Green investment has emerged as a crucial tool for sustainable development, but its determinants across heterogeneous regional contexts remain inadequately understood. This study examines determinants of green investment across Chinese provinces, focusing on R&D intensity, pollution control intensity and innovation capacity. We employed fixed-effects regression and bias-corrected least squares dummy variable (LSDV) dynamic panel estimators to demonstrate that R&D intensity has a significant positive effect on green investment. In contrast, pollution control intensity exhibits negative associations, indicating substitution between conventional pollution control and innovative green technologies. Green investment determinants vary considerably by region, with R&D intensity exhibiting the strongest impacts in Central China and pollution control intensity showing the most pronounced negative effects in the Eastern provinces. These findings contribute to the understanding of green investment determinants and provide valuable insights for policymakers seeking to balance environmental objectives with economic development through targeted regional approaches to R&D promotion and environmental regulation.

Environmental sustainability is a major issue mainly linked with industrial growth and is a major challenge for emerging economies. Countries around the world have signed agreements to achieve carbon neutrality, as pollution has a significant adverse effect on our ecosystem and economic development (Umar et al., 2024). The adverse effect on ecosystem is due to high pollution, natural resources depletion and rising temperatures (Huang & Lei, 2021; K.-C. K.-C. Zhang et al., 2024). In response to environmental sustainability challenges, countries around the world have pledged significant investments in green technologies, demonstrated by China's goal of achieving carbon neutrality by 2060. China among other countries, has established an ambitious goal for achieving zero carbon emissions and promoting environmental sustainability (Sun et al., 2022). In this context, green investment emerges as a key instrument for policymakers and firms to decrease environmental pollution (Tian et al., 2024; W. Zhang et al., 2024). Many studies have been conducted to identify the factors that influence green investment and their role in achieving sustainable development (Xu et al., 2020; Yang et al., 2024; Zhao et al., 2023; Zheng et al., 2025; Zhu et al., 2022).

One of the key aspects of green investment is the R&D expenditure, in which the organizations and governments allocate resources to develop innovative technologies to mitigate environmental degradation (Herzer, 2025; Luo et al., 2021). Studies have examined the effect of R&D on environmental performance and green investment and have shown a positive relationship between R&D investment and environmental outcomes (Hailemariam et al., 2022; Orlando et al., 2022). Additionally, investment in R&D have a positive influence on innovation performance, which subsequently enhances green investment (Xu et al., 2020). However, it is important to understand the mechanisms through which R&D affects green investment and contributes to environmental sustainability. In this context, Bataine et al. (2024) argued that R&D expenditures enhance the relationship between environmental practices and competitive advantage, which compels organizations to invest more in green technologies. Similarly, Chen et al. (2023) found positive associations between R&D spending and green industrial development in both the short-run and long-run.

China's pollution-control intensity operates through regulations (command-and-control, market-based, and green-finance). Earlier studies on the relationship between environmental regulations and investment have shown mixed results, indicating that there is a trade-off between pollution control regulation frameworks and green investment (Bao et al., 2021; Du et al., 2022). In this regard, Wang et al. (2022) divided environmental regulation into formal (command-control, market-incentive) and informal environmental regulations (IER) to show an inverted U-shape for command-control and green investment in heavily polluting enterprises; market-incentive shifts from no effect to positive, and IER stays positive. Huang and Lei (2021) also showed an inverted U-shaped relationship between environmental regulation and corporate green investment, which implies that a moderate level of regulation promotes green investment while excessive regulation may have a negative effect. Previous studies mainly focus on national-level analysis and failed to analyze the regional heterogeneity to have a complete overview, as the regional differences in resource endowment, industrial structure, and economic development can significantly affect green investment. Dai and Zhang (2025) demonstrated that the correlation between environmental regulations and the effectiveness of green investments in substantially polluting Chinese firms is nonlinear, characterized by twofold threshold and spatial spillover effects. Similarly, Song et al. (2024) revealed a stronger negative command-control effect in energy-intensive central/western provinces, while market-based rules more often promote green innovation in the developed east. The variations in provincial characteristics necessitate differentiated approaches to promote green investment across regions.

