Taking the assumptions of the resource dependency theory as our starting point, the main objective of this investigation is to gain an understanding of how and in what way board members who serve on multiple boards (interlocks) can affect a firm's profitability, and whether it is useful to consider the derivation of these interlocks according to the type of board member (executive or non-executive) who possesses them. Using dynamic panel data analysis (GMM) and a sample of 88 firms quoted on the Spanish Continuous Market for the period 2005–2008, our results confirm the existence of a curvilinear (inverted-U) relation between interlocks and firm performance. The results demonstrate that this relation is only significant if we include the total number of external ties rather than just the number of links generated by non-executive directors. We can also confirm that the degree of familiarity and shared knowledge between board members (measured by average board tenure) affects this relationship.

Partiendo de los supuestos de la teoría de dependencia de recursos, el principal objetivo de esta investigación pasa por conocer cómo y de qué forma la pertenencia de los consejeros a múltiples consejos (interlocks) podría afectar a la rentabilidad de la empresa y si es importante considerar en esta relación la procedencia de los interlocks según la tipología del consejero que lo ostente (consejeros ejecutivos y no ejecutivos). Mediante un análisis de datos de panel dinámico (GMM), y a través de una muestra de 88 empresas cotizadas en el Mercado Continuo español para el periodo 2005–2008, los resultados obtenidos confirman que existe una relación curvilínea (en forma de U invertida) entre los interlocks y el rendimiento de la empresa, y que esta relación es sólo significativa si tenemos en cuenta el número total de vínculos externos, y no sólo cuando tomamos en número de vínculos generados por los consejeros no-ejecutivos. Asimismo, podemos afirman que el grado de familiaridad y conocimiento mutuo entre los miembros del consejo (medido por la permanencia media del consejo) influye sobre esta relación.

The board of directors can be viewed as a source of competitive advantage for an organisation, since it provides access to valuable external resources and allows the firm to respond to outside events (Pfeffer & Salancik, 1978; Wincent, Anokhin, & Boter, 2009). Studies based on the resource provision role of the board have generally focused on the external connections brought by the directors; the ties to other firms created by their joint board membership, known as interlocking directorates, are the most commonly used in the literature (Beckman & Haunschild, 2002; Gulati, Nohria, & Zaheer, 2000; Hillman & Dalziel, 2003; Kor & Sundaramurthy, 2009; Nahapiet & Ghoshal, 1998; Ortiz, Aragón, Delgado, & Ferrón, 2012).

Prior studies have sought to understand how the resources brought by board members via their interlocks affect a firm's performance and have proposed both positive (Kim & Cannella, 2008) and negative (Goerzen & Beamish, 2005) relations, and reached a variety of conclusions. These inconsistent results are due to, in the majority of cases, the existence of different types of interlocks, and the different effects these have on the firms’ performance and strategies. For example, Davis (1991) examine how a firm's interlocks formed with other companies that have adopted poison pill strategies in the past, increasing the likelihood of the firm adopting similar tactics; Shipilov, Greve, and Rowley, (2010) analyse how the adoption of a practice by one organisation is positively influenced by the accumulated adoption of the same practice by its interlocking firm; and finally, Diestre, Rajagopalan, and Dutta (2014) examine how board members’ experience in a specific market increases the likelihood of an interlocking firm entering that new market.

However, despite attempts in the literature to classify the various types of interlocks, the majority of studies ignore any distinction according to origin (from executive or non-executive directors); they are examined implicitly, with little awareness of the importance of the ties brought by non-executive directors (Certo, 2003; Filatotchev, 2006; Johansen & Pettersson, 2013; Kor & Sundaramurthy, 2009; Tian, Haleblian, & Rajagopalan, 2011), and ignoring the rich potential of the links formed by executive directors. Firms need to appoint non-executive board members who will bring new resources and knowledge to the top management team (TMT) (Kor & Misanyi, 2008). This is not to say, however, that the resources brought by executive directors should be ignored, especially when they also contribute new resources and knowledge derived from their external ties, and in particular through their interlocks.

