Contemporary studies of Chief Financial Officers (CFO) paint a picture of the role pre-1960 as being reflective of a more transactional one. Historical research sheds some doubt on this, and tends not to separate the role from its occupier. We provide an analysis of such a role in a large brewery from about 1920 to 1945. Drawing on the concept of position-practices, our results suggest that a CFO-predecessor role was informed by existing position-practices, which are separately identifiable from the occupier of the role itself. Some of the position-practices are recognizable in contemporary CFO roles. Importantly, focusing on the role as opposed to the occupier, gives our study potential to more broadly inform future research on the contemporary role.

Los estudios contemporáneos sobre la figura del «director financiero» (Chief Financial Officer, CFO) lo describen con un papel más transaccional antes de 1960. Las investigaciones históricas arrojan algunas dudas, pero tienden a no separar el rol del sujeto. En nuestro trabajo analizamos dicha figura en el seno de una gran fábrica de cerveza durante el periodo 1920–1945. Basándonos en el concepto de posición-prácticas, nuestros resultados muestran que anteriormente el rol del CFO estaba orientado hacia posiciones-prácticas existentes pero independientes del sujeto que las llevaba a cabo. Algunas posiciones-prácticas se pueden reconocer en los roles del CFO contemporáneo. Es importante destacar que centrarnos en el rol frente al sujeto nos da la posibilidad de orientar de una forma más amplia nuestros futuros trabajos sobre el rol contemporáneo.

Chief Financial Officers (CFO) are increasingly seen next to the Chief Executive Officer (CEO) in many firms (Datta & Iskandar-Datta, 2014; Zorn, 2004), often actively leading the strategic course of the firm alongside the CEO. Much practitioner literature refers to such roles as the business partner role of the CFO (see for example, CGMA, 2015; Farag, Plaschke, & Rodt, 2012; Quinn, 2014a). In some jurisdictions (e.g., the US) this gain in hierarchical power is also underpinned by regulations (Gore, Matsunaga, & Eric Yeung, 2011). The CFO has thus experienced an apparent dramatic role change in recent decades (Datta & Iskandar-Datta, 2014; Farag et al., 2012; Hiebl, 2013) in comparison to predecessor roles.

The CFO role has not always been this prominent, especially prior to the 1960s (Zorn, 2004). Not having the CFO title, from today's perspective, finance directors, chief accountants and financial controllers before this time (and even still today) have been labelled “bean counters” by some contemporary literature (Granlund & Lukka, 1998; Sharma & Jones, 2010; Weber, 2011; Zorn, 2004). Their responsibility was “to prepare the books and report back to higher level management on the overall financial risk and performance of the enterprise” (Sharma & Jones, 2010, p.1). Such contemporary literature creates the notion that before the 1960s, CFO predecessors were more or less exclusively focused on bookkeeping and reporting. They did not delve into business partnering roles, advising the CEO/Board of Directors and/or act as critical counterparts to managers in the way contemporary CFOs do (Goretzki, Strauss, & Weber, 2013; Graham, Davey-Evans, & Toon, 2012; Granlund & Lukka, 1998). However, contemporary literature presents little empirical evidence to support this view, it is more taken-for-granted, with a view that contemporary CFOs have a more important and more business partner-like role compared to predecessors (e.g., Farag et al., 2012; Zorn, 2004).

However, an exploration of historical literature reveals such a contemporary view is questionable. For instance, Boyns and Edwards (1997a, 1997b) present evidence that 19th century accountants prepared information for managers, to help run the business. Similarly, Matthews (1998, 2001) argues that 20th century accountants have always acted as management advisors. The historical literature also notes that after the First World War, this advisory role increased as firms increasingly expanded their internal accounting departments (Loft, 1986; Matthews, 1998). However, historical studies lack details of such roles and many questions remain unexplored. For example, we could ask what are similarities and differences in the roles of accounting department heads in the early 20th century compared to contemporary CFO roles? Is the CFO role simply presented as more important today than in previous times? Did the CFO role emerge dramatically in the 1960s or was the emergence more gradual? One way to answer such questions is to explore the role of a CFO predecessor in a historic context. In this paper, we detail the role of a chief accountant from about 1920 to 1945 and focus specifically on the role as a structure independent of the individual. We do this by drawing out the position-practices associated with the role – as outlined by Cohen (1989) and Stones (2005). Briefly here, position-practices can be defined as slots in which actors, in clustered groups, fit to reproduce structures–structures being properties that bind social ties. Coad and Glyptis (2014) suggest that further research is needed on the position-practice relations of individuals. Specifically, they suggest that the adoption of a position-practice perspective may provide novel insights into how accounting and control practices change over time. This paper responds to Coad and Glyptis (2014) by adding to our understanding of the emergent nature of the role of the contemporary CFO through associated position-practices.

