Digital transformation acts as a stabilizer for corporate production efficiency and a catalyst for sustainable development. This paper provides digital transformation indicators at the enterprise level based on text analysis and uses listed companies in China from 2009 to 2021 as the research subject to explore the impact of digital transformation on the total factor productivity (TFP) and the dynamic mechanism of human–machine collaboration in its transmission process. The findings reveal that (1) digital transformation significantly enhances TFP, a conclusion that remains valid after considering endogeneity issues and conducting a series of robustness checks, thereby refuting the productivity paradox associated with digital transformation; (2) furthermore, the enabling effect of digital transformation on TFP varies significantly across enterprises due to differences in ownership, factor intensity, asset size, degree of marketization, tax preference, and geographical location; (3) in terms of the impact mechanism, digital transformation promotes TFP by enabling efficient human–machine collaboration patterns. This study not only complements research on the influencing factors of microenterprise TFP, providing empirical evidence for improving enterprise production efficiency, but also offers insights for local governments to formulate differentiated digital policies.

With the continuous innovation and extensive application of digital technology, the global economy has prospered via the digital economy, a trend that has become the core driving force for the economy to move to a higher-quality development stage. China's 20th Party Congress Report stressed the need to accelerate the development of the digital economy and promote the deep integration of the digital and real economies, to create a grand blueprint of a digital China. In this context, digital transformation is not only the microlevel support of the rapid development of the digital economy at the enterprise level but also one of the high-quality core elements of economic development strategy architecture. It promotes the deep blending of the digital and real economies, stimulating TFP growth potential of the micro-enterprise, which is of great significance. At the same time, as a new development pattern emerges, the Chinese economy is faced with a complex situation of tighter resource endowment constraints, a prominent bottleneck of production efficiency, the limited value-added space of the value chain, and increasing environmental pressure. Enterprises are generally aware that the previous extensive growth model has had difficulty meeting the internal requirements of sustainable development. It is crucial to explore and implement a new development model, by reshaping the growth system, to seek breakthroughs to meet challenges and achieve a substantial improvement in TFP.

The digital transformation of enterprises refers to the innovation in traditional production and operation models and business models in terms of the production process, transaction models, and operation management with the help of digital technologies such as data, information, and algorithms. The overall aim is to promote enterprises to the stage of high-quality development (Niu, 2024). However, in the actual process of promotion, the digital transformation of enterprises faces multiple challenges, and the transformation pressure in different situations constitutes significant differences for traditional enterprises. Specifically, with their abundant capital accumulation and technological advantages, industry leaders can often smoothly promote digital transformation; in contrast, many small and medium-sized enterprises (SMEs) are faced with the dual dilemma of insufficient transformation willingness and limited transformation ability due to practical factors such as limitations of scale and a lack of management experience. In view of this, it is not only of urgent practical significance to deeply analyze the effect of enterprise digital transformation on productivity, but it also has important theoretical research value.

Despite the fact that existing research has yielded many valuable results, there are still many areas to improve, given the complexity of the mechanisms and the diversity of measures of TFP. On the one hand, some scholars believe that enterprise digital transformation has an enabling effect on TFP (Wu et al., 2024); on the other hand, some scholars believe that resource mismatch and insufficient management ability may lead to a negative energy effect of digital transformation on TFP (Ding et al., 2024; Wen et al., 2024). In addition, there is still no unified standard for the measurement of enterprise digital transformation, and there is a lack of relevant statistical data. Hence, the relevant research on its economic consequences also lacks the support of empirical tests to some extent. At the macrolevel, the existing research mainly adopts the national economic accounting method or the entropy method to construct the digital economy development index to evaluate the digital development level of a certain region. At the microlevel, the mainstream measurement methods include the proportion of digital intangible assets, ICT-related indicators based on tracking survey data, and the construction of digital word frequency indicators. Among them, the first two methods often have difficulties in practice, such as in obtaining data and weak sample representativeness.

Based on the above background, this work took the panel data of Chinese listed companies from 2009 to 2023 as a research sample. At the theoretical and empirical levels, we discuss the driving role of enterprise digital transformation on TFP, and from the perspective of human–machine collaboration, we determine whether it helps to fully release the enabling effect of digital transformation. Finally, according to the research, we put forward a path to realize the high-quality development of enterprises under the application conditions of the new generation of information technology, in order to provide a valuable reference for theoretical research and practical exploration in related fields.

Literature reviewWith the rapid development of the new generation of information technology, the enterprise business model is gradually moving toward a new stage of digital and intelligent transformation. In recent years, governments and academia have increasingly focused on how to effectively tap the potential of the digital transformation of enterprises to maximize their role in improving TFP and accelerate the transformation in economic growth drivers. Based on the existing research results, the related discussion can be summarized in the following terms.

The first area comprises the driving factors and measurement evaluation of the digital transformation of enterprises. In the context of the booming development of the digital economy, the related research on the digital transformation of enterprises shows a significant growth trend, and the research depth and perspectives show the characteristics of diversification. In terms of drivers, the existing research can be roughly divided into two categories: internal factors and external factors. Internal factors focus on capability drivers at the enterprise level, covering data resource management, information technology adoption, organizational structure optimization, employee digital capability development, the multi-functional background of CEOs, and leadership characteristics (Wang, 2023; Zhao et al., 2024). The external factors focus on the guiding role of the policy environment, including direct financial subsidies, indirect tax incentives, specific support policies for the digital industry (Ji & Huang, 2024; Zhang et al., 2024). In terms of measurement evaluation, among the three methods mentioned above, digital word frequency index construction is increasingly favored. Some scholars use big data technology to intelligently analyze the occurrence frequency of keywords closely related to the digital transformation of enterprises in specific text materials, believing that the level of frequency can reflect the effectiveness of enterprises in digital transformation to a certain extent. For example, Hu et al. (2024) started from the four dimensions of digital technology application, internet business model innovation, intelligent manufacturing practice, and modern information system construction, systematically sorted and summarized the keyword groups closely related to the dimensions, and then used text analysis technology to count the number of disclosures of these keywords in the annual financial reports of listed companies, which was used as important data support for the construction of the evaluation index of the effectiveness of the digital transformation of listed enterprises in the manufacturing industry.

The second area comprises TFP and its influencing factors. On the one hand, TFP, as the core index to measure the quality of modern economic development, is regarded as the internal driving force of the high-quality development of enterprises. It not only covers the marginal output growth from technological progress but also includes the efficiency improvement from the optimization of resource allocation. In short, TFP refers to the overall efficiency of various input factors into the final output. On the other hand, the existing literature identifies the factors influencing the TFP of firms in terms of both external and internal factors. The former includes factors such as firms' R&D investment, the executive compensation gap, the human capital structure, and resource allocation efficiency (Chen et al., 2024). For example, Yan et al. (2023) pointed out that R&D investment has an incentive effect on TFP, but only a moderate R&D investment intensity can have the most significant promotion effect on an enterprise’s TFP. The latter includes factors such as government support, environmental protection policies, digital infrastructure construction (Lv et al., 2024; Lin & Zhang, 2024). Wang et al. (2023) showed that the specialization economy formed by industrial agglomeration can improve technical efficiency and promote the TFP of enterprises in the communications equipment, computer, and other electronic equipment industries.

