The current crisis puts pressure on companies to be more transparent about their business model, their value proposal, their risks and future impacts with a short, medium and long term focus.

To address this need for transparency and with the aim of providing a common framework to meet all these needs, The International Integrated Reporting Committee (IIRC) has developed a framework called Integrated Reporting (IR).

The objective of this research is to understand the state of affairs in the level of attention of the principles of Integrated Reporting in the industrial companies which have adopted this initiative in their communications concerning the achievement of a sustainable environment.

The results show that, despite the efforts of the analyzed companies to address the guiding principles, they still have a long way to go, especially in relation to the principle of “conciseness”. It has also been proven that the companies analyzed were not influenced by the environment relating to the level of attention given to the incorporation of this type of reporting.

La crisis actual presiona a las empresas para que sean más transparentes acerca de su modelo de negocio, su propuesta de valor y sus riesgos e impactos futuros con un enfoque de corto, medio y largo plazo.

Para atender esta necesidad de transparencia y con el ánimo de ofrecer un marco común que responda a todas las necesidades, The International Integrated Reporting Committee (IIRC) ha desarrollado un marco de referencia denominado Integrated Reporting (IR).

El objetivo de esta investigación es conocer el estado de la cuestión en cuanto al nivel de atención de los principios del Reporting Integrado en las empresas industriales que han incorporado esta iniciativa en su comunicación respecto a su actuación para el logro de un entorno sostenible.

Los resultados del estudio demuestran que, a pesar de los esfuerzos realizados por las empresas analizadas por atender los principios orientadores, aún les queda mucho camino por recorrer, principalmente en relación al principio «Concisión». Además, se ha contrastado que las empresas analizadas no han sido influidas por el entorno en relación con el nivel de atención prestado a la incorporación de este tipo de reporting.

The current crisis accompanied by recent corporate scandals peppered by numerous cases of corruption, puts pressure on companies to be more transparent about its business model, their value proposition, their risks and future impacts. The information provided must maintain simultaneously a focus on the short, medium and long term, demanding financial and non-financial information from them, to disclose to their stakeholders on how they are performing and how they will respond to their objectives.

The financial information provided by the annual accounts replies to the need to know what the financial position of the company is and what resources it provides to meet its future objectives, at least in the short term. These resources are the tangible capital, knowledge which is essential to make an assessment of the company from an investor's standpoint. However, financial reporting is not without its critics (Eccles & Serafeim, 2011).

At present, to understand the long-term prospects of companies, it is necessary to supply financial and non-financial information on their tangible and intangible capitals, which would lead to a holistic approach on the organization's reporting. The interrelationship between these capitals generates the necessary capabilities to create value and meet future challenges (Eccles & Saltzman, 2011).

Also, instability, the environment, the situation of economic and political crisis, lack of confidence in institutions, are all issues that have caused greater demands for information from the various stakeholders. To provide this information, on their economic, social environmental and governance impacts, companies are developing their sustainability or social responsibility reports, accompanied in most cases by the corporate governance reports.

Some international organizations have identified sustainability as a crucial issue in the current context of international financial crisis. The European Union (EU, 2011) stated that socially responsible companies could contribute to the goals of sustainable, intelligent and inclusive growth for 2020, and that this disclosure of information is key to identifying material risks and improving public confidence in these companies. These arguments are in line with the pronouncements of other agencies like the U.S. Agency for International Development (USAID, 2011), the Center for Strategic & International Studies (CSIS, 2010) or the OECD (2007).

However, despite the growing interest in reporting on sustainability (Jensen & Berg, 2012), its implementation is not free of difficulties (Stubbs, Higgins, & Milne, 2013) and there are significant barriers to the integration of this information in the financial reports, given the absence of standards to normalize the non-financial information (Eccles, Krzus, Rogers, & Serafeim, 2012a;. Sierra-García, Zorino-Grima, & García-Benau, 2013). According to the findings of Eccles and Serafeim (2011) conducted on a sample of 2,255 companies, only 48.25% of the analyzed companies include environmental issues in their financial reports and only 44.07% include social issues in their reports.

To answer this need for transparency in terms of sustainability and with the aim of providing a common framework for communicating the process of value creation, The International Integrated Reporting Committee (IIRC) has been developing, since 2011, a framework called Integrated Reporting (IR). IR has advocated the publication of a single document combining financial, social, environmental and governance reports and other key elements (IIRC, 2013). Using this framework should show the connections between the two types of information and its contribution to the creation of sustainable value (Eccles & Serafeim, 2011).

Since to date little research has been carried out on the proposed IR and its impact on sustainability reporting (Eccles, Krzus, & Watson, 2012b), the objective of this research is to understand the state of affairs in industrial companies that have publicly acknowledged their incorporation of Integrated Reporting in their communication processes. Some of them joined the pilot launched by IIRC in 2013, and others have been considered by IIRC as an example of good practice, their reports being included in the database of the IR project. Beyond analyzing of the contents of the reports, and given the difficulty of comparing them to the diversity of information and situations that different companies could meet, we aim to analyze if the companies which have committed to this framework may have been influenced by the environment in which they operate and if they respond clearly to the guiding principles of this initiative.

The study is structured as follows: after this introduction, a review of the literature related to sustainability reporting and its evolution to the proposal made by IIRC, which leads us to propose the hypothesis of the research carried out. The methodology used and the results obtained are then presented, finishing with the conclusions of the analysis.