The remainder of this paper is organized as follows. Next, we present an analysis of contemporary CFOs’ roles and some insights on their predecessors. Then, we summarize structuration theory and detail the concept of position-practices and set out our research method. This is followed by a description of the CFO position-practices from our case. Finally, we discuss the position-practices of a CFO predecessor, and contrast them with contemporary CFO research.

Literature reviewGiven our research objective as outlined in the introduction, a summary of extant literature on the role of contemporary CFOs and the role of accountants in CFO-type roles in the past is given to provide an initial view of such roles and sets the context for the study.

Contemporary CFO rolesTo establish the role (as conveyed through position practices later) of a CFO predecessor, it is useful to explore the role of a present-day CFO. Contemporary literature seems to attribute the origin of the CFO to external factors, namely legislative changes (Zorn, 2004). To understand the term “CFO”, Mian's (2001, p. 145) definition is a useful start, suggesting that the CFO's primary responsibility is the “management of the financial system of the firm”. Mian (2001, p. 144–145)also notes that the CFO usually “oversees preparation of financial reports and serves as the point person for external communication of financial strategy [and] bears the ultimate responsibility for activities related to raising capital and serves as the primary Wall Street contact”. Serving as the primary contact for capital markets has been regarded as one important trigger for the increase in importance the CFO position has enjoyed in recent decades (Farag et al., 2012). The percentage of large US firms with CFO positions increased from virtually nil in the early 1960s to more than 80% at the end of the 1990s (Zorn, 2004). The importance and influence of the CFO role has also been revealed by studies on the impact of CFO characteristics or CFO turnover on accounting practices. For instance, Aier, Comprix, Gunlock, and Lee (2005) report that the financial literacy of CFOs significantly influences the likelihood of earnings restatements. Other studies show that CFOs significantly affect accounting choices (e.g., Barua, Davidson, Rama, & Thiruvadi, 2010; Burkert & Lueg, 2013; Feng, Ge, Luo, & Shevlin, 2011; Ge, Matsumoto, & Zhang, 2011; Geiger & North, 2006; Jiang, Petroni, & Yanyan Wang, 2010; Li, Sun, & Ettredge, 2010; Naranjo-Gil, Maas, & Hartmann, 2009). Other literature reveals the CFOs’ role also includes oversight of key finance and accounting functions such as management/cost accounting, financial accounting or treasury (Bremer, 2010; Hiebl, Neubauer, & Duller, 2013).

Another aspect of contemporary CFOs’ roles is increasingly acting as a business partner/key advisor to fellow top managers (Baxter & Chua, 2008; Favaro, 2001; Gerstner & Anderson, 1976; Weber, 2011). This may imply leading the strategic course of a firm with the CEO (Datta & Iskandar-Datta, 2014; Farag et al., 2012; Zorn, 2004). The vast majority of such CFOs report that their main focus is not acting in a compliance and transaction role, but more as a planner and strategist. Voogt (2010) also presents evidence that CFOs invest significantly more of their time on enterprise risk management. Similar to Voogt's (2010) results, survey results from the largest Australian firms indicate that CFOs increasingly draw on strategic and leadership skills to contribute to value creation in the respective firms (Sharma & Jones, 2010). The changing role of CFOs to a strategist one in contemporary organizations is not uncontested however – see for example Baxter and Chua (2008), Bremer (2010), Hiebl and Feldbauer-Durstmüller (2014), Howell (2002) and Lüdtke (2010).

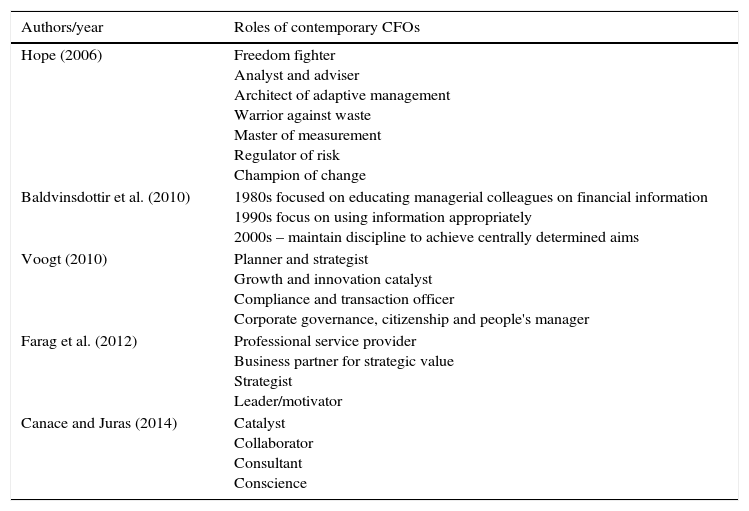

Some contemporary literature provides useful summaries and/or categorizations of the CFO role – which are summarized in Table 1. For example, Hope (2006) provides seven roles of a contemporary CFO (see Table 1). Baldvinsdottir, Burns, Nørreklit, and Scapens (2010) provide a useful analysis of the main features of the role during the three decades from the 1980s to the 2000s. Canace and Juras (2014) suggest four key roles. Similar typologies of CFO roles are presented by Farag et al. (2012) and Voogt (2010). These aforementioned studies all share a common thread in that they note the role of the contemporary CFO is an evolutionary one.

