This paper analyses the relative performance of clustered and non-clustered companies during the different phases of the cluster life cycle. It starts by explaining the location of most of the Portuguese cork manufacturing companies in Santa Maria da Feira, a small county in the north of the country, whereas the bulk of cork is produced in the South. The historical roots of the Feira cluster are examined, as well as the identification of its life cycle phases. The performance of clustered and non-clustered companies is compared using labour productivity data over a long time span of several decades. This exercise illustrates the crucial importance of history for the understanding of cluster dynamics, as well as many other (evolutionary) economic phenomena.

Este artículo analiza el comportamiento relativo de las empresas aglomeradas y no aglomeradas durante las diferentes fases del ciclo de vida del clúster. Comienza explicando la localización de la mayoría de las empresas corcheras manufactureras portuguesas en Santa Maria da Feira, una pequeña localidad del norte del país, mientras que el grueso del corcho se produce en el sur. Se examinan las raíces históricas del clúster de Feira, así como la identificación de las fases de su ciclo de vida. También se compara el desempeño de las empresas aglomeradas y no aglomeradas usando datos de productividad laboral durante un largo período de tiempo de varias décadas. Este ejercicio ilustra la importancia crucial de la historia para la comprensión de la dinámica de los clústers, así como de muchos otros fenómenos económicos evolutivos.

This paper analyses the relative economic performance of clustered and non-clustered firms during the different phases of the cluster life cycle. According to the relevant literature, clusters tend to follow a predictable path in time, from emergence to the development phase, followed by maturity and then eventual renewal or decline (Belussi and Sedita, 2009; Menzel and Fornahl, 2009; Martin and Sunley, 2011).

These different phases can cross different industrial revolutions since industrial districts or clusters may have their roots in a distant historical path, sometimes before the first industrial revolution. Along the phases, the performance of the cluster or of the firms therein, can differ in terms of efficiency and give place to other organisational structures. Or, otherwise, clusters may have capacity to adapt, survive and overcome the changes of the second and third industrial revolutions, competing with Chandler's “big business”, just because clusters are, in some sectors, more flexible and better adjusted to the specificities of the markets (Piore and Sabel, 1984; Colli, 2009).

As clusters can be an important determinant of the economic evolution of the regions where they are located, the identification and understanding of the different phases of a cluster life cycle are crucial to regional policy. In this sense, many authors, namely Porter (2003) and Martin and Sunley (2006), argue that the study of clusters allow a better knowledge of the economic dynamics of regions and their strengths and weaknesses regarding the complex process of location of production activities in the globalisation era of our times.

In this paper, an empirical study is made of the Portuguese cork industry and its well established cluster in Santa Maria da Feira. Cork is an important sector in Portugal, in fact, the only one where the country has world leadership, both in terms of production and international trade, as well as in the domains of technology, research and innovation (Zapata, 2002). It is also an interesting case study, since the environmental and rural development advantages of this industry are very important for some rural areas of the country, as cork is a renewable raw material which is periodically harvested from cork oak trees, without destructing them.

First of all, the main facts and trends of this industry are briefly discussed, and then an explanation is given for a puzzling location behaviour, which is that most of the Portuguese cork manufacturing firms are concentrated in Santa Maria da Feira, a small county in the north of the country, whereas the bulk of cork is produced in the South, in the Alentejo and Ribatejo regions (Lopes and Branco, 2013). The main historical reason for this puzzle is connected with the dominant position in that region of an anchor firm in the sense of Markusen (1996, p. 302), the firm Amorim & Irmãos.

However, some elements of a Marshallian industrial district are also evident in Santa Maria da Feira, where a large number of small firms exist with a predominance of a traditional, family-owned, character (Branco and Parejo, 2011).

After this brief panoramic view of the cork industry in Portugal, the historical roots and past and path dependency of the trajectory of the Santa Maria da Feira cork cluster are analysed, with the main purpose of identifying its life cycle phases, which is the main contribution of this paper. Along with some qualitative trends, the analysis is based on a quantitative approach, using four indicators: (1) the number of firms, (2) the number of employees, (3) the number of working hours, and (4) the value of production. The analysis covers a long time span, from 1947 until 2009, which is the last year with available data.

Following the identification of the cluster life cycle phases, an analysis of the economic performance of firms located in Santa Maria da Feira and in other regions of the country is made, also covering a long time span of several decades, comparing labour productivity values and hourly wages, as well as export performance for a more recent period (2004–2011).

This empirical analysis is a quantitative illustration of the crucial importance of history for the understanding of cluster dynamics, as well as many other (evolutionary) economic phenomena, along the lines suggested by Boschma and Frenken (2006) and Zeitlin (2008).

Another purpose of the paper is to search whether or not firms in the cork industry regional cluster tend to be more efficient and productive than other (dispersed) firms of the same sector, combining a qualitative (historical, institutional) and a quantitative (statistical, microeconomic) approach. This is an important research topic as the relevant literature has been until now unable to produce unambiguous results (Spencer et al., 2010; Kukalis, 2010; Felzenstein et al., 2012; Ruland, 2013).

The rest of the paper is organised as follows. The theoretical framework about clusters and their life cycle phases is presented in Section 2. Section 3 describes the main features of the Portuguese cork industry, with particular focus on the cork cluster of Santa Maria da Feira. In Section 4, the historical roots and path dependency of the trajectory of this cluster are exposed, as well as the identification of its life cycle phases. Section 5 concludes.

2Theoretical background: a life cycle approachClusters and Industrial Districts (ID) can reflect different realities, as emphasised, among others, by, Becattini et al. (2009) and Akoorie (2011). However, this distinction is for some purposes not very useful. Clusters can have different sizes, and firms within clusters can also have different dimensions, but this variety is not strange to some ID. Similarly, the “industrial atmosphere” present in an ID can also be found in a cluster, to the extent that the formal relation between companies can be strengthened by the presence of a social network of cooperation, with roots in local history and culture. In this paper we opt to use mainly the concept of cluster.

Clusters and ID are important for regional development and prosperity, as clustered firms can benefit from agglomeration and external economies in the Marshallian sense. Understanding clusters in all their facets is useful for regional policy decision makers (Porter, 2003). In his masterpiece, Principles of Economics, Marshall argued that external economies emerging from an ID resulted from the agglomeration of small firms which are strongly connected with each other and specialise in different phases of the same production process (Marshall, 1920). A concentration of this kind permits the creation of a pool of specialised workers and forces the creation of subsidiary industries and specialised suppliers.

During the 1970s, the concept of Marshallian district was applied to the case of Italy by Giacomo Becattini, which revived the concepts of industrial atmosphere and external economies, but also introduced new elements, such as local people's historical and social roots and also the relationship between people and the production system, whereby firms and market institutions are but one small part of the ID (Becattini et al., 2009; Scott and Walsh, 2005; Hashino and Kurosawa, 2013; Cirer-Costa, 2014).

The same kind of economies can be found in the notion of cluster proposed by Porter (1998), as a geographical concentration of interconnected firms, specialised suppliers, service providers and institutions, competing and cooperating in the same location. The local grouping of similar firms in related industries within a well-defined area refines this concept and allows for the identification of the cluster's basic units: firms and institutions that are connected to a specific sector (defining a value chain) and are geographically concentrated. Menzel and Fornahl (2009) argue that interconnections inside the “spatial and sectorial involucre” refer to traded and untraded interdependencies, including market exchange of goods and services, labour market mobility, imitation behaviour, social networks, face-to-face interaction and cooperation.

Empirical studies making comparisons between clustered and non-clustered firms reinforce the conclusion that companies inside the cluster tend to perform better that non-clustered ones (Spencer et al., 2010).

An analysis over a long term horizon may bring new conclusions to the fore which emphasise the understanding of how and why the cluster actually became a cluster, and how it evolves. However, the historical factors prevalent at the origin of a cluster may not be the same as those of the rest of its lifecycle, and sometimes the advantages of the clustered firms diminish and are not permanently present, or can even become a threat in the face of external pressures or internal changes. Piore and Sabel (1984) make an interesting historical analysis of the role of ID in several countries (USA, France, Germany, Italy and Japan).

So, a dynamic approach is necessary to capture all the facets of the evolution of a cluster, considering it as a complex and adaptive system. The evolutionary economic geography approach contemplates the life cycle of clusters, emphasising their origin, how and why they decline and how and why they may turn into new fields (Arthur, 1990; Boschma and Frenken, 2006). Menzel and Fornahl (2009) distinguish between emergence, growth, maturity and decline, as being the phases of a cluster's life, and they attach different characteristics to each phase.

However, few clusters follow a rigid life cycle from emergence to growth and decline. Following Martin and Sunley (2011), the adaptive cycle model can be used for understanding complex systems such this. The approach of these authors tries to deal with two contradictory features of a dynamic system: stability and change. Stability implies a growing internal interconnection between the parts of the system, but tends to reduce the capacity to adapt to a changing environment. The adaptive life cycle conciliates these contradictory features by taking into account several phases of the cycle which can be evaluated according to three dimensions: the accumulation of resources, internal connectivity of a system's components, and resilience, as a measure of system vulnerability to (and recovering from) shocks.

Some studies, such as Belussi and Sedita (2009) which analysed Italian ID, link the several phases of the life cycle to quantitative and qualitative characteristics. In quantitative terms, the number of firms and employees is different along the cluster's life cycle: the emergence phase is characterised by only a few but growing number of small firms; the growth phase has a growing number of employees; the maturity phase, when the cluster is able to maintain employment at a high level; and finally, the declining phase, when the number of firms and employees diminishes. In qualitative terms, several factors influence the different stages of the cluster life cycle, some of which are related to the external environment of the cluster, while others are specific to the cluster and its dynamics.