The third area comprises the relevant research on the impact of enterprise digital transformation on TFP. As the concept of digital transformation is newer, the judgment on the relationship between digital transformation and TFP has not been unified. Since the concept of the IT production paradox was put forward, many studies have focused on how to effectively explore the potential effectiveness of IT and accurately control the measurement error in order to solve this paradox. In recent years, with the booming wave of digital economy, academia has started to deeply discuss the application of digital value theory in improving production efficiency. In the specific social and economic background of China, some research has shown that the digital transformation of enterprises can promote the growth of TFP through intellectual property rights protection, the change in managers’ willingness, the improvement in the innovation effect, and the optimization of the operation and management structure (Zhang & Zhang, 2023; Fu & Madni, 2024). However, the study by Hajli et al. (2015) found that not all companies undergoing digital transformation benefit from the process, and only a small number of companies enjoy the economic dividends from the digital drive.

To summarize, the existing literature has carried out beneficial studies on digital transformation and TFP, respectively, which provide ideas, experience, and inspiration for this research; however, there is still room for further development. Firstly, there is diversity in the measurement methods for digital transformation, with no unified standard established, and relevant statistical data are scarce, consequently limiting the empirical validation in terms of its economic consequences. Notably, the keyword frequency analysis method based on corporate annual report texts, leveraging its advantages in data availability and scalability, has been widely applied to depict the digitalization process of enterprises (such as the semantic intensity of terms including artificial intelligence, cloud computing, and big data). However, existing studies are mostly confined to single industries or short observation windows, making it difficult to capture the long-term dynamic effects and cross-industry heterogeneous patterns of digital transformation. For instance, differences in the pace of digital strategy deployment and technology absorption capacity between state-owned enterprises and private enterprises or the divergence in the adaptability of digital technologies between capital-intensive and labor-intensive enterprises may all lead to significant variations in the effectiveness of TFP improvement. Therefore, the lack of detailed analysis on inter-firm heterogeneity can also result in biases in understanding the economic consequences of digital transformation. Secondly, the mechanisms through which digital transformation influences enterprise TFP remain unclear. The existing literature predominantly adopts a technology empowerment perspective, emphasizing that digital transformation enhances TFP by optimizing resource allocation efficiency (e.g., data-driven precise decision making), enhancing organizational dynamic capabilities (e.g., agile innovation), or reducing transaction costs (e.g., supply chain collaboration). Nevertheless, such studies often treat digital transformation as a black box, neglecting the crucial intermediary role of human–machine collaboration in technology application and value creation. Digital transformation is not merely a technological substitution but achieves efficiency leaps through human–machine complementarity (e.g., the integration of AI-assisted decision making with human experiential judgment) and human–machine integration (e.g., the reconstructive matching of intelligent systems with employee skills). These gaps render current research inadequate in unveiling the underlying logic driving TFP improvement through digital transformation, particularly in explaining the significant digital productivity paradox observed among enterprises with similar technological investments.

Compared with the existing literature, the contributions of this research are primarily as follows: (1) Based on the core proposition of technology diffusion–factor reallocation–efficiency leap in endogenous growth theory, this work constructs an analytical framework for the co-evolution of enterprise digital transformation and TFP. Furthermore, at the empirical level, using panel data from Chinese A-share listed companies, this research extracts the frequency of digital transformation keywords such as artificial intelligence, industrial internet, and blockchain from corporate annual reports through text mining techniques to construct a digital transformation index. Additionally, a two-way fixed effects model and instrumental variable method are employed to mitigate endogenous interference. This not only provides a more refined measurement tool for quantitatively assessing the microeconomic effects of digital transformation but also offers empirical evidence from the Chinese context to address the productivity paradox debate surrounding enterprise digital transformation in emerging economies. (2) The existing literature predominantly focuses on the average effect of digital transformation on TFP, neglecting the heterogeneous responses arising from the interaction between firm-level micro attributes and external environments. This study identifies and analyzes the heterogeneous impacts of enterprise digital transformation on TFP based on differences in firm-level characteristics (ownership type, factor intensity, and asset size) and external macro factors (marketization level, tax incentives, and geographical location of the enterprise). These findings provide new theoretical insights into understanding the conditional nature of the enabling effects of digital transformation. (3) Considering that the emergence of information technology systems during the process of enterprise digital transformation may replace some low-skilled workers, along with an urgent need for high-level talent to manage and operate new equipment and complete non-routine tasks, we innovatively offer theoretical explanations and empirical data on how digital transformation affects enterprise TFP from the perspective of human–machine collaboration. This not only compensates for the inadequate attention paid by the existing literature to the socio-technical system attribute of digital transformation but also provides theoretical guidance for enterprises to unleash digital dividends in the co-evolution of technology–organization–people. It also offers a decision-making basis for administrative departments to adopt relevant measures to address deficiencies.

Theoretical analysis and research hypothesesDistinct from computer integrated manufacturing, digital transformation empowers the informatization process of enterprises, leveraging key technologies such as the Internet of Things (IoT), cyber–physical systems (CPS), cloud computing, and big data analytics to achieve synergy in internal research and development (R&D), design, and supply chain management. This process enhances the exchange and sharing of data and knowledge elements across enterprise systems. Specifically, on the one hand, this research builds a theoretical model based on the existing literature reviews and endogenous growth theory to investigate the impact mechanism and effects of digital transformation on TFP. On the other hand, it explores the direct impact pathways of digital transformation on TFP from the perspectives of production entities (enterprises) and analyzes the indirect dynamic mechanisms inherent in human–machine collaboration.

Theoretical modelsIn order to explore the influence of digital transformation on the TFP of enterprises, this research makes the following assumptions:

First, the final product market is completely competitive and only produces a single category of products and services.

Second, in the market, n enterprises (in different regions) jointly produce the final product Y by using capital and labor, and the production function of the final product is

where Y represents the final product output; Yi represents the input of products produced by enterprise i; θi represents the investment share owned by enterprise i.Third, if we do not consider the implementation of a digital transformation strategy, the production function of enterprise i is

Here, Yi,t, Li,t, and Ki,t, respectively, represent the total output, labor input, and capital input of i enterprise in t period. Substituting formula (3) into the formula (1) givesFourth, the TFP of enterprises can be regarded as the ratio of the total output to the total input; that is, TFP=Y/X=∏i=1nAi,tθi. Hence, the TFP of enterprises will be determined by the input share and technological progress level of each enterprise.

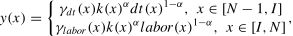

Furthermore, this work includes the variable of artificial intelligence technology in the benchmark model, in order to investigate the impact of the digital transformation strategy on the TFP of enterprises. Based on the model framework constructed by Acemoglu and Restrepo (2018), this research assumes that the intermediate commodity Yi produced by enterprise i is the sum of various production tasks x, each production task obeys the Cobb–Douglas production function, and the production task interval is [N−1].

