This paper mainly focuses on decisions taken by politicians that may affect the level of municipal corruption. Specifically, we study whether local politicians’ incentives to be corrupt are influenced by the wages they receive and/or their intention to run for next elections. This issue has hardly been empirically tackled before at local level.

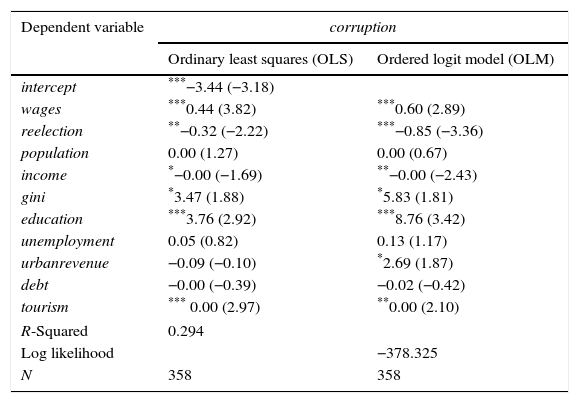

Method and dataOur sample comprises 358 Spanish municipalities of over 20,000 inhabitants for the period 2004–2009. We use two different methods of estimation, ordinary least squares and ordered logit model, to analyze the influence of politician's wages and/or their intention to seek re-election on corruption. We utilize as gauge of corruption the total cases of urban corruption (reported in the online press) in each municipality during this period.

ResultsWe show an impact of wages and re-election on corruption. First, relatively higher wages do not reduce politicians’ incentives to be corrupt. Second, when politicians want to be re-elected, corruption decreases. We also find that income level, income inequality, education level, municipal urban revenues and touristic nature of the municipality affect corruption.

ConclusionsOur findings suggest that it is necessary that local governments pay particular attention to rules related to the way politicians’ wages are set and the term limits restrictions.

Este artículo se centra principalmente en las decisiones que adoptan los políticos y que pueden afectar al nivel de corrupción municipal. Específicamente, se analiza si los impulsos que mueven a los políticos locales a corromperse están influidos por los salarios que reciben y/o su intención de presentarse a las próximas elecciones. Esta cuestión apenas se ha abordado empíricamente antes a nivel local.

Método y datosNuestra muestra comprende 358municipios españoles de más de 20.000habitantes durante el período 2004-2009. Utilizamos dos métodos diferentes de estimación: los mínimos cuadrados ordinarios y el modelo logit ordenado, para analizar la influencia en la corrupción de los salarios de los políticos y/o su intención de presentarse a la reelección. Utilizamos como medida de corrupción el total de casos de corrupción urbana (comunicados en la prensa en línea) en cada municipio durante este período.

ResultadosSe muestra que existe repercusión de los salarios y la reelección en la corrupción. En primer lugar, los salarios relativamente más altos no reducen los impulsos de los políticos a corromperse. En segundo lugar, cuando los políticos quieren ser reelegidos, la corrupción disminuye. También encontramos que el nivel de ingresos, la desigualdad en los ingresos, el nivel de educación, los ingresos urbanos municipales y la naturaleza turística del municipio afectan a la corrupción.

ConclusionesNuestros hallazgos sugieren que es necesario que los gobiernos locales presten especial atención a las normas relacionadas con la forma en que se fijan los salarios de los políticos y el límite en la duración de las restricciones.

A major problem in every political system is that politicians in office may use their power to pursue their own interests, rather than those of citizens. Politicians are in a position that allows them to divert public funds into their own pockets (Svaleryd & Vlachos, 2009). In fact, it has been claimed that policymakers seek power, ego-rents and even bribes (Tella & Fisman, 2004).

Transparency International (2012) defines corruption as the abuse of entrusted power for private gain. Corruption generally comprises illegal activities, which mainly come to light only through scandals, investigations or prosecutions. Although previous studies have explored several factors of corruption, most of them have been conducted at national levels. In fact, the European Commission (2014) considers that no comprehensive approach of corruption has been developed at regional and local levels.

The evaluation of corruption is more complex at the regional and local level. There are three principal approaches to measure corruption at the macro level: (1) general or target-group perception (Seldadyo & De Haan, 2006); (2) incidence of corruptive activities (Seldadyo & De Haan, 2006); and (3) bribes reported, the number of prosecutions brought or court cases directly linked to corruption (Transparency International, 2012). The first kind of measures reflects the feeling of the public or a specific group of respondents about corruption. The second approach is based on surveys among those who potentially bribe and those whom bribes are offered. The third kind of measures groups more objective variables that are also used as indicators of corruption levels. However, at local level, the difficulty of measuring corruption levels through any of these approaches has become a major obstacle due mainly to the limited availability of surveys and database needed to measure corruption in a proper way (Ferraz & Finan, 2007). For this reason, as stated above, while numerous have examined the determinants of corruption in an international comparative approach, municipal research on this issue is more scarce.

Our paper contributes to close this perception gap. It analyzes the determinants of corruption at local level, with a focus on municipal politicians’ decisions connected to corruption. In particular, we investigate whether local politicians’ incentives to be corrupt are influenced by their wages and/or their intention to run for next election. We use a sample of 358 Spanish municipalities over 20,000 inhabitants for 2004–2009.

In Spain, corruption cases have become an important problem in the recent years. One of main Spanish local governments’ responsibilities is town planning, according to which they can classify land for urban development with little or no consultation. Therefore, there is a serious risk that local politicians might accept bribes from real estate developers in exchange for rezoning their lands. Indeed, according to Jimenez (2009), the Spanish town-planning model and the last extraordinary building boom were the main sources of local political corruption in Spain. Furthermore, Spanish laws allow local politicians to set their own salaries and run for election as many times as they want, since terms are not limited. Therefore, we consider it interesting to analyze this issue in a context in which corruption is more feasible and political power is highly discretionary, namely, Spanish local governments.

We show that relatively higher wages do not reduce politicians¿ incentives to be corrupt, and when they seek re-election, corruption decreases. Moreover, we also find that income, income inequality, education level, municipal urban revenues and touristic nature of the municipality affect corruption.

