The objective of this paper is to analyze the influence of board resource diversity on firm reputation. We classify board members as business experts, support specialists, political directors and other community influentials, in an effort to address whether business, technical expertise or political ties in the boardroom affect stakeholders’ opinion and, therefore, firm reputation.

This study confirms that not all outside directors are equally effective in improving firm reputation, and that certain kinds of outside directors, especially business experts, help increase it. However, the findings note an inverted U-shaped non-linear relationship with these directors, which means that the effect of business experts on reputation is positive up to a point, after which the relationship becomes negative. The findings also evidence that, contrary to popular beliefs, directors with previous experience as politicians are not negatively viewed by stakeholders. Moreover, this type of community influential directors has positive effects on firm reputation in regulated firms as well as in those of the public work sector.

Corporate reputation measures the collective judgment of an organization held by its stakeholders (Brammer and Millington, 2005). The relevance of corporate reputation as a valuable firm asset is shown in the increasing number of reputational rankings issued during the last years, such as Fortune or Financial Times rankings (Musteen et al., 2010).

Previous research has evidenced a high variety of benefits related to corporate reputation as employee retention, corporate branding, market price and firm performance (Bear et al., 2010). In this respect, the interest in corporate reputation is increasing worldwide among managers and scholars, and some papers have examined the effect on firm reputation of corporate governance variables like board gender (Brammer et al., 2009) and ownership concentration (Delgado-García et al., 2010). However, research on the role of board composition on firm reputation is still scarce, despite the board of directors’ being at the center of the policy debate (Kim et al., 2014) and worldwide corporate governance codes are encouraging firms to comply with their good governance recommendations related to board composition and board diversity (Musteen et al., 2010).

In this regard, the interest in the issues related to board composition has increased after the financial crisis, as it was questioned to what extent the lack of qualifications, skills, and expertise of directors was responsible for the crash of corporate governance in many companies. In this respect the European Commission states that “accurate assessment of skills and expertise is the most important factor in selecting new non-executive board members” (European Commission, 2011, p. 7). Similarly, there is an increasing concern regarding the high presence of directors with political ties in Spanish boardrooms, which may affect stakeholder opinion and therefore company reputational levels.

Previous literature highlights two main roles of board of directors: monitoring and advising. Although most of the research has focused on the monitoring function, recent papers highlight the board advisory role and evidence that directors are sought when they can provide political influence, expertise or contacts (Dass et al., 2014). Therefore, according to van der Walt and Ingley (2003), the concept of board diversity should not look for representatives of particular interests (e.g. gender), but people with certain skills, knowledge and experiences that bring unique perspectives and valuable contributions to firm decisions. In this context board diversity should look for “skill” more that the traditional “representation” role of directors. Thus, and following to Bear et al. (2010) we understand diversity of board resources as the variety in resources (e.g. professional background) that directors bring to the boardroom. This board diversity combines a mix of competences and capabilities that represents a pool of social capital for the company (van der Walt and Ingley, 2003).

Despite the fact that the board of directors is an important governance mechanism to affect stakeholder perceptions, the literature on the effects of board resource diversity on reputation is scarce. As an exception, Bear et al. (2010) analyzed the effect of gender and background diversity on CSR ratings and firm reputation. They did not find a significant effect of the diversity of board resources, although they noted that their results may be influenced by sample criteria due to their only using a small sample of US health care companies in 2009. Musteen et al. (2010) also examined the role of board composition on firm reputation, but only examined the role of outside directors and not the specific effect of the different categories of outsiders according to their professional background.

In this paper we analyze the influence of board resource diversity on corporate reputation. Our analysis proceeds in two steps. First, we examine the global effect on board resource diversity on firm reputation. Reputation is measured by using the MERCO ranking provided for the 100 Spanish companies with the best reputations. This index has been previously used by Fernández Sánchez and Sotorrío Luna (2007) and Delgado-García et al. (2010, 2013).

Second, we examine the role of specific members of the board according to their professional background. In this respect, previous studies find that not all directors are equally effective monitors or valuable advisers, noting they have different problem-solving skills, professional experiences, business exposures and variability in their abilities (Baysinger and Zardkoohi, 1986). Then, while most studies have treated outside directors as a homogeneous group, in this paper we use the boardroom classification of Hillman et al. (2000) and classify board members as business experts, support specialists, and community influentials, examining whether business, technical expertise or political ties in the boardroom affect firm reputation. Other papers that have used the Hillman classification are Markarian and Parbonetti (2007), Bear et al. (2010), Haynes and Hillman (2010) or Jones et al. (2008), among others.

Although agency theory has dominated research about board of directors, other theoretical approaches such as the signaling theory, stewardship theory, and the resource dependency theory can provide interesting insights. We assume that the appointment of business experts and support specialist as directors can have a positive effect on firm reputation due to these members can signal a relevant attribute to the market regarding firm abilities and intentions. Similarly, the previous experience in the industry of business experts can also improve their monitoring role and therefore, affect to reputational assessments by stakeholders. The effect of support specialist directors on stakeholder perceptions is mainly understood by the stewardship theory, which considers important to have a board that complements the management with knowledge and skills. The effect on reputation of the appointment of community influential directors, mainly formed by ex politicians, is not so clear. According to the resource dependence theory, the aid that these directors provide comes in the form of preferential access to commitments or support from important elements outside the firm. Then, although these directors can facilitate ties with government, business elite, and non-profit companies, stakeholders may also penalize companies having a high proportion of community influentials on their boards, especially in a country as Spain, characterized by a high level of corruption and a low level of transparency.

We focus on Spain, an interesting setting for several reasons. First, Spain is a country characterized by the “comply or explain” principle in the enforcement of corporate governance regulations, a high concentration of dominant shareholders and low developed capital markets (Iturriaga and Rodríguez, 2017). Second, this research is related to the 14th recommendation of the Good Governance Code of Spanish Listed Companies (2015), according to which firms should have a diverse board in skills and background, and “director selection policy should seek a balance of knowledge, experience and gender in the board's membership”. Spain is also valuable because of the high number of directors with political connections in their boardrooms, mainly explained by the number of privatizations made in Spain during the last decades and the high ownership concentration (Bona-Sánchez et al., 2014). In addition, in contrast to the Anglo-Saxon capital markets, Spain's capital markets are characterized by high ownership concentration and a low investor protection level, where the board of directors is the prevalent mechanism of control (García-Meca et al., 2015a,b). These specific attributes of Spain make even more important the study of the Hillman taxonomy of business experts, support specialists and community influentials and its influence on stakeholders perceptions. Finally, in Spain there is a reputational index comparable to other measurements of reputation published in top-journals such as Fortune (Delgado-García et al., 2010). These features collectively provide an extremely interesting environment in which to study the reputational consequences of the professional diversity on boardrooms.

