Understanding the influence of digital inclusive finance (DIF) on inclusive green growth (IGG) is crucial for promoting the green transformation and sustainable development of developing economies. This study explores the effect of DIF on IGG in Chinese cities, and how DIF affects IGG by effectively coupling financial instruments with green transformation goals through a “triple mediation mechanism”. The findings reveal that DIF significantly promotes IGG, as well as economic growth, income distribution, welfare inclusiveness, and environmental protection. Furthermore, green technology innovation, industrial upgrading, and employment quality play a mediating role in the DIF-IGG relationship. Additionally, the main effect is stronger in the east and south, and cities with higher level of economic development, industrial upgrading, population density, agricultural entrepreneurship, and non-agricultural entrepreneurship, as well as in the 2016–2022 period. Overall, this study reveals the mechanisms and effects of DIF on IGG, expands the scope of research on economic green transformation, and provides new empirical evidence and valuable references for advancing financial sustainability and IGG in China and other developing countries. It also offers insights into addressing the current global ecological and environmental crises, and economic inequality.

Today, digital transformation has become an absolute necessity (Kraus et al., 2022; Leal-Rodriguez et al., 2023), as it facilitates adaptation to the Fourth Industrial Revolution (Uddin, 2024) and can profoundly affect businesses (Buck et al., 2023; Sumbal et al., 2024), including creating financial innovation opportunities. Digital inclusive finance (DIF) represents one such model of financial innovation, whose potential inclusive and green attributes can enable urban economic green transformation. Indeed, in recent years, with the continued integration of digital technology and financial inclusion, DIF has been recognized as a crucial factor in promoting inclusive green growth (IGG) in developing countries. For instance, it can alleviate financing challenges encountered during economic green transformation by providing low cost and efficient financial services, particularly for investments in low-carbon technologies and green projects. DIF also utilizes digital technologies such as smart terminals and cloud computing to provide financial products and services to the public, transcending temporal and spatial limitations, and promoting information and resource sharing (Hui, 2021). This can help with the demand for financial product and service innovation in IGG. Therefore, DIF can play a vital role in promoting IGG and sustainable development in developing countries.

The traditional growth model has helped the Chinese economy in achieving rapid development for >40 years, with an average annual gross domestic product (GDP) growth rate of 13.7 % from 1978 to 2024. However, this growth model has also led to environmental degradation, resource depletion, and income distribution inequality (Long & Ji, 2019; Liu & Waqas, 2024), creating uncertainties in China’s economic green transformation and sustainability (Gu et al., 2021). A key characteristic of emerging economies transitioning to developed economies is their emphasis on creating a sustainable society and the pursuit of sustainable development (Shao et al., 2020). In recent years, China’s implementation of such strategies, including IGG initiatives, has attracted international attention given that the country is the world’s largest developing country. Since 2010, China has indeed achieved significant progress in promoting IGG, with increasing synergies among economic growth, environmental protection, and social inclusion. For example, from 2010 to 2023, China grew annually at 6.5 % on average, while the average annual energy consumption growth was 2.8 % and the country achieved a cumulative reduction of 30.6 % in energy intensity, which is equivalent to saving approximately 1.65 billion tons of standard coal. This has set a positive example for developing countries worldwide. However, the fundamental, structural, and trend-based pressures facing China’s economic green transformation have not been fundamentally alleviated. The issue of insufficient inclusiveness in green growth remains prominent. Therefore, accelerating IGG has significant practical implications for promoting global economic green transformation and sustainable development, including for China.

From a practical perspective, China’s IGG initiative represents a comprehensive transformation of diverse areas, encompassing development concepts, production modes, and lifestyles, which requires dual support from both financial and technological resources. However, due to long-standing disconnections in financial intermediation and technological penetration mechanisms, the national financial system has struggled to achieve inclusiveness and equity, making it difficult to implement China’s IGG objectives. The recent literature has also explored the impact of DIF on inclusive green development and inclusive growth. For instance, Liu and Xu (2023) argue that the core of DIF lies in the broadening, rationalization, and sophistication of the financial system, thereby providing momentum for enterprises’ inclusive green development. Hu et al. (2023) suggest that the essence of DIF enabling inclusive growth is to fully leverage technological innovation advantages, overcome barriers in traditional inclusive finance models, and provide equal digital financial services to vulnerable groups. However, these studies are limited to explorations at the enterprise and provincial levels, with few examining DIF’s effect on urban IGG in developing countries such as China. Addressing this gap, this study examines the theoretical and empirical issues concerning DIF’s effect on IGG of Chinese cities. This investigation can help advance financial sustainability and IGG in China and other developing countries, while addressing current global ecological environmental crises and economic inequality issues.

Background and literature reviewThe emergence and development of DIFIn 2005, the United Nations formally proposed the concept of inclusive finance for the first time, and defined it as a financial business model aimed at narrowing the gap between the rich and poor and improving financial inclusion. In 2013, China formally proposed to develop inclusive finance. Involving the integration of digital technology and inclusive finance, DIF has become an important way to enhance global financial sustainability. In 2016, the release of the G20 Digital Financial Inclusion Principles clearly showed that digital finance had become a recognized model of inclusive finance (Emtehani et al., 2021). Building on its earlier successes as well, in 2023, China clearly emphasized the need to promote the development of DIF in an orderly manner, including improving the level of inclusive financial technology, building a healthy DIF ecosystem, and improving the DIF regulatory system.

Notably, due to different national conditions, the DIF policies of major economies exhibit differences. European countries have chosen a market integration path by establishing rules first. For example, the European Union (EU) is seeking to support environmental goals and financial inclusion by establishing the world’s most stringent green asset recognition standards, and promoting open banking and green data sharing. On the one hand, the green asset identification standard can clearly demarcate the definition of “green”, reduce market fragmentation and investors’ green identification costs, and attract capital for green projects in Europe. On the other hand, open banking and green data sharing policies can effectively integrate Europe’s environmental performance, carbon emissions, and other green data, helping investors accurately assess the green value and potential risks of projects.

The United States has adopted a market-led innovation incentive system, such as allowing technology giants such as Apple Pay to issue green consumer finance products, supporting private companies such as Tesla to lead the innovation of green financial products, and promoting tax credit measures in the Inflation Reduction Act. On the one hand, technology giants use their huge user base and digital platforms to rapidly promote green and low-carbon consumption scenarios, and lower the threshold for adopting green technologies. Simultaneously, they encourage consumers to choose green products through tools such as consumer points rewards and carbon footprint tracking, thereby forming a demand side driver as well. On the other hand, the Inflation Reduction Act provides tax credits for renewable energy projects such as photovoltaics and wind power, and for the purchase of electric vehicles, significantly reducing the risk of corporate green investments. However, the tax credit policy relies on personal taxpaying ability. As such, low-income families in the United States may not fully enjoy the benefits due to their low tax burden, which may exacerbate the imbalance in the distribution of benefits in the green transition. In addition, the act also requires the localization of clean technology production, which can promote the transformation of traditional industrial states to green manufacturing. However, the skill mismatch in the transformation process may lead to the exclusion of some workers.