Considering that the essence of digital transformation lies in the use of intelligent equipment to supplement and replace human capital, it will not be realized automatically. In view of this, this work refers to the research practice of Yang and Hou (2020), assuming that when enterprises perform intelligent tasks, the production of intermediate products is realized by traditional capital and intelligent capital, while when they perform non-intelligent tasks, enterprises can choose to produce only using labor or implementing a digital transformation strategy. For convenience, this research divides the task interval into [N−1,I] and [I,N], which represent the production task interval using digital technology and the production task interval using labor force, respectively. Therefore, the production function of each production task x can be expressed as

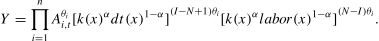

where k(x), labor(x), and dt(x) represent the demand for capital, labor, and digital technology for each production task x, respectively; γdt(x) and γlabor(x) represent the production efficiency under the digital transformation strategy and the pure labor mode, respectively. γim(x)>γlabor(x). Thus, the production function of enterprise i isFurther, this work substitutes formula (6) into formula (1), and the production function of the whole market can be obtained as follows:

Let β=I−N+1 represent the degree of digital transformation of enterprises, and after excluding the input of production factors, the formula of the TFP of enterprises can be obtained as follows:

The derivation of Eq. (8) can be obtained as follows:

Formula (9) shows that the digital transformation of enterprises has a positive role in promoting TFP, and with the improvement in the degree of digital transformation, enterprises prefer to use intelligent capital for production, thus further promoting the rise of TFP.

Research hypothesesDirect influence path of digital transformation to empower TFPWith the advancement of the Fourth Industrial Revolution, China's economy and society are gradually entering the digital economy era, where emerging technologies such as artificial intelligence and big data are replacing traditional production methods to provide impetus to economic and social operations. As a crucial component of the economy, enterprises have adopted digital transformation strategies as the cornerstone for innovating their business models and systems. This transformation is also the inevitable path to achieving efficient connectivity across the entire industry and value chains. The impact of digital transformation on enterprises' TFP is mainly manifested in the following aspects (the influence path is shown in Fig. 1).

First, digital transformation takes data elements as the core driving force, reconstructs the traditional production function through technology embedding, and breaks the law of diminishing marginal returns of capital and labor. From a technical perspective, the core of enterprises' digital transformation lies in the deep integration of new-generation information technology with production and operation activities, which reconstructs enterprises' productive forces and production relations, accelerates changes in production methods and enterprise forms, and thereby realizes new business models. In the context of imperfect market mechanisms, the misallocation of production factors such as capital and labor in Chinese enterprises is a significant reason for their low TFP (Hsieh & Klenow, 2009). However, with the help of cutting-edge digital technologies such as cloud computing, big data, and artificial intelligence, enterprises can automate internal procedural tasks, triggering a series of changes in organizational structure, marketing strategies, production processes, product design, research and development paradigms, and employment models (Wang & Shao, 2024). These transformations not only stimulate the amplifying effect of digital technology on the efficiency of existing physical production factors but also enhance the versatility and shareability of production factors, laying a solid foundation for creating new shared production dynamics and improving TFP. For example, according to BYD's technical white paper in 2023, BYD collects real-time production line data through the industrial internet platform and utilizes AI to optimize the process parameters, thereby increasing the battery production yield from 90 % to 98 % and directly reducing the factor consumption per unit output. This process validates the breakthrough of the Solow paradox: the penetration effect of digital technology significantly enhances the combined efficiency of capital and labor through the exponential appreciation of data elements. According to the China Intelligent Manufacturing Development Report (2023), enterprises that have adopted the industrial internet have experienced an average increase in production efficiency of 23 % and a reduction in failure rates by 35 %, confirming the amplifying effect of technological synergy on TFP. Meanwhile, in every aspect of production and operation, enterprises convert scattered data into high-value data information through technical processing, which not only optimizes resource allocation efficiency in production, sales, and research and development but also effectively alleviates information asymmetry by opening these data to upstream and downstream enterprises and users throughout the market, promoting close cooperation and complementary advantages among enterprises up and down the industry chain and further enhancing operational efficiency (Lin & Teng, 2023). In addition, the free flow of these high-value data in the market also optimizes resource allocation in the overall market, enabling enterprises to access higher quality production factors, thereby achieving a comprehensive efficiency upgrade. Therefore, by efficiently utilizing data information as a key factor, enterprises' digital transformation successfully achieves the goal of efficiency transformation, exerting a significant positive impact on promoting the growth of TFP.

Secondly, enterprises' digital transformation can enhance their decision-making efficiency by alleviating information asymmetry. The information here refers to processed data, and data processing plays a crucial role in converting various soft information into hard data. Therefore, data processing is key to mitigating information asymmetry. Enterprises' digital transformation mitigates information asymmetry through data processing, mainly reflected in the following two dimensions. From the perspective of information identification costs, digital transformation can break traditional time and space constraints, effectively reducing information identification costs in markets and transactions, thus alleviating information asymmetry. For example, according to Pdd Holdings Inc (2023) ESG report, big data technology can capture weak signals that are overlooked by traditional methods through non-parametric models. Pdd Holdings Inc demand forecasting model, trained on behavioral data from 600 million users, has reduced the surplus rate of agricultural products from 12 % to 4 %, demonstrating the optimization capability of data-driven resource allocation. From the perspective of information use efficiency, in the process of digital transformation, enterprises not only innovate business models but also build a resource-aggregated value network encompassing products, funds, customers, and information (Chen & Srinivasan, 2024). This network addresses information asymmetry among stakeholders by incorporating more decision-making factors, promoting intelligent decision making. Therefore, enterprises' digital transformation can quantify decision-making results to a certain extent through comprehensive data analysis, thereby reducing or even eliminating decision makers' cognitive biases and enhancing decision-making efficiency (Zhang & Guo, 2022). This mechanism precisely addresses the key factor constraining the improvement of enterprises' TFP — information asymmetry. In other words, the constraining factors of enterprises' TFP and the internal mechanisms through which enterprises' digital transformation exerts its effects are highly unified. Therefore, enterprises' digital transformation promotes TFP by enhancing decision-making efficiency.

Lastly, enterprises' digital transformation can improve their TFP by enhancing their economies of scale. Digital transformation prompts the emergence of digital products with low or even zero marginal costs within enterprises' product portfolios (Lyu, 2024). For example, traditional home appliance manufacturers introduce smart home products, bundling hardware with software services for sale, allowing consumers to unlock diverse hardware functionalities by purchasing different levels of software services. Compared to hardware products, these software services exhibit typical low marginal cost characteristics. By bundling hardware and software products, enterprises help spread fixed costs, reduce long-term average costs, and thereby achieve economies of scale, increasing TFP. Furthermore, in traditional transaction models, the limitations of geographical space lead to natural market segmentation for both the supply and demand sides. However, digital transformation enables enterprises to leverage digital technologies such as e-commerce platforms and mobile payment tools to facilitate transactions that were previously difficult to achieve, breaking through geographical constraints (Zhang et al., 2022). Additionally, digital transformation enhances enterprises' ability to convert information from both supply and demand sides into data, utilizing big data technology to effectively integrate and precisely match supply and demand, addressing issues of coordination and transaction costs, and significantly improving resource allocation efficiency. Therefore, digital transformation helps enterprises expand their product sales scale, realize economies of scale, and thereby enhance TFP.

Based on the above theoretical analysis, this study puts forward the following hypothesis:

Hypothesis 1 Under otherwise unchanged conditions, digital transformation can exert a significant positive impact on a firm's TFP through multiple mechanisms, including technology integration and restructuring, alleviating information asymmetry to enhance decision-making efficiency and strengthening economies of scale.

