This article analyzes the co-evolution of technological capabilities of electric companies’ subsidiaries and Small and Medium Enterprises connected through common Research and Development projects. The analysis is based on the following variables: learning, network and autonomy, which together form the construct of Embeddedness, i.e. the level of involvement these companies develop. In order to achieve the objectives, the authors conducted interviews aiming to identify the characteristics of each variable. As a result, an evolution in the technological capabilities was found, in both the subsidiaries and the partner companies, after the development of the projects. This accumulation is achieved through the relationship with the levels of Embeddedness (learning and network); and such relationship is directly proportional in the beginning of the projects and inversely proportional in the end. The change in the relationship between variables highlights the companies’ capacity to absorb and accumulate the acquired knowledge even when the partnership has already ended.

O artigo objetiva analisar como ocorre a coevolução das Capacidades Tecnológicas de subsidiárias de energia elétrica e Pequenas e Médias Empresas que se relacionam a partir da execução de projetos de Pesquisa e Desenvolvimento. A análise é baseada nas seguintes variáveis: aprendizado, network e autonomia, as quais, juntas, formam o constructo Embeddedness referente ao envolvimento que estas empresas estabelecem entre si. Para alcançar o objetivo proposto, os autores realizaram entrevistas visando diagnosticar as características presentes dentro de cada variável. Como resultado encontrou-se uma evolução nas capacidades tecnológicas tanto das subsidiárias como das empresas parceiras após o desenvolvimento dos projetos. Este acúmulo é conseguido através da relação com os níveis de Envolvimento (aprendizado e network); relação esta que se apresenta diretamente proporcional no início dos projetos e inversamente proporcional ao final deles. Esta mudança na relação entre as variáveis destaca a capacidade que as empresas desenvolvem em absorver e acumular o conhecimento adquirido mesmo quando já finalizada a parceria.

El objetivo en este artículo es analizar cómo se produce la coevolución de las capacidades tecnológicas de filiales de energía eléctrica y pequeñas y medianas empresas (PyMEs) que se relacionan a partir de proyectos de Investigación y Desarrollo (I&D). El análisis tiene como base las siguientes variables: aprendizaje, redes y autonomía, que forman el constructo de Embeddedness referente a la relación que estas empresas establecen entre sí. Para lograr el objetivo propuesto, los autores han llevado a cabo entrevistas con el fin de examinar las características presentes en cada variable. Como resultado, se encuentra una evolución en las capacidades tecnológicas tanto de las filiales como de las empresas asociadas después del desarrollo de los proyectos. Esta acumulación se logra por medio de la relación con los niveles de Embeddedness (aprendizaje y redes); una relación que se muestra directamente proporcional al comienzo de los proyectos e inversamente proporcional a su término. Este cambio en la relación entre las variables destaca la capacidad que las empresas desarrollan para absorber y acumular el conocimiento adquirido, incluso cuando la asociación o colaboración ya ha terminado.

Researchers are increasingly addressing studies of multinational subsidiaries (Achcaoucaou & Miravitlles, 2012; Bartlett & Goshal, 1986; Birkinshaw, Hood, & Young, 2005; Cantwell & Mudambi, 2005; Lee, 2010), in the area of strategy and international negotiations. This growth is based on the fact that subsidiaries are organizations that could have a strong impact on their host economy, due largely to the fact that these companies have easy access to resources from their parent-companies, sometimes sharing valuable assets such as knowhow among the different units, incorporating the relations of the countries in which they are based and thus facilitating intra-knowledge and inter-firm flow (Almeida & Phene, 2004).

Since they are immersed in a new environment, often at a certain cultural distance, the subsidiaries endeavor to partner with local companies to set up networks. This includes those aiming for technological development in order to reach a higher level of organizational performance since, according to Liu and Chaminade (2010), network links are positively related to the performance of technological innovation.

Moreover, to achieve this performance of technological innovation, companies still aim to develop what we know as technological capabilities, which are nothing but the resources required to generate and manage technical change (Bell & Pavitt, 1993), in other words, the innovation process.

According to Polanyi (1944) these partnerships built up by companies can be understood as embeddedness, which is characterized as an immersion of these players (companies) in social relationships in their own sphere. Uzzi (1996) adds to this idea saying that these social links created with various players in their environment could contribute to achieving performance.

When subsidiaries build these partnerships with local small and medium-size enterprises (SMEs), the study of such interplay also becomes more relevant to the extent that: (i) there is sparse literature on the success of innovations in this context and the study of capabilities required to further such a process and (ii) the incentive given to innovation of this type of enterprise is a significant part of the effort of technological innovator policies developed in emerging countries, since they believe in the key role of these policies in national economic development (Forsman, 2009; Lee, 2010; OECD, 2005).

Numerous papers in literature are concerned with the role of subsidiaries of multinational corporations (MNC) in their host countries, mainly in the relationship formed with local economies (Cantwell & Mudambi, 2005; Chang, Mellahi & Wilkinson, 2009). Several subjects are addressed constantly adopting this viewpoint, such as creating knowledge (Almeida & Phene, 2004); performance (Andersson, Forsgren, & Holm, 2002; Birkinshaw et al., 2005); innovation (Kokko & Kravtsova, 2008); networking (Achcaoucaou & Miravitlles, 2012) and so on.

It is noticeable in the past few years that studies have intensified regarding the development of innovative and technological corporate capabilities, including papers addressing the question in the international sphere from the viewpoint of technological evolution of these companies and investigating the role of subsidiaries in the creation and accumulation of such technological capabilities (Almeida & Phene, 2004; Ariffin & Bell, 1999; Birkinshaw & Hood, 1998; Chang et al., 2009; Lee, 2010).

However, many studies that address the behavior of subsidiaries portray the reality of businesses mostly located in Asian countries, namely China, Malaysia and Taiwan (Chang et al., 2009; Lee, 2010), thereby revealing the specificities of these places, creating a gap in geographical coverage in literature. There are many differences between countries in the Far East and the West and this is reflected in the economy, technology and innovation in those countries. So it is important that the role of MNC subsidiaries is also studied more in the emerging countries in the West, so that a comparison can therefore be made of these two contexts.

One example of these studies is by Chang et al. (2009) who present characteristics of the embeddedness process between the multinational and subsidiary, when the latter plunges into a new environment. In this case, Taiwan multinationals exert strong control over their UK subsidiaries. Another example is the work by Ariffin and Bell (1999) who studied some subsidiaries located in Malaysia: the results concern the mechanisms of technological learning, which these companies now use and provide a prior condition to joining R&D-based innovation.

This gap in literature, as already mentioned, widens even further when referring to SMEs, bearing in mind that the studies in this area often refer to large enterprises (Birkinshaw & Hood, 2000; Chang, 2011; Danneels, 2002). Thus, a certain gap is visible in the study of the dual effects of partnerships among subsidiaries and SMEs in their technological developments, dealing with their technological evolution mostly in a scenario of emerging countries outside the Asian axis. Furthermore, these studies do not sufficiently address the factors affecting embeddedness and the technological coevolution between companies, and this demonstrates a need for understanding how the technological capabilities of these different companies evolve when they are embedded.

Since few studies address the matter of this technological evolution (accumulation of technological capabilities) of subsidiaries in an embeddedness context in the environments where they are located, this defines the starting point of this research, namely: How do the technological capabilities of SMEs and subsidiaries evolve, working together in developing projects related to research and development (R&D), considering the factors of embeddedness?

The purpose of this study is to understand how coevolution of the technological capabilities of two subsidiaries of a multinational in the electricity sector occurs, and of SMEs related to them in R&D projects, in the Brazilian cities of Fortaleza and Rio de Janeiro in Northeast and Southeast Brazil, respectively. Hence, the study proposes to examine the embeddedness and consequent coevolution of the technological capabilities among subsidiaries of a multinational and the SMEs associated with them when implementing R&D projects. To do so a qualitative methodology case of studies will be used.

With that in mind, this paper will contribute to the literature three ways: (i) To identify and operationalize the factors affecting the embeddedness process in which subsidiaries and SMEs are to be found; (ii) to identify how the technological capabilities of both types of enterprise have evolved in the process based on their embeddedness; and (iii) to assess coevolution of the technological capabilities of the subsidiary and SMEs before, during and after the project adopted among them.

Theoretical frameworkThe strategy of installing subsidiaries, mainly in emerging countries, has been a source of accumulation of capabilities and, consequently, an increase in performance for parent companies. Subsidiaries, finding themselves embedded in a new operating environment, relate in different ways with the companies in these countries, mediated by a number of variables present in the process.