The genesis and roots of a cluster are hard to identify, but this stage is crucial for establishing the cluster basis and its subsequent growth process. The understanding of how and why clusters emerge is critical, since the choices made in the past can influence subsequent choices.

Several prominent factors are responsible for the origin of clusters: some specific to the cluster and/or its territory (‘local factors’), and other ‘global’, such as the entry of multinational corporations (Belussi and Sedita, 2009). Local factors are determined by historical legacy and the social capital connected with the industrial structure (for instance an ancient tradition for crafts, and the values and attitudes towards entrepreneurship, cooperation, innovation and institutions). Resource endowments are also relevant (natural resources, labour, infrastructures, etc.), as well as the presence of an anchor firm that could pave the way for success and stimulate several start-ups. Local demand and national/local policies complete these local factors.

Menzel and Fornahl (2009) sustain that the context in which the cluster arises is decisive for its growth, as the cluster must reach a critical level in terms of firms and employees in order to move on to the next phase. The growth rate of the firms inside the cluster must exceed the growth of the non-clustered firms. The number of spin-offs is crucial, and can be boosted by the local business environment.

This phase coincides with rapid growth and accumulation of resources, such as: specialised productive capital, supporting institutions and specialised labour. The interconnectivity of the system components increases (between firms and institutions) and resilience (adaptability) is high (Martin and Sunley, 2011).

Some authors argue that the establishment of a cluster in a certain region can result from random facts, or “coincidences”. Krugman (1991) claims that “historical accidents” are responsible for the emergence of clusters, which implies that the specific features of a location are not so important during the initial phase, and that evolution emerges randomly within the economic landscape. Along these lines, Arthur (1990) and Boschma and Frenken (2006) describe the origin of a cluster as being a stochastic process of start-ups and spin-offs. The cluster establishes itself when the number of firms reaches a threshold and starts to generate increasing returns. Klepper (1997) offers a more firm-focused perspective, whereby successful firms attract more firms, and the location of these firms is accidental. Martin and Sunley (2006) argue that ‘coincidences’ are not random, but result from a strategic option by firms, and regional particularities are sometimes important.

The main methods of functioning and features are established during the emergence phase of a cluster, in terms of sectoral specialisation and the establishment of networks between firms, which leads to the definition of a technological direction.

The development phase is dependent on initial conditions and also the ability of local firms to anticipate or react to changes which affect international demand and/or global competition. A growing cluster is characterised by a strong increase in employment, resulting from the strong growth of existing firms and a high number of start-ups. The cluster becomes well established and may eventually stabilise around a particular form, structure and mode of self-reproduction. The interconnections are high, and resilience is low.

During this phase, clustered firms perform better, which reinforces their spatial concentration and accumulation of resources. The creation of a specialised labour market and a supportive infrastructure leads to the competitive advantage of clustered companies, which is based on innovation and higher productivity.

According to Elola et al. (2012), the development phase is mainly driven by the path dependent mechanism and a cluster can remain in this stage for a considerable period of time, depending on how inflexible it becomes, and on the nature of external shocks. The factors present during this stage can also be local and/or global. In terms of local factors, these authors highlight the accumulation of social capital and also the firms’ strategies. The strategic capabilities developed by clustered firms and regional agents (universities, standards agencies, trade associations and state and local governments) are determinant for establishing the competitive advantage of the cluster. Firms can adopt a strategy based on cost leadership or diversification. In terms of global factors, these authors emphasise the role of cluster-leading firms and cluster associations in attracting outside knowledge to the cluster. In other cases, a reallocation process can take place as a means of establishing some business relationships with service providers outside the cluster.

The maturity phase is decisive for the future of the cluster and the “lock-in” situation may, or may not, be avoidable. In quantitative terms, a mature cluster is in equilibrium, with neither significant growth, nor a decrease in terms of employees and firms. Martin and Sunley (2011) call this the “conservation” phase. The cluster stabilises around a particular form, structure and self-reproduction mode. According to these authors, when facing a sudden change or shock, the cluster can enter into a “release phase”, whereby some firms close and others disinvest, and the cluster then contracts in size.

Menzel and Fornahl (2009) refer to the fact that declining clusters face a decrease in the number of firms and specialised employees, due to failures, mergers and rationalisations. Start-ups become rare, and the cluster loses the ability to sustain its diversity and to adjust to changing condition, as well as the potential for independent renewal. Considering Elola et al. (2012), it appears that the formerly identified local factors no longer provide sources of competitive advantages to the firms, and “lock-in” situations may occur. The survival capacity of the cluster depends on the firms’ capabilities to react to changes and to renew.

Following Martin and Sunley (2011), three alternatives are possible: (1) firms have the capacity to upgrade and enter into a new development path through the implementation of new, yet related, technologies; (2) an old cluster declines and disappears, but is replaced by a new one with a new specialisation, and; (3) the cluster declines and no new cluster emerges, leading to the industry disappearance from that location.

To sum up, the clustering process is influenced by multiple path dependences, based not only on Marshallian external economies, but also on specific experiences of local firms in learning and innovation, as well as the interaction between the ID and its environment (contingency) and the choices of the relevant actors (agency). Popp and Wilson (2007) propose a nondeterministic life-cycle model along these lines and emphasise the importance of an inductive, narrative driven historical approach to fully understand the evolution of clusters in a long period of time.

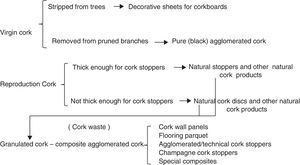

3The most relevant facts and trends of the Iberian cork businessThe cork business has three facets (Zapata, 2002; Parejo, 2010). Firstly, cork is obtained from the cork oak tree (Quercus suber), and in Portugal these trees can be predominantly found in the “Montado” ecosystem.1 The Iberian Peninsula possesses soil and climate conditions which give Portugal and Spain an absolute competitive advantage for the production of cork and this tree is found all over its territory. Although the western Mediterranean Basin presents optimal natural conditions for cork oak, the southwest of the Iberian Peninsula has been the most important region in terms of area occupied by this tree for almost two centuries (Aronson et al., 2009). The cork is utilised as the raw-material for cork industries.

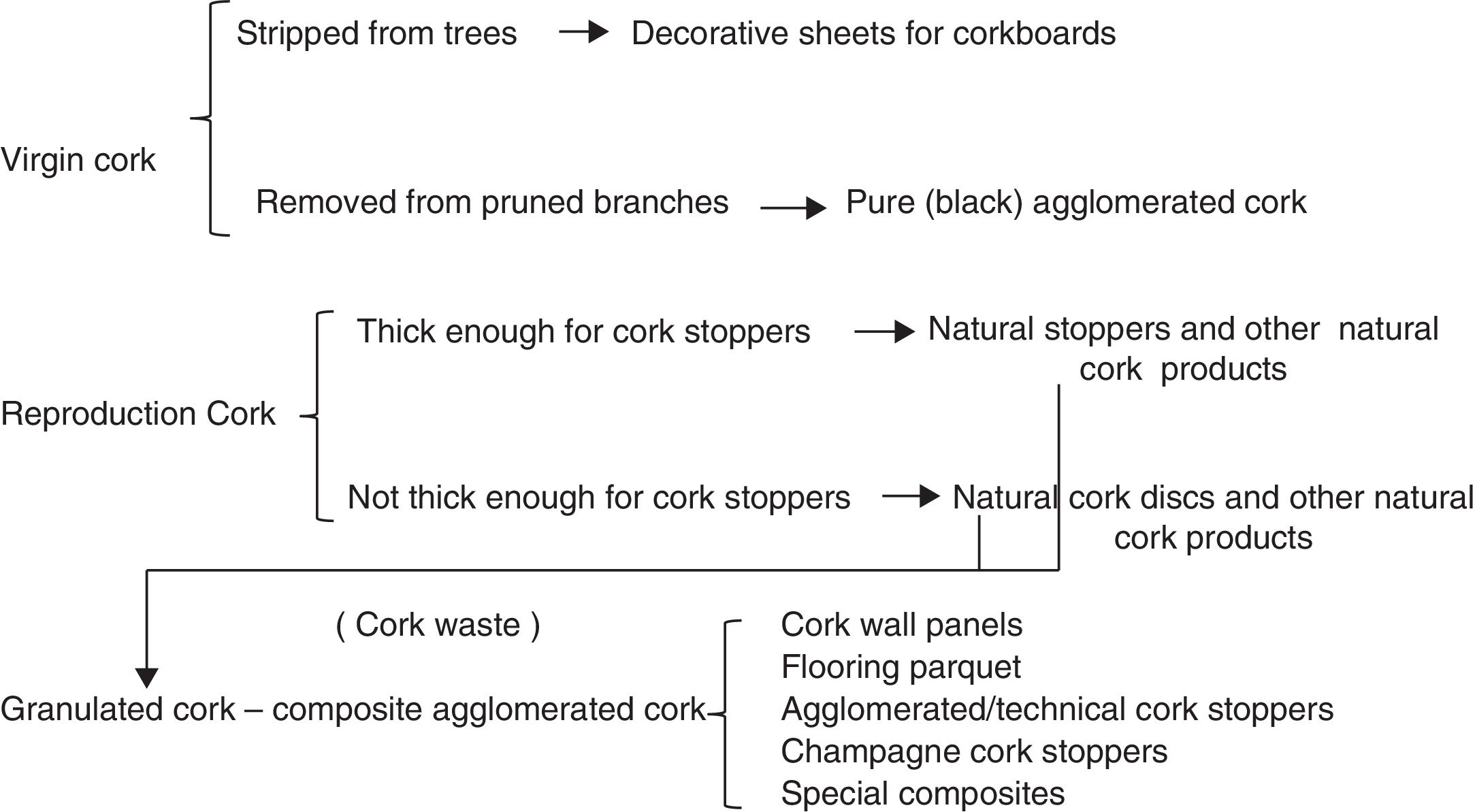

Secondly, there are several types of cork industries (Mendes and Graça, 2009): Cork Planks industry produces planks, which is a semi-transformed product that can be used to produce bottle stoppers; Natural Cork industry produces stoppers and discs; Agglomerate Cork industry produces agglomerate products such as coverings (floors and walls).

