Non-fungible tokens (NFTs) have garnered attention because of their potential to disrupt traditional business models in various industries. This study provides insights into the drivers of individuals' intentions to purchase NFTs by investigating the relationship between perceived value (scarcity, uniqueness, verifiability, and royalty), as well as facilitating conditions, social influence, individual differences, and personality traits, and the intention to purchase NFTs. Decision-makers, creators, and investors can benefit from understanding these drivers. The proposed model integrates constructs from multiple adoption frameworks and related NFT literature to analyze the individual determinants of NFT purchase intentions. This study utilized a survey to collect data from participants and employed the partial least squares structural equation modeling (PLS/SEM) technique to validate the proposed model empirically. The findings indicate that perceived value, facilitating conditions, social influence, individual differences, and personality traits significantly shape individuals’ intentions to purchase NFTs. Perceived scarcity, verifiability, and royalty were found to be positively associated with perceived value, whereas perceived uniqueness did not demonstrate a statistically significant relationship. Furthermore, the study suggests that individual differences and personality traits do not moderate the relationship between perceived value and NFT purchase intention. However, individual differences and personality traits are directly associated with NFT purchase intention.

In recent years, the non-fungible token (NFT) industry has flourished and has drawn a great deal of attention globally (Wang et al., 2021), sparking curiosity about its capacity to create new market prospects. An NFT is a blockchain-based record of ownership of physical or digital goods and is seen as a revolutionary approach to promoting and generating income from digital assets (Borri et al., 2022). Investor interest in NFTs can be attributed to many factors and variables (Albayati et al., 2023).

The economic challenges of 2020, largely due to COVID-19, not only marked a period of hardship but also sparked a significant shift in the intersection of technology and economic value, leading to a rapid acceleration in technology adoption and the creation of new economic opportunities (Baker et al., 2022; Popescu, 2021). NFTs are one such emerging technology that has commanded growing interest worldwide (Albayati et al., 2023; Alexander & Bellandi, 2022). NFTs enable the production of distinctive digital assets that can be purchased and sold similarly to physical assets, giving a fresh perspective on digital ownership (Rehman et al., 2021). A thorough understanding of the factors driving NFT purchases is essential for creators, sellers, and investors to thrive in the rapidly growing NFT market. Understanding the motives and preferences of NFT customers allows producers and sellers to create focused marketing tactics that appeal to potential buyers and adjust their offers to fit consumer demand, hence increasing sales and income. Therefore, it is imperative to identify the key drivers of intention to purchase NFTs.

Despite the growing body of research on NFTs, critical gaps remain in fully understanding purchasing intentions. Griffiths et al. (2024) examined NFT buyer motivations and found that intrinsic motivation and anticipated future value significantly impact purchase intentions.Ng et al. (2025) explored NFT investment intentions by incorporating investment theories and technology adoption models, offering a new framework to analyze the psychological and social influences on NFT investments. While these studies contribute valuable insights, they do not fully capture the multidimensional nature of NFT adoption, particularly in terms of behavioral, market, and technological aspects.

Studies often focus on isolated dimensions such as intrinsic motivation, investment behavior, or platform usability. However, these studies fail to capture the multifaceted drivers that include psychological, social, and technological elements in a unified framework. Yu (2025) further emphasizes this limitation, noting that most existing NFT research concentrates on technical aspects while overlooking their broader role in shaping consumer engagement and marketing strategies. This gap limits our understanding of how various constructs interact to influence NFT purchase behavior. Addressing this gap is essential, both to inform the development of more comprehensive adoption models in academic theory and to equip practitioners with actionable insights for market strategies in a rapidly evolving digital economy.

This research proposes a comprehensive model that integrates constructs from adoption theories and pertinent NFT literature to address these gaps. It aims to identify the main variables influencing the intention to purchase NFTs, offering insights into the desires and motivations of potential buyers while also exploring how businesses can take advantage of the burgeoning market of digital assets. The proposed model was applied and assessed in a real-world setting to determine its validity and effectiveness.

This study employs an empirical approach, utilizing a survey-based research design to gather participant data and investigate the factors related to individuals' intentions to purchase NFTs. The collected data are then analyzed using Partial Least Squares/Structural Equation Modeling (PLS/SEM) to examine the relationships between variables and validate the proposed model. The investigation aims to shed light on the main drivers of NFT purchase decisions by exploring the relationships between variables such as perceived value, facilitating conditions, social influence, individual differences, and personality traits. The study’s findings enhance our understanding of NFT adoption, particularly purchase intentions, which are influenced 63 % by perceived value, personality traits, social influence, and facilitating conditions. Moreover, perceived scarcity, verifiability, and royalty significantly explain buyers' perceived value. Our study provides practical implications for NFT decision-makers, creators, and investors in the evolving market, as well as theoretical implications for academia.

This research begins by outlining objectives, followed by an extensive literature review integrating adoption theories and NFT-relevant theoretical literature. We devised a conceptual model by identifying research gaps. Data collection employed a survey method to collect data from participants to understand factors influencing NFT purchase intentions. Collected data were analyzed using PLS/SEM to examine variable connections and model validity.

Literature reviewDue to the novelty of NFTs, literature on their acceptance is scarce. We review the history of cryptocurrencies, define NFTs, and explore their adoption using concepts from multiple technology and innovation adoption theories, as well as NFT-related theoretical literature. Building on this, we draw parallels between the acceptance of cryptocurrencies and NFTs. We conclude that the primary factors of NFT purchasing are social influence and NFT hype, individual differences, NFT features and characteristics, and facilitating conditions. We detail how each criterion relates to buyer intention.

Bitcoin, introduced in 2009 by Satoshi Nakamoto, aimed to create a decentralized peer-to-peer currency exchange platform through cryptographic proof, eliminating the need for a reliable third party (Nakamoto, 2008). While Bitcoin is the most valued cryptocurrency, its structural limitations confine it to currency transactions (Porat et al., 2017). In 2013, Ethereum, proposed by Vitalik Buterin, became the second-largest cryptocurrency, offering a versatile platform beyond digital currency (Dutta et al., 2023; De Vries, 2023). Ethereum's versatile platform enables the development of advanced applications beyond digital currency. These tokens, which have the same properties and value as all the others, are known as fungible tokens (Ardavanis, 2022; Hammi et al., 2023). Ethereum also has the same value as every other Ethereum and operates through smart contracts that are stored on a blockchain and executed based on predefined conditions. Smart contracts include logical assertions in transactions and operate as a third-party arbitrator (Cong & He, 2019). Several standards have been established to make smart contracts more comprehensible and compatible. One prominent standard on the Ethereum blockchain is ERC-20, which serves as the fundamental technical framework for implementing smart contracts related to fungible tokens (Kong & Lin, 2021). In 2017, CryptoPunks introduced NFTs based on the ERC-721 standard, distinguishing them from ERC-20 tokens by their non-fungibility (Kong & Lin, 2021). The ERC-721 standard has a feature that assures each token is unique and non-fungible, allowing NFTs to be utilized in innovative applications (Entriken et al., 2018)