The composition of the board is affected by the age and stability of the firms in its sector and thus the majority of the top management team of newly created firms (new ventures) tend to be board members. As a result, in order to verify that the firm's decisions are being taken in an appropriate manner, the literature on corporate governance is beginning to question whether board members possess and are contributing sufficient resources, and to ask whether non-executive directors should be appointed to make up for the possible failings of its executive directors (Dalziel, Gentry, & Bowerman, 2011; Knockaert & Ucbasaran, 2013; Knockaert, Bjornali, & Erikson, 2014). However, in established firms of a certain size, the literature takes for granted that it is appropriate to appoint non-executive directors. It considers that non-executive directors exert an important control over the management, provide support and advice thanks to their human capital or professional experience (many board members enjoy a high professional prestige) and are able to bring in resources from outside the firm through their network of contacts (Finegold, Benson, & Hecht, 2007; Kroll, Walters, & Son, 2007). On the other hand, influenced by agency theory, the literature presupposes that executive directors, members of the top management team (Dalziel et al., 2011), will pursue their own interests and rewards at the expense of the firm's shareholders. This means that little attention has been paid to the external resources brought by executive directors or the need to study the board as a group of individuals who contribute valuable and complementary resources.

We therefore consider it appropriate to examine the value that all board members contribute through their interlocks. In this investigation, we propose that the resources brought by the directors, regardless of type, enable the firm to take better decisions, thanks to their pooled knowledge and experience (Filatotchev, 2006), and that this ultimately affects firm performance.

Finally, by considering the complete set of resources brought by all of the board members, regardless of type, we are supporting an idea that has already been proposed in a number of studies (Forbes & Milliken, 1999; Gabrielsson & Huse, 2004; Stevenson & Radin, 2009; Van Ees, Gabrielsson, & Huse, 2009) that the board should be viewed in its entirety as a “group of individuals”, whose effectiveness depends not only on the individual resources contributed by each member, but also on its ability to act as a team and to share and assimilate these resources. The aim of our investigation is to pursue this line of research in greater depth, introducing the moderator effect of board tenure on the relation between interlocks and firm performance. A board with high average board tenure encourages better relations and greater trust between its members (Le, Kroll, and Walters, 2013), encouraging a mutual and efficient exchange of the vision and strategic resources acquired from other firms. By looking at board tenure therefore, we can analyse the effect of the degree of familiarity and mutual understanding between board members and their essential role in the assimilation and application of the resources that can be gained through interlocks.

This work is structured as follows: in the first section we explain our choice of subject and set out our objectives. In the subsequent sections we carry out a literature review that allows us to propose a set of hypotheses. In the final section we explain our empirical study, followed by an analysis and interpretation of the results obtained.

Literature review and proposed hypothesesThe more traditional literature, based on agency theory (Fama & Jensen, 1983; Letza, Sun, & Kirkbride, 2004) identifies the control function as the board's principal activity, and assumes that non-executive board members are more effective than executive board members in controlling the senior management and protecting shareholder interests. This perspective reinforces the particular importance of the role of non-executive directors in board composition. To this can be added the recent financial scandals of high-profile firms (Enron, Tyco, WorldCom, Adelphia), which have reminded us of the importance of board independence, while bringing about a reduction in the number of executive board members and giving primacy to the board's control function. Recent studies (Hillman & Dalziel, 2003; Lynall, Golden, & Hillman, 2003; Stiles & Taylor, 2001) consider that new functions should be included, such as service, or resource provision, this latter being at the heart of our investigation. These new functions are founded on the use of knowledge, information, experience, capabilities, etc., namely, the set of resources that each board member brings to the board. This new viewpoint affects studies of board composition by altering the initial perspective: board composition should not only be viewed in quantitative terms (percentage of non-executive directors), but also in qualitative terms, since every board member, regardless of type, contributes complementary resources to the firm, which are required by the group as a whole for effective decision-making (Certo, 2003; Hillman & Dalziel, 2003; Westphal & Fredrickson, 2001).

The resource dependency theory considers that the board of directors is an effective mechanism for the firm, in that its members have outside contacts or external links with the environment (Kim, 2005). Of all the external connections, the relations that have been studied most frequently by researchers are the ties to other firms through shared board members (interlocking directorates) (Beckman & Haunschild, 2002; Gulati et al., 2000; Hillman & Dalziel, 2003; Kor & Sundaramurthy, 2009; Nahapiet & Ghoshal, 1998; Ortiz et al., 2012).

Interlocks and their effect on firm performanceThe experience that directors acquire by serving on other boards (interlocks) is a valuable resource that enables them to fulfil their roles more effectively because of their ability to apply their external experiences (Hillman & Dalziel, 2003; Kor & Sundaramurthy, 2009; Tian et al., 2011). Boards with a high number of external connections will benefit from rapid access to important external information and critical resources (Kor & Sundaramurthy, 2009). Prior studies have shown that these external connections play an important role in the transfer of knowledge and successful practices between firms (Burt & Carlton, 1989; Shipilov et al., 2010). Firms might also benefit from their directors’ ties, gaining support from external stakeholders and other influential agents, which could be critical for the organisation's performance (Hillman, Cannella, & Paetzold, 2000; Kiel & Nicholson, 2006). Finally, the legitimacy of the decisions taken by these firms will also increase when their directors also serve on the boards of other companies (Mizruchi & Stearns, 1988, 1994; Westphal, Seidel, & Stewart, 2001).