Thirdly, the international trade of cork and cork products is dominated by Portugal and Spain, the main producers and exporters of cork and cork products.

Regarding technological aspects, the most important innovation was the discovery of the capabilities of cork as a stopper for bottles filled with liquids, especially champagne. This radical innovation marked the beginning of the cork industry at the end of seventeenth century. Still today, the major use for cork is the production of stoppers. According to Zapata (2002) this innovation marks the beginning of the first phase of the industry, known as the “craft phase” (from the eighteenth century until the end of the nineteenth century), which is characterised by being labour intensive and largely carried out by handcrafts in workshops. As Bernardo (1947) points out, in the third quarter of the eighteenth century, Portugal already had established workshops in Lisbon and Porto, which produced cork artefacts and planks, and this information is confirmed by the Balança Geral do Commercio do Reyno de Portugal (General Trade Balance of the Kingdom of Portugal). Nevertheless, this was a late start compared with the origins of the Catalonian industry, which dates back to 1750 in Girona (Medir Jofra, 1953).

However, the great boost to this industry in Portugal occurred later on (during the first years of the nineteenth century), with the arrival in Portugal of Catalan and French specialists. Mechanisation only began in 1820, with the advent of the plane (“garlopa” in Portuguese), a tool used to cut cork planks for the manufacturing of stoppers, although the most relevant feature of the dominant stopper industry was essentially based on handicraft until the 1890s.

The second phase (from the end of the nineteenth century until the 1950s) can be classified as the “mechanical phase”. Between the first phase and the second, although both merged in the case of Portugal, exports of Portuguese cork grew remarkably, but the trade of cork stoppers was of little significance, as it faced high trade barriers in the developed countries, with the exception of England and Denmark (Reis, 1993). This trade was dominated by the Catalonian industry, and Portugal mainly specialised in cork planks (Parejo, 2010). According to Lains (1995, pp. 94–101), at the end of the nineteenth century cork exports already occupied the third place in the ranking of Portuguese exports.

During this period another major radical innovation took place: the use of agglomerated cork.2 This innovation led to a more capital-intensive industry, coexisting with the traditional cork stopper industry, which was also highly intensive in specialised labour (Zapata et al., 2009). Cork production moved from being workshop-based, to being factory-based, some of which upstream vertical integrated, as it also produced the planks that would be used for the production of stoppers (Zapata, 2002). This also allowed the production of a range of cork products with several uses, including building material, as well as agglomerate stoppers.

This new period saw the growing importance of the cork business worldwide. According to Parsons (1962), only after the First World War can we track the presence of the agglomerate cork industry in Portugal and Spain, and in the case of Portugal, most of the factories were clustered in Setubal (a region in the centre of Portugal), albeit financed by foreign capital (Fig. 1).

The international dimension of the cork business was always present in these two Iberian countries. During the first half of the twentieth century, raw cork and planks remained the most important exports for Portugal, and the cork manufacturing industry expanded in advanced countries that do not have cork oak trees, such as the USA, Germany and the United Kingdom. In contrast, the Catalonian region (Spain) appeared as one of the main producers of stopper in the world, benefiting from the proximity to the region of champagne and to European markets and also the deep knowledge of these markets. Stoppers represented 23% of Portuguese cork exports during the period 1910–1913, and only 8% of cork production was manufactured (Lains, 1995, pp. 94–101).

Trade by Portugal and Spain, the main producers of cork, had different characteristics until the Spanish Civil War (1936–1939): Portugal exported cork as raw material and planks, while Spain exported manufactured cork products.

The ascendance of Portugal began in the 1930s, after the Spanish Civil War, and it soon became the world leader in the cork business, although still with a lower proportion of transformed cork exports (Branco and Parejo, 2008).

Since the mid-twentieth century, several synthetic materials have competed with cork for several uses. This affected the cork industry and led to the third phase of the cork business. The agglomerate cork companies entered in decline, and some even disappeared. This period also witnessed the decline of the cork industry in most of the developed countries that imported cork as a raw material. Simultaneously, and the facts are correlated, Portugal and Spain took over all the facets of the business in a process that Zapata (2002) called the “Iberization of the Cork Business”. Cork lost its use for coverings and insulation, and the cork industry became, therefore, basically the manufacturing of stoppers. As a result, Portugal's position was reinforced and it became the world leader in cork exports and manufactured cork products, the latter becoming dominant in the Portuguese cork export structure since the second half of the 1960s (Branco and Parejo, 2008).

Finally, the cork business has three strong features that have been reinforced since the second half of the 1980s (Zapata et al., 2009): (1) the concentration of demand in the market of wine producers, mainly from Europe, enhanced by the positive effect of the entry of Portugal and Spain to the European Union; (2) the cork business became a quasi mono-product industry, specialised in the production of stoppers; and (3) Portuguese cork exports showed a stable, although slightly diminishing trend.

4The life cycle of the cork industry cluster of Santa Maria da FeiraIn this section we analyse the life cycle of the cork industry cluster of Santa Maria da Feira, using the concepts and methods described in Section 2. It is useful to identify the different phases of this cycle chronologically, which is a difficult task, given the somewhat undefined nature of the concepts in question (Martin and Sunley, 2003).

The main sources used in this identification are: Estatística Industrial do Distrito de Aveiro (Manufacturing Statistic of Aveiro District), a national inquiry directed to manufacturing and commercial activity that started in 1860 and ended in 1867; Inquérito Industrial (Manufacturing Census), ordered by the Portuguese government, between the 1880s and the end of the First World War, in three moments (the 1890 version had a larger range, including fishing, mining and manufacturing); Boletim do Trabalho Industrial (Bulletin of Manufacturing Labour), an official report resulting from the action of Circunscrições Industriais (Manufacturing Administrative Regional Divisions), created by the Decree of 14 April 1891 and mainly aimed for inspection actions of manufacturing and labour legislation, as well as the compilation of statistics; Quadros de Pessoal (Tables of Employees), a more recent data set with detailed and comprehensive information on Portuguese workers and firms, collected by the Ministry of Employment and Social Security.

In terms of origins of the cork industry in this region of Portugal, the first reference to the production of cork artefacts in Santa Maria da Feira is made in 1865, in the Estatística Industrial do Distrito de Aveiro, which recorded three factories and seven workshops with a total of 77 employees (Oliveira, 1867). The factories were founded by local businessmen and production was sold to the Porto wine business and the raw material came from Aveiro. At the end of the nineteenth century, according to the Inquérito Industrial of 1890, four cork workshops were located in the Aveiro district, with a total of seven employees (DGCI, 1891).

In 1911, according to the Boletim do Trabalho Industrial, Santa Maria da Feira had nine cork factories, with a total of 142 employees. The Bulletin also records the presence of three 58 horse power steam machines (DGCI, 1912). Certainly these numbers would have included the business of the Amorim family, which, in 1908, was established in Santa Maria de Lamas (a locality of Santa Maria da Feira), being a workshop that manufactured cork stoppers (Branco and Parejo, 2011). In 1917, the same source recorded 41 units all producing stoppers, with 368 employees (DGCI, 1926a).

In 1922 the Amorim&Irmãos, Lda was officially founded as a family firm, having a factory that exported Portuguese stoppers world-wide. For the same period, the Boletim do Trabalho Industrial recorded in Santa Maria da Feira, 41 cork units with 389 employees (DGCI, 1926b).

The decisive factors for the location of the firm Amorim&Irmãos in Santa Maria da Feira were connected with family reasons, namely because the wife of António Alves Amorim (the founder of Amorim&Irmãos) was born in Lamas. But we can ask why they chose a region in the North, while the bulk of cork production was concentrated in the South. The explanation lies in historical reasons, but is also connected with natural resources and market forces. Regarding natural resources, cork oak is widely found all over the Portuguese territory and cork was also harvested in the North, although only on a very small scale. Regarding market forces, the proximity to the main Oporto wine warehouses attracted several investments to the regions surrounding the city of Oporto. In fact, the origins of the Amorim business can be traced there in the nineteenth century, in Vila Nova de Gaia.

Access to navigable rivers and the proximity of railway lines and roads of the main network were also relevant factors in the Portuguese cork industry decision to concentrate between rivers Douro and Vouga, benefiting from the building in 1913 of Linha do Vouga (Vouga Railway) connecting the Linha do Norte (North Railway) and Linha do Dão (Dão Railway).

The emergence phase starts around 1930 when the county of Santa Maria da Feira had 20 cork units, with 1270 employees, out of a total of 92 industrial units, employing a total of 1530 employees. Comparing the considerable weight of Feira cork industry employees (83%), with the weight of cork units (22%), shows how small the Feira cork units were (DGI, 1931).