The paper is structured as follows. Literature section reviews the literature on corruption. Methodology section provides details of the sample, econometric model and control variables. Results and discussion section presents the empirical results and the discussion. Finally, conclusions and further research section summarizes conclusions and proposes further research.

LiteratureAccording to Zimmerman (1977), as in all organizational contexts, an agency problem exists between elected officials and voters. Voters, principals, elect a politician, agent (Barro, 1973; Ferejohn, 1986). The interests of politicians and voters are not perfectly aligned, so politicians in office may use their power to pursue their own interests, rather than those of the citizens.

Persson, Roland, and Tabellini (1997) model this political agency problem as one of rent extraction. Voters pay taxes to fund public goods that are provided by politicians with uncertain costs. Given that politicians know these costs, they take advantage of this information asymmetry by extracting rents from the tax collected for personal benefit, which reduces the funds available for supplying public goods. Therefore, voters’ utility decreases as the amount of rents extracted increases (Alt & Lassen, 2003).

Although all of the ways of obtaining political rents can be seen as unethical, only some of them actually are illegal. According to Transparency International (2012), corruption is defined as the abuse of entrusted power for private gain through illegal activities. This abuse of entrusted power by politicians through corruption is a threat to many modern democracies. However, while the pervasive effects of corruption have been well documented, the root causes are poorly understood (Ferraz & Finan, 2011).

Some recent empirical studies have explored the determinants of corruption, most of them at national levels. Furthermore, several of these factors have not been analyzed in depth. For example, while there are convincing theoretical arguments why political decisions affect corruption, the empirical evidence is rather scarce. Below, we present the literature on two main decisions taken by municipal politicians that may affect the level of corruption: politicians’ wages and their intention to run for next elections.

Politicians’ wagesEfficiency wage theories posit that higher levels of pay induce higher productivity. This effect can be explained by three different efficiency models. First, sociological models postulate that employees who believe they are overpaid (comparing their wages with those of comparable employees) are more likely to work harder and be more productive (Adams, 1963; Akerlof, 1984; Cappelli & Chauvin, 1991). Second, the shirking model suggests that employees overpaid exert effort and avoid improper behaviour so as to retain their jobs and continue earning above-market rents (Baker, Murphy, & Jensen, 1988; Shapiro & Stiglitz, 1984). While the first two arguments are due to motivation reasons, the third argument is based on the selection model. This model argues that firms have imperfect information about worker abilities, thus they may attract higher quality employees by offering higher wages (Malcomson, 1981; Weiss, 1980; Yellen, 1984).

All these models support the idea that a wage increase fosters employees’ productivity. Chen and Sandino (2012) complement the efficiency wages theories by examining the impact of relative wages on employee theft. Thus, they predict that relatively higher wages will discourage employee theft for two reasons: first, employees receiving relatively higher wages are less inclined to commit theft as they attempt to reciprocate positively to their employers and/or to retain their high-paying jobs (motivation mechanism); second, firms that offer relatively higher wages may attract a higher proportion of honest workers (selection mechanism).

Chen and Sandino (2012) also contribute to the management control literature that examines the effects of control mechanisms on employee behaviour (Hannan, 2005; Kuang & Moser, 2009; Matuszewski, 2010). Thus, higher wages can provide an alternative mechanism to deter fraudulent behaviour, beyond other honesty inducing control mechanisms studied in the accounting and control literature (Evans, Hannan, Krishnan, & Moser, 2001; Hansen, 1997; Hesford & Parks, 2010; Webb, 2002; Zhang, 2008). However, not all politicians respond in the same way to the same incentives. Thus, regardless of the wage level, some politicians might be corrupt because of their own psychological or moral makeup, or because some of the bribes offered may be too large for some politicians to resist. In this sense, the fight against corruption pursued exclusively on the basis of wage increases can be very costly to the budget of a municipality, which may not be welcomed by citizens, and can achieve only part of the objective, since despite high wages, some individuals may continue to engage in corrupt practices (Tanzi, 1998).

Extending efficiency wage theories to the public sector, Gagliarducci and Nannicini (2011) state that paying politicians more could also improve their performance (productivity) for different reasons. First, politicians’ morale could increase as their wages rise (sociological models). Second, paying politicians better may increase their performance because of their need to hold office (shirking model) (Besley, 2004). Finally, higher wages will attract more quality citizens into politics (selection model).

As Chen and Sandino (2012) do for private sector, Van Rijckeghem and Weder (2001) and Alt and Lassen (2003) have also tried to complement the efficiency wage theories for public sector. Thus, they have studied the impact of politicians’ wages (employees) on corruption (employee theft).

The public choice literature has also developed the management control theory by analyzing how control mechanisms can reduce political corruption (Andreoni, Erard, & Feinstein, 1998; Becker & Stigler, 1974; Besley & McLaren, 1993; Braun & Di Tella, 2004; Treisman, 2000). This theory posits that corruption depends on the auditing intensity and the combination of sticks (fines, dismissal) and carrots (wages, prestige, pensions) offered to the agent (politician). In this way, quality of bureaucracy, judicial system and public sector wages are crucial factors influencing corruption (Seldadyo and De Haan, 2006; Van Rijckeghem & Weder, 2001).

There are some empirical studies that link corruption to the extent of wages in public sector (Alt & Lassen, 2003). Andvig and Moene (1990), Van Rijckeghem and Weder (2001), Alt and Lassen (2003), Herzfeld and Weiss (2003) and Beylis, Finan, and Mazzocco (2012) show a negative relationship between wages and corruption. This means that raising wages can be an alternative mechanism to deter corruption. However, Seldadyo and De Haan (2006) obtain that an increase in government wages leads to more corruption. Finally, other studies do not find a statistically significant relationship between these variables (Gurgur & Shah, 2005; Treisman, 2000).

Accordingly, we propose the following hypothesis:H1 There is a relationship between the politicians’ wages and the level of corruption.

The abuse of entrusted power by democratically elected politicians through corruption is a central issue in a large number of countries. As stated above, a political agency problem exists between politicians and voters (Barro, 1973; Ferejohn, 1986). A crucial assumption of the political agency literature is that corruption diminishes the probability of being re-elected (Alt & Lassen, 2003).