The groundbreaking development of artificial intelligence technology is triggering a structural transformation in production paradigms, with its core characteristic being the construction of a new production function that integrates the physical world, digital space, and human wisdom into a ternary fusion. This process transcends the traditional logic of automation replacing physical labor, and through a closed-loop mechanism of task decomposition, capability matching, and co-evolution, it promotes the transition of human–machine relations from instrumental use to ecological symbiosis, opening up new avenues for the growth of enterprises' TFP (Wang et al., 2023b).

As digital transformation accelerates, enterprise operation models are undergoing profound changes. Smart manufacturing, as the core driving force, breaks down traditional boundaries between design, manufacturing, and service by deeply integrating new-generation information and communication technologies (ICT) with artificial intelligence (AI), promoting the high-level integration of global information and the deep fusion of the information–manufacturing space. Against this transformational backdrop, the traditional model of machine substitution for humans is gradually evolving toward a new paradigm of human–machine collaboration. This shift not only adapts to the increasing complexity and specialization of production tasks but also fosters a novel decision-making and organizational framework, significantly enhancing TFP in enterprises. The rise of the human–machine collaboration model benefits from the widespread application of intelligent systems (such as robots, computers, AI algorithms, and automated control systems) in enterprises. These systems not only possess powerful computing and automated execution capabilities but also form close interactive and collaborative relationships with humans, jointly addressing the complexity and uncertainty in production and social tasks. For instance, at the task execution level, digital systems optimize operational precision in production processes through pattern recognition. At the innovation generation level, generative AI technology expands the boundaries of human creativity. This human–machine collaboration model effectively overcomes the capability trap in traditional human–computer interaction, enabling enterprises to simultaneously enhance operational efficiency and innovation effectiveness. At different stages of enterprise development, the human–machine collaboration model also exhibits dynamic evolution characteristics. The digital transformation of start-ups is mainly manifested in the construction of digital infrastructure capabilities, while the human–machine collaboration model focuses on operational-level standardized process reengineering. The digital transformation of growth-stage enterprises tends to cultivate digital expansion capabilities, with human–machine collaboration shifting its focus to decision support for intelligence augmentation. Mature enterprises focus on reconfiguration capability breakthroughs, and human–machine collaboration evolves into the collaborative evolution of the innovation ecosystem. These phased evolution characteristics validate the core viewpoint of the Dynamic Capabilities Theory, i.e., enterprises achieve a spiral enhancement of sensing–capturing–reconfiguring capabilities through human–machine collaboration, thereby fully leveraging the role of digital transformation in promoting TFP in enterprises.

Furthermore, within the framework of human–machine collaboration, humans and intelligent systems have formed a collaborative work model with complementary advantages. Humans' creativity, emotional intelligence, complex decision-making capabilities, and comprehensive application of cross-disciplinary knowledge are fully utilized, while intelligent systems provide strong support with their efficient and precise computing and automation capabilities. This model not only significantly enhances the standardization and efficiency of production processes but also brings unprecedented flexibility and innovation capabilities to enterprises. To elaborate, in the human–machine collaboration model, digital systems have constructed a closed-loop management system of sensing–analysis–adjustment through real-time data monitoring. For example, when equipment idleness or material shortages occur on the production line, the system can automatically dispatch resources to fill the gap, similar to how a traffic navigation system adjusts routes based on real-time road conditions. This dynamic adjustment capability enables enterprises to reduce idle resources and precisely match human resources, equipment, and raw materials to the most needed links. Therefore, by optimizing resource allocation, improving production efficiency, and enabling better adaptation to market changes, enterprises can continuously drive innovation and thus occupy an advantageous position in the market.

Additionally, according to organizational learning theory, human–machine collaboration promotes the digital accumulation and sharing of knowledge and experience, further enhancing the efficiency of team collaboration and the scientific nature of decision making. The in-depth implementation of digital transformation provides strong technical support and a data foundation for human–machine collaboration, enabling intelligent systems to more accurately understand human intentions, optimize production processes, and predict and respond to potential issues. In this environment, enterprises can respond more quickly to market changes, continuously drive innovation, achieve significant improvements in TFP, and lay a solid foundation for sustainable development.

In summary, digital transformation, by promoting efficient human–machine collaboration, has not only driven profound changes in enterprise operation models but also opened the door for businesses to enter a new era of smart manufacturing. In this new era, human–machine collaboration will become the norm in enterprise production, injecting strong momentum into sustainable development. By continuously optimizing resource allocation, improving production efficiency, and fostering innovation, enterprises will thrive in the market, achieve significant improvements in TFP, and make greater contributions to social prosperity and progress.

Based on the above theoretical analysis, this study puts forward the following hypothesis:

Hypothesis 2 Under otherwise unchanged conditions, human–machine collaboration is an important dynamic mechanism for digital transformation to promote the TFP of enterprises.

TFP characterizes the additional productive efficiency that can be achieved with a given level of factor inputs. The first step in estimating the TFP of an enterprise is to rationalize the form of the production function. The Cobb–Douglas production function (C-D function for short) is more flexible than other production functions such as the Trans-log function, which helps to avoid the estimation error caused by the improper setting of the function. In view of this, this work selected the C-D production function to represent the TFP of enterprises, and its specific form is expressed as follows:

where Yit, Ait, Litα, and Kitβ denote the output, TFP, labor input, and capital input, respectively. By taking the logarithmic transformation of the above equation, the following linear form is obtained:Here, yit,lit,kit,and εitdenote the output, labor input, capital input, and the logarithmic form of TFP, respectively. Estimation of this equation yields the desired estimate of TFP. Meanwhile, this work drew on the research paradigm of Zhang et al. (2023) and adopted the Levinsohn–Petrin method (hereinafter referred to as the LP method) to measure the TFP of enterprises. The core logic of the method lies in the selection of intermediate inputs as proxies for non-observable productivity shocks as a strategic response to the problem of simultaneity bias that may arise in the estimation process (Levinsohn & Petrin, 2003). From Eq. (11), the functional form of the firm's TFP is obtained asHere, i and t represent the enterprise and year, respectively; Y stands for the total operating income; L represents the number of employees in the enterprise; K represents the net fixed assets of the enterprise; M represents the input of intermediate goods. This work selected the operating cost plus various taxes and fees minus (depreciation and amortization plus employee compensation) for calculation.Core explanatory variable: digital transformationHow to accurately measure the degree of enterprise digital transformation is a challenge. At present, academics have not yet reached a consensus on the quantitative standard of enterprise digital transformation, resulting in a diversity of measurement methods. Some scholars tend to select specific indicators such as the application of enterprise resource planning (ERP), the scale of information technology investment, the proportion of telecommunication expenses to information assets, and the proportion of enterprise information technology personnel as the basis for measurement. For example, Liu (2020) quantified the level of the digital transformation of an enterprise based on the proportion of hardware and software investment in an enterprise's digital investment to its total net assets. Although these indicators are intuitive and easy to obtain, they reveal more about the informational level of an enterprise and cannot fully capture the complexity and depth of digital transformation. In recent years, some scholars have conducted keyword frequency statistics on annual reports of listed companies through text analysis technology and then constructed enterprise digital transformation indexes. Given that the annual reports of listed companies are both summarizing and forward-looking, their lexical utilization can map out the strategic orientation and future planning of enterprises. Therefore, it is not only theoretically reasonable but also highly feasible to quantify the degree of digital transformation from the frequency of enterprise digital transformation-related terms in annual reports. However, it should be noted that the digital transformation index constructed by this method still has a drawback, i.e., the forward-looking information in the annual reports may reflect the enterprises' expected planning or preliminary investment in digital transformation rather than the actual effectiveness of digital transformation. This research argues that although the above methodology has some measurement error in measuring the extent of a company's digital transformation, it can be regarded as a systematic error, given that such problems are likely to be prevalent in the annual reports of most companies. Under this premise, the digital transformation indices are still comparable across companies and years. For the purpose of this work, it can be assumed that such errors do not have a fundamental impact on the results.

