Keynes (1930) and Samuelson (1965) proposals open the possibility of matching predictability and efficiency, as evidenced by the seminal study by Fisher (1930). Recent findings suggest that the foreign exchange market gradually incorporates relevant information allowing the formation of prices in a rational manner but not randomly. Models of exchange rate by term based on asset valuation suggest that the inclusion of risk in the spot rate increases the degree of predictability. The results show that after incorporating an accurate measure of risk, predictability of medium term foreign exchange rate increases.

Las propuestas de Keynes (1930) y Samuelson (1965) abren la posibilidad de compatibilizar eficiencia con predictibilidad según se deduce del estudio seminal de Fisher (1930). Recientes hallazgos sugieren que el mercado de divisas incorpora gradualmente la información relevante favoreciendo la conformación de precios de manera racional y no aleatoria. Los modelos del tipo de cambio a plazo basados en la valuación de activos sugieren que la inclusión del riesgo al tipo de cambio spot aumenta el grado de predictibilidad. Los resultados muestran que tras incorporar una medida precisa de riesgo se aumenta sustancialmente la predictibilidad del tipo de cambio en el mediano plazo.

The FOREX market is the most important financial market in the world, its daily trading volume of negotiation impacts on the behavior of other financial markets or those of goods and services. More recent data show that the daily volume of trade hits 9 trillion dollars, which exceeded by more than one hundred times the daily average value of Wall Street shares.

Therefore, it is a very profitable market. Since the FOREX market liberalization and the adoption of the system of flexible exchange rate, in 1973, exchange rates have become increasingly erratic and volatile. That is why it is frequent that corporate decisions are increasingly adopting exchange rate forecasting techniques. Even speculative positions, protectionist or arbitrage of investors have to take into account the behavior of exchange rates.

The literature shows studies that begin to explain, not only the composition of the current exchange rates, but to find those elements that determine their value over time. So, for more than a century, economists have tried to establish and then model the factors that determine the exchange rate. Economic literature precisely documents the existence of five theories that explain the determinants of exchange rate. One of these models assumes efficient markets, and then equilibrium is always achieved. Although in the practice, it is a fact difficult to achieve due to arbitrage operations (Eun and Resnick, 2007).

The latter point brings an interesting discussion: Either exchange rates are given at random or by irrational movements given that operators are involved in efficient markets or, investors make rational decisions that allow them to take advantage of arbitrage opportunities. The certainty of the term arbitrage opportunities will depend on the robustness of the exchange rate forecasts.

In this regard, one of the first studies on exchange rate arbitrage conditions term was proposed by Samuelson (1965) and empirically developed by Cornell and Dietrich (1978) without conclusive results achieved in their models. At that time the common denominator of these studies was to consider the theoretical forward rate as an unbiased predictor of the exchange rate term. However, the seminal work of Messe and Rogoff (1983) showed the poor predictive ability of models to determine the exchange rate compared to a naive random walk model (random walk). Since then there has been an enormous effort to both deepen and unravel the causes of the extreme difficulty of forecasting exchange rates. They also provided alternative procedures of some predictive improvement over the random walk model.

Thus, recent models suggest that the inclusion of risk prediction models to the exchange rate will provide more robust models, but for this, it is essential to capture it properly. We will develop our model by following the line of the latter approach.

This study has been divided into four sections. The following section gives particular attention on models based on assets valuation thus giving rise to the third section that analyzes the statistical robustness according with the classical risk models that will permit conclusions at the end.

Different approachesBasic approaches about exchange rate predictionsAsymmetries frequently come in profitable arbitrage operations, therefore, this value will fluctuate not only between the contributions that are being made in different currencies (spot market), but will also change over time. Thus, exchange rate is given by the ratio of one currency against another in the following way:

Where, QA refers to the number of units of currency A required to convert in terms of currency B, and 1B refers to the counter-currency.

For more than a century, economists have tried to establish and model the factors that determine the exchange rate1. Recent theories that show better result are those based on assets valuation, due to their ability to explain the behavior of exchange rates from monetary market expectations for inflation and interest rates. There are various models developed within this approach which vary only in the degree of recognition of their impact on exchange rates.

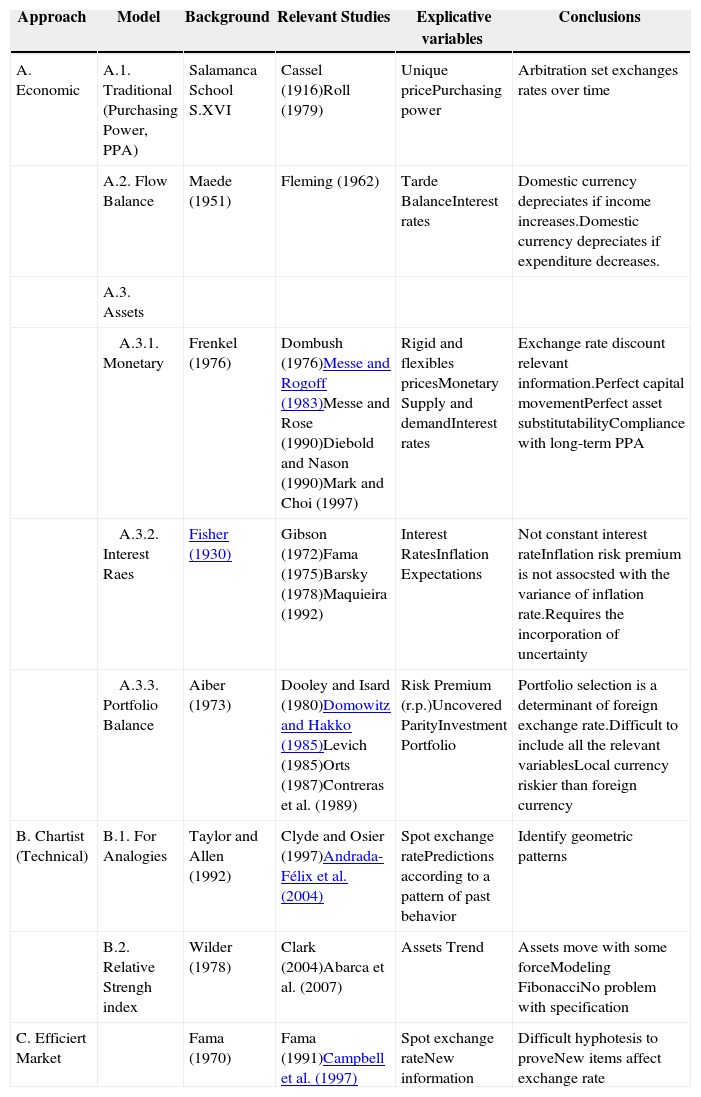

In practice, companies generate their own forecasts, while others pay specialized firms to do the job. Forecasting techniques would be classified in any of the following approaches: a) Efficient Market Model, b) Technical or Chartist Model and c) Economic or Fundamental Model. Table 1 collects the main features of the models above.

