The purpose of this paper is to explore the extent to which fin-tech freelancers are interested in further development of their own business and receive funding for launching and upscaling their start-up.

Design/methodology/approachUsing a fuzzy set qualitative comparative analysis (fsQCA), this study examines how experience in dealing with different fin-tech solutions, online reputation, innovation, capabilities and interest to apply for funding affect the desired outcome: turning freelancing services into entrepreneurial initiatives.

FindingsFin-tech enables freelancers to become smart entrepreneurs and tailors their experience to capture entrepreneurial opportunities allowing them to apply for funding to a large range of instruments.

Research limitations/implicationsThe study was limited to a small sample of fin-tech entrepreneurs and the generalization of results calls for caution.

Originality/valueA configurational framework aiming to turn fin-tech freelancers into entrepreneurs is proposed, which encompasses the antecedent conditions of personal experience, reputation, innovation and commitment to find money for creating start-ups.

El fin de este papel es la exploración del método en el que los profesionales de la industria fin-tech están interesados en desarrollar su propio negocio y también recibir financiamiento para el lanzamiento y la modernización de la función del mismo negocio.

Diseño/metodología/criteriosUtilizando un análisis comparativo cualitativo del conjunto opaco (fsQCA), este estudio analiza la manera en la cual la experiencia en el acercamiento de las diferentes soluciones fin-tech, reputación online, capacidades de innovación e interés de aplicar para el financiamiento afecta el resultado deseado: la transformación de los servicios independientes en iniciativas empresariales.

ConstatacionesFin-tech permite a los profesionales libres de convertirse en empresarios inteligentes, adaptando la experiencia para captar oportunidades empresariales y permitirlos presentar una petición de financiamiento para una gama amplia de instrumentos.

Limitaciones/implicaciones en el estudioEl estudio fue limitado a un pequeño tipo de empresarios fin-tech y la generalización de los resultados necesita prudencia.

Originalidad/valorSe propone un cuadro de configuración que trasforme los profesionales libres fin-tech en empresarios, que contengan las condiciones antecedentes de la experiencia personal, la reputación, la innovación y el compromiso de buscar dinero para crear una nueva empresa.

Freelancers are perceived as a hybrid of employees and entrepreneurs. On the one hand, they can be considered employees, as they are hired on determined period by firms, offering their intangible professional knowledge. On the other hand, they are entrepreneurs because their work is based on their own risk and reward, without any organizational support (Born & Witteloostuijn, 2013).

The approach of taking entrepreneurship as a phase in the career of a self-employed person helps to contextualize the entrepreneurial decision (Gustafsson, 2006) within the professional life of a freelancer. Considering the very limited body of knowledge reflecting the entrepreneurial decisions of freelancers, this study takes the first step toward enriching the understanding of the causal configurations that link freelancers’ experience, online reputation, innovation capabilities and interest in funding entrepreneurial ideas to their mentality change: freelancers turned entrepreneurs. The results show the causal recipes that produce the desired outcome: the freelancers’ entrepreneurial decision.

This paper begins by addressing the possible career trajectories of self-employment reflected in the freelance experience. It examines the ways of turning freelancing services into entrepreneurial initiatives and the motivation a freelancer might have for developing their own business. It then proposes the conceptual framework focused on a configurational approach and considers its applicability to entrepreneurial fin-tech freelancers. Finally, through fsQCA methodology, it investigates the fin-tech freelancers’ motivations of developing entrepreneurial careers, based on their experience in dealing with different fin-tech solutions, online reputation, innovation capabilities and interest in applying for funding for their ideas.

Theoretical backgroundFreelancers have gained growing attention from business researchers with a particular focus on their behavior, career paths, and entrepreneurship (Born & Witteloostuijn, 2013; Jang, 2017). Existing literature highlights freelancing's expansion as regards to the number of professionals and of innovative service domains in which freelancers are engaged.

The traditional research focus of academics on the vulnerability side of the low-skilled freelancers does not resonate with the labor market performance of more highly skilled freelancers, who are innovative and earn a significantly higher income than employees (Burke, 2015).