Digital content has long been accessible for free on websites, but it can be difficult for actual owners, such as artists, to validate and monetize their digital content. Copying is easy, and verifying the authenticity of digital content is complex (Chohan & Paschen, 2023). Furthermore, customers can simply purchase non-digital goods like clothes and books, and it is challenging for them to buy genuine digital items. NFTs represent ownership of digital content like artwork. This facet ensures exclusive ownership at any given time. Through smart contracts, original artists receive a cut of future NFT sales (royalties) automatically, ensuring they benefit from secondary transactions while consumers acquire unique digital assets. In 2021, the NFT market's rapid growth attracted investors seeking alternative investments (Kampakis, 2022). Kong and Lin (2021)) deem NFTs a revolutionary investment offering higher profits than traditional financial investments in the Fintech era. In order to assess NFTs' financial profitability and investment performance, Kampakis (2022) used the hedonic regression (HR) model over 3 years (2018–2021) to examine the NFT collection known as CryptoPunks, which is one of the NFT collections with the largest trade turnover. The findings demonstrate that investment in CryptoPunks had the largest return on investment (ROI) during 2018 and 2021, with an average monthly return of 34.19 % and a standard deviation of 61.76 %, which is a favorable tradeoff between risk and return. The study by Zhang et al. (2022) demonstrates that NFTs function as a safe haven for various asset classes, including stocks and US currency, during both the pre-COVID-19 pandemic and pandemic periods.

Investors’ or customers’ intention to use NFTsIn addition to the digital world, the usage of NFTs is growing in the area of physical assets. NFTs have the potential to be utilized for various purposes, including verification of driving licenses, academic diplomas, tickets, IDs, passports, medical and insurance documents, real estate and property ownership, and supply chain management (Ardavanis, 2022; Regner et al., 2019). This ongoing development of unique NFT use cases offers a chance to draw a broad swath of new consumers to the crypto ecosystem (Ardavanis, 2022). Therefore, it is crucial to identify consumers' intentions to buy NFTs. Through this approach, developers and businesses can enhance the alignment of their products and services with the needs and preferences of potential customers.

Technology acceptance or adoption refers to the intention of users to utilize technology to execute their tasks. Over time, various models and frameworks have been developed to explain this adoption by identifying key factors influencing user acceptance (Taherdoost, 2018). Among these, the Technology Acceptance Model (TAM) and the Unified Theory of Acceptance and Use of Technology (UTAUT) are the most widely used in studying technology adoption and user acceptance.

TAM is a foundational framework in the domain of information systems, introduced by Davis et al. (1989). TAM assesses the speed of technology adoption, primarily focusing on Perceived Usefulness (PU) and Perceived Ease of Use (PEU) (Lai, 2017). PU reflects users' belief that a technology enhances productivity, while PEU relates to the perceived simplicity of using the technology (Davis et al., 1989). TAM has evolved into TAM2 and TAM3, with TAM3 incorporating drivers of PU and PEU, including social influence, individual differences, system characteristics, and facilitating conditions (Lai, 2017).

Venkatesh et al. (2003) developed UTAUT to consolidate previous TAM-based studies, integrating key elements from earlier technology adoption models, including TAM. UTAUT retains the essence of PU and PEU through Performance Expectancy (PE) and Effort Expectancy (EE) while introducing Social Influence and Facilitating Conditions, two constructs absent in TAM (Ling et al., 2011). Despite their extensive use in studying technology adoption, both TAM and UTAUT have limitations in explaining the adoption of NFTs, which function not only as technological innovations but also as items of social, financial, and psychological value, distinguished by their unique characteristics. TAM and UTAUT focus on productivity-driven adoption, making them insufficient for explaining NFT adoption, which is influenced by market speculation, psychological appeal, and digital ownership. While TAM incorporates social influence and system characteristics in later extensions, it still assumes adoption is based on usability and efficiency, overlooking key NFT-specific characteristics. Similar critiques of TAM's limitations have been made in other domains. For instance, Neves et al. (2025) highlight that TAM fails to fully explain user decisions in the context of sustainable technologies because it does not account for factors beyond perceived usefulness and ease of use. This aspect aligns with our argument that NFT adoption also extends beyond traditional technology acceptance models, requiring a framework that incorporates financial incentives, community influence, and digital ownership. Likewise, UTAUT extends TAM by including social and infrastructural factors. However, it remains rooted in mandatory and task-driven adoption, failing to account for financial incentives, community-driven hype, and the role of NFT-specific characteristics. A new or expanded theoretical framework is necessary since a single theory or framework does not adequately explain the adoption of technologies (Pentina et al., 2023). Given these gaps, NFT adoption extends beyond traditional technology acceptance frameworks, requiring a model that integrates these overlooked constructs. We employ a mixed-methods approach that yields more comprehensive conclusions and offers a deeper understanding of the phenomenon as a whole (Venkatesh et al., 2016).

While research on NFTs has expanded, most previous studies focus on only one or two dimensions of adoption. The following table (Table 1) summarizes key studies on NFT adoption, outlining their focus areas.

– Overview of Prior Studies on NFT Adoption.

| Study | Objective | Results |

|---|---|---|

| (Griffiths et al., 2024) | Investigate NFT buyer motivations using Self-Determination Theory (SDT), distinguishing between intrinsic and extrinsic drivers, and analyze the moderating role of future value expectations. | Intrinsic motivation (personal enjoyment and interest) is the strongest driver of NFT purchases. Future value expectations influence purchase decisions, but primarily as a moderating factor. External regulation and social pressure have a limited impact, while amotivation reduces purchase intentions. NFTs function similarly to digital luxury goods rather than purely speculative investments. |

| (Ng et al., 2025) | Examine key factors influencing individuals’ intentions to invest in NFTs, focusing on personal innovativeness, reward sensitivity, NFT knowledge, subjective norms, perceived value, and perceived risk. | Personal innovativeness, reward sensitivity, NFT knowledge, subjective norms, and perceived value positively impact NFT investment intentions. Age and income moderate the effects of subjective norms and perceived value. The perceived risk of traditional investments had a weaker impact. |

| (Chang et al., 2024) | Examine the factors influencing NFT purchase intention by integrating perceived scarcity and perceived risk within the Theory of Planned Behavior (TPB). | Perceived scarcity and perceived ease of use positively influence NFT purchase intention, while perceived risk negatively impacts it. Attitudes, subjective norms, and perceived behavioral control are key determinants of purchase intention. Additionally, attitude mediates the effect of perceived ease of use, and subjective norms mediate the effect of perceived scarcity on purchase intention. |

| (Vega & Camarero, 2024) | Explore the adoption of NFTs using the UTAUT2 model, incorporating additional factors like social capital and fear of missing out (FOMO). | Return expectancy and hedonic value significantly influence NFT adoption. Perceived risk negatively affects purchase intention, with stronger effects on non-buyers. Social capital impacts repurchase intent but not initial adoption. |