Most relevant studies about the behavior of the exchange rate

| Approach | Model | Background | Relevant Studies | Explicative variables | Conclusions |

|---|---|---|---|---|---|

| A. Economic | A.1. Traditional (Purchasing Power, PPA) | Salamanca School S.XVI | Cassel (1916)Roll (1979) | Unique pricePurchasing power | Arbitration set exchanges rates over time |

| A.2. Flow Balance | Maede (1951) | Fleming (1962) | Tarde BalanceInterest rates | Domestic currency depreciates if income increases.Domestic currency depreciates if expenditure decreases. | |

| A.3. Assets | |||||

| A.3.1. Monetary | Frenkel (1976) | Dombush (1976)Messe and Rogoff (1983)Messe and Rose (1990)Diebold and Nason (1990)Mark and Choi (1997) | Rigid and flexibles pricesMonetary Supply and demandInterest rates | Exchange rate discount relevant information.Perfect capital movementPerfect asset substitutabilityCompliance with long-term PPA | |

| A.3.2. Interest Raes | Fisher (1930) | Gibson (1972)Fama (1975)Barsky (1978)Maquieira (1992) | Interest RatesInflation Expectations | Not constant interest rateInflation risk premium is not assocsted with the variance of inflation rate.Requires the incorporation of uncertainty | |

| A.3.3. Portfolio Balance | Aiber (1973) | Dooley and Isard (1980)Domowitz and Hakko (1985)Levich (1985)Orts (1987)Contreras et al. (1989) | Risk Premium (r.p.)Uncovered ParityInvestment Portfolio | Portfolio selection is a determinant of foreign exchange rate.Difficult to include all the relevant variablesLocal currency riskier than foreign currency | |

| B. Chartist (Technical) | B.1. For Analogies | Taylor and Allen (1992) | Clyde and Osier (1997)Andrada-Félix et al. (2004) | Spot exchange ratePredictions according to a pattern of past behavior | Identify geometric patterns |

| B.2. Relative Strengh index | Wilder (1978) | Clark (2004)Abarca et al. (2007) | Assets Trend | Assets move with some forceModeling FibonacciNo problem with specification | |

| C. Efficiert Market | Fama (1970) | Fama (1991)Campbell et al. (1997) | Spot exchange rateNew information | Difficult hyphotesis to proveNew items affect exchange rate |

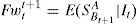

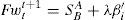

The model based on efficient market, considered by many as a purely theoretical assumption (see Campbell et al., 1997), has had an enormous influence on financial studies of assets valuation, including exchange rate issue. The latter model is based on the idea of Fama (1970) where it is assumed that all the information is relevant and discounted by the agents. Thus, the current exchange rate will reflect all the relevant information, such as inflation, trade balance, economic growth and money supply conditions; then, the exchange rate would be affected only if it receives new information, even if unexpected. As a result, the new exchange rate is fixed independently of its historical performance. From this perspective, it is not surprising that the exchange rate follow a random walk and, therefore, the current exchange rate would be the best predictor of the exchange rate term (Fwtt+1). Hence the predictor is defined as:

Where It is the available information, Fwtt+1 is the theoretical forward exchange rate, St+1 is the spot exchange rate at maturity. In general, it is assumed that differences between interest rates causes that exchange rate Fwtt+1 vary with respect to the current exchange rate.2

In addition, another model called “Chartist”, based on the approach of Caballer (1998) and efficient market establishes that information is automatically reflected in price and therefore does not justify the development of previous studies, i.e.: “If I have no idea of the value of a company, but others more powerful than me have it and those big, acting in the market, leave a trail of their conclusions I can reach their own conclusions” (Elliot et al., 2000: 47). This approach analyzes figures and statistical charts to anticipate the movement of the currency. Following this line of research, several indicators have been designed (such as RSI, Fibonacci) to predict, with acceptable accuracy, the trend and strength of the currency. It has been accepted, by the academic community, that the use of these tools determines the timing of investment or asset sale (Andrada-Félix et al., 2004).

However, between these different approaches, the best predictor can be based on economic fundamentals. This is because the economic agent is rational given that the relevant information is being gradually introduced to the expectations of investors. In the next section, we will study advanced approaches to build up our own model to find the best exchange rate predictor.

The forward exchange rate under models based on asset valuationThe classical theory is based on asset valuation which begins by calculating the points pips to be added to the spot rate in order to find the forward exchange rate, i.e.,

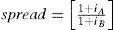

We can see that the predictive accuracy is subject to exchange rate fluctuations with the spot rate (S) at maturity, i.e., at the time of the operation. Moreover, improving the timing problem detected in Fisher's classical model (1930), the general equation may be specified by:

Where, n is the forward term in days; spread is the differential between the interest rates of the currencies on each country, i.e. pips have to add or subtract the current exchange rate; here the interest rates should match the exchange rate term calculated in the forward. In any case, differential in interest rates represents the gap between the interest rate in country A (iA) and the interest rate in country B (iB), i.e.,

Kozikowzki (2000) shows an adjustment to the formula (4) that captures difference in rates and terms3:

Anomalies and risk premiumsFinancial economists have extensively analyzed whether the currency forward markets reflect all relevant information. In this sense, in an environment without arbitrage, the assumptions of risk neutrality and rational expectations lead to believe that the interest rate should be an unbiased predictor of forward exchange rates (Ai). This assertion has been called unbiased forward exchange rate Hypothesis (UFER).

From the beginning, we have the following specification to test the UFER:

Even though the null hypothesis established in equation (10) defines the conditions of equation (11), i.e., α=0, β=1, subsequent investigations about unit root tests (unit roots) have raised serious doubts about the properties of equation (11), as the conventional wisdom about the behavior of unit root would continue to exchange rates. This concern about spurious regressions prompted researchers to explore alternatives such as stationary behavior in equation (11)4 that led to the following equation:

Where ΔlnABA=(lnABA−lnSBA). The early estimates were based on this equation (8) that continued to reject the UFER both in tests of forward exchange rates at various maturities as in experiments that used different currencies. In this situation, the studies showed findings regarding the paradox of capital premium, contradicting, this way, Fisher's classical theory that assumed the positions of the premium or discount affecting prices under the same pattern. At bottom, it seems unlikely that the simple rule of investing in the highest rate guarantees good results and be predictive and, then, it is an issue that has not been tested or fully explored. Although an interesting finding of this research is to obtain frequent βˆ negative estimates5. A βˆ negative means that investors would be happy to invest in currencies with higher interest rate.6 See table 3 that shows the results of testing the dispersion of forward exchange rate as a predictor of the spot exchange rate.

