development hinders innovation when endeavouring to avoid the risk of losing current customers. For example, Trinugroho et al. (2021) and Brown et al. (2009) contend that with their flexible financing system, financial markets sometimes allow young and innovative businesses to compete with traditional and less innovative companies. This competition can cause creative destruction, pushing innovation and monopolies in the market system. However, such credit market deepening can harm innovation. As banks tend to safeguard customers’ interest, they would be sceptical of the competition, ultimately slowing down innovation (Adeniyi et al., 2015).

Several empirical findings support the perspective that banks are reluctant to grant loans to high-risk innovative projects. For example, Hall & Lerner (2010) assert that innovative firms equipped with higher intangible assets such as R&D and intellectual property find it hard to manage collateral-free debt financing because banks usually prefer tangible assets as collateral for granting credit (Abor & Biekpe, 2007). Jarboe and Ellis (2010) find that innovative firms strive to obtain collateral in the event of the need to raise finance because of being in a largely intangible asset class. Keasey & Watson (1994) find that although banks are prime debt holders in financial markets, they are more risk-averse than their counterparts, equity holders. Stiglitz & Weiss (1981) find that banks only design loan contracts to attract low-risk projects and retain business interest. Petersen & Rajan (1995) claim that the banking sector has an intrinsic prejudice against high-risk investments. This bias discourages enterprises from investing in highly innovative projects (Morck & Nakamura, 1999). Taskinsoy (2022) finds that commercial banks are more reluctant to finance innovative projects than equity market counterparts because of their risk-averse nature. Hsu et al., (2014) also assert that banking sector's low risk-taking approach limits innovation potential. The authors conclude that innovation firms’ intangible asset quality raises difficulties for banks to assess creditworthiness and the value of collateral; therefore, banks generally refrain from investing in innovation projects to avoid risk.

In contrast, Comin & Nanda (2019) argue that a well-functioning credit sector encourages firms to adopt innovative technologies by minimising liquidity risks. Kalemli-Ozcan et al. (2003) propose that credit markets offer several risk-sharing tools with which specialised technologies can be promoted. Cetorelli et al. (2001) claim that firms reliant on external funding can grow business more rapidly in a developed credit market. Xiao & Zhao, (2012) find that credit markets with less government ownership positively affect innovation. In another study, Law et al. (2018) argue that credit market deepening may not influence innovation in countries with poor governance systems, but the effect of credit market development on innovation is positive and significant in countries where institutional quality is higher. Dabla-Norris et al. (2012) assert that innovation cannot prosper and productivity is hindered in the absence of an effective credit market. Gatti and Love (2002) find that smooth access to credit improves firms’ productivity. Sharma (2007) determines that countries with stable credit markets offer more innovation opportunities, particularly for small businesses. Existing literature suggests that innovation projects face the challenges in raising finances because of an inherently prolonged return structure and higher financing requirements. However, with the development of the credit market, this barrier begins to diminish and financiers usually diversify the risk inherited with these projects. Therefore, King & Levine (1993) contend that given the phenomenon of risk-return trade-off, credit market participants invest more in innovation following risk diversification and portfolio maximisation strategies. Gorodnichenko et al. (2010) argue that although globalisation positively impacts innovation, the presence of a stable credit market can still be a key driver for countries to exploit technological spill-overs. Based on the above empirical evidence, we develop our second hypothesis.

Hypothesis 2 Investment risk affects innovation promotion.

In a market economy framework, firms require continuous innovations to ensure competitiveness, and meeting this requirement necessitates a high volume of investment (Duane Ireland & Webb, 2007). Alam et al. (2019) propose that investment in innovative ventures is a key determinant of economic development. Hall (2002) finds that innovative projects yield higher returns than routine projects, and the prospect of higher returns motivates enterprises to invest in innovation. Jafari-Sadeghi et al. (2023) and Sadraei et al. (2022) argue that investing in technology is central to growth and development has accelerated the emergence of digitalisation in the business world. Therefore, as Bakker (2013) argues, investment in innovation over the past few decades has been phenomenal. However, several studies claim that firms experience funding constraints for several reasons that ultimately constrain investment decisions (Leitner & Stehrer, 2013). Carpenter & Petersen (2002) find that information asymmetry, highly fluctuating rates of return and lack of collateral often make it difficult for high-tech companies to secure bank loans. Petryk et al. (2020) assert that maintaining a higher investment potential is crucial for a region to support local businesses with the finances needed for growth and development. Therefore, regions indulge in competition to attract investments and conquer markets (Camagni, 2002). Tagoe et al. (2005) suggest that the management of public debt, overall economic environment, accessibility of collateral and the quality of firms’ bookkeeping and investor relationships affect the overall investment climate of the regions. Some studies argue that a region's institutional quality determines the extent of the business potential of that region, determining that regions with good institutional quality tend towards more innovation finance than those in with low institutional quality (Levine, 1998; Marcelin & Mathur 2014; Law et al., 2018). The authors conclude that credit markets that are located in regions with a strong legal environment, efficient bureaucracy and a low rate of corruption are capable of minimising investment risk and increasing the potential for investment. Therefore, innovative firms within such regions’ financial market benefit from financing more than those located in regions with a weak governance atmosphere and investment potential. Another study determines that the rule of law, stable political practice and government accountability (some of the major drivers of investment potential), positively affect credit market development–innovation nexus, suggesting an investment-friendly business climate for innovation financiers (Agyemang et al., 2018).

