Against the macro background of the digital economy reshaping global value chains, this study empirically examines Chinese A-share listed companies as research samples and finds that digital transformation can significantly enhance enterprise competitiveness. This conclusion remains robust in robustness checks such as Propensity Score Matching (PSM) and instrumental variable methods. Furthermore, four digital transformation pathways are proposed: cultural leadership (CLP), talent development (TDP), capital-driven transformation (CDP), and process optimization (POP). Innovatively adopting Agent-Based Modeling and Simulation (ABMS), a complex adaptive system comprising 200 agents is constructed. Simulation results indicate that the combination of TDP and CDP performs best among all individual and two-policy combinations. In addition, the combination of CLP and CDP exhibits a high effect on enhancing enterprise competitiveness with relatively low-efficiency loss, making it another preferable policy combination for enterprises. This study provides new theoretical paradigms and practical pathways for enterprises to advance digital transformation, offering significant insights into building competitive advantages in the digital economy era.

The global society is undergoing a profound technological innovation, with the emerging digital economy attracting widespread attention from the international community. Since 2015, numerous countries, such as the United States, France, the United Kingdom, and Japan, have introduced and implemented a series of policies to foster the development of the digital economy, accelerating their economic growth. The Chinese government has also elevated the development of the digital economy to a national strategy(Li et al., 2024). According to data released by the National Bureau of Statistics of China, the scale of the digital economy has grown from 2.6 trillion yuan in 2005 to 56.1 trillion yuan in 2023, with its share of GDP increasing from 14.2 % to 44.5 %.

While the thriving digital economy is impacting the global economy positively, it is also reshaping governance models ranging from governments to organizations and enterprises. From national to industry and corporate levels, all compete to advance digital transformation to achieve sustainable and high-quality development. Against this backdrop, research on digital transformation is increasing, and its economic effects are receiving optimum attention. Digital transformation helps create job opportunities, optimizes employment structures (Yu et al., 2024), enhances labor productivity (Song et al., 2022), boosts enterprises' innovation capabilities (Jian et al., 2023; Liu et al., 2024), reduces production costs (Yin et al., 2022), and accelerates industrial transformation and upgrading (Bai et al., 2021), promoting high-quality economic development. Regarding industrial integration and talent employment, Wu and Qi (2022) found that through digital transformation, effective industrial integration between manufacturing and service industries can be achieved. The changes in digital technology have given rise to new economic models, such as the platform economy and the sharing economy, and also positively impacted the improvement of human capital structure and the quality of employment (Wei, 2022). In the research on enterprise competitiveness, scholars have indicated that with the increasing maturity of digital technology, enterprises can transform existing products and services and expand their business models by dedicating more resources and energy to develop new products or services to seize market opportunities (Liu et al., 2023). In addition, digital transformation reshapes the enterprise's value creation model (Chen et al., 2023), all of which enhances the corporate competitiveness of enterprises.

However, the driving effect of this innovative transformational behavior on the high-quality development of firms only applies to some firms, and a significant portion of firms do not benefit from it (Sumbal et al., 2024). Liang et al. (2022) showed a threshold effect of the impact of enterprise digital transformation on long-term corporate competitiveness. In the early stage of transformation, when enterprise management and operation costs are high, the digital transformation would lead to a decline in corporate competitiveness, and with the deepening of the transformation of the grind, management and operation costs gradually reduced, and corporate competitiveness begins to improve.

However, the previous studies have notable deficiencies. First, while there is abundant research on the individual influencing factors of digital transformation and the enhancement of enterprise competitiveness, there is a severe lack of specialized research on the specific pathways through which enterprises can conduct digital transformation to enhance their competitiveness. These pathways only emerge in the conclusion and recommendation sections of studies, and a scientific and standardized research system has not yet been formed. Second, given the scarcity of specialized research on the pathways of enterprise digital transformation, simulation studies on the implementation effects of these pathways are extremely rare, making it impossible to verify the validity of the relevant suggestions proposed by scholars.

Given this, this study delves into the relationship between digital transformation and enterprise competitiveness from both theoretical mechanisms and simulation practices. First, it employs empirical research methods to explore the impact of digital transformation on enterprise competitiveness and verifies the robustness of the impact mechanism using the instrumental variable method and the Propensity Score Matching (PSM) method. Subsequently, four specific paths for digital transformation are proposed, and the implementation effects of individual paths and combinations of multiple paths are simulated. Furthermore, recommendations for selecting digital transformation paths tailored to small and medium-sized enterprises (SMEs) in different industries are proposed, providing a theoretical framework and simulated data reference for enterprises' digital transformation and competitiveness enhancement.

Compared with existing studies, this study’s innovations and marginal contributions are mainly reflected in the following aspects: First, it innovates the research perspective on digital transformation. When exploring the economic effects of digital transformation, this study adopts an analytical perspective focused on enterprise competitiveness, distinguishing itself from current academic theoretical and empirical research on digital transformation conducted from macroeconomic and industry-level perspectives. This enriches the study of the microeconomic effects of digital transformation. Second, there is innovation in constructing multidimensional pathways. Given the current state where literature emphasizes the impact mechanisms of digital transformation but overlooks pathway research, this study proposes four specific pathways for enterprise digital transformation: the culture-leading pathway (CLP), the talent development pathway (TDP), the capital-driven pathway (CDP), and the process optimization pathway (POP). These pathways encompass technological innovations and delve into crucial areas such as corporate culture, human resource management, and capital operations, viewing digital transformation as a comprehensive process involving changes at all organizational levels rather than promoting a single technological application. Third, this paper contributes to the quantitative assessment of the combined effects of pathways. Previous studies mostly focus on comparing a single or a few pathways. In contrast, this study systematically simulates the impact of all possible pathway combinations on enterprise competitiveness using the ABMS method, revealing synergies among pathways. It also provides empirical guidance and strategic recommendations for enterprises on selecting and implementing digital transformation pathways efficiently under resource constraints.

Theoretical model and research assumptionsDigital transformation and corporate competitivenessDigital transformation is a strategic means by which firms integrate digital technologies into their business models and ecosystems to facilitate business growth (Li et al., 2022). At its core lies the use of digital technologies to reconfigure business processes and organizational structures. Haes and Grembergen (2013) emphasize the dual role of digital technologies in facilitating corporate strategy. They not only support the implementation of current strategies but also provide the necessary technical support base for the research and deployment of new ones. Specifically, by systematically collecting, processing, and analyzing information, firms can gain comprehensive and accurate business insights, which provide the basis for data-driven decision-making in strategic planning and execution. In addition, the integrated application of information technology improves the effectiveness of communication, collaboration, and supervision within the enterprise and enhances the organization's adaptability and responsiveness, thus demonstrating higher efficiency and effectiveness in implementing, adjusting and reforming strategies. The deep integration of digital technologies, such as big data and blockchain, with business operations and management has enabled the emergence of new operational processes, organizational structures, and corporate strategies. Although this may bring challenges to enterprises, by grasping the opportunities and facing the difficulties, digital technologies bring significant business value to enterprises. With the continuous development and innovation of digital technology, the ability of enterprises to handle unstructured data has increased in scope, depth, and frequency, which not only brings about an accelerated flow of information within the enterprise but also shifts the governance structure of the enterprise to be learning-oriented. The reshaping and updating of the internal structure of the enterprise not only improves the level of internal control and ensures orderly operations but also enhances the scientific and effective implementation of strategy, production quality, and safety management, thus steadily improving the enterprise’s performance.

In addition, based on the theory of information asymmetry, digital transformation increases the openness of corporate information and externally reinforces investor trust and evaluation, easing the financing constraints faced by enterprises and contributing to the growth of corporate performance. Simultaneously, if the large amount of data that enterprises generate during production and operation is effectively utilized, it would unlock the additional benefits of information. However, in reality, this data is often not effectively utilized owing to various constraints. Digital transformation effectively solves this problem by enhancing data analysis and processing capabilities with the help of data technology, which realizes the conversion of data into effective information that can reflect the internal situation of enterprises(Changalima et al., 2025). After this information is transmitted to the market, it can enable the market to understand the production and operation status of enterprises faster and more comprehensively, improve the disclosure level of information between enterprises and external investors, and alleviate financing constraints (Wu et al., 2021). Further, the deep interaction and integration of digital technology with traditional industries is fundamentally changing the basic logic and mode of business operations. For example, under increasingly competitive and unstable market conditions, the manufacturing industry is gradually undergoing a digital transformation to enhance the efficiency of R&D, production, and distribution with the help of information technology. Concurrently, the comprehensive use of big data to analyze the product development process has led to the efficient integration of people and data, thereby significantly contributing to a company's R&D innovativeness and increasing its competitiveness in the market (Stundziene et al., 2024; Zastempowski, 2024). Furthermore, by reconstructing its business model, the company can significantly compress its response time to market changes, optimize its operational effectiveness while improving its competitiveness, and consequently incentivize revenue enhancement. In summary, this study proposes the following hypotheses:

H1. Digital transformation significantly improves corporate competitiveness.

We selected the companies listed in the A-share market from 2012 to 2022 as the research object. Since the 18th Party Congress in 2012, informatization has been officially listed as one of the priorities in the national development strategy, forming the strategic layout of the “New Four Harmonization.” Subsequently, China has gradually implemented several policies to promote the development of the digital economy. Given this background, the dissertation chose 2012 as the starting time of the research sample and conducted the following processing of the selected sample data:

- (1)

Delete sample data that are primarily engaged in the financial services business;

- (2)

Deletion of sample data of total assets less than total liabilities;

- (3)

Delete sample data for STs with irregular listing status;

- (4)

Retaining sample data that is not missing for at least 5 consecutive years;

- (5)

Do an indentation of the data by 1 percent above and below.

Among them, the financial data were obtained from the Cathay Pacific database, and the annual reports of listed companies were obtained from the Juchao Information Network. After screening and processing, 26,172 valid observation samples were obtained, providing a solid data foundation for the subsequent analysis.

Variable setting(1) Explained variables

The explanatory variable firm corporate competitiveness is measured by return on total assets (ROA), which is the efficiency with which a firm utilizes its total assets to generate net income. Therefore, it is expressed by the formula 1:

(2) Explanatory variables

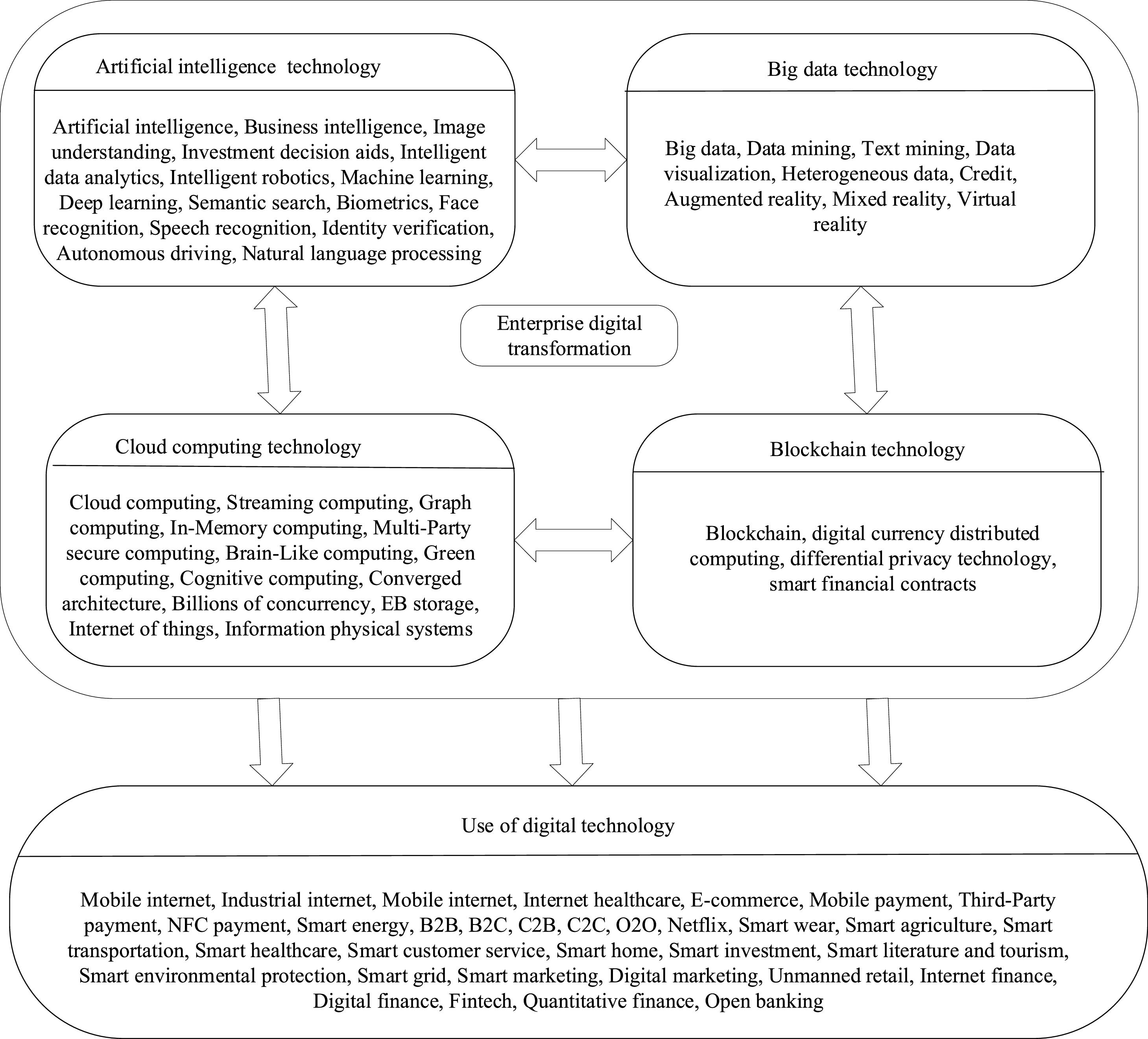

Enterprises digital transformation explored in the dissertation is built on advanced digital technologies, including but not limited to artificial intelligence, blockchain, cloud computing, and big data, collectively referred to as “ABCD” technologies (Qi et al., 2020). This conceptual framework provides a theoretical foundation for the study to measure enterprise digital transformation. Drawing on the research of Wu et al. (2021), the dissertation quantifies the frequency of keywords related to digital transformation through text analysis, constructing an index to measure the comprehensive intensity of enterprise digital transformation by aggregating and log-transforming these frequency data.

An enterprise's annual report is a significant tool that reflects the results of the operation and foretells its future direction. Therefore, information about digital transformation in annual reports can be seen as a reflection of an enterprise's active transformation. Companies that frequently mention digital transformation are likely to be more active in the transformation process. Rather than using a binary variable to indicate whether a firm has undergone digital transformation, it is more convincing to use the frequency of occurrence of relevant feature words in annual reports as a measure. To quantify the extent of firms' digital transformation, this study first established a digital transformation indicator system based on the relevant terms provided in the literature by Wu et al. (2021) (see Fig.1). Second, annual financial reports of all listed companies from 2012 to 2022 were collected from the official websites of Shenzhen and Shanghai stock exchanges. Finally, Python software was utilized for text processing, including word root recognition, matching, and counting. In this process, expressions containing negative prefixes such as “didn't,” “no,” etc., were excluded, and the final word frequency counts were logarithmically transformed (taking the logarithm after adding 1) as a way to get a quantitative indicator to measure the digital transformation of the enterprise.

