Problems regarding the change of auditor and the opinion issued by the auditor through the financial audit report have been shown to be an important issue.

The objective of this study is to examine to what extent the change of auditor is related to the type of opinion that the auditor expressed in the audit report.

In pursuit of this objective, an empirical study was carried out supported by a sample from a set of entities with securities admitted to trading on the Portuguese stock market in the period between 2006 and 2012 (seven years) and using logistic regression to test whether the reception of the qualified audit report indicated the change of auditor.

The findings point to there being a significant positive relationship between the qualified audit report and a change of auditor, verifiable for qualified opinions on assets and others, but not to the qualified opinions on equity and liabilities.

The largest number of qualified opinions occur in the years 2007, 2009 and 2011, most of which were related to equity and assets, and the change of auditor is more associated with qualified opinions on assets and other qualified opinions than the qualified opinions on equity and liabilities.

Los problemas existentes relativos al cambio de auditor y a la opinión emitida por el auditor a través del informe de la auditoría financiera está probado que se trata de un tema de gran interés.

El objetivo de esta investigación es examinar hasta que punto el cambio de auditor está relacionado con el tipo de opinión que el auditor expresa en el informe de la auditoría.

En la consecución de este objetivo se llevó a cabo un estudio empírico apoyado en una muestra, un conjunto de entidades con valores admitidos a negociación en el mercado de valores portugués, en el período comprendido entre 2006 y 2012 (siete años) mediante regresión logística utilizada para comprobar si la recepción del informe de auditoría financiera lleva al cambio de auditor.

Los resultados apuntan a la existencia de una relación positiva significativa entre el informe de auditoría y el cambio de auditor, verificable por las reservas de activos y otros, pero no a las reservas de los fondos propios y prestados.

El mayor número de reservas se produce en los años 2007, 2009 y 2011, la mayor parte de las reservas naturales se relaciona con la equidad y activos, y el cambio de auditor está más asociado con las reservas de activos y otras reservas que con las reservas de los fondos propios y ajenos.

The audit report issues the auditor's opinion on the financial demonstrations of the enterprise, such that it becomes of huge importance, both for the users of the financial information and for the administration of the enterprise.

However, the users of the financial information often misunderstand that the auditor's opinion is too technical and concise and the administration of the enterprises may be tempted to relate the auditor's continuity with his/her opinion.

The research undertaken studies the relationship between the kind of opinion issued by the auditor in his/her annual report and the change of auditor, in terms of his/her continuity, from a sample of entities with values admitted to trade in the Portuguese stock market, in the period between 2006 and 2012, and used logistic regression to test whether the reception of the audit report from four types of qualified opinions indicated the change of auditor.

The article is structured in four parts: the first one discloses the audit's theoretical context in terms of the report and the auditor's opinion and the second one reviews the factors that explain the change of the auditor, the third develops the empirical study in terms of sampling and variables, and the fourth and last part discusses the results.

In the current economical and social context of our society this article aims to enhance the scientific contribute on the issue of the change of auditor, which has given rise to so much controversy from the researchers and authors in the science community.

This research advantageously enhances the nature and the potential impact of the information provided by the auditor to anyone interested in the entities and allows stakeholders to question the administration on the information reliability and the current auditor's trust.

Audit's theoretical frameworkThe audit reportThe audit report is the document where the auditor issues his/her opinion on the financial demonstrations of the enterprise audited, such that this opinion is regarded by society as having a public character. The audit report is often regarded as a “barometer” for the enterprise's financial situation and not only as a document that reveals reliability on the financial demonstrations (Arens and Loebbecke, 1996), such that the audit report is the climax of the audit process through which the auditor issues his/her opinion on the audited financial demonstrations or the reasons not to issue them.

Under that line of thought, Becker, Defond, Jiambalvo, and Subramanyam (1998) state that the audit reduces the existing information differences among the managers and the remaining people interested on the enterprise, since the users of such information gain access to reliable financial demonstrations through the certification conveyed by the auditor.

Thus, the message issued by the auditor must be perfectly understood and its function clearly defined, that is, “the issuer task is to fight for a simple, clear, interesting and interactive message, in such a way that it conveys at least the main points to the public target” (Kotler, 1996).