This paper contributes to the literature by showing the influence of board human resources on firm reputation. Specifically, this study confirms that not all outside directors are equally effective in improving firm reputation, and that some outside directors, especially business experts, help to raise it. In addition, the paper contributes to the literature that views directors from the perspective of the resource dependence theory, and highlights the need to consider the specific skills, expertise, and connections of board members as a means of reducing uncertainty in the economy. Therefore, our paper differs from previous literature by using specific categories of directors, supporting the view that firms should highlight the unique monitoring and advising capabilities of directors and noting that distinguishing directors according to their skills and abilities is crucial to understanding how boards impact on reputation. In addition, this Hillman taxonomy allows us to consider the special board category of ex-politicians, which is common in Spain and which previous literature has evidenced their effect of the firm earnings quality (Bona-Sánchez et al., 2014) and board remuneration (García-Meca, 2016). This paper also indicates that professional diversity differs from other types of diversity (e.g. gender, demographic) that are more common in previous research. Finally, the findings contribute to the literature on politically connected firms, shedding light on the limited empirical evidence of the effects of political ties and firm reputation.

The study is relevant and timely given the recent Spanish Stock Market Commission recommendations to disclose the experience, qualifications, skills, and attributes that justify the appointment of directors (Good Governance Code of Spanish Listed Companies, 2015), as well as the European Commission calls for a more professional boardroom of directors to ensure the board understanding of the firm's financial objectives, the complexities of global markets, and the impact of the business on different stakeholders (European Commission, 2011).

The remainder of the paper is organized as follows. The second section reviews the main theoretical ideas and states our hypotheses about the influence of board resource diversity on firm reputation. The third section describes the sample, data, and empirical method. The fourth section contains the empirical results. Finally, the fifth section provides our summary and conclusions.

Board resource diversity and firm reputationPfeffer and Salancik (1978) denote four primary benefits that board members bring to the firm: provision of specific resources, such as expertise and advice from individuals with experience; channels for communicating information between external organizations and the firm; aids in obtaining commitments or support; and legitimacy. Similarly, Zahra and Pearce (1989) note that along with the control and strategy functions of the board, there is a service function of directors related to enhancing firm reputation and strengthening external contacts and strategic ties.

These roles and functions of board members improve with a heterogeneous board in terms of skills and experience. Therefore, as well as being valuable monitors, directors also provide other valuable resources such as technical expertise, knowledge in specific areas or legitimacy. In addition, according to Brammer et al. (2009), board diversity might have a role in shaping firm reputation because of its capacity to influence perceptions of company effectiveness. This assumption is based on the resource dependence theory that assumes that directors bring resources to the firm, such as skills, information, ties, their own reputation, and credibility, which in turn improve board effectiveness. In addition, according to the agency theory, variety in experiences, skills and knowledge is crucial to address the monitoring role of directors. This role refers to the ability of directors to protect shareholder interests from the self-interests of management and thereby reduce agency costs. With respect to the signaling theory, increasing board diversity can also be a signal of firm sensitivity to the needs and requirements of particular stakeholders (Brammer et al., 2009). This can affect corporate reputation since reputation assessments depend on the congruence between corporate behavior and stakeholders preferences. According to van der Walt and Ingley (2003), boards should reflect the structure of today's multicultural society with more backgrounds and experiences. This movement from boardroom uniformity would better accomplish stakeholder requirements and thereby affect firm reputation because it is a signal of good corporate governance. Finally, the institutional theory also supports the association between board diversity and firm reputation suggesting that corporations increase their diversity in boards in order to gain social legitimacy. Musteen et al. (2010) state that this theory is gaining more relevance after the corporate scandals that have increased the regulatory and public scrutiny on boards, as well as the number of governance rating agencies that examine whether firms attain the ideal standard of governance required (i.e. number of outsiders in boards). According to this view, board diversity should lead to higher corporate reputation as it is institutionally appropriated by the firm. In this line, board resource diversity improves creativity, innovation and quality decision-making on boards of directors and affects firms’ corporate social responsibility and corporate governance (Erhardt et al., 2003; Kang et al., 2007).

Most of the literature has examined the effect of social board diversity (gender, age, ethic) and underlying or occupational diversity (education, expertise) on firm performance (e.g. Francis et al., 2015; García-Meca et al., 2015a), but the literature on the effects of board resource diversity on reputation is scarce. Although both terms (performance and reputation) are interrelated, corporate reputation is a reflection of the impression of the key stakeholders about a firm, and in addition to firm performance they rely on other organizational attributes to have a judgment about a firm reputational value (Fombrun and Shanley, 1990). Previous research notes that there is a positive relationship between reputation and financial performance (Roberts and Dowling, 2002) but the effect on reputation of other governance attributes is scarcely known. According to Gabbioneta et al. (2007) the governance structure (including board of directors) is likely to be one of the key drivers of corporate reputation because of its capacity to influence perceptions of board effectiveness. This board information is available to stakeholders and assists evaluators in their judgments about firm reputation (Deutsch and Ross, 2003). In this regard, we suggest that the higher board resource diversity, the better the ability to understand problems and manage complex situations due to this higher diversity brings more skills, competences and knowledge to the boardroom. Board resource diversity also means, under the supervision role of directors, a wider variety of interests represented and therefore, a major reliance on firm decisions by the stakeholders. This positive effect of board resource diversity on firm reputation can be also explained by the signaling theory. Then, according to Musteen et al. (2010), reputation can be considered as an outcome of a signaling process, wherein signals such as board attributes are used by stakeholders to make reputational judgments about the company.

According to the above arguments, we pose the hypothesis:H1 There is a positive association between board diversity and firm reputation.

This classification is also supported by the resource-based and resource dependence theories. These theories highlight the value of the board advisory function and show that director advice is relevant when they can provide financial expertise, contacts, and political influence (Dhaliwal et al., 2010; Dass et al., 2014).

In this regard, the inconclusive and heterogeneous results regarding independent directors in previous literature can be due to the fact that these studies have not considered the specific skills, abilities and knowledge of board members. According to this view, Hillman et al. (2000) distinguish between three main categories of outside directors: business experts, support specialists and community influential. This classification has been already used by Markarian and Parbonetti (2007), Jones et al. (2008), Bear et al. (2010) and Haynes and Hillman (2010), among others.

Business experts have knowledge based on their experience as previous executives of other firms. As they have wide expertise in industry problem solving and decision making, their appointment can be positively valued by the stakeholders. In this regard, as previous managers, their prestige in their profession can help them extract resources for successful company operations (Zahra and Pearce, 1989). They also provide useful network connections with boards and customers from focal firms (Bear et al., 2010). Stakeholders can value the appointment of these directors because they are able to anticipate industry conditions, evaluate risk, and overcome information challenges. They also have superior abilities to serve the strategic needs of the company, since they have expertise in related industries (Jones et al., 2008). According to Dass et al. (2014), the expertise of directors from related industries can strengthen the quality of information available to the board and improve their monitoring function, thereby enhancing board effectiveness. Faleye et al. (2014) also point out that industry expertise is one of the most important qualifications directors can bring to the boardroom because it offers an understanding of strategic opportunities and competitive threats.

Research has found that board industry expertise has a positive impact on firm performance (Dass et al., 2014; Drobetz et al., 2014), investments in innovation (Faleye et al., 2014) and better acquisition decisions (Kroll et al., 2007). Fich (2005) also studied the effect on firm returns of directors with CEO experience and noticed that announcement returns were greater for directors with previous expertise as a CEO of another listed company. In Australia, Gray and Nowland (2014) noted that the market reaction to the appointment of directors with business experience increases with the numbers of years of experience and the number of directorships of the director. Although these studies have provided valuable insights, the effect that business directors have on corporate reputation has not been examined yet. The above discussion leads to the second hypothesis:H2 The proportion of business experts on boards is positively related to firm reputation.

