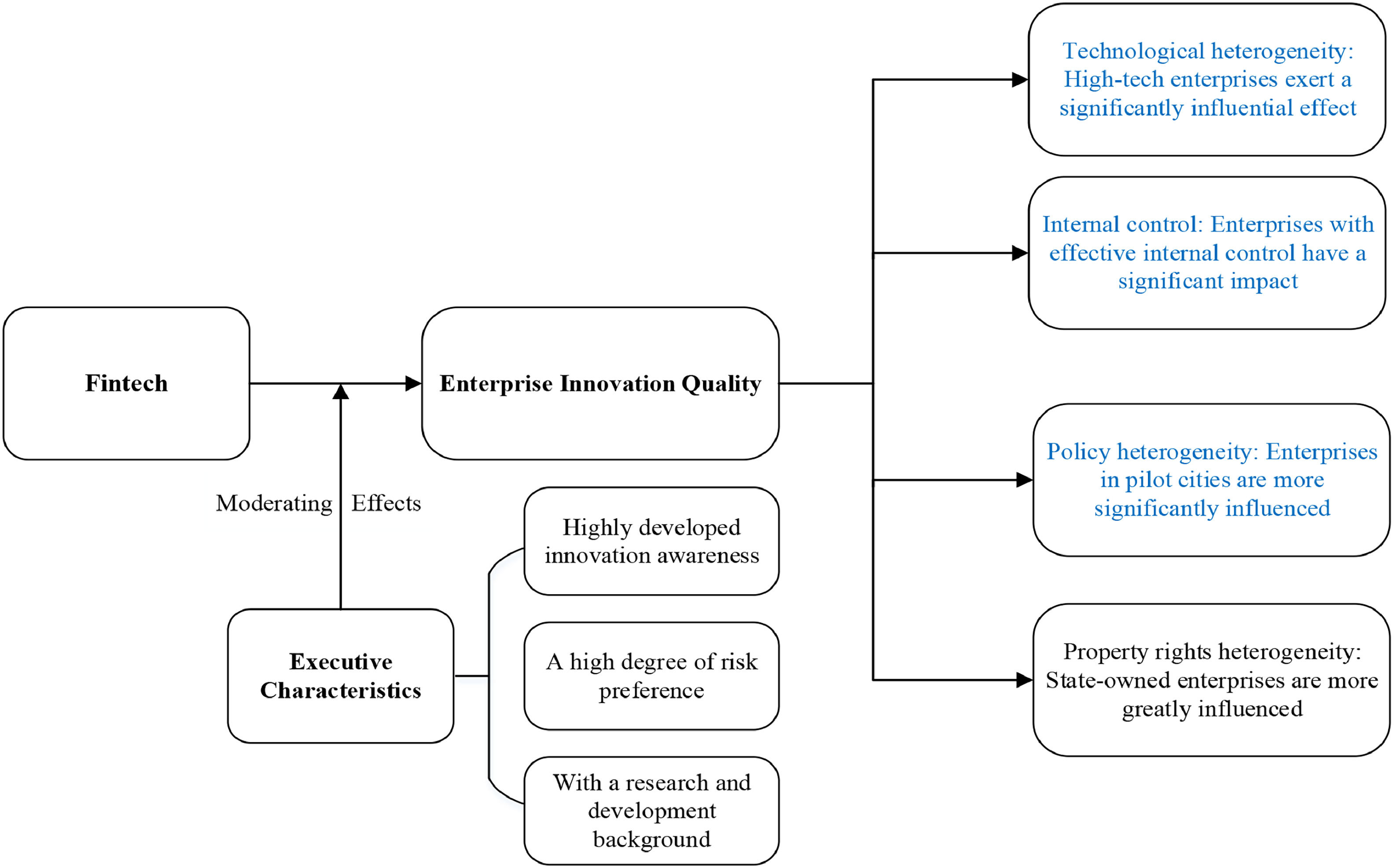

We constructed an urban fintech index and analyzed data from 2834 publicly traded Chinese enterprises for the period 2010–2022 to investigate the impact of fintech on the innovation quality of enterprises. The findings indicate that this impact is positively reinforced by the innovation consciousness, risk propensity, and research and development background of senior executives. The heterogeneity analysis reveals that fintech has a more significant impact on the innovation quality of high-tech enterprises, State-owned enterprises, enterprises with effective internal control systems, and those located in cities designated as experimental zones for policy innovation (policy pilot cities).

Fintech has transformed the operational and innovation models of enterprises within the context of the digital economy trend, utilizing technologies such as blockchain, artificial intelligence (AI), and big data (Li et al., 2021; Tian et al., 2019). It has provided a fresh impetus to enterprise innovation by improving the efficacy of financial services (Komandla, 2023; Kou & Lu, 2025). As a fundamental component of the national economy, the innovation quality of the manufacturing industry is directly correlated with the national economy’s sustainable development capacity and competitiveness (Chin et al., 2021). The manufacturing industry experiences the dual pressures of limited innovation resources and rapid technological evolution, within the context of the dual circulation development paradigm and the backdrop of increasing global competition. Consequently, it is imperative to employ fintech to accomplish transformative breakthroughs (Zhou et al., 2022).

