A private company has several options in the job market, such as hiring, outsourcing, or dismissing employees. The management flexibility of dismissing employees, even without just cause, provides an economic benefit for companies. By addressing real options, this study aims to measure the effects of this flexibility on the employer's decision to hire more employees as well as to invest in the more productive employees through graduate incentives. This article evaluates the adverse impacts of labor laws that restrict this flexibility, such as the Severance Indemnity Fund (FGTS) fine and the prior notice of termination of employment, in order to find out how much the employee adds value to the company and, consequently, to its salary. Using this methodology, this study also evaluates, from the employer's perspective, the relevance and value maximization of the company's financial support programs for employees taking graduate courses. Results show that severance costs reduce the net value of the employee to the employer. Should these costs be disconsidered and the benefit in value transferred to the employee this could be equivalent in a 4.5% increase in salary. Likewise the possibility of investing in graduate course at the correct moment but only for the more productive employees can increase their net value significantly, doubling the net value of the employee to the employer.

As empresas privadas têm diversas opções no mercado de trabalho tais como contratar, terceirizar ou dispensar empregados. A flexibilidade gerencial de poder demitir empregados, mesmo sem justa causa, gera um benefício econômico para as empresas. Usando a abordagem de Opções Reais, neste trabalho procurou-se mensurar os efeitos desta flexibilidade na decisão do empregador em contratar mais empregados, assim como, investir nos empregados mais produtivos por meio de programas de pós-graduação. Nesta pesquisa avaliou-se os efeitos adversos das leis trabalhistas que restringem essa flexibilidade, tais como a multa do FGTS e do aviso prévio, de forma a determinar o quanto o empregado adiciona de valor para a empresa e, consequentemente, ao seu salário. Utilizando essa abordagem procurou-se avaliar pela ótica do empregado, a relevância e maximização de valor criada pelos programas de incentivo a cursos de pós-graduação. Os resultados mostraram que os custos de demissão reduzem o valor do empregado para o empregador. Ao desconsiderar estes e transferindo os benefícios diretamente ao empregado, resultaria em incremento de 4,5% no salário deste. Outrossim, a possibilidade de investir numa pós-graduação no momento oportuno, mas somente para os empregados mais produtivos, pode aumentar valor do empregado de forma significativa, duplicando este para o empregador.

Company decisions to hire, train, or dismiss employees are influenced by the employer's expectations about how much the employee will contribute in generating cash flow for the company, similar to the decision to invest in an asset. Hiring an employee may generate revenue for the company; however, it also comes with a cost. Similar to other investment decisions, the decision to hire an employee comes with some uncertainty related to the employee's performance (his labor supply) as well as the amount that his services are used (demand for labor). It is valid to investigate whether the decisions to hire or dismiss employees, in light of the volatility of the company's demand, are made considering the value of management flexibility of hiring or dismissing employees.

During an economic crisis, it is very common for mass layoffs to occur because the labor cost is higher than the value of its economic production. Since the social cost of unemployment is very high, especially the cost of maintaining the living conditions of unemployed people and their families, the labor laws of several countries impose costs when the work contract is terminated without just cause in order to discourage this action.

In Brazil, the main obligations are the prior notice of termination of employment and the Severance Indemnity Fund (FGTS) fine. The latter, paid by the company that decides to fire employees without just cause, is equivalent to about 4% of the sum of the salaries received by the employee (40% fine to the dismissed employee, plus 10% fine to the government, both on 8% of all salaries reviewed to date – FGTS accumulated value, amounting to around 4% of all salaries received). The former, when paid to the employee, has a value equal to the sum of the salaries and other labor rights proportional to the period of 30 days plus three days for each year of service to the company.

However, even if these costs are effective in reducing the number of dismissals, they also tend to negatively affect the decision to hire, as will be investigated in this study. Thus, in normal economic situations, both the level of employment as well as the salaries are smaller when there is not total flexibility to lay off employees. Furthermore, the costs for terminating the employment relationship increases the incentive for labor outsourcing.

The employers must understand the effects of management inflexibility when dismissing employees in order to make the correct decision when hiring. Furthermore, it is essential to analyze the cost–benefit of public policies that affect the flexibility to lay off employees without just cause. The costs imposed by labor laws on companies when the work contract is terminated without just cause serve to protect workers against a dismissal not initiated by the employee. The receipt of 40% of the total deposits made to the employee's FGTS account during the work contract is a boost to the newly-unemployed person and his family. However, companies may lose interest in hiring employees due to these costs, and this is not as easy to observe or measure.

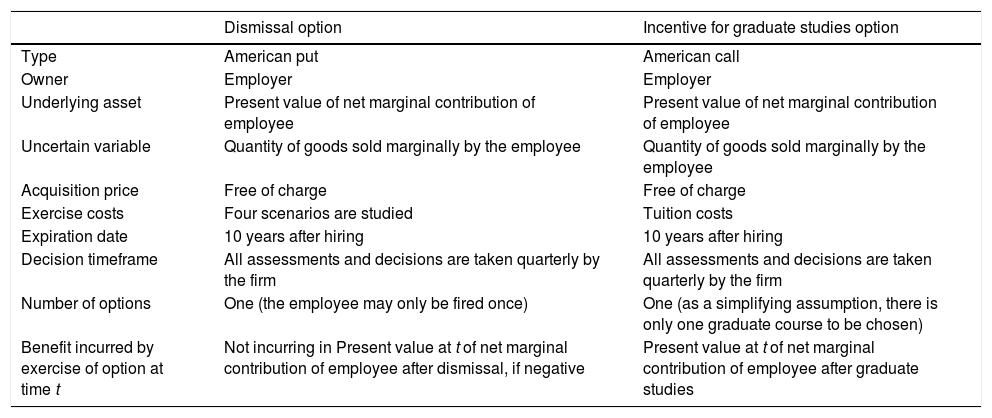

In order to investigate the adverse impacts of labor laws that restrict flexibility of dismissing employees, this article adopts the real options analysis methodology for two purposes, one main and a secondary objective. These are modeled as synthesized in Table 1 and further explained in Chapter 4. As a main purpose, the dismissal option is analyzed in four different scenarios. Two of them, real cases in Brazil: dismissal with FGTS fine and indemnified proportional prior notice (in force since October 13, 2011) and dismissal with FGTS fine and indemnified 30-day prior notice (in force before October 13, 2011). The other two are theoretical scenarios: dismissal with FGTS fine only and unrestricted dismissal. This paper seeks to compare the results in order to measure the undesired effects of reduced employee value for the company, which may cause an adverse effect on hiring new employees or on the salary amount of each of these components.

Modeled options.

| Dismissal option | Incentive for graduate studies option | |

|---|---|---|

| Type | American put | American call |

| Owner | Employer | Employer |

| Underlying asset | Present value of net marginal contribution of employee | Present value of net marginal contribution of employee |

| Uncertain variable | Quantity of goods sold marginally by the employee | Quantity of goods sold marginally by the employee |

| Acquisition price | Free of charge | Free of charge |

| Exercise costs | Four scenarios are studied | Tuition costs |

| Expiration date | 10 years after hiring | 10 years after hiring |

| Decision timeframe | All assessments and decisions are taken quarterly by the firm | All assessments and decisions are taken quarterly by the firm |

| Number of options | One (the employee may only be fired once) | One (as a simplifying assumption, there is only one graduate course to be chosen) |

| Benefit incurred by exercise of option at time t | Not incurring in Present value at t of net marginal contribution of employee after dismissal, if negative | Present value at t of net marginal contribution of employee after graduate studies |

Secondly, as a secondary purpose, this article also uses real options theory to analyzing the business option of funding graduate courses for their best-performing employees in order to encourage them to increase their performance. This option will be investigated under the assumption that it is an expensive investment and that it will raise the salary of the employee selected for the course. This study shows the difference between a program that offers financial support for graduate studies to all employees when they enter the company and a program that views the incentive as an option to be given only when the company expects that the chosen employee will bring a financial return on that investment and at a time that maximizes his net present value.

All major characteristics and approaches used in the article are listed in Table 1.

This article is divided into six sections. The theoretical framework is presented after the introduction, giving a review of the existing literature on the real options theory and the labor laws related to dismissal without just cause. The third section analyzes hiring, training, and dismissal without just cause generically as well as with a focus on Brazil. The fourth section describes the methodology used to estimate the value of the dismissal options and the support for graduate studies as well as to calculate the impact of the costs of terminating the work contract on the value of the marginal economic benefit expected from the employee. The fifth section presents the results and examines the sensitivity of the results with the main parameters of the model. Finally, the last section presents the conclusions of this study for Brazil, their delimitations, and suggestions for further works.

Theoretical frameworkThis section gives a review of the literature about the real options analysis and of labor laws with a focus on Brazil.

Real options analysisWhen a company decides whether or not to hire an employee, hiring will incur in costs with an expectation of future rewards. The employer, even intuitively, creates an expectation of that employee's productivity. This makes the decision to hire an employee similar to the decision to invest in an asset. Traditionally, the cash flow is discounted for the valuation of assets, which, according to Brigham and Ehrhardt (2002), consists in estimating and discounting the future cash flows in order to obtain the net present value (NPV) of the asset. However, this technique does not adequately consider the existence of management flexibilities, which often involve long-term investment decisions.

When an agent has the right, but not the obligation to take a particular action, it is called an option. Usually the options have a previously defined cost to be able to obtain them. One example is the cost to adapt a factory in order to provide it with the flexibility to produce different types of products. On the other hand, there are also less frequent cases in which a free option can be taken, but when put into action is considered expensive. This is the case with the option to lay off an employee who is hired by the employer. The dismissal option is free of charge, which means that the company does not expend any resources to obtain this option, but must cover additional expenses when exercising the option to dismiss the employee without just cause.

The Real Options Theory, first registered by Myers (1977), adapts the financial options theory of Black–Scholes (1973) in real assets and corporate projects. Tourinho (1979) used for the first time a Real Options model to evaluate an investment in a reserve of non-renewable natural resources. The first books fully dedicated to the topic were published during the 1990s. Dixit and Pindyck (1994) developed analyses of investments under conditions of uncertainty and during a continuous time. Weisbrod (1962) analyzes the labor market using an analogy with the options theory, later extended in Comay, Melnika, and Pollatschekm (1973).

It is important to note that, although the first articles that used the real options methodology were mainly devoted to financial analyses in the industrial sector, more recently the real options theory has been used in several other areas.

More recently still, the methodology began being applied in studies related to human resources. Dockner and Siyahhan (2011) interrelate the investment in human capital with the value of risky R&D projects. Trigeorgis and Baldi (2012) develop an alternative real options framework based on the flexibility of human capital. Brady (2014) analyzes the strategic use of real options for temporary work contracts. Santos, Brandão, and Maia (2015) use the real options methodology to analyze the choice between a career in a private and one in a public agency. However, no other study has used the real options theory to evaluate the impact that the cost of dismissal without just cause has on the employee's value and on hiring new employees, which is the main objective of this paper.

