Healthcare spending in the United States (US) accounts for 17.3% of its total GDP and has grown significantly over the past few decades [1,2] with prescription drugs accounting for approximately 9% ($405.9 billion). Medication costs in the US have been shown to be triple that of other high-income countries [3]. Currently, routine use of international reference pricing is not used in the US; studies have suggested that implementation of international reference pricing can lower US drug spending by 52% or $83.5 billion annually [4].

It is estimated that up to 1.59 million people are chronically infected with hepatitis B virus (HBV) in the US, and around 2.4 million are living with hepatitis C virus (HCV) [5,6]. Both HBV and HCV infections can lead to advanced liver disease, liver cancer, and death if left untreated [7,8]. There is currently no cure for HBV, and patients often require lifelong antiviral treatment that can be cost-prohibitive [9]. However, overall spending on HBV antiviral therapy has declined over the past decade with the introduction and increased utilization of generic HBV medications [10]. Combination direct acting antiviral medications (DAAs) for HCV were first introduced in 2014 and initially cost up to $84,000 per treatment course [2]. To date, only 34% of patients diagnosed with HCV in the US between 2013-2022 have been cured, which may be in some part due to unaffordable drug pricing [11]. As new drugs continue to enter the market, the high cost of DAAs remains a constant barrier to the success of hepatitis treatment programs worldwide [12–14].

This study aims to expand the literature on hepatitis drug treatment pricing by examining the current price differences between generic and originator (“name brand”) medications for HBV and HCV in the US as compared to seven other peer high-income countries. This study also explores potential cost savings to Medicare Part D if international reference pricing were to be adopted.

2Materials and MethodsPublicly available drug formularies for Canada, UK, Japan, France, Germany, Italy, and Australia were used to collect 2024 prices for 7 medications used for HBV (lamivudine, adefovir, tenofovir disoproxil fumarate (TDF), tenofovir alafenamide (TAF), entecavir, peginterferon alfa-2a, emtricitabine/TDF) and 7 HCV medications (sofosbuvir/velpatasvir, sofosbuvir/ledipasvir, sofosbuvir, ribavirin, elbasvir/grazoprevir, glecaprevir/pibrentasvir, sofosbuvir/velpatasvir/voxilaprevir). Foreign currencies were converted to US dollars based on the conversion rate on January 1st, 2024.

Current US drug prices were obtained from UpToDate®’s listed representative average wholesale price (AWP) from manufacturers [15]. If a range of prices was provided from multiple manufacturers, the lowest price was selected for a more conservative price comparison. Medicare Part D drug prices from 2022, listed as the average spend per dosage unit weighted, were also collected from the Center for Medicare & Medicaid Services (CMS) [16]. Dosage unit refers to the drug unit in the lowest dispensable amount. Using CMS data, the price difference between the Medicare average drug price and the global average drug price was multiplied by the total dosage units of medication dispensed to estimate the annual cost savings for Medicare. If there were fewer than 3 countries with pricing data available for a given medication, that medication was excluded from the total cost savings calculation. Savings for preferred HBV medications (TDF, TAF, ETV) and HCV medications (sofosbuvir/velpatasvir, glecaprevir/pibrentasvir, sofosbuvir/velpatasvir/voxilaprevir) were also calculated in a subgroup analysis [17,18].

2.1Ethical statementsThis study relied exclusively on publicly available sources without use of patient data or participants. Ethical approval was not required as no identifiable or sensitive data were used.