The primary focus area of the present study is the influence of fintech on the quantity of enterprise innovation. Nevertheless, the mechanism by which fintech impacts innovation quality has not been extensively investigated. The characteristics of senior executives—the linchpin of an enterprise’s strategic decision-making—influences the application of fintech and quality of innovation. However, this viewpoint has not been exhaustively examined (Goldstein et al., 2019). Concurrently, manufacturing enterprises exhibit substantial disparities in property rights characteristics and technological capabilities (Gao et al., 2023; Yue et al., 2024). This heterogeneity leads to a divergent impact of fintech on innovation quality (Yue et al., 2024). Systematic research is required to determine how these factors influence the relationship between fintech and innovation quality.

Based on the foregoing analysis, we acquired numerous urban fintech companies through Tianyancha to demonstrate the development of urban fintech. Additionally, by utilizing the patent citation data of listed companies, we constructed an indicator for the innovation quality of manufacturing enterprises. This investigation explores the mechanism based on which fintech influences the innovation quality of manufacturing enterprises, considering two perspectives: executive characteristics and enterprise heterogeneity. The following questions capture the main aims of the study: Can fintech markedly improve the quality of enterprise innovation? Can diverse executive characteristics exert a moderating effect on fintech and the quality of enterprise innovation? Will various types of enterprises exert different influences on innovation quality?

The study’s contributions encompass the following two aspects. First, we investigated the impact of fintech on the innovation quality of manufacturing enterprises. This investigation was conducted from the viewpoints of three executive characteristics: innovation consciousness, risk preference, and research and development (R&D) background. It methodically reveals the moderating mechanism of senior executive characteristics in the relationship between fintech and innovation quality. This endeavor addresses the theoretical gap in current research at the micro-decision-making entity of enterprises and introduces a new research dimension. Second, we conducted heterogeneity analyses in four respects: whether the enterprise is high-tech, whether the internal control is effective, the nature of property rights, and whether it is located in a policy pilot city.

We identified that fintech’s impact on the quality of innovation in enterprises exhibits significant variations. This conclusion not only enhances the research findings on the relation between fintech and enterprise innovation but also provides valuable insights into the topic. It provides a scientific basis for the government to develop targeted industrial policies and guide fintech in effectively empowering innovation in the manufacturing industry. Furthermore, it effectively addresses the research deficit in guiding policy practice. These research findings hold significant reference value for promoting fintech development and enhancing the innovation quality of enterprises.

Literature reviewFintechThe rapid expansion of fintech has catalyzed global financial innovation in recent years (Alt et al., 2018; Tian et al., 2019). By employing technologies such as blockchain, AI, and big data, fintech revolutionizes the way financial services are delivered. Essentially, it is the practical application of the “technology-economy synergy paradigm”—a concept within Schumpeter’s innovation theory—in the financial sector. The application of AI in credit assessment has effectively addressed the problem of information asymmetry. Meanwhile, the advancements achieved by blockchain in payment and settlement have redefined the value transfer mechanism (Du & Xie, 2021; Pal et al., 2021). These technologies not only improve the efficacy of financial services but also decrease financing costs (Kou & Lu, 2025; Li & Xu, 2021).

Furthermore, they facilitate greater inclusivity and intelligence in financial services through digital transformation. For instance, the transition to a cashless society has been accelerated by the application of digital currencies and smart payments (Nicoletti et al., 2017; Yamin & Abdalatif, 2024). Fintech is transforming into a crucial resource that meets the Valuable, Rare, Inimitable, Non-substitutable (VRIN) criteria from the perspective of strategic resources because of its technological attributes, including the value of data, the scarcity of algorithms, and the inimitability of systems (Barney, 1991; Lockett et al., 2009). This establishes a novel foundation for enterprises to obtain an innovative advantage.

Enterprise innovation qualityThe cross-industry enabling effects of fintech have become more apparent in enterprise innovation. The dynamic capabilities theory also demonstrates that enterprises are obligated to identify innovation opportunities within technological trends by utilizing their sensing capabilities (Teece, 2007). For instance, enterprises that utilize big data to anticipate and respond to market demands can establish a competitive edge. Fintech facilitates the conversion of innovation outcomes through technology spillovers and helps enterprises optimize market insights through data analysis. Consequently, it has become an essential external support for the innovation initiatives of small and medium-sized enterprises and entrepreneurs (Chen et al., 2019; Gao & Jin, 2022; Li et al., 2023a).

Nevertheless, current research predominantly focuses on the influence of fintech on the quantity of innovation or ecological innovation. The investigation of the fundamental issue of enterprise innovation quality remains scarce. The quality of enterprise innovation has become a crucial metric for evaluating an enterprise’s competitiveness and sustainable development. Its essence is not limited to the quantity of innovation output; it also prioritizes the technological profundity, market efficacy, and sustainability of innovation (Duan et al., 2021; Feng & Li, 2021).