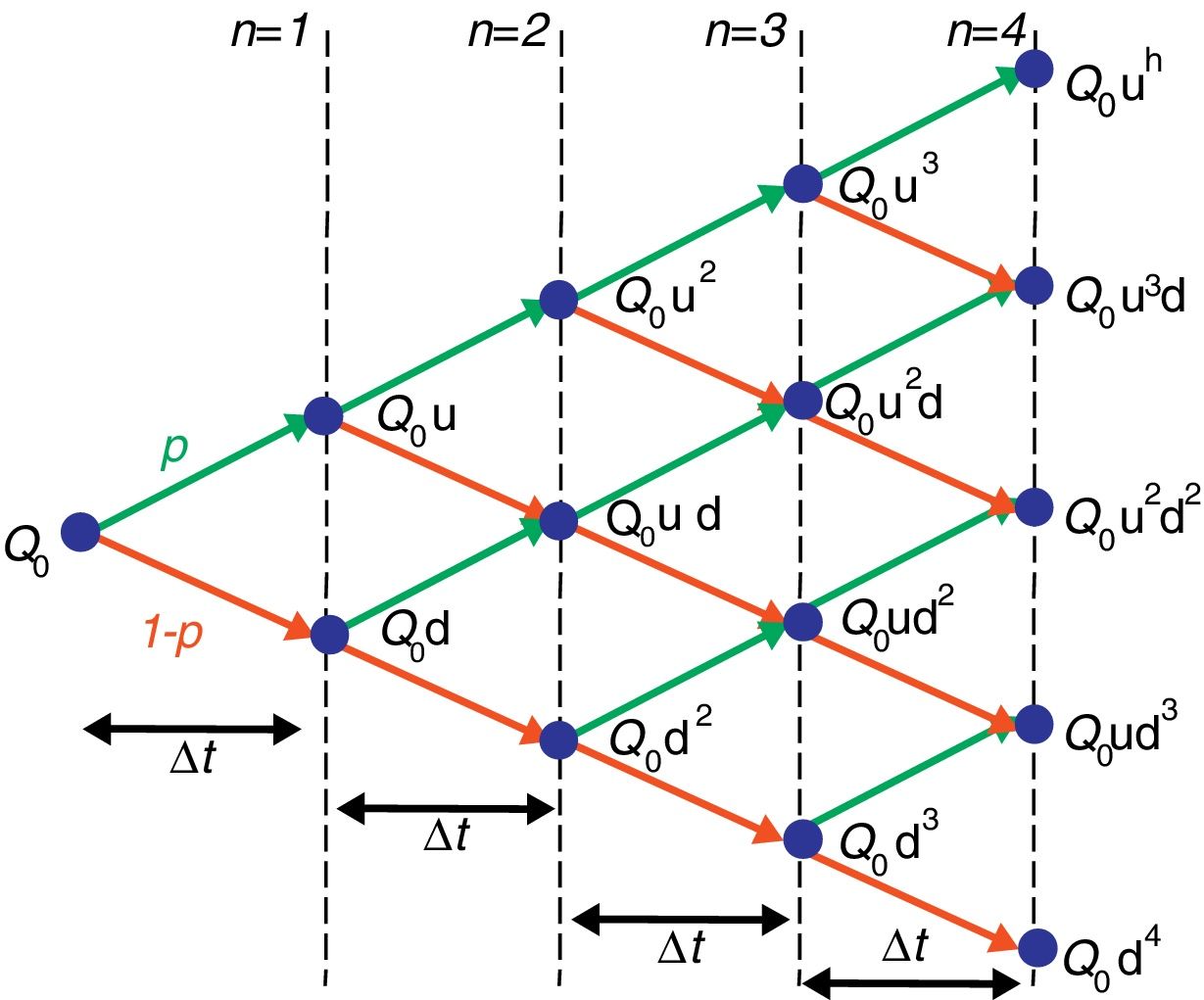

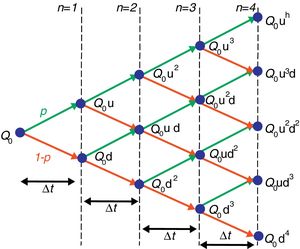

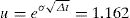

The Cox, Ross, and Rubinstein (1979) binomial model is usually adopted for the real options analysis and is based on the creation of recombinant binomial trees (or lattices) that determine the paths that the price of the asset evaluated follows until the time of expiration of the real option. From each point in discrete-time (n), the uncertain variable (Q) can either increase or decrease by a ratio given by u (up) and d (down) respectively, whose probabilities of occurrence are, respectively, p and (1−p), as can be seen in Fig. 1.

When Qt follows a Brownian geometric motion as demonstrated by Hull (2009), the values of u, d, and p originally proposed by Cox et al. (1979) for the binomial tree (lattice) that prevent arbitrage and allow a risk neutral valuation are respectively given by Eqs. (1)–(3).

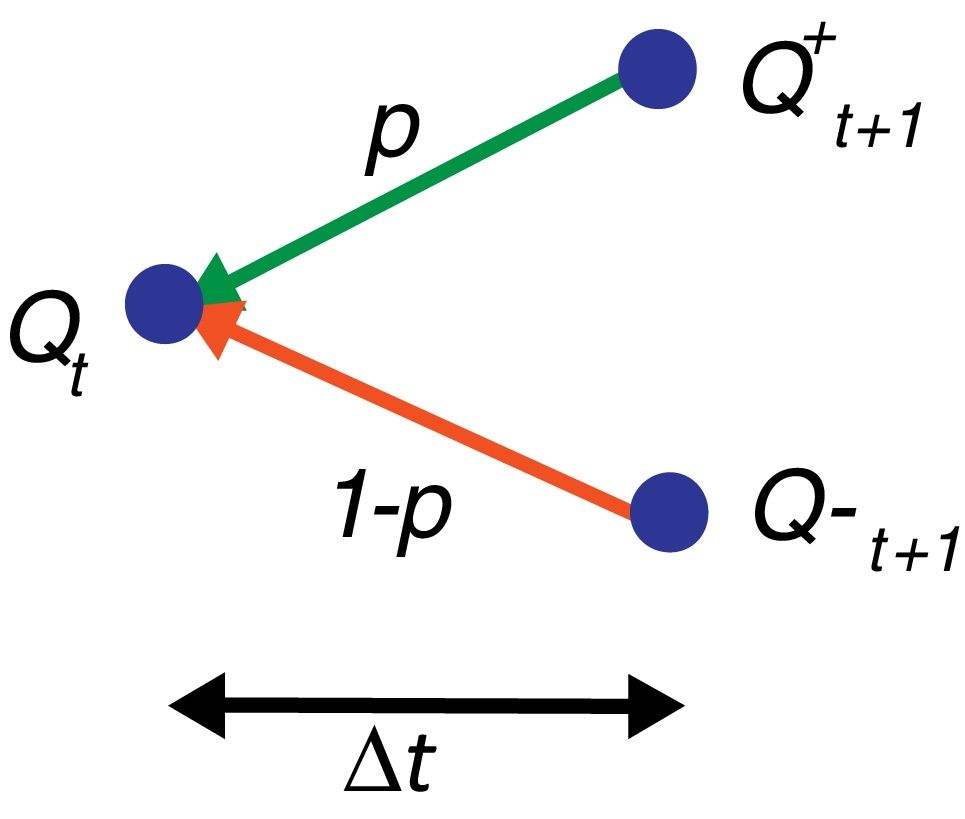

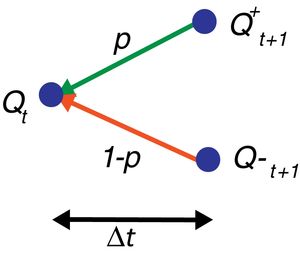

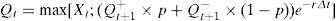

The option value is estimated starting at the end of the projected lattice by maximizing the results of exerting the option or not: maximum (Qt; Xt); where Qt is the value of the underlying asset at each point of the last period of the lattice, and Xt the exercise value at that point. Then, stepping back one prior, maximization is again estimated, adding also the possibility of using the continuation value as shown in Fig. 2.

The maximizing of results at each point of the binomial tree is now (4).

Recursively applying this method up to the start period of the binomial tree allows the value of the real options to be estimated.

Labor lawsAccording to Heckman and Pagés (1996), it is common for reforms that increase workers’ rights to occur in periods immediately following a country's return to democracy. Brazil, which returned to democracy in 1985 and promulgated a new Constitution in 1988, has experienced in this new Magna Carta a considerable increase in the number of penalties for dismissing employees, such as the FGTS fine, which is now four times the initial value according to Barros and Corseuil (2004). This same paper, by means of econometric studies, did not find any significant evidence of the impact on the demand for labor in Brazil due to these changes in the labor laws. However, it found fluctuations in the coefficients, which could be explained by macroeconomic events. The authors pointed out, however, that their results did not necessarily mean that there were not any effects. Because of this, they believe that further studies have to be made on this subject to arrive at a definitive conclusion.

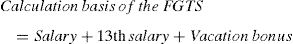

The FGTS is a compensation fund for dismissals without just cause. According to the summary made by Barros and Corseuil (2004), it is a type of social security fund in which the employee accumulates resources while he is employed. The deposits in the employee's FGTS account are done every month with a value equal to 8% of the remuneration paid or payable during the previous month. The remuneration includes commissions, Christmas bonus (13th salary), and the constitutional vacation bonus (a third of a salary while on vacation), among others. The amounts deposited in the account are increased 3% per year over the reference rate, which is, by definition, positively correlated with the fixed rates charged by the 30 largest financial institutions in the country in their bank certificates of deposit. When an employee is dismissed without just cause, he is entitled to withdraw the funds present in his FGTS account, as well as an additional amount equivalent to 40% of the funds deposited by the employer during the employee's term of the work contract (FGTS fine).

According to Noronha (2000), the FGTS has eliminated job stability in Brazil. Furthermore, Souza (2007) states that the fund was created in order to gradually eliminate employment stability in the country. However, it is important to note that this only refers to employees subject to the legal system of Consolidated Labor Laws (CLT), so for civil servants and magistrates in Brazil there is still ample stability, which is why this article also discusses the case of the absence of the option for the employer to dismiss employees.