However, despite these benefits, some authors believe that there are also risks or dangers associated with interlocks (Fligstein, 1995; Palmer, Barber, & Xueguang, 1995). Prior studies have argued that serving on a number of boards limits the time and attention that directors can dedicate to each one and reduces the degree of internal cohesion within the board. As a result, they suggest that when board members have a high number of interlocks it could be damaging to the firm's performance (Kor & Sundaramurthy, 2009). Therefore, while a moderate number of external links can help to improve firm performance, it is reasonable to suggest that above a certain level, this positive influence could become negative, creating a curvilinear relation (inverted-U) between the number of board interlocks and the firm's results.

Finally, as we indicate in the introduction, the majority of investigations into the relation between interlocks and firm performance have only studied the links brought by non-executive directors. However, it is important to consider the resources that executive directors contribute through their own external connections. These directors also provide access to resources and key information on how other board's function, which can be directly applied to the firm's decision-making processes. Furthermore, external ties have been linked to the good reputation of board members which, in the case of executive directors, improves investors’ perceptions of the firm's decision-makers (Bjornali & Gulbrandsen, 2010; Ferris, Jagannathan, & Pritchard, 2003; Johnson, Schnatterly, Bolton, & Tuggle 2011; Kim & Cannella, 2008; Shropshire, 2010; Wincent et al., 2009). Experience obtained from other firms via a tie created by an executive director could be applied directly to the focal firm's decision-making, with no need for any kind of intermediary, and is likely to increase the transfer of knowledge and successful practices between firms. The risks associated with an excessive number of external connections, such as the lack of time and attention paid to the focal firm, would also be reduced/minimised since executive directors are fully aware of the firm's operations because of their own involvement with the management of the firm.

Therefore, in view of these arguments, we propose the following: H1. There is a curvilinear (inverted-U) relation between (non-executive and executive) directors’ membership of multiple boards (interlocks) and firm performance, such that performance will improve as the total number of interlocks rises, but then falls as the total number of interlocks increases.

Following another line of study, Adler and Kwon (2002) suggest that the behaviour of a group, such as a board of directors, is influenced by its external ties, and also by its ability to work towards common objectives. These authors make the point that these two board member relations – external and internal ties – are not mutually exclusive. Taking these arguments, we propose that boards with a high number of external ties also require a high level of shared knowledge and familiarity between the directors, in order to facilitate their internal relations and to mitigate the possible negative effects of boards with a high number of interlocks. With Kor and Sundaramurthy (2009), we argue that experience on a particular board gives directors the opportunity to become more familiar with the capabilities, habits and personalities of their fellow board members, breaking down barriers between them and allowing them to share and apply the resources gained from these external ties. We therefore propose that board tenure, which refers to the degree of familiarity and knowledge sharing between board members during the period that they serve together on the board, moderates the relation between a high number of interlocks and firm performance.

We therefore propose the following working hypothesis: H2. Average board tenure moderates the relation (inverted-U) between directors’ membership of multiple boards and firm performance. Specifically, when average board tenure is high, the percentage decrease in firm performance (associated with an increase in the number of external ties) is reduced.

The sample of firms used in this study comprises Spanish firms quoted on the Madrid Stock Exchange and the Continuous Market during the period 2005–2008. These firms were chosen because of their obligation to publish data relating to their corporate governance and performance. We subsequently eliminated the following firms: (1) those classified as financial services (if they included estate agencies), given the difficulty involved in interpreting all of the data relating to that sector; (2) firms that ceased to be quoted during the period of analysis (we only included firms that were quoted on the stock exchange for the entire study period); and (3) firms for which we did not have access to their annual reports. Within these limitations, we obtained a total of 94 firms, but from this total we had to eliminate another six firms that did not provide data on their directors’ interlocks, leaving a final sample of 88 firms.

The data on the firms’ results were obtained from the DataStream database and information on board composition was obtained from the Comisión Nacional del Mercado de Valores (CNMV, the Spanish Stock Market Commission); from their reports we were able to access the names of all the board members for each firm in our sample – a total of 3482 directors for the period 2005–2008.

