Quid pro quo policies, mainly in foreign partial acquisitions of state-owned enterprises (SOEs) in China, have been controversial due to the corresponding forced technology transfer for market access. Whether and how quid pro quo affects SOE innovation has received limited attention. This study develops a model to analyze how government intervention in SOEs’ social responsibility and the cost advantage of multinational enterprises (MNEs) affect SOE innovation during partial acquisitions. The model shows that increases in SOEs’ social responsibility in industries strongly characterized by public goods and significant technical disparities compared with MNEs and reductions in SOEs’ social responsibility in industries with intense competition decrease SOEs’ relative control. Due to MNEs’ cost advantage, they can often gradually gain control of joint ventures, which weakens SOEs’ innovation resources and independence. The results imply that even if quid pro quo brings technology to SOEs, it is not conducive to SOE innovation; therefore, the government should liberalize quid pro quo.

Innovations have become increasingly crucial for firm growth and competition. Foreign investment brings opportunities and pressures for domestic firms in developing and transition economies to innovate and improve their competitive position (Fons-Rosen, Kalemli-O ̈zcan, Sørensen, Villegas-Sanchez & Volosovych, 2018). The technological gap between firms in advanced economies and domestic firms in developing and transition economies has encouraged a growing number of firms in developing and transition economies to exchange their traditional internal innovation practices for new forms of cooperation such as joint ventures (JVs), cross-border mergers and acquisitions (M&As) and various other types of technology-sharing agreements. According to the United Nations Conference on Trade and Development, approximately half of the world's foreign direct investment (FDI) was directed to developing and transition economies in 2011. This proportion increased to two-thirds in 2020. However, developing and transition economies such as China, India, Vietnam, the Philippines, and Brazil continue to impose considerable restrictions on FDI in some sectors (Bai, Barwick Jia, Cao & Li, 2020). By the 1970s, a quid pro quo approach requiring multinational enterprises (MNEs) to form JVs with domestic firms and transfer technology in return for market access had become a common practice in many developing and transition economies (Holmes, Mcgrattan & Prescott, 2015). This quid pro quo approach was identified as a form of forced technology transfer based on foreign ownership restrictions by the report of the Office of the US Trade Representative on the US–China trade debate in 2018.

Despite the longstanding controversy over such quid pro quo activities, there have been limited studies on their benefits to the domestic firms of host countries. The most crucial goal of host country governments in using quid pro quo is to increase technology transfer (Wang & Zhou, 2021). Another goal of China's government is to promote the institutional reform of state-owned enterprises (SOEs). In developing and transition economies, personal connections are often more important than legal standards or impartial justice systems, so relationships with governmental authorities are particularly critical (Luo, 2001; Lei, 2021). Therefore, foreign investors prefer firms that are relatively large and innovative and that benefit from public subsidies (Jiang, Keller, Qiu & Ridley, 2019). Obtaining ownership of SOEs can provide MNEs access to the country's powerful domestic networks and resources that are only available to SOEs. Thus, many MNEs have been motivated to form JVs with SOEs.

In China, quid pro quo was first introduced in the automobile industry. Many state-owned automakers set up new firms with foreign automakers in the form of JVs. Numerous JVs became restructured SOEs that were partially acquired by MNEs. In the 1990s, MNEs mainly acquired smaller SOEs that were sometimes average performers and concentrated in industries such as the detergent, cosmetics, camera equipment, mobile communications, drinks, and beer industries. Many MNEs employed full acquisitions and entered the market with their own brand products that replaced Chinese brands or acquired Chinese brands and then replaced them with their own (Cooke, 2006). The Notice Regarding Transfer to Foreign Investors of State-owned Shares and Legal Person Shares of Listed Companies was promulgated on November 4, 2002. It allowed MNEs to partially acquire some large- and medium-sized SOEs. Since then, cross-border M&As have focused on large- and medium-sized SOEs with high profits, substantial industry advantages, and valuable resources. Furthermore, the Catalogue of Industries for Guiding Foreign Investment issued in 2009, 2011, 2015, and 2017 and the Catalogue of Encouraged Industries for Foreign Investment (Edition 2020) encourage MNEs to merge with Chinese domestic enterprises, including SOEs. However, if such a merger involves transferring state-owned assets or the administration of state-owned equity in public listed companies, an application to the State-owned Assets Supervision and Administration Commission (SASAC) or the provincial department of state assets for approval is required. Technology transfer is still a crucial factor in the approval of a merger. Usually, due to the important economic and political positions of these large- and medium-sized SOEs, MNEs can only partially acquire them, and they are subsequently restructured into JVs.

Although most related literature suggests that quid pro quo can lead to technology transfer from MNEs to domestic firms (Wang & Zhou, 2021; Bai et al., 2020; Holmes et al., 2015), research on the innovative effect of quid pro quo is scarce. Unfortunately, no studies exist on whether partial acquisitions via quid pro quo affect SOEs’ innovative capability; if so, how the process of foreign partial acquisition affects the innovation of a target SOE; and whether heterogeneity exists across different industries.

This study aims to fill this research gap. It builds a model based on a theoretical framework to analyze how MNEs’ partial acquisition of SOEs in the form of JVs affects the independent innovation of these partner SOEs in developing and transition economies. This study contributes to the literature in several ways. First, it emphasizes that acquiring technology does not necessarily improve innovation capability. We build a theoretical framework to analyze how partial acquisition affects participants’ innovation, including their research and development (R&D) input, efficiency, and output. This framework and mechanism analysis extend the theory on the relationship between quid pro quo and innovation. Furthermore, this study distinguishes between acquirers and targets in JVs in the form of foreign partial acquisition and constructs a model to analyze how the partial acquisition process affects the innovation of an acquirer and its target. It contributes to an improved understanding of the dynamic effect of foreign partial acquisition on innovation. Finally, this study focuses on foreign partial acquisitions of SOEs in developing and transition economies. In 2019, the proportion of capital held by SOEs in Chinese industries was 47.87%. Moreover, the 2008 global financial crisis accelerated the development of SOEs in many developing countries (Nash, 2017; Boubakri, Ghoul, Guedhami & Megginson, 2018). With the global industrial restructuring due to the technology revolution and growing intangible asset trade along global value chains, SOEs may have to cooperate with MNEs in some industries. This study provides a new research perspective and has significant policy and managerial implications for China and other developing and transition economies.

