This study empirically investigated the effects of green credit policies on corporate innovation in China, utilizing panel data for A-share listed manufacturing companies from 2008 to 2022. The analysis employed double-difference models, with the 2012 introduction of the Green Credit Guidelines treated as an exogenous shock. Green credit schemes were found to restrict innovation among more heavily-polluting enterprises. In terms of mechanisms, financial constraint effects outweighed the Porter effect, with heightened financial limitations imposed by green credit schemes driving the observed decrease in corporate innovation. Additionally, the degree of local financial development was found to strongly mediate how green credit policies impacted innovation-related investments, while government subsidies and internal investment levels exacerbated the negative effects of green credit schemes on innovation. Green credit-related declines in innovation within heavily polluting industries were exaggerated for privately owned versus state-owned enterprises. Similarly, technology-intensive enterprises, those operating in highly competitive markets, and those less-dependent on human labor also experienced greater reductions in innovation. Finally, green credit-related declines in innovation were most severe for enterprises located in the Central Region of China.

The construction of an ecological civilization and sustainable economic development are intricately interconnected. China, as an important developing nation, faces both ecological and environmental challenges that directly impact the well-being of hundreds of millions of individuals. As China’s economic system undergoes reform, it has achieved significant developmental milestones, yet new challenges are emerging, including natural resource scarcity, environmental vulnerabilities, and limited environmental capacity (Primario et al., 2024). Hence, finding an effective balance between economic development and environmental protection has emerged as a top concern in swiftly industrializing nations such as China. Enterprises, as significant polluters, should proactively incorporate green development standards into their commercial and production operations (Wu et al., 2021; Zhao et al., 2024). Innovation is a crucial factor allowing businesses to enhance both their economic and environmental performance. In the current era, which is characterized by swift transformations, innovation has become an essential and irreplaceable source of competitive advantage for organizations. To distinguish themselves in a highly competitive market and achieve long-term economic growth, enterprises must engage in ongoing innovation to adapt to changing market needs. Nevertheless, due to the presence of significant externalities, substantial investment requirements, and considerable risks, profit-oriented enterprises may be hesitant to adopt green innovations without external regulatory involvement. Hence, the promotion of corporate innovation as a green management practice has become a necessity.

Environmental regulations can serve as a means for the government to encourage enterprises to adopt best management practices. Consequently, the Chinese government has enacted a range of proactive environmental regulatory policies; among the numerous laws and regulations, the Green Credit Guidelines of February 2012 represent a key example. Green credit is a crucial component of green financial systems, and policymakers worldwide have become interested in effectively utilizing this market-oriented policy instrument (Chen et al., 2022). Green credit represents a significant policy innovation that encourages businesses to actively engage in environmental governance, while facilitating economic transformation and other structural adjustments. Green credit policies differ from conventional environment-related regulatory policies by integrating government regulation with market incentives; these policies utilize both command-and-control measures and incentive-based approaches (Xing et al., 2020). Due to the incomplete development of China's capital market in terms of resource allocation, bank loans remain the primary method of external financing for enterprises. Historically, banks have typically relied on hard information for assessing creditworthiness, including factors like the number of assets and profitability as disclosed in clients' financial accounts (Lu et al., 2021). Soft indicators, such as energy efficiency and green development standards, were frequently disregarded or undervalued (Wei & Sun, 2021). Corporate green management practices are unavoidably influenced by bank credit rules. It remains unclear how green credit regulations impact the extent of business innovation, which serves as a significant means to enhance corporate management practices.

At present, the literature on the economic repercussions of green credit schemes is divided based on two primary hypotheses. One perspective is grounded in neoclassical economic theory, which posits that environmental regulation leads to an escalation in the expenses associated with adhering to environmental standards. Environmental regulation therefore decreases enterprises' willingness to make different choices and thereby reduces flexibility with management practices (Rubashkina et al., 2015; Stucki et al., 2017). The second perspective, referred to as the Porter effect, posits that carefully crafted environmental regulations can encourage enterprises to adopt environmentally friendly management practices, thereby offsetting a portion or even the entirety of the expenses incurred (Hu et al., 2021; Wei & Sun, 2021). Hence, key questions remain regarding the impact of green credit policies on innovation (Wei & Sun, 2021), as well as the underlying mechanisms shaping policy effects.

This study systematically examined the mechanisms shaping green credit policy effects on innovation among heavy polluters, employing the 2012 Green Credit Guidelines as a quasi-natural experiment, alongside data from Chinese A-share listed manufacturing firms from 2008 to 2022; a difference-in-differences model was utilized. The study contributes to the existing literature by providing an in-depth investigation of the relationship between the implementation of green credit policies and corporate innovation within the Chinese context. Prior work has predominantly examined the impact of green credit policies on corporate emissions, focusing on carbon emission reductions (Li et al., 2018; Xing et al., 2020) and financing costs (Yan et al., 2020; Chai et al., 2022). In this study, innovation was integrated into the research framework concerning green credit policy effects and correlations between policy implementation and innovation were examined. This approach enhances our understanding of how green credit policy implementation impacts firms from a micro-entity perspective, broadening our perspective of environmental regulatory instruments and serving as an additional reference for evaluating the impacts of green credit policies post-implementation. In this study, the role of green credit policies in potentially restricting innovation in significantly polluting industries was rigorously examined from four perspectives: financing limitations, financial development, government subsidies, and investments. A heterogeneity analysis was performed to examine the role of diverse factors on micro-level impacts of green credit policy implementation, finding significant effects of competition, firm ownership, geography, labor intensity, and technology intensity. Overall, this study broadens our understanding of how green finance policy influences company innovation.

Literature reviewDeterminants of corporate innovationInnovation represents the fundamental competitive advantage of any enterprise, with innovation and development being interdependent and inseparable. The determinants of enterprise innovation can be categorized into internal and external factors. Internal factors pertain to an enterprise's intrinsic elements, including available natural resources, employee motivation, organizational structure and culture, ownership configuration, and talent composition. External factors encompass macro-political and market influences, such as governmental policies, market conditions, public market interest, and social resources.

Tax incentives may render firms better able to manage costs associated with investments in innovation, while higher returns on innovation also mitigate its risks to some degree (Rao, 2016). Corporate investment in innovation is regulated by the government at the macro level and also shaped by individual actions. For example, Chen et al. (2017) discovered that national cultures characterized by greater individualism exhibit a stronger pursuit of profit, resulting in enhanced innovation efficiency, while Guo et al. (2018) showed that analyst involvement stimulates firms to pursue innovation activities. An integrated model formulated to assess the influence of robust environmental regulations on corporate technological innovation (He et al., 2020) suggested a positive relationship between the two, while also identifying that financing can have substantial crowding-out effects on technological innovation. Similarly, Allen et al. (2021) showed that a robust financial regulatory framework can enhance creative activities, while Dai et al. (2020) showed that media reports can exert subtle pressure on managers, reducing investment in new initiatives. Related investigations at the market level have found that greater industry competition compels firms to enhance their innovation efficiency to avoid rivalry with other industry participants (Oware, 2021). Furthermore, this escape-from-competition effect is observed exclusively among firms possessing R&D capabilities.

