This paper addresses the adequacy of the Local Government financial reporting model for internal decision-making by developing an exploratory empirical study that evaluates internal users’ satisfaction concerning the reporting model within the municipality of Bragança. It additionally examines to what extent internal control and financial reporting information opportunity are important for municipalities’ internal decision-making. In Portugal important developments have recently emerged in public sector accounting systems in the context of internal decision-making and control, hence calling for further studying Local Government current financial reporting model in this context.

From an experimental questionnaire applied to decision-makers of Bragança municipality in 2010, main findings show that the actual reporting model is not the most appropriate in providing information for internal decision-making in that municipality. Moreover, both internal control and opportunity of the financial reporting information seem to have significant importance in the context of internal decision-making.

The reforms in public sector accounting systems, as a consequence of New Public Management (NPM) initiatives, led to the preparation and presentation of a new financial reporting model. The accounting systems in public sector accounting in general, and in the Local Government in particular, have become more informative (as in the case of Portugal). The present concern is to provide more and better information, and to try to satisfy users’ needs through the dissemination of useful and opportune information that would enable them to assess and make decisions in a more rational and logical way.

The new developments in public sector management and accounting, occurred internationally, have also been observed in the Portuguese accounting system, namely in the Local Government, with the publication of the Official Local Government Accounting Plan (POCAL) in 1999. The adoption of the new Local Government accounting system significantly changed the form and content of financial and budgetary statements prepared and disclosed by Portuguese municipalities. The introduction of an accrual basis regime complementing the cash basis regime, the integration of three accounting subsystems (budgetary, financial and cost accounting) and modifications in municipalities’ financial reporting model, are some of the main changes that have occurred in the Local Government accounting system in Portugal.

Even though a considerable passage of time has elapsed since the adoption of accrual accounting, the debate on its usefulness for the public sector, namely for Local Government, still flourishes (e.g., Anessi-Pesina & Steccolini, 2007; Brusca, 1997; Christiaens, 1999, 2001; Cohen, Kaimenakis, & Venieris, 2009; Cohen, 2007, 2009; Lapsley, Mussari, & Paulsson, 2009; Nasi & Steccolini, 2008; Neilson & Gregor, 2007; Steccolini, 2004). The major concern revolves around the usefulness of applying a commercially based accrual accounting system to the Local Government in pursuance of ‘sector neutrality’ (Kober, Lee, & Ng, 2010). Although prior literature has considered the usefulness of accrual accounting in Local Government in different countries, little of this work has been focused in examining the usefulness of the new Local Government reporting for management purposes, especially for decision-making and internal control (e.g., Cohen, 2009; Grossi & Reichard, 2009; Mack & Ryan, 2006; Mack, 2004; Yamamoto, 2008). On the issue of the usefulness of accrual accounting for public sector managerial decision-making, Andriani, Kober, and Ng (2010) say that it is relevant to deliberate how informative accrual accounting is for internal decision-making, but it is also necessary to corroborate this by seeking input from those actively involved in the decision-making processes.

Empirical analyses on the decision usefulness of accrual accounting in the Portuguese Local Government are non-existent. Internationally, very few studies have directly investigated Local Government managers for their perceptions on the usefulness of accrual accounting information disclosed in the Local Government financial reporting, namely in the context of decision-making and internal control. Accordingly, our study wants to extend the research and literature about Portugal by examining the Local Government reporting, through an exploratory empirical analysis. The research is a first approach to Local Government financial reporting in a Portuguese municipality, which will later be extended to all Portuguese municipalities.

In this context, this study develops an exploratory empirical analysis, based on the case of the municipality of Bragança, in the northeast Portugal. The main objectives are to evaluate internal users’ satisfaction concerning Local Government financial reporting model in the context of decision-making within that municipality, as well as to analyse the importance of internal control and the degree of opportunity of financial reporting information.

The paper is structured as follows. Section 2 comprises the literature review regarding accrual-basis in financial reporting usefulness for decision-making in the Local Government. A presentation of the financial reporting model in Local Government in Portugal is found in Section 3. Section 4 describes the research framework and methodology employed, also presenting the main characteristics of the respondents to the survey. Section 5 is devoted to presenting and discussing the main findings. Section 6 finally reviews the conclusions of the study, as well as its limitations.