Most freelancers are engaged in online networks to increase the probability to find customers and sign contracts with them. In these networks, their experience, innovation skills and online reputation are valuable intangible assets appreciated by the customers (Saundry, Stuart, & Antcliff, 2007).

Digital technologies and the innovative business models are dramatically challenging freelancers’ options for their future careers. A person may prefer to work as a freelancer, being self-employed for reasons of high-level expertise in a domain, self-fulfillment and self-realization. Freelancers’ self-employed work characteristics (expertise, reputation, innovativeness, motivation for entrepreneurial phase) are strongly related to work-life balance satisfaction (Annink, Den Dulk, & Amorós, 2016).

For many people, freelance activities are a desirable option, even if entrepreneurship appears as a tempting opportunity. Although freelancers are satisfied with their way of working, their work includes only a few entrepreneurial characteristics and it seems that they would prefer to capture entrepreneurial opportunities in their future career (Bögenhold, Heinonen, & Akola, 2014). Freelancers represent self-employed people, who are commonly counted as entrepreneurs and opportunity seekers (Bögenhold & Klinglmair, 2016).

The results of a study conducted by Falco and Haywood (2016) challenge researchers’ minds with a central question: is the rise in freelance activities the result of improved opportunities for successful entrepreneurship, or is it the reflection of limited opportunities in wage-based employment?

A freelancer who is very strong in professional knowledge and innovation capabilities would not be well advised to become an entrepreneur because he would waste knowledge and potential earnings that he could earn as self-employed by developing his strongest specified skills and accumulating experience and reputation (Backes-Gellner & Moog, 2013).

Freelance workers represent a valuable pillar of the worldwide labor force, enabling customers from a wide variety of domains to hire them in order to meet operational requirements in a very flexible way. The ongoing expansion of the freelance workforce reflects that access to a pool of skilled and motivated freelancers remains highly appreciated by customers (Kitching & Smallbone, 2015). However, freelancers’ doors to entrepreneurship remain open, if they are truly interested in the catalyzing effect of management training on growth-related entrepreneurial attitudes (Schamp & Deschoolmeester, 1998). In contrast, other opinions reflect that many organizations in recent years took wrong turns with the extensive use of freelancers, as the short-term cost-savings were more tempting in relation to the development of their own human capital resources (Luthans & Youssef, 2004).

The new economy generated a fin-tech ecosystem, in which start-ups play the pivotal role. Fin-tech freelancers turned entrepreneurs have driven major innovations in the areas of payment, wealth management, lending, crowdfunding, capital market, and insurances by niche financial markets, and providing more personalized financial services (Lee & Shin, 2018). Most innovations related to fin-tech include crypto-currencies and the block-chain, new trading systems, artificial intelligence and machine learning, peer-to-peer lending, and mobile payment systems (Philippon, 2016). Some authors (Kalmykova & Ryabova, 2016) consider that the fin-tech regulation is not still ready for total control of new start-ups and their platform-based business models.

Financial services have placed workers under pressure to deliver results in an increasingly insecure and hostile environment, determining many of them to choose a fin-tech freelancer career. Financial and banking institutions are seeking functional flexibility through greater use of multi-skilled fin-tech freelancers (Tempest, McKinlay, & Starkey, 2004).

Financial technologies (Fin-techs) enhance competition in financial markets, as they provide innovative value propositions that traditional financial institutions do less efficiently and widen the pool of freelancers eager to develop fin-tech services. From the entrepreneurial perspective, the value chain of fin-tech freelancers carries out one or few of specific financial activities in an unbundled way (Pozzolo, 2017).

The disruption potential of both fin-tech freelancers and start-ups, designing intuitive services for the financial market changed the game rules; in this way, financial institutions and banks are looking actively at collaboration opportunities with them (Laven & Bruggink, 2016).

Freelancers are able to capture opportunities in financial technology, using flexible, efficient, and mobile tools designed for the needs of this field. They need to reconsider the approach to innovative financial management services that are rooted in financial technology. Fin-tech enables freelancers to become smarter spenders, savers, and entrepreneurs – all while reducing costs and saving customers’ time (Applegate, 2016).

In order to develop the fin-tech start-up ecosystem, one possibility is that policymakers might wish to create incentives and provide crowdfunding opportunities for freelancers, so that they will lower the cost of services for customers and will be attracted by entrepreneurial initiatives (Fenwick, McCahery, & Vermeulen, 2017).