Estimation of spread in the Forward Exchange Rate

| ΔlnABA=α+β(lnFwtt+1−lnSBA)+ϵt+1 | ||||

|---|---|---|---|---|

| Works | Period | Counties | β˙ | Significance level of 5% |

| Fama (1984) | 1973–32 | Japan | −0.29 | No |

| Switzerland | −1.14 | No | ||

| United Kingdom | −0.90 | No | ||

| Canda | −0.87 | No | ||

| Barnhart and Szakmary (1991) | 1974–88 | Germany | −3.63 | Yes |

| United Kingdom | −1 65 | Yes | ||

| Japan | −0.59 | No | ||

| Canada | −2.02 | Yes | ||

| Bekaert and Hodrick (1993) | 1975–89 | Germany | −3.015 | Yes |

| United Kingdom | −2.021 | Yes | ||

| Japan | −2.098 | Yes | ||

Researchers have come to conclude that the inconsistencies found in a recent connection to the classical theories on exchange rates could be due to economic factors irrelevant to attract the attention of speculators and therefore difficult to detect. As a result, it raises an interesting possibility to find this relationship in which the inclusion of risk would be given depending on the behavior and level of interest rates of the currencies involved.

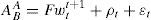

The possibility of a premiumWith little strength on the empirical findings on the UFER, Fama (1984) and Nieuwland et al. (2000) are only a few attempts to reconcile the anomalous results found in practice with efficient market theory. The existence of a risk premium for them would be the variable that would explain the exchange rate term. The argument is that risk aversion investors have required compensation to motivate them to take that risk, and after relaxation of the neutrality that could be at risk while maintaining the rationality, the formation of expectations denote as follows:

Equation (8) emphasizes the importance of detecting the presence of a risk premium ρt, capturing many economic relations, theory often prescribes those variables that are unobservable. This observation is important because while economic models can be considered robust when they incorporate risk premiums, failing to detect the risk premium means that these models are inadequate rather than when they provide information without considering the premium.

For this reason, researchers have been focusing, through numerous techniques for the detection of a risk premium in the forward market. For example, Barnhart and Szakmary (1991) incorporated Kalman filter extraction method which approaches signals, detecting some deterministic components in the error. According to their findings, the error can be characterized in an AR (1) which can be removed with systematic patterns. However, the presence of a systematic component is not sufficient to conclude that this bias compensates the risk of speculation agents down because they would be leaving out the formation of rational expectations. However, the method proposed by Barnhart and Szakmary (1991) cannot determine the possibility of risk compensation because it does not explain the increase in predictability.

In this regard the Engel's seminal work (1982) on autoregressive conditional heterocedasticity (ARCH)-which initially was used to verify if the volatility of the forecast error could explain the assumptions about the behavior of interest rates, resulted in ARCH-type models in the mean (ARCH-M), and would be useful to identify and analyze the performance of financial assets during periods of turbulence but also of peace. Among the conclusions in this type of works it is shown that a greater variation in yields creates a greater climate of uncertainty for investment, so investors with some degree of risk aversion will demand compensation for the above average during the periods of uncertainty. Domowitz and Hakkio (1985) found that after a certain level in the conditional variance by investors, there is an increase in risk premiums as compensation rises.

In this sense, the ARCH-M model detects the influence of conditional volatility on the conditional mean and, therefore, can measure the expectations and influence of stakeholders on higher risk premiums in more turbulent times. However, Domowitz and Hakkio (1985), Baillie and Bollerslev (1990) and Bekaert and Hodrick (1993) found little evidence to reinforce the idea that the premium depends on the conditional variance of error in the forecast. Fundamentally, the sense of volatility has been the limiting factor for explaining abnormality. It is true that agents, acting on both sides of the market, are subject to the same volatility but that volatility alone cannot explain what makes a premium currency. Then, the ARCH-M model does not explain why a currency attracts premium7 as a natural progression of the issue would be to explain the relationship that exists between the systematic risk and the participant's expectations in the currency market.

Systematic risk and the risk premiumIt has been found that the Fisher effect generates a non-symmetrical relation between nominal interest rates and increased inflation. Consequently, the real interest rate does not correspond to the risk-free rate, since it incorporates other types of risk. The articles that studied the relationship between systematic risk and the risk premium do not make explicit why a currency attracts premium as it does. Cumby (1988) and Kaminsky and Peruga (1990) found some correlation between risk and the determination of future awards but failed to try to detect the percentage that, a priori, would be distributed among participants.

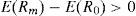

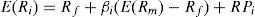

Fortunately, there are models in financial economics that estimate with some degree of precision a certain distribution. The criteria followed by this kind of approach is that it is in equilibrium, then the risk is associated with high performance. Thus, assuming that investors have an aversion to risk and expect a premium to compensate for positions held in other currencies, the balance is presented as:

This approach highlights the semivariance models to test the UFER balance by the equilibrium that investors incorporate in their expectations.

Despite the restrictive assumptions under which it was originally designed, even with weak empirical support, one of the most powerful models of semivariance is the CAPM. This model is, however, one of the most used tools in financial research of asset pricing because it has the good sense to propose a linear relationship between the expected return on risky assets (assets k)8. Several researchers have tried to find a precise modeling of the risk premium in foreign exchange markets by CAPM.

While early studies ignored the possibility of time-varying results, recent research has shown that they are an important feature of financial markets. In this sense, the CAPM can be re-specifying the expectations for time t, conditional on information available at time t-1. Harvey (1991) detected some variation in risk across different contexts and times.

Financial literature clearly shows that not only the risk premium associated with currency determines the variation in risk over time, but systematic market risks must also be taken into account.

Drawing on the status of the topic, we committed to the task of deriving the classical equation (4) in our own model. In the original version, as seen in equation (5), the spread on interest rates (Pfw) added to the current exchange rate is determined by the difference between exchange rates subject to exchange rate term fw, i.e.,

However, when doing a simple inspection of the relationship given in equation (12) it follows a likely problem of non-normality assumption of the original data extracted from the money market. To eliminate this problem, the relationship between the fees is referred back to its natural logarithm, which leads us to modify the equation (12) by a set of Pfw indicator we call λi, which can be represented by the following expression:

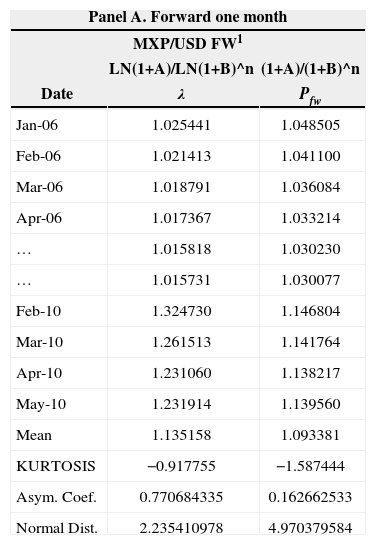

We note that both Pfw as λi capture the so-called International Fisher Effect, λi adjusting it, a priori, to be less dispersed. In a preliminary trial, as expected, the addition of the logarithmic function to equation (13) allows the data grouped a behavior close to normal (see table 4). Normality tests were done on the Fw exchange rate to a one-month period and for a 3 month Fw. Parity analyzed in the table was for mexican peso/U.S. Dollar. The rate for the mexican market was the 28-day and 91-day CETE, while for the U.S. market, we considered treasury bills with a one-month and three-month maturity.