2Accrual-basis in financial reporting usefulness in the Local GovernmentThe international literature shows that the introduction of accrual-basis in the accounting information systems has been one of the most important trends of public sector accounting recent reforms (Anessi-Pessina & Steccolini, 2007; Brorström, 1998; Chan, 2003; FEE, 2007; Guthrie, 1998; Hyndman & Connolly, 2011; Olson, Humphrey, & Guthrie, 2001; Pallot, 1997; Pina, Torres, & Yetano, 2009).

Accrual accounting has been implemented throughout OECD countries at all levels of government, even in those such as European Continental countries, which have received the NPM doctrine with suspicion (because in these countries the bureaucratic public administration styles concerned with the compliance with legality as their primary rule) (Christiaens & Rommel, 2008; Pina et al., 2009).

In general, the aim of accounting reforms in the public sector, introducing accruals, is the improvement of the information provided to decision-makers, internal control and stakeholders at large. This improvement is a necessary condition for the enhancement of accountability and performance in public sector organisations in view of the key role accounting information plays in decision-making in organisations (Pettersen, 2001). For Guthrie (1998) and Caperchione (2006) accrual accounting reforms have overall been introduced because the information that cash accounting provided was considered to be insufficient, either for transparency and accountability and/or for decision-making. The traditional cash budgetary accounting systems exclusively focusing on inputs have been transformed into output-orientated accrual accounting systems that closely resemble those of the private sector (Broström, 1998; Guthrie, 1998; Hyndman & Connolly, 2011; Torres, 2004).

Literature stresses that accrual accounting has many advantages, which can be grouped and summarised as follows (Anessi-Pessina & Steccolini, 2007; Brorström, 1998; Brusca & Condor, 2002; Chan, 2003; FEE, 2007; Guthrie, 1998; Hyndman & Connolly, 2011; Olson et al., 2001; Pallot, 1997; Pina et al., 2009): (i) it provides the total cost of government programs, activities and services provided; better measurement of costs and revenues; enhancement of control processes and transparency; (ii) greater focus on outputs; focus on the long-term impact of decisions; (iii) more efficient and effective use and management of resources and greater accountability; (iv) reduction and better measurement of public expenditures; (v) better presentation of the financial position of public sector organisations; (vi) better financial management through the improvement of performance measurements and greater comparability of managerial performance; (vii) greater attention to assets and more complete information on public organisations’ liabilities through better assets and liabilities management; and (viii) better quality decision-making in relation to the allocation of available resources.

However, several disadvantages underlying the government accrual accounting are also highlighted, such as (FEE, 2007; Guthrie, 1998; IFAC-IPSASB, 2011c; Paulsson, 2006): (i) the cost of implementation; (ii) increased complexity; (iii) profit orientation; and (iv) low use of the balance sheet information made by decision-makers.

Various researchers have criticised the adoption of accrual-based accounting by public organisations, especially because the particular nature of public entities and the heterogeneity of their activities (e.g., Guthrie, Olson, & Humphrey, 1999; Guthrie, 1998; Hyndman & Connolly, 2011; Lapsley et al., 2009; Wynne, 2008). The doubts about the benefits of adopting accrual-based accounting led some authors to investigate the ‘new’ financial reporting usefulness in the public sector (e.g. Andriani et al., 2010; Bergmann, 2011; Brusca, 1997; Cohen et al., 2009; Cohen, 2009; Grossi & Reichard, 2009; Kober et al., 2010; Mack & Ryan, 2006; Mack, 2004; Neilson & Gregor, 2007; Tayib, Commbs, & Ameen, 1999; Windels & Christiaens, 2008; Yamamoto, 2008). Particularly the studies of Kober et al. (2010) and Andriani et al. (2010) attempted to assess whether accrual accounting information really has any incremental value over cash numbers for decision-making for both internal and external users.

