Monetary unions are very particular currency regimes, which aim at lowering transaction costs and annulling infra-union exchange risks. Despite its benefits, this exchange rate arrangement is subject to a plethora of faults and weak points mainly due to its intrinsic ‘one-size-fits-all approach’. In the past and perhaps in the future too, precisely this core aspect has caused breakups of previous historical experiences (cf. the Latin, Scandinavian or Austro-German currency union). Now, the European Monetary Union (EMU) between 17 heterogeneous country members is threatened by the same matters of concern. In the light of the ongoing debt crisis, theoretical as well as empirical evidence proves that at least nine (forgotten or even whitewashed) critical assertions apply to the Euro Area and its durability. As we will endeavor to prove, the Eurozone is seriously endangered by its missing attention to heterogeneity, divergences and plurality of actors as well as economic needs.

Las uniones monetarias son regímenes cambiarios que tienen por objeto disminuir los costos de transacción y anular los riesgos de cambio infra-unión. A pesar de sus beneficios, este acuerdo de tipo de cambio está sujeto a una miríada de fallas y puntos débiles debido principalmente a su intrínseco «enfoque único». Tiempo atrás—y quizás también en un futuro—, precisamente este aspecto esencial ha provocado la disolución de experiencias históricas previas (cf. la unión monetaria latina, escandinava o austro-alemana). Actualmente la Unión Económica y Monetaria Europea (UEM), conformada por un grupo heterogéneo de 17países miembros, es amenazada por las mismas cuestiones preocupantes. A la luz de la actual crisis de la deuda, la evidencia tanto teórica como empírica demuestra que al menos 9afirmaciones críticas (desatendidas o incluso encubiertas) son aplicables a la zona Euro y su permanencia. Como intentaremos probar, la Eurozona está seriamente en riesgo por su falta de atención a la heterogeneidad, a las divergencias y a la pluralidad de los actores, así como a las necesidades económicas.

The ‘evergreen’ economic and financial crisis in the Euro Area has been at the origin of several debates on currency unions’ sustainability (Canofari et al., 2012), which add recent evidence to some earlier scientific warnings (Sadeh, 2003) regarding the notion of ‘optimal currency area’, namely the quintessence (or minimum requirement) for common economic stability. Since the European Monetary Union (EMU) and its unique architecture are truly a novelty in economic history, economists as well as politicians are still struggling to find the ‘magic cure’ for sovereign over-indebtedness, sluggish economic growth in the South and overheated member economies in the North – in other words, infra-European imbalances – as well as increasing requests for financial help by EMU countries in economic trouble. In fact, “[w]ith little experience to rely upon and limited theoretical backing, economists and policy-makers had to invent practically everything in little time” (Wyplosz, 2006). In order to entirely grasp the Euro Area's peculiarities of newness, which are at the same time seriously endangering its sustainability, it should be reminded that “the EMU-project is unique in the history of monetary unions. We have not found any clear and unambiguous historical precedent to EMU, where a group of monetary and politically independent countries surrendered their national currencies to form a common monetary union […] while still retaining political independence” (Bordo and Jonung, 1999).

Now, the paper will not provide any ‘miraculous’ solution, because some profound causes of the crisis itself seem to be still ignored. In fact, policy makers show the deleterious tendency to (try to) tackle economic effects without exploring their origins. This pragmatism leads to nothing except from wasting sizeable financial resources and being at the origin of generalized distrust in rapid recovery. As economic literature has highlighted, the crisis of the Euro Area has various roots and is aggravated by several factors of uncertainty and divergence. According to our analysis, which aims at presenting some sources of economic disease, at least nine innovative findings emerge from studying how currency unions, namely the exchange rate regime adopted by 17 European countries, behave during economic turmoil. Let us therefore enunciate these points, which will be analyzed separately and represent the main elements of our memorandum, namely an invitation to memory. In fact, we claim that:

- •

in good times, currency unions benefit from high degrees of confidence in reciprocal strengths, but they become excessively exposed to financial instability during economic slowdowns (Anomalous cyclical exposure to good and bad times (Section 2.1));

- •

communication becomes an even more crucial factor to ensure prompt responsiveness to common economic policies. This being said, it is rather difficult to coordinate announcements formulated by a plethora of national and supra-national actors (Communication challenges and univocity (Section 2.2));

- •

despite any disclaimers, every exchange rate arrangement remains reversible. In other words, the Euro as a common currency can be anytime reverted to national money units, which can be in turn be devaluated, but not mutated into any others. This matter of fact is a latent threat in terms of credibility and confidence in durable economic stability after monetary unification (The permanent menace of reversibility (Section 2.3));

- •

in the same way as roped parties have to rely on each climber and his climbing abilities, currency unions are subject to the economic success of each member country (The roped party effect of common currencies (Section 2.4));

- •

despite the increasing tendency to common prescriptions, shared currencies suffer the consequences of ‘one-size-fits-all solutions’ like common exchange as well as central interest rates for dissimilar members (One size does not fit all/If it does not fit, use a bigger hammer! Or not? (Section 2.5));

- •

although economists reduce European countries to the Euro Area or the European Union, there subsist huge differences between respective cultures and societies. These characteristics enrich on the one hand Europe itself, but they are also responsible for great conflict potential among country groups. In fact, policy measures suitable for Northern countries must not necessarily have the same positive effects for Southern nations and vice versa (Cultural and social peculiarities as intrinsically tying or disaggregating factors (Section 2.6));

- •

the separation of monetary from political powers is ineffective as well as at the origin of huge conflicts (The indivisibility of monetary and political powers (Section 2.7));

- •

since instability deriving from economic turmoil in member countries can potentially affect the Euro Area as a whole, communitarian policy makers will be (tacitly) prone to rescue nations in economic troubles. In fact, the abandonment of the Eurozone by some countries can destabilize other European economies and, eventually, lead to the Euro breakup. This matter of fact can be (or can have been) at the origin of moral hazard episodes by member countries (The trinomial of monetary unions, moral hazard and ‘too big to fail’ diagnosis (Section 2.8));

- •

it is no mystery that monetary unions aim at neutralizing exchange risk between adherent countries. Nonetheless, infra-union devaluation and appreciation risks have been bartered for greater exposure to sovereign default risks, which are potentially more prejudicial (The bad deal of bartering exchange rate risks for sovereign risks (Section 2.9)).

As the reader will easily grasp, the European political and social project, which is a great ideal and should be therefore protected from negative influence, is nowadays threatened by several structural factors of crisis and uncertainty. Universally known, currency unions are ‘the’ super-fix currency regime par excellence and, precisely as such, involve some essential caveats, which are mainly a direct consequence of what has been notoriously called ‘optimum currency area’ (Mundell, 1961). Although there has been no general consensus on EMU's fulfillment of this requirement, it is incontestable that the Euro Area has been subject to asymmetric shocks and shows a pronounced tendency toward wide spreading imbalances. If we add to it that this particular type of currency union has been ‘tweaked’ through intrinsically restrictive prescriptions like the (totally unjustified) need for near-zero public deficits (cf. the Treaty on Stability, Coordination and Governance in the Economic and Monetary Union alias Fiscal Compact), this mix of elements becomes very detrimental to the stability of the Eurozone itself! Claiming that “the Euro is much, much more than a currency. The Euro is the guarantee of a united Europe. If the Euro fails, then Europe fails.” (Merkel, 2011 (own translation)) sounds perhaps emphatic, but is for sure very risky. In fact, the Euro should be treated as ancillary to the European project itself, which is by far more ambitious and system-relevant than its artificial currency. Therefore, national as well as communitarian policymakers should be particularly concerned with defending the European vision without necessarily linking it to the failures and successes of the Euro.

2The logical-analytical determination of the ‘original sins’ of the Euro AreaIn order to analyze the previous assertions, it is particularly useful to combine logical-analytical findings on how monetary unions work with some statistical data aiming at corroborating the main negative trends caused by monetary unification. Of course, the paper's focus will be on the Euro Area case, which is not only the best example of modern (large) currency unions, but also needs to be urgently deepened to prevent the enduring economic escalation in the Eurozone.