Normality Test on the spread in interest rate

| Panel A. Forward one month | ||

|---|---|---|

| MXP/USD FW1 | ||

| LN(1+A)/LN(1+B)^n | (1+A)/(1+B)^n | |

| Date | λ | Pfw |

| Jan-06 | 1.025441 | 1.048505 |

| Feb-06 | 1.021413 | 1.041100 |

| Mar-06 | 1.018791 | 1.036084 |

| Apr-06 | 1.017367 | 1.033214 |

| … | 1.015818 | 1.030230 |

| … | 1.015731 | 1.030077 |

| Feb-10 | 1.324730 | 1.146804 |

| Mar-10 | 1.261513 | 1.141764 |

| Apr-10 | 1.231060 | 1.138217 |

| May-10 | 1.231914 | 1.139560 |

| Mean | 1.135158 | 1.093381 |

| KURTOSIS | −0.917755 | −1.587444 |

| Asym. Coef. | 0.770684335 | 0.162662533 |

| Normal Dist. | 2.235410978 | 4.970379584 |

| Panel B. Forward three months | ||

|---|---|---|

| MXP/USD FW1 | ||

| LN(1+A)/LN(1+B)^n | (1+A)/(1+B)^n | |

| Date | λ | Pfw |

| Jan-06 | 1.067897 | 1.132515 |

| Feb-06 | 1.060208 | 1.117890 |

| Mar-06 | 1.056606 | 1.110843 |

| Apr-06 | 1.049728 | 1.096666 |

| … | 1.047138 | 1.092212 |

| … | 1.048036 | 1.094867 |

| Feb-10 | 2.018797 | 1.502704 |

| Mar-10 | 1.875191 | 1.487485 |

| Apr 10 | 1.846749 | 1.483609 |

| May-10 | 1.848171 | 1.485585 |

| Mean | 1.439967 | 1.311504 |

| KURTOSIS | 0.376142 | −1.491645 |

| Asym. Coef. | 1.1009714 | 0.211805526 |

| Normal Dist. | 0.576482512 | 1.356961397 |

The analysis of panel A in table 4, on the exchange rate at one month, shows that both curves are asymmetrically positive. Also, equation (13) generates a kurtosis closer to 0 in comparison to the equation (12) which means a more symmetrical distribution. This is ratified by the normal distribution index that shows greater symmetry (2.23541) in equation (13) in contrast to the biased distribution from equation (12). These results suggest the use of equation (13) can be more efficient and capture the differential in interest rate between countries.

In what follows we will identify, precisely, the change in the behavior of unadjusted spreads, consequence of a steady behavior.9 The data confirms the superiority of λ against Pfw in that it fosters a greater degree of normalcy. A kurtosis (0.3761 versus −1.4916) closest to 0 and a normal distribution coefficient (0.5764 versus 1.3569) more in line with a symmetrical curve adjustments show that the logarithms of the differences in types are needed to work with less biased values.

Taking a look at the traditional equation (4), we understand that it is subject to the spot rate but also to the behavior of interest rates in an open economy adjusted statistically by a logarithmic function; however, we note the absence of a permanent measure and unexpected volatility of exchange rates.10 Since Aliber (1973) introduced the concept of portfolio investment to explain the behavior of exchange rates, attention has been focused on quantifying the errors of estimation and market risk as factors that will increase the precision models to predict exchange rates.

There have been several attempts to correctly estimate the level of risk without a strong advance in the field. For example, Brealey et al. (2005) tell us the wisdom to define low risk premium; while for 1996, U.S. Treasury bills were the appropriate proxy for all market risk premiums, however, some time later, they themselves acknowledged that “we have no official position on the market risk premium, but we believe that a range between 6% and 8.5% is reasonable for the United States”.

In 2005, they changed their minds and accepted that the interval should be “between 5 and 8%.” It was such distrust among the policymakers' opinions that Brealey et al. (2005: 154) argue: “This debate comes to just a firm conclusion: do not trust anyone who claims to know what return investors expect”.

Inclusion of the risk premium under the CAPM approachAs long as we focus cornerstone in the development of our predictive equation seems no more than a chimera, then, our company is impossible. However, we must accept that there are also important and significant advances in the design of the risk premium. In our case we say that the inclusion of the risk premium in the function of the forward exchange rate can be denoted by βi.

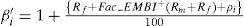

From equation (9) we felt the need to incorporate a risk premium or premium assumed by investors in the exchange rate so the inclusion of βi as a risk measure is reasonably necessary because it permits to measure the ability of countries to comply with their obligations under delays, which, invariably, will be reflected in the cost of money. If the risk premium of a country decreases, we would expect a drop in interest rates as a significant increase in growth. Then, this risk premium would affect the relationship in the adjusted interest rate and the spot rate as follows:

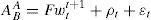

The reduced form of the forward exchange rate would be expressed as:

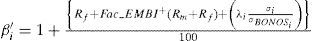

To shape our risk premium proxy (β′i), a CAPM approach methodology has been used.

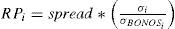

Adjustments to the CAPM approachTo adjust the CAPM approach according to the particularities of the FOREX market we will follow some recommendations: a) García (2009), with respect to the adjustments, these would be made to the variables that make up the initial proposal of the CAPM, b) Damodaran (2002), in relation to an extended CAPM, and c) Madura (2004), who analyzes the additional risk in this approach and that investors incorporate in their expectations. Thus, equation (15) under the proposed Damodaran (2002) is extended to incorporate an underlying risk that is calculated from a spread between sovereign bonds and the relative standard deviation, RPi, that is:

By adding this underlying risk we would be solving the problem caused by the methods of risk measurement which only added risk to the country risk discount rate (bond spread). The assumption made by Damodaran (2002) is fundamental because it is, correctly, assumed that the whole country risk is not “non-diversifiable”. Damodaran's proposal to measure the country risk (RPi) incorporates the relative standard deviation as follows:

Where:

σBONOSi: The standard deviation of the sovereign bonds for the United States.

σi: Standard deviation of sovereign bonds for country i

spread: The difference between sovereign bonds.