Earlier studies suggest that there was hesitancy in using accrual accounting in public sector. For example, in a study in Northern Ireland government departments, Connolly and Hyndman (2006) found that accrual information was more likely to be used during departments’ discussion at high level management, but was of limited use at operational level. They also found accrual information was considered by operational accountants as having benefit for managing fixed assets, but not necessarily influencing decisions. Similarly, Brusca (1997) on the degree of usefulness that auditors and finance directors of Spanish Local Governments assigned to financial statements and to their items, concludes that financial reporting in Spanish Local Governments can be useful for finance directors, management, audit offices and lenders, but the information provided is not used to its maximum.

Brusca (1997), Askim (2008), Yamamoto (2008), Windels and Christiaens (2008), Cohen (2009) and Grossi and Reichard (2009) have provided evidence that the adoption of new financial reporting models in Local Government, based on business reporting models, is not the most appropriate for decision-making and internal control. For example, Grossi and Reichard (2009), in a study developed in Germany and Italy, found that the incommunicability of higher quality information derived from accrual-based financial statements and the absence of experience with new accounting concepts (based on accruals) are some of the factors that lead financial reporting users to consider the model adopted inadequate to meet their needs in terms of information for decision-making. Brusca (1997), Christiaens (2001), Grossi and Reichard (2009), Paulsson (2006), Askim (2008), Yamamoto (2008), Kober et al. (2010) and Andriani et al. (2010) found that the incomprehensibility of financial information prepared on accrual basis, included in the current financial reporting, might justify its limited use by users in the process of decision-making and therefore evidence financial reporting inadequacy.

However, findings from recent studies by Kober et al. (2010) and Andriani et al. (2010) lead to conclude that the understanding of the relevance of accrual-based information has increased over time, inasmuch as users have learned how to read and interpret this information. The results have additionally allowed concluding that accrual-based information, several years after its introduction in public sector accounting systems, is as attractive to decision-making as information prepared on a cash basis, since users are more familiar with the new information as they have obtained more experience. These results were also verified by Bergmann (2011), through empirical evidence from Switzerland, pointing out that the accounting basis used (accrual versus cash) influences decision-making. However, Kober et al. (2010) stress that the availability of cash information seems to be critical for the acceptance of accrual accounting, in the sense that the latter is accepted as long as the former continues to be provided.

The concept of usefulness of information is widely regarded as accomplishing with several qualitative characteristics of information (Kober et al., 2010). The International Public Sector Accounting Standards Board (IPSASB)1 recommends as key qualitative characteristics of public entities’ financial information, understandability, relevance, reliability and comparability. Although not explicitly establishing any hierarchy between these characteristics, some restrictions are, however, referred as constraints in obtaining relevant and reliable information, while not as being restrictions in obtaining useful information (IFAC-IPSASB, 2011a, IPSAS 1, Appendix A). Relevant and reliable financial information may lose its relevance for decision-making if it is not made available at the appropriate time (timeliness in preparing and disclosing the information). Therefore, opportunity or timing of disclosure2 is a constraint in providing relevant information. Accordingly, when discussing usefulness of financial information one must relate it to relevance. Relevance influences decisions and is eminent in the preparation and presentation of financial information.3 In this context, timely information is given greater utility (Brusca, 1997; Grossi & Reichard, 2009). If, on the one hand, disclosing timely information allows for the making of well-informed decisions and satisfies the needs of decision-makers (Brusca, 1997; Lapsley, 1992), on the other hand it is generally accepted that the quality of financial reporting depends on its opportunity4 and comprehensibility (Ryan, Stanley, & Nelson, 2002). The degree of utilization of financial information for decision-making varies according to their usefulness (Kober et al., 2010; Mack & Ryan, 2006; Mack, 2004; Yamamoto, 2008). Yamamoto (2008) believes that if financial reporting is effective in presenting financial information, it will certainly promote the use of this information by different user groups and, therefore, be appropriate for decision-making.