To obtain information relating to each director's interlocks, we turned to Axesor, a consultancy firm specialising in the provision of information on firms and directors, obtained from official registers. The information from Axesor, available in the Official Mercantile Registry Bulletin (BORME), provided a list of the ties that each director has with one or more boards, in both quoted and unquoted firms, for each year of the study. To achieve this, we used the start and end dates corresponding to the interlock of each board member. Within these guidelines, the total number of external ties was 14,972.

The information on our control variables was obtained from a number of sources, depending on whether the variable was linked to the firm or the board. At the firm level, the information on firm size and age was obtained from the Osiris database and the stock exchange sectoral classification published by CNMV. Information at board level regarding the number of directors on each board, CEO/Chair duality and the type of directors on each board was obtained from the corporate governance reports published by the CNMV.

Dependent variableWe used return on assets (ROA) as our measurement of financial performance for each firm. We calculated the ROA (with a one-year lag, ROA+1) as the profit derived from the company's operations divided by the firm's total assets for each year. In general, we consider that countable measures such as ROA reflect the influence of the internal management more accurately than market-based measures, which are more susceptible to the influence of exogenous economic factors (Elitzur & Yaari, 1995; He & Huang, 2011).

Independent and moderator variablesBoard tenure is calculated as the average number of years that board members have served on a particular board (Golden & Zajac, 2001; Johnson, Hoskisson, & Hitt, 1993; Kaymak & Bektas, 2008; Kor & Sundaramurthy, 2009; McIntyre, Murphy, & Mitchell, 2007).

We define interlocks as the ties that are formed when a board member serves on the board of another firm. This measure of interlocks has previously been used in the literature on boards (Filatotchev, 2006; Haynes & Hillman, 2010; Kor & Sundaramurthy, 2009; Wincent et al., 2009; Ortiz et al., 2012; Pombo & Gutiérrez, 2011; Tian et al., 2011). Non-executive directors’ interlocks are calculated as the total number of external ties with other firms that are formed by a board's non-executive directors. The total number of interlocks is calculated as the total number of external ties formed by both executive and non-executive directors with other firms.

Taking the lead from other studies on corporate governance, we have included the following control variables that might affect the proposed relations: CEO/Chair duality (Ellstrand, Tihanyi, & Johnson, 2002; Holm & Schuler, 2010; Singla, George, & Eliyaht, 2010), measured as a dummy variable with the value 1 when the chief executive of a firm is also Chair of the board and 0 otherwise; board size (Kim, 2005, 2007; Kroll, Walter, & Wright, 2008; Ocasio, 1994; Sanders & Carpenter, 1998; Zahra, Priem, & Rasheed, 2007), measured as the number of directors on the board; firm age (Barroso, Villegas, & Pérez-Calero, 2011; Calof, 1993; Zahra et al., 2007), measured as the number of years since the firm was founded; percentage of non-executive directors (Datta, Musteen, & Herrmann, 2009; Filatotchev, Dynomina, Wright, & Buck, 2001; Singla et al., 2010), calculated as the sum of non-executive directors on each board divided by the total number of board members; firm size, measured by the number of employees in each firm for each year; and the firm's previous performance, measured by previous return on assets (ROA) (Kim, 2005; Tian et al., 2011). Finally, to control for temporal and sectoral effects, we included dummy variables for each year (2005–2008) and industry, according to the stock market industry classification published by the CNMV.1

Statistical estimationsTo test our hypotheses we used an estimation process that is appropriate for our theoretical arguments and robust enough to withstand the typical problems associated with panel data analysis. We therefore used the Arellano–Bond model and used the generalised methods of moments (GMM) method (Arellano & Bond, 1991; Arellano & Bover, 1995; Greene, 2003). These authors propose the use of GMM, using the lagged values of the original independent variables as instruments, thereby resolving the problem of endogeneity. Hermalin and Weisbach (2000) and Aguilera and Cuervo-Cazurra (2009) argue that endogeneity makes it hard to analyse relations between board composition and firm value, and so if this is not controlled, the results could generate errors and inconsistent estimations. In this work, potential endogeneity could be due to the problem of simultaneity or inverse causality (Hermalin & Weisbach, 2003) and therefore, in accordance with prior studies, we have included the percentage of non-executive directors within the total number of board members as sources of endogeneity (Andrés de, Valentín, & Félix, 2005; Jackling & Johl, 2009; Kim, 2007; Kor & Sundaramurthy, 2009; Pombo & Gutiérrez, 2011). We used the Stata/SE software programme to calculate all of our estimations.