Fin-tech freelancers’ reputation is strongly correlated with their involvement in networks, in which they gain a market position, branding themselves under a unique name. Alternately, innovative forms of cooperation – such as co-working spaces — are formally organized, in which incoming jobs are divided among members having frequently complementary skills (Arvidsson, Gandini, & Bandinelli, 2016).

Financing freelancers’ entrepreneurial ideas for fin-tech start-up creation is crucial for multiple reasons, one of which could be the traditional funding gap that innovative start-ups face everywhere (Haddad & Hornuf, 2016).

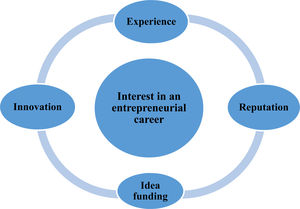

Based on the aforementioned theoretical issues from the relevant body of knowledge, the research proposition is formulated as follows: The configurations of antecedent conditions for freelancers’ career building blocks (experience, reputation, innovation, and idea funding opportunity) have equifinality in achieving the path toward an entrepreneurial career.

MethodQualitative comparative analysis (QCA) is an emerging research technique aiming to close the gaps between qualitative and quantitative analyses (Rihoux & Ragin, 2009). In contrast to quantitative research, QCA creates the opportunity to analyze how multiple causal configurations affect an outcome (Ragin, 2014). The value of QCA for this current research relies on the existence of conditions that are sufficient (but not necessary) to determine an outcome. Using consistency (analogous to correlation) and coverage (a measure of effect size), QCA explains how causal configurations lead to a certain outcome (Woodside, 2010). Qualitative comparative analysis (QCA) genuinely introduces the concept of “equifinality,” based on the idea that multiple paths to a desired outcome may coexist in a configurational research design (Fiss, 2007).

The research process aims at highlighting the significant contribution of QCA to unlock the entrepreneurial opportunities hidden in the careers of most freelancers from fin-tech field.

Research frameworkThis study explores how causal configurations of antecedent conditions (freelancers’ experience in dealing with different fin-tech solutions, online reputation, innovation capabilities and interest in applying for entrepreneurial idea funding) affect the desirable outcome: freelancers’ motivation to turn into fin-tech entrepreneurs. The research model (Fig. 1) reflects the freelancers’ motivation to embrace an entrepreneurial career as a linear function whose arguments are their experience, reputation, innovation skills and idea funding.

The motivation for an entrepreneurial career benefit from fin-tech freelancers’ expertise gained in their projects, which increase the likelihood of a positive attitude toward creating their own start-ups. Online reputation refers to the degree to which a fin-tech freelancer's expertise is positively related to high-valued outcomes by the customers, who share in the online networks their testimonials regarding the effective collaboration. Fin-tech freelancers’ have to respond through innovation to the opportunities arising from the emerging technology in the financial markets. Fin-tech start-ups, which have disrupted the financial service sector, are looking for providers of capital to bridge the funding gap in this fast-growing market niche.

The constructs of the conceptual model outline the pathways from fin-tech freelancers’ expertise to online business success, involving innovation capabilities in highly competitive financial markets, ability to create and manage their online reputation, creative thinking, building trust in online networks and finding appropriate funding instruments for their ideas.

Data collectionThe design framework exposes causal configurations of freelancers’ career building blocks (experience, reputation, innovation, and idea funding) and underlines appropriate career development paths toward entrepreneurship.

The research approach employs a convenience sample (40 qualified fin-tech freelancers from online networks) because a significant degree of expertise is compulsory for the research configurational design.

A five-item questionnaire has been designed and posted online on Google Forms (https://goo.gl/forms/fPthj2yELl1GJKhx2), but also conveyed through different online platforms where fin-tech freelancers interact with their potential or existent customers.

The questionnaire has been divided into two sections, according to the need for a configurational approach of the outcome. The first four items in the questionnaire reflect the antecedent conditions, being interpreted as stimulus to which the freelancers react: experience in dealing with different fin-tech solutions, online reputation, innovation capabilities and interest in applying for entrepreneurial idea funding. They are assessed through a five-point Likert scale. The fifth item outlines the outcome: turning freelancing services into entrepreneurial initiatives, being evaluated through a five-point scale: Very probably – Definitely not.