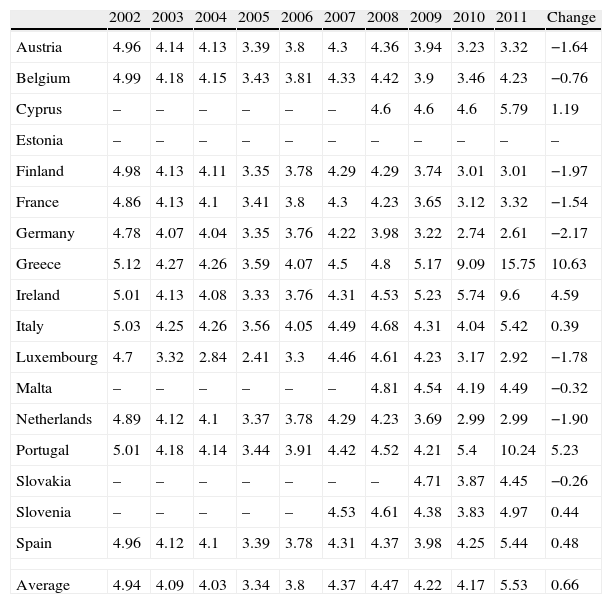

2.1Anomalous cyclical exposure to the influence of good and bad timesWe will soon prove that one main characteristic of the European Monetary Union is its intrinsic inhomogeneity, which leads in turn to great concerns with regard to its durability. In the light of this matter of fact, it is pretty obvious to claim that infra-national discrepancies are reflected by different economic performances (Table 1). Since member countries of the Euro Area have been exposed to dissimilar economic dynamics, it is also evident that (much-feared) asymmetric shocks are likely to occur even in the future (“The Eurozone may be prone to suffer from rotating slumps by its design. But ill-timed asymmetric shocks have made matters worse. […] If there is one major lesson from this sorry tale of macroeconomic instability within the Eurozone, it is this: the architecture of the EMU lacks an effective macroeconomic stabilization mechanism that would control divergence and limit the size of cyclical fluctuations for the individual member states” (Landmann, 2011)). More precisely, currency unions show a pronounced tendency to conceal economic difficulties experienced by their members in periods of good conjuncture and to exacerbate elements of weakness in times of economic troubles.

Change in nominal long-term interest rates in the Euro Area.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | Change | |

| Austria | 4.96 | 4.14 | 4.13 | 3.39 | 3.8 | 4.3 | 4.36 | 3.94 | 3.23 | 3.32 | −1.64 |

| Belgium | 4.99 | 4.18 | 4.15 | 3.43 | 3.81 | 4.33 | 4.42 | 3.9 | 3.46 | 4.23 | −0.76 |

| Cyprus | – | – | – | – | – | – | 4.6 | 4.6 | 4.6 | 5.79 | 1.19 |

| Estonia | – | – | – | – | – | – | – | – | – | – | – |

| Finland | 4.98 | 4.13 | 4.11 | 3.35 | 3.78 | 4.29 | 4.29 | 3.74 | 3.01 | 3.01 | −1.97 |

| France | 4.86 | 4.13 | 4.1 | 3.41 | 3.8 | 4.3 | 4.23 | 3.65 | 3.12 | 3.32 | −1.54 |

| Germany | 4.78 | 4.07 | 4.04 | 3.35 | 3.76 | 4.22 | 3.98 | 3.22 | 2.74 | 2.61 | −2.17 |

| Greece | 5.12 | 4.27 | 4.26 | 3.59 | 4.07 | 4.5 | 4.8 | 5.17 | 9.09 | 15.75 | 10.63 |

| Ireland | 5.01 | 4.13 | 4.08 | 3.33 | 3.76 | 4.31 | 4.53 | 5.23 | 5.74 | 9.6 | 4.59 |

| Italy | 5.03 | 4.25 | 4.26 | 3.56 | 4.05 | 4.49 | 4.68 | 4.31 | 4.04 | 5.42 | 0.39 |

| Luxembourg | 4.7 | 3.32 | 2.84 | 2.41 | 3.3 | 4.46 | 4.61 | 4.23 | 3.17 | 2.92 | −1.78 |

| Malta | – | – | – | – | – | – | 4.81 | 4.54 | 4.19 | 4.49 | −0.32 |

| Netherlands | 4.89 | 4.12 | 4.1 | 3.37 | 3.78 | 4.29 | 4.23 | 3.69 | 2.99 | 2.99 | −1.90 |

| Portugal | 5.01 | 4.18 | 4.14 | 3.44 | 3.91 | 4.42 | 4.52 | 4.21 | 5.4 | 10.24 | 5.23 |

| Slovakia | – | – | – | – | – | – | – | 4.71 | 3.87 | 4.45 | −0.26 |

| Slovenia | – | – | – | – | – | 4.53 | 4.61 | 4.38 | 3.83 | 4.97 | 0.44 |

| Spain | 4.96 | 4.12 | 4.1 | 3.39 | 3.78 | 4.31 | 4.37 | 3.98 | 4.25 | 5.44 | 0.48 |

| Average | 4.94 | 4.09 | 4.03 | 3.34 | 3.8 | 4.37 | 4.47 | 4.22 | 4.17 | 5.53 | 0.66 |

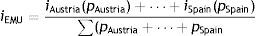

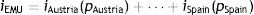

In this specific regard, renowned economists have repeatedly and presciently claimed that “significant regional problems will continue to arise after the elimination of statutory barriers to labor and commodity movements across national borders. Reflationary initiatives by the depressed regions will be limited by the external constraint. Even in a currency union, Member States will face sharply rising costs of debt financing, Governments which nevertheless run budget deficits will deplete their reserves and run up against the external constraint” (Eichengreen et al., 1990). Not surprisingly, this is precisely what is nowadays going on in the Eurozone. For instance, let us analyze some main trends in long-term interest rates, which somehow represent investors’ and savers’ confidence in the stability of the national economy as a whole. In this specific regard, Table 1 clearly shows that EMU member countries have experienced years of (at least, perceived) trustfulness characterized by heavy drops in borrowing costs, but, as soon as the debt crisis broke out, long-term interest rates began growing steadily and reaching anomalously high levels in European countries in economic difficulties (e.g. Greece, Ireland, Portugal) as well as unprecedentedly low levels in ‘virtuous’ nations (e.g. Austria, Finland, Germany, Luxembourg, Netherlands). Why is it so? Since the European Monetary Union is plagued by severe dissimilarities in economic terms and financial markets are not prone (or ready) to suddenly disinvest from the Euro Area as a whole, economically trustful countries gain even more attractiveness, while weaker member nations negatively attract the attention of the financial community. More precisely, “after the creation of the euro, large capital flows started to fly from core Eurozone countries into the periphery. The peripheral Eurozone economies (mainly Greece, Ireland and Spain) in their catching-up phase appeared to core European member states with large savings and little domestic investment prospects as a great investment opportunity. […] In this sense capital flows (and leverage) were the ‘financial manifestation’ of the macroeconomic imbalances. When the financial crisis broke in late 2007, the risk perception changed dramatically and resulted in a sudden stop of private capital flows” (Gros and Alcidi, 2011). Obviously enough, these elements of irregular (and asymmetric) exposure to good as well as bad conjuncture would not exist, if there would be common long-term interest rates for the Eurozone in its entirety (iEMU) resulting for instance from weighing the interest values of each member country (iAustria+⋯+iSpain) by its percentage contribution to Eurozone's yearly GDP (pAustria+⋯+pSpain):

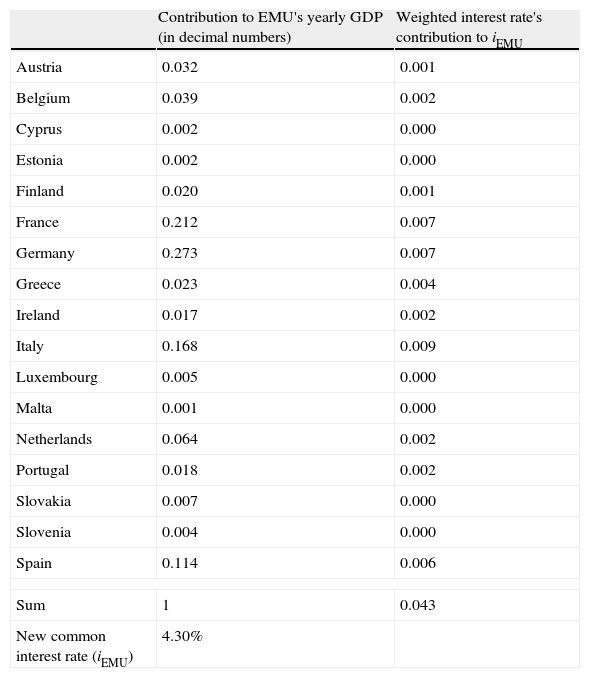

where ¿pAustria+⋯+pSpain is necessarily equal to 1 being the sum of all national weights. Therefore, the formula above can be transformed into the following expression:As Table 2 shows, the long-term interest rate valid for all EMU member countries would be then equal to 4.3%. This (symbolic) result derives from the calculation procedure based on 2011 data.