Levine (2003) finds that the financial sector supplies the necessary investment to the private sector and contributes to economic growth. Sadorsky (2010) also demonstrates that financial development assists the economy to minimise financial risk and transaction costs, increases access to investment and promotes innovation. Greenwood and Jovanovic (1990) determine that financial markets can make considerable investments through eccentric risk sharing among a large pool of investors. The supply-leading approach of finance and growth dynamics argues that financial markets induce economic growth by channelling funds from the savers to the investors (Patrick, 1966). Cline et al. (2020) find the debt market to be a significant pathway to financing for the US corporate sector, and banks have a leading role in this regard. Zeqiraj et al. (2020) assert that the banking sector is the major financier of industries in developing countries. Wellalage & Fernandez (2019) also note that private sector financing in developing economies is mostly bank-centric and equity markets have a minimal role in this regard.

Empirical studies illustrate that bank loans are more cost-effective than other types of credit, such as public debts; however, banks’ credit decisions depend on the identified business potential of the proposed project. Banks function as financial mediators and contribute to innovation promotion and economic growth (Schumpeter, 1911, King & Levine, 1993), but they also have a fiduciary responsibility of shareholder wealth maximisation. Scholtens (2006) proposes that banks satisfy the expectations of both savers and investors when forming capital investments. Banks use extensive social capital that is primarily mobilised through customers’ deposits and governments’ bailout plans to help weak banks with taxpayers’ money (Cornett et al., 2016). Thus, banks may be torn between short-term goals to maximise profit and the long-term, de facto responsibility as custodians of social capital (Herbohn et al., 2019).

Another strand of literature proposes that lenders in a stable credit market base credit decisions on considering enterprises’ present and potential financial performance, particularly risk and transaction cost-adjusted cash flow (Kumar & Francisco, 2005; Jafari-Sadeghi & Dana, 2022). Moreover, businesses with higher sales-to-assets ratios and lower liabilities-to-assets ratios are more likely to have higher access to finance. Existing literature also suggests that young, small and innovative enterprises face more credit constraints than large, established businesses (Bigsten et al. 2003). The conventional view is that innovative businesses are less likely to receive external credit (Agénor & Canuto, 2017; Hosseinzadeh et al., 2022). As noted previously, banks expect a premium to adjust for adverse selection issues and firms use collateral to vouch for projects’ quality, but innovative firms primarily possess intangible assets (intellectual property) that may constitute deficient collateral value. Therefore, banks do not consider such intangible assets to be collateral, rendering some innovative companies unable to access the required financing (Wellalage & Fernandez, 2019). Based on these empirical findings, we present our third hypothesis.

Hypothesis 3 Investment potential affects innovation promotion.

We investigate the impact of credit deepening on innovation in Russian regions. Referencing Hsu et al. (2014), Xin et al. (2017) and Pradhan et al. (2018), we use the total number of patents as the proxy for innovation. For the proxy of credit deepening, previous studies, i.e. Sadorsky (2010), consider multiple measures, including financial sector deposit to GDP ratio and private credit provided by banks to GDP ratio; however, Al Mamun et al. (2018) propose that bank deposits are highly associated with banks’ total assets because large banks usually possess a higher number of deposits. Fe & Kouton (2022) assert that bank deposits are closely linked to loans extended by the private sector; therefore, we consider loans granted to resident legal entities and individual entrepreneurs by banks and other financial institutions as our sole proxy for credit deepening.

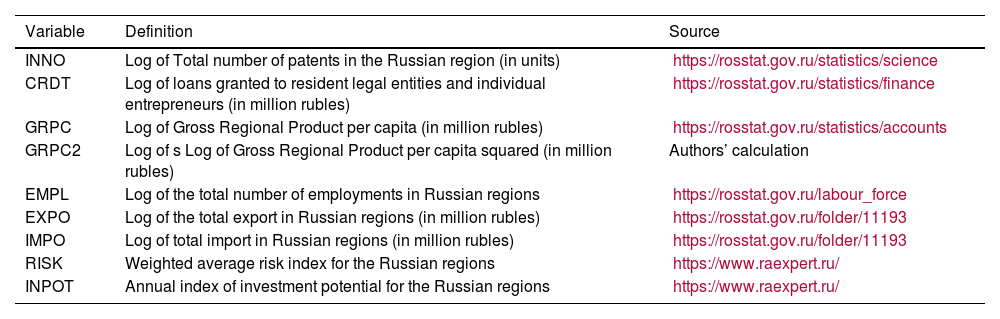

We also use some control variables to investigate our main hypothesis from different perspectives. Our control variables include gross regional product (GRP) per capita, total export, total import, total number of employed individuals, investment risk and investment potential indices, which multiple studies have used for exploring innovation and financial development and the innovation–growth nexus (see for example, Dabla-Norris et al. (2012), Pradhan et al. (2018), Mtar & Belazreg, 2021)). We use the investment risk index and investment potential index of the Russian regions to examine whether they have any indirect influence on innovation promotion. We collect data on these variables for 66 regions of the Russian Federation from the Federal-State statistics database of the country. A detailed explanation of the variables and sources of data collection is presented in Table 1.

Variables, definitions, and source

We construct the following econometric framework to test our first hypothesis that bank credit affects innovation:

where, INNO, CRDT, GRPC, GRPC2, EMPL, EXPO, IMPO, RISK and INPOT respectively denote innovation, bank credit, GRP per capita, augmented GRP per capita, employment, export, import, investment risk and investment potential.Applying the traditional conditional regression method, we model Eq. (2) as follows:

where the superscript i stands for the number of regions for the full panel, t refers to the time series, ln refers to the natural logarithm, α refers to the intercept, β represents the parameters and εi,t refers to the error term for the equations.Econometric proceduresCross-sectional dependence (CD) testsWe commence our empirical model analysis by investigating the interdependence across the cross-sections. The strong impact of economic partnership, globalisation and other mutual associations contribute to the panel data dependence problem among cross-section units. Previous studies overlooking the cross-section dependence issue for panel data estimations could suffer from CD in the dataset and reveal inconsistent findings. Therefore, Breusch and Pagan (1980) offer the Lagrange multiplier (LM) test to determine whether CD is present. The following equation contains the calculation procedure for the LM statistic:

where T denotes the time period, N illustrates the number of cross-section entities and ρ^ij2 shows the sample measure of the residuals’ cross-sectional correlation that emerges from the ordinary least squares calculation. The major shortcoming of the LM test statistic includes its suitability for a large number of Ts and a relatively small number of N. Therefore, to overcome this drawback, Pesaran (2015) developed an LM statistic to check the CD test as follows:The assumption of the null hypotheses of both LM tests indicates that cross-sectional entities are independent, as viewed in the alternative hypothesis.