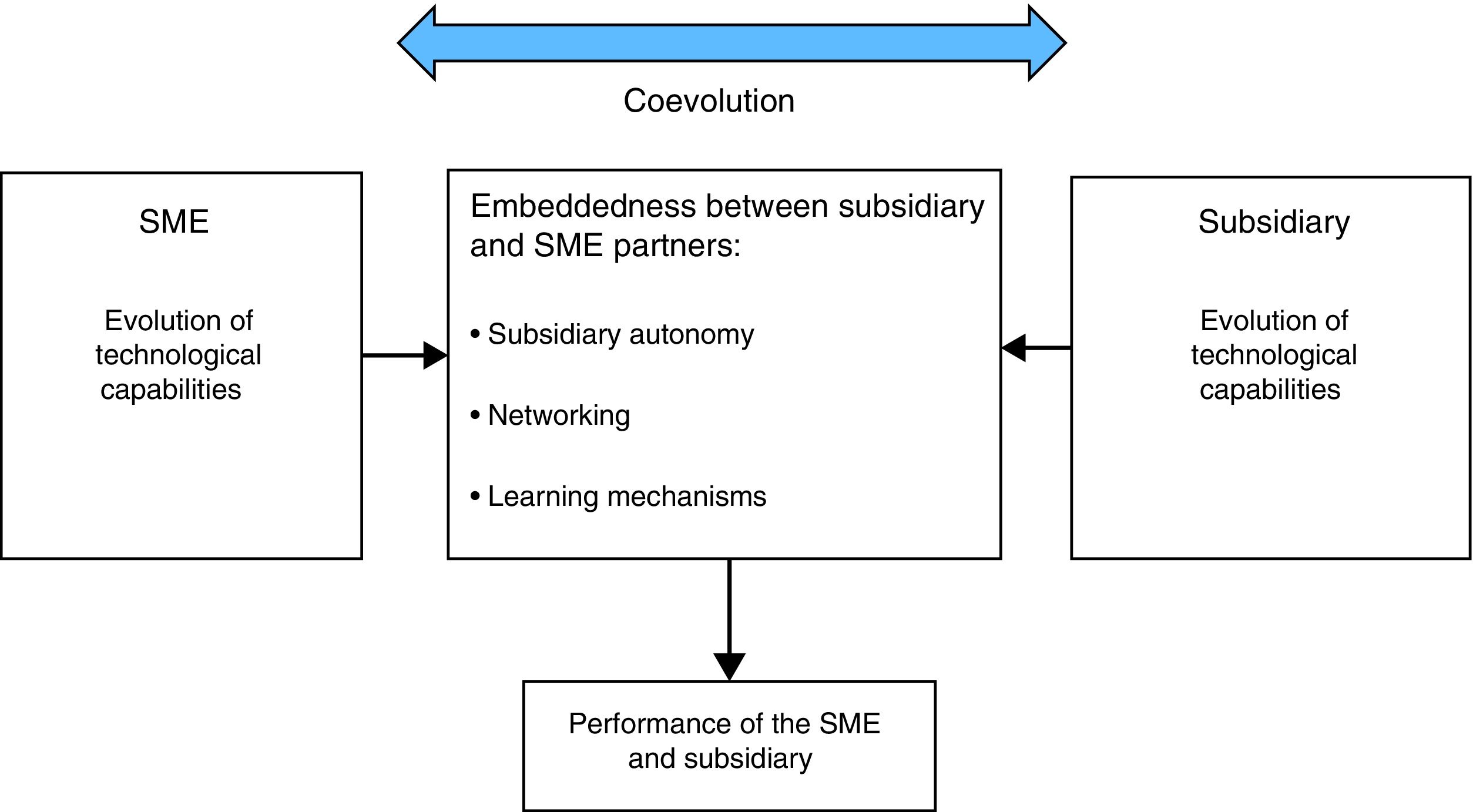

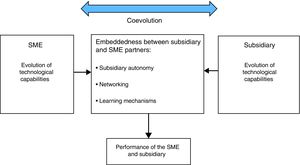

These variables and the consequent coevolution between the players are addressed herein from a framework based on pertinent literature (Fig. 1), which shows the embeddedness and coevolution of technological capabilities of the subsidiaries with the SMEs in the host country that interact with them. In the following subsections each element in this framework and the relationship between them will be discussed.

Keiser (1989) points out that the coevolutional forms of organization originate in a certain set of political and social circumstances. These circumstances are formed from interplay among exogenous and endogenous influences (North, 1990). The organization considered an open system is a subject addressed by authors Baum and Singh (1994) and which is raised again in the discussion on organizational ecosystems. Drust and Poutanen (2013) discuss collaborative arrangements, or forms of collaborations between companies, assuming this to be a dominant topic in organizational theories.

Several of these theories have emphasized the existing relationship between the organization and its external environment. The links made between the external and internal players enable development of the company's capabilities and, also, this relationship consists of a cycle of interplay considered to be the essence of the feedback process, in which the behavior of variables within such a cycle is closely linked, influencing one another (Ahuja, Soda & Zaheer, 2012; Carney & Gedajlovic, 2002; Vonortas & Zirulia, 2015).

According to McCarthy, Lawrence, Wixted and Gordon (2010), in addition to the pace of environmental change, organizational changes are becoming increasingly complex and interconnected. Accordingly, a coevolutional approach is a good way to study and understand such changes (Breslin, 2016).

From a coevolution view, authors Carney and Gedajlovic (2002) suggest that the notion of interdependence is fundamental, in the sense that the companies are influenced by and also influence their environment (Baum & Singh, 1994). Poroc (1994) comments that the coevolution processes should be understood through the notion that he calls organizational community, to which institutions, regulatory agencies and a business population belong. The core of this community is the interplay series by which members exchange ideas, resources and commitments. Thus, the author states that evolution of an organizational community could be defined as the coevolution of its components.

Several works are developed to study empirically how the corporate coevolution process occurs, proposing frameworks and analyzing the influences that the factors exert both on businesses and the included environment (Rodrigues & Child, 2003; Suhomlinova, 2006; Volverba & Lewin, 2003). These frameworks help envisage which factors are more relevant for the study of the topic of corporate coevolution.

Rodrigues and Child (2003) propose a framework analyzing four dimensions: performance, process, objectives and policies, and form. These dimensions apparently complement the idea suggested by Volverba and Lewin (2003) that the coevolution prospect is an integrating force and that, therefore, is based on a variety of relevant theoretical outlooks.

The coevolutional approach assumes that change could occur in all populations that interplay with organization, this change being driven by interplay of both parties. Also, for this coevolution to occur, it is necessary for the company to have an adaptive learning capability and be able to involve mutual interplay and influence (Volverba & Lewin, 2003).

Another author contributing to the discussion is Suhomlinova (2006), who considers that analyzing the mutual influences between organizations and environments in transition economies is a gap in literature. This is why he develops a coevolutional model of organizational change in transition where it focuses on the survival of the organization.

Based on these authors it may be said that companies that adopt coevolutional models need to interact with the factors within and outside the organization, in order to adapt to the embedded medium and, principally, survive in an environment full of selective factors. In this respect, it is noted that the models incorporate the premise of the adaptation and selection factors, considering them not as orthogonal forces but rather fundamentally interrelated.

EmbeddednessPolanyi (1944) gave a valuable addition to the academic field when introducing the term embeddedness, which considers that the economic agents are immersed in social relations. Based on this, some authors began to pay closer attention to this ongoing process in the practice of managerial life, namely: Granovetter (1985), Uzzi (1996), Zukin and DiMaggio (1990), Steiner (2006) and more recently, Meyer, Mudambi, and Narula (2011) and Halaszovich and Lundan (2016).

Uzzi (1996) contributed to literature by explaining a benefit of this social immersion. He stated that the performance of competitive companies could be facilitated by the social links that they create with several actors in their social environment. Zukin and DiMaggio (1990) broaden this concept when they propose four immersion mechanisms that consider interconnecting the concerns of economics and social organization: cognitive, cultural, political institution and social structural mechanisms.

Meyer et al. (2011) state that the embeddedness process creates both business opportunities and operational challenges. This process brings the company into closer interplay with the other companies at lower costs (Halaszovich & Lundan, 2016).

Based on the mechanisms proposed by Zukin and DiMaggio (1990) this paper suggests a study of social immersion based on a three-pillar approach: learning, which is coupled to the cognitive and cultural mechanisms; networking, related to social structures, since they refer to the need to understand how network structures and qualities of their relationships affect the economic activity of a given organization; and lastly, autonomy, which is coupled with the mechanism of political institutions, bearing in mind that this factor concerns the competent attributes of a certain institution in order to adopt their processes and practices independently.

LearningIn the environments of technological development the variable most commonly described as a determining factor is organizational learning. However, to achieve this it is necessary to acknowledge that the individual learning process has a strong impact on the concept and practices of organizational learning, since the latter starts from individuals.

Individual learning, interplay and sharing knowledge and experiences with each other facilitate organizational learning, but organization knowledge cannot be generated on its own but rather from the individual's initiative and interplay with his or her work peers organized in groups. From this viewpoint, organizational learning is to some extent the socialization of individual learning within the organization (Nonaka & Takeuchi, 2008).