Determination procedure of a common nominal long-term interest rate.

| Contribution to EMU's yearly GDP (in decimal numbers) | Weighted interest rate's contribution to iEMU | |

| Austria | 0.032 | 0.001 |

| Belgium | 0.039 | 0.002 |

| Cyprus | 0.002 | 0.000 |

| Estonia | 0.002 | 0.000 |

| Finland | 0.020 | 0.001 |

| France | 0.212 | 0.007 |

| Germany | 0.273 | 0.007 |

| Greece | 0.023 | 0.004 |

| Ireland | 0.017 | 0.002 |

| Italy | 0.168 | 0.009 |

| Luxembourg | 0.005 | 0.000 |

| Malta | 0.001 | 0.000 |

| Netherlands | 0.064 | 0.002 |

| Portugal | 0.018 | 0.002 |

| Slovakia | 0.007 | 0.000 |

| Slovenia | 0.004 | 0.000 |

| Spain | 0.114 | 0.006 |

| Sum | 1 | 0.043 |

| New common interest rate (iEMU) | 4.30% | |

Of course, we are well conscious that each country presents several as well as different interest rates. Anyway, this matter of fact is not (necessarily) an impediment, because we consider either the average interest rates or simply long-term data. After that, since the latter hypothetical scenario assumes that national long-term interest rates should be replaced with a common value (iEMU) namely in this case 4.3%, it is also pretty clear that after time 0 (t0), which is represented by the year 2011 in our example, policy makers would not have any new data on national long-term interest rates in order to calculate the new common interest value (iEMU) as weighted measure. Nevertheless, this would not be a significant obstacle to our proposal, since iEMU would be then determined by demand and supply on financial markets. The value of 4.30% at time 0 (t0) would remain a valid indicator for increasing (iEMU<4.30%) or shrinking (iEMU>4.30%) (borrowing) reputation of the Eurozone in its entirety as compared to year 0 (t0). In this specific regard, we are pretty sure that EMU's common interest rate would be significantly below the threshold of 4.30%, which is manifestly overestimated as compared to leading economies worldwide. Obviously enough, it is very likely that the positive influence of ‘virtuous’ countries like Austria, Finland, Germany, Luxembourg and the Netherlands would overweigh in the determination process of iEMU on financial markets.

In fact, a similar phenomenon also occurs in the case of Japan, the United Kingdom and the United States of America, whose economic uncertainties somehow seem to be considered harmless by international investors (Table 3). This matter of fact is not astonishing, because financial markets evaluate the stability of economic subjects as a whole. In this specific regard, speculators as well as investors require (excessively) high interest rates from single EMU member countries, but they would not request similarly high earnings from the European Monetary Union (EMU) in its entirety. As empirical evidence proves, downgrading in ratings, which often occurs only after the bursting of the crisis itself (Reinhart, 2002), has affected single countries including France, Greece, Italy, etc. The European Financial Stability Facility (EFSF) has also lost its top-rating, but only as a consequence of the fact that its leading member countries have been previously downgraded. Since Eurozone's credibility assessment results nowadays from the sum of national reputation levels, it is not unlikely that the European Stability Mechanism (ESM) will be declassified too. Precisely this detrimental trend characterized by scarce trustfulness of some member countries spreading over to the European Monetary Union (EMU) as a whole should belong to the past. In fact, Japan's, United Kingdom's or United States’ ratings (and long-term interest rates) are for sure not influenced by the state of health of single regions or Federal States, but correspond to the general assessment of country's creditworthiness. Evidently, this different evaluation approach leads to significantly lower interest rates (Table 3). Unless the Eurozone will represent a sole economic nation in the eyes of financial markets, every single matter of concern at the national level will be considered severe enough to endanger EMU's survivability!

Change in nominal long-term interest rates in key-currency countries.

| 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | Change | |

| Japan | 1.27 | 0.99 | 1.5 | 1.39 | 1.74 | 1.68 | 1.49 | 1.35 | 1.18 | 1.12 | −0.15 |

| United Kingdom | 4.91 | 4.58 | 4.93 | 4.46 | 4.37 | 5.06 | 4.5 | 3.36 | 3.36 | 3.05 | −1.86 |

| USA | 4.6 | 4 | 4.26 | 4.28 | 4.79 | 4.63 | 3.65 | 3.25 | 3.2 | 2.76 | −1.84 |

| Average | 3.59 | 3.19 | 3.56 | 3.38 | 3.63 | 3.79 | 3.21 | 2.65 | 2.58 | 2.31 | −1.28 |

It is no scientific discovery to claim that “over the last two decades, communication has become an increasingly important aspect of monetary policy. The evidence suggests that communication can be an important and powerful part of the central bank's toolkit since it has the ability to move financial markets, to enhance the predictability of monetary policy decisions, and potentially to help achieve central banks’ macroeconomic objectives” (Blinder et al., 2008). Therefore, economists and financial analysts are actively involved in evaluating central banks’ communication strategies and their effectiveness. In this specific regard, it already belongs to common knowledge that the European Central Bank (ECB) is considered to be more transparent than the Federal Reserve although relatively less than the Bank of England, the Reserve Bank of New Zealand and the Bank of Canada (Eijffinger and Geraats, 2006). Nonetheless, some essential caveats should be also mentioned in order to distinguish between de iure (i.e. declared) and de facto (i.e. practical) transparency: “[o]n the basis of the treaty's requirements, one would think that the ECB is more accountable than most other central banks. […] In its early operations, however, the ECB has shown less accountability than one would have expected” (Bini Smaghi and Gros, 2000). Despite this new research stream, economists still seem to be unaware of the relevance of the question on how can communication be successfully managed in monetary unions. In fact, it would be simply unrealistic to focus on the ECB as the only speaking voice in the Eurozone! As daily evidence has proven, announcements by representatives of the European Central Banks have been often enough contradicted by politicians of member countries. Obviously, confusion and distrust in ECB's policy effectiveness has become increasingly diffuse leading to (even more) instability in financial markets. For instance, it is no mystery that ECB President Mario Draghi has been openly criticized by Bundesbank President Jens Weidmann. For sure, this ongoing situation does not clarify if interventions to rescue the common currency will be actually supported by the most influential shareholders of the ECB. Thanks to its Euro 1.72 bn. corresponding to 18.94 per cent of paid-up capital, the Deutsche Bundesbank is thus the main contributor to ECB's capital (European Central Bank, 2012a).

As wide spreading yield differentials in the Euro Area show, financial markets have proven to be rather skeptical toward European recovery, which is seriously endangered by the missing degree of univocity in determining who has to face investors, savers and speculators through the press and who has to say what or, as stated by the former President of the European Central Bank Jean-Claude Trichet, to improve “verbal discipline” (European Parliament, 2010).

In this specific regard, economic analysis shows that “creating a single voice for the euro is a perilous political endeavor, which explains why member states have so far avoided the issue. Deciding who will speak on behalf of the euro in international monetary fora raises a host of critical questions” (McNamara and Meunier, 2002). Of course, the immediate consequences of this detrimental way of managing communication do not enhance credibility and confidence in the European Central Bank (ECB), although good reputation is one of the most significant aspects of monetary policy. In the contrary, the European Monetary Union lacks diffuse convergence of opinions, which in turn leads to incessant inner diatribes on monetary strategy (Deutsche Bundesbank, 2012a, b), which weakens the impact of ECB's anti-cyclical interventions. For sure, the reformed Euro Area urgently needs to (re)define infra-union communication mechanisms, because they are one of many key-elements necessary to strengthen Europe's credibility in tackling the ongoing crisis. In fact, although large currency unions made of 17 member countries are not easily manageable as empirical evidence shows, this challenge cannot be circumvented! Visibly enough, it subsists a clear logical chain between bad and/or contradictory (e.g. non-univocal) communication and panic-like symptoms in financial markets. As recent publications have proven, “public statements by Euro Area politicians on restructuring increased market pressure, resulting in higher bond spreads and higher conditional volatility, in particular when issued by a politician from an AAA-rated country” (Mohl and Sondermann, 2012) and “[t]he mere rhetoric of relevant politicians increases the uncertainty of financial markets considerably” (Goldbach and Fahrholz, 2010).

Although this reform proposal could appear less structural than subjects for debate like ‘banking union’ or ‘fiscal union’, it is definitely not less relevant. Once again, the European Monetary Union is in need of stability, which has to be also (re)introduced through the medium of proper communication, i.e. an essential tool at central banks’ disposal in an era of global interconnectedness.