The rest of the paper is organized as follows. First, a literature review is presented, followed by a discussion on the mode of cross-border M&As in China, their underlying motivation, and the theoretical framework. Then, a model is built to analyze how MNEs’ partial acquisition of SOEs affects SOEs’ innovation. This paper concludes with a discussion followed by policy recommendations and future research suggestions.

Literature reviewFDI entry mode and the effect of quid pro quoThe FDI entry mode depends on the host country's market competition. Our context is Chinese strategic industries, wherein most MNEs form JVs with SOEs or partially acquire SOEs and then restructure them into JVs. Regarding specific industries, Hennart (1991) and Hennart and Reddy (1997) prove that in high-growth, highly concentrated, or resource-intensive industries or industries with relatively significant economies of scale where domestic enterprises occupy a dominant position, FDI tends to enter via JVs or partial acquisitions. Elango and Sambharya (2004) also find that in industries characterized by high profit or relatively high plant scale, JVs or acquisitions are preferred over greenfield operations as entry modes. Due to the regulatory restrictions on the level of foreign ownership in some industries within developing and transition economies, FDI must be conducted via partial rather than full acquisitions (Contractor, Lahiri, Elango & Kundu, 2014). Alquist, Berman, Mukherjee and Tesar (2019) find that in less financially developed countries, MNEs have larger stakes in partial acquisitions within industries that are highly dependent on external finance than within those that are less dependent. Partial acquisitions create a hostage effect that facilitates ex-ante target screening and ex-post contract enforcement. Partial acquisitions also arise because an acquirer may not have sufficient funds or wish to purchase an entire target at once due to uncertainty regarding the target's future cash flows (Otsubo, 2021).

Some studies on quid pro quo in the form of foreign partial acquisitions show that in developing economies, domestic firms benefit from technology transfer and knowledge spillovers from MNEs in the context of international JVs (Jiang et al., 2019; Liu, Lu & Yang, 2020; Holmes et al., 2015). Conversely, other studies argue that international JVs may discourage the innovation of domestic partners through a cannibalization effect (Howell, 2018). Bai et al. (2020) find that FDI via quid pro quo facilitates knowledge spillover and quality upgrading in the Chinese automobile industry; however, FDI via quid pro quo is not a prerequisite for knowledge spillover. Technology transfer from MNEs can help domestic partners improve their technical level in developing and transition economies (Fons-Rosen et al., 2018). However, this transfer does not necessarily promote the innovation ability of domestic firms. Most studies analyzing the innovative effect of quid pro quo take the Chinese automobile industry as a research setting. However, little literature exists on the impact mechanisms in different industries.

Innovative effect of JVs and M&AsThe innovative effect of JVs and M&As has been analyzed from several perspectives, such as those of the resource-based view (Stiebale & Vencappa, 2022), technology management (Cassiman, Colomno, Garrone & Veugelers, 2005), industrial organization (Haucap, Rasch & Stiebale, 2019), and international economic issues, such as entry mode choices related to FDI (Nocke & Yeaple, 2007). Most of these studies are based on firms in advanced economies, and their empirical results are mixed. From a theoretical perspective, due to technology transfer, reorganizing R&D activities and economies of scale or scope, international JVs, and cross-border M&As contribute to improving the productivity and innovation performance of the firms involved (Braguinsky, Ohyama, Okazaki & Syverson, 2015;Federico, Langus & Valletti, 2018). Developing and transition economies differ from developed countries in terms of their institutions, levels of economic development, marketization, and corporate governance quality (Lei, 2021). In developing and transition economies, firms with different types of ownership have different objective functions, market positions, and market behavior. Foreign acquisitions of firms with different types of ownership may entail different innovation effects.

Some theoretical approaches argue that international JVs and cross-border M&As are conducted to access domestic firms’ assets rather than solely to exploit the existing assets of the investor (Jiang et al., 2019). In developing and transition economies, SOEs are closely tied to governments; they receive direct financial subsidies and indirect preferential treatment (Lei, 2021), which help them establish monopolies in home markets. Due to these unique features of international JVs and cross-board M&As in developing and transitional economies, it is plausible that research findings based on international JVs and M&As in developed countries may not be applicable to developing and transition economies. In addition, the entry mode of FDI can affect the transfers of technology and competition intensity of host countries (Morita & Nguyen, 2021). Some studies focusing on China find that MNEs entering via M&As have a higher propensity toward control and a stronger motivation to find new monopoly advantages than entering via other modes (Chen & Wang, 2003). Some studies have built models to analyze the innovation effect of new international JVs established between MNEs and domestic firms (Howell, 2018; Holmes et al., 2015).

Most studies analyze the innovative effects of M&As on acquired firms without considering the ownership type of the corresponding targets. The innovative effect following the acquirer's partial acquisition of its target is conditional upon their unique control and capabilities. Shifts in ownership and control structure have different innovative impacts on the acquirer and target. Moreover, in developing and transition economies, foreign partial acquisitions involving firms with different ownership types may have different innovative effects. This study develops a model to understand how the process of foreign partial acquisition involving SOEs influences the independent innovation of target SOEs.