(3) Control variables

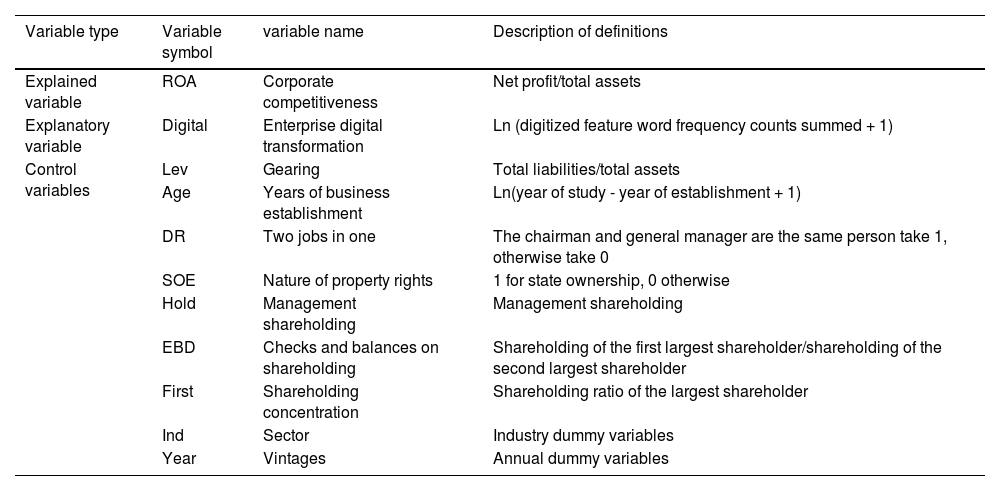

Drawing on previous studies, the control variables are mainly chosen to be gearing ratio, firm's year of establishment, two job titles, nature of ownership, management shareholding, equity checks and balances, and equity concentration. Industry and year dummy variables are also introduced to control for industry and year fixed effects. Specific variables and descriptions are shown in Table 1.

Definition of variables.

To study the relationship between digital transformation and the corporate competitiveness of enterprises, the study constructs a two-way fixed effects model as follows:

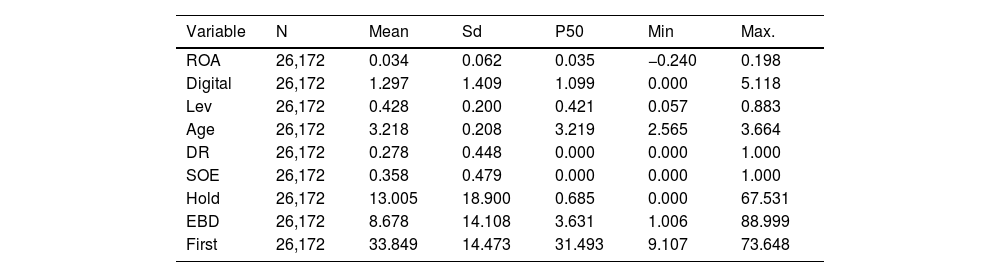

whereirepresents the firm, thetrepresents the year, and the explanatory variableROAi,trepresents the firstiyear of the company'styear's corporate competitiveness;Digitali,tis the core explanatory variable, representing the intensity of digital transformation of the firm.β0is the constant term, which is the regression coefficient of digital transformation on corporate competitiveness, andControlsi,tis a series of control variables usingInd andYear controlling for year and industry fixed effects, the ϵi,t is a random stochastic error term, with variables specifically defined in Table 1.Empirical analysis and hypothesis testingDescriptive statisticsTable 2 shows the descriptive statistics results; the mean value of corporate competitiveness (ROA) is 0.034, with a range of fluctuations from −0.240 to 0.198 and a standard deviation of 0.062. This data indicator reveals a certain degree of variance in the corporate competitiveness of different listed companies. Digital transformation (Digital) has a mean value of 1.297, with minimum and maximum values of 0 and 5.118, respectively, and a standard deviation of 1.409, suggesting that the listed companies in the sample exhibit a high degree of heterogeneity in their digitalization process and that some have not yet embarked on digital transformation. The mean value of the gearing ratio (Lev) is 0.428, with a minimum value of 0.057 and a maximum value of 0.883, showing that the sample firms, as a whole, possess a low debt burden. The mean value of Dual Role (DR) is 0.278, indicating that about 72 % of the sample firms have achieved separation of the Chairman and Managing Director positions. The mean value of the nature of ownership (SOE) is 0.358, and the median is 0.479, indicating that state-owned firms account for a lower proportion of the sample than non-state-owned firms. The statistical values of the other four control variables also show that the sample firms have large differences in the number of years of establishment, management shareholding, equity checks and balances, and equity concentration, which are also important variables affecting the individual value of listed firms.

Descriptive statistical results.

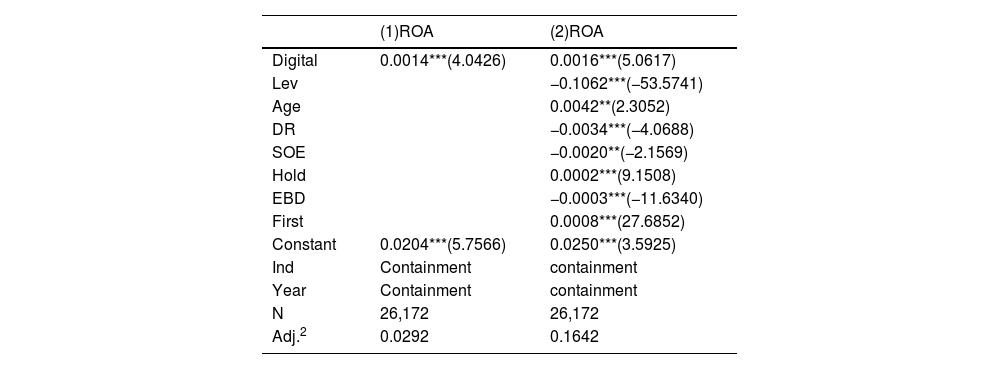

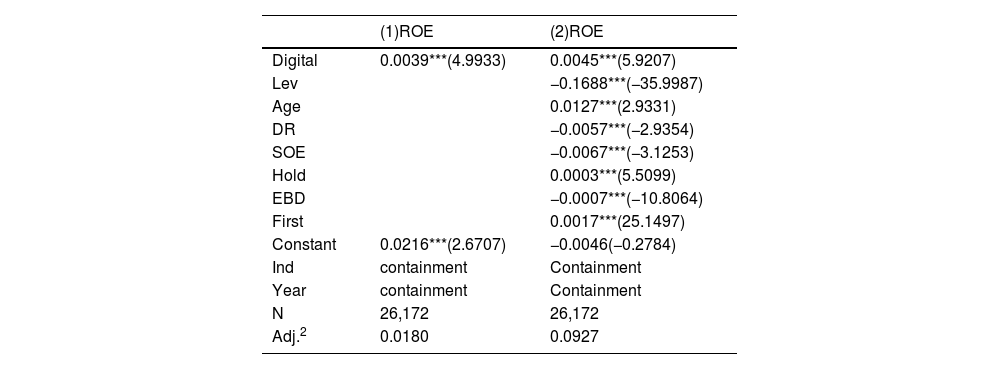

In analyzing the relationship between firms' digital transformation and corporate competitiveness, Table 3 presents the results of the corresponding regression analysis. Column (1) of the model considers industry and year fixed effects, while column (2) further incorporates firm-level control variables. Comparing the results of these two models, it can be seen that when no other control variables are included, the model's adjusted R2 is 0.0292, indicating that the explanatory variables explain corporate competitiveness to a lesser extent. However, when additional control variables are introduced, the adjusted R2 significantly improves to 0.1642, indicating that the selected control variables enhance the model's ability to explain the corporate competitiveness of the firms significantly. In column (1), the coefficient of Digital transformation (Digital) is 0.0014 and passes the significance test at a 1 % confidence level, which initially reveals a significant positive relationship between the two. In column (2), even after controlling for other variables, the positive effect of Digital transformation (Digital) on corporate competitiveness (ROA) remains significant at the 1 % level, which further confirms hypothesis H1. Notably, the regression coefficient of the degree of digital transformation increases slightly from 0.0014 to 0.0016, and the t-value also increases from 4.0426 to 5.0617, indicating that the addition of control variables did not significantly change the magnitude of the regression coefficients of the original variables and their significance levels. This stability indicates that the omission of key variables in the modeling setup is less likely to lead to estimation bias, strengthening the credibility of the study's conclusions.

Benchmark regression analysis.

Note:***, **, and * indicate 1 %, 5 %, and 10 % significance levels, respectively.

The establishment of H1 also aligns with the findings of many scholars. Huang et al. (2023) indicate that digital innovation enhances enterprise performance by boosting labor productivity, reducing operational costs, and strengthening competitive advantages, thereby increasing corporate competitiveness. Xu et al. (2024) argued that digital transformation increases the quantity and quality of corporate innovation and improves the ability to control financial and capital costs. These enhanced capabilities help enterprises achieve higher outputs at the same investment level. Wang et al. (2023) indicate that digital transformation can amplify a company's ability to adapt to market changes, facilitate internal knowledge sharing and dynamic transfer, and bolster corporate vitality, which is conducive to sustainable development and subsequently enhances corporate competitiveness. Additionally, multiple studies have shown that digital technology can improve information transparency and data availability, facilitate changes in corporate governance, and enhance the quality of corporate information and internal controls (Li et al., 2024). By strengthening internal controls and influencing internal management mechanisms (Cui et al., 2023), companies can flexibly respond to unforeseen events in daily operations and improve their resilience to risks (Zhao, 2024). Numerous studies have directly or indirectly emphasized the crucial role of digital transformation in enhancing corporate competitiveness.

Robustness check(1) Substitution of explanatory variables

In the dissertation, further to test the robustness of the study findings, a regression was conducted again using return on equity (ROE) instead of ROA while keeping all other conditions unchanged. The regression results are presented in Table 4, which shows that the coefficient of Digital transformation (Digital) is consistently positive before and after including control variables in the model and passes the significance test at the 1 % confidence level. This finding strongly supports the research hypothesis H1 of the thesis, that is, digital transformation is positively related to corporate competitiveness with a high degree of robustness.

Table 4.Regression results with replacement of explanatory variables.

Note: ***, **, and * indicate 1 %, 5 %, and 10 % significance levels, respectively.

(2) The PSM

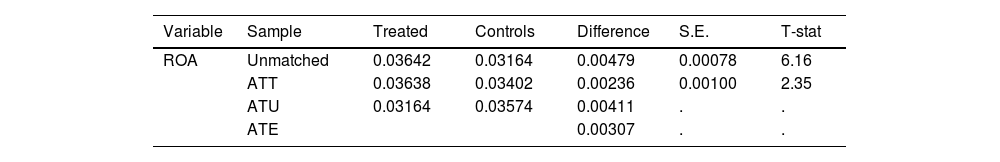

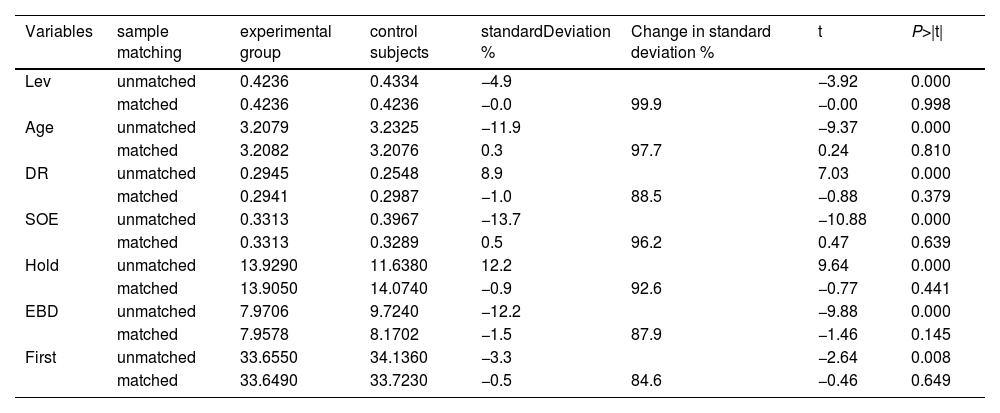

To address the potential issue of sample self-selection bias, control for unobservable factors that may influence a firm's decision to adopt digital transformation, and more accurately assess the causal effect of digital transformation on a firm's competitiveness, this study conducts an in-depth endogeneity test using the PSM method. Drawing on Hou et al. (2022), this study categorizes the full sample based on whether the firms have implemented digital transformation or not and selects Lev, Age, DR, SOE, Hold, EBD, first, as matched covariates, control group firms with similar characteristics to those of the treatment group, that is, firms that have implemented digital transformation, are found for the treatment group, in other words, firms that have implemented digital transformation, through the nearest-neighbor matching method.

The results for the Average Treatment Effect (ATE) are presented in Table 5. Before matching, significant differences were present in the covariates between the treatment and control groups. However, after 1:1 matching, the differences between the two groups were substantially reduced. The results in Table 6 further indicate that PSM effectively eliminated the differences in characteristics between digital transformation and non-transformation firms.

Balance test.

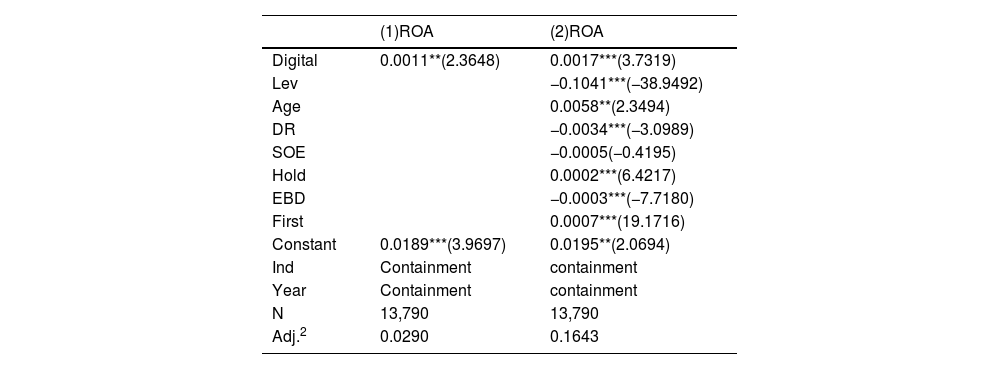

Then, the PSM-matched data are regressed, and the regression results are shown in Table 7. In column (1), after controlling for time and industry effects, the estimated coefficient of digital transformation (Digital) is 0.0011, which passes the significance test at the 5 % confidence level, indicating that digital transformation has a significant positive impact on firms' corporate competitiveness. Column (2) adds other control variables to column (1), and the results show that digital transformation (Digital) remains significantly positively related to corporate competitiveness (ROA) and passes the significance test at the 1 % confidence level. This finding demonstrates the robustness of the findings even after controlling for sample self-selection bias.

(3) Instrumental variables approach

PSM matched basic regression results.

Note: ***, **, and * indicate 1 %, 5 %, and 10 % significance levels, respectively.

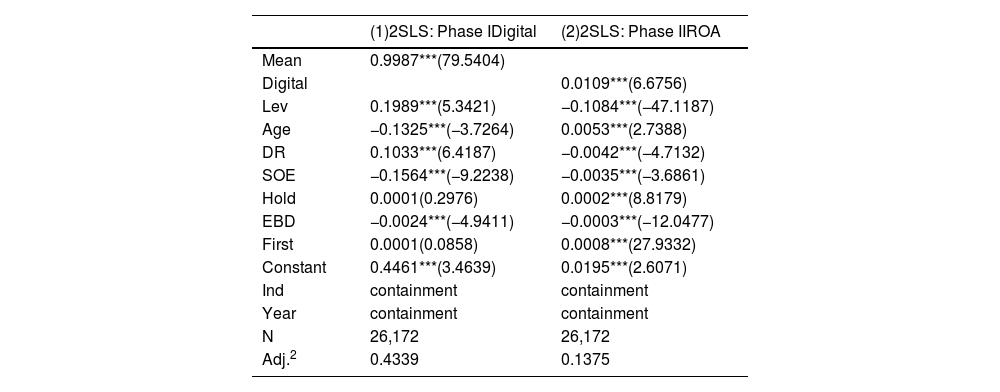

The early stages of an enterprise's digital transformation are usually accompanied by significant investment in digital infrastructure, which places stringent demands on the enterprise's financial position. Enterprises with excellent corporate competitiveness tend to have healthier cash flows and, therefore, have relatively fewer financial constraints on digitalization, making them competent in advancing their digitalization processes. As the transformation deepens, the efficiency of many aspects of an enterprise's production, management, and sales is improved, further contributing to the growth of its corporate competitiveness. Thus, a bidirectional causal relationship may exist between a firm's digital transformation and corporate competitiveness. To address this issue, this study draws on Chen and Deng (2022) study, adopts the mean (Mean) of the degree of enterprises’ digital transformation in the same industry and the same year as an instrumental variable, and conducts an endogeneity test by the two-stage least squares method. The regression results are shown in Table 8.

