Even though sustainable resource use has become a strategic priority, there remains limited empirical evidence on how board diversity influences water and energy efficiency, particularly in emerging economies such as those in Latin America. Accordingly, this study investigates the relationship between board diversity and resource efficiency, specifically water and energy consumption, within Latin American firms. Drawing on a sample of non-financial companies listed in Pacific Alliance countries (Chile, Colombia, Mexico, and Peru) from 2018 to 2023, we employ mixed-effects multiple linear regression to evaluate the influence of structural and demographic board characteristics on resource efficiency. The findings indicate that demographic diversity, particularly gender representation, female board leadership, director age, tenure, and international education, is significantly associated with improved resource efficiency. The presence of women on boards, especially in chair positions, is positively linked to water efficiency, suggesting that female leadership contributes strategically to sustainable resource management. Among structural variables, board independence exerts the strongest positive influence on both water and energy efficiency. These results underscore the critical role of board composition in advancing Sustainable Development Goals 6 and 7 while demonstrating that different dimensions of diversity may affect water and energy management through distinct mechanisms. This study contributes to the literature by developing diversity indices tailored to emerging markets, establishing empirical links between governance features and sustainability outcomes, and offering actionable insights for policymakers and corporate leaders in Latin America. The findings reinforce the importance of promoting diversity in top management to enhance organisational practices aligned with global sustainability goals.

Corporate sustainability has gained increasing relevance in response to stakeholder pressure, evolving international regulations, and global challenges such as climate change and resource scarcity (Armin Razmjoo et al., 2020; Bebbington & Unerman, 2018; García-Sánchez et al., 2025; Moratis & Brandt, 2017; Rosati & Faria, 2019; Van Zanten & Van Tulder, 2018). Within this context, the efficient use of water and energy, aligned with Sustainable Development Goals (SDGs) 6 and 7, has become a strategic priority. However, limited empirical research has examined the impact of board diversity on the efficient use of these resources, particularly in emerging Latin American economies.

This study addresses that gap by analysing the relationship between board diversity—both structural (size, independence, ownership, and duality) and demographic (gender, female chair, female CEO, tenure, age, international education, and foreign directors)—and economic efficiency in water and energy use among firms in the Latin American Integrated Market (MILA), composed of countries in the Pacific Alliance. In doing so, it contributes to the literature on corporate sustainability and governance by providing empirical evidence from a relatively underexplored region, while also offering practical insights for more equitable and sustainable resource management.

Boards of directors play a central role in shaping organisational strategy and performance (Kagzi & Guha, 2018). A diverse board, encompassing varied experiences, perspectives, backgrounds, and qualifications, enhances decision-making quality and strengthens corporate governance. The literature suggests that attributes such as age, gender, ethnicity, nationality, experience, education, independence, and board seniority influence governance and firm performance (Adams & Ferreira, 2009; Al-Musali & Ku Ismail, 2015; Harjoto et al., 2019; Harjoto & Rossi, 2019). Notably, greater gender diversity on boards has been associated with increased use of renewable energy and improved environmental performance (Atif et al., 2021).

Focusing on the Pacific Alliance countries (Chile, Colombia, Mexico, and Peru), this study explores the link between board diversity and efficiency in water and energy use. These countries share several corporate governance and ownership structure characteristics, yet differ in the maturity and stringency of their environmental, social, and governance (ESG) and sustainability disclosure frameworks. This contrast provides a compelling setting in which to examine how board diversity relates to resource efficiency.

This regional context is salient for several reasons. First, Latin America faces significant sustainability challenges related to natural resources. Second, corporate boards in the region exhibit relatively low levels of diversity. For instance, it is estimated that approximately 92 % of board seats in Latin America are held by men (Marquez-Cardenas et al., 2022; Zehnder, 2018), indicating a pronounced underrepresentation of women in senior leadership roles. These findings align with recent studies by Pinheiro et al. (2024) and Pombo et al. (2022), which underscore the significance of gender diversity, as well as human and relational capital, in enhancing corporate sustainability and performance in Latin America. Although efforts to promote sound corporate governance and inclusion mechanisms have been undertaken in regional capital markets, empirical evidence on how diversity affects sustainability outcomes remains scarce.

Theoretically, this study draws on agency theory (Fama & Jensen, 1983; Jensen & Meckling, 1976) and resource dependence theory (Barney, 1991), both of which provide complementary lenses through which to understand the role of board diversity in advancing organisational sustainability. From the perspective of agency theory, a diverse board strengthens internal control mechanisms, enhancing oversight and mitigating managerial opportunism (Poletti-Hughes & Briano-Turrent, 2019). Resource dependence theory, in contrast, highlights the strategic value of board members as providers of human capital, whose knowledge, experience, and external connections enhance a firm’s capacity to adapt, innovate, and create value (Penrose, 1959; Richard, 2000; Yilmaz et al., 2021). In this regard, board diversity is linked not only to financial performance but also to non-financial outcomes, such as the efficient use of key natural resources (Newbert, 2007; Wan et al., 2011).

Despite progress in expanding access to basic services across Latin America and the Caribbean, significant disparities persist. Approximately 75 % of the population has access to safely managed drinking water services, leaving around 161 million people without adequate access (CEPAL, 2022). In the energy sector, access reaches 97 %, yet 17 million people remain without electricity (CEPAL, 2022). These deficiencies, exacerbated during the COVID-19 pandemic, disproportionately affect rural and vulnerable populations.

Within the Pacific Alliance, overall service coverage is high, though structural disparities remain. Chile and Colombia approach universal coverage in both water and electricity (Statista, 2022; World Bank, 2023; La Silla Vacía, 2023), and both are transitioning their energy matrices towards cleaner sources (World Economic Forum, 2023). Nonetheless, each faces pressing environmental challenges. Chile, for example, is grappling with a prolonged drought, necessitating alternative water sources such as desalination. Colombia continues to address urban–rural disparities and has initiated reforms to strengthen water governance (Data Who, 2024).

Mexico and Peru, while also reporting water coverage above 90 %, face challenges related to service quality, continuity, and governance (DAPA, 2023; Apoyo Consultoría, 2023). In both countries, territorial inequalities, institutional fragmentation, and insufficient infrastructure in rural areas hinder reliable access. While electricity coverage exceeds 95 %, some isolated communities still depend on decentralised energy solutions.

Beyond the governance–performance nexus, this study posits that board diversity also operates through an innovation channel. Heterogeneous boards increase cognitive diversity, expand external networks, and enhance absorptive capacity, thereby enabling firms to identify, evaluate, and implement innovations in governance and operations that improve resource efficiency. Drawing on resource dependence theory and the absorptive capacity literature (Cohen & Levinthal, 1990; Pfeffer & Salancik, 2015), the presence of directors with diverse backgrounds, international exposure, and independent status enhances firms’ access to specialised knowledge and best practices in eco-efficiency (Hart, 1995; Russo & Fouts, 1997).