In the research context of the manufacturing industry, we define the innovation quality of manufacturing enterprises by synthesizing previous academic research. Specifically, it refers to the comprehensive level demonstrated by the outcomes of the technological innovation activities of enterprises, including technological advancement, market value, and strategic significance (Feng & Li, 2021). The core is reflected in the technical complexity, breakthrough characteristics, commercial transformation potential of patents, and their contribution to the long-term competitiveness of enterprises (Chin et al., 2021; Duan et al., 2021). It is essential to recognize that integrating fintech as a novel strategic resource into the innovation system depends on an enterprise’s capabilities. Specifically, the enterprise must optimize resource allocation by developing intelligent financing platforms (Gomber et al., 2018; Teece, 2010). Furthermore, it necessitates that the enterprise restructures, allowing for modifications to its organizational structure and processes, such as the reconfiguration of supply chain finance using the blockchain technology (Peiyao & Runze, 2024). Ultimately, this induces a dynamic alignment of technology and organization (Teece, 2014). Digital transformation enhances the quality of innovation by streamlining the innovation process (Zhang et al., 2024). A more comprehensive examination of the fundamental relationship between fintech and innovation quality is necessary because fintech is the primary driving force behind digital transformation.

Fintech and corporate innovationResearchers have explored the interaction mechanism between fintech and corporate innovation, revealing the various channels through which fintech influences corporate innovation. Fintech, a strategic resource characterized by value, scarcity, and inimitability (Barney, 1991), requires activation through a firm’s dynamic capabilities to unlock its innovation potential from the perspective of resource-capability synergy. Fintech reconfigures credit assessment to facilitate financing by using big data and AI. This restructuring optimizes credit allocation, reduces costs, increases efficiency, and mitigates financing constraints that result from information asymmetry. The efficacy of resource integration (Teece, 2010) directly promotes a company’s investment in innovation. Empirical evidence suggests that it has a substantial impact on the expansion of patent applications (Yue et al., 2024). Fintech’s irreplaceable resource characteristics, such as the distributed ledger of blockchains, automate the confirmation of intellectual property rights and establish a trustworthy platform for cross-organizational technological cooperation (Wang et al., 2023; Yue et al., 2024). These features accelerate the flow and recombination of innovation resources in technological collaboration contexts.

Concurrently, fintech facilitates the optimization of resource allocation. By employing data analysis to obtain insights into market demands, organizations can refine their innovation strategies through reconfiguration capabilities (Rao et al., 2022), particularly in the realm of green technology (Li et al., 2023b). The core mechanism is further elucidated by the integration of the resource-based view and the dynamic capabilities theory. Ultimately, firms optimize organizational processes through reconfiguration capabilities, transform fintech trends into innovation resources through integration capabilities, and achieve dynamic alignment between technological resources and organizational capabilities (Teece, 2014). Additionally, firms identify fintech trends through their sensing capabilities. In a dynamic environment, firms can only establish sustainable innovation advantages by closely integrating the VRIN attributes of fintech with these capabilities (Barney, 1991; Freeman et al., 2021; Teece et al., 1997).

The existing literature has investigated the impact of fintech on enterprise innovation, but three shortcomings remain. First, current literature mainly focuses on green innovation or the quantity of innovations; few studies have investigated the impact of fintech on the quality of enterprise innovation. Second, the moderating mechanism of executives between fintech and enterprise innovation quality remains ambiguous. Executives are the ultimate decision-makers of enterprises and significantly influence innovation quality, yet few studies have explored this from the perspective of executive characteristics. Third, very few studies have examined heterogeneous differences in the impact of fintech on the quality of enterprise innovation. For example, evaluating whether the enterprise is a high-tech company is essential. Additionally, the location of the enterprise may be relevant, specifically whether the location is a fintech pilot city. Furthermore, it is necessary to examine whether the enterprise is State- or non-State-owned.

Research hypothesesFintech promotes optimizing resource allocation, alleviating financing constraints, and enhancing the efficiency of enterprise innovation (Li et al., 2025; Luo et al., 2022; Tan et al., 2023). In the traditional financial model, information asymmetry and market segmentation result in the ineffective allocation of resources to enterprises and projects in need (Li et al., 2025). Through big data analysis and algorithmic models, fintech precisely matches capital demand and supply, optimizing resource allocation (Gao & Jin, 2022; Li et al., 2021). Financial institutions can guide funds to projects with high innovation potential. This guidance is based on the innovation capabilities and market prospects of enterprises. Consequently, the utilization efficiency of innovation resources is enhanced (Li et al., 2025). The application of blockchain technology renders transaction information more transparent and traceable. It reduces information asymmetry, lowers transaction costs, and improves the efficiency of resource allocation (Guo et al., 2023; Kou & Lu, 2025; Li et al., 2025). By optimizing resource allocation, fintech can provide better resource support for enterprise innovation and enhance innovation quality (Rao et al., 2022).

Fintech also offers diversified financing methods and risk management tools. These tools offer enterprises greater options to reduce financing costs and help them promptly identify and address potential risks, ensuring the smooth progress of innovation projects (Gao & Jin, 2022; Kou & Lu, 2025; Li et al., 2023a, 2023b). In addition to providing financial support, fintech also helps enterprises more accurately identify market opportunities and innovation directions through data analysis (Gao & Jin, 2022; Li et al., 2025). Fintech can perform comprehensive extraction and analysis of extensive data with AI and big data technologies. These data include the enterprise’s internal as well as external information. By analyzing this data, fintech provides precise market predictions and offers decision support for the enterprise (Kou & Lu, 2025; Li et al., 2021). Fintech enables enterprises to promptly grasp market dynamics, adjust innovation strategies, and improve innovation efficiency and competitiveness. Furthermore, it has introduced greater transparency in market information. Such competitive pressure propels enterprises to enhance the quality of innovation (Zhao et al., 2025). Consequently, we propose the initial hypothesis:

H1 Fintech can significantly enhance the innovation quality of manufacturing enterprises.

