The study investigated the understanding of the directors and managers of the Research Units (Unidades de Pesquisa – UP) linked to the Brazilian Ministry of Science, Technology and Innovation (Ministério da Ciência, Tecnologia & Inovação – MCTI) on the creation of value and innovations from Knowledge and Intellectual Capital management, analyzing their understanding of the theme and the way in which the intangible assets – mainly information and knowledge – are transformed by the UP. To develop the objective and research question, it was necessary to (i) characterize the organizational context of the UP, (ii) to discuss the applicability of the relevant conceptual framework to Knowledge Management, Intellectual Capital and Intangible Assets in order to follow the value created within the UP, (iii) demonstrate the recognition of the innovations achieved by the UP and the way they are viewed by the managers, and (iv) portray the understanding of the directors and managers about the Intellectual Capital within the unit in which they are inserted. A descriptive approach was adopted, with functionalist discussion and quantitative research to measure the relationship between the data and test hypotheses about the sample – the interdependence between value creation drivers and the differentiated perception about value creation via intangible drivers. The findings allow to affirm that there are distinct clusters of UP, with greater importance, in general, attributed to Relational Capital.

Research institutes have an unquestionable responsibility and importance in the development of science and technology in Brazil and all over the world. They have a direct commitment to the creation, retention of knowledge and new practices, with the purpose of converting them into value, thus meeting the needs and demands of society, solving problems in the cities, favoring the increase of the agroindustry production, as well as helping the organizations to maintain competitive differentials that allow to overcome the obstacles interposed and the positioning in a turbulent market, thus leveraging the economic development of the country (Cavalcanti, 2001; Tigre, 2006).

The Ministry of Science, Technology and Innovation (Ministério da Ciência, Tecnologia e Inovação – MCTI), one of the main knowledge gatekeepers in Brazil, congregates federal Research Units (Unidades de Pesquisa – UP) in several States of the Federation, which evolved according based on the development needs imposed by the socioeconomic advance and, consequently, storing knowledge throughout its existence (Brazil, 2015).

It is important to emphasize that, currently, the real wealth of a country derives from the creation of knowledge (Cavalcanti, 2001). This, in turn, transforms and returns in the form of brands, patents, products, scientific research, publications, certifications and tools that guarantee a greater competitive advantage, becoming a benchmark in a globalized market (Barney & Hesterly, 2006). It guarantees economic, intellectual and social growth, thus achieving a competitive differential for society, organizations and the country.

In this context, knowledge becomes a differential factor for many organizations, whether public or private. Organizations in the knowledge age are in constant process of change, and the valuation of Intellectual Capital and Intangible Assets is an imperative issue in this new scenario (Cavalcanti, 2001; Rezende, 2014).

According to Sveiby (1998), the management, evaluation and creation of these intangible stock and flows are of vital importance to organizations. Wealth and well-being previously assessed, quantified, and measured by physical capital assets are measured based on intangibles, knowledge created, managed, shared, transferred, and retained within organizations (Barney & Hesterly, 2006). In addition, it is important to note that the use of resources – including, but not limited to, intangible assets – can generate extraordinary profits, which are ultimately responsible for the creation of company value.

With the popularization of information and communication technologies, new markets, professions and products have emerged. As a result, these drivers force a change of focus and management models adopted by the organizations, leading to new strategies to be able to understand the existing disruptive technologies and to guarantee new commercial relations without losing the already acquired market reputation. According to Davis and Meyer (1999) we are in the era of the Blur economy where there are no longer stable solutions, where successful ventures, whether public or private, are not “resting” at any time.

The Blur era consists of speed, connectivity and intangibility. From this perspective, phenomena such as globalization, the opening up of new markets, resulting from increased connectivity of markets and the flows of products, capital and technology between the countries corroborate with this idea and impose on companies reformation in their form of organization and the adequacy of its functional areas, through constant innovation in all its processes, in order to meet the requirements of global competitiveness. This implies new standards of competitiveness (Davis & Meyer, 1999).

In the global context, research institutes in industrialized countries undergo a process of intense and rapid transformation, due to the increasing complexities in organizational processes and research and development activities, in order to find solutions to the problems of society and industry, such as Also bring increases in scientific and academic production.

This study presents, as main objective, the intention to demonstrate how the typical resources of Knowledge Management and Intellectual Capital, in the mainstream sense (Edvinsson & Malone, 1997; Stewart, 1998; Sveiby, 1998) and Brazilian researchers (Cavalcanti, 2001; Rezende, 2014; Tigre, 2006), interact directly in the creation of value. As a plan, the study is an analysis that focus approaches and means with which the UP interact with knowledge management and intellectual capital. To reach this objective, a survey was applied to the directors and managers of the UP.

The academic interest directed to the study of intangible assets and intellectual capital in UP was the engine for understanding how the interactions between them can contribute to the creation of value.

It is important to have as background the institutional missions of the UP, as exemplified below, aligned through a regulated management agreement and signed each year between the management of the MCTI and those of the UP – with an undeniable responsibility for the transformation of knowledge into value, through its scientific production, in patent creations, scientific works, certifications and products.

- •

INT National Institute of Technology: “Participate in the sustainable development of Brazil, through technological research, transfer of knowledge and promotion of innovation” (National Institute of Technology, 2016).

- •

LNCC National Laboratory for Scientific Computation: “Research, development and training of human resources in scientific computing, especially in the construction and application of mathematical and computational models and methods in solving scientific and technological problems, as well as providing computational environment for processing of high performance, aiming at advancing knowledge and meeting the demands of society and the Brazilian State” (National Laboratory of Computer Science, 2016).

The Ministry of Science Technology and Innovation has a fundamental role in the socioeconomic development of the State. To ensure its consolidation, MCTI uses as a tool the production and popularization of Science, Technology and Innovation, emphasizing those applicable to populations in conditions of social vulnerability (Brazil, 2016).

The Department for Science, Technology and Innovation for Social Inclusion (SECIS), created in 2003, formulates, implements and monitors policies, programs, projects and actions to disseminate scientific, technological and innovative knowledge. To do this, integrates and applies various social institutions and media education institutions rural and urban, through the process of educational training and professional training, considering the socioeconomic conditions and the regional peculiarities of the communities. Thus, it contributes directly to reduce inequalities of opportunities, to stimulate the generation of employment and income, to improve the quality of life and to lead the country to a sustainable development. It is up to the UP to develop structuring projects that meet these types of demand (Brazil, 2016).

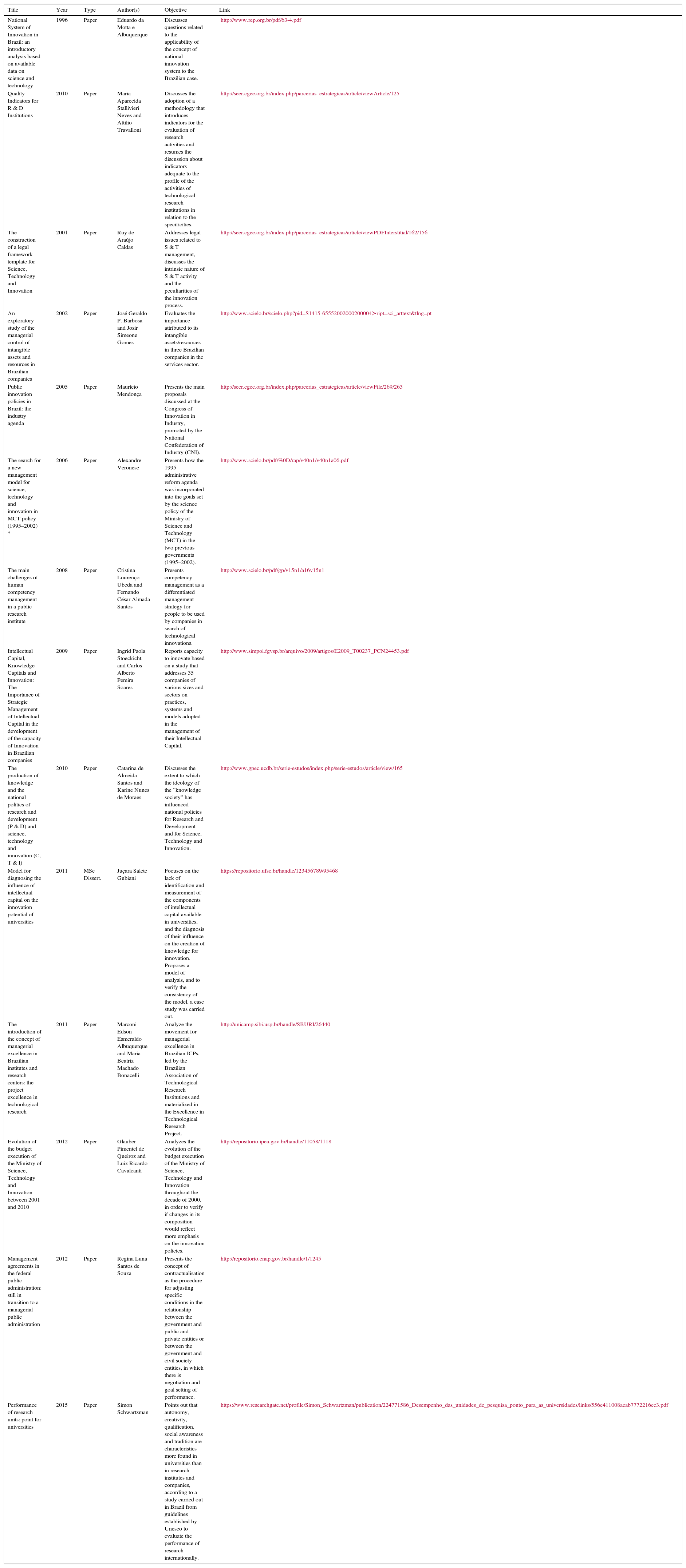

In Brazil, validated studies point to a small number of researches on knowledge management (KM) and intellectual capital (IC) applied in institutions related to UP (Appendix 1).