Review of the LiteratureIn recent years there has been growing interest in research on the disclosure of non-financial or sustainability information by businesses, using the approach of different theories. Amongst these theories, the Agency Theory should be highlighted, (Ness & Mirza, 1991) according to which companies disclose information to the extent that the benefits outweigh the associated costs. Studies like Hasseldine, Salama, & Toms (2005) demonstrate the usefulness of these reports to improve their competitive edge and enhance their reputation. The Political Theory (Gray, Kouthy, & Lavers, 1995) assumes that the performance of companies depends on the economic, political and social environment in which they operate, which influences them when deciding how to respond to the demands of stakeholders. The Stakeholder Theory, using the approach of Roberts (1992), assumes that the disclosure of information on corporate commitments to sustainability is used strategically to manage relationships with stakeholders, and therefore the level of disclosure will depend on the power and influence of said stakeholders. This approach is in line with the strategic level of the Stakeholder Theory defined by Goodpaster (1991). Finally, the rise of reporting on sustainability can be analyzed using the Theory of Legitimacy, in which authors indicate that the reports are used to improve the reputation of businesses and therefore to attain the support of key stakeholders in their operations (Lindblom, 1994; Suchman, 1995; Deegan, 2002; O’Donovan, 2002).

All research deriving from different theories has emphasized the importance of transparency about the quantitative and qualitative information, to predict the impacts of the development of business activity. However, there is no single theoretical framework for businesses to systematize information about corporate responsibility or their contribution to sustainability (Kabir, 2007; Branco & Rodrigues, 2007).

This interest in the communication of commitment to sustainability has led to the publication of international guidelines on the diffusion of such practices across the board. These guidelines may be useful in order to facilitate the diffusion of the various economic, social, environmental, ethical and governance issues to a wide range of stakeholders (Gray, 2006; Chen & Bouvain, 2009; Dumay, Guthrie, & Farneti, 2010). Many of these guidelines have been formalized through different normalizing proposals for management policies of social responsibility and for the contents of the information for sustainability. Among the most important guidelines we must highlight the OECD (2011), the World Bank (World Bank, 2007), AccountAbility (2008a, 2008b), the United Nations Global Compact (UNGC, 2009) and the Guide on the UN Guiding Principles on Business and Human Rights (UN, 2011); but the most widespread initiative so far is that developed by the Global Reporting Initiative G3 (GRI, 2006), the latest version being the G4 (GRI, 2013).

However, in turn, concerns about sustainability reporting have been accompanied by the conclusions of some relevant analysts’ reports in the field of accounting (Deloitte, 2015, IMA, 2011, PWC, 2011) which have highlighted the need to incorporate a mindset focused on communicating the companies contribution make towards sustainability. This would require better communication on certain aspects such as: commitment to stakeholders (Sierra-García et al., 2013), materiality (Eccles et al., 2012a.), the simplicity of the reports (Abeysekera, 2013), insurance (Eccles et al., 2012b and Sierra-García et al., 2013) and generating confidence in the transparency process which companies follow (O’Donovan, 2002); this is the path to take for this behavior to start getting results (EU, 2013).

In this context, and under the pressure of an international (financial and governance) crisis, accompanied by the performance of companies in an increasingly globalized world characterized by limited resources, different types of institutions are joining a global coalition (IIRC), that recognizes Integrated Reporting as the way to communicate the process of creating corporate value and its contribution to sustainability to stakeholders.

IIRC stresses that this information is key to understanding the long-term sustainability of the company, through the business model and strategy, to provide information demanded by investors and other stakeholders, and to effectively and efficiently locate limited resources (IIRC, 2013).

The incorporation of this initiative or another similar IR is being promoted by the European Union (EU) for the disclosure of non-financial information (EU, 2014) by certain large companies and groups. This regulation will force companies to disclose such information from 2017 onwards.

For Eccles et al. (2012b), Integrated Reporting provides businesses with three types of benefits. Firstly, internal benefits through stronger commitment with respect to shareholders and improvement in resource allocation decisions; this will result in a lower reputational risk. Secondly, external or market benefits would be created by improving the quality of information provided to investors and improving the company's position in the sustainability indexes. And finally, by reducing regulatory risk, in responding to information requests from the capital markets and the adoption of a standard structure which will be generally accepted in the future.

Brown and Dillard (2014) stress the need for dialogue between the IIRC and other initiatives, with the aim of expanding their contents, to try to shed light on neglected issues and to diversify attention to stakeholders beyond prioritization given to investors. Thus, in recent months it has been observed that IIRC has shifted its orientation developing a ‘Corporate Reporting Dialogue’ initiative to respond more consistently and efficiently to market demand for a reporting derived from dialogue between the different reporting proposals (Corporate Reporting Dialogue, 2015). The following entities have adopted this proposal: CDP Driving Sustainable Economies, Climate Disclosure Standards Board (CDSB), Financial Accounting Standards Board (FASB), Global Reporting Initiative (GRI), International Financial Reporting Standards (IFRS), Integrated Reporting (IR) International Organization for Standardization (ISO) and Sustainability Accounting Standards Board (SASB). This shows us that IR is under continuous development. Research may provide it clues about what areas may need improvement.

The IR framework is based on a set of principles that match the search for a proper balance between flexibility and prescription, materiality and relevance, conciseness and demand for information. It defines as basic principles (IIRC, 2013):

- 1.

Strategic approach and Future orientation. An integrated report should enable better understanding of how the strategy of an organization contributes to the creation of value in the short, medium and long term. In order to do this, an analysis of risks and opportunities must be carried out, showing how it has learned from the past and present in order to move forward.

- 2.

Connectivity of information. An integrated report should show the interrelationship or interdependence between the different types of capital and the factors that affect the ability to create value.

- 3.

Relationship with stakeholders. An integrated report should show the quality of the relationship with stakeholders and, how and to what extent it meets their needs.

- 4.

Materiality. The integrated report should report the aspects which substantially affect the process of creation of value, for which information on the analysis process of materiality will be provided and on which of them are keys.

- 5.

Conciseness. An integrated report should seek a balance between the other principles and the amount of information that is provided, avoiding the inclusion of superfluous information.