Based on this, this work followed the research framework of Wang and Zhong (2024) and adopted the word frequency statistics method to construct the digital transformation index of enterprises, with the following specific steps. First, we systematically summarized and screen out the keywords related to digital transformation and used the policy-oriented documents and authoritative research reports on digital transformation at the national level as the blueprints, such as the Digital Empowerment of Small and Medium-sized Enterprises Special Action Plan issued by the General Office of the Ministry of Industry and Information Technology, as a basis to further enrich and improve the thesaurus of enterprise digital transformation features. The thesaurus was constructed from the underlying digital technology level (covering four major fields: big data technology, cloud computing technology, blockchain technology, and artificial intelligence technology) and the digital technology application level (encompassing the two dimensions of internet business models and intelligent business scenarios) (see Fig. 2). Second, we used Python crawler technology to organize the annual reports of Chinese listed companies between 2009 and 2023, to analyze the text of the annual reports (stored in textual format) with the help of the Jieba Chinese word segmentation tool, and to implement word frequency statistics. Finally, based on the segmentation results, we accurately counted the frequency of the keywords related to digital transformation in the annual reports of the companies and obtained the total digital word frequency by adding up the word frequency of each keyword. It is worth noting that, in view of the significant right-skewed distribution of such data, this research referred to the processing method of Gao et al. (2023) and performed the logarithmic transformation of the total digitized word frequency after adding 1, to generate a more robust and comprehensive indicator reflecting the status of the digital transformation of enterprises.

Mechanism variable: human–machine cooperation (MC)The degree of human–machine cooperation can fully reflect the proficiency of enterprise workers in the operation of intelligent machinery and equipment and judge whether enterprises can empower production links and improve production efficiency through the powerful computing and data processing capabilities of machines, to achieve an increase in TFP. In view of this, this work referred to the research practice of Guo et al. (2024) and used the coordination model to measure the level of human–computer cooperation. Specifically, first, to fully capture the robot aspect of human–machine collaboration in enterprises, this work followed the research approach of Qi et al. (2024) by considering the penetration rate of industrial robots in various Chinese cities as a proxy for smart manufacturing, thereby indirectly reflecting the degree of digitalization and intelligence in the external environment. To further reflect the actual application of machinery and equipment by enterprises, this study utilized the AI dictionary constructed by Yao et al. (2024) as a preset proper noun dictionary and incorporated it into the 'Jieba' word segmentation module to count the number of AI-related terms in the annual reports of listed companies. The natural logarithm of the number of AI keywords plus one was then used as the enterprise AI index (AI). The AI dictionary was generated primarily based on the list of AI-related terms provided by Chen and Zhang (2024), the AI Industry Chain Overview of the Science and Technology Innovation Board published by Ping An Securities and other industry research reports, as well as the AI lexicon provided by the World Intellectual Property Organization (WIPO). A total of 73 terms such as artificial intelligence, machine learning, and Internet of Things were manually selected. After that, through two rounds of back-to-back evaluation by experts, scholars, and enterprise CIOs, ambiguous words, such as the contextual distinction between information and intelligence, were eliminated, and new words, such as artificial intelligence, were supplemented to ensure the scientificity of the keyword screening. The contents of the dictionary are shown in Table 1. Second, the levels of smart manufacturing, AI, and enterprise human capital were standardized to the [0,1] interval. Subsequently, the level of human–machine collaboration was calculated according to formulas (13) to (15). The calculation formulas are as follows:

Here, U represents the coupling degree; V stands for the comprehensive coordination index. The parameter values are all set to 1/3, indicating that intelligent manufacturing, artificial intelligence, and human capital are equally important.Artificial intelligence dictionary.

In order to mitigate, as much as possible, the problem of omitting important variables, which may bias the causal inference of the model, we selected the following control variables, based on the research perspectives of the existing literature: the management expense ratio; percentage of independent directors; two positions in one; proportion of shareholding of the top five shareholders; return on net assets; cash flow ratio; asset–liability ratio; enterprise size; age of the enterprise listing; management ownership percentage. The descriptive statistics and construction methods of the variables selected in the paper are shown in Table 2.

Variable construction and descriptive statistics.

In order to identify the relationship between digital transformation on firms' TFP, this work constructed the following panel model:

where TFP_LP denotes the TFP of enterprise measured using the LP method; DCG denotes the degree of digital transformation of the firm; Controls represents all control variables; Industry and Year represent the industry and year fixed effects, respectively; α1and βj denote the constant term and the regression coefficient to be calculated by fitting, respectively; εit is the random error term.In addition, in order to verify whether human–computer collaboration has a mediating effect in the mechanism of digital transformation affecting the TFP of enterprises, this work drew on the research method of Wen and Ye (2014) and constructed the following set of regression equations.

In the above system of equations, the effect of digital transformation on the TFP of enterprises is tested by model (17), and if the coefficient θ is significant, then the effect of digital transformation on human–machine collaboration is tested by model (18). If the coefficient θ1 is significant, then model (19) is used to test the effect on the TFP of enterprises after adding both mediating and explanatory variables. If the coefficients ζ2 and θ2 both pass the significance test, then it indicates that there is a partial mediating effect. If the coefficient ζ2 is significant, but θ2 is not significant, then it indicates the presence of a full mediation effect. Otherwise, the mediation effect does not hold. Finally, the Sobel test and 500 Bootstrap sampling test were used to more accurately reflect the results of the mediation effect to enhance the robustness and reliability of the study.

Data sourcesIn view of the limitations of data availability, this study selected the data of Chinese listed companies during the period from 2009 to 2021 as the initial research sample set and conducted a series of rigorous data preprocessing steps to ensure the validity and reliability of the samples. The specific processing procedures were as follows: (1) we deleted the samples of firms with peculiarities in ST (special treatment) and *ST (de-listing risk warning), as well as those with peculiarities in financial data; (2) we excluded the samples of firms that conducted IPO (initial public offerings) during the study period; (3) we deleted the samples of firms with missing key variables and only retained the samples that had no missing data for more than five consecutive years; (4) in order to control the possible bias of outliers on the estimation results, we implemented the upper and lower 1 % bilateral shrinking tail treatment for all continuous variables, and after screening, we obtained a total of 24,342 valid sample observations. The firm-level data mainly came from authoritative databases such as CSMAR (China Securities Market Accounting Research Database), WIND (Wanderlust Information), and CNRDS (China Research Data Service Platform). The data on annual reports of enterprises were obtained from the official websites of the Juchao Information Network, the ShenZhen Stock Exchange, and the Shanghai Stock Exchange.