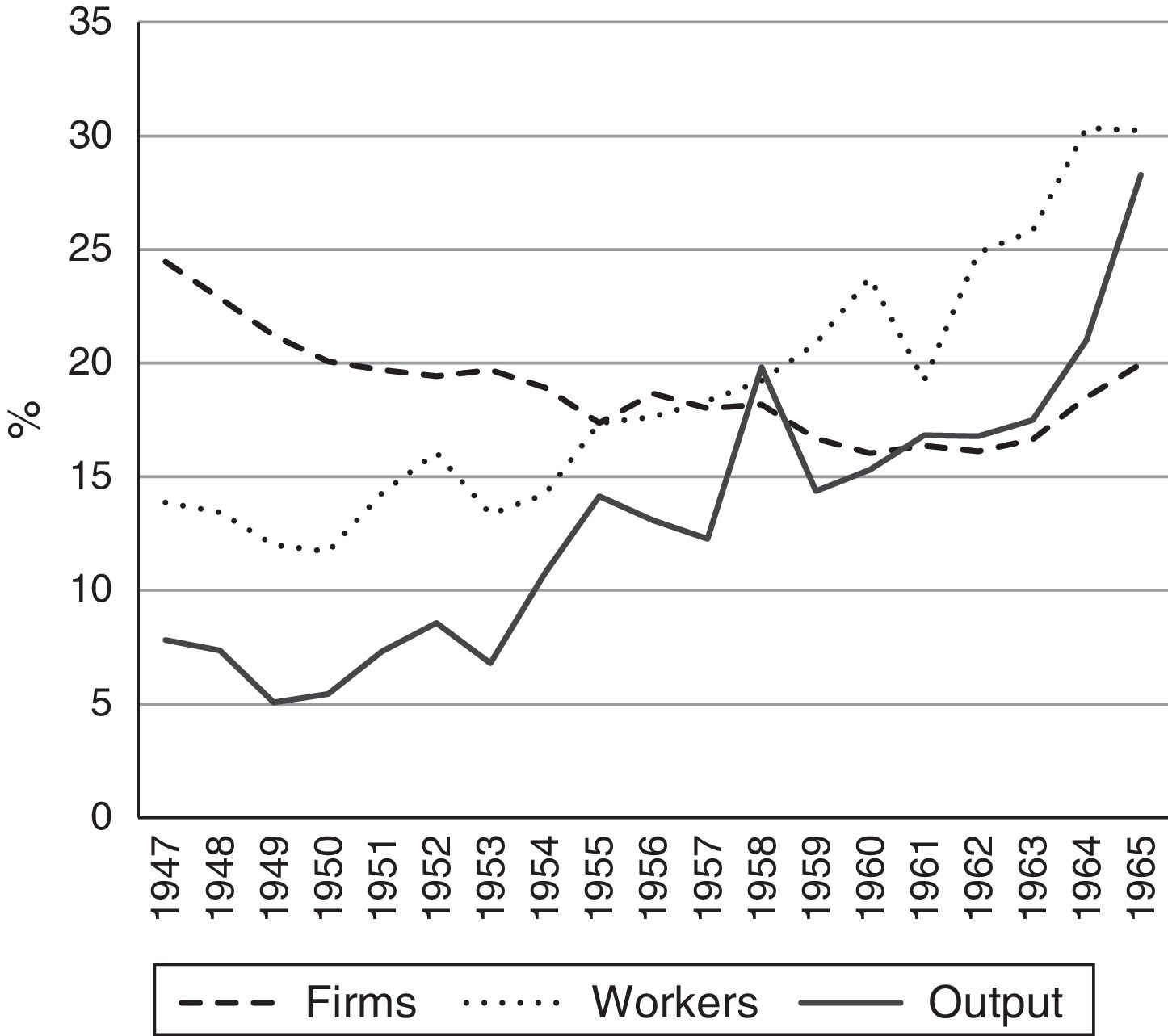

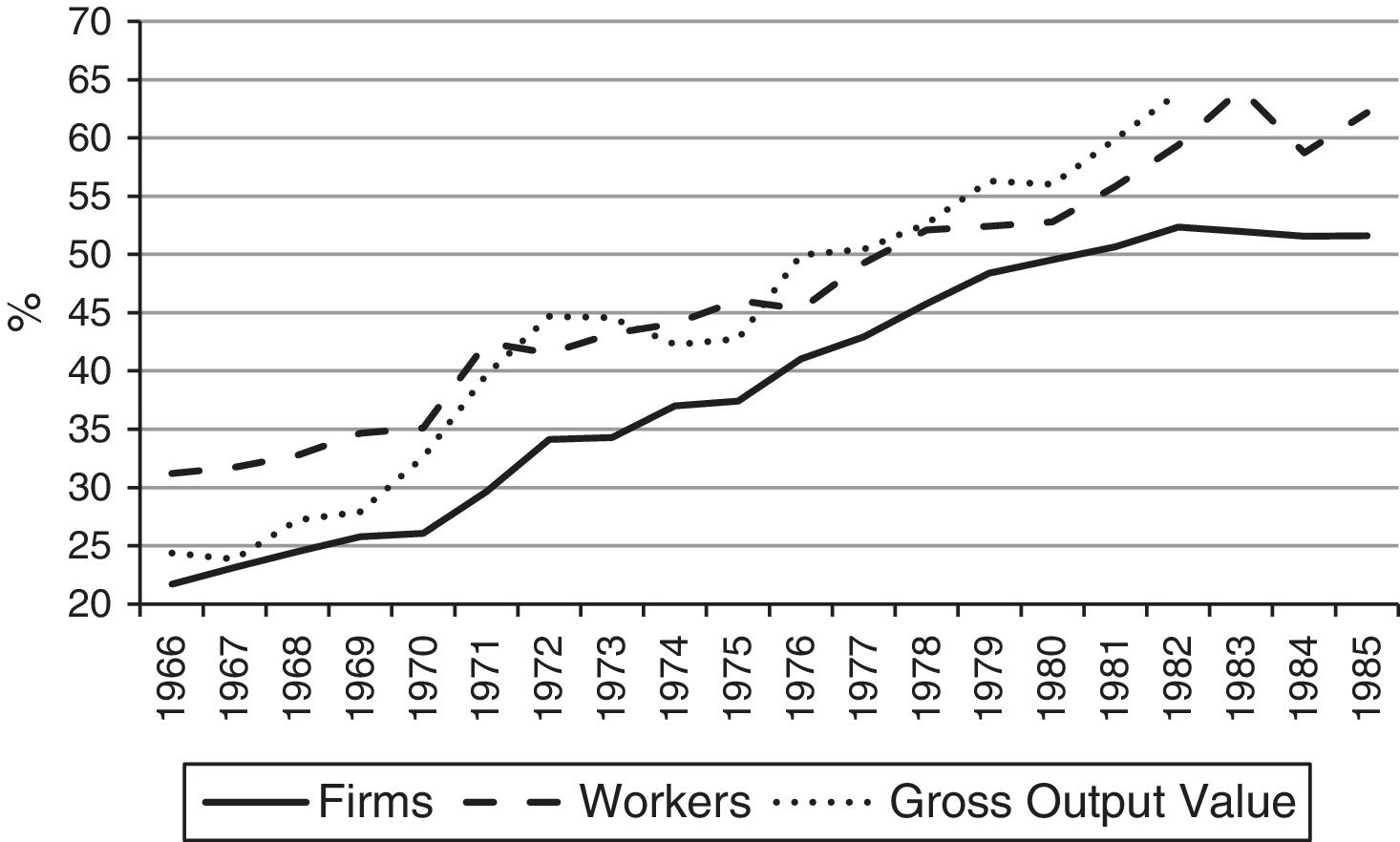

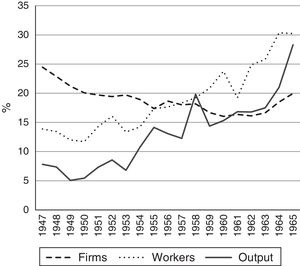

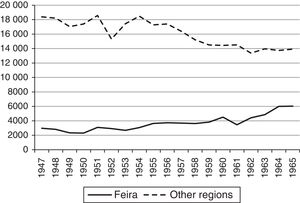

Bearing in mind all the relevant factors, it can be considered that the emergence phase of the Feira cork cluster started in the 1930s, when the number of firms in this region increased and attained a level of about a quarter of all Portuguese cork firms in the 1940s. However, the relative weight of the number of employees and hours worked was only around 15%, and the percentage of output value was below 10%, which points to a small average size of firms. As for the most significant indicators data is only available since 1947, this is the starting point of our chronology. The end of the emergence phase can be traced back to the mid 1960s, as, although the relative number of firms diminished a little, their average size increased (20% in 1965, which is the year chosen as the end point). Furthermore the relative weight of employees and hours worked had doubled by then, and the output value had more than tripled (see Fig. 2).

