The purpose of this paper is to investigate whether forward-looking disclosures and corporate reputation lead to a reduction in stock return volatility. This study measures financial forward-looking information, by conducting a content analysis of annual reports for a sample of US companies. Since every annual report was manually examined and coded, the study is therefore restricted to the companies listed in Standard and Poor's 100. Results show that financial forward-looking information has significant effects on capital markets. This study contributes to the current literature on voluntary disclosure, by examining the link between the disclosure of financial forward-looking information and stock return volatility. Since stock volatility is linked to information asymmetries and to a higher risk of a company, this analysis implies certain practical implications for both managers and regulators regarding the importance of specific disclosure strategy in capital markets. Moreover, results indicate that forward-looking information disclosed by companies of a higher reputation has a greater effect on stock return volatility. This is the first study that demonstrates that corporate reputation moderates the effects of forward-looking information in capital markets. In addition to the level of disclosed information, the interpretation and the effectiveness of forward-looking information depends on the reputation of a company.

El objetivo de este trabajo es investigar si la divulgación de información previsional y la reputación corporativa llevan a una reducción de la volatilidad de las acciones. La información previsional financiera es medida mediante un análisis del contenido de los informes anuales de una muestra de empresas estadounidenses. Puesto que cada informe anual fue examinado y codificado manualmente, la muestra se limita a las empresas que aparecen en Standard and Poor's 100. Los resultados muestran que la divulgación de información previsional financiera tiene efectos significativos en los mercados de capitales. El trabajo contribuye a la literatura existente, examinando la relación entre la divulgación de información previsional financiera y la volatilidad de las acciones. Dado que la volatilidad de las acciones se asocia a la existencia de asimetrías informativas y a un mayor riesgo de las empresas, los resultados tienen implicaciones directas para empresas y reguladores respecto a la importancia de las estrategias específicas de divulgación de información previsional. Adicionalmente, la información previsional divulgada por las empresas más reputadas tiene un mayor efecto en la volatilidad de las acciones. Este es el primer estudio que demuestra que la reputación corporativa modera los efectos de la información previsional en los mercados de capitales. La interpretación y la efectividad de la información previsional no depende sólo del nivel de divulgación, sino también de la reputación de una empresa.

In theory, increased levels of disclosure reduce the possibility of information asymmetries, as measured through bid-ask spread, stock liquidity and stock return volatility (Cormier, Ledoux, & Aerts, 2010). Nevertheless, the literature provides no clear definition of the concept of “increased levels of disclosure” (Leuz & Verrecchia, 2000). Previous research suggests that information quality affects the uncertainty about the future of a company and stock volatility (Easley & O’Hara, 2004; Pastor & Veronesi, 2003). Disclosure may take various forms, and not all kinds of information disclosure would have the same impact on capital markets. Both managers and policymakers are interested in ascertaining which information is useful for investors and which can have an effect in capital markets. Specifically, forward-looking information has become crucial, since historical information could be insufficient for investors. Both organisms and researchers have stated the significance of forward-looking information in order to improve the forecasts about a company and ease decision-making processes in capital markets. Despite stock volatility being a concern for both regulators and managers, the association between forward-looking information and stock return volatility remains unexplored. On the other hand, there is an ongoing debate concerning how investors value and interpret the information disclosed by companies (Beyer, Cohen, & Beverly, 2010). Each company transmits a different degree of confidence to the markets. The vast majority of studies have focused on the level of information disclosed, but the effects of disclosure practices can be further varied depending on corporate reputation. Although the resource-based theory emphasizes the importance of corporate reputation, evidence fails to demonstrate that this intangible resource can also influence disclosure practices and changes in the stock price. Since the reputation of the messenger should play an important role in the effectiveness of the message (Mercel, 2004), investors may have a positive emotional predisposition when interpreting information disclosed by firms with a high reputation.

This paper extends previous research by analyzing the effect of financial forward-looking information (such as earnings forecasts, expected revenues, and anticipated cash flows) on stock return volatility. This information can provide a major source of corporate disclosure differentiation, since it is verifiable ex-post, and hence its disclosure may lead to greater accountability and an increase in reputational costs. Research has specifically considered the disclosure of forward-looking information of a financial nature, however previous studies have yet to analyse the relationship between this information and stock return volatility. This paper also analyses the effect of the financial forward-looking information disclosed by most reputable firms on stock return volatility. This is the first study that investigates how corporate reputation moderates the effects of forward-looking information. This study extends previous research by showing that, in addition to the level of disclosure and the source of information, the reputation of a firm may also influence the effect in capital markets of the information disclosed by companies. Information disclosed by firms of a higher reputation can better mitigate stock volatility through an enhancement of the credibility of the information.

The sample of this study is made up of the companies in the Standard and Poor's 100 in the year 2009. In order to measure the level of information, all annual reports are individually examined and manually coded. The results show that the disclosure of financial forward-looking information reduces stock return volatility. Managers could benefit from these findings, which support the idea that investors and financial analysts take advantage of financial forward-looking information. Furthermore, these results may well be of interest to regulators, as they could set information requirements more efficiently to reduce information asymmetries in capital markets. Secondly, the results suggest that financial forward-looking information disclosed by companies with a better corporate reputation is more effective in reducing stock return volatility. This evidence is relevant for managers, who must be aware of the importance of the creation and maintenance of corporate reputation in the effectiveness of disclosure strategies.

The paper proceeds as follows. “Theoretical framework and hypothesis development” section contains a conceptual background and the hypothesis development. “Research design” section describes the sample and explains the research design. The main results of the study are presented in “Empirical results” section. Summary and conclusions are provided in “Conclusion remarks” section.