In addition to external factors, internal factors may affect enterprise innovation. The existing literature shows an inverse relationship between the financing constraints faced by enterprises and levels of innovation. To address these constraints, Ayyagari et al. (2011) examined how diverse funding channels might provide options for firms to minimize costs, hence fostering innovative development. Employee equity incentives may also enhance motivation for innovation, thereby fostering corporate innovation development. Furthermore, foreign shareholding can facilitate the swift dissemination of technology externally; therefore, enhancing the employee experience may elevate an enterprise’s technological capabilities and foster innovation (Luong et al., 2017). By examining data from publicly traded corporations in the United States, Miller et al. (2022) found that a deficient internal control environment adversely affects the capacity of an enterprise to engage in creative activities. In addition, both internal talent and digital infrastructure are essential prerequisites for digital transformations to positively influence innovation (Sun, Fang, Li, & Wang, 2024b). Finally, strong environmental, social, and governance performance can enhance an enterprise’s innovation output (Kong et al., 2022).

Green credit policies and business innovationResearch to date examining how green credit policies influence corporate innovation has been shaped by three alternate viewpoints. The first, the Porter effect, posits that green financing rules stimulate enterprises to participate in innovative activities. The Porter effect highlights the compensatory aspects of corporate innovation and posits that sensible environmental regulations should enhance long-term capacity for scientific and technological innovation. Many studies have examined the validity of the Porter effect. For example, Zhang et al. (2024a) showed that green credit policies can enhance investment efficiency by reducing mean investment size in heavily polluting enterprises. Additionally, highly polluting enterprises, as opposed to non-polluting enterprises, are more inclined to be innovative due to financing constraints and the required disclosure of environmental data (Jiang & Ma, 2024). Highly polluting enterprises are therefore motivated to improve their environmental performance as a result of green credit laws. This is because polluting enterprises face limitations in obtaining funding and are also required to disclose information about their environmental impact. In contrast, non-polluting enterprises do not face the same pressures. As a result, polluting enterprises have experienced notable enhancements in performance (Zhang et al., 2024), primarily due to heightened innovation and decreased operational expenses. In recent years, the green innovation capability of enterprises has grown as a result of the reinforcement of green credit policies (Kong et al., 2024; Qiu & Yu, 2024).

The second viewpoint is that the implementation of green credit policies may create complications for businesses, such as higher expenses and challenges in securing funding, which limit their ability to invest in new endeavors. This phenomenon was illustrated by Zhang et al. (2022) who analyzed the financial data of A-share listed corporations from 2009 to 2015. The adoption of the green credit policies was shown to effectively restrict the financing and investment activities of heavily polluting enterprises. Similarly, the introduction of green credit policies may have a detrimental impact on digital innovation (Lu et al., 2023). This is because these policies impose financial limitations on businesses and reduce investment in research and development (R&D), thereby impeding digital innovation. In a study conducted by Tian et al. (2024), the influence of green credit regulation on the effectiveness of enterprises' green investment was assessed. Green credit policies were found to mitigate overinvestment by impacting financing constraints and to address underinvestment through commercial credits. In a recent study of green credit policy impacts on significantly polluting enterprises, these policies were found to hamper digital transformation by imposing stricter financial limitations on enterprises and reducing their investments in innovation. Green credit policies have discernible impacts on different types of green innovations (Lin et al., 2023). They may hinder basic green innovations while promoting strategic green innovations among heavily polluting enterprises. Similarly, green credit policies can adversely affect the quantity and quality of green innovations when enterprises are constrained by green credit (Yin et al., 2023). This is due to the suppression of corporate debt financing.

The relationship between green credit policies and innovation investment is nonlinear. For example, Chen et al. (2019) utilized panel data from 24 environmental enterprises listed on the Shanghai and Shenzhen stock exchanges between 2012 and 2017. Their objective was to analyze the association between green credit and corporate R&D using a threshold model. A favorable nonlinear correlation was found between green credit and the extent of company R&D, with the location of the threshold influenced by factors such as bank loans, firm size, and government subsidies.

Theoretical analysis and research hypothesisInstitutional backgroundWith the rapid growth of the global economy, environmental concerns have become increasingly dire, and the concept of a green economy is consequently garnering political attention (Yu & Cao, 2024). The Equator Principles were adopted in 2003 by a consortium of 10 prominent institutions, including ABN AMRO and Citibank. Following these Principles, funds related to environmental protection, social responsibility, and other relevant activities are managed in accordance with the environmental protection guidelines of the World Bank and the Social Responsibility Policy of the International Finance Corporation. China's green finance development model is primarily driven by green credit policies. Since 2007, the Chinese government has actively advanced the use of environmentally friendly credit practices, including green taxation, procurement, and credits (Aizawa & Yang, 2010). Among these strategies, green credit regulations are considered the most sophisticated. In 2016, China proposed the creation of a G20 Green Finance Study Group, with the aim of tracking the global development of green finance and encouraging environmental best practices among international financial institutions. Presently, both the Chinese government and financial institutions are increasingly drawing attention to environmental concerns, suggesting a range of incentives to stimulate investment into environmentally friendly initiatives.

Fig. 1 and Fig. 2 illustrate green credit balances and green credit ratios for China's six largest state-owned commercial banks, namely the Agricultural Bank of China, Bank of China, Bank of Communications, China Construction Bank, Industrial and Commercial Bank of China, and Postal Savings Bank of China, from 2013 to 2022. During this period, the green credit ratio steadily increased year after year. The Industrial and Commercial Bank of China showed the highest green credit balance in 2022, surpassing RMB four trillion; additionally, its green credit ratio was also maximized in 2022, reaching 17.1 %.

Credit facilities are crucial for most businesses to guarantee the smooth operation of their production facilities and innovation endeavors. Green credit, a type of environmental regulation, may stimulate corporate innovation through what is known as the Porter effect. The implementation of green credit policies may stimulate innovation in heavily polluting enterprises through external financing pressure and enhancing potential gains from innovation. This is because, after the implementation of green credit policies, banks will include environmental protection requirements in their credit access standards. As a result, heavily polluting enterprises will be compelled to address environmental issues in order to continue receiving credit from banks. Failure to do so will result in the loss of credit support, significantly impacting operations. Enterprises facing significant pressure go meet credit rules may increase their investment into innovative projects and technological advancement, as well as upgrade their production methods and technology to effectively reduce pollution levels throughout the manufacturing process. Those enterprises making such changes and upgrades are more likely to receive favorable treatment from the financial market than other more polluting enterprises in the same industry. This includes gaining access to more bank loans and achieving higher stock market valuations. These financial benefits can provide ample funds for further development, creating a positive cycle and strengthening a given enterprise’s competitive edge.