Support specialists include legal experts, finance specialists (e.g., bankers, venture capitalists, and investment bankers) as well as sales and marketing professionals (e.g., advertising executives). This wide expertise helps to add new perspectives and helps directors in their monitoring and advising work, which can benefit shareholders through improved resource utilization and strategy formulation. These directors also maintain useful networks with professional associations, which can improve collaboration with key stakeholders (Bear et al., 2010), and they can act as decisions supporters (Baysinger and Zardkoohi, 1986). Directors with expertise in legal, technological or business areas and without management experience may also be more independent and critical, which can be highly valued by firm stakeholders according to the stewardship theory. In this regard, Francis et al. (2015) found that the presence of academic directors is associated with higher acquisition performance, higher stock price informativeness and lower discretionary accruals. Gray and Nowland (2014) also showed that boards usually have lawyers, accountants, scientists, engineers and bankers as professional directors, and that firms benefit when they limit their board diversity to a specific subset of professional expertise. Nevertheless, he did not find an association between the overall professional diversity and firm value. In this line some papers study the effect of specific professional expertise such as banking expertise or financial expertise, noting their positive effects in enhancing accounting conservatism (Krishnan and Visvanathan, 2008) and accounting quality (Badolato et al., 2014). There is also evidence that lawyer directors reduce corporate risk-taking and increase firm value (Litov et al., 2014) and that financial expertise is related to positive stock market reaction when these directors are appointed (Defond et al., 2005).

The importance of support specialists has increased since the financial crisis, as it was questioned to what extent the lack of qualifications and specific technical background of independent directors were responsible for the collapse. Based on these arguments and previous evidence, we suggest that the appointment of support specialists increases firm reputation. Therefore, we pose the hypothesis:H3 The proportion of support specialists on boards is positively related to firm reputation.

On the one hand, community influentials can facilitate ties with government, academia, business elite, and non-profit companies, which may help companies to make more effective decisions in a complex environment. These directors can also be seen as a strategic company resource that can facilitate better access to capital and financial connections (Claessens et al., 2008), more favorable tax treatment or more relaxed market entry regulation (You and Du, 2012). Additionally, these directors may help the firm by providing expertise in bureaucratic and legislative procedures (Goldman et al., 2009). They may also bring non-business perspectives that can be valued by shareholders, providing legitimacy and watching over stakeholders’ interests in board discussions. Thus, some papers have found a positive influence of boardroom political ties on firm performance (Faccio and Parsley, 2009).

Although previous research has noted that directors with political connections are common in Spain and that they affect earnings informativeness (Bona Sanchez et al., 2014) and board remuneration (García-Meca, 2016), the effects on firm reputation have not been examined yet. In addition, although the appointment of directors with corporate strategy or regulatory affairs knowledge may improve firm reputation, the beneficial effect of the directors with political connections is not so clear, expecting a different effect for the rest of other community influential members such as leaders of cleric or non-profit organizations. Therefore, if we split community influentials between directors with political ties and the rest of them, we can expect that political connected directors can have a negative influence on reputation.

Then, directors with political connections may utilize political resources in their own interests rather than shareholder interests. Hence, they may prefer to lower the information provided to outsiders because they may want to protect the firm's political ties from public scrutiny as well as its competitive advantages (Bona Sanchez et al., 2014). According to the signaling theory, the appointment of ex politicians can be considered a negative signal about firm reputational merits. This can be perceived by shareholders, who may penalize companies with a high proportion of community influentials on their boards. These political directors are usually more prevalent in countries with weak legal systems and a high level of corruption (Chen et al., 2011). In this line, several papers have found a negative effect of political connections on firm performance (Boubakri et al., 2008; Chaney et al., 2011). Therefore, we distinguish between political directors and the rest of community influential directors and pose the following hypotheses:H4a The proportion of political directors on boards is negatively related to firm reputation. The proportion of the rest of community influential directors on boards is positively related to firm reputation.

Finally, because the composition of the workforce varies systematically across industries we think industry may moderate the influence of these political directors on firm reputation. According to Markarian and Parbonetti (2007) board directors perform their tasks according to the characteristics of the firms, along with the environment. Regulated industries are more affected by public policies than other companies are. Thus, in regulated environments, the presence of community influential directors, especially political directors, may be more relevant because of the legitimacy they can provide, along with the political ties with regulatory agencies. In addition, these directors may facilitate access to govermental decision makers and therefore influence their decisions. According to the resource dependence theory, linkages provided by these directors can also lower transaction costs and uncertainty, enabling firms to anticipate and adapt to political changes. In this regard, Hillman (2005) found that companies in regulated industries have more former politicians on their boards and note their positive effect on financial performance. In addition, we suggest that companies in public works industry are also highly dependent on public policies and political decisions. Therefore, we propose that firms with more political directors will be better valued by their stakeholders when they are in regulated or public sector companies, and we pose the hypothesis:H5 The influence of political directors on firm reputation is higher in regulated industry and/or in public works sector.

The sample is formed by the firms included in the MERCO (Spanish Monitor of Corporate Reputation) – ranking of the 100 most reputable firms in Spain for 2004–2015. We exclude financial companies because they are under special scrutiny by financial authorities, which constrains the role of their directors (García-Meca et al., 2015b) and because of their specific accounting information. Neither do we include firms whose financial or board data were not available. Financial information was obtained from the SABI database and data on board composition was hand-collected from the web page of the CNMV (Spanish National Commission of Stock Exchange). This web page contains the annual corporate governance reports that all the Spanish listed companies have to publish since 2003. The final unbalanced panel comprised 43 firms and 311 observations. It is important to note that we work with a truncated sample, given that the numerical value for the reputation index is only given for those companies that are ranked within the first 100 reputable firms.

The dependent variable is corporate reputation (Reput). This variable has been proxied by using the MERCO ranking provided for the 100 Spanish companies with the best reputations. This index is similar to Fortune's AMAC or The Financial Times rankings of corporate reputation, and it has been previously used by Fernández Sánchez and Sotorrío Luna (2007) and Delgado-García et al. (2010, 2013). It is based on a multi-stakeholder methodology comprising five evaluations and twelve sources of information, including executives, financial analysts, NGO representatives, labor union members, members of consumer associations, economic journalists, CSR experts, employees and human resources directors. The measure is well suited to our objectives since these survey respondents are likely to be familiar with the board attributes in the firm they are valuing. In the final stage, scores are rescaled so that the top firm in the rank receives a value of 10,000 points, while the bottom one receives a value of 3000 points. As the values used for this rescaling process from year 2004 to 2009 were different, we rescaled the scores of those years to homogenize them. Finally, and to facilitate a better interpretation of the results, we divided all the scores by 1000, obtaining a variable whose value ranges from 3 (lower level of reputation) to 10 (higher level of reputation).

We classify outside directors into business experts, support specialists and community influentials, following Hillman et al. (2000) taxonomy. BE, SS and CI represent the proportion of business experts, support specialist and community influentials in the boardroom, respectively. Business experts (BE) are former or retired executives, excluding insiders and support specialists, from other organizations who are mainly directed to provide general managerial advice and counsel regarding key decisions facing (Kroll et al., 2007). Support specialists (SS) provide linkages and specialized expertise that generally facilitate firms’ access to finance, capital and legal support. These directors come from professional fields such as law, accounting, public relations or investment banking. They differ from business experts in the sense that they lack general management expertise (Jones et al., 2008). Finally, community influential (CI) members include retired politicians, members of the clergy, and leaders of social organizations. Since political directors has a very important proportion in the category of community influentials we decided to distinguish between political directors (POL) and the rest of community influential directors, mainly formed by leaders of non-profit organizations (Other_CI). See Table 1 for a description of the variables. These categories are exclusive, and in those scarce cases where one director could belong to two categories the director was included in the category that can explain most his/her appointment.