Based on the above discussion, this study aims to explore the impact of R&D intensity and pollution control intensity on green investments in Chinese provinces using data from 2007 to 2023. This study highlights the role of these determinants in achieving the ultimate goal of carbon neutrality and environmental sustainability. In contrast to national-level studies, which overlook regional differences, this research study examines the linkage between R&D intensity and green investment at the provincial level, providing insights into variances in regions. This study also explores the role of innovation, foreign direct investment, economic growth and urbanization on green investment. This study's examination of regional variations in green investment determinants offers important insights for policy strategies to draft specific frameworks for provinces. Additionally, this study enhances the reliability of the findings by addressing potential endogeneity concerns that may arise from the enduring nature of green investment over time through the use of dynamic panel estimation techniques.

Literature reviewR&D intensity and green investmentXu et al. (2020) examined the linkage between R&D investment, ESG performance and green innovation performance for the period 2015–2018 for 223 firms. The findings of their study showed that R&D investment is positively linked to green innovation performance, while ESG performance increases innovation performance and also moderates the relationship between R&D investment and green innovation performance. Chen et al. (2023) examine the effect of green investment and technological progress on green industrial development. The outcomes of this study verified the positive linkage between R&D expenditures and green industrial development in both the short and long run, while green investment also positively impacts green industrial development in both time frames, and technological progress has a positive effect only in the long run. Similarly, bidirectional causality is found between R&D investment and green investment. Similarly, L.Wang and Si (2025) identified an inverted U-shaped relationship between R&D intensity and green innovation performance in Chinese manufacturing enterprises, with effectiveness varying by ownership type and geographic location. R&D intensity serves as a crucial tool in green investment decisions. Rahmadhani et al. (2024) demonstrated that R&D intensity fully mediates the relationship between corporate social and environmental responsibility expenditure and corporate investment in Indonesian companies. Additionally, R&D investments serve as a mediating channel through which green innovation impacts accounting-based financial performance, while ESG disclosure mediates market-based performance effects.

The positive impact of R&D intensity on green investment is theoretically supported by various perspectives. One perspective is that R&D capabilities are valuable, rare, and difficult-to-imitate resources that enable firms to develop and implement environmentally sustainable technologies (Castellani et al., 2022; Horbach et al., 2012). On the other hand, R&D activities generate knowledge assets that facilitate the identification and exploitation of green investment opportunities and foster green economic growth (Fang et al., 2022). Furthermore, the dynamic capabilities framework suggests that R&D enhances firms' ability to reconfigure their resource base to address rapidly changing environmental challenges (Uyar et al., 2022). From a more practical standpoint, R&D intensity increases firms' technological absorptive capacity, reduces the cost and uncertainty associated with green investments, and creates path dependencies that favor continued investment in environmentally sustainable technologies (Ayoub & Lhuillery, 2024; Hazarika, 2021).

Pollution control intensity and green investmentThe literature reveals substantial complexity regarding the relationship between pollution control intensity and green investment. China's pollution-control intensity operates through regulations (command-and-control, market-based, and green-finance) (Bao et al., 2021). Huang and Lei (2021) identified an inverted U-shaped relationship between command-control environmental regulation and green investment, whereas market-based and public-participation regulations demonstrated consistently positive associations with environmental investments. Z.Wang et al. (2022) further expanded this understanding by analyzing threshold effects across different regulatory approaches, employing non-linear panel threshold regression on data from Chinese heavily polluting enterprises. The results of their study showed that command-control, market-incentive, and informal regulations exert differential impacts on green investment decisions, with these relationships varying significantly across regulatory intensity levels. In contrast, Zhu et al. (2022) studied the impact of environmental regulation and political connections on corporate green investment. The results established that the impact of environmental regulation on corporate green investment is moderated by political connections, suggesting that firms with stronger political ties may respond differently to environmental regulatory pressures compared to those with weaker political connections.

Research reveals that environmental regulations can have counterintuitive effects, with stricter regulations sometimes reducing corporate environmental investment growth, particularly impacting pollution-intensive industries, western regions, and smaller companies more severely. However, independent director supervision can help mitigate these negative impacts (C. Wang et al., 2024). Conversely, environmental regulations demonstrate positive effects by stimulating green innovation both locally and regionally, creating beneficial feedback loops with green investment (Li et al., 2023). Government support, financial development, and regulatory frameworks can amplify green investment's impact on promoting innovation (Li et al., 2023). The effectiveness of environmental regulations depends heavily on complementary policies, with government subsidy programs requiring robust regulatory frameworks and industry-specific considerations to successfully drive corporate green transformation (Shan & Ji, 2024).