- 6.

Reliability and Integrity. An integrated should make sure that all material aspects are included, both positive and negative, in a balanced way, as well as the scope of the information provided without material errors.

- 7.

Consistency and comparability. An integrated report should provide information comparable over time and externally.

The attention to these principles is a guarantee of the effectiveness of Integrated Reporting, that its’ implementation is really an improvement upon other types of reports and that it remedies the deficiencies of corporate reporting (KPMG, 2011; Jensen & Berg, 2012).

Previous research on Integrated Reporting, such as Dey and Burns (2010); Eccles and Krzus (2010); Lewis (2010); Abeysekera (2013); Brown and Dillard (2014) and Cheng, Green, Conradie, Konishi, & Romi (2014), have focused on the analysis of the needs and new internal mechanisms to facilitate this type of reporting (Stubbs & Higgins, 2014), as well as an progression in the contents. Other studies, such as Frías-Aceituno, Rodríguez-Ariza, & García-Sánchez (2013); García-Sánchez, Rodríguez-Ariza, & Frías-Aceituno (2013); Sierra-García et al. (2013) and Frías-Aceituno et al. (2014), analyzed the motivations and some explanatory factors for the adoption of this proposal. However, so far, less attention has been focused on studying the performance of its guiding principles (Soh, Leung, & Leong, 2015).

The prominence that the current Integrated Reporting is experiencing parallel to the importance of sustainability reporting as well as having reviewed previous writings on the subject, has led us to aim this research at analyzing the level of attention to the principles proposed by IR when preparing their reports, by those industrial companies which have recognized the adoption of this new type of reporting.

Given that one of the main characteristics of this type of reporting is integration, the attention to the principles to respond effectively to this IR framework requires a combined observance (KPMG, 2011; PWC, 2011; IIRC, 2013; Deloitte, 2015), which will be shown by the correlation between them. Moreover, the IR proposal seeks to avoid the information asymmetries highlighted by the Agency Theory (Frias-Aceituno, Rodríguez-Ariza, & García-Sánchez, 2014), and meet the demands of multiple stakeholders (Roberts, 1992). Our study is based on the proposition that the relevance of the information provided to all stakeholders can only be guaranteed if the guiding principles are addressed comprehensively, so they should be interrelated. This means a better integrated thinking that should imply, for example, improve cooperation, strategic focus, and easier links between key performance indicators (Sierra-García et al., 2013). This leads us to pose the following hypothesis:

H1: The development of an Integrated Reporting implies a positive correlation between the different principles.

Also, for effective transparency, greater accuracy and adequacy of the information provided is necessary, and therefore finding a balance between the principles proposed by IR with the principle of “conciseness”. Abeysekera (2013) proposes to integrate different types of content (narrative, numerical figures, links, etc.) to achieve this principle, due to the difficulty of effectively communicating the value creation process of an organization with a short, medium and long-term strategic approach. From the perspective of Stakeholder Theory, Chersan (2015) states that it becomes increasingly difficult to establish what content should have an Integrated Reporting. The difficulty derives from the impact that an incomplete, and most of all, lack of information may have on the decision-making process by stakeholders. Lizcano et al. (2011) conclude that the type of integrated report that prevails is usually a sum of other documents, arising from the voluntary exercise of putting together different reports. This aggregation of contents does not necessarily lead to better monitoring of the guiding principles or more relevant information to stakeholders. For this reason we propose to test the following hypothesis:

H2: Greater attention to the different principles is not correlated with the number of pages in the report.

Another issue to be contrasted in this study is whether as suggested by the Political Theory (Gray et al., 1995), companies are not alien to the environment in in which they carry out their operations when communicating their sustainability commitments. One issue that seems necessary to consider in this analysis is the effect of various aspects related to the legal system of the country. It would be reasonable to think that companies operating in similar institutionally countries could adopt similar reporting practices (Jensen & Berg, 2012; Dragu & Tiron-Tudor, 2013; García-Sánchez et al., 2013; Frías-Aceituno et al., 2013). From the perspective of Stakeholder Theory, the civil law legal system involves a larger number of interest groups, promoting the rights of employees and other stakeholders. In these countries there has been a trend towards greater dissemination of complementary information to the financial statements. While the common law legal system is more geared towards the protection of the shareholders. As a result of increased protectionism toward the rights of owners in these countries financial reports have dominated (Jensen & Berg, 2012). Moreover, according Frías-Aceituno et al. (2013), there are also arguments for the influence of the country's legal system from the Theory of Legitimacy as particularly companies that are located in civil law countries can use such reports to strengthen their commitments with stakeholders and the ones that are located in common law countries can obtain benefits such as the lower cost of capital and enhanced reputation. This assumptions lead us to formulate the following hypothesis:

H3: Companies with headquarters in countries with civil law systems tend to develop Integrated Reporting.

Another issue that might be relevant in our study is the possible link between IR and the level of development of the corporate social responsibility in the country where the company is located (Jensen & Berg, 2012; Dragu & Tiron-Tudor, 2013; Sierra-Garcia et al., 2013). The likelihood of disclosing and Integrated Reporting is to positively associated having a higher ranking position in the sustainable competitiveness index. To verify this possible connection, we propose to study a last hypothesis:

H4: Companies based in countries with the highest ranking of sustainable competitiveness tend to develop integrated reports.

Empirical AnalysisSample selectionAccording to the findings of Chersan (2015), the level of observance of Integrated Reporting principles is conditioned by the sector to which the company belongs. For that reason, and because this is a preliminary study, the study is limited to a specific sector: the industrial sector. In future work the results for this sector can be compared with other sectors to support these differences.