To Pasiouras, Gaganis, and Zopounidis (2007) the audit report consists of a report where the auditor issues an opinion regarding the financial demonstrations of the audited enterprise, enhancing whether they are free from relevant distortions and whether they were developed according to the specific current legislation and follow the accounting norms and principles.

Also to Hope and Langli (2010), the audit report is an instrument of communication, wherein the related parts are informed on the conclusions provided by the auditor, as well as on the possible problems found in the internal controls and/or the financial demonstrations of the enterprises audited, including those regarding the enterprise ability to continue.

The justified theories of the audit in the present society must be framed in the financial information area since the audit report and its publishing are a reliability element added to that information.

Finding an adequate theory to explain its existence is, in the opinion of Almeida and Silva (2013) an academic and intellectual challenge, wherein the agency's theory is the one which is more inclusive and unifying of the various justifying theories.

The agency's theory comes from the separation between property and entities management, which has given rise to differences in the information and agency conflicts among owners and managers, thus strengthening the auditor's role for its reliability and credibility provided to the society since it forms an instrument of screening and reduction of the agency's conflict.

This way, by being part of the social control process (Lee, 1996) or of the responsibility of providing the accounts Flint, 1988) the audit is justified on the basis of the agency's theory, which is regarded to a certain extent as a cover for the risk of information (Porter, Simon, & Hatherly, 2008).

In the same line, Almeida and Silva stated that “the auditor may be seen as a referee who defines the consistency of the financial demonstrations developed by the agent, taking as a pattern the rules of accounting (…) and as such the auditor is regarded as an agent who verifies the actions of another in a context of minimization of the main cost” (p. 48).

Nonetheless, it is also important to refer that the auditory is related to the theory of signalling (disclosure and transparency regarding the market signals the entity and may reduce the financing costs), to the decision taking theory (as it allows for the assessment of the information value to potentiate better decisions, according to Saada, 2000), to the theory of the government of societies (according to Power (1997) as it is an inclusive part of the architecture of control imposed by internal or external motives), the theory of insurance (according to Cosserat and Rodda (2009) the insolvency is sought to be associated with an audit's flaw, supported by the assumption that the release of fraud financial information is also the auditor's responsibility).

The relevance and understanding of the audit reportAuthors such as Siqueira (2004), Boynton, Johnson, and Kell (2002), Wiesner (1987), Ricchiute (2002) and Cabal Garcia (2001) and national and international organizations such as the American Institute of Certified Public Accountants (AICPA), the Institute of Chartered Accountants in England & Wales (ICAEW), the Compagnie Nationale des Commissaires aux Comptes (CNCC), the Ordem dos Revisores Oficiais de Contas (OROC), the Instituto de Contabilidad y Auditoría de Cuentas (ICAC), the International Federation of Accountants (IFAC) and the European Federation of Accountants have been concerned about the clarification of the audit report's main causes for not being fully understood. The main reasons for the report's lack of understanding are as follows:

- •

Standardized report: as the structure of the report is according to the norms, regardless of the activity sector it is applied to, it becomes more a symbolic document than a communication between the auditor and the user, which leads to the users not reading the audit reports.

- •

Technical language: the commission for the auditor's responsibilities (Cohen Commission) enhances the use of a highly standardized language which results in an ambiguity for most of the users who often lack the accountant or audit skills.

The users are not familiar with the terminology used in the reports and that is why they find it difficult to understand the message transmitted. If the aim of the audit report is to give credibility to the financial demonstrations issued by an enterprise it becomes crucial that its users understand it.

Thus, García and Martínez (2001) have realized that on the one hand the excessive use of technical terms in the audit report and on the other hand the report's content being too concise make it difficult to understand. Gay and Schelluch (2006), in their research on this issue, enhance the uncertainty in the understanding of the audit report from most of the stakeholders.

- •

The responsibility of the audit report is not clarified. Ruíz Barbadillo (1998) believes that despite the research carried out in the previous decades, the audit report still does not allow its users to understand its nature and the asset that is the information conveyed in it.

That idea is shared by López Combarros (1996) when he defends that “regarding these areas it is necessary to communicate to the users of the financial demonstrations the exact range of the work we hope to perform and the level of responsibility we take on.”