Alt and Lassen (2003) argue that when the politician remains in office or when the politician does not run for next election, corruption could increase. First, if the incumbent is “too sure” of remaining in office, corruption would be high. Second, if the incumbent is almost certain not to have a next period, for example due to term limits, nothing is lost in terms of re-election possibilities and the incumbent may be more corrupt. In other words, a politician who faces the possibility of re-election can exploit the information asymmetry to increase re-election chances by behaving honestly, refraining from corruption. Accordingly, politicians who have incentives to run the next election are likely to be less corrupt than politicians who have not (Ferraz & Finan, 2011). However, politicians who run for re-election may use illicit means, such as illegal campaign practices, electoral fraud or voter intimidation, to enhance their probabilities of being re-elected and continue their illegal activities (Nyblade and Reed, 2008). In other words, re-election can also feed corruption.

There is a growing empirical literature which analyze how electoral process influences politicians behaviour (see, e.g., Alt & Lassen, 2003; Alt, de Mesquita, & Rose, 2011; Besley & Case, 1995; List & Sturm, 2006). For instance, Besley and Case (1995) show that economic policy choices by lame duck governors (governors who cannot run next time due to term limits) are different from those who have a reputation to sustain. Alt and Lassen (2003) apply this reasoning to the political corruption behaviour and find that statutory term limits tend to increase corruption. Politicians in their last term may be more corrupt since they do not have electoral incentives and they do not need to maintain their reputation. In the same way, Ferraz and Finan (2011) study how re-election incentives affect political corruption. Using a dataset of Brazilian municipalities, they find that politicians with re-election incentives are significantly less corrupt than politicians without re-election incentives. In the same way, Beylis et al. (2012) also show that mayors who face re-election incentives are significantly less corrupt than mayors who are unable to run for re-election. Therefore, by increasing an elected official's political horizon, the incentive to engage in corruption decreases. However, Chang (2005) shows that if politicians who run for re-election have uncertainty regarding their chances of winning election, they will be more corrupt in order to finance campaigns to remain in power.

Given the above, we propose the following hypothesis:H2 There is a relationship between re-election and the level of corruption.

The sample comprises 358 Spanish municipalities of over 20,000 inhabitants for the period 2004–20091 (see “Econometric model” section for more information about the time window). The initial number of municipalities was 388, but the lack of data for some variables led to a sample size reduction. The dataset includes political, socio-economic and financial variables.

We must note that working at sub-national level has an important advantage regarding data features. Studies focusing on national data usually take one country or a sample of countries. In the former case, the number of observations is small. In the latter, an international comparison is possible, with an increase of observations. However, the problem of institutional differences among countries arises. Sub-national samples solve both problems, because regional and local electoral data provide more observations than national elections (Rogoff, 1990). In addition, the institutional background is homogeneous, compared to samples from different countries.

Moreover, we use a sample of municipalities of over 20,000 inhabitants since the available resources for large municipalities are wider than in smaller ones, and so sustainability analysis has greater scope and impact (Navarro-Galera, Rodríguez-Bolívar, Alcaide-Muñoz, & López-Subires, 2016; Rodríguez-Bolívar, Navarro-Galera, Alcaide-Muñoz, & López-Subires, 2014). In fact, many studies on Spanish local governments have also considered exclusively municipalities with relatively large populations (Brusca, Manes-Rossi, & Aversano, 2015; Guillamón, Bastida, & Benito, 2011; Navarro-Galera et al., 2016; Pina, Torres, & Royo, 2010; Rodríguez-Bolívar et al., 2014).

Finally, we think that local governments in Spain provide an ideal institutional setting to test our hypothesis for several reasons. First, Spain is perceived as being among the most corrupt country in the European Union (European Commission, 2013). Second, executive accountability is limited. The Spanish Supreme Audit Institution is the only body responsible for auditing government accounts and financial management. However, although the agency is legally independent, in practice it is influenced by the two major political parties. Therefore, the institution is not very effective in controlling public sector's efficiency and effectiveness. Third, Spanish laws allow local politicians to set their own salaries and run for election as many times as they want since number of terms is not limited. And lastly, Spain is one of the most decentralized countries in Europe. In fact, Spanish local governments decide a number of important tasks, including the elaboration and execution of urban plans. The whole municipal territory is divided into three land categories: non-developable, developable and urban land. The main purpose of town planning is to decide about the non-developable or developable land. The legal urban planning framework has been based on three basic essentials (Romero, Jimenez, & Villoria, 2012): (1) all land in the country was “classified” by municipal plans as fit or unfit for building and urban development; (2) most of the capital gains generated by land classification were rendered to the landowner regarded as fit for development, and just a small part of it (10% to 15%) was recovered by the public administration that decided on land use; and (3) if a public administration needed to expropriate land for public use, the law required a calculation of its value that prevented in practice to expropriate land classified as fit for urban development. From mid-1980s onwards a new significant element in land-use plans emerged without any supporting legislation. Some important municipal governments started to sign town planning agreements with developers who would be willing to fulfil more commitments than required by law, in exchange for amendments in the current urban plan, including the rezoning of some plots. The agreements were signed only by the developers and the town mayor and paved the way to amendments on the existing urban plan (in a legal procedure with little publicity and citizen participation) which very often meant a complete transformation of the city model envisaged in the amended plan. The extraordinarily widespread use of these urban agreements in Spanish local governments shows the great flexibility in the approach to urban development, and it also explains the growing problems of corruption in this field, since local politicians might accept bribes from real estate developers in exchange for rezoning their lands. In fact, according to Jiménez, Villoria, and Garcia-Quesada (2012), cases of corruption increased dramatically during the last housing boom. In this sense, an article on Spanish corruption in the New York Times reads: “The concentration of power in the hands of regional and municipal officials and their ties to the local savings banks created ideal conditions for corruption in the construction boom years” (“Small-Town Mayor's Millions as Exhibit A on Graft in Spain”, New York Times, May 4th, 2013).

Econometric modelThe main aim of our empirical analysis is to assess whether local politicians’ incentives to be corrupt are influenced by their wages and/or their intention to seek re-election. For this purpose, we use the number of cases of political corruption detected in each Spanish local government during the period 2004–2009 (corruption) as dependent variable. Therefore, we use the third of the three principal approaches to measure corruption we have mentioned in the Introduction section (bribes reported, the number of prosecutions brought or court cases directly linked to corruption).