This innovation dynamic is particularly relevant in Latin American emerging markets, where ESG and climate-related regulatory frameworks are becoming more stringent, yet information asymmetries remain. Board diversity facilitates the adoption of innovations, such as advanced metering, circular water management, or energy intensity indicators, that directly contribute to greater resource efficiency. Recent evidence indicates that board characteristics (e.g. size, independence, gender diversity, and international experience) influence sustainability disclosure and performance in the region (Correa-García et al., 2020; Pombo et al., 2022). This study extends that argument by suggesting that such attributes not only improve oversight but also activate innovation mechanisms that promote more efficient resource use.

Accordingly, the objective of this research is to examine the relationship between board diversity, both structural and demographic, and efficiency in the use of water and energy in firms across the Pacific Alliance, in alignment with SDGs 6 and 7. The study seeks to generate empirical evidence from emerging economies, contribute to scholarly discourse on sustainability and corporate governance, and offer practical insights for designing inclusive and sustainable business strategies. It recognises that progress in this domain depends not only on regulatory frameworks but also on the active engagement of the private sector in promoting equity, diversity, and sustainability (Bebbington & Unerman, 2018; Fuso Nerini et al., 2018; Rosati & Faria, 2019; Zhao & Shi, 2025).

The remainder of this paper is structured as follows: Section 2 outlines the theoretical framework, reviews relevant literature, and presents the study’s hypotheses. Section 3 describes the research methodology and data. Section 4 presents the empirical results. Section 5 discusses the findings and concludes.

Literature review and study hypothesesTheoretical backgroundThis study is grounded in agency theory (Fama & Jensen, 1983; Jensen & Meckling, 1976) and resource dependence theory (Pfeffer & Salancik, 2015; Reitz, 1979; Richard, 2000). These frameworks offer complementary perspectives on the role of board diversity and its influence on the efficient use of natural resources within the sustainability agenda.

Agency theory and corporate governanceAgency Theory examines the relationship between principals (owners or shareholders) and agents (managers or executives), highlighting the potential misalignment of interests that generates agency conflicts and costs (Jensen & Meckling, 1976). Given that managers may pursue personal objectives over shareholder value, governance mechanisms, such as boards of directors, are necessary to monitor behaviour and mitigate these risks (Eisenhardt, 1989).

The board of directors serves as a central governance mechanism that reduces information asymmetry and ensures managerial decisions align with corporate goals (Fama & Jensen, 1983). Traditionally, this theory has focused on board independence and size as key oversight factors. However, more recent studies indicate that diversity in board composition, whether structural (e.g., size, independence, ownership, duality) or demographic (e.g., gender, age, background, international experience), enhances oversight quality and strategic decision-making (Adams & Ferreira, 2009; Harjoto & Rossi, 2019).

In this context, board diversity can enhance the efficiency of natural resource use by promoting varied perspectives, rigorous debate, and more effective monitoring of sustainable strategies. Inefficiencies in water and energy usage often arise from short-term incentives or weak oversight. A diverse board is better positioned to support sustainable resource management (Poletti-Hughes & Briano-Turrent, 2019).

Resource dependence theory and the strategic role of the boardResource dependence theory (Pfeffer & Salancik, 2015) posits that firms operate within interdependent environments and must acquire and manage critical resources to succeed. Boards of directors’ function as intermediaries between the firm and its external environment, facilitating access to strategic information, networks, and essential resources (Hillman et al., 2000).

Unlike agency theory, which centres on control mechanisms to reduce agency costs, resource dependence theory underscores the strategic value of boards in contributing human and social capital. Diverse boards offer broader expertise, experience, and skill sets, enabling firms to respond more effectively to regulatory shifts and environmental challenges (Alkharafi et al., 2024; Barney, 1991; Yilmaz et al., 2021).

Regarding water and energy efficiency, board diversity can contribute specialised knowledge in sustainable practices, innovation, and regulatory compliance, supporting the implementation of resource-optimising strategies (Richard, 2000). Furthermore, as sustainability becomes a growing concern among investors and stakeholders, board diversity enhances the firm's responsiveness and strengthens its competitive advantage in emerging markets (Newbert, 2007; Wan et al., 2011).

Although these two theories approach board roles from distinct angles, their integration offers a comprehensive understanding of how board diversity, both structural and demographic, affects resource efficiency and sustainable management.

Sustainable development and its relationship with water and energy consumption in Latin AmericaSustainable development is defined as the pursuit of meeting present needs without compromising the capacity of future generations to meet theirs (Toumi et al., 2017). While historically the OECD countries have been the primary energy consumers, energy use in developing economies has doubled over the past three decades (Niu et al., 2011). Advancing sustainable development requires improving energy security, reducing greenhouse gas emissions, limiting environmental damage from energy production and consumption, managing water resources efficiently, and ensuring universal access to clean water and energy.

Latin America and the Caribbean (LAC) comprise around 9 % of the global population and contribute approximately 7 % of global GDP (World Bank, 2023). In energy terms, the region accounts for roughly 6 % of global consumption and 5 % of energy-related CO₂ emissions (International Energy Agency, 2023). Despite encompassing 33 countries and territories, the region exhibits marked economic disparities: in 2022, GDP per capita ranged from approximately USD 15,500 in Chile to USD 6800 in Colombia (World Bank, 2023).

Moreover, LAC is particularly vulnerable to climate change. According to reports by CEPAL and other agencies, without substantial intervention, climate change could cost the region over 140 % of its current GDP by the end of the century (CEPAL, 2022; Chang & Soruco Carballo, 2011).

Several LAC countries have advanced renewable energy transitions. Brazil, Mexico, Chile, and Colombia have diversified their energy matrices by integrating wind, solar, and hydroelectric technologies. For instance, in 2015, Mexico and Chile ranked among the world’s top 10 markets for renewable energy (International Renewable Energy Agency, 2016). More recent data confirm an increasing share of renewables in the region’s electricity mix (International Energy Agency, 2023). However, dependence on fossil fuels remains significant: in 2013, oil accounted for nearly 46 % of the primary energy supply, and natural gas represented about 23 % of electricity generation. Projections suggest that by 2030, approximately 10 million people in the region may still lack access to electricity, requiring an additional 10 TWh in generation capacity and significant investment (Sheinbaum-Pardo & Ruiz, 2012).