We also considered the possible problems of heteroscedasticity and autocorrelation. In order to establish if there was a problem of heteroscedasticity we carried out a modified Wald test, which rejected the H0 absence of heteroscedasticity, and we therefore selected the robust option in Stata for all of our models. To control for autocorrelation, we ran the Wooldridge test, using the xtserial command in Stata. The H0 absence of correlations was rejected, and the test therefore indicated that there was a problem of autocorrelation to be corrected.

We consider our model to be “autoregressive” and have therefore included the lagged dependent variable (ROAt−1) as the instrument, but the lagged dependent variable was intrinsically correlated to the non-observed effects at panel level, giving inconsistent standard estimators for the linear regression models for the random and fixed effects. This supports our use of the GMM method (Arellano & Bond, 1991; Arellano & Bover, 1995; Greene, 2003).

To test the validity of the model specification when using GMM, the Hansen Statistic of overidentifying restrictions was applied to evaluate the lack of correlation between the instruments and the terminal error in all of our models. The acceptance of the H0 Hansen statistic implies the absence of any correlation between the instruments used and the terminal error in all of our models. We also included the m2 statistic, which enabled us to confirm the absence of any secondary-order serial correlation in the regression residuals. Further to these comparative specification tests, we included the following Wald tests in the estimations: first (z1) joint significance of the reported coefficients of the explanatory variables and second (z2) joint significance of the dummy time variables. Both were statistically significant.