Meanwhile, China has adopted a government-led model, such as supporting IGG goals by formulating green finance and financial technology development plans, proposing dual carbon goals and carbon reduction support tools, supporting mobile payments and green loans, and encouraging green financial product innovation and digital employment. The Chinese model, through the closed-loop of “target constraint - digital infrastructure - product innovation - employment support”, considers inclusiveness while rapidly promoting green transformation, especially amplifying the effect of digital technology on inclusive finance and regional rebalancing. However, the strong state control may inhibit spontaneous market innovation. Hence, endogenous drivers should be fostered by introducing a competitive subsidy mechanism. Compared with European and American countries, China is better at using scale advantages and digital governance tools to achieve the inclusive green transformation of the economy. However, one should remain vigilant against the lack of grassroots adaptability and digital divide, which may be caused by policy rigidity. At present, China’s DIF levels are among the best in the world. In 2023, green loans had increased 36.5 % from 2022 to reach 30.08 trillion yuan. China’s digital payment and digital finance also rank first in the world, accounting for 45.60 % (34.62 trillion yuan) and 15.6 % (4.17 trillion yuan) of the corresponding global markets, respectively. Overall, the rapid development and application of DIF in China has alleviated the bias and environmental cost problems of traditional finance to a certain extent, and provided a driving force for promoting the green transformation of regional economies. This undoubtedly provides valuable experience reference for developing countries on how to use digital technology to promote sustainable finance and IGG.

The emergence and development of IGGIGG began with the concept of inclusive growth proposed by the Asian Development Bank in 2007. Meanwhile, the World Bank defined IGG as “a sustainable development model that takes into account both economic growth and the improvement of social and environmental well-being, and achieves green growth while ensuring social inclusion with equal opportunities”. The 2012 Rio+20 Summit also emphasized the importance of promoting IGG. Subsequently, through the United Nations report and systematic research of the Asian Development Bank, the issue of IGG gradually gained widespread attention from countries globally. In 2016, the United Nations proposed the Sustainable Development Goals, which also incorporated the principles of IGG. Since then, many countries have begun formulating new development strategies centered on IGG. In summary, IGG is a sustainable development model that considers economic growth, sustainability, and inclusiveness. Its goal is to combine the interests of industrialized countries with green growth and inclusive growth in developing countries to address the global ecological and environmental crisis, and economic inequality, thereby achieving sustainable development.

DIF researchIn recent years, the development of DIF has received great attention from global policymakers and scholars. Most scholars have reached a general consensus on the economic effects of DIF, believing that it plays a positive role in promoting household consumption (Zhang et al., 2020; Chen & Chang, 2024) and sustainable employment (Geng & He, 2021), narrowing the urban-rural income gap (Li & Feng, 2023), reducing farmers’ poverty vulnerability (Liu et al., 2024; Wu & Zhang, 2025), and easing financing constraints (Ross & Blumenstein, 2015). Some scholars have studied the influencing factors of DIF. Data network coverage and smartphone penetration are the main determinants of the development of DIF (Beck et al., 2016). Meanwhile, other scholars argue that digital financial literacy is necessary to optimize DIF (Gumilar et al., 2024). However, a supportive regulatory environment, a clear regulatory system, and supportive government policies are also crucial to the sustainable development of DIF (Xiao et al., 2024). This is because digital technology is constrained by factors such as privacy issues, illiteracy, and limited economic accessibility. In summary, DIF is affected by factors such as technical infrastructure, digital financial literacy, government policies, and regulatory systems. Since the Internet is an important medium for DIF, some scholars have also explored the impact of mobile payments on DIF. For example, Huang et al. (2020) argue that mobile payments in China are revolutionizing financial inclusion, driven by supply shortages, a friendly regulatory environment, and the latest technological developments.

IGG researchIGG lacks a unified authoritative definition, with scholars interpreting it from different perspectives. From a development economics perspective, IGG is regarded as a sustainable development strategy (Schoneveld & Zoomers, 2015; Zhang & Li, 2023). From a welfare economics perspective, scholars believe that the core goal of IGG is to improve people’s welfare (Kumar 2017; Berkhout et al., 2018). Then, what kind of economic growth is IGG? Despite the lack of consensus on the definition of IGG, the core essence is unanimously recognized: IGG aims to pursue the coordinated development of economic, social and environmental sustainability. Scholars have also focused on the measurement and influencing factors of IGG (Ofori et al., 2023; Li et al., 2023; Wu et al., 2025; ; Okombi & Ndoum, 2024). However, the multifaceted nature of the IGG definition has led to a lack of consensus on measurement methods, indicator frameworks, and influencing factors. In general, there are two main methods for measuring IGG: evaluating input-output efficiency and building a comprehensive indicator system. Scientifically evaluating IGG is crucial to guide the economy toward green and inclusive transformation, especially selecting scientific and appropriate indicators and measurement methods.

The effect of DIF on IGGExtant research focuses on two aspects. First, the effect of DIF on the green economy. Chinese scholars generally believe that digital finance can promote green growth by supporting corporate digital transformation and solving energy poverty. For instance, digital technology can be used to help companies improve the success rate of green innovation projects (Fan et al., 2022; Razzaq & Yang, 2023; Chen & Zhang, 2024). Meanwhile, DIF promotes industrial green transformation by strengthening innovation capabilities and improves green total factor productivity by alleviating factor mismatch (Tan & Shu, 2020; Zhu et al., 2022, 2023). In addition, DIF improves regional carbon performance and energy efficiency of the real economy (Duan et al., 2021; Zhou & Wang, 2024), and promotes green agricultural development (Ma et al., 2024; Guo et al., 2024). European studies have shown that digital finance has enhanced financial inclusion in EU countries, and promoted the accessibility and sustainable development of financial inclusion in Balkan countries (Spilbergs, 2023; Gigauri et al., 2023). Meanwhile, DIF has reduced the carbon footprint of the top 30 remittance recipients (Farzana et al., 2024). However, some scholars have proposed different views. Faisal et al. (2018) find a nonlinear relationship between financial development and environmental pollution in Turkey. Ahmad et al. (2022) and Abbas et al. (2024) show that financial inclusion has negatively affected the ecological environment of BRICS countries and green economic growth in 12 developing countries such as Indonesia. In most cases, the China-Europe DIF research supports the sustainability and inclusiveness of financial services, and the idea that DIF positively affects the green economy and sustainable development. However, the opposite results are observed in many developing countries.

Second, the effect of DIF on green investment and green innovation. On the one hand, DIF reduces the financing cost of green projects by providing financial products such as online financing platforms, digital bonds, and green funds (Wang & Zan, 2024). Green transformation is usually accompanied by higher investment risks. DIF can use technology to provide more investment options, thereby positively affecting green investment (Gu et al., 2024; Zhu et al., 2024). For example, peer-to-peer (P2P) lending platforms in the United States, the United Kingdom, Sweden, and South Korea use digital technology to provide green financial resources to the market (Jung & Lee, 2022). These green investments include innovative financial products such as green bonds, green funds, and crowdfunding, which help diversify investment risks and attract more investors to participate in green projects.

On the other hand, digital transformation promotes knowledge creation by leveraging corporate innovation culture and the regional innovation environment (Chen et al., 2024a), and positively affects corporate innovation (Liu et al., 2023; Chen et al., 2024b). A particularly illustrative example is the role of inclusive finance’s digital transformation in promoting corporate green innovation. Within the framework of green innovation, digital finance helps increase urban economic concentration and develop local financial systems (Zhu et al., 2024). This can create an environment conducive to the external financial framework, thereby stimulating corporate green innovation behavior (Hao et al., 2023). In the Chinese context, DIF has a significant positive effect on green technology innovation of non-state-owned enterprises, heavily polluting industries, and enterprises in the central and western regions (Wang et al., 2022; Shu & Huang, 2024). Regarding the underlying factors, DIF can improve the enthusiasm of enterprises for green technology innovation by enhancing the coverage breadth, use depth, and digitization degree of digital finance (Xu et al., 2023). Here, improving information disclosure and easing financing constraints play key mediating roles (Kong et al., 2022; Du et al., 2024). However, some scholars have highlighted that although DIF has improved the green innovation efficiency of a region, it has a siphon effect on surrounding cities (Zhang et al., 2022a). In summary, DIF or digital finance provides convenient financing channels, reduces financial constraints, improves resource allocation, and increases information transparency. It can help investors identify and invest in green projects more quickly, thereby jointly promoting the development of green investment and green innovation.