This variable comes from the Corruption database made by professors Jerez, Martín and Pérez (University of La Laguna, Spain) for the research project “Land urbanization and local policy in Spanish democracy: an insight on agriculture”. Due to the lack of official statistics on municipal corruption, these authors used online press to identify urban related corruption cases. They include in their dataset those municipalities that present any irregular urban practice or excessive development. Specifically, they included cases in which politicians have been charged for prevarication, bribery, embezzlement of public funds, crimes against land use, etc., regardless of whether they have been prosecuted or not (see Martín, Jerez, Pérez, & García, 2010). They detected 676 cases of corruption in Spanish local governments from 2000 to 2009.

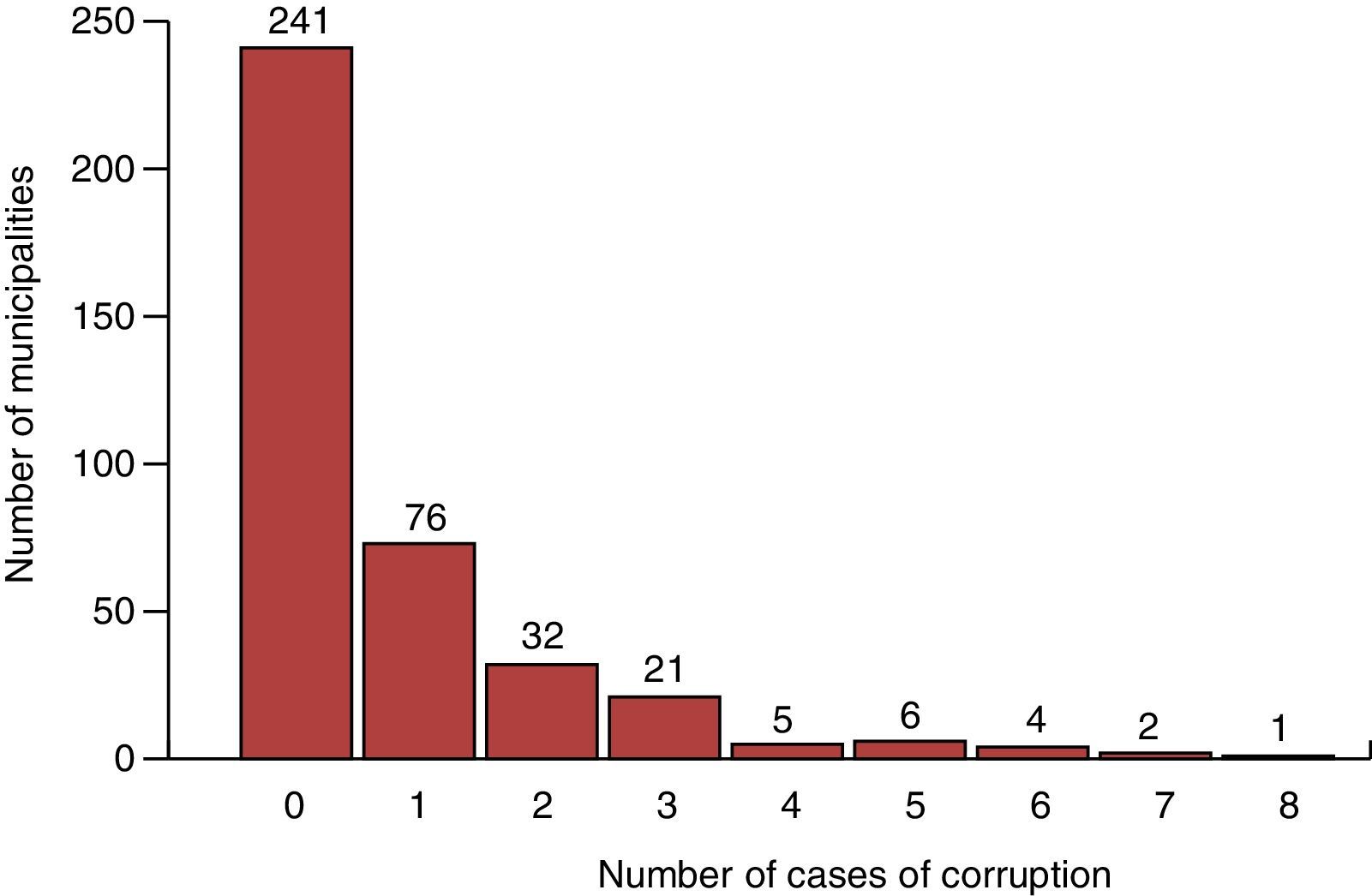

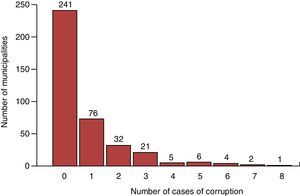

As we explain above, our study focuses on Spanish municipalities of over 20,000 inhabitants for the period 2004–2009. Although the corruption database has data from 2000 to 2009, we only choose this time window (2004–2009) due to way we measure the incentives of politicians to run the following re-election, as explained below. During this period (2004–2009), 299 cases of corruption were detected on Spanish municipalities of over 20,000 inhabitants. Specifically, 147 municipalities of the 388 that made up our initial sample present at least one case of corruption. Fig. 1 shows the distribution of the variable corruption.

We therefore estimate the following regression:

where i indicates municipalities, α is the constant of the equation, γ1, γ2and βj are the parameters to be estimated, Xji is the vector of control variables and ¿i is the error term.We analyze two different approaches: ordinary least squares (OLS) and ordered logit model (OLM). As we stated above, our dependent variable is the number of cases of corruption in each municipality during the period 2004–2009; therefore, it is discrete and ordered, inasmuch as less cases of corruption (or none) are better than more cases. In this case, the latter model is more appropriate than OLS due to the ordinal nature of the dependent variable. When the dependent variable is ordered categorical, both ordered probit model and the ordered logit model are appropriated. In these models, the probabilities of each outcome, conditional on the independent variables, are modelled using the cumulative normal distribution or Weibull distribution, respectively (Collett, 2003). If residuals are not normally distributed, which is our case, ordered logit model should be applied.