As proposed by Damodaran, the spread of sovereign bonds would be a useful indicator to approximate quantification of country risk, but, not enough. The spread between interest rates on sovereign bonds is a biased indicator due to investment policies and it is not adjusted for investment decisions of participants. We, therefore, propose a more specific proxy that will redefine the spread according to the proposal made in equation (13) since they correspond directly to the expectations set by investors, but in this case:

iA: The risk-free rate of country A's currency

iB: The risk-free rate of country B's currency

n: Term which corresponds both exchange rate and deposit rates fw i

Then, substituting the spread for ρi in equation (17) we have:

With respect to the adjustments that are made to other variables in the CAPM, we propose the following:

Rf: Given that this is the risk free rate, it adapts to the risk-free rate of the base currency, A rate.

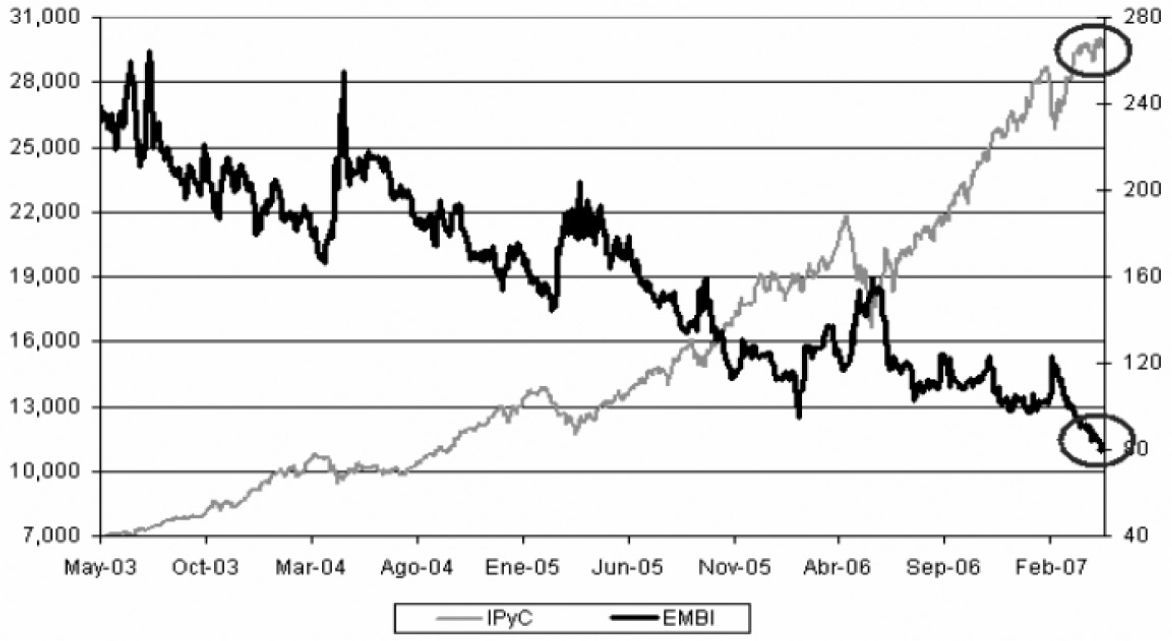

βi: The variable that measures market risk. We use the proxy EMBI+ because it corresponds to a more representative measure of risk for weak markets, as it is the relationship of the mexican peso against other currencies. Also, the substitution of the classical βi can also be due to the favorable results obtained from the empirical test for the EMBI+11 (see figure A).

Figure A.Correlation between Mexican Price Index (IPyC) and country risk (EMBI)

Source: Ponce (2007)

E(Rm) − Rf Since our intention is to find the excess market, we use the method of moving averages to twelve months on the deposit rate to capture this variable. This is consistent because it assumes that investors prefer to shape their minimum performance expectations from historical behavior of the local risk-free rate (country A).

Remember that β′i is the proxy of the risk premium is added/subtracted from the spot rate and that this risk has been formed from an approach adapted from the CAPM. However, in our attempt to refine the risk variable, we should observe the following restrictions:

- 1.

The elements of the risk premium are divided by 100 to give them a marginal approach,

- 2.

The risk premium β′i is calculated additive but not a residual, so that market variables join the unit.

- 3.

Fac_EMBI+ is used, which comes from dividing the EMBI+/1,000. This approach provides a factor which is interpreted directly as the percentage that the investor in country “A” would have in terms of the situation in the United States.

Then, β′i is composed as follows:

And redefining the equation in terms of ρi, the risk premium can be expressed as:

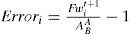

Empirical modelWe will prove whether or not the model proposed here can predict prices of financial assets. To demonstrate the degree of precision, we focus on the behavior of random errors that explain the difference between the forecast Fwtt+1 and the exchange rate term ABA.

Our data includes mexican peso (MXP) against the U.S. dollar (USD); the MXP against the pound sterling (GBP) and the MXP against the euro (EUR) for a period that goes from one month to three months. The data spans from January 2006 to May 2010, which is collected from Bloomberg. The interest rates comes from the central banks of the involved countries. The rates used are: for MXP, the 28 and 91-day CETE, for the dollar, treasury bills at one and three months, for the pound, the one-month LIBOR and three-month GBP, and finally for the EUR, the one-month EURIBOR rate to three months is considered. Moreover, the long-term bonds can be appropriate for the dollar Treasury Bonds; for the case of GBP, the British GS to 20 years, and for the EUR Bonds, European government. Furthermore, the EMBI+ indicator is also considered and taken from JP Morgan Chase.

Estimation errorsA test is necessary to measure the degree of success of the function (14) through a practical assessment test which measures the accuracy of forward simulation calculated against the exchange rate at maturity, i.e.,