Literature summaryExtant research mainly focuses on the theoretical and empirical issues of DIF and IGG. Further, it demonstrates the inherent relationship between DIF and the green economy, green investment, and green innovation. However, few scholars have conducted a comprehensive discussion on the effect of DIF on IGG. Specifically, extant research suffers from some limitations: First, most studies focus on enterprises and provinces in developing and European countries, and ignore the effect of DIF on IGG at the city level. Some studies do mention the issues of urban industrial green development and green total factor productivity. For example, Zhu et al. (2022) observe that DIF can improve urban green total factor productivity by alleviating capital and labor mismatches. Tan and Shu (2020) find that new financial development can promote urban industrial green development by strengthening financial marketization and innovation capabilities. However, the authors do not explore the impact of DIF on the internal dimensions of green total factor productivity and industrial green development.

Second, when measuring the IGG level, some studies do not clarify the meaning of IGG, and confuse it with “inclusive growth” or “green growth”, resulting in blurred indicator boundaries. Most studies focus on economic and environmental indicators, with few incorporating social inclusion indicators (such as fair income distribution and universal welfare). Further, due to excessive reliance on economic data or subjective weighting methods while allocation dimension weights, the measurement results are not rigorous enough.

Third, when discussing the transmission mechanism, most studies only apply traditional financial development theory for analysis, which focuses on traditional paths such as digital transformation, financing constraints, resource mismatch, technological innovation, innovation culture, and environment. However, the failure to construct a unique analysis model for DIF, especially the lack of integration of key factors such as green innovation, industrial upgrading, and employment quality into the theoretical framework, leads to insufficient explanatory power.

Fourth, China’s development, and thus, DIF development exhibit clear regional balances. However, few studies evaluate the regional heterogeneity of DIF’s effect on IGG. Meanwhile, when discussing regional heterogeneity, most studies adopt the traditional classification method wherein the country is classified in the three regions of east, central, and west. They do not adequately reflect or examine the increasing north-south gap caused by the continued shift of China’s economic center to the south.

Contribution of this studyBased on panel data from 282 cities at or above the prefecture level in China from 2010 to 2023, this study comprehensively explores the mechanism and effect of DIF on IGG from both theoretical and empirical perspectives. We also examine the triple mediation mechanism of green technology innovation, industrial upgrading, and employment quality. In addition, this study focuses on the regional heterogeneity of DIF’s influence on IGG, and supplements the discussion of heterogeneity from four aspects: temporal, economic development, industrial structure, and population density differences.

This study makes four contributions: First, considering the limited literature on the effect of DIF on IGG in developing countries, this study addressing this gap by identifying DIF as a key driving factor for IGG in Chinese cities.

Second, this study not only clearly defines the connotations of IGG, but also explains its main characteristics from the four aspects of goals, methods, resource views, and values. Thus, it helps clarify the boundaries for the dimensional design and indicator selection of the IGG evaluation system. Specifically, this study incorporates the three pillars of economy, society, and environment into the definition of IGG. Further, our indicator evaluation system integrates the four dimensions of economic growth, income distribution, welfare universalization, and environmental protection. This helps address the shortcomings of traditional research that over-relies on economic and environmental indicators, and ignores social inclusion indicators. Moreover, this study uses both subjective and objective combined weighting methods to allocate the weights of the 4 dimensions and their 16 indicators, mitigating the challenges associated with using only type of weighting methods.

Third, this study reveals three mediation mechanisms of the main effect: green technology innovation, industrial upgrading, and employment quality. This promotes theoretical development at the following three levels: (1) It helps overcome the limitations of traditional financial theory, which focuses on capital allocation efficiency. Meanwhile, this study effectively couples financial instruments with green transformation goals through the three mediation mechanisms. Specifically, we construct a six-dimensional synergistic framework encompassing finance, technology, industry, employment, economy, and environment, and explain how DIF promotes IGG through multi-level transmission mechanisms. (2) This study advances green growth theory. Specifically, we demonstrate that DIF can promote the transformation of the economic system towards an inclusive green direction through the coordinated efforts of technology, industry, and employment, thus providing a dynamic evolutionary perspective for the green growth theory. (3) This study enriches the labor economics theory. It reconstructs the logic of the employment quality effect in the green transformation, demonstrating that DIF not only provides financing, but also forces the upgrading of labor skills through the requirements of green transformation, promoting the transition of the employment market from “demographic dividend” to “skill dividend”.

Fourth, this study focuses on the heterogeneity of the impact from different geographical regions. It reveals realistic reasons for the differentiation in the influence of DIF on IGG across the east, central, west, and northeast regions, as well as the differences between the north and south, providing new empirical evidence for promoting the balanced development of China’s economic green transformation. Specifically, it promotes the theoretical development at the following two levels: (1) Supplementing the circular cumulative causal theory. Regional heterogeneity analysis reveals that the DIF penetration differences between regions (such as the lagging digital infrastructure in the northeast) create a self-reinforcing mechanism of “digital-green dual divide” through green technology innovation and industrial upgrading, supplementing the applicability of circular cumulative causal theory (Kaldor, 1970) in the digital age. (2) It provides inspiration for the redefinition of green fairness. Traditional environmental justice theory focuses on pollution distribution (such as poorer regions bearing more environmental risks). Meanwhile, our regional heterogeneity analysis shows that digital capability inequality is exacerbating the spatial deprivation of green opportunities (such as the lack of digital skills training in the north). Hence, digital rights should be incorporated into the framework of sustainable development justice.

Theoretical analysis and research hypothesesDirect effect mechanism of DIF on IGGDIF is a new financial service model driven by digital technology (Huang & Huang, 2018). Its inherent green attributes and positive environmental externalities significantly promote the construction of a green economic development system and enhance green total factor productivity (Zhu et al., 2022). On the one hand, DIF can stimulate enterprises to proactively invest in green initiatives, strengthening the compensatory effects of green technology innovation and increasing the feasibility of green development from an economic benefit perspective (Liu & Xu, 2023). According to the endogenous growth logic of Porter’s hypothesis, this market self-organized cost-benefit reconstruction mechanism can yield excessive economic returns from the regulation-induced green R&D investment via improved technological efficiency. This can essentially create a positive feedback loop of “environmental regulation-financial incentives-technological leap”. Meanwhile, by utilizing DIF, consumers and financial institutions can reduce the energy consumption related to cash, paper, and transportation, significantly lowering the associated pollution emissions. From a production function perspective, this digital payment model reconstructs the technical path of financial transactions through dematerialization, substantially reducing the marginal environmental cost per unit transaction volume. At the consumer behavior level, digital financial platforms effectively solve the preference-behavior gap in green consumption by building a system combining environmental information, financial tools, and consumption scenarios. For example, numerous environmental service platforms built on digital finance can enhance residents’ environmental awareness, guiding them towards green consumption and thereby promoting the development of green industries (Zheng et al., 2022).