Contemporary CFO roles.

| Authors/year | Roles of contemporary CFOs |

|---|---|

| Hope (2006) | Freedom fighter Analyst and adviser Architect of adaptive management Warrior against waste Master of measurement Regulator of risk Champion of change |

| Baldvinsdottir et al. (2010) | 1980s focused on educating managerial colleagues on financial information 1990s focus on using information appropriately 2000s – maintain discipline to achieve centrally determined aims |

| Voogt (2010) | Planner and strategist Growth and innovation catalyst Compliance and transaction officer Corporate governance, citizenship and people's manager |

| Farag et al. (2012) | Professional service provider Business partner for strategic value Strategist Leader/motivator |

| Canace and Juras (2014) | Catalyst Collaborator Consultant Conscience |

In summary, we could say that today most CFOs are still concerned with, and exert decisive influence on, the accounting functions of their firms. There is also some evidence that modern-day CFOs increasingly act as strategists and oversee enterprise risk management functions, although there is some debate in the literature on this element of the role. As we will see later, roles such as those noted in Table 1 incorporate position-practices.

Historic internal accountant rolesThe term “CFO” is a relatively new one – according to Zorn (2004), it first appeared in 1966. Before this time, executives in charge of US firm's financial systems held titles such as “financial controller”, “(executive) vice president of finance” or “treasurer” (Matthews, 1998; Whitley, 1986; Zorn, 2004). In the United Kingdom (UK), even today the term CFO is not overly common, with preference shown to titles such as “(group) finance director” (Graham et al., 2012; Hussey & Lan, 2001). However, even the title “finance director” was not common until after the Second World War (Matthews, Anderson, & Edwards, 1997; Matthews, 1998), with “chief accountants” or “financial controllers” being the pre-war norm (Matthews, 1998).

Existing research exploring the role of accountants in the earlier 1900s does not offer detail, but rather tends to explore accountants in certain industries or as a group in society (see for example, Boyns & Edwards, 2007; Boyns, Matthews, & Edwards, 2004; Fleming, McKinstry, & Wallace, 2000; Loft, 1986; Matthews et al., 1997; Matthews, 1998, 2001; McKinstry, 1999; McLean, 2013; McLean, McGovern, & Davie, 2015). However, the extant literature does offer some insight into important developments for accountants at this time. The literature we briefly outline here reflects the context of our case firm, namely a UK-based firm around 1920–1945 – for detail of some developments in accounting in Spanish firms, see for example Gutiérrez, Larrinaga, and Núñez (2005). At the turn of the 20th century, most firms engaged public accounting firms for accounts preparation and audit work (see for example, Loft, 1986; Matthews et al., 1997; Matthews, 1998). Public accountants also acted as advisors and non-executive directors in many firms (Matthews, 1998, 2001). Accountants such as those mentioned in the literature were however external (public) accountants, not internal (management) accountants. The First World War (WW1) was a driver of change in the accounting profession, bringing management accounting to a new light. Several studies (Boyns et al., 2004; Fleming et al., 2000; Loft, 1986) report an increased focus on cost accounting in many UK firms during and after WW1. During the war, firms contracted to supply the war effort relied on more sophisticated costing techniques to establish prices for goods for which had no normal market. The UK government engaged cost investigation departments to prevent suppliers profiteering based on costs; thus increasing the need for cost accounting and qualified accountants (Loft, 1986). The importance of cost accounting continued to rise, resulting in the formation of the Institute of Cost and Works Accountants (ICWA) in March 1919 (see Armstrong, 1987). The post-war economic depression from 1920 to 1925 resulted in a continued focus on costs (Boyns & Edwards, 2007; Boyns et al., 2004; Fleming et al., 2000). Thus, the number of internal (cost) accountants rose, and the size of accounting departments in many firms increased (Matthews, 1998). This, in turn, most likely resulted in an increasingly important role for chief accountants and financial controllers and there is evidence that the 1920s saw the first finance director positions in British firms (Boyns & Edwards, 2007; Matthews, 1998).

From the late 1920s until the Second World War (WW2), there were some further developments. For example, the introduction/development of standard costing, marginal costing and budgeting (Boyns & Edwards, 2007; Boyns et al., 2004). More professionally qualified accountants also joined industry, and developed internal accounting procedures (Matthews, 1998, 2001). However, the mentioned literature does not provide much detail on what these accountants actually did, and this in a way, contributes to the accepted view of pre-CFO accountants as being less involved in general organizational life than contemporary CFOs – as noted, contemporary literature seems to attribute the origin of the CFO to external factors (Zorn, 2004). But is this the full picture? A more detailed account of the role of CFO predecessors, and the practices associated with their roles, may provide an understanding of the practices of a modern-day CFO. Before providing this detail, we first detail our theoretical lens for this study.