| (Díaz et al., 2023) | Examine the adoption of art NFTs in Mexico and Colombia, focusing on the factors influencing adoption, including technological, economic, and cultural aspects. The study applies the S-curve model to assess the adoption phase and explores motivations, attitudes, and barriers. | Around 2 % of the population in both countries has adopted NFTs, aligning with the Early Adopters phase. Digital art uniqueness and rarity drive adoption, while blockchain knowledge and trust also play a role. Cultural differences impact adoption—Mexico values artistic heritage, while Colombia emphasizes community-driven engagement. Challenges include weak digital infrastructure, market instability, regulatory uncertainty, and a lack of education on NFTs. |

| (Vomberg & Von Gegerfelt, 2025) | Identify distinct NFT buyer segments and explore their engagement patterns in NFT markets. | Five NFT buyer segments were identified: Curious Speculators (18 %), Cautious Investors (5 %), Utility-Driven Buyers (35 %), Tech-Savvy Investors (29 %), and Status-Seeking Socializers (13 %). Speculative buyers prioritize resale, while other segments value utility, technology, or social engagement. Utility-driven buyers are the largest group, highlighting the importance of NFTs beyond mere financial gains. The study emphasizes the role of incentivized referrals in enhancing NFT buyer engagement. |

| (Lee et al., 2025) | Investigate young consumers' motivations for purchasing virtual luxury NFT wearables, analyzing the role of economic, functional, experiential, and symbolic values within the Customer Value Framework (CVF) and the moderating effects of gender and income. | Purchase attitude is influenced by economic value, functional quality, functional rarity, hedonic pleasure, self-presentation, and social status, while functional utility, hedonic scarcity, and self-expression have no significant effect. Purchase attitude strongly predicts both purchase intention and willingness to pay premiums. Gender and income moderate these effects, with functional quality impacting only males and high-income groups, and stronger purchase intention for females. |

These studies provide valuable insights into the factors influencing NFT adoption, but do not fully capture the interplay between psychological, social, economic, and technological factors influencing NFT adoption. We propose a holistic model that integrates these dimensions for a more comprehensive understanding to address this lacuna. The following sections explore key factors shaping NFT adoption.

Social influence and NFT hypeIn today's market, social media plays a crucial role in shaping public opinions (Qian et al., 2022). Social media platforms, beyond networking, are recognized for their persuasive capacity and influence on society. Shaw and Sergueeva (2019), Alalwan et al. (2017), and Lunney et al. (2016) have explored and confirmed the influence of social media on people's intentions to adopt various technological innovations. Some researchers suggest that NFT buyers are driven by a herd mentality or FOMO, as seen in other digital assets, making social media a catalyst for speculative behavior (Bao et al., 2023; Mamidala & Kumari, 2023; Özdemir & Kumar, 2024). Qian et al. (2022) analyzed NFT sentiments on Twitter using NLP. With 237 million daily users in 2022, Twitter is a key information hub impacting financial markets. Google Trends revealed NFT interest fluctuations tied to industry news. Global events, like the Ukraine War, caused a 50 % Q1 2022 NFT revenue decline. The study highlighted the impact of influential Twitter users, citing celebrity adoption, such as filmmaker Kevin Smith's exclusive NFTs for "Killroy Was Here," which are accessible only to NFT owners.

Some people believe that the NFT market is experiencing a financial bubble brought on by a frenzy (Arhum Khawaja, 2021). Research suggests that NFT purchases are often speculative investments, with price volatility linked to cryptocurrency fluctuations and potential market manipulation (Anselmi & Petrella, 2023; Dowling, 2022; Vidal-Tomás, 2022, 2023). Similarly, Pinto-Gutiérrez et al. (2022) argue that NFTs benefit from crypto hype, especially Bitcoin. Using Google search data from 2017 to 2021, they correlate "non-fungible token" and "NFT" searches with cryptocurrency profits. Results show strong ties between NFT interest and Bitcoin outcomes, with increased interest following Bitcoin and Ether profit surges.

Individual differences and personality traitsA scarcity mindset fuels urgency, motivating rapid actions to acquire goods or services. The increasing popularity of NFTs is driven by their growing scale and the scarcity mentality. This mindset motivates excessive buying and spending to develop a sizable market for NFTs using cryptocurrency as the medium of exchange across the blockchain. Monetary inflation amplifies the perception of scarcity, contributing to the substantial growth of the NFT market (Schrader-Rank, 2021). With no physical restrictions, NFTs offer greater accessibility and liquidity globally, allowing anyone with the funds to become a potential investor in the market.

System characteristicsUnderstanding the decentralized architecture and characteristics of NFT technology is crucial for its acceptance and adoption. With their unique attributes, NFTs have the power to entice consumers to purchase. Kong and Lin (2021)) pointed out that NFTs are distinct from financial assets and enable purchasers to receive non-financial benefits (like social position) from possession because of their special characteristics. These benefits extend beyond practical utility and are closely tied to how NFTs serve as status symbols, exclusivity, and personal identity. Commodity theory (Greenwald et al., 2013; Lynn, 1991) posits that the perceived value of a commodity increases when it is scarce and can be owned or exchanged. Lynn's (1991) meta-analysis confirms that scarcity enhances perceived value and suggests that one explanation may be that possessing scarce commodities fosters feelings of personal distinctiveness or uniqueness, aligning with uniqueness theory. These mechanisms also align with concepts from luxury branding and symbolic capital (Bourdieu, 2002), where rare or unique items are valued not only for their inherent properties but also for their ability to signal status and distinction.

In addition to scarcity and uniqueness, other system characteristics, such as verifiability and royalties, contribute to the perceived value of NFTs. Verifiability enhances trust by ensuring authenticity, traceability, and transparency of ownership, while royalties add value by providing ongoing rewards to creators and offering potential financial returns to buyers. Table 2 summarizes the key NFT characteristics and their theoretical foundations.

– NFT Characteristics.

| Characteristics | Explanation | References |

|---|---|---|

| Scarcity | Scarcity, similar to precious metals, enhances perceived value. Creators can control NFT scarcity by setting quantity caps, facilitated by blockchain's ability to schedule and limit digital content distribution over time. From a behavioral economics perspective, scarcity cues can trigger urgency, perceived exclusivity, and FOMO. | (Cialdini, 2009; Lynn, 1991; Popescu, 2021) |

| Uniqueness | NFTs are distinct in that no two NFTs are the same. According to uniqueness theory and symbolic consumption frameworks, consumers often acquire and display unique possessions to express their individuality and distinguish themselves within social contexts. | (Albayati et al., 2023; Chohan & Paschen, 2023; Popescu, 2021; Tian et al., 2001) |

| Verifiability | Blockchain's key features facilitate public verification of ownership by recording all transactions on the blockchain, ensuring traceability. | (Albayati et al., 2023; Popescu, 2021; Wang et al., 2021) |

| Royalties | Smart contracts, embedded in metadata, ensure creators earn profits from secondary sales, popularizing the idea of including ownership rights within the product itself. | (Chohan & Paschen, 2023) |

Industries' early adoption of NFTs holds the potential for substantial future rewards. Initially supported by collectors and art associations, NFTs have expanded beyond into various industries, with the gaming sector leading adoption. Games like Crypto-Kitties enable players to buy, breed, and trade digital assets, creating revenue streams for creators. (Wilson et al., 2022).