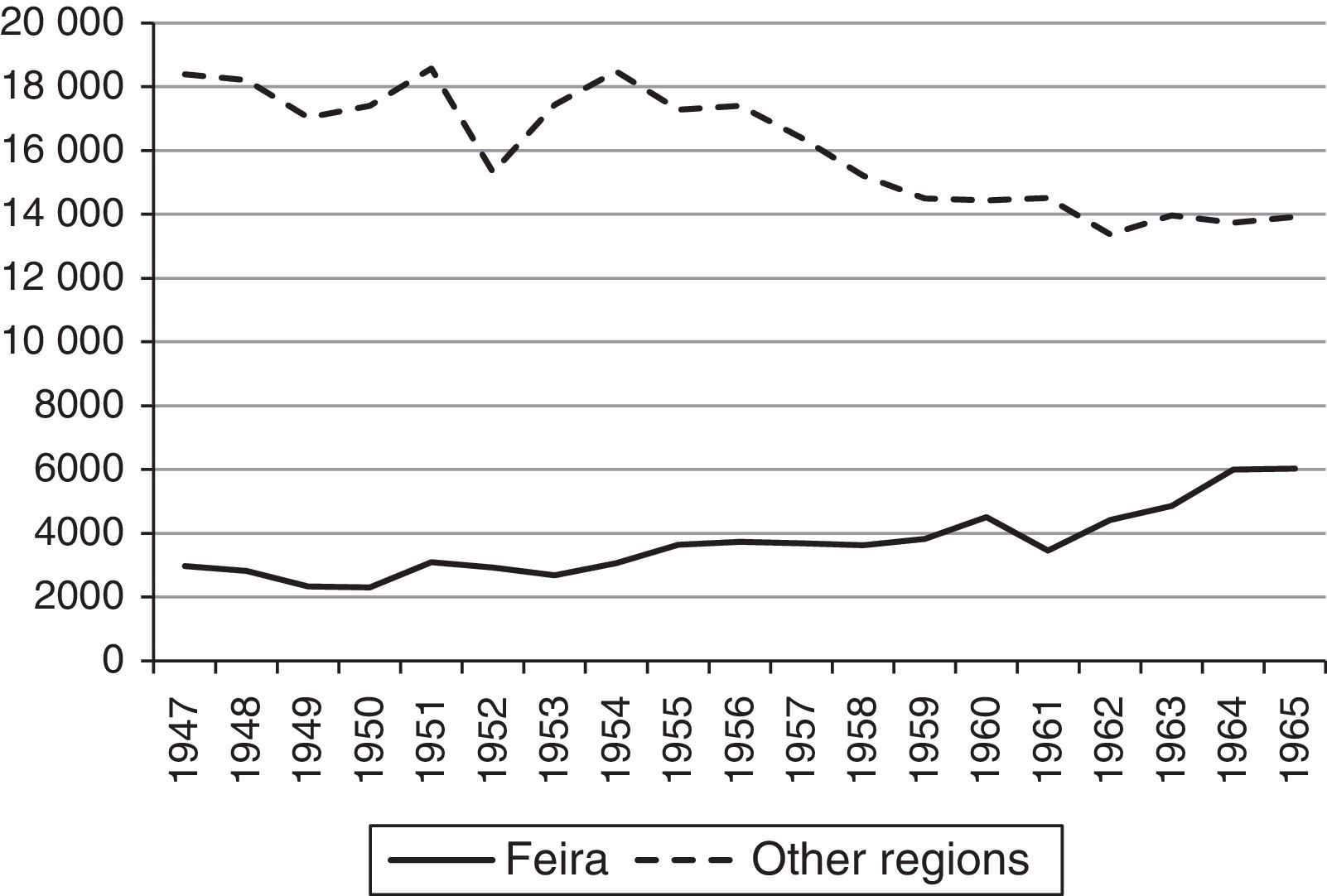

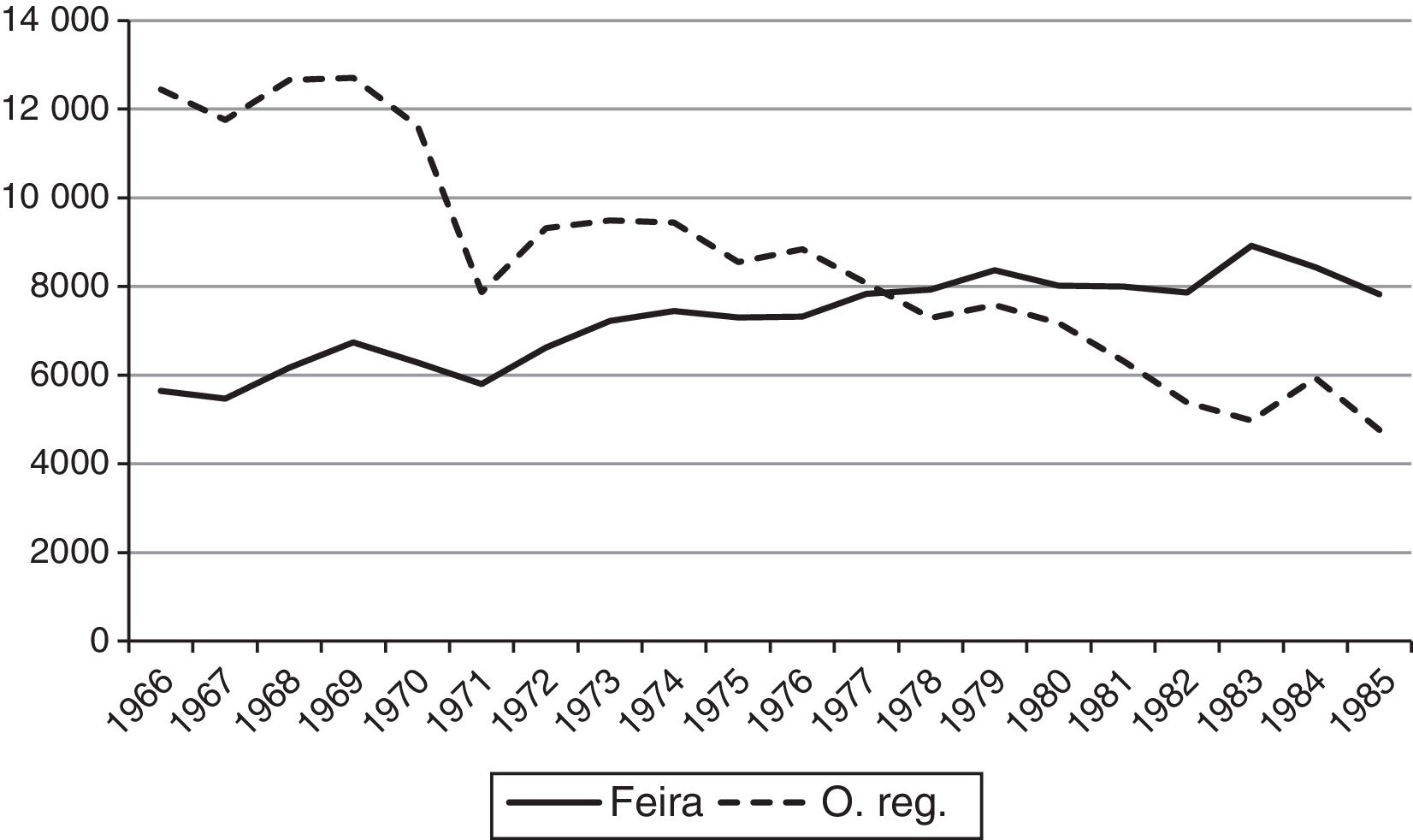

In order to better assess the performance of Feira's cork processing firms during this period, it is important to take into account the context of the entire life cycle of the cork industry, both nationally and internationally. In Portugal, this period corresponds to a positive trend in cork harvest and the subsequent cork products export, but a negative trend in terms of exports of unprocessed cork. The good performance of the industry in Feira was not seen in other regions of Portugal, where the labour force declined in this period (see Fig. 3).

It is interesting to track the evolution of the industry in terms of employees and firms in Feira since the beginning of the 1930s, when the Condicionamento Industrial (Industrial Conditioning)3 first came into effect, as this was the institutional framework for the Portuguese economic activities, which aimed to control the competition between firms within the same industrial sectors. The national industrial policy did not hinder the growth of activities in the cork sector, at least in the stoppers industry, although the same cannot be said about the agglomerates industry. Since 1947 the cork stoppers industry was released from Condicionamento Industrial, although restrictions for the planks industry and agglomerated industry remained in place, as did those for cottage industry production. These two changes were crucial for Feira and for the expansion of the cork stoppers industry.

The governmental entities which managed the industrial licencing scheme were very ‘tolerant’ of the expansion of the cork business, paving the way for the Portuguese domination of the international trade of cork stoppers. During the 1950s, the use of planes was predominant in the manufacturing process of stoppers, and by the 1960s, drills had become widespread in the small, medium and large factories Since the 1940s, Feira had more cork stopper factories, but it was only at the end of the 1950s that the region became the leader, not only in terms of establishments, but also in terms of cork stopper production, ending the dominance of Setúbal (JNC, 1969).

The decline of the Catalonian cork industry contributed too. In fact, the evolution of Spain, which is the other major producer of cork products, is even worse, as a consequence of the serious problems caused in the 1930s by the Civil War, from which the Spanish cork sector never entirely recovered, particularly its previously strong Catalonian cluster (Zapata, 2002; Branco and Parejo, 2008, 2011; Mendes, 2009).