Technological learning is normally understood to have two meanings. The first refers to the route to accumulate technological capability. This route might change over time: technological capabilities can be accumulated in different directions and at different speeds. The second meaning concerns the various processes by which individuals’ technical (tacit) knowledge is transformed in the organization's physical systems, production processes, procedures, routines and goods and services. Here the term learning applies to the second meaning. It is understood hereinafter that learning is the process that allows the company to accumulate technological capability as time goes by.

Figueiredo (2002, 2003), based on Latecomer Company Literature (LCL) and Technological Frontier Company Literature (TFLC), develops a learning process model in which he identifies the different processes by which the company acquires technical knowledge – from external and internal sources – to build its technological capability. The model consists of four learning processes: (1) external knowledge-acquisition; (2) internal knowledge-acquisition; (3) knowledge-socialization and (4) knowledge-codification. These, in turn, are subdivided in knowledge-acquisition mechanisms and processes (1 and 2) and knowledge-conversion mechanisms and processes (3 and 4). The processes are examined on the basis of four features: variety (in terms of presence/absence of a process); intensity (repetition over time in creating, updating and reinforcing the learning process); functioning (regarding the functionality of the process over time) and interaction (way in which the learning processes influence each other).

Thus, learning and its mechanisms must be an important variable in building the concept of embeddedness. In the proposed framework this variable is a determinant for the embeddedness of subsidiaries with SMEs: Embeddedness is established between these players by sharing knowledge in the learning process.

NetworkingIn the specific case addressed herein, the embeddedness environment comprises the technological development and innovation networks. The external network with the different actors involved in the process of organizational or technological innovation could play a key role as a strategic source for skills development (Andersson et al., 2002). When cooperating with external actors, businesses increase their ability to reorganize their knowledge base, since the learning provided by networking also keeps a relationship with the actors’ ability to restructure the functions and contents of their interplay. Powell, Koput and Smith-Doerr (1996) find evidence that relates growth of companies to their networking. According to the authors, the skill to absorb knowledge from the environment depends, among other things, on the network of inter-organizational relations formed by the companies.

According to the study by Liu and Chaminade (2010), the network link is positively related to technological innovator performance. The authors explain that the more connected and compacted the network the more frequent the learning interplay, since a large number of people can cross a shorter social distance to learn from each other. This result confirms what Baletsrin, Verschoore, and Reyes (2010) say about the results that can be provided by a network. The authors claim that that networking benefits for companies are learning, success and innovation.

The literature offers a range of network typologies that fulfill the various criteria to be explored; the degree of formalization (Grandori & Soda, 1995); degree of centralization (Corrêa, 1999); degree of similarity (Santos, Pereira, & França, 1994); perpetuity of cooperation (Belussi & Arcangel, 1998); geographical concentration (Sheremetieff, 2003); presence of ICT (OECD, 2005); and purpose (Castilla, Hwang, Granovetter, & Granovetter, 2000; Porter, 1992).

In relation to the networks classified by their purpose, that is, the objective for setting up a network, the authors list:

- •

Networks of access and opportunity, related to the labor market (manpower) (Castilla et al., 2000);

- •

Networks of power and influence – reflecting the flow of influence of financial institutions on corporations (Castilla et al., 2000);

- •

Networks of production and innovation – relating to innovation development (Castilla et al., 2000);

- •

Networks with tangible interrelations – presenting relationships differentiated by various types of sharing, such as production, market, procurement, technology and infrastructure (Porter, 1992);

- •

Networks with intangible interrelations – involving transfer of knowhow (Porter, 1992).

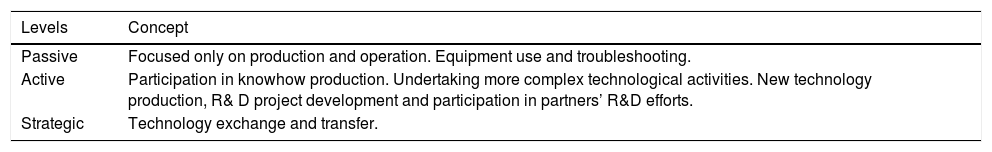

Another classification in the literature, which helps extend knowledge about networking is presented by Dantas and Bell (2011) that use levels to measure the variation in the network formation process. These levels vary depending on that in Table 1.

Network levels.

| Levels | Concept |

|---|---|

| Passive | Focused only on production and operation. Equipment use and troubleshooting. |

| Active | Participation in knowhow production. Undertaking more complex technological activities. New technology production, R& D project development and participation in partners’ R&D efforts. |

| Strategic | Technology exchange and transfer. |

Source: Adapted from Dantas and Bell (2011).

Birkinshaw (1997), Birkinshaw, Hood, and Jonsson (1998) and others refer to the subsidiaries winning “mandates”; that is, they assumed the responsibility and have autonomy to learn, develop and manufacture goods on a global basis. These mandates could also be lost and won. In other words, if on one hand subsidiaries are used abroad to leverage specific benefits, on the other, they could contribute to increase these or create new benefits for the multinational companies (MNCs).

Cantwell and Mudambi (2005) in their paper address two different mandate typologies that a company could receive from its parent company: competence-creating mandate, referring to the competence given for the role of creating, generating new technologies and R&D development, and competence-exploiting mandate, which is the type of competence designed only for operation and exploitation.

So, the subsidiary role is no longer restricted to adapting the parent company's technology to local market requirements (Li, Ferreira & Serra, 2009), but also now includes major sources of technological development (Ghoshal & Bartlett, 1988; Li et al., 2009).

Birkinshaw et al. (1998) discussed how subsidiaries might contribute to some specific benefits for the MNCs and the importance of the relationship between the head office and subsidiaries, and also for the subsidiaries to develop initiative. According to the authors, it is the subsidiaries’ initiative that ensures their contribution to the development and creation of specific benefits for the MNC.

Birkinshaw (1997) considers that the initiatives show a high potential value for the MNC. Moreover, he deems that, although the most common form is probably to identify and investigate an opportunity of a new product on the local market, it would be possible to extend the concept by showing that other forms of initiative could also be identified: internal and global. The author developed a model describing the three types of initiative of a controlled company depending on the market place: local market, consisting of competitors, suppliers, clients and regulatory agencies; internal market, characterized by the internal operations of the company and global market, which includes clients and suppliers that are outside the internal and local market.

Cantwell and Mudambi (2005) consider that the ability to achieve an effective voice within the parent company depends on three factors: (i) the characteristics and potential of development of the place where a company is situated; (ii) the organization's internal status, that is, level of capabilities and possibilities of achieving independent initiatives, and (iii) strategic practices and origins of the parent company's group with regard to its potential to encourage networking at a local level with external partners.

Technological capabilitiesThe term has been used to reference the resources required to generate and manage technical change (Bell & Pavitt, 1993) and it is through such capabilities that businesses undertake their productive and innovative activities (Miranda & Figueiredo, 2010).

These capabilities, in order to continue in an accumulation process, are influenced by all variables present in the environment in which the organization is inserted. The variables of embeddedness, especially, have a fundamental influence on this process. The method and frequency of the company's embeddedness can provide benefits in terms of knowhow accumulation and innovative performance. These benefits could even spread to other partners involved in these relationships (Uzzi & Gillespie, 2002).

From the literature it is found that a number of empirical studies provide grounds for relating the study of technological capabilities with the variables addressed herein. Lin (2015), Figueiredo and Piana (2016), Figueiredo (2009), Dantas and Bell (2011), Kim (1997), Dosi (1988), Lall (1992), and Bell and Pavitt (1993, 1995) are some of those who offer the idea of a relationship between capabilities and the learning process within the organization.

On the other hand, Vandaier and Zaheer (2016), Vonortas (2013), Lasagni (2012), Yokakul and Zadiew (2010), Forsman (2009), Amato Neto (2000), Liu and Chaminade (2010) and Baletsrin et al. (2010) show the relationship existing in the network factor, connections and partnerships that companies establish in order to help in the process of capabilities accumulation.

Lastly, Cantwell and Mudambi (2005), Birkinshaw (1997), Bartlett and Goshal (1986), and Birkinshaw and Hood (1998) also collaborate when presenting in their studies the relationship existing between technological capabilities and the autonomy factor.

Concerning the form of technological capability classification/accumulation, Dantas and Bell (2011) identified a series of capability dimensions whose variations could be observed to check the degrees of these capabilities in developing companies, arising from four different levels, as follows:

- •

Assimilative capability – activities focused on training and learning about operationalization and the use of technologies (also arising from the concept of Absorptive Capability adopted by Cohen and Levinthal (1990), that describe it as a skill for recognizing the value of the new, external knowledge, assimilating and applying it for commercial purposes).

- •

Adaptive capability – construction of an initial knowledge design base, introduction to more formal and deliberative methods of learning.

- •

Generative capability – independent activities of R&D, more comprehensive knowledge bases, scientific knowledge in relevant disciplines and technologies.

- •

Strategic capability – generation and implementation of new technologies than are capable of taking the company to the international technological frontier.

This study is characterized as explanatory, to the extent that “it aims to clarify the factors contributing to the occurrence of a certain phenomenon” (Vergara, 2009, p. 45).