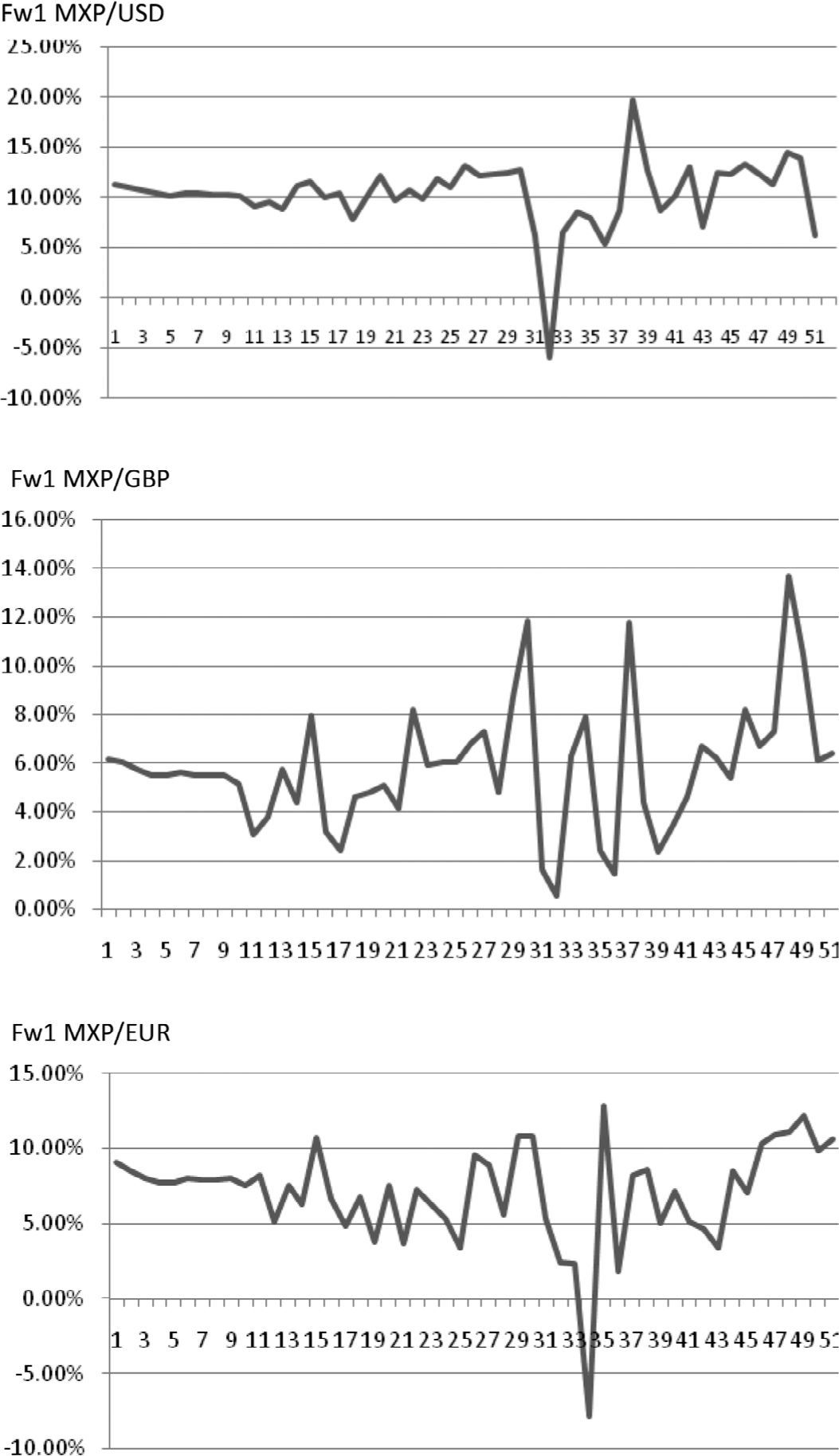

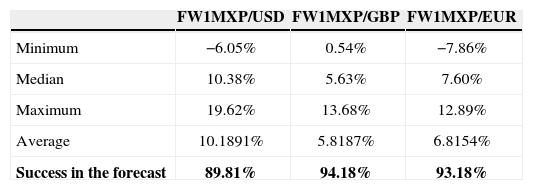

Figure B gives the behavior of the estimation errors found for forward exchange rates to a month. Thus, for the MXP against USD, we have a minimum error forecast rate of −6.05%, which means an overvaluation with respect to the exchange rate at maturity. Moreover, as long as time goes further the error hits 19.62% which means that the formula underestimates the exchange rate. Also, MXP/GBP suffers a greater volatility than the previous interim parity. We note that the handicap is set at 14% and, in general, we also note that we never overvalued the peso against the pound over time. However, for the case of the exchange rate MXP/Eur, we noticed that at a certain point, the formula recognizes a full appreciation of 7.86 and a maximum underestimation around 12.89%.

Table 5 shows the relative values of the prediction error for the peso/currency forward within a month. Although significant levels warn volatility in the exchange rate behavior, note that the predictive model (14) succeeds, much higher than other models based only on interest rates. The tests were made on random errors and they show a predictive ability to forecast 89.81% for a month on the MXP/USD, a 94.18% for the rate MXP/GBP and a 93.18% of the MXP against the Euro.

Forecast success in the predictorThe results shown by equation (14) suggest a very good level of accuracy for the years under assessment (close to or above 90% of accuracy). Contrary to the findings of Bekaert and Hodrick (1993) in the sense that, for them, the premium does not depend on the conditional variance of forecast error, this is included, successfully, in equation 14.

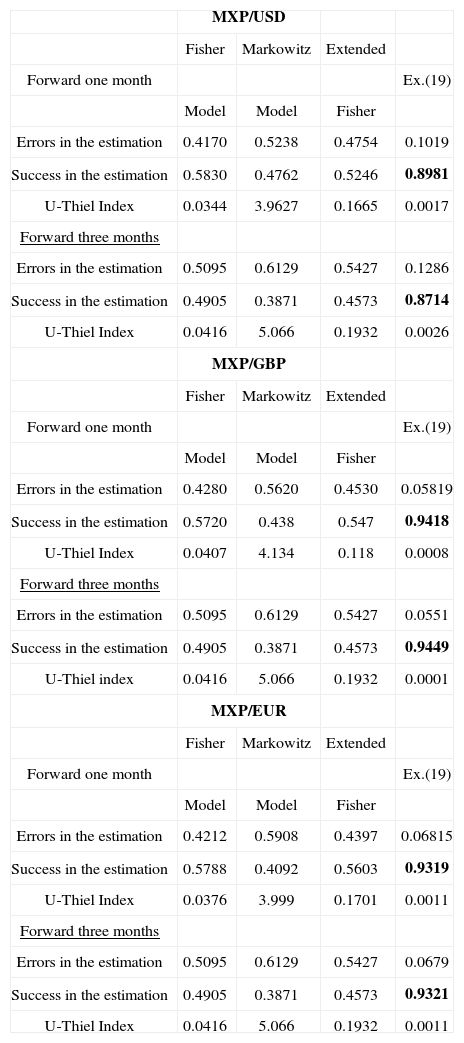

Table 6 shows the accuracy of the classic formulas studied in this paper to forecast the forward exchange rate of the peso against the dollar. The results suggest, again, to be less predictive in classical models compared to equation (14). Much of this predictive failure can be explained by the lack of a risk premium which equation (18) does contain. While the wisdom of the classical formula is around 52%, equation (14) is located at 89; so does the three-month prognosis of being an average accuracy level of 44% in classical equations compared to 87% of the model (14). In the case of forecasts for the pound sterling and the euro, the precision of equation (14) increases at a level above 90% vs. 50% obtained by the classic formulas. How reliable are these results? To this purpose, we apply a validation model that allows us to obtain objective results. Such is the case of U-Thiel index whose results are displayed in table 6 and show that in all the predictions of equation (14) it produces consistent results and investors make rational decisions as our predictors have a better predictive performance than random walk since the index is less than 1.