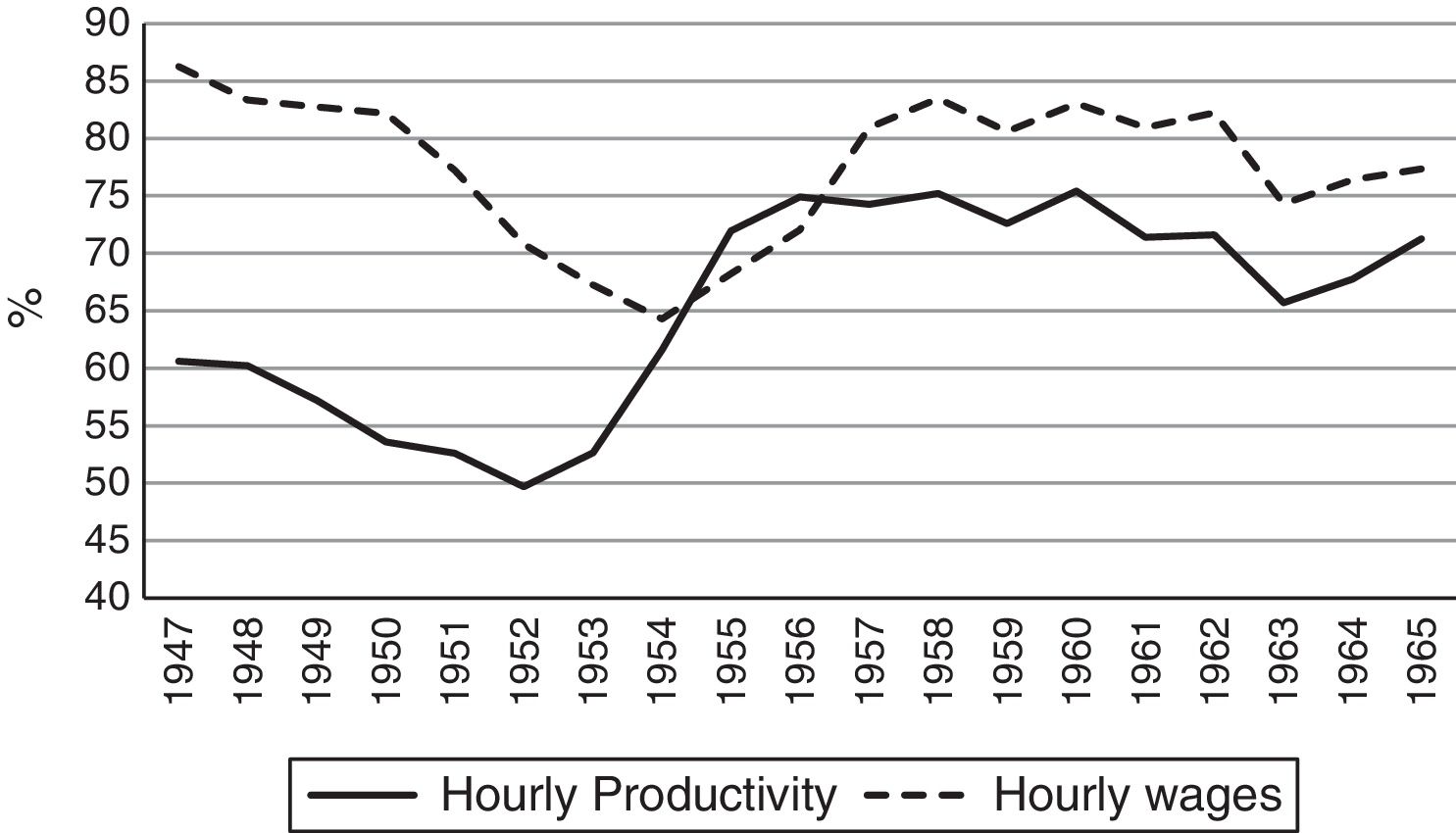

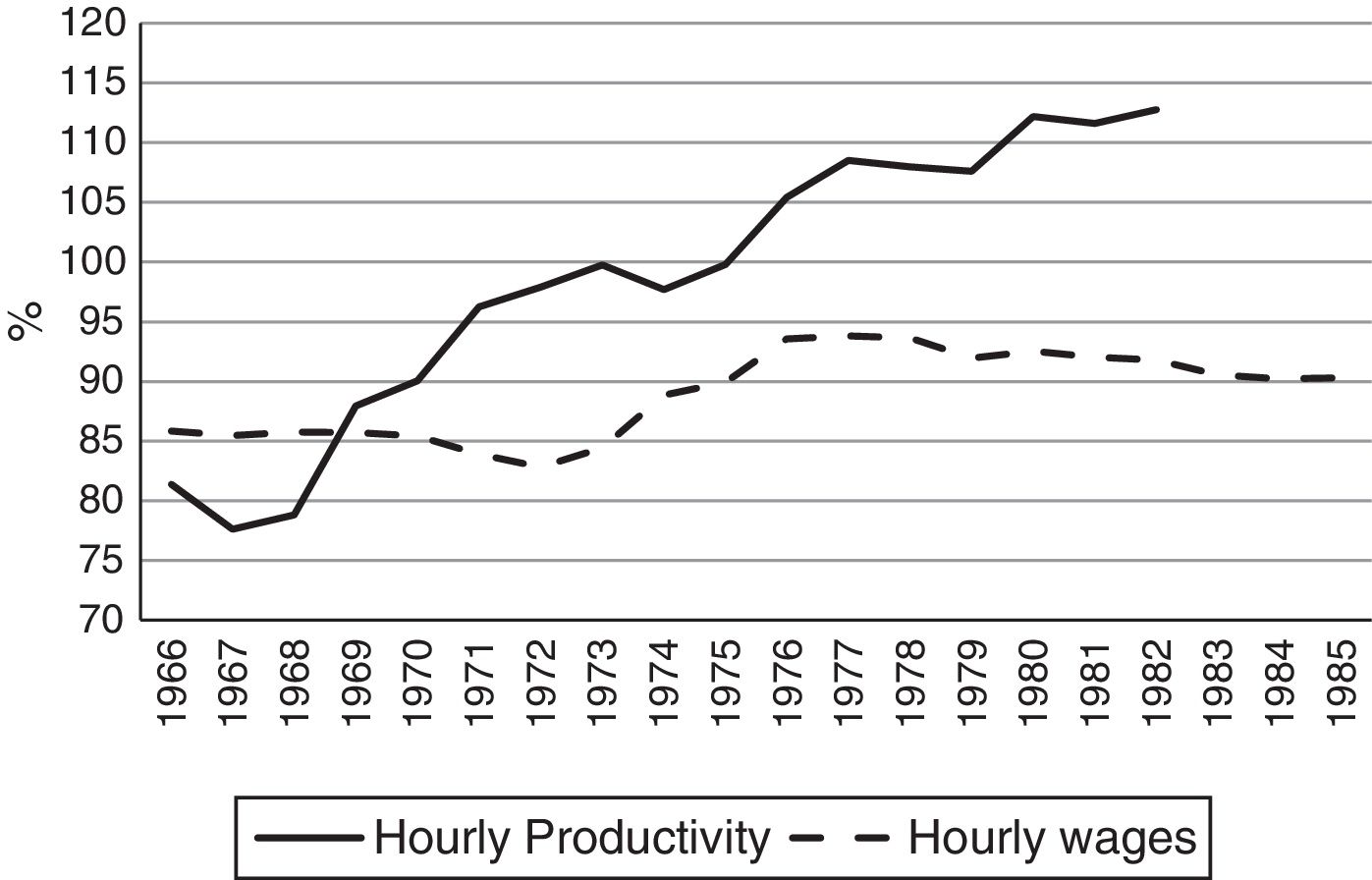

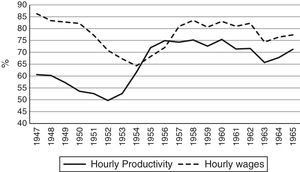

Finally, it is interesting to see that the emergence of the Feira cluster in this period was based on low hourly wages, compensating the lower value of labour productivity, which was favourable for the cluster (Fig. 4).

The wage differential between the South and the North of Portugal (wages were between 50 and 100 percent higher in the former region) reinforced the competitive advantage of Feira. This differential was brought about by the legal framework for the national wages policy for the sector (Branco and Parejo, 2008, 2011). The Condicionamento Industrial and the legislation of the time regarding cork industry wages supported the national position of the Feira cluster, reinforcing the regional specialisation of the cork stoppers industry and justifying the ‘puzzling location’ of the cork industry mentioned above: it was clearly growing in the North and losing importance in the South. In addition to the historical reasons already mentioned in the description of the origins of the cluster, the crucial location factor is labour cost, which is a relevant explanation, due to the weight of wages in production costs, compared to raw materials, or even transport costs (Mira, 1994, 1998; Branco and Parejo, 2011).

In the 1930s, Amorim&Irmãos was already the largest producer in the North, with 150 employees. During this decade, the firm adopted a strategy of upstream vertical integration, by acquiring a small store in Abrantes, near one of the biggest areas of cork oak forest, and also near to the railway line. In 1939 this store became a factory, producing planks for the main factory. In the 1940s, Amorim&Irmãos employed 321 employees, with a production capacity of 70,000 tonnes of cork a day. Using a definition by Chandler, Amorim&Irmãos can now be classified as a ‘big business’ (Chandler, 1990). The firm also controlled the distribution channels, cutting out the intermediaries and having a dominant presence in the business at the time, buying Portuguese cork and selling it to wine producers. Given this dominant role in the region, Amorim&Irmãos acted as an anchor firm to the Feira cork cluster.

Surrounding this ‘big business’ at Santa Maria da Feira were a large number of small handicraft workshops, based on family labour, producing stoppers to supply the Porto wine producers. Several studies highlight the importance of two elements of the cork industry of Feira: the ties between Amorim&Irmãos and the other small production units, and also the small size of these units, which enabled the larger firms to better cope with fluctuations in external demand (Ruivo, 1992, 1996; Mira, 1994, 1998).

The larger producers, namely Amorim&Irmãos, were vertically integrated upstream, producing cork planks and stoppers. These firms supplied cork to small producers and most of these only produced stoppers and were family-based cottage industries. Low production costs, especially for wages, together with the flexibility of the articulation between big firms and small producers, were strong success factors for Feira, in terms of competition at the international level. Moreover, the decline of the cork business in the South of Portugal and in Spain, as well as in other countries which did not produce cork, reinforced the strength of the cork industry of Feira, based on local investment and intrinsic strengths.

The ‘industrial atmosphere’ in this region resulted from the accumulation of knowledge over several years about both the raw material and the production process of stoppers. The creation of new workshop facilities resulted from factory employees’ initiative, who in their homes and using family hand labour, carried on certain phases of the production process, requiring specialised knowledge and rudimentary equipment.