The adoption of a green credit program could alternatively impose a financial constraint effect on innovation by significantly polluting enterprises. Due to growing public awareness and governmental focus on environmental conservation, the lending risks banks face in regards to highly polluting enterprises have increased, thereby impacting the credit decision-making process. Enterprises that are significant sources of pollution are likely to face strong public scrutiny and will inevitably face legal action and/or administrative sanctions. This will not only increase the likelihood of borrowers defaulting on bank loans but also harm the reputation of the lending banks. Consequently, banks must now consider environmental risks when deciding on loans and conduct more rigorous evaluations for highly polluting enterprises. This leads to the creation of a financial constraint effect, whereby such enterprises are hampered in their ability to innovate. In this study, these alternate hypotheses (H1a and H1b) are considered.

H1a: The adoption of green credit policies will enhance innovation among industries that are major pollution sources.

H1b: The adoption of green credit policies can impede innovation among industries that are major pollution sources.

Theoretical mechanisms regarding financing constraintsFollowing the principles of sustainable development, the government, as a macro-regulator, should prioritize green and low-carbon initiatives with the aim to maximize societal benefits. According to stakeholder theory, the government and private enterprises have distinct interests; environmental regulations may conflict with the economic interests of businesses, necessitating governmental intervention in the form of pertinent legislation for oversight and guidance. Green finance offers a viable avenue to sustainable economic development, requiring the collaborative involvement of the government, firms, and financial institutions to successfully execute green finance policies. While most organizations leverage industrial technology to their economic advantage, certain technologies may concurrently present specific environmental challenges for both businesses and society at large. As a result, technological innovation within organizations is essential. Enterprise innovation is influenced by diverse factors, including governmental policies and the credit financing environment.

The fundamental nature of green credit is to impose environmental limits on the credit available to enterprises through regular credit rationing. Following the enactment of green credit policies, banks typically adopt a more rigorous approach to loan approvals for major polluters, leading to elevated interest rates and a substantial rise in financing costs for firms. Given the high risks and uncertainty associated with innovative projects, enterprises may encounter financial constraints amidst escalating financing costs. Consequently, management may adopt a conservative approach: prioritizing debt repayment and exhibiting reluctance to invest in long-term innovative projects, while simultaneously grappling with daily financial challenges. Companies plagued by ongoing financial difficulties typically lack capacity to strategize for technical advancement; additionally, shareholders and suppliers exert pressure on the corporation to prioritize cash flow stabilization. At the same time, meeting environmental standards can consume substantial financial resources, compelling firms to opt for short-term solutions that address only the symptoms, while forgoing long-term investment in novel technologies that could tackle both symptoms and core causes. Within this detrimental cycle, investments in environmental protections appear to increase but ultimately impede genuine green innovation.

When enterprises face heightened financing constraints, attracting external investment becomes increasingly challenging. Heavily polluting enterprises may encounter difficulties in securing funds through conventional credit avenues, while alternative financing methods, such as issuing green bonds or pursuing equity financing, impose even higher barriers. This culminates in further financial restrictions to enterprise innovation. Therefore, green credit regulations may hinder innovation due to financing limitations, as posited in study hypothesis H2.

H2: Green credit regulations can hinder innovation by imposing financing limitations.

Theoretical mechanisms regarding the level of financial developmentIn the present context of ongoing economic shifts and sustainable development, financial systems have become fundamentally important to economic functioning. Financial development may be assessed based on the magnitude of the financial market, the efficacy of financial institutions, the variety of financial products, and the robustness of financial regulation; together, these factors significantly influence corporate innovation. From the standpoint of financial market structure, the implementation of green credit policies has significantly altered how financial resources are allocated. In accordance with governmental mandates, banks and financial institutions have proactively modified their credit frameworks, prioritizing the funding needs of green industries and those associated with minimal pollution. Heavily polluting firms face credit line restrictions and much higher financing costs, resulting in a deteriorating financing climate in the financial sector. In some cases, the acceptance rate for loan applications from significantly polluting firms is 40 % lower than that of green sector enterprises, and the average loan interest rate is 20 % to 30 % higher. This reallocation of financial resources results in significant funding shortages for major polluters, impeding both innovation inputs and outputs.

The business focus and risk tolerance of financial institutions have also changed under the influence of green credit policies. Financial institutions now prioritize environmental performance and sustainable development when evaluating enterprises. More rigorous risk assessments are applied to heavily polluting entities, and in certain instances, financial institutions may actively terminate business relationships with such enterprises. This hinders significantly polluting firms from accessing a range of financial services and innovation supports, including venture financing and financial advising. In many instances, heavily polluting firms have been compelled to suspend innovation initiatives due to legislative impacts. At the same time, owing to the shrinkage of financial institutions and shifts in risk appetite, severely polluting firms encounter challenges in securing comprehensive financial services and assistance essential for innovation. During the innovation process, this means that enterprises are unable to leverage the expertise of financial institutions for effective risk management and resource integration, thereby exacerbating uncertainty. This situation can diminish both the motivation of enterprises to engage in innovation and their efficiency with ongoing innovative endeavors. Therefore, green credit rules may impede innovation via their effects on financial system development, as posited in study hypothesis H3.

H3:Green credit rules may impede corporate innovation by limiting financial development.

Research designStudy data and selection of variablesStudy data sourcesGiven that the Green Credit Guidelines were implemented in February 2012, study data were collected for A-share listed manufacturing enterprises from 2008 to 2022, excluding manufacturing enterprises that were listed as ST, * ST, or PT during the sample period (Wang et al., 2024). Cases where key variables were missing were also excluded from the study data set. The final data set contained 3140 listed enterprises and 23,850 observations. To distinguish polluting and non-polluting manufacturing enterprises, the Listed Company Environmental Verification Industry Classification and Management Directory was used. This document was issued by the Ministry of Environmental Protection (MEP) in 2008. It categorizes listed enterprises from 14 industries, such as thermal power, iron, and steel, as heavily polluting industries (experimental group), while other industries are categorized as non-polluting (control group). The study data were primarily obtained from the China Stock Market & Accounting Research (CSMAR) database. To avoid disproportionate effects of extreme values on the estimation results, all continuous variables were subset to include only data between the 1 % and 99 % quartiles (excluding extreme values).

Study variable selectionA detailed description of the variables included in this study is provided (Sun, Fang, Li, & Ai, 2024a) in Table 1.