Instrumental variable test results.

Note:***, **, and * indicate 1 %, 5 %, and 10 % significance levels, respectively.

As shown in Table 8, in the first-stage regression, the coefficient of the instrumental variable (Mean) is 0.9987, which passes the significance test at the 1 % confidence level and also passes the weak instrumental variable test (F-statistic is greater than 10), proving that the instrumental variable selection is reasonable. In the second-stage regression, the estimated coefficient of Digital Transformation (Digital) corrected using instrumental variables is 0.0109, which still passes the significance test at the 1 % confidence level, indicating that the robustness of the research findings is further validated after controlling for endogeneity issues.

Other perspectives on mechanism researchThis study investigates the impact mechanism of digital transformation on corporate competitiveness using Chinese companies listed on the A-share market between 2012 and 2022 as the research subject. To explore the universal applicability of this impact mechanism, the research findings are compared with relevant studies from other countries and different markets. The comparisons reveal that digital transformation plays a role in enhancing corporate competitiveness across companies in various economic systems and industries. Tortora et al. (2021) conducted a quantitative study on a sample of 210 company managers in Italy, which showed that digital transformation altered the way companies conduct business and manage relationships, blurred the boundaries between stakeholders, enhanced corporate knowledge acquisition and information exchange capabilities, bolstered digital innovation capabilities, and consequently improved corporate competitiveness. Hirvonen et al. (2020) studied Finnish SMEs in the manufacturing sector in the South Ostrobothnia region. The authors found that those SMEs that underwent digital transformation earlier and possessed stronger digital capabilities had a stronger ability to leverage information systems in the market, gaining a greater advantage and stronger corporate competitiveness. Ferreira et al. (2019) researched 938 companies from various regions in Portugal across agriculture, extractive industries, manufacturing, construction, and services, discovering that digital transformation significantly boosts corporate innovation capabilities and performance. Companies that adopted new digital processes exhibited a notably higher number of innovations in products or services, stronger innovation capabilities, faster business growth, and thus greater corporate competitiveness. In a study of 2156,360 European SMEs, Scuotto et al. (2021), found that enhancing employees' digital literacy could promote SMEs' growth and innovation performance. This result emphasizes the impact of digital transformation in personnel training on corporate competitiveness from the human resource perspective.

Several scholars have discussed other external factors that influence enterprises. To ensure clarity in the research mechanism and refinement of the model, this study does not incorporate other external factors into the theoretical framework but discusses their impacts in the form of a review.

Regarding social factors, the evolution of social structure has driven the digital transformation process in enterprises. On the one hand, the continuous decline in the working-age population triggers an urgent need for enterprises to reconstruct efficiency. Under the pressure of rising labor costs and widening skill gaps, enterprises accelerate the deployment of automation equipment and intelligent management systems to replace traditional labor-intensive models. This substitution not only occurs in manufacturing but is also extending into the service industry. On the other hand, population aging is driving bidirectional changes on both the demand and supply sides: from the demand side, an aging society generates structural demand for digital services such as telemedicine and smart elderly care devices; from the supply side, enterprises need to use digital tools to bridge the knowledge transfer gap caused by the rising proportion of older employees. These factors prompt enterprises to use digital technology, produce digital products and services, and enhance their market share. Additionally, cultural dimensions are influential, as reflected in the iteration of consumption habits and technological cognition. Younger generations' natural adaptability to digital interactions forces enterprises to reconstruct customer touchpoints. The prevalence of social media and mobile payments pushes traditional enterprises to establish digital service systems, while society's focus on data privacy and algorithm ethics urges enterprises to build compliance frameworks concurrently during their digital transformation.

Economically, the uncertainty of macroeconomic cycles strengthens enterprises' intrinsic motivation to achieve cost efficiency through digitization. During economic downturns, enterprises are more inclined to adopt asset-light technology architectures, such as cloud computing, to replace traditional IT infrastructure, optimize resource allocation efficiency, and maintain competitiveness. From the consumer demand perspective, the exponential growth of personalized demands forces enterprises to build flexible production capabilities. Enterprises increasingly apply digital technology in acquiring market demand information, customizing production plans, and arranging production schedules to enhance efficiency and reduce costs, thereby promoting the transition from mass standardized production to small-batch customized manufacturing through digital means. The deepening of the global competitive landscape also drives enterprises to leverage digital technology to transcend geographical boundaries and gain advantages in international competition. For example, multinational enterprises establish distributed supply chain networks using blockchain technology, reducing cross-border transaction costs while enhancing supply chain resilience.

Technologically, the rapid development of basic technologies and the continuous decline in computing costs have made digital technology solutions, once limited to theoretical levels, increasingly commercially feasible. Many emerging technologies entering the market through software and hardware significantly lower the barriers for enterprises to access technology. The multiplier effect of technological combination innovation can help enterprises overcome long-standing difficulties. For instance, the combination of 5G's low latency and edge computing enables closed-loop control for predictive maintenance of equipment in manufacturing. Integrating blockchain and the Internet of Things (IoT) solves the challenge of trust transmission in supply chains. These developments have significantly increased enterprises' favorability and willingness to introduce digital technology. Introducing digital technology enhances operational efficiency, freeing employees from trivial structured tasks, allowing them more time to address unstructured tasks and learn new technologies to improve their competitiveness. In this process, enterprises gradually form a deep dependence on technology, forcing them to continue introducing new digital technologies and deepening their digital transformation process.

In summary, governments, society, the economy, and technology are directly or indirectly promoting and guiding enterprises to enhance their competitiveness through digital transformation. Digital transformation is an irreversible and inescapable trend for enterprises.

Proposal of digital transformation pathways and simulation of their effects on enhancing enterprise competitivenessDigital transformation pathwaysPrevious research findings indicate that digital transformation significantly enhances enterprise competitiveness. In operational practice, enterprises need to identify digital transformation pathways that align with their resources and strengths. Therefore, the following four digital transformation pathways are proposed, and simulations of their effects on enhancing enterprise competitiveness are conducted to explore reasonable and effective pathway combinations, providing data support for enterprises in selecting their digital transformation pathways. The four digital transformation pathways are:

The Cultural Leadership Path (CLP) focuses on digital transformation at the enterprise culture level to lay a solid foundation for digital transformation through cultural change. When implementing this path, enterprises should start with top leadership by clarifying the vision and goals of digital transformation and integrating them into the core values of their corporate culture (Chen et al., 2024). For this purpose, enterprises should conduct multi-level and multi-form internal training and seminars, inviting industry experts, technical consultants, and internal digital pioneers to share successful experiences and cutting-edge trends in digital transformation, so that all employees deeply understand the importance and necessity of digital transformation (Bai et al., 2024). Meanwhile, by establishing an innovation reward mechanism, a culture of tolerance for failure, and regular innovation project incubation activities, employees are encouraged to try new technologies and methods actively, viewing “trial and error” as an inevitable path to innovation, stimulating the enthusiasm and initiative of all employees to participate in digital transformation (Uchida et al., 2024).

Regarding resource requirements, enterprises need to invest specific human resources in organizing training and seminars and inviting external experts for guidance. Simultaneously, corresponding training facilities and platforms are required to support the dissemination and promotion of digital culture. In addition, the continuous advancement of corporate culture construction requires sustained capital investment for promotional activities, incentives, and cultural development activities to ensure that the digital culture takes root and deepens within the enterprise. However, some issues may occur during the implementation of this path. When top-level cognition and execution are inadequate, and management only pays lip service to cultural transformation, it can become a mere formality. Second, there may be conflicts between traditional organizational culture and the open, trial-and-error spirit required for digitization. Middle-level managers may respond negatively due to changes in the power structure, while grassroots employees may feel anxious owing to insufficient skills or changes in work patterns, leading to resistance to change. Therefore, when adopting this path, enterprises need to supervise the execution of senior executives and manage conflicts and changes effectively.

The CLP represents a transformation at the consciousness level of enterprises, which is relatively abstract. In the process of measurement and control, this abstract pathway can be transformed into the cultural symbol penetration rate. Specific measurement indicators can include the coverage rate of digital-themed visual identity in office spaces and the density of digital keywords in annual public speeches by corporate executives.

Given the innovative and abstract nature of the CLP, Renhe Pharmaceutical’s is used to demonstrate its effectiveness. Renhe Pharmaceutical is a typical representative of traditional pharmaceutical manufacturing enterprises. Adopting a cultural leadership approach has driven systematic changes within the enterprise and achieved remarkable accomplishments in digital transformation. The company has established a service-centric value system. Through a dual leadership model, combining transformational and transactional leadership, Renhe Pharmaceutical has motivated all members to actively embrace digital service value propositions, successfully overcoming the challenge of organizational inertia during the transformation process and facilitating its transition from a traditional manufacturer to a digital service provider. Additionally, the company has established health records and databases for users through digital means, explored more ways to connect and communicate with consumers, and further strengthened its user-centric service culture. Implementing the CLP has yielded significant results for Renhe Pharmaceutical. Leveraging digital transformation, the company has built a solid and comprehensive service chain, formed a powerful integrated supply chain advantage, and significantly enhanced its market competitiveness (Dong et al., 2021). The digital transformation practices of this enterprise fully demonstrate the feasibility and effectiveness of the CLP.

The Talent Development Path (TDP) emphasizes digital transformation at the employee development level, aiming to build a versatile talent team that meets the needs of digital transformation. Enterprises should develop comprehensive and systematic employee training plans covering digital curriculum systems from basic to advanced, including but not limited to training in key digital skills such as data analysis, cloud computing technology, and artificial intelligence applications (Bai et al., 2024; Ye et al., 2024). Specifically, enterprises can integrate internal and external training resources to build a combined online and offline learning platform, providing employees with flexible and diverse learning opportunities through online courses, workshops, practical exercises, and other forms. Establish a continuous learning mechanism by encouraging employees to participate in industry certification exams to obtain relevant professional qualifications and linking learning outcomes with career advancements and performance evaluations to motivate employees to enhance their digital capabilities continuously. In addition, enterprises need to strengthen cross-departmental collaboration and communication, promote the integration of business and technical talents, and cultivate versatile talents who understand business and technology to provide solid talent support for digital transformation (Li et al., 2024).

The resource requirements for the TDP focus on the development and procurement of training courses, the establishment and maintenance of learning platforms, and the invitation and cooperation with external experts (Zhang et al., 2024). Concurrently, the human resources department needs to invest more effort in evaluating training effectiveness and planning talent development to ensure the effective utilization of training resources and the continuous improvement of talent capabilities. During the implementation of this path, the first potential issue to note is the disconnection between training content and business needs. If digitalization courses are overly theoretical or not designed specifically for the enterprise's context, it can lead to a separation between learning and application. Second, talent loss and incentive failure also deserve more attention. After training composite talents, they may be poached by competitors offering higher salaries. Moreover, if internal promotion channels within the enterprise are not linked to digital skills, it can diminish employees' motivation to learn. Therefore, enterprises need to align training content with business needs and manage talent retention effectively, such as by forming a stable psychological contract with talents before and after training, providing opportunities for promotion or salary incentives, and enhancing their loyalty to the enterprise.

The TDP is also relatively abstract. To facilitate monitoring and control, it can be embodied in the metric of digital capability conversion rate, measured by the coverage of digital skill certifications among key position employees, the frequency of digital skill application after receiving digital training, and the performance improvement rate.

Given the innovative and abstract nature of this pathway, Midea Group is used as a case to illustrate its effectiveness. Midea Group, in collaboration with the Ministry of Industry and Information Technology, has formulated digital talent standards for the manufacturing industry and established a related training system to enhance the digital capabilities of all employees. As of 2023, over 160,000 person-times at Midea Group have taken digital-related courses, and nearly 20,000 individuals have obtained digital talent certifications. The proportion of business personnel with Python data analysis capabilities has increased from 12 % in 2020 to 58 %. These digital talents have produced >3800 innovation cases, with a 19-percentage-point increase in product demand forecasting accuracy, saving the enterprise over 100 million yuan in operating costs within a year (Xiang et al., 2022). This demonstrates that the TDP is feasible and effective during enterprise digital transformation.

The Capital-Driven Path (CDP) emphasizes providing sufficient momentum for enterprises' digital transformation by rationally allocating capital resources. Enterprises should view digital transformation as a long-term strategic investment, incorporating it into their overall strategic planning, and formulating budgets scientifically and reasonably to ensure that key digital projects receive adequate funding (Zhou et al., 2023). Therefore, enterprises should establish dedicated special funds for digital transformation, used for critical areas such as technology research and development innovation, high-end talent recruitment, cooperative research and development projects, and digital infrastructure construction. Establish a flexible and scientific investment evaluation mechanism to periodically evaluate and review the progress, effectiveness, and return on investment of digital projects, promptly adjust investment strategies, optimize resource allocation, and ensure the effectiveness and efficiency of capital investment (Yu et al., 2024).

Regarding resource requirements, first, a professional financial team and project management team are needed to handle budget preparation, fund allocation, and investment benefit evaluation for digital transformation projects. Second, good cooperative relationships with financial and venture capital institutions need to be established to expand financing channels and provide diversified financial support for digital transformation. During the implementation of this path, attention should be paid to the issues of short-sightedness and blindness in fund allocation to avoid investing heavily in hardware procurement while neglecting software system integration and talent adaptation, leading to a situation where assets are valued more than operations. Additionally, the formalization of investment evaluation mechanisms should be avoided. If enterprises only evaluate projects based on technological advancement rather than business value, it can result in numerous “vase-like” innovations, causing a waste of funds and time.

The SMEs may face difficulties implementing the CDP due to insufficient funds. This issue can be addressed through the following methods: by expanding diversified financing channels, such as applying for special loans for digital transformation from banks and other financial institutions, and fully leveraging platform-based products to accelerate digital transformation. For instance, SMEs can utilize cloud-based deployment platforms like the IMS to establish digital management processes, thereby saving substantial costs in purchasing expensive hardware equipment or conducting complex system installation and configuration.

The Process Optimization Path (POP) focuses on digital transformation at the enterprise business process level, aiming to improve operational efficiency and collaboration capabilities through technology application and process reengineering. Enterprises should fully utilize cutting-edge technologies such as cloud computing, big data, and the IoT to comprehensively review and deeply optimize existing business processes, identifying and eliminating inefficient links and redundant steps (Tian et al., 2023; Wang et al., 2024). For example, implementing deep integration of Enterprise Resource Planning (ERP) and Customer Relationship Management (CRM) systems to break down data barriers between departments, enabling real-time data sharing and seamless business process integration; promote Robotic Process Automation (RPA) technology to automate repetitive and regular business processes, improving business processing efficiency and accuracy while reducing human errors; introduce artificial intelligence-assisted decision-making systems to provide scientific and precise decision-making support for enterprise management based on big data analysis, further enhancing the enterprise's operational management level and market competitiveness (Sjödin et al, 2023).

The resource requirements for this path focus on purchasing and deploying advanced digital technology platforms and systems, such as ERP, CRM, RPA, and AI tools. Additionally, a professional technical team is required to handle system implementation, maintenance, and upgrades and provide relevant technical training for employees to ensure the effective implementation of technology applications. The business process reengineering and organizational structure adjustments involved in the process optimization may also require corresponding human resources and management efforts to ensure a smooth transition. The issues to note when implementing this path relate to the organizational fit of technological tools. Impulsively introducing systems such as ERP and RPA may lead to incompatibility due to the high complexity of the enterprise's original processes. Moreover, data silos and cross-departmental collaboration barriers also deserve attention. Inconsistent data standards and unreasonable permission allocations among departments may significantly diminish the effectiveness of system integration. Therefore, it is crucial to introduce digital and intelligent systems compatible with the enterprise's business processes and ensure effective cross-departmental collaboration. Establishing unified data standards within the organization, enhancing information communication, and allocating permissions reasonably are essential.