Slope homogeneity testsAfter examining CD, we examined the slope homogeneity of the coefficients, applying the slope homogeneity test introduced by Pesaran & Yamagata (2008). However, slope homogeneity can result in uncertain calculations for a heterogeneous panel (Dong et al., 2018). Moreover, previous approaches to homogeneity test passed over country-specific characteristics (Bedir & Yilmaz, 2016). Hence, Pesaran & Yamagata (2008) propose a standardised dispersion test statistic (Δ~) to estimate slope homogeneity, referencing Swamy (1970), which is expressed as follows:

where the Swamy (1970) test is denoted by S̲. In the case of a small sample, the adjustedΔ~ (Δ~adj) can be specified as follows:where N is the numeral of the cross-section units, S illustrates the values of the Swami (1970) test and k indicates the number of independent variables. If the value of the level of significance (p-value) is smaller than 5%, then the null hypothesis is rejected at a 5% significance level. This implies that the cointegrating coefficients of the test statistics are heterogeneous. The Δ~ and Δ~adj are appropriate for both large and small panel samples, respectively. The Δ~ form is transmuted into Δ~adj as a mean-variance bias adjusted parameter, and v is the adjusting variance parameter. The standard Δ~ test requires no autocorrelation.Panel unit root testsWe examine the stationarity of the panel data to avoid spurious outcomes (Fang & Chang, 2016), applying the second-generation panel unit root test, cross-sectional Im–Pesaran–Shin (CIPS) (Im et al., 2003). The CIPS test assesses CD and the common correlation effect. We construct the CIPS regression using the following equation:

where Δ denotes the change mechanism, Y stands for the examined variable, Y̲t and ΔY̲t express the 1N∑i=1NYit and 1N∑i=1NΔYit, respectively and ωit is the disturbance term.Method of moments quantile regression (MMQR)We apply the MMQR proposed by Machado & Santos Silva (2019) to examine heterogeneous and distributional effects across the quantiles among innovation, investment risk, investment potential, bank credit, GDP per capita, export, import and employment in Russian regions. Koenker (2004) and Canay (2011) contend that traditional panel quantile regression methods present consistent estimations in the existence of outliers and are appropriate when the conditional means of two variables are weakly associated. However, Awan et al. (2022) assert that conventional panel quantile regressions fail to observe the probable existence of unobserved heterogeneity over cross-sectional units. Koenker (2004) and Canay (2011) argue that the MMQR method has the benefit of estimating the covariance effects among the determinants of innovation and its corresponding conditional heterogeneity that identifies their specific associations and reveals the overall characteristics of the dataset that traditional approaches accomplish by changing the mean only. Another advantage of applying the MMQR method is that it considers the possible existence of endogeneity in the descriptive variables. Similarly, this method is appropriate in conditions where a particular effect tends to immerse the variation of the entire panel. In addition, the MMQR method provisions for location asymmetries and offers considerable insights regarding non-crossing estimation in quantile regressions. Fixed effects models cannot tackle the heterogeneity issue, but the MMQR application overcomes it because it can generate heterogeneous estimation for the whole distribution. Furthermore, the heterogeneous nature of the coefficients indicates that MMQR handles heterogeneity problems. By performing mean square error analysis, Machado & Santos Silva (2019) find that MMQR provides a more robust outcome than traditional regression models. Therefore, we adopt the MMQR approach to test our hypotheses. The conditional quantile Qy(τ|X) estimations of the model of different locations and scales are determined using the following equation:

where probability P{δi+Z′itγ>0}=1,and(α,β′,δ,γ′)′ are the parameters that need to be forecasted. Individual (i) fixed effects are indicated as (αi,δi), i = 1, …..., n and the k vector of known elements of (X) is denoted by Z, which are distinguishable alterations with constituent l as follows:where Xit is independently and equally dispersed for any fixed i and also over time t. Uit is also independently and equally dispersed among the individual i through time t, which is extraneous to Xit and is uniformed to complete the moment conditions. Eq. (10) derives the following:where Xitis a vector of all the independent variables and Qy(τ|X) assumes that the operational quantiles are disseminated to the dependent variable Yit (innovation) depending on the dispersion (location) of independent variables Xit. The individual (i) quantile (τ) fixed effect is confirmed by the scalar coefficient signified as αi(τ)=αi+δiq(τ). The shift in the intercept does not characterise the individual effect in contrast to general least squares fixed effects. These constraints do not consider time variance and heterogeneity, which appropriately vary along the conditional quantile distribution of the endogenous variables. The τ-th sample quantile signified by q (τ) can be measured by considering the result of the optimisation shown in Eq. (11):where ρτ(A)=(τ−1)AI{A≤0}TAI{A>0} indicates the check function.Analysis of resultsDescriptive statisticsWe begin our data analysis by presenting the descriptive statistics for the panel data employed in our research. The overall standard deviation (SD) comprises the measures of the spatial SD (between) and the SD over the period (within).