Executives with a keen sense of innovation can keenly perceive fintech’s development trends. They can appreciate its effectiveness in enhancing the quality of enterprise innovation. These executives can effectively integrate fintech into the enterprise’s development strategy (Lai & Wee, 2023; Talke et al., 2010; Wang et al., 2022) and optimize resource allocation based on their nuanced appreciation of fintech. Furthermore, they can persuade enterprises to augment their R&D investment (Collins & Reutzel, 2017; Lai & Wee, 2023; Makkonen, 2022). Innovative executives view fintech as a valuable resource for enhancing the enterprise’s innovation capabilities and can proactively explore fintech’s application scenarios within the organization. For example, they can utilize big data to analyze customer needs and develop supply chain finance platforms using the blockchain technology. This approach clarifies more innovation opportunities and enhances the quality of innovation (Kou & Lu, 2025; Pal et al., 2021).

According to the upper echelons theory, executives’ innovation cognizance is paramount as it directly influences the enterprise’s innovation strategy and resource allocation, thereby driving its R&D investment and performance (Bromiley & Rau, 2016; Collins & Reutzel, 2017; Makkonen, 2022; Talke et al., 2010). Executives with a pronounced sense of innovation possess a nuanced appreciation of fintech’s development trends. Furthermore, they can organically integrate fintech with the enterprise’s R&D, production, sales, and other links. This integration leads to an optimal allocation of innovative resources (Kou & Lu, 2025; Li et al., 2021; Rao et al., 2022). High cognition of innovation among executives will impel enterprises to explore new products and markets, which will elevate their innovation capabilities and market competitiveness (Wang et al., 2022). In contrast, executives with weak innovation awareness may consider conventional financial models as sufficient for the needs of the enterprise, neglecting the innovation opportunities offered by fintech. Thus, we suggest the subsequent hypothesis:

H2 Executives’ innovation cognition can significantly strengthen the positive impact of fintech on the innovation quality of manufacturing enterprises.

Executives with higher risk appetite possess an adventurous spirit and strategic mindset, and therefore, can promptly seize the potential development opportunities presented by fintech (Rana & Debata, 2025; Wang et al., 2022). They will explore novel fintech application scenarios and promote innovation (Zhu et al., 2025). Executives with relatively high-risk preferences will undertake technological and market risks when encountering uncertainty. This decision-making behavior can expedite the application of fintech and improve the quality of enterprise innovation. Such decision-making behaviors can accelerate fintech applications and enhance enterprise innovation quality (Rana & Debata, 2025). In contrast, executives with lower risk appetite often adopt conservative strategies owing to excessive risk concerns, potentially missing out on innovation opportunities. Furthermore, the influence of risk appetite on innovation exhibits a non-linear characteristic. Moderate risk-taking can facilitate exploratory innovation (Cui et al., 2024). Based on the above analysis, we propose the following hypothesis:

H3 Executives with high-risk appetite can significantly strengthen the positive impact of fintech on the innovation quality of manufacturing enterprises.

The quality of enterprise innovation is significantly influenced by the R&D background of senior executives, particularly in the context of fintech and enterprise innovation (Li & Xiang, 2022; Lin et al., 2011). Executives with an R&D background possess professional knowledge and experience in the technological domain, enabling enterprises leverage fintech to enhance the quality of innovation (Lin et al., 2011; Yan et al., 2023). The development of fintech provides enterprises with a broader range of financing channels and innovation resources for resource acquisition (Huang et al., 2025; Xue et al., 2022). With the application of technologies such as AI and big data, financial institutions can more accurately evaluate the innovation capabilities of enterprises. Additionally, it helps assess the development potential of these enterprises. Consequently, financial institutions can devise more rational financing plans (Li et al., 2021; Xue et al., 2022).

Executives with an R&D background possess a nuanced appreciation of technological feasibility and market prospects. This enables them to effectively articulate the advantages of innovation projects to financial institutions, thereby elevating the competitiveness of the financing proposal. Ultimately, this increases the likelihood of securing greater financial support. Furthermore, research has demonstrated that organizations with executives who have a Science, Technology, Engineering, and Mathematics (STEM) educational background invest in fintech-related areas at a substantially higher rate (He et al., 2021). Based on the above analysis, we propose the following hypothesis:

H4 Executives with an R&D background can significantly strengthen the positive impact of fintech on the innovation quality of manufacturing enterprises.

Using the revised Guidelines for Industry Classification of Listed Companies (2012), we selected manufacturing enterprises listed on the A-share market from 2010 to 2022. Concurrently, the following treatments were applied to the samples: Companies with abnormal financial conditions and severe data deficiencies were eliminated. Ultimately, unbalanced panel data of 2834 manufacturing enterprises were obtained. The enterprise data in this study are sourced from the China Stock Market & Accounting Research (CSMAR) Database.

Variable selection- 1.

Explained variable—The variable that is the subject of this study is the excellence of enterprise innovation (Innovation). The quality of enterprise innovation is assessed by the number of patent citations of listed companies, as evidenced by the research of Hall et al. (2005) and Bradley et al. (2017).

- 2.