The key independent variables in our model are wages and reelection, which capture the effects of top politicians’ salary and their intention to seek re-election on municipal corruption, respectively. The former is the average of the ratio of the average wage paid to politicians over the average wage in the municipality for 2004–2009. This ratio measures if a politician's wage exceeds the average wage paid to the citizens of the municipality.

Spanish laws entitle top municipal politicians to set their own salaries. Each year, the municipal government submits a budget for approval by the municipal council. Top politicians’ wage has its own separate line item in the municipal budget. Top politicians are defined as the members of the municipal council who make up the municipal government and they are responsible for elaborating the municipal budget. Accordingly, they are able to determine their own salary in the budget. The budget must be approved as minimum by a simple majority of the municipal council. Although the council has the power to reject this budget, it will be passed when the ruling party or parties govern in majority. In these cases, local top politicians are totally free to set their own salaries. If the ruling party or parties govern in minority, they need the support of one or more opposition parties to pass the budget, and hence to set the amount allocated to top politicians’ wage. Consequently, decisions on top politicians’ wages are up to local authorities. The Spanish government passed in December 2013 a new law that aims to limit local politicians’ wages. It took effect in January 2014. In the period of this research this law did not exist, thus top politicians were able to set their own salaries.

Reelection is a dummy variable that takes a value of one if the mayor runs for re-election in 2007, and zero otherwise. Local elections in Spain take place every four years and politicians can run for elections as many times as they want, since there are not term limits’ restrictions. During the period that the Corruption database is available (2000–2009), two elections took place: in 2003 and in 2007. This means the mayor may have run for re-election in 2003 and 2007. We focus on the period 2004–2009 to analyze only the behaviour of politicians according to their intention to run in the 2007 election, since our database only allows us to introduce the information on one election due to the dependent variable's measurement (total cases of urban political corruption in each municipality), appearing each municipality only once in the database.

Local elections are based on closed party lists and municipal council members are elected on a proportional basis. Thus, the mayor is elected by the members of the municipal council; he/she is responsible for appointing the officials of the municipal government from among the municipal council members. Obviously, the mayor selects the officials of the municipal government from the members of the party or parties that support him/her.

Control variablesIn order to isolate the effect of our variables of interest (wages and reelection), it is necessary to control for the effects of other factors on corruption that stem from the theoretical and empirical underpinnings. Among the control variables, we consider the population of the municipality (population). According to Billger and Goel (2009), population may have two opposite effects on corruption. A greater concentration of the population increases opportunities for interaction between potential bribe takers and bribe givers, resulting in more corrupt deals. In contrast, a highly concentrated population may increase the number of people that can act as deterrent, monitoring potential bribe takers and bribe givers. Consequently, we would expect a positive impact of population on corruption if the first effect is the predominant (Alt & Lassen, 2003; Meier & Holbrook, 1992). However, the opposite result would be expected if the second one prevails (Billger & Goel, 2009; Hill, 2003). Finally, other studies do not find a significant relationship (Damania, Fredriksson, & Mani, 2004; Ferraz & Finan, 2007; Glaeser & Saks, 2006).

Income controls for the municipality's income, gauged as the average of income per capita for 2004–2009. Despite income is traditionally used to explain corruption, its impact is not clear. Most authors conclude that corruption is lower in richer societies (Alt & Lassen, 2003; Billger & Goel, 2009; Damania et al., 2004; Ferraz & Finan, 2007; Glaeser & Saks, 2006; Herzfeld & Weiss, 2003; Hill, 2003; Lindstedt & Naurin, 2006; Persson, Tabellini, & Trebbi, 2003; Serra, 2006; Shabbir & Anwar, 2007; Treisman, 2000), whereas others show that income increases corruption (Braun & Di Tella, 2004; Fréchette, 2006). These latter authors argue that during booms periods, “moral standards” are lowered since greed becomes the prevailing force for economic decisions.

We also control for the degree of inequality in the distribution of family income in the municipality (gini). Scott (1972) and Husted (1999) argue that with a more equal income distribution, a relatively large middle class can group to protect its interests and, as a consequence, these groups weaken particularistic demands which tend to promote corruption. However, if the level of equality is low, both wealthy and poor people may have incentives to be corrupt. On the one hand, wealthy people may have greater motivation and opportunities to use bribery and fraud to preserve and advance their status (You & Khagram, 2005). On the other hand, people with low income may try to gain an illegal income in order to sustain their lives, so that corruption may be spread in the municipality (Ata & Arvas, 2011; Paldam, 2002; Shen & Williamson, 2005). Some empirical studies find that income inequality increases corruption (Ata & Arvas, 2011; Glaeser & Saks, 2006; Paldam, 2002), whereas others fail to prove this relationship (Brown, Touchton, & Whitford, 2011; Ferraz & Finan, 2005; Park, 2003; Shabbir & Anwar, 2007).

Education level (education) is also argued to affect corruption. Previous studies consider that corruption decreases when citizens are more educated, given their greater ability to monitor their politicians (Ali & Isse, 2002; Alt & Lassen, 2003; Ferraz & Finan, 2007; Glaeser & Saks, 2006; Persson et al., 2003; Treisman, 2000). However, other studies show that when population becomes more educated, corruption increases (Fréchette, 2006; Seldadyo & De Haan, 2006; Shabbir & Anwar, 2007). They argue that, as the population is getting more educated, and thus better at controlling politicians, politicians are also becoming more educated and thus better at performing corrupt acts. If politicians are getting better faster than population is improving its monitoring capability, this could explain this result.

We also consider the unemployment (unemployment). If increased unemployment is due to a cyclical downturn, it may capture a temporary decrease in income of the target population and therefore may reduce the size and frequency of a bribe (Mocan, 2008; Rehman & Naveed, 2007). Nevertheless, if high unemployment is structural, which may lead to lower income for politicians, unemployment may be positively correlated with corruption (Mocan, 2008).