LAC holds approximately 34 % of the world's renewable freshwater resources, estimated at 18.5 billion cubic metres annually, with a per capita availability of around 3000 m³ per year (United Nations World Water Assessment Programme [WWAP], 2015; Food & Agriculture Organization, 2021). Nevertheless, while countries such as Chile and Mexico report potable water coverage exceeding 95 %, access remains lower in Colombia (circa 90 %) and Peru (approximately 85 %) (Food & Agriculture Organization, 2021; Urquiza & Billi, 2020). These statistics suggest that despite progress in infrastructure, water crises persist, driven by poor management, inadequate infrastructure, and unequal access, particularly in rural areas (Batista Mattos et al., 2019; Bezerra et al., 2022).

Water governance in LAC has been heavily shaped by neoliberal models. In Chile, for example, private investment accounts for 86 % of water infrastructure (Rodríguez et al., 2022), which complicates the enforcement of the right to water, a right that is constitutionally protected in some countries but not in others.

Agriculture consumes approximately 68 % of the region’s freshwater supply and must adopt more efficient and sustainable practices to ensure long-term viability (Mahlknecht et al., 2020). Water regulation varies significantly across the region, and coordination is often hampered by limited communication, insufficient technical capacity, and inadequate data access. These factors exacerbate inefficient water use and generate conflicts over resource management (Akhmouch, 2012; Dourojeanni, 2001; Guzmán-Arias & Calvo-Alvarado, 2013).

In conclusion, although LAC has made notable strides in extending access to water and energy, persistent challenges remain concerning quality, continuity, equity, and integrated management. The literature reveals a scarcity of comprehensive studies linking water and energy efficiency with sustainable development in the region, underscoring the need for further research to promote the global optimisation of resource use.

Board diversity and resource efficiencyThe adoption of sustainable practices and the response to climate change challenges have prompted companies to reassess their corporate governance. Within this context, board diversity emerges as a crucial factor in enhancing strategic decision-making, optimising resource use, such as water and energy, and thereby strengthening sustainable performance. As illustrated in Fig. 1, this study categorises board diversity into two dimensions: structural and demographic (Hafsi & Turgut, 2013). Structural diversity establishes the formal governance framework and oversight capacity, while demographic diversity contributes valuable cognitive and social perspectives to sustainable decision-making.

Structural diversity refers to the board’s formal and organisational characteristics, including its size, member independence, ownership composition, and role duality (where the CEO also serves as chairman). Agency theory (Fama & Jensen, 1983; Jensen & Meckling, 1976) emphasises the importance of these features in enabling the board to oversee and align managers’ interests with those of shareholders. A larger board or greater independence may enhance corporate decision-making, particularly in relation to resource efficiency.

Research indicates that a board structure promoting functional diversity and separation of powers encourages more effective, sustainable strategies by reducing managerial capture and fostering critical thinking (Adams, de Haan, Terjesen & Van Ees, 2015; Miller & Del Carmen Triana, 2009). Additionally, well-structured boards tend to disclose more sustainability information (Al-Shaer & Zaman, 2016; Rao & Tilt, 2016).

While increased board size can broaden perspectives and better represent stakeholder interests (Luoma & Goodstein, 1999), it may also create coordination challenges. Romano et al. (2018) found that companies with more than six board members are generally more efficient in water management. Board independence enhances oversight, and owner-directors help align long-term interests (Singhania et al., 2023; Artif et al., 2021; Fasan & Mio, 2017). Conversely, leadership duality tends to weaken board independence, diminishing oversight quality and hindering environmental policy implementation (Artif et al., 2021; Jensen & Meckling, 1976; Romano et al., 2018). Drawing on these insights, the following structural hypotheses regarding water and energy efficiency in the Latin American context are proposed:

H1: Structural differences influence energy consumption efficiency.

H1a:Larger board size is positively associated with energy efficiency.

H1b:Higher proportion of independent directors is positively associated with energy efficiency.

H1c:Owner-directorship is positively related to energy consumption efficiency.

H1d:Leadership duality is negatively associated with energy efficiency.

H2: Structural differences influence water consumption efficiency.

H2a:Larger board size is positively associated with water efficiency.

H2b:Higher proportion of independent directors is positively associated with water efficiency.

H2c:Owner-directorship is positively related to water consumption efficiency.

H2d:Leadership duality is negatively associated with water efficiency.

Demographic diversity includes personal attributes such as gender, age, international experience, educational background, and board tenure. Resource dependence theory (Barney, 1991; Pfeffer & Salancik, 2015) suggests these characteristics enhance the board’s human and social capital, improving access to external knowledge and resources essential for sustainability.

Previous studies link female board representation with greater sensitivity to social and environmental issues and improved sustainability reporting quality (Alkharafi, 2024; Barako & Brown, 2008; Karim, 2021b). Atif et al. (2021) find that a higher proportion of female directors correlates positively with increased adoption of clean energy, supporting the view that women in leadership promote ambitious environmental initiatives. Furthermore, female CEOs tend to reduce energy consumption, indicating that significant female presence in top management fosters sustainable practices. Thus, gender diversity may broaden ethical perspectives within the board, enhancing resource efficiency and corporate environmental performance.

Director age is often considered a proxy for experience and prudence, favouring long-term decision-making (Coles et al., 2008; Romano et al., 2018). Directors with international experience, cultural diversity, and varied age profiles enrich strategic discussions and promote innovative solutions for efficient water and energy use (Ali et al., 2014; Müller, 2014). Romano et al. (2018) report that companies are less efficient in water management when most board members lack advanced academic qualifications. Based on this theoretical and empirical evidence, the following demographic hypotheses on water and energy efficiency are proposed:

H3: Demographic differences influence energy consumption efficiency.

H3a:Higher proportion of females on the board is positively associated with energy efficiency.

H3b:Having a female chairperson is positively associated with energy efficiency.

H3c:Female CEO is positively associated with energy efficiency.

H3d:Board tenure is positively related to energy consumption efficiency.

H3e:Board age is positively associated with energy efficiency.

H3f:Presence of directors with international education is positively associated with energy efficiency.

H3g:Presence of foreign directors is positively associated with water efficiency.

H4: Demographic differences influence water consumption efficiency.

H4a:Higher proportion of females on the board is positively associated with water efficiency.

H4b:Having a female chairperson is positively associated with water efficiency.

H4c:Female CEO is positively associated with water efficiency.

H4d:Board tenure is positively related to water consumption efficiency.

H4e:Board age is positively associated with water efficiency.

H4f:Presence of directors with international education is positively associated with water efficiency.

H4g:Presence of foreign directors is positively associated with water efficiency.

This section outlines the procedure followed for sample selection, defines the variables used in the analysis, and describes the methods employed to empirically validate the proposed hypotheses.