2.3The permanent menace of reversibilityRecently, the President of the European Central Bank (ECB) himself has claimed that Euro's “irreversibility means that it cannot be reversed. There is no going back to the Lira or the Drachma or to any other currency. It is pointless to bet against the euro. It is pointless to go short on the euro. That was the message. It is pointless because the euro will stay and it is irreversible” (Draghi, 2012b) and that “we will do whatever it takes within our mandate – within our mandate – to have a single monetary policy in the Euro Area, to maintain price stability in the Euro Area and to preserve the euro. And we say that the euro is irreversible. So unfounded fears of reversibility are just what they are: unfounded fears” (Draghi, 2012c). Now, it is pretty evident that central bankers’ announcements must be clear, fearless and determined enough to inspire confidence (“I am communicating this message as the President of the ECB to all stakeholders, citizens, businesses and markets. Investors need a long-term vision because they undertake long-term commitments. For them, it is very important that our leaders and governments are determined to keep the euro irreversible. So, if I say this, I am saying what our political leaders are fundamentally saying. Again, I am saying it because it is important to do so. Markets should know that the euro is irreversible. That helps them to properly price Euro Area assets and it helps us in the conduct of our monetary policy” (Draghi, 2012a)). But is the Euro as common currency really irreversible? Despite many assurances, it is reversible indeed!

But why is it so? Of course, because of the intrinsic essence of every exchange rate arrangement. In fact, currency unions are nothing else than more or less flexible regimes (f.i. pure float, managed float, crawling band, crawling peg, peg with horizontal band) or fix exchange rate agreements (f.i. fixed peg, currency board, dollarization/eurozation, monetary union). Obviously enough, the European Monetary Union is subject to ‘the’ super-fix currency standard par excellence, but this matter of fact does for sure not prevent the Euro currency from being reversible. For instance, economic history tells us that there have been several examples of comparable currency unions, which have strenuously battled against inner economic problems and systematically failed. There is in this regard no doubt that the Euro Area is the most interesting case in time, but this conclusion does not prevent it from being exposed to the same difficulties or to even more economic troubles. Why is it so? Obviously enough, because “individual partners lose the capacity derived from an exclusive national currency to augment public spending at will via money creation – a privilege known as seigniorage. Technically defined as the excess of the nominal value of a currency over its cost of production, seigniorage can be understood as an alternative source of revenue for the State beyond what can be raised by taxes or by borrowing from financial markets. Sacrifice of the seigniorage privilege must also be compared against a monetary union's efficiency gains” (Cohen, 2010). Hence, we draw two main conclusions: on the one hand, seigniorage, which represents one of the leading monetary tools of central banks like the Federal Reserve or the Bank of Japan, has been given up and States have to collect enough taxes or borrow from financial markets in order to comply with their financial requirements. As a matter of fact, the first scenario goes hand in hand with an increasingly higher fiscal burden, while in the second case public administrations expose themselves to fluctuating moods, fears and feelings of investors as well as speculators. On the other hand, currency unions present some main benefits, which are mostly related to shrinking transaction costs because of the absence of intra-union exchange rates. Although we truly believe that under these conditions cons outweigh pros, this last assertion will not be further deepened (or, at least, not in this paper).

What remains profoundly veridical is that no currency arrangement is irreversible, although it is quite sure that breaking up the Euro and reintroducing national currencies would be very costly! In somebody's eyes, this is maybe a good argument for Euro's alleged irreversibility…. As empirical evidence has shown, financial markets are perfectly aware of Euro's reversibility, which hangs over its destiny as a Sword of Damocles. For sure, there can be no skepticism on the reversibility fears of the Eurozone subsisting in the business as well as financial sectors, which has explicitly analyzed the disruptive consequences of such a breakup and has also published specific guides to brace investors for the worst scenario (Accenture, 2011; Dun & Bradstreet Limited, 2012). In fact, national currencies as the US Dollar, Japanese Yen or the former European currencies were not reversible to anything, because they were naturally given currencies, i.e. they were imaginarily placed at time 0 (t0) on the timeline of national monetary history. In other words, even in case of sharp depreciation, the Italian Lira would have remained the Italian Lira. On the contrary, the Euro is an artificial currency, which is placed at time 1 (t1) on the timeline of monetary history. This apparently subtle distinction is very significant, because it represents an unprecedented matter of concern for investors worldwide. In fact, in addition to depreciation/appreciation assumptions already attached to national currencies, financial markets (may) fear the disintegration of the currency itself. Evidently enough, this is a completely new (and extraordinarily perilous) dimension! In fact, “although the analysis of potentially destabilizing influences has received a greater attention in recent years, contributions in this area have typically been confined to the transition phase preceding the formal establishment of a currency union. The issue of its long run sustainability, on the other hand, has so far received a surprisingly scant attention; in other words, once a currency union is established, this regime shift is usually regarded as a strictly irreversible process. Treating the introduction of a common currency as an irrevocable choice is a relevant shortcoming in the existing theoretical literature. The above assumption, moreover, stands in sharp contrast with the historical record of the last two centuries. As revealed by the empirical evidence, the actual experience of currency unions has indeed been remarkably mixed: while some of them were highly successful, others ultimately proved unsustainable” (Menoncin and Tronzano, 2005).

For sure, we do not even need to analyze each case of monetary unions’ breakup: the Austro-German (1857–1866), Latin (1865–1927) and Scandinavian (1873–1931) currency unions are probably sufficient to prove the reversibility of every exchange rate arrangement. Now, the fact that the Euro currency can be intrinsically reversed and member countries in trouble may exit as last resort results in sudden confidence crises during economic turmoil and anomalously high propensity of investors to bet against Euro's durability (Apray, 2011). At the back of their minds, financial markets are well conscious of the risk of reversibility, which keeps menacing the recovery as well as Euro's daily routine. Not enough, these apprehensions are continuously nurtured by incautious statements by European representatives like the EU Economic and Monetary Affairs Commissioner Olli Rehn, who is worried about the potential “disintegration of the Eurozone” (Rehn, 2012), or by the Vice President of the European Commission Joaquìn Almunia, who merely claims that Greece's “exit would be a tragedy, and not only for Greece” (Almunia, 2011). These assertions not only validate the ‘roped party effect’, which will be duly explained in the next sections, but it also does not deny (or even exclude) that member countries may leave the Eurozone – in fact, no (currency) agreement can prevent one party from not fulfilling it, does not it? The Euro currency has been (at least, tacitly) reversible starting from its very introduction, but the common money unit has maybe become more precarious after unclear statements, uncoordinated disclaimers and, more generally, bad crisis management.

2.4The roped party effect of common currenciesWhat we call ‘roped party effect of common currencies’ represents nothing else than an intuitive conclusion, which is directly interrelated with the founding principles of monetary unions. In fact, currency unions are mostly described with the British idiomatic expression ‘United we stand, divided we fall’. But is it really true that the European Monetary Union has become more vigorous after having let in new member countries, which are characterized by pretty divergent economic fundamentals? Probably not! For sure, the idiomatic phrase mentioned above does not apply to monetary unions and should be therefore turned into ‘United we stand, united we fall’…. In other words, if one member country is afflicted by a severe crisis and fears on the sustainability of the currency arrangement itself arise, financial markets will be induced to stand in awe of the system's durability and will not be prevented from assuming the worst case, namely the breakup of the currency union. In addition, “a final factor that is hindering an increased global role for the euro is the continued hesitation on the part of euro-zone countries themselves to embrace their newly created currency. Leaders of a number of euro-zone countries including Germany, France, and Italy have at one time or another hinted that an exit strategy might be needed under certain economic conditions. Even if these murmurings are intended only for internal political consumption, they leave the rest of the world with a nagging sense of doubt about the longevity of Euroland. But doubts about the wisdom of economic and monetary integration persist across Europe. This wariness also influences the ability of the European Central Bank to take over monetary policy efficiently and limits the ability of the euro to become a true rival of the dollar in global financial markets” (Dominguez, 2006). But why is it so? Logically, because of the findings explained in Section 2.7 and the reduced degree of unanimity in decision making: in fact, this is the same principle observable for married couples where choices have to be (mostly, at least) made in consultation. Single people can be therefore more committed to their decisions than couples, who have to come to an agreement. In the light of these arguments, it seems pretty likely that financial markets as well as politicians fear the consequence of any ‘domino effect’ originating from the exit or financial collapse of Greece or, even more, Italy and Spain. If common currencies would not be subject to this ‘roped party effect’ as we claim to be, there would be no plausible reason for fearing cascade effects from Southern European countries’ insolvency and claiming that the Euro currency itself would be in danger because of Greece's exit.