In a research performed by Schelluch and Gay (2006), the conclusions were that the auditors believe to have higher levels of responsibility and accountability than that which is actually conferred to them by the users of the financial information. The shareholders skeptical attitude probably comes from the recent financial scandals in the enterprises.

Explaining factors of the change of auditorThe auditor is responsible for alerting the administration about the weaknesses, uncertainties or irregularities found, which are often materially relevant and must therefore be mentioned in the auditor's report, and which give rise to a qualified auditor's report, and as such the qualified auditor's report may have particular consequences: the enterprise's administration may “press” the auditor to issue an unqualified audit report, as the value of the shares as well as the administration fees may be affected (Chow & Rice, 1982).

The administration will try to eliminate the possibility of the auditor of issuing qualified auditor's reports as those reports may have a negative impact on the perception of the stakeholders over the administration in general and the enterprise in particular.

The enterprise scandal that involved Enron and the associated audit enterprise, Arthur Andersen, has started the discussion on the auditor's independency through the process of auditing, since the hiring period of the auditor is of about 10 years. Thus, when the Sarbanes-Oxley Act was being implemented there was a suggestion of implementing the requirement of change of auditor in the USA, which never really happened (Defond & Francis, 2005).

However, the change of auditor has been implemented in India, Australia, Singapore, South Chorea, Hong Kong, among others. In Portugal, the CMVM has implemented the change of auditors for the enterprises with open capital.

The literature about the qualified audit reports and the change of auditor is linked. The most advocated variables to justify the auditor's opinion in the report include, amongst others:

- •

Audit's enterprise fees (Addams & Davis, 1994; McKeown, Mutchler, & Hopwood, 1991);

- •

Financial issues (Carpenter & Strawser, 1971; Haskins and Willams, 1990);

- •

Change of Administration (Burton & Roberts, 1967; Carpenter & Strawser, 1971);

- •

Enterprise size (Chow & Rice, 1982; Shank & Murdock, 1978; Warren, 1980).

For the last few decades several empirical researches have been carried out both in Europe and in the United States of America, highlighting a set of variables related to the change of auditor, namely financial issues, entity size and administration or change of financial manager.

From the set of researches performed, the Smith's (1986) performed in the USA show that only 4% of the change of auditor comes from the issuing of a qualified opinion.

Worth referring to is another research performed in the USA by Davidson, Jiraporn and DaDalt (2004) on the potential reasons for the change of the auditor, which are based on situations in which the managers look for an audit of an inferior rank with costs for the agency, that is, signalling the existence of issues on the quality of the financial auditory.

Also, in Europe, namely in the United Kingdom, a research has been performed by Hudaib and Cooke (2005), wherein it was realized that the entities with more financial issues and where there is the change of the financial manager are more inclined to get a qualified opinion from the auditor and that the likelihood of the change of auditor rises with the gravity of the opinion.

The worldwide literature has performed various researches related to the reasons that cause the enterprises to change the auditor as stated above and which are centred on two approaches.

One is the market approach in which the change of auditor is analyzed according to the nature of the audit demand that the enterprises carry out and the supply performed by the audit professionals. The change of auditor is related to the changes in the economic-financial and corporative features of the enterprises (Firth, 1999; Francis & Wilson, 1988; Johnson & Lys, 1990; Palmrose, 1986).

The other approach is contractual, which focuses on the perception of the audit as a contract in which the enterprise freely appoints the auditor and where the possibility of a disagreement between the auditor and the enterprise may lead to a decision from the enterprise to change the auditor (Francis & Krishnan, 1999; Lennox, 2000).

Summing up, we can conclude that there is a difference concerning the impact of the audit report and the change of the auditor. If, on the one hand some authors point out the change as a result of the clients search for auditors who issue a clear opinion, on the other hand, organizations such as SEC (2000) and authors such as Petty and Cuganesan (1996) defend the need to impose measures of mandatory rotation of the auditors, arguing that long contracts reduce the auditors motivation to keep an independent relationship with the clients.

Empirical researchPopulation and samplingThe population target consists of the entities issuing security values admitted to trade in a continuous market in the Portuguese stock market, and the sampling is based on the above mentioned entities that have provided their financial demonstrations on the internet site of the “Comissão do Mercado de Valores Mobiliários” (CMVM) during the month of July 2013, corresponding to the period between 2006 and 2012 (for seven years).