Calibration processThe research design focuses on the assumption that relationships between the antecedent conditions employed in this study are asymmetric, because fin-tech freelancers’ motivations for an entrepreneurial vary from one to another. Therefore, alternative combinations of causal conditions can lead to the outcome.

We transformed the values for the causal conditions (experience, reputation, innovation, and idea funding) and the outcome (freelancers’ motivation to turn into entrepreneurs) into fuzzy-set scores ranging from 0 (fully out) to 1.00 (fully in). Table 1 reflects the calibration of the causal conditions and outcome, considering their values in the specific assessment scales.

Calibration of scales (Ragin, 2014).

| Scale point | Fuzzy-set value | Membership |

|---|---|---|

| Strongly agree/Very probably | 1 | Fully in |

| Agree/Probably | 0.75 | More in than out |

| Neither agree or disagree/Possibly | 0.5 | Cross-over (neither in nor out) |

| Disagree/Probably not | 0.25 | More out than in |

| Strongly disagree/Definitely not | 0 | Fully out |

The definition of the fuzzy-set values for the antecedent conditions is consistent with the same rule for calibration of the outcome, reflecting the logic of the constructs in the configurational design approach.

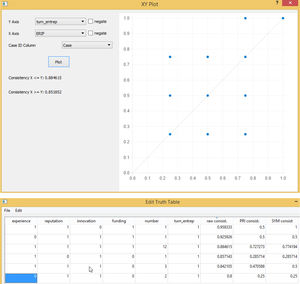

We have defined a new variable ERIF as the result of computing the fuzzy-set values of the antecedent conditions in the conceptual model (experience, reputation, innovation and funding) using fsQCA software (Table 2):

Calibrated fuzzy-sets of the 40 cases.