Theoretical backgroundIn essence this paper is a study of accounting-related change, comparing the role of modern-day CFOs to a similar role from an earlier time and context. Several methods have been used in contemporary literature to study accounting change. For example, many contemporary accounting studies draw on actor–network theory (see for example, Alcouffe, Berland, & Levant, 2008; Dechow & Mouritsen, 2005), institutional sociology (see for example, Nor-Aziah & Scapens, 2007; Seal, 2006; Tsamenyi, Cullen, & Gonzalez, 2006), embedded agency perspectives (see for example, Englund, Gerdin, & Abrahamsson, 2013; Sánchez-Matamoros, Araújo Pinzón, & Álvarez-Dardet Espejo, 2014), and old institutional economics (see for example, Burns & Scapens, 2000; Lukka, 2007; Quinn, 2014b; Robalo, 2014). In the accounting history literature, some of these approaches have also been used to study accounting change. For example, institutional sociology has been used in historic studies by Carmona, Ezzamel, and Gutierrez (1998) and Núñez (2002); concepts from old institutional economics have been used by, for example Hiebl, Quinn, and Martínez Franco (2015) and Quinn and Jackson (2014). Other accounting history scholars such as Edwards (1992), Edwards and Boyns (1992), Hernández-Esteve (1996) and Carnegie and Napier (2002), have noted more general aspects of change, such as the process of change, change agents and comparative dimensions of change. Taking the theoretical approaches noted, starting with institutional sociology, it is less suited to the present study as its focus is primarily the organization. Second, old institutional economics focuses primarily on agents, effectively ignoring macro concepts such as the organization and structures within organizations – such as roles, for example. Third, while very useful and informative, studies on the general nature of change in an historic context provide less theoretical underpinning to explore more specific aspects such as roles within organizations. Thus, we explored further approaches to studying accounting change. Structuration theory has also been used in such studies, and some concepts from it are relied upon as a lens for this study. As will be detailed below, structuration theory takes into account structures and agency. Thus in terms of exploring the role of a CFO-type person, it allows us to consider both the person in the role and the role itself, independent of the person.

Structuration theoryIn comparison to theoretical approaches noted above, structuration theory incorporates both structures and agency without giving primacy to either. Typically, contemporary organizational roles such as the CFO, consist of structures (such as position within the organization) and agency (such as the personal traits and experience). Structuration theory is a social theory, originally set out by Anthony Giddens. It is primarily concerned with understanding the relationships between the activities of knowledgeable agents and the structuring of social systems. A system comprises a set of discernibly similar social practices. A structure refers to the structuring properties that bind these social practices. An agent is the individual engaged in these social practices, while agency refers to the actions taken by that individual (see Giddens, 1984). Structuration theory analyses both without giving primacy to either as encompassed by Giddens (1984) which presents duality of structure, illustrating how structures are both the medium and outcome of social interaction. In this duality, structures exist both internally within agents as memory traces that are the product of phenomenological and hermeneutic inheritance, and externally as the manifestation of social actions. Giddens’ structuration theory has been used in management accounting research as a sensitizing device, facilitating the exploration of how management accounting practices may be implicated in the social order of organizations (Macintosh & Scapens, 1990).

Stones (2005, pp. 7–8) builds on Giddens’ work, moving away from “ontology in general” to an “ontology in situ”. Stones (2005) presents a strengthened version of structuration theory which may be used to guide empirical research in specific contexts, such as the present case. He achieves this by breaking duality of structure into four analytically separate components. These are (1) external structures as conditions of action; (2) internal structures within the agent; (3) active agency; and, (4) outcomes, as modified structures and events. Stones’ (2005) work retains Giddens’ focus on the knowledgeability and conduct of agents but goes further by seeking to explore how this knowledgeability and conducts is affected by external structures. In summary, structuration theory, but particularly the work of Stones (2005) allows us to make sense of social actions within organizations. It provides a framework with which it is possible to identify and analyze structures which inform how individuals think, work and do fulfil their role.