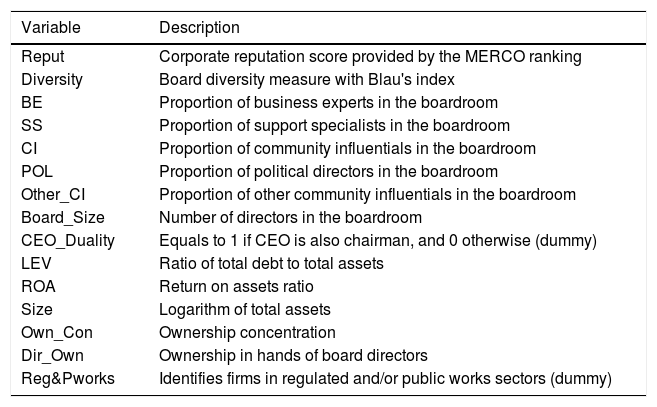

Variable description.

| Variable | Description |

|---|---|

| Reput | Corporate reputation score provided by the MERCO ranking |

| Diversity | Board diversity measure with Blau's index |

| BE | Proportion of business experts in the boardroom |

| SS | Proportion of support specialists in the boardroom |

| CI | Proportion of community influentials in the boardroom |

| POL | Proportion of political directors in the boardroom |

| Other_CI | Proportion of other community influentials in the boardroom |

| Board_Size | Number of directors in the boardroom |

| CEO_Duality | Equals to 1 if CEO is also chairman, and 0 otherwise (dummy) |

| LEV | Ratio of total debt to total assets |

| ROA | Return on assets ratio |

| Size | Logarithm of total assets |

| Own_Con | Ownership concentration |

| Dir_Own | Ownership in hands of board directors |

| Reg&Pworks | Identifies firms in regulated and/or public works sectors (dummy) |

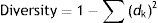

Then, we define Board Diversity as the variety in professional background, experience, and network connections in the boardroom. We use the Blau's index, that measures the distribution of directors according to their skills, experience and background, and is the most common measure of board diversity (Harrison and Klein, 2007; Bear et al., 2010). It is defined as the difference between 1 and the sum of the squares of the proportion of unit members (directors) d in each category k that composes the group. In our case, we take in consideration four categories (business experts, support specialists, community influentials and insiders).

The values the index in our study range from 0 (no diversity at all) to 0.75 (maximum diversity, with directors equally distributed across the four categories).

We control for a number of factors that can influence corporate reputation. First, we include firm performance (ROA), financial leverage (LEV) and firm size (Size) since previous literature has shown their influence on corporate reputation (Brammer and Pavelin, 2006; Delgado-García et al., 2010). Size is the logarithm of total assets and is a measure of firm size; LEV is the financial leverage and ROA is the return on assets.

We also consider a range of corporate governance attributes, such as board size (Board_Size), measured as the total number of directors in the board, ownership concentration (Own_Con) measured as the proportion of stock owned by significant shareholders, and director ownsership (Dir_Own) that represents the proportion of shares in hands of directors. Additionally, CEO duality is a dummy variable that takes the value of one if the CEO is also chairman. We expect a positive effect of all the control variables except for CEO duality and Dir_Own (Brammer et al., 2009; Musteen et al., 2010).

We use a dummy variable (Reg&Pworks) to identify companies that operate in regulated sectors and/or in public works sector. Regulated industries in Spain are pharmaceuticals, energy, telecommunication services, postal services, oil, gas and consumable fuels and rail and aerial transport. Public works sector comprises companies dedicated to infrastructure projects financed by the Government.

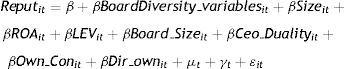

Empirical methodWe first report a descriptive analysis to show the main characteristics of our sample. This step provides preliminary evidence about a possible effect of board diversity on corporate reputation and about possible differences among the types of directors according to their skills and backgrounds. Then we run the following baseline model:

where the Reput variable stands for the corporate reputation ranking and BoardDiversity_variables represent the diversity measures already explained and represented by the Blau's Index (model 1), business experts (model 2), support specialists (model 3) and community influentials (divided into politicians and other community influentials)(model 4). μ represents the individual effect; γ represents the time effect; and ¿ represents the stochastic error. Macroeconomic factors that affect all the firms in the same period are included in the time effect.We are dealing with a truncated sample, due to the fact that our dependent variable takes a value for the reputation index only for those companies that are ranked with revenues higher than 50 million euros. In addition, the reputation rank is limited to those firms with reputation scores between 3000 and 10,000 points, suffering from truncation bias. Consequently, we base our analysis on the truncated estimation procedure (Wang and Hsiao, 2007), and not on ordinary least squares (OLS), which can provide biased estimates in presence of omitted firm-specific variables. Therefore, we use a truncated regression with fixed effects, which is robust to the presence of unobservable individual heterogeneity. Controlling for correlated unobserved fixed factors is likely to be important in this context, since firm reputation is likely to be influenced by time invariant factors.

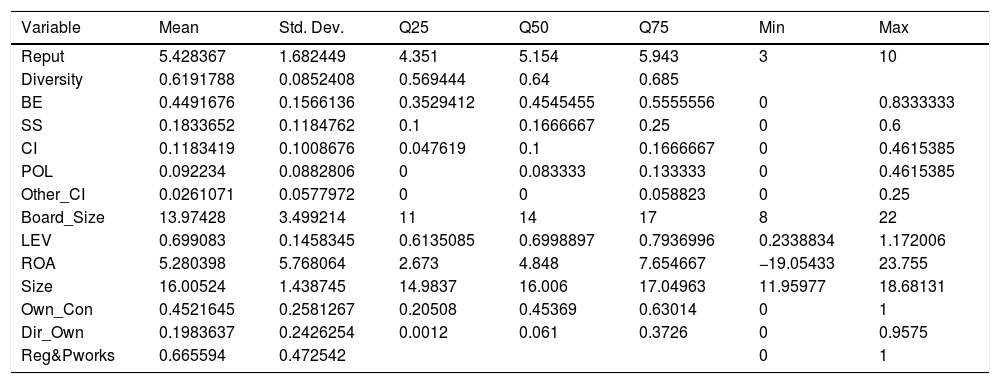

ResultsDescriptive statisticsTable 2 presents the mean value, the standard error and the quartiles of the main variables. Diversity accounts for 4.37. The means of business experts (BE), support specialists (SS) and community influentials (CI) are 44.91, 18.33 and 11.83 respectively. We observe than the majority of community influential directors were ex-politicians (mean 9.22). The mean corporate reputation rating was 5428.36 and the standard deviation was 95,402.