Validation of predictive models

| MXP/USD | ||||

| Fisher | Markowitz | Extended | ||

| Forward one month | Ex.(19) | |||

| Model | Model | Fisher | ||

| Errors in the estimation | 0.4170 | 0.5238 | 0.4754 | 0.1019 |

| Success in the estimation | 0.5830 | 0.4762 | 0.5246 | 0.8981 |

| U-Thiel Index | 0.0344 | 3.9627 | 0.1665 | 0.0017 |

| Forward three months | ||||

| Errors in the estimation | 0.5095 | 0.6129 | 0.5427 | 0.1286 |

| Success in the estimation | 0.4905 | 0.3871 | 0.4573 | 0.8714 |

| U-Thiel Index | 0.0416 | 5.066 | 0.1932 | 0.0026 |

| MXP/GBP | ||||

| Fisher | Markowitz | Extended | ||

| Forward one month | Ex.(19) | |||

| Model | Model | Fisher | ||

| Errors in the estimation | 0.4280 | 0.5620 | 0.4530 | 0.05819 |

| Success in the estimation | 0.5720 | 0.438 | 0.547 | 0.9418 |

| U-Thiel Index | 0.0407 | 4.134 | 0.118 | 0.0008 |

| Forward three months | ||||

| Errors in the estimation | 0.5095 | 0.6129 | 0.5427 | 0.0551 |

| Success in the estimation | 0.4905 | 0.3871 | 0.4573 | 0.9449 |

| U-Thiel index | 0.0416 | 5.066 | 0.1932 | 0.0001 |

| MXP/EUR | ||||

| Fisher | Markowitz | Extended | ||

| Forward one month | Ex.(19) | |||

| Model | Model | Fisher | ||

| Errors in the estimation | 0.4212 | 0.5908 | 0.4397 | 0.06815 |

| Success in the estimation | 0.5788 | 0.4092 | 0.5603 | 0.9319 |

| U-Thiel Index | 0.0376 | 3.999 | 0.1701 | 0.0011 |

| Forward three months | ||||

| Errors in the estimation | 0.5095 | 0.6129 | 0.5427 | 0.0679 |

| Success in the estimation | 0.4905 | 0.3871 | 0.4573 | 0.9321 |

| U-Thiel Index | 0.0416 | 5.066 | 0.1932 | 0.0011 |

Despite the progress shown on the robustness of equation (14) the presence of a marginal risk is still possible. Note the high “peaks” that estimation errors reach: from 12.89% and 19.62%. These findings, however, give us the opportunity to continue refining our proposal, which basically seeks to have a greater degree of modeling and control of random errors. In this sense, Mosqueda (2008) finds that the earning power theory is an approach that would help to explain the random behavior of the variables that make up the prospective model. Indeed, this theory establishes the relationship between profit and capital resources to generate and promote profits. Here, the formation of expectations rests on historical data which is estimated from past information enough to predict future events. In this sense, equation (14) would follow from the modeling of a risk premium set given its historical performance:

We show the results on the forward exchange rate calculated by the adjusted risk premium (see table 7). In all cases risk premium was overstated. At a confidence level of 95%, the regression on the possibility of reward (15) in a one-month forward, suggests an adjustment to the risk premium −0.00074, −0.0006 and −0.0019 for the USD, GBP and the EUR respectively. In this case the forecast of the peso against the euro demanded a greater degree of adjustment.

Predictive ability of adjusted risk premium

| MXP/USD | MXP/GBP | MXP/EUR | R2 | Adjusted R2 | ||

|---|---|---|---|---|---|---|

| Fw1 | No risk premium adjustment | 0.89810 | 0.94180 | 0.93190 | 0.9031 | 0.8991 |

| Typical error | 0.39544 | 0.61315 | 0.61944 | |||

| Risk premium adjustment | 0.89884 | 0.9424 | 0.9338 | |||

| Typical error | 0.33844 | 0.44359 | 0.47263 | |||

| Adjustment on the risk premium | −0.00074 | −0.0006 | 0.47263 | |||

| Fw3 | No risk premium adjustment | 0.8714 | 0.9449 | 0.9321 | 0.9370 | 0.9276 |

| Risk premium adjustment | 0.9061 | 0.9507 | 0.9553 | |||

| Typical error | 0.38635 | 0.40098 | 0.40837 | |||

| Adjustment on the risk premium | −0.0347 | −0.0058 | −0.0232 |

FW1: Forward rate of one month

FW1: Forward rate of one month FW3: Forward rate of three months

Also, the regression on the adjusted premium is observed in a multiple correlation coefficient that is very high: a R2 of 0.9031 and an adjusted R2 of 0.8991, which correspond to the typical error levels as low. With respect to three-month forward, it also recognizes the need for a greater degree of adjustment on the risk premium because the behavior of the estimation errors may become, mostly, a volatile and erratic behavior over time. Thus, same way as in the calculation of the one-month exchange rate, the results suggest a correction to the risk premium, given a confidence level of 95%, from −0.0347, −0.0058 and −0.0232, respectively.

The increase in the coefficient of determination (R2 and R2 Adj. of 0.9370 and 0.9275 compared with 0.9031 R2 and adjusted R2 of 0.8991 obtained with equation (14) without adjusting for risk) is interpreted as an increase in the ability of β′1 to collect the investor's expectations and to discount the value of the spot rate.

In previous studies, Mark (1995), for example, found multiple correlation coefficients with levels ranging from 0.179 (for the Canadian market) up to 0771 (for the Swiss franc), without coefficients statistically significant. On the other side, Neely and Sarno (2002), incorporated the value at risk approach, replicating the study of Mark (1995) with coefficients of determination similar to Mark's: 0,065 for the Canadian dollar, 0.0675 to the German mark disappeared, 0,173 for the yen and a 0,137 in the case of the Swiss market.

Based on the above, we can infer that by the adjustment to the risk premium for the possibility of Premium and given a non-seasonal historical behavior, it is possible to achieve a higher degree of predictive ability.