It is, therefore, an open field for exploration and description of the mechanisms capable of characterizing the creation of value in science, technology and innovation.

In this sense, the purpose of investigating the UP managers’ understanding of the conversion of Intellectual Capital into innovation and value – characterizing their sense of the role of intangible management and the way in which transformation is seen of knowledge by the UP – and as a driving force the research question “Which components of intellectual capital are present and how do they interact in the creation of value in the context of MCTI's Research Units?”

In the development of this research, we undertake a literature review composed of discussions about innovation as a mechanism (Levinthal & March, 1993; Mohr, 1982) of value development (Topic 2); on the management of knowledge as a practice for value appropriation (Topic 3); and for the assessment of intangibles as an artifact for value management (Topic 4).

Next we present the delimitation of our investigation – field and object – the UP of the MCTI (Topic 5); procedures and protocol (Topic 6); the findings on the hypotheses with respective discussions (Topic 7); followed by final remarks (Topic 8).

The centrality of the innovationAccording to Schumpeter (1934), innovation can be conceptualized as the dynamic process in which economic development is driven by the impacts of creative destruction, characterized by new technologies breaking the application of old ones, which would meet the idea of general equilibrium of the economy, according to the proposition of neoclassical theory. Innovation, therefore, would not be just another technical term focused on technological aspects; would also refer to social and economic dimensions (Schumpeter, 1934).

For Drucker (1981), Van De Ven, Polley, Garud, and Venkataraman (1999) and Toivonen and Tuominen (2009), innovation is a system of development and implementation of a novelty, which includes new processes for developing ideas, as well as new technologies and new products, arrangements or processes.

Innovation takes on vital importance in scenarios marked by the importance given to knowledge as a source of value. The expansions of the domestic/external markets, global/local, require precision and definition of the innovative management of which they are part. New markets are created for products and services that involve intensive use of information and communication technology (ICT), and information goods and services are characterized as immaterial (Sveiby, 1998; Tigre, 2006).

Knowledge occupies an increasingly important role in the economy, assuming factors of productive processes more important than land, capital and labor. This concept is less comprehensive than the knowledge economy, because it focuses on information sectors, leaving aside material products, which are also modified by the use of information and knowledge. Many of the traditional economic principles are not adequate for the analysis of the Knowledge Economy, since they were elaborated based on the physical world, in which the potential for the formation of economies of networks and exploration of economies of scope is much more limited (Tigre, 2006).

Information refers to encoded data, whereas knowledge involves tacit aspects, that is, it involves abilities that constitute a Human Capital (HC) of difficult reproduction or codification. Thus, Human Capital is part of a sum of “new” capital, which integrates into Intellectual Capital (Nonaka & Takeuchi, 1997; Stewart, 1998).

The tangible assets long ago ceased to be the measures for the economies of the 20th and 21st centuries. Often, innovations are more impacting than the physical resources of an organization. An innovation can bring great returns and innovative organizations are those that break paradigms to grow and win (Barney & Hesterly, 2006).

The role of investments in science and technology is precisely to leverage the innovation process by ensuring a competitive differential and sustainable sustainability; innovation occurs when an exchange of technologies for new ones is linked to changes in products receiving innovations. An invention becomes innovation when it receives a technological reformulation, or a transformation in its layout – bringing, consequently, competitive differentiation and profits for the organization, according to the concept of (Schumpeter, 1934).

For Barney and Hesterly (2006), a company assumes competitive advantage when it is able to generate greater economic value than its competitors – innovations would be the main initiative that an organization has as a proposal to guarantee such a differential.

The discontinuities experienced in knowledge production cause the replacement of the traditional research model, improving the integrations processed at the disciplinary frontiers, and through them, breaking previously established barriers and causing redefinitions of the limits of the academic disciplines.

In this sense, the Triple Helix (TH) model points to the challenge of knowledge coordination as a role played by institutions involved in the production of knowledge. The main focus is not on their own, but the basic relationship among university, industry and government. We can think of three models from the basic university–industry–government relationship, in the formation of innovation systems (Etzkowitz & Leydesdorff, 2000):

- (i).

In the first, the three instances (university, industry and government) are defined institutionally – the interplay among them occurs through industrial relations, technology transfer and official contracts, and are widely disseminated in developed or developing countries;

- (ii).

In the second, the helixes are defined as different communication systems, consisting of market operations, technological innovation and control of interfaces – interfaces generate new forms of communication linked to technology transfer and constitute an intermediate sphere; and

- (iii).

In the third, the institutional instances of the university, industry, and government, in addition to traditional functions, assume roles of one another – the university has a quasi-governmental role, as a disseminator of knowledge, innovation and local and regional technology.

The models and networks among TH instances are currently the sources of innovation, manifested based on combining results from each instance in isolation. Each instance responds and reconfigures its operational process, maintaining its specific function: academic research, industrial advances, and government economic development policies.

It is possible to observe that organizational innovation arises from this network interaction, and it becomes as important as the physical medium involved in the research. There are incubators and technological parks with an innovative dynamic capable of promoting exchanges of experiences, collaboration, and even the formation of new disciplines. Universities are now functioning as strategic centers in the production of regional development, attracting close to companies with government support. In this way current values and norms would be emerging at the interfaces of TH (Etzkowitz, 2003).

Knowledge managementNonaka and Takeuchi (1997), Edvinsson and Malone (1997), Sveiby (1998), Stewart (1998), Cavalcanti (2001), Tigre (2006) emphasize that we live in a knowledge society, in which Knowledge Management is a complex and multifaceted phenomenon, under a controversial concept whose expression, although widely used, presents different emphases, approaches and interfaces, deserving of a thorough, meticulous and articulated analysis.

Thus, it is reasonable to propose that knowledge exists in advance in the human mind and between minds. Knowledge outside this context is seen as information (Alvarenga Neto, 2008). The shift to the cognitive age has raised the condition of organizational knowledge of something to be eliminated and avoided for something to be accepted and cultivated.

Inconsistencies, polarities, dichotomies and oppositions would not be improper to knowledge, since knowledge encompasses two complementary components, explicit knowledge and tacit knowledge (Takeuchi & Nonaka, 2008).

Each individual creates knowledge in a unique and personal way, resulting from the paradigms of the individual with the data provided by the environment in which it is. In this way, it is almost impossible that when two or more distinct people receive the same information, they create the same knowledge (Setzer, 1999).

According to Sveiby (1998), practical knowledge is largely unspoken. It is a knowledge that does not allow codification and is difficult to share. Polanyi (1967) defines tacit knowledge as personal and non-transferable, context-specific, and thus difficult to formulate and communicate.

Choo (1998) adds that tacit knowledge is “implicit, used by the members of an organization to do their work and build the meaning of their worlds.” It also states that it is “non-codifiable” knowledge that is difficult to disseminate and is vital for organizations, since innovations only occur through the development of the implicit knowledge of the people who are embedded in an organization.”

Nonaka and Takeuchi (1997) argue that explicit or codified knowledge refers to knowledge transmissible through systematic and formal language. For these authors, to an ontological point of view, knowledge exists only in the individual and it is inherent, being created by individuals.

According to Nonaka and Takeuchi (1997), organizational knowledge would be the set of knowledge created by a group of individuals within an organization, using contextual conditions: collective interaction, expressed in words, numbers,” or even in sounds, always shared in the form of data, manuals, audiovisual and scientific formulas.

For Stewart (1998), the knowledge-driven company travels at the speed of light. The steel, previously used as an accounting calculation asset, today is outperformed by software systems. Today, a simple popular car has more intangible value added to its final price than the steel used in its production.

Managers began to undertake information dissemination tasks, that is, process and transmit information, and no longer delegate to people what to do and how to do and how to ensure the execution of the proposed work (Nonaka & Takeuchi, 1997). This Human Capital of organizations carries an enormous amount of knowledge. This knowledge lies not only within organizations, but also in other business sectors.

An example of this is the case of the Brazilian Agricultural Research Company EMBRAPA, which develops research in the field with a variety of genetically modified fruits that are more resistant to the tropical diseases that attack production in Brazil. In addition to being more resistant, fruits do not lose their flavor – therefore, production increases along with profitability. Nowadays, in the global market economy, fruits result of knowledge and technology rather than from growing strength. Knowledge is thus the new engine of economics (Cavalcanti, 2001).

In the times of the internet where everything is connected and the speed of transmission of information is high, knowledge is the great driver of new business, and organizations that retain knowledge have a great differential over others. For Cavalcanti (2001), it is unlikely to find a single sector of a company or organization that has not made or makes use of the information, or has not become dependent on knowledge, either to attract new customers, manage inventories and production, or to channel your distribution network. This enormous amount of information that is dumped daily in organizations is often not used or converted into knowledge. Companies that can translate this information into knowledge often become distributors of information (Nonaka & Takeuchi, 1997).

Intellectual capital and intangible assetsStewart (1998) was one of the first contemporary scholars to propose a more precise conceptualization on the essence of Intellectual Capital: the sum of all the knowledge of the employees of a company that, articulated, create value and, consequently, wealth. This new way of managing and creating tangible and intangible assets derives from knowledge, intellectual resources, individual or group skills, which, cumulatively, create resources responsible for the success, growth and increase of the competitive differential of organizations, thus guaranteeing their survival.

The tangible word comes from the Latin tangere, which means ‘to touch’, and denotes what can be possessed or realized. Tangible assets consist of the physical assets of an organization, such as inventory, land and buildings. In contrast, intangible goods, besides being unable to be touched or seen, would be devoid of physical matter, that is, they have economic value, but they do not have physical matter (Stewart, 1998).

The last decades show gradual changes in the society that culminated in the process of globalization. The advances made in the technological area of production, information technology and telecommunications, as well as in other areas, give rise to new ways of perception and appreciation of society as a whole. In this way, significant changes in the world economy have been observed by several scholars (Edvinsson & Malone, 1997; Edvinsson, 2003; Price et al., 2013) as the period of transition from an industrial society to a knowledge society. Thus, to the existing resources, and until then valued and used in production – land, capital and labor – is added knowledge, and these changes, mainly, the economic model of the nations, especially the way of valuing the human being.