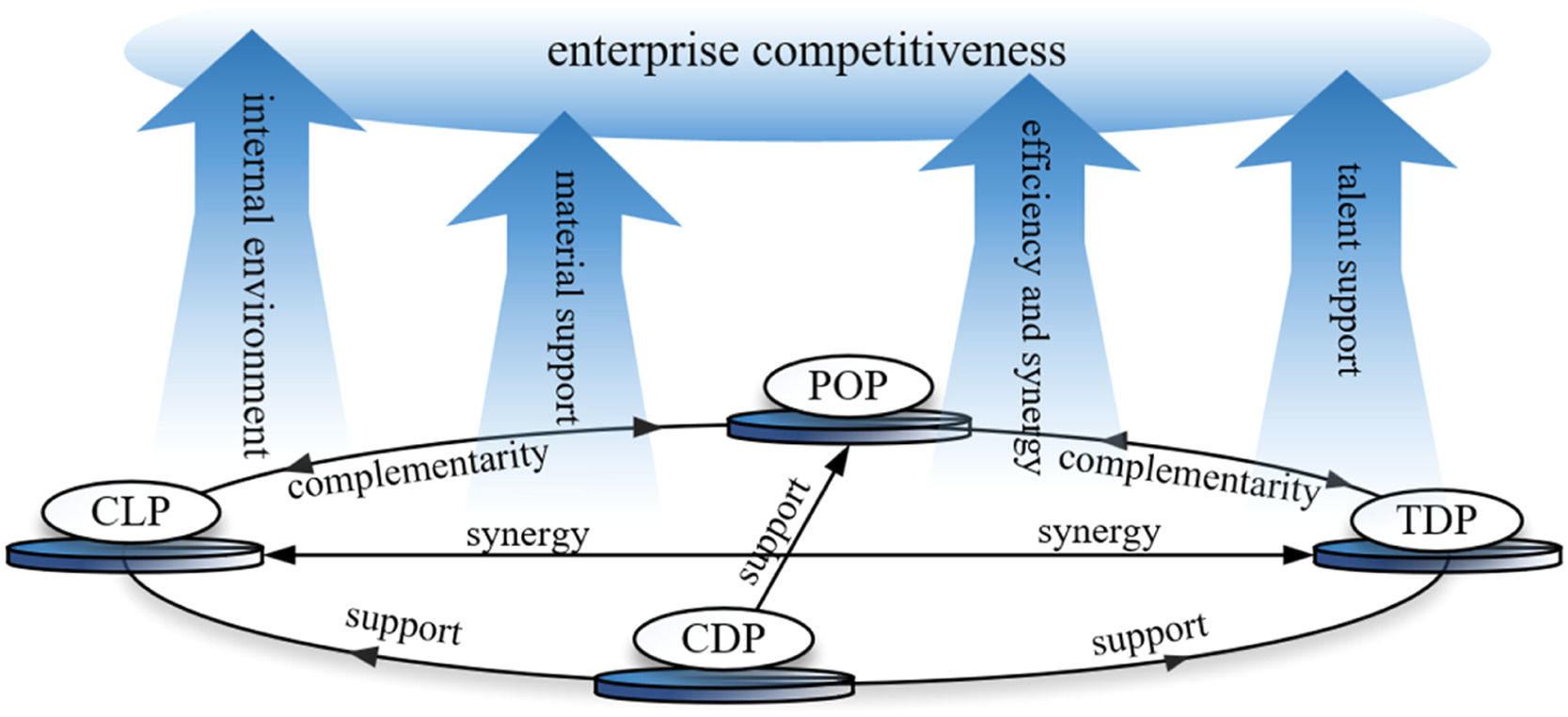

The four pathways mentioned above do not exist in isolation but interact and reinforce each other (see Fig. 2). A synergy exists between the CLP and the TDP. Through the CLP, enterprises can create a digital cultural atmosphere that encourages innovation and tolerates failure, stimulating employees' enthusiasm and initiative and making them more willing to embrace the challenges and changes brought about by digital transformation. The TDP, nonetheless, optimizes the talent structure, enabling employees to better adapt to the requirements of the digital culture.

The CDP provides the necessary financial support for implementing the other three pathways. Whether it's the establishment of technology platforms, the cultivation and introduction of talent, or the organization of cultural activities, they all require capital support. The CDP ensures precise investment in key areas of digital transformation by rationalizing budget planning, setting up special funds, and establishing investment evaluation mechanisms.

Complementarity exists between the POP and both the CLP and TDP. Process optimization provides a practical platform and application scenarios for the CLP and TDP. For example, by optimizing processes, enterprises can better demonstrate the tangible benefits of digital transformation, thereby enhancing employees' identification with and participation in the digital culture. Concurrently, optimized processes offer employees more opportunities to engage with and apply new technologies, supplementing their digital skills. Furthermore, the implementation effects of the POP can intuitively reflect the effectiveness of an enterprise's digital transformation, providing robust evidentiary support for the continuous advancement of the CLP and TDP, further strengthening internal confidence and determination towards digital transformation.

The synergistic effect among the four pathways also manifests in their collective impact on enhancing corporate competitiveness. The CLP creates a favorable internal environment for digital transformation, the TDP provides strong intellectual support, the CDP offers solid material guarantees, and the POP improves operational efficiency and coordination capabilities. These four pathways interact and reinforce each other, forming an organic whole that jointly drives the enterprise's digital transformation process, achieving a comprehensive enhancement of corporate competitiveness.

However, since implementing each pathway requires significant resources, enterprises may face challenges of significantly increased resource pressure when comprehensively advancing all four pathways. In addition, the synergistic relationships among the pathways can lead to certain efficiency losses, resulting in situations where “1 + 1 < 2.” Therefore, enterprises should fully assess their resource strengths and weaknesses and select suitable pathways flexibly for advancement based on their actual situations. Subsequent simulation processes will demonstrate the implementation effects of each viable pathway and its combinations, providing a scientific basis for enterprise decision-making.

Simulation methods and processesUtilizing ABMS technology, we constructed a simulation model to assess the effectiveness of various policy pathways in enhancing enterprise competitiveness. The ABMS integrates the Complex Adaptive Systems (CAS) theory with modern computer simulation technology (Nguyen et al., 2024). Setting behavior rules, interaction logic for individual Agents, and their interactions with the environment can dynamically simulate the macro-level behavior of complex systems. The principle behind ABMS lies in leveraging the autonomy and adaptability of Agents to uncover the dynamic characteristics that emerge from individual interactions within the system (Li et al., 2024). Currently, this methodology has been widely applied in research across various disciplines, such as sociology, behavioral science, economics, and biology. For instance, Lin et al. (2024) employed this method to simulate land-use changes under different carbon market scenarios, while Sun et al. (2023) simulated the impact of various community sizes on urban expansion. Compared with existing literature, this methodology is also applicable to simulating the effectiveness of different digital transformation pathways on competitiveness enhancement in this study.

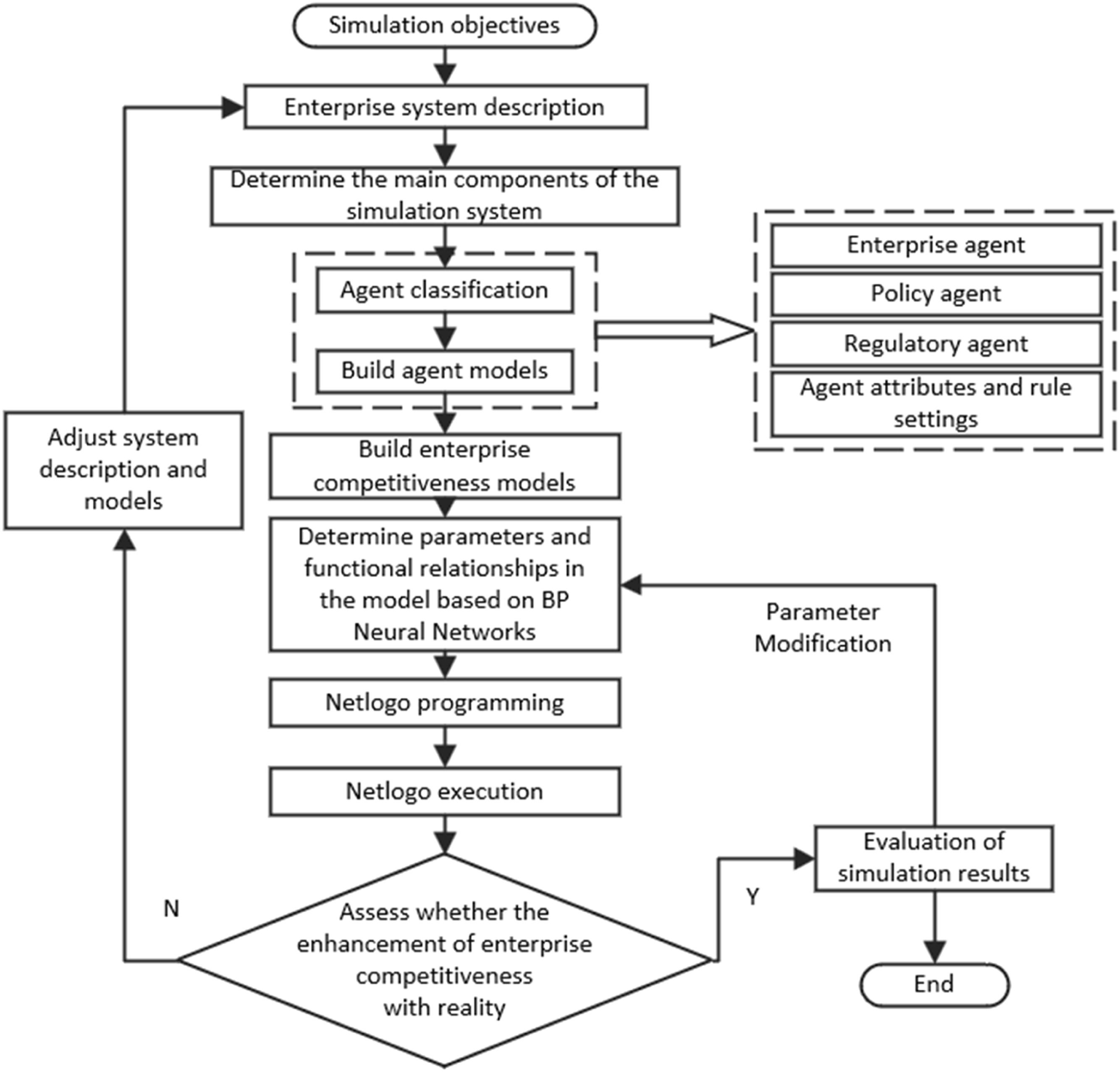

The simulation process is illustrated in Fig. 3. First, the attributes and behavioral rules of various Agents in the simulation model are designed. Subsequently, a BP artificial neural network is employed to determine the response function of enterprise Agents' competitiveness to policies. Finally, the Netlogo simulation platform is adopted to systematically simulate the models of different policy pathways' effects on enterprise competitiveness. The simulation simulates the dynamic change processes and outcomes of enterprise competitiveness in scenarios without policy intervention and with interventions from different policy combinations. It analyzes and compares the effects of divergent and the same policy pathways under varying intensities on enterprise competitiveness.

In this study, the agents are classified into three types: enterprise agents, policy agents, and regulatory agents. Regarding the factors influencing enterprise agents' competitiveness, previous research has shown that digital transformation can significantly enhance enterprise competitiveness. When utilizing BP neural networks to train the response function of enterprise competitiveness to policies, the coefficient results obtained from previous research are considered. The policy agent represents the four policy pathways proposed in this chapter. During the simulation system's operation the regulatory agent monitors and analyzes changes in enterprise competitiveness to form policy effect evaluations. It then feeds back individual policies or policy combinations that require further analysis to the policy agent, enabling the policy agent to make adjustments, continue running the simulation system, and output data.

Owing to the diminishing marginal returns characteristic of policy pathway inputs and outputs, implying that as more inputs are added, the incremental effect on enhancing enterprise competitiveness diminishes. In the absence of abrupt policy changes, more potent policy inputs are required to improve enterprise competitiveness further. To incorporate this characteristic into the simulation process, the concept of policy efficiency μ−1(0<μ−1<1)is introduced, and further, a policy cost function C is introduced, formulated as:

In this formula, j can take values of 1, 2, 3, or 4, representing the four policies of CLP, TDP, CDP, and POP, respectively. μjis a coefficient reflecting the diminishing marginal returns characteristic of the cost of the j-th policy. When μj is larger, it implies that as the investment in policy j increases, the unit policy cost rises faster, indicating lower policy efficiency. P represents the intensity of the policy pathway, with j values of 1, 2, 3, and 4 corresponding to the four policies of CLP, TDP, CDP, and POP(Cao et al., 2022; Qi et al., 2023). This formula is incorporated into the policy agent's mode of action on enterprise agents in Netlogo to ensure that the simulation process fully considers the characteristic of diminishing marginal returns.

During the simulation process, BP neural networks are used to train data and determine the response function. BP neural networks are a core infrastructure in artificial intelligence, capable of mimicking the operational mechanisms of human brain neural networks and effectively performing distributed parallel information processing tasks (Rumelhart et al., 1988). The BP neural network model belongs to the category of feedforward networks, characterized by containing one or more hidden layers. The overall structure comprises three parts: an input layer, a hidden layer, and an output layer. The core of its learning mechanism lies in iteratively adjusting the network connection weights to minimize the total error of the network or to reach a preset number of training iterations.

Assuming that the input layer is equipped with m neurons, the hidden layer contains q neurons, and the output layer is configured with l neuron, the learning process of the BP neural network is outlined as follows:

First, in the initialization stage of the network, initial weight values are assigned to all neurons, typically set as small random positive numbers.

Second, a training dataset is introduced. The network receives a series of input matrices labeled as x(1), x(2), …, x(n), with corresponding desired output matrices t(1), t(2), …, t(N), where N represents the total number of training samples.

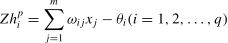

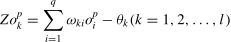

Third, forward computation in the BP network is performed. Taking sample P as an example, the input Zhpiof the ith neuron in the hidden layer can be expressed as:

In the above equation, ωij (i = 1,2,…,q; j = 1,2,…,m) represents the connection weight between input layer neuron j and hidden layer neuron i, θi is the threshold of hidden layer neuron i, and xip is the value of input layer neuron j in sample p. The output oip of hidden layer neuron i is determined by the activation function g(Zhip), commonly chosen as the sigmoid function, which is in the form of:

Subsequently, the output oip of hidden layer neuron i is transmitted to the output layer through weight coefficients. The total input Zokp of output layer neuron k is calculated as follows:

In the above equation, ωkirepresents the connection weight between hidden neuron i and output layer neuron k, and θkis the threshold of output layer neuron k. The actual output okp of output layer neuron k is also determined by the activation function g(Zokp).

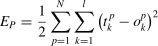

Fourth, error calculation is performed. The total error Ep of the BP neural network system is defined as:

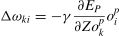

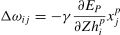

Where tkp is the desired output of output layer neuron k.If the total error Ep does not meet the preset standard, the fifth step is entered, which is the adjustment of weight coefficients. The adjustment direction is the negative gradient direction of the error function. The adjustment amounts of the output layer and input layer weight coefficients are given by Eqs. (8) and (9) respectively:

Where Δωki and Δωij represent the adjustment amounts of the output layer and input layer weight coefficients, respectively, and γ is the learning rate (greater than 0). Through repeated training, the error is reduced to a satisfactory level (Yu, 2021).