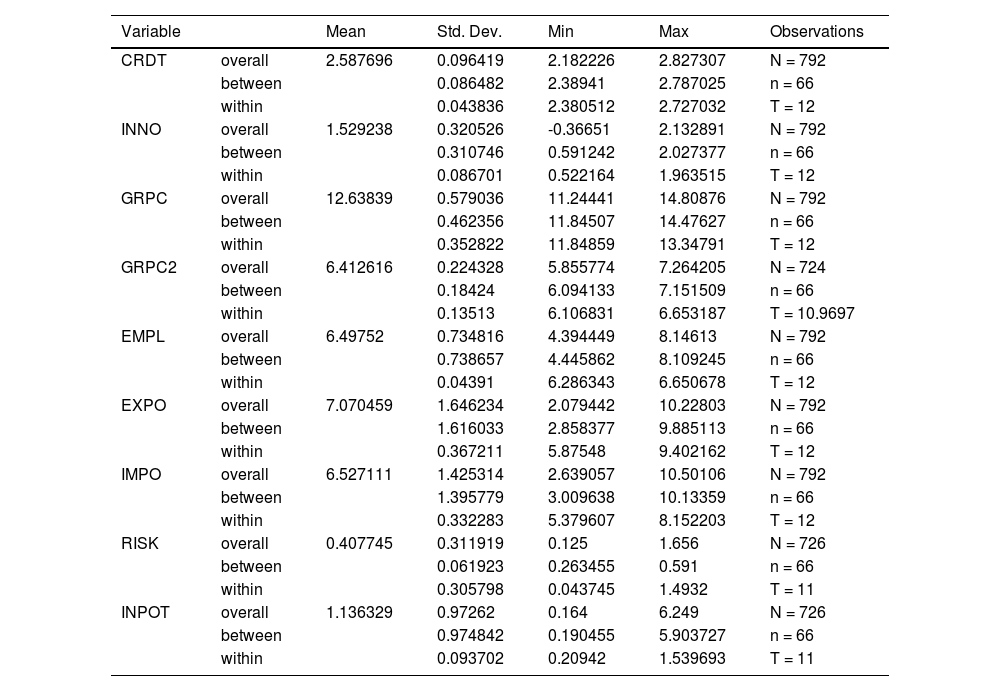

Table 2 presents the descriptive statistics for the panel data employed in our research. The overall SD includes the measures of the spatial SD (between) and the SD over the period (within). Considering the measures of innovation, we observe a higher magnitude of the spatial SD, which reveals the high variance in the indicators among Russian regions. This outcome allows us to apply the MMQR approach to test our research hypotheses. The estimation results confirm that Russian regions are highly diverse in terms of innovation, economic development and investment potential. The SD for financial development reflects a lower magnitude of variation across regions and over time; therefore, we assume that most regions have similar credit level deepening. However, the within value of the SD for credit deepening reflects the lowest magnitude, indicating the lower rates of credit development in Russia.

Descriptive Statistics

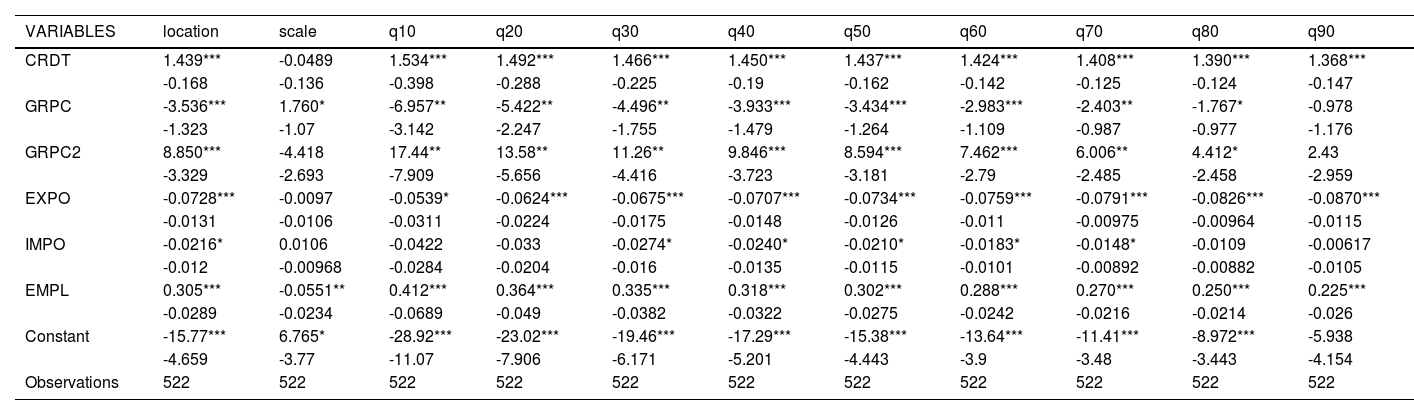

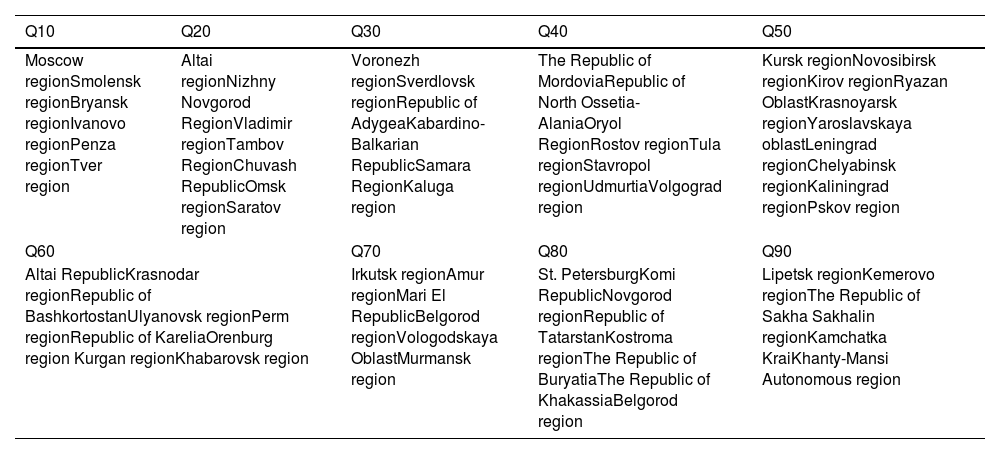

In this section, we present the results of our main estimation under the different economic scenarios of the Russian regions. Quantile regression distinguishes quantiles based on the dependent variable (innovation). According to the proxy employed to quantify innovation, lower quantiles (q10–q30) refer to the regions with the lowest innovation, while the highest quantiles (q70–q90) refer to the regions with the highest innovation. We also distinguish regions with a medium degree of innovation, which are included in the medium quantiles (q40–q60). Regional distributions by quantile are presented in Appendix 1.