Knowledge has gradually changed the value of organizations, as the use of this resource in practice, coupled with the use of available technologies and created to serve in a globalized environment, creates intangible benefits that embody value to organizations.

The appropriation – demonstration, measurement and disclosure – of this set of intangible benefits is assigned the title of Intellectual Capital (IC). The concept directs the need to adapt the strategies, a new management approach and new ways of measuring the value of the company that appreciate the resources of knowledge. According to Rodríguez and Díaz (2004), the initial and classic definition that emerged in the last decade of the 20th Century considers IC to be the difference between the share market value – manifested, for example, in the capital market – and the equity share accounting value.

The traditional business accounting considers that one of its main initial objectives is to determine the economic and financial result of an organization, a characteristic that remains strong until today. However, we know that much has been said recently that accounting reports do not depict certain organizations realities: sometimes the book value of the stock is well below its market value, suggesting a failure of accounting to deal with the new value criteria of society (Stewart, 1998; Sveiby, 1997).

Edvinsson and Malone (1997) propose that IC should fill this gap and be the arithmetical measure of all the main components at play. Intellectual Capital in a company can be perceived by the market around them, but not by books; it does not consist in the sum of the parts, but in the way the parts interact with each other (Bhartesh & Bandyopadhyay, 2005).

Flamholtz (1985), Sveiby (1997), Kaplan and Norton (1997), Edvinsson and Malone (1997), Stewart (1998), Lev (2001) and Boulton et al. (2001), have argued that the creation of wealth in organizations, shows, over time, more related to intangible assets or intellectual assets.

Sveiby (1998) conceptualized as intangible assets in the same direction as Stewart called Intellectual Capital (IC). The value of these assets, according to the author, only appears indirectly in the stock market or when the company is sold, being contained in the difference between the market value and the book value.

We observe that Intellectual Capital and Intangible Assets are strategic factors for creating and quantifying value to organizations. Researchers in the area have as objective to map the best way to retain, create, transform Intellectual Capital into financial return for organizations, thus ensuring a competitive differential and, consequently, its sustainability.

The value drivers – both stocks and flows – based on the roots and mainstream IC literature are: Human Capital (HC), Structural Capital (SC) and Relational Capital (RC), complemented by the Financial Capital (FC) (Edvinsson & Malone, 1997; Stewart, 1998; Sveiby 1997).

The MCTI and the research unitsThe basic and instrumental areas of science, technology and innovation are coordinated today in Brazil by the Ministry of Science, Technology and Innovation (MCTI). Until the 1970s, the area of science did not have ministerial responsibility, being subordinated to the Ministry of Planning, and its coordination was the responsibility of the CNPq National Research Council, now the National Council of Scientific and Technological Development.

The first attempts to integrate national science and technology actions took place when the Ministry of Planning created the Program for Support to Scientific and Technological Development (PADCT), covering the four main development agencies of the country: CNPq, FINEP Studies and Projects Agency, CAPES Coordination for the Improvement of Higher Education Personnel and the STI Secretariat of Industrial Technology. The purpose of PADCT was to test methodologies for project planning, evaluation and execution, and integrating the common actions of the four agencies.

Members of the scientific and political community, including Minister Renato Archer, mobilized and referred to the first New Republic government proposal that was accepted by President Tancredo Neves and put into practice by his successor, President José Sarney through Decree 91146, in March 15, 1985, establishing the competencies of the PADCT: (i) national policy of scientific research, (ii) technology and innovation; (iii) planning, coordination, supervision and control of science and technology activities; (iv) software development and automation policy; (v) national biosafety policy; (vi) space policy; (vii) nuclear policy; and (viii) control of sensitive goods exports.

In order to perform the aforementioned activities, the MCTI has a complex structure divided into: (i) direct and immediate assistance agencies to the minister of state; (ii) specific singular organs; (iii) research units; (iv) decentralized units; (v) collegiate bodies; and (vi) related entities.

Facing this matrix and decentralized structure, the MCTI adopts as a central mechanism for management the terms of management commitment (TCG), which consist of agreements signed between the MCTI and each unit, establishing goals, translated into agreed indicators.

The TCG comprises four major elements, in addition to the contractual text signed among the UP: (i) strategic objectives (mission guidelines, operational directives, administrative and financial guidelines); (ii) assumptions (for compliance with TCG); (iii) indicators (physical, operational, administrative and financial, of human resources and their respective technical concepts); and (iv) performance evaluation procedures (conducted through a follow-up committee that meets with managers and coordinators to follow up on the goals and suggest possible course corrections in management).

The performance of the UP, compared to the commitments made annually in the TCG, is monitored every six months and evaluated annually by the assessment of the agreed targets and indicators.

Performance evaluation is based on national, focal and institutional indicators, grouped by key areas and followed up by assigning a score (from zero to ten) representing the achievement of the goal and a final concept, obtained by weighted across six categories ranging from “poor” to “excellent” overall performance.

The performance appraisal system comprises:

- a)

Physical and operational metrics:

- •

Amount and index of publications;

- •

General publication index;

- •

International cooperation programs, projects and actions;

- •

National cooperation programs, projects and actions;

- •

Process index and techniques developed; and

- •

Index of basic research projects developed.

- •

- b)

Administrative-financial metrics:

- •

Available resources for research and development;

- •

Percentage of own revenue; and

- •

Index of budget execution.

- •

- c)

Human resources metrics:

- •

Training and development;

- •

Percentage of fellows; and

- •

Percentage of outsourced personnel.

- •

- d)

Measure of social inclusion: introduced in 2003, have to be improved because of the difficulty in coming together on the design of social inclusion in the context of the actions and consequences of the advance of scientific and technological knowledge, being a free indicator and located according to the understanding of each UP.

- e)

End categorization: general concept given by the evaluators in view of the mutual comparison between goals and results achieved.

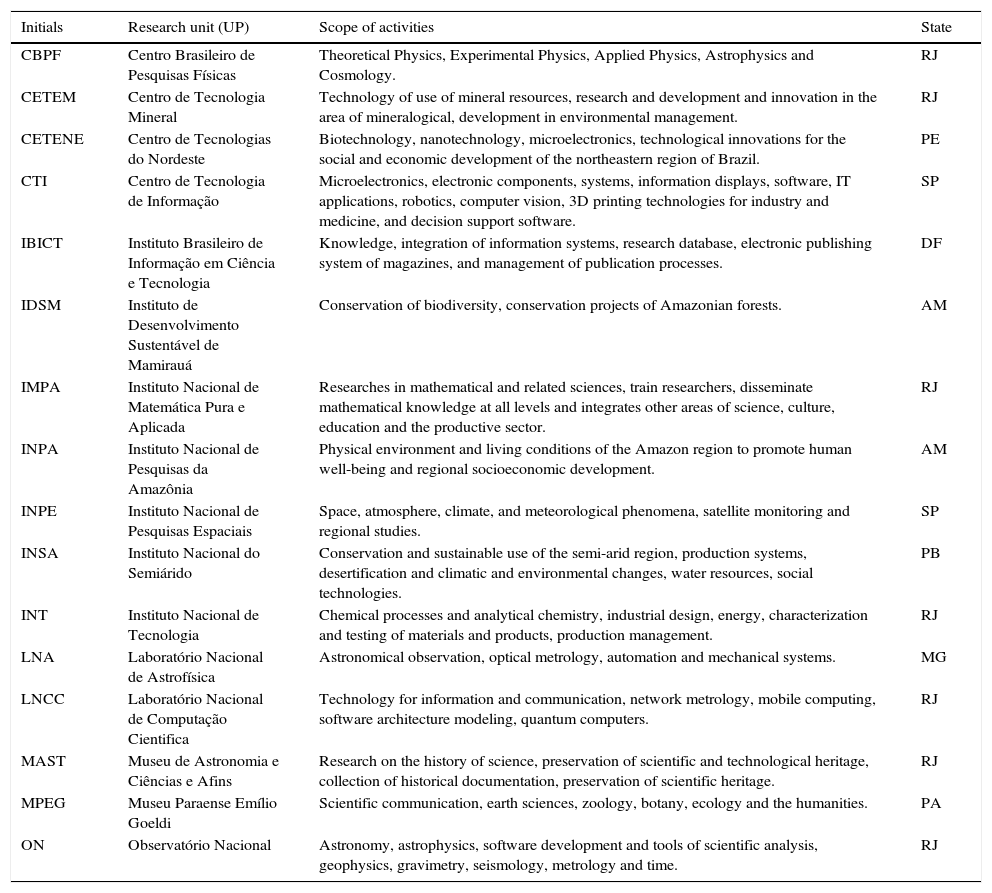

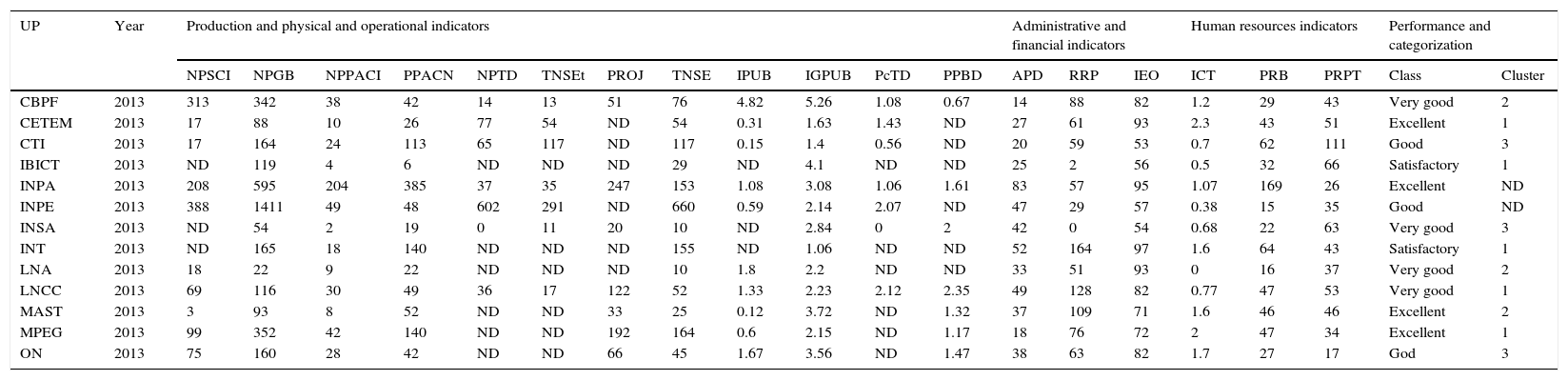

Appendix 2 presents a synthetic overview with outcome indicators for the year 2013.