Definition of study variables.

This paper utilized a double-difference model to assess the impact of green credit policies on innovation by manufacturing enterprises. The basic regression model was constructed as follows:

where Innovi;t denotes the innovation level of a manufacturing enterprise; treatedi denotes a group dummy variable, which takes a value of one for the experimental group (heavily polluting enterprises) and zero for the control group (non-polluting enterprises); Policyt denotes a second dummy variable which takes a value of one for data from 2012 and later (after the adoption of the Green Credit Guidelines) and zero for data from before 2012; treatedi×Policyt is a double difference variable; Xi;t denotes a series of control variables including manufacturing firm size, debt leverage, and so on; δi denotes industry-related fixed effects; λt denotes time-related fixed effects; εi;t represents a random error term; and i and t represent the individual manufacturing enterprises and time, respectively. The change in innovation level for heavily polluting manufacturing enterprises before and after the implementation of the Green Credit Guidelines can be represented as: ΔInnovuntreated=β2. Here, the focus is on coefficientβ3, which reflects the net effect of the introduction of the Green Credit Guidelines on the innovation level of heavily polluting manufacturing enterprises when other factors are excluded.Empirical resultsBaseline regression resultsDirect impacts of green credit policies on business innovationTable 2 displays the results of the double-difference model examining green credit policy effects on enterprise innovation. In the Table, Columns 1 to 2 give the regression findings for highly polluting manufacturing enterprises and other firms, with industry and year effects, control variables, and so on added in turn. In Columns 1 and 2, the negative coefficients of the interaction terms (treated × Policy) were significant at the 1 % level; thus, the introduction of green credit policies considerably hindered innovation in heavily polluting industrial firms, supporting study hypothesis H1b. As an example, the interaction coefficient in Column 2, which incorporated all control variables, measures −0.028; this suggests that implementation of the Green Credit Guidelines resulted decrease (on average) in innovation for heavily polluting manufacturing firms compared to other firms. Huaneng Group is one of China's largest state-owned power enterprises, which mostly utilizes coal to produce electricity and therefore generates significant air pollution. Motivated by the green credit program, Huaneng initiated a partial green transformation and received financial backing via green credit. Green credit policies have therefore had a substantial impact on Huaneng’s operations, given its continued reliance on environmentally detrimental means of electricity generation. However, Huaneng Group's utilization of green credit, while facilitating its clean energy initiatives, has adversely affected its short-term financial standing due to its excessive reliance on coal-based power. Since adopting these policies, Huaneng has lowered its investment in innovation-related projects due to increased compliance expenses. Within two years of implementing green credit policies, Huaneng's annual R&D investment decreased from 1.2 billion yuan in 2019 to 0.9 billion yuan in 2021; the proportion of R&D allocated to green technologies rose annually, while innovation efforts in non-green sectors were constrained.

Baseline results from the double-difference model.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level, respectively; () enclose t-values.

The baseline regression model was further expanded into a dynamic model (using event study methods) to examine trends in corporate innovation after the implementation of the Green Credit Guidelines in 2012. Specifically, the baseline regression model was updated to incorporate only data from 2013 to 2022, with a biannual dummy variable introduced to represent each two-year group (i.e., 2013–2014, 2015–2016, etc.). This new dummy variable was then multiplied with the group dummy variable (treated) and the model reestimated to determine enterprise innovation (Innov). The dynamic model formula is outlined as follows:

where treatedi × yeart denotes the interaction between the group dummy variable and the year dummy variable. The coefficients and confidence intervals estimated from the dynamic model are shown in Fig. 3.Following the introduction of the Green Credit Guidelines in 2012, the marginal effect line was most different from zero (Fig. 3), later approaching a value of zero annually beginning in 2017, as the absolute values of Innov (estimated from the dynamic model) began to decline. From 2013 to 2016, the policy shock period saw enhanced corporate financing constraints owing to more stringent credit approval criteria and elevated financing costs. These financing constraints led to challenges such as insufficient R&D funding and heightened liquidity pressure, resulting in a precipitous decrease in innovation investment. This crowding out effect of financial constraints on corporate innovation prevails today. As additional green credit policies were implemented from 2017 to 2020, financial institutions developed a differentiated credit assessment system to provide financing support to enterprises actively pursuing green technologies. As such, some enterprises overcame funding constraints through innovative financing mechanisms (e.g., green patent pledges and carbon-neutral bonds), resulting in a 32 % reduction in the absolute value of financing constraints (Innov) and thereby mitigating green credit-related inhibitory effects on innovation. Post-2020, propelled by the dual-carbon objective, further governmental supports were introduced, expediting the creation of green financial products (e.g., the Agricultural Bank of China has introduced sewage right mortgages). As illustrated in Fig. 1, the Industrial and Commercial Bank of China’s green credit balance measured 17.1 % in 2022. At this time, enterprises that had upgraded to green technology were able to partially mitigate policy constraints through financing facilities, resulting in a further reduction in financing constraints on innovation (the absolute value of Innov decreased by 62 %); however, the overall impact of green credit remains significantly negative.

Tests of model robustness(1) Parallel trend test

The accuracy of the difference-in-differences method primarily depends on the assumption of parallel trends. Therefore, a parallel trend test is required prior to conducting a double-difference analysis. To satisfy the parallel trend assumption, manufacturing enterprises in the treatment (experimental) and control groups should show parallel trends in terms of innovation investment prior to implementation of the Green Credit Guidelines; in other words, the difference between treatment and control groups would remain the same had the Green Credit Guidelines not been implemented. To assess trends before and after the policy change, the dynamic effects of the Green Credit Guidelines on innovation investment were illustrated for both experimental and control groups (Fig. 4). This visualization revealed that the coefficient of the interaction term (values on the left side of the dashed line) did not differ from zero before the policy change. Thus, between the first and fourth period, a parallel trend existed for manufacturing enterprises from both treatment and control groups in terms of innovation investment. This supports the validity of the difference-in-differences model estimates made in this study.

(2) Placebo test

To address the potential issue of missing variables, a counterfactual placebo test analysis was employed. This analysis sought to determine whether the observed impacts of the Green Credit Guidelines on innovation among manufacturing enterprises were due to the Guidelines themselves or other unmeasured factors. To test for missing variables, a placebo experiment was conducted, wherein the effects of the Guidelines on corporate innovation were independently estimated 500 times after randomizing the data. The resulting distribution of placebo p values for all 500 repetitions is illustrated in Fig. 5. The regression coefficients clustered around zero and followed a normal distribution. The majority of the regression results were not statistically significant, indicating that implementation of Green Credit Guidelines in the random data sets had minimal-to-no effect on corporate innovation. Therefore, it can be assumed that no hidden factors influenced the baseline regression results in this study. This suggests that the Green Credit Guidelines strongly impacted innovation in heavily polluting manufacturing companies.