NFTs have the potential to become a cornerstone of the virtual economy in the future and emerge as the most significant asset in the metaverse (Kong & Lin, 2021). The metaverse, combining augmented reality and the Internet, facilitates various online activities like shopping, work, gaming, and socializing (Wang et al., 2021). Blockchain serves as the ideal decentralized foundation for this virtual world. In immersive environments like Decentraland, users can participate in diverse activities, including gameplay, showcasing artwork, buying avatars, accessories, and virtual land. Decentraland, a successful Ethereum-based project, enables residents to purchase virtual land parcels measuring 16 m × 16 m (Dowling, 2022).

NFTs cover a range of digital collectibles, from trading cards to digital art and intellectual properties (Wang et al., 2021). Unlike traditional platforms such as YouTube and Instagram, which lack clear routes for creators to monetize their work, NFTs offer new possibilities. In the intellectual property realm, NFTs present a faster and more secure method for patent, copyright, or trademark protection, offering opportunities for businesses, academic institutions, and creators to profit. NFTs enable the tokenization of inventions, providing transparency for tracking changes in patent ownership and automating royalty collection for licensed inventions (Bamakan et al., 2022; Wilson et al., 2022).

NFT purchase intention research model proposalThis study aims to gain a deeper understanding of the key factors influencing individuals' intention to purchase NFTs by building on the insights synthesized from prior literature. To achieve this, a research model is proposed by integrating key concepts from the adoption theories and relevant theoretical literature on NFTs. This model addresses existing gaps by offering a comprehensive framework that reflects the behavioral, technological, and market-driven dimensions of NFT adoption.

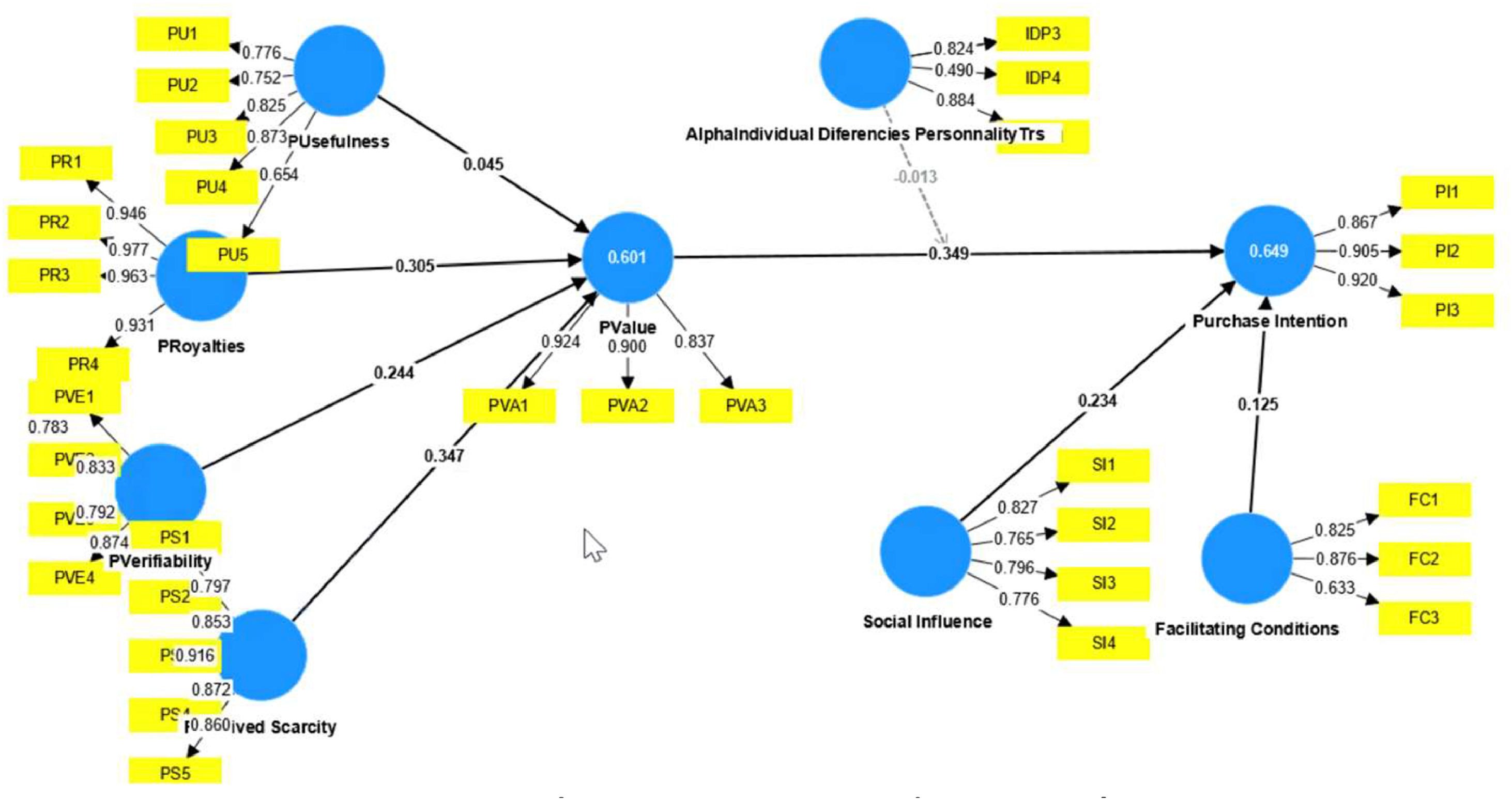

The following section presents the theoretical model, including the study’s constructs and hypotheses. The proposed model consists of nine distinct constructs: Perceived Scarcity, Perceived Uniqueness, Perceived Verifiability, Perceived Royalty, Perceived Value, Social Influence, Facilitating Conditions, Individual Differences and Personality Traits, and NFT Purchase Intention. These constructs represent multidimensional factors that may be associated with individuals' decisions to engage in NFT purchases. Fig. 1 illustrates our proposed theoretical model, which suggests that perceived scarcity, perceived uniqueness, perceived verifiability, and perceived royalty are positively associated with the perceived value of NFTs. The perceived value, in turn, is positively associated with NFT purchase intention.

Additionally, social influence and facilitating conditions are also directly associated with purchase intention. Furthermore, individual differences and personality traits play a positive role in shaping NFT purchase intention. Finally, individual differences and personality traits moderate the relationships between perceived value and intention to purchase NFTs.

To better understand how NFTs can serve as a marketing tool, we can examine their primary characteristics as subcategories. The special characteristics of NFTs have hastened their adoption in the financial industry (Ho & Song, 2023). One of the fundamental economic principles, supply and demand, explains the idea of scarcity and rarity. When supply remains constant, but demand exceeds supply, prices go up, causing shortages (Kiliçaslan & EkiZler, 2022). The user's perception of the goods and acceptance and adoption process is impacted by how scarce the items are (Suri et al., 2007). Rare products enhance exclusivity, influencing users to buy and creating an optimal purchase experience (Lynn, 1991).