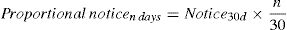

Each country has the autonomy to regulate the labor relations present in its territory. Some are more liberal, while others impose burdens on the employer when the work contract is terminated without just cause. In Brazil, in addition to the aforementioned 40% of the total deposits made to the employee's FGTS account during the work contract, the employer must pay another 10% of the same calculation basis to the Federal Government (social contribution), totaling a fine equivalent to 50% of the total deposits bearing interest. Furthermore, the prior notice of termination of employment should be given at least 30 days before the dismissal, which, in many cases, means that the company notifies the employee that it wishes to terminate the labor contract and already exempts him from coming to work, since the productivity of an employee that knows he will be fired is usually very low. Yet the company will have to pay a salary to this employee who will not be coming to work, characterizing an indemnified prior notice. As provided in the CLT, only during the first 90 days of employment can a company terminate the employment relationship without having to pay the FGTS fine or give the prior notice of termination.

Until Law 12,506/11 was published, the prior notice of termination of employment in Brazil was 30 days, regardless of the employee's length of service in the company. Since October 13, 2011, three days are added for each year worked, up to a maximum of 60 days, thus totaling up to 90 days of prior notice. This change will also be analyzed in this article.

Hiring, training, and dismissal without just causeDisregarding emotional factors, the decision to hire an employee can be described economically as follows: if the marginal economic benefit expected from hiring the employee is greater than the cost, it is best to hire him. If not, then he should not be hired. Thus, it is necessary to define the value for the marginal economic benefit expected that the employee will provide to the company as well as the value of the cost expected with hiring him.

Marginal economic benefit expected from the employmentAn employee starts to bring marginal benefit for a company when the fruit of his labor (marginal productivity of labor) exceeds his costs (salary paid to the employee plus all applicable labor charges) including any necessary training. If the benefit is lower than the costs, keeping the employee will bring an extra expense.

The best way to calculate the marginal productivity of labor is to estimate the difference between the company's production with the employee and its production without the employee. And the cost is found by adding the applicable labor charges to the value of the salary in the contract.

Since the employer does not know at the time of hiring what will be the employee's marginal productivity of labor, nor what will be the employee's value over time, it is an expectation with many uncertainties. This value is affected by issues that are intrinsic and extrinsic to the employee.

The conditions inherent to the employee are all those that are influenced by the employee, whether consciously or unconsciously. The main ones are the following: the employee's interest, motivation, influence on the team (positive or negative), and his competence to achieve the results that the employer desires, either individually or collectively.

The conditions extrinsic to the employee are all those that affect his productivity, but are not influenced by him. A rise or fall in demand for the product or service offered by the company, for example, exogenously impacts the marginal productivity of the employee because they cannot be changed by him.

However, the remuneration paid in return for labor supply for a given function is predictable, since it is stipulated in the contract and usually increases according to inflation. A similar predictability also exists when finding the value of the applicable labor charges since they are defined in the Brazilian legislation, although the law can be changed at any time.

Thus, the marginal benefit to be generated by the employee whose employment is under analysis can be calculated using the discounted cash flow technique. If the present value of the expected future marginal benefit is equal to or greater than the employment cost, it has a positive net present value, meaning hiring the employee is recommended. However, the discount rate used in discounting the present value of the cash flow is difficult to estimate since the values of this flow are very uncertain. Furthermore, this financial technique is not the best method when the flow contains management flexibility, such as the dismissal of the employee, which resembles an abandonment option in a real options valuation.

Thus, choosing a methodology that adequately addresses the management flexibility will allow the value of the real option of laying off an employee to be estimated and, therefore, how much this flexibility increases the present value of the marginal benefit that the employee will generate for the company. Finally, this added value of the dismissal option will imply that it is more advantageous for the company to hire an employee, possibly leading to the employment of more employees.

Training – support for graduate studiesHeckman, Lochnerl, and Toddp (2006) focus on the use of options to analyze investment in human resources. Companies invest in various types of training in order to qualify their employees for carrying out their functions. The purpose of continually qualifying employees is to maximize the results of the company. Also, investing in training helps to motivate human resources and stay in the company.

Some companies offer support programs for graduate studies by them paying the partial or full value of a graduate course for an employee who meets certain prerequisites usually related to length of service and performance in the company. Commonly, the employee attends classes at night while working during the day. However, there are also cases where the employee dedicates exclusively to taking the graduate course, taking time off from work while attending classes and writing his thesis paper. Neri (2005) points out several benefits for the employee due to a better education, including a higher chance of getting a job and higher salary.

Employment costWhen hiring an employee, the company pays non-recurring costs related to recruitment, selection, hiring, medical assessment, contracts, etc. The higher the desired level of education and experience is, the more expensive the process will be. Thus, the employment cost is positively correlated with the salary defined for the function.

MethodologyIn order to estimate the expected marginal economic benefit from hiring an employee, the methodology will consider the employee as an asset whose estimated value is the present value of the marginal future cash flows that he will bring to the employer. Included in this cash flow are the revenue that the employee will marginally add to the company and the costs with salaries, labor charges, and the employee's training. The binomial model developed by Cox, Ross, and Rubinstein in 1979 will be used to analyze the real options described in Table 1, presented in the introduction section of this paper. Finally, it is worth mentioning that in this model the company will always seek to maximize the employee's marginal net present value. The decisions of offering graduate studies to the employee and of dismissing the employee without just cause will exclusively obey this criterion.

The model's time analysis for this article is divided quarterly and for a total of 10 years since currently Brazilian employees work for less time in a particular company, causing a high turnover, meaning that the time frame is less than the useful life of its labor. According to Dieese (2016), the global turnover rate in Brazil for workers hired under the CLT legal system was 62.8% in 2014. The income tax rate applied to the company's cash flow will be 34%. The values in the flow are expressed in real terms, that is, with the quarter's inflation discounted.

The next subsections will introduce the two modeled options and present the company's marginal expenses and revenues that arise from the decision of hiring the employee. One minus the other will equal the employee's marginal economic benefit for the company. Finally, the discount rate of the cash flow will be introduced. The cash flow will be important for the estimation of the net present value of the employee to the company, which will drive the flexibility decisions of the rational employer.

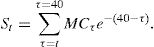

Dismissal optionThe dismissal of an employee is an abandonment option held by the company, and will be modeled as a put option. Its equation at the expiration date is given by max{St,Xt}, where St is the present value of the Contribution Margin (MCt) of the employee to the company as will be discussed in chapter ‘Revenues generated by hiring the employee’, and Xt is a function that represents the cost of dismissing the employee an time t, according to the studied scenario (a lower than zero number), both at time t=40 (quarter). The value of Xt is the sum of Eqs. (6) and (7), or, in the case of an unrestricted dismissal option Xt=0. During the previous quarters, the decision is either exercising the dismissal option for a cost of Xt or maintaining the employee, which will be the present value of the Contribution Margin (MC) from this time to the expiration time at: t=40, as shown in Eq. (5).

During the first quarter, the option equation will be max{St=0, 0} in any given scenario, because there are no severance costs incurred when terminating a probation contract, which may last for up to the 90th day of the labor contract.

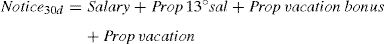

When carrying out the option, the company will lay off the employee at the time of the prior notice and shall indemnify the employee for the next 30 days not worked plus three days for each full year worked. The employer will pay him the indemnity funds defined by the labor law: salary for these days of notice and the following benefits at the rate of 1/12: 13th salary, vacation, and vacation bonus. This equals, per month of notice, the equivalent to 43/36 of the salary.

Therefore:

Additionally, the company must pay the FGTS of the period that will be indemnified and the proportional amounts of the constitutional vacation bonus and the 13th salary indemnified. In this way, if the employee is fired, for example, after completing five years of service to the company, the prior notice will equal 45 days (30+5×3 days).

Finally, the employer must pay the FGTS fine, which will be levied on all of the FGTS paid and payable values. In the model of this work, it is equivalent to 4% of the sum of the salaries paid and payable since the employment, including the 13th salary and constitutional vacation bonus, corrected for inflation. This is a reliable simplification since 40% of the FGTS paid to the employee plus the additional 10% paid as a social contribution to the federal Government (according to article 1 of the Supplementary Law No. 110/2001) equals approximately half of 8% of the total salary (including the 13th salary and constitutional vacation bonus) paid to the employee.

This dismissal cost will be counted as an expense to be paid at the moment that the employee is dismissed. It is reasonable to assume that the salaries and the balance of the FGTS account are adjusted according to inflation indexes. In this way, the salary and the balance of the FGTS account, for simplification, will be constant in real terms in the model.

where t is the number of months that the employee worked for the company, including the prior notice.This paper will analyze not only the scenario where all these costs exist, but also other three comparable scenarios: FGTS fine plus indemnified prior notice restricted to 30 days (in force before October 13, 2011), no prior notice (only FGTS fine) and, finally, a scenario where no costs existed. Note that the last two scenarios are theoretical and only serve the purpose of estimating the individual effects of each of the components of Brazilian severance costs.

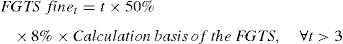

Incentive for graduate studies optionThis flexibility for the employer is analog to an expansion option, and is therefore modeled as a call option. The function is comparable to the previous option, but the main difference is that the exercise of the option does not lead to a termination of the contract. Instead, in: maximum {St, X}, the function X for this option means the company will pay for the graduate studies at time t, which will imply an increase in the employee's productivity and its salary from that moment on, until the end of the time frame modeled, or t=40 quarters. The amount X that the company will pay for the employee's graduate studies, if it decides to offer it, will be R$ 30,000.00. The employee will study while working, which is usual in Brazil and means that he will not have to stop working while taking the course. The result of the training will be reflected in the model as a 50% increase in the employee's productivity from time t (when the option is exerted) until the time frame of the case studied: t=40 (quarters). The salary, however, will have a 66% increase for the same time duration. In this case, the function St is the present value of the net increase in Marginal Contribution of the employee to the employer from time t to 40, expiration of the option time frame, as already described in Eq. (5). A sensitivity analysis of these variables will be made because the increase in productivity and the salary increase may vary according to sector and course. Both (increase in productivity and salary) will incur in the model at the start of the course as a simplifying assumption, for there is no way to objectively determine the timing and how gradual the impact on productivity is expected to be. The results obtained by Neri (2005) were considered when defining the values for the base scenario of the methodology, which indicates a large heterogeneity of types of trainings and courses that can impact differently the increase in productivity and the salary increase, which vary around these numbers chosen for the base scenario of the methodology.

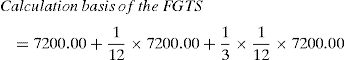

Expenses incurred by hiring the employeeFor the model, we will use the case of an employee that formalized a work contract for an indeterminate period and receives a monthly salary of R$ 7200.00. Generically, the employee is considered a salesperson of the products manufactured by the company, and to simplify the case, his remuneration is fixed. All of the benefits required by the labor laws of the country will be paid to the employee. It should be noted that the 13th salary (Christmas bonus) and a third of the monthly salary while on vacation (vacation bonus) are rights that make up the calculation basis of the FGTS, meaning that the employer must pay 8% of this amount of FGTS to the employee's linked account. Thus, the calculations can be simplified by provisioning the 13th salary and the vacation bonus every month, which ends up to be about R$ 800.00 per month.