(3) Replacement of explanatory variables

A baseline regression analysis was conducted to assess the relationship between innovation inputs and outputs (Sun et al., 2025). To ensure the reliability of the results, the baseline regression was repeated including another aspect of innovation output, namely the proportion of a company’s operating revenue accounted for by its annual R&D expenditures at the beginning of the study period (Table 3). Additionally, industry effects, year effects, control variables, and other relevant factors were sequentially incorporated into the analysis. Consider Column 2 an illustration, where the coefficient of the interaction term is included (i.e., treated × Policy), along with all control variables. Here, Green Credit Policy had a negative value (significant at the 1 % level), further supporting the conclusions of the baseline regression.

Baseline regression analysis with alternate explanatory variables.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level, respectively; () enclose t-values.

(4) Controlling for other policy shocks

Aside from green finance regulations, other policies implemented within the same timeframe may have influenced the extent of green innovation, for example the amendment of the Environmental Protection Law of the People's Republic of China. The Environmental Protection Law of China was revised and approved by the Eighth Meeting of the Standing Committee of the Twelfth National People's Congress on April 24th, 2014. It went into effect on January 1st, 2015. The revised Environmental Protection Law mandated manufacturing enterprises to prioritize the use of environmentally friendly methods and industrial equipment that is low polluting and highly energy efficient. Additionally, manufacturing enterprises were required to minimize the release of pollutants and other waste, as well as carbon emissions. This amendment likely influenced the execution of the Green Credit Guidelines. In this study, the effects of the Environmental Protection Law Amendment were not considered, and instead dummy variables were incorporated for the years from 2015 onward.

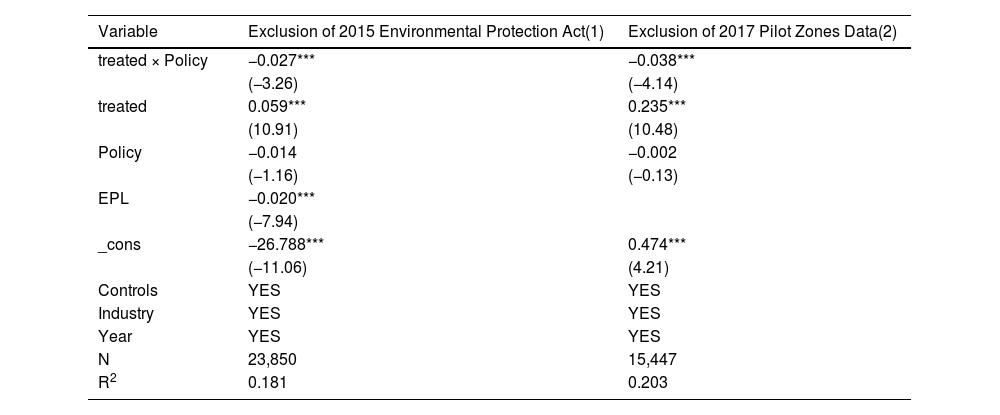

Another potentially relevant policy shift is the ongoing implementation of green financial reform and innovation pilot zones. Since 2016, the People's Bank of China, along with seven ministries and commissions, has established pilot zones for green financial reform and innovation in 10 regions across six provinces, autonomous regions, and municipalities directly under the central government. The regions affected include Chongqing, Guangdong, and Xinjiang. Each pilot zone has a specific focus in terms of the direction of green financial development, but all pilot zone projects are expected to influence the effectiveness of the Green Credit Guidelines. To assess the impact of the pilot zones project, the baseline regression analysis was repeated after removing samples from provinces participating in the pilot zones project (Table 4).

Controlling for shocks from other policy shifts.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level, respectively; () enclose t-values.

Column 1 in Table 4 displays the regression findings when excluding the effects of the 2015 Environmental Protection Act (EPA) policy shock. Comparing these results to the baseline regression results, the interaction term treated×Policy remained negative and significant at the 1 % level. Thus, after accounting for the 2015 EPA policy, the Green Credit Guidelines still reduced innovation among heavily polluting manufacturing enterprises, although to a lesser extent than in the baseline regression. This suggests that the 2015 EPA amendment also negatively affected innovation in heavily polluting manufacturing firms.

The results in Column 2 of Table 4 represent regression findings when excluding provinces hosting green finance reform pilot zones. Comparing these results to the baseline regression results, the interaction term treated×Policy remained negative and significant at the 1 % level. Thus, even after excluding the effects of the 2017 financial reform and innovation pilot zones, the Green Credit Guidelines still inhibited innovation among heavily polluting manufacturing enterprises, further supporting the conclusions of the baseline regression. In fact, these inhibitory effects were stronger than in the baseline regression, suggesting that 2017 pilot zones project had a discernible impact on innovation in heavily polluting manufacturing enterprises.

Heterogeneity analysis(1) Heterogeneity due to property rights

Based on prior studies of property rights, samples were categorized as state-owned enterprises or private enterprises, and independent regression analyses were carried out for each group (Table 5). In the private enterprise analysis, the interaction termtreated×Policy was significantly negative. However, in the state-owned enterprise analysis, the interaction term treated×Policy was not significant. This suggests that green credit policies predominantly affected private enterprises, limiting corporate innovation mostly in the private sector. Note that green credit policies function as environmental regulations, and the relationship between environmental regulation and enterprise innovation can be complex, not being simply positive or negative. For example, the relationship often depends on the threshold set by a given environmental regulation. Higher expenses related to environmental compliance can potentially constrain corporate R&D budgets and impede innovation. When enterprises (including banks and financial institutions) are state-owned, they may receive financial assistance even when facing credit constraints due to pollution. Compared to heavily polluting, private enterprises, state-owned enterprises typically do not experience significant declines in financing capital after the implementation of green credit policies, rather experiencing an increase in loan interest rates.

Regression results when dividing samples based on property rights.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

(2) Heterogeneity due to enterprise dependence on technology

Samples were divided into highly technology-intensive enterprises and weakly technology-intensive enterprises, and separate regression analyses were conducted for each group (Table 6). In the highly technology-intensive enterprise analysis, the interaction term treated×Policy was significantly negative; in the weakly technology-intensive enterprise analysis, the interaction term treated×Policy was not significant. This suggests that the negative effects of green credit policies on innovation mostly occurred among highly technology-intensive enterprises. Green credit policies aim to direct capital toward environmental conservation and low-carbon activities. Although heavily polluting enterprises that are also highly dependent on technology may have advantages in terms of technological innovation, these innovations rely on cutting-edge technologies that are also high risk and difficult to accurately assess. When green credit policies are implemented, banks may reduce credit support for such enterprises due to concerns about the level of risk, thus leading to reductions in corporate innovation. Innovative projects within heavily polluting firms often require large capital investments with long payback periods. Green credit policies may raise the cost of financing for these firms, especially if debt leverage is high. Higher financing costs may therefore lead firms to reduce investments in innovation in order to maintain a stable financial position.