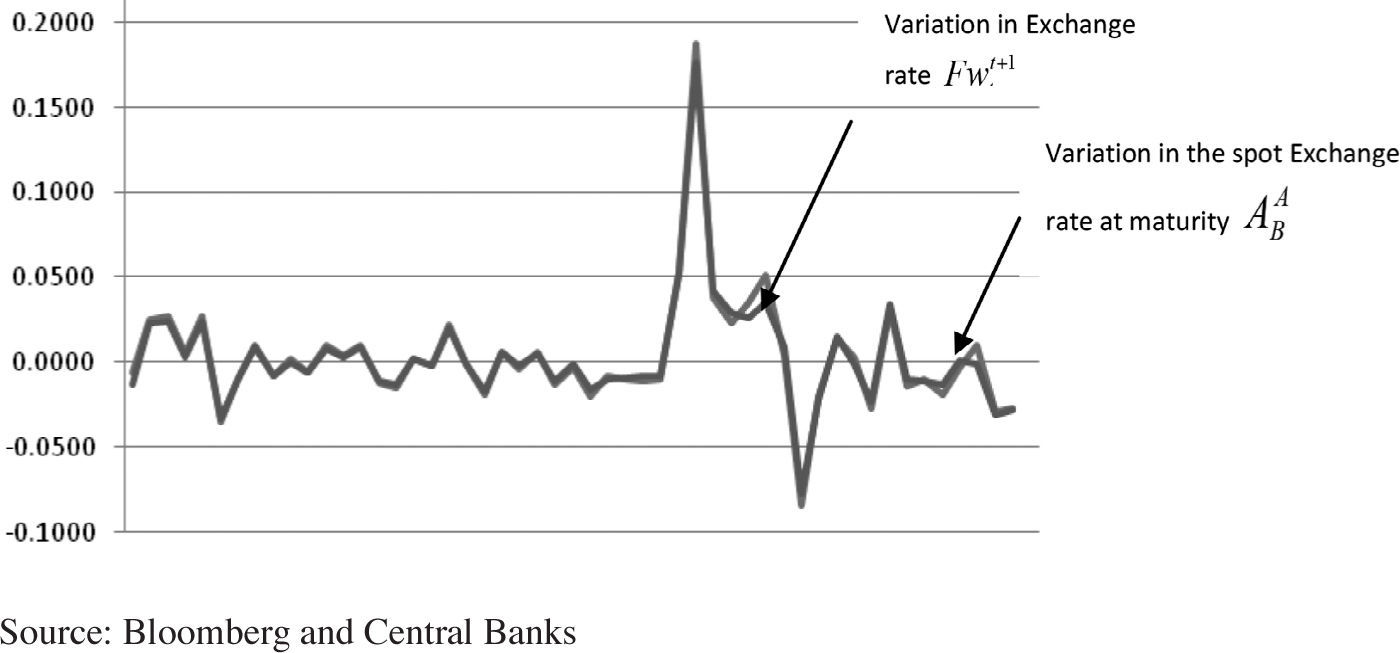

Figure C shows, by way of example, an almost perfect correlation between the marginal behavior of the forward rate, Fwtt+1, estimated by equation (14), with the percentage changes that occur in the spot rate at maturity, ABA. In this sense, it is clear the relevance of incorporating the adjusted risk premium, β′i, because it captures, as suggested by Harvey (1991), the performance variant of the premium demanded by investors across different contexts and times.

ConclusionsIn light of these findings we can conclude that the results are encouraging because they not only model the behavior of the risk premium but the function given in equation (14) has a dynamic characteristic that makes it more powerful. Note, for example, that the high degree of accuracy and specification permits to reinforce the idea that interest rates can be an unbiased proxy for the exchange rate subject to adjustment under the CAPM approach.

We noticed a close and strong correlation between changes in spot rates and forward estimates for equation (14) that allows us to infer that it is possible to keep accurate prices with consistent forecast regarding the terms. The spot exchange rate itself is an unbiased proxy for forward exchange rates when it is adjusted to the expectations that are formed by investors. The latter goes along the line of Jensen (1978) who already establishes the need for a prime to offset risk.

Despite the findings of other studies, we found no random relationship in the appropriate level of risk that investors expect, but on the contrary, we see some rationality in shaping expectations of risk that would occur from the different adjusted economic positions of countries. The results provided by economic models, mainly those based on interest rates, are better specified than those obtained in a study of random walk.

Of course, we will refer to the free market exchange rate. Fixed exchange rate and managed float regime are ruled, for example, by issues directly related to monetary policy rather than to market conditions.

The main problem in this theory is that the actual exchange rate as the Fw or theoretical exchange rate should be a good term exchange rate predictor. However, Agmon and Aminud (1981), for example, could not find empirical evidence that demonstrate that the Fw exchange rate follows a random behavior approach.

Empirical results are shown in table 2. We use monthly information of the foreign exchange and money markets for a period from September 2009 to January 2010. The results of the three classical proposals may suggest that the better equations are specified in equation (4) and equation (6). However, the DM test for nonlinear specification is implying here the possibility of considering a risk variable that will be developed further. See that not all the periods can be perfectly forecasted by the two best equations.

A very common interpretation of spurious regressions would be that the variables are significantly associated but experiencing a low value of R2, this suggests that additional variables are missing in the equation, the absence of which in turn explains the low value of Durbin-Watson experience.

Further research made by Front and Thaler (1989), for example, reported that the values of should be at −0.88.

That might result contradictory to the recommendations of the economic theory that says that the investment in a weak currency (for the high interest rates) originates a decrease in the investor's capital because the currency of investment is devaluated. However, there is evidence that shows that a higher interest rate brings a guarantee to investors because the currency with higher interest rate tends to appreciate.

Baillie and Bollerslev (1989) concluded in their empirical study that after using monthly data they did not find strong conditional heterocedasticity that, a priori, they felt would be in connection with finer sampling intervals.

Fernández (2008) analyzes a hundred books about financial matters, and found that 89 out of these 100 books explicitly recommend CAPM to calculate the required return to shareholders from the risk considered in balance function.

Engel (2000) found that the exchange rate experienced a stationary process and, therefore, the deviations were large and persistent but stationary, still, even in the presence of transaction costs.

In his work, Fernández argues that there are 4 types of Market Risk Premium which generate controversy and confusion as they obey to very different realities, namely: a) Historical Market Risk Premium: is the difference between the historical performance of Stock Market (of a stock index) and fixed income, b) Expected Market Risk Premium: is the expected value of the future profitability of the Stock Market above the fixed income, c) Required Market Risk Premium: is the incremental return that an investor requires from the stock market (to a diversified portfolio) over the risk free rate (required equity premium). It is to be used to calculate the required return [to action] [?], d) Implicit Market Risk Premium: the market risk premium required to match the market price.

It is noteworthy that the EMBI is used when dealing with the relationship of currencies from developed countries. In a statistical test, we checked a data span of three years, and we find that the EMBI plus EMBI+ were better specified than other indicators for sovereign risk. Research suggests that the EMBI+ (along with two other variables that tested their monthly performance over the last 5 years), explained more than 50% of the performance for different emerging markets, which did not happen if we have taken into account the “typical β“.