On the other hand, DIF leverages digital technologies such as big data and cloud computing to accurately assess risk credit and financing needs, achieving real-time, point-to-point matching of financial resources. This enhances the resource allocation efficiency of financial services (Li & Yang, 2024). The virtual nature of digital technology and its unique ability to allocate resources across time and space significantly expand coverage to remote areas or specific industries that traditional finance struggles to reach, thus improving the inclusiveness and accessibility of financial services. DIF, exemplified by digital payment services, lowers the threshold for financial services, enhances service efficiency, and promotes regional technology advancement, thereby effectively increasing regional total factor productivity (He & Yang, 2021). In addition, DIF uses big data analysis to provide more market segments for green investment, especially small green and innovative green technology companies that are not covered by the traditional financial system. Moreover, the digital transformation of finance promotes the development of technology-intensive manufacturing, and ultimately, promotes green development (Duan et al., 2021). In this process, the technical functions of the manufacturing industry, and senior managers’ support for the digital strategy and digital culture are important factors affecting digital transformation (Strazzullo, 2024).

Accordingly, we propose our first hypothesis as follows:

Hypothesis 1: DIF promotes IGG in Chinese cities.

The indirect effect of DIF on IGGMediating role of green technology innovationDIF promotes IGG by stimulating green technology innovation via resolving the mismatch between the structural contradictions of the traditional financial system and needs of green transformation, and using digital technology to overcome the green technology identification dilemma in traditional finance. From a new structural economics perspective, green technological innovation can overcome the constraints of diminishing returns to factors, resource endowment constraints, and environmental carrying thresholds under the traditional growth model by reconstructing the technical parameters of the production function. Therefore, green technology innovation serves as the foundation and driving force for green economic development (Liu, 2018), and a key factor in improving energy and environmental performance (Cao et al., 2021).

From a growth paradigm transformation perspective, green technology innovation reshapes factor combination efficiency through induced technological change. This enables green technology innovation to drive the economy from extensive growth to innovation-driven intensive growth (Wang & Zhan, 2023), becoming a key way to achieve an economic development-environmental protection win-win (Daron et al. (2012); Li & Bai, 2021). However, constrained by the high cost of green transformation, China often faces a funding shortage in promoting green technology innovation and green industry development. Still, with the continuous expansion of the digital financial system, DIF and green finance can be innovatively integrated into multiple green scenarios such as ESG investment and financing, green buildings, and carbon trading markets, greatly enhancing the supply and innovation of green financial products. This provides sustained financial support for new technology R&D activities in green industries, alleviating the financing difficulties of green technology innovation. Meanwhile, DIF uses digital technology to effectively simplify the procedural and complicated green financial service process under the traditional financial system, significantly improves the efficiency of green financial services by shortening the approval time of each link, and speeds up the green certification and evaluation of green enterprise technology innovation projects. Thus, DIF promotes green innovation into the Schumpeterian “creative destruction” cycle by building a “technology-capital-policy” co-evolutionary ecosystem. This not only provides enterprises with smooth financing channels and a good financial environment, but also significantly improves the green technology innovation path and environmental governance cost dilemma.

Accordingly, this study proposes the following hypothesis:

Hypothesis 2: DIF promotes IGG by enhancing green technology innovation.

Mediating role of industrial upgradingDIF promotes industrial upgrading by reconstructing the financial resource allocation mechanism, providing a structural impetus for the green transformation of the economy. The development of DIF has helped in accumulating capital for innovation, enabling entrepreneurs to gain purchasing power through the financial markets and reorganize production factors, thus triggering technological progress and promoting industrial upgrading. The traditional financial system tends to favor large enterprises. Meanwhile, DIF reduces the financing costs of small and medium-sized enterprises (SME), and green industries through big data risk control and supply chain finance, allowing more innovative and green enterprises to grow. On the one hand, digital financial technology promotes the intelligent upgrading of traditional industries, such as digital production in manufacturing and smart development in agriculture, and improves production efficiency and resource utilization. Meanwhile, guided by China’s dual carbon goals, national policies toward green industries have facilitated the flow of long-duration capital to the green financial industry. This has aided the development of green and related emerging industries. These industries have high growth potential and low policy risks. Thus, the profit-seeking and risk-averse characteristics of financial institutions drive increased investments in green, low-carbon, and emerging technology-intensive industries, thereby promoting industrial structure upgrading (Jiang & Jiang, 2020). This can prompt enterprises to adopt cleaner production technologies, thereby promoting energy conservation and emission reduction, and improving resource utilization efficiency.

On the other hand, digital technology provides massive data and computational power support for developing green financial products, effectively stimulating the supply and innovation of these products. A rich variety of green financial products can effectively stimulate residents’ demand for green savings and green consumption. The green finance supply side and green consumption demand side form a synergy to attract more social capital to flow into the green and low-carbon field, and jointly promote the green and low-carbon transformation of the industrial structure. In addition, the distributed blockchain ledger ensures the openness and transparency of the flow and use of funds, monitoring the flow of green credit and other funds to green, environmentally-friendly industries. With the continuous changes in capital flows, high-pollution industries will take the initiative to transform and upgrade under the pressure of survival. Meanwhile, it will also drive the development of emerging industries such as high-tech, which will inevitably drive high-quality economic development (Zhang et al., 2022b).

Based on these arguments, this study proposes the following hypothesis:

Hypothesis 3: DIF can promote IGG by driving industrial upgrading.

Mediating role of employment qualityDIF can drive IGG by optimizing the employment structure and empowering human capital. For instance, DIF plays a positive role in expanding the coverage of financial services and improving their quality and efficiency, making inclusive financial services accessible to all. This creates positive externalities for job creation and employment quality enhancement. On the one hand, many SMEs have not been able to fully realize their ability to create jobs due to a lack of access to adequate financial support (Kadiri et al., 2012). DIF enhances the inclusiveness and broad reach of financial services, effectively alleviating credit constraints for potential entrepreneurs and addressing the financing challenges faced by SMEs and individual businesses in their early stages. It indirectly stimulates demand for labor by these enterprises. This not only helps them attract more highly skilled talents, but also provides a broad space for labor transformation and re-employment. Meanwhile, some DIF platforms combine blockchain and other technologies to promote the transparency of information such as labor contracts and social insurance, protect workers’ rights and interests, and thus, form a healthier and more stable employment environment. Enhanced financial accessibility has also increased employment and entrepreneurship levels among residents in low-income and remote areas (Bruhn & Love, 2014), thereby alleviating income distribution inequality and economic inequality.

On the other hand, financial institutions use big data technology to analyze the behavioral data and credit level of enterprises. This increases the turnover rate of production factors within enterprises, leading to the creation of more high-quality job opportunities. Moreover, business types such as digital payments, Internet wealth management, Internet lending, and Internet insurance accelerate the efficiency of savings-to-investment conversions, improve information transparency, and increase the overall turnover rate of production factors in society, thereby enhancing employment quality. In addition, DIF can significantly reduce the search costs and risk identification costs in financial markets, transforming traditional value delivery processes, and unlocking substantial commercial space. This supports regional technology innovation and economic growth (Sun & Chai, 2023). Further, regional economic growth inevitably raises wage levels, attracting more highly skilled talent. This improves the employment environment and enhances job quality, thereby promoting an inclusive economy. As traditional industries gradually withdraw or transform, the development of emerging and green technology industries often has a greater demand for high-quality talents. Supported by DIF, these industries can create more high-quality employment opportunities, reduce employment discrimination against low-income groups, and improve urban inclusiveness.