Regression results when dividing enterprises based on their reliance on technology.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

(3) Heterogeneity due to market competition

The annual median of the Herfindahl index was employed to divide samples into two groups based on market competition (i.e., market concentration): low and high competitiveness. Independent regression analyses were performed for each group (Table 7). The interaction term treated×Policy was significantly negative (−0.042***) in the high market competitiveness analysis, but not significant (0.007) in the low market competitiveness analysis. This suggests that the negative effects of green credit policies on corporate innovation (for heavily polluting industrial firms) are more severe in those enterprises operating in highly competitive markets. In such markets, companies may have heightened operational constraints and capital demands, alongside relatively elevated fixed cost ratios. Fixed costs, including equipment acquisitions, facility leases, and R&D expenditures, are essential to business operations and remain constant over time. With the implementation of green credit policies, firms may be required to invest substantial capital in environmental remediation and/or technical enhancements to comply with more stringent environmental regulations. These additional expenses exacerbate the burden of fixed costs carried by the firm. Yet due to intense market competition, their profit margins are already limited, and they face significant capital pressure. Under green credit regulations, banks may reduce credit assistance for heavily polluting firms due to environmental risk factors, hence complicating capital acquisition for these entities. In the face of capital limitations, firms may prioritize the allocation of scarce resources toward everyday operations and competitive market presence, reducing funding for long-term, high-risk innovative endeavors. Therefore, green credit schemes may more negatively impact innovation in enterprises in highly competitive markets. Furthermore, such enterprises often depend on cost-effective, high-efficiency production techniques to sustain their competitive edge. Under green credit programs, companies must allocate additional resources toward environmental enhancements, potentially diminishing efficiency and/or elevating manufacturing prices. To remain competitive, firms may need to reduce expenditures in other domains, including innovation.

Regression results when dividing enterprises based on market competitiveness.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

(4) Heterogeneity due to industry dependence on labor

Samples were divided into two groups based on industry dependence on labor, whether strongly or weakly labor intensive. Independent regression analyses were performed for each group (Table 8). In samples from weakly labor-intensive industries, the interaction term treated×Policy was significantly negative; conversely, in samples from strongly labor-intensive industries, the interaction term treated×Policy was not significant. This suggests that green credit policies more negatively impact innovation in weakly labor-intensive industries (that are also highly polluting). Despite the diminished reliance on human labor in certain industries (e.g., automated manufacturing sectors, electronics manufacturing, etc.), substantial capital is required for equipment modernization, technological advancement, and other innovative endeavors. Following the enactment of green credit policies, banks exhibit more prudence in extending loans to such firms due to environmental risk factors, reducing access to funds for these enterprises. This escalation of financial constraints often translates into a loss of funds for innovation and other long-term goals. Green credit policies may also require firms to allocate more financial resources toward R&D for novel technologies and equipment upgrades to comply with policy mandates. Therefore, to comply with environmental regulations, firms must sometimes diminish capital investment in alternative innovation projects, resulting in a reduction in innovation.

Regression results for enterprises with different levels of labor. intensity.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

(5) Geographical heterogeneity

Based on the geographical location of firms in mainland China across 31 provinces, municipalities, and autonomous territories, samples were categorized into three groups: East Coastal Region (East), Central Region (Mid), and West Region (West). These regions correspond to China’s three principal economic zones. Independent baseline regression analyses were conducted for each geographic group (Table 9). The treated×Policy interaction was negative and statistically significant (1 % significance level) in the Central Region, but not in the West and East Regions. Thus, green credit policies more strongly impacted corporate innovation in the Central Region. One potential explanation for the lack of effect in the Eastern Region is the high economic growth and more refined industrial structure associated with this Region, along with a greater variety of funding avenues, risk management instruments, and enhanced capacity for innovation. Therefore, despite financing limits imposed by green credit policies, enterprises in the Eastern Region may nevertheless secure funds via alternative avenues, thereby sustaining or even augmenting innovation inputs. By comparison, the Western Region has comparatively poor economic development, but benefits from national initiatives, such as the Western Development Strategy, which may alleviate the adverse effects of green credit regulations to some extent. The Western Region may also benefit from financial agglomeration, owing to regulatory backing and the advancement of particular industries (e.g., resource-based industries), potentially also mitigating financing limitations. The Central Region represents a more transitional phase of economic development, lacking the economic prowess and innovative capacity of the Eastern Region, while not benefiting from the same policy advantages as the Western Region; this intermediate status may render it more vulnerable to the direct effects of green credit policies.

Regression results for enterprises belonging to three separate geographic regions.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

A double-difference model was used to examine how green credit policies have affected credit resource allocation and to determine if these policies have resulted in disproportionate financing constraints for heavily polluting manufacturing enterprises versus green enterprises. Financing constraints are one of the key impediments to business innovation. Green credit policies are essentially the issuance of credit funds to better support corporate innovation. The double-difference model is outlined as follows:

where SA is an index used as a proxy for financing constraints (Hadlock & Pierce, 2010); treated and Policy are defined as before; andXi;t denotes a series of control variables, including cash flow (Cf), debt leverage (Lev), firm age (FirmAge), firm size (Size), growth (Grow), and profitability (ROA). There is a large body of literature examining how financing constraints affect corporate innovation more generally; therefore, this study focused on the impact of green credit policies specifically when examining financing constraints and corporate innovation (Table 10).Mediating effects of financial constraints.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

Table 10 reports the double-difference model estimates of the mechanisms by which green credit policies affect firm innovation. Column 1 contains the regression results for green credit policy effects on firm innovation, and Column 2 contains the regression results for green credit policy effects on financing constraints. The treated×Policy interaction was negative (significant at the 1 % level) for the former and positive (significant at the 5 % level) for the latter. This suggests that the implementation of green credit policies exacerbated financing constraints for heavily polluting manufacturing firms, thereby inhibiting corporate innovation. As an example, the coefficient for the treated×Policy interaction measures 0.015 in Column 2 of Table 10, implying a 1.5 % increase in financing constraints for heavily polluting manufacturing firms after implementation of the Green Credit Guidelines, supporting study hypothesis H2.