SampleThis study focuses on firms listed on the MILA Pacific Alliance index, comprising 492 companies traded on the stock exchanges of Peru, Chile, Colombia, and Mexico. The period of analysis spans from 2018 to 2023. These developing economies have experienced significant growth in recent years and play an increasingly important role in the global economy (Chandy & Narasimhan, 2015; Kearney, 2012). They are home to a substantial proportion of the global population and exhibit considerable cultural diversity (Kearney, 2012; Sudhir et al., 2015; Yilmaz et al., 2021). Moreover, these countries possess abundant natural resources and rich biodiversity, positioning them at the forefront of global sustainability debates. For these reasons, the study focuses on firms operating within Pacific Alliance countries.

These four markets exhibit: (i) shared institutional characteristics, including a civil law origin, high ownership concentration, the prominent role of business and family groups, and integration via MILA, facilitating comparability in corporate governance and disclosure practices; and (ii) notable differences in the development and enforcement of governance codes, the existence of diversity mandates, and ESG and climate risk reporting requirements. This configuration provides a ‘natural laboratory’ for examining how board diversity, both structural and demographic, affects sustainability outcomes in a region marked by resource constraints and an evolving regulatory landscape.

Data on water and energy consumption disclosures, as well as board characteristics, were collected from non-financial reports available on corporate websites. Financial and accounting data were obtained from the Refinitiv Eikon database. Companies were selected based on three criteria: they must be non-financial, disclose information on water and energy management, and report board composition characteristics.

Table 1 presents the final sample, comprising 95 firms observed annually from 2018 to 2023, yielding 570 firm-year observations. The sample is dominated by firms from Chile (39 %) and Mexico (37 %), followed by Peru (17 %) and Colombia (7 %).

Dependent, independent and control variablesTwo dependent variables are constructed to assess the firms’ economic efficiency in the use of water and energy resources. Water economic efficiency is defined as the ratio of total revenue to net water consumption. Net water consumption is calculated as water extracted or produced, plus water recycled or reused, minus water discharged. Energy economic efficiency is measured as the ratio of total revenue to total energy consumption, the latter being the sum of renewable and non-renewable energy consumed by the firm. These variables capture firms' effectiveness in utilising key natural resources, a critical dimension of corporate sustainability.

The independent variables are grouped into two indices: one measuring structural board diversity (ISD) and the other, demographic board diversity (IDD). Both indices comprise 11 variables, as detailed in Table 2. The use of composite indices is well established in the corporate governance literature (Bebchuk et al., 2009; Hafsi & Turgut, 2013), and pluralism indices have previously been applied to quantify board diversity (Molz & Boman, 1995). Each index was constructed using a tercile-based method. Following Hafsi and Turgut (2013), continuous variables were divided into terciles and assigned scores of 0 (below average), 1 (average), and 2 (above average). Dichotomous variables were coded as 0 or 1.

Independent and control variables.

In total, 11 independent variables related to board composition and structure were included, based on prior literature (Arayssi, Jizi & Tabaja, 2020; Barako & Brown, 2008; Cicchiello, Fellegara, Kazemikhasragh & Monferrà, 2021; Fasan & Mio, 2017; Filatotchev & Nakajima, 2014; Nicolò, Zampone, Sannino & De Iorio, 2022; Pareek, Sahu & Gupta, 2023; Singhania et al., 2023), and adapted to the context of this study. Control variables were introduced to mitigate potential sources of bias. All monetary values were standardised to thousands of US dollars. Total assets were log-transformed, while leverage was defined as total liabilities divided by total assets, consistent with prior research (Correa-García et al., 2020; Cuadrado-Ballesteros et al., 2015; El Ghoul et al., 2016; Grougiou et al., 2016; Michelon et al., 2015). Industries were classified according to the Standard Industrial Classification system. Full details of all variables are presented in Table 2.

Model and analysis techniqueThe study employs eight models, four focusing on structural diversity and four on demographic diversity, to disaggregate and more precisely examine how each diversity dimension affects resource efficiency. Separate models are developed for water and energy efficiency, as the determinants and dynamics for each resource are likely to differ. Both composite indices (ISD and IDD) and individual variables are used to assess overall effects and identify the specific drivers of sustainable performance. This multi-model strategy enhances the robustness of the findings by testing consistency across aggregated and disaggregated governance measures.

To test the study’s hypotheses, multiple linear mixed-effects regression models were employed. These models are well-suited for data with hierarchical or nested structures, as they account for both fixed and random effects. This allows for the control of unobserved heterogeneity and intra-group correlation, thereby increasing the reliability of the results. Mixed-effects models are widely used across the social sciences for these reasons (Snijders & Bosker, 2012).

The models were estimated using the lme4 package in R, employing Restricted Maximum Likelihood estimation. Initially, all independent and control variables were included. Subsequently, two simplified model versions were estimated, retaining only variables with statistically significant coefficients (p < .05). The final model specifications are as follows:

Structural board diversity variables and their impact on water and energy efficiency:

Model 1: Log(Energy Efficiency) = ß0 + ß1·ISD + ß2· Assets + ß3· Leverage + (1 | Company) + eij

Model 2: Log(Water Efficiency) = ß0 + ß1·ISD + ß2· Assets + ß3· Leverage + (1 | Company) + eij

Model 3: Log(Energy Efficiency) = ß0 + ß1·Independence + ß2· Leverage + + ∑jγj·Country++∑jγj·Industry+(1|Company)+ eij

Model 4: Log(Water Efficiency) = ß0 + ß1·Independence + ß2· Assets + ß3· Leverage + ∑jγj·Country++∑jγj·Industry+(1|Company)+ eij

Demographic board diversity variables and their impact on water and energy efficiency:

Model 5: Log(Energy Efficiency) = ß0 + ß1·IDD + ß2· Leverage +(1 | Company) + eij

Model 6: Log(Water Efficiency) = ß0 + ß1·IDD + ß2·Assets + ß3· Leverage ∑jγj·Industry+(1|Company)+eij

Model 7: Log(Energy Efficiency) = ß0 + ß1·FemaleChair + ß2· Age + ß3· Tenure + ß4· Studies Abroad + ß5· Leverage + ∑jγj·Country++∑jγj·Industry+(1|Company)+ eij

Model 8: Log(Water Efficiency) = ß0 + ß1·FemaleDirectors + ß1·FemaleChair + ß2· Age + ß3· Tenure + ß4· Assets + ∑jγj·Country++∑jγj·Industry+(1|Company)+ eij

Model performance was evaluated using the Akaike Information Criterion and the Bayesian Information Criterion. Variance inflation factors (VIFs) confirmed the absence of multicollinearity, while heteroscedasticity tests indicated constant residual variance. This comprehensive methodological approach ensures the robustness of the findings and strengthens the validity of the relationships observed between board diversity and resource efficiency.