Theoretical framework and hypothesis developmentTheory predicts that an increase in the level of disclosure should reduce information asymmetries in capital markets, and this would lead to many potential benefits (Healy & Palepu, 2001). Corporate disclosure is crucial for the functioning of capital markets, and several potential effects have been associated to a reduction in information asymmetries: an improvement in stocks liquidity, a decrease in companies’ cost of capital, and an increase in financial analysts’ following (Healy & Palepu, 2001). In particular, low levels of volatility suggest fewer information asymmetries, and previous studies have considered stock return volatility as a proxy for information asymmetry (Cormier et al., 2010; Lang & Lundholm, 1993; Leuz & Verrecchia, 2000). Stock return volatility has received a great deal of attention since it is an important issue in both theory and practice. An increase in stock return volatility would lead to a higher perception of the risk of a firm and hence, a rise in the cost of capital of companies (Bushee & Noe, 2000). These authors also state that volatility can become a negative indicator for firm value, thereby making stock-price compensation less effective and/or more costly. The increase of stock volatility in recent years and the expected impact of information asymmetries on stock prices have raised questions about whether financial information can mitigate stock return volatility (Rajgopal & Venkatachalam, 2011). Prior research in the accounting and finance literature offers several reasons why information can affect stock return volatility. Specifically, a decrease in information asymmetries would imply a reduction in the periodic surprises about a firm and make its stock price less volatile (Bushee & Noe, 2000). Pastor and Veronesi (2003) argue that poor information quality affects the uncertainty about the future performance of a company. Easley and O’Hara (2004) find that financial reporting quality influences the information environment of a company and hence, its cost of capital and stock volatility. Nevertheless, the literature lacks any provision of evidence concerning the relationship between the disclosure of forward-looking information and stock return volatility.

Literature on disclosure tends to use general measures of information based on subjective ratings provided by analysts (Brown & Hillegeist, 2007; Haggard, Martin, & Pereira, 2008) or self-constructed indices (Botosan, 1997; Michelon, 2013; Rodríguez-Domínguez & Noguera-Gámez, 2014). The majority of prior studies that have analysed the effect of voluntary disclosure on capital markets have focused on the level of the disclosed information in the annual reports. Although capital market participants are expected to use all sources of information to make decisions about a company, annual report disclosures are shown to be highly correlated with other ways of communication (Botosan, 1997; Lang & Lundholm, 1993). Both mandatory and voluntary information have been addressed by researchers. Specific types of information have been examined: intellectual capital (Husin, Hooper, & Olesen, 2010), segment information (Prencipe, 2004), environmental information (Husillos & Álvarez-Gil, 2008), information on corporate social responsibility (Aribi & Gao, 2012) and sustainability (Rodríguez-Ariza, Frías, & García, 2014), or information on risks (Linsley & Shrives, 2006; Rodríguez-Domínguez & Noguera-Gámez, 2014), among others. Not all types of information may have an effect on capital markets. In this study, a disclosure measure based on forward-looking information is designed, by assuming that this information is valuable in the decision-making process.

Previous empirical evidence shows that forward-looking disclosure practices of firms are relatively conservative since the disclosure of this information is costly. First, it may provide useful information for competitors and lead to proprietary costs. Moreover, managers are exposed to potential litigation and reputational costs if they disclose inaccurate forward-looking information (Celik, Ecer, & Karabacak, 2006). However, under an agency perspective, companies can voluntarily disclose information in order to reduce conflicts of interest between managers and investors (Jensen & Meckling, 1976). Furthermore, the disclosure of specific information can provide a strategy to manage relations with stakeholders (Ullmann, 1985). According to stakeholders’ theory, disclosure strategies are essential mechanisms for companies to influence the perceptions and expectations about a company and to satisfy stakeholders’ needs (Archel, Husillos, Larrinaga, & Spence, 2009; Michelon, 2013).

In particular, in the U.S., the disclosure of forward-looking information is specifically promoted through the “safe harbor” rules. The purpose of these rules is to encourage the voluntary disclosure of forward-looking information by removing the deterrent of liability in making such disclosures. In 1995, the SEC adopted rules to provide “safe harbor” protection for forward-looking information. The disclosure of this information is not considered fraudulent unless it is shown that such a statement was made or reaffirmed without reasonable basis or was disclosed other than in good faith. Although the disclosure of forward-looking information is promoted, there are no rules about the report of financial forward-looking information in the US context. Companies are expected to reveal this information only when the associated benefits exceed the costs of disclosure (Baginski, Hassell, & Kimbrough, 2004).

In line with agency theory, the disclosure of forward-looking information can reduce the degree of information asymmetry and improve the decision-making process, and hence the cost of financing for companies may be reduced (Aljifri & Hussainey, 2007). The rapid changes in the economic environment make historical information insufficient for stakeholders, and the publication of forward-looking information may help investors improve their forecasts about a company (Wang & Hussainey, 2013). The disclosure of this information is also assumed to reduce the information gap between firms and investors by improving the anticipation of future earnings (Schleicher & Walker, 1999), share price (Hussainey, Schleicher, & Walker, 2003), and the future performance of a firm (Hussainey & Aal-Eisa, 2009). The disclosure of forward-looking information has been associated with higher accuracy in analysts’ forecasts (Barron, Kile, & O’Keefe, 1999), increased analyst following (Lang & Lundholm, 1996), and lower information risk (Graham, Harvey, & Rajgopal, 2005). Therefore, potential benefits from the disclosure of forward-looking information have been stated by both organisms (AICPA, 1994; CICA, 2002; FASB, 2001) and researchers.

Nevertheless, forward-looking information is a broad concept which includes a variety of disclosures, and the content of this information is also an important issue. The disclosure of forward-looking information with a financial nature has specifically been examined by some researchers (Celik et al., 2006; Hussainey et al., 2003), since this information is assumed to be value-relevant for investors. In this line, other studies have paid attention to the disclosure of earnings forecasts (Hirst, Koonce, & Venkataraman, 2008; Karamanou & Vafeas, 2005).

This study extends prior literature on voluntary disclosure, in particular, research on forward-looking information, by examining the link between the disclosure of financial forward-looking information and stock return volatility.

Financial forward-looking information is expected to be more credible since it is easily verifiable and its disclosure may lead to greater accountability. Moreover, since financial forward-looking information is precise and refers to the future performance of a company, this information is likely to be value-relevant for investors.

From an agency perspective, the disclosure of value-relevant information reduces the uncertainty about a company and therefore mitigates information asymmetries. Since information asymmetries can affect stock return volatility, the application of agency theory implies a relationship between stock volatility and the disclosure of financial forward-looking information.