ConjecturesIn order to unfold the research question, assumptions and hypotheses were formulated from the literature review, leading to the constitutive and operational definition of variables and constructs related to the theoretical clipping on Knowledge Management, Intellectual Capital, Intangible Assets, Value Creation and Innovation Management.

From the studies of Neves and Travalloni (2010), Caldas (2010), Veronese (2006), Ubeda and Santos (2008), de Almeida Santos and de Moraes (2013), Albuquerque and Bonacelli (2011), Gubiani (2011), we argue that MCTI Research Units have as common purpose and reason for existence – core value proposition – the development of pure and applied knowledge in science and technology, for the improvement of economic sectors, regions and economy of the Country and society as a whole. The process of innovation based on the different knowledge and skills held in each UP is the result of the combination of resources under the management of these organizations – assets – with the predominance of those of an intangible nature.

So, we formulated Assumption 1 – [A1] the interaction of tangible and intangible assets provokes and enhances the creation of value, especially in situations involving knowledge management, with specific purpose of creating innovation – and respective Hypothesis 1 – [H0,1] there is no mutual dependence among the various expressions of Intellectual Capital for value creation and innovation management: (i) HC×SC; (ii) HC×RC; (iii) HC×IC; (iv) HC×Value Creation; (v) HC×Innovation Management; (vi) EC×RC; (vii) EC×IC; (viii) SC×Value Creation; (ix) EC×Innovation Management; (x) RC×IC; (xi) RC×Value Creation; (xii) RC×Innovation Management; (xiii) IC×Value Creation; and (xiv) IC×Innovation Management.

We adopt as protocol to test H0,1 the following procedures: (i) Constitutive and operational definition of the variables and constructs from the questionnaire; (ii) Consolidation of the questionnaire data; (iii) Identification of missing data and incomplete cases; (iv) Identification of discrepant cases (maintained); (v) Computation of the descriptive statistics of the variables FREQUENCIES (STDDEV MINIMUM MAXIMUM MEAN MEDIAN SKEWNESS SESKEW KURTOSIS SEKURT HISTOGRAM NORMAL); (vi) Computation of the constructs and their descriptive statistics, normality and reliability: EXAMINE; RELIABILITY; and (vii) Testing of significance of parametric and non-parametric correlations between computed constructs: NONPAR CORR.

The expected results for testing H0,1 are (i) Refutation of H0,1a, up to H0,1n – indicating the existence of a positive and significant correlation among the constructs or dimensions that express the Intellectual Capital; and (ii) Refutation of H0,1g, H0,1h, indicating the existence of a positive and significant correlation between Intellectual Capital, Value Creation and Innovation Management.

From the studies of Albuquerque (1996), Barbosa and Gomes (2002), Mendonça (2005), Stoeckicht and Soares (2009), Souza (2012), Queiroz and Cavalcante (2012) we argue that Perceptions about value creation from the dimensions of Intellectual Capital and Intangible Assets are conditioned by the context in which management effectively develops, since, even in an organizational environment where there is a value proposition common to all of the studied population, it is reasonable Consider the dependence on traits and factors that are linked to the trajectory and the moment of each entity.

So, we formulated Assumption 2 – [A2] Perceptions about value creation and management derive and depict components intrinsic to each organization, but from a population viewpoint it is possible to use the theoretical framework of Intellectual Capital Management and Intangible Assets to establish – empirically – differences and, consequently, taxonomies of the UP – and respective Hypothesis 2 – [H0,2] There are no differentiated hierarchical clusters of UP based on the dimensions Human Capital, Structural Capital, Relationship Capital and Financial Capital.

We adopt as protocol to test H0,2 the following procedures: (i) Computation of the hierarchical groupings by the Ward method, based on the Euclidean distance between the constructs linked to each subject: CLUSTER; (ii) Perform Variance Analysis tests for each construct in the identified groups: ANOVA; (iii) Performing Multivariate Analysis of Variance tests for all constructs in the identified groups: MANOVA; (iv) Computation of the descriptive statistics of the variables in each hierarchical grouping: SUMMARIZE; (v) Performance of non-parametric tests of mean differences of variables and constructs in the identified groups: MEANS TABLES; NPAR TESTS (M-W); (vi) Tabulation of observations according to hierarchical groupings of the dimensions of Intellectual Capital and Innovation Management: CTABLES.

The expected results is the refutation of H0,2 – pointing out the existence of at least three hierarchical clusters capable of classifying the UP according to the dimensions of value creation, with statistical significance.

Methodological proceduresThis study discusses, from a functionalist and descriptive approach (Vergara, 2009), the perception about the presence of Intellectual Capital and the interaction dynamics of these drivers for the transformation and creation of value in UP.

The research adopts the quantitative approach to identify: (i) the extension of the perception of Intellectual Capital by the directors and managers of the UP; (ii) the recognition of the intangible assets inserted in the UP and their form of conversion for the creation of value; and (iii) if it occurs, what is the perception regarding the management of the innovations developed by the UP.

According to Gil (2002), researchers “working on numbers” would be able to obtain accurate information, make analyzing and express their opinions to the limit of generalization.

Regarding the research approach, we can characterize it as being a bibliographical and field study (Vergara, 2009). The bibliographic study addresses the theoretical reference about Intellectual Capital, Intangible Assets and Knowledge Management, addressing the field research, data collection of the questionnaires made available via e-mail to the administrators commissioned at the Research Units of the Ministry of Science, Technology and Innovation (MCTI).

The sample used is non-probabilistic and chosen for accessibility; thus, and due to the response rate, we did not use statistical procedures to select subjects.

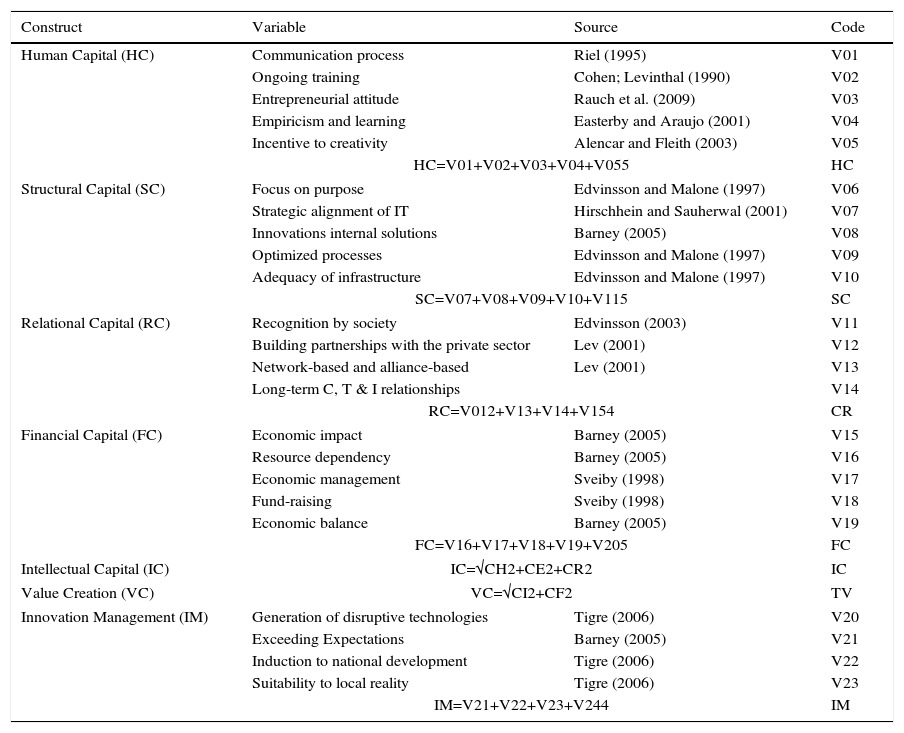

From the arguments proposed, for example, by Edvinsson (2003), Mertins, Alwert, and Will (2006), Joshi and Ubha (2009), Martins (2009), Price et al. (2013) and those anticipated in Edvinsson and Malone (1997), Stewart (1998), Sveiby (1998), Bontis (1998), Lev (2001) and Kayo (2002), we selected metrics – variables and constructs (Table 1) – to characterize subjects’ impressions regarding concepts and practices of Knowledge Management, Intellectual Capital and Intangible Assets applied to the UP.