| Case | Experience | Reputation | Innovation | Funding | Turn_entrep | ERIF |

|---|---|---|---|---|---|---|

| 1 | 1 | 0.75 | 1 | 0.75 | 0.75 | 0.75 |

| 2 | 0.75 | 0.5 | 0.75 | 0.25 | 0.5 | 0.25 |

| 3 | 1 | 1 | 1 | 0.75 | 1 | 0.75 |

| 4 | 0.5 | 1 | 0.75 | 0.5 | 0.75 | 0.5 |

| 5 | 1 | 0.75 | 0.75 | 0.25 | 0.25 | 0.25 |

| 6 | 0.75 | 0.5 | 1 | 0.5 | 0.75 | 0.5 |

| 7 | 1 | 0.75 | 1 | 0.25 | 0.5 | 0.25 |

| 8 | 1 | 1 | 1 | 0.75 | 0.25 | 0.75 |

| 9 | 0.25 | 0.75 | 1 | 0.25 | 0.25 | 0.25 |

| 10 | 0.75 | 1 | 1 | 0.75 | 1 | 0.75 |

| 11 | 0.75 | 1 | 0.5 | 0.75 | 0.5 | 0.5 |

| 12 | 1 | 0.75 | 1 | 0.25 | 0.75 | 0.25 |

| 13 | 0.75 | 0.25 | 0.75 | 0.5 | 0.25 | 0.25 |

| 14 | 1 | 0.75 | 1 | 0.75 | 0.75 | 0.75 |

| 15 | 1 | 1 | 1 | 1 | 1 | 1 |

| 16 | 0.75 | 1 | 0.75 | 0.75 | 0.5 | 0.75 |

| 17 | 1 | 0.75 | 1 | 0.5 | 0.25 | 0.5 |

| 18 | 0.25 | 0.75 | 1 | 0.75 | 0.25 | 0.25 |

| 19 | 1 | 1 | 0.75 | 0.75 | 1 | 0.75 |

| 20 | 0.75 | 1 | 0.75 | 1 | 0.75 | 0.75 |

| 21 | 1 | 1 | 0.75 | 0.5 | 0.25 | 0.5 |

| 22 | 0.75 | 0.5 | 1 | 0.25 | 0.5 | 0.25 |

| 23 | 0.25 | 0.75 | 0.75 | 0.25 | 0.25 | 0.25 |

| 24 | 1 | 0.75 | 1 | 1 | 0.5 | 0.75 |

| 25 | 0.75 | 0.75 | 1 | 0.5 | 0.5 | 0.5 |

| 26 | 0.75 | 0.5 | 0.75 | 0.25 | 0.25 | 0.25 |

| 27 | 0.75 | 0.25 | 0.75 | 0.25 | 0.25 | 0.25 |

| 28 | 0.75 | 0.5 | 1 | 0.5 | 0.5 | 0.5 |

| 29 | 1 | 0.75 | 1 | 0.75 | 1 | 0.75 |

| 30 | 0.5 | 0.75 | 0.5 | 0.25 | 0.25 | 0.25 |

| 31 | 0.75 | 0.5 | 1 | 0.25 | 0.25 | 0.25 |

| 32 | 0.75 | 1 | 0.75 | 0.5 | 0.5 | 0.5 |

| 33 | 1 | 0.75 | 0.25 | 0.75 | 0.5 | 0.25 |

| 34 | 1 | 0.5 | 1 | 0.75 | 0.5 | 0.5 |

| 35 | 0.75 | 0.75 | 0.75 | 0.5 | 0.25 | 0.5 |

| 36 | 0.75 | 1 | 0.5 | 0.75 | 0.5 | 0.5 |

| 37 | 0.25 | 0.75 | 0.5 | 0.25 | 0.25 | 0.25 |

| 38 | 0.75 | 1 | 0.75 | 0.5 | 0.5 | 0.5 |

| 39 | 0.75 | 0.75 | 1 | 0.75 | 0.25 | 0.75 |

| 40 | 1 | 0.5 | 0.75 | 0.75 | 0.5 | 0.5 |

ERIF represents a computed variable on the basis of antecedent conditions embedded into the research model. Its values highlighted with bold has been computed with fuzzyand function in fsQCA software.

FsQCA allows flexibility in the assessment of cases through calibration. As mentioned above, each case is assigned membership scores for the important causal conditions such as ERIF impact on Turn_entrep.

FindingsThe first step of the analysis seeks the combination of conditions that are sufficient for the outcome. It examines whether a causal recipe of conditions is always present when the outcome is present.

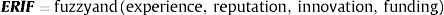

We proceeded to the analysis of the consistency and coverage scores on fuzzy-set XY plots (Fig. 2). The visual representation of cases on XY plot graph reveals that antecedent conditions are sufficient for the outcome, due to the positioning of majority of the cases above the diagonal of the graph.

XY plots show whether a specific condition is necessary or sufficient to achieve the outcome, outlining how consistent a given condition is with the statement of being a necessary or a sufficient condition. Moreover, XY plots provide graphical insights regarding how relevant empirically the research proposition is.

The consistency score (the extent to which a causal combination leads to an outcome) is 0.884, while the coverage score (how many cases with the outcome are represented by a particular causal condition) is 0.851. These scores imply that the distribution of fuzzy sets is consistent with the assertion that ERIF is a subset of the outcome (turn_entrep). We can also state that ERIF coverage of the outcome (turn_entrep) is 85.1%.

The high consistency value reported by XY plot indicates that the condition is sufficient for the outcome. Although the values of consistency and coverage suggest causality in this research design, the determination of causality needs interpretation of the configurations using truth table analyses.

The truth table reveals different configurations of cases by listing all logically possible combinations of causal conditions and performing the analysis of sufficient conditions. Six configurations were identified in the research sample (Table 3).

Truth table analysis for the research sample.

| Experience | Reputation | Innovation | Funding | Number | Turn_entrep | Raw consist. | PRI consist | SYM consist |

|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 0 | 1 | 1 | 1 | 0.958333 | 0.5 | 1 |

| 0 | 1 | 1 | 1 | 1 | 1 | 0.925926 | 0.5 | 0.5 |

| 1 | 1 | 1 | 1 | 12 | 1 | 0.884615 | 0.727273 | 0.774194 |

| 1 | 0 | 1 | 0 | 1 | 1 | 0.857143 | 0.285714 | 0.285714 |

| 1 | 1 | 1 | 0 | 3 | 1 | 0.842105 | 0.470588 | 0.5 |

| 0 | 1 | 1 | 0 | 2 | 1 | 0.8 | 0.25 | 0.25 |

Performing analyses to find the complex solution involves the respect of the condition: a consistency cut-off of 0.8, which means that the membership score of the outcome (freelancers’ motivation to turn into entrepreneurs) is consistently higher than the membership score of the causal configurations (experience, reputation, innovation, and idea funding).