The industrial sector is one of the most affected sectors by the crisis situation as a result of the contraction of trade, particularly in export-oriented countries (Marelli et al., 2012) for its role in the production of intermediate goods and services between the material suppliers and the end users. It should assume an important role in sustainable development as a key interlocutor between the various stakeholders as well as its influence on variables such as unemployment or income per capita (Izraeli & Murphy, 2003). It is therefore appropriate to communicate what the value creation process of companies that make up this sector will be, to publicize how it is responding to this crisis; information is being provided through reporting this trend, highlighting the importance of analyzing to judge if you are performing adequately.

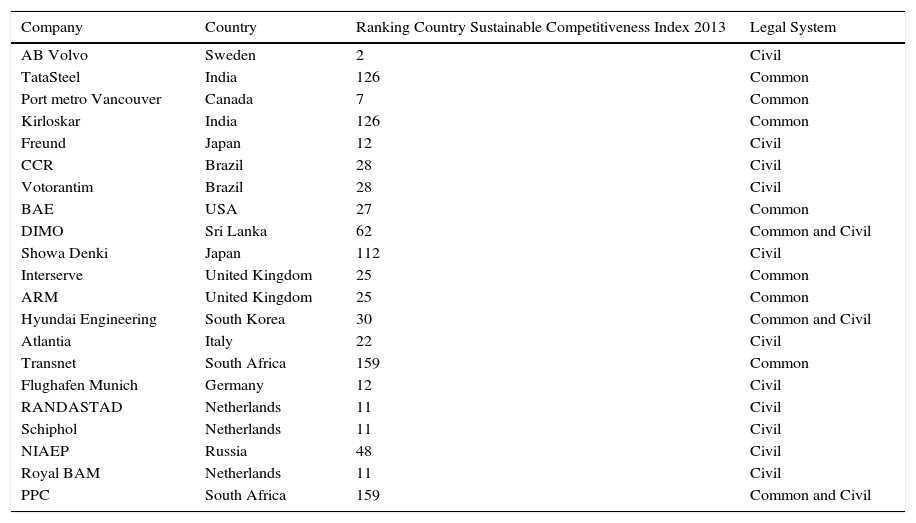

Therefore, the industrial companies that have joined as participants of the pilot launched by the IIRC for the development of Integrated Reporting memories or have been identified as companies that perform best practices in this project appearance by the IIRC, are the scope of this study. Thus the sample is composed of 21 companies (Annex 1), classified by IIRC as industrial in character, whose activity is the production of goods and services internationally, all of them large companies, in line with other studies such as Sierra-Garcia et al. (2013).

MethodologyThe object of study were the reports of the fiscal year 2013, or 2013 to 2014 when its elaboration does not correspond to the calendar year. Since the IR standard was published in 2013, this would be the first report to have a common frame of reference. The reports were taken from the websites of the investigated companies.

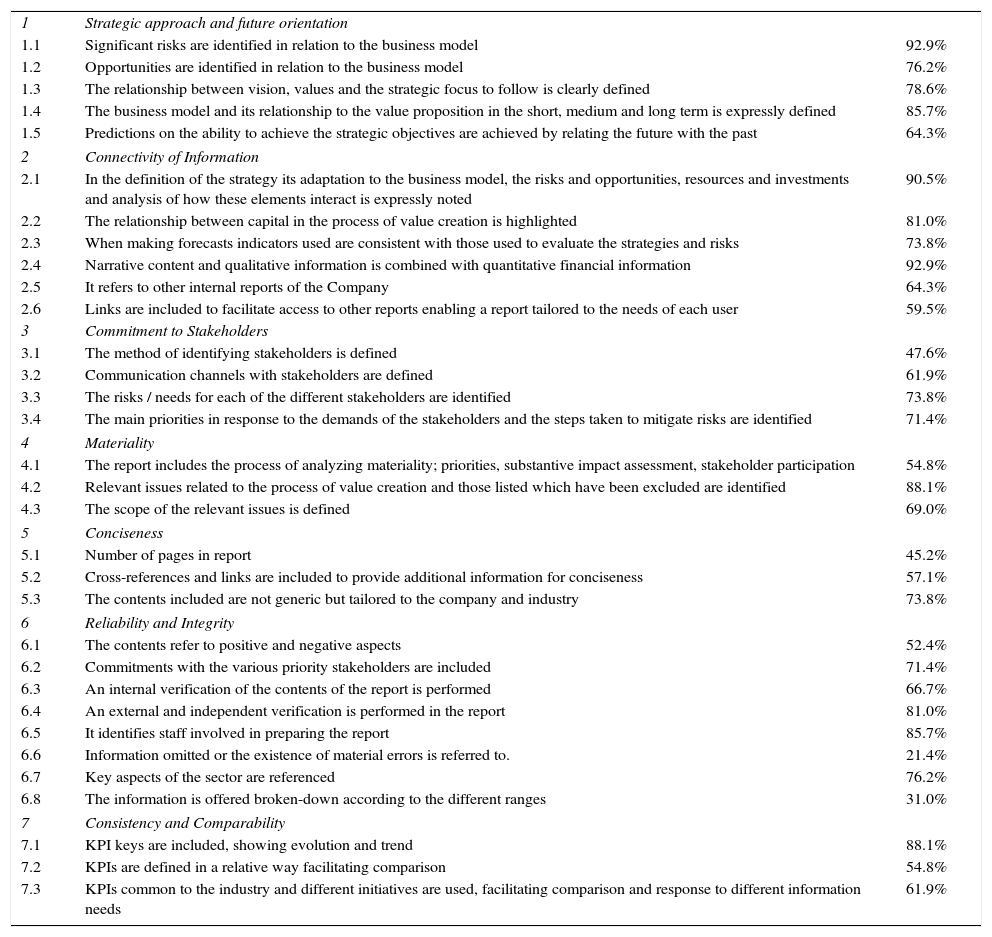

To evaluate the level of implementation of the IR principles and following the methodology used in other studies (Lizcano et al., 2011; Chersan, 2015), we analyzed the document prepared by IIRC (2013) to define, as accurate as possible, those items that might be related with each of the principles set out in the framework of Integrated Reporting. After this analysis we have drawn a chart of items made in concise terms to be identified in the reports. Finally, 32 items that respond to the seven principles outlined in the initiative were defined (Annex 2).