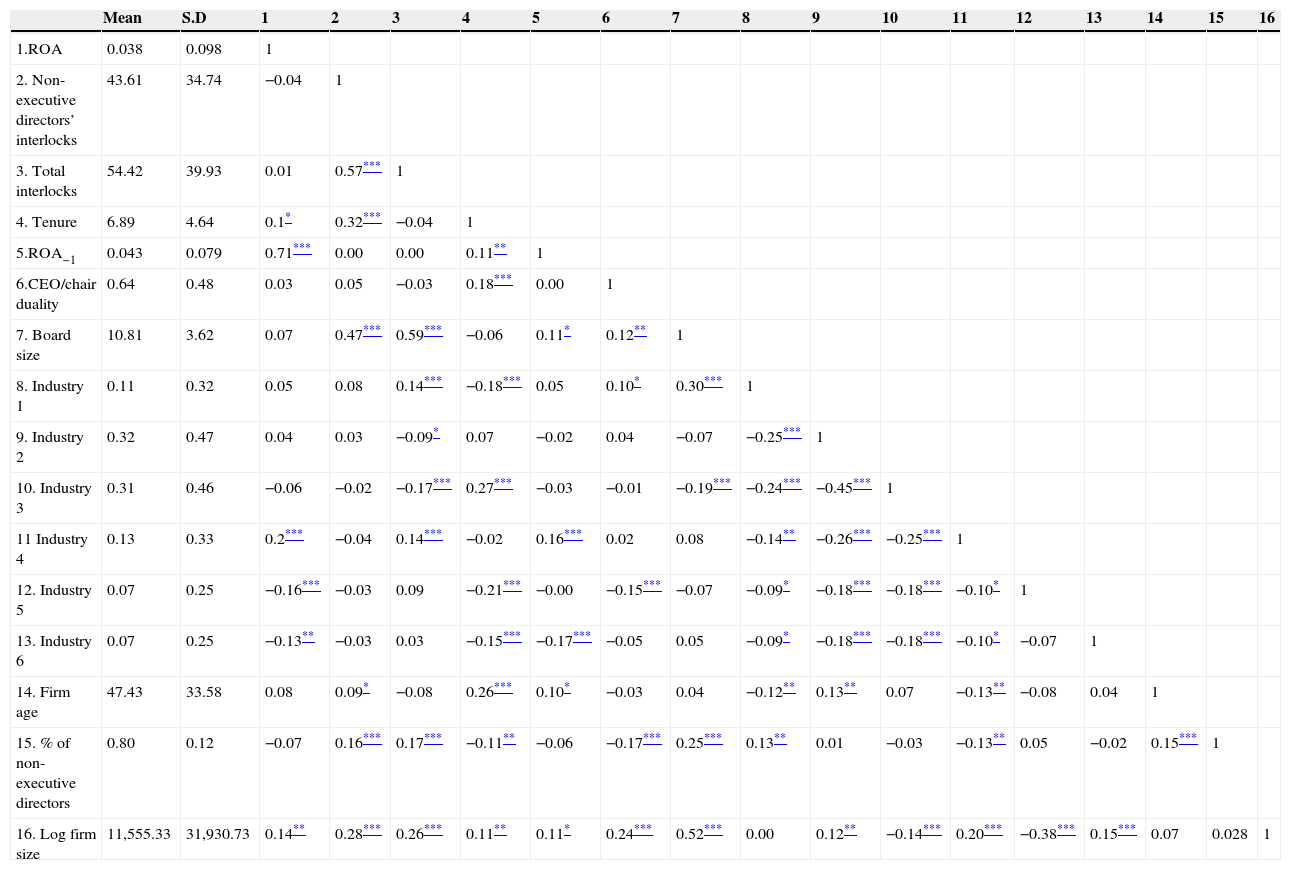

Table 1 sets out the descriptive statistics and the correlation matrix for the variables. The variables used in the model were not strongly correlated either between themselves or with the control variables, and there were therefore no problems of multicollinearity. In order to avoid the possible problems of multicollinearity between the primary effects and interaction terms, the independent variables were centred before the interaction variables were created (Aiken & West, 1991).

Correlation matrix.

| Mean | S.D | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1.ROA | 0.038 | 0.098 | 1 | |||||||||||||||

| 2. Non-executive directors’ interlocks | 43.61 | 34.74 | −0.04 | 1 | ||||||||||||||

| 3. Total interlocks | 54.42 | 39.93 | 0.01 | 0.57*** | 1 | |||||||||||||

| 4. Tenure | 6.89 | 4.64 | 0.1* | 0.32*** | −0.04 | 1 | ||||||||||||

| 5.ROA−1 | 0.043 | 0.079 | 0.71*** | 0.00 | 0.00 | 0.11** | 1 | |||||||||||

| 6.CEO/chair duality | 0.64 | 0.48 | 0.03 | 0.05 | −0.03 | 0.18*** | 0.00 | 1 | ||||||||||

| 7. Board size | 10.81 | 3.62 | 0.07 | 0.47*** | 0.59*** | −0.06 | 0.11* | 0.12** | 1 | |||||||||

| 8. Industry 1 | 0.11 | 0.32 | 0.05 | 0.08 | 0.14*** | −0.18*** | 0.05 | 0.10* | 0.30*** | 1 | ||||||||

| 9. Industry 2 | 0.32 | 0.47 | 0.04 | 0.03 | −0.09* | 0.07 | −0.02 | 0.04 | −0.07 | −0.25*** | 1 | |||||||

| 10. Industry 3 | 0.31 | 0.46 | −0.06 | −0.02 | −0.17*** | 0.27*** | −0.03 | −0.01 | −0.19*** | −0.24*** | −0.45*** | 1 | ||||||

| 11 Industry 4 | 0.13 | 0.33 | 0.2*** | −0.04 | 0.14*** | −0.02 | 0.16*** | 0.02 | 0.08 | −0.14** | −0.26*** | −0.25*** | 1 | |||||

| 12. Industry 5 | 0.07 | 0.25 | −0.16*** | −0.03 | 0.09 | −0.21*** | −0.00 | −0.15*** | −0.07 | −0.09* | −0.18*** | −0.18*** | −0.10* | 1 | ||||

| 13. Industry 6 | 0.07 | 0.25 | −0.13** | −0.03 | 0.03 | −0.15*** | −0.17*** | −0.05 | 0.05 | −0.09* | −0.18*** | −0.18*** | −0.10* | −0.07 | 1 | |||

| 14. Firm age | 47.43 | 33.58 | 0.08 | 0.09* | −0.08 | 0.26*** | 0.10* | −0.03 | 0.04 | −0.12** | 0.13** | 0.07 | −0.13** | −0.08 | 0.04 | 1 | ||

| 15. % of non-executive directors | 0.80 | 0.12 | −0.07 | 0.16*** | 0.17*** | −0.11** | −0.06 | −0.17*** | 0.25*** | 0.13** | 0.01 | −0.03 | −0.13** | 0.05 | −0.02 | 0.15*** | 1 | |

| 16. Log firm size | 11,555.33 | 31,930.73 | 0.14** | 0.28*** | 0.26*** | 0.11** | 0.11* | 0.24*** | 0.52*** | 0.00 | 0.12** | −0.14*** | 0.20*** | −0.38*** | 0.15*** | 0.07 | 0.028 | 1 |

Fuente: elaboración propia.