Thus, this study proposes the following hypothesis:

Hypothesis 4: DIF can promote IGG by improving employment quality.

Research designVariablesDependent variableDrawing on the literature review, this study defines IGG as a sustainable development model that considers economic growth, social equity, and environmental friendliness. In terms of the economy, IGG envisions a green economy characterized by sustained economic growth and ecological environment improvement, which goes beyond simple GDP growth (Sun & Wang, 2025). In terms of society, IGG aims to improve human well-being, strengthen equal opportunities, and narrow the gap between the rich and poor (Xu & Xu, 2020). In terms of the environment, IGG means sustainable development, attaching importance to resource conservation, ecological protection, and environmental balance (Aslam & Ghouse, 2023). Based on this definition of IGG and following Zhang and Li (2023), this study constructs an IGG evaluation system (Table 1) which includes four dimensions: economic growth (EG), income distribution (ID), welfare inclusiveness (WI), and environmental protection (EP). The selection of indicators follows the principles of scientificity, representativeness, and data availability. Meanwhile, following Chen et al. (2022), this study adopts a combination of subjective and objective weighting methods to measure the index of IGG and its four dimensions of 282 cities in China from 2010 to 2023, and maps the level index to 0∼10.

IGG Evaluation system.

Note: “+” means that the indicator attribute is positive; “-” means that the indicator attribute is negative.

In a world increasingly driven by digital transformation, digital technologies such as big data, blockchain, metaverse, and artificial intelligence hold great promise for economic and social progress (Xiao et al., 2024), and promote the rapid development of DIF. Different from traditional finance, DIF pays more attention to digital technology and has many advantages such as wide coverage, low cost, high efficiency, and less pollution. Thus, according to mainstream practices, this study uses the urban DIF index released by Peking University as the measure of the DIF development level. The larger the value of the index, the higher the level of development of DIF in the city. DIF is a comprehensive concept that includes three dimensions: the breadth of coverage (Breadth), depth of usage (Depth), and degree of digitalization (Digitization). These encompass 33 indicators (Guo et al., 2020). Its applicability and reliability have been widely recognized by the academic community.

Mechanism variablesDIF may promote IGG in cities through the mediating role of green technology innovation, industrial upgrading, and employment quality. Therefore, the three are selected as mechanism variables for transmission mechanism testing. First, green technology innovation refers to management and technology innovation aimed at protecting the ecological environment. This study uses the total number of green patent applications to measure the level of green technology innovation. Second, industrial upgrading refers to the process of improving the development of industrial structure. This study uses the ratio of the added value of the tertiary industry to the added value of the secondary industry to measure the degree of industrial upgrading. The larger the ratio, the higher the degree of industrial upgrading. Third, employment quality refers to the degree to which labor is combined with the means of production and receives income. It reflects both the skill level of individuals and the operation of the labor market in a country or region. Here, employment quality is measured by the per capita wage level of in-service employees.

Controlled variablesConsidering that other factors can also affect IGG in cities, this study selects the following nine indicators as controlled variables: First, traditional financial development is measured by the ratio of year-end deposit and loan balances of financial institutions to regional GDP. Next, the consumption level of residents is measured by the ratio of total retail sales of consumer goods to regional GDP. Third, fixed assets investment is measured by the ratio of total fixed assets investment to regional GDP. Fourth, the intensity of education investment is measured by the ratio of education expenditure to regional GDP. Fifth, the intensity of technology investment is measured by the ratio of science and technology expenditure to regional GDP. Six, the level of urbanization is measured by the number of people per square kilometer. Seventh, human capital is measured by the number of students enrolled in primary, secondary, and higher education institutions per 10,000 people. Eight, unemployment level is measured by the ratio of the number of registered unemployed individuals in urban areas at the end of the year to the total population at the end of the year. Finally, the level of passenger transportation is measured by highway passenger volume.

Model constructionBenchmark regression modelThe two-way fixed effects model can effectively control city-specific and time-specific unobservable factors, allowing us to pay more attention to the effect of time-varying variables on the results and improve the accuracy of the estimated results. In addition, this model is particularly suitable for analyzing panel data and can better capture the dynamic changes of variables. Therefore, this study applies a two-way fixed effects model to test Hypothesis 1. The benchmark regression model is constructed as follows:

where IGGrepresents IGG; DIF represents DIF; Controlsrepresent a series of controlled variables. i and t represent the city and year, respectively; c0 denotes constants; c1 and cjdenote regression coefficients; μi,wt, and εit denote city fixed effects, year fixed effects, and random disturbances, respectively.Mediating effect modelThe mediation effect model can decompose the total effect into the direct and indirect effects. Consequently, we analyze in greater how the core independent variable affects the dependent variable through the mechanism variables. Here, we test whether green technology innovation, industrial upgrading, and employment quality mediate the DIF-IGG relationship using Eqs. (2) and (3):

H0:α1β1=0. where Mediator represents mechanism variables; α1 represents the effect of DIF on this variable; β1 represents the effect of the mechanism variables on IGG when controlling for DIF; and k1 represents the direct effect of DIF on IGG when controlling for the mechanism variable. Based on the principles of the mediation effect model, if all three terms (α1,β1,k1) are significant, then a partial mediation effect exists. If terms α1 and β1 are significant but k1 is not, then a complete mediation effect exists. If at least one of α1 and β1 are not significant, a coefficient product test is necessary to further test these terms, which checks whether H0:α1β1=0. This study uses the Bootstrap method to construct the confidence interval for the coefficient product estimator. If 0 is included in the interval, it suggests the absence of a mediation effect. Conversely, if 0 is not included, it demonstrates the presence of a partial mediation effect.

DataThis study uses the panel data from 282 prefecture level and above cities in China from 2010 to 2023. Following Zhang and Li (2023), the sample data come from the China Urban Statistical Yearbook and various city statistical yearbooks, with some missing data filled in using interpolation method. Considering the lag in the effects of DIF, and to avoid the issue of bidirectional causality between controlled variables and the dependent variable, all independent variables are lagged by one period, covering the data range from 2010 to 2022. Natural logarithms are applied to all non-relative value variables to reduce the potential heteroscedasticity and volatility in the sample. To eliminate the interference of price fluctuations on the empirical results, the consumer price index of each province was used to deflate all monetary-measured variables in the sample using 2009 as the base year. Table 2 presents the descriptive statistics.

Descriptive statistics of the variables.

Sources: The authors calculated this table with sample data.

Table 3 shows the benchmark results for Eq. (1). Columns (1) to (5) show the results of DIF on IGG and its four dimensions without adding controlled variables. Columns (6) to (10) are the results after adding the controlled variables. Clearly, R2 continuously increases after adding controlled variables, which indicates a significant improvement in the model’s fit and verifies the rationality of the controlled variables selected in this study. Columns (1) and (6) show that regardless of whether controlled variables are included, the coefficients of DIF are significantly positive. Thus, DIF has a significant promoting effect on IGG. Columns (2) to (5) and Columns (7) to (10) show that regardless of whether controlled variables are included, the regression coefficients of DIF are significantly positive for all IGG dimensions of economic growth, income distribution, welfare inclusiveness, and environmental protection. Therefore, Hypothesis 1 is supported. The development of DIF effectively aids cities in promoting economic growth, improving income distribution, enhancing welfare inclusiveness, and bolstering environmental protection. Consequently, this supports urban IGG. This finding is consistent with Liu and Xu (2023), who believe that DIF significantly improves the inclusiveness of regional green development. Moreover, Zhu et al. (2023) find that the effect of DIF on urban green economic efficiency has a spatial spillover effect.