A case study field survey was carried out with two multinational subsidiaries, one installed in the city of Fortaleza (Ceará state) and the other in Niterói (Rio de Janeiro state) and with small and/or medium-size enterprises that work with them in developing R&D-related projects. The company size was classified based on the number of employees, in accordance with a Sebrae guideline. The choice of these two subsidiaries is because of the researchers’ accessibility to both institutions.

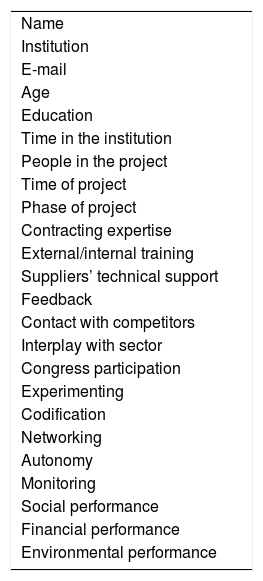

The data collection techniques used were: Semi-structured interviews defined by Triviños (1987) as questions based on theories and hypotheses related to the topic of interest; documentary analysis (where some already completed old projects were analyzed, documents referring to the history of the R&D sector, and scientific reports and studies representing outputs of the process) and direct observation that, according to Gil (2007), is characterized by a researcher observing the facts spontaneously. The question guide used in the interview is presented in Appendix A hereof.

The following was adopted for data treatment: interviews were recorded and later transcribed in order to use the content analysis technique. To work the variables represented in the framework, the qualitative data obtained from the interviews were operationalized to transform them in quantitative data and then analyze them.

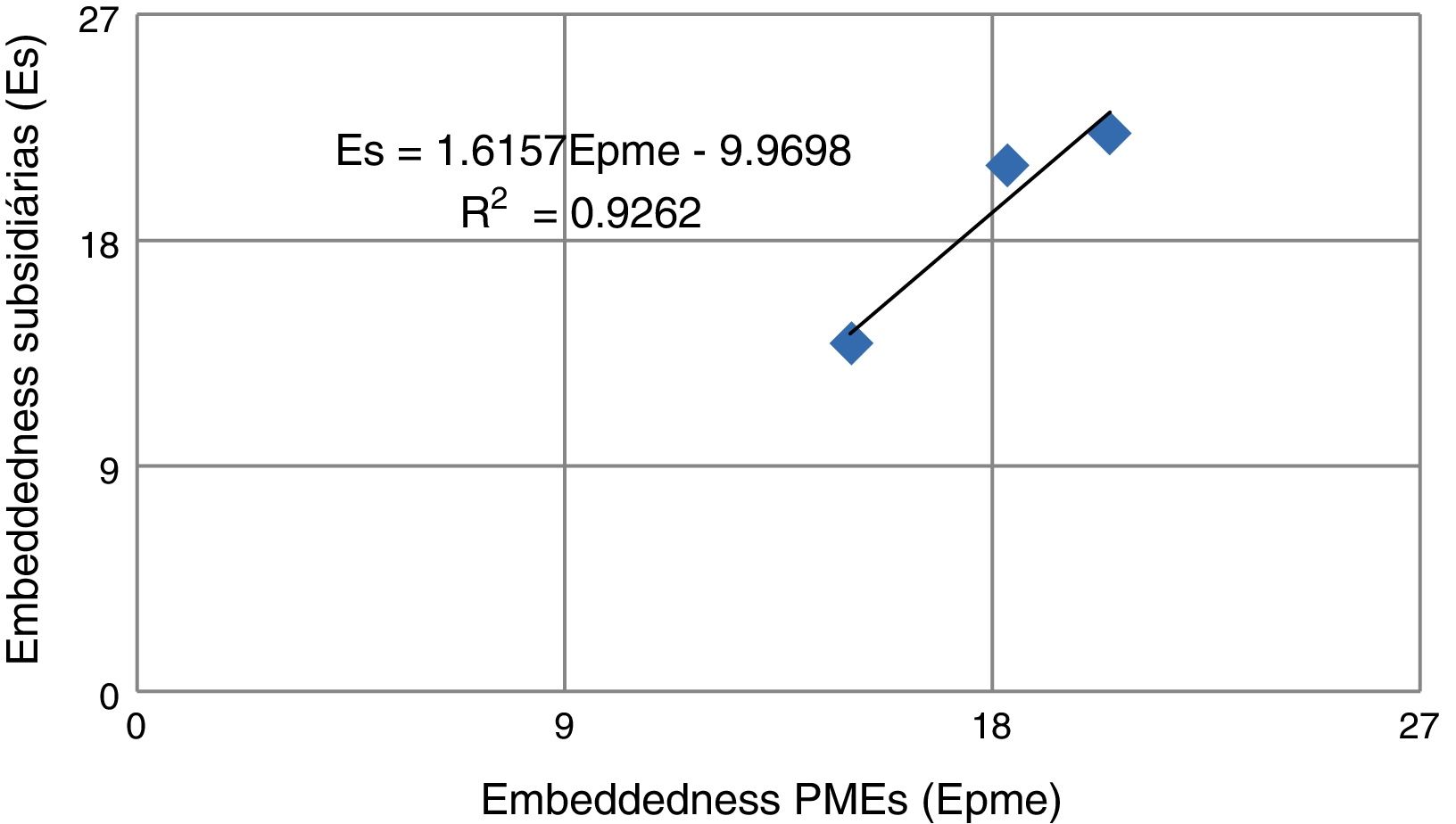

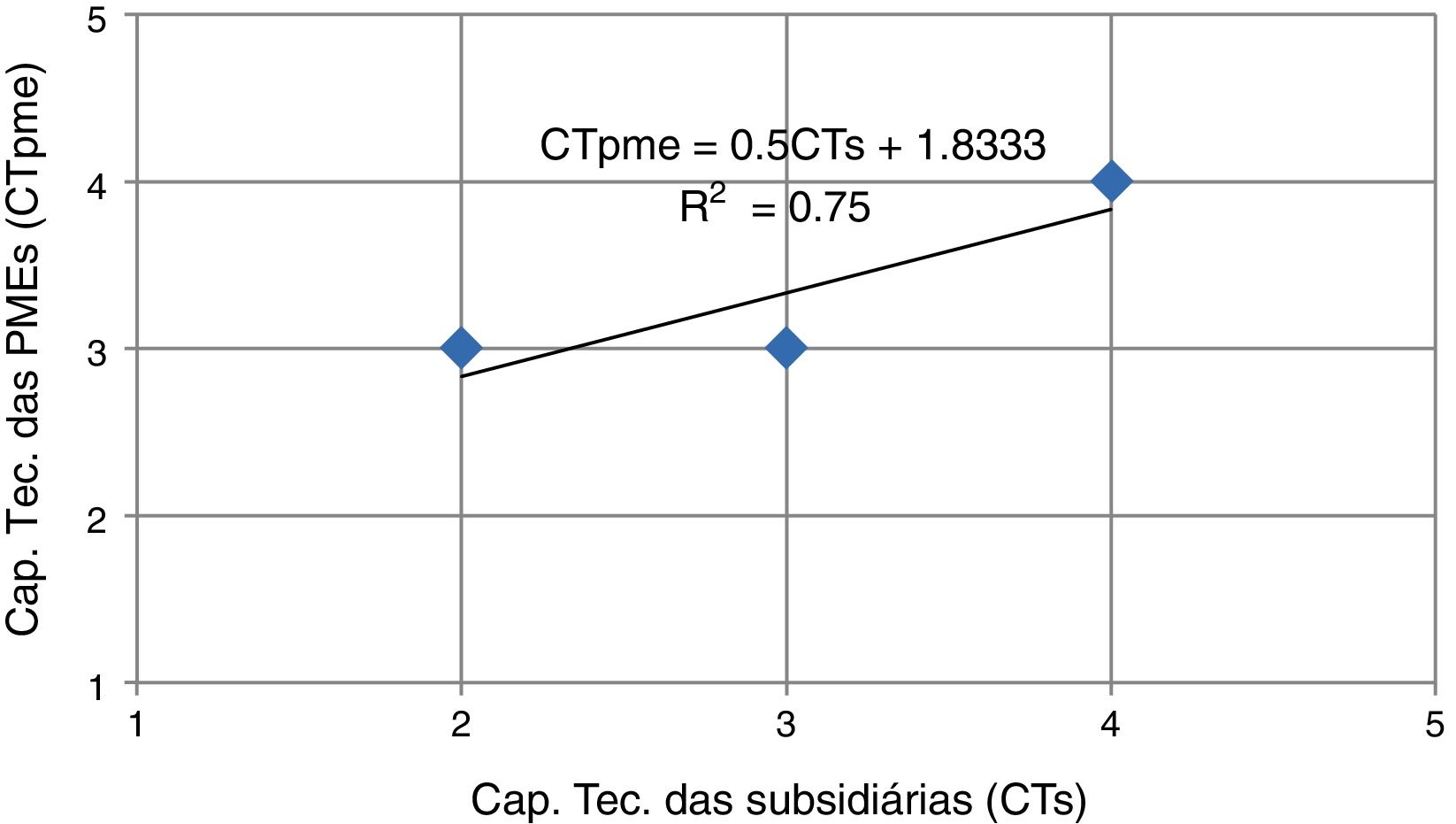

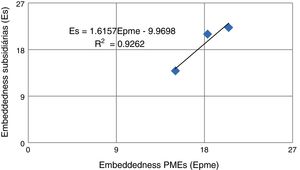

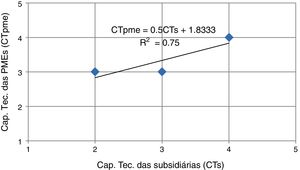

For this analysis two simple regression analyses were carried out (Hair Jr., Black, Babin, Anderson, & Tatham, 2009) using the ordinary least squares algorithm and considering as variables: Regression 1 – Embeddedness of the subsidiary (dependent) and embeddedness of the SME (independent); Regression 2 – Technological capability of the SME (dependent) and technological capability of the subsidiary (independent). The estimated equations of the straight lines are presented as follows:

where Es=subsidiary embeddedness (1–27); Ep=SME embeddedness (1–27); CTpme=SME technological capability (1–5); CTs=subsidiary technological capability (1–5); a=vertical intercept; b=angular coefficient.The dimensions of the three variables belonging to the embeddedness construct will vary in level, so that it is noticeable how certain variables evolve over time, bearing in mind that the levels adopted in this study are cumulative.

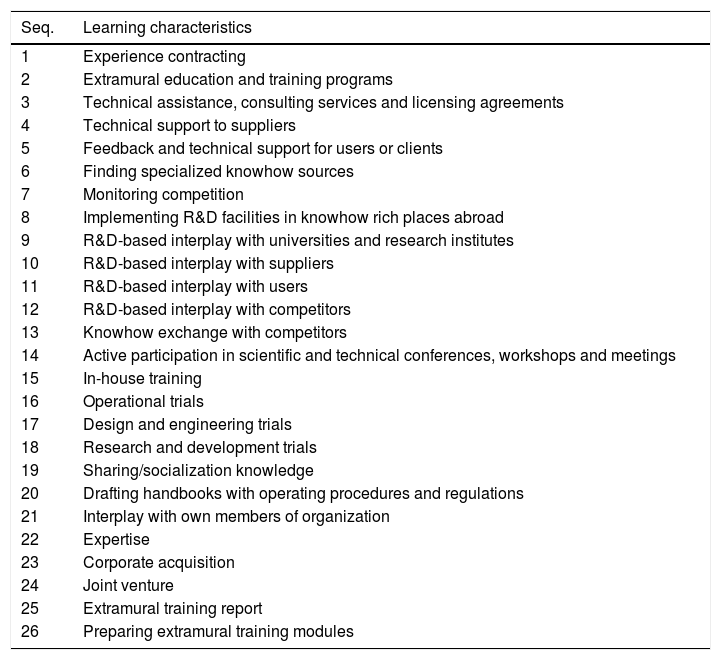

To operationalize the learning variable, the model by Figueiredo (2002) was used, which characterizes the processes of knowledge acquisition, socialization and codification. The characteristics present in each dimension were found by searching literature on the relevant topic (Figueiredo, 2009; Kogut & Zander, 1992; Nonaka & Takeuchi, 1997; Nonaka, 1994; Simon, 1991). To analyze the level of learning in each characteristic, the proposal of Figueiredo (2003) was adopted when basing this analysis on the variety (or frequency) of such characteristics. In this way, to observe the learning variable in this study, a set of characteristics was observed belonging to each project analyzed (characteristics studied listed in Appendix B).

The authors based the application of the network variable on the dimensions proposed by Castilla et al. (2000) – access, power and innovation networks – and on the levels of networking as proposed by Dantas and Bell (2011) – active, passive and strategic. Each network dimension assessed at the three levels was the network variable on a one-to-nine scale. This level was obtained using the average of the interviewed companies.

The autonomy variable was applied based on initiatives taken in three different markets: local, home and global (Birkinshaw, 1997). They were leveled based on three stages: stage 1, corresponding to an exploitation skill only; stage 2, developing into a creative skill; and stage 3, with regard to creating not only daily goods and services but also technology (Cantwell & Mudambi, 2005).

Lastly, technological capabilities were considered based on four levels used in the study by Dantas and Bell (2011) – assimilative, adaptive, generative and strategic capability. In order to measure each variable, the phases of the projects were considered as a time proxy and divided into before, during and after the projects. Unlike the embeddedness variables, the measurement of technological capabilities variable will not be based on levels, since their categories are considered to be specific, representing different realities that the company might or might not have at any given time.

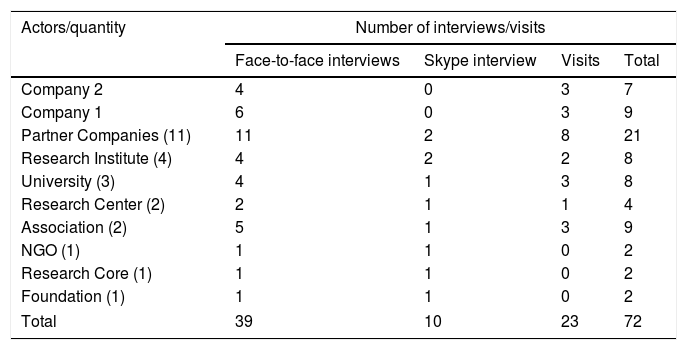

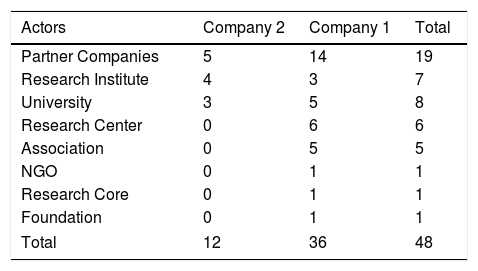

Data sourceThe case study was carried out between October and December 2013 in Ceará and Rio de Janeiro states. Forty-nine interviews were conducted with the R&D project managers of the two subsidiaries (referred herein only as “COMPANY 1” from Fortaleza and “COMPANY 2” from Niterói) and of the partner institutions (totaling 25) in addition to 23 visits, totaling 48 analyzed projects as shown in Tables 2 and 3.

Quantity of interviews/visits carried out.

| Actors/quantity | Number of interviews/visits | |||

|---|---|---|---|---|

| Face-to-face interviews | Skype interview | Visits | Total | |

| Company 2 | 4 | 0 | 3 | 7 |

| Company 1 | 6 | 0 | 3 | 9 |

| Partner Companies (11) | 11 | 2 | 8 | 21 |

| Research Institute (4) | 4 | 2 | 2 | 8 |

| University (3) | 4 | 1 | 3 | 8 |

| Research Center (2) | 2 | 1 | 1 | 4 |

| Association (2) | 5 | 1 | 3 | 9 |

| NGO (1) | 1 | 1 | 0 | 2 |

| Research Core (1) | 1 | 1 | 0 | 2 |

| Foundation (1) | 1 | 1 | 0 | 2 |

| Total | 39 | 10 | 23 | 72 |

The average time of each interview was 30min. Most were conducted in the actual institution, except for those located outside Rio de Janeiro or Ceará states. The managers also facilitated access to some materials, such as reports, or even the prototype of the product to be developed.

The partner companies interviewed were small and this enabled learning all about their structure, as well as the employees and modus operandi. In the subsidiaries the managers provided knowhow mainly in the R&D sector, where some project experiments are discussed and sometimes implemented. Due to this accessibility, the authors succeeded in confirming some information provided during the interviews by direct observation of the workplace, materials, equipment, products, and also by chatting with other people involved in the process.

Analysis and resultsThe case of the two subsidiaries presented a total volume of 72 R&D projects completed since 2010 and implemented by different types of partner institutions (companies, foundations, universities, research centers and nongovernmental organizations). R&D projects developed by those electricity companies were regulated by Aneel (national electricity regulatory agency), which establishes that they “must be ruled by finding innovations to confront the market and technological challenges of the electricity companies” (Aneel, 2008, p. 7). Each project was framed in a certain phase (directed basic research, advanced research, experimental development, first in series, precursor batch and market insertion) and should be completed within a maximum 60-month term. Although subsidiaries have partnered with numerous types of organization the case specifically studied the R&D projects in conjunction with SMEs.