Core explanatory variable—The urban fintech index (Fintech) is the primary explanatory variable in this study. The degree of fintech development is an essential independent variable of interest in this investigation. Studies have mainly explored its effect on corporate financing constraints and the efficacy of risk management. Nevertheless, a unified standard for the specific quantification methodologies of fintech remains lacking. This research employs a relatively objective and replicable approach to develop a fintech index system, drawing on existing studies (Lee et al., 2021). The specific stages of the construction process are discussed below. First, a fintech-related lexicon is created, including fundamental terms such as blockchain, AI, big data, cloud computing, and finance. This guarantees that the indicators’ scope accurately reflects the present state of fintech applications. Subsequently, Tianyancha conducts an individual search for each keyword in the lexicon to ensure the objectivity and precision of enterprise classification. Finally, the natural logarithm of the total number of fintech-related enterprises in each city is calculated. The number of fintech enterprises can effectively reflect the local level of fintech development in a given city. Particularly, a higher value suggests that the fintech sector in that region is developing at a faster pace.

- 3.

Control variables—In this study, the total assets of the enterprise (Size), the shareholding ratio of the largest shareholder (Top1), the asset–liability ratio (Lev), the return on assets (ROA), cash flow (Cflow), the age of the enterprise (Age), the number of directors (Board), and the revenue growth rate (Sale) are selected as control variables. Additionally, we account for individual fixed effects and time-fixed effects. Table 1 presents the description of variables.

Table 1.Description of variables.

Table 2 presents the descriptive statistics of the variables. The study sample encompasses 22,243 enterprise data points. The enterprise innovation quality standard deviation is 0.904, with a mean of 0.089. This suggests that the innovation performance of most of the enterprises is relatively dispersed, with notable variances. The maximum value is 41.055, indicating that a few individual enterprises have demonstrated outstanding innovation achievements within the sample. These companies may have made substantial investments in technological research and development. Alternatively, they may have focused on innovative products. Consequently, they present a specific extreme value phenomenon. The standard deviation of fintech is 2.108, and the mean is 4.409. This reveals that the investment or development degree of most enterprises in the fintech domain is relatively concentrated at a medium level. The maximum value is 8.228, suggesting that in the sample, there remains a minor proportion of enterprises that have performed rather prominently in this field.

Descriptive statistics.

Regarding the control variables, the enterprise scale and the board of directors are relatively concentrated. The shareholding ratio of the largest shareholder, the asset–liability ratio, the return on assets, and the operating income growth rate fluctuate considerably. The cash flow is relatively concentrated, and the enterprise age is relatively young. Overall, enterprises show significant disparities in the domains of innovation and fintech. Additionally, other variables also undergo fluctuations.

Model specificationThis study employs panel data, and each firm demonstrates unique characteristics (e.g., corporate culture), resulting in unobservable individual effects. Consequently, we apply an unobserved effects model. The p-value is 0.0000, as determined by the Hausman test. This compelling evidence suggests that the null hypothesis should be rejected, indicating that the fixed effects model should be implemented instead of the random effects model. Therefore, this paper employs a two-way fixed effects model that accounts for both individual entities and time. The model is presented as follows:

Among them, the explained variable Innovationit is the quality of enterprise innovation; the core explanatory variable Fintechit is the fintech index of the city where the enterprise is located; the control variables influence the quality of enterprise innovation; Yeart and Firmi represent the time-fixed effects and individual fixed effects, respectively; εit is the random disturbance term.

Combining the previous mechanism analysis, we will explore its action mechanism from three perspectives: the innovation awareness of senior executives, the risk preference of senior executives, and the R&D background of senior executives. The empirical model is as follows:

Among them, the explanatory variables are moderating variables, encompassing executive innovation awareness (Awareness), executive risk preference (Risk), and executive R&D background (RD). To evaluate executives’ perspectives on innovation, Chen et al. (2015) employed a text analysis approach. Employing data from Chinese manufacturing enterprises for the period 2006–2011, they empirically demonstrated that a firm’s innovation activities are influenced by the perception of innovation held by the senior management. To evaluate the innovation awareness of executives in listed companies, we analyzed the text in the board report section of the annual report. The specific procedures are discussed below.

Annual reports of the designated listed companies were gathered and converted from PDF to simple text format. Subsequently, the proportion of essential words was determined via batch computer operations using a shell script programming language. Nine concepts indicative of executives’ innovation consciousness were chosen: “innovation,” “independence,” “research and development,” “scientific research,” “new products,” “new technologies,” “development,” “research,” and “patents.” The board report's total word count was divided by the total number of these words. This proportion represents the intensity of the awareness of innovation of the executives, mathematically defined as the total number of keywords reflecting this awareness, divided by the total word count of the board report segment in the annual report.

This study selected six indicators: the proportion of risky assets to total assets, the debt-to-asset ratio, the core profit ratio, the retention rate of earnings, the self-funding satisfaction rate, and the capital expenditure rate. The indicators corresponded to five aspects: asset structure, debt-paying ability, profit structure, profit distribution, and cash flow. The indicators are applied to assess the level of executive risk preference. This study gauged the R&D background of executives based on their R&D experience. Executives with an R&D background were assigned a value of 1; otherwise, 0.