Furthermore, Brannon and Brock (2001) claim that the notion of rarity might be more efficient in goods perceived as being more innovative from the buyer's viewpoint. Individuals recognize how rarity can serve as a marketing driver in the digital universe through restricted NFT sales, exclusive accessibility, and the sale of physical collections that are only available to those with NFTs. Additionally, every individual token will be priced, which establishes a virtual scarcity and fuels people's feeling of urgency for a certain good (Kiliçaslan & EkiZler, 2022). Thus, we propose the following hypothesis:

Hypothesis 1 (H1) Perceived scarcity is positively associated with the perceived value of NFTs.

The integration of uniqueness into marketing theories, such as regret theory (Loomes & Sugden, 1982) and reactant theory (Brehm, 1966), emphasizes a brand's distinctiveness in standing out and gaining consumer preference (Netemeyer et al., 2004). Consumers favor items that meet their needs and offer expertise, experience, and distinctiveness (Simonson & Nowlis, 2000). Users' desire for originality is satisfied by uniqueness, which also influences how positively they see the goods (Cheema & Kaikati, 2010). Customers are more likely to choose an item when it is viewed as unique, increasing perceived value (Dhar & Sherman, 1996). Before NFTs, one of the most popular scholarly debates was the uniqueness of products, particularly digital versions. According to Atasoy and Morewedge (2018), the uniqueness of digital commodities could be lower than that of physical items due to their simplicity of replication.

In contrast to this strategy, NFTs leverage smart contracts, mitigate duplication risks, and provide exclusivity by enabling customers to demonstrate continuous ownership (Hofstetter et al., 2022). This research explores how NFTs' uniqueness fosters consumer interest, leading to a heightened perception of the goods' value. Thus, we propose the following hypothesis:

Hypothesis 2 (H2) Perceived uniqueness is positively associated with the perceived value of NFTs.

In decentralized applications, every NFT has a publicly recorded owner, easily authenticated by anyone, unlike centralized apps managed by institutions (Chohan & Paschen, 2023). NFTs, representing physical or digital items, leverage blockchain for distinctiveness through metadata in smart contracts. The transparent transaction history in the blockchain ensures authenticity and eliminates counterfeiting (Popescu, 2021). Each NFT's verifiable and traceable history enhances user confidence in adopting the technology, shaping perceptions of the goods' value (Dev et al., 2022). The transparency of NFT transactions increases the likelihood of successful transactions, boosting customer interest in purchases (Chen et al., 2022). Therefore, we posit:

Hypothesis 3 (H3) Perceived verifiability is positively associated with the perceived value of NFTs.

NFTs revolutionize how artists earn royalties by ensuring a fixed payment with each sale, a feature absent in traditional systems (Wang et al., 2021). Through smart contracts on the blockchain, creators receive automatic, traceable royalties on every NFT resale, eliminating reliance on third parties for payment processing. Unlike conventional systems, smart contracts have no expiration, ensuring perpetual royalties for creators (Ardavanis, 2022). This innovation enhances the intellectual property market, providing creators with ongoing rewards for their work and contributing to the perceived value and interest in NFT purchases (Ardavanis, 2022; Bamakan et al., 2022). By ensuring ongoing financial returns, royalties contribute to the attractiveness of NFTs as an investment, reinforcing their long-term worth beyond ownership and collectability. The expectation of future financial gains and investment returns plays a crucial role in investment decisions (Griffiths et al., 2024). Prior research has shown that the prospect of future profits influences individuals' willingness to buy NFTs (Wang et al., 2023). Thus, financial incentives, including royalties, shape buyers' perceived value of NFTs. Hence, we posit:

Hypothesis 4 (H4) The expectation of receivers’ royalties is positively associated with the perceived value of NFTs.

According to Dodds et al. (1991), perceived value positively affects consumers' intention to purchase. This factor indicates that buyers often choose a product based on its perceived value (Dodds & Monroe, 1985). Research by Kim et al. (2008) revealed that people's intentions to utilize mobile Internet are significantly influenced by perceived value. Similar findings were discerned by Liu et al. (2015), who discovered a strong influence of perceived value on people's intentions to utilize mobile coupon applications. Another study also stated that perceived value plays a significant role in influencing consumers' willingness to embrace and adopt cell phones (Pitchayadejanant, 2011). Therefore, we propose the following hypothesis:

Hypothesis 5 (H5) The perceived value of NFTs is positively associated with NFT purchase intention.

Social influence refers to the impact of others' tendencies on an individual's technology adoption (Chen et al., 2022), and it plays a pivotal role in shaping consumer intentions for new technologies. Numerous studies support the positive influence of social impact on technology adoption (Chaouali et al., 2016; Hsu & Lu, 2004; Malhotra & Galletta, 1999). Ramjan and Sangkaew (2022) found that close friends significantly influence the intention to buy NFTs, with purchasers often following the lead of trustworthy individuals, such as relatives or friends. Communication platforms encourage consumers to assess risks and build trust when deciding on technology use (Chaouali et al., 2016). The study of Qian et al. (2022) demonstrated how influential individuals with engaged followings can shape public opinion on NFTs through platforms like Twitter. NFT developers used this marketing tactic to grow the market, boost demand, and ultimately boost sales. Therefore, we propose the following hypothesis:

Hypothesis 6 (H6) Social influence is positively associated with NFT purchase intention.

A facilitating condition refers to an individual's perception that new technology can be easily used due to the availability of the necessary technological infrastructure (Venkatesh et al., 2012). Existing research has scientifically proven that facilitating conditions are the primary factor in consumers' desire to embrace a technology (Beh et al., 2021; Venkatesh et al., 2003). Progress in information technology, as well as the COVID-19 pandemic, raised the need for non-eye-to-eye interactions, hastening the launch and progression of metaverse platforms. The extended pandemic prompted the deliberate creation of immersive online platforms. NFTs became a valuable asset in the metaverse, facilitating content generation, trading, and linking virtual and physical worlds for value exchange (U.-K. Lee & Kim, 2022). Prathivi and Oktavio (2022) demonstrate that as more people join the metaverse, there are more opportunities for purchasing NFTs. Intellectual property is another valuable feature of an NFT (Ardavanis, 2022). NFTs facilitate the verification, protection, buying, selling, and earning of intellectual property revenue. The demand for NFT technology, which enables digital asset validation, is rising and is expected to continue. NFTs have experienced significant growth, transitioning from absence in Gartner's Hype Cycle for Emerging Technologies in 2020 to reaching the peak of inflated expectations the following year (Bonnet & Teuteberg, 2023). With innovative use cases, NFTs have proven to be valuable assets in enterprises, enticing people to make NFT purchases. Therefore, we propose the following hypothesis:

Hypothesis 7 (H7) Facilitating conditions are positively associated with NFT purchase intention.