From the above discussion, the following hypothesis is formulated:H1 The disclosure of financial forward-looking information leads to a reduction of stock return volatility.

Furthermore, this paper also extends previous literature by examining the effect of forward-looking information disclosed by firms of a higher reputation, under the premise that the information provided by these firms has a greater mitigating effect on stock volatility. Corporate reputation represents the perception of the quality of the firm's management (Hammond & Slocum, 1996) and can be expected to increase the investors’ confidence in a firm.

First, this assumption relies on the psychological effect that corporate reputation can have on investors. Forward-looking disclosures by firms with a higher reputation can be more credible for investors and have a greater effect in the mitigation of information asymmetries, by reducing the uncertainty about a company.

On the one hand, it is obvious that investors’ behaviour can also be determined by social and psychological aspects, and corporate reputation may have positive effects on the emotional predisposition of individual investors (Helm, 2007). Capital market agents can perceive firms with a higher reputation as more solid, and therefore the image of a firm may be considered an intangible factor that determines investors’ loyalty and confidence. Since stock return volatility may also reflect irrational sentiments of investors (Venkatachalam, 2000), this volatility could be determined by corporate reputation.

Beyond the individual effect of corporate reputation on stock volatility, it can also be expected that the reputation of a company influences the way investors interpret its disclosures. Although prior studies have generally focused on the level of forward-looking information, the way that investors perceive the information disclosed by companies is also expected to be important to reduce information asymmetries. Corporate reputation can play an important role in the reduction of the uncertainty of the information disclosed by firms, thereby affecting the way that investors make decisions. The information disclosed by firms of a higher reputation may be more credible, and the credibility of information is a key factor for investors to make decisions (Schwarzkopf, 2007).

For the disclosure in financial statements, credibility is enhanced by independent audit firms that certify whether financial reporting decisions by managers are consistent with accounting standards (Kothari, Li, & Short, 2010). However, much of the evidence on the credibility of voluntary disclosures focuses on the accuracy and stock price effects of management forecasts (Healy & Palepu, 2001). Nevertheless, specific firms’ characteristics can also be expected to affect disclosure credibility. For example, Frost (1997) finds evidence that disclosure credibility declines for financially distressed firms.

Particularly, there is no research about the relationship between corporate reputation and the effectiveness of financial information disclosed in annual reports. Corporate reputation may influence the way that investors use financial information, especially when firms report voluntary information that is not subject to regulation. In particular, forward-looking information needs to be credible in order to have an effect on capital markets. This information can be more credible for firms with a higher reputation, since corporate reputation could lead to an increase in investors’ trust. In theory, the reputation of the messenger should play an important role in the effectiveness of the message (Mercel, 2004). Therefore, it is expected that firms with a high reputation increase the believability of their forward-looking voluntary disclosures.

Despite the discussion presented above, the role of corporate reputation in both disclosure strategies and the reduction of stock volatility still remains an open research question. According to the previous arguments, the combined effect of financial forward-looking information and corporate reputation is examined in order to analyse whether information disclosed by companies of a higher reputation has a greater effect on stock volatility. Therefore, the following hypothesis is formulated:H2 The disclosure of financial forward-looking information by firms of a higher reputation (versus firms of lower reputation) has a greater effect in the reduction of stock return volatility.

The final sample was composed of 73 non-financial companies included in Standard and Poor's 100 in the year 2009. The U.S. equity market is the world's largest, and U.S. returns hold substantial influence for many non-U.S. returns (Rapach, Strauss, & Zhou, 2013). Furthermore, the U.S. context is influenced by the existence of safe-harbour rules, which promote the disclosure of forward-looking information. Companies in S&P 100 are more visible and they are likely to disclose more information. The recent financial crisis was characterised by extreme stock price volatility (Ozenbas & San Vicente Portes, 2013). The need for corporate transparency is enhanced in periods of crisis, and the question concerning the impact of specific disclosures on stock volatility gathers greater significance. The analysis is limited to one year because firm's disclosure policies are expected to remain constant over time (Abraham & Cox, 2007; Botosan, 1997; Hail, 2002).

The disclosure measure was calculated by reading and analyzing all annual reports from 2009. One of the common limitations of hand-collected data is that sample sizes are traditionally small, since the process is a very time-consuming task. Abraham and Cox (2007), Aljifri and Hussainey (2007), Guo, Lev, and Zhou (2004), Husin et al. (2010), and Prencipe (2004), also carried out content analysis techniques by using hand-collected data for samples between 30 and 72 firms.

Definition of variablesThe dependent variable: stock return volatilityIn order to analyse the effect of disclosure on stock return volatility, data about daily prices in 2010 were collected, since annual reports for the year 2009 were published in 2010. Therefore, the change in share prices immediately after the publication of the annual reports was measured. Stock return volatility (STDRET) was calculated in logarithmic terms (Bushee & Noe, 2000; García Lara, García Osma, & Peñalva, 2014), as the natural log of one plus the standard deviation of daily stock returns. A minimum of three months of daily return observations was required to calculate stock volatility1; therefore companies with a lower number of observations were dropped from the sample. Validation tests were performed to confirm that this variable captures the risk of a firm, and the results were satisfactory, as shown in the next section.

The independent variable: information disclosureThe level of financial forward-looking information was captured by examining annual reports published by companies. The annual report is chosen since it has been traditionally considered to be an influential source of information for investors (Lang & Lundholm, 1993; Marston & Shrives, 1991). Furthermore, annual report disclosure is highly correlated with other financial communications (Lang & Lundholm, 1993). This paper aims to analyse the effect of voluntary forward-looking information on the markets. Annual reports were downloaded from companies’ websites. Regulated sections (financial statements and notes) were excluded from the analysis and only voluntary narrative disclosures in the annual report were examined.2

Forward-looking disclosure refers to current plans and future forecasts that enable investors and other users to assess a company's future financial performance (Aljifri & Hussainey, 2007). Forward-looking disclosure involves both financial and non-financial information. This paper focuses on specific financial information, such as earnings forecasts, expected revenues, anticipated cash flows, or any other financial indicator. A number of studies have suggested that the disclosure of forward-looking information of a financial nature, and particularly about earnings, is value-relevant for investors (Celik et al., 2006; Hirst et al., 2008; Hussainey and Aal-Eisa, 2009). This information is easily ex-post verifiable, and financially verifiable disclosures are more effective than unverifiable disclosures at improving accuracy and reducing dispersion of analysts’ forecasts (Bozzolan, Trombetta, & Beretta, 2009).