Empirical analysisBaseline regressionTable 3 presents fintech’s influence on the manufacturing innovation quality of enterprises. Columns (1) and (2) present the results of the separate regression and the regression with control variables, respectively. As fintech elevates the innovation quality of manufacturing enterprises, we contend that it can effectively address the financing constraints of enterprises. It offers financial support for enterprise innovation. Traditional financial institutions favor lending to large and State-owned enterprises when making credit decisions. Nevertheless, small and medium-sized private enterprises encounter obstacles in securing adequate financial support. This is predominantly due to the absence of collateral and information asymmetry. The big data technology can collect sizeable data corresponding to various aspects, and present valuable insights based on streamlined data analysis. This offers financial institutions a more comprehensive and accurate portrait of enterprise information. Fintech platforms can more accurately align the supply and demand of funds by employing AI algorithms and big data analysis. This enables them to guide funds to enterprises and projects with the most significant innovation potential. Additionally, fintech can develop highly accurate risk-assessment models by employing technologies such as AI and big data. These models help enterprises comprehensively identify, evaluate, and manage various risks encountered during innovation. Consequently, the likelihood of innovation failure is diminished. Thus, fintech can significantly enhance the quality of innovation in manufacturing enterprises. H1 is valid.

The influence of financial technology on the innovation quality of manufacturing enterprises.

Robust t-statistics in parentheses, *** p < 0.01, ** p < 0.05, * p < 0.1.

The core explanatory variable in this study is data at the macro-city level, while the explained variable is data at the micro-enterprise level. The development of fintech in the areas where enterprises are located can impact the quality of their innovation. Conversely, it is unlikely that improving the innovation quality of a single enterprise will significantly impact the fintech development level of the entire city—reverse causality does not exist between the two. Nevertheless, endogeneity issues may persist because of factors such as measurement errors and omitted variables.

We draw upon the methodologies of Zheng et al. (2025) and apply the Relief Degree of Land Surface (RDLS) as an instrumental variable for the endogeneity test. This variable represents the elevation difference between the highest and lowest points in a given area. On the one hand, the RDLS does not impact the quality of corporate innovation, thereby fulfilling the exclusivity condition. This is because the inherent topographical characteristics are not directly causally linked to the internal innovation mechanisms of enterprises. On the other hand, the RDLS significantly influences the construction of internet infrastructure. In regions with a greater RDLS, the challenges and costs associated with laying optical cables, establishing networks, and constructing base stations escalate. Terrain complexity hinders seamless connectivity, impacting the development of digital infrastructure.

Consequently, the RDLS can—to a reasonable extent—mirror the development state of urban fintech, and exhibit a correlation with the level of fintech advancement. Specifically, a higher RDLS in a city implies greater difficulties in building internet infrastructure. This restricts the dissemination and development of fintech applications, leading to relatively weaker fintech development in these areas. Thus, the instrumental variables we have chosen satisfy the criteria of relevance and homogeneity.

This study employs the two-stage least squares method for regression examination. Regressions (1) and (2) in Table 4 present the endogeneity examination results using the RDLS as the instrumental variable. The Kleibergen-Paap rk LM statistic and the Cragg-Donald Wald F statistic are 14.1692 and 169.7651, respectively. These results indicate that the model has successfully passed the under-identification test and the weak instrumental variable test. The regression results of the second stage reveal that the influence of fintech on the innovation quality of manufacturing enterprises remains substantially positive, and the original regression results are robust.

Endogeneity test.

The citation frequency of enterprise patents is the initial metric applied to assess the quality of enterprise innovation in this study. However, indicator singularity may induce deviations in the research results. To further verify the model’s robustness, we employ the number of enterprises granted invention patents as an alternative indicator. Next, we re-run the regression analysis. Regression (1) in Table 5 presents the empirical results under this alternative indicator. The regression coefficient remains considerably positive when the number of granted invention patents of enterprises is utilized to evaluate innovation quality, as indicated by the results. This outcome is in accordance with the preceding conclusion. Consequently, the outcome of the initial regression analysis is resilient.

Robustness test.

Regression adopts bootstrap estimation standard errors and the number of bootstrap samples B = 500.

To further validate the robustness of the empirical outcomes, we utilized the Bootstrap approach for regression analysis. Bootstrap is a non-parametric statistical method, which generates multiple new samples by resampling the original sample. This procedure enables a highly accurate estimation of the distribution of model parameters. Consequently, it enhances the reliability and robustness of the estimation. In regression (2) in Table 5, we adopted the Bootstrap method and obtained conclusions aligned with the original results. Specifically, fintech’s positive influence on the innovation quality of manufacturing enterprises remained significant. This indicates that the model results were not significantly affected by changes in the estimation method. This analytical outcome further verifies the positive correlation between fintech and the innovation quality of manufacturing enterprises. It suggests that this result exhibits significant robustness under different estimation methods.

Analysis of moderating effectsExecutive innovation consciousnessExecutive innovation cognizance significantly influences the development of enterprise strategies and impacts the long-term development trajectory of enterprises. Executives with significant innovation cognizance can capitalize on the opportunities that fintech presents during the fast-paced fintech development wave. Executives with a keen sense of innovation can exploit these opportunities by actively promoting the deep integration of their enterprises with fintech. This integration helps optimize the allocation of resources and enhances the quality of enterprise innovation. Consequently, executives who favor innovation are more inclined to capitalize on the advancements in fintech. In this manner, they can address the financial constraints of manufacturing enterprises, thereby improving their quality of innovation. To test this mechanism, we introduce the variable of executive innovation consciousness and the interaction term between fintech and executive innovation consciousness. The empirical findings are summarized in Table 6 under regression (1). The interaction term coefficient between fintech and executive innovation consciousness is significantly positive. This suggests that executive awareness of innovation can dramatically enhance the impact of fintech on the quality of enterprise innovation. H2 is valid.