We also control for the municipal financial situation. The increase of funding resources, such as urban revenues and debt, may be related to corruption. Thus, we include the variable urbanrevenue, which is the average of the ratio of the sum of revenue directly related to urban development decisions over total non-financial revenues for 2004–2009. Corruption is defined as the misuse of entrusted authority for private benefit. Therefore, governments with higher urban revenues may have a higher probability of corruption by using this money (Treisman, 2000). In the same vein, the literature supports that higher public debt (debt) is associated with higher corruption, since governments also may use this funding for their own benefit. However, governments with higher levels of debt may be monitored by lenders to a greater extent, which may lead to lower level of corruption (Seldadyo and De Haan, 2006).

Finally, we introduce the variable tourism in our model to take into account that the last building boom has happened mainly in touristic areas. According to Jiménez et al. (2012), cases of corruption increased dramatically during the last housing boom. Therefore, it is expected that touristic municipalities will face more cases of corruption.

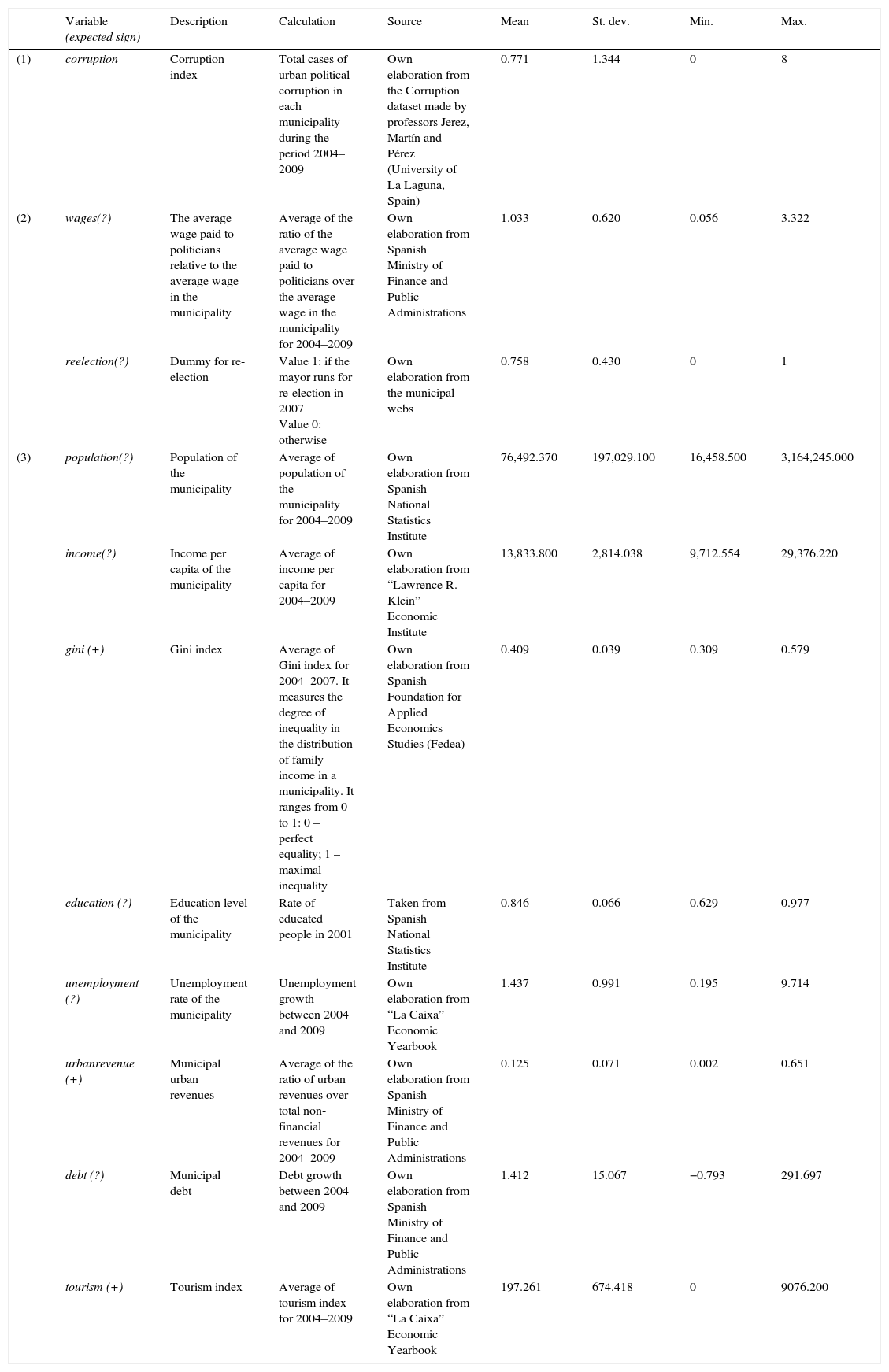

Table 1 describes the variables and basic statistics.

Definition of variables and descriptive statistics.

| Variable (expected sign) | Description | Calculation | Source | Mean | St. dev. | Min. | Max. | |

|---|---|---|---|---|---|---|---|---|

| (1) | corruption | Corruption index | Total cases of urban political corruption in each municipality during the period 2004–2009 | Own elaboration from the Corruption dataset made by professors Jerez, Martín and Pérez (University of La Laguna, Spain) | 0.771 | 1.344 | 0 | 8 |

| (2) | wages(?) | The average wage paid to politicians relative to the average wage in the municipality | Average of the ratio of the average wage paid to politicians over the average wage in the municipality for 2004–2009 | Own elaboration from Spanish Ministry of Finance and Public Administrations | 1.033 | 0.620 | 0.056 | 3.322 |

| reelection(?) | Dummy for re-election | Value 1: if the mayor runs for re-election in 2007 Value 0: otherwise | Own elaboration from the municipal webs | 0.758 | 0.430 | 0 | 1 | |

| (3) | population(?) | Population of the municipality | Average of population of the municipality for 2004–2009 | Own elaboration from Spanish National Statistics Institute | 76,492.370 | 197,029.100 | 16,458.500 | 3,164,245.000 |

| income(?) | Income per capita of the municipality | Average of income per capita for 2004–2009 | Own elaboration from “Lawrence R. Klein” Economic Institute | 13,833.800 | 2,814.038 | 9,712.554 | 29,376.220 | |