Content analysis techniques were used to quantify the amount of financial forward-looking information in the annual reports. The financial forward-looking disclosure variable (FFLDIS) refers to the number of sentences within an individual annual report which contain this information. Each piece of information was manually analysed to select all the sentences with financial forward-looking information. The use of sentences as a unit of measure for disclosure has been established as providing complete, reliable and meaningful data for further analysis (Milne & Adler, 1999). Previous studies on forward-looking disclosure have also employed sentences in order to measure the level of disclosure (Aljifri & Hussainey, 2007; Beretta & Bozzolan, 2008; Celik et al., 2006; Wang & Hussainey, 2013). In line with prior studies (Arangunen & Ochoa, 2008; Linsley & Shrives, 2006), certain decision rules were followed for the quantification of the level of disclosure. For example, tables that provided financial forward-looking information were interpreted as one line equals one sentence.

Before examining annual reports, a preliminary test was performed so as to set up several coding rules. In order to measure reliability of the coding process, two annual reports, randomly selected from the sample, were examined independently by two different researchers, and the results were satisfactory. In order to guarantee the internal validity of the measure of financial forward-looking information, the reliability of this variable was again verified at the end of the process.

Corporate reputationDespite the difficulties in the measurement of corporate reputation, researchers have stated that most reputable firms obtain greater financial benefits (Black, Carnes, & Richardson, 2000). Previous literature in the U.S. context is largely based on the survey performed by Fortune magazine to design a measure of corporate reputation. This magazine provides a list of the most admired companies in the United States. In this survey, executives, directors and analysts are asked to rate a company on several criteria, from investment value to social responsibility. The Fortune survey results in some corporate reputation rankings, which are generally accepted as a reference for large companies in the United States in the assessment and management of their reputation.

In order to measure corporate reputation, the ranking for the “World's Most Admired” companies was used.3 Therefore, corporate reputation (REP) was a dummy variable that took a value of 1 if a firm was included in Fortune ranking and 0 otherwise. This type of measure is commonly used in academic journals (Black et al., 2000; Chung, Schneeweis, & Eneroth, 2003; Gallego, Prado, Rodríguez, & García, 2010; Martínez-Ferrero, 2014; Roberts & Dowling, 2002).

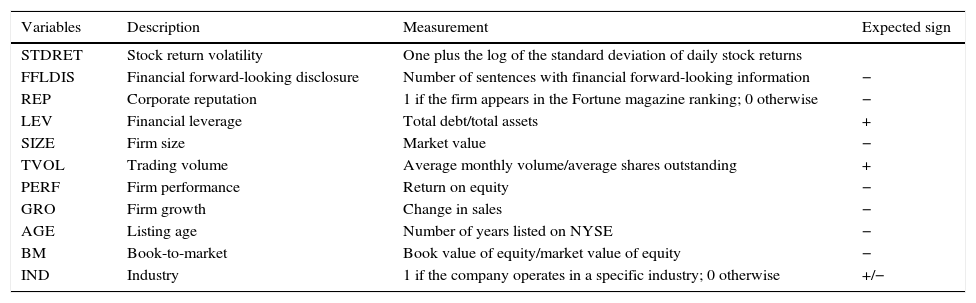

Control variablesIn line with previous studies, several variables that are expected to influence stock return volatility were included in the model to control for potentially omitted relationships.

Leverage (LEV). Leverage is an indicator of the risk of a firm, and the literature predicts a positive association between leverage and stock return volatility (Bushee & Noe, 2000; Rajgopal & Venkatachalam, 2011). The ratio of total debt to total assets was employed to calculate leverage.

Firm size (SIZE). Previous empirical evidence suggests that small firms experience a higher return volatility (Bushee & Noe, 2000; Pastor & Veronesi, 2003). Market value was used as a proxy for firm size.

Trading volume (TVOL). Prior research supports a positive connection between trading volume and stock price volatility (Bushee & Noe, 2000; Kyröläinen, 2008). Trading volume was measured as the average monthly volume over the year divided by average shares outstanding.

Firm performance (PERF). Better performance leads to lower stock volatility (Rajgopal & Venkatachalam, 2011). In this study, firm performance was measured through return on equity.

Growth (GRO). Growth variables can also affect investors’ decisions (Bushee & Noe, 2000). The variable used to capture company growth was changes in sales.

Listing age (AGE). Older firms in stock markets experience lower growth prospects and this implies a reduction in stock return volatility (Chok & Sun, 2007; Xu & Malkiel, 2003). Firm age is calculated as the number of years that a company has been listed in the New York Stock Exchange.

Book-to-market (BM). Book-to-market is expected to have a negative influence on stock return volatility (Bushee & Noe, 2000; Rajgopal & Venkatachalam, 2011). This variable was measured through the ratio of book value of equity to market value of equity.

Industry (IND). Return volatility can be correlated with specific industries (Chok & Sun, 2007; Pastor & Veronesi, 2003). Industries were defined in accordance with the Standard Industry Codes (SIC).

All the variables included in the empirical analysis are presented in Table 1, indicating the expected association with stock return volatility.