Descriptive statistics.

| Variable | Mean | Std. Dev. | Q25 | Q50 | Q75 | Min | Max |

|---|---|---|---|---|---|---|---|

| Reput | 5.428367 | 1.682449 | 4.351 | 5.154 | 5.943 | 3 | 10 |

| Diversity | 0.6191788 | 0.0852408 | 0.569444 | 0.64 | 0.685 | ||

| BE | 0.4491676 | 0.1566136 | 0.3529412 | 0.4545455 | 0.5555556 | 0 | 0.8333333 |

| SS | 0.1833652 | 0.1184762 | 0.1 | 0.1666667 | 0.25 | 0 | 0.6 |

| CI | 0.1183419 | 0.1008676 | 0.047619 | 0.1 | 0.1666667 | 0 | 0.4615385 |

| POL | 0.092234 | 0.0882806 | 0 | 0.083333 | 0.133333 | 0 | 0.4615385 |

| Other_CI | 0.0261071 | 0.0577972 | 0 | 0 | 0.058823 | 0 | 0.25 |

| Board_Size | 13.97428 | 3.499214 | 11 | 14 | 17 | 8 | 22 |

| LEV | 0.699083 | 0.1458345 | 0.6135085 | 0.6998897 | 0.7936996 | 0.2338834 | 1.172006 |

| ROA | 5.280398 | 5.768064 | 2.673 | 4.848 | 7.654667 | −19.05433 | 23.755 |

| Size | 16.00524 | 1.438745 | 14.9837 | 16.006 | 17.04963 | 11.95977 | 18.68131 |

| Own_Con | 0.4521645 | 0.2581267 | 0.20508 | 0.45369 | 0.63014 | 0 | 1 |

| Dir_Own | 0.1983637 | 0.2426254 | 0.0012 | 0.061 | 0.3726 | 0 | 0.9575 |

| Reg&Pworks | 0.665594 | 0.472542 | 0 | 1 |

Variables: Reput is a measure of corporate reputation provided by the Merco Empresas index. Diversity is the Blau index of board diversity in terms of knowledge, skills and connections. BE, SS and CI represent the proportion of business experts, support specialists and community influentials in the boardroom, respectively. POL represents the proportion of directors with political connections. Other_CI represents the proportion of other community influentials (e.g. cleric or leaders of social organizations). BoardSize is the total number of directors in the board. LEV is the finantial leverage. ROA is the return on assets. Size is the natural logarithm of firm's total assets. Own_con is the proportion of stock owned by significant shareholders. Dir_own is the proportion of shares in hands of directors.

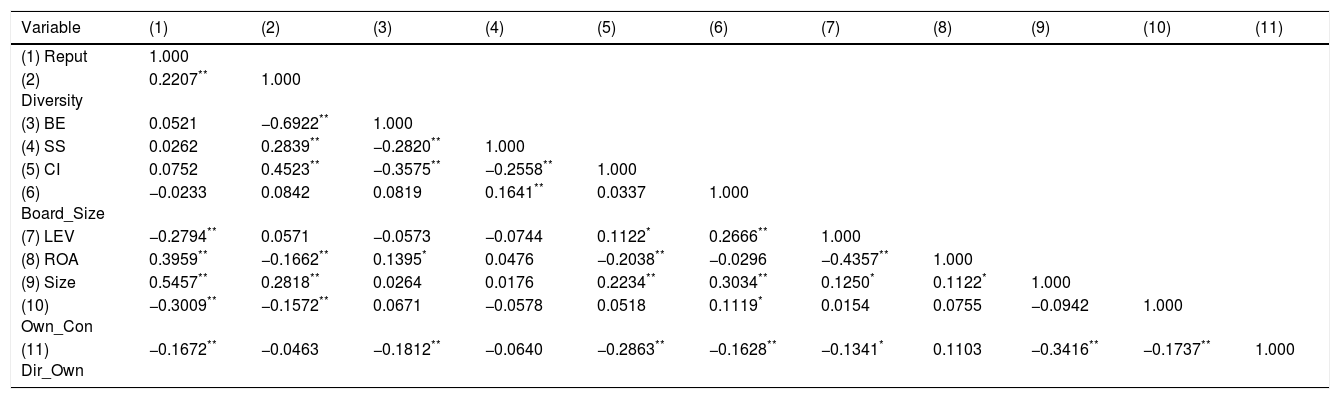

Table 3 presents the correlation matrix among variables. All variables present low correlation coefficients, so multicollinearity should not be a concern. In addition, our VIF (variance inflation factor) scores are below five, and thus we confirm that multicollinearity does not skew our results.

Correlation matrix.

| Variable | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) | (10) | (11) |

|---|---|---|---|---|---|---|---|---|---|---|---|

| (1) Reput | 1.000 | ||||||||||

| (2) Diversity | 0.2207** | 1.000 | |||||||||

| (3) BE | 0.0521 | −0.6922** | 1.000 | ||||||||

| (4) SS | 0.0262 | 0.2839** | −0.2820** | 1.000 | |||||||

| (5) CI | 0.0752 | 0.4523** | −0.3575** | −0.2558** | 1.000 | ||||||

| (6) Board_Size | −0.0233 | 0.0842 | 0.0819 | 0.1641** | 0.0337 | 1.000 | |||||

| (7) LEV | −0.2794** | 0.0571 | −0.0573 | −0.0744 | 0.1122* | 0.2666** | 1.000 | ||||

| (8) ROA | 0.3959** | −0.1662** | 0.1395* | 0.0476 | −0.2038** | −0.0296 | −0.4357** | 1.000 | |||

| (9) Size | 0.5457** | 0.2818** | 0.0264 | 0.0176 | 0.2234** | 0.3034** | 0.1250* | 0.1122* | 1.000 | ||

| (10) Own_Con | −0.3009** | −0.1572** | 0.0671 | −0.0578 | 0.0518 | 0.1119* | 0.0154 | 0.0755 | −0.0942 | 1.000 | |

| (11) Dir_Own | −0.1672** | −0.0463 | −0.1812** | −0.0640 | −0.2863** | −0.1628** | −0.1341* | 0.1103 | −0.3416** | −0.1737** | 1.000 |

Variables: Reput is a measure of corporate reputation provided by the Merco Empresas index. Diversity is the Blau index of board diversity in terms of knowledge, skills and connections. BE, SS and CI represent the proportion of business experts, support specialists and community influentials in the boardroom, respectively. Board_Size is the total number of directors in the board. LEV is the finantial leverage. ROA is the return on assets. Size is the natural logarithm of firm's total assets. Own_con is the proportion of stock owned by significant shareholders. Dir_own is the proportion of shares in hands of board directors.

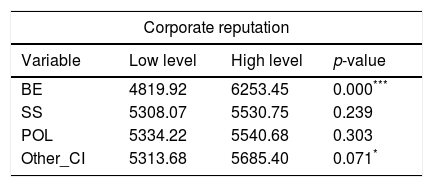

For an exploratory analysis in Table 4 we divide the sample into two groups depending on the proportion of business experts (BE), support specialists (SS), politicians (POL) and other community influential members (Other_CI) in the boardroom. We define a group of firms with the proportion of business experts (BE) over the BE median value and the group of firms with the proportion of business expert directors below the BE median value. We apply the same pattern to SS, POL and Other_CI. Next, we conduct a test of means comparison to explore whether corporate reputation is different between both groups in each category of directors.