We first estimate our model to demonstrate the overall impact of credit market development on innovation considering the time horizon and all regions of the Russian Federation. We then check the robustness of our findings and whether they consistently contextualise the four different scenarios of high investment risk, low investment risk, high investment potential and low investment potential.

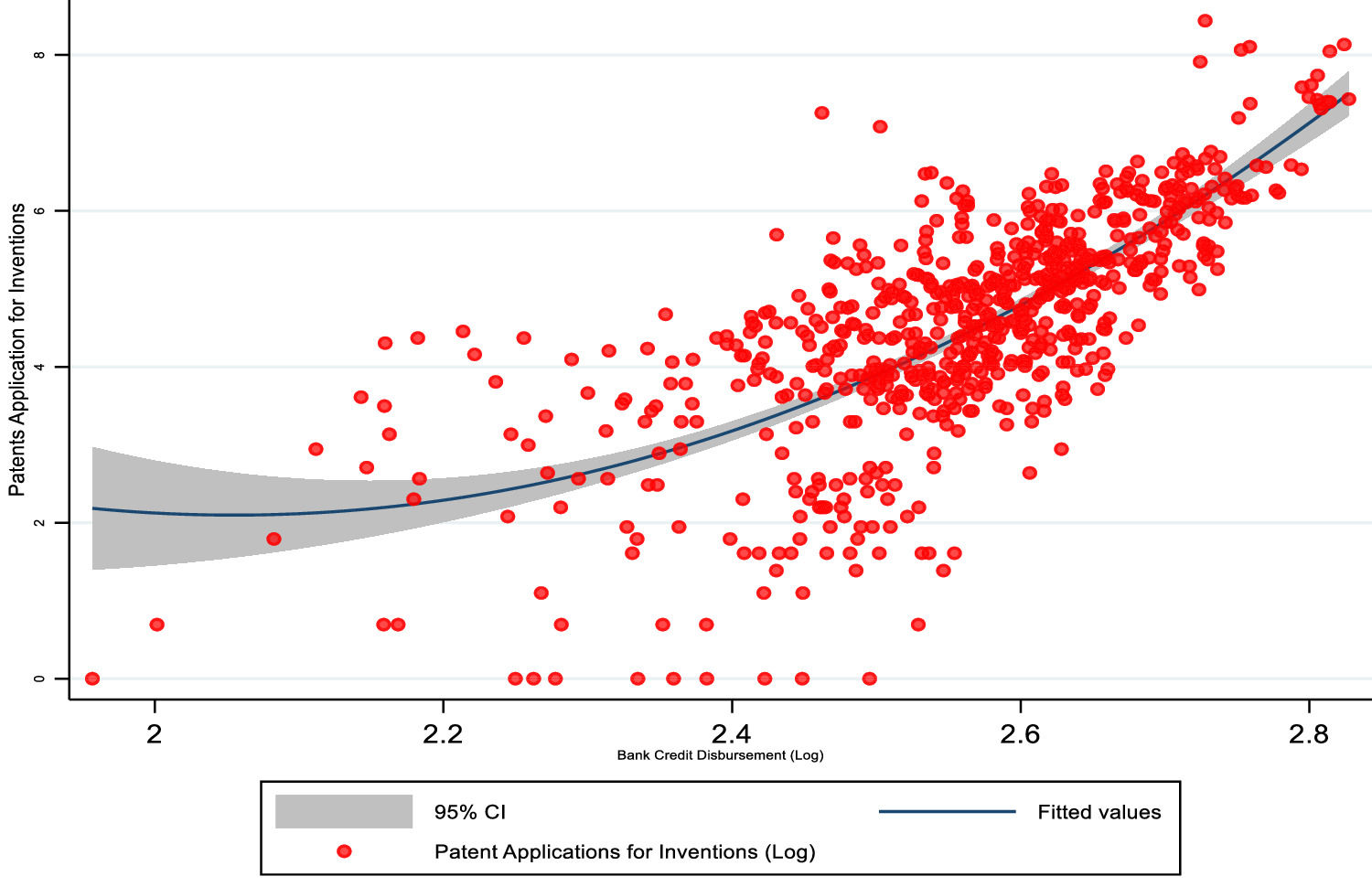

Table 3 presents the overall dynamics of credit market development on innovation in the Russian regions. The coefficient of bank credit is positive and significant at the 1% level from quantiles –90, indicating that an increase in the number of loans granted to resident legal entities and individual entrepreneurs increases innovation in all regions and all quantiles. However, the coefficient values for credit market deepening range from 1.534 (10th quantile) to 1.368 (90th quantile), indicating that the magnitude of the effect of credit market deepening on innovation tends to be higher in the lowest and medium quantiles (q10–q60) but lower in the highest quantiles. This trend strengthens our hypothesis that regions with less innovation need more credit facilities to foster innovation. The spatial fixed effect for innovation confirms that credit deepening contributes to innovation; however, the time fixed effect exhibits no significant effect, indicating that credit deepening does not affect innovation, which we explain via the lower variation of the indicator over time. The coefficients of the GRP are negative and significant for quantiles 10–80, but for the GRP square, the coefficient values are positive and significant. This indicates a U-shaped relationship between innovation and regional economic growth, meaning that more regional economic development ensures more innovation promotion in these regions of Russia. However, like the credit–innovation relationship, regions with low innovation are more influenced by regional economic progress, suggesting that regions with fewer innovation opportunities requires priority attention from policymakers. The coefficients of regional export are negative and significant in all quantiles and those of regional import are negative and significant in quantiles 30–70. This implies that reductions in imports and exports enhance innovation in the Russian regions. Russia usually imports technologies and exports commodities such as oil and gas. Our finding suggests that reducing technology imports will encourage local businesses to be more innovative