Theoretical frameworkForm and motivation of partial acquisition between SOE and MNEGaining access to technology and developing innovation capabilities are significant motivations for SOEs to offer themselves as foreign acquisition targets. Many large SOEs in China, particularly those in the construction and heavy machinery industries, have been acquired by and affiliated with MNEs in the past decade. In recent years, most cross-border M&As have taken the form of horizontal partial acquisitions by acquiring a stake in an existing SOE. Partial acquisitions are a hybrid option combining characteristics from total acquisitions and JVs. Usually, partial acquisitions are categorized as JVs and partially owned greenfield ventures (Hennart, 1991; Cooke, 2006). In the 1980s and 1990s, FDI mostly took the form of JVs with SOEs and greenfield wholly foreign-owned enterprises, respectively, and throughout the 21st century, cross-border acquisitions have been increasing (Cook, 2006). Cook's (2006) definition of a JV is consistent with that of a partially owned greenfield venture.

In China, the SASAC is the shareholder of SOEs. There are two main SOE–MNE alliance patterns. One comprises partially owned greenfield ventures, wherein SOEs and MNEs jointly invest in and are shareholders of a new JV. The other comprises partial acquisition, wherein an MNE invests and holds a stake in an SOE, and then the ex-SOE is transformed into a JV in which the SASAC and MNE are shareholders. Thus, the partially acquired firm is a Sino–foreign JV. In this case, the MNE holds a stake in the partially acquired firm and maintains its previous operations in its home country. However, the SOE maintains an ownership position only in the partially acquired firm and does not have other assets or operations. When forming a partially owned greenfield venture, the participating MNE and SOE hold a stake in the JV and maintain their previous operations. However, many SOEs strip their core assets and put them into their JVs, which makes the technology of these SOEs dependent upon their JVs. Therefore, the innovative effect of forming a partially owned greenfield venture may be the same as that of forming a partially acquired firm. For example, the SOE Nanjing Yuhuan Water Heater Co. put all its machinery, technology, marketing channels, brands, production permits, factory floor (leasing), and employees into a JV with the MNE A.O. Smith in 1995. Afterward, it became a shell company and its development and innovative capacity depended on the JV.

In China, SOEs have specific social responsibilities and enjoy certain privileges in terms of government support related to financing, resources, and procurement. Large- and medium-sized SOEs are primarily concentrated in monopoly industries, have relatively strong market power, and have accumulated relatively abundant resources, including market networks, supply networks, franchise rights, and brands. However, such administrative monopolies’ long-term advantages have led to SOEs’ inefficiency and restrained their innovation (Shi & Zhang, 2018; Zhang, Yu & Chen, 2020). With increasing competition, SOEs are motivated to cooperate with MNEs via partially owned greenfield ventures or partial acquisitions to acquire knowledge or the latest technology and management skills or develop international markets by associating with well-known international brands (Cooke, 2006).

Cross-border M&As may be motivated by the desire of foreign firms to exploit complementarities between local firms’ country-specific capabilities and acquirer firms’ “intangible technological advantages” (Nocke & Yeaple, 2007) because some capabilities, such as marketing, distribution, and country-specific institutional competency, are imperfectly mobile across countries. In China, industries with high SOE concentration are protected by regulatory restrictions and have high barriers to entry. Holding a stake in an SOE or forming a partially owned greenfield venture with an SOE is a viable mode for MNEs to enter such industries and access SOEs’ resources or robust domestic networks, especially those involving government officials (Luo, 2001).

Huck, Konrad and Müller (2004) argue that two properties characterize the governance structure of acquired firms. After a partial acquisition, each entity often remains independent for valuation purposes, and acquirers are always strongly incentivized to exercise some degree of control over their targets (Akhigbe, Madura & Spencer, 2004). Partial acquirers may attempt to take over the remaining stake of their partially acquired firms. In some acquisitions, the acquirer and the target are kept separate in terms of management, distribution, advertising programs, and product and brand portfolios because each brand has a different value. In the case of most partially acquired firms, the acquirer and target sell products under their respective brands. Many MNEs subsequently obtain more control over their targets and replace well-established Chinese brands with foreign ones (Cooke, 2006). Therefore, post-acquisition integration is a game for control and resource between the partial acquirer and its target.