ResultsThis section begins with a descriptive analysis of the study sample, followed by a multiple linear mixed-effects regression to examine relationships among the variables.

Descriptive statisticsTable 3 presents descriptive statistics for both continuous and categorical variables. On average, boards comprise 10 directors, with a range of 3 to 20 and moderate dispersion. Of these, 12.17 % are women, though this proportion varies substantially across firms. The average tenure is 9.5 years, indicating significant experience but also considerable variability. Independent directors typically constitute less than half of the board, though this proportion differs widely, reflecting varying levels of independence. Similarly, the proportion of owner-directors varies across companies, which may affect strategic decision-making and board autonomy.

Descriptive statistics.

The mean age of board members is 61 years, ranging from 48 to 76.5. Slightly over 20 % are foreign, suggesting a notable, albeit not dominant, international presence. This variable also exhibits considerable heterogeneity, as some firms have high foreign representation while others have none. Among foreign directors, approximately half have received an international education, though this too varies across firms.

With respect to control variables, total assets show a high standard deviation, indicating substantial differences in firm size. Leverage data reveal that, on average, firms finance 56 % of their assets through debt, with a maximum value of 1.5, suggesting that some firms carry high levels of indebtedness. The Structural Diversity Index (ISD) ranges from 1 to 7, with a mean of 3.70 (SD = 2.03), indicating moderate variability in structural board characteristics. The Demographic Diversity Index (IDD) ranges from 0 to 11, with a mean of 4.71 (SD = 2.33), similarly suggesting considerable demographic variation across boards.

For the dependent variables, energy efficiency (logged) has a mean of 5.97 (SD = 2.15), indicating substantial variation. The data suggest that some firms demonstrate very low energy efficiency, whereas others perform significantly better. Water efficiency (logged) shows a mean of 0.58 (SD = 2.66), also indicating a wide range, with firms varying considerably in performance.