3Financial reporting model in Local Government in PortugalPortugal, like many other countries, has experienced significant reforms in public sector accounting and reporting over the last three decades. In regards to Local Government, the reforms have been converging with those followed internationally (Jorge, Carvalho, & Fernandes, 2008; Pina et al., 2009) and the landmark was the approval of POCAL in 1999.5 The adoption of a financial reporting model based on business sector reporting (accrual basis regime) in Local Government was one of the key changes introduced by POCAL. Thus, one of the main purposes of this ‘new’ Local Government accounting and reporting system is disseminating useful information for internal decision-making and internal control by municipal leaders (POCAL Introduction), apart from external accountability.

The adoption of the accounting and reporting model under POCAL allowed in Local Government “the consistent integration of budgetary, patrimonial6 and cost accounting in a modern public sector accounting, which is a fundamental instrument to support Local Government management” (POCAL section 3.4.2.2). The objective of the Local Government accounting and reporting system is therefore, apart from accountability and legal conformity control, also to provide timely, useful and reliable information, meeting the needs of different users with regards to, among others, decision-making and internal control.

According to Fernandes (2007), in order for “the accounting information to be useful, it must be reliable and complete, requiring faithful representation of transactions, as well as of the budgetary, economic, financial and patrimonial reality”. As a consequence of the changes in the Local Government accounting system and information requirements, changes in the financial reporting model were inevitable. Thus, Local Government financial reporting was extended, providing information on the economic, financial and patrimonial position (accrual basis) in addition to the budgetary position (cash basis), to enable users’ decision-making7 and allowing for more efficient and rational analyses. Additionally, it allows greater transparency in the use of public financial resources, aiming at maximizing their efficiency, effectiveness and economy.

Within POCAL, particular attention must be called to the importance of the cost accounting subsystem for decision-making by internal users. The information provided by this subsystem is an essential management tool, enabling additional information to municipalities’ management, by calculating costs per functions and determining costs underlying the setting of tariffs and prices. However, it is a fact that the information generated by cost accounting is not a mandatory part of the municipalities’ financial reporting as required by POCAL.8

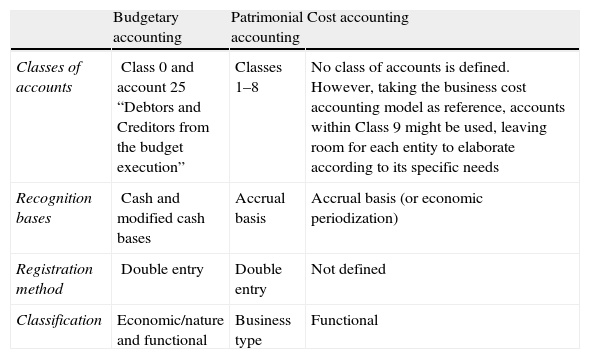

Table 1 summarises POCAL accounting integrated system, referring to classes of accounts, recognition bases, registration method and expenditure/revenue classifications for each of the accounting subsystems.

Local Government accounting and system under POCAL.

| Budgetary accounting | Patrimonial accounting | Cost accounting | |

| Classes of accounts | Class 0 and account 25 “Debtors and Creditors from the budget execution” | Classes 1–8 | No class of accounts is defined. However, taking the business cost accounting model as reference, accounts within Class 9 might be used, leaving room for each entity to elaborate according to its specific needs |

| Recognition bases | Cash and modified cash bases | Accrual basis | Accrual basis (or economic periodization) |

| Registration method | Double entry | Double entry | Not defined |

| Classification | Economic/nature and functional | Business type | Functional |

The local authorities’ needs, reflected in the preparation and disclosure of a greater diversity of information, have led to an increase of their reporting statements. The main statements that, at present, are part of the Local Government financial reporting according to POCAL are presented in Table 2.