Hence it came that the population consisted of 120 entities, of which 37 were cut (as they did not present any kind of economic-financial information, both on the internet site of the CMVM and their own internet site) and 26 (for being financial entities, therefore their financial demonstrations disclosed a specific framework not comparable to the other entities), wherein the sample consists of 57 entities, which represent about 69% of the total entities.

These 57 entities were analyzed in a consistent manner throughout the research period even if at some times they were not included in the list of issuing entities, according to the CMVM and, altogether a set of 337 observations were achieved during the research period of time.

Description of the research and variablesIn order to analyze to what extent the change of auditors can be explained by the auditor's report itself, we have graded the auditor's reports in a period of seven years, that is, without qualified opinions and ranked, as this leads to a more consistent picture as well as a more objective reality (Cho and Trent, 2006).

Thus, Patton (2002) has adopted an identical procedure of explanation, as it contributes to the validity and reliability, building a more faithful picture of the phenomenon through convergence.

We have adopted the statistical technique of logistic regression, just as McFadden (1973), Ismail, Ali Ahmed, Md Nassir, and Abdul Hamid (2008) and Heliodoro and Paula (2014) have defended and used to analyze the relationship between the dependent variable θ (Yn) – change of auditor (which takes on the value of 1. When there is a change of auditor and the value 0 (zero) in the opposite situation) – and four independent variables, estimated by the method of maximum similitude, which are:

- •

Qualified opinion on equity;

- •

Qualified opinion on liabilities;

- •

Qualified opinion on the asset;

- •

Other qualified opinions not mentioned in the ones described above.

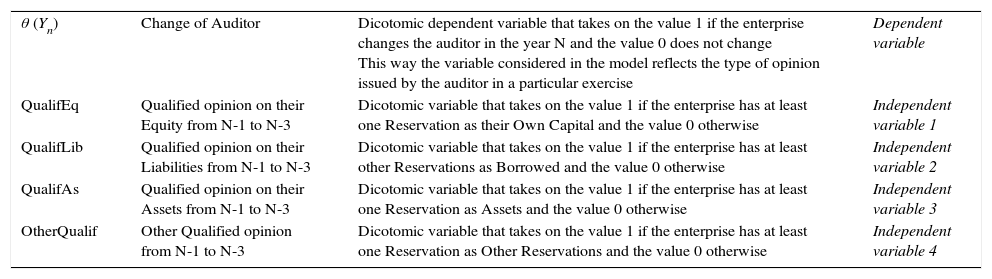

Table 1 enhances the variables which were the object of research, that is, the dependent variable as well as the four independent variables.

Description of the variables: Dependent and independent.

| θ (Yn) | Change of Auditor | Dicotomic dependent variable that takes on the value 1 if the enterprise changes the auditor in the year N and the value 0 does not change This way the variable considered in the model reflects the type of opinion issued by the auditor in a particular exercise | Dependent variable |

| QualifEq | Qualified opinion on their Equity from N-1 to N-3 | Dicotomic variable that takes on the value 1 if the enterprise has at least one Reservation as their Own Capital and the value 0 otherwise | Independent variable 1 |

| QualifLib | Qualified opinion on their Liabilities from N-1 to N-3 | Dicotomic variable that takes on the value 1 if the enterprise has at least other Reservations as Borrowed and the value 0 otherwise | Independent variable 2 |

| QualifAs | Qualified opinion on their Assets from N-1 to N-3 | Dicotomic variable that takes on the value 1 if the enterprise has at least one Reservation as Assets and the value 0 otherwise | Independent variable 3 |

| OtherQualif | Other Qualified opinion from N-1 to N-3 | Dicotomic variable that takes on the value 1 if the enterprise has at least one Reservation as Other Reservations and the value 0 otherwise | Independent variable 4 |

The selection of independent variables allows for the realization of to what extent the entities in the sampling have changed their auditors, for having received a qualified opinion, which is considered as relevant and the object of international acknowledgement by the scientific community, by Ball, Walker, and Whittre (1979), Ballesta and García-Meca (2005), Brío González (1998), Gómez-Aguillar and Ruiz Barbadillo (2000, 2003) and Senteney, Chen, and Ashok (2006).