The final footnotes values should be:

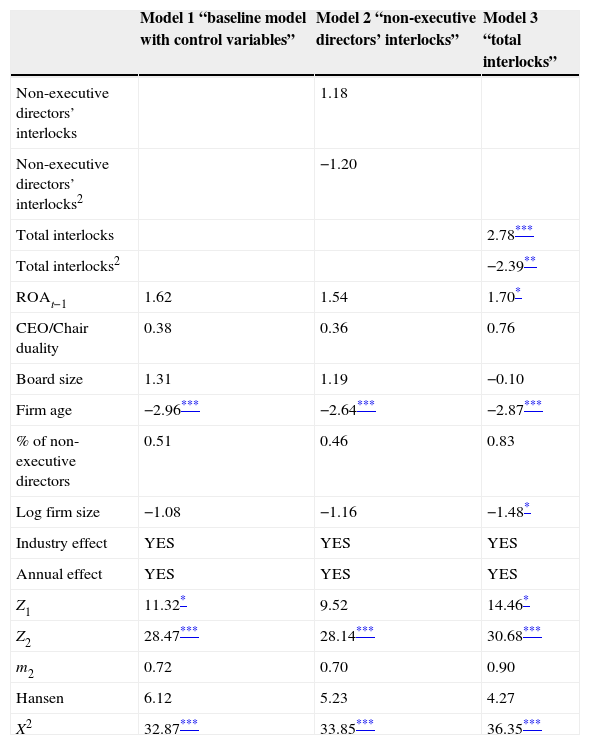

The results obtained are set out below (Tables 2 and 3). Model 1 is the base model that includes all of the control variables. Curiously, none of the variables, with the exception of firm size, are significant.

Results of the analysis of non-executive directors’ interlocks versus total interlocks and firm performance.

| Model 1 “baseline model with control variables” | Model 2 “non-executive directors’ interlocks” | Model 3 “total interlocks” | |

|---|---|---|---|

| Non-executive directors’ interlocks | 1.18 | ||

| Non-executive directors’ interlocks2 | −1.20 | ||

| Total interlocks | 2.78*** | ||

| Total interlocks2 | −2.39** | ||

| ROAt−1 | 1.62 | 1.54 | 1.70* |

| CEO/Chair duality | 0.38 | 0.36 | 0.76 |

| Board size | 1.31 | 1.19 | −0.10 |

| Firm age | −2.96*** | −2.64*** | −2.87*** |

| % of non-executive directors | 0.51 | 0.46 | 0.83 |

| Log firm size | −1.08 | −1.16 | −1.48* |

| Industry effect | YES | YES | YES |

| Annual effect | YES | YES | YES |

| Z1 | 11.32* | 9.52 | 14.46* |

| Z2 | 28.47*** | 28.14*** | 30.68*** |

| m2 | 0.72 | 0.70 | 0.90 |

| Hansen | 6.12 | 5.23 | 4.27 |

| X2 | 32.87*** | 33.85*** | 36.35*** |

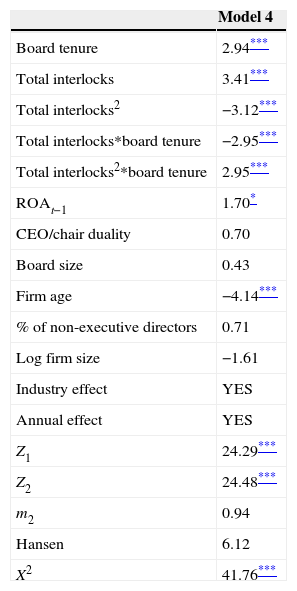

Results of the moderating effect of average board tenure on the relationship between total interlocks and firm performance.

| Model 4 | |

|---|---|

| Board tenure | 2.94*** |

| Total interlocks | 3.41*** |

| Total interlocks2 | −3.12*** |

| Total interlocks*board tenure | −2.95*** |

| Total interlocks2*board tenure | 2.95*** |

| ROAt−1 | 1.70* |

| CEO/chair duality | 0.70 |

| Board size | 0.43 |

| Firm age | −4.14*** |

| % of non-executive directors | 0.71 |

| Log firm size | −1.61 |

| Industry effect | YES |

| Annual effect | YES |

| Z1 | 24.29*** |

| Z2 | 24.48*** |

| m2 | 0.94 |

| Hansen | 6.12 |

| X2 | 41.76*** |

As can be observed, our results confirm our two proposed working hypotheses. With regard to hypothesis 1, models 2 and 3 confirm that the inverted-U relation between interlocks and firm performance is only significant when we include the total number of interlocks rather than the number of ties belonging only to the non-executive directors. In model 3, the estimated coefficient for the total number of interlocks was statistically significant (p<.01) with a positive value, while the total number of interlocks was statistically significant (p<.05) with a negative value.

Model 4 includes the moderating variable, board tenure. The table shows that the board tenure coefficient is statistically significant (p<.01), with a positive value. The squared term of the interlocks was negative and significant (p<.01). The linear interaction term for tenure and the interlocks was negative and significant (p<.01), and the squared interaction term (p<.01) was positive and significant.