This paper is less concerned with the wider constructs of structuration theory, but draws on position-practices. The concept of position-practices did not emanate directly from Giddens’ work. Subsequent theorists sought to establish what Thrift (1985, p. 618) referred to as the “missing institutional link” in Giddens’ work. Bhaskar (1979) used the term “position-practice” to describe the slots in which actors, in clustered groups, fit to reproduce structures; in this way position-practices could be regarded as the missing institutional link. These slots incorporate the position which the actor occupies, and the ‘practice’ in which the actor must engage by occupying that position. Cohen (1989) combines and modifies the views of Giddens (1984) and Bhaskar (1979), describing position-practices as resulting from past practices that pre-exist the human agents that subsequently inhabit, re-produce or transform them. Stones (2005) agreed with the notion that position-practices result from past practices and pre-exist agents that subsequently inhabit them. Stones (2005) views position practices as the physical representation of structures, but like all structures, their reproduction or modification requires action by the agent inhabiting them. In this context, Stones (2005) identifies structures independently of their occupants. Institutionalized positions, positional identities, prerogatives and obligations are accepted as emergent properties of past practices and provide pre-existent conditions for subsequent actions (Stones, 2005, p. 63). For this study, practices can be regarded as position-practices if they are observable over time, interrelated within wider organization position-practices and broadly acknowledged by others as associated with the role (see Cohen, 1989, p. 210, Stones, 2005, pp. 62–63).

It is clear from the propositions of Stones (2005) that contemporary CFO roles if viewed from a position-practice perspective, emanate from past practices. Arguably then, a contemporary CFO occupies largely the same role as his/her predecessor. As noted, Stones (2005) identifies structures independently of their occupants, which is empirically useful to overcome the proposition from structuration theory that structure and action are inseparable. Overcoming this inseparability offers two key advantages. First, it allows us to explore the role separate from the individual, at least analytically, which is embodied in the objective of this paper. Second, in contrast to Hiebl et al. (2015) who draw on the concept of organizational routines, drawing here on position-practices allows us to develop an improved understanding of the emergence of the macro role of a CFO as opposed to the micro routines they carried out. The more macro nature of a role may make our findings more applicable to other studies of the emergence of the present-day CFO. Additionally, as noted in the introduction, Coad and Glyptis specifically suggest research drawing on position practices “could be done more towards the ontic level of analysis” (2014, 159). Their study is a meso-level study, focusing on position practices relation in a joint venture. This study is more towards the ontic level, focusing on a role.

MethodThis paper draws on data collected for a more micro-level study of accounting tasks and roles (see Hiebl et al., 2015). It uses records related to the Chief Accountant from the corporate archive of Guinness at the St. James's Gate Brewery in Dublin. The Guinness brand and company is now incorporated within Diageo plc. The research period was approximately 1920–1945. Guinness was the largest employer in the city of Dublin during this time, employing about 3500 staff (Dennison & MacDonagh, 1998) and was the largest brewery in Ireland. Its main markets were Ireland and the United Kingdom. Profits before tax in 1920 were £12.9million, £2.4million in 1930, and £1.5million in 1940 with an average profit during the period of study of £5.7million.

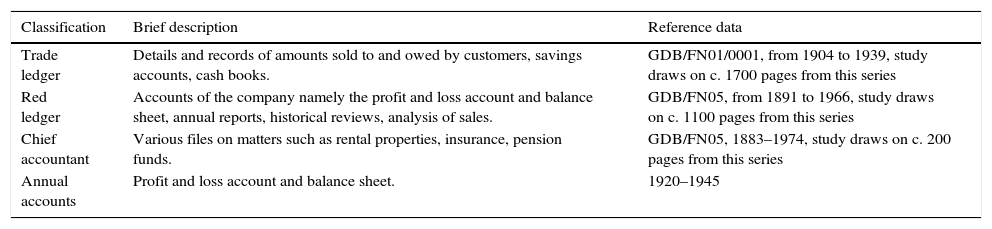

The above mentioned timeframe was chosen as it is post-WW1, and is a time when literature suggests management accounting (and roles of management accountants/CFO predecessors) developed. It was also a time when there was little or no regulatory influences on the work of accountants/CFO predecessors – the first modern-day Companies Act in the United Kingdom was passed in 1948 (and 1963 in Ireland), and accounting standards did not emerge until the 1970s. We should note that our timeframe does span into the WW2 period, which in Ireland was termed “The Emergency” as Ireland was a neutral country. As the accounting department, and the Chief Accountant were based in Dublin, no effects of the war were apparently relevant to the study of the role. The records analyzed are detailed in Table 2. The majority of documents examined were typed and thus easily readable. The records which are what Scott (1990, pp. 81–82) calls recurrent and regular and routines. Recurrent records form the daily operations of an organization whereas regular records are regularly produced, but are not essential to daily operations – for example the financial statements. Documents were digitally photographed for ease of analysis.