Test of median comparison.

| Corporate reputation | |||

|---|---|---|---|

| Variable | Low level | High level | p-value |

| BE | 4819.92 | 6253.45 | 0.000*** |

| SS | 5308.07 | 5530.75 | 0.239 |

| POL | 5334.22 | 5540.68 | 0.303 |

| Other_CI | 5313.68 | 5685.40 | 0.071* |

Variables: BE, SS, POL and Other_CI represent the proportion of business experts, support specialists, political directors and other community influentials in the boardroom, respectively.

Although not conclusive, the results suggest that business experts is the main category related to differences in corporate reputation. More specifically, firms with a higher proportion (over the median) of business experts (BE) have a higher level of corporate reputation (p<0.01) with also significant results for the category of other community influential (Other_CI) directors (p<0.1). We find insignificant results for the proportion of support specialist (SS) in the boardroom as well as for political directors (POL).

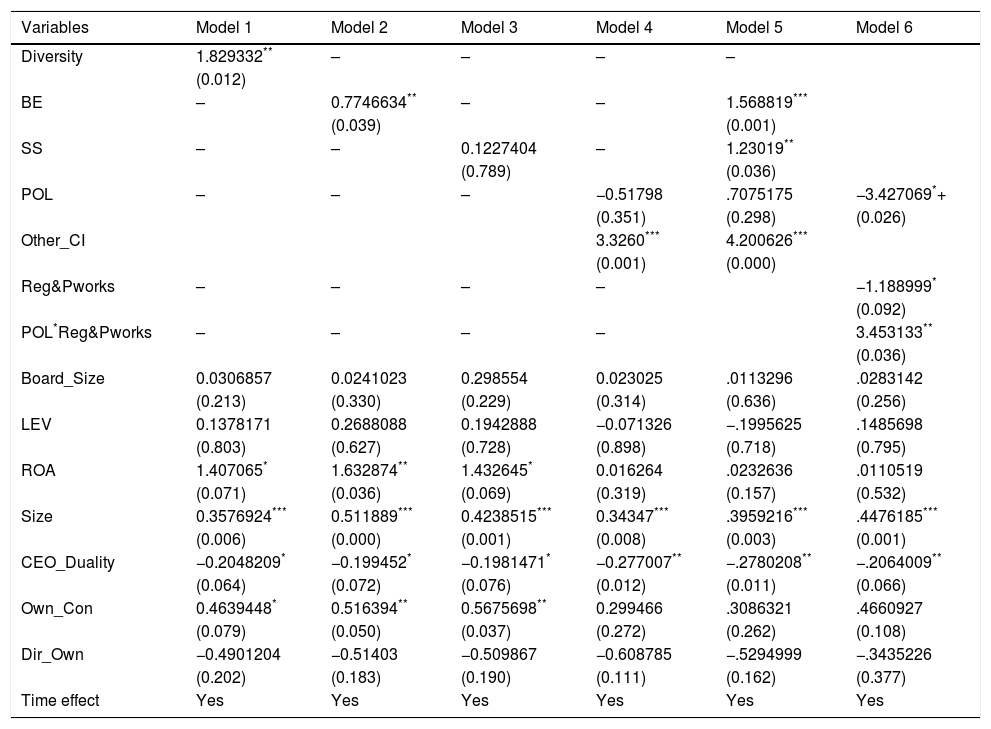

Regression resultsTable 5 provides the estimates for the first hypothesis, where in column 1 we test if the overall board diversity affects corporate reputation. Coefficient of board diversity variable is positive and significant (p<0.05), which is in line with our expectations and suggests that board diversity affects and increases stakeholder perception of firm reputation. Models 2, 3 and 4 measure the effect of the different directors: business experts (BE), support specialists (SS), political directors (POL) and other community influentials (Other_CI) on corporate reputation. Model 6 tests a global model including all the diversity variables (Diversity, BE, SS, POL, Other_CI). Positive and significant coefficients denote a positive effect of these variables on firm reputation. Wald tests results show that all models are statistically significant.

Regression results of relationships with corporate reputation.

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| Diversity | 1.829332** | – | – | – | – | |

| (0.012) | ||||||

| BE | – | 0.7746634** | – | – | 1.568819*** | |

| (0.039) | (0.001) | |||||

| SS | – | – | 0.1227404 | – | 1.23019** | |

| (0.789) | (0.036) | |||||

| POL | – | – | – | −0.51798 | .7075175 | −3.427069*+ |

| (0.351) | (0.298) | (0.026) | ||||

| Other_CI | 3.3260*** | 4.200626*** | ||||

| (0.001) | (0.000) | |||||

| Reg&Pworks | – | – | – | – | −1.188999* | |

| (0.092) | ||||||

| POL*Reg&Pworks | – | – | – | – | 3.453133** | |

| (0.036) | ||||||

| Board_Size | 0.0306857 | 0.0241023 | 0.298554 | 0.023025 | .0113296 | .0283142 |

| (0.213) | (0.330) | (0.229) | (0.314) | (0.636) | (0.256) | |

| LEV | 0.1378171 | 0.2688088 | 0.1942888 | −0.071326 | −.1995625 | .1485698 |

| (0.803) | (0.627) | (0.728) | (0.898) | (0.718) | (0.795) | |

| ROA | 1.407065* | 1.632874** | 1.432645* | 0.016264 | .0232636 | .0110519 |

| (0.071) | (0.036) | (0.069) | (0.319) | (0.157) | (0.532) | |

| Size | 0.3576924*** | 0.511889*** | 0.4238515*** | 0.34347*** | .3959216*** | .4476185*** |

| (0.006) | (0.000) | (0.001) | (0.008) | (0.003) | (0.001) | |

| CEO_Duality | −0.2048209* | −0.199452* | −0.1981471* | −0.277007** | −.2780208** | −.2064009** |

| (0.064) | (0.072) | (0.076) | (0.012) | (0.011) | (0.066) | |

| Own_Con | 0.4639448* | 0.516394** | 0.5675698** | 0.299466 | .3086321 | .4660927 |

| (0.079) | (0.050) | (0.037) | (0.272) | (0.262) | (0.108) | |

| Dir_Own | −0.4901204 | −0.51403 | −0.509867 | −0.608785 | −.5294999 | −.3435226 |

| (0.202) | (0.183) | (0.190) | (0.111) | (0.162) | (0.377) | |

| Time effect | Yes | Yes | Yes | Yes | Yes | Yes |

p-values in parenthesis.

p<0.01.

Estimated coefficients from truncated regressions (being Reput>3) with fixed effects and year dummies.

Variables: Diversity is the Blau index of board diversity in terms of knowledge, skills and connections. BE and SS represent the proportion of business experts, support specialists and community influentials in the boardroom, respectively. POL represents the proportion of directors with political connections. Other_CI represents the proportion of other community influentials (e.g. cleric or leaders of social organizations). Reg&Pworks is a dummy variable which identifies firms operating in regulated and/or public work sectors. Board_Size is the total number of directors in the board. LEV is the finantial leverage. ROA is the return on assets. Size is the natural logarithm of firm's total assets. CEO_Duality is a dummy variable which equals to 1 if CEO is also chairman, 0 otherwise. Own_con is the proportion of stock owned by significant shareholders. Dir_own is the proportion of shares in hands of directors.

Regarding control variables, the results in Table 5 show that firm size (Size), firm performance (ROA), and ownership concentration (Own_Con) positively affect firm reputation, while CEO duality (Ceo_Duality) has a negative influence.