The results of benchmark regression.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources: The authors developed this table using empirical results.

Column (6) shows that the coefficient of DIF is 0.131, indicating that a 1 % increase in the level of DIF can promote a 0.131 % increase in the level of urban IGG. According to columns (7) to (10), the regression coefficients of DIF for the four dimensions are as follows: EG (0.091), ID (0.355), WB (0.020), and EP (0.059). That is, a 1 % increase in the level of DIF can increase EG by 0.091 %, ID by 0.355 %, WB by 0.02 %, and EP by 0.059 %. Further, DIF has the greatest effect on ID, followed by EG, EP, and WB. This is mainly because DIF, by reducing transaction costs, expanding the range of customer services, and improving the financial supply system, provides convenient, fair, and low cost financial support to disadvantaged groups that were previously excluded from the traditional financial market. This effectively alleviates the market failures of traditional finance and resulting issues of income distribution inequality.

Robustness testReplacing independent variableWe test the robustness of the results by using the following three alternative independent variables, which actually constitute DIF: the breadth of coverage (Breadth), depth of usage (Depth), and degree of digitization (Digitization). The effects of the three dimensions on IGG are tested separately, with the results presented in columns (1) to (3) of Table 4. Clearly, the regression coefficients for three dimensions exhibit minimal changes and remain significantly positive at the 1 % level, indicating the robustness of the benchmark results.

The results of robustness test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources: The authors developed this table using empirical results.

To mitigate the endogeneity problem caused by omitted variables, this study adds four controlled variables to the benchmark regression model (1): degree of government intervention (Fis), transportation freight level (Fre), agricultural entrepreneurship level (AE), and non-agricultural entrepreneurship level (NAE). The results are presented in column (4) of Table 4. Fis is measured by “the ratio of local fiscal general budget expenditure to regional GDP”. Fre is measured by “highway freight volume”. AE is measured by “the total number of registered enterprises in agriculture, forestry, animal husbandry, and fishery”. NAE is measured by “the total number of registered enterprises in other industries”. According to column (4), after adding control variables, the regression coefficient of DIF on IGG drops to 0.076, but is still significant at the 1 % level, verifying the robustness of the benchmark results.

Excluding special yearsIn 2015, China experienced its most severe financial crisis since the establishment of the stock market in 1990. In 2018, numerous P2P platforms collapsed and shut down, affecting the development of DIF in China. China’s economic and social development was significantly impacted by the COVID-19 pandemic from 2020 to 2023. These events may influence the impact of DIF on IGG. Therefore, this study re-runs the regression after excluding the years 2015, 2018, and 2020–2023. The results are presented in column (5) of Table 4. After excluding these special years, the regression coefficient of DIF on IGG changes very little and remains significantly positive at the 1 % level, further demonstrating the robustness of the benchmark results.

Excluding special citiesCertain Chinese municipalities enjoy significant advantages in terms of policy benefits, economic strength, environmental awareness, energy conservation, emission reduction, and welfare inclusivity. Further, there may be a potential issue of selection bias in model cities. Therefore, this study re-runs the regression after excluding the four municipalities of Beijing, Tianjin, Shanghai, and Chongqing. The results are presented in column (6) of Table 4. The coefficient of DIF on IGG and its significance remain basically unchanged, suggesting that the benchmark results still hold.

Using quantile regressionsThe benchmark regression model primarily depicts the effect of DIF on urban IGG within the average range, neglecting its effect across the entire conditional distribution of urban IGG. Thus, the effect of DIF on IGG might structurally vary at different levels of growth, potentially affecting the accuracy of the estimation results. Additionally, when there are outliers in the sample data, the sum of squared residuals in the least squares model is easily influenced by extreme values, leading to biased regression results and ignoring the characteristics at the tails of the distribution. Therefore, this study further uses a quantile regression model. Specifically, we test IGG at the 0.15, 0.50, 0.75, and 0.90 quantiles, with the results presented in columns (1) to (4) of Table 5. The effect of DIF on IGG varies at different quantiles, exhibiting a U-shaped trend of first decreasing and then increasing as the quantiles increase. However, the values are all significantly positive. For example, at the 0.15 and 0.90 quantiles, the regression coefficients of DIF are the largest at 0.156 and 0.155, respectively; at the 0.50 and 0.75 quantiles, the regression coefficients of DIF are relatively small at 0.133 and 0.140, respectively. Thus, the development of DIF has a stronger promoting effect on cities with lower and higher levels of IGG. This conclusion also inspires us to give priority to strengthening the development of DIF in such cities so that it can further play a key driving role in the green transformation of the economy in the region and surrounding cities.

The results of robustness test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources: The authors developed this table using empirical results.

To address potential endogeneity stemming from bidirectional causality, omitted variables, and measurement errors in the relationship between DIF and urban IGG, this study employs an instrumental variable approach. We choose Internet penetration rate (Inter) as an instrumental variable based on three reasons:

First, Inter is significantly correlated with DIF. DIF depends on network infrastructure (such as the Internet and mobile payments). Regions with high Inter are more likely to promote digital financial services, thus meeting the requirements of strong correlation in the first stage. Second, the development of the Internet provides simple and fast means of communication and information retrieval, while also providing extensive information and service resources for economic and social development. Theoretically, Inter mainly reflects the level of communication infrastructure construction. Other important factors, such as fiber optic laying policies and terrain conditions, may not be directly related to IGG, thus meeting the exogeneity conditions of instrumental variables. Third, from the perspective of the exogenous sources of historical policies, in 2013, the Chinese government announced the implementation of the “Broadband China” strategy. For example, some remote areas completed fiber optic coverage ahead of schedule due to policy support, which has nothing to do with the local IGG needs. This further verifies that Inter meets the exogenous conditions of instrumental variables.

Then, we use two-stage least squares and two-step optimal generalized method of moments methods to conduct endogeneity tests. The results are shown in columns (5) and (6) of Table 5. The coefficients of DIF are significantly positive, indicating that DIF significantly promotes urban IGG. In addition, the weak instrumental variable test shows that the F-statistic is 32.471, rejecting the null hypothesis of the existence of weak instrumental variables. Thus, the exogeneity assumption of instrumental variable is reasonable. In summary, after considering endogeneity issues, the benchmark results remain robust.

Transmission mechanism analysisBased on the theoretical mechanism analysis in Section 3, this study uses the mediation effect models (2) and (3) to test the transmission mechanism to verify whether green technology innovation, industrial upgrading, and employment quality mediate the DIF-IGG relationship. The results are shown in Table 6.

The results of transmission mechanism test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources: The authors developed this table using empirical results.

Columns (1) and (2) of Table 6 report the test results for green technology innovation as a mechanism. The results partially support Hypothesis 2. Column (1) shows that the coefficient of DIF on GTI is 0.344 and significant at the 1 % level, indicating that DIF can promote green technology innovation. Column (2) shows that the coefficients of both DIF and GTI on IGG are significantly positive, indicating that green technology innovation has a partial mediating effect between DIF and IGG. Thus, DIF can indirectly empower IGG by enhancing green technology innovation. This is consistent with Cao et al. (2021), who believe that digital finance can improve energy and environmental performance by strengthening green technology innovation.