The low barriers of entry and exit left space for this type of a more informal economy (Meneses et al., 1949). The high range of calibres of stoppers, compounded by the high investment needed for the production of cork planks, led to one of two situations: either outsourcing (whereby the large firms buy the final product), or the supply of cork planks by the large firms for the production of stoppers. In either case, the larger firms held the power in these market relationships, as they controlled production costs and competition. The leading firms have an interest in maintaining a large number of small producers. When these domestic industries venture into foreign markets and their business gains dimension, they operate in market segments that are not dominated by the leading firms (Pinheiro et al., 2002).

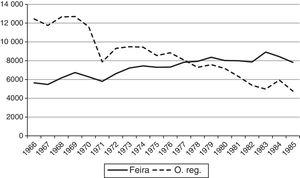

The development phase of the Feira cluster corresponds to the period between the mid 1960s and the mid 1980s. For the sake of simplicity and empirical purposes, let us say 1966–1985. Over these two decades, the cork industry in Santa Maria da Feira experienced remarkable relative growth. In fact, around 1980, more than half of all the Portuguese cork industry was concentrated in this region, in terms of the number of firms and employees, as well as output value (see Fig. 5).

This positive relative trend of the Santa Maria da Feira cork cluster was also a lasting one, as the number of employees in this region grew to around 2000 in this period. On the other hand, the industry suffered a serious definitive decline in other regions of Portugal, with a loss of more than a half of all employees between 1966 and 1985. As we can see in Fig. 6, in 1978, the employment rate in Santa Maria da Feira was greater than that of all other regions of Portugal.

According to the cluster life cycle approach, the Development phase corresponds to the growth and dominance of the industry in the region, taking full advantage of external economies of scale, a skilled labour supply, face to face contacts (social capital), the improvement of infrastructures, and the presence of auxiliary institutions. Also relevant are the strategic capabilities of the anchor firm.

Corticeira Amorim was founded in 1963, at Mozelos (Santa Maria da Feira), initiating the launch of a new phase of vertical integration and product diversification, combined with horizontal integration. Corticeira Amorim also started to produce agglomerate cork products, using as raw material the residues generated by Amorim&Irmãos.4 The business went to the third family generation, and Corticeira Amorim became a multinational firm and bought several competing companies (for instance, Wicanders, Comatral in Morocco, and Samec in Spain), which enabled it to dominate all the phases of production and competition, especially from Spain. It also opened/bought several offices abroad, in order to dominate the distribution process, leading to the consolidation of the Portuguese dominance of the cork business worldwide (Parejo et al., 2013; Branco et al., 2014).

Another important element in the dynamics of the cluster was the Portuguese Cork Association (APCOR), which had its origins in the creation of the Grémio Regional dos Industriais Corticeiros do Norte (Regional Corporation of Northern Industrial Cork Producers) and dates from 1956.

In 1985, the Centro Tecnológico da Cortiça (Cork Technological Centre – CTOR) was created, together with the Centro de Formação Profissional da Indústria da Cortiça (Centre for Professional Training of the Cork Industry – CINCORK). CTOR was of great importance, as it changed the technological centre from France to Portugal, becoming one of the most advanced research centres of this kind in the world (APCOR, 2006). CINCORK started its activity also in Feira, promoting the training of highly skilled employees.

The onset of synthetic and plastic products was a death sentence for several cork agglomerate industrial groups in the region of Setúbal, namely Mundet. Amorim&Irmãos resisted better to strong competition from these products, as its business was essentially the production of cork stoppers. Furthermore, the initial low-cost strategy, which had been a potential creator of a “lock-in” situation, was abandoned. The cluster of Feira overcame the challenge of globalisation, benefitting also from the decline of other foreign cork industries, both located in Portugal and other countries.

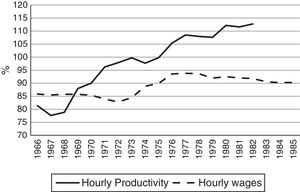

During the Development phase, the most relevant empirical signal of the strength of Feira cluster was the remarkable increase in relative (hourly) labour productivity, from around 80% of the national average at the beginning of this period, to around 115% at the end. The firms of Feira also benefitted from the relatively small increase in (hourly) labour costs (Fig. 7).

The wage evolution was a result of the the agreement of 1968 between the three corporations (Grémios) representing the cork industry (North, Centre and South), which aproximate the wages in this industry paid in the North with those of the other regions.

A final word about the structure of Portuguese exports is worth mentioning. At the end of the World War II, manufactured products began to increase in importance, accompanying the emergence of the Santa Feira cluster, and in the 1950s the position of these products was already consolidated (Branco and Parejo, 2008, 2011; Mendes, 2009). The life cycle of the cork business became the life cycle of the cluster and Feira became synonymous of cork.

In the mid 1980s the cluster of Feira was entering in the Maturity phase. It is more difficult to empirically illustrate this stage, because we do not know exactly when and how it will end.

Some studies covering the cork industry during this period tend to detect an absence of clear and sustainable advantages of the concentration of production beyond a certain level, largely because of eventual congestion effects, shortages of skilled labour and other infrastructures, or a technological lock in (Branco and Lopes, 2013). Those events can imply the decline of a cluster.

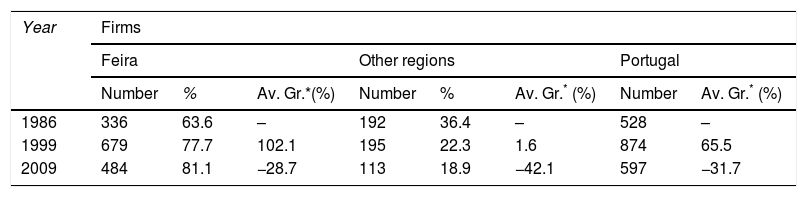

We will now present the most important empirical trends of this phase, from 1986 up until the present (2009, in fact, due to lack of data thereafter), which can be divided into two periods: up to, and after, the advent of the euro (1999).

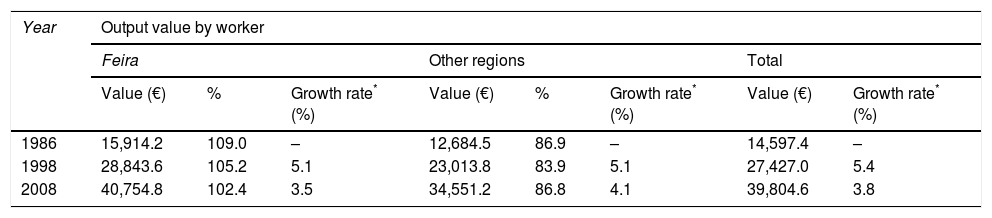

Between 1986 and 1999, there was a remarkable growth in the number of firms in Feira, pointing to the prolongation of the Development phase of the cluster. However, the number of employees remained static, indicating a phase of Maturity. This last perspective is reinforced during the subsequent period, with a marked decline in all available indicators (see Table 1). Numbers were much worse for the other regions of Portugal, which meant that even during its maturity stage, the Feira cork cluster reinforced its role in the country, representing more than 80% of all the industry.

Firms, employees and monthly hours in S. M. da Feira and other regions of Portugal.

| Year | Firms | |||||||

|---|---|---|---|---|---|---|---|---|

| Feira | Other regions | Portugal | ||||||

| Number | % | Av. Gr.*(%) | Number | % | Av. Gr.* (%) | Number | Av. Gr.* (%) | |

| 1986 | 336 | 63.6 | – | 192 | 36.4 | – | 528 | – |

| 1999 | 679 | 77.7 | 102.1 | 195 | 22.3 | 1.6 | 874 | 65.5 |

| 2009 | 484 | 81.1 | −28.7 | 113 | 18.9 | −42.1 | 597 | −31.7 |

| Year | Workers | |||||||

|---|---|---|---|---|---|---|---|---|

| Feira | Other regions | Portugal | ||||||

| Number | % Total | Av. Gr.* (%) | Number | % | Av. Gr.* %) | Number | Av. Gr.* %) | |

| 1986 | 9702 | 59.2 | – | 6679 | 40.8 | – | 16,381 | – |

| 1999 | 9673 | 75.7 | −0.3 | 3105 | 24.3 | −53.5 | 12,778 | −22.0 |

| 2009 | 7387 | 84.7 | −23.6 | 1336 | 15.3 | −57.0 | 8723 | −31.7 |

| Year | Monthly hours | |||||||

|---|---|---|---|---|---|---|---|---|

| Feira | Other regions | Portugal | ||||||

| N (103) | % Total | Av. Gr.* (%) | N (103) | % | Av. Gr.*(%) | N (103) | Av. Gr.*(%) | |

| 1986 | 1503.5 | 58.3 | – | 1073.2 | 41.7 | – | 2576.7 | – |

| 1999 | 1410.1 | 75.8 | −6.2 | 450.0 | 24.2 | −58.1 | 1860.0 | −27.8 |

| 2009 | 1104.7 | 84.9 | −21.7 | 196.5 | 15.1 | −56.3 | 1301.3 | −30.0 |

Note: *Average growth.

The economic performance of the cluster during this phase, as measured by average labour productivity, increases over the whole period, but to a larger degree up to the introduction of the euro in Portugal. The same trend occurs outside Feira, although with lower absolute values, which indicates some economic advantage for clustered firms, even during the Maturity stage, but at a stabilised level (see Table 2).