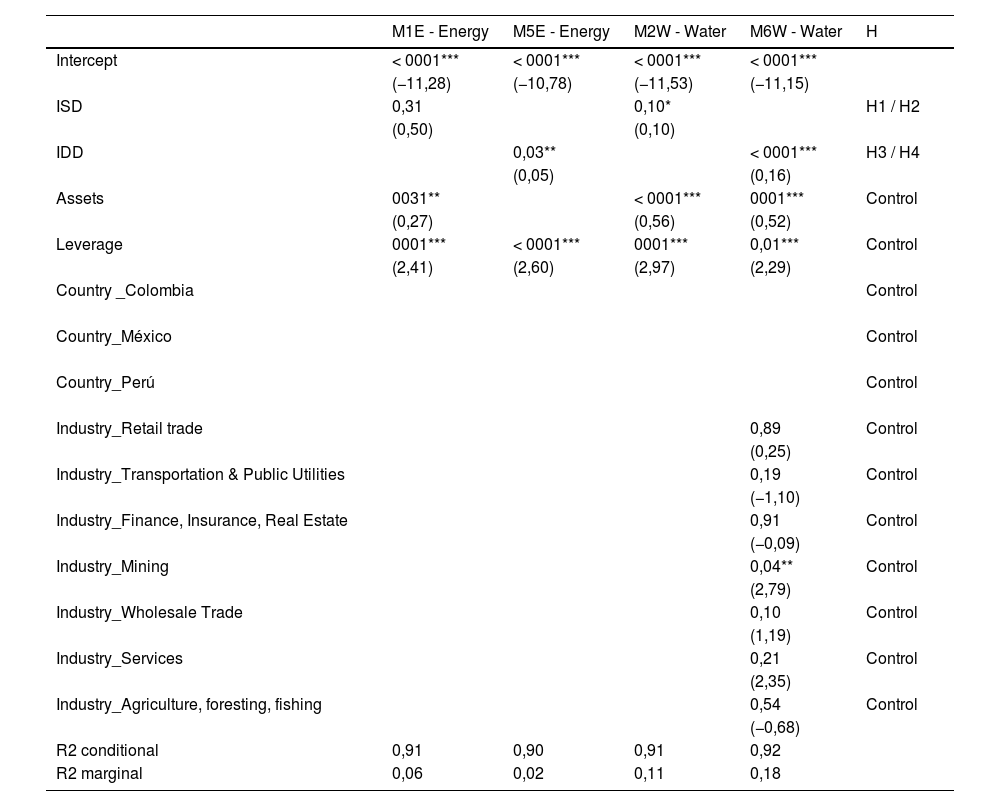

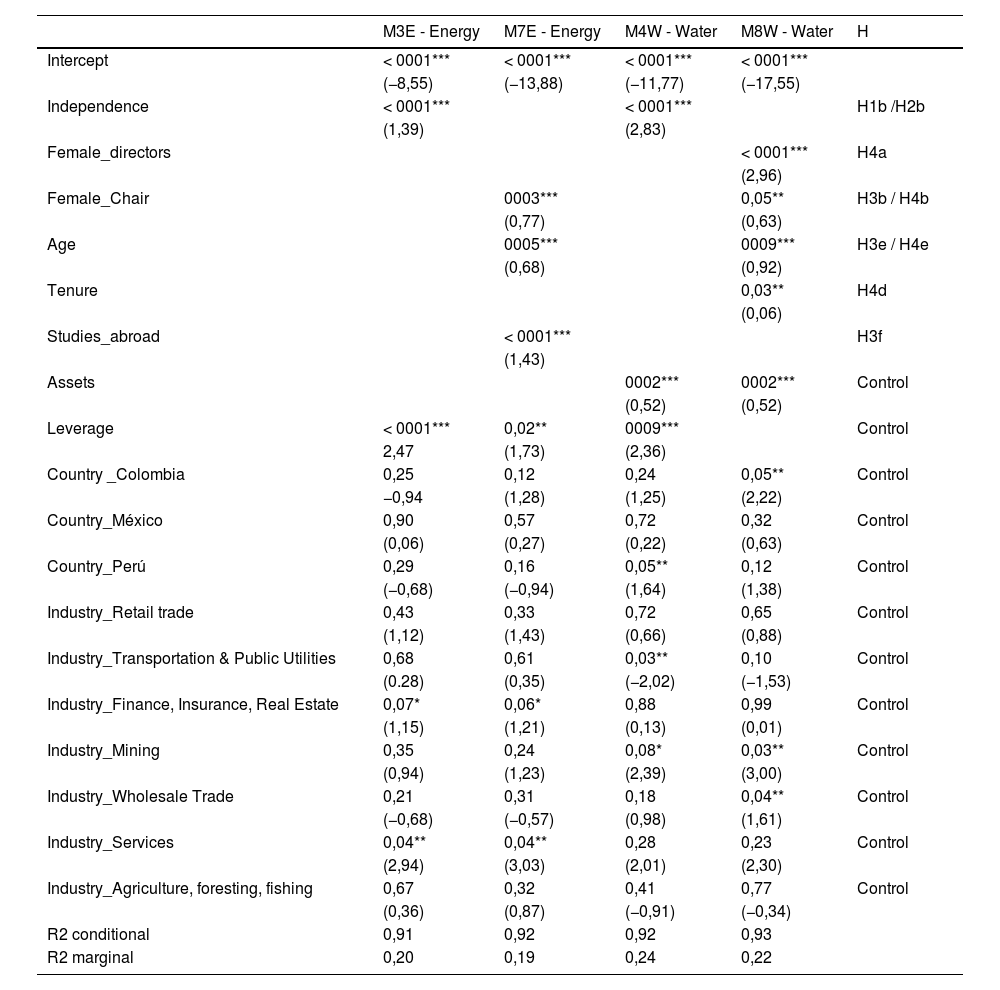

Explanatory analysisTables 4 and 5 present the results of the mixed-effects regression models. The hypotheses relate board diversity, both structural and demographic, and governance attributes to energy and water efficiency. The analysis incorporates fixed and random effects.

Simplified results of multiple linear mixed-effects regressions on the impact of board diversity Indices (ISD and IDD).

*, ** and ***, indicate significance at 10 %, 5 % and 1 % levels, respectively.

Simplified results of multiple linear mixed-effects regressions on the impact of individual board diversity variables.

*, ** and ***, indicate significance at 10 %, 5 % and 1 % levels, respectively.

Model 1 (M1E), which evaluates the effect of ISD on energy efficiency, produces a positive but statistically insignificant coefficient (p = 0.31). Therefore, H1 is not supported. In contrast, Model 2 (M2W), which examines water efficiency, shows a marginally significant positive effect of ISD (p = 0.10), providing modest support for H2.

Although Models M1E and M2W do not demonstrate robust effects of ISD, Models M3E and M4W indicate that board independence is highly significant (p < 0.001) for both energy and water efficiency. These findings support H1b and H2b and align with agency theory and prior research (Fasan & Mio, 2017), which highlight the role of independent directors in enhancing oversight and mitigating opportunistic behaviour.

Several control variables are also significant. Firm size (total assets) is significant in Models M1E, M2W, and M4W, and leverage is significant across all models. These results suggest that resource efficiency is influenced not only by board diversity but also by operational scale and financial constraints. Country controls in Model M4W and industry controls in Models M3E and M4W help account for contextual factors, revealing sectoral differences consistent with existing literature (Correa-García et al., 2020; El Ghoul et al., 2016).

In Model M3E, firms in the ‘Finance, Insurance, Real Estate’ and ‘Services’ sectors exhibit lower energy efficiency than the reference group. In Model M4W, Peru records the lowest water efficiency among the countries analysed, potentially due to infrastructural limitations, fragmented water governance, and territorial disparities. Additionally, the ‘Transportation & Public Utilities’ and ‘Mining’ sectors show significantly lower water efficiency, possibly reflecting the complexity and intensity of water use in these industries.

Demographic board diversity and its influence on the economic efficiency of water and energy consumptionThe IDD is positively and significantly associated with both energy and water efficiency in Models 5 (M5E) and 6 (M6W), supporting H3 and H4 (H3/H4, p = 0.03 and p < 0.001, respectively). These findings suggest that more demographically diverse boards are linked to improved resource management practices.

Model 7 (M7E) reveals that having a female board chair (H3b, p = 0.002), older directors (H3e, p = 0.005), and a greater proportion of internationally educated directors (H3f, p < 0.001) all significantly enhance energy efficiency. These results underscore the importance of international exposure and diversity in fostering sustainable decision-making.

Model 8 (M8W), which focuses on water efficiency, shows that a higher proportion of women on the board (H4a, p < 0.001), a female board chair (H4b, p = 0.05), director age (H4e, p = 0.009), and director tenure (H4d, p = 0.03) all positively and significantly influence performance. These findings corroborate earlier research (Atif et al., 2021; Barako & Brown, 2008), which associates female board representation with enhanced sustainability practices. From a theoretical perspective, resource dependence theory suggests that demographic diversity strengthens a board's human capital by enhancing access to knowledge and networks that improve resource governance. Moreover, the experience and tenure of board members appear to support the adoption of long-term strategies, especially under conditions of environmental and financial pressure.

Control variables such as total assets and leverage remain significant, confirming their relevance in shaping efficiency outcomes. Country and industry controls reveal further contextual differences. The ‘Finance, Insurance, Real Estate’ and ‘Services’ sectors are among the least efficient in energy use, while the ‘Mining’ and ‘Wholesale Trade’ sectors display lower water efficiency. Among the countries examined, Colombia ranks lowest in water efficiency, possibly due to socioeconomic disparities and geographic fragmentation. Prior research has linked such inefficiencies to limited infrastructure investment and weak institutional coordination (Guzmán-Arias & Calvo-Alvarado, 2013).

Non-significant hypotheses and their implicationsThe absence of statistically significant relationships for several hypothesised variables warrants further analysis, as these non-findings offer valuable insights into the complex dynamics between board diversity and resource efficiency in Latin American contexts. Table 6 summarises all hypotheses, their expected directions, and final outcomes, illustrating both significant and non-significant results.

Summary of hypotheses testing results.

Decisions are based on a significance level. (+)/(–) denote the expected direction.

With regard to structural diversity, the non-significant effects observed for board size (H1a/H2a), owner-directorship (H1c/H2c), and leadership duality (H1d/H2d) suggest that these relationships may be non-linear or contingent upon other contextual factors. For instance, board size may exhibit an inverted-U relationship with efficiency, where benefits diminish or reverse beyond an optimal point. Similarly, in Latin America, where concentrated family ownership and business group affiliations are prevalent, owner-directors may exert influence through informal mechanisms parallel to formal board structures, rendering their impact less visible through conventional governance metrics.