Once the variables representing the IR guiding principles have been defined, and in order to assess their level of monitoring, we have applied a methodology for analyzing the contents of Integrated Reporting memories of companies in the sample. This methodology has been used previously in other studies of a similar nature (Lizcano et al., 2011; Dragu & Tiron-Tudor, 2013; Navarro et al., 2014; Chersan, 2015). Each of the 32 items were reviewed by two researchers in the reports of the companies and treated as numeric variables that have a value of 0, 1 or 2 (to determine the degree of attention to the item), following the methodology already used by Frías-Aceituno et al. (2013). The analyzed item is set to 0 if it appears not reflected in the report, 1 if the information supplied is insufficient and 2 if it appears sufficiently explained. There are three items which corresponding to a dummy variable whose objective was to identify whether or not the aspect in question was being answered. Also, we have defined as contrasting variables according to previous studies (Jensen & Berg, 2012), the legal system of the country according to information from the World Bank (World Bank Group, 2015) and the assessment of the performance of the country where the main company is based, according to its participation in the sustainable competitiveness index compiled by SolAbility (SolAbility, 2013). Both variables are defined as ordinal variables, but in order to include them in the analysis of the country's membership of a particular legal system they are assigned a value of 0 for the common legal system, 1 when the system is mixed, and 2 for the civil legal system.

For the analysis of the principle “Conciseness”, a contrasting variable has also been introduced which is the length of the report measured in number of pages, defined as a numerical variable, at which the value of 0 is assigned if the number of pages exceeds 200, 1 if the number of pages is between 100 to 200, and 2 if the number is less than 1001.

For analysis of the level of attention to the principles, a global index has been developed composed of the average of the 32 items studied. All variables have been equally weighted in the general index, given the lack of experience about the importance of each principle in the composition of the index (Navarro-Galera et al., 2014; Dragu & Tiron-Tudor, 2013).

To carry out the investigation, different methodologies have been applied:

- a)

A descriptive analysis, based on an analysis of frequency, which determines the level of global and individual attention to the principles proposed by IIRC.

- b)

An analysis of correlations between principles to analyze the level of integrity found in responding to different principles by the companies analyzed (hypothesis H1). The same methodology is also applied to an analysis between the level of attention of the various principles and the principle “Conciseness” to verify hypothesis H2, and to contrast hypotheses H3 and H4.

- c)

An exploratory cluster analysis, which allows us to group the various companies analyzed depending on their differences and similarities in the level of attention to the principles. The localization of the companies grouped in each cluster will allow us to investigate the hypotheses H3 and H4.

We analyzed the level of attention to incorporating principles of Integrated Reporting in companies in the industrial sector. This analysis was done according to the frequencies in the scores assigned to each of the 32 variables that make up the seven guiding principles (Annex 2). The percentages in each of the principles have been calculated taking into account the maximum score that could have been obtained in each of them.

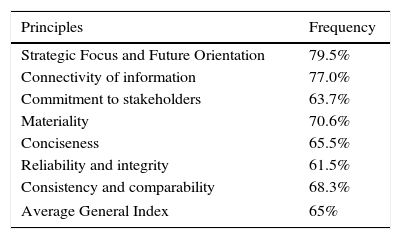

An overall average rate of compliance with the principles in the companies analyzed has also been created. To measure this average index all principles were weighted in a balanced manner, in the absence to date of research which could establish a differentiated weight for each of them. The results obtained are shown in Table 1.

Average frequencies for each of the Principles.

| Principles | Frequency |

|---|---|

| Strategic Focus and Future Orientation | 79.5% |

| Connectivity of information | 77.0% |

| Commitment to stakeholders | 63.7% |

| Materiality | 70.6% |

| Conciseness | 65.5% |

| Reliability and integrity | 61.5% |

| Consistency and comparability | 68.3% |

| Average General Index | 65% |

The results in Table 1 demonstrate that the analyzed companies in the industrial sector have made an effort to meet all the principles, but in all cases we see values of less than 80%. We could say that in the reports of 2013 we see a learning process towards incorporating the IR framework. The highest levels of attention to the principles presented were in the “Strategic Approach” (79.5%), “Connectivity of information” (77.0%) and “Materiality” (70.6%). An intermediate follow-up was observed in the rest of principles: “Consistency and comparability” (68.3%), “Conciseness” (65.5%) and “Commitment to stakeholders” (63.7%). “Reliability and integrity” is the principle which has a lower frequency (61.5%).

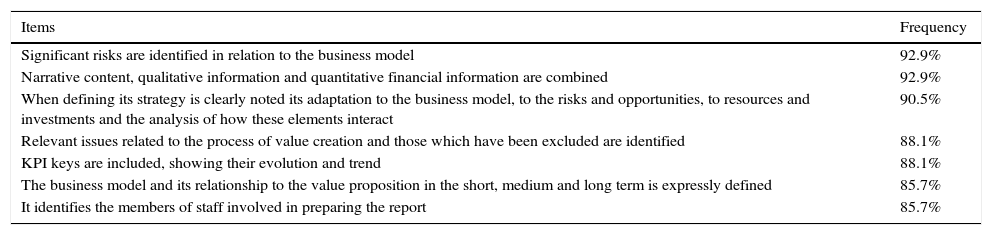

In frequency analysis for each of the items (Table 2) it should be noted that those who have obtained the highest scores are usually those whose report combines both financial information with non-financial, in which risks and the business model and the evolution and the tendency of some KPI are identified. All these issues were highlighted as essential elements of the IR proposal by the expert group of the project led by AECA (2012).