In order to test hypothesis 5 we analyze the moderating role of the regulated industry on the specific effect that political directors (POL) have on corporate reputation. Therefore, we have added the interacted variable POL*Reg&Pworks (model 6). Interestingly, and according to our expectations, the coefficient is positive and significant. Taken together, our results show that the effect of having political directors on board is positive and significant only in regulated industries.

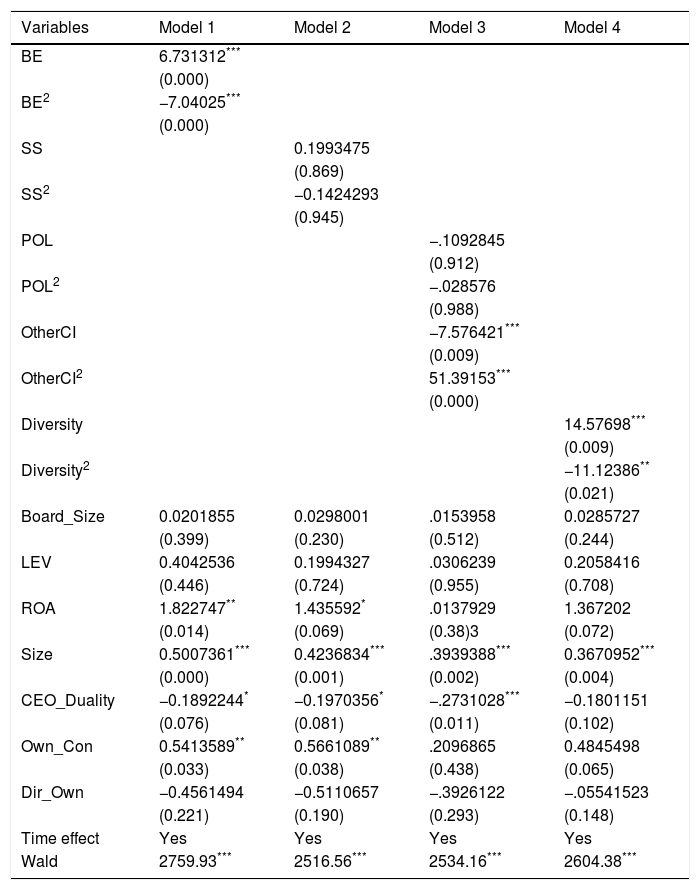

As an analysis extension we try to capture possible non-linearities between board composition and corporate reputation. Table 6 shows a non-linear effect between business experts and corporate reputation (+/−), with an inflection point of 0.43. Therefore, with the appointment of business experts, firm reputation tends to grow until a certain point (43% of BE on boards), at which point the relationship becomes negative. Results of other community influential variable also note that the positive effect of these directors only happens at high proportions of the category. The non-linear effect is also captured by the global variable Diversity. These results would support van der Walt and Ingley's (2003) arguments that suggest that boardroom uniformity is not beneficial, emphasizing the necessity of maintaining a balanced and diversified board with a wide representation of skills, knowledge, and talent instead. Overall, our results confirm that the balanced presence of professional directors enhances firm reputation and the number of business expert directors matters in Spanish businesses.

Analysis of non-linearities.

| Variables | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| BE | 6.731312*** | |||

| (0.000) | ||||

| BE2 | −7.04025*** | |||

| (0.000) | ||||

| SS | 0.1993475 | |||

| (0.869) | ||||

| SS2 | −0.1424293 | |||

| (0.945) | ||||

| POL | −.1092845 | |||

| (0.912) | ||||

| POL2 | −.028576 | |||

| (0.988) | ||||

| OtherCI | −7.576421*** | |||

| (0.009) | ||||

| OtherCI2 | 51.39153*** | |||

| (0.000) | ||||

| Diversity | 14.57698*** | |||

| (0.009) | ||||

| Diversity2 | −11.12386** | |||

| (0.021) | ||||

| Board_Size | 0.0201855 | 0.0298001 | .0153958 | 0.0285727 |

| (0.399) | (0.230) | (0.512) | (0.244) | |

| LEV | 0.4042536 | 0.1994327 | .0306239 | 0.2058416 |

| (0.446) | (0.724) | (0.955) | (0.708) | |

| ROA | 1.822747** | 1.435592* | .0137929 | 1.367202 |

| (0.014) | (0.069) | (0.38)3 | (0.072) | |

| Size | 0.5007361*** | 0.4236834*** | .3939388*** | 0.3670952*** |

| (0.000) | (0.001) | (0.002) | (0.004) | |

| CEO_Duality | −0.1892244* | −0.1970356* | −.2731028*** | −0.1801151 |

| (0.076) | (0.081) | (0.011) | (0.102) | |

| Own_Con | 0.5413589** | 0.5661089** | .2096865 | 0.4845498 |

| (0.033) | (0.038) | (0.438) | (0.065) | |

| Dir_Own | −0.4561494 | −0.5110657 | −.3926122 | −.05541523 |

| (0.221) | (0.190) | (0.293) | (0.148) | |

| Time effect | Yes | Yes | Yes | Yes |

| Wald | 2759.93*** | 2516.56*** | 2534.16*** | 2604.38*** |

p-values in parenthesis.

p<0.01.

Estimated coefficients from truncated regressions (being Reput >3) with fixed effects and year dummies.

Variables: Diversity is the Blau index of board diversity in terms of knowledge, skills and connections. BE and SS represent the proportion of business experts, support specialists and community influentials in the boardroom, respectively. POL represents the proportion of directors with political connections. Other_CI represents the proportion of other community influentials (e.g. cleric or leaders of social organizations). eg&Pworks is a dummy variable which identifies firms operating in regulated and/or public work sectors. Board_Size is the total number of directors in the board. LEV is the finantial leverage. ROA is the return on assets. Size is the natural logarithm of firm's total assets. CEO_Duality is a dummy variable which equals to 1 if CEO is also chairman, 0 otherwise. Own_con is the proportion of stock owned by significant shareholders. Dir_own is the proportion of shares in hands of directors.