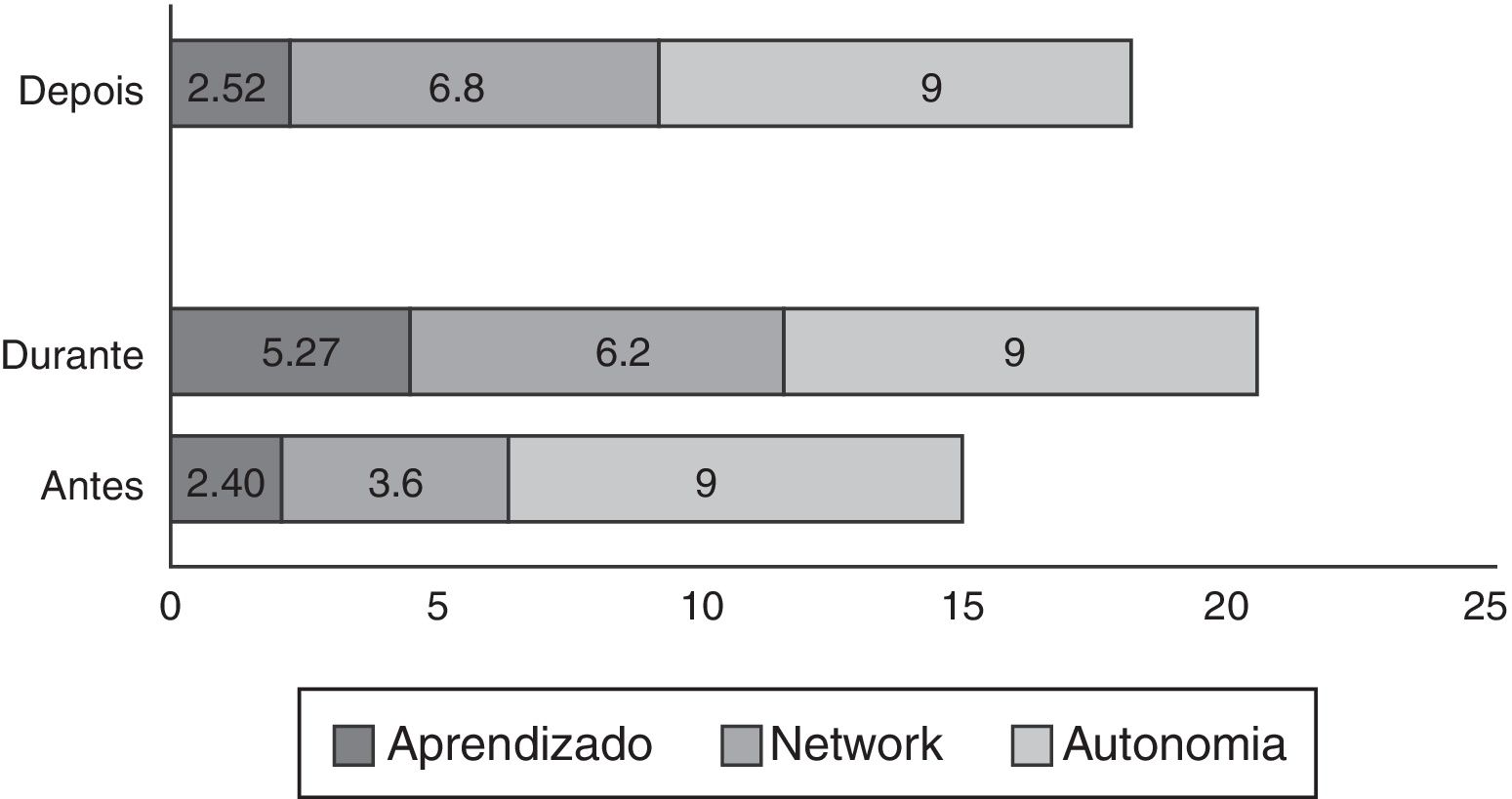

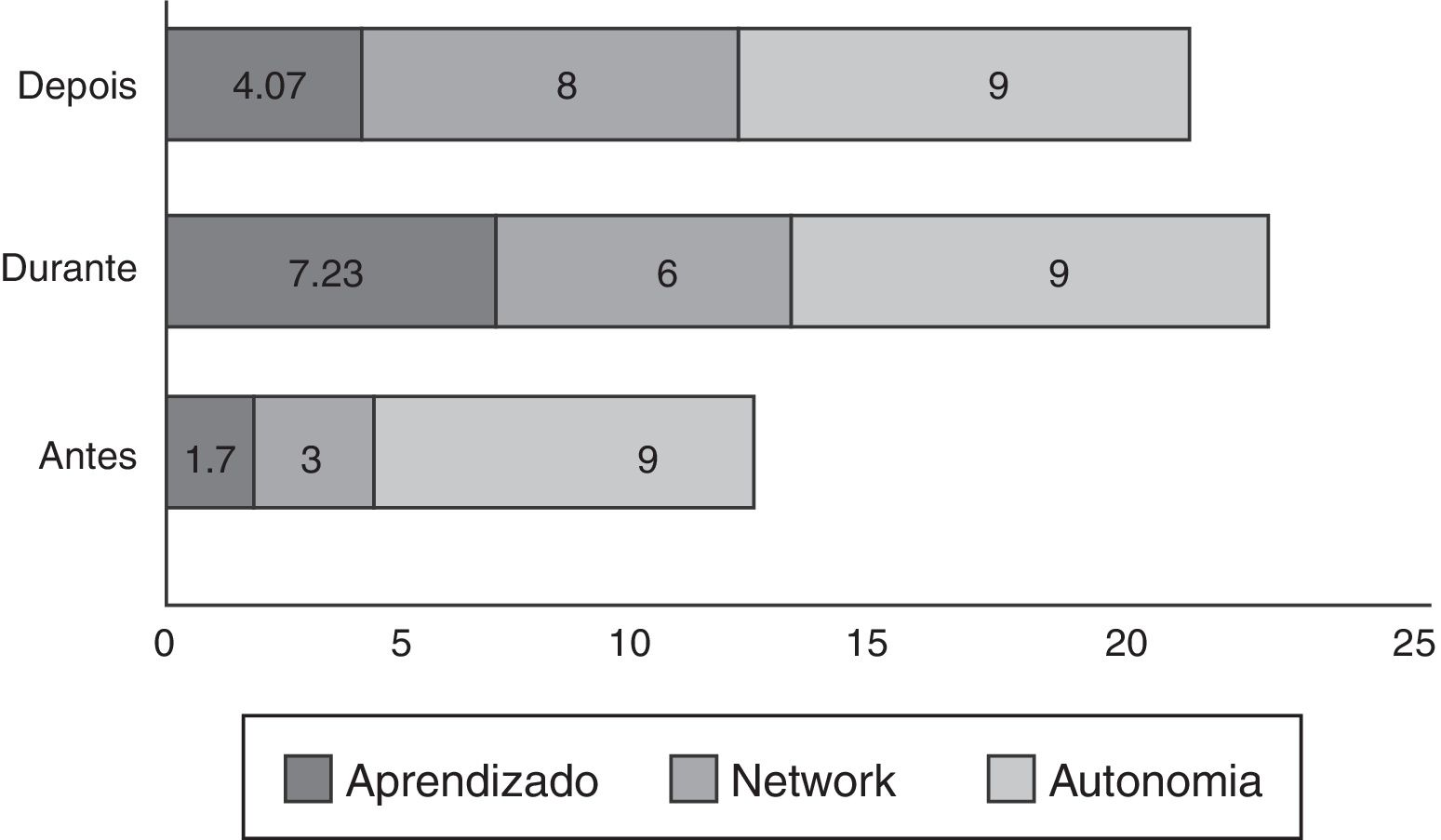

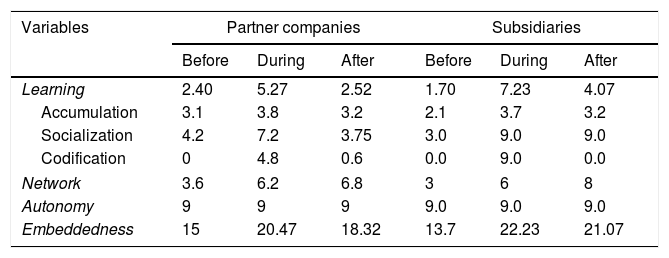

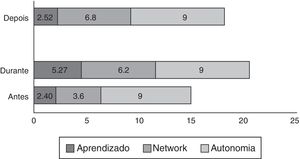

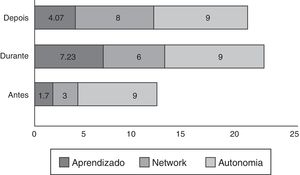

EmbeddednessWhen gaging the evolution of embeddedness adopted by subsidiaries and partner companies (Table 4, Figs. 2 and 3) it is found that R&D projects emphasize these levels of embeddedness, which is apparent by the rise in values attributed to learning and networking when they are implemented. When subsidiaries first implement the projects they raise the learning level by around 119% (from 1.7 to 7.23, according to the average characteristics present in these periods), which can be confirmed by listening to a manager of a partner company: “The projects used to have more or less nine employees but today have more than 20”. After completion this rate drops to 52% (from 7.23 to 4.07). It should be stressed that here it is not accumulated learning but its measure of flow; that is, the subsidiaries learn a further 119% when they adopt R&D projects with their SME partners and learn 52% less after the projects close, considering their research and development objective. In the case of the network, the increase in networking rises from 3 to 6 when the projects are implemented and even more so from 6 to 8 when they terminate. Therefore, it is clear that subsidiaries increase their embeddedness by learning and networking with the R&D projects. Looking at the embeddedness construct as the sum of the others, it is perceived that embeddedness rises 36% and drops only 10% when they are finalized. Accordingly, it can be said that subsidiaries generally achieved higher levels of embeddedness when undertaking their R&D projects in conjunction with the SMEs, and that this was due to learning and networking, while autonomy levels, according to interviewees and collected evidence, were already high and terminated high, “All autonomy comes from us, the group only organizes the format”, says the manager of one subsidiary.