As per Rogers' innovation diffusion theory, individual differences and personality traits impact the acceptance of new technologies (Rogers et al., 2014). Sudzina and Pavlicek (2019) note that personality traits favorably impact cryptocurrency adoption. As NFTs employ cryptocurrencies as a form of trade, they can also have an impact on NFT adoption. Self-efficacy and personal innovativeness are the two aspects of personality traits that this study considers (Esmaeilzadeh et al., 2019; Hasan et al., 2022). Personal innovativeness reflects an individual's willingness to adopt innovative technologies (Agarwal & Prasad, 1998; Yi et al., 2006). Agarwal and Prasad (1998) and Shaw and Sergueeva (2019) define personal innovativeness as the willingness to take risks linked to an inherently innovative character. Those with higher risk endurance are more open to experimenting with new technology due to their optimistic views on its utilization (Xu & Gupta, 2009). Some studies discovered that personal innovativeness serves as a strong moderator between the desire to utilize cryptocurrency and perceived value (Abbasi et al., 2021; Hasan et al., 2022). Since cryptocurrency is used to pay for NFT purchases, we may claim that personal innovativeness moderates the relationships between perceived value and intention to purchase NFTs. Several studies have also demonstrated that personal innovativeness influences the intention to adopt blockchain technology (Abbasi et al., 2021; Alaklabi & Kang, 2018). Similarly, Ng et al. (2025) found that personal innovativeness is positively related to an individual’s willingness to invest in NFTs. Self-efficacy, the belief in one's ability to complete a task (Hasan et al., 2022), varies among individuals and significantly influences the acceptance of new technologies(Rogers et al., 2014). This aspect suggests that those with high levels of technological self-efficacy find it easier to use new technology overall. Hizam et al. (2022) found that personal innovativeness and self-efficacy have a favorable impact on behavioral intention to adopt Web3 technology, which includes NFTs as a widespread use case. Therefore, one can infer that personal innovativeness and self-efficacy can also affect the intention to purchase NFTs. According to Ho and Song (2023), utilizing NFTs necessitates self-efficacy to minimize learning endeavors and boost individuals' confidence in investing in the metaverse. Consequently, those with a strong sense of self-efficacy are more inclined to embrace NFTs, and self-efficacy can moderate the relationships between perceived value and intention to purchase NFTs. These justifications enable us to propose the following hypotheses:

Hypothesis 8 (a) (H8(a)) Individual differences and personality traits moderate the relationships between perceived value and intention to purchase NFTs.

Hypothesis 8 (b) (H8(b)) Individual differences and personality traits are positively associated with NFT purchase intention.

We developed a questionnaire utilizing the measurement model with validated scales from the literature to attain the study's objectives and assess the constructs. The development of the measurement model was also guided by an extensive evaluation of the existing scientific literature pertaining to the topic being studied. The survey, created and managed with Qualtrics, consisted of three sections. The first section included filter questions to identify participants with crypto and NFT experience. The second section evaluated constructs, and the third gathered demographic data. Participants used a seven-point scale for responses. The survey was distributed through platforms like LinkedIn, Reddit, and Discord community channels.

In order to examine and interpret the collected data, we utilized the SmartPLS tool and followed a two-step PLS/SEM method (Hair et al., 2013). PLS/SEM as a method to examine statistical data is preferred in business information systems research for several reasons. PLS/SEM can be utilized with small sample sizes and does not require normality assumptions, which is one of these causes (Sohaib et al., 2020). It can also be particularly valuable to assess the reliability of a predictor when examining its potential moderating effect on the relationship between different constructs (Abbasi et al., 2021). After presenting the data obtained from the measurement model, this section provides an explanation of the results obtained from the structural model analysis.

Sample characterizationThe survey involved 165 participants: 66.10 % male, 31.36 % female, and 2.54 % choosing not to disclose their gender. After excluding incomplete responses, 125 complete responses were analyzed. About 52.50 % reported prior experience with cryptocurrencies, and 7.75 % had purchased NFTs. Participants, representing 23 countries, are detailed in Table 3, with a geographic distribution visualized in Fig. 2.

The PLS/SEM method was employed to assess the validity of the research model and examine the reliability of the constructs, utilizing metrics such as outer loading, Cronbach's Alpha, Composite Reliability (CR), Fornell-Larcker, Heterotrait-Monotrait Ratio (HTMT), Average Variance Extracted (AVE), and Inner Variance Inflation Factor (Inner VIF) (Abbasi et al., 2021; Hizam et al., 2022; Chen et al., 2022). The indicators' reliability was assessed using outer loadings, with most values above 0.70, indicating adequate indicator reliability for all constructs (Chin et al., 2003; Hizam et al., 2022; Sarstedt et al., 2017). Lower outer loading values for IDPT4 and FC3 (Appendix A) suggest a weaker relationship, prompting consideration for removal, following standard practice (Chen et al., 2022; Wong, 2013). Overall, the majority of indicators were deemed reliable based on their outer loading values. Construct reliability and validity were assessed using Cronbach's alpha and CR. Table 4 presents the Cronbach's alpha values, all exceeding 0.7, demonstrating high overall reliability for the collected data (Shahzad et al., 2018). Rho_a, situated between Cronbach's alpha and rho_c, signifies a construct's internal consistency and reliability (Hair et al. 2019). All constructs demonstrated strong internal consistency, with CR values surpassing the threshold of 0.7 (Hair et al., 2011). Convergent validity was confirmed by AVE values exceeding 0.50 (Hair et al., 2011). This collective evidence implies that our constructs are accurate and trustworthy.

– CR, Cronbach’s alpha, and AVE results.

We employed several statistical techniques to evaluate discriminant validity, including the Fornell-Larcker criterion and HTMT (S et al., 2020). Discriminant validity guarantees that distinct constructs measure distinct attributes or characteristics, preventing them from measuring the same underlying construct (Jiraphanumes et al., 2022). Table 5 confirms the Fornell-Larcker criterion, where the primary AVE value for each variable is higher than its correlation with other variables. (S et al., 2020). Additionally, we assessed discriminant validity using the cross-loadings approach (Barclay et al., 1995; Chin, 1998), which requires each indicator to load higher on its intended construct than on any other construct. The cross-loading results are provided in Appendix B.

– Fornell-Larcker criterion results.

Table 6 shows the HTMT values, none of which exceed 0.90, confirming the distinctiveness of the constructs. Therefore, the study provides evidence that discriminant validity has been achieved.

–HTMT results.

Table 7 indicates no multicollinearity issues, as all indicators have VIF values below 5.

– Inner VIF results.

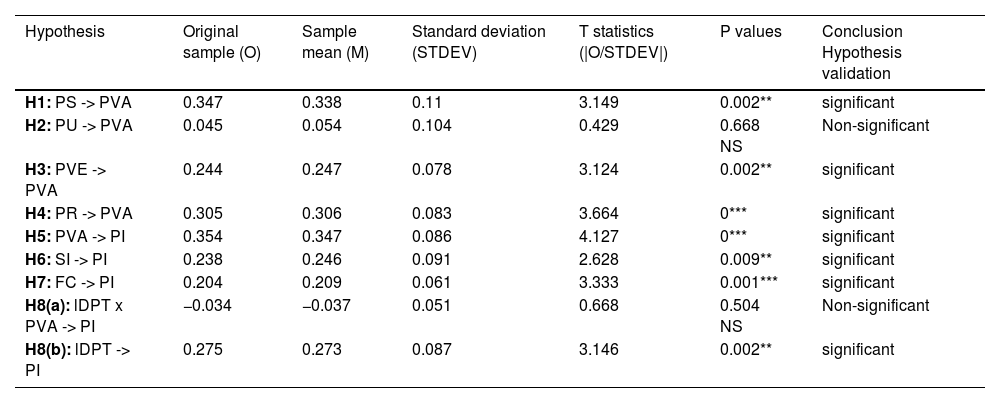

Once the adequacy of the measurement model was confirmed, the next phase involved evaluating the structural model, which was carried out in this study using the path coefficients and bootstrapping approach with 5000 subsamples (Al-Adwan et al., 2023; Martinez-Ruiz & Aluja-Banet, 2009). The structural model of the study is depicted in Fig. 3, and the detailed path model is provided in Table 7.