Archival records related to the chief accountant at Guinness.

| Classification | Brief description | Reference data |

|---|---|---|

| Trade ledger | Details and records of amounts sold to and owed by customers, savings accounts, cash books. | GDB/FN01/0001, from 1904 to 1939, study draws on c. 1700 pages from this series |

| Red ledger | Accounts of the company namely the profit and loss account and balance sheet, annual reports, historical reviews, analysis of sales. | GDB/FN05, from 1891 to 1966, study draws on c. 1100 pages from this series |

| Chief accountant | Various files on matters such as rental properties, insurance, pension funds. | GDB/FN05, 1883–1974, study draws on c. 200 pages from this series |

| Annual accounts | Profit and loss account and balance sheet. | 1920–1945 |

In terms of identifying positions practices from the documents in Table 2, we treat the documents as outputs of the practices of the Chief Accountant. If the documents reveal evidence of similar practices regardless of who occupied the Chief Accountant role, this demonstrates that a role emerges from past practices and pre-existing conditions (see Cohen, 1989; Stones, 2005). We should note that similar does not mean the format of the documents, as we are more concerned with practices associated with a macro-level role. The documents, although static in nature, are reflections of enacted practices of independent agents. However, in a similar vein to Quinn (2014b) and Hiebl et al. (2015) – who use routines in an archival setting – we are not observing action and thus are limited to relying upon the documents as observable representations of the Chief Accountant's role. The documents are however extensive and clear, and thus quite useful for the purposes of the study. For example, if ledgers or reports are similar overtime, this would suggest practices are based on past practices.

FindingsBefore providing an overview of the position-practices associated with the Chief Accountant role at Guinness, a general outline of the department and the persons in the role is given. This sets the context for later discussion.

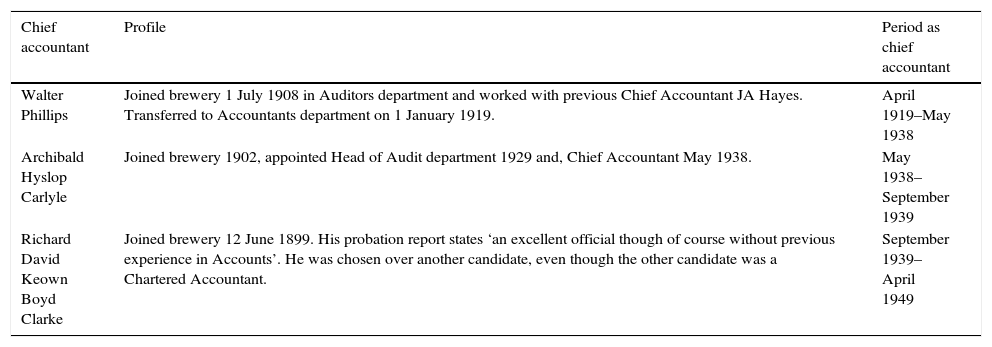

An overview of the Guinness accounting departmentThe Chief Accountant led the accounting department at Guinness. During the period of analysis, three persons held the role (see Table 3). As noted earlier, in this study we analytical separate the person from the role, as thus we do not focus on any one person. As far as we can establish from the archival documents, the Chief Accountant was promoted from within, having previously held the role of Deputy Chief Accountant. Personnel and wages/salaries files are only accessible to relatives, but we did find evidence from signatures on internal reports that each Chief Accountant previously held the Deputy role. The archives do not reveal a job description for the role of the Chief Accountant and the evidence suggests that the holders of the role were not professionally qualified accountants at this time – as corroborated by an examination of the List of Members of the main accounting body in Ireland at the time.

Chief accountant profiles.

| Chief accountant | Profile | Period as chief accountant |

|---|---|---|

| Walter Phillips | Joined brewery 1 July 1908 in Auditors department and worked with previous Chief Accountant JA Hayes. Transferred to Accountants department on 1 January 1919. | April 1919–May 1938 |

| Archibald Hyslop Carlyle | Joined brewery 1902, appointed Head of Audit department 1929 and, Chief Accountant May 1938. | May 1938–September 1939 |

| Richard David Keown Boyd Clarke | Joined brewery 12 June 1899. His probation report states ‘an excellent official though of course without previous experience in Accounts’. He was chosen over another candidate, even though the other candidate was a Chartered Accountant. | September 1939–April 1949 |

The total number of staff in the Accountant's Department was approximately 60 persons on average between 1920 and 1945. This comprised about ten management level staff (referred to as #1 Staff), including the Chief and Deputy Chief Accountant, and an average of 50 clerks. The number of #1 Staff was 15 in 1925, but this declined to 11 in 1929 and to 10 by 1934. The number of clerks was also higher in the 1920s, peaking at 67 in 1926. This declined to about 50 from 1930 and stood at 46 by 1940. The declining number of staff is explained by a combination of falling trade and some automation within the department (Hiebl et al., 2015). Board of Directors’ meeting minutes of the time reveal that the Chief Accountant was not a Board member and did not normally attend meetings. He did regularly advise the Board on accounting and cost related issues, as evidenced by mention of costs and information in the Board minutes. Additionally, an Audit Office was located within the Accountant's Department, performing manual task such as checking supplier invoices and payments for correctness. The Department also provided support to the Park Royal brewery in London, which opened in 1936, and prepared wages and salaries of staff. And, as noted by Quinn (2014b) the Department provided cost information to sections of the Dublin brewery, such as the Cooperage and the Engineer's Department. In summary, the Chief Accountant at Guinness was someone who was not professionally qualified rather internally trained, managed a department, and reported to and advised the Board of Directors.