Local Government financial reporting according to POCAL.

| POCAL sections | Reporting statements | |

| Statements of budgetary information and accomplishment | 7.2 | Budget (summary) |

| 7.2 | Budget | |

| 7.3.1 | Budgetary control statement – expenditure | |

| 7.3.2 | Budgetary control statement – revenue | |

| 7.1 | Multi-annual investment plan (PPI) | |

| 7.4 | PPI annual accomplishment | |

| 7.5 | Cash flow statement16 | |

| 7.5 | Order accounts statement17 | |

| 7.6 | Treasury operations statement18 | |

| 8.3.1-1 | Budgetary modifications statement – revenue | |

| 8.3.1-2 | Budgetary modifications statement – expenditure | |

| 8.3.2 | PPI modifications statement | |

| 8.3.3 | Statement of administrative contracts – contracts situation | |

| 8.3.4-1 | Current transfers statement – expenditure | |

| 8.3.4-2 | Capital transfers statement – expenditure | |

| 8.3.4-4 | Current transfers statement – revenue | |

| 8.3.4-5 | Capital transfers statement – revenue | |

| 8.3.4-3 | Statement of grants given | |

| 8.3.4-6 | Statement of grants obtained | |

| 8.3.5-1 | Statement of fixed income assets | |

| 8.3.5-2 | Statement of variable income assets | |

| 8.3.6-1 | Statement of indebtedness – borrowings | |

| 8.3.6-2 | Statement of indebtedness – other debts | |

| Statements of patrimonial, financial and economic information | 5 | Balance sheet |

| 6 | Income statement by nature | |

| 8.2.7 | Statement of gross fixed assets and accumulated depreciation and adjustments | |

| 8.2.29 | Cost statement of goods sold and materials consumed | |

| 8.2.30 | Statement of production variation | |

| 8.2.31 | Statement of financial income | |

| 8.2.32 | Statement of extraordinary income | |

| Report | 13 | Management report |

In order to get conformity and regularity of the information prepared, POCAL also defines procedures9 to be included within each entity's internal control system, by which it is intended to ensure, namely: legality and regularity of transactions, accomplishment of plans and policies made at a higher level, safeguarding of assets, statements approval and control, accuracy and integrity of accounting records, management effectiveness, and opportunity while preparing reliable financial information (section 2.9.2 of POCAL).

Therefore, internal control is important to support information usefulness, inasmuch as it allows assuring for its accuracy, opportunity and reliability.

Within Local Government, among the various types of internal control specific information is subject to, stand out (Bernardes, 2001): (1) internal administrative control (includes the hierarchical control and procedures and records relating to the process of decision-making, embracing plans, policies and aims set by those in charge); (2) internal accounting control (relates to ensure reliability of accounting records, to facilitate the review of authorised financial transactions by those responsible, and the safeguarding of assets); (3) self-control (implies defining and applying criteria of organisation and functioning of a municipality's services and bodies, namely procedures, accounting circuits, and control points, with the critical assessment by the municipality itself that simultaneously decides and executes); and (4) internal audit (assists municipal officials in the effective performance of its functions, by providing analyses, evaluations, recommendations, advice and further information, hence assuring the internal control system reliability).

Studies in other realities also show that internal control is indeed critical to the usefulness of financial information for internal decision-making. For example, while analysing the determinants of the relationship between the use and usefulness of financial information for decision-making process of politicians from central and Local Governments in Japan, Yamamoto (2008) concluded, among other things, that politicians emphasised the importance of internal control in the use of financial information for their decisions. Also Brusca (1997), in the case of Spanish municipalities, established the existence of the positive relationship between internal control financial information is subject to and its usefulness.

4Research framework and methodologyAs explained, during past decades, Local Government accounting in Portugal, as in other countries, has undergone serious modifications, including with respect to financial reporting. The introduction of accrual-based accounting led to significant changes in municipalities’ financial reporting presentation and contents. Municipalities’ financial reporting model, based on that of the business sector, apart from assuming an important role in accountability, also assumes a key role both in supporting internal users’ decision-making and in internal control.

Reinforced by a significant lack of theoretical and empirical research in Portugal,10 the issue of the usefulness of financial reporting in the context of internal decision-making of Portuguese municipalities is clearly an under-studied area of research. Consequently, taking the municipality of Bragança as exploratory example, the main objective of this research is to evaluate users’ satisfaction in relation to the financial reporting model, as well as to analyse the importance of Local Government financial reporting information opportunity, in the context of internal decision-making. In other words, we intend to assess the adequacy of the current financial reporting model with respect to the process of internal decision-making and control, taking Bragança municipality as a starting point to a study that expects to embrace all Portuguese municipalities.