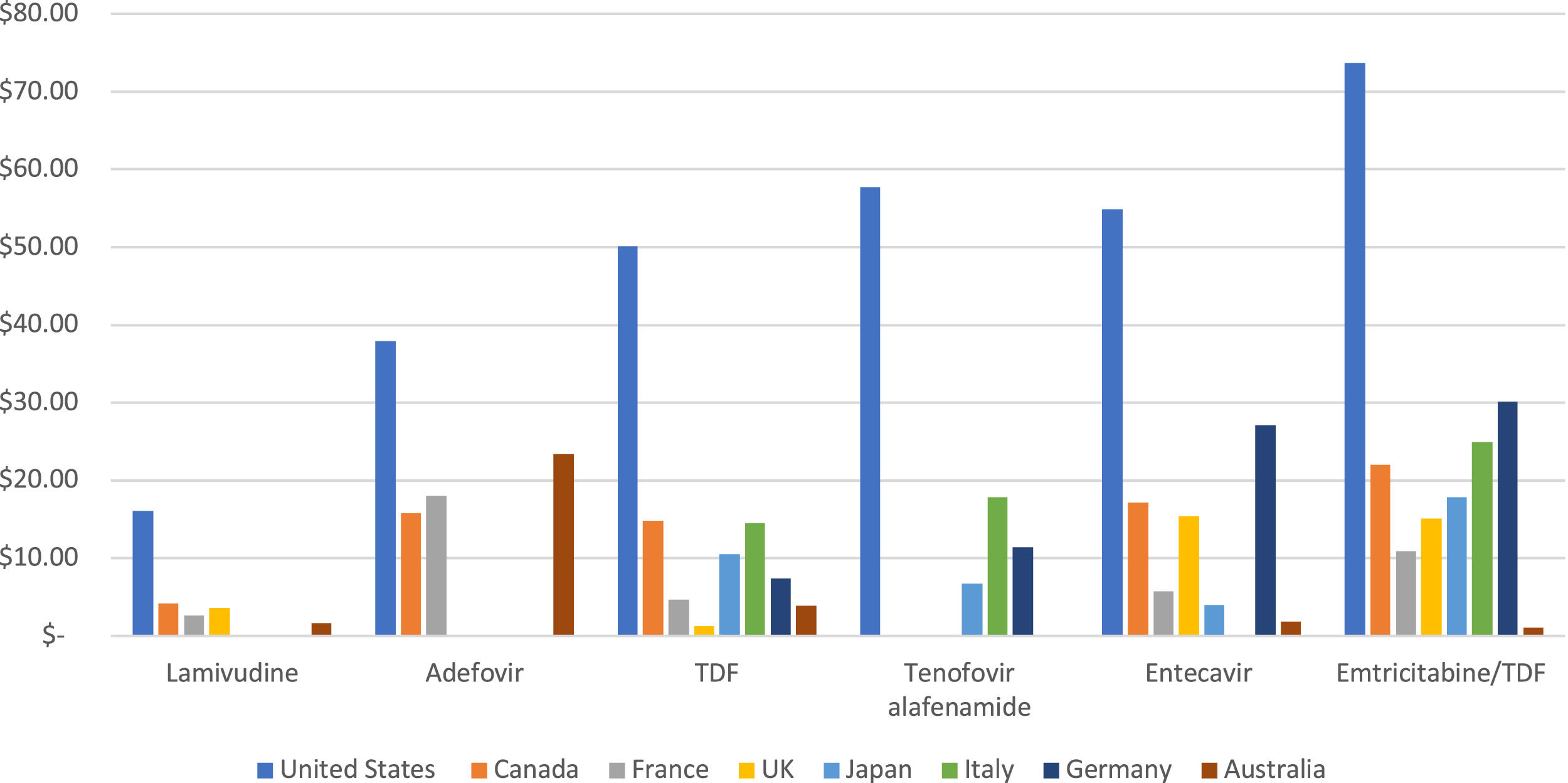

3Results3.1Hepatitis B3.1.1Average Wholesale Price (AWP)US AWP prices for HBV originator medications were on average 4.71x (range 1.99-6.17x) the average drug prices in the non-US G7 countries and Australia (Fig. 1). Lamivudine costs $16.09 per dosage unit in the US, whereas it ranges between $1.67-$4.13 among comparison countries. Similarly, adefovir costs $37.89 vs. $15.79-23.37 globally, TDF $50.14 vs. $1.20-$14.76, tenofovir alafenamide fumarate $57.66 vs. $6.72-17.81, entecavir $54.90 vs. $1.83-$17.11, peginterferon alfa-2a $1336.10 vs. $116.76-$336.65, and emtricitabine/TDF $73.69 vs. $1.02-$30.11 (Table 1).

Prices per medication are listed in USD. Generic prices are noted in parentheses.

The US AWP prices for HBV generic medications were on average 45% cheaper or 0.55x the average generic prices of comparison countries, ranging between 0.48-0.66x. Per dosage unit, TDF costs $3.65 in the US compared to $3.69-$7.25 among comparison countries. Similarly, entecavir costs $2.60 vs. $1.57-11.24 and emtricitabine/TDF $2.34 vs. $2.41-$5.72. TAF is not available as a generic drug in either group.

3.1.2Medicare pricingMedicare’s average spend per dosage unit for HBV originator medications was on average 4.11x (range 2.98-7.0x) the average HBV originator drug prices of other G7 countries and Australia (Table 1). The estimated annual cost savings is calculated to be $172,568,666 if the average global originator price is adopted as a reference price for Medicare. For the preferred HBV drugs of TDF, TAF, and entecavir, estimated savings would be $123,855,721.

The average spend per dosage unit for generic HBV medications by Medicare was on average 1.57x (range 0.83-2.56x) the average generic HBV drug prices of comparison countries. The estimated annual cost savings is calculated to be $45,316,710 if the average global generic price is adopted as a reference price for Medicare.