In times of economic troubles and growing financial instability, common currencies have to rely all the more on infra-union cohesion as well as sound policies taken by other member countries. As easily imaginable, there are (too) many unknown quantities, which make it hard(er) for investors and savers to blindly trust 17 different EMU nations. In addition, if rating agencies are actively involved in revoking triple AAAs and, by doing so, they literally split Euro Area members into ‘good’ and ‘bad’ ones, unregulated financial markets will have an additional, all-embracing reason for distrust. In keeping therefore with the motto, ‘united we stand, united we fall’….

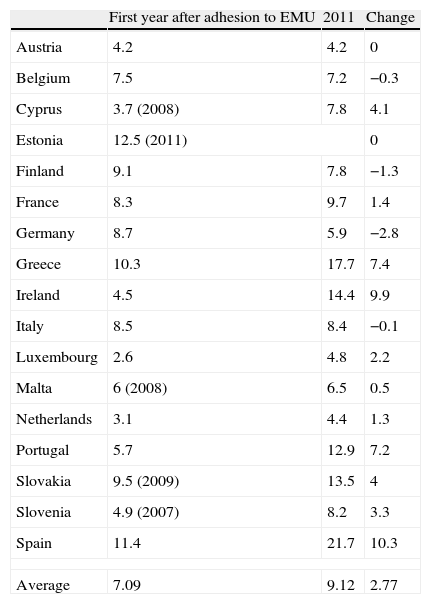

2.5One size does not fit all!/If it does not fit, use a bigger hammer! Or not?An additional element of structural weakness is the Euro's innate ‘one-size-fits-all approach’. It is no mystery that the European Monetary Union formulates a single economic policy, which should comply with the specific needs of each member country. In actual fact, it is rather utopistic to think of the Eurozone as an optimal currency area, whose member nations have homogeneous needs! On the contrary, as easily graspable, EMU is characterized by several aspects of diversity ranging from economic as well as cultural and social peculiarities. In the light of this, it results that the Eurozone is not only a suboptimal currency area: “the EMU by contrast is a dubious candidate for an optimal currency area because although it too trades intensively within the region, national work restrictions greatly impair intra-European labor mobility, and supranational fiscal power is feeble because rich members don’t want to assume heavy financing burdens during turbulent times. […] EMU architecture is comparatively economically inefficient, bubble prone and unusually subject to systemic risk. […] A greater political union is key to the preservation of the European monetary union” (Razin and Rosefielde, 2012). Interestingly enough, empirical evidence shows that even three (apparently, very similar) Scandinavian countries like Denmark, Norway and Sweden have not constituted any optimal currency region during the Scandinavian Currency Union (Bergman, 1999). Furthermore, the Euro Area also urgently needs to take advantage from a diversified monetary policy mix, which cannot be anymore supplied by national Governments (“While the Treaty on the Functioning of the European union (TFEU) institutes a single monetary policy, it maintains national responsibilities for other economic (e.g. fiscal and structural) policies” (European Central Bank, 2011)). Let us face the actual situation resulting from an accurate analysis of infra-communitarian data. For instance, unemployment rates are dramatically (but for sure not unpredictably) divergent (Table 4).

Change in unemployment rates in the Euro Area.

| First year after adhesion to EMU | 2011 | Change | |

| Austria | 4.2 | 4.2 | 0 |

| Belgium | 7.5 | 7.2 | −0.3 |

| Cyprus | 3.7 (2008) | 7.8 | 4.1 |

| Estonia | 12.5 (2011) | 0 | |

| Finland | 9.1 | 7.8 | −1.3 |

| France | 8.3 | 9.7 | 1.4 |

| Germany | 8.7 | 5.9 | −2.8 |

| Greece | 10.3 | 17.7 | 7.4 |

| Ireland | 4.5 | 14.4 | 9.9 |

| Italy | 8.5 | 8.4 | −0.1 |

| Luxembourg | 2.6 | 4.8 | 2.2 |

| Malta | 6 (2008) | 6.5 | 0.5 |

| Netherlands | 3.1 | 4.4 | 1.3 |

| Portugal | 5.7 | 12.9 | 7.2 |

| Slovakia | 9.5 (2009) | 13.5 | 4 |

| Slovenia | 4.9 (2007) | 8.2 | 3.3 |

| Spain | 11.4 | 21.7 | 10.3 |

| Average | 7.09 | 9.12 | 2.77 |

In fact, “the economic consequences of EMU are also likely to be negative. Imposing a single interest rate and an inflexible exchange rate on countries that are characterized by different economic shocks, inflexible wages, low labor mobility and separate national fiscal systems without significant cross-border cyclical transfers will raise the overall level of cyclical unemployment among the EMU members” (Feldstein, 1997). More generally and in the light of the enduring economic crisis, high and divergent unemployment rates are not necessarily a consequence of European Central Bank's policy interventions, but they are due to boundaries drawn by participation criteria to the Euro Area (“[T]he ECB monetary policy is systematically biased against output stabilization and lacks the flexibility that a proper inflation targeting strategy has” (Rossi, 2004)). As a matter of fact, widening economic and financial performances by member countries, which are a logical effect of their different competitive potential, are forcibly blowing the European Monetary Union to pieces. The principle we are writing about is very intuitive and can be compared to an elastic band, which is not anymore able to sustain pressure originating from items too big (and too different in form) to be held together. As soon as disaggregating forces become unsustainably massive, the gum band tears apart and every object held together cuts its own path which it has been until then prevented from.

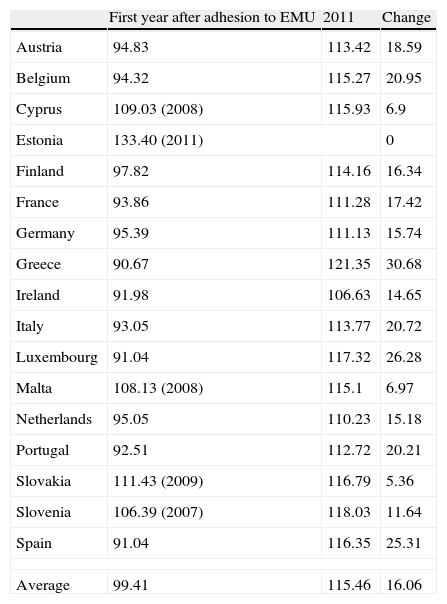

Even inflation rates, which should be relevant in the light of ECB's focus on price stability, do not obey monetary policies. Well aware of this fact, ECB President Mario Draghi states that “we want to repair monetary policy transmission channels and we clearly see a risk, and I mean the convertibility premium in some interest rates. But the Governing Council knows that monetary policy would not be enough to achieve these objectives unless there is also action by the governments. If there are substantial and continuing disequilibria and imbalances in current accounts, in fiscal deficits, in prices and in competitiveness, monetary policy cannot fill this vacuum of lack of action. Action by the governments at the Euro Area level is just as essential for repairing monetary policy transmission channels as is appropriate action on our side” (Draghi, 2012b). In fact, high and divergent yields on Government bonds modify the impact of commonly fixed interest rates, but it is also true that the Euro Area has suffered different inflation rates starting from its very foundation (Table 5).