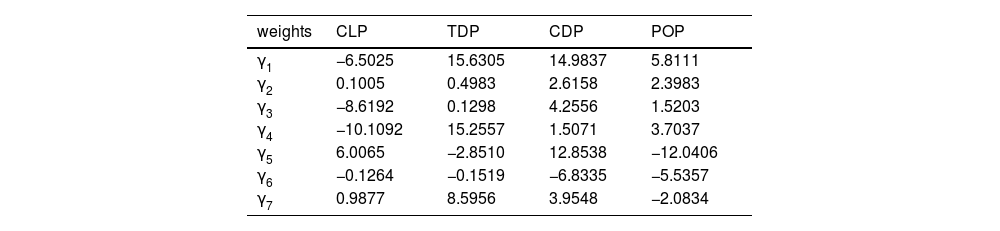

According to the research conducted by Wang et al.(2024), the number of hidden neurons γi is set to 7, the number of iterations is set to 1000, the error threshold is set to 10−6, and the learning rate is set to 0.01.

The weight results from the input layer to the hidden layer are shown in Table 9, and the weights from the hidden layer to the output layer are:

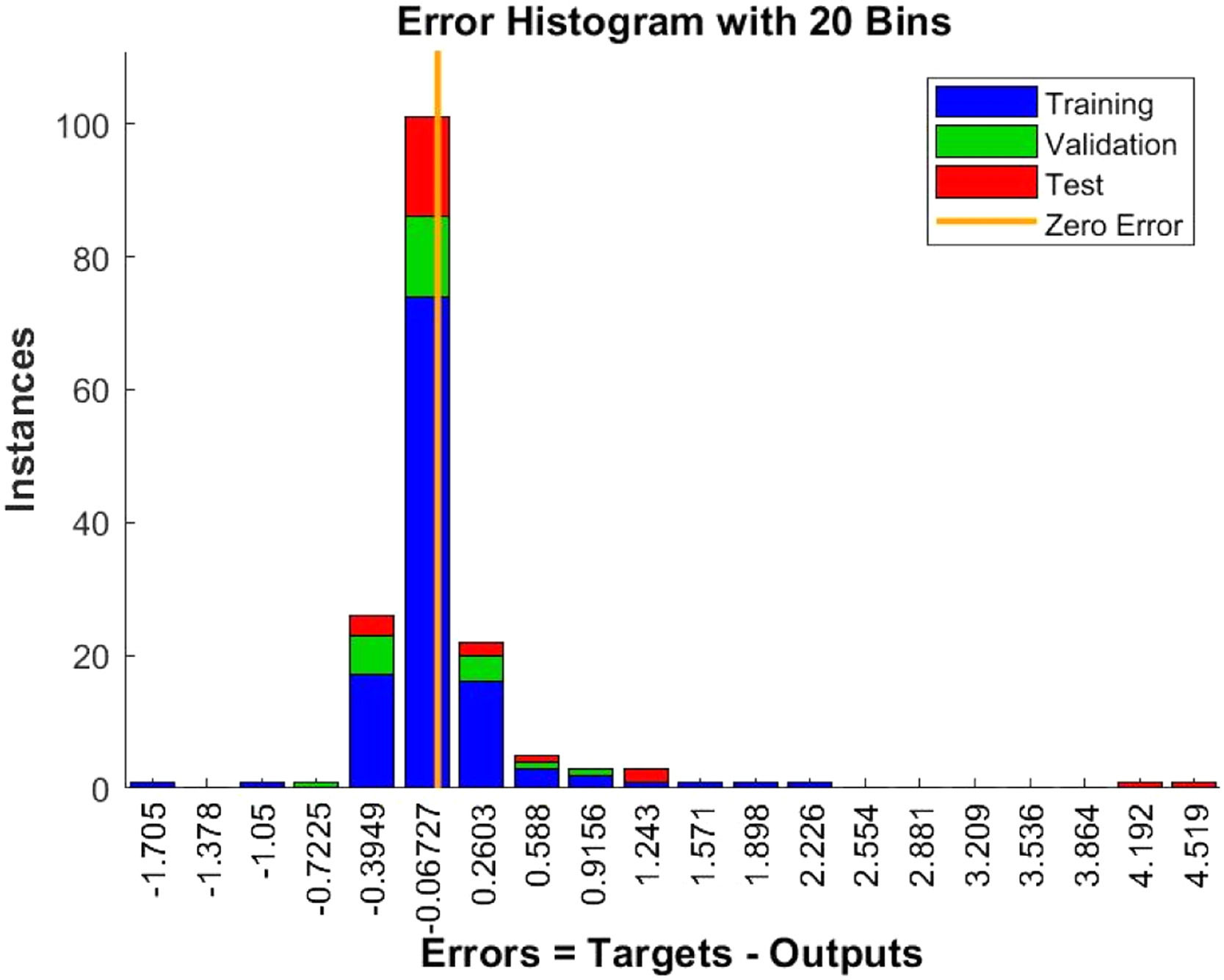

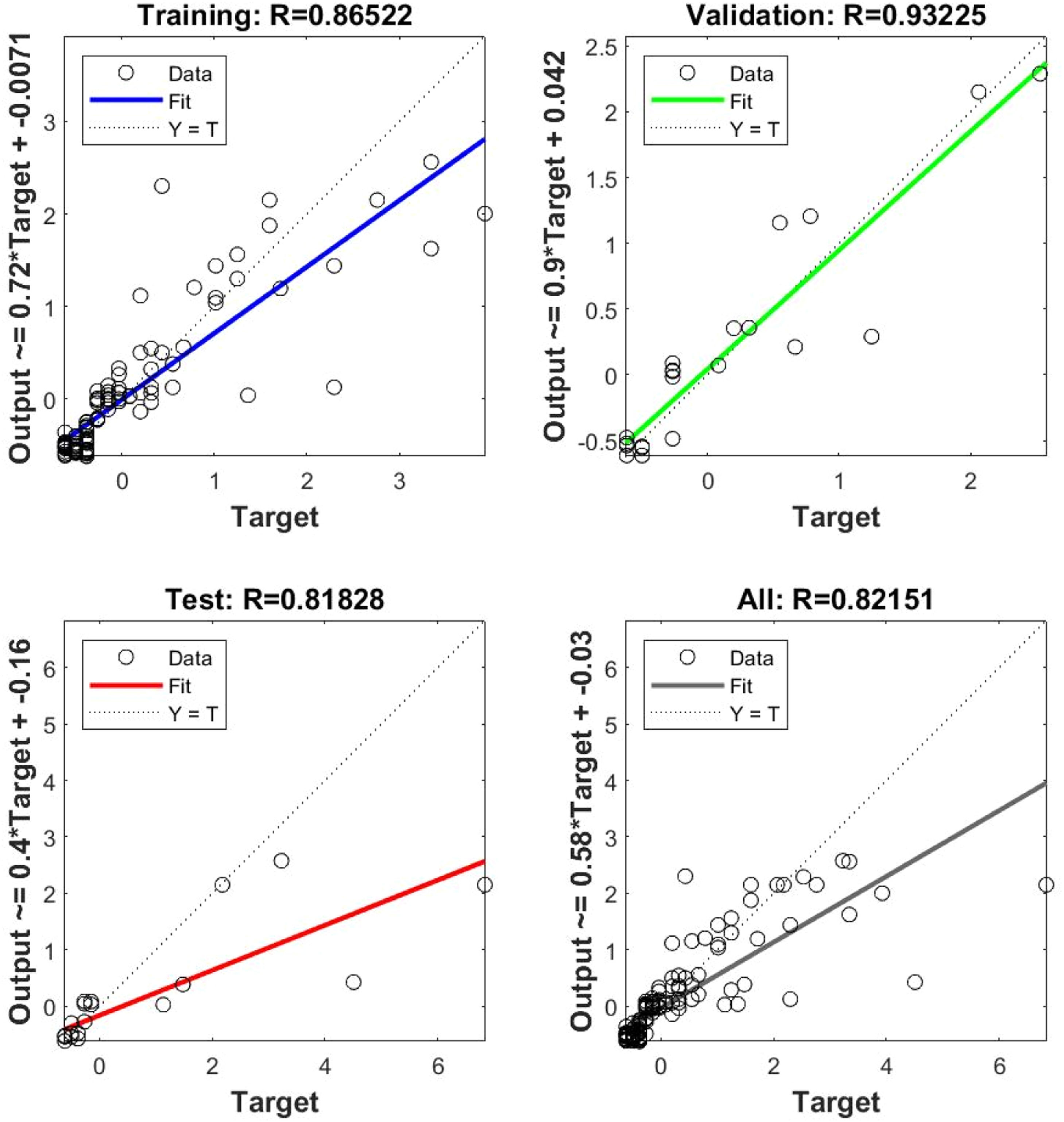

The error distribution of the prediction results is shown in Fig. 4, which includes the error situations for both the training and test sets. The horizontal axis represents the error interval, and the vertical axis represents the number of points falling within each interval. The error value of each point is calculated as the target value minus the predicted value. Points closer to the “zero error” line have smaller errors. The errors of both the training and test sets are concentrated between −0.3949 and 0.2603, indicating that the prediction errors are generally small.

Fig. 5 demonstrates the correlation between the predicted and target values. The correlation coefficient (R) for the training set is 0.86522, indicating a strong correlation between the predicted values and the target values on the training set. The correlation coefficient (R) for the validation set is 0.93225, slightly higher than that of the training set, suggesting that the model performs well on unseen data. The correlation coefficient (R) for the test set is 0.81828, slightly lower than those of the training and validation sets, but still indicates that the model has certain predictive ability on the test set. The correlation coefficient (R) for all samples is 0.90077, close to that of the training set, indicating that the predictive performance of the overall dataset is relatively stable.

Overall, the model demonstrates high predictive performance on the training and validation sets, indicating that the model can fit the training data well and maintain good predictive ability on unseen validation data. Regarding the risk of overfitting, although the correlation coefficient of the validation set is slightly higher than that of the training set, the difference is not significant, and the correlation coefficient of the test set also remains within a good range, suggesting that the risk of overfitting is low for the model.

Simulation resultsIndividual and combined simulations were conducted for four digital transformation pathways to assess the differences in their effects on enhancing enterprise competitiveness, considering various pathways, intensities, and combinations thereof.

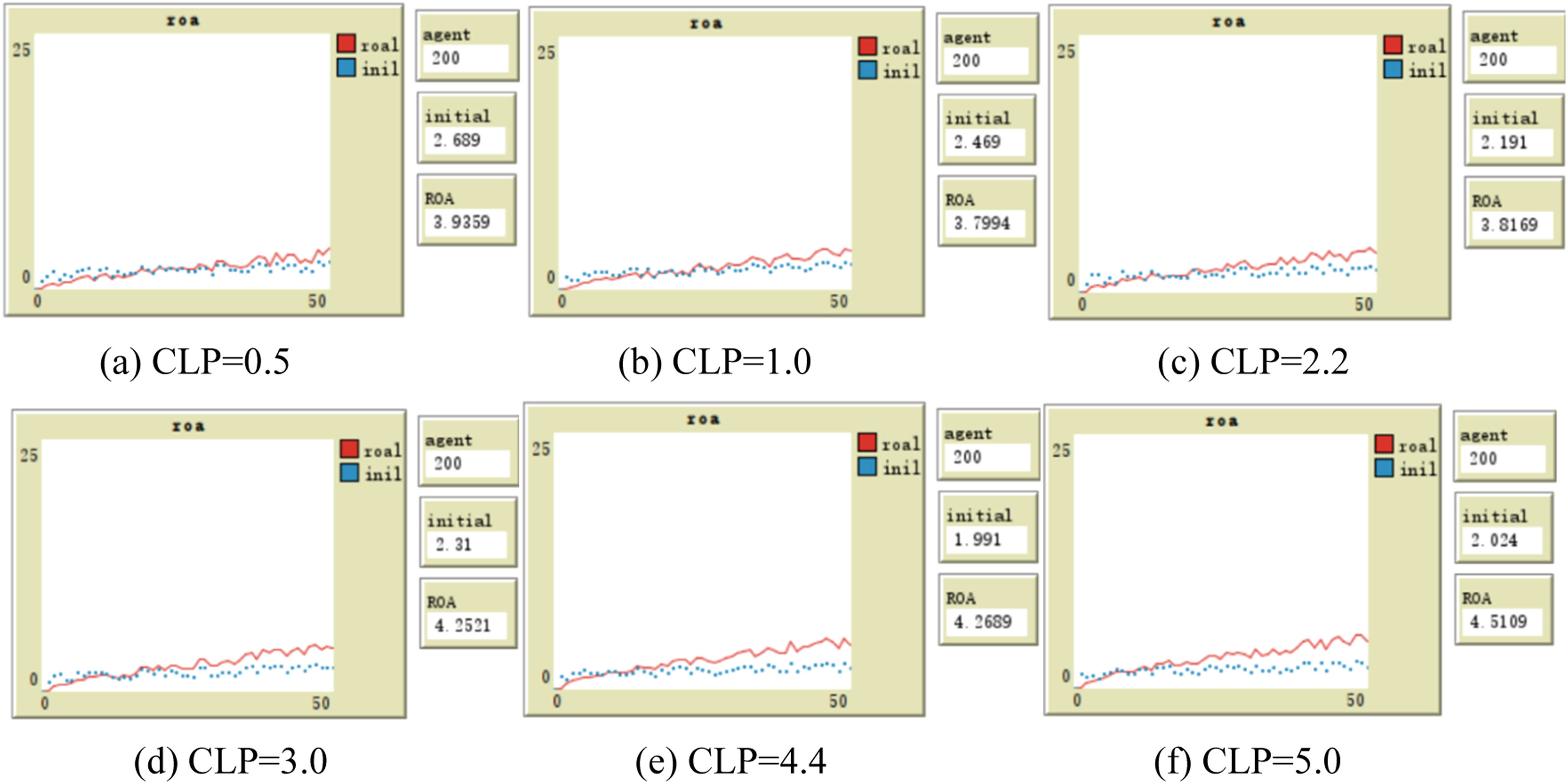

Simulation results for individual pathways(1) The CLP

Fig. 6 displays the simulation results of the impact of implementing cultural leadership policies with varying intensities on enhancing enterprise competitiveness. The dotted line represents the state of enterprise competitiveness without any policy intervention (hereinafter referred to as the initial state). Due to the complex environment in which enterprises operate, influenced by various factors, their competitiveness generally exhibits a fluctuating upward trend. The solid lines depict the changes in enterprise competitiveness after policy implementation. The solid lines below the dotted line indicate that the costs of implementing the policies outweigh the benefits of competitiveness enhancement. Policies such as CLP, which focus on ideological guidance, require a lengthy period to generate significant benefits. When the intensity of CLP is 2.2 or below, its effect on enhancing corporate competitiveness is not significant. When the intensity is 3.0 and 4.4, the ROA begins to exceed the initial state after 15 periods. When the intensity of CLP reaches 5.0, there is a substantial and faster improvement in corporate competitiveness after 8 periods, with the final ROA value being 4.5109. However, on the whole, the effect is not ideal when this policy is implemented alone.