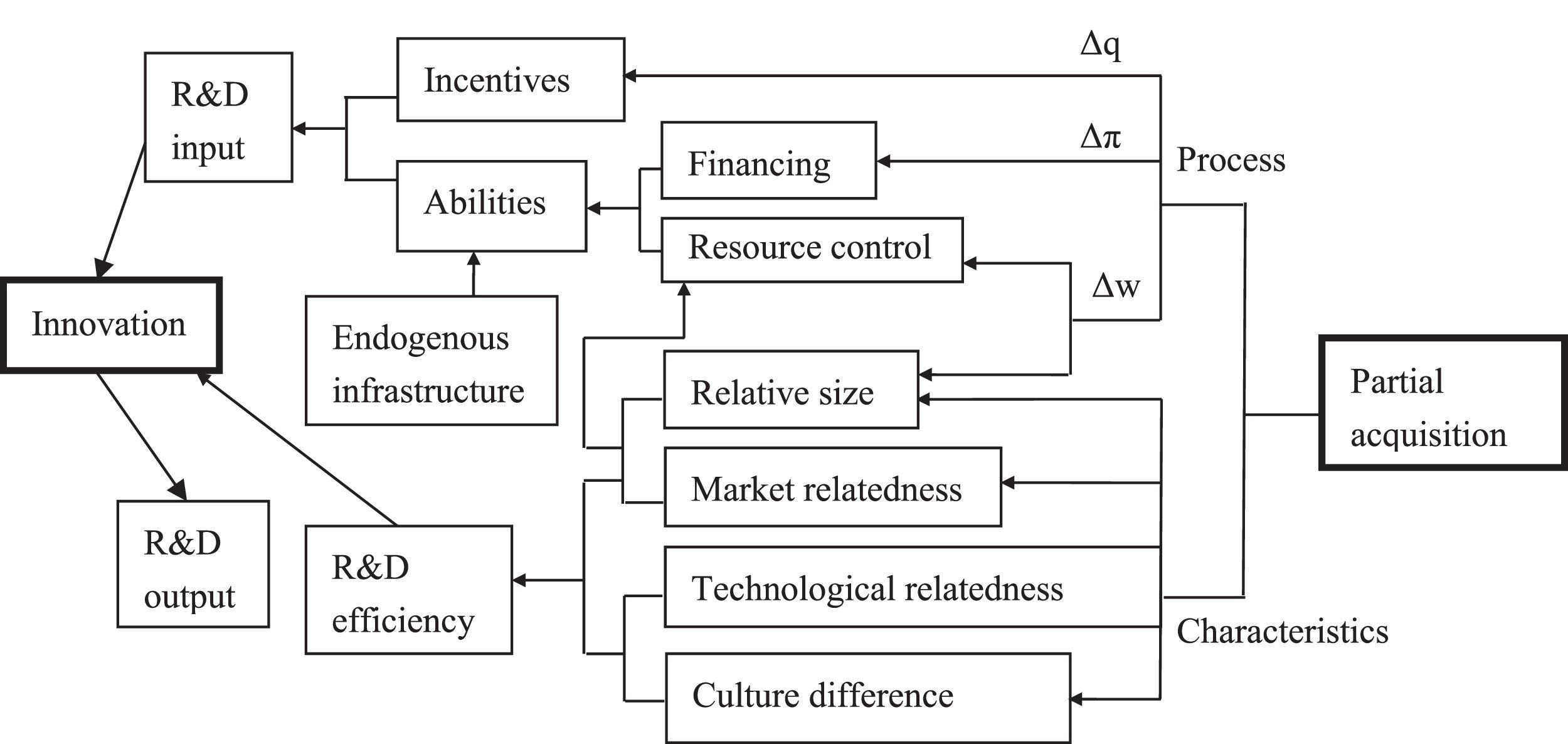

Effect of partial acquisition on the R&D process of an acquirer and its targetWe draw upon theories of technological innovation, learning, and the resource-based view to develop our theoretical framework. As Stiebale (2016) shows, foreign M&As can relocate the innovative activity of acquirers and targets between them. The process of partial acquisition may have innovative effects on an acquirer and its target by influencing their R&D processes, in which R&D input and efficiency influence R&D output (Fig. 1). A firm's innovative incentives and abilities influence its R&D input (Arora, Belenzon & Sheer, 2021). Differences between the acquirer and target in terms of key characteristics, such as their market relatedness, technological relatedness, and cultural differences, and the relative size of the acquired knowledge base may affect R&D efficiency (Ahuja & Katila, 2001).

The size of an acquirer's knowledge base relative to that of its target's knowledge base reveals the degree of difficulty that the acquirer will be faced in absorbing the newly acquired knowledge and the degree to which the target's organizational routines will be disrupted. An acquirer's relatively large knowledge base can disrupt the existing innovative activities of the target and make different integration stages time-consuming and risky (Ahuja & Katila, 2001). Furthermore, the greater the size of an acquirer's knowledge base is, the larger the stake that the acquirer holds in the acquired firm and the stronger the relative control it can obtain. In contrast to vertical and conglomerate acquisitions, acquirers and targets are competitors in horizontal acquisitions. Fear of helping a competitor develop new technology may be an incentive to hold back in an acquisition, for example, by withholding certain research results. Cassiman et al. (2005) find that R&D efficiency gains are smaller if acquired entities were rivals in the product market before their acquisition than if they were not rivals. This suggests that the larger the relative size of the acquired knowledge base is and the stronger the involved firms’ market relatedness is, the greater the tendency of the acquirer to control key knowledge resources in the acquired firm is.

Similar knowledge resources facilitate the integration of acquired knowledge bases (Rachel, Brock, Rosenfeld & Deir, 2018). However, if the two knowledge bases are too similar, little contribution will be made to subsequent innovation performance. Similar R&D activity in a target is often discontinued due to duplication issues, and additional resources are allocated to efficient acquirers after an M&A. Other factors, such as cultural differences between an acquirer and its target, may prevent technology transfer by making communication and the assimilation and application of new knowledge difficult, thereby hurting innovation (Huang, Zhu & Brass, 2017). Usually, a large technology gap and low absorptive capability induce weak knowledge spillovers from foreign acquirers to their targets.

High levels of innovative incentives are conducive to increased innovation efforts, which shows the strong motivation of a firm willing to innovate. High levels of innovative abilities facilitate high levels of R&D, which shows the strong ability of a firm, that is, it “can” innovate. Howell (2017) suggests that to be incentivized to undertake R&D, a firm must be able to appropriate enough returns to make the investment worthwhile. A monopoly faces low market uncertainty and can easily appropriate returns from its R&D investments. The value of a reduction in unit cost induced by innovation will increase with a firm's output, and high innovation costs require a large amount of corresponding output. Therefore, in an acquired firm, if the output of one participant's brand or its relative output to another participant's brand declines, the reduced expectation of innovation returns will decrease the incentives to increase R&D activity for this brand.

In addition to a firm's endogenous innovative infrastructure, its innovative resources, including technology, R&D personnel, and sources of finance, determine its innovative abilities. For many firms, it is difficult to obtain external financing due to the uncertainty and information asymmetry associated with innovative activities (Acharya &, Xu, 2017). Some firms become targets of MNEs because of a relative scarcity of capital due to weak financial development (Alquist et al., 2019). Moreover, a lack of financing to expand investment makes some firms choose to be targets. Acquisitions allow firms to redefine their R&D programs and specialize in specific technological fields (Stiebale, 2016; Levine, 2017). By producing under the respective brands of the acquirer and target within an acquired firm, the participant with more or dominant control power can control essential resources and make decisions and tends to allocate more knowledge resources to innovate its own brand.