Change in the Harmonized Consumer Price Index (HCPI).

| First year after adhesion to EMU | 2011 | Change | |

| Austria | 94.83 | 113.42 | 18.59 |

| Belgium | 94.32 | 115.27 | 20.95 |

| Cyprus | 109.03 (2008) | 115.93 | 6.9 |

| Estonia | 133.40 (2011) | 0 | |

| Finland | 97.82 | 114.16 | 16.34 |

| France | 93.86 | 111.28 | 17.42 |

| Germany | 95.39 | 111.13 | 15.74 |

| Greece | 90.67 | 121.35 | 30.68 |

| Ireland | 91.98 | 106.63 | 14.65 |

| Italy | 93.05 | 113.77 | 20.72 |

| Luxembourg | 91.04 | 117.32 | 26.28 |

| Malta | 108.13 (2008) | 115.1 | 6.97 |

| Netherlands | 95.05 | 110.23 | 15.18 |

| Portugal | 92.51 | 112.72 | 20.21 |

| Slovakia | 111.43 (2009) | 116.79 | 5.36 |

| Slovenia | 106.39 (2007) | 118.03 | 11.64 |

| Spain | 91.04 | 116.35 | 25.31 |

| Average | 99.41 | 115.46 | 16.06 |

Obviously, differences in terms of prices are no exception in monetary unions too, but, Table 5 evidently shows how stagflation pressures, i.e. economic stagnation combined with inflation, are plaguing Southern European countries (Greece, Italy and Spain). In any case, there is no clear trend in the evolution of the Harmonized Consumer Price Index (HCPI), which in turn means that the Eurozone is subject to asymmetric shocks (f.i. deflation in some country groups and inflation in other nations). European institutions themselves also highlight that “a single monetary policy for Member States that does not fulfill the conditions of an [optimal currency area] can produce different rates of inflation and therefore, different real interest rates, different real exchange rates and large booms and busts in different Member States that need to be dealt with to avoid serious breakdowns of the monetary union” (European Parliament, 2012). As Table 5 proves, the European Central Bank has not been able to accomplish to its own (and sole) task aiming at “keeping inflation below, but close to, 2% over the medium term” (European Central Bank, 2012b). In addition, if we look at data resulting from national consumer price indexes (European Commission, 2012c,d), the upward trend in prices is even more explicit. But why is it so? Or, more precisely, why the European Central Bank seems to be unable to maintain enduring price stability across its member countries? Certainly, ECB's ineffectiveness is not (only) imputable to its course of action or its policy mix, but rather to anybody's generic inability to formulate a common approach suitable for 17 (!) inhomogeneous nations. As we will soon enough see, the Euro Area cannot be nearly compared to the United States of America, because EMU member countries have retained political autonomy and suffer widening economic divergences. Precisely these dissimilarities have been experienced by the United States of America in the past centuries, but they have been also overcome by their federal States thanks to their common cultural, linguistic and social peculiarities, which are unmistakably far away from belonging to the Euro Area.

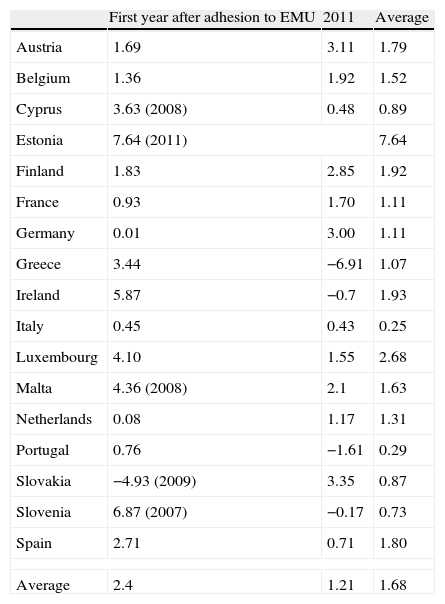

Even GDP growth rates are foreseeably dissimilar and outline the intrinsic impossibility of formulating any ‘one-size-fits-all solution’ (Table 6).

Change in GDP growth rates among member countries.

| First year after adhesion to EMU | 2011 | Average | |

| Austria | 1.69 | 3.11 | 1.79 |

| Belgium | 1.36 | 1.92 | 1.52 |

| Cyprus | 3.63 (2008) | 0.48 | 0.89 |

| Estonia | 7.64 (2011) | 7.64 | |

| Finland | 1.83 | 2.85 | 1.92 |

| France | 0.93 | 1.70 | 1.11 |

| Germany | 0.01 | 3.00 | 1.11 |

| Greece | 3.44 | −6.91 | 1.07 |

| Ireland | 5.87 | −0.7 | 1.93 |

| Italy | 0.45 | 0.43 | 0.25 |

| Luxembourg | 4.10 | 1.55 | 2.68 |

| Malta | 4.36 (2008) | 2.1 | 1.63 |

| Netherlands | 0.08 | 1.17 | 1.31 |

| Portugal | 0.76 | −1.61 | 0.29 |

| Slovakia | −4.93 (2009) | 3.35 | 0.87 |

| Slovenia | 6.87 (2007) | −0.17 | 0.73 |

| Spain | 2.71 | 0.71 | 1.80 |

| Average | 2.4 | 1.21 | 1.68 |

For example, every economist and policy maker knows how different cyclical interventions have to be in good as compared to bad times. In other terms, the centrally fixed ECB interest rate as well as the nominal ‘one-to-one’ correspondence between infra-union exchange rates categorically impedes conjunctural adjustments, which characterize any monetarily sovereign nation worldwide. Unless these obstacles to competitiveness and prosperity will be removed, the Eurozone will continue to suffer boosting discrepancies, which will even more seal the current deadlocked situation. After all, even before the creation of the Euro currency, several scientists were conscious that “the ECB [would] be unable to rely on broad consensus over monetary policy. Especially in times of stagnation or crisis, it will be the focus of intense political pressure from business, labor, governments, and regions with divergent interests” (Frieden, 1998). As commonly known, this is exactly what the European Monetary Union is nowadays undergoing: for instance, Germany and Finland are particularly desirous of avoiding quantitative easing (or any similar measures), which are in the contrary endorsed by Southern country groups like Greece, Italy and Spain. The next future will certainly prove that this trend will not only endure, but will also become even more pronounced.

2.6Cultural and social peculiarities as intrinsically tying or disaggregating factorsThere is no doubt that the Euro Area is inhomogeneous even in cultural terms. But what kind of economic implications do these divergences imply? For instance, it becomes likely that some countries will be more prone to promote anti-cyclical stimulation plans – also at the cost of increasing inflation in the short term – while policymakers of other nations will have a rather different approach to economic diseases (“Wasteful strategic debt policy may arise from conflicts about the preferred stance of monetary policy both between the ECB and the fiscal authorities and between heterogeneous fiscal authorities themselves” (Beetsma and Bovenberg, 2005)). These findings can be easily conceived in any monetary union made of 17 member countries and represent at the same time a source of great uncertainty. In fact, heterogeneity, which is generally speaking undoubtedly an element of strength, can be at the origin of conflicts in nearly every tying exchange agreement. Rightly so, the former French President Nicolas Sarkozy has pointed out in a speech in Toulon on 1 December 2011 that “we each have our history; we each have our past wounds. When we talk about currency, Germany remembers its history. We must understand that and we must respect it. We each have our institutions, our political culture, our concept of the Nation. In one case it is federal and in the other unitary. We need to understand that difference. We must respect it” (Sarkozy, 2011). Now, these assertions are profoundly true and should be respected, but at the same time it is not possible to claim that Germany's fears of inflation necessarily correspond to the shared view in the Euro Area. Nonetheless, letting single approaches permeate the European level too is not easy and can be at the origin of huge conflicts, as the current debt crisis is still showing. Who does not remember revolution-like turmoil in Greece, because European authorities were against additional financial help and continued pleading for further sacrifices? Perhaps, skeptics can claim that demonstrations have also occurred in other occasions and are not necessarily interlinked with currency unions. According to our analysis, this hypothetical objection is only half-true, since economic and monetary unification (as the phrase itself recalls) aims at homogenizing peculiar characteristics of member economies. Of course, homogenization is not incontrovertibly bad, but it is at least a great challenge to be understood by nearly 330 million citizens in the Euro Area.