Accordingly, a questionnaire was applied to municipality of Bragança11 as a pilot experience to be adjusted in the future. This exploratory study hence followed a quantitative approach, which was considered to be suitable because it would make possible to obtain data from every relevant decision-makers of the population.

In the municipality of Bragança a total of 21 relevant decision-makers were identified. As respondents to the questionnaire, they were selected taking into consideration their predominant role as internal municipal decision-makers and subsequently as main users of the financial reporting. Within the municipality to be analysed, all internal decision-makers that, at the time of implementing the questionnaire (March 2010), were holding the following positions,12 were considered for the study: Mayor and Aldermen in the executive body, Heads of Department, Heads of Division, and Technical Coordinators of the Financial Division within the Department of General Administration and Financial Management. The 21 individuals were then grouped according to the position or function they performed in the municipality, namely policy decision-makers (Mayor and Aldermen) and technical decision-makers (Heads of the Department, Heads of Division and Technical Coordinators).

In order to generically evaluate municipality's financial reporting model, respondents were asked to classify on a Likert scale13 from ‘1 – not adequate’ to ‘5 – totally adequate’, the degree of adequacy that the current reporting model has in providing information to support internal decision-making. In the case of answers other than ‘very adequate’ and ‘totally adequate’, they were also asked to indicate, choosing from a diverse set of items, the reasons that justified the answer. The reasons given (for example, the exclusion of budgetary, economic-financial and patrimonial indicators, the discrepancy between the accounting basis for budgetary and patrimonial accounting, among others) were selected from studies developed in other countries, including those by Brusca (1997), Paulsson (2006), Askim (2008), Yamamoto (2008) and Grossi and Reichard (2009). In order to analyse the relationship among internal control, information opportunity and the municipality's financial reporting adequacy, the respondents were additionally asked, also on a scale of ‘1 – nothing important’ to ‘5 – extremely important’, about the importance of different types of internal control which financial information might be subjected to. For this purpose, a brief explanation was provided on the meaning of each type of internal control listed in the question (self-control, internal administrative control, internal accounting control and internal audit). Information about the reasons why respondents considered internal control of financial information as important for decision-making was then collected. Considering the conclusions of Brusca (1997), Mack (2004) and Grossi and Reichard (2009) concerning the fact that the preparation and disclosure of opportune financial information are related with financial reporting adequacy, we also wanted to get evidence on this. So, the respondents were asked to classify, on a scale of ‘1 – never’ to ‘5 – always’, a number of situations related to financial information disclosure, taking into consideration their importance for decision-making.

Data analysis has involved descriptive statistics, namely, measures of central tendency and measures of dispersion, condensing the data into a few summary measures.

4.1Characteristics of the respondentsWith intent of future characterising the population, the survey applied included questions about respondents’ personal (age, educational level and background) and professional (current function and respective length of time) data. In regard to the personal characteristics, findings in Bragança show that the majority of respondents (76.2%) were between 36 and 55 years of age, 14.3% were over 56 and 9.5% were between 26 and 35. The great majority of the respondents (71.4%) had a Bachelor degree, 19.1% had a Master degree and only 9.5% were high school graduates. In regard to the background, there was a large heterogeneity among the respondents, due to the functions they held. However, it is noteworthy that a significant percentage had an engineering background (28%). As to the professional characteristics, the majority of respondents (61.9%) have held functions in the municipality for five years or longer. Fig. 1 presents the distribution of the answers by positions held in the municipality: 33.4% of the respondents belong to the executive body (Mayor and Aldermen) of the municipality, thus corresponding to the group of policy decision-makers. The remaining (66.6%) are distributed at other hierarchical levels, forming the group of technical decision-makers.