Data and methodologyThis study utilizes panel data obtained from the National Bureau of Statistics (NBS) of China. The data includes 31 provinces (excluding Hong Kong, Macau, and Taiwan) denoted by "i" from the period of 2007–2023 denoted by "t". The dependent variable is green investment and the data is obtained from the China Statistical Yearbook on Environment. Greem investment is the industrial pollution control investment per unit of industrial output and the measure captures the relative intensity of environmental investment rather than absolute values, thus controlling for provincial size differences. Research and development (R&D) data is sourced from the China Statistical Yearbook on Science and Technology, and gives the industrial R&D expenditure per unit of industrial output. While economic indicators, including GDP (real GDP per capita), urbanization (the proportion of urban population to total population, and FDI investment (total foreign investment) are extracted from the China Statistical Yearbook. Patent data, which serves as a proxy for innovation (represented by granted patents per 10,000 population), is collected from the China National Intellectual Property Administration (CNIPA). To examine the determinants of green investment across Chinese provinces, the baseline model follows a fixed-effects specification to control for time-invariant provincial characteristics:

where GreenInvestmentit represents the green investment for province i in year t, R&DIntensityit is the R&D intensity, Xit is a vector of control variables including GDP, urbanization, and FDI investment, μi represents provincial fixed effects, and εit is the error term. The second model incorporates pollution control intensity as an explanatory variable:The third and most comprehensive model further includes innovation:

To address potential endogeneity concerns arising from the persistence of green investment over time, we extend our analysis by employing a dynamic panel specification:

where ρ captures the persistence effect of past green investment on current investment levels. Lastly, to investigate regional heterogeneity, we estimate the dynamic panel model separately for four geographic regions of China:In the above equation, the superscript r denotes the specific region (East, Central, West, or Northeast). This study employs a multi-stage methodological approach to ensure robust and reliable estimation results. For the baseline analysis, fixed-effects panel regression is applied to control for time-invariant province-specific heterogeneity that might otherwise bias the estimated coefficients. Robust standard errors clustered at the provincial level are employed to address potential heteroscedasticity and autocorrelation within provinces. To address the potential bias arising from the inclusion of a lagged dependent variable in the presence of fixed effects, we employ the bias-corrected least squares dummy variable (LSDVC) estimator. The LSDVC estimator is particularly suitable for dynamic panel data with a relatively small number of cross-sectional units and a moderate time dimension, which characterizes our dataset. For the regional heterogeneity analysis, provinces are classified into four regions based on China's official regional division (East, Central, West, or Northeast). This classification reflects substantial differences in economic development, industrial structure, and environmental challenges across regions.

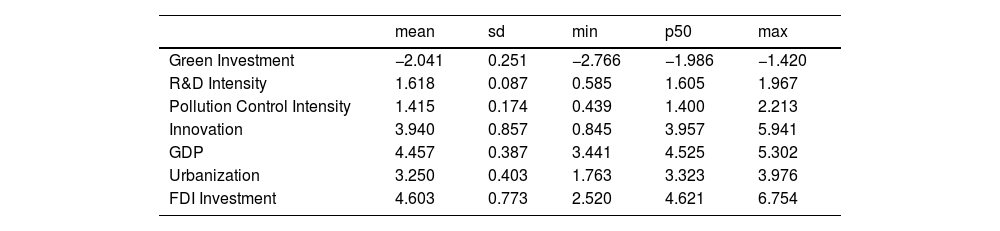

Results and discussionsTable 1 gives the descriptive analysis of the variables used in the analysis. The mean value of green investment is −2.041 with a standard deviation of 0.251, indicating a relatively moderate variation in green investment across observations. R&D intensity has a mean value of 1.618 with a comparatively lower standard deviation of 0.087, suggesting more uniformity in R&D investments. Similarly, pollution control intensity exhibits a mean of 1.415 with a standard deviation of 0.174. Innovation demonstrates the highest variation among these primary variables with a standard deviation of 0.857 around a mean of 3.940. The control variables—GDP, urbanization, and FDI investment—show means of 4.457, 3.250, and 4.603, respectively.

Descriptive Statistics.