Analysis of moderating effects.

Executives with a high tolerance for risk are more likely to be open to novel experiences. They are willing to endure the uncertainties induced by the application of fintech and ready to accept the consequences of innovation failure. This enables enterprises to engage in high-risk, high-return innovation activities, improving the quality of innovation. Executives with a high-risk appetite are more inclined to select radical innovation strategies, which enable enterprises to achieve innovation breakthroughs more rapidly. Additionally, such executives are better at leveraging fintech for risk management. For instance, they can employ big data analytics to identify and assess risks and employ blockchain technology to mitigate transaction risks. Thus, the enterprise can control innovation risks more effectively, increase the probability of successful innovation, and enhance the quality of innovation. To test this mechanism, we introduce the variable of executive risk appetite and the interaction term between fintech and executive risk appetite. The empirical findings are presented in regression (2) in Table 6. The coefficient of the interaction term between fintech and executive risk appetite is substantially positive. This indicates that executives with a high-risk appetite can significantly elevate the impact of fintech, which improves the quality of innovation of enterprises. H3 is valid.

Executive’s R&D backgroundExecutives with an R&D background can better appreciate fintech’s technical principles and application scenarios and, therefore, formulate more effective fintech application strategies. They can integrate fintech with the enterprise’s existing technologies, business processes, and organizational structures more effectively, fostering a deep connection between fintech and the enterprise’s core business. Consequently, enterprises can conduct technological innovation with greater continuity, maintain a technological leading edge, and enhance the quality of innovation. Furthermore, executives with an R&D background can more accurately assess the technical feasibility, cost-effectiveness, and risks of different fintech solutions, which enables them to select the most suitable solutions for the enterprise. To evaluate this mechanism, we introduce a fictitious variable that denotes whether the executives have an R&D background and the interaction term between fintech and the placeholder. The empirical results are presented in regression (3) in Table 6. The interaction term coefficient between fintech and the R&D background of the executives is significantly positive. This suggests that executives with an R&D background can considerably improve the quality of enterprise innovation by leveraging fintech. H4 is valid.

Heterogeneity analysisThis study groups the samples based on four aspects to investigate fintech’s discrepant influences on different types of enterprises. These aspects include whether the enterprises are high-tech, whether their internal control is effective, whether they are located in fintech pilot cities, and whether they are State-owned enterprises. Thereafter, the study conducts regression analyses to examine fintech’s impact on the innovation quality of manufacturing enterprises under different circumstances.

Technological heterogeneityDepending on whether the enterprises were considered high-tech or not, the sample was divided into two categories: high-tech enterprises and non-high-tech enterprises. Subsequently, group regressions were conducted for each category. The regression results for high-tech and non-high-tech enterprises are presented in (1) and (2) of Table 7, respectively. Intriguingly, we identified a substantial positive correlation between the innovation quality of high-tech enterprises and fintech. However, this correlation was not significant for non-high-tech enterprises. The Chinese government accords immense importance to scientific and technological innovation. Particularly, it encourages high-tech enterprises to invest in and innovate technologically, facilitating their acquisition of financial support more readily than other enterprises, thereby enhancing their innovation quality. Fintech is instrumental in facilitating the digital transformation of enterprises and improving technological support. By introducing advanced technologies, such as AI, big data, and blockchain, fintech enables enterprises to construct intelligent and efficient digital platforms. From a theoretical mechanism perspective, high-tech enterprises possess a robust technological foundation and immense innovation capabilities, which enables their effective integration with fintech, leading to better innovation quality. In contrast, non-high-tech enterprises have relatively low technological levels. Consequently, their ability to absorb and apply fintech is limited. This leads to an inconspicuous effect on fintech innovation quality. Consequently, fintech can significantly improve innovation quality in high-tech enterprises, not non-high-tech ones.

Analysis of the heterogeneity of enterprise technology and the heterogeneity of enterprise internal control.

Internal control is a key component of corporate governance. It prevents excessive concentration and abuse of management power, effectively guiding enterprises in making innovation investments. Its efficacy directly influences the efficiency of fintech utilization of enterprises and the quality of innovation. High-quality internal control enables enterprises to optimize their organizational structure and achieve mutual supervision and checks among internal directors, supervisors, and management. This mitigates the agency conflict between owners and managers regarding innovation investment. Furthermore, enterprises may improve their information transparency by implementing adequate internal controls. It promotes more comprehensive low-carbon information disclosure by enterprises. This facilitates the supervision by the external market over the innovation investment of enterprises, which fosters enterprise innovation. Based on this, we divided enterprises into two groups depending on the effectiveness of internal control for regression analysis and conducted inter-group difference tests. The regression results are presented in Columns (3) and (4) of Table 7.

The analysis indicates that when an enterprise’s internal control is effective, fintech’s positive effect on innovation quality is significant; similarly, when the former is ineffective, the latter is insignificant. This finding suggests that sound internal control can augment fintech’s positive effect and enhance enterprise innovation quality.