Thus, the monthly salary of the employee in the model, plus the provision mentioned, above equals R$ 8000.00. This will be the value of the employee's monthly remuneration in the model when the annual financial entitlements are calculated proportionally, as well as the calculation basis of the FGTS.

The hiring cost is considered half this value, which is R$ 4000.00. This amount is in line with current market standards, considering all of the expenses incurred from recruiting candidates for the job vacancy until signing the work contract. This will be the acquisition cost of the asset.

The amount that the company must pay every month for the hired employee includes, in addition to the salary and benefits that are paid to the employee, other labor charges paid to the Government (INSS, education allowance, S System, etc.), and these vary according to what tax regime the company is registered, what economic sector it operates in, etc. We will assume that the company pays R$ 24,000.00 each year in labor charges, which means an average monthly disbursement of R$ 2000.00, or 25% of R$ 8000.00. This 25% is in line with a study released by the Inter-Union Department of Statistics and Socio-Economic Studies (DIEESE), which considers the costs related to contributions to INSS, INCRA, SESI or SESC, SENAI or SENAC, and SEBRAE, as well as education allowance and insurance for occupational accidents. It is important to note that the percentage is being applied on the total disbursement of the company of R$ 8000.00 per month, which already considers the 13th salary and the additional one third for vacation. This is why this study was used as a reference, which is less than what is calculated by business entities since they consider paid vacations, weekly rest, holidays, and other labor benefits in their calculation in order to state that an employee costs about twice his salary for the contractor. Even if the concession of a benefit by the company implies in a cost for it, this is already considered in the labor contract and in the amount of the proposed monthly salary, which tends to be less than it would be if there was no vacation, holidays, etc., therefore they are not extra expenses arising from employing the employee. For simplification purposes, we will consider a monthly disbursement of R$ 10,000.00 in the cash flow of which R$ 8000.00 is for salary and other legal benefits paid to the employee and R$ 2000.00 is for the labor charges paid to the Government, even though, in practice, part of this is provisioned to be paid during vacations and another part is to be paid for the 13th salary, and so on, because the company will invariably owe these charges.

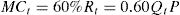

Revenues generated by hiring the employeeSince the base case being evaluated is an employee who works in a company's sales team, we will consider that for every product sold, 40% of the revenue will be used to pay variable costs and expenses and 60% will be the contribution margin.

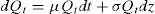

where Rt is the marginal sales revenue generated by the employee in quarter t, Qt is the quantity of goods sold marginally by the employee in quarter t, P is the unit price of the goods sold (fixed value), MCt is the employee's marginal contribution margin for the company in quarter t.The amount of units marginally sold, which is the number of units sold by the company as a whole beyond what it would sell if this employee had not been hired, will follow a Wiener Process with a drift of 2% p.a., which is consistent with Brazilian annual gross domestic product mean growth over the last 10 years, and a volatility of 30% p.a.

where μ is the drift, which is the growth rate of Qt, σ is the volatility parameter of Qt, dt is the infinitesimal increment of time, dz is the standard Wiener increment, dz=εdt,ε∼N(0,1)A positive drift indicates, among others, an increase in the employee's productivity over time in the profession. The model will use as base scenario a volatility of 30% per year, but since the volatility of the quantity that an employee sells depends on the segment in which the company operates, a sensitivity analysis using the parameters of 10%, 20%, and 40% per year will also be performed. In order to understand the magnitude of such levels of volatility, note that the volatility of the annual revenue of the brewery company Ambev S/A, the largest Brazilian publicly traded company by market capitalization, was 5.4% per year from 2007 to 2015.

The value of 30% per year was used for the base scenario because it is expected that the volatility of the quantity marginally sold by the employee is greater than the volatility of the company's revenue, since the company is nothing but a portfolio of employees. Furthermore, the volatility of the demand is not the only factor that influences the performance of the employee, since there are factors that are intrinsic to the employee that determine his ability to offer adequate services.

The asset's expected cash flow of the model is the employer's initial expectation, even though done intuitively, regarding the marginal benefit that the employee will bring the company. The values of the flow may change as time passes because new information will emerge and the environment will change. Such unpredictable events create volatility in the value of the expected marginal benefit and these may be events that are intrinsic or extrinsic to the employee.

Note that this volatility is different for different companies. Probably, there is a positive correlation between it and the volatility of the company's revenue. Imagine the case of an employee of an oil exploration company. If the company is already in the process of extracting oil, the volatility of the marginal benefit expected of your employee is less than if the same company is still in the pre-operational drilling phase, because, in this latter case, if the company concludes that the extraction is infeasible, the marginal benefit of the employee will be zero minus his expense to the company, which is negative. But if the drilling is followed by a successful oil extraction, probably the marginal benefit of the employee will be positive.

Other important factors that cause volatility are the intrinsic issues of the employee himself. During the selection phase, it is common for the applicants to present themselves as the best solution for the company among all the other applicants, with a high expected marginal benefit, but, generally, the employer is aware that the impetus of the candidates in this phase is higher than it will be for their actual work. The employer seeks to select the best candidate, however after hiring, some people change their attitude in such a way that they can become problematic employees for the company, and can adversely affect the performance of their colleagues. This employee will end up being replaced by another, given that the expected marginal benefit of a new employee will be greater than the expected marginal benefit of the problematic employee.

However, when dismissing a problematic employee, it is possible that the dismissal is filed as a termination of employment contract with just cause, in which case the company would be exempt from paying the FGTS fine and notice. Thus, the result of this model is much more sensitive to the volatility generated by extrinsic factors to the employee than generated by the other factors.

The employee's effort to sell and, especially the volatility of the demand will be important factors affecting the volatility of the quantity sold. The cash flow expectation will depend, however, on the expectation of the quantity marginally sold by this salesperson, which is already discounted of any effect of a sales cannibalization of some colleague in the company.

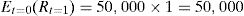

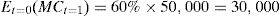

It is assumed that the expectation of the quantity sold in marginal terms will be 50,000 units in the first quarter. The selling price of each unit will be R$ 1.00. Since it will also be corrected for inflation, it will be fixed in the model. Thus, the expectation of the marginal contribution margin for the first quarter, without considering the costs of the employee's salary, will be R$ 30,000.00 in the first quarter.

where Et=0(Rt=1) is the expectation when hiring of R for the next quarter and Et=0(MgContribt=1) is the expectation when hiring of MC for the next quarter.Thus, the employee's marginal cash flow for the company in a given quarter can be calculated by taking the contribution margin in the quarter t and subtract the salary cost and the other labor charges mentioned in the previous subsection. The sum of these costs is initially equivalent to R$ 10,000.00 per month or R$ 30,000.00 in the first quarter. This means that the expected cash flow for the first quarter will be zero, and have positive values for the subsequent quarters due to the positive drift. Since the analysis is entirely based on the marginal effect of hiring employees, the fixed costs of the company are not considered.

Binomial tree modeling of the options of dismissal and graduate incentiveThe discount rate of the cash flow chosen for the analysis will be 10% per year in real terms, of which 5% per year is the risk-free rate in real terms and the rest is the risk premium also in real terms. The choice of these rate values is justified by the desire to represent the values observed in the Brazilian economy in the last decade.

As mentioned before, the uncertain variable modeled using the Cox et al. (1979) model, is Qt, or the amount of units marginally sold by the employee. Thus, the risk-neutral binomial tree that mirrors the real tree, according to arbitrage-free assumptions, should have a risk neutral drift μ of 1.53% per year. This (μ) value was obtained by extrapolation and has the property of matching the risk-neutral NPV (discounted at the risk free rate) with a drift of μ for Qt, to the risk adjusted NPV (discounted at the risk adjusted rate) with a risk neutral drift of 2% and, using the approach of Freitas and Brandão (2010).

The following parameters were obtained using these parameters of volatility and discount rate:

As the uncertainty modeled in the binomial tree is Qt, the Quantity of goods sold marginally and applying Eq. (9), these generate directly the Marginal Contribution revenue MC of the employee, which is ultimately the employee free cash flow to the company. So after calculating the binomial tree of Qt, with (9) a second lattice is directly obtained for corresponding MCt. At the end of this MC lattice we start exerting the option of maximization with Eq. (11) which is similar to (4), but for the employees generated Cash Flow to the company.

Therefore, this lattice model has no dividend yield since it already is a Cash Flow Lattice. At the end of the 40th quarter period, the options are exercised and then discounted backwards, checking exercise or continuation at each period and nod, until time 0, where the expanded value is found. Both options (Put and Call) were calculated using similar models of binomial trees (or lattice), the difference laying in the benefit incurred with each one of the options modeled.

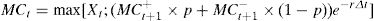

Results and sensitivity analysisFor the worker analyzed under the aforementioned assumptions, the marginal net present value of the cash flows for the time span of the case studied (ten years after hiring in quarter periods, as cited in Table 1) by the discounted cash flow method is R$ 39,400. This value disregards the real option of laying an employee off during that period, which is similar to cases where there is employment stability. Therefore we will have: 39,400=∑040MCte−k(t−t0).