Chief accountant's practicesThe daily practices (i.e. tasks) associated with the Chief Accountant role are now outlined. Detail of these tasks is less important here, as we are more concerned with how these tasks form practices associated with the role of Chief Accountant i.e. position-practices (see later).

Two ledgers are noted in Table 2. The Trade Ledger is in modern terms the accounts receivable ledger; the Red Ledger the nominal ledger. The records reveal that the vast majority of clerks in the department were allocated to Trade Ledger tasks such as recording sales, customer payments and calculating amounts owed (i.e. balances on account). These rather routine tasks were monitored by the Chief Accountant and were inputs to the Red Ledger. A detailed instruction manual existed for clerks, and this manual increased in size from the 1920s in particular. Further analysis of the manual reveals no mention of tasks for other accounting staff – such as the Chief Accountant or Deputy Chief Accountant. This lack of instructions suggests that higher level tasks such as nominal ledger-keeping and financial statement production was part of the Chief Accountant's role. There were approximately six staff dedicated to the Red Ledger – these included the Chief Accountant and his deputy. The Red Ledger was used as the basis for the preparation of the company financial statements. The Chief Accountants files include numerous examples of annual financial statements and working papers which are the main output of the Red Ledger.

The archives also reveal some other practices of the Chief Accountant role including property management, risk management and investment management. The records reveal Guinness had extensive property interests, with the rental income from these properties accounted for by the Chief Accountant and his Deputy, as the role of clerks appears limited. The Chief Accountant also organized insurance on the rental properties and general business insurance (see Quinn & Jackson, 2014). The records also reveal the Chief Accountant was responsible for cash management and investment. At the time of our study, Guinness held about £1 million to £2million in cash and deposits. The Chief Accountant received regular bank statements and issued instructions to banks to transfer funds into and out of deposit accounts. There is also evidence investments made in stocks of companies and government bonds, more so from the mid-1930s onwards. The files reveal very similar annual tasks during the entire study period. For example, all properties were listed on an annual basis in a schedule to assess their market value for insurance purposes. Records of running costs and repair costs of properties were maintained in a similar fashion. Similarly, insurance schedules showing the values of properties, plant and equipment had a similar format throughout the period. The files also reveal correspondence from other managers and the Board of Directors on property and insurance matters.

Discussion of position practicesAs noted previously, some contemporary literature (see Zorn, 2004) suggests a somewhat rapid emergence of the CFO role – a transformational-type event from a bean-counter to business partner. As noted earlier using a structuration perspective, the role of a CFO incorporates positions practices and a key dimension of position-practices is they “can be identified independently of their incumbents” (Stones, 2005, p. 63) – at least analytically. We operationalize this concept of position-practices to provide an overview of practices associated with the Chief Accountant role at Guinness, independent of the person occupying the role. As noted in the methods section, practices such as those of the Chief Accountant qualify as position-practices if they are observable over time, interrelated within wider organization position-practices and are broadly acknowledged by others as associated with the role. Thus, for example, ad-hoc practices associated with the role would typically not be regarded as a position-practice.

One role of the Chief Accountant was as a supervisory role, overseeing the Trade Ledger. From the archival documents, we have established that this role was very similar over time. For example, the Trade Ledgers themselves were prepared in a similar format each year during our study period, and memoranda to/from the Chief Accountant on Trade Ledger items – such as customer sales, cash receipts – were very similar. We have also established the Trade Ledger was inter-related to the Red Ledger (as a data input) and as far as we can determine, this supervisory role was as integral component of the expected role of the Chief Accountant. It is thus a position-practice as described earlier. Second, the Chief Accountant as the custodian and a user of the Red Ledger, operated within a clearly evident position-practice. The Red Ledger was similarly maintained during our analysis period, as evidenced by its outputs, namely financial statements and associated working papers. These outputs remained in the same format during the entire study period. And, as already noted, the Red Ledger and Trade Ledger were interrelated. This position-practice was also interrelated to the wider position-practice relations of the Board of Directors – as evidenced by the inputs of the Chief Accountant to Board meetings on cost matters. This position-practice was clearly recognized by other organizational members as typical of the role as head of the accounting function. Third, the investment and risk roles of the Chief Accountant similarly portray the characteristics of a position-practice. The tasks in this role were repeated similarly each year. This position-practice was interrelated to the Red Ledger practices and broader organizational position-practices. It was also acknowledged as typical of the role during the analysis period, as evidence by correspondence from other managers to the Chief Accountant. Thus, in summary, we can identify three general sets of position-practices based on the archival evidence, (1) a supervisory role, (2) information provider/scorekeeper role and (3) a treasury management/risk role.