The complex solution provided by the Quine-McCluskey algorithm (Table 4) provides valuable insights highlighting that experience and reputation are the most influential predictors of the outcome. Their combination represents a successful recipe for fin-tech freelancers’ interest in turning into entrepreneurs.

This finding is in line with the constructs of the logic cases: experience and reputation were better positioned on Likert scales than innovation and idea funding.

Discussion, conclusions, limitations and future researchThe major benefits of this study are twofold. Firstly, it is one of the first QCA studies that specifically targets freelancers’ interest toward entrepreneurship. According to the official statistics, the number of freelancers will continue to increase; however, the current evidence from this research, even it analyses only 40 cases, strongly suggests that fin-tech freelancers’ interest in entrepreneurship still remains low. Secondly, as the fin-tech freelance career is highly influenced by a combination of factors, such as experience, reputation, innovation and opportunities of idea funding, as is argued in this research, freelance careers development should provide a great opportunity to embrace entrepreneurship. Even if we have expected a stronger motivation for entrepreneurial initiatives, we strongly believe that this empirical study of fin-tech freelancers provides configurational settings for testing insights from the entrepreneurial career perspective.

This study used fsQCA to identify the sufficient conditions for fin-tech freelancers to perceive entrepreneurship as a desirable career trajectory. Most studies regarding the antecedents of entrepreneurial careers of freelancers have focused on capturing entrepreneurial opportunities rather than the effect of combinations of factors. This study therefore differentiates itself from previous studies by identifying and analysing configurations of entrepreneurship predictors (strength, sentiment, passion, experience, reputation, innovation, and idea funding) that enable freelancers to think about a future entrepreneurial career.

A first important finding of this study is that a model based on the proposed entrepreneurial career trajectories for fin-tech entrepreneurs, endowed with four building blocks for entrepreneurial success (experience in dealing with different fin-tech solutions, online reputation, innovation capabilities and interest in applying for funding) is largely suited to explain freelance career pathways, as demonstrated by the support of the research question. A second major finding of this study places experience and reputation as the main drivers for future entrepreneurial careers in the case of fin-tech freelancers. A future entrepreneurial life in fin-tech is impossible without experience in working with many customers and reputation as a provider of innovative fin-tech solutions. The precursors of entrepreneurial career, emphasized in this paper, are in line with the research conducted by Zhao, Seibert, and Lumpkin (2010), who highlight that personality traits as conscientiousness, emotional stability, and openness to new experiences, specific to freelancers, are associated with successful entrepreneurship.

The complex solution for this configurational research design explains the importance of successful entrepreneurial recipes for achieving the outcome – a desirable change in fin-tech freelancers’ mentality. The results show that the right combinations of antecedent conditions can have a significant impact upon transforming fin-tech freelancers’ careers.

From managerial implications perspective, the causal recipes in this study provide valuable insights regarding how to transform learnings in entrepreneurial opportunities by designing fin-tech business models able to disrupt this market niche. As regarding the contribution to theoretical body of knowledge, the research claims to gain configurations of conditions aiming to increase the freelancers’ propensity to entrepreneurship, addressing the emergent paradigm of freelancing turned entrepreneurs.

The limitations of this study are as follows: firstly, the data was gathered for only 40 fin-tech freelancers, which limits the generalizability of our findings. Secondly, this study examines only four antecedents of the outcome, which could be challenged by other researchers and practitioners for their relevance.

As fin-tech freelancers’ career choices are always influenced by the dynamics of this market niche, further research should look not only into developments of the constructs used as antecedent conditions, but also at other aspects that may guide the outcome: the motivation of freelancers to embrace an entrepreneurial life.