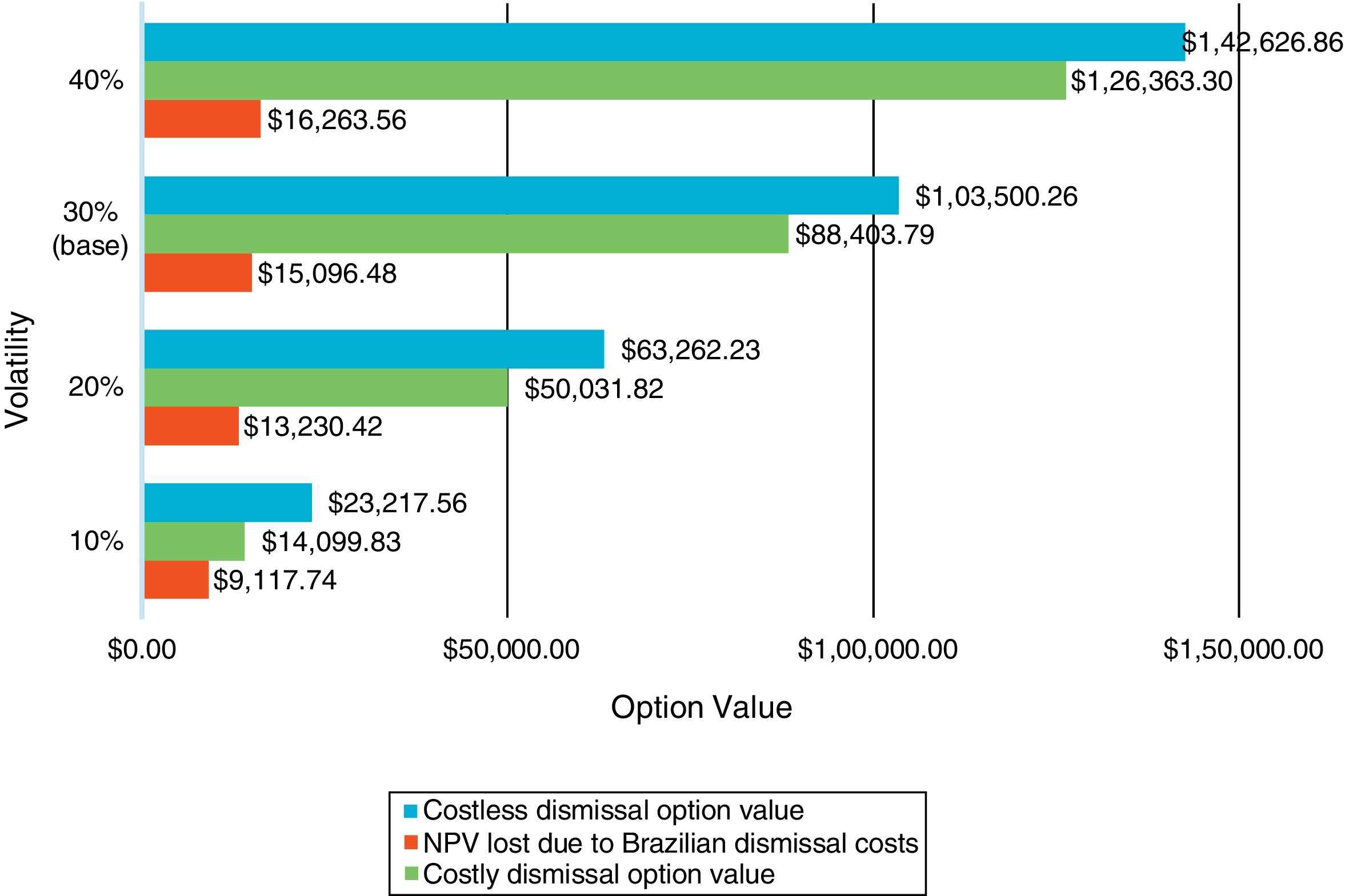

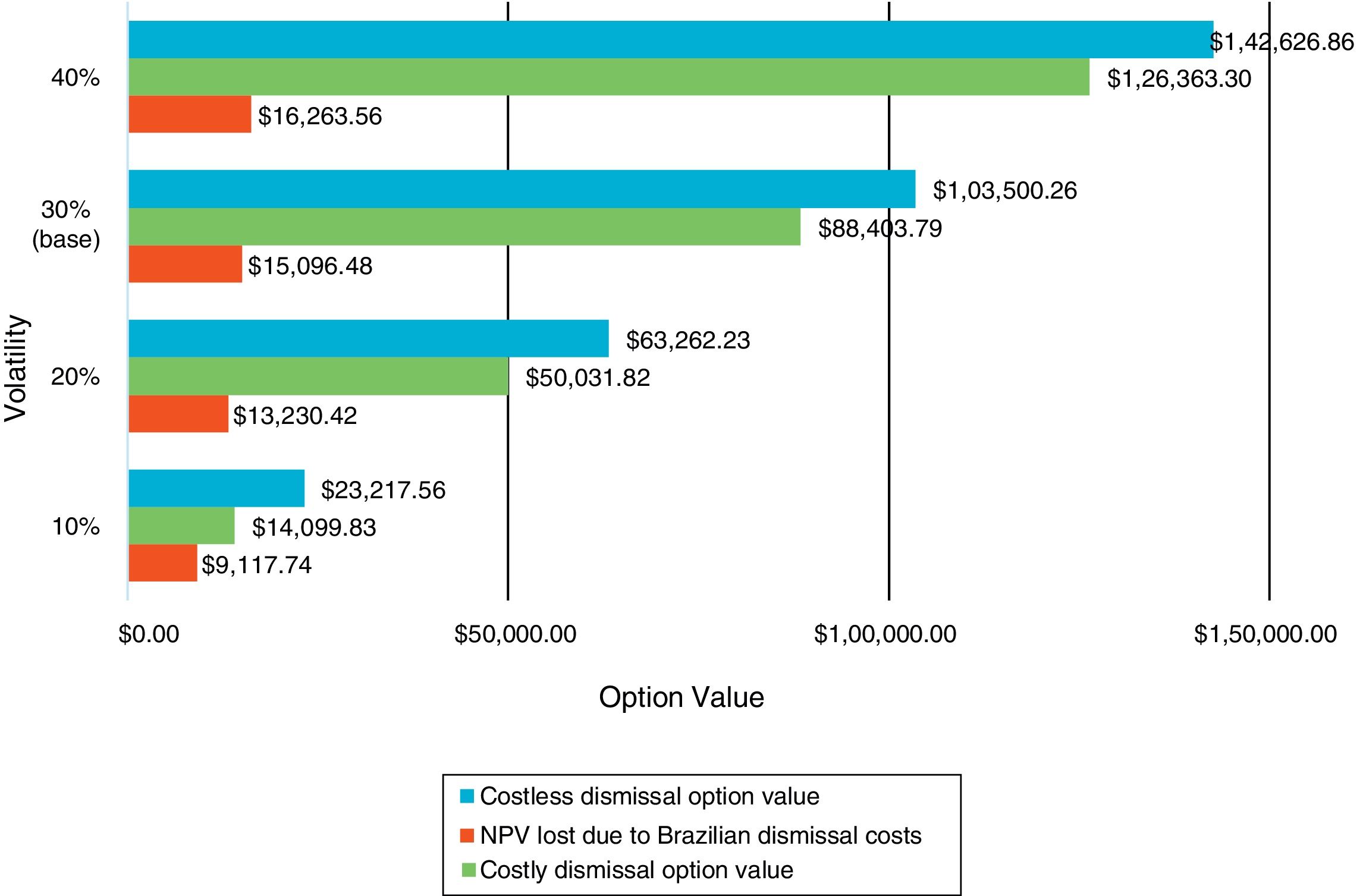

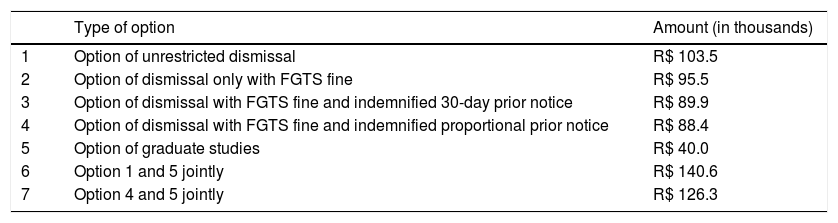

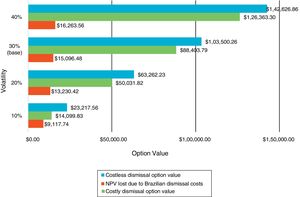

If the employer had free possibility to dismiss the employee without paying severance fines, which means in the presence of the real option of unrestricted dismissal without costs for its exercise, the net present value would increase by 262% to R$ 143,000. Thus, the value of the real option of dismissing the employee of the model corresponds to R$ 103,500.

In the Brazilian case, when there is an indemnified prior notice and the FGTS fine to be paid to the employee, the net present value increases less to R$ 127,900. Thus, the value of the real option of dismissal with costs for its exercise is worth R$ 88,400, which is equivalent to 14.6% less than the real option of dismissal in the absence of severance costs of FGTS fine and proportional prior notice indemnified.