5Findings and discussion5.1Level of adequacy the financial reporting modelConcerning the level of adequacy the current financial reporting model has to provide while offering information to support internal decision-making, the majority of respondents (86%) considered it to be ‘adequate’; 9% found it ‘inadequate’ or ‘slightly adequate’, and only 5% considered it ‘very adequate’ or ‘totally adequate’.

In order to know the reasons why some respondents did not consider the financial reporting model in the higher levels of adequacy for internal decision-making, a set of eight possibilities was presented in the questionnaire, from which respondents should select. In Fig. 2, the labels ‘marked’ and ‘not marked’ represent the respondents who did or did not choose the option referred to, respectively.

As observed, the main reasons indicated by the respondents for a lesser adequacy (including ‘inadequate’, ‘slightly adequate’ and ‘adequate’) of the financial reporting model for internal decision-making were the fact that a ‘large number of accounting documents’ is required (66.7%), ‘non-inclusion of statements of cost accounting’ as well as ‘non-inclusion of budgetary, economic-financial and patrimonial indicators’ (both with 52.4% of responses).

Results showed that respondents in Bragança perceived municipality's financial reporting model adopted to disclose financial information as not very adequate for their internal decision-making. This finding is partially consistent with those obtained by Brusca (1997), Askim (2008), Yamamoto (2008), Windels and Christiaens (2008), Cohen (2009) and Grossi and Reichard (2009). A more detailed analysis intended to check whether the reasons for the financial reporting model not being considered highly adequate (including ‘very adequate’ and ‘totally adequate’) to provide information for internal decision-making, are independent from the group of the decision-makers. For this purpose the Fisher test14 was run, since dichotomous variables are used. The statistical test results for a significance level of 0.05 revealed that the choice of the reasons why respondents did not consider the financial reporting model highly adequate for internal decision-making depended on the group of decision-makers (technical decision-makers or policy decision-makers).15 Thus, findings displayed in Fig. 3 indicate the technical decision-makers group found as the main reasons for lower adequacy, the ‘non-inclusion of cost accounting statements’ (61.54%) and the ‘large number of accounting documents required’ (53.85%). The group of policy decision-makers also considered the ‘large number of accounting documents required’ (85.71%) and the ‘non-inclusion of budgetary, economic-financial and patrimonial indicators’ (30.77%).

It is interesting to note that while both agree on the extensive number of accounting statements, policy decision-makers, as expected, give importance to the lack of indicators allowing them an overview of the municipality's general condition; while technical decision-makers (at an operational level) find the lack of cost accounting information more critical as an instrument to allow knowing the costs so as to manage services properly.

5.2Importance of internal control and opportunity of the financial reporting informationIn order to characterise the importance of internal control and the degree of the opportunity of the financial reporting information, a set of three questions was prepared to evaluate: the relevance of the internal control which financial information is subjected to, what is its influence on financial information usefulness for internal decision-making, and what is the degree of opportunity of financial information disclosure.

Table 3 summarises the importance respondents attached to different types of internal control which financial reporting information is subjected to. The study found that all of the types of internal control that, according to POCAL, financial information is subjected to, are considered very relevant by the respondents in Bragança. These results confirm the findings obtained both by Brusca (1997) and Yamamoto (2008), who pointed out that financial reporting users assign significant importance to the existence of internal control of information.

Importance of internal control types.

| Description | Frequencies | Statistics | ||||

| <3 | 3 | >3 | Median | Mean (n=21) | Std. deviation | |

| Internal administrative control | – | 23.8% | 76.2% | 4 | 4.19 | 0.831 |

| Internal accounting control | – | 23.8% | 76.2% | 4 | 4.10 | 0.814 |

| Self-control | – | 23.8% | 76.2% | 4 | 4.10 | 0.768 |

| Internal audit | 4.8% | 23.8% | 71.5% | 4 | 4.00 | 0.944 |

Notes: Scale [1] nothing important – [5] extremely important. In this table, <3 represents the scales [1] – nothing important and [2] – slightly important, 3 represents the scale [3] – important, and >3 represents the scales [4] – very important and [5] – extremely important.