in producing goods locally (import substitution) and reducing commodity exports will allow local companies to produce diversified products and advance economic diversity. Additionally, total employment also promotes innovation, as the coefficients of employment are positive and significant for all the quantiles, suggesting that the more skilled people that. join the workforce, the more innovative the regions become Fig. 1 shows a scatter plot of the innovation–credit nexus of the Russian regions, demonstrating positive causality between innovation and credit market deepening in Russia.

Innovation-credit development nexus in Russian regions

Note: ***, **, & * indicate 1%, 5% & 10% significance level.

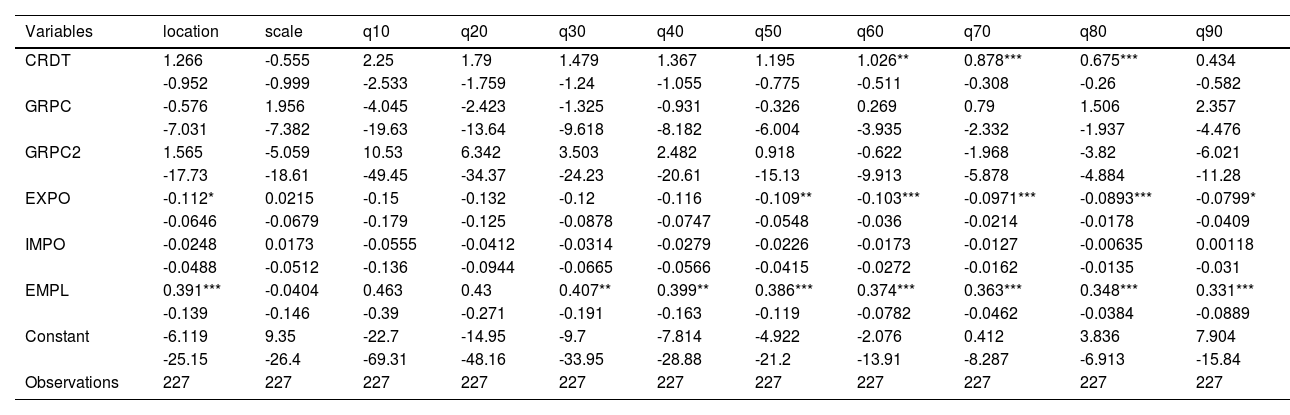

In Table 4, we present the impact of credit market development on innovation in the Russian regions that carry higher investment risk. Regions with low and medium levels of innovation (q10–q50) experience a poor effect from credit market development in terms of innovation than those with higher innovation levels (q60–q90). This phenomenon suggests that investment risk is a determining factor for gaining credit for innovation projects in regions where investment risk is higher and innovation is lower. Notably, highly innovative regions are not affected by investment risk. This could occur because businesses in highly innovative regions have the potential of yielding a higher return on investment, which might stimulate banks to finance them. The coefficients of GRP and GRP squared are insignificant in all quartiles, implying no robust causality with innovation probability of the Russian regions where investment risk is high. The coefficients of regional export are negative and significant from the medium to high quantiles (q60–q90), indicating that regions with medium and high innovation levels are not influenced by investment risk. In these regions, commodity export continues to reduce and promote innovation. However, the coefficients of regional import are negative and insignificant in all quantiles, demonstrating that import reduction promotes innovation in Russian regions but this occurs insignificantly in highly risky regions. Finally, total employment promotes innovation in those regions and the coefficients of employment are positive and significant for all quantiles indicating no effect of investment risk in this regard.

Innovation-credit development nexus in Russian regions with high investment risk

Note: ***, **, & * indicate 1%, 5% & 10% significance level.