Theoretically, green finance policies should catalyze corporate innovation via a push mechanism (the Porter effect); nevertheless, the empirical data presented here indicate that this has not occurred, potentially due to the short-sightedness and cognitive biases of enterprises. Heavy polluters, confronted with demands for environmental compliance, often incur substantial costs for necessary upgrades and alterations. They experience significant short-term operational pressures and must swiftly adhere to regulatory requirements to sustain their operations and production. In the face of these pressures, management opts for a lowest cost compliance strategy to mitigate the risk of fines and shutdowns for noncompliance, thereby ensuring the enterprise's survival. This approach compels enterprises to curtail innovation budgets, select compliance programs that satisfy only minimum standards, and acquire off-the-shelf pollution control equipment rather than investing in the development of new technologies.

A second possible explanation for the negative effect of Green Credit Guidelines on corporate innovation involves technical impediments and substantial transition costs. Research and development cycles for green technology can be protracted, fraught with risk, and characterized by a reliance on outdated, polluting industrial technologies. Tangible obstacles exist to technological conversion; for instance, chemical companies cannot directly upgrade their antiquated equipment to clean technologies, necessitating a complete overhaul of production lines. This results in initial investments exceeding manageable levels, a problem compounded by a lack of support from green credit policies and transitional subsidies; as a result, enterprises must forgo innovation due to insufficient financial backing. When the cost of business financing surpasses the anticipated return on innovation, a direct reduction in innovation investment results.

When green credit policies are enacted as a means of environmental regulation, heavily polluting manufacturing enterprises are forced to reduce investments into technological innovation due to financing constraints. To obtain bank loans, such firms must reduce pollution associated with their operations to meet new environmental requirements and also hit emission reduction targets; the costs of meeting these new standards reduces the funding available for innovation. More critically, green credit policies exacerbate financing constraints for heavily polluting manufacturing enterprises, causing a further reduction in the funds available for innovation and thus leading to the failure of the Porter effect.

Mediating effects of the level of local financial developmentBased on the above discussion of financing constraints, the extent of local financial development (a macro-variable) likely represents an additional mediating variable, suggesting a need for a multidimensional analysis of the mechanisms through which green credit policies influence corporate innovation behavior. Previous publications have clearly shown that local financial development positively impacts corporate innovation behavior. Thus, this study exclusively focused specifically on green credit policy effects on business innovation and financing restrictions. Table 11 displays the results of baseline regressions with financial development incorporated as a mediating variable. The implementation of green credit policies diminished the extent of local financial development.

Mediating effects of the level of local financial development.

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

In Model 1, the treated×Policy coefficient measured −0.029 and was significant at the 1 % level. This aligns with the findings of the prior baseline regression, wherein green credit policies substantially hindered innovation in heavily polluting manufacturing enterprises. This suggests that the detrimental impact of green credit policies on enterprise innovation remained significant even without the inclusion of financial development as a mediating variable. In Model 2, the treated×Policy coefficient measured −0.081 and was significant at the 5 % level, indicating a substantial adverse effect of green credit policies on local financial development. This suggests that green credit hinders enterprise innovation by constraining local financial development, thereby corroborating study hypothesis H3.

Moderating effectsModerating effects of government subsidiesGovernment subsidies may moderate the effects of green credit policies on corporate innovation as illustrated in Table 12. In the regression analysis, the variable Sub had a significant positive effect (1 % significance level). Additionally, the interaction term treated × Policy × Sub was statistically significant (5 % significance level), confirming that government subsidies have a moderating effect on the relationship between green credit policies and innovation. This effect was positive for heavily polluting enterprises, meaning that government subsidies strengthened the inhibitory effects of green credit policies on innovation in these enterprises, further validating study hypothesis H3. One possible explanation is that local governments, may prioritize employment, investment, and other economic outcomes, allocating subsidies to heavily polluting industries instead of enforcing green credit restrictions. This can discourage such industries from innovating and transitioning to more environmentally friendly practices within the green credit system. Furthermore, ongoing efforts to maintain sustainable green credit systems are hindered by significant technical challenges and long term funding gaps, slowing the transformation of heavily polluting enterprises. Additionally, there is a mismatch between short-term, sporadic government subsidies and the long-term nature of innovation and transformation, which may hamper utilization of government subsidies by heavily polluting enterprises to achieve innovative outcomes.

Moderating effects of government grants.

| Variable | (1) |

|---|---|

| treated × Policy | −0.024*** |

| (−2.86) | |

| treated × Policy × Sub | −0.947** |

| (−2.26) | |

| Controls | YES |

| Industry | YES |

| Year | YES |

| N | 23,850 |

| R2 | 0.196 |

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

The moderating effects of government subsidies represent an external factor shaping corporate innovation, while another potential moderator, the level of investment, represents an important internal factor. Here, the level of investment was quantified as the ratio of cash paid for the construction of fixed assets, intangible assets, and other long-term assets to the total assets at the beginning of the period. Regression analysis results are presented in Table 13.

Moderating effects of the level of investment.

| Variable | (1) |

|---|---|

| Innov | |

| treated × Policy | −0.023*** |

| (−3.06) | |

| treated × Policy × Invest | −0.034* |

| (−1.85) | |

| _cons | 0.099*** |

| (17.62) | |

| Controls | YES |

| Industry | YES |

| Year | YES |

| N | 23,850 |

| R2 | 0.179 |

*, **, *** denote statistical significance at the 10 %, 5 %, and 1 % level respectively; () enclose t-values.

In the regression analysis (Table 13), the treated × Policy × Invest interaction was negative, but this was significant only at the 10 % level. This suggests a small but meaningful moderating effect of the level of investment on the relationship between green credit policies and corporate innovation, when compared to the baseline regression results. Incorporating information on investment amplified the inhibitory effects of green credit policies on innovation. This may be because heavily polluting industries often exhibit myopic and prejudiced investment choices in reaction to green financing regulations. Funds may be allocated toward the acquisition of pre-existing equipment and basic facility renovations to achieve minimal environmental compliance, while neglecting investments in R&D initiatives with long-term innovative potential. For instance, chemical companies may invest heavily in conventional exhaust gas purification systems but forgo the advancement of new processes, thereby exacerbating constraints on long-term innovation imposed by green credit policies. Simultaneously, long-term investments necessitate significant capital, and when policy constraints limit financing, enterprises may be compelled to pursue high-cost funding avenues, such as steel companies issuing high-interest bonds. Elevated interest rates consequently diminish funding for innovation, leading to a continuous decline in innovative capacity. Moreover, enterprise investments face a resource mismatch issue, with funds frequently allocated to non-core or inefficient sectors; for example, paper companies might invest in real estate while neglecting R&D for environmental technology. This slows the pace of innovation, further intensifying the detrimental impact of green credit policies.