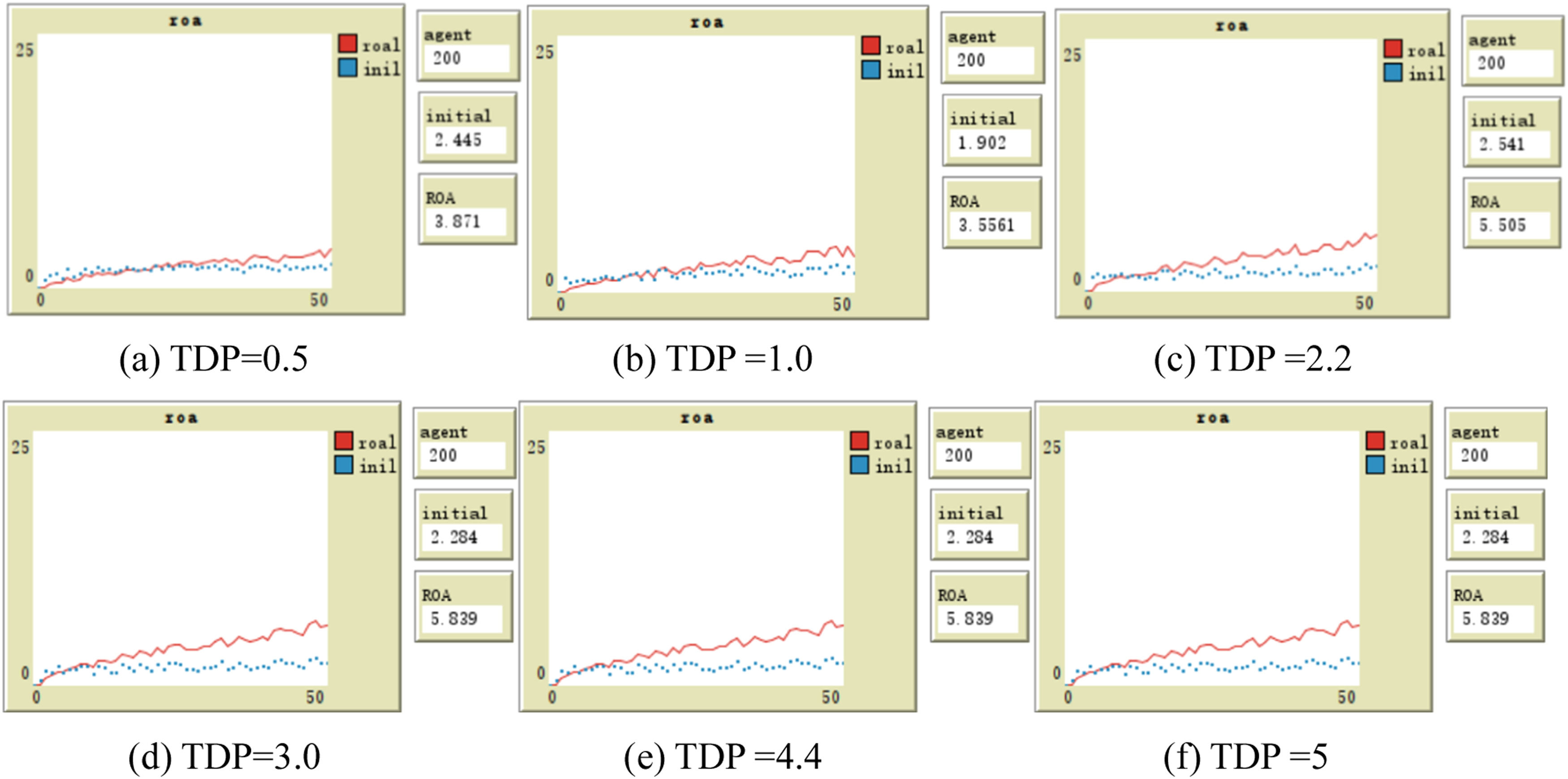

(2) The TDP

The simulation results for implementing talent development policies with varying intensities are shown in Fig. 7. When the intensity of TDP is 1.0, the ROA exceeds the initial state after 20 periods. When the intensity of TDP is 4.4 and 5.0, the duration for the policy to bring about a substantial increase in corporate competitiveness shortens to 6 periods and 3 periods, respectively. The effect becomes more pronounced as the intensity of TDP increases beyond 2.2, with a larger increase in corporate competitiveness compared to CLP. This indicates that, compared to the CLP, the TDP is more effective in rapidly enhancing corporate competitiveness in the short term.

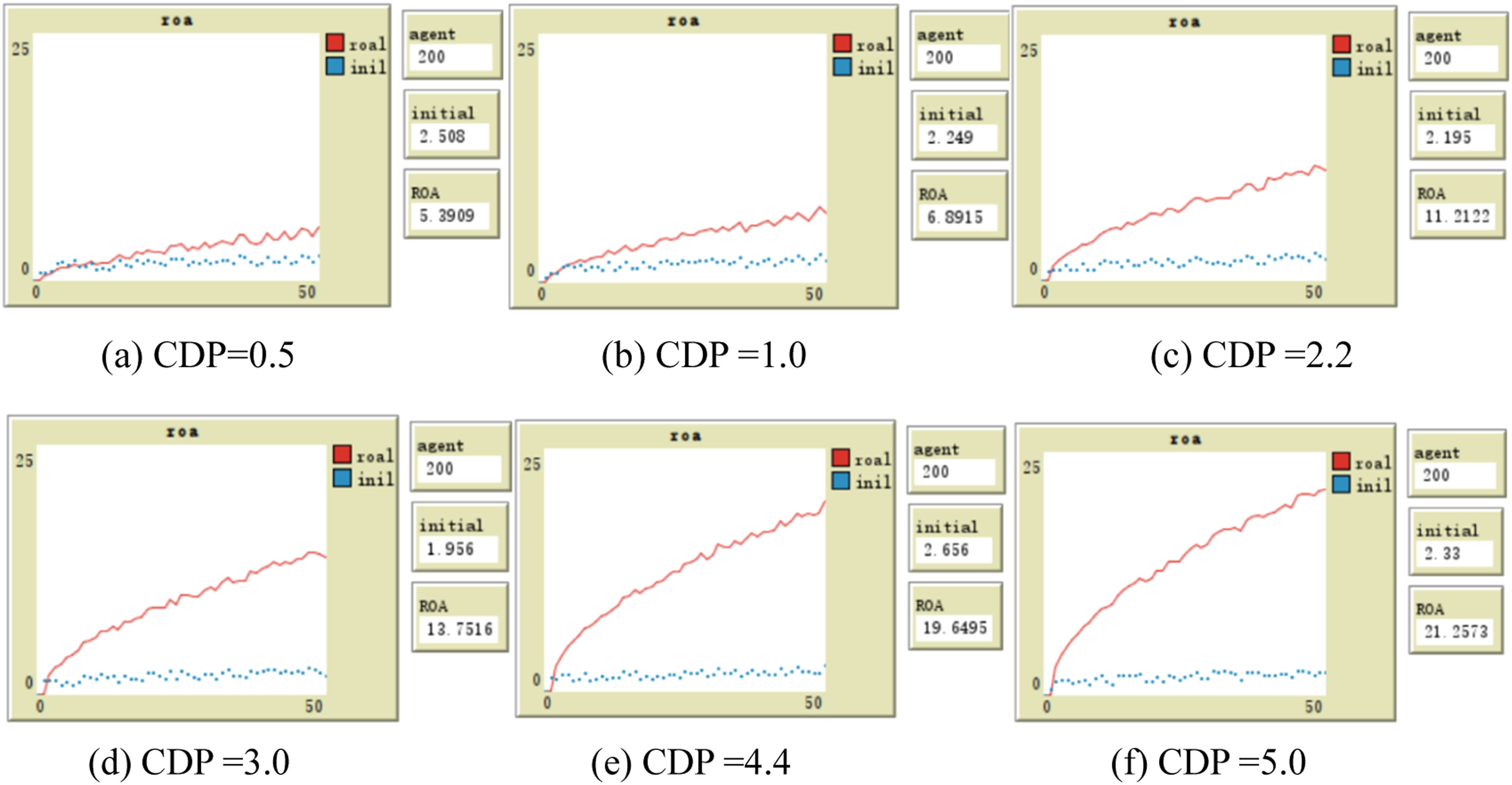

(3) The CDP

The simulation results for implementing capital-driven policies with varying intensities are shown in Fig. 8. After the intensity of CDP reaches 2.2, the ROA exceeds the initial state around the 3rd period. The effect of enhancing corporate competitiveness when the intensity of CDP is 1 is almost identical to that when the intensity of TDP is 5, indicating that digital transformation driven by capital is very efficient. It enables enterprises to achieve higher net profits in the short term, enhances their competitiveness, and highlights their advantages. Therefore, it is recommended that enterprises continuously increase their digital transformation budgets and invest more in digital transformation.

(4) The POP

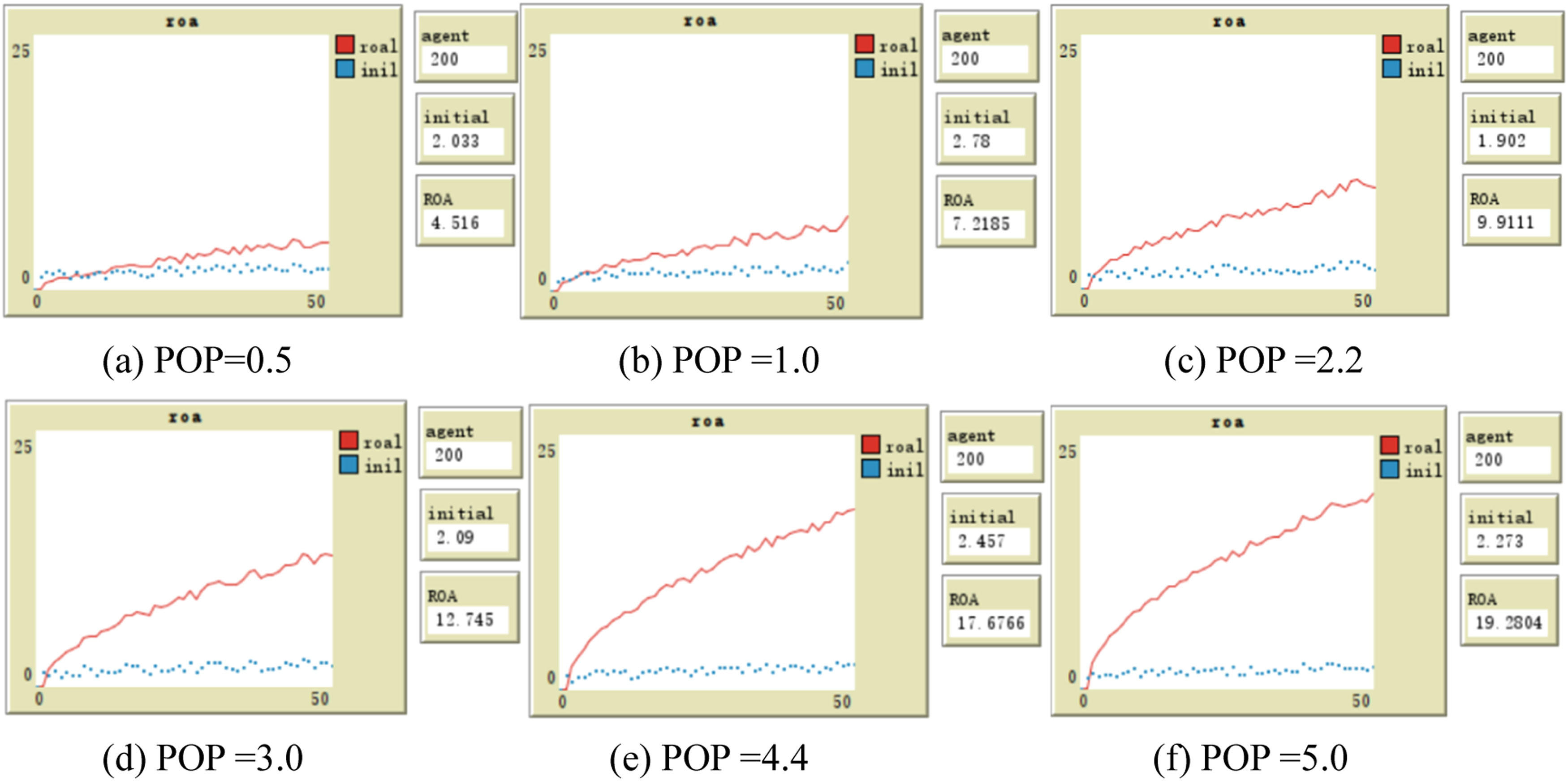

The simulation results for implementing process policies with varying intensities are shown in Fig. 9. When the intensity of POP is 0.5, the policy implementation effect cannot offset the policy cost before the 15th period. However, when the intensity reaches 2.2, a relatively high positive benefit emerges in the 3rd period, with a rapid growth rate. A mutation occurs when the intensity ranges from 3.0 to 4.4, leading to a significant improvement in the effect, with final values of 12.745 and 17.6766, respectively, slightly inferior to that of CDP. This suggests that digital transformation in business process optimization at a lower intensity does not significantly enhance corporate competitiveness. Integrating business processes with digital technology and awareness directly affects enterprises’ production and operation activities. Weak and uncertain policy changes may fail to bring about substantial changes in business processes and may even lead to confusion in some processes, leading to a waste of resources and a decline in efficiency. Therefore, if enterprises intend to embark on digital transformation through business process optimization, they must possess a firm awareness of transformation, implement strong transformation policies, and maintain a high degree of execution to ensure the success of the transformation and the enhancement of corporate competitiveness.

Simulation results for combinations of two policies(1) Combination of CLP and Other Pathways

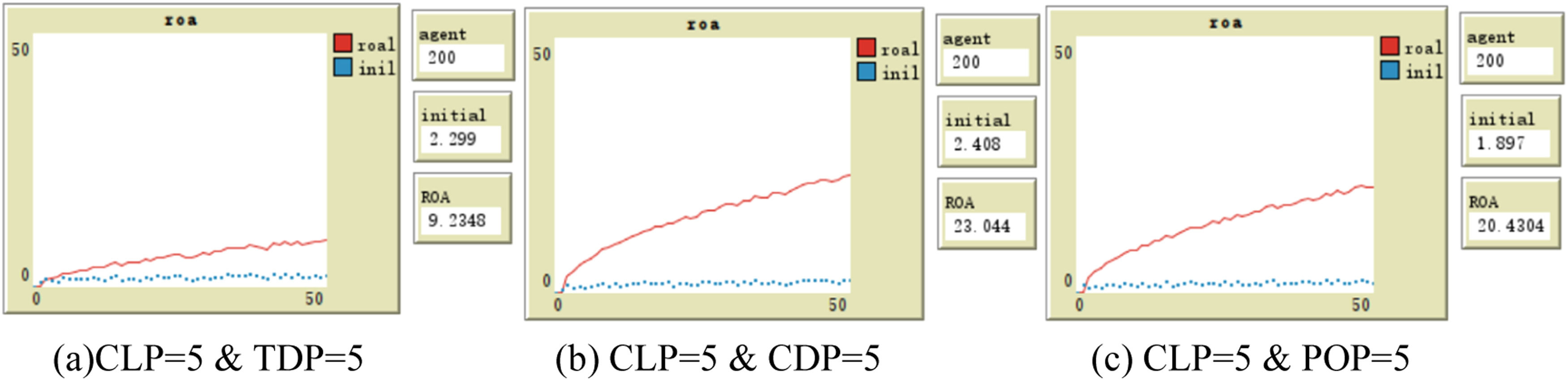

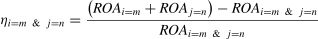

The CLP is an initiative to subtly change employees' perceptions at the conscious level and emphasize the importance of digital transformation awareness in an enterprise's ideological and cultural construction. Combining it with TDP, CDP, and POP is reasonable and feasible. The specific effects are shown in Fig. 10. It can be observed that combining CLP with other policies significantly shortens the time for the ROA to exceed the initial state, with a noticeable enhancement in enterprise competitiveness occurring within 2 to 4 periods. When the intensities of CLP and TDP are both set to 5, the final ROA value for their combination is 9.2348. This value is not equal to the sum of the final ROA values for each policy when their intensities are 5 separately (11.4108) but is less than that sum. This indicates that combining policies can result in some efficiency loss. The reason for this efficiency loss is that different policies may overlap regarding the factors and mechanisms that stimulate enterprise competitiveness. For example, both CLP and TDP can incentivize employees' digital transformation awareness, but the magnitude of this improvement is limited within a certain period. Once a threshold is reached, even if more policies are implemented to stimulate further growth, a significant increase may not occur. Therefore, the efficiency loss associated with policy combinations should also be considered when evaluating the effectiveness of policy combinations. The formula for calculating efficiency loss η is:

In this context, ηi=m&j=n represents the efficiency loss, where i and j denote different policies, and m and n represent the intensities of those policies. ROAi=mrepresents the final ROA value when policy i is implemented at an intensity of m.ROAi=m&j=n represents the final ROA value when policies i and j are implemented at intensities m and n.