This is mainly because, from the perspective of China’s economic reality, SMEs contribute >60 % of GDP and 80 % of urban employment. However, their green technology R&D faces the dual dilemma of narrow financing channels and difficult risk assessment. Digital technology penetration has reconstructed the financial service model: First, through big data risk control, the value of green innovation is accurately identified and carbon reduction potential of SMEs is evaluated, which significantly improves the financing success of green technology start-ups. Second, blockchain technology can help in building a traceable green financial asset pool, realize the supervision of the entire green credit process, and guide funds to environmental protection industries. Third, mobile payment networks form the foundations of inclusive finance, enabling banks to support green industries such as photovoltaic agriculture through scenario-based green credit products. This transformation enables DIF to reduce the marginal cost of green innovation and internalize positive environmental externalities. Meanwhile, it activates the green potential of the economies of Chinese counties through inclusive financing mechanisms and promotes the diffusion of new energy industry clusters to third- and fourth-tier cities. This technology-finance-industry collaborative innovation is the key path for China to promote the dual strategy of economic green transformation and common prosperity.

The mediating role of industrial upgradingColumns (3) and (4) of Table 6 report the test results for industrial upgrading as a mechanism. The results partially support Hypothesis 3. Column (3) shows that the coefficient of DIF on IU is 0.074 and significant at the 1 % level, indicating that DIF can promote industrial upgrading. Column (4) shows that the coefficients of both DIF and IU on IGG are significantly positive, indicating that industrial upgrading has a partial mediating effect between DIF and IGG. In other words, DIF can indirectly promote IGG by driving industrial upgrading. This finding is supported by Wang and Zan (2024), who believe that DIF improves urban energy and environmental efficiency by promoting industrial upgrading.

The Chinese economy faces the dual challenges of high energy consumption intensity of traditional industries and imbalanced regional industrial gradients. DIF solves the above structural contradictions through the following three dimensions: First, through blockchain smart contracts and Internet-of-Things, the real-time monitoring of carbon emissions can be realized. Then, financial institutions can be guided to tilt preferential loan policies towards green and low-carbon enterprises. Second, the digital supply chain finance clears the bottlenecks to the green upgrading of the industrial chain, creates a green industrial chain platform to connect small and medium-sized suppliers, and effectively reduces the financing costs of green enterprises through order validation financing, thereby increasing the output of the circular economy. Finally, DIF has significantly increased the green certification premium of characteristic agriculture and increased the proportion of green GDP in counties by empowering thousands of village-level cooperatives. This industrial upgrading driven by DIF has not only accelerated the green substitution of high-pollution industries, but also activated the endogenous driving force of county economies, forming a new pattern of coordinated promotion of green transformation of growth models and improvement of people’s welfare.

The mediating role of employment qualityColumns (5) and (6) of Table 6 report the test results for employment quality as a mechanism. The results partially support Hypothesis 4. Column (5) shows that the coefficient of DIF on EQ is 0.107 and significant at the 1 % level, indicating that DIF can improve social employment quality. Column (6) shows that the coefficients of both DIF and EQ on IGG are significantly positive, indicating that social employment quality has a partial mediating effect between DIF and IGG. In other words, DIF can indirectly promote IGG by enhancing social employment quality. This is consistent with Geng and He (2021), who have studied 40 countries along the Belt and Road, and find that DIF significantly promoted regional sustainable employment.

This is mainly because DIF drives IGG by optimizing the employment structure and empowering human capital. Currently, China faces the dual challenges of shrinking traditional employment market and insufficient supply of green skills. DIF reshapes the employment ecosystem with a three-level mechanism: First, the green small and micro enterprise financing platform enabled by blockchain activates the emerging employment growth axis, provides intelligent credit for environmental protection technology companies. Further, it drives a significant increase in regional green R&D positions and average wages. Second, the digital payment ecosystem has created new contexts for green skills training. For example, Alipay’s “Ant Forest” has linked 300 vocational colleges to develop carbon asset management courses and certified 150,000 digital environmental protection skilled talents, thereby accelerating the expansion of employment in the environmental service industry. Third, the digitalization of supply chain finance can alleviate employment quality dilemma in counties, provide green business loans to farmers, and transform some farmers into ecological agricultural technicians, thereby reducing pollution emissions from traditional agriculture. This employment quality improvement mechanism has created a virtuous cycle of human capital upgrading and green transformation. This the collaborative path for China’s economy to overcome the “middle-income trap” and achieve green transformation.

Heterogeneity analysisConsidering that the prominent regional imbalance in China’s economic development, the endowment advantages and development potential of different regions and periods can result in heterogeneity in DIF’s effects on IGG. Therefore, we examine these regional heterogeneities across regions, time, economic development levels, industrial structures, population densities, and industries.

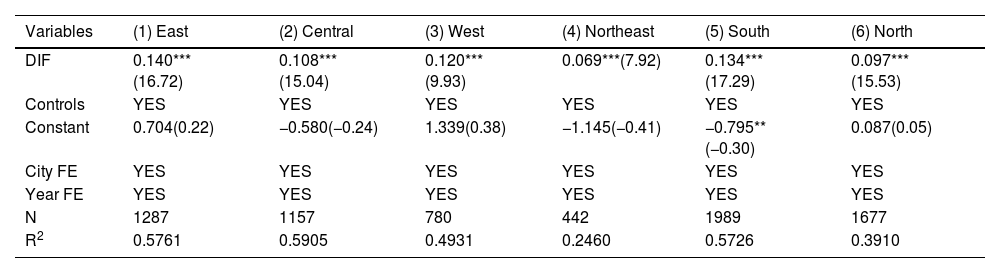

Regional heterogeneityTo examine regional heterogeneity, this study divides the sample into four regions: east, central, west, and northeast. The results are shown in columns (1)-(4) of Table 7. The coefficients of DIF are all significantly positive, indicating that DIF has heterogeneous effects on IGG across the four regions. The coefficient of DIF in the east is the largest (0.140), followed by the west (0.120), central (0.108), and northeast regions (0.069). These heterogeneities may be driven by the following reasons:

The results of regional heterogeneity test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources:The authors developed this table using empirical results.

First, the difference in digital infrastructure. The east is the core area of China’s digital economy and financial technology innovation. Its coastal provinces (such as Guangdong, Zhejiang, and Jiangsu) have the most complete digital infrastructure in the country (such as 5 G network coverage and Internet penetration), a highly mature digital payment ecosystem (such as Alipay and WeChat Pay), and numerous technology companies and financial institutions. These conditions provide the technical foundation for promoting DIF. Meanwhile, benefiting from the national “Western Development” and “Eastern Data and Western Computing” strategies, the western regions (such as Sichuan and Guizhou) have made huge investments in data centers, clean energy complexes, and other fields in recent years, and their digital infrastructure has been rapidly improved. DIF can indeed help remote areas leapfrog in the development ladder by supporting green projects such as distributed photovoltaics and ecotourism. However, the overall economic scale and technological application depth in the west still lags behind the east. Next, the digital infrastructure in the central region (such as Henan and Hubei) is at a medium level. However, the proportion of traditional manufacturing industries is high, while the combination of green transformation needs and DIF is insufficient. Finally, the northeast (such as Liaoning and Heilongjiang) faces problems such as the decline of traditional industries and serious population loss. The slow renewal of digital infrastructure has restricted the penetration efficiency of DIF.