Formation of embeddedness.

| Variables | Partner companies | Subsidiaries | ||||

|---|---|---|---|---|---|---|

| Before | During | After | Before | During | After | |

| Learning | 2.40 | 5.27 | 2.52 | 1.70 | 7.23 | 4.07 |

| Accumulation | 3.1 | 3.8 | 3.2 | 2.1 | 3.7 | 3.2 |

| Socialization | 4.2 | 7.2 | 3.75 | 3.0 | 9.0 | 9.0 |

| Codification | 0 | 4.8 | 0.6 | 0.0 | 9.0 | 0.0 |

| Network | 3.6 | 6.2 | 6.8 | 3 | 6 | 8 |

| Autonomy | 9 | 9 | 9 | 9.0 | 9.0 | 9.0 |

| Embeddedness | 15 | 20.47 | 18.32 | 13.7 | 22.23 | 21.07 |

Source: Own author.

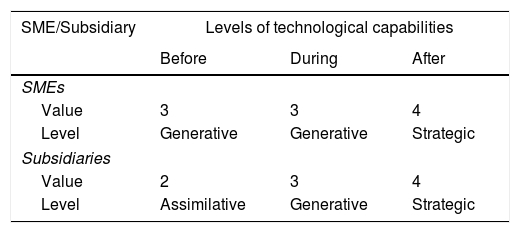

In relation to technological capabilities, it was seen that subsidiaries and SMEs alike evolved to post-project strategic capabilities and that, in the case of subsidiaries, evolution was greater since they started at a lower level (assimilative), while the SMEs began, before the projects, with generative capabilities, which is perhaps why they have been chosen as partners in these R&D projects (Table 5).

This coevolution behavior among SMEs and subsidiaries suggests that it should concern how their embeddedness performed when undertaking R&D projects in partnership. In one of the two subsidiaries, a timetable was presented to the researcher showing the evolution of the R&D sector, which emerged from the development of such projects. Other evidence that could be shown here regarding the evolution of technological capabilities is based on what the managers said: “Today the company is moving from that formalizing level of painstaking work to the brainstorming level” (manager of a subsidiary); “Now the company has credibility for development and innovation” (manager of a partner company).

The managers of a subsidiary acknowledged that when first undertaking projects the work had to be done, “as a stop-gap”. In time, however, they perceived their importance for the organization at a level of advanced technologies, work-facilitating innovations and ideas that guaranteed the company a top position. Since then the company has been specializing in developing such projects and as a result leveraged its capabilities from just an assimilative to a generative level. The importance of the projects is so vital for the company that the managers believe that, in the near future, this level of capability will tend to increase to the strategic level, since they recognize that the results of the projects are now reaching international competitors, with a view to patents.

Concerning the SMEs, although the majority are now at a generative technological capability level due to the fact of being companies focusing on project development, with a significant innovative and technological load, they have shown that, by partnering with the subsidiaries, their capability may rise to the strategic level in the short term, confirmed by some statements: “The company now has knowhow to operate in the energy efficiency area”. So, already technologically developed in some certain segments, the partnership has helped develop a new niche, with major impacts on the competition. Another statement shows that the results of the project have produced a global patent and the international market sees it as a possible marketing item: “The product created a global patent shared with the subsidiary”. This inferred that the level of technological capability of the interviewed SMEs has real possibilities of evolving in the short term to the maximum (strategic) level. Appendix C provides some evidence from the interviews, which give support to the quantitative findings demonstrated herein. Based on this evidence, it can be understood more clearly how the embeddedeness process, including learning, network and autonomy variables, influenced the evolution of the technological capabilities in not only the two subsidiaries in question, but also the partner companies embedded in projects with them.

CoevolutionThe evaluations by the different sources of empirical evidence (interviews, observations and documents) of the variables and embeddedness construct have revealed that subsidiaries must present a coevolutional movement of their technological capabilities by carrying out the analyzed R&D projects. This finding is based on evidence, such as scientific articles published in academic journals on project development, which aggregates the learning level of both companies; and on the fact that some of those responsible for the projects have begun and others even completed the master's level for further specialization and contribution to the work. Moreover, we even heard the following phrase from one of the managers of a partner company: “The partnership with “COMPANY 1” and the university helped kick-start innovation in the company and we are now, after the project, mature enough to propose, even on our own, innovator solutions for the market”. This shows that the networking factor has been extremely important for the life of these SMEs, since similar recurring phrases have been heard, while there is more evidence in subsidiaries procuring these companies to propose new projects, continuity and new solutions. The numerous meetings of managers of subsidiaries clearly demonstrate that coevolution of subsidiaries and partners, in fact, did exist with the development of R&D projects, reinforced by the SME-subsidiary association when analyzing the constructs embeddedness and technological capabilities (Figs. 4 and 5).

The graphs in Figs. 4 and 5 respectively show the coevolution of the construct embeddedness (consisting of the variables: learning, networking and autonomy), and the technological capabilities among subsidiaries and partner companies in the three time periods. The variables were obtained from the operationalization shown in Table 4.

It is apparent, after analyzing these figures, that there is a positive coevolution direction between the subsidiaries and SMEs; in other words, both embeddedness and technological capabilities move in the same direction. The trends of a linear relationship, demonstrated by the calculated regressions, may indicate that there is a closer relationship between the fluctuations of the related variables. Thus, the estimated equations show that embeddedness between the SMEs and subsidiaries is more closely related than the technological capabilities (greater positive incline). It can probably be said that there is a loss of coevolutional “energy”. The idea is that the different types of embeddednesss created by SMEs and subsidiaries probably influence each other, indicated by the linear regression, presenting the important adjustment coefficient above 0.9. This relationship jointly affects the technological capabilities of the organizations involved. However, what is noticeable is that, despite a very close embeddedness, the coevolution of the technological capabilities, although having existed, did not follow the same pattern of proximity, perhaps because of the recurring differences in managerial and technological maturities among the projects and companies analyzed.

Conclusions and final considerationsThe purpose of this study was to understand how the coevolution of technological capabilities occurs of the two subsidiaries of a multinational in the electricity sector and of SMEs associating with them in R&D projects. To do so a case study was developed involving interviews with the two subsidiaries and partner companies.

The main results from this survey show that, from the projects developed in partnership, the level of embeddedness rose for both the subsidiaries and the SMEs. This level of embeddedness can be translated by the learning levels absorbed by these companies and by the networking level, which characterizes the networks formed while developing such projects. This result is positive for every institution involved, since, even with the completed project, its results are perpetuated within the organization.

Moreover, it was apparent that the levels of technological capability also evolved from the development of projects in partnership. This result is also more significant for the subsidiaries, which were regarded at minimum capability levels, that is, only with operating skills. After the study was completed, this index evolved to enable them to reach a capability level with more innovative and strategic activities.

It was also possible to fill a gap in literature that was limited, in studies of this kind, to scenarios in Asian countries, as in the work by Chang et al. (2009), which focused on Taiwan subsidiaries located in the UK. Diverging from this research herein, Chang's study presented a result that the Taiwan multinationals exert strong control over their UK subsidiaries, while in this study it was apparent that a high level of autonomy is given to the subsidiaries, and these can act independently and even appropriate the results from projects run in their host country. This discrepancy occurs probably as a result of the existing cultural difference between the two countries, which causes the corporate management to diverge.

In the case of the study by Ariffin and Bell (1999) on Malaysian subsidiaries, one of the results concerns the technological learning mechanisms now adopted by these companies and that offer a prerequisite for entry of an R&D-based innovation. To confirm the findings of the aforementioned authors, this study corroborates this result when addressing the learning factor as a variable that contributes to the evolution of technological capabilities and, consequently, to innovation.

Still referring to the gaps suggested in the introduction to this paper, this study looked to work in the scenario of SMEs, revealing the potential that these Brazilian organizations have to develop their capabilities and also provide the growth of institutions partnering with them.

Concerning this study's contributions, it is possible to highlight the following: (i) the factors of embeddedness (learning, networking and autonomy) influencing the relationship between subsidiaries and SMEs were operationalized to work better; (ii) understanding how the coevolution of both companies occurred in relation to their technological capabilities, observing how these factors contribute to developing the theory on coevolution and embeddedness; (iii) the study was conducted by observing three different periods in relation to the projects developed by these partnering companies, which provides an interpretation of the data with regard to time; and (iv) it was noted how the existing regional differences in the sphere of the relationships of the two subsidiaries in question influenced the evolution of their capabilities.