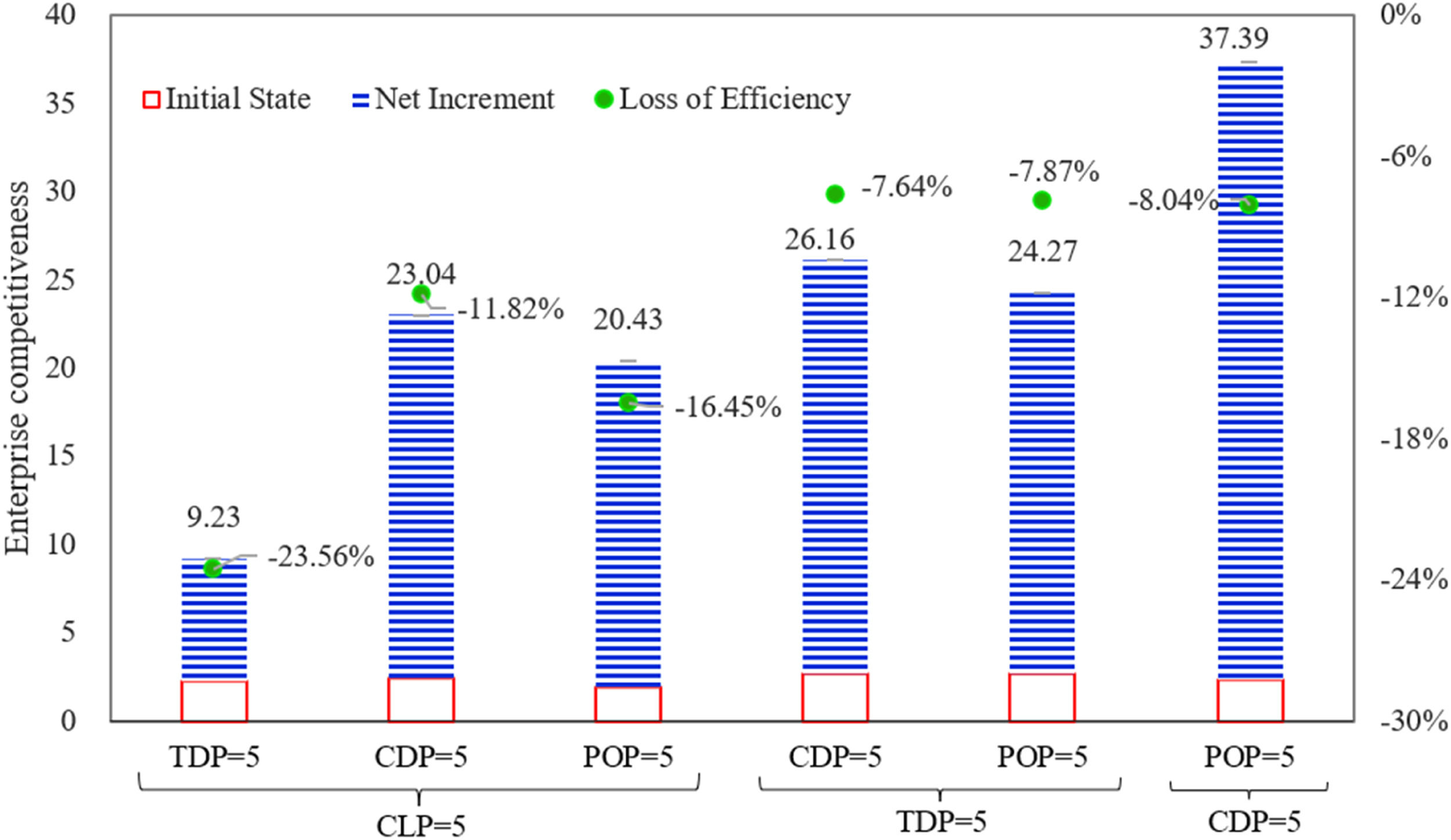

After comprehensively comparing the results of combining CLP with other policies, it was found that the combination of CLP and CDP yielded the highest final ROA value (23.044), followed by the combination with POP (20.4304), and the combination with TDP resulted in a relatively lower final ROA value (9.2348).The results of combining CLP with other pathways are shown in Fig. 10. Regarding efficiency loss, the combination of CLP and CDP incurred an efficiency loss of 11.82 %, the combination with POP incurred an efficiency loss of 16.45 %, and the combination with TDP incurred an efficiency loss of 23.56 %. Therefore, the combination of CLP and CDP has a higher effect on enhancing enterprise competitiveness and a lower efficiency loss, making it a preferred policy combination for enterprises. When enterprises have a limited budget for digital transformation, the combination of CLP and POP can be adopted, which may further enhance enterprise competitiveness.

(2) Combination of TDP with other pathways

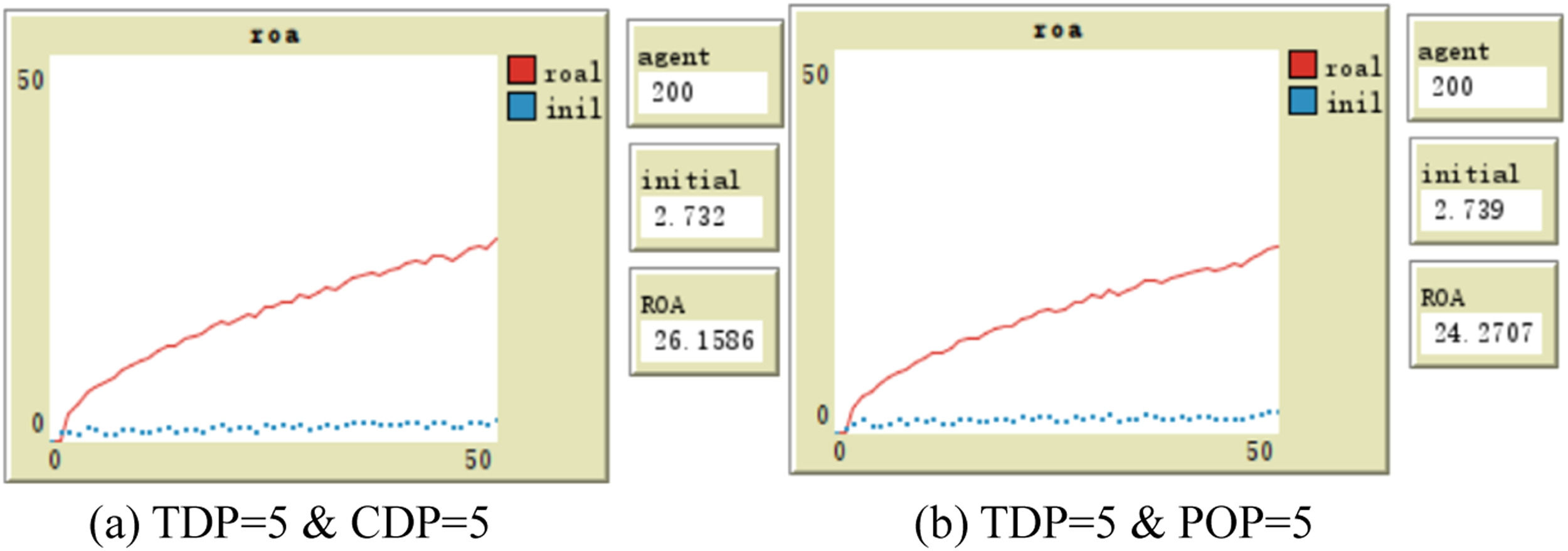

Enterprises undergoing digital transformation require employees who are willing and can embrace digital transformation. Therefore, the combination of TDP with CDP and POP is also reasonable. The specific effects are shown in Fig. 11. For enhancing enterprise competitiveness, the combination of TDP and CDP resulted in a higher final ROA value (26.1586), while the combination with POP resulted in a slightly lower final ROA value (24.2707), but it still performed well. Regarding efficiency loss, the former incurred an efficiency loss of 7.64 %, and the latter incurred an efficiency loss of 7.87 %. Overall, the combination of TDP and CDP performed better compared to all the individual policies and policy combinations mentioned earlier.

(3) Combination of CDP and POP

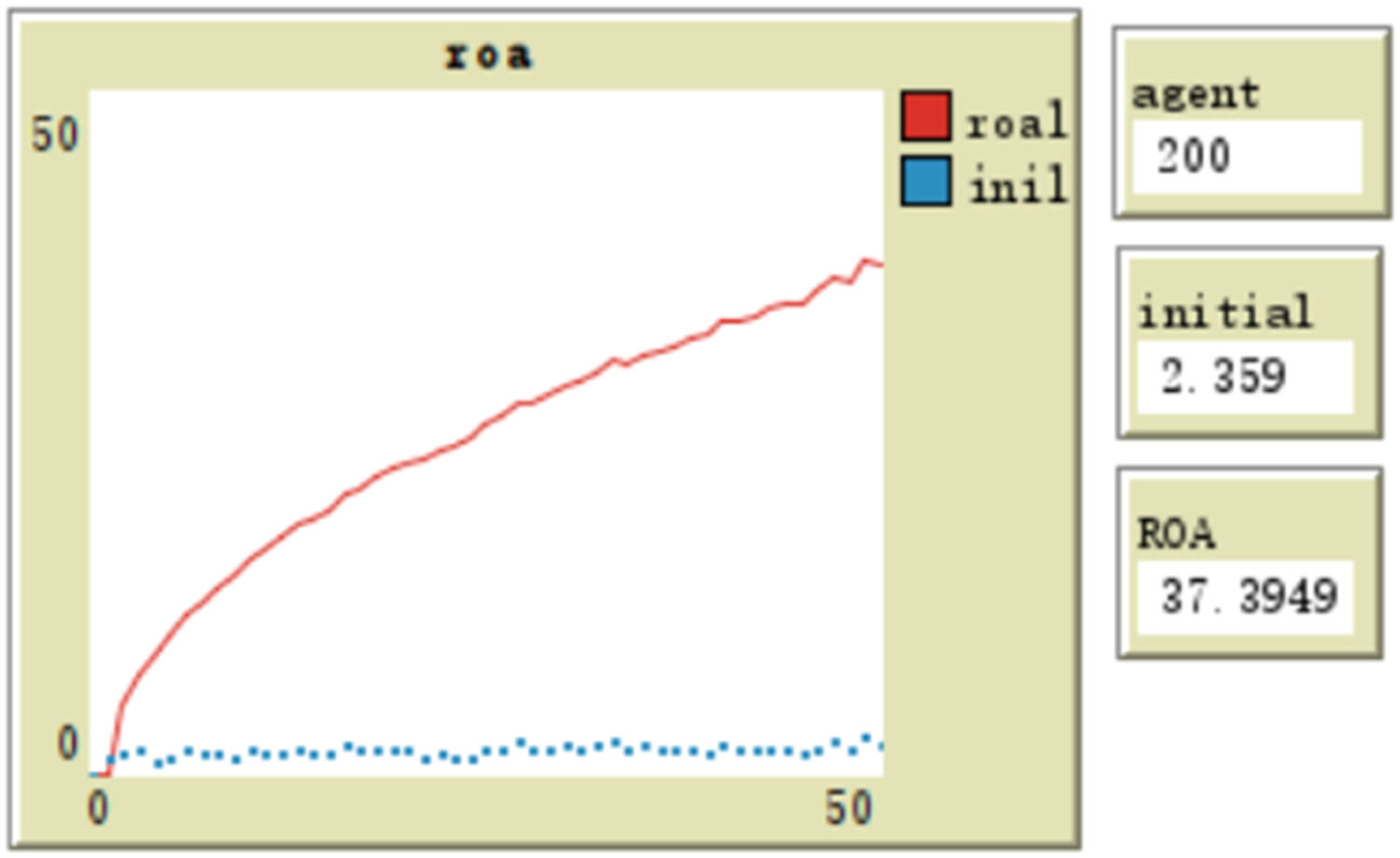

The results of the combination of CDP and POP are shown in Fig. 12. Robust financial support and business process transformation and optimization can efficiently achieve digital transformation for enterprises and bring substantial profit margins. This policy combination yields a final ROA value as high as 37.3949, with an efficiency loss of 8.04 %. Compared to other policies, this combination results in a rapid increase in ROA with moderate efficiency loss. When enterprises urgently need digital transformation to enhance their competitiveness, adopting this policy combination can yield immediate results. However, a significant investment of funds and energy is required to complete the comprehensive optimization and transformation of business processes. Enterprises should consider their resources and development stage before making decisions.