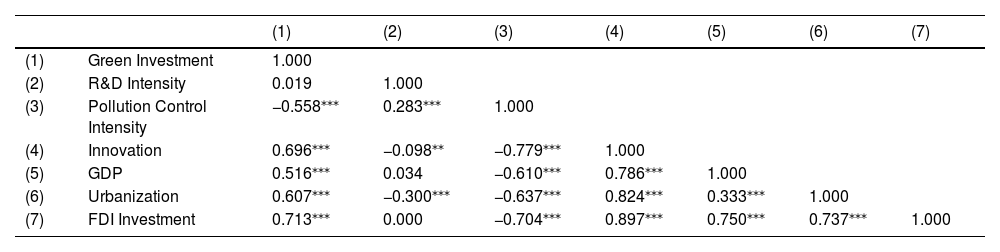

Table 2 gives the correlation among the variables and shows that green investment exhibits a strong positive correlation with innovation (0.696), GDP (0.516), urbanization (0.607), and FDI investment (0.713). This suggests that provinces with higher levels of innovation, economic development, urbanization, and foreign direct investment tend to allocate more resources to green investment. In contrast, green investment demonstrates a significant negative correlation with pollution control intensity (−0.558), indicating a potential substitution effect between these two environmental strategies. The correlation between R&D intensity and green investment is positive but negligible (0.019) and statistically insignificant, suggesting that R&D intensity may influence green investment through other mediating factors rather than directly.

Correlation Matrix.

Note: *** is for the significance level of 1 %.

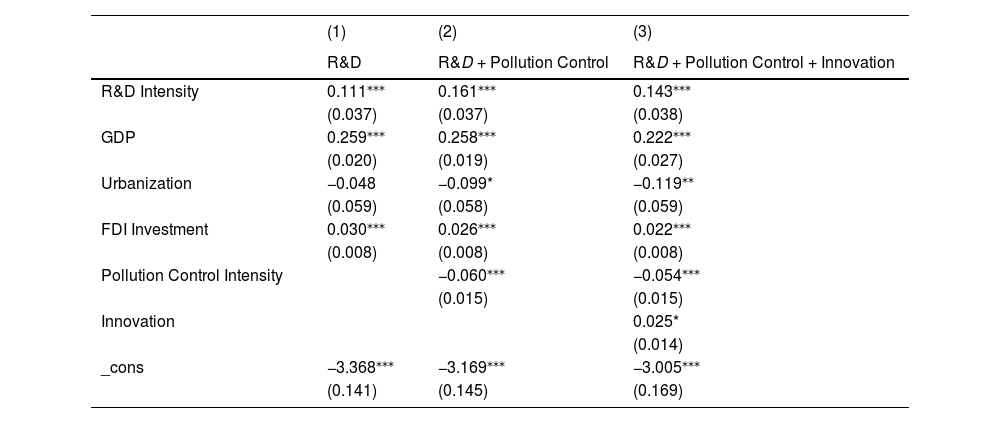

Table 3 presents the baseline regression results with green investment as the dependent variable. The results from Model 1 indicate that R&D intensity has a positive and statistically significant effect on green investment (coefficient = 0.111), supporting the theoretical premise that R&D activities foster environmental innovations. GDP also demonstrates a strong positive association with green investment (coefficient = 0.259), suggesting that economically developed provinces have greater capacity and perhaps willingness to invest in green technologies. FDI investment similarly shows a positive relationship with green investment (coefficient = 0.030), consistent with the pollution halo hypothesis whereby foreign investment brings advanced environmental management practices. Urbanization, however, shows a negative but statistically insignificant coefficient of −0.048.

Baseline regression.

Note: ** & *** is for the significance level of 5 % and 1 %.

In Model 2, with the addition of pollution control intensity, the magnitude of the R&D intensity coefficient increases (coefficient = 0.161), suggesting that when controlling for traditional pollution control measures, the effect of R&D on green investment becomes more pronounced. Pollution control intensity itself exhibits a negative and significant relationship with green investment (coefficient = −0.060), indicating a possible trade-off between conventional pollution control approaches and innovative green investments.

Model 3, the most comprehensive specification, includes innovation as an additional predictor. The coefficient for innovation is positive and marginally significant (coefficient = 0.025), suggesting that provinces with higher innovation capabilities tend to invest more in green technologies, although the effect is relatively modest. The inclusion of innovation slightly reduces the magnitude of the R&D intensity coefficient (coefficient = 0.143), indicating that part of the R&D effect on green investment operates through the innovation channel. The negative effect of pollution control intensity remains robust with a coefficient of −0.054.