Analysis of empirical resultsMulticollinearity testIn the in-depth investigation of the effective mechanism of digital transformation affecting the TFP of enterprises, we selected more control variables in order to obtain more accurate and less biased estimates. In order to avoid the potential problem of multicollinearity, which interferes with the statistical significance of the variables and the reliability of the parameter estimation, we carried out a multicollinearity test, and the test results are shown in Table 3. The largest variance inflation factor (VIF) for the enterprise scale (Size) of 1.610, the second largest variance inflation factor for the asset–liability ratio (Ar) of 1.510, the average variance inflation factor of 1.190, and the rest of the variables of the VIF were not more than the critical criterion of 10; thus, it can be concluded that the econometric model constructed in this study does not have the problem of multicollinearity, which provides a reliable premise for the subsequent regression analysis.

Analysis of benchmark regression resultsAfter the Hausman test, the p-values all rejected the original hypothesis at the 1 % significance level. In view of this, we adopted the panel fixed effects model as the benchmark model for the subsequent empirical tests and strictly controlled the year fixed effects and industry fixed effects in the regression process to ensure the accuracy of the analytical results. For model robustness considerations, we still report the estimation results of the RE model and the POLS model, which are detailed in Table 4.

Benchmark regression result.

Note: ***, **, * represent significance levels at 1 %, 5 %, and 10 %, respectively; t-values adjusted for heteroskedasticity, and robust standard errors are in parentheses. Same below.

As can be seen from column (1) of Table 4, the estimated coefficient of digital transformation affecting the TFP of enterprises was 0.0264 and passed the 1 % significance test when all control variables were included. This indicates that digital transformation has a significant role in promoting the TFP of enterprises. The RE model and POLS model regression results did not produce significant changes, and the only difference was in the size of the coefficient; hypothesis 1 can be initially confirmed. The reason for this is that digital transformation can deeply empower the enterprise's R&D and design, raw material procurement, product manufacturing and sales of finished products, real-time management, and monitoring of the product's whole life cycle process, significantly shorten the product production cycle, and reduce the defective rate, thus enhancing the efficiency of factor utilization. At the same time, digital transformation can profoundly affect and even reshape the overall management process of the enterprise, which helps to eliminate the boundaries and barriers between various departments within the enterprise and realize the real-time and transparent organization management and production management process. Through this transformation, enterprises can significantly improve the efficiency of information transfer and processing efficiency and thus effectively reduce management, transportation, information transfer, and other operating costs. This series of positive effects on the production management system promotes the formation of an efficient production mode and ultimately promotes the enterprise's TFP.

Robustness testsThe aforementioned benchmark regression results confirm that digital transformation significantly contributes to firms' TFP, and in order to ensure the reliability of the conclusions, we employed the following four validations.

Replace the explained variableConsidering that the TFP of enterprises in the benchmark regression was calculated via the LP method, it is assumed that the intermediate input can completely represent the productivity impact. If the adjustment of enterprise's intermediate input is disturbed by non-productivity factors (such as policy intervention), it may lead to estimation bias. In view of this, we followed the research paradigm of Demir et al. (2022), used the fixed effect estimation method to recalculate the TFP of enterprises, and conducted the regression estimation accordingly. Although the fixed effect estimation method cannot completely solve the endogenous problem, it can provide complementary evidence by stripping the inherent differences of individuals. The regression results are detailed in column (1) of Table 5. The estimated coefficient of digital transformation was 0.0205, and it passed the 1 % significance test. This suggests that the baseline conclusions of this study remain robust after replacing TFP measure.

Robustness test results.

Referring to Zhao's (2021) research method, we extracted some text contents of the Report of the Board of Directors, Discussion and Analysis of Management, and Discussion and Analysis of Operating Situation in the annual reports of listed companies and extracted a certain number of successful corporate samples through manual judgment. The criterion was determined according to whether the enterprise adopted digital new technology, implemented an internet business model, realized intelligent manufacturing, and built a modern information system in production and operation. After that, the disclosure times of keywords were counted from four aspects: digital technology application, internet business model, intelligent manufacturing, and modern information system, to reflect the development degree of enterprises in all aspects. On this basis, we standardized the word frequency data, used the entropy method to determine the weight of each index, and finally obtained the digital transformation index (DCG2) of listed companies, which was used as a substitute index for the core explanatory variables in the benchmark regression. The specific estimation results are shown in column (2) of Table 5. It can be seen that the empowerment effect of digital transformation on the TFP of enterprises still existed, and the influence coefficient was 0.0004, which was significant at the level of 1 %. This is basically consistent with the estimated results of the benchmark regression, which further verifies the reliability of the regression results.

In addition, considering that the abovementioned way of replacing explanatory variables still depends on the frequency of text words, there may be strategic disclosure bias. Therefore, we further introduced the digital patent (DP) as an objective technical capability index to replace digital transformation and verified whether it promoted the TFP of enterprises. From the regression result of column (3), the influence coefficient of DP was 0.0001, and it passed the significance test of 1 %. The influence coefficient was slightly lower than that of digital transformation, which may be due to the R&D-application lag effect of digital patent indicators representing the actual output of technology research and development, which cannot be quickly reflected in the improvement in TFP. Although there are differences in the order of magnitude, the consistency of their directions (all significantly positive) verifies the robustness of the core conclusion.

Introduce the provincial fixed effectIn the above benchmark regression model, we incorporated firm characteristic variables to minimize the problems caused by omitted variables, but it is still possible that important variables affecting firms' TFP were omitted. In view of this, we drew on the methodology of Zhu and Yu (2024) and introduced province fixed effects to effectively control for time-varying macro-environmental factors at the province level, and the adjusted regression results are displayed in column (4) of Table 5. The results show that the impact coefficient of digital transformation was 0.0264 after the inclusion of province fixed effects and passed the 1 % significance test. This further confirms the important role of digital transformation on firms' TFP improvement and reinforces the core findings of this study.

The lag phase of core explanatory variablesConsidering that the implementation of digital transformation by enterprises is a gradual process, whose effect may lag behind the inputs and construction in the current period, there may be a lag effect on the impact on TFP. In view of this, we referred to the research method of Li et al. (2024b), lagged one period of enterprise digital transformation treatment, and re-ran the regression; the regression results are shown in column (5) of Table 5. The results show that the lagged one-period of enterprise digital transformation still had a significant positive contribution to TFP, with an impact coefficient of 0.0220, which once again confirms that the regression results are reliable.

Excluding the sample of municipalities directly under the central governmentBecause China's municipalities directly under the central government (Beijing, Tianjin, Shanghai, and Chongqing) took the lead in issuing smart manufacturing-related plans, standard specifications, and supportive policies, and there is heterogeneity between these and other cities in terms of factors such as digital infrastructure construction, innovation capability, resource endowment, and talent cultivation, we excluded the sample of enterprises located in the region of municipalities and re-ran the regression test. The regression coefficient of digital transformation in column (1) of Table 6 was 0.0278, which was significant at a 1 % confidence level, indicating that the core conclusion of digital transformation promotes the TFP of enterprises has not changed.

Robustness test results (continued).

In the situation where digital transformation affects the TFP of enterprises, because it takes some time to complete technology implementation, staff training, and business process adjustment, the promotion effect of digital transformation on TFP may have a certain lag. Therefore, we put the t-1 period of TFP into the regression equation and analyzed the influence of digital transformation on the current TFP through the dynamic panel estimation model and the performance of this influence in the t-1 period. As can be seen from column (2) of Table 6, the estimation coefficient of digital transformation was 0.0152, and it passed the significance test of 1 %. The estimated coefficient of the TFP of enterprises in the t-1 period was 0.4647, which passed the significance test of 1 %. This shows that digital transformation has a significant lag in improving the TFP of enterprises, which is helpful for enterprises in evaluating the long-term effect of digital transformation more scientifically and formulating reasonable digital transformation strategies and investment plans.