Items with higher frequencies (> 85%).

| Items | Frequency |

|---|---|

| Significant risks are identified in relation to the business model | 92.9% |

| Narrative content, qualitative information and quantitative financial information are combined | 92.9% |

| When defining its strategy is clearly noted its adaptation to the business model, to the risks and opportunities, to resources and investments and the analysis of how these elements interact | 90.5% |

| Relevant issues related to the process of value creation and those which have been excluded are identified | 88.1% |

| KPI keys are included, showing their evolution and trend | 88.1% |

| The business model and its relationship to the value proposition in the short, medium and long term is expressly defined | 85.7% |

| It identifies the members of staff involved in preparing the report | 85.7% |

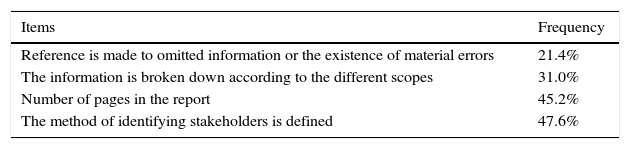

Conversely, if we refer the analysis to issues that have attracted less attention in the observance of the guiding principles of IR (Table 3), we note that there is rarely a statement on the information that has been omitted from the report, the information is hardly ever broken down according to their scope, a great effort has not made to adapt the length of the report to a number of pages referring only to relevant information without repetition, and what is especially notable is the lack of description of the procedures used to identify stakeholders, which is key to understanding the process of value creation and its contribution to sustainability.

Items with lower frequencies (<50%).

| Items | Frequency |

|---|---|

| Reference is made to omitted information or the existence of material errors | 21.4% |

| The information is broken down according to the different scopes | 31.0% |

| Number of pages in the report | 45.2% |

| The method of identifying stakeholders is defined | 47.6% |

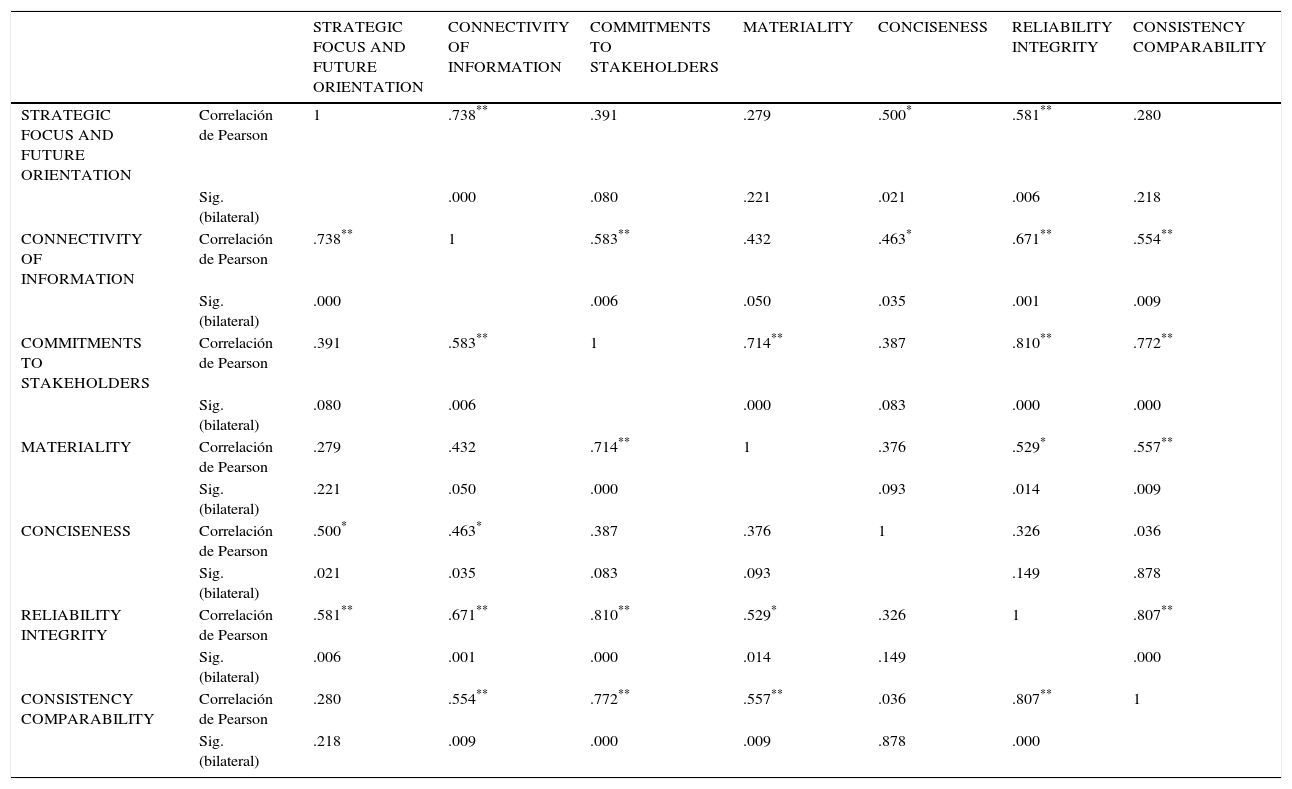

With regard to the first hypothesis of this study, the results of Table 4 confirm the integrity in incorporating the principles. Only the principle of “Conciseness” does not seem to be correlated significantly with any other principle. The highest correlations exist between the principle of “Reliability and Integrity” and principles of “Commitment to stakeholders” (0.810) and “Consistency and comparability” (0.807). The correlation between the latter two principles is 0.772. And finally, it highlights the correlation between the “Strategic focus and future orientation” and “Connectivity of information” (0.738). Some other correlations between the principles are significant, albeit with lower ratios. This allows us to confirm hypothesis H1.