Logistic regression is a statistical technique that aims at producing, from a set of observations, a model that allows for the prediction of values on the basis of one or more variables ranked as independent variables and considered binary.

The research was based on the reports and accounts and on the audit of the different entities that were the object of the research in order to identify the typology of the auditor and his/her stay in the entity through time, as well as the number and type of qualified opinions, wherein the Statistical Package for the Science Social (SPSS), version 21, was used for the needed statistical analysis.

Results analysisThe assessment of the results achieved consists of a descriptive analysis of the constant qualified opinion of the audit report and the logistic regression.

Regarding the type of qualified opinions the following points have been found:

- •

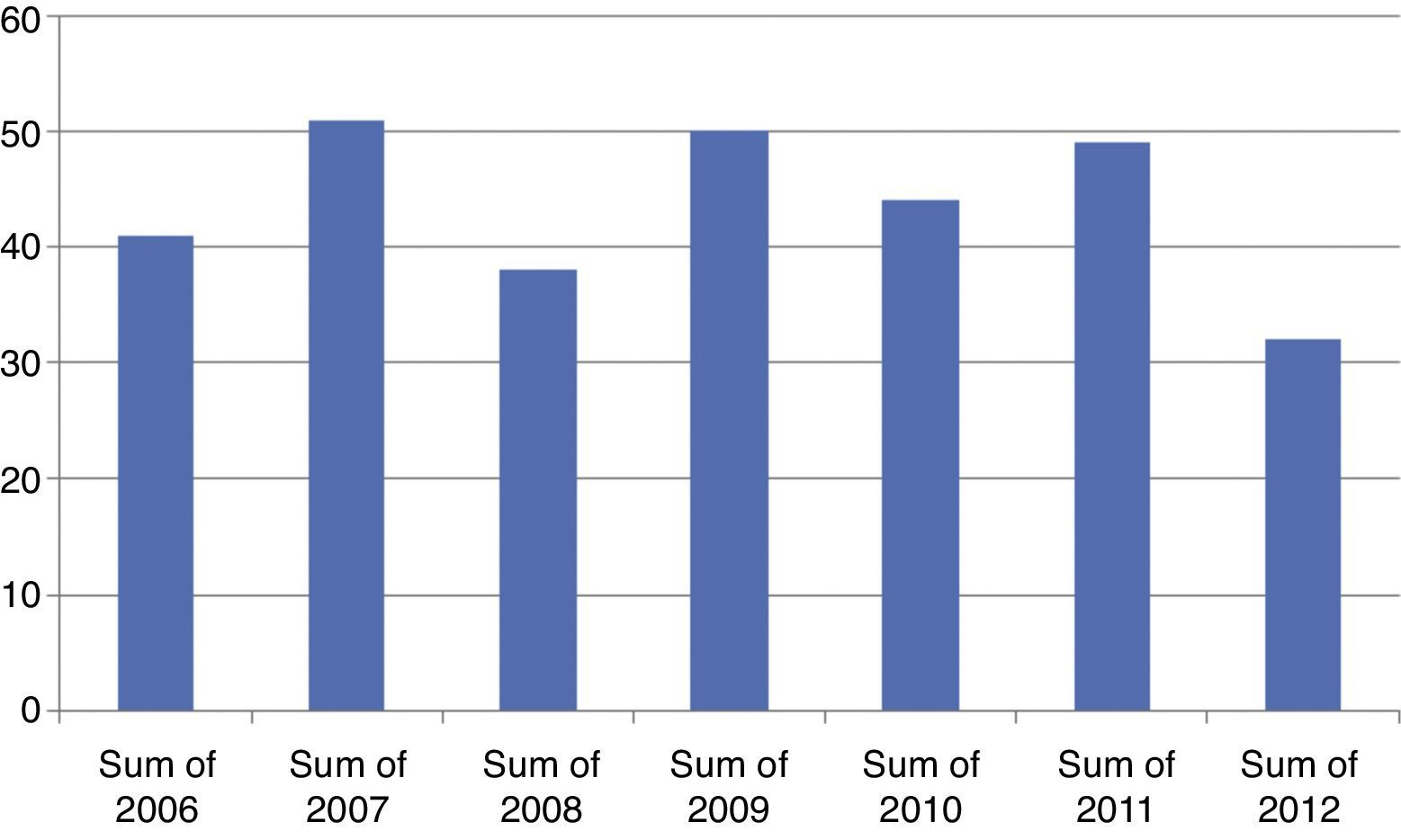

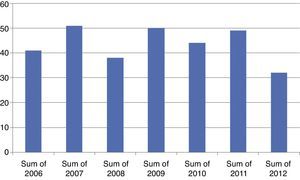

In terms of time the rise in the number of qualified opinions between 2006 and 2007 – 305 qualified opinions were reported in this period, which represent an average of 43.57 qualified opinions every year, wherein the number of qualified opinions shifted between a minimum of 33 (in 2012) and a maximum of 51 (in 2007), as can be seen in Fig. 1. It should be highlighted that there is a higher number of qualified opinions in years of legislative elections (2009 and 2011) and that, at the same time, there is a lower number of qualified opinions in the year before the legislative elections (2008 and 2010), except for the year 2012.