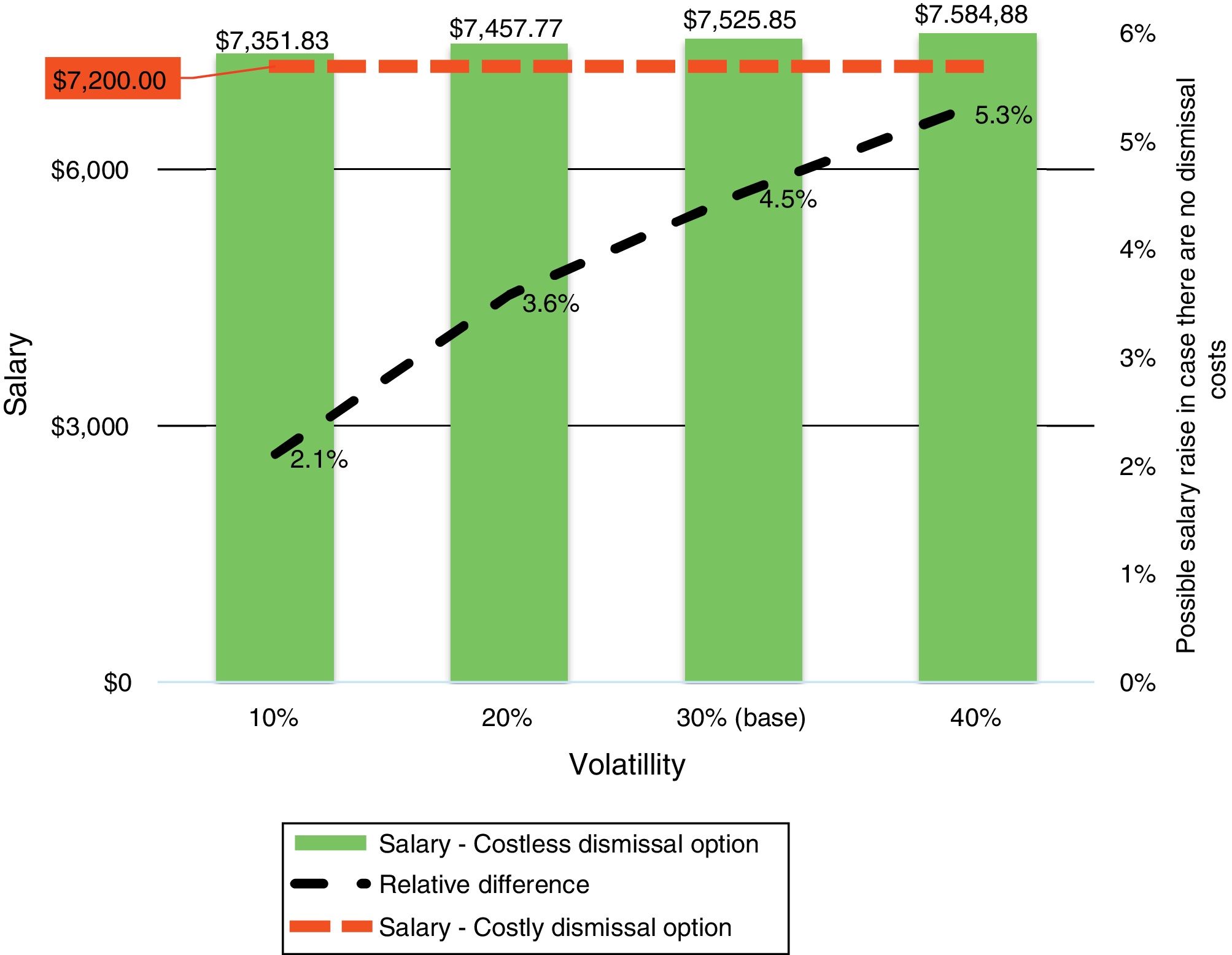

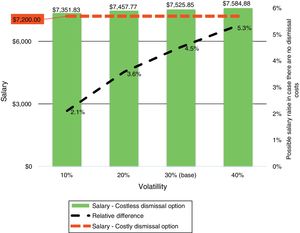

Labor rights of indemnified prior notice and FGTS fine together result in the loss of R$ 15,100 in the employee's value for the company, which is equivalent to 10.6% of the employee's NPV, whose employer holds the option to unrestricted dismissal. Although these severance expenses have their merit as described in this work, it is important to consider that if they did not exist, the salary of the employee analyzed in this model could be R$ 7525.85, instead of R$ 7200.00, which is 4.5% higher that would result in the same loss of net present value for the company. It should be noted that this salary increase would also increase the payment of labor costs in 4.5% to the government and to the employee himself, such as INSS, FGTS and 13th salary. Therefore, it could bring these other benefits to both without loss to the company in terms of present value of cash flows, in accordance with the model's premises.

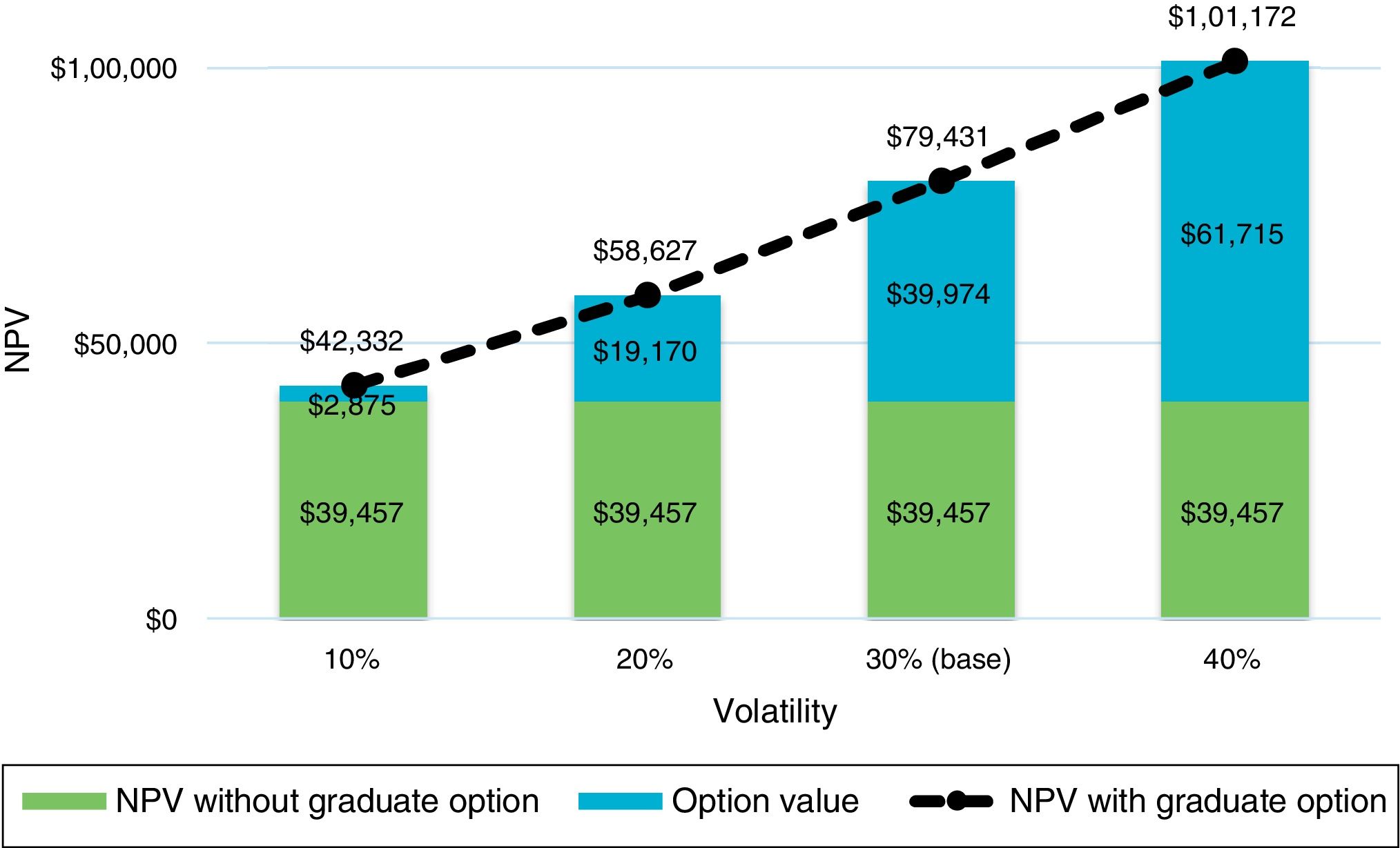

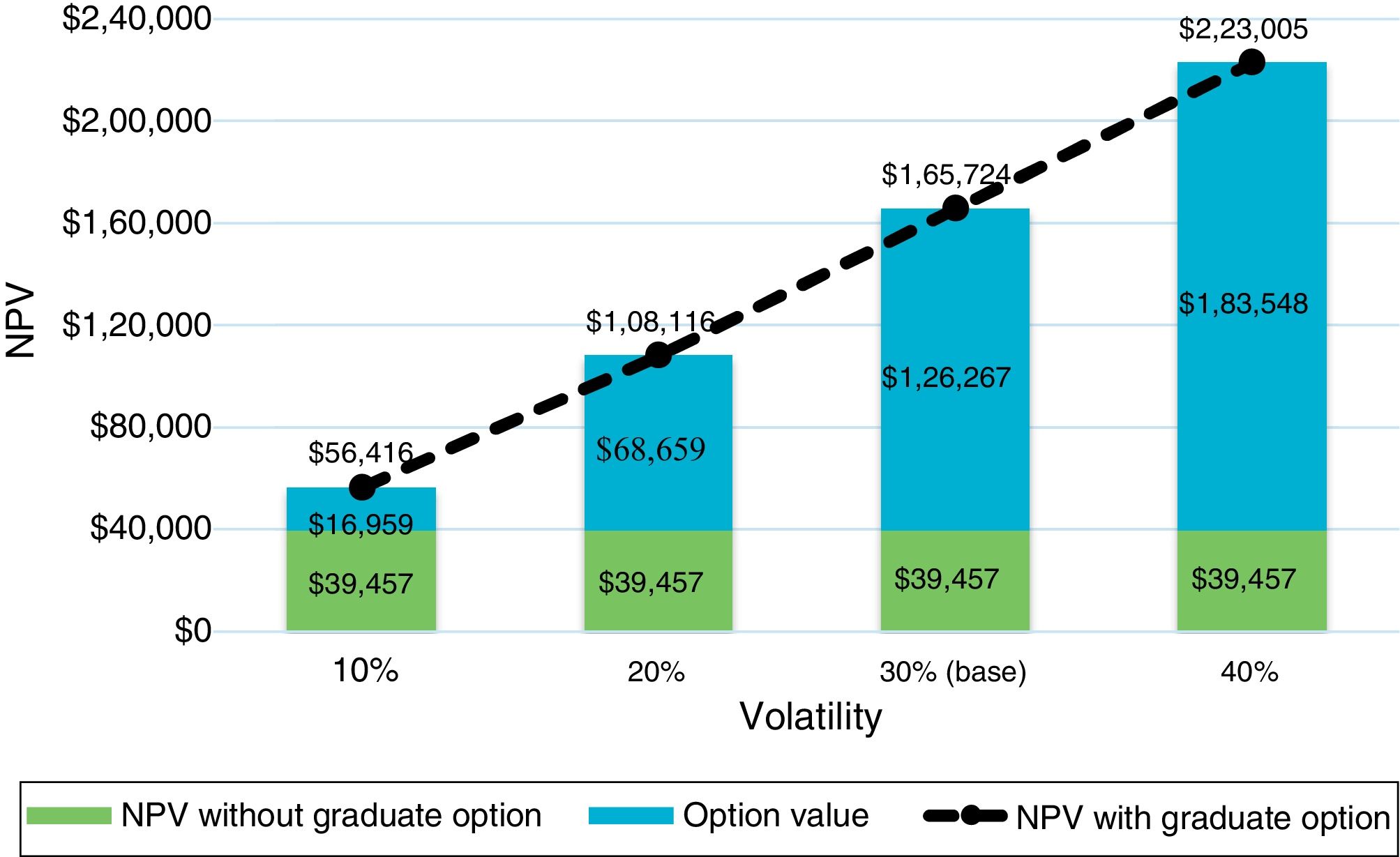

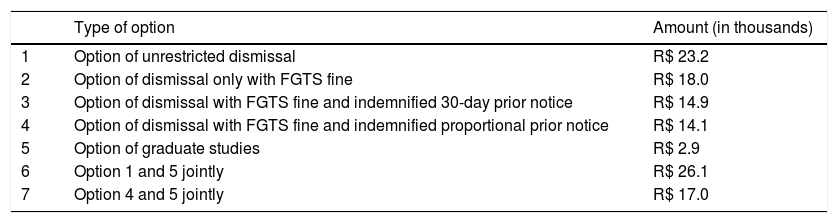

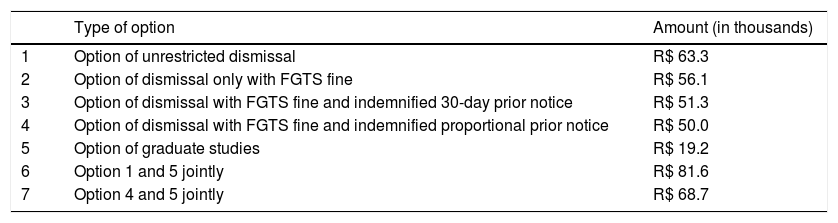

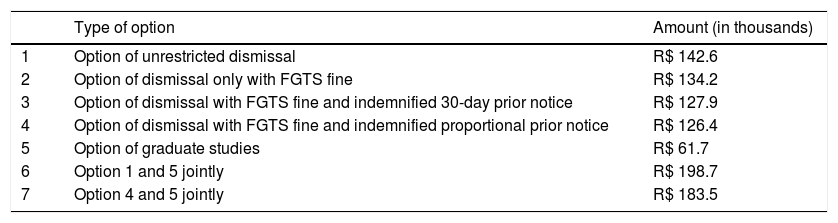

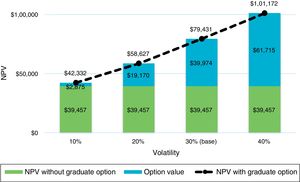

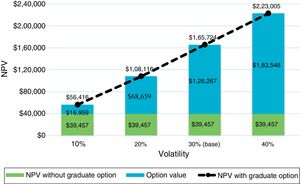

Figs. 3 and 4 respectively show the results obtained concerning the value of real options analyzed and the salary increase. In order to analyze the sensitivity of the results to the volatility of the employee's productivity, the results are shown for four different scenarios of annual volatility.