Correlations between Principles.

| STRATEGIC FOCUS AND FUTURE ORIENTATION | CONNECTIVITY OF INFORMATION | COMMITMENTS TO STAKEHOLDERS | MATERIALITY | CONCISENESS | RELIABILITY INTEGRITY | CONSISTENCY COMPARABILITY | ||

|---|---|---|---|---|---|---|---|---|

| STRATEGIC FOCUS AND FUTURE ORIENTATION | Correlación de Pearson | 1 | .738** | .391 | .279 | .500* | .581** | .280 |

| Sig. (bilateral) | .000 | .080 | .221 | .021 | .006 | .218 | ||

| CONNECTIVITY OF INFORMATION | Correlación de Pearson | .738** | 1 | .583** | .432 | .463* | .671** | .554** |

| Sig. (bilateral) | .000 | .006 | .050 | .035 | .001 | .009 | ||

| COMMITMENTS TO STAKEHOLDERS | Correlación de Pearson | .391 | .583** | 1 | .714** | .387 | .810** | .772** |

| Sig. (bilateral) | .080 | .006 | .000 | .083 | .000 | .000 | ||

| MATERIALITY | Correlación de Pearson | .279 | .432 | .714** | 1 | .376 | .529* | .557** |

| Sig. (bilateral) | .221 | .050 | .000 | .093 | .014 | .009 | ||

| CONCISENESS | Correlación de Pearson | .500* | .463* | .387 | .376 | 1 | .326 | .036 |

| Sig. (bilateral) | .021 | .035 | .083 | .093 | .149 | .878 | ||

| RELIABILITY INTEGRITY | Correlación de Pearson | .581** | .671** | .810** | .529* | .326 | 1 | .807** |

| Sig. (bilateral) | .006 | .001 | .000 | .014 | .149 | .000 | ||

| CONSISTENCY COMPARABILITY | Correlación de Pearson | .280 | .554** | .772** | .557** | .036 | .807** | 1 |

| Sig. (bilateral) | .218 | .009 | .000 | .009 | .878 | .000 |

To delve deeper into integrity when incorporating the principles, we have analyzed the level of correlation between the level of attention to the principle “Conciseness” and the other principles, as a result of the difficulties noted in reporting to be precise and succinct. The results obtained by the correlation analysis show that there is a significant correlation only between the principle of concision and the principles of strategic orientation and connectivity. For this reason, it has been possible to partially corroborate the hypothesis H2.

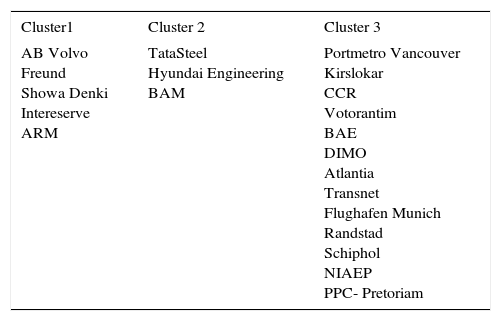

Finally, to test the hypothesis H3 and H4 an analysis of correlations between the overall index and the variables belonging to the legal system and the country's position in the ranking of sustainable competitiveness has been carried out (Annex 1). The results of this analysis have not allowed us to confirm these hypotheses. Therefore, to delve further into the potential impact of the environment on complying with the guiding principles of IR a cluster analysis was conducted (Table 5).

The formation of the cluster is not related to membership of the legal system nor with the position of the country in the ranking where the headquarters of the companies analyzed are located.

It has been shown that the groups in Table 5 correspond to the levels achieved in the average index of each of the companies. Thus, some companies with higher rates of attention to the guiding principles of IR are grouped in cluster 3. Those who have obtained intermediate values are grouped in cluster 1, whereas those with a lower level of attention belong in the cluster 2. All this is regardless of the legal system and the sustainable competitiveness ranking of the country.

Discussion and ConclusionsThe objective of this research has been to study the level of attention to the guiding principles of the IR initiative. Reports of industrial companies adhering to the initiative have been analyzed, concluding that, using a frequency analysis to monitor these principles, although an effort has been made to follow the principles of IR, much remains to be done, and that compliance is still in a phase that could be considered as incipient for some of these companies.

While some issues such as the strategic approach to information and the relationship between capitals in the process of value creation seem to have a high level of monitoring, other aspects would require a greater emphasis, if we want that reports have greater credibility and transparency. We refer specifically to the need for greater engagement of stakeholders in the process of preparing reports, to identify material issues, or the mechanisms to assurance the information, which would give the reporting higher reliability.

Although the results lead us to believe that the level of attention to principles is not very high, however, is being provided in an integrated manner, except for the attention given to the principle “Conciseness”. In a previous study, Eccles et al. (2012a) concluded that the reports on climate change of industrial companies use repetitive language; and that despite their size, it was not easy to quantify the impacts on the creation or destruction of value as a result of the lack of metrics. Some results of our research corroborate these findings. The existence of a high narrative content has been proven, but sometimes does not respond to the recommendations of the guiding principles about its “Conciseness”.

Other question that has been proven is the difficulty to ensure the comparability of information, even though all the reports analyzed are from companies which belong to the industrial sector, as the KPIs used are not homogeneous. In this sense, it may be desirable for this aspect to be one of the elements to be discussed in the dialogue process recently opened by IIRC with other initiatives.

Finally, it has not been possible to contrast the results of the study of Jensen and Berg (2012), about the degree of attention to IR influenced by the legal system of the country where the company is headquartered, or their position in the sustainable competitiveness index. At present, attention given to the principles could be more conditioned by the internal preferences of those who prepare the information than by the influences of the environment.