Policy heterogeneityIn 2011 and 2016, the Chinese government established two batches of pilot cities for the integration of science and technology with fintech. These cities serve as crucial testing fields for the advancement of fintech and provide a boost to the innovation initiatives of local enterprises. We divided the sample into two groups based on whether the cities where the enterprises are located are fintech pilot cities. The empirical results for enterprises in pilot and non-pilot cities are displayed in Columns (1) and (2) of Table 8. The development of fintech significantly enhances innovation quality in manufacturing enterprises. This effect is observed in both pilot cities and non-pilot cities. However, the effect is more pronounced in pilot cities.

Analysis of policy heterogeneity and heterogeneity of enterprise property rights.

This result suggests that policy pilot cities foster a more conducive environment for the advancement of fintech. They achieve this by offering policy support, financial investment, and technological infrastructure development. Enterprises in pilot cities can access and apply fintech earlier and on a broader scale, and implement advanced technologies such as big data, cloud computing, and AI before others. Consequently, they can achieve a remarkable improvement in the quality of innovation. Additionally, pilot cities typically gather many fintech enterprises and innovative talent, creating a favorable innovation ecosystem that promotes the enhancement of enterprise innovation quality. In contrast, enterprises in non-pilot cities lack policy support and resource input, leading to sluggish fintech application and development and less conspicuous improvement in innovation quality. Thus, fintech development has greater impact on enterprises in pilot cities.

Heterogeneity of property rightsThe nature of property rights is a key factor influencing the innovation behavior and innovation quality of enterprises. This study classifies enterprises into two groups depending on the nature of their property rights: State-owned enterprises and non-State-owned enterprises. Regressions are conducted for each group separately. The empirical results of the two samples, namely State-owned and non-State-owned enterprises, are presented in Columns (3) and (4) of Table 8. We identified that fintech significantly improves the content of innovation. This effect is more pronounced in State-owned enterprises than on non-State-owned ones. This finding suggests that State-owned enterprises typically enjoy greater support from the government, and, therefore, financial institutions are more inclined to offer them loans. Furthermore, the development of fintech enables these enterprises to access financial support and technological resources more conveniently. Thus, compared to non-State-owned enterprises, they can significantly improve their innovation quality. Moreover, State-owned enterprises constitute an essential macro-control tool of the State and respond actively to national policy calls; therefore, they can better utilize fintech, leading to greater innovation. Thus, the innovation quality of State-owned enterprises is more significantly influenced by fintech.

Research conclusions and policy recommendationsResearch conclusionsAn empirical study based on data from 2834 listed companies from 2010 to 2022 indicates that fintech, as measured by the urban fintech index, can significantly improve the innovation quality of manufacturing enterprises. Further investigations reveal that the characteristics of the top management team constitute a crucial moderating mechanism. Specifically, when corporate executives possess a keener sense of innovation, a higher risk tolerance, or an R&D background, the promotional effect of fintech on innovation quality is significantly amplified. This finding transcends the traditional research framework that solely focuses on the direct influence of executives on innovation. This pioneering research systematically clarifies the moderating pathways of micro-decision-making entities in the process of technological dissemination. Its positive impact on innovation quality is more pronounced in high-tech enterprises, enterprises with effective internal control systems, State-owned enterprises, and enterprises located in policy pilot cities.

Fig. 1 systematically integrates the three key findings regarding the influence on innovation quality: the main effect of technological empowerment, the moderating mechanism of the top management team, and the multi-dimensional heterogeneous boundaries. In contrast to the single-perspective limitations of previous research, these conclusions not only refine the quality-oriented transmission chain within the technology-organization fit theory but also provide a scientific foundation for formulating hierarchical policies and optimizing corporate management.

Policy recommendationsInitially, the government should develop policies to empower fintech in high-tech enterprises and pilot cities, focusing on regions with concentration of high-tech industries. Special subsidies and tax incentives could encourage the adoption of blockchain for intellectual property management and big-data risk control. Furthermore, a fintech-industrial innovation platform should be established to enhance policy support precision.

Subsequently, a mechanism to foster digital capabilities among executives should be established. Enterprises should implement fintech training for administrators, integrating digital awareness into performance evaluations. The government should establish a Manufacturing Innovation-Oriented Executive Talent Fund and subsidize enterprises hiring executives with fintech or R&D credentials.

Third, the collaboration between internal control and fintech should be optimized to align organizational capabilities with technology. Regulatory authorities should include fintech in internal control evaluation and disclose fintech investment links in annual reports, particularly blockchain application in supply chain finance. The government can offer tailored fintech solutions for small and medium-sized enterprises, including AI-based R&D fund monitoring.

Fourth, support policies for State-owned and non-State-owned enterprises should differ. State-owned enterprises should focus on fintech for core tech R&D, using a Digital Innovation Fund to develop industry-specific platforms. Non-State-owned enterprises, especially SMEs, should be encouraged to adopt inclusive fintech services such as supply chain finance + blockchain to address financing and tech transformation challenges.

FundingThis research was supported by the National Social Science Fund of China (20CSH064).

CRediT authorship contribution statementXiao Zhang: Writing – review & editing, Methodology, Conceptualization. Zheng Huang: Writing – original draft. Xiaoyu Liu: Validation, Supervision. Yanbo Rong: Writing – review & editing, Data curation.

☆The usual disclaimer applies.