Definition and measurement of variables.

| Variables | Description | Measurement | Expected sign |

|---|---|---|---|

| STDRET | Stock return volatility | One plus the log of the standard deviation of daily stock returns | |

| FFLDIS | Financial forward-looking disclosure | Number of sentences with financial forward-looking information | − |

| REP | Corporate reputation | 1 if the firm appears in the Fortune magazine ranking; 0 otherwise | − |

| LEV | Financial leverage | Total debt/total assets | + |

| SIZE | Firm size | Market value | − |

| TVOL | Trading volume | Average monthly volume/average shares outstanding | + |

| PERF | Firm performance | Return on equity | − |

| GRO | Firm growth | Change in sales | − |

| AGE | Listing age | Number of years listed on NYSE | − |

| BM | Book-to-market | Book value of equity/market value of equity | − |

| IND | Industry | 1 if the company operates in a specific industry; 0 otherwise | +/− |

The following model was initially proposed, in which stock return volatility is a function of the disclosure of financial forward-looking information, corporate reputation, and all the control variables:

STDRETt+1=f (FFLDISCt, REPt, LEVt, SIZEt, TVOLt, PERFt, GROt, AGEt, BMt, INDkt)

A stepwise regression analysis with backward elimination was performed to extract significant variables from the entire group of independent variables.4 Although the initial model was built based on theory, a stepwise regression technique was used to ascertain variables that can better predict stock return volatility. Results from the stepwise regression yield the following expression:

STDRETt+1=α+β1FFLDISCt+β2REPt+β3LEVt+β4SIZEt+β5TVOLt+β6PERFt+¿

In the next section, ordinary least squares (OLS) regressions are performed to determine the effect of financial forward-looking information and corporate reputation on stock return volatility. Initially, four statistical models were performed:

Model 1: STDRETt+1=α+β1LEVt+β2SIZEt+β3TVOLt+β4PERFt+¿

Model 2: STDRETt+1=α+β1FFLDISCt+β2LEVt+β3SIZEt+β4TVOLt+β5PERFt+¿

Model 3: STDRETt+1=α+β1REPt+β2LEVt+β3SIZEt+β4TVOLt+β5PERFt+¿

Model 4: STDRETt+1=α+β1FFLDISCt+β2REPt+β3LEVt+β4SIZEt+β5TVOLt+β6PERFt+¿

Additionally, the effect of the financial forward-looking information is analysed for both most reputable firms in the sample and firms with a lower reputation:

Model 5 (only firms in Fortune ranking): STDRETt+1=α+β1FFLDISCt+β2LEVt+β3SIZEt+β4TVOLt+β5PERFt+¿

Model 6 (excluding firms in Fortune ranking): STDRETt+1=α+β1FFLDISCt+β2LEVt+β3SIZEt+β4TVOLt+β5PERFt+¿

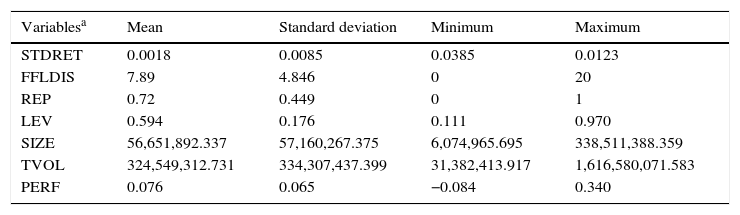

Table 2 presents the descriptive statistics for each variable included in the statistical models. Results show divergences in disclosure strategies. Not all companies in the sample disclose financial forward-looking information, with 20 sentences as the maximum number of sentences with this type of information disclosed by any company in the sample analysed. On average, companies disclose over seven sentences containing financial forward-looking information. If this information is value-relevant for investors, then an impact on stock return volatility would be expected. Over 70% of companies are included in the ranking on corporate reputation published by Fortune magazine. The companies that appear on that list are expected to be trustworthy for investors and this would lead to mitigation in stock volatility. The dispersion of most variables is on an acceptable level. Outliers and influential observations were not found.

Descriptive statistics (73 companies).

| Variablesa | Mean | Standard deviation | Minimum | Maximum |

|---|---|---|---|---|

| STDRET | 0.0018 | 0.0085 | 0.0385 | 0.0123 |

| FFLDIS | 7.89 | 4.846 | 0 | 20 |

| REP | 0.72 | 0.449 | 0 | 1 |

| LEV | 0.594 | 0.176 | 0.111 | 0.970 |

| SIZE | 56,651,892.337 | 57,160,267.375 | 6,074,965.695 | 338,511,388.359 |

| TVOL | 324,549,312.731 | 334,307,437.399 | 31,382,413.917 | 1,616,580,071.583 |

| PERF | 0.076 | 0.065 | −0.084 | 0.340 |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. FFLDIS refers to the number of sentences with financial forward-looking information. REP is a dummy variable with a value of 1 if a company is included in Fortune ranking and 0 otherwise. LEV is computed as the ratio total debt to total assets. SIZE refers to market value of equity (thousand of euros). TVOL is measured as the average monthly volume over the year divided by average shares outstanding. PERF is measured by the ratio net income by total equity.

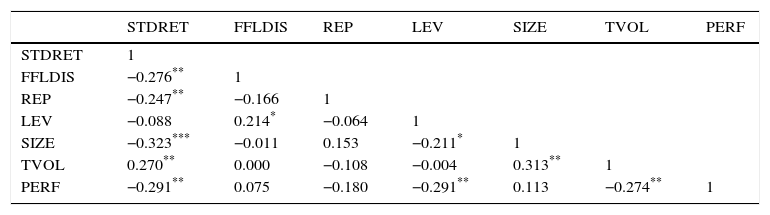

Table 3 shows the bivariate correlations between the variables included in the statistical models. As no bivariate correlation is high, there is initial evidence about the lack of multicollinearity between variables.

Correlation matrix.

| STDRET | FFLDIS | REP | LEV | SIZE | TVOL | PERF | |

|---|---|---|---|---|---|---|---|

| STDRET | 1 | ||||||

| FFLDIS | −0.276** | 1 | |||||

| REP | −0.247** | −0.166 | 1 | ||||

| LEV | −0.088 | 0.214* | −0.064 | 1 | |||

| SIZE | −0.323*** | −0.011 | 0.153 | −0.211* | 1 | ||

| TVOL | 0.270** | 0.000 | −0.108 | −0.004 | 0.313** | 1 | |

| PERF | −0.291** | 0.075 | −0.180 | −0.291** | 0.113 | −0.274** | 1 |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. FFLDIS refers to the number of sentences with financial forward-looking information. REP is a dummy variable with a value of 1 if a company is included in Fortune ranking and 0 otherwise. LEV is computed as the ratio total debt to total assets. SIZE refers to market value of equity (thousand of euros). TVOL is measured as the average monthly volume over the year divided by average shares outstanding. PERF is measured by the ratio net income by total equity.