Limitations and future researchesThe results and conclusions of the study are limited by the small number of companies that have adapted their reports after the end of the period of consultation draft of the IR conceptual framework in March 2013. We have chosen this early stage to analyze the first approaches to the IIRC proposal and to study in the future the evolution of the contents in time as well as progress on the maturity of the guiding principles.

Some of the hypotheses have not been proven because of the reduced size of the sample, which constitutes an important limitation to the study. In future researches the sample could be larger when the IR initiative reaches a level more mature and greater monitoring by companies.

Furthermore, the study is limited to a specific sector: the industrial sector. Over time, the development of the initiative and the incorporation of a greater number of companies to the database IIRC will enable a comparative analysis by sectors that could show whether there are significant differences between them.

Likewise, the study may be limited by the methodology. The system for allocating scores to each of the defined variables could introduce subjectivity in the results. However, this does not negate the conclusions of this study.

Conflict of interestThe authors have no conflict of interest to declare.

Identification and characteristics of the sample.

| Company | Country | Ranking Country Sustainable Competitiveness Index 2013 | Legal System |

|---|---|---|---|

| AB Volvo | Sweden | 2 | Civil |

| TataSteel | India | 126 | Common |

| Port metro Vancouver | Canada | 7 | Common |

| Kirloskar | India | 126 | Common |

| Freund | Japan | 12 | Civil |

| CCR | Brazil | 28 | Civil |

| Votorantim | Brazil | 28 | Civil |

| BAE | USA | 27 | Common |

| DIMO | Sri Lanka | 62 | Common and Civil |

| Showa Denki | Japan | 112 | Civil |

| Interserve | United Kingdom | 25 | Common |

| ARM | United Kingdom | 25 | Common |

| Hyundai Engineering | South Korea | 30 | Common and Civil |

| Atlantia | Italy | 22 | Civil |

| Transnet | South Africa | 159 | Common |

| Flughafen Munich | Germany | 12 | Civil |

| RANDASTAD | Netherlands | 11 | Civil |

| Schiphol | Netherlands | 11 | Civil |

| NIAEP | Russia | 48 | Civil |

| Royal BAM | Netherlands | 11 | Civil |

| PPC | South Africa | 159 | Common and Civil |

Issues discussed in relation to compliance with the Principles and Guidelines of IR.

| 1 | Strategic approach and future orientation | |

| 1.1 | Significant risks are identified in relation to the business model | 92.9% |

| 1.2 | Opportunities are identified in relation to the business model | 76.2% |

| 1.3 | The relationship between vision, values and the strategic focus to follow is clearly defined | 78.6% |

| 1.4 | The business model and its relationship to the value proposition in the short, medium and long term is expressly defined | 85.7% |

| 1.5 | Predictions on the ability to achieve the strategic objectives are achieved by relating the future with the past | 64.3% |

| 2 | Connectivity of Information | |

| 2.1 | In the definition of the strategy its adaptation to the business model, the risks and opportunities, resources and investments and analysis of how these elements interact is expressly noted | 90.5% |

| 2.2 | The relationship between capital in the process of value creation is highlighted | 81.0% |

| 2.3 | When making forecasts indicators used are consistent with those used to evaluate the strategies and risks | 73.8% |

| 2.4 | Narrative content and qualitative information is combined with quantitative financial information | 92.9% |

| 2.5 | It refers to other internal reports of the Company | 64.3% |

| 2.6 | Links are included to facilitate access to other reports enabling a report tailored to the needs of each user | 59.5% |

| 3 | Commitment to Stakeholders | |

| 3.1 | The method of identifying stakeholders is defined | 47.6% |

| 3.2 | Communication channels with stakeholders are defined | 61.9% |

| 3.3 | The risks / needs for each of the different stakeholders are identified | 73.8% |

| 3.4 | The main priorities in response to the demands of the stakeholders and the steps taken to mitigate risks are identified | 71.4% |

| 4 | Materiality | |

| 4.1 | The report includes the process of analyzing materiality; priorities, substantive impact assessment, stakeholder participation | 54.8% |

| 4.2 | Relevant issues related to the process of value creation and those listed which have been excluded are identified | 88.1% |

| 4.3 | The scope of the relevant issues is defined | 69.0% |

| 5 | Conciseness | |

| 5.1 | Number of pages in report | 45.2% |

| 5.2 | Cross-references and links are included to provide additional information for conciseness | 57.1% |

| 5.3 | The contents included are not generic but tailored to the company and industry | 73.8% |

| 6 | Reliability and Integrity | |

| 6.1 | The contents refer to positive and negative aspects | 52.4% |

| 6.2 | Commitments with the various priority stakeholders are included | 71.4% |

| 6.3 | An internal verification of the contents of the report is performed | 66.7% |

| 6.4 | An external and independent verification is performed in the report | 81.0% |

| 6.5 | It identifies staff involved in preparing the report | 85.7% |

| 6.6 | Information omitted or the existence of material errors is referred to. | 21.4% |

| 6.7 | Key aspects of the sector are referenced | 76.2% |

| 6.8 | The information is offered broken-down according to the different ranges | 31.0% |

| 7 | Consistency and Comparability | |

| 7.1 | KPI keys are included, showing evolution and trend | 88.1% |

| 7.2 | KPIs are defined in a relative way facilitating comparison | 54.8% |

| 7.3 | KPIs common to the industry and different initiatives are used, facilitating comparison and response to different information needs | 61.9% |

Abeysekera (2013) recommends that the number of pages should be around 10, but taking into account the common practice in reporting, where it is difficult to find a report under 100 pages, we have chosen to establish these benchmarks on the grounds that it is already showing a progressive conciseness to reduce the number of pages to under 100 if an integration of financial and non-financial information is made.