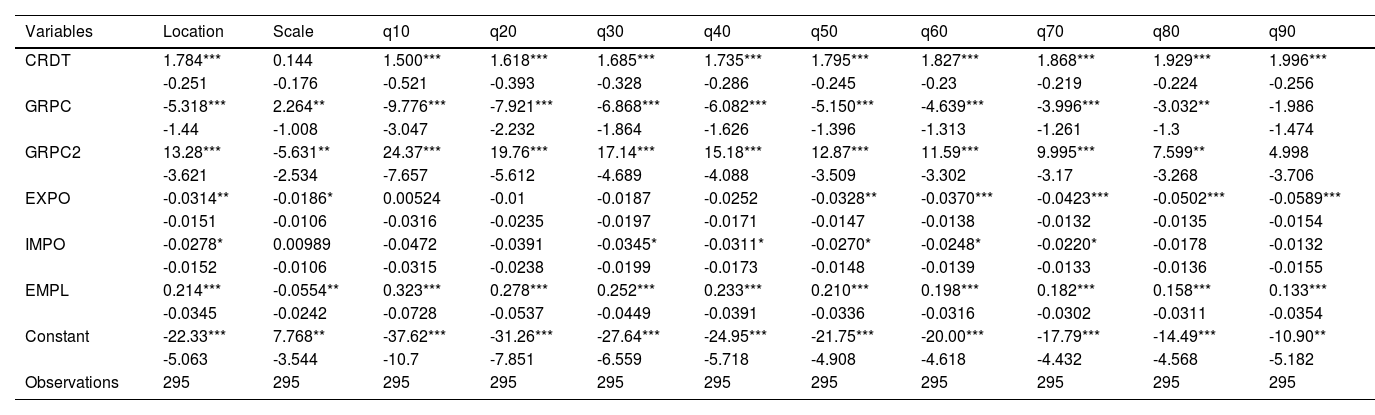

In Table 5, we present the impact of credit market development on innovation in the Russian regions with lower investment risk. In general, all Russian regions with low investment risk exhibit a positive credit–innovation relationship; however, the magnitude of this relationship is higher in the medium and high quantiles and lower in the lowest quantiles. This indicates that medium and highly innovative regions enjoy more credit facilities than regions with low innovation scenarios. The coefficients of the GRP are negative and significant in quantiles (q10–q80), but for GRP squared, the values are positive and significant in the same quantiles (q10–q80). This scenario implies that there is a U-shaped relationship between regional economic growth and innovation in the Russian regions with low investment risk, which resembles our first estimation outcome, which demonstrated that more regional economic development ensures more innovation promotion in regions of Russia. The degree of relationship also coincides with the earlier finding in this regard (Table 3). The coefficients of regional export are negative and significant in quantiles 50–90, indicating that reduction in exports continues to promote innovation in the regions with medium and high innovation levels. The coefficients of regional import are negative and insignificant in quantiles 30–70, meaning that reduction in import accelerates innovation from the lowest to the highest quantiles (except q80 and q90). These findings validate our first estimation result, which demonstrate that import reduction encourages innovation in all the regions of Russia. Finally, total employment promotes innovation, as the coefficients of employment are positive and significant for all quantiles showing no risk effect in this context.

Innovation-credit development nexus in Russian regions with low investment risk

Note: ***, **, & * indicate 1%, 5% & 10% significance level.

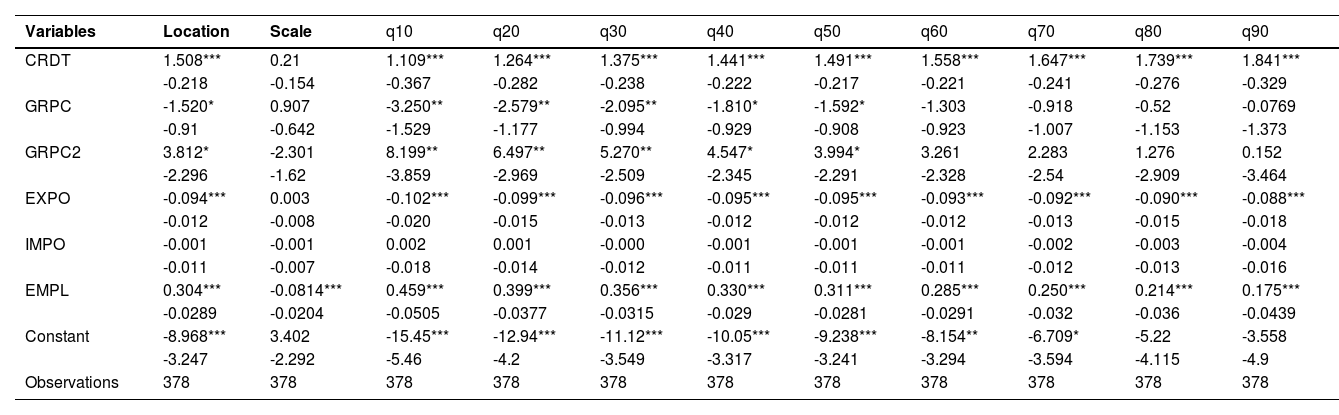

In Table 6, we present the impact of credit market development on innovation in the Russian regions with high investment potential. The coefficients of bank credit are positive and significant for all quantiles (q10–q90), suggesting that credit market development spurs innovation in regions with high investment potential. However, as with the previous result with low investment risk, the degree of relationship between credit market development and innovation tends to increase from the lowest to the highest quantile. These findings affirm that regions with high innovation, high investment potential and low investment risk benefit from more financing for innovation from Russian banks. However, unlike the case with low risk regions, the coefficients of GRP squared are negative and significant from the lowest to medium quantiles (q10–q60). This implies that regional economic growth intensifies innovation in the lowest and medium quantiles but has no significant influence in the highest quantiles. The coefficients of regional export are negative and significant in all quantiles coinciding with the previous results (Table 3). However, the coefficients of import are negative and insignificant, showing no effect on the credit–innovation nexus of the regions with high investment potential. Total employment also promotes innovation, as the coefficients of employment are positive and significant for all quantiles and are not affected by regions’ investment potential.

Innovation-credit development nexus in Russian regions with high Investment potential

Note: ***, **, & * indicate 1%, 5% & 10% significance level.