In summary, the independent valuation purposes of the involved acquirer and target may encourage them to gain more control over resources in the acquired firm. Partial acquisitions between SOEs and MNEs may increase their overall R&D budgets and enable the acquired firm to tackle larger R&D projects and engage in more research projects than either individual firm could have done. However, the reallocation of control, profit, and output of the MNE and SOE's brands between themselves may also affect their innovative incentives and abilities. Therefore, we outline a simple model to illustrate how changes in the control (Δϖ), profit (Δπ), and output (Δq) of SOEs may affect their incentives and abilities to perform R&D activities.

ModelModel constructionWe conduct a comparative static analysis and focus on the effect of acquisitions between MNEs and SOEs on the innovation of SOEs. Considering the nonprofit maximizing behavior of SOEs, we follow a model built by Sansing (2000) that analyzes the market competition effect of JVs between nonprofits and for-profit organizations and its effect on decreasing production costs. Our model analyzes the impact of government intervention on MNEs’ control in the JVs and then examines the development of the involved SOE.

For simplicity, we assume that initially, only one SOE (a monopoly) exists in a particular market. An MNE can enter the market through a greenfield investment or a partial acquisition of an existing SOE. If an MNE enters the market via a greenfield investment, the SOE and MNE engage in Cournot competition in the market. The SOE's output and production cost per unit of output areqsandcs, respectively, whereas the MNE's output and production cost per unit of output are qfand cf, respectively. If the MNE enters the market via a partial acquisition of the SOE, we assume that the JV sells products under the respective brands of the SOE and MNE. They share profit π under an agreed-upon sharing rule wherein (1 − ϖ)π + η is allocated to the MNE and ϖπ−η is allocated to the SOE, where 0 ≤ ϖ ≤ 1, η ≥ 0. ϖ is the proportion of profit and control rights allocated to the SOE, which is determined based on the size of the SOE's share in the acquired firm; moreover,η is the profit allocated to the MNE, which is independent of the share proportion. The integration of the MNE's technological advantage with the SOE's resource advantage may benefit the JV in terms of innovation or economies of scale that can help reduce production costs. The JV's production cost cj equals γ1cfwhen it is controlled by the MNE and equals γ2cswhen it is controlled by the SOE. Parameters γ1 and γ2 indicate the cost-decreasing effect of integrating the SOE's resources and MNE's technology. The greater the advantage from integration is, the smaller the value of γ1 or γ2 is, whereγ1, γ2> 0.

Suppose the inverse function of the market demand satisfies p = d − Q, where d > 0, and total quantity Q is supplied by the SOE before the MNE enters. However, the total quantity is supplied by the SOE and MNE separately when the MNE enters the market through a greenfield investment and by the JV when the MNE enters the market through a partial acquisition of an incumbent SOE. Due to its state ownership, the SOE's goals involve not only the production of goods but also the provision of political support for the government and various social services and benefits (Buckley, Clegg & Wang, 2002). Therefore, we specify the SOE's objective function as the sum of its profit and part of consumer welfare, whereas the MNE maximizes only its profit. The government generally requires that an SOE's public responsibility be assured even after its acquisition by an MNE. We suppose that its goal is to maximize the objective function of SOE regardless of who controls the JV.

Subscripts s, f, and j denote the SOE, MNE, and JV, respectively; superscripts s and f represent the corresponding variables when the SOE and MNE control the JV, respectively.

Before the MNE enters, the objective function of the SOE is given as:

Fraction α denotes the weight of the SOE's social responsibility compared with its profit. Differentiating Eq. (1) with respect to qs yields the following equilibrium: qs* = d−cs2−α. For qs* ≥ 0, it holds that 0 ≤ α < 2. In what follows, we describe the objective function and solution when the MNE enters the market through a greenfield investment and a partial acquisition of the SOE.

When the MNE enters the market through a greenfield investment, its objective functions and that of the SOE are given by

Differentiating Eqs. (2) and (3) with respect to qf and qs yields the following equilibrium: qf* = (2−α)(d−cf)−(d−cs)3−α, qs* = 2(d−cs)−(1−α)(d−cf)3−α. For qf* ≥ 0 and qs* ≥ 0, it holds that 1−α2 < d−csd−cf ≤ 2 − α and 0 ≤ α ≤ 2.

When the MNE enters the market through a partial acquisition of the SOE and obtains a stake of over 50% and, thus, control of the JV, the ownership type of the acquired firm changes from state-owned property to non-state-owned property, but the target's property is still state-owned. When the MNE owns less than 50% of the JV and has only minority control over it, the JV remains state-owned, and the property of the target also remains state-owned. When the MNE controls the JV, the choice variablesqj, ϖ, and η are chosen to maximize the SOE's utility. The first constraint requires the MNE's post-acquisition profit to be no less than that of the greenfield investment πf*; otherwise, the MNE will not pursue the acquisition. Given the sharing rule, the second constraint ensures that the MNE maximizes its profit by choosingqj. The equilibrium is determined by

Solving Eq. (6) yields the equilibrium quantity as follows:

Because qjf does not depend on ϖ or η, setting η = 0 and substituting qjf from Eq. (7) and η = 0 into Eq. (5) yields

Solving Eq. (4) yields profit πsf and social responsibility wsf of the SOE as follows:

As shown in Eq. (4), the SOE realizes the utility given by usf = πsf + wsf. For 0 ≤ ϖ* ≤ 1, it holds that 1 − 2d−csd−cf ≤ α ≤73 − 23d−csd−γ1cf. Solving Eq. (5) yields the profit of the MNE:

Substituting qjf from Eq. (7) into equation πjf = qj(p − γ1cf) yields the total profit of the JV:

When the JV is controlled by the SOE, the choice variables qj, ϖ, and η are chosen to maximize the SOE's utility subject to two constraints. However, the second constraint requires that the SOE maximizes its profit by choosing qj based on the sharing rule. The equilibrium is the solution to the following formulas:

Solving Eq. (15) yields the equilibrium quantity qjs = ϖ(d−γ2cs)2ϖ−α, where ϖ > α2. Substituting qjs into Eq. (14) yields η. Substituting qjs and η into Eq. (13) yields social responsibility wss and total utility uss of the SOE:

The SOE realizes utility given by uss = πss + wss. When ∂uss∂ϖ = α2(1−ϖ)(2ϖ−α)3(d − γ2cs)2 = 0, for 0 ≤ ϖ ≤ 1 and ϖ > α2, it holds that 0 < α < 2 and ∂2uss∂ϖ2 = −α2(6−4ϖ−α)(2ϖ−α)4(d − γ2cs)2 < 0. Therefore, when ∂uss∂ϖ = 0, uss is maximized, thereby yielding ϖ** = 1 and the following:

Solving Eq. (13) yields the profit of the MNE:

Substituting qjs from Eq. (18) into equation πjs = qj(p − γ2cs) yields the total profit of the JV:

Comparative static analysisTo illustrate how a change in the control (Δϖ), profit (Δπ), and output (Δq) of an SOE may affect its innovation activities, we start by analyzing the impact of a change in the value of α on the equilibrium solution. If the JV is controlled by the MNE, differentiating Eqs. (8) and (9) with respect to α yields:

Eqs. (7) and (12) show that α does not affect qjf and πjf. Differentiating Eq. (10) with respect to α yields ∂wsf∂α = 12(d−γ1cf2)2 > 0. This means that consumer welfare wsf increases by α. Eqs. (21) and (22) show that if 2 − d−csd−cf < α < 3, it holds that ∂ϖ*∂α < 0 and ∂πsf∂α < 0. As shown earlier, when the JV is controlled by the MNE, it holds that 1 − 2d−csd−cf ≤ α ≤ 73 − 23d−csd−γ1cf. As a result, if 2 − d−csd−cf < α ≤ 73 − 23d−csd−γ1cf, it holds that ∂ϖ*∂α < 0 and ∂πsf∂α < 0. This suggests that the more consumer welfare that the SOE provides, the less relative control ϖ*and profit πsf the SOE will have. When 2 − d−csd−cf < α ≤ 73 − 23d−csd−γ1cf, the SOE's social responsibility is relatively high.

In some industries in which the government needs to consider consumer welfare, the government is often motivated to increase wsf by increasing α. To compensate for the reduction in SOEs’ profit induced by an increase in α, the government usually supports SOEs with certain institutional advantages, such as protective or preferential policies. However, SOEs’ relative control ϖ* decreases with α, whereas MNEs’ relative control (1 − ϖ*) increases with α. As a result, MNEs can obtain stronger control in JVs, which makes it easier for them to exploit SOEs’ advantages. Once an MNE gains further control, it can allocate more resources to innovative activities and the output of its brand. A reduction in the absolute or relative output of an SOE's brand decreases its influence and expectation of its innovation returns, thereby discouraging the SOE from innovating independently. A reduction in related control, brand output, and profit discourages SOEs from innovating independently. This explains why some SOEs in China lost their brands and capacity for independent innovation after being acquired by MNEs.

If the government reduces SOEs’ social responsibility when 2 − d−csd−cf < α ≤ 73 − 23d−csd−γ1cf, the profit πsf and control ϖ* of SOEs will increase with a decrease in α, which may enhance SOEs’ innovative base and encourage them to innovate independently. Accordingly, we put forth the following proposition:

Proposition 1 In industries with relatively high social responsibility, when the MNE controls the JV, the SOE's relative controlϖ*and profitπsfdecrease with an increase in its social responsibilityα, which weakens the resources and independence of the SOE's innovation. Conversely,ϖ*andπsfincrease with a decrease inα, which may enhance the resources and independence of the SOE's innovation.

The government is motivated to increase wsf by increasing α mostly in industries strongly characterized by public goods. In some natural monopoly industries, such as the water, electricity, gas, and transportation industries, the natural monopoly characteristics in some aspects of these industries change as technology advances and market demand increases. The government has gradually opened these areas, which has allowed MNEs to enter. However, due to the public goods characteristic of these industries, the government must ensure consumer welfare and usually requires acquired firms to assume certain levels of social responsibility. By comparing Eqs. (1) and (4), we can observe that the ratio of a firm's social responsibility to its profit is α∫0qs(d−x−p)dx / [qs(p − cs)] = α2(1−α) before acquisition and α∫0qj(d−x−p)dx / [qj(p –γ1cf)] = α2 after acquisition. The government may require an acquired firm to maintain or not substantially reduce its ratio of social responsibility to profit. This approach increases the SOE's social responsibility αeven if the ratio of the JV's social responsibility to its profit decreases.

As mentioned above, the SOE's profit and relative control decline with α. Consequently, the government must provide additional allowances or protective policies to compensate for the corresponding reduction in the SOE's profit. Over time, the SOE obtains more administrative monopoly advantages. However, it may be relatively easy for the MNE to exploit its administrative advantages because the MNE has stronger control. There are two potential reasons for this phenomenon. First, to ensure that the acquired firm maintains or does not substantially reduce its level of consumer welfare when the MNE controls the JV, the government may have to allow the MNE to increase its investment and control of the JV. Second, an increase in consumer welfare reduces the SOE's profit, which makes its development increasingly reliant on government support; moreover, its self-development capacity gradually weakens, so the MNE can increase its control of the JV by virtue of its power. For example, many SOEs in the gas industry have been acquired by MNEs, such as BP, Oman National Petroleum, India Gas, and South Korea's SK Group. However, the public goods characteristic continues to restrain these SOEs’ development, which allows the MNEs to increase their investment and control of JVs and obtain additional resources. This has hindered the development of gas SOEs and crowded some of them out of the market.