Labour productivity in S. M. da Feira and other regions of Portugal.

| Year | Output value by worker | |||||||

|---|---|---|---|---|---|---|---|---|

| Feira | Other regions | Total | ||||||

| Value (€) | % | Growth rate* (%) | Value (€) | % | Growth rate* (%) | Value (€) | Growth rate* (%) | |

| 1986 | 15,914.2 | 109.0 | – | 12,684.5 | 86.9 | – | 14,597.4 | – |

| 1998 | 28,843.6 | 105.2 | 5.1 | 23,013.8 | 83.9 | 5.1 | 27,427.0 | 5.4 |

| 2008 | 40,754.8 | 102.4 | 3.5 | 34,551.2 | 86.8 | 4.1 | 39,804.6 | 3.8 |

| Year | Output value by working hour | |||||||

|---|---|---|---|---|---|---|---|---|

| Feira | Other regions | Total | ||||||

| Value (€) | % | Growth rate* (%) | Value (€) | % | Growth rate*(%) | Value (€) | Growth rate* (%) | |

| 1986 | 102.7 | 110.66 | – | 78.9 | 85.1 | – | 92.8 | – |

| 1998 | 197.9 | 105.01 | 5.6 | 158.8 | 84.3 | 6.0 | 188.4 | 6.1 |

| 2008 | 272.5 | 102.13 | 3.3 | 234.9 | 88.0 | 4.0 | 266.8 | 3.5 |

Note: *Average growth rate.

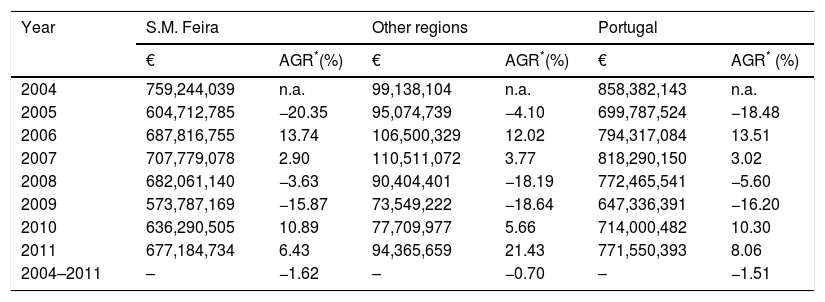

Using a different indicator of economic performance, namely exports, which was available on a regional basis only for a short period of recent years, a similar conclusion emerges, pointing to the weakening of cluster advantages during the Mature Phase of the life cycle (see Table 3).

Cork exports, values – 2004–2011.

| Year | S.M. Feira | Other regions | Portugal | |||

|---|---|---|---|---|---|---|

| € | AGR*(%) | € | AGR*(%) | € | AGR* (%) | |

| 2004 | 759,244,039 | n.a. | 99,138,104 | n.a. | 858,382,143 | n.a. |

| 2005 | 604,712,785 | −20.35 | 95,074,739 | −4.10 | 699,787,524 | −18.48 |

| 2006 | 687,816,755 | 13.74 | 106,500,329 | 12.02 | 794,317,084 | 13.51 |

| 2007 | 707,779,078 | 2.90 | 110,511,072 | 3.77 | 818,290,150 | 3.02 |

| 2008 | 682,061,140 | −3.63 | 90,404,401 | −18.19 | 772,465,541 | −5.60 |

| 2009 | 573,787,169 | −15.87 | 73,549,222 | −18.64 | 647,336,391 | −16.20 |

| 2010 | 636,290,505 | 10.89 | 77,709,977 | 5.66 | 714,000,482 | 10.30 |

| 2011 | 677,184,734 | 6.43 | 94,365,659 | 21.43 | 771,550,393 | 8.06 |

| 2004–2011 | – | −1.62 | – | −0.70 | – | −1.51 |

Note: *Annual growth rate.

It must be emphasised that this period was marked by the great recession of 2009, which strongly penalised exports. However the cork industry as a whole has shown a remarkable resilience since then. What the future will bring to this sector both in Feira and other regions of Portugal is, obviously, difficult to assess.

The dependence on Corticeira Amorim may lead to a decay of the cluster with its actual features, namely small firms articulated with a large firm, to the extent that more than 80% of Portuguese cork exports are dominated by big business.

According to Parejo et al. (2015), from 1960s on, Corticeira Amorim began a process of relocation of several phases of production and partial vertical integration. Throughout the 1980s and 1990s, Corticeira Amorim maintained its internationalisation strategy for production through the acquisition of several Spanish companies, and also the purchase of controlling shareholdings of several European cork firms. Spain emerged as a strategic location of the business in terms of the supply of raw material, stopper production and proximity to the French wine markets. According to the Annual Report of the company, by the first decade of the 21st Century, this multinational has 296 agents (44 located in Spain); 30 industrial plants (eight in Spain) and 84 firms (fourteen of which were in Spain), and it has become the cork industry world leader (Corticeira Amorim, 2012).

5ConclusionsThis paper is about the identification of the phases of Santa Maria da Feira cork industry cluster life cycle and the assessment of the relative economic performance of clustered and non-clustered (dispersed) companies in these different phases.

This cluster is important for the economic and social development of this Portuguese region, as it is the main source of employment, value added and exports and also the main support of this key sector in Portugal, the only one where the country is a world leader, in production, exports and R&D. It is also an industry with environmental and rural development advantages, as its raw material, cork, is a natural renewable resource.

In the theoretical framework of the paper, four sequential phases of the cluster life cycle were presented and discussed, namely emergence, development, maturity and (eventual) renewal or decline, although the relevant literature points to the non-deterministic and contingent nature of this process. The contribution of a historical approach is crucial because the origins are determinant for the nature of the cluster, in terms of specialisation, technology and firms’ interconnections, which are consolidated in the emergence phase. In the development and the maturity phases, the strategies of the firms, namely the leading ones, when they exist, are determinant for the performance of the whole, as well as for the ultimate destiny of the cluster, its lock-in and decline or renewal.

The empirical content of the paper combines a qualitative (historical, institutional) and a quantitative (statistical) long term approach to the cork business in Portugal, starting with a brief explanation of its most relevant facts and trends, namely the location of the cluster in Santa Maria Feira, a northern region of Portugal, whereas most of the raw materials are in the south of the country, due to the familiar background of the founder of the cluster's anchor firm, Amorim&Irmãos.

Other aspects can also be pointed out. Since the onset of the cork industry, Feira has been connected with stoppers production as a consequence of the development of the Porto wine business. As an anchor firm, Amorim&Irmãos always had specific and differing characteristics, with an integrated business, a considerable number of employees and a dominance of distribution channels. A social network of strong bonds between this company and other small firms, some of them functioning out of family homes, others being small handicraft workshops, in both a formal and informal way, created a Marshallian industrial atmosphere, which is still present in the region.

Other important historical and institutional factors for the advantage of Feira location are the wage policy of Estado Novo and its industrial policy, Condicionamento Industrial, which objectively favoured the consolidation of the cluster in the North of Portugal.

In quantitative terms, a comparative analysis of the economic performance of firms localised in Feira and in other regions of the country was then made, using labour productivity and wage data for a long time span of several decades, covering all the stages of the cluster evolution. The main conclusions substantially support the theoretical predictions found in the cluster life cycle literature. In the emergence phase, between the mid-1940s and the mid-1960s, the Feira cluster became slowly more important, in terms of the number of companies, employees and production, but the economic performance (productivity) is below the country's average. In the development phase, until the mid-1980s, a remarkable growth of the cluster occurs, as well as a substantial improvement in its absolute and relative economic performance, measured by hourly labour productivity. Finally, the maturity phase in the 1990s and the first decade of the new millennium is denoted by an apparent exhaustion of the advantages of clustering, with congestion and possible lock in effects.

It has not yet been clearly and unequivocally determined whether the future phase of the Santa Maria da Feira cork cluster will be one of decline or renewal as this depends on many factors, which warrant continuous and careful observation and research. One of the most determinant factors is the business strategy and behaviour of the anchor firm, Corticeira Amorim, which has led for a long time the cork business in Portugal and indeed the rest of the world. In this context, the future strategy and performance of the anchor firm, Corticeira Amorim, could be determinant for the fortune of the cork industry in the region of Santa Maria de Feira.

We gratefully acknowledge the financial support from national funds by FCT (Fundação para a Ciência e a Tecnologia), Portugal. This article is part of the Strategic Projects Pest -OE/HIS/UI0431/2014 and Pest – OE/EGE/UI0436/2014. We also thank the useful comments and suggestions from three anonymous referees.

‘Montado’ is an agro-silvo-pastoral system, which is characterised by the presence of a significant number of adult cork oaks. By the end of the 19th Century this ecosystem already dominated the landscape of the Alentejo, integrating dense tree cover and land uses such as hunting, acorn harvesting, grazing, cultivating and beekeeping (Bugalho et al., 2009; Pinto-Correia and Fonseca, 2009).

White agglomerate, which is the result of grinding virgin cork (obtain from the first strip of the cork oak) and black agglomerate, made from cork waste which is ground and heated to a high temperature. See APCOR (2011).

The Condicionamento Industrial is the industrial policy of Estado Novo (the Portuguese political regime between 1926 and 1974). It aimed to control the competition between firms within the same industrial sector, being one of the vertices of industrial policy of Estado Novo (the Portuguese political regime between 1926 and 1974). The CI lasted until 1974. Regarding its effects on the cork industry, see Branco and Parejo (2008) and Branco and Parejo (2011).

This company belonged to the Amorim family, coexisting with Amorim&Irmãos. It was a family business, although not all partners of Amorim&Irmãos were partners of Corticeira Amorim. The Corticeira Amoirm S.G.P.S., S.A. is the result of the transformation of Corticeira Amorim, S.A. into a holding company, a process which took place in 1991, forming Grupo Amorim. See Branco and Parejo (2011) and Branco et al. (2014).