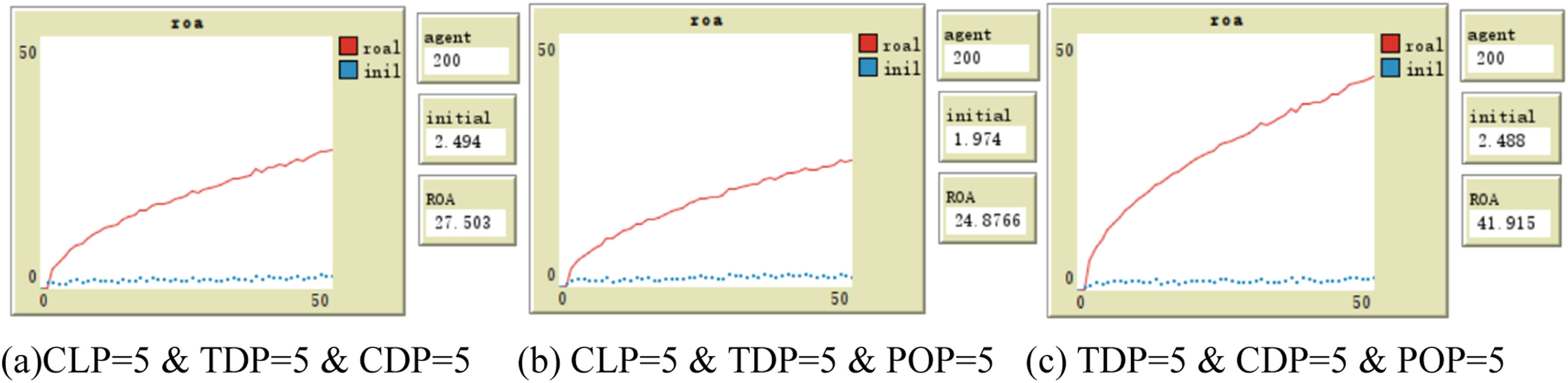

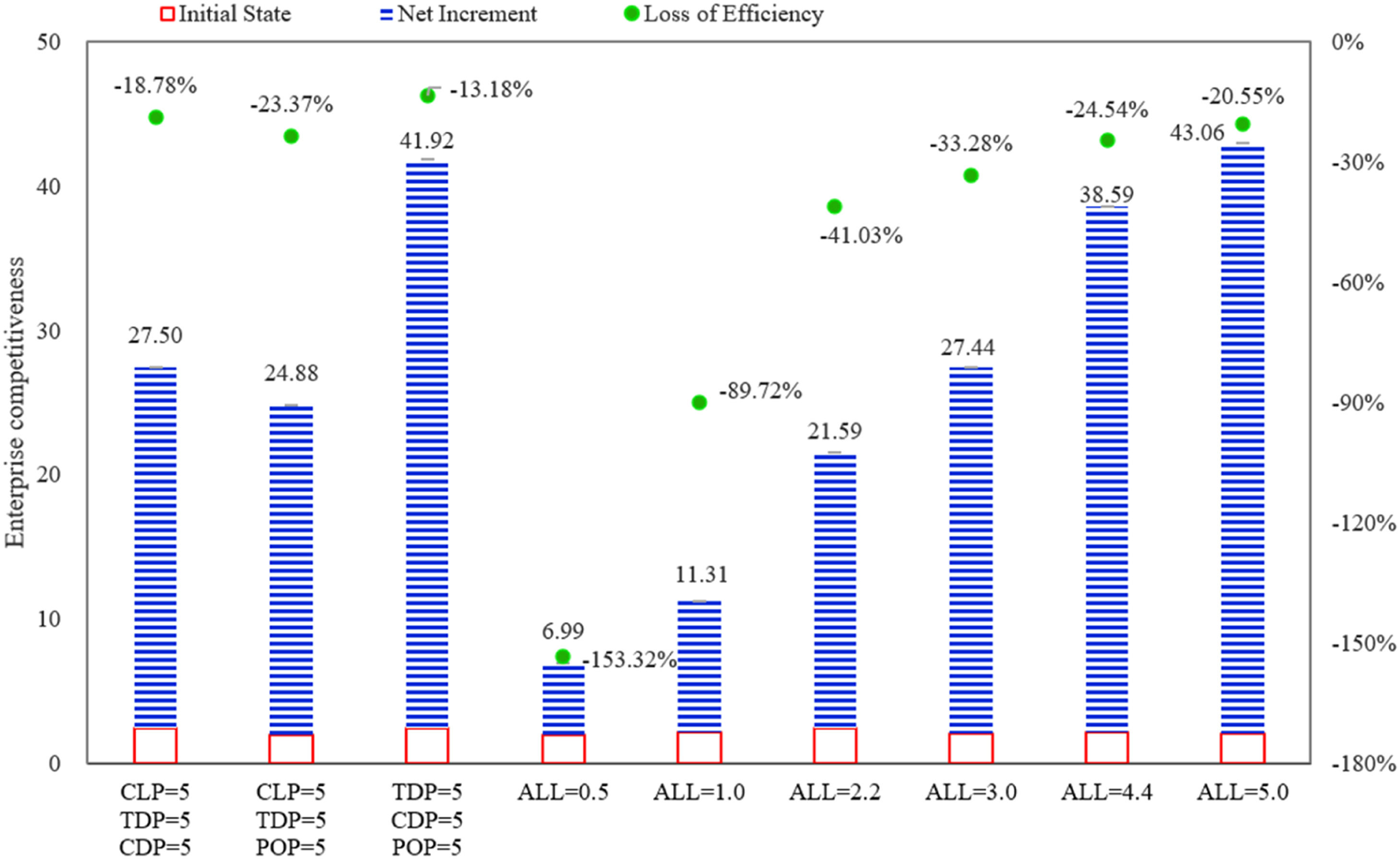

Combination of multiple policiesNext, we analyze the effects of combining three or more policies. There are three ways to combine three policies, as shown in Fig. 13. The combination of TDP, CDP, and POP yields the highest final ROA value (41.915) with an efficiency loss of 13.18 %. The combination of CLP, TDP, and CDP has the second-highest final ROA value (27.503) but with an efficiency loss of 18.78 %. The combination of CLP, TDP, and POP results in the lowest final ROA value (24.8766) and the highest efficiency loss of 23.37 %. It can be observed that combining three policies tends to result in higher efficiency losses. The combination of TDP, CDP, and POP can significantly enhance enterprise competitiveness, and the efficiency loss is within an acceptable range, making it a viable option. However, the ROA values of the other two combinations are comparable to that of the combination of TDP and CDP but with much higher efficiency losses. Therefore, adopting the combination of TDP and CDP is more reasonable and effective.

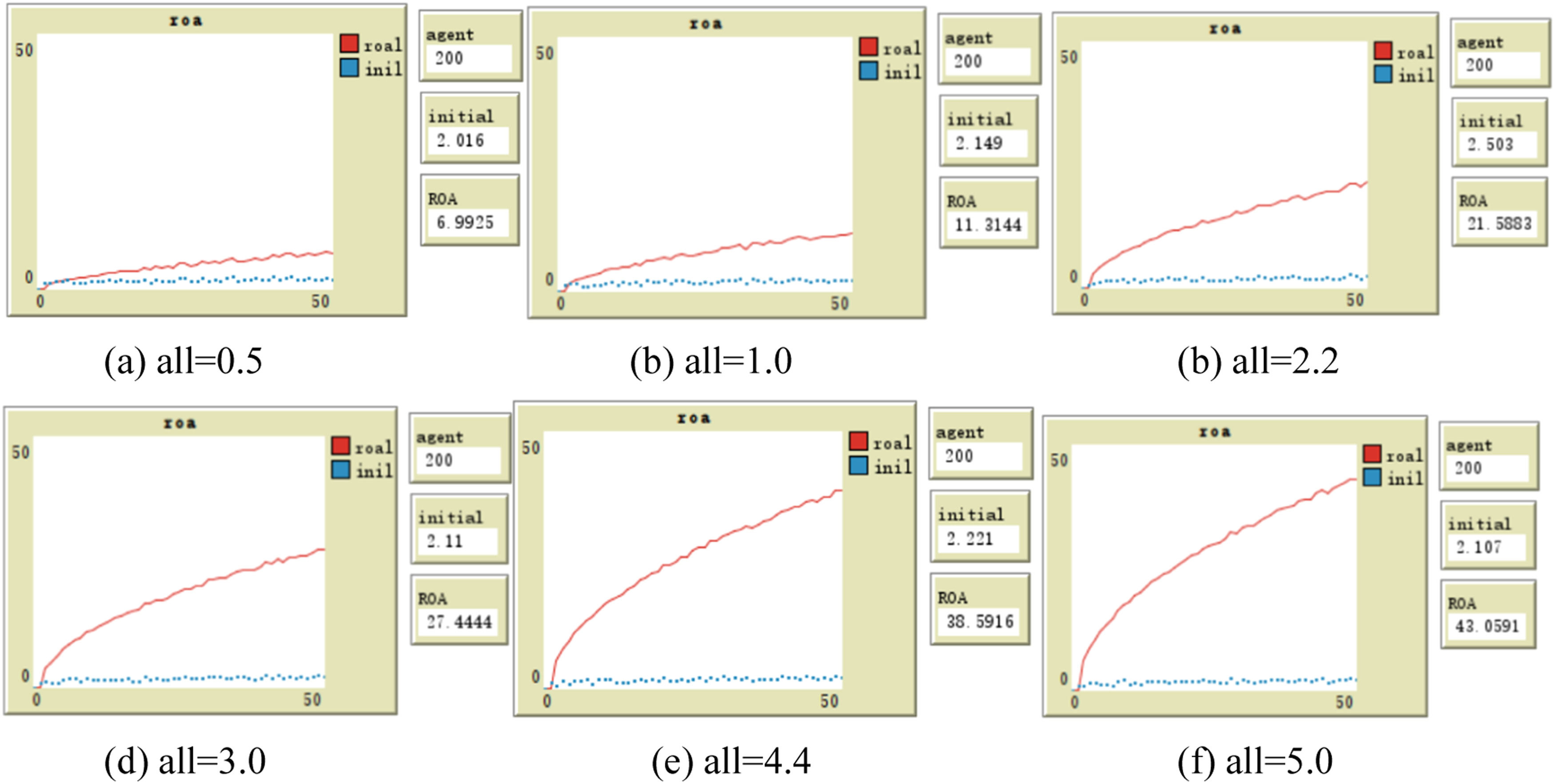

Fig. 14 demonstrates the enhancement of corporate competitiveness when the four policies act together. When the intensity of all four policies is 0.5, the efficiency loss is 153.32 %. When the intensity of all policies is 3.0, the ROA value reaches 27.4444, and the efficiency loss decreases to 33.28 %. When the intensity of all policies is 5.0, the ROA value is 43.0591, with an efficiency loss of 20.55 %. The combined implementation of these four policies can significantly boost enterprise competitiveness in the short term. However, a relatively low intensity of policy implementation can lead to substantial efficiency losses. Therefore, enterprises must strengthen their efforts in cultural development, talent development, capital investment, and business process optimization after making decisions on digital transformation. By firmly adhering to the transformation mindset, enterprises can achieve favorable transformation outcomes and effectively enhance their competitiveness.

Comprehensive comparison of simulation resultsThe preceding text describes the trends and efficiency losses in the impact of various pathways and their combinations on enterprise competitiveness over time. Below is a comprehensive comparison of the differences between periods 50 and 0 after implementing policy pathways to distinctly contrast the effects of different pathways (or combinations) on enhancing enterprise competitiveness at varying intensities.

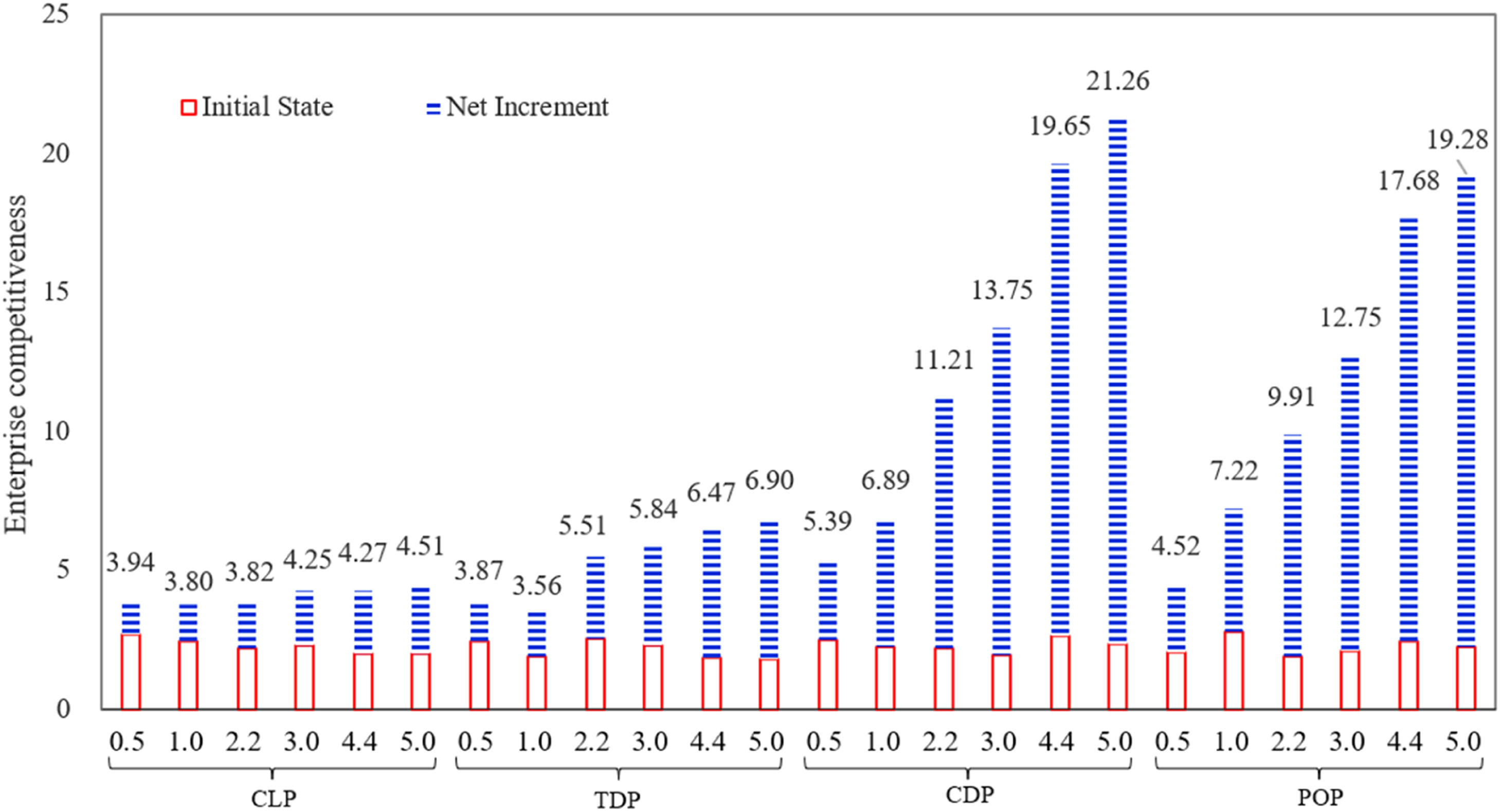

Fig. 15 displays the effectiveness of four individual pathways in enhancing enterprise competitiveness at different intensities. It can be observed that the CLP at different intensities has a relatively weak effect on enhancing enterprise competitiveness. The CDP exhibits the strongest effect in enhancing enterprise competitiveness. Medium or high-intensity CDP and POP can significantly improve enterprise competitiveness, whereas low-intensity POPs are the least effective.

Fig. 16 demonstrates the effects of combining two policy pathways. The combined effect of CLP with CDP and POP shows a significant improvement compared to the CLP alone. The combination of TDP and CDP yields good results and has the lowest efficiency loss. The combination of CDP and POP exhibits the most notable effect in enhancing enterprise competitiveness, with very low-efficiency loss, making it the best-performing among the combinations of the two pathways.

Fig. 17 presents the effects of combining three or more pathways. The efficiency loss for combinations of three or more pathways is significantly higher than that of two. The combination of TDP, CDP, and POP has a very significant effect on enhancing enterprise competitiveness, with the lowest efficiency loss compared to other combinations. The combination of CLP, TDP, and CDP has a moderate promotional effect, while the combination of CLP, TDP, and POP has a lower promotional effect and a larger efficiency loss, which enterprises should consider carefully. When combining four pathways, the efficiency loss is relatively high. Only when all four pathways are based on high intensities can enterprises reduce efficiency loss while ensuring competitiveness enhancement. However, this requires significant cost investments for enterprises and necessitates comprehensive consideration based on factors such as the enterprise's development stage, strengths, and the urgency of digital transformation.

Conclusions and recommendationsSummary of research findingsBased on a decade of data from China's A-share listed companies, this study uncovers the underlying dynamic mechanisms and institutional synergies driving the enhancement of corporate competitiveness through digital transformation. Furthermore, this study proposes a multi-path combinatorial simulation model, revealing the complex system characteristics of digital transformation. Cultural leadership establishes the cognitive foundation, talent development activates innovation momentum, capital-driven strategies enhance resource support, and process optimization achieves a closed value loop. The synergistic effect among these four-dimensional paths essentially represents the process of organizational routine reconstruction and dynamic capability iteration. These findings provide a strategic toolbox for the digital transformation of enterprises in emerging economies and offer insights into constructing national innovation ecosystems in the digital economy era. They suggest that policymakers should guide enterprises to deeply integrate the digitalization process with sustainable development goals through institutional innovation, cultivating new competitive advantages amidst the resonance of technological revolution and institutional change.

Simulation results for the paths indicate that each path significantly impacts corporate competitiveness at varying intensities, albeit with differing degrees and efficiencies of influence. The CLP yields minimal short-term results and must be implemented with other policies. A higher intensity of CLP can enhance enterprise competitiveness faster, highlighting the foundational role of corporate culture in digital transformation. Compared to CLP, TDP can rapidly boost enterprise competitiveness in a shorter period, underscoring the crucial role of talent in digital transformation. Meanwhile, digital transformation driven by capital is highly efficient, enabling enterprises to achieve higher net profits in the short term and significantly enhance their competitiveness. Regarding the POP, lower-intensity process optimization policies have a weak effect, while high-intensity policies can significantly boost enterprise competitiveness, indicating that business process integration with digital technology and awareness is crucial.

To enhance enterprise competitiveness in a shorter period, enterprises can choose policy combinations for digital transformation based on their resources and advantages. The combination of TDP and CDP performs best among all individual and two-policy combinations. The combination of CLP and CDP offers high enterprise competitiveness enhancement with lower efficiency losses, making it a preferred policy combination for enterprises. The combination of TDP, CDP, and POP can substantially enhance enterprise competitiveness, albeit with relatively higher efficiency losses that remain within an acceptable range, making it an adaptable combination.

The findings of this study provide significant guidance for enterprises in their digital transformation practices, emphasizing that enterprises of different sizes and industries should flexibly configure pathway combinations based on their resource endowments, industry characteristics, and transformation goals to maximize competitiveness.