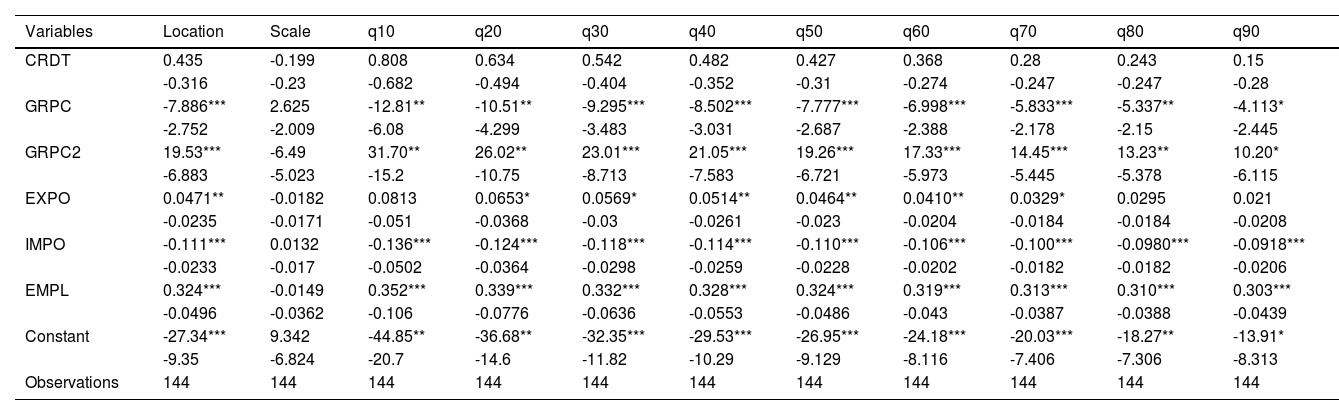

Table 7 presents the impact of credit market development on innovation in Russian regions with low investment potential. The coefficients of bank credit are positive but insignificant in all quantiles for these regions, indicating that credit market development insignificantly interacts with innovation promotion in Russian regions where the business potential is low. The magnitude of the credit–innovation relationship in these regions indicates that although insignificant, the lowest quantiles tend to have a higher intensity of credit–innovation causality than medium and high quantiles. The coefficients of GRP are negative and significant in all quantiles, but those of GRP squared are positive and significant in all quantiles, indicating a U-shaped relationship between innovation and regional economic growth in low potential Russian regions. This finding contradicts the results obtained for highly risky regions, indicating that tough investment potential matters for credit–innovation dynamics, and regional development still promotes innovation in low potential areas of the Russian Federation. The coefficients of regional export are negative and significant in quantiles 20–70, indicating that reduction in exports in low potential areas contributes to the promotion of innovation; however, the coefficients of regional import are negative and insignificant in all quantiles, with no effect in this regard. Total employment also promotes innovation, as the coefficients of employment are positive and significant for all quantiles posing no influence for low investment potential.

Innovation-credit development nexus in Russian regions with low Investment potential

Note: ***, **, & * indicate 1%, 5% & 10% significance level

Distribution of the regions by quantiles

We find a significant correlation between credit market development and innovation in Russian regions. The result of our econometric estimation confirms that the credit market positively drives innovation in Russian regions. Our investigation also reveals four relevant insights concerning the innovation–finance nexus from the perspective of investment risk and investment potential. First, regions with high investment risk scores are insignificantly influenced by credit market development concerning innovation. Second, regions with low investment risk scores exhibit positive and significant innovation–credit relationships. Third, regions with high investment potential show positive and significant innovation–credit relationships. Fourth, regions with low investment potential show insignificant innovation–credit relationships. Our empirical findings coincide and diverge with the related body of literature. For example, our baseline finding that credit deepening promotes innovation aligns with several previous studies, such as Lucas (1988), Romer (1990), Aghion et al. (2005), Chen et al. (2010), Nanda & Nicholas (2014)Laeven et al. (2015), Pradhan et al. (2018) and Comin & Nanda (2019). However, some previous studies contradict our findings; for example, Stiglitz (1985), Pástor and Veronesi (2009) and Rajan (2012). Hsu et al. (2014) and Law et al. (2018) find that the credit market discourages innovation due to the risk and uncertainty involved in innovative ventures. This disagreement also aligns with our other finding that regions with high investment risk receive fewer credit facilities for innovative projects. Regions carrying low investment risk show a positive and significant connection between credit market development and innovation. This proposition agrees with Stiglitz & Weiss (1981), Hall & Lerner (2010) and Abor and Biekpe (2007), who argue that credit markets are risk-averse and only opt for investing in low-risk projects. However, Aghion et al. (2009) and Comin & Nanda (2019) differ with that perspective, arguing that banks apply several risk management measures with which they continue financing risky projects and contribute to promoting innovation. We also find that Russian regions with high investment potential benefit from more credit than regions where the business environment is weak. Carpenter & Petersen (2002), Tagoe et al. (2005), Leitner & Stehrer (2013) and Camagni (2002) support this finding. Petryk et al. (2020) claim that banks tend to invest where the environment for doing business is more favourable. However, this proposition contradicts Sadorsky (2010) and Greenwood and Jovanovic (1990), who claim that financial development assists the economy to minimise financial risk and transaction cost by eccentric risk sharing among a large pool of investors, which is how it increases access to investment and promotes innovation.

Conclusion, policy implications and future research directionConsidering the indispensable contribution of the Russian banking sector for promoting innovation, we investigate the nexus between innovation and credit market deepening to reveal the dynamics of innovation in Russian regions, applying MMQR to address the regional heterogeneity of the panel. Our baseline result illustrates that credit market deepening significantly promotes innovation in Russian regions. Our empirical investigation further reveals that the magnitude of the nexus between innovation and the credit market is significantly higher in regions where the investment risk is lower. In addition, regions with high investment potential receive more credit for innovation. Our results indicate that only developing the credit market is inadequate to promote innovation. Policymakers should take measures to reduce the risk of investing in regions where innovation is stuck due to the lack of finance. We also stress the need to enhance the investment potential of regions that receive less funding for innovation because of low potential. We suggest establishing a favourable investment climate by adopting business-friendly rules and regulations. Our study demonstrates that the Russian banking sector can have a critical role in the economic transformation of the country by encouraging innovation; however, policymakers must design strategies to minimise investment risk and enhance business potential in regions where the flow of innovation finance is lower.

Our study has some limitations that must be acknowledged. First, the findings of the study may not reflect the recent dynamics of the finance–innovation nexus in the context of Russian regions since the Russian economy has been under several economic sanctions since late February 2022, which has affected the country's financial sector significantly. Therefore, the results of this study may not be applicable to Russia's current economic circumstances. Second, the study relies solely on data published by the Federal Statistics Department of the Russian Federation, which raises robustness concerns.

AcknowledgementThis study was supported by the grant of the Russian Science Foundation No: 19-18-00262.