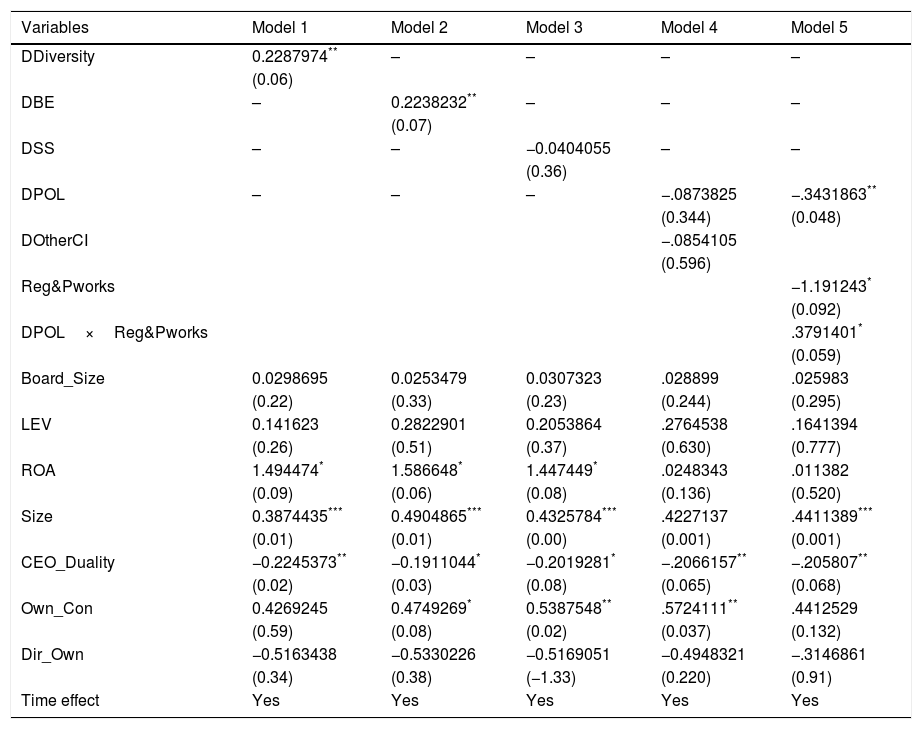

In this section we extend our analysis on the incidence of board composition on corporate reputation by considering alternative measures to our board variables. We define four new dummy variables: DDiversity, DBE, DSS and DPOL and DOther_CI that take the value of one if the values of Diversity, BE, SS, POL and Other_CI are above the mean, respectively, and zero otherwise. Table 7 shows that the results are qualitatively similar to those shown in Table 5.

Robustness analysis.

| Variables | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 |

|---|---|---|---|---|---|

| DDiversity | 0.2287974** | – | – | – | – |

| (0.06) | |||||

| DBE | – | 0.2238232** | – | – | – |

| (0.07) | |||||

| DSS | – | – | −0.0404055 | – | – |

| (0.36) | |||||

| DPOL | – | – | – | −.0873825 | −.3431863** |

| (0.344) | (0.048) | ||||

| DOtherCI | −.0854105 | ||||

| (0.596) | |||||

| Reg&Pworks | −1.191243* | ||||

| (0.092) | |||||

| DPOL×Reg&Pworks | .3791401* | ||||

| (0.059) | |||||

| Board_Size | 0.0298695 | 0.0253479 | 0.0307323 | .028899 | .025983 |

| (0.22) | (0.33) | (0.23) | (0.244) | (0.295) | |

| LEV | 0.141623 | 0.2822901 | 0.2053864 | .2764538 | .1641394 |

| (0.26) | (0.51) | (0.37) | (0.630) | (0.777) | |

| ROA | 1.494474* | 1.586648* | 1.447449* | .0248343 | .011382 |

| (0.09) | (0.06) | (0.08) | (0.136) | (0.520) | |

| Size | 0.3874435*** | 0.4904865*** | 0.4325784*** | .4227137 | .4411389*** |

| (0.01) | (0.01) | (0.00) | (0.001) | (0.001) | |

| CEO_Duality | −0.2245373** | −0.1911044* | −0.2019281* | −.2066157** | −.205807** |

| (0.02) | (0.03) | (0.08) | (0.065) | (0.068) | |

| Own_Con | 0.4269245 | 0.4749269* | 0.5387548** | .5724111** | .4412529 |

| (0.59) | (0.08) | (0.02) | (0.037) | (0.132) | |

| Dir_Own | −0.5163438 | −0.5330226 | −0.5169051 | −0.4948321 | −.3146861 |

| (0.34) | (0.38) | (−1.33) | (0.220) | (0.91) | |

| Time effect | Yes | Yes | Yes | Yes | Yes |

Estimated coefficients from truncated regressions (being Reput >3) with fixed effects and year dummies.

Variables: DDiversity, DBE, DSS, DPOL and DOther_CI are dummy variables that take the value of one if the values of Diversity, BE, SS, POL and Other_CI are above their respective means, and zero otherwise. Reg&Pworks is a dummy variable which identifies firms operating in regulated and/or public work sectors. Board_Size is the total number of directors in the board. LEV is the finantial leverage. ROA is the return on assets. Size is the natural logarithm of firm's total assets. CEO_Duality is a dummy variable which equals to 1 if CEO is also chairman, 0 otherwise. Own_con is the proportion of stock owned by significant shareholders. Dir_own is the proportion of shares in hands of directors.

t-values in parenthesis.

In this paper, we study the influence of board experience, skills and expertise on firm reputation of companies in Spain. We classify board members as business experts, support specialists, political directors and other community influentials, and examine whether business, technical expertise or political ties in the boardroom affect stakeholders’ opinion and therefore firm reputation.

Our results show a positive and statistically significant association between board diversity in terms of skills, background and connections and corporate reputation. This suggests that a high level of diversity on the board of directors can act as a relevant and visible signal of board effectiveness, which influences stakeholder perceptions about firm reputation.

Regarding the classification of outside directors, following the Hillman et al. (2000) taxonomy, we find that, as predicted, the proportion of business experts on boards is positively related to firm reputation. Their experience and expertise in industry problem solving and decision making is appreciated by the stakeholders. Therefore, this study confirms that not all outside directors are equally effective in improving firm reputation, and that certain kinds of outside directors, especially business experts, help increase it. However, the analysis extension shows an inverted U-shaped non-linear relationship with these directors, with an inflection point at 0.43, which means that the effect of BE on reputation is positive up to this point, and then becomes negative. The findings note that, contrary to popular beliefs, directors with previous experience as politicians are not negatively viewed by stakeholders. Moreover, this category of community influentials has positive effects on firm reputation, but only in regulated and public works sector firms, confirming that in these industries these directors may be more important because of the legitimacy they can provide, along with the political ties with regulatory agencies. We also confirm the need to distinguish between political directors and the rest of community influentials due to the effects on reputation are different.

Our study provides empirical evidence to support the idea that board composition in relation to experience, background and connections has an important influence on stakeholders’ perceptions and hence on firm reputation. The results support the view that firms should highlight the unique monitoring and advisory capabilities of directors and note that distinguishing directors according to their skills and abilities is crucial to understanding how boards impact on reputation.

The paper has interesting contributions for policy-makers, due to the high concern about the need to have professional boards with more diversity in their profiles and backgrounds to provide the board a range of values, views, and sets of competencies (Good Governance Code of Spanish Listed Companies, 2015; European Commission, 2011). The results are also interesting for managers and directors since we emphasize the necessity of having a diversified board with a wide representation of skills and knowledge. These results are also relevant for practitioners, as appointing directors with political ties should not be a deterrent to board effectiveness but specific professional expertise in board affects shareholder perceptions.

This paper has some limitations. As discussed before, we use MERCO index scores to proxy for corporate reputation. MERCO is limited to the 100 leading companies with the best reputation in Spain; hence, our sample excludes a substantial proportion of firms. This data limitation could be avoided in future works by using alternative methodologies to measure reputation, such as the Reputation Quotient (Fombrun et al., 2000). In addition, the directors were classified into different types (BE, SS and CI) by the authors on the basis of the biographical information available and, while quite accurate, the classification is not totally exempt from a certain degree of subjectivity.

The authors gratefully acknowledge the helpful comments and suggestions received from the editor and the referees during the review process. Emma García-Meca acknowledges the financial support of the Spanish Ministry of Economy (Research Project ECO 2017-82259-R). We also thank the Research Agency of the Spanish Government for financial support (Project ECO2017-82259-R).