- •

In terms of the type of qualified opinions it is clear that the higher number of qualified opinions concerns equity (106, about 35%), followed by the qualified opinions on the asset (70, approximately 23%), the other qualified opinions (68, which represent 22%) and, finally, the qualified opinions concerning the liabilities (61, about 20%).

- •

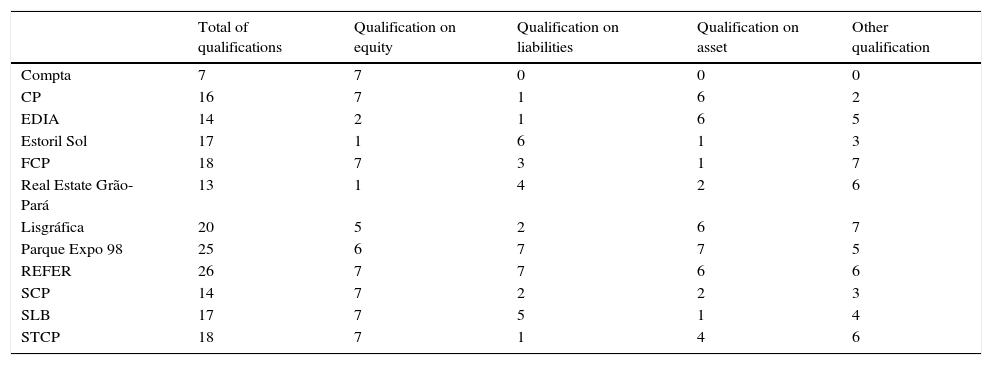

If we consider the type of qualified opinions it becomes clear that the highest number of qualified opinions concerns equity and other qualified opinions and that the lowest number concerns the qualified opinions on liabilities, as can be seen in Table 2.

Table 2.Entities with a higher number of qualified opinion, by type.

Total of qualifications Qualification on equity Qualification on liabilities Qualification on asset Other qualification Compta 7 7 0 0 0 CP 16 7 1 6 2 EDIA 14 2 1 6 5 Estoril Sol 17 1 6 1 3 FCP 18 7 3 1 7 Real Estate Grão-Pará 13 1 4 2 6 Lisgráfica 20 5 2 6 7 Parque Expo 98 25 6 7 7 5 REFER 26 7 7 6 6 SCP 14 7 2 2 3 SLB 17 7 5 1 4 STCP 18 7 1 4 6 Source: The authors.

We have found that the highest number of qualified opinions (7) refers to equity (covering eight entities), followed by qualified opinions on asset and other qualified opinions (four entities each) and, lastly, the qualified opinions on liabilities (seven) in two of the types identified, which is the case of Refer (qualified opinions on equity and liabilities), FCP (qualified opinions on equity and other qualified opinions) and Parque Expo 98 (qualified opinions on liabilities).