Adjust the sample observation periodThe outbreak of the COVID-19 epidemic in 2020 was a global exogenous shock, which had an unexpected and nonlinear impact on the business environment (such as supply chain interruption, shrinking demand, and policy intervention) and the digital transformation process (such as being forced to accelerate an online transition). This impact may be mixed with the active digital transformation behavior of enterprises, leading to a deviation in the estimation results. In addition, the fluctuation in the TFP of enterprises during the epidemic period may have been more driven by the epidemic itself (such as shutdown and sudden drop in demand) than by the long-term effect of digital transformation. Eliminating abnormal years can avoid the interference of extreme values on the regression results. Based on this, the year after 2020 was excluded and regressed, and the results are shown in column (3) of Table 6. The empirical results show that digital transformation still had a significant positive effect on the TFP of enterprises after excluding the epidemic year. This shows that the impact of digital transformation on the TFP of enterprises was not driven by the special environment of the epidemic but is universal across periods. Moreover, this approach can effectively avoid the risk of false causality and ensure that the estimation results capture the endogenous driving effect of digital transformation, rather than the short-term stress response forced by the crisis.

In summary, the aforementioned robustness checks have excluded, from different dimensions, the interference of factors such as model misspecification, measurement errors, and external shocks. Despite the differences in magnitude of the estimated coefficients across various methodologies, all results passed the economic significance test, and the standardized direction and intensity of effects exhibit consistency with the baseline regression. It is noteworthy that the direction of the impact of the core explanatory variable remained entirely consistent across all tests, with stable statistical significance and no systematic deviation observed in coefficient differences. Therefore, although different measurement perspectives from various methodologies lead to reasonable fluctuations in the absolute values of the coefficients, the positive effect of digital transformation on the enhancement in TFP demonstrates robustness both in terms of statistical significance and economic logic, thereby reinforcing the reliability of the core conclusions in this study.

Endogenous treatmentWithin the framework of exploring the effects of digital transformation on firms' TFP, we introduced many control variables in an attempt to alleviate the endogeneity problem caused by the absence of key variables and the lack of measurement accuracy. However, the modeling still faces the problem of joint endogeneity caused by the mutual causality between digital transformation and TFP. Specifically, through digital transformation, firms may positively contribute to TFP through mechanisms such as broadening financing channels and optimizing the allocation of factors of production. Conversely, firms with higher TFP are more likely to adopt and implement a digital transformation strategy, as they usually have higher cash flow resources and thus show greater financial support and a propensity for transforming.

In view of this, following the relevant methods of econometric causal inference, we constructed instrumental variables from the following two dimensions and tested them using the two-stage least squares (2SLS) method. First, referring to Xu et al. (2024), the mean value of the digital transformation of other enterprises in the same segment in the same year was selected as the first instrumental variable. The reasons for the selection are as follows: enterprise digital transformation constitutes a costly and risky systematic project, facing extremely high uncertainty. As numerous enterprises stand at the crossroads of digital transformation, they harbor aspirations. Yet, they often find themselves hesitating, rooted in the quandary of not knowing how to transform; they are gripped by the fear of the unknown, a dread of change. As a result, companies often tend to search for benchmark companies in their neighborhoods to learn and imitate their digital transformation strategies in order to improve their own transformation success rate. In summary, in the same year and within the same industry, the digital transformation effectiveness of other enterprises shows a high degree of correlation with this enterprise, but this correlation is not directly related to the TFP of the enterprise, thus satisfying the theoretical requirements of correlation and exclusivity. Secondly, the provincial data on the number of fixed-line telephones per 100 people in 1984 was chosen as the basis to construct the second instrumental variable. At the level of exogeneity verification for the exclusion restriction, double validation was employed to ensure the exogenous nature of the variable. Firstly, the penetration rate of fixed-line telephones, as a predetermined variable, was established >30 years prior to the sample period, thereby eliminating reverse causality with the current productivity of enterprises from a temporal perspective. Secondly, through a review of the historical literature, it was confirmed that there is no known transmission mechanism between traditional communication infrastructure and the TFP of enterprises; its impact can only be realized through the pathway of digital transformation. However, since the raw data of this variable are in cross-sectional form and cannot be directly used for panel data analysis, we referred to the study of Song et al. (2024) to construct the cross term between the number of fixed-line telephones per 100 people and the digital transformation of the enterprise lagged by two periods in 1984 for each province, which was used as an instrumental variable for the level of digital transformation of that enterprise in that year. Furthermore, considering the widespread presence of heteroskedasticity and serial correlation issues in economic variables, we further employed the two-step optimal generalized method of moments (GMM) for testing, thereby obtaining more precise parameter estimation results. The GMM can effectively deal with the heteroscedasticity and sequence correlation problems in panel data by using the orthogonal moment condition; that is, the tool variable matrix and the model error term satisfy the orthogonal constraint condition. Furthermore, the orthogonal moment condition of the GMM allows flexible adjustment of the correlation structure between tool variables and error terms. For example, when the error term has a moving average process, the potential correlation between the long-distance lag variable and the current error term can be avoided by limiting the maximum lag order of the tool variable, thus ensuring the effectiveness of the moment condition while controlling the correlation of the sequence. In addition, the two types of instrumental variables selected in this study may be subject to weak exogenous risk, and the GMM optimizes the effectiveness of instrumental variables through a weighted matrix, providing more robust estimation results in weak instrumental variable scenarios. The specific results are shown in Table 7.

Endogeneity treatment results.

In the first stage of regression, the two kinds of instrumental variables selected were significantly positively correlated with digital transformation, which was consistent with the expected sign direction. Meanwhile, in the instrumental variable under-identification test, the Kleibergen–Paap rk LM statistics of the two types of instrumental variables were 171.258 and 1881.997, respectively, which significantly rejected the original hypothesis; in the instrumental variable weak identification test, the Kleibergen–Paap rk Wald F statistics of the two types of instrumental variables were 171.742 and 2115.122, both of which were greater than the critical value of 16.38 at the 10 % significance level of the Stock–Yogo weak identification test, indicating that there is no weak instrumental variable problem. Therefore, both types of instrumental variables selected in this work are reasonable and feasible. In the second-stage regression, after endogeneity adjustment, the positive promotion effect of digital transformation on firms' TFP still held and passed the 1 % significance test. This result suggests that endogeneity problems due to omission of important variables or two-way causality did not have a significant impact on the core findings, and the estimated coefficients slightly increased. In addition, from the regression results of the GMM, digital transformation has a significant positive effect on the TFP of enterprises, and the influence coefficient is close to the regression coefficient of the second stage, which once again demonstrates the reliability of our core conclusions.