Moreover, this situation is common in industries with large technical disparities compared with MNEs. Due to this technology gap, the government often implements policies to exchange market share for technology by attracting MNEs to establish JVs with or conduct partial acquisitions of domestic enterprises, especially SOEs. Additionally, to make SOEs more attractive targets and encourage MNEs to bring advanced technology, the government often supports SOEs through government procurement and projects. For example, in the Chinese electric power equipment industry, the three largest SOEs established JVs. They cooperated with MNEs in technology as follows: Shanghai Electric Group and Siemens, Harbin Electric Group and GE, and Dongfang Electric Group and Mitsubishi. Consequently, these three cooperative groups have almost entirely monopolized the equipment supply sector for Chinese power stations. Although the technology of the three SOEs has improved by obtaining some technology from their foreign partners, their core technology is still dependent on these foreign partners. In contrast, the MNEs have enhanced their monopoly advantage.

While the privatization of SOEs follows the “manage large enterprises (well) while easing control over small ones” policy, the government intervention is focused on large- and medium-sized SOEs and specific industries strongly characterized by public goods and significant technical disparities with MNEs. There are a few cases in which foreign partial acquisitions have promoted the innovation of SOEs, whereas government intervention has decreased. One such successful case is the locomotive and rolling SOE, CSR Sifang Co., which established a JV with the Canadian MNEs Bombardier and PowerCorp in 1998. In 2000, the administration of CSR Sifang Co. shifted from the Ministry of Railways to the Central Enterprise Working Committee and government intervention decreased. In 2008, Bombardier took over PowerCorp's stake in the JV and shared 50% ownership. The good performance induced by many orders from the Chinese Ministry of Railways and the reduction of government intervention helped CSR Sifang Co. maintain its power rights (50%) in the JV and encourage its foreign partner to transfer advanced technology. Since the JV was established, the innovative capability of CSR Sifang Co. has improved.

In industries with medium to high levels of competition, the SOE's social responsibility is relatively low. Eqs. (21) and (22) show that if 0 ≤ α ≤ 2 − d−csd−cf, it holds that ∂ϖ*∂α > 0 and ∂πsf∂α > 0. As shown earlier, when the JV is controlled by the MNE, it holds that 1 − 2d−csd−cf ≤ α ≤ 73 − 23d−csd−γ1cf. As a result, if 1 − 2d−csd−cf ≤ α ≤ 2 − d−csd−cf, it holds that ∂ϖ*∂α > 0 and ∂πsf∂α > 0. In general, the value of α is closely related to the proportion of state-owned equity and the relationship between the SOE and government, which reflects the degree of the government's control over the SOE. An increase in competitive intensity decreases the SOE's social responsibility, which leads to the following proposition:

Proposition 2 In industries with relatively intense competition, when the MNE controls the JV, with a reduction in the SOE's social responsibilityα, its relative controlϖ*and profitπsfdecrease, whereas the MNE's relative control (1 −ϖ*) increases, which weakens the capacity of the SOE to independently innovate.

Proposition 2 shows that after the acquisition, when an MNE is in control, it can weaken the corresponding SOE's control by increasing its foreign capital and expanding its foreign equity to decrease the size of the state-owned share. Then, the MNE can integrate and control critical resources to innovate its brand. Some MNEs have even abolished the original R&D departments of their partner SOEs after acquisition and relied on their own R&D centers abroad. This reduces such an SOE's development capacity, especially in the Chinese IT and telecom industry, which has the highest proportion of MNE investments and product market share. Furthermore, MNEs control most of the shares of the firms they acquire to maintain trade secrets and market dominance (Cooke, 2006). Alternatively, MNEs can achieve absolute control of their JVs to weaken government control by controlling the corresponding SOEs. This is consistent with a recent phenomenon; an increasing number of MNEs have reduced Chinese shares by increasing foreign capital and expanding foreign equity, which has shifted their position from relative to absolute control. Certain MNEs have transformed the ownership of some partially acquired firms into sole ownership by taking over the remaining stake in the target. This approach has helped MNEs in China occupy a dominant position in some industries, such as wholesale and retail trade, mobile phones, computers, intel architecture servers, network equipment, computer processors, and tires.

For instance, the leading SOE Northwest Bearing stripped its assets, gathered core technology and products, and put them into a JV with the German MNE FAG. However, its shares were ultimately taken over by FAG, and Northwest Bearing lost its brand and railway bearings product. The same occurred with other leading SOEs, such as the Dalian Electrical Machinery Plant, Dalian Second Electrical Machinery Plant, and Jiamusi Lianhe Reaper Plant. As the largest equipment manufacturer in the oil refining industry, the first branch of the Lanzhou Petrochemical Machinery Plant had built a value chain involving R&D, design, production, marketing, and sales. After putting its core assets into a JV with U.S. National Oil Well and sharing 49% ownership in the JV, it engaged in a single processing business. After the acquisition, the outstanding personnel, including the R&D personnel of Shenyang Drilling Machines and Wuxi Weifu, were incorporated into these JVs and their technology centers were closed or merged. Such a loss of control over R&D personnel and technology centers eliminates the independence and resource base of SOEs’ innovation.

Comparing the situation of the JV controlled by the MNE with that of the JV controlled by the SOE, we can see that d−γ2csd−γ1cf < 2−α2; comparing Eqs. (7) and (19), we can see that qjf > qjs; comparing Eqs. (12) and (20), we see that πjf > πjs; and comparing Eqs. (10) and (16), we find that wsf > wss. Eqs. (11) and (19) show that πff = πfs; therefore, it is easy to verify that πsf = πjf − πff > πss = πjs − πfs and usf = πsf + wsf > uss = πss + wss. Therefore, when an MNE has a cost advantage, compared with the case in which the SOE controls the JV, the SOE gains more profit and utility; moreover, the government realizes more consumer welfare when the JV is controlled by the MNE. Thus, the following proposition can be made:

Proposition 3 When the MNE has a cost advantage, the SOE and government often prefer that the MNE controls the partially acquired firm.

In some industries, owing to restrictions on the level of foreign ownership or the vital political position of the SOE, it is difficult for the MNE to gain control rights in the JV. Even when the SOE owns most of the shares, the MNE decides what technology to introduce to the JV. On many occasions, only old technology is introduced to the SOE (Cooke, 2006), namely, γ2 ≈ 1, so the SOE cannot be expected to improve its innovative capacity in the acquisition process. Usually, a target SOE's resource advantage can be transferred to the JV relatively easily. Therefore, it is easy to satisfy γ1 < 1 and 0 < γ1 ≤ γ2.