Constitutive and operational definition of variables and constructs.

| Construct | Variable | Source | Code |

|---|---|---|---|

| Human Capital (HC) | Communication process | Riel (1995) | V01 |

| Ongoing training | Cohen; Levinthal (1990) | V02 | |

| Entrepreneurial attitude | Rauch et al. (2009) | V03 | |

| Empiricism and learning | Easterby and Araujo (2001) | V04 | |

| Incentive to creativity | Alencar and Fleith (2003) | V05 | |

| HC=V01+V02+V03+V04+V055 | HC | ||

| Structural Capital (SC) | Focus on purpose | Edvinsson and Malone (1997) | V06 |

| Strategic alignment of IT | Hirschhein and Sauherwal (2001) | V07 | |

| Innovations internal solutions | Barney (2005) | V08 | |

| Optimized processes | Edvinsson and Malone (1997) | V09 | |

| Adequacy of infrastructure | Edvinsson and Malone (1997) | V10 | |

| SC=V07+V08+V09+V10+V115 | SC | ||

| Relational Capital (RC) | Recognition by society | Edvinsson (2003) | V11 |

| Building partnerships with the private sector | Lev (2001) | V12 | |

| Network-based and alliance-based | Lev (2001) | V13 | |

| Long-term C, T & I relationships | V14 | ||

| RC=V012+V13+V14+V154 | CR | ||

| Financial Capital (FC) | Economic impact | Barney (2005) | V15 |

| Resource dependency | Barney (2005) | V16 | |

| Economic management | Sveiby (1998) | V17 | |

| Fund-raising | Sveiby (1998) | V18 | |

| Economic balance | Barney (2005) | V19 | |

| FC=V16+V17+V18+V19+V205 | FC | ||

| Intellectual Capital (IC) | IC=√CH2+CE2+CR2 | IC | |

| Value Creation (VC) | VC=√CI2+CF2 | TV | |

| Innovation Management (IM) | Generation of disruptive technologies | Tigre (2006) | V20 |

| Exceeding Expectations | Barney (2005) | V21 | |

| Induction to national development | Tigre (2006) | V22 | |

| Suitability to local reality | Tigre (2006) | V23 | |

| IM=V21+V22+V23+V244 | IM | ||

The drivers constructs (HC, SC, RC and FC) followed the mainstream logic of additive scales to point out IC dimensions and value creation (Edvinsson & Malone, 1997; Edvinsson, 2003; Stewart, 1998) and the resultant constructs (IC, VC, IM) followed, since they are product of combined axis, vector operationalization (Rezende, 2006).

The sample reached 13 UP, covering 52 respondents, of whom we obtained 40 validated answers, totaling 70% of subjects. Data collection was performed through an electronic questionnaire with propositions (survey), applied via e-mail.

Selltiz et al. (1965) argue that the survey has some advantages, such as the fact that it is a less costly technique and that the application does not require so much skill of the researcher. In addition, it can be applied at the same time to a large number of people, it provides certain uniformity in the measurement of data, and it ensures greater trust among respondents, to guarantee anonymity and to make less pressure for an immediate response, allowing subjects to careful respond questions.

From the first to the fifth block of the survey, we adopt a six-point Likert Scale – from total disagreement to total agreement (Kerlinger, 1964; Moreira & Nogueira, 1997). This choice supports a statistical model that, with an ordinal observable metric that has already been used to characterize agreement in relation to the propositions about strategic alignment (Rezende, 2014) – positioning the subject's perception before the phenomenon, to ascertain the level of implementation in the evaluation and management of Intellectual Capital and Intangible Assets. The sixth block characterizes the sample subjects.

The field research begun after a contact made with the Secretariat of the Coordination of the UP in the MCTI (SCUP), by means of e-mail, in which we requested the collaboration to carry out the study, being defined that the authorization would leave the direction of each unit, through the epistolary formalization of the university, explaining the reason for the research and the content of the proposed work.

Once adjusted, the electronic addresses of the managers of the UP for presentation contact were provided by SCUP, in which they were clarified: (i) the basis of this investigation; (ii) the motive and the content of the research; (iii) implications expected for academia and society as a whole; and (iv) the possible results. Appendix 2 lists the MCTI Research Units, some of them headquartered in Rio de Janeiro and, therefore, received field visits to make possible more understanding of the activities in charge of UP and how they deal with value creation.

The survey would reach up to 64 possible respondents, but we did not get a positive response from the following institutes: (i) IDSM did not respond to any contact made by e-mail and telephone; (ii) INPA claimed that the content of the research was outside the field and the responding authority of the indicated subjects; and (iii) INPE understood that because it was a space research agency, it could not participate in the government's policy of access to information.

From the epistemological and the ontological point of view, the perception of the managers of the UP – that is, in what way they manifest themselves in relation to the presence of the phenomenon of management of Intellectual Capital within the respective UP delimited the research.

The respondent completed the electronic questionnaire, sending it for tabulation in a spreadsheet, observing a window of 60 days for application. Data processing and analysis were performed using the IBM SPSS version 20.0 application.

Findings and discussionAccording to the data of the sample the subjects of the study have the following profile:

- •

53.8% of the sample is in the State of Rio de Janeiro, and the remaining 46.2% were divided into six other States of the Country (DF, MG, PA, PB, PE, and SP).

- •

Most respondents are male professionals (72.5%).

- •

17.5% are directors of UP and 82.5% are coordinators.

- •

The mean age found in the subjects were 50 years and 6 months.

- •

The schooling of the interviewees reveals 62.5% with a PhD degree, 20% of the Master degree; And 17.5% with graduation, expected distribution for S & T professionals – the concentration of professionals with only graduation refers to administrative coordination.

- •

As for training itself, typical courses of S & T – Engineering (22.5%), Physics (20%) and Mathematics (15%) predominate. The subjects’ postgraduate studies are concentrated in Management (25%), Engineering (15%) and Physics (12%).

- •

Almost one-third of the sample (32.5%) have been working in UP for more than 20 years.

- •

With regard to working time in the current position in the UP, the findings show that 70% of the respondents are in the management position less than four years; 17.5% are managers between four and eight years.

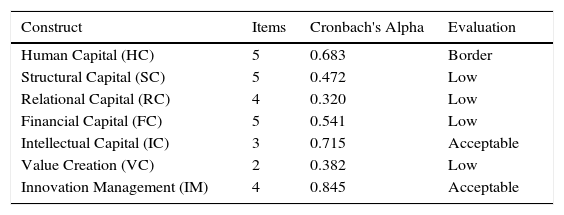

Table 2 depicts the results of the reliability tests of the computed constructs, based on the Cronbach's Alpha, a measure aimed at estimating the internal consistency of a construct calculated from the variance of the individual items and the variance of the sum of the items of all questionnaires using the same measurement scale. In general, Cronbach's Alpha is considered acceptable from 0.70 (Hair, Babin, Money, & Samouel, 2005).

Reliability of constructs.

| Construct | Items | Cronbach's Alpha | Evaluation |

|---|---|---|---|

| Human Capital (HC) | 5 | 0.683 | Border |

| Structural Capital (SC) | 5 | 0.472 | Low |

| Relational Capital (RC) | 4 | 0.320 | Low |

| Financial Capital (FC) | 5 | 0.541 | Low |

| Intellectual Capital (IC) | 3 | 0.715 | Acceptable |

| Value Creation (VC) | 2 | 0.382 | Low |

| Innovation Management (IM) | 4 | 0.845 | Acceptable |

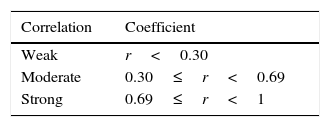

In face of the number of observations and subjects, we chose the nonparametric Spearman test for absolute correlation, adopting as parameters the limits presented in Table 3, in analogy to Pearson's coefficients.

Pearson's correlation intensity.

| Correlation | Coefficient |

|---|---|

| Weak | r<0.30 |

| Moderate | 0.30≤r<0.69 |

| Strong | 0.69≤r<1 |

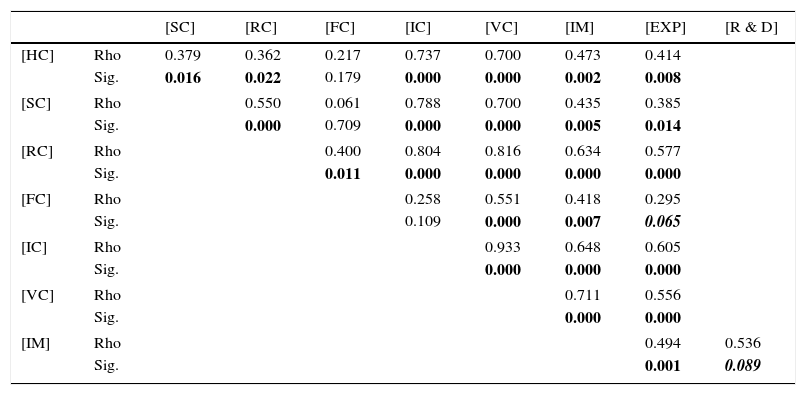

Taking into account the reliability found and the conjectures A1 plus H0,1, we compute the Rho correlation coefficients of the investigated constructs in order to describe relations of interdependence (Table 4) – the coefficients and values of p are represented next to the arrows.

Interaction among the researched constructs.

| [SC] | [RC] | [FC] | [IC] | [VC] | [IM] | [EXP] | [R & D] | ||

|---|---|---|---|---|---|---|---|---|---|

| [HC] | Rho | 0.379 | 0.362 | 0.217 | 0.737 | 0.700 | 0.473 | 0.414 | |

| Sig. | 0.016 | 0.022 | 0.179 | 0.000 | 0.000 | 0.002 | 0.008 | ||

| [SC] | Rho | 0.550 | 0.061 | 0.788 | 0.700 | 0.435 | 0.385 | ||

| Sig. | 0.000 | 0.709 | 0.000 | 0.000 | 0.005 | 0.014 | |||

| [RC] | Rho | 0.400 | 0.804 | 0.816 | 0.634 | 0.577 | |||

| Sig. | 0.011 | 0.000 | 0.000 | 0.000 | 0.000 | ||||

| [FC] | Rho | 0.258 | 0.551 | 0.418 | 0.295 | ||||

| Sig. | 0.109 | 0.000 | 0.007 | 0.065 | |||||

| [IC] | Rho | 0.933 | 0.648 | 0.605 | |||||

| Sig. | 0.000 | 0.000 | 0.000 | ||||||

| [VC] | Rho | 0.711 | 0.556 | ||||||

| Sig. | 0.000 | 0.000 | |||||||

| [IM] | Rho | 0.494 | 0.536 | ||||||

| Sig. | 0.001 | 0.089 | |||||||

Bold-italic values indicate p<0.10.

Bold values indicate p<0.05.