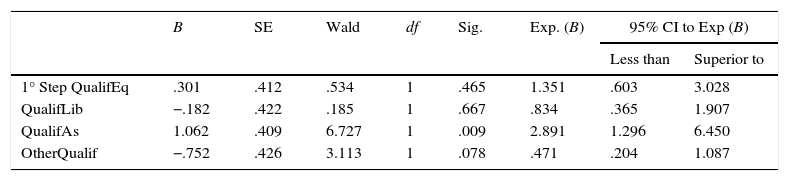

Concerning the result of logistic regression, a level of significance has been defined (α) of 0.1 as it is an acceptable probability Newbold, 1997) and when the coefficient of the variables present a p-value lower than the level of significance defined (p-value>α), then there is an influence of this independent variable, hence Table 3.

Independent variables.

| B | SE | Wald | df | Sig. | Exp. (B) | 95% CI to Exp (B) | ||

|---|---|---|---|---|---|---|---|---|

| Less than | Superior to | |||||||

| 1° Step QualifEq | .301 | .412 | .534 | 1 | .465 | 1.351 | .603 | 3.028 |

| QualifLib | −.182 | .422 | .185 | 1 | .667 | .834 | .365 | 1.907 |

| QualifAs | 1.062 | .409 | 6.727 | 1 | .009 | 2.891 | 1.296 | 6.450 |

| OtherQualif | −.752 | .426 | 3.113 | 1 | .078 | .471 | .204 | 1.087 |

Bearing in mind the results of the Wald test, shown in Table 3, we have concluded that the independent variables disclose two different behaviours:

- •

Inductor to the change of the auditor from the independent variable 3 – Qualified opinions on the Asset from N-1 to N-3 (QualifAs) and the independent variable 4 – Other qualified opinions from N-1 to N-3 (OtherQualif) – for disclosing a p-value lower than the level of significance defined (α=0.1), thus affecting the dependent variable – the change of auditor – that is, the existence of these two types of qualified opinions in the audit report is an important factor to allow for a change of the auditor by the enterprise audited.

- •

Non-inductor to the change of the auditor from the independent variable 1 – Qualified opinions on Equity from N-1 to N-3 (QualifEq) – and the independent variable 2 – Qualified opinion on Liabilities from N-1 to N-3 (QualifLib) – for disclosing a p-value higher than the level of significance defined (α=0.1), not affecting the dependent variable – the change of the auditor – that is, the existence of these two types of qualified opinions is not a decisive factor to replace the auditor.

Different authors defend that there are many factors that influence the change of the auditor, wherein there are different approaches that try to explain them, namely the contractual approach and the traditional one.

The audit reports of the entities that issue securities admitted to trade in a continuous market in the Portuguese stock market and that consist of our sample in the period between 2006 and 2012 enhance 305 qualified opinions that:

- •

Refer to an annual average of 43.57 qualified opinions.

- •

Most of the qualified opinions (58%) are relative both to equity (with 35%) and to asset (with 23%).

Referring mostly to entities with public capital (with about 55%), followed at a great distance the sportive anonymous societies (with 27%) and the entities with private capital (with the remaining 18%).

The change of the auditor (dependent variable) is influenced by the situation of several types of qualified opinions (independent variables) as the following has been found:

- •

The non-existence of qualified opinions has led to the keeping of the auditor in about 66% of the cases.

- •

The finding of one to seven qualified opinions led to, on the one hand, a change of the auditor (in about 50% of the cases) and, on the other hand, to two changes of the auditor (in 33% of the situations).

- •

The qualified opinions on the asset and others are decisive to the change of the auditor, according to the result of the logistic regression carried out.

- •

The qualified opinions on equity and liabilities do not contribute to the change of the auditor, as a consequence of the logistic regression carried out.

The change of the auditor may be a consequence of an intentional behaviour carried out by the entity in order to avoid the adverse image before the users of the accounting financial information of the financial audit report, that is, the entities that can change the auditor do it in an intentional way so as to prevent a negative image from the stockholders.

The existence of qualified opinions on the asset and others in the audit reports are the most relevant and the ones that contribute to the change of the auditor as the entities seek to save the “value of the active”, which adds up to the stakeholders satisfaction.

The conclusions of the research are limited to the number of entities in the sample and to the period of time analyzed. If the period of time were longer and the sample size were larger, then the results could eventually be more consistent.

In spite of the above mentioned limitations the research undertaken has contributed for a better understanding of the existing relationship between the type of opinion issued by the auditor through the audit report and the change of the auditor.

Conflict of interestsThe authors declare no conflict of interest.