Once an MNE occupies the controlling position, from Propositions 1 and 2, we know that the MNE can often gradually gain more control and then control the resources and independence of the JV's innovation. Therefore, the following can be stated:

Proposition 4 When the MNE has a cost advantage and there are no restrictions on the level of foreign ownership, the MNE can usually eventually control the JV and exploit the SOE's administrative advantages. As a result, the resources and independence of the SOE's innovation are weakened.

Propositions 3 and 4 indicate that if the MNE has a cost advantage, it can obtain the control position in the negotiation process or gradually occupy the control position after the M&A. Once an MNE occupies the control position, it uses its advantages to gradually gain absolute control and then controls the JV's innovation resources and technological development path. Usually, MNEs have a significant cost advantage in China, especially compared with SOEs. The MNE's cost advantage stems from its core asset advantages, which reflect its competitive advantages in terms of technology, innovation, management, and branding. As shown in Tables 1 and 2, the profit rate and output per capita of SOEs are lower than those of private and foreign enterprises based on enterprise and industry data, which is consistent with the findings of Shi and Zhang (2018) and Zhang et al. (2020). Thus, promoting independent innovation through the development of SOEs and JVs or through partial acquisitions between MNEs and SOEs is challenging.

Efficiency and performance of enterprises in China based on firm data.

Note: The enterprises are classified by registration type. The profit rate is proxied by the ratio of total profit to total assets. Output per capita is proxied by the ratio of business revenue to total assets.

Source: China Industrial Enterprise Database.

Efficiency and performance of enterprises in China based on industry data.

Source: China Statistical Yearbook.

This study's model shows that when an MNE has a significant cost advantage, it can usually obtain control rights in the JV and its partner SOE will lose its innovation resources and independence. This finding is supported by a case study on China's automobile industry, wherein SOEs gain technology but have weak innovative capability and few products of their own brand (Howell, 2018; Bai et al., 2020). Due to regulation and government intervention, initially, MNEs can only partially acquire SOEs. Undoubtedly, foreign partial acquisition can create a new economic entity that features a broad range of monitoring devices, enhances the reform of SOEs, and brings the positive effects of knowledge spillovers and technology transfer. This contributes to the improvement of SOEs’ technology; however, it does not necessarily lead to the enhancement of their independent innovation capacity. SOEs’ loss of relative control in JVs may increase their dependence on the transfer of technology from MNEs. It may lead to a loss of capacity for independent innovation in the long run, which has effects that reach beyond that of the low technical level. A loss of capacity for independent innovation impedes the development of SOEs.

In addition, this study finds different dynamic effect mechanisms of JVs through cross-border M&As on innovation in different industries. In industries strongly characterized by public goods (e.g., the water, electricity, gas, and transportation industries) and those featuring significant technical disparities compared with MNEs (e.g., the electric power equipment and automobile industries), an increase in SOEs’ social responsibility makes it easier for MNEs to gradually obtain stronger control rights. Moreover, in industries with relatively intense competition, such as the wholesale and retail trade, network equipment, computer processor, and tire industries, a reduction in SOEs’ social responsibility makes it easier for MNEs to reduce SOEs’ relative control, which weakens the resources and independence of SOEs’ innovation. These findings suggest that foreign partial acquisition via quid pro quo cannot improve SOEs’ innovative capability in the case of government intervention in industries strongly characterized by public goods and industries featuring great technical disparities compared with MNEs and in the case of SOEs’ entry into competitive industries. Chinese authorities have put a premium on transfers of technology to SOEs through foreign acquisition. Our findings emphasize that owing to the cost disadvantage of SOEs induced by their ownership and government intervention, foreign acquisition may lead to an improvement in their technology and a decrease in their capacity for independent innovation.

Implications and further researchThis study has policy implications for the Chinese government. First, the government should gradually liberalize quid pro quo, which will help reduce trade disputes. It is inappropriate to rely on external technology via quid pro quo instead of the internal reform of the state-owned sector to enhance SOEs’ capacity for independent innovation. Furthermore, our findings imply that the liberalization of quid pro quo does not hinder SOEs’ innovation. Second, our findings indicate that low performance is a crucial factor restricting SOEs from improving their innovation capability through R&D cooperation with MNEs. Currently, SOEs’ assets account for a large proportion of the total assets in many Chinese industries. Therefore, except government control and the avoidance of foreign control in specific critical industries, it is essential to reduce government intervention and allow different market entities to compete equally. Doing so will provide equal opportunities for the development of private enterprises and expose SOEs to competitive pressures to innovate and improve competitiveness.

This study also has policy implications for other developing countries. The 2008 global financial crisis led to an increase in the use of government ownership as a bailout strategy in developed and developing countries; currently, SOEs account for 28 of these emerging markets’ 100 largest companies (Nash, 2017; Boubakri et al., 2018). Recently, many developing and transition economies, such as Vietnam, Laos, India, Malaysia, Brazil, and Russia, have increased the permitted level of foreign ownership in many industries and adopted cross-border M&As as external sources of technology. Our findings have wider policy and managerial implications for these economies.

This study does not conduct qualitative analysis to provide evidence for theoretical research due to a lack of data on the acquirers and targets involved with the JVs. For future research, more qualitative research and case studies based on data from questionnaire surveys or field research are needed to determine how cooperation between MNEs and SOEs affects the innovation of SOEs. Moreover, future research would benefit from adopting a more nuanced view of innovation via international cooperation between MNEs and SOEs. Thus, it is vital to find cooperation modes between MNEs and SOEs that do not consist of quid pro quo.

FundingThis research is funded by National Social Science Foundation of China. Fund ID is 21AJY003.