As predicted, the disclosure of financial forward-looking information and corporate reputation are negatively correlated with stock volatility. In line with previous literature, stock return volatility presents the expected correlation with most of the control variables. Stock return volatility presents a positive association with trading volume, and indicates a negative correlation with firm size and firm performance. These results validate our data about the calculation of stock return volatility since there is no contradiction with theoretical arguments and they fit in with previous studies.

Financial forward-looking information is found to be associated with leverage. This correlation confirms the evidence shown by prior literature (Aljifri & Hussainey, 2007; Mathuva, 2012) that assumes that debt ratio could be used as indicator of firms’ risks. Companies with a high debt ratio can disclose more financial forward-looking information to reduce their finance costs.

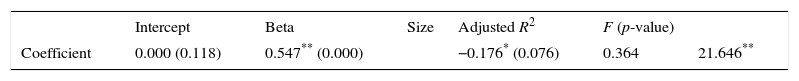

The validity of the dependent variable of the study (STDRET) can also be assessed by examining the correlation matrix. A robust measure of the risk of a company is known to be negatively associated with firm size (Botosan, 1997). Since stock return volatility should capture the risk of firm, a negative relationship with firm size is implied, as shown in Table 3. Moreover, the systematic risk of a company (BETA) is also widely accepted as a measure of risk (Botosan, 1997; Bushee & Noe, 2000; Fama & French, 1992). In order to assess the validity of STDRET, Table 4 shows the results from a regression of STDRET on beta and size, and all the expected aforementioned relationships are confirmed.

Regression of STDRET on market value and beta.

| Intercept | Beta | Size | Adjusted R2 | F (p-value) | ||

|---|---|---|---|---|---|---|

| Coefficient | 0.000 (0.118) | 0.547** (0.000) | −0.176* (0.076) | 0.364 | 21.646** |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. BETA is calculated from a market model by considering daily returns over an annual period. SIZE refers to market value of equity (thousand of euros).

In order to test the hypotheses developed in the paper, several statistical models are performed. The assumptions underlying the regression model are verified for all the models, and no problems about multicollinearity and heteroscedasticity are present.

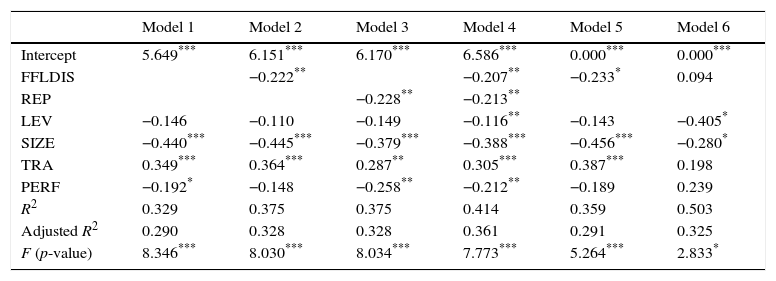

Table 5 contains six models including a variety of explanatory variables to predict stock return volatility.

Regression analysis.

| Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 | |

|---|---|---|---|---|---|---|

| Intercept | 5.649*** | 6.151*** | 6.170*** | 6.586*** | 0.000*** | 0.000*** |

| FFLDIS | −0.222** | −0.207** | −0.233* | 0.094 | ||

| REP | −0.228** | −0.213** | ||||

| LEV | −0.146 | −0.110 | −0.149 | −0.116** | −0.143 | −0.405* |

| SIZE | −0.440*** | −0.445*** | −0.379*** | −0.388*** | −0.456*** | −0.280* |

| TRA | 0.349*** | 0.364*** | 0.287** | 0.305*** | 0.387*** | 0.198 |

| PERF | −0.192* | −0.148 | −0.258** | −0.212** | −0.189 | 0.239 |

| R2 | 0.329 | 0.375 | 0.375 | 0.414 | 0.359 | 0.503 |

| Adjusted R2 | 0.290 | 0.328 | 0.328 | 0.361 | 0.291 | 0.325 |

| F (p-value) | 8.346*** | 8.030*** | 8.034*** | 7.773*** | 5.264*** | 2.833* |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. FFLDIS refers to the number of sentences with financial forward-looking information. REP is a dummy variable with a value of 1 if a company is included in Fortune ranking and 0 otherwise. LEV is computed as the ratio total debt to total assets. SIZE refers to market value of equity (thousand of euros). TVOL is measured as the average monthly volume over the year divided by average shares outstanding. PERF is measured by the ratio net income by total equity.

Model 1 includes only control variables for stock return volatility that have been traditionally considered in prior literature. The objective of this model is to confirm that there are no contradictory findings with previous studies, which could affect analysis in a later stage. The results are as expected. The explanatory power of the model is 29% and the expected sign is determined for the association between stock return volatility and all the variables, except for leverage.

In addition to those explanatory variables above, Model 2 also considers, as an independent variable, the disclosure of financial forward-looking information (FFLDIS). The regression shows how this variable individually helps to explain the level of stock return volatility beyond that of the control variables. The adjusted R2 in Model 2 increases 3.8%. The new independent variable is significant at a 5% level, and has a negative association with stock volatility. Results from Model 2 indicate that the disclosure of financial forward-looking information leads to an incremental reduction in stock return volatility. These findings confirm theoretical arguments proposed about the effect of this type of information on capital markets, and hence hypothesis H1 is supported.

For a better understanding of the association between reputation and stock return volatility, the individual effect of corporate reputation is presented in Model 3. Moreover, the complementary effect of corporate reputation together with the disclosure of financial forward-looking information is shown in Model 4.

Model 3 adds, as an independent variable, only corporate reputation (REP) to the control variables in order to test for the individual impact of corporate reputation on stock volatility. The adjusted R2 in this model increases 3.8% in comparison with Model 1. This result indicates that corporate reputation individually helps to predict the level of stock return volatility, and has an incremental effect over the control variables. This incremental effect on explanatory power of the model is exactly the same than the additional effect presented for FFLDIS in Model 2.