| gini (+) | Gini index | Average of Gini index for 2004–2007. It measures the degree of inequality in the distribution of family income in a municipality. It ranges from 0 to 1: 0 – perfect equality; 1 – maximal inequality | Own elaboration from Spanish Foundation for Applied Economics Studies (Fedea) | 0.409 | 0.039 | 0.309 | 0.579 | |

| education (?) | Education level of the municipality | Rate of educated people in 2001 | Taken from Spanish National Statistics Institute | 0.846 | 0.066 | 0.629 | 0.977 | |

| unemployment (?) | Unemployment rate of the municipality | Unemployment growth between 2004 and 2009 | Own elaboration from “La Caixa” Economic Yearbook | 1.437 | 0.991 | 0.195 | 9.714 | |

| urbanrevenue (+) | Municipal urban revenues | Average of the ratio of urban revenues over total non-financial revenues for 2004–2009 | Own elaboration from Spanish Ministry of Finance and Public Administrations | 0.125 | 0.071 | 0.002 | 0.651 | |

| debt (?) | Municipal debt | Debt growth between 2004 and 2009 | Own elaboration from Spanish Ministry of Finance and Public Administrations | 1.412 | 15.067 | −0.793 | 291.697 | |

| tourism (+) | Tourism index | Average of tourism index for 2004–2009 | Own elaboration from “La Caixa” Economic Yearbook | 197.261 | 674.418 | 0 | 9076.200 |

Keys: (1) dependent variable; (2) key independent variables: political decisions; (3) control variables: socio-economic and financial factors.

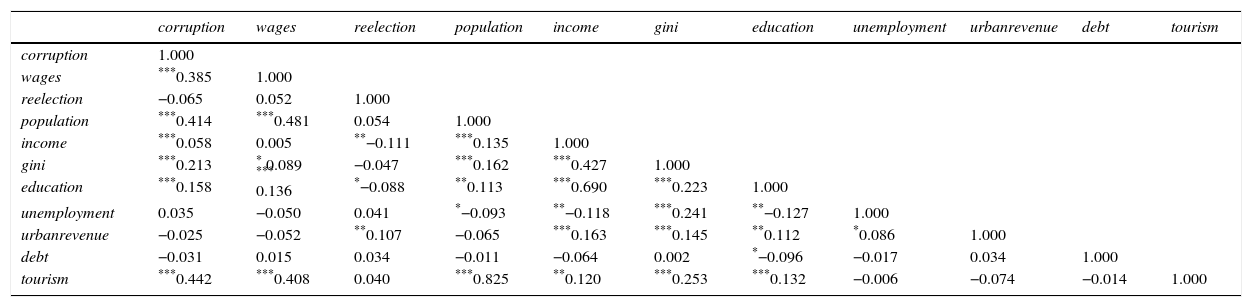

Table 2 presents a preliminary assessment of the relationship between the key variables. This table shows a high correlation between the independent variables tourism and population and between education and income. In any case, we have calculated the variance inflation factor (VIF), which measures the degree of collinearity between the independent variables in a regression, and it shows that our model does not present problems of multicollinearity (VIF-values greater than 5 may indicate multicollinearity- see Table 3). Therefore, all these independent variables are included in our model.

Correlations between variables.

| corruption | wages | reelection | population | income | gini | education | unemployment | urbanrevenue | debt | tourism | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| corruption | 1.000 | ||||||||||

| wages | ***0.385 | 1.000 | |||||||||

| reelection | −0.065 | 0.052 | 1.000 | ||||||||

| population | ***0.414 | ***0.481 | 0.054 | 1.000 | |||||||

| income | ***0.058 | 0.005 | **−0.111 | ***0.135 | 1.000 | ||||||

| gini | ***0.213 | * 0.089 | −0.047 | ***0.162 | ***0.427 | 1.000 | |||||

| education | ***0.158 | *** 0.136 | *−0.088 | **0.113 | ***0.690 | ***0.223 | 1.000 | ||||

| unemployment | 0.035 | −0.050 | 0.041 | *−0.093 | **−0.118 | ***0.241 | **−0.127 | 1.000 | |||

| urbanrevenue | −0.025 | −0.052 | **0.107 | −0.065 | ***0.163 | ***0.145 | **0.112 | *0.086 | 1.000 | ||

| debt | −0.031 | 0.015 | 0.034 | −0.011 | −0.064 | 0.002 | *−0.096 | −0.017 | 0.034 | 1.000 | |

| tourism | ***0.442 | ***0.408 | 0.040 | ***0.825 | **0.120 | ***0.253 | ***0.132 | −0.006 | −0.074 | −0.014 | 1.000 |

Estimation of regressions.

| Dependent variable | corruption | |

|---|---|---|

| Ordinary least squares (OLS) | Ordered logit model (OLM) | |

| intercept | ***−3.44 (−3.18) | |

| wages | ***0.44 (3.82) | ***0.60 (2.89) |

| reelection | **−0.32 (−2.22) | ***−0.85 (−3.36) |

| population | 0.00 (1.27) | 0.00 (0.67) |

| income | *−0.00 (−1.69) | **−0.00 (−2.43) |

| gini | *3.47 (1.88) | *5.83 (1.81) |

| education | ***3.76 (2.92) | ***8.76 (3.42) |

| unemployment | 0.05 (0.82) | 0.13 (1.17) |

| urbanrevenue | −0.09 (−0.10) | *2.69 (1.87) |

| debt | −0.00 (−0.39) | −0.02 (−0.42) |

| tourism | *** 0.00 (2.97) | **0.00 (2.10) |

| R-Squared | 0.294 | |

| Log likelihood | −378.325 | |

| N | 358 | 358 |

T-values (OLS) and Z-values (OLM) in parentheses. Maximum VIF (OLS regression): 3.64.

Table 3 presents the results of the OLS and OLM regressions.