Table 3 consolidates the tests of the hypotheses H0,1a; H0,1b; H0,1c; H0,1d; H0,1e; H0,1f; H0,1g, H0,1h; H0,11; H0,1j; H0,1k; H0,11; H0,1m; H0,1n, pointing:

- (i)

The existence of a moderate correlation between the constructs Human Capital and Intellectual Capital, leading to the refutation of H01,c;

- (ii)

The existence of strong correlation between Human Capital and Value Creation, leading to the refutation of H01,d;

- (iii)

The existence of strong correlation between Structural Capital and Intellectual Capital, leading to the refutation of H0,1g;

- (iv)

The existence of strong correlation between Structural Capital and Value Creation, leading to the refutation of H01,h.

The inclusion of constructs that express Financial Capital and with the previous experience of the subjects on conceptual and instrumental issues related to the Knowledge Management and Intellectual Capital complement the initial model, synoptically results presented in Table 4. We also test correlation among all TCG metrics and Innovation Management, obtaining just indiciary result on the interdependence of R & D available results and the proposed IM construct.

Differentiated perceptions about value creation based on intangible driversAssumption A2 and the underlying assumptions were tested by similarity and dissimilarity among the constructs HC; SC; RC; FC – measures based on Euclidean distance in a multidimensional space. The observations were grouped, leading to the identification of three hierarchical clusters with five, three and five cases: (i) Cluster 1: LNA. CBPF, MAST; (ii) Cluster 2: INT, LNCC, IBICT, CETEM, MPEG; and (iii) CTI, IMPA, INSA, ON.

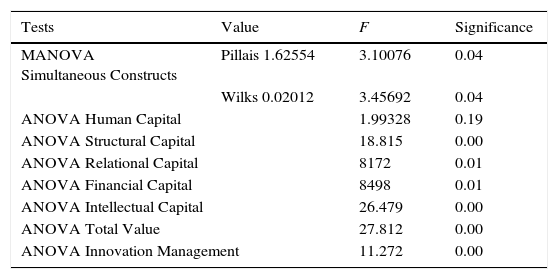

The MANOVA procedure (Table 5), Multivariate Analysis of Variance, confirms the robustness of the hierarchical clustering, implying in the refutation of H0,2, for p<0.05, since there are at least two distinct clusters when hierarchized from the constructs HC, SC, RC, FC (Table 4). Individually the constructs also presented differentiated patterns in each of the groupings, for p<0.05.

Tests of multivariate and univariate analysis of variance.

| Tests | Value | F | Significance |

|---|---|---|---|

| MANOVA Simultaneous Constructs | Pillais 1.62554 | 3.10076 | 0.04 |

| Wilks 0.02012 | 3.45692 | 0.04 | |

| ANOVA Human Capital | 1.99328 | 0.19 | |

| ANOVA Structural Capital | 18.815 | 0.00 | |

| ANOVA Relational Capital | 8172 | 0.01 | |

| ANOVA Financial Capital | 8498 | 0.01 | |

| ANOVA Intellectual Capital | 26.479 | 0.00 | |

| ANOVA Total Value | 27.812 | 0.00 | |

| ANOVA Innovation Management | 11.272 | 0.00 | |

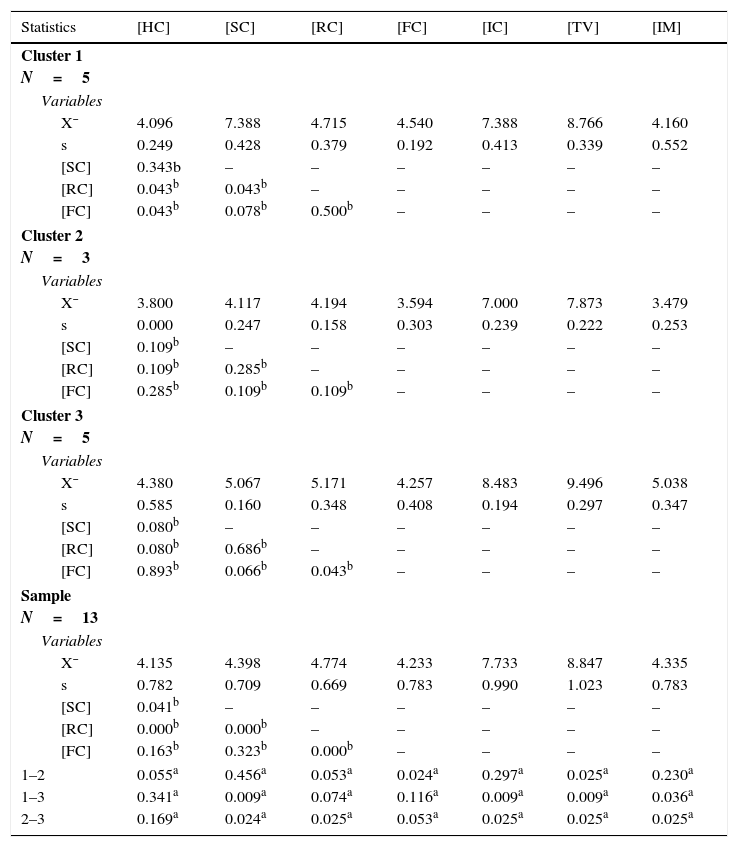

We can affirm, as shown in Table 6, that in six of the seven constructs analyzed there is a difference of the groupings when highlighted: (i) Structural Capital for clusters 1 versus 3 and 2 versus 3; (ii) Relational Capital for paired clusters 2 and 3; (iii) Financial Capital for paired clusters 1 and 2; (iv) Intellectual Capital for clusters 1 versus 3 and 2 versus 3; (v) Value, for all pairings (1, 2 and 3); and (vi) Innovation for paired clusters 1 and 3 and for 2 and 3, and a 95% confidence interval was observed.

Statistics and mean differences in clusters.

| Statistics | [HC] | [SC] | [RC] | [FC] | [IC] | [TV] | [IM] |

|---|---|---|---|---|---|---|---|

| Cluster 1 N=5 | |||||||

| Variables | |||||||

| X¯ | 4.096 | 7.388 | 4.715 | 4.540 | 7.388 | 8.766 | 4.160 |

| s | 0.249 | 0.428 | 0.379 | 0.192 | 0.413 | 0.339 | 0.552 |

| [SC] | 0.343b | – | – | – | – | – | – |

| [RC] | 0.043b | 0.043b | – | – | – | – | – |

| [FC] | 0.043b | 0.078b | 0.500b | – | – | – | – |

| Cluster 2 N=3 | |||||||

| Variables | |||||||

| X¯ | 3.800 | 4.117 | 4.194 | 3.594 | 7.000 | 7.873 | 3.479 |

| s | 0.000 | 0.247 | 0.158 | 0.303 | 0.239 | 0.222 | 0.253 |

| [SC] | 0.109b | – | – | – | – | – | – |

| [RC] | 0.109b | 0.285b | – | – | – | – | – |

| [FC] | 0.285b | 0.109b | 0.109b | – | – | – | – |

| Cluster 3 N=5 | |||||||

| Variables | |||||||

| X¯ | 4.380 | 5.067 | 5.171 | 4.257 | 8.483 | 9.496 | 5.038 |

| s | 0.585 | 0.160 | 0.348 | 0.408 | 0.194 | 0.297 | 0.347 |

| [SC] | 0.080b | – | – | – | – | – | – |

| [RC] | 0.080b | 0.686b | – | – | – | – | – |

| [FC] | 0.893b | 0.066b | 0.043b | – | – | – | – |

| Sample N=13 | |||||||

| Variables | |||||||

| X¯ | 4.135 | 4.398 | 4.774 | 4.233 | 7.733 | 8.847 | 4.335 |

| s | 0.782 | 0.709 | 0.669 | 0.783 | 0.990 | 1.023 | 0.783 |

| [SC] | 0.041b | – | – | – | – | – | – |

| [RC] | 0.000b | 0.000b | – | – | – | – | – |

| [FC] | 0.163b | 0.323b | 0.000b | – | – | – | – |

| 1–2 | 0.055a | 0.456a | 0.053a | 0.024a | 0.297a | 0.025a | 0.230a |

| 1–3 | 0.341a | 0.009a | 0.074a | 0.116a | 0.009a | 0.009a | 0.036a |

| 2–3 | 0.169a | 0.024a | 0.025a | 0.053a | 0.025a | 0.025a | 0.025a |

The subjects of Cluster 3 signaled a higher perception of value creation and innovation results in relation to the subjects of the other UP. In this same cluster, the understanding of all Intellectual Capital drivers (HC, SC and RC) prevails as key resources, with greater differentiation for the perception about the effects of Relational Capital.

In contrast, Cluster 1 stands out due to the perception of the value associated with the management of flows and stocks of Financial Capital. In view of the findings, it was possible to create hierarchies for both the drivers of value creation and innovation within each cluster and among groups (Table 7).

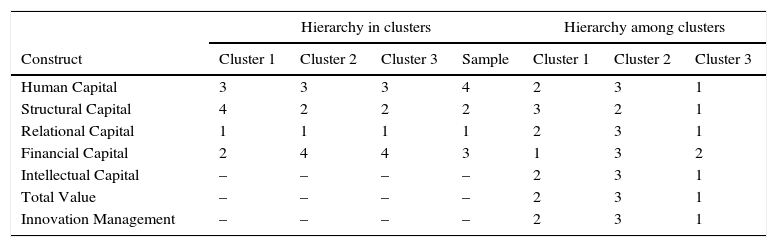

Hierarchy of value drivers.

| Hierarchy in clusters | Hierarchy among clusters | ||||||

|---|---|---|---|---|---|---|---|

| Construct | Cluster 1 | Cluster 2 | Cluster 3 | Sample | Cluster 1 | Cluster 2 | Cluster 3 |

| Human Capital | 3 | 3 | 3 | 4 | 2 | 3 | 1 |

| Structural Capital | 4 | 2 | 2 | 2 | 3 | 2 | 1 |

| Relational Capital | 1 | 1 | 1 | 1 | 2 | 3 | 1 |

| Financial Capital | 2 | 4 | 4 | 3 | 1 | 3 | 2 |

| Intellectual Capital | – | – | – | – | 2 | 3 | 1 |

| Total Value | – | – | – | – | 2 | 3 | 1 |

| Innovation Management | – | – | – | – | 2 | 3 | 1 |

Thus: (i) for the subjects of Cluster 1 the most important driver is Relational Capital and the least important is Structural Capital; (ii) in Cluster 2 the perception is that the most important driver is Relational Capital and the least important is Financial Capital; (iii) Cluster 3 places greater importance on Relational Capital and less on Financial Capital; and (iv) in the sample as a whole, Relational Capital prevails and Human Capital is the one that has the worst evaluation about the contribution in the creation of value.