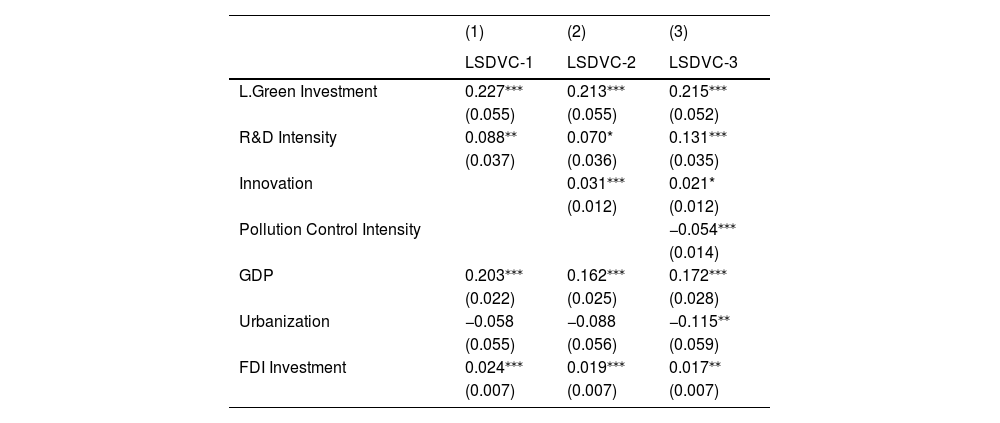

Table 4 presents the results of robustness checks using the bias-corrected least squares dummy variable (LSDV) dynamic panel data estimator. This approach accounts for the potential persistence in green investment by incorporating its lagged value as a predictor. The lagged green investment coefficient is positive and highly significant across all specifications (ranging from 0.213 to 0.227), confirming that green investment exhibits substantial persistence over time, which aligns with the expectation that environmental investments typically involve long-term commitments and path dependencies.

Robustness Checks for Green Investment Determinants using Bias-corrected LSDV dynamic panel data estimator.

Note: *, ** & *** is for the significance level of 10 %, 5 % and 1 %.

The LSDV estimates validate the baseline findings while providing additional insights into the dynamic nature of green investment determinants. R&D intensity maintains its positive and significant effect across all specifications, though with slightly reduced magnitudes compared to the baseline models (ranging from 0.070 to 0.131). Innovation similarly exhibits a positive and significant effect, particularly in Model 2 (β = 0.031), reinforcing its role as a driver of green investment. Pollution control intensity continues to demonstrate a negative and significant relationship with green investment (coefficient = −0.054) in Model 3.

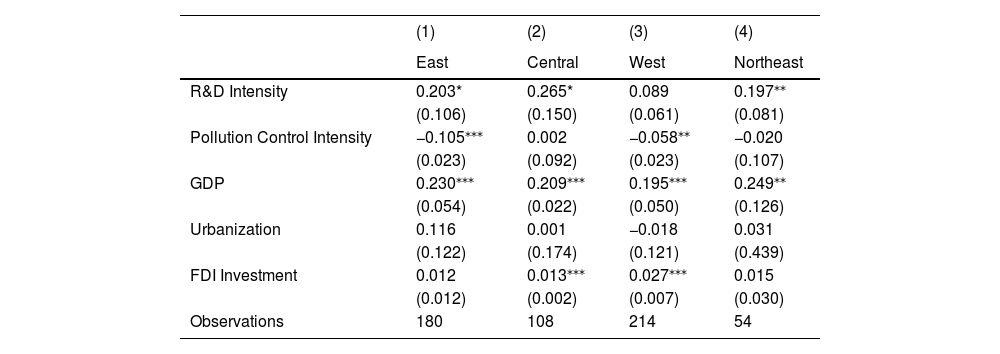

Table 5 examines regional heterogeneity in the determinants of green investment, categorizing provinces into four regions (East, Central, West, and Northeast). R&D intensity demonstrates positive effects across all regions, but with varying magnitudes and significance levels. The effect is most pronounced in the Central region (coefficient = 0.265), followed by the East (coefficient = 0.203) and Northeast (coefficient = 0.197), while it is positive but statistically insignificant in the West (coefficient = 0.089). This pattern aligns with the varying levels of technological and scientific capacity across regions, with more developed regions generally showing stronger R&D effects on green investment.

Regional Heterogeneity in Green Investment (LSDVC Estimates).

Note: *, ** & *** is for the significance level of 10 %, 5 % and 1 %.

Pollution control intensity exhibits significant regional variations in its relationship with green investment. The effect is strongly negative in the East (coefficient = −0.105) and moderately negative in the West (β = −0.058), while it is essentially negligible in the Central (coefficient = 0.002) and Northeast (coefficient = −0.020) regions. This heterogeneity may reflect differences in environmental regulatory frameworks, industrial structures, and pollution control strategies across regions. The strong negative effect in the East suggests that more economically advanced coastal provinces have potentially shifted from conventional pollution control to innovative green technologies.