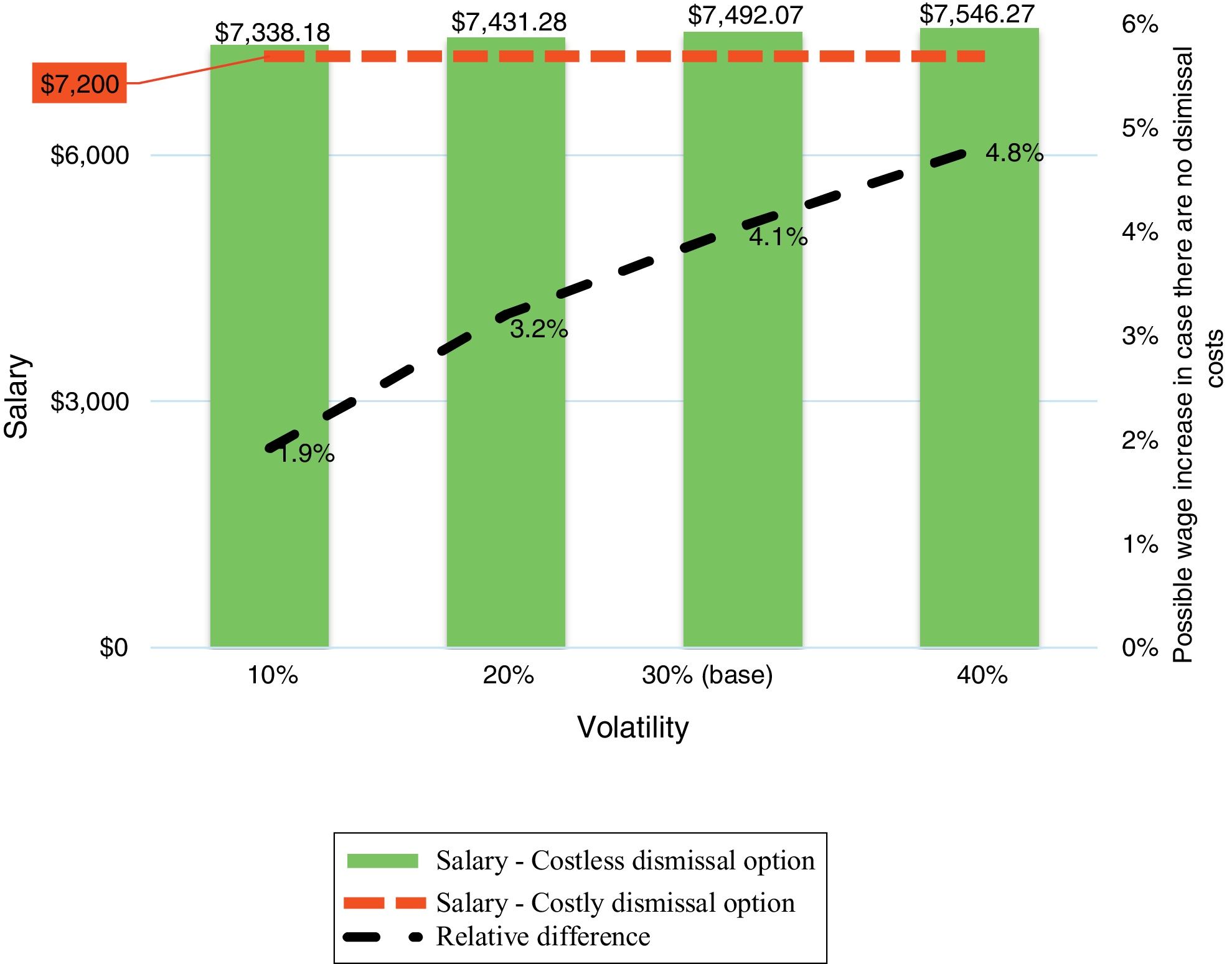

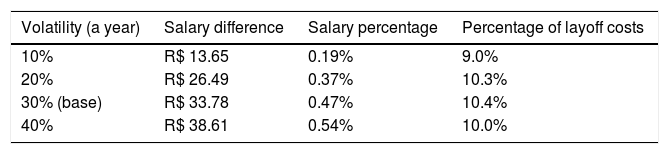

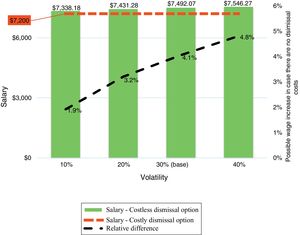

Note that, when performing the same analysis considering the prior notice of 30 days regardless of the employee's length of service in the company, which is what occurred in Brazil before the publication of Law 12,506/11, the following result is reached as expressed in Figs. 5 and 6.

Thus, it becomes possible to estimate the impact arising from introducing the 3-day increase per year of service on the basis of calculating the indemnified prior notice. Simply take the differences between the values of the figures presented above, as can be seen in Table 2.

Effect on the salary with adding three days per year of service in the prior notice calculation basis.

| Volatility (a year) | Salary difference | Salary percentage | Percentage of layoff costs |

|---|---|---|---|

| 10% | R$ 13.65 | 0.19% | 9.0% |

| 20% | R$ 26.49 | 0.37% | 10.3% |

| 30% (base) | R$ 33.78 | 0.47% | 10.4% |

| 40% | R$ 38.61 | 0.54% | 10.0% |

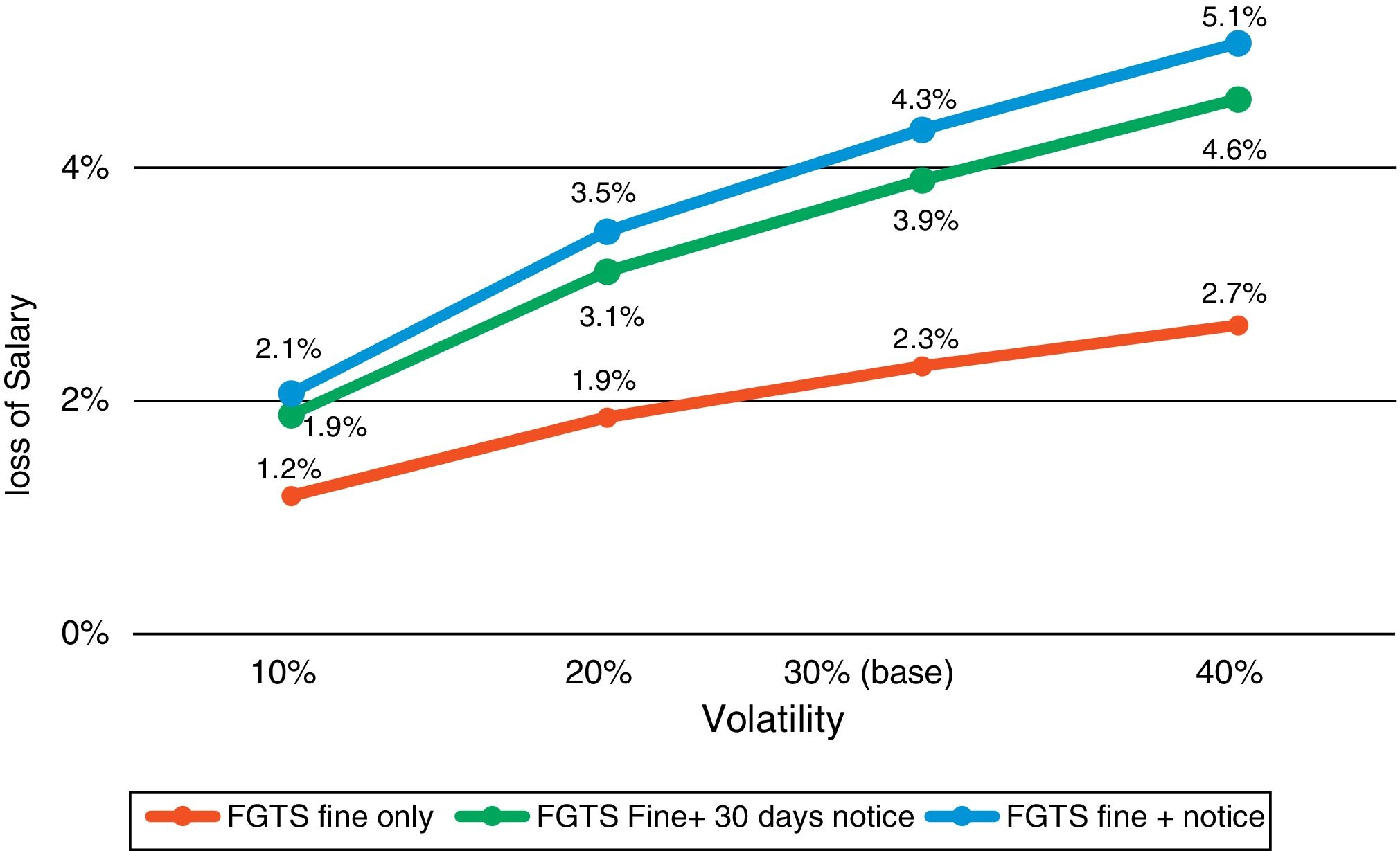

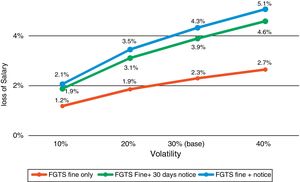

The model also allows you to calculate the loss of the employee's net present value analyzed in relation to the exclusive function of the FGTS fine. Thus, it will be assumed that there is no need for a prior notice and that the employment agreement is ended as soon as the employer decides to do so, without a need of indemnity for the subsequent month nor payment of payroll charges such as the deposit of FGTS. It can also be noticed that the amount of the FGTS fine itself in this scenario will be slightly lower since there will be no payment of FGTS by the period of the prior notice. In Fig. 7, one can notice the marginal effect of each labor rule on the employee's salary, by equivalence of NPV.