Therefore, in relation to hypothesis 2, we can confirm the moderating effect of board tenure on the negative relation between a high total number of interlocks and firm performance. However, and although it was not predicted in our hypothesis, this moderator effect also exists in the positive relation between a small total number of interlocks and firm performance. In comparison to model 3, adjusted model 4 is fairly significant, producing an increase in the value of X2, which suggests that board tenure moderates the curvilinear effects of the total number of interlocks on performance.

ConclusionsUnlike agency theory, which argues that a high percentage of non-executive directors is required to fulfil the board's control function, more recent theories have focused on the search for qualified and competent directors, regardless of type. However, with regard to interlocks, the majority of authors have concentrated exclusively on the study of the non-executive directors’ ties (Kim, 2007; Kor & Sundaramurthy, 2009; Tian et al., 2011) to compensate for the executive directors’ lack of business experience or external contacts (Filatotchev, 2006). On the other hand, from the resource dependency perspective, with its focus on the capture of resources for the firm (Hillman & Dalziel, 2003), the essential aspects have been board size – if the number of board members rises, the opportunity to capture external resources also increases – and diversity within the board, since more diverse boards have access to a broader range of resources. Logically, these two variables also affect board composition. Our study demonstrates that another variable – less explored and of greater interest for explaining the influence of the board on a firm's results – is the consideration of the board as a single entity, which does not take account of board member type when analyzing their potential for establishing external links. In fact, the results obtained in our investigation (a comparison of models 2 and 3) demonstrate the need to view the board as a single entity.

Our models 3 and 4 also support our predictions. If a board wishes to be more efficient, it should increase the number of interlocks. However, increasing the number of these ties could also have a negative effect on the board's internal functioning, as the group's cohesion might be reduced when board members are forced to divide their energies and attention between too many responsibilities. The board will therefore achieve its greatest productive efficiency when it has not only access to the greatest possible number of resources but is also able to function as a compact social group when taking decisions. We argue that internal relations, through board tenure, moderate the negative effects caused by a high number of board interlocks, and highlight the need to view the board as a decision-making body. Furthermore, although it was not predicted in our hypotheses, the results also show that board tenure moderates the positive relation between a low number of external links and firm performance. Directors with an appropriate/non-excessive number of ties and who therefore have more time to dedicate to their own board will be negatively influenced by a long tenure with the firm. A possible explanation that has not previously been considered is that if the two elements are combined (a lot of time to dedicate to the board and long tenure), directors could be affected by their own beliefs and the schemes that have been developed within their firm, and therefore the resources acquired in other firms could become a less valuable resource. That is to say, the board members could start to be more affected by a set of behaviour patterns learned in their own firm than by the knowledge that they acquire from the firms on whose boards they serve. Executive directors will only be able to take decisions that are defined by these patterns and the abilities of non-executive directors to provide resources and offer advice to the management team will be reduced.

In the majority of cases, the difficult balance between board independence and the board's social capital (via interlocks) can vary, depending on the context and type of firm, which suggests that future investigations should focus on these aspects. For example, firms operating in dynamic markets, or which face an initial public offering (IPO), should pay particular attention to their human and social capital requirements in relation to the strict independence of their non-executive directors (Filatotchev, 2006; Kor & Sundaramurthy, 2009). Other possible future lines of investigation could look in greater detail at the nature of interlocks. In this study, we have only considered national interlocks, between Spanish firms. It would be of interest to see whether the effects on performance of interlocks with foreign firms differ from those identified in this study, or even how this would affect the other dependent variables, such as the firm's internationalisation. Entry into new markets, or setting up subsidiaries in international markets, brings significant benefits for the firm's growth. These also tend to be complex operations, given the high levels of uncertainty and risk of failure associated with them (Sanders & Carpenter, 1998). In this context, interlocks constitute a very important tool that gives board members the opportunity to access information that mitigates risks and allows them to seek information from other firms. Finally, we would point out that this work does not specify whether the interlocks are “intragroup” – ties between firms belonging to a particular group, with shared ownership or even overlapping activities – or are interlocks between firms that are completely independent of each other with regard to their ownership structure. This distinction might affect our results.

We have used the information from the database relating to the stock market industry classifications proposed by CNMV, coded as follows: (1) petroleum and energy; (2) raw materials, industry and construction; (3) consumer goods; (4) consumer services; (5) financial and property services; and (6) technology and communications. Given the differences in the frequency of the observations for each sector, we have assigned “1” to industries 1, 4, 5 and 6; “2” to industry 2; and “3” to industry 3.