On the side of demographic diversity, several hypothesised relationships also failed to attain statistical significance. These include the proportion of women on boards in relation to energy efficiency (H3a), the presence of a female chief executive officer (H3c/H4c), board tenure in relation to energy efficiency (H3d), international education in relation to water efficiency (H4f), and the presence of foreign directors (H3g/H4g). The divergent results concerning gender diversity's impact on water versus energy efficiency imply that different dimensions of sustainability may be shaped by distinct mechanisms. Water management, often linked to community welfare and public health concerns, may be more aligned with the perspectives female directors contribute to board discussions. By contrast, energy management may be perceived as more technical or operational within the Latin American context. Furthermore, the lack of significant findings for international education and foreign directors suggests that international exposure alone does not inherently lead to improved resource efficiency. The translation of such attributes into meaningful outcomes may depend upon the presence of supporting institutional structures, incentive systems, or strategic alignment. These non-significant findings delineate important boundary conditions for theories concerning board diversity and sustainability. They indicate that the relationship between governance characteristics and resource efficiency is more nuanced and context-specific than frequently portrayed in the literature. The results underscore the necessity for more sophisticated theoretical models that incorporate non-linearities, interaction effects, and institutional contingencies, particularly when applying governance theories developed in Western contexts to emerging economies such as those in Latin America.

Robustness checks and model validationTo assess the potential for multicollinearity, the VIF was calculated for each variable. All values were below the critical threshold of 10, with the highest VIF recorded at 1.30. This indicates an absence of collinearity among the explanatory variables.

The Breusch–Pagan test was applied to evaluate the assumption of homoscedasticity, considering the null hypothesis of constant variance in residuals (Breusch & Pagan, 1979). The test results did not indicate significant heteroscedasticity (M1E, p = 0.536; M2W, p = 0.567; M3E, p = 0.560; M4W, p = 0.656; M5E, p = 0.541; M6W, p = 0.674; M7E, p = 0.547; M8W, p = 0.743), confirming that the assumption is satisfied.

Outlier detection using Cook’s distance revealed no influential observations capable of distorting the results. The normality of residuals was evaluated through visual inspection and supported by additional statistical tests, none of which suggested deviations that could compromise the estimates’ validity.

Regarding explanatory power, the marginal R² values were: M1E = 0.06, M2W = 0.11, M3E = 0.20, M4W = 0.24, M5E = 0.02, M6W = 0.18, M7E = 0.19, and M8W = 0.22. These results indicate that fixed effects account for between 2 % and 24 % of the variance in resource usage disclosure. Conditional R² values (M1E = 0.91, M2W = 0.91, M3E = 0.91, M4W = 0.92, M5E = 0.90, M6W = 0.92, M7E = 0.92, M8W = 0.93) demonstrate that the inclusion of random effects substantially enhances predictive power, explaining between 90 % and 93 % of total variance.

Analysis extensionTo further assess robustness, marginal effects were estimated using the emmeans package in R (Lenth, 2025). This method calculates covariate-adjusted means, also known as estimated marginal means or least-squares means, which is particularly useful in unbalanced designs, as it allows for equitable comparisons across groups regardless of sample size disparities (Searle et al., 1980). The procedure was applied to the study’s four hypotheses (H1–H4), which link ISD and IDD to measures of energy and water efficiency.

Adjusted efficiency means were estimated for each of the four countries (Chile, Colombia, Mexico, and Peru), controlling for the covariates used in the original models. These comparisons, therefore, reflect net efficiency differences associated with diversity levels, isolated from the influence of control variables.

The adjusted means for both energy and water efficiency did not differ significantly across countries for any combination of structural or demographic diversity. Pairwise comparisons between countries, adjusted using the Tukey method for multiple testing, confirmed that none of the differences were statistically significant at the α = 0.05 level (Abdi & Williams, 2010). Even the largest observed differences in adjusted means were non-significant, supporting the conclusion that board diversity does not account for consistent cross-country differences in efficiency under the conditions examined.

The robustness of sectoral findings was also tested. Estimated marginal means by industry were computed, re-transformed to the original scale using the exponential function (exp()), and evaluated with the Kenward–Roger method for degrees of freedom and Tukey adjustments for multiple comparisons. No pairwise industry differences remained statistically significant at α = 0.05 after correction. Most p-values exceeded 0.90, indicating limited evidence of mean efficiency differences across industries once country and control variables were accounted for.

Collectively, these results suggest that while some sectoral heterogeneity is evident in coefficient-level patterns, particularly in Mining, Services, Finance, Transportation and Public Utilities, and Wholesale Trade, the absence of significant differences in marginal means may reflect insufficient statistical power or suggest that diversity-efficiency relationships are more effectively captured through interactions or random slopes within a multilevel framework. These possibilities are discussed further in Section 5.4 as directions for future research.

DiscussionThis study offers significant empirical evidence on the relationship between board composition and energy and water use efficiency in Latin American companies, thereby contributing to the growing literature on corporate governance and sustainability reporting in emerging markets. The findings hold important theoretical and practical implications, particularly regarding the achievement of the United Nations SDGs.

Theoretical contributionsOur research advances the corporate governance and sustainability literature in several ways. First, it extends agency theory by demonstrating that specific dimensions of board diversity, especially the proportion of independent directors, improve monitoring effectiveness in resource management. Our results reveal that independent directors play a crucial role in mitigating agency problems related to resource efficiency, reinforcing the relevance of traditional agency theory perspectives in sustainability outcomes within emerging markets. This finding aligns with, yet also extends, prior research (Adams & Ferreira, 2009; Fasan & Mio, 2017) by linking board independence specifically to resource efficiency metrics rather than broader environmental indicators.

Second, our findings robustly support resource dependence theory in sustainability contexts. Significant positive relationships between demographic diversity attributes (notably gender diversity, female board chairs, age diversity, and international education) and resource efficiency indicate that diverse boards provide valuable cognitive resources, perspectives, and networks that enhance strategic decision-making in natural resource management. This corroborates Barney’s (1991) resource-based view, extending it to sustainability-specific outcomes in Latin America. Notably, demographic diversity exhibits a more consistent association with resource efficiency than structural diversity, suggesting that the cognitive and social capital dimensions emphasised by resource dependence theory are more critical for sustainability performance than formal governance structures alone.

Third, our study integrates these theoretical perspectives, illustrating their complementary nature in explaining sustainability governance. While agency theory elucidates the importance of independence in monitoring resource use, resource dependence theory highlights how diverse human capital strengthens a firm’s capacity to implement efficient resource management. This integrated approach advances the theoretical understanding of sustainable corporate governance beyond single-theory frameworks that have predominated prior studies.

Fourth, the study deepens theoretical insights into the gender-sustainability nexus in corporate governance. The significant positive association between female representation, both in overall board composition and chair positions, and resource efficiency empirically supports theoretical arguments about gender-based differences in risk perception, stakeholder orientation, and long-term strategic thinking in sustainability contexts (Atif et al., 2021; Karim, 2021b). These findings contribute to the expanding discourse on how gender diversity influences corporate environmental performance in emerging economies.