From the point of view of each driver of value creation and innovation: (i) HC is most appreciated in Cluster 3; (ii) the SC in Cluster 3; (iii) the RC also in Cluster 3; (iv) the FC in Cluster 1; (v) the IC, in view of the higher value given of all the drivers, in Cluster 3; (vi) the creation of value as a whole in Cluster 3; And (vii) the development of innovations also in Cluster 3. Thus, it is reasonable to propose that Cluster 3 would have a more favorable perception of value creation, while Cluster 2 is the most critical in almost all respects.

Final remarksThe main objective of this work was to investigate the perception of managers of the Research Units (UP) linked to the MCTI regarding the drivers of Intellectual Capital and Intangible Assets that interfere in the transformation of knowledge and that interact in the creation of value and in the production of innovation.

The investigation proposed to understand how the UP attaches importance to the variables derived from the literature review and its operationalization in the form of constructs related to the mainstream approach on Intellectual Capital.

The findings allowed the identification of the interdependence of the dimensions of value creation and dissimilarities regarding the perception of the subjects and institutions about variables and dimensions of value creation in UP.

Thus, the hypotheses tested confirmed the existence of significant correlations among the theoretical dimensions, the total value construct obtained vectorially (Rezende, 2006) and the conditioning factors of innovation management (Table 4). The previous experience of the subjects with the conceptual framework inherent in the management of intellectual capital and intangible assets presents a moderate to weak correlation with the dimensions of value creation, probably creating no bias.

From the point of view of the development of Hypothesis 1 – interdependence among value creation drivers – the highest correlation between Relational Capital and Value Creation is highlighted, leading to the belief that the subjects appreciate the effects of knowledge generation and network innovation – the same is true for Innovation Management.

The development of Hypothesis 2 – differentiated perception about the creation of value via intangible drivers – refutes the existence of a common and unified thinking among the PUs on how value creation takes place, with a greater or lesser appreciation of drivers of intangible assets according to the observed UP.

When confronted between the general assessment concept attributed to the MCTI – following indicators present in the agreement of the TCG celebrated with each UP – we verified that there is a certain mismatch between concept emission and metrics, a situation that is repeated when the hierarchical groupings and the attributed evaluation are compared.

Apparently, the managers’ perception does not follow the logic of the TCG adopted by the MCTI, since in this the stratification of the performance of the UP comes from a strong bias in the publication of the production, underlies this logic and metric of evaluation in-process knowledge as the real force of scientific production.

However, since the production of knowledge is subject to scale, scope and network effects, and generating effects on the possibilities of publication it is necessary to take into account the size, age and repercussion of the UP.

On the other hand, it is undeniable that there is sensitive knowledge that should not even be published in view of its strategic nature. In this case, UP those develop sensitive knowledge could be penalized by the current evaluation process.

From the point of view of the academic contribution, we identified that most respondents recognize Intellectual Capital and its importance for the creation of value, evidenced by the results found and ratified with the correlation coefficients.

The UP has ties of cooperation. Even though they are governmental bodies, we can point out that at certain moments they demonstrate to be hybrid organizations, interacting not only with government and with each other, but with industry, selling their services, and with the higher education institutions, collaborating in the training of masters and doctoral students, as well as the model of Etzkowitz and Leydesdorff (2000), which points out continuities in the role played by the institutions that participate in the production of knowledge.

The focus, however, would not be what they play, but the basic relationship between institutions: university, industry, and government.

We could suggest a fourth actor not present in the propositions of the Triple Helix, perhaps not directly interacting with the UP: the Society. It is for her that most scientific productions converge and are converted into value and innovation. One of the goals put by the MCTI for the UP is the reduction of the inequality of the municipalities and states of the country. It is stated in the TCG “the activities of social inclusion”, used as one of the evaluation metrics of the UP. Each unit has the freedom to create activities and social inclusion work with the local community, seeking to insert the communities in the research units, thus showing how important knowledge in the social context.

Visiting the UP, was possible to observe several events with schools in the region, encouraging students to experience “Scientist for a Day” experiences, through experiments aimed at students. For this evaluation there is no metric of punctuation according to the amount of insertion of colleges or scientific events, science fairs and activities directed toward students.

As a managerial contribution, we identified ways for UP's managers see weaknesses within respective structures and to see the constructs of Intellectual Capital and its variables within UP as effective drivers of value creation and innovation magnification. The same occurred as (i) the Financial Capital (FC), in the search for new ways to raise funds for the UP; (ii) for Human Capital (HC), with continuous investments in training and technical training of researchers; (iii) Structural Capital (SC), with the constant improvement of existing processes, and creating strategic alignment aimed at optimizing internal processes and creating new production processes; and (iv) for Relational Capital (RC), with new internal and external partnerships to the Research Units (UP), ensuring interchange with suppliers and potential clients that seek solutions from the institutes, enhancing new investments to ensure the continuity of research in S & T.

With a greater investment in social inclusion, aiming to guarantee a better recognition of society and expanding its networks of alliances to guarantee new partnerships and to re-establish existing ones; and in Innovation Management, continuing the disruptive technologies, thus guaranteeing an overcoming of expectations.

Future studies should cover the interactions between TCG indicators – apparent and surprisingly not yet aligned with the transformation of intangibles into knowledge – and the drivers of Intellectual Capital management.

Ex post facto remarksThe arrival of President Michel Temer in May 2016 brought about changes in the structure of the federal public machine and integrated the communications portfolio into the responsibilities of MCTI – which includes policy formulation and program coordination in the area of electronic technologies and digital technologies applied to information and communications management.

Since such technologies form the basis of the New Economy (Davis & Meyer, 1999; Shapiro & Varian, 1998), it is reasonable to expect that a new organizational configuration (Mintzberg, 1983) of the MCTI will have effects on the form and content of UP, emphasizing the importance of intangibles as drivers of value creation.

Conflicts of interestThe authors declare no conflicts of interest.

| Title | Year | Type | Author(s) | Objective | Link |

|---|---|---|---|---|---|

| National System of Innovation in Brazil: an introductory analysis based on available data on science and technology | 1996 | Paper | Eduardo da Motta e Albuquerque | Discusses questions related to the applicability of the concept of national innovation system to the Brazilian case. | http://www.rep.org.br/pdf/63-4.pdf |

| Quality Indicators for R & D Institutions | 2010 | Paper | Maria Aparecida Stallivieri Neves and Attilio Travalloni | Discusses the adoption of a methodology that introduces indicators for the evaluation of research activities and resumes the discussion about indicators adequate to the profile of the activities of technological research institutions in relation to the specificities. | http://seer.cgee.org.br/index.php/parcerias_estrategicas/article/viewArticle/125 |

| The construction of a legal framework template for Science, Technology and Innovation | 2001 | Paper | Ruy de Araújo Caldas | Addresses legal issues related to S & T management, discusses the intrinsic nature of S & T activity and the peculiarities of the innovation process. | http://seer.cgee.org.br/index.php/parcerias_estrategicas/article/viewPDFInterstitial/162/156 |

| An exploratory study of the managerial control of intangible assets and resources in Brazilian companies | 2002 | Paper | José Geraldo P. Barbosa and Josir Simeone Gomes | Evaluates the importance attributed to its intangible assets/resources in three Brazilian companies in the services sector. | http://www.scielo.br/scielo.php?pid=S1415-65552002000200004≻ript=sci_arttext&tlng=pt |

| Public innovation policies in Brazil: the industry agenda | 2005 | Paper | Maurício Mendonça | Presents the main proposals discussed at the Congress of Innovation in Industry, promoted by the National Confederation of Industry (CNI). | http://seer.cgee.org.br/index.php/parcerias_estrategicas/article/viewFile/269/263 |

| The search for a new management model for science, technology and innovation in MCT policy (1995–2002) * | 2006 | Paper | Alexandre Veronese | Presents how the 1995 administrative reform agenda was incorporated into the goals set by the science policy of the Ministry of Science and Technology (MCT) in the two previous governments (1995–2002). | http://www.scielo.br/pdf/%0D/rap/v40n1/v40n1a06.pdf |

| The main challenges of human competency management in a public research institute | 2008 | Paper | Cristina Lourenço Ubeda and Fernando César Almada Santos | Presents competency management as a differentiated management strategy for people to be used by companies in search of technological innovations. | http://www.scielo.br/pdf/gp/v15n1/a16v15n1 |

| Intellectual Capital, Knowledge Capitals and Innovation: The Importance of Strategic Management of Intellectual Capital in the development of the capacity of Innovation in Brazilian companies | 2009 | Paper | Ingrid Paola Stoeckicht and Carlos Alberto Pereira Soares | Reports capacity to innovate based on a study that addresses 35 companies of various sizes and sectors on practices, systems and models adopted in the management of their Intellectual Capital. | http://www.simpoi.fgvsp.br/arquivo/2009/artigos/E2009_T00237_PCN24453.pdf |

| The production of knowledge and the national politics of research and development (P & D) and science, technology and innovation (C, T & I) | 2010 | Paper | Catarina de Almeida Santos and Karine Nunes de Moraes | Discusses the extent to which the ideology of the “knowledge society” has influenced national policies for Research and Development and for Science, Technology and Innovation. | http://www.gpec.ucdb.br/serie-estudos/index.php/serie-estudos/article/view/165 |