GDP demonstrates a consistently positive and significant effect on green investment across all regions, with coefficients from 0.195 to 0.249. This indicates the fundamental role of economic development in enabling green investment, irrespective of regional contexts. Urbanization, however, shows no significant effect in any region, contradicting the negative effect observed in the national-level analysis. This inconsistency suggests that the urbanization-green investment relationship may be more complex and possibly mediated by other regional factors not captured in the models. FDI investment exhibits a positive effect across all regions but is statistically significant only in the Central and West regions. The stronger effect in the West may indicate that FDI plays a particularly crucial role in bringing green technologies to less developed western provinces, where domestic innovation capabilities may be more limited. The insignificant effect in the East and Northeast suggests that in these regions, domestic factors may be more influential in driving green investment decisions compared to foreign investment.

Conclusion and policy recommendationsThe rapid rise in environmental degradation is a global concern and poses challenges to human lives, where green investment in the industrial sector plays a pivotal role in mitigating such degradation. This study investigates the determinants of green investment across Chinese provinces by examining the role of R&D intensity, pollution control intensity, innovation, and other economic factors. The empirical findings reveal that R&D intensity exerts a positive and statistically significant impact on green investment (β = 0.143), suggesting that increased R&D activities significantly contribute to the adoption of environmentally friendly technologies in the industrial sector. In contrast, pollution control intensity demonstrates a negative association with green investment (β = −0.054), indicating a potential substitution effect between traditional pollution control approaches and innovative green technologies. Moreover, innovation exhibits a positive relationship with green investment (β = 0.025), though with a relatively modest magnitude compared with other variables, which aligns with the theoretical premise that innovative capabilities foster environmental technologies adoption. The dynamic panel data analysis further confirms these findings while providing additional insights into the temporal persistence of green investment patterns. The significant coefficient of lagged green investment (β = 0.215) confirms substantial path dependency in environmental investments, where past investment decisions significantly influence current allocations. The regional heterogeneity analysis reveals substantial variations in the determinants of green investment across China's diverse provinces. R&D intensity demonstrates the strongest effect in the Central region, followed by the East, and Northeast regions, while its effect in the West remains positive but statistically insignificant. In contrast, pollution control intensity exhibits a strongly negative effect in the East and moderately negative in the West, while showing a negligible impact in the Central and Northeast regions.

The findings of this study carry significant implications for policymakers and environmental governance. Firstly, the positive relationship between R&D intensity and green investment suggests that policies promoting R&D activities can significantly enhance environmental investments in the industrial sector. Thus, governments should strengthen R&D tax incentives, increase public research funding, and facilitate university-industry collaborations to stimulate environmentally oriented innovations. Secondly, the negative association between pollution control intensity and green investment indicates a potential policy dilemma, where excessive focus on end-of-pipe pollution control might inadvertently discourage more fundamental technological transformations. Therefore, policymakers should design integrated environmental governance frameworks that balance immediate pollution reduction goals with long-term technological transitions toward green production systems.

Furthermore, the regional heterogeneity analysis reveals significant variations in the determinants of green investment across China's provinces. The effect of R&D intensity is strongest in the Central region, followed by the East and Northeast, while remaining positive but statistically insignificant in the West. The Eastern provinces should focus on transforming pollution control investments (which showed a strongly negative effect) into innovation-driven green technologies through targeted R&D subsidies and environmental tax reforms. In contrast, for Central provinces (where R&D showed the strongest positive effect), strengthening research capacity through provincial innovation centers and university-industry partnerships would be more effective, while Western provinces would benefit from FDI incentives specifically targeting green sectors, given their stronger FDI coefficient. The consistent positive effect of GDP across all regions indicates that provincial five-year economic plans should explicitly link industrial output targets with corresponding green investment requirements to ensure that economic growth translates into environmental improvements rather than increased pollution.

CRediT authorship contribution statementZhengfu Xie: Software, Investigation, Conceptualization. Wanting Liu: Validation, Resources, Funding acquisition, Conceptualization. Ran Tao: Writing – original draft, Visualization, Resources, Methodology, Formal analysis, Conceptualization. Nicoleta-Claudia Moldovan: Writing – review & editing, Writing – original draft, Software, Project administration, Formal analysis, Conceptualization.

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this article.

This study is supported by General Project of Guangdong Provincial Philosophy and Social Sciences Planning 2023: Research on the Resource Integration Mechanism of Party Building Classification-led Elderly-friendly Community Construction (GD23CDS03).