2.7The indivisibility of monetary and political powersWe already know that the Treaty of Maastricht (1992) prescribes a rather precise separation between monetary powers in the hands of the European Central Bank and economic as well as political powers, which national Governments are in charge of. Since monetary matters represent a subcategory of economic responsibilities, it is immediately evident that there will be huge conflict potentials between communitarian and national policymakers or, more precisely, between ‘one-size-fits-all solutions’ formulated at the European level (concerning fundamental elements of economic policy) and tailor made measures decided at the national level, which can be in contrast with the ECB itself. In addition, there are “grave doubts whether this [fiscal co-ordination] can work. Fiscal policy decisions at the EC level will be subject to nationalistic haggling, and central cooperation and coordination will be limited by each country's desire to avoid a net loss nationally. Fiscal policy at the national level, which already faces many constraints, will be further shackled by the fiscal limits set by the Maastricht Treaty. Monetary autonomy will have been abandoned. Consequently the inhabitants of each member nation are likely to suffer a reduction in their ability to control their own economic destinies. At times of pressure and cyclical downturn, they might perceive this loss as greater than the gain from preserving the single market by remaining within the monetary system” (McKay, 1999). The principle of the indivisibility of monetary and political powers is furthermore interlinked with another core term, namely sovereignty: thus, “monetary integration involves a consideration of two quite different types or dimensions of sovereignty. One is policy sovereignty, and the other is legal sovereignty. Policy sovereignty refers to the ability to conduct policy independent of commitments to other countries. Legal sovereignty refers to the ability of a state to make its own laws without limitations imposed by any outside authority. Both concepts need to be considered in plans for monetary unions” (Mundell, 2002). In fact, the abandonment of monetary autonomy cannot be replaced by making (excessive) recourse to fiscal policies, as it nowadays happens (Beretta, 2013). Not enough, any segmentation between monetary and economic (e.g. fiscal) powers is not only unsupported by theoretical as well as empirical evidence, but it also contravenes the principle of univocity stated in Section 2.2. As renowned thinkers have in addition pointed out, “assigning to a central bank in a monetary union the sole duty of controlling price inflation and assigning to the fiscal authorities the duty of controlling budget balances are always less efficient than co-operation between the authorities” (Meade and Weale, 1995). In the light of these observations, some first obstacles to any separation between monetary and economic powers are manifestly related to efficiency because of lacking participative management between national and communitarian authorities and effectiveness due to (potentially) incoherent economic policies at the national as compared to the European level. The same disturbing mechanisms apply to processes of decision making, because they are split into national and communitarian competence levels. In fact, no problems would subsist, if there would be a political union too. Plethoricly enough, economic literature has been skeptical on the feasibility of bringing about a monetary union “without a previous political union. [M]onetary unions certainly cannot take place when national governments are not sufficiently committed to it to tame or compensate special interests opposed to it, when there are no neutral supranational institutions to mediate conflicts, when some government can monetize their financial difficulties at the expense of their partners, when protectionism is mounting, or when hostility between nations is perceptible. Monetary union became a victim of conflicting national ambitions, of the banker's interest in preserving exchange profits, but also of the lack of trust between States. No State would yield its monetary sovereignty knowing that it might become partially liable for the costs of financial mismanagement by its neighbor. Monetary unification created excessive and sometimes contradictory expectations in its supporters: it could not deliver political advantage for some governments and simultaneously sustain peaceful aspirations, economic development, and free trade” (Einaudi, 2000). At the latest, as soon as national and communitarian decision makers (will) start thinking differently in economic, monetary and/or political terms, the exchange agreement will begin to be innerly threatened.

2.8The trinomial of monetary unions, moral hazard and ‘too big to fail’ diagnosisThe phrase ‘too big to fail’ is often used in relation to banks and financial institutions. Despite that, this formulation seems to be even more applicable in the case of EMU countries. Why is it so? Well, it is a fact that Italy, Spain or even Greece are nations in trouble, which are at the same time treated as unrenounceable or, precisely, ‘too big to fail’. Now, it is quite sure that, if countries like Italy and Spain should be bailed out, communitarian financial resources would be insufficient (‘too big to bail’). Nonetheless, the message we want to deliver here is precisely that, because of the permanent menace of reversibility (Section 2.3) and the roped party effect (Section 2.4), currency unions are constantly menaced by their intrinsic faults. As prominent economists have also pointed out, “the credibility of exchange-rate commitments under the nineteenth-century gold standard was supported by special circumstances not present today. Past experience thus suggests that many of the benefits of currency unification can in principle be reaped through the maintenance of firmly fixed exchange rates between distinct national currencies. Experience also suggests, however, that the special circumstances conferring credibility to governments’ commitments to fixed rates in earlier years are not present in Europe today” (Eichengreen, 1992). It is therefore plethoric enough to claim that every single source of crisis affecting system-relevant member countries is treated as a cause of disease, which is likely to spread to the currency area as a whole. This is obviously so, because the Euro is conceived as the sum of reputation levels, economic performances and affection for the common currency showed by each member nation. At the same time, EMU members are exposed to a devious incentive to behave hazardously in economic terms. In fact, as soon as Governments become cognizant of their systemic relevance for the stability of the Euro currency itself, they become likely to act in a prejudicial as well as imprudent way, because they assume to benefit from the communitarian agreements: “should indebted countries inside a monetary union themselves believe that a bail-out mechanism exists, they may be encouraged to be less fiscally prudent than otherwise. […] In order to counter moral hazard, the monetary union must combine a binding ‘no bail-out’ rule with stringent rules preventing any member of a monetary union incurring levels of debt that are not sustainable. […] In particular, it seemed that insufficient attention was given […] to the total level of a nation's outstanding sovereign debt, indicating, perhaps, that moral hazard had become and endemic feature of the dynamics of European monetary union” (Scott, 2012). Probably, the moral hazard phenomenon deriving from the ‘too big to fail’ status has heavily characterized some decisions before, but less during the current crisis. Thus, economies in trouble have rapidly realized that communitarian loans would be granted only under heavy conditionalities. Despite that, admonitions from economically ‘virtuous’ countries cannot have nothing more than a low impact on Italy's and Spain's policy decisions, because both the ‘virtuous’ and the ‘vicious’ know that the European Monetary Union has to rely on them. Evidently, this kind of scenario cannot be defined as a win-win situation, since it is prejudicial to the European project in its entirety.

2.9The bad deal of bartering exchange rate risks for sovereign risksLet us make a first statement, which should appear objective even in the eyes of skeptical readers: currency unions eliminate infra-union exchange rate risks, while “exchange-rate risk is […] associated only with international trade” (Eudey, 1998). Manifestly, no fluctuations can occur, if member countries decide to abolish their national currencies and adopt a new, common one. In a similar way, the Euro remains subject to appreciation and depreciation risks with respect to the remaining foreign currencies (f.i. the US-Dollar), although this characteristic is shared by nearly every money unit in today's floating regimes. What is significantly different and represents a dramatic threat to the Eurozone itself is that exchange rate risks have been literally bartered against augmented sovereign default risks. While the first risk typology is likely to positively as well as negatively affect the external sector of national economies – it is therefore a vox media in economic science – increased exposure to State's bankruptcy is evidently a greater (and more concrete) matter of concern. But why should the Eurozone suddenly become potentially more vulnerable to sovereign defaults? Once again, because of the peculiar exchange rate regime, namely the establishment of a monetary union, which has ‘confiscated’ some essential policy tools.

For instance, although (nearly) every economist should be conscious that central banks cannot create positive values, namely real wealth, from scratch or through over-issuing money, it is also clear that they can either lend the Government part of their liquidity without (strict) conditionalities or temporarily over-issue money to purchase public bonds and refinance the public sector. In order to avoid inflationary repercussions, this over-issue of money should be a sort of anticipated monetization of future earnings and therefore gradually be reabsorbed. Despite its huge monetary powers, the European Central Bank cannot be considered as a ‘true’ lender of last resort, because its (self-imposed) task field is stubbornly limited by law to some particular economic aspects like fighting inflation (“The main objective of the Eurosystem is to maintain price stability: safeguarding the value of the Euro” (European Central Bank, 2013)). In addition, no central bank can claim to be called ‘lender of last resort’ and contemporarily attach huge (and preposterous) conditionalities to any (although extraordinary) credit concession to its member countries. Since EMU nations have become well aware of this huge loss to contrast economic crises, they tend to wait before asking for financial helps (cf. Spain). In the meantime, States are forced to either borrow additional funds on financial markets, which normally require high interest payments, or dramatically increase taxation at the national level as shown in Beretta (2013) by comparing the VAT standard rate pre-EMU with the VAT standard rate during EMU. According to our findings, this trend seems to affect the Euro Area as a whole, although it is more pronounced in economically troubled countries.

Furthermore, as economic history well teaches, several Governments have fought (and reabsorbed) public indebtedness through currency devaluation and augmented price levels. According to this scenario, the national economy would be stimulated to increase commercial exports. By doing so, the country would be able to earn more foreign currencies from international trade, expand its domestic production and eventually lower the debt burden. Since exchange rates are nominally fixed for ‘poorer’ as well as ‘richer’ countries, the first cannot anymore devaluate their currency, although the communitarian exchange value does clearly not reflect the economic performance of each member nation. In this regard, there is no doubt that, if some Southern European countries would regain influence over their exchange rates, the financial and debt crisis would not have reached the current contagion-like dimension.

As an additional matter of fact, it is pretty usual that public indebtedness decreases in times of upswinging economic growth due to higher tax inflows and increases during economic turmoil because of higher unemployment and lower GDP growth rates. Of course, this logical chain is not an economic dogma, which must be always true. Nonetheless, it is correct to claim that there is a pronounced trend toward the scenario described above: in the light of this, “the sensitivity of debt crises to growth slowdowns makes it particularly important to have sound growth forecasting practices” (Easterly, 2011). Now, since EMU members are not anymore allowed to get indebted over the ‘magic’ threshold of 0.5 per cent (as compared to yearly GDP), it is pretty evident that countries in trouble will not benefit anymore from the previous degree of monetary sovereignty, which would permit them to regain some monetary agility.