The findings presented in Table 8 demonstrate that perceived scarcity (H1, β=0.347, p < 0.05) and perceived verifiability (H3, β=0.244, p < 0.05) had a medium relationship with perceived value, while perceived uniqueness (H2, β=0.045, p > 0.05) was determined to be statistically insignificant.

– Path model results.

Note: PS, Perceived Scarcity; PU, Perceived Uniqueness; PVE, Perceived Verifiability; PR, Perceived Royalty; PVA, Perceived Value; PI, Purchase Intention; SI, Social Influence; FC, Facilitating Conditions; IDPT, Individual Differences and Personality traits.

Perceived royalty was also found to have a significant relationship with perceived value (H4, β=0.305, p < 0.001). Furthermore, the results indicated that perceived value had a significant effect on purchase intention (H5, β=0.354, p < 0.001). The proposed research model also identified social influence (H6, β=0.238, p < 0.05) and individual differences and personality traits (H8(b), β=0.275, p < 0.05) as having a medium relationship with purchase intention, while facilitating conditions (H7, β=0.204, p < 0.001) showed a strong association. However, the results did not support the study's hypothesis H8(a), which proposed that individual differences and personality traits moderate the relationship between perceived value and purchase intention, as indicated by the insignificant beta coefficient of −0.034 and a p-value greater than 0.05. Therefore, the results suggest that individual differences or personality traits do not moderate the association between perceived value and NFT purchase intention. This finding indicates that, in the context of NFTs, individual differences and personality traits may not significantly influence the relationship between perceived value and purchase intention.

In summary, H1, H3, H4, H5, H6, H7, and H8(b) were supported, while H2 and H8(a) were rejected.

The R-square (R2) values provide information about the contribution of all variables (Chen et al., 2022). In this study, the R-square value of 0.634 for purchase intention indicates that the model can explain 63.4 % of the total variance in purchase intention, while the R-square value of 0.601 for perceived value demonstrates that 60.1 % of the total variance can be explained. These results suggest that the model exhibits a high level of predictive power, with R2 values of 0.634 and 0.601 for purchase intention and perceived value, respectively. The significant effect of independent constructs on the dependent constructs in the research is supported by the high value of R-square (S et al., 2020).

DiscussionThis study aimed to uncover the key factors driving NFT purchase intention in response to their rapid growth and integration into consumer markets and industries. The following discussion interprets the findings based on the proposed hypotheses.

This research employs a comprehensive approach integrating adoption theories and relevant NFT-related literature to investigate the factors influencing the acceptance and adoption of NFTs. The results of this study indicate that various factors, including perceived scarcity, perceived verifiability, perceived royalty, perceived value, social influence, facilitating conditions, individual differences, and personality traits, can all be associated with the decision to purchase NFTs. Moreover, this study also highlights that perceived royalty, perceived value, and facilitating conditions are significantly related to NFT purchase intention.

Hypothesis 1 (H1) posited that perceived scarcity would be positively associated with the perceived value of NFTs. The results supported this relationship. This outcome aligns with prior research results by Chang et al. (2024), which found that consumers are drawn to purchasing NFTs due to their perceived scarcity. Perceived scarcity can increase the perceived value of NFTs by fostering a sense of exclusivity and urgency surrounding limited-edition digital assets, making it a crucial element for NFT creators and marketers to emphasize. Furthermore, scarcity could be influenced by social influence and psychological factors such as the FOMO. Research suggests that FOMO increases consumer urgency to seek scarce opportunities (Zhang et al., 2020) and has been positively related to purchase intention (Dinh & Lee, 2022).

Hypothesis 2 (H2) proposed that perceived uniqueness would be positively associated with the perceived value of NFTs. However, the results did not support this hypothesis. One possible explanation is that customers may prioritize the limited-edition nature of NFTs, which triggers a FOMO among potential buyers rather than focusing solely on the uniqueness of the NFTs. This finding contrasts with previous research on luxury brand consumption, such as that by Wiedmann et al. (2007), which highlights uniqueness as a key driver due to its role in differentiation and status signaling. However, unlike traditional luxury goods, the perceived uniqueness of NFTs does not play a dominant role in purchase decisions. Instead, factors such as scarcity, social influence, and other market and individual determinants appear to have a greater impact on perceived value. Previous studies (Kiliçaslan & EkiZler, 2022) have similarly shown that scarcity plays a more significant role than uniqueness in determining perceived value.

Hypothesis 3 (H3) posited that perceived verifiability would be positively associated with perceived value of NFTs. The findings supported this hypothesis. This facet is consistent with previous literature (Popescu, 2021), which suggests that blockchain technology provides immutable ownership records and transparent transaction history, allowing NFTs to be verifiable by network participants and reducing the risk of counterfeiting, thereby enhancing consumer trust. This factor implies that NFT platforms should emphasize transparency and verifiability to enhance perceived value.

Hypothesis 4 (H4) proposed that perceived royalty would be positively associated with perceived value of NFTs. This hypothesis was supported by a statistically significant and strong positive relationship. This aspect aligns with prior research (Griffiths et al., 2024), which suggests that expectations of future value influence NFT purchase intention, as buyers often consider potential financial returns when assessing NFT assets. NFT creators should emphasize royalties as a long-term incentive for buyers.

Hypothesis 5 (H5) stated that perceived value would be positively associated with NFT purchase intention. The findings supported this hypothesis with a strong and statistically significant association. This outcome contrasts with Kiliçaslan and EkiZler (2022) who found that perceived value did not emerge as a significant factor in influencing the purchase intention of NFTs. However, another study indicates that technical impact, which refers to the technical aspects that affect service quality and delivery, can affect users' attitudes and intentions (Albayati et al., 2023). Our study similarly demonstrated that perceived value, which encompasses the quality and characteristics of NFTs, is related to purchase intention.

Hypothesis 6 (H6) posited that social influence would be positively associated with NFT purchase intention. The results supported this hypothesis. Consistent with prior research (Albayati et al. 2023), which demonstrated that social influence and the opinions of trusted individuals impact decision-making in the NFT Metaverse. The literature highlights that social media shapes public opinion and drives herd behavior or FOMO (Bao et al., 2023; Mamidala & Kumari, 2023; Özdemir & Kumar, 2024). Celebrity endorsements and online trends influence the speculative nature of NFTs (Qian et al., 2022). This phenomenon suggests that NFT marketers can leverage social media campaigns and influencer partnerships to boost adoption.