The three sets of position-practices show distinct similarities over three differing persons occupying the Chief Accountant role. These position-practices stem mainly (if not solely) from past practices which are internal to the organization and, as through the lack of formal written instructions and/or job descriptions, were dependent on past practices being handed down from one role occupier to another. As noted earlier, the analysis period pre-dates the accounting regulation (such as company law and accounting standards) that we know today, which highlights the general absence of external influencing factors on the role. We also noted earlier that none of the Chief Accountants during our analysis period were professionally qualified. Therefore the role was mainly determined by the position-practices of predecessors – which is typified by the fact that the Deputy Chief Accountant was appointed Chief Accountant. Archival records for the Deputy Chief Accountant do not exist, but it is quite likely that the position-practice of the Deputy role were influenced by those of the Chief role.

In contrast, the modern-day CFO is typically subject to more external influences, such as capital markets, firm owners, professionalism, regulation and other macro factors such as globalization and economic conditions (Büttner, Schäffer, Strauß, & Zander, 2013; Favaro, 2001; Friedman, 2014; Hiebl, 2015; Wang, 2010). The impact of these factors on the CFO role is evident in the contemporary literature (see earlier). Although we do not empirically analyze a contemporary CFO role, the contemporary roles as set out in Table 1 incorporate position-practices (see for example, Feeney (2013), where a Head of Finance role is established according to position-practices). Reflecting on Cohen (1989) and Stones (2005), position-practices emerge from past practices, and serve as pre-existent conditions for subsequent action, the modern day CFO role must incorporate practices such as those of the Chief Accountant as outlined above. These past practices will have evolved in response to the changing context of modern organizations. Cohen refers to this as “circumstantial variation” (1989, p. 210) which can occur in any reproduction of a position-practice. The contemporary literature supports this, in that it still identifies practices such as those of the Chief Accountant as an element of the contemporary CFO role (for example, the scorekeeper role, see Baxter & Chua, 2008; Voogt, 2010). The contemporary CFO exists within a wider web of internal and external structures, and their associated position-practices. These provide the contemporary CFO with their structural context of action. However, based on the archival evidence from Guinness, a CFO predecessor (such as the Chief Accountant) shared position-practices which are today woven into the broader role of the contemporary CFO. This concurs with Stones (2005), who notes position-practices as emergent properties of past practices. For example, we found evidence in an internal company magazine from April 1960 which suggests the role of the Chief Accountant was very similar, 15 years after our analysis period and with a new occupant in the role. The 1960 article notes terms and organizational structures associated with the role which are very similar to those mentioned above.

In contrast, the traditional view of predecessors of a contemporary CFO is one of a bean-counter type role concerned with little more than book-keeping and external reporting (Granlund & Lukka, 1998; Hiebl, 2013; Sharma & Jones, 2010; Zorn, 2004). This view suggests the modern-day CFO was “created” in a more radical and instantaneous fashion by external factors such as legislation (Zorn, 2004), rather than in an emergent way. The three sets of position-practices set out above, of the Chief Accountant at Guinness suggests that human agents subsequently inhabit, re-produce and (potentially) transform the roles (through position-practices) into what we would today term a CFO role. This addresses our initial research objective in that it enhances our understanding of the emergence of CFO-type roles in contemporary firms.

Concluding commentsThe aim of this paper, as noted in the introduction, is to detail the role of a chief accountant, focusing specifically on the role as a structure independent of the individual and to draw some comparisons to contemporary CFO roles. We draw on the concept of position-practices as theoretical backdrop. Our study shows that, in the absence of external influences more common to today's CFO, the nature of a CFO-predecessor role was largely influenced by the position-practices of that position. This adds to (and supports) the work of Hiebl et al. (2015) by offering a role-based view of the emergence of the modern-day CFO, which is less likely to be firm-specific. The paper also responds to calls by Coad and Glyptis (2014) to adopt position-practices as an explanatory lens to study accounting change. This may encourage scholars to explore the historic development of CFO roles in other firms in a similar way, adding to extant knowledge.

The study has some limitations, the primary limitation being it is based on data from a single case organization and may not be generalizable. Having said that, the data is clear, detailed and well-preserved thus giving some us confidence. And as noted above, we would encourage further research, as our role focus (through position-practices) can be applied in other firms. A second limitation is inherent within the research objective, in that we do not study later time periods when external influences such as legislation may affect the nature of position-practices. Thus, further research in more contemporary timeframes would be useful and add to this study.

Conflict of interestsThe authors declare no conflict of interest.

The authors would like to thank Deirdre McParland and Eibhlin Roche at the Guinness Archive and two anonymous reviewers for most helpful comments on earlier versions of this paper.