In addition to these contributions that help develop the theory, a practical contribution of this study is also apparent: electricity companies are able to understand how embeddedness and the partnerships formed in developing R&D projects are fundamental for accumulating technological capabilities and levels of learning and networking. This could encourage them to more interplay and to find partnerships that help in this development, assisting the sector's innovation process as a whole.

Furthermore, studying the SMEs, observing how their embeddedness occurs, technological development contributes to their endeavors to form even more partnerships with large enterprises in order to absorb new knowhow. Relationships and interplay provide a visibility in the market and, consequently, access to new opportunities. The learning acquired while conducting R&D-related projects leverages for these companies an area that very often is intended only for universities. The result of this research was to discover that the SMEs played a key role in the capability evolution process on a mutual basis; in other words, not only their own capabilities were more developed but they were also able to help in the evolution process of the subsidiaries.

In relation to the limitations of this study, we mention the following: since the study only involved projects in the electricity sector, this could skew possible attempts at generalization. To eliminate this possible skewing, one of the suggestions raised in this paper could be replicated in other sectors in order to confirm the finding herein or not, and therefore reach a generalization on the matter.

The second limitation is caused by the assessment method for the variables and constructs, which considers quantifying the empirical evidence collected in the field, in an attempt to shine light on the relations of the studied variables and on which the researchers may have made an error of judgment.

Lastly, another suggestion for future studies is that the scope of the study could extend to the relationships of the constructs studied with the performance of these organizations working in partnership.

Conflicts of interestThe authors declare no conflicts of interest.

| Name |

| Institution |

| Age |

| Education |

| Time in the institution |

| People in the project |

| Time of project |

| Phase of project |

| Contracting expertise |

| External/internal training |

| Suppliers’ technical support |

| Feedback |

| Contact with competitors |

| Interplay with sector |

| Congress participation |

| Experimenting |

| Codification |

| Networking |

| Autonomy |

| Monitoring |

| Social performance |

| Financial performance |

| Environmental performance |

| Seq. | Learning characteristics |

|---|---|

| 1 | Experience contracting |

| 2 | Extramural education and training programs |

| 3 | Technical assistance, consulting services and licensing agreements |

| 4 | Technical support to suppliers |

| 5 | Feedback and technical support for users or clients |

| 6 | Finding specialized knowhow sources |

| 7 | Monitoring competition |

| 8 | Implementing R&D facilities in knowhow rich places abroad |

| 9 | R&D-based interplay with universities and research institutes |

| 10 | R&D-based interplay with suppliers |

| 11 | R&D-based interplay with users |

| 12 | R&D-based interplay with competitors |

| 13 | Knowhow exchange with competitors |

| 14 | Active participation in scientific and technical conferences, workshops and meetings |

| 15 | In-house training |

| 16 | Operational trials |

| 17 | Design and engineering trials |

| 18 | Research and development trials |

| 19 | Sharing/socialization knowledge |

| 20 | Drafting handbooks with operating procedures and regulations |

| 21 | Interplay with own members of organization |

| 22 | Expertise |

| 23 | Corporate acquisition |

| 24 | Joint venture |

| 25 | Extramural training report |

| 26 | Preparing extramural training modules |

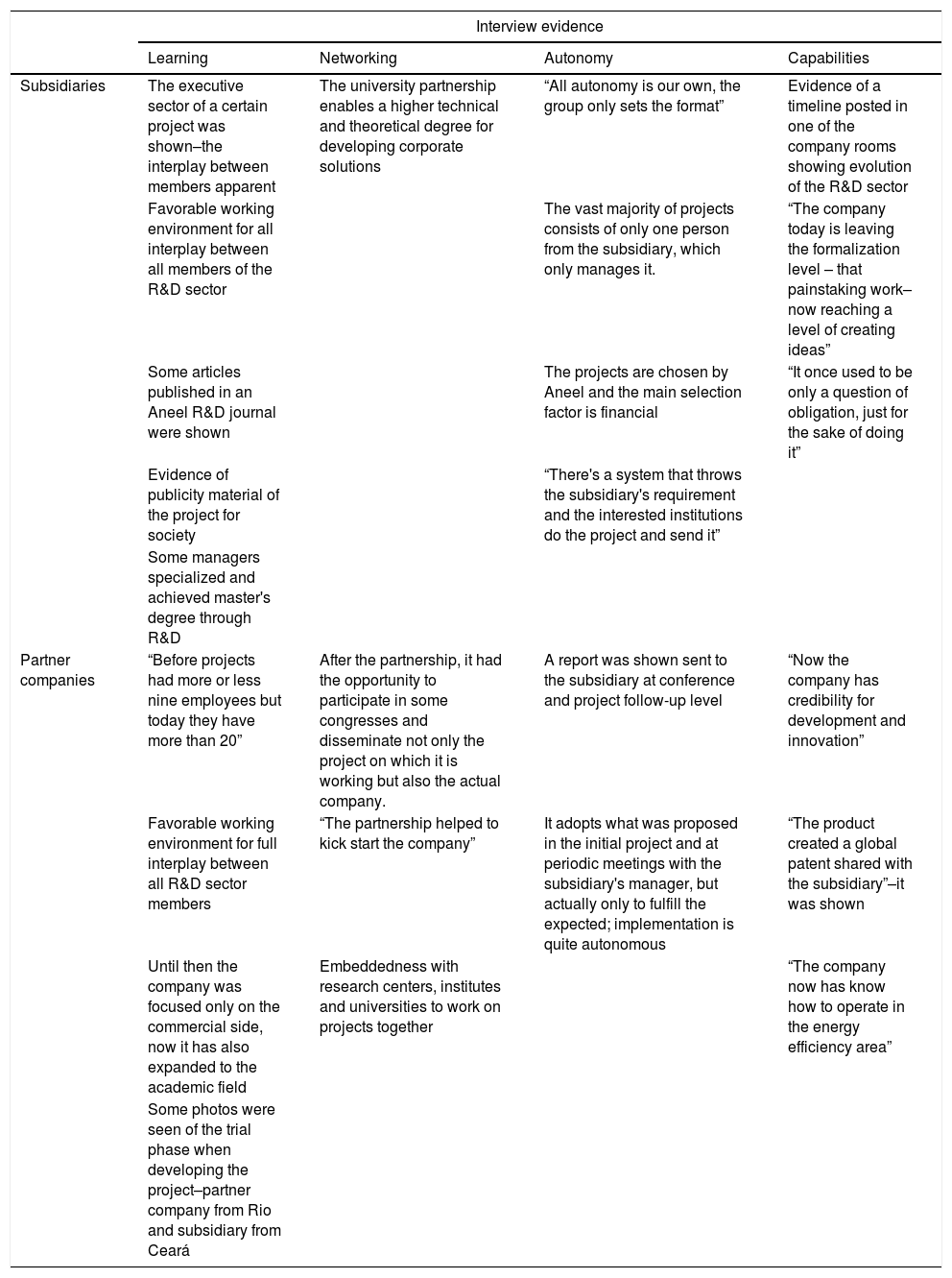

| Interview evidence | ||||

|---|---|---|---|---|

| Learning | Networking | Autonomy | Capabilities | |

| Subsidiaries | The executive sector of a certain project was shown–the interplay between members apparent | The university partnership enables a higher technical and theoretical degree for developing corporate solutions | “All autonomy is our own, the group only sets the format” | Evidence of a timeline posted in one of the company rooms showing evolution of the R&D sector |

| Favorable working environment for all interplay between all members of the R&D sector | The vast majority of projects consists of only one person from the subsidiary, which only manages it. | “The company today is leaving the formalization level – that painstaking work–now reaching a level of creating ideas” | ||

| Some articles published in an Aneel R&D journal were shown | The projects are chosen by Aneel and the main selection factor is financial | “It once used to be only a question of obligation, just for the sake of doing it” | ||

| Evidence of publicity material of the project for society | “There's a system that throws the subsidiary's requirement and the interested institutions do the project and send it” | |||

| Some managers specialized and achieved master's degree through R&D | ||||

| Partner companies | “Before projects had more or less nine employees but today they have more than 20” | After the partnership, it had the opportunity to participate in some congresses and disseminate not only the project on which it is working but also the actual company. | A report was shown sent to the subsidiary at conference and project follow-up level | “Now the company has credibility for development and innovation” |

| Favorable working environment for full interplay between all R&D sector members | “The partnership helped to kick start the company” | It adopts what was proposed in the initial project and at periodic meetings with the subsidiary's manager, but actually only to fulfill the expected; implementation is quite autonomous | “The product created a global patent shared with the subsidiary”–it was shown | |

| Until then the company was focused only on the commercial side, now it has also expanded to the academic field | Embeddedness with research centers, institutes and universities to work on projects together | “The company now has know how to operate in the energy efficiency area” | ||

| Some photos were seen of the trial phase when developing the project–partner company from Rio and subsidiary from Ceará | ||||

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.