Contribution to the literatureThis study makes original contributions to the knowledge of sustainability and corporate governance in emerging economies, particularly Latin America. First, it enriches the literature on board diversity by focusing on a less-studied geographical and cultural context: companies within the Pacific Alliance. While previous evidence predominantly originates from North America, Europe, or Asia, Latin American markets have received limited attention. By analysing firms in Chile, Colombia, Mexico, and Peru, our research partially fills this gap, providing empirical data on how board diversity relates to sustainable efficiency in institutional settings distinct from developed economies. This regional perspective complements global studies.

Second, thematically, our research focuses specifically on economic efficiency in water and energy use as measures of sustainable performance. Prior studies on corporate sustainability typically employ aggregated environmental indicators (e.g., global ESG indices or carbon emissions). In contrast, our approach centres on critical natural resources (water and energy) fundamental to achieving SDG 6 and SDG 7, especially in regions where resource scarcity limits development.

Third, the study contributes to corporate governance literature by developing and applying two indices adapted to emerging markets: one for ISD and another for IDD. These composite indices integrate multiple board diversity dimensions into single measures. Unlike unidimensional approaches (such as percentages of women or independent directors alone), the ISD and IDD capture the board’s multidimensional composition. These indicators constitute useful tools for future research aiming to quantify diversity comprehensively and for firms benchmarking their governance against sectoral or regional standards.

Practical implicationsFor policymakers and regulators in Latin America, our findings align with the Inter-American Development Bank (IDB) report urging progress towards more transparent, harmonised, and practical ESG and climate risk disclosures. We recommend: (i) mandatory public disclosure of board composition metrics (gender, independence, age, tenure, international experience) alongside water and energy efficiency indicators through a standardised ‘board diversity matrix’ and water/energy efficiency key performance indicators (KPIs) (e.g., cubic metres of water and kilowatt-hours per unit of revenue or production), aligned with ISSB/IFRS S1–S2, GRI, or SASB sector metrics; (ii) adoption of harmonised taxonomies and reporting templates to reduce heterogeneity across countries, particularly within the Pacific Alliance/MILA, and improve comparability, including common XBRL tags to facilitate machine-readable aggregation by supervisors and investors; (iii) introduction of diversity targets under comply-or-explain frameworks to enhance sustainability outcomes; and (iv) strengthened oversight and capacity building through dashboards, public scorecards tracking company progress, and targeted training programmes. These measures support the regional drive towards transparent green financial markets (Inter-American Development Bank, 2023).

Corporate leaders and board members should regard diversity as a strategic governance lever for sustainability beyond regulatory compliance. Firms may: (i) establish explicit diversity policies and targets; (ii) create or empower sustainability committees with diverse membership to oversee resource efficiency initiatives; and (iii) integrate water and energy efficiency KPIs into board dashboards and executive compensation schemes, including baselines, reduction pathways, verification protocols (e.g., ISO 50001, ISO 14046), and conduct regular audits supported by digital measurement and Internet of Things data governance systems.

Investors with an ESG focus can incorporate board diversity metrics, especially gender, independence, and international experience, into assessment models as early indicators of resource efficiency. To promote disclosure of board composition and resource efficiency metrics in line with emerging regional reporting frameworks, investors should implement structured engagement checklists covering: (a) standardised diversity matrices for boards, (b) quantified water and energy efficiency targets, and (c) evidence of innovative efficiency initiatives (e.g., circular water projects, ISO 50001 adoption, energy intensity KPIs linked to executive pay).

Limitations and future researchDespite its contributions, this study has several limitations. First, certain structural variables (board size, owner-directorship, leadership duality) did not show significant effects, suggesting potential non-linear relationships or moderating variables not included in the model. Similarly, although index-based diversity measurement is a recognised practice, further refinement of value assignments could capture governance nuances more effectively. Future research should explicitly model non-linear and contingent effects by (i) incorporating polynomial terms, (ii) applying restricted cubic splines or generalised additive models, and (iii) specifying interaction terms between structural and demographic attributes.

Another limitation concerns generalisability, as the study focuses exclusively on Pacific Alliance companies. Future research could broaden the sample to other regions or economic contexts. Although sector-level coefficients indicate heterogeneous patterns, Emmens’ analysis revealed not statistically significant pairwise differences after multiple testing adjustments. Future studies should model diversity–industry interactions explicitly, employ random slopes by industry in multilevel models, or enlarge sample sizes to increase power for sector-specific inference. Finally, future research could explore additional dimensions omitted here. For example, investigating how diversity at managerial levels beyond the board affects resource efficiency, or how interactions between diverse boards and executive teams influence sustainable outcomes, would deepen understanding of governance mechanisms.

ConclusionsThis study demonstrates that demographic board diversity and independence are critical determinants of corporate water and energy efficiency. It contributes novel evidence from Latin American emerging markets, a context underrepresented in prior research on corporate sustainability, by directly linking board composition to specific sustainability outcomes.

Drawing on agency theory and resource dependence theory, the analysis reveals that both structural characteristics (such as the proportion of independent directors) and demographic characteristics (such as gender diversity and internationalisation) enhance resource efficiency. The development of composite indices to measure structural and demographic diversity also constitutes a methodological contribution for future research and professional application.

Taken together, these findings broaden the literature on corporate governance and sustainability, offering a more nuanced understanding of how diverse boards can promote the efficient use of critical resources. This supports progress towards Sustainable Development Goals related to clean water and affordable energy.

For practitioners and policymakers, the implications are clear: firms, particularly in emerging markets, should view board diversity not merely as a compliance requirement, but as a strategic lever for improving sustainability performance. Companies can operationalise these insights by diversifying their boards (e.g. increasing female and international representation and maintaining a strong contingent of independent directors) and enhancing oversight of sustainability issues through specialised committees and director training. In parallel, policymakers and regulators could reinforce governance frameworks by promoting board diversity and empowerment, and by introducing transparency requirements for reporting board composition and resource efficiency outcomes.

This study underscores the pivotal role of board composition in advancing sustainable resource use and provides evidence to support the alignment of corporate governance with global sustainability objectives.

CRediT authorship contribution statementIvette Núñez-Laguna: Writing – original draft, Visualization, Validation, Supervision, Software, Resources, Methodology, Investigation, Formal analysis, Data curation, Conceptualization. Nicolás Gambetta: Writing – review & editing, Validation, Supervision, Methodology, Investigation, Formal analysis, Conceptualization. María Antonia García-Benau: Writing – review & editing, Visualization, Validation, Supervision, Project administration, Investigation, Funding acquisition, Formal analysis, Conceptualization.

The authors gratefully acknowledge financial support from Consellería d"Educació, Universitats i Ocupació, Generalitat Valenciana CIAICO/2022/075, as well as the 2022 Scholarship Program of Fundación Carolina and the University of Piura (Perú).