The establishment of a financial support program for graduate studies along the lines presented in the previous section (cost of R$ 30,000 covered by the employer, resulting in an increase in employee productivity 50% and a salary increase of 66%) can increase the employee's NPV provided that the decision is taken at the right time. If the employer offers the program regardless of the employee's performance and early in his career in the company, the employee's NPV calculated without real options would fall from R$ 39,500 to −R$ 68,500, mainly reflecting the increase in the cost of the employee's salary.

It should be noted that this decision is not the most appropriate for this case under analysis because in this way the company would renounce the real option of offering the incentive only to those employees that it has an expectation that they will bring a financial return on the investment made of paying for the graduate studies course. The transformation of the incentive program for graduate studies into an imposition causes a loss of net present value of R$ 107,900 to the employee analyzed in this study.

If the company decides to offer incentives to graduate studies only to employees in which it has the expectation that they will bring a financial return on this investment and at the time to maximize their net present value, a gain of R$ 40,000 can be reached in the absence of the possibility of the employee's dismissal, thus increasing the NPV by 101%, from R$ 39,500 to R$ 79,400.

Because private companies not only set up the option to institute incentive programs for graduate studies, but also maintain the option of dismissal in Brazil, even with the payment of severance costs cited in this study, it is best to analyze jointly the options of graduate study incentive programs and dismissal in both cases of the employer covering the costs or not.

It can be noticed, based on the results presented in Figs. 81. and 8.2, that the options have a high added value without meaning that the existence of the two jointly significantly subtract a value mutually. In fact, the sum of the values of the options calculated separately is less than 5% greater than their joint value, as can be seen in Tables 3–6. This is expected considering that they are options exercised in opposite situations with a low overlap between the regions of exercise: the layoff occurs when the employee does not have good productivity, while the investment in graduate studies is offered to high performance employees. On the other hand, one option absorbs some value from the other because there is the possibility, though remote, that the employee attending graduate school will afterwards have a performance lower than expected while his salary becomes higher, which by law cannot be reduced. In this scenario, the company would exercise both options: first, to invest R$ 30,000 in the employee's graduate studies and later dismiss him without just cause in order to maximize the NPV.

Value of the model's options under a volatility assumption of 10% p.a.

| Type of option | Amount (in thousands) | |

|---|---|---|

| 1 | Option of unrestricted dismissal | R$ 23.2 |

| 2 | Option of dismissal only with FGTS fine | R$ 18.0 |

| 3 | Option of dismissal with FGTS fine and indemnified 30-day prior notice | R$ 14.9 |

| 4 | Option of dismissal with FGTS fine and indemnified proportional prior notice | R$ 14.1 |

| 5 | Option of graduate studies | R$ 2.9 |

| 6 | Option 1 and 5 jointly | R$ 26.1 |

| 7 | Option 4 and 5 jointly | R$ 17.0 |

Value of the model's options under a volatility assumption of 20% p.a.

| Type of option | Amount (in thousands) | |

|---|---|---|

| 1 | Option of unrestricted dismissal | R$ 63.3 |

| 2 | Option of dismissal only with FGTS fine | R$ 56.1 |

| 3 | Option of dismissal with FGTS fine and indemnified 30-day prior notice | R$ 51.3 |

| 4 | Option of dismissal with FGTS fine and indemnified proportional prior notice | R$ 50.0 |

| 5 | Option of graduate studies | R$ 19.2 |

| 6 | Option 1 and 5 jointly | R$ 81.6 |

| 7 | Option 4 and 5 jointly | R$ 68.7 |

Value of the model's options under a volatility assumption of 30% p.a.

| Type of option | Amount (in thousands) | |

|---|---|---|

| 1 | Option of unrestricted dismissal | R$ 103.5 |

| 2 | Option of dismissal only with FGTS fine | R$ 95.5 |

| 3 | Option of dismissal with FGTS fine and indemnified 30-day prior notice | R$ 89.9 |

| 4 | Option of dismissal with FGTS fine and indemnified proportional prior notice | R$ 88.4 |

| 5 | Option of graduate studies | R$ 40.0 |

| 6 | Option 1 and 5 jointly | R$ 140.6 |

| 7 | Option 4 and 5 jointly | R$ 126.3 |

Value of the model's options under a volatility assumption of 40% p.a.

| Type of option | Amount (in thousands) | |

|---|---|---|

| 1 | Option of unrestricted dismissal | R$ 142.6 |

| 2 | Option of dismissal only with FGTS fine | R$ 134.2 |

| 3 | Option of dismissal with FGTS fine and indemnified 30-day prior notice | R$ 127.9 |

| 4 | Option of dismissal with FGTS fine and indemnified proportional prior notice | R$ 126.4 |

| 5 | Option of graduate studies | R$ 61.7 |

| 6 | Option 1 and 5 jointly | R$ 198.7 |

| 7 | Option 4 and 5 jointly | R$ 183.5 |

It can also be observed, as expected, that the volatility of the employee's productivity exerts a wide difference on the results, while it is important that every employer properly assess this parameter, even if intuitively, in order to make the best decision.

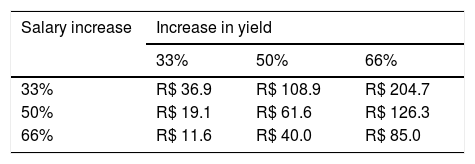

Finally, it should be pointed out that a graduate course can impact differently the performance and the salary of a professional. Different careers are affected in different ways, which makes it important that this study analyzes the different parameters for the salary increase and to increase the employee's performance. Their impact on the employee's NPV for the company can be seen in the following table, considering a volatility of 30% per year and an investment of R$ 30,000 by the company (Table 7).

ConclusionsEven though the legal imposition of costs when dismissing employees without just cause brings a financial benefit to employees and their families at a moment they are economically weak, as well as it being a factor that can protect jobs during recessionary times, this study suggests that, on the other hand, it partially removes the employee's economic value. This can cause the company to not hire the potential employee or to limit the salary being offered to a lower level than compared to the situation in which the dismissal without just cause is free of extra costs, especially in sectors of the economy where there is a high volatility in revenues.

The situation in which the company decides not to hire an employee can occur when, although intuitively, the employer considers that the net present value is negative for the company when hiring the employee. As the study shows for a base case in Brazil, the decline in the net present value of the employee for the company can be significant in the presence of costs when terminating the work contract, which can cause an employee with a potential positive NPV (that may be contracted) into an employee that is no longer wanted. When analyzing the economy as a whole, one can infer, therefore, that the existence of these expenses can negatively impact the level of employment in a situation of equilibrium.

In the base case studied, the fall in NPV due to the existence of indemnified prior notice proportional to length of service and the FGTS fine is R$ 15,100, which is equivalent to more than the monthly wages of two employees. By applying the methodology to the case of the same employee under the labor legislation previous to the publication of Law 12,506/11, which is with prior notice of 30 days regardless of length of service, then there is decline in the NPV of R$ 13,600. The difference of R$ 1500 can be attributed to the new rules that were introduced with the proportional prior notice that expanded the prior notice by three days for each full year of service provided by the employee to the company.

In cases where, regardless of the existence of severance costs, the employee's NPV is positive for the company (only varying the amount), the results of this study may suggest that the employee could demand a higher salary in the situation where there are no severance expenses when exercising the option to dismiss the employee. In the base case studied, if the salary (and other compulsory labor amounts) of the employee that can be dismissed by the company without severance costs were increased by 4.5%, his NPV would be equal to that of the employee with severance costs. This implies that the loss in value of the monthly salary arising from the existence of the FGTS fine (40% for the employee and 10% for the government) and the indemnified proportional prior notice is 4.3%. If the prior notice were 30 days regardless of length of service, the loss would be 3.9%. If there were just the FGTS fine as severance costs, the salary loss would be 2.3%.

It should be noted, however, that this study sought to analyze the corporate decisions of hiring an employee and termination of a work contract without just cause considering only the financial aspect. However, there are several emotional factors that influence the decision to hire and dismiss a worker. One of them is that many employers find it difficult to let their employees know about their dismissal because it usually implies in great economic hardship for the worker's family. Furthermore, the dismissal of one or more employees of a company entails in a reduction in the morale of the other employees, which negatively impacts the organizational climate and hence productivity. Because of this, some employers might postpone the decision to dismiss an employee even if the delay may seem economically disadvantageous to the company.

Regarding the graduate study incentive program in which the company is willing to pay all or part of the cost of a graduate course for an employee, this study shows that the offer of the benefit only for the best performing employees offers a positive average return while the indiscriminate offering to all employees in the beginning of their career can result in a negative NPV.

The establishment of a graduate study incentive program with cost and effects as presented in this model may increase the employee's NPV by R$ 40,000 if the company decides to offer the benefit only to employees that are expected to come to bring a financial return on this investment and at a time that maximizes their net present value. This means more than five times the salary of the employee in question.

On the other hand, if the employer offers the program regardless of the employee's performance and early in his career in the company, the employee's NPV calculated without real options would fall from R$ 39,500 to −R$ 68,500, mainly reflecting the increase in the cost of the employee's salary in the model. Therefore, this decision is not the most appropriate for this case under analysis because in this way the company would renounce the real option of offering the incentive only to those employees that it has an expectation that they will bring a financial return on the investment made of paying for the graduate studies course. The transformation of the incentive program for graduate studies into an imposition causes a loss of net present value of R$ 107,900 to the employee analyzed in this study instead of a gain of R$ 40,000.

Some limitations are present in the methodology presented. The model assumes that the worker's remuneration is fixed, with no variable part. However, it is common for companies to offer variable compensation. This restriction was imposed solely because of wanting to calculate the FGTS fine analytically in the binomial model. When examining only other types of costs of exercising the option of dismissal or when using a Monte Carlo Simulation, this restriction can be made flexible. Furthermore, the model does not consider the employee's salary progression. The impacts on the company's organizational climate due to laying off employees were also not considered. This implies in an extra cost since in order to prevent or reverse a worsening in the organizational climate, the company will incur more expenses.

Although severance costs may decrease employee's net present value for the company, including making the salary lower than it would be if there were no such costs, this paper does not suggest that the protection of dismissal without just cause is bad for the employee or for the economy, since the benefits of these measures were not analyzed.

Conflicts of interestThe authors declare no conflicts of interest.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.