Model 4 studies the complementary effect on stock return volatility of FFLDIS and REP, both of which are included as independent variables. The expected relationships between each of these variables and STDRET remain significant. The explanatory power of Model 4 reaches 36.1%, the highest value of all models. This value represents a rise of 7.1% compared with Model 1, and an increase of 3.3% compared with Model 3. In addition, all the control variables appear to be significant in this model. It can therefore be stated that the joint consideration of FFLDIS and REP add explanatory power to the previous models, and these variables play a complementary role in the reduction of stock volatility.

Although it is commonly accepted that reputation is an essential part of a company's intangible assets, its effect on stock value still remains unclear for academics and practitioners (Gök & Özkaya, 2011). Results from Models 3 and 4 confirm that reputation is a key factor that reduces investors’ uncertainty and also causes a direct impact on stock volatility.

Two additional models are added in order to examine whether the information disclosed by companies of a higher reputation has an even greater effect on stock return volatility. In Model 5, the effect of financial forward-looking information is analysed for firms of a higher reputation. Only those companies included in the reputation ranking provided by Fortune magazine are considered. In Model 6, the analysis is replicated for companies with lower reputation (those not included in Fortune ranking). Results reveal that the disclosure of financial forward-looking information has an effect on stock volatility only for firms of a higher reputation. This result may be explained because corporate reputation, as predicted, affects the way investors perceive the information disclosed by firms. This evidence supports hypothesis H2.

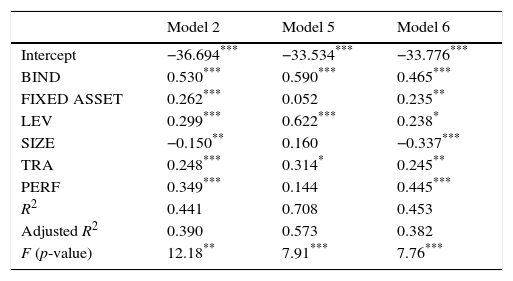

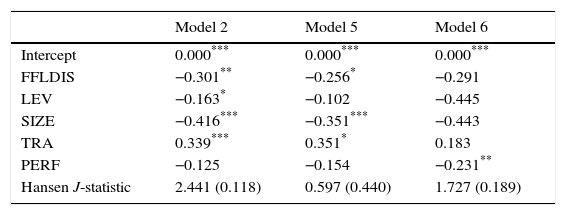

A potential problem in the analyses of linkages between voluntary disclosure and firm outcomes is the issue of endogeneity between the dependent and independent variables. In order to address this concern, instrumental variables were used to predict values of the measure of voluntary disclosure. The ideal instrumental variables should be highly related to the endogenous independent variable and unrelated to the dependent variable (Larcker & Rusticus, 2010). In this study, two instrumental variables were used to predict the level of voluntary financial forward-looking information: board independence and capital intensity. On a theoretical level, these variables should be determinants of financial forward-looking information but should bear no relationship to the stock return volatility. A correlation analysis reveals that these variables correlate with the level of this information but not with stock volatility. First, board independence is traditionally considered to be effective in monitoring managerial opportunism (Fama & Jensen, 1983), and companies with a higher proportion of independent directors can be expected to have more voluntary disclosures. García-Meca and Sánchez-Ballesta (2010) confirm the existence of a positive relationship between board independence and voluntary disclosures, especially in those countries, such as the United States, with high investor protection rights and with firms that are more proactive towards disclosing information. On the other hand, capital intensity (CAP_INT) is also expected to be positively related to voluntary disclosure choices, since firms’ willingness to disclose information increases with an increase in their demand for capital (Verrecchia, 1983; Wagenhofer, 1990). Table 6 presents the results of the first-stage OLS regression, which enables the level of financial forward-looking information to be predicted by means of the instrumental variables. In Table 7, the results of the instrumental variable estimation (2-Step GMM estimation) are shown. In this stage, the effect of financial forward-looking information on stock return volatility is analysed, where the level of this information is instrumented by using board independence and capital intensity. In order to confirm the hypotheses, the models that contain the disclosure of information as an independent variable are included. The validity of the instruments finally used is confirmed through Hansen's test. The literature assumes that p-values over 0.10 signal that the instruments are uncorrelated with the error term (Acero Fraile & Alcalde Fradejas, 2012; García-Castro, Ariño, & Canela, 2010). Results from Table 7 (Model 2) show that there is a negative association between the disclosure of financial forward-looking information and stock return volatility. Models 5 and 6 analyse this relationship for both more reputable and less reputable firms respectively. Results again indicate that the association between financial forward-looking information and stock volatility is only significant for firms with a higher reputation.

First-stage regression of FFLDIS.

| Model 2 | Model 5 | Model 6 | |

|---|---|---|---|

| Intercept | −36.694*** | −33.534*** | −33.776*** |

| BIND | 0.530*** | 0.590*** | 0.465*** |

| FIXED ASSET | 0.262*** | 0.052 | 0.235** |

| LEV | 0.299*** | 0.622*** | 0.238* |

| SIZE | −0.150** | 0.160 | −0.337*** |

| TRA | 0.248*** | 0.314* | 0.245** |

| PERF | 0.349*** | 0.144 | 0.445*** |

| R2 | 0.441 | 0.708 | 0.453 |

| Adjusted R2 | 0.390 | 0.573 | 0.382 |

| F (p-value) | 12.18** | 7.91*** | 7.76*** |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. BIND refers to the proportion of independent directors. CAP_INT is the natural logarithm of fixed assets. LEV is computed as the ratio total debt to total assets. SIZE refers to market value of equity (thousand of euros). TVOL is measured as the average monthly volume over the year divided by average shares outstanding. PERF is measured by the ratio net income by total equity.