Hypothesis 7 (H7) proposed that facilitating conditions would be positively associated with NFT purchase intention. This hypothesis was supported, showing a statistically significant association. This finding aligns with prior research that suggests facilitating conditions impact the behavioral intention to use cryptocurrency (Gunawijaya & Rahadi, 2023; Joshi et al., 2023). Huang and Kao's (2015) study also demonstrated that facilitating conditions have a significant influence on individuals' behavioral intention and usage of technology. This aspect implies that in order to promote the purchase of NFTs, it is crucial to consider the facilitating conditions necessary for users to access and use the technology easily.

Hypothesis 8a (H8a) posited that individual differences and personality traits would moderate the relationship between perceived value and purchase intention. However, this hypothesis was not supported, as the results revealed no statistically significant moderating association. This factor suggests that perceived value influences purchase intention regardless of individual differences. This result is consistent with a previous Hasan et al. (2022) study, which also found no significant moderating effects in related contexts.

Hypothesis 8b (H8b) proposed that individual differences and personality traits would be directly and positively associated with NFT purchase intention. The findings supported this hypothesis. This aspect aligns with past studies (Ng et al., 2025), which found that traits such as personal innovativeness influence an individual’s willingness to invest in NFTs. As Al-Adwan et al. (2023) noted, individuals with high personal innovativeness are more likely to embrace novel technologies, such as metaverse-based learning systems. Additionally, they often exhibit increased self-efficacy, which facilitates their successful adaptation to new educational technologies like metaverse-based learning platforms. This factor suggests that understanding consumers' personal innovativeness and self-efficacy is essential when marketing NFTs in the metaverse, as these traits can influence adoption and engagement with digital assets.

One of the significant limitations of this study is the small sample size and the limited number of individuals with NFT experience. This factor is attributed to the early stages of NFT adoption. NFT adoption is expected to increase in the future, potentially leading to more substantial sample sizes for future studies. Additionally, the sample composition raises concerns about generalizability, as most participants assessed NFT adoption hypothetically rather than based on actual purchasing behavior. This facet may influence the results, making them more indicative of perceived adoption intention rather than actual purchasing behavior.

Conclusions, implications, and future workImplications for academiaThe primary objective of this research is to determine the key factors that influence an individual's choice to buy NFTs. A hypothesized model was constructed to achieve this goal by integrating adoption theories and relevant theoretical literature on NFT. A survey was then conducted to collect empirical data.

The findings indicate that perceived value and facilitating conditions are more strongly associated with individuals' inclination to buy NFTs than social influence and individual differences and personality traits. Additionally, while perceived scarcity, perceived verifiability, and perceived royalty were demonstrated to be positively associated with perceived value, the influence of perceived uniqueness on perceived value was not statistically significant. Moreover, perceived royalty also exhibited a pronounced impact on perceived value. Furthermore, the study findings indicate that individual differences and personality traits do not moderate the relationship between perceived value and NFT purchase intention. In other words, the association between perceived value and the intention to purchase NFTs remains consistent regardless of an individual's unique characteristics or personality traits. However, it was also observed that individual differences and personality traits are directly associated with NFT purchase intention rather than acting as a moderator.

This research contributes to the growing body of academic literature by providing insightful information that will serve as a strong foundation for future studies on the adoption of NFTs, consumer behavior, and the factors influencing people's intent to purchase NFTs. Furthermore, this work has expanded our understanding of the increasing interest and attention toward NFTs. It has, therefore, opened the door for more research in academia, enabling the investigation of NFT adoption and its affecting elements.

Implications for practiceNFTs are rapidly reshaping digital marketing practices. The 2021 Gartner Hype Cycle for Key Technologies highlights that NFTs have the potential to alter marketing strategies across industries substantially.

The study significantly contributes to our understanding of NFT adoption, offering valuable insights for businesses and marketers targeting NFT buyers. Consequently, marketing managers need to be ready to meet the rising demand of consumers for NFTs and fulfill their growing interest in these digital assets (Chohan & Paschen, 2023). Businesses can tailor their strategies and enhance their marketing efforts in the NFT sector by comprehending how perceived value, facilitating conditions, social influence, individual differences, and personality traits are associated with purchase intention. Understanding these variables aids in addressing consumer needs, increasing the likelihood of customer acquisition and retention in the NFT market.

Based on the study's results, businesses can prioritize perceived value components, such as perceived scarcity, verifiability, and royalties, in their NFT offerings, marketing messaging, and promotional activities to effectively attract new customers. Ensuring transparency is crucial for perceived verifiability. This aspect entails providing accurate information about NFTs' origin, ownership, and legitimacy, as well as establishing reliable and secure platforms for NFT transactions. Transparent information regarding potential royalties or earnings associated with specific NFTs should also be provided to address the association between perceived royalty and perceived value. Finally, to leverage the association between perceived scarcity and perceived value, businesses can focus on highlighting the limited availability of NFTs through their marketing and promotional campaigns. The study's findings also emphasize the association of social influence, facilitating conditions, individual differences, and personality traits with NFT purchase intention. Businesses can leverage social influence by highlighting the positive social and financial benefits associated with owning NFTs. By highlighting how owning and supporting NFTs contributes to artists, promotes digital art, and fosters community participation, businesses can appeal to socially conscious buyers and tap into this market segment.

Furthermore, businesses can enhance user experiences, simplify the NFT purchase process, and develop user-friendly interfaces to improve facilitating conditions and attract a broader user base. Additionally, businesses and marketers can develop personalized marketing strategies by recognizing the association of individual differences and personality traits with NFT purchase intention. This endeavor involves identifying buyer personas with distinct characteristics and preferences and tailoring their messaging, branding, and outreach efforts accordingly. Customized approaches enable companies to better connect with their target audience and optimize the effectiveness of their marketing efforts in the NFT industry.

The study's cross-sectional approach limits its ability to capture changes in human behavior over time. Future research should employ longitudinal studies to better understand evolving factors influencing NFT acceptance. This design allows for observing progressive changes in behavior and attitudes over an extended period, offering more comprehensive insights. Additionally, it is highly recommended that future research should prioritize the examination of the post-adoption behavior of NFT adopters to reveal the factors that foster their continued utilization of this technology. Furthermore, future research could explore the differences between NFT buyers and non-buyers through a multi-group analysis, providing deeper insights into whether the drivers of purchase intention differ between these groups. Future research should also target a larger proportion of NFT buyers to compare their responses with those of potential adopters, ensuring a more accurate representation of real purchasing behavior.

Ethical standardsThe study was conducted in accordance with ethical standards and approved by the Ethics Committee of NOVA Information Management School and MagIC Research Center.

CRediT authorship contribution statementMona Zavichi: Writing – review & editing, Writing – original draft, Visualization, Validation, Methodology, Investigation, Data curation, Conceptualization. Manuela Aparicio: Writing – review & editing, Validation, Supervision, Funding acquisition, Formal analysis.

Authors’ Declaration of no conflict of interest.

This research was funded by FFCT–Fundação para a Ciência e Tecnologia, I.P. (Portugal), under research grant UIDB/04152—Centro de Investigação em Gestão de Informação (MagIC).

– Cross-loadings results.