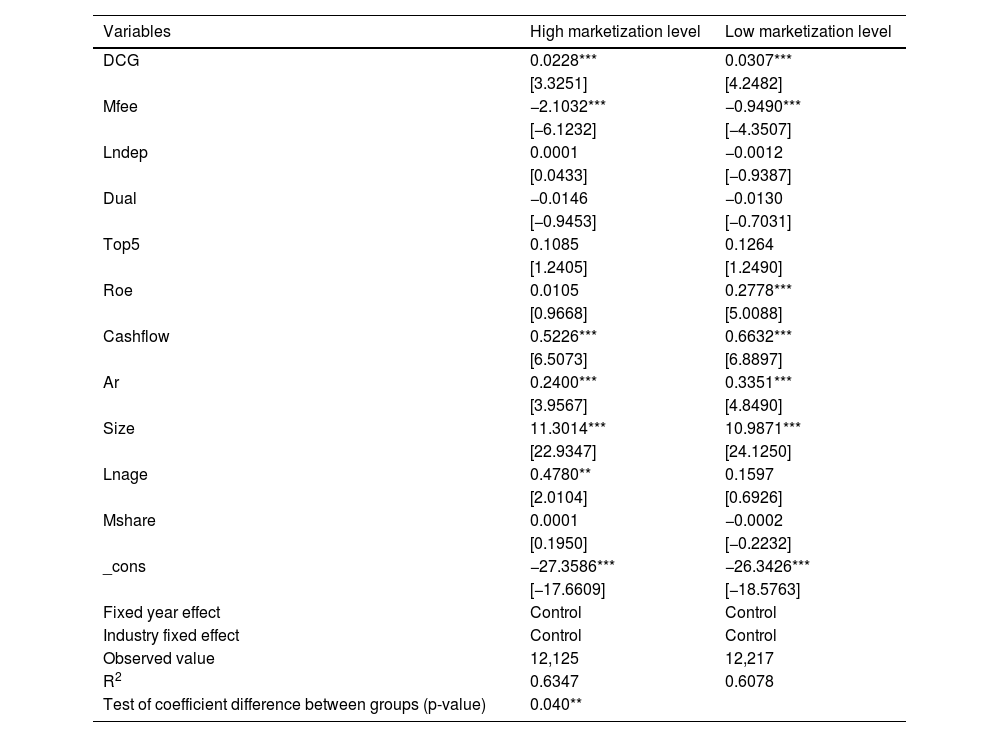

Heterogeneity analysisHeterogeneity analysis based on firms' micro characteristicsNature of property rightsConsidering the significant differences among enterprises of various ownership types in terms of their organizational form, business model, resource abundance, and government support, as well as their varying degrees of emphasis and dependence on digital transformation, we divided the sample into central state-owned enterprises (SOEs), local SOEs, and non-state-owned enterprises for analysis. The specific estimation results are shown in Table 8. The impact of digital transformation on enhancing the TFP of enterprises did not fundamentally vary with the nature of enterprise ownership. However, for central state-owned enterprises, the promoting effect of digital transformation on their TFP was the most pronounced, with an influence coefficient of 0.0311, passing the significance test at the 10 % level. Non-state-owned enterprises and local SOEs followed in order. The possible reasons for these results are as follows. Firstly, from the perspective of differences in policy support and strategic orientation, the digital transformation of central SOEs is often integrated into national strategies (such as digital China and new infrastructure), receiving specialized policy support (such as financial subsidies, tax incentives, and data openness pilots), and the transformation objectives are linked to government performance indicators, resulting in stronger execution. However, local SOEs are constrained by local financial capabilities and fragmented policies, while non-state-owned enterprises rely more on market-based resources, with weaker policy support. This leads to a lack of systematic top-down design in digital transformation, which restricts its promotion of enterprise TFP. Secondly, from the perspective of differences in data integration and application scenarios, central SOEs can break down internal data silos through administrative directives, achieving full-domain integration of production, supply chain, and customer data, providing a high-quality data foundation for AI algorithm optimization. Moreover, the business scenarios of central SOEs are complex and diverse (such as energy production, logistics scheduling, and financial risk control), making it easier for digital technologies to find high-value application scenarios. Thirdly, from the perspective of differences in soft budget constraints and resource acquisition, central SOEs benefit from implicit government guarantees and preferential financing channels, making their digital transformation investments less subject to short-term profitability pressures and capable of undertaking high sunk-cost technological R&D. However, local SOEs are constrained by local fiscal capacity and debt ceilings, while non-SOEs face credit discrimination, making their digital transformation investments vulnerable to being squeezed out by short-term cash flow pressures. Especially during economic downturns, hard-constrained enterprises are more inclined to cut digital spending to survive. Therefore, the promotion effect of digital transformation on enterprises' TFP cannot be fully utilized. Fourthly, from the perspective of differences in principal–agent conflicts and implementation incentives, as a national strategic implementation vehicle, the management of central SOEs has dual goals of economic performance and policy implementation. Digital transformation is included in the SASAC evaluation system, and agency costs are reduced through strong incentive-compatible contracts to ensure that technological investment is transformed into productivity improvement. However, in non-SOEs, there is a significant divergence in goals between owners and professional managers. The long-term benefits of digital transformation are mismatched with managers' tenure, which induces short-sighted behavior. Especially when the digital leadership of management is insufficient, managers are more inclined to choose shallow digital transformation (such as the computerization of the financial system), which is easy to quantify and quick to attain results, while avoiding a long-term investment in reshaping the organizational structure and upgrading human capital, thus restraining the full release of the technical dividends. In summary, central SOEs have advantages in terms of resource abundance and policy embeddedness, enabling their digital transformation to be more easily converted into TFP improvement. In contrast, local SOEs and non-state-owned enterprises are constrained by one or more shortcomings, leading to lower marginal returns from digital transformation. This finding suggests that policymakers need to design differentiated support paths for enterprises of different ownership types (such as strengthening the supply of inclusive digital infrastructure for non-state-owned enterprises) to unleash the potential of full domain transformation.

Sub-sample regression results distinguishing the nature of firm ownership.

Lu and Dang (2014) pointed out that there are differences in the degree of reliance on technology and external resources of enterprises with different factor intensities, and thus their TFP is different. In view of this, we combined the industry classification guidelines for listed companies (2012), divided the enterprise sample into three categories: technology-, capital-, and labor-intensive, and conducted group regression; the estimation results are shown in Table 9. The results show that the digital transformation of both labor-intensive and capital-intensive enterprises can have a significant positive effect on their TFP, and the estimated coefficient of the former was larger. However, technology-intensive firms did not pass the significance test. This is because, firstly, although labor-intensive firms do not yet have the first-mover advantage to fully implement digital transformation, the penetration and application of digital technology has initially shown a partial substitution effect on low-skilled labor. By replacing repetitive manual labor with digital equipment such as industrial robots and intelligent sorting systems, labor costs and operational errors are directly reduced. Moreover, digital tools liberate low-skilled workers from mechanical operation and turn them to high value-added tasks such as equipment monitoring and process coordination, thus realizing skill re-engineering. This trend is conducive to optimizing the labor structure and cutting production costs, which in turn drives the growth of TFP (Zhai & Liu, 2023). Second, the process of digital transformation is highly dependent on investment in intangible assets, while the supporting role played by traditional tangible assets cannot be ignored. Capital-intensive industries, due to their inherent asset base, provide the necessary material conditions for digital transformation and promote the TFP of enterprises in the process; in technology-intensive industries, enterprises tend to build up their competitive advantages through continuous scientific and technological research and technological accumulation. The innovation and upgrading of digital technology constitute the core competitiveness of such industries. However, this is also why the contribution of digital transformation to TFP of technology-intensive firms may be overshadowed by the high degree of technological sophistication that already exists within them, and thus its direct contribution may not be fully realized.

Sub-sample regression results distinguishing firms' intensity factor.