Second, the difference between industrial structure and green transformation needs. The industrial structure in the east is dominated by high technology and service industries, private enterprises are active, and SMEs have strong financing needs for green technologies. Here, DIF has effectively lowered the financing threshold for green small and micro enterprises through big data risk control and precise matching. Green industries such as new energy and low-carbon technologies are also highly concentrated in the east, which has led to significant synergy between DIF and green economy. The west clearly has a resource-based economy. However, it also has high ecological vulnerability. Still, the country’s policy inclination towards ecological protection in the west (such as the upper reaches of the Yangtze River) and renewable energy (such as wind power and photovoltaic) has led to a close combination of DIF and green projects in this region. Meanwhile, the central has taken over the industrial transfer from the east. However, the proportion of high energy consuming industries is still high. While there is a large demand for funds for green technology upgrades, there is a lack of supporting policies. The northeast relies on heavy industry (such as steel and petrochemicals). Here, the green transformation faces technology path dependence and employment pressure. The effect of DIF on the greening of traditional industries is limited.

Third, differences in population structure and financial literacy. In the eastern region, there is an influx of young people and a highly-educated population, high acceptance of DIF, strong public awareness of environmental protection, and a virtuous circle of green consumption and digital payment. The proportion of rural population in the west is high and financial literacy is generally low. Still, DIF covers remote areas through mobile terminals (such as agricultural loans and green agricultural products e-commerce), filling the gap in traditional finance. The central and northeastern regions have serious labor outflows, prominent aging problems, limited use scenarios for DIF (such as low digitalization of pension payments), and weak demand for green consumption.

Regional heterogeneity: southern and northern perspectivesNext, the national economic center has further moved southward, with the development gap between the north and south becoming increasingly prominent. Therefore, this study divides the sample into two groups, southern and northern cities, based on the Qinling-Huaihe line, and empirically evaluates the regional heterogeneity. The results are shown in columns (5) and (6) of Table 7. The coefficient of DIF in the south is 0.134, which is significantly greater than that in the north. This difference may be driven by three main reasons:

First, the difference between digital infrastructure and marketization. The digital infrastructure coverage rate in the south (such as the Yangtze and Pearl River Deltas) is one of the highest in the country. Further, the private economy is active, with a mature market-based financial ecosystem, and efficient market-oriented combination of DIF and green technology. Meanwhile, the traditional state-owned economy accounts for a high proportion in the north, while the digital infrastructure update also lags behind (especially in the old industrial areas of Northeast). Financial resources flow more to state-owned enterprises or heavy asset industries, and DIF has insufficient penetration into small and micro green enterprises.

Second, the difference between industrial structure and green economic foundation. The south is dominated by electronic information, high-end manufacturing, and digital economy industries, with developed green industrial clusters (such as Shenzhen’s new energy and Hangzhou’s digital economy) and high enterprise digitization. DIF can directly enable green technology R&D, and the low-carbon supply chain. The north is more dependent on traditional industries such as energy and heavy chemical industry (such as Shanxi coal and Northeast petrochemical). Green transformation faces path dependence and technology lock-in effects. Here, DIF may find it difficult to overcome the structural barriers of high-carbon industries.

Third, differences in geographical resources and energy structure. The southern region has abundant hydropower and solar energy resources, and a high proportion of clean energy (such as Yunnan hydropower and Jiangsu offshore wind power). Here, DIF can efficiently connect with distributed energy projects. Conversely, the northern region is highly dependent on coal (such as Inner Mongolia and Shanxi), and the cost of energy transformation is high. Thus, DIF exhibits clear risk aversion for the green transformation of the coal-fired power industry.

Temporal heterogeneityTo examine the heterogeneous effect of DIF on IGG in different periods, this study divides the sample into two periods, 2010-2015 and 2016-2022, and performs regressions for the respective periods. The results are shown in columns (1) and (2) of Table 8. The coefficients of DIF are 0.074 and 0.804 in 2010-2015 and 2016-2022, respectively, and both pass the significance test at the 1 % level. Thus, DIF has a stronger positive effect on IGG in 2016-2022. This may be because the development and adoption of digital technology accelerated during this period, making the effect of DIF more obvious. In particular, the application of Internet technology in the financial industry gradually increased in 2010-2015, while the transformation of traditional financial channels was mainly reflected in the increasing online presence of offline business. This resulted in a weak enabling effect of DIF on IGG during the sample period. However, since 2016, DIF has received tremendous policy support and has been widely known by all sectors of society. Consequently, it has achieved rapid development with the help of modern information technologies such as big data, cloud computing, and artificial intelligence, and gradually replaced Internet finance to become a new innovative model of financial services. Therefore, its effect on IGG in cities will be more obvious.

The results of heterogeneity test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources:The authors developed this table using empirical results.

To test how the promotion of IGG by DIF may be affected by the level of regional economic development, this study adopts the economic growth dimension as an indicator of the level of regional economic development. Specifically, the samples with an economic growth dimension index less than the mean are classified as the low-level economic development group, while the remaining are classified as the high-level economic development group. Then, we perform respective regressions. The results are shown in columns (3) and (4) of Table 8. The coefficients for DIF are all significantly positive. Thus, DIF contributes more to IGG in regions with higher economic development levels. This is primarily because regions with higher levels of economic development have better economic foundations and financial literacy. Here, more economic agents participate in the application of digital technology and development of financial innovation. Thus, it leads to more positive externalities in the development of digitally inclusive finance and makes DIF play a more significant role in promoting IGG in regions with high economic development levels.

Industrial structure heterogeneityNext, we examine heterogeneity by the industrial structure. We divide the samples with industrial upgrading levels less than the mean into a low-level group and the remaining with levels greater than or equal to the mean into a high-level group, and perform regressions for each group. The results are shown in columns (5) and (6) of Table 8. The coefficients of DIF are significantly positive. Thus, DIF has a greater role in promoting IGG in regions with higher levels of industrial upgrading. This is mainly because the industrial upgrading in these regions may bring higher environmental standards and technological applications. Then, DIF can help more companies obtain the financial and technical support needed for green transformation and promote the green growth of the overall economy. Meanwhile, regions with higher levels of industrial upgrading may have better digital infrastructure, such as high-speed networks and big data centers, which provides a technical basis for the implementation of DIF, and makes it easier to promote and play a role.

Population density heterogeneityNext, we test whether there is heterogeneity by population density. Specifically, we adopt “the ratio of the total population to the administrative area of the city” as the measure of population density. Samples with a population density less than the mean are classified as the low population density group, while samples with a population density greater than or equal to the mean are classified as the high population density group. Then, we perform regression for each group, with the results shown in columns (1) and (2) of Table 9. The coefficients for DIF are all significantly positive, while the values are larger in the high group. Thus, DIF has heterogeneous effects on IGG by population density. Specifically, the effect is stronger in the high population density group. The population density of cities determines how their factor resources are allocated and utilized (Duranton & Puga, 2020). Digital infrastructures are normally better constructed and arranged in high population density cities. This can positive affect economic growth, advance urban-rural integration, improve people’s well-being, and promote energy conservation as well as emission reductions. Therefore, high population density cities are more conducive for DIF to fulfill its financial inclusion function, integrating the potential advantages, and driving the green and inclusive transformation of economic growth.

The results of heterogeneity test.

Notes: t values are shown in brackets; ***, ** and * indicate statistical significance at 1 %, 5 %, and 10 % levels, respectively.

Sources:The authors developed this table using empirical results.