Conclusions and recommendationsResearch conclusionsTo test for the Porter effect and the financial constraint effect, this study analyzed data from heavily polluting enterprises within the manufacturing sector. Panel data were collected for China's A-share listed manufacturing firms from 2008 to 2022 to investigate how green credit policies have affected corporate innovation. A heterogeneity analysis was also performed to explore how enterprise ownership, geographical location, labor-dependence, market competition, and technology-dependence moderated the effects of green credit programs. Financing constraints were used as a focal point to develop a mediating-effect model to examine the relationship between green credit policy-financing constraints and enterprise innovation activity inputs and to explore the mechanisms by which green credit policies influence corporate innovation. Based on the preceding analysis, the extent of local financial development was also included as a mediating variable. Government subsidies and internal investments were examined as potential moderating variables.

First, this study illustrates that utilizing innovation inputs as a metric of corporate innovation reveals that green credit schemes significantly impede innovation in heavily polluting enterprises, with these results being consistent across multiple tests of model robustness. Second, in the heterogeneity analysis, compared to state-owned enterprises, privately owned, heavily polluting enterprises showed a greater decline in innovation following the implementation of green credit programs. This disincentive to innovation was particularly significant for highly technology-dependent enterprises compared to those that were less technology intensive. Similarly, enterprises in highly competitive markets and those less dependent on human labor were more significantly impacted than those in less competitive spaces or those more strongly reliant on human labor. Finally, enterprises located in the Central Region of China experienced greater reductions in innovation due to policy constraints. Third, evaluation of intrinsic mechanisms driving green credit effects on innovation in heavily polluting enterprises revealed that financial constraint effects exceeded the Porter effect (i.e., heightened financing constraints imposed by green credit policies were the primary driver of declines in innovation). Subsequent mechanistic analyses revealed that the extent of local financial development strongly mediated the impact of green credit policies on corporate innovation activities. Furthermore, government subsidies and greater internal investments exacerbated green credit policy effects. The results of this study offer significant insights for policy formulation.

Policy recommendationsFrom the government’s perspective, established industries (e.g., the chemical sector, iron, and steel) may face more issues concerning perverse incentives and insecure property rights. As a result, certain enterprises, due to local employment and tax pressures, receive a disproportionately high share of subsidies, yet commit <5 % of their budget to investments in green innovation. Current subsidies therefore reflect a bias toward protecting scale over innovation. On average, state-owned enterprises receive subsidies that are 1.8 times greater than those of private enterprises yet only 60 % of the green patent authorizations granted to private firms. This underscores current inequities in subsidy distribution within China. To address these inequities, the implementation of a governmental framework may be useful to quantify the effectiveness of green innovation; this system would prioritize emission reductions (a 5 % subsidy increase for every 10 % reduction in pollutants, e.g., SO₂ and wastewater), innovation quality (a subsidy of 500,000 RMB for each national green patent and double this rate for international patents), and sustained investment in green innovation (i.e., subsidies for green R&D expenditures).

To ensure the effective implementation of green credit policies, as well as to support the transition of heavily polluting firms into more environmentally sustainable entities, the banking sector will require additional oversight and regulation. As green financing has gained traction, prominent commercial banks have generally embraced the use of green loans to bolster environmental initiatives. However, this has not been universally the case. Therefore, regulators must find ways to ensure the banking sector does not obstruct technological advancement in heavily polluting industries, while also fostering environmental conservation. Greater collaboration among financial institutions within a given region in China may facilitate a more balanced distribution of financial resources. To better promote both corporate innovation and environmental conservation, the banking sector may innovate in several areas, including: intellectual property pledge financing (e.g., permitting pledge financing at 60 % of the assessed value), the dynamic valuation of environmental technology patents, and the use of dedicated channels for corporate finance transformation. Offering patent failure insurance could mitigate the risks associated with the geographical concentration of heavily polluting enterprises. Similarly, the formation of a regional financial development fund, which allocated a specific percentage of funding to innovation projects within heavily polluting enterprises, would encourage a more equitable distribution of financial resources. Such an initiative would address local deficiencies in innovation funding and foster both corporate innovation and industrial advancement.

Research outlookComparison of global policy frameworksThis study examined the unique features of China's green credit program, but did not comprehensively compare these to other national programs. Follow-up studies might expand their focus to include multiple nations with well-developed green financial systems, including those belonging to the European Union, as well as Japan and the United States. This would allow for comparisons of implementation approaches (e.g., carbon pricing strategies), incentives (e.g., green bonds and tax concessions), and policy frameworks (e.g., the European Union's Sustainable Finance Classification Scheme), as well as a more complete assessment of green credit policy effects on corporate innovation across diverse institutional contexts. For example, China's bank-centric financial system could be compared to the capital market-centric systems in Europe and the United States. These disparate systems may have different impacts on the efficacy of policy transmission, necessitating data collection from multiple countries to test the ubiquity of financial constraint versus Porter effects. Given the complexity of green credit policy instruments and institutional collaborations, nations may be categorized into single-indicator and multi-indicator types based on administrative directives. Countries employing a multi-indicator approach utilize a blend of approaches to collecting information on incentive-based regulations.

Variation in policy implementation and outcomesComparing nations, differences in corporate ownership structure, financial development, and industry characteristics may strongly influence the efficacy of green credit policies. For example, the financial resilience of state-owned firms in China may counterbalance the negative effects of green credit policies, whereas policy outcomes may vary substantially among privately owned enterprises in Europe and the United States due to the diversity of market-based funding avenues. Future panel data models may investigate how variables such as the nature of enterprise property rights and technological intensity moderate policy outcomes across nations. Furthermore, differences between emerging and industrialized nations, in terms of the environmental regulation landscape and available technological resources, warrant consideration when evaluating the worldwide relevance of threshold effects for green credit schemes.

Analysis of policy spillover effects from a global value chain perspectiveDue to globalization, China's green credit policies may affect the conduct of international corporations via global investment and supply chains. Future studies might examine spillover effects of these policies on corporate innovation among foreign-funded firms in China and Chinese-funded overseas enterprises. For example, it would be interesting to examine potential interactions between the European Union’s Carbon Border Adjustment Mechanism and China's green credit policies in terms of cross-border technological collaborations among enterprises. Similarly, the effects of financial cooperation among countries belonging to the Belt and Road Initiative might be investigated as they pertain to overseas investments by highly polluting Chinese enterprises.

FundingGeneral Project of Social Science Foundation of Jiangsu Province ‘Research on the Influence Mechanism of Artificial Intelligence on the Integration of Advanced Manufacturing Industry and Modern Service Industry in Jiangsu Province (24EYB003)’.

CRediT authorship contribution statementGuanglin Sun: Writing – review & editing, Writing – original draft, Supervision, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Qinyao Feng: Writing – review & editing, Writing – original draft, Software, Methodology, Investigation, Funding acquisition, Formal analysis, Data curation, Conceptualization. Shanshan Wu: Writing – review & editing. Chuanxin Xia: Writing – review & editing, Writing – original draft, Resources, Project administration, Methodology, Formal analysis.