Second-stage regression (GMM estimation).

| Model 2 | Model 5 | Model 6 | |

|---|---|---|---|

| Intercept | 0.000*** | 0.000*** | 0.000*** |

| FFLDIS | −0.301** | −0.256* | −0.291 |

| LEV | −0.163* | −0.102 | −0.445 |

| SIZE | −0.416*** | −0.351*** | −0.443 |

| TRA | 0.339*** | 0.351* | 0.183 |

| PERF | −0.125 | −0.154 | −0.231** |

| Hansen J-statistic | 2.441 (0.118) | 0.597 (0.440) | 1.727 (0.189) |

STDRET is calculated as one plus the log of the standard deviation of daily stock returns. FFLDIS refers to the level of financial forward-looking information, instrumented by board independence and capital intensity. LEV is computed as the ratio total debt to total assets. SIZE refers to market value of equity (thousand of euros). TVOL is measured as the average monthly volume over the year divided by average shares outstanding. PERF is measured by the ratio net income by total equity.

Results indicate that there is a negative association between financial forward-looking information disclosed in annual reports and stock return volatility. Regardless of specific firm characteristics, companies that provide more financial forward-looking information are more likely to reduce their stock return volatility.

The theoretical arguments are confirmed and hypothesis H1 is supported. In line with agency theory, this evidence can be explained because the disclosure of this information can reduce the information gap between firms and investors. Investors take advantage of financial forward-looking information, and hence this information constitutes a mechanism to mitigate instability in share price. Although prior literature demonstrates that information quality has an effect on capital markets, this study shows that specific forward-looking information helps to reduce stock volatility. In line with previous literature, these results also confirm that annual reports remain important vehicles for corporate managers to disclose voluntary information.

This paper suggests that the disclosure of this kind of specific information is highly relevant, since it triggers reactions in capital markets; however, the content is not the only factor. Not only does this paper indicate that financial forward-looking information has significant effects on capital markets, but it also shows that the information disclosed by firms of a higher reputation can be more credible for capital market participants. The disclosure of information by companies of a higher reputation is more readily accepted as more credible, and hence, it is more effective in reducing stock return volatility.

The expected relationship between corporate reputation and the effectiveness of forward-looking information in the reduction of stock volatility is confirmed and hypothesis H2 is supported. This is the first study that demonstrates that corporate reputation moderates the effects of forward-looking information in capital markets. Corporate reputation may cause a psychological bias in investors, who perceive companies with a high reputation as more solid and reliable. Therefore, corporate reputation can influence the interpretation and the perception of the information disclosed by firms. If investors perceive that information disclosed by companies of a high reputation is more credible, then the uncertainty towards a company can be minimised.

Our results are robust to various regression methods. Instrumental variables are used to address the potential endogeneity issue between stock volatility and the disclosure of financial forward-looking information. The results from the GMM estimation support hypotheses H1 and H2.

Conclusion remarksThere is an ongoing debate about the effects of disclosure strategies in capital markets. Previous literature has examined firms’ disclosure practices as a potential solution to agency problems and information asymmetries. This study validates and broadens the scope of prior empirical studies of the factors that are considered to have an effect stock return volatility. Financial forward-looking disclosure is studied in order to determine whether it could be strategically used to minimise stock volatility. In order to quantify the level of financial forward-looking information disclosed by firms, a content analysis is conducted over the companies listed on Standard and Poor's 100. Additionally, this paper analyses the role of corporate reputation as a mechanism for the reduction of stock return volatility.

Results show that the financial forward-looking information disclosed in annual reports helps to reduce stock volatility. This paper contributes to the existing literature on forward-looking disclosure since stock volatility has become a significant concern for both regulators and managers. An increase in this variable would lead to a perception of a higher risk of a firm, and hence a rise in the cost of capital of companies (Bushee & Noe, 2000). This analysis implies a step forward in disclosure literature, and provides certain practical implications for both managers and regulators, since the understanding of the effect of specific disclosure strategies in capital markets can be improved. These results have direct a implication for managers, who may strategically use this information when designing disclosure policies to influence investors. Additionally, in the U.S. context, these results hold significant implications for companies because the “safe harbor” rules protect firms from potential adverse repercussions due to the disclosure of inaccurate forward-looking information in the SEC filings and the annual reports. These findings also have direct implications for regulatory bodies in the preparation of rules and recommendations about disclosure requirements. These findings also constitute a significant contribution towards the debate concerning the need for the establishment of specific guidelines regarding the disclosure of this financial forward-looking information.

Results also indicate that, although the level of disclosure has a significant effect on stock volatility, the effect of this disclosure is further varied depending on corporate reputation. This study extends previous research by showing that the interpretation and the effectiveness of forward-looking information depends on the reputation of a firm. Disclosure studies have previously focused on the disclosure process, but more effort is needed in this area to analyse how investors’ perceptions about a company may influence the effects of the disclosed information. Although the benefits of corporate reputation have largely been discussed from the resource-based view, this theory can be extended because corporate reputation is shown to influence the reporting process of companies. This evidence also has implications for managers, who must be made aware of the importance of the achievement and maintenance of a good reputation. Corporate reputation plays an important role in the disclosure process since the reputation of a firm appears to be crucial in the effectiveness of its information.

Like all studies, this paper presents several limitations. One of the common limitations of studies that employ content analysis techniques by using hand-collected data is the sample size. This research focuses only on U.S. companies for one specific year. Research on this topic may be extended by analysing different contexts. Future research lines can also consider relevant factors that might moderate the analysed relationship between voluntary forward-looking disclosure and stock volatility, such as corporate governance and/or the legal environment. Despite the limitations presented in this study, sensitivity analyses for the main variables were performed and different regression models were used in order to increase the robustness of the results. Our evidence provides several interesting insights about potential mechanisms in order to reduce information asymmetries in the markets, and they create new and encouraging opportunities for research.

Conflict of interestThe author declares that there are no conflicts of interest.

Private Securities Litigation Reform Act (1995).

In addition, for the calculation of the log of the standard deviation of daily stock returns, at least 6 months of daily return observations was required, and the final results were very similar.

Following Hussainey et al. (2003), voluntary narrative disclosures were analyzed, such as financial highlights, summary results, chairman's statement, chief executive officer's review, operating and financial review, financial review, financial director's report, finance review, business review, operating review.

For detailed information, see http://money.cnn.com/magazines/fortune/most-admired/.

This method involves computing a regression equation with all the predictor variables, then going back and deleting those independent variables that fail to contribute significantly. Stepwise regression uses chi-square statistics to automatically determine which variable to omit from the model.