Last but not least, what do the United States of America, England or Japan have in monetary terms, which the Euro Area does not have? Once again, the first country group is monetarily sovereign, which should of course not be regarded as a particular or even privileged status! Nonetheless, it is quite sure that the Eurozone cannot count on central banking institutions like the Federal Reserve Banks, the Bank of England or the Bank of Japan. This is true not because the European Monetary Union has (self-evidently) its own organizations, but because EMU members cannot anymore take advantage from some fundamental ‘privileges’ in terms of monetary flexibility as other leading countries worldwide still can. Now, these assertions do not (necessarily) provide enough evidence to show why the Euro Area has literally bartered zero-level exchange rate risks for increased sovereign default risks. As a matter of fact, even Germany, namely the ‘virtuous’ country par excellence, has lost some part of its monetary adaptability, which has been mainly compensated through increased taxation levels and less proneness to public spending.

For instance, Table 7 sums up the main trends in Gross Fixed Capital Formation (GFCF) by sectors. In this specific regard, it clearly appears that the public sectors of EMU countries as a whole contribute less to the stock of capital goods than Japan, the United Kingdom as well as the United States of America, which are our (monetarily sovereign) terms of comparison, while the German State, which is at the head of a particularly innovative country, invests even less than the rest of the Euro Area. Interestingly enough, the public sector of the United Kingdom and the United States of America, which are traditionally neoliberal countries, seem to be more prone to be actively involved in investing in new capital goods than the Eurozone as a whole.

Gross Fixed Capital Formation (GFCF) by sectors.

| Total(bn €) | State(bn €) | Contribution to total amount(as %) | Other sectors(bn €) | Contribution to total amount(as %) | |

| European Monetary Union | |||||

| 2002 | 1482.6 | 178.7 | 12.05 | 1303.9 | 87.95 |

| 2011 | 1805.6 | 219.6 | 12.16 | 1585.7 | 87.82 |

| European Union | |||||

| 2002 | 1949.9 | 232.7 | 11.93 | 1717.2 | 88.07 |

| 2011 | 2347.6 | 316.8 | 13.49 | 2030.8 | 86.51 |

| Germany | |||||

| 1991 | 356.75 | 39.86 | 11.17 | 316.89 | 88.83 |

| 2001 | 421.74 | 38.88 | 9.22 | 382.86 | 90.78 |

| 2011 | 469.85 | 42.68 | 9.08 | 427.17 | 90.92 |

| Japan | |||||

| 1991 | 905 | 135.9 | 15.02 | 769.1 | 84.98 |

| 2001 | 1130.2 | 231.6 | 20.49 | 898.6 | 79.51 |

| 2011 | 873.4 | 139.7 | 15.99 | 733.7 | 84.01 |

| United Kingdom | |||||

| 1991 | 154.4 | 19.1 | 12.37 | 135.3 | 87.63 |

| 2001 | 276.1 | 24.5 | 8.87 | 251.6 | 91.13 |

| 2011 | 248.1 | 38.3 | 15.44 | 209.8 | 84.56 |

| United States of America | |||||

| 1991 | 780 | 117.7 | 15.09 | 662.3 | 84.91 |

| 2001 | 2221.4 | 288.5 | 12.99 | 1922.9 | 86.56 |

| 2011 | 1582.2 | 248.6 | 15.71 | 1333.6 | 84.29 |

According to our analysis, these results are not unexplainable, because the Eurozone and its members are the only country groups, which have to cut public expenses to satisfy communitarian budgetary constraints and to comply with their inability to make use of (expansive) monetary policies. Empirical evidence is particularly strong and additionally corroborated by data for the European Union, which consists of 27 (instead of 17) members. Now, although 17 EU nations are also part of the Euro Area, the public sectors of the remaining 10 countries are so active in contributing to the Gross Fixed Capital Formation (GFCF) – evidently, because of not being affiliated to the Eurozone and, therefore, subject to its constraints – that they contribute to raising the average from 12.16 (cf. EMU) to 13.49 per cent (cf. EU) in 2011! Reduced public investments are only one consequence of the European currency arrangement, which prevents member countries from counting on their own central bank (and, of course, its benevolence in granting credits) and forces (at least, the most ‘virtuous’) nations to cut their expenses and proactively save resources. This (though necessary) way of doing leads to greater exposure to cyclical effects in bad times and, more generally, to more limited policy tools in crises. In fact, there is wide acceptance of the ‘golden rule’ (tracing back to decades ago) that “in a crisis characterized by the existence of unemployed factors the task is to direct the economy toward full employment, through a determined expansion of investment over saving, and effective utilization of public investment for this purpose; in a condition of full employment, to stabilize the economy by creating and maintaining an equilibrium between saving and investment; and, finally, in the case of eventual inflationary expansion of investment over saving in a fully employed economy, cautiously to restore equilibrium” (Richter-Altschäffer, 1938). Obviously, if some EMU Governments are not well aware of these constrictions and do not proactively reduce their expenses, they will soon or later get in trouble and ask for financial helps. And this is precisely what is going on in Cyprus, Greece, Italy, Portugal, Spain: under these conditions, there is little doubt that other countries will follow!

3ConclusionThe European common currency is severely endangered by its intrinsic characteristics, which are also responsible for having dramatically reduced the intervention ability of policymakers. Of course, credibility and reputation, which should be doubtlessly implied by super-fix currency regimes, have no chance to assert themselves in the presence of widening divergences between 17 unequal member countries. Under these conditions, the European Central Bank (ECB) will continue to be unable to formulate appropriate economic policies, which cannot obviously be recessive for one country group and inflationary for other nations. This paradigmatic dilemma is precisely the result of the ‘one size fits all’ approach characterizing the Euro currency itself: as soon as discrepancies and imbalances prevail, the situation gets out of control.

Now, what should European policymakers do in order to restore confidence in the Euro Area? First of all, they should unmistakably decide between two possible alternative paths:

- •

rescuing the Euro currency and the exchange agreement;

- •

not rescuing the Euro currency and the exchange agreement.

Although this is a very simple question, it seems to subsist no unequivocal consensus on it. In fact, if policymakers opt to rescue the Euro currency and the exchange agreement, there should be no hesitation in letting the European Central Bank (ECB) purchase bonds issued by Governments of countries in economic trouble. In fact, some of them are not anymore able to refinance themselves autonomously on the financial markets (Table 1). Obviously, the central bank should become aware enough of its crucial role and policy tools to break the current bottleneck. In fact, the European Central Bank (ECB) already has all these (unused) instruments and monetary powers, which are typical for every central bank of countries (or country groups) like England, Japan, the United States of America and, of course, the Euro Area. Furthermore, economic growth should be stimulated even at the cost of (temporary and managed) increases in public indebtedness of some countries. Otherwise stated, there can be no prolonged debt reimbursement without sustained economic growth. In addition, communitarian institutions should pay more attention to imbalances and divergences in the Euro Area itself. In fact, there can be no sustainability in the Eurozone unless there is profound convergence in real terms. For sure, this process of homogenization will last at least several years (if not decades), but it is a necessary step toward true integration.

Otherwise, if there is no agreement on rescuing the Euro currency, the member countries of the Eurozone should either reconvert their currency stocks into national money units or (try to) maintain the Euro as a medium of payments for international transactions. Since it is easily conceivable that European politicians will not abandon the project of monetary unification, we prefer to abstain from deepening this last scenario (Beretta, 2011, 2012a,b,c). What remains profoundly true is that the Euro Area is condemned to failure in absence of structural interventions aiming at restoring a minimal degree of consideration for heterogeneity. In fact, we think of the ‘one size fits all’ approach as the true ‘original sin’ attached to the Eurozone, which has not realized the intrinsic faults of monetary unions and artificial currencies. On the contrary, economic and social diversity should be treated as a source of great benefits and strengths in the worldwide arena. For sure, if policymakers will continue to frown upon different economic trends in different European countries, there will be limited place for a community of people, traditions and peaceful coexistence. Precisely these inestimably precious characteristics are nowadays seriously endangered by economic measures, which do not reflect common feelings of all European peoples and are regarded with distrust because of their ‘top-down’ approach. Unless the Euro will get rid of its main faults, EMU member countries should constantly be well prepared to rescue their common currency ad infinitum… …but “a currency, which has to be rescued, is not anymore a currency” (Hankel, 2012 (own translation)).