The positive and significant coefficient of wages in both regressions indicates that when top politicians are better paid with respect to the average of municipal population, municipal corruption increases (corruption). This finding shows that relatively higher wages do not reduce politicians’ incentives to be corrupt, so that public sector wages are not an effective mechanism to deter corruption in the case of Spanish municipalities. Despite the fact that politicians earn high wages, some of them may continue to engage in corrupt practices because of their own psychological or moral makeup, or because some of the bribes offered may be too attractive (Tanzi, 1998). This result agrees with Seldadyo and De Haan (2006), who also obtain that an increase in government wages leads to more corruption.

As for reelection variable, we find that when politicians want to be re-elected (reelection), corruption decreases (corruption). This agrees with political agency models that suggest that the possibility of re-election provides incentives for incumbents not to be corrupt so as to increase their re-election chances (Alt & Lassen, 2003; Ferraz & Finan, 2011). Alt and Lassen (2003), Ferraz and Finan (2011) and Beylis et al. (2012) also show that politicians with re-election incentives are significantly less corrupt than politicians without re-election incentives.

Regarding our control variables, population of the municipality (population) has a positive but not significant impact on the level of corruption (corruption). This result agrees with Damania et al. (2004), Glaeser and Saks (2006) and Ferraz and Finan (2007). Moreover, we find that the lower the economic level of the municipality (income), the higher the level of corruption (corruption). This is in line with most authors, who conclude that corruption is higher in poorer societies (Alt & Lassen, 2003; Billger & Goel, 2009; Damania et al., 2004; Ferraz & Finan, 2007; Glaeser & Saks, 2006; Herzfeld & Weiss, 2003; Hill, 2003; Lindstedt & Naurin, 2006; Persson et al., 2003; Serra, 2006; Shabbir & Anwar, 2007; Treisman, 2000).

As for the variable gini, our estimates reveal that corruption depends on the degree of inequality in the distribution of family income in the municipality, i.e., high inequality means greater corruption. In municipalities with high level of inequality, both wealthy and poor people may have incentives to be corrupt. While wealthy people may have greater motivation to use bribery and fraud to preserve and advance their status, poor people may try to gain an illegal income to make a living (Paldam, 2002; You & Khagram, 2005; Shen & Williamson, 2005; Ata & Arvas, 2011). This agrees with the results of Paldam (2002), Glaeser and Saks (2006) and Ata and Arvas (2011), who also find that that income inequality increases corruption.

The positive and significant coefficient of education indicates its positive effect on corruption. Although previous literature is not conclusive in this regard, our results are in line with Fréchette (2006), Seldadyo and De Haan (2006) and Shabbir and Anwar (2007), who argue that, as citizens become more educated, and thus better at monitoring their politicians, politicians are also getting more educated and thus better at performing corrupt acts. Therefore, if politicians are getting better faster than citizens are improving their controlling capability, a higher education level may result in a higher corruption level.

The non-significance of the variable unemployment means that the unemployment rate of the municipality turns out not to be a determinant of corruption.

Regarding the municipal financial situation, we find that governments with higher urban revenues have a higher probability of corruption (Treisman, 2000). The increase of urban revenues could increase probability of corruption by using this money for private benefit. However, municipal debt (debt), appears not to affect corruption (corruption).

Finally, we find that the variable tourism positively impacts on corruption. It demonstrates that touristic areas, more affected by the housing bubble, face more cases of corruption.

Conclusions and further researchThis paper focuses on the decisions made by municipal politicians that may affect the level of corruption. Specifically, we assess whether local politicians’ incentives to be corrupt are influenced by the wages they receive and/or their intention to run to the next elections.

Using a sample of 358 Spanish municipalities over 20,000 for 2004–2009, we show an impact of wages and re-election on corruption. First, higher politicians’ wages do not reduce their incentives to be corrupt. The main arguments on this link between wages and corruption are that some politicians, despite earning high wages, may continue to engage in corrupt practices because of their own psychological or moral makeup or because some of the bribes offered may be too attractive. Second, when politicians want to be re-elected, corruption decreases. This is in line with political agency models that suggest that politician who faces the possibility of re-election can restrain from corruption due to the possibility that voters find out their corrupt behaviour and punish them at the polls. Finally, we also find that income level, income inequality, education level, municipal urban revenues and touristic nature of the municipality affect corruption.

Our study has important practical implications. In fact, our findings suggest that it is necessary that local government pay particular attention to rules related to the way politicians’ wages are set and the term limits restrictions.

On the one hand, higher wages may motivate politicians and/or attract more quality citizens into politics so that they improve their performance. However, not all politicians respond in the same way to the same incentives. Actually, some politicians, despite earning high wages, are corrupt for lack of principles. In this sense, the fight against corruption based exclusively on setting high wages may be ineffective to deter this and also it can be very costly to the budget of a municipality, especially in time of crisis. For this reason, it seems desirable to fix local top politicians’ wages by law as a way to prevent them from setting their own salaries as they want. In the case of Spain, the government passed in December 2013 a new law that aims to limit local politicians’ wages (it took effect in January 2014, thus outside our time window). According to this law, the population of the municipality is the main criterion for determining local politicians’ wages. However, we believe that not only population, but also other features should be considered, for instance, politicians’ workload or the income level of the municipality, among others. A discussion, therefore, should be opened about what we must understand for being well-paid and the factors that should be taken into account to set efficient wages.

On the other hand, if there are term limits and the incumbent is almost certain not to have a next period, nothing is lost in terms of re-election possibilities and the incumbent may be more corrupt. Therefore, increasing term limits, that is, the elected official's political horizon, may reduce municipal corruption. In Spain, as stated above, politicians can run to the elections as many times as they want, since terms are not limited. Nevertheless, only removing the term limits may not solve corruption problems as it occurs in Spain. For example, if an incumbent decides not to run the next elections he/she may be corrupt independently if there are term limits or not. Accordingly, we think that other effective mechanisms to control politicians’ behaviour are needed. In this regard, audit policies that reveal information about government performance can increase the probability to detect corrupt politicians.

As far as further research is concerned, new datasets should improve the information about corruption at municipal level. This would allow us to complement our analysis based on online information and to use other corruption measures, such as money stolen, for example. Furthermore, we think that it would be interesting to evaluate the long-term evolution of corruption. Finally, efforts should be undertaken to analyze how the implementation of mechanisms related to audit impact on corruption.

Conflicts of interestThe authors declare that they have no conflicts of interest.