3.2Hepatitis C3.2.1Average Wholesale Price (AWP)US AWP prices for HCV originator medications were on average 1.78x the average drug prices in six other countries (range 0.63-2.66x) (Fig. 2). Sofosbuvir/velpatasvir costs $1,068 per dosage unit in the US compared to a range between $288.90-$978.56 among comparison countries. Similarly, sofosbuvir/ledipasvir costs $1,350 vs. $393.71-$602.19 globally, sofosbuvir $1,200 vs. $295.02-$565.64, ribavirin $8.27 vs $2.31-$9.24, elbasvir/grazoprevir $312 vs $260.14-$880.72, glecaprevir/pibrentasvir $188.57 vs. $129.42-$274, and sofosbuvir/velpatasvir/voxilaprevir $1,068 vs. $288.90-$1,063.63 (Table 1). No generic pricing data for HCV was available for the comparator countries outside the United States as generic formulations are not available in these countries.

3.2.2Medicare pricingMedicare’s average spend per dosage unit for HCV DAA originator medications was on average 1.38x (range 0.27-2.33x) the average HCV DAA originator drug prices of six other countries. The estimated annual cost savings for Medicare is calculated to be $459,143,731 if the average global price of HCV DAA combinations is adopted as a reference price. Specifically looking at preferred HCV drugs (sofosbuvir/velpatasvir, glecaprevir/pibrentasvir, sofosbuvir/velpatasvir/voxilaprevir), the estimated cost savings would be $414,400,298.97.

4DiscussionThis study demonstrates the greater financial burden that the US health care system faces in treating patients with HBV and HCV in the US compared to those in seven other major industrial countries. The US AWP & Medicare prices of HBV originator medications were higher than the HBV originator drug prices in all the comparator countries studied.

Only 3 of the 7 HBV medications had generic equivalents with prices found in 3 or more countries in the study (TDF, entecavir, emtricitabine/TDF). With the exception of entecavir in Japan, US AWP generic prices for HBV drugs were lower than the generic prices in the other countries studied. This finding is consistent with prior research demonstrating that US prices for unbranded generic drugs are on average 84% of prices globally [3]. However, Medicare generic prices for entecavir and emtricitabine/TDF were higher than the average generic prices globally. While the introduction of generic HBV medication may significantly lower the cost of treatment for US patients, there may still be pricing disparities when comparing to the price equivalents in other countries.

In the US, HCV DAA pricing was more variable. Across both AWP and Medicare data, the average price of HCV DAAs in the US was higher than the average prices in six other countries. However, the AWP and Medicare prices of 3 of the 7 DAA medications (ribavirin, elbasvir/grazoprevir, glecaprevir/pibrentasvir) were actually lower than their average prices in the comparator countries. Across all countries, DAA combinations containing sofosbuvir were significantly more expensive than DAA medications without (Fig. 2). This suggests that the cost of HCV treatment is highly dependent on the medications used.

This study has several limitations. The prices used for this study are the average wholesale prices from manufacturers, which does not account for any rebates or negotiated rates that determine the final out-of-pocket expense for patients or insurers. This may lead to higher, but more conservative estimates of the financial burden HBV and HCV patients may face. Additionally, due to data limitations, Medicare Part D pricing data is from 2022 in comparison to 2024 pricing data used from the other seven countries in this study, but given inflation this would lead to a conservative estimate of the difference in originator drugs but may mitigate the savings in generic drug pricing. Given the differences in varying healthcare systems, this study focuses on the overall price ranges of medications and the larger differences between originator and generic medications.

5ConclusionsThe adoption of international reference pricing may produce significant cost savings for Medicare and help control HBV infection and advance the HCV elimination initiative in the US. Greater transparency in the pricing process is needed to achieve these goals while globally acknowledging the complexity of drug pricing policies between jurisdictions.

FundingThis research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author contributionsL.Y., Data acquisition & analysis, drafting of manuscript, critical revision; X.Y., Data acquisition, drafting of manuscript, critical revision, supervision; G.M., Critical revision; C.T., Critical revision; A.B.J., Conceptualization and design, critical revision, supervision; R.S.B., Critical revision; S.E.C., Conceptualization and design, critical revision, administrative support.

See Title Page for individual author’s declaration of interests which include: Madrigal Pharmaceuticals, Mallinckrodt Pharmaceuticals, Salix Pharmaceuticals, Dynavax Technologies, AbbVie Inc, Gilead Sciences, Intercept Pharmaceuticals, AstraZenica, Gilead Sciences Canada, Glaxo Smith Kline, Ipsen, Merck, and Oncoustics.