| Model for diagnosing the influence of intellectual capital on the innovation potential of universities | 2011 | MSc Dissert. | Juçara Salete Gubiani | Focuses on the lack of identification and measurement of the components of intellectual capital available in universities, and the diagnosis of their influence on the creation of knowledge for innovation. Proposes a model of analysis, and to verify the consistency of the model, a case study was carried out. | https://repositorio.ufsc.br/handle/123456789/95468 |

| The introduction of the concept of managerial excellence in Brazilian institutes and research centers: the project excellence in technological research | 2011 | Paper | Marconi Edson Esmeraldo Albuquerque and Maria Beatriz Machado Bonacelli | Analyze the movement for managerial excellence in Brazilian ICPs, led by the Brazilian Association of Technological Research Institutions and materialized in the Excellence in Technological Research Project. | http://unicamp.sibi.usp.br/handle/SBURI/26440 |

| Evolution of the budget execution of the Ministry of Science, Technology and Innovation between 2001 and 2010 | 2012 | Paper | Glauber Pimentel de Queiroz and Luiz Ricardo Cavalcanti | Analyzes the evolution of the budget execution of the Ministry of Science, Technology and Innovation throughout the decade of 2000, in order to verify if changes in its composition would reflect more emphasis on the innovation policies. | http://repositorio.ipea.gov.br/handle/11058/1118 |

| Management agreements in the federal public administration: still in transition to a managerial public administration | 2012 | Paper | Regina Luna Santos de Souza | Presents the concept of contractualisation as the procedure for adjusting specific conditions in the relationship between the government and public and private entities or between the government and civil society entities, in which there is negotiation and goal setting of performance. | http://repositorio.enap.gov.br/handle/1/1245 |

| Performance of research units: point for universities | 2015 | Paper | Simon Schwartzman | Points out that autonomy, creativity, qualification, social awareness and tradition are characteristics more found in universities than in research institutes and companies, according to a study carried out in Brazil from guidelines established by Unesco to evaluate the performance of research internationally. | https://www.researchgate.net/profile/Simon_Schwartzman/publication/224771586_Desempenho_das_unidades_de_pesquisa_ponto_para_as_universidades/links/556c411008aeab7772216cc3.pdf |

Source: own elaboration.

| Initials | Research unit (UP) | Scope of activities | State |

|---|---|---|---|

| CBPF | Centro Brasileiro de Pesquisas Físicas | Theoretical Physics, Experimental Physics, Applied Physics, Astrophysics and Cosmology. | RJ |

| CETEM | Centro de Tecnologia Mineral | Technology of use of mineral resources, research and development and innovation in the area of mineralogical, development in environmental management. | RJ |

| CETENE | Centro de Tecnologias do Nordeste | Biotechnology, nanotechnology, microelectronics, technological innovations for the social and economic development of the northeastern region of Brazil. | PE |

| CTI | Centro de Tecnologia de Informação | Microelectronics, electronic components, systems, information displays, software, IT applications, robotics, computer vision, 3D printing technologies for industry and medicine, and decision support software. | SP |

| IBICT | Instituto Brasileiro de Informação em Ciência e Tecnologia | Knowledge, integration of information systems, research database, electronic publishing system of magazines, and management of publication processes. | DF |

| IDSM | Instituto de Desenvolvimento Sustentável de Mamirauá | Conservation of biodiversity, conservation projects of Amazonian forests. | AM |

| IMPA | Instituto Nacional de Matemática Pura e Aplicada | Researches in mathematical and related sciences, train researchers, disseminate mathematical knowledge at all levels and integrates other areas of science, culture, education and the productive sector. | RJ |

| INPA | Instituto Nacional de Pesquisas da Amazônia | Physical environment and living conditions of the Amazon region to promote human well-being and regional socioeconomic development. | AM |

| INPE | Instituto Nacional de Pesquisas Espaciais | Space, atmosphere, climate, and meteorological phenomena, satellite monitoring and regional studies. | SP |

| INSA | Instituto Nacional do Semiárido | Conservation and sustainable use of the semi-arid region, production systems, desertification and climatic and environmental changes, water resources, social technologies. | PB |

| INT | Instituto Nacional de Tecnologia | Chemical processes and analytical chemistry, industrial design, energy, characterization and testing of materials and products, production management. | RJ |

| LNA | Laboratório Nacional de Astrofísica | Astronomical observation, optical metrology, automation and mechanical systems. | MG |

| LNCC | Laboratório Nacional de Computação Cientifica | Technology for information and communication, network metrology, mobile computing, software architecture modeling, quantum computers. | RJ |

| MAST | Museu de Astronomia e Ciências e Afins | Research on the history of science, preservation of scientific and technological heritage, collection of historical documentation, preservation of scientific heritage. | RJ |

| MPEG | Museu Paraense Emílio Goeldi | Scientific communication, earth sciences, zoology, botany, ecology and the humanities. | PA |

| ON | Observatório Nacional | Astronomy, astrophysics, software development and tools of scientific analysis, geophysics, gravimetry, seismology, metrology and time. | RJ |

Source: own elaboration, based on the contents of institutional UP websites.

| UP | Year | Production and physical and operational indicators | Administrative and financial indicators | Human resources indicators | Performance and categorization | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| NPSCI | NPGB | NPPACI | PPACN | NPTD | TNSEt | PROJ | TNSE | IPUB | IGPUB | PcTD | PPBD | APD | RRP | IEO | ICT | PRB | PRPT | Class | Cluster | ||

| CBPF | 2013 | 313 | 342 | 38 | 42 | 14 | 13 | 51 | 76 | 4.82 | 5.26 | 1.08 | 0.67 | 14 | 88 | 82 | 1.2 | 29 | 43 | Very good | 2 |

| CETEM | 2013 | 17 | 88 | 10 | 26 | 77 | 54 | ND | 54 | 0.31 | 1.63 | 1.43 | ND | 27 | 61 | 93 | 2.3 | 43 | 51 | Excellent | 1 |

| CTI | 2013 | 17 | 164 | 24 | 113 | 65 | 117 | ND | 117 | 0.15 | 1.4 | 0.56 | ND | 20 | 59 | 53 | 0.7 | 62 | 111 | Good | 3 |

| IBICT | 2013 | ND | 119 | 4 | 6 | ND | ND | ND | 29 | ND | 4.1 | ND | ND | 25 | 2 | 56 | 0.5 | 32 | 66 | Satisfactory | 1 |

| INPA | 2013 | 208 | 595 | 204 | 385 | 37 | 35 | 247 | 153 | 1.08 | 3.08 | 1.06 | 1.61 | 83 | 57 | 95 | 1.07 | 169 | 26 | Excellent | ND |

| INPE | 2013 | 388 | 1411 | 49 | 48 | 602 | 291 | ND | 660 | 0.59 | 2.14 | 2.07 | ND | 47 | 29 | 57 | 0.38 | 15 | 35 | Good | ND |

| INSA | 2013 | ND | 54 | 2 | 19 | 0 | 11 | 20 | 10 | ND | 2.84 | 0 | 2 | 42 | 0 | 54 | 0.68 | 22 | 63 | Very good | 3 |

| INT | 2013 | ND | 165 | 18 | 140 | ND | ND | ND | 155 | ND | 1.06 | ND | ND | 52 | 164 | 97 | 1.6 | 64 | 43 | Satisfactory | 1 |

| LNA | 2013 | 18 | 22 | 9 | 22 | ND | ND | ND | 10 | 1.8 | 2.2 | ND | ND | 33 | 51 | 93 | 0 | 16 | 37 | Very good | 2 |

| LNCC | 2013 | 69 | 116 | 30 | 49 | 36 | 17 | 122 | 52 | 1.33 | 2.23 | 2.12 | 2.35 | 49 | 128 | 82 | 0.77 | 47 | 53 | Very good | 1 |

| MAST | 2013 | 3 | 93 | 8 | 52 | ND | ND | 33 | 25 | 0.12 | 3.72 | ND | 1.32 | 37 | 109 | 71 | 1.6 | 46 | 46 | Excellent | 2 |

| MPEG | 2013 | 99 | 352 | 42 | 140 | ND | ND | 192 | 164 | 0.6 | 2.15 | ND | 1.17 | 18 | 76 | 72 | 2 | 47 | 34 | Excellent | 1 |

| ON | 2013 | 75 | 160 | 28 | 42 | ND | ND | 66 | 45 | 1.67 | 3.56 | ND | 1.47 | 38 | 63 | 82 | 1.7 | 27 | 17 | God | 3 |

Source: own elaboration, based on the contents of institutional UP websites.

Legend: NPSCI – Number of publications in periodicals, with ISSN, indexed in SCI; NPGB – Total number of publications in periodicals; NPPACI – Number of programs, projects and actions developed in a formal partnership; PPACN – Number of Projects, Research and Actions of National Cooperation; NPTD – Number of processes, prototypes, software and techniques developed in the year, measured by the number of final reports produced; PROJ – Number of projects; TNSE – Number of top level technicians; IPUB – Index of Publications; IGPUB – General Index of Publications; TNSEt – Higher Level Technicians linked to technological research activities (researchers, technologists and scholars), with twelve or more months of work in UP/MCTI completed or to be completed during the TCG; PcTD – Index of Processes and Techniques Developed; PPBD – Index of Basic Research Projects Developed; Guidance Index of Defended Dissertations and Theses; TPTD – Index of Published Papers by Thesis Defended per year at CBPF; PD – Index of Post Docs; PV – Visitor Researcher Index; APD – Application in Research and Development; RRP – Relationship between Own Revenue and OCC; IEO – Budget Execution Index; ICT – Training and Capacity Index; PRB – Relative Participation of Fellows, NTS – Total Number of Servers; PRPT – Relative Participation of Outsourced Personnel.

Note: The “Class” field presents the final framework to UP as assessed by the MCTI; the field “Cluster” presents the hierarchical grouping in which the UP was located from the Euclidean distance between the Intellectual Capital drivers.

Peer Review under the responsibility of Departamento de Administração, Faculdade de Economia, Administração e Contabilidade da Universidade de São Paulo – FEA/USP.