‘Internal administrative control’ (with an important mean of 4.19) is highlighted as the most important, followed by ‘internal accounting control’ and ‘self-control’, also very relevant, but with a slight lower importance (4.10). A lower importance was assigned to ‘internal audit’, but still quite high (4.00).

In attempting to assess whether the group of technical decision-makers differ, in central tendency, from the group of policy decision-makers about the importance attributed to different types of internal control, the nonparametric Mann–Whitney test was used. Empirical evidence (Table 4) indicates that the two groups of decision-makers have no statistically significant differences in relation to the importance attributed to different types of internal control.

Importance of internal control types by decision-makers groups.

| Description | Sample (n=21) | Technical decision-makers | Policy decision-makers | Sig. | ||

| Mean (n=14) | Std. deviation | Mean (n=7) | Std. deviation | |||

| Internal administrative control | 4.19 | 4.21 | 0.802 | 4.29 | 0.951 | 0.778 |

| Self-control | 4.10 | 4.00 | 0.877 | 4.25 | 0.488 | 0.472 |

| Internal accounting control | 4.10 | 4.29 | 0.825 | 4.00 | 0.816 | 0.425 |

| Internal audit | 4.00 | 4.29 | 0.825 | 3.71 | 1.113 | 0.235 |

Abbreviation: Sig., significance of the Mann–Whitney test.

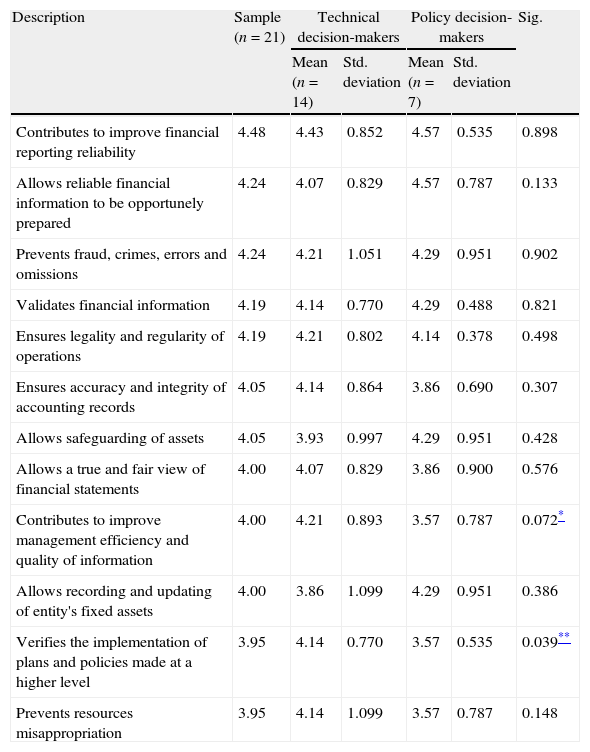

In order to know the reasons why respondents considered internal control important for decision-making, a few statements related to the importance of internal control were included in the questionnaire (Table 5).

The importance of internal control.

| Description | Frequencies | Statistics | ||||

| <3 | 3 | >3 | Median | Mean (n=21) | Std. deviation | |

| Contributes to improve financial reporting reliability | 4.8% | – | 95.2% | 5 | 4.48 | 0.750 |

| Allows reliable financial information to be opportunely prepared | 4.8% | 9.5% | 85.7% | 4 | 4.24 | 0.831 |

| Prevents fraud, crimes, errors and omissions | 9.5% | 9.5% | 81.0% | 5 | 4.24 | 0.995 |

| Validates financial information | 4.8% | – | 95.2% | 4 | 4.19 | 0.680 |

| Ensures legality and regularity of operations | 4.8% | – | 95.2% | 4 | 4.19 | 0.680 |

| Ensures accuracy and integrity of accounting records | 4.8% | 14.2% | 81.0% | 4 | 4.05 | 0.805 |

| Allows safeguarding of assets | 4.8% | 28.6% | 66.6% | 4 | 4.05 | 0.973 |

| Allows a true and fair view of financial statements | 9.5% | 4.8% | 85.7% | 4 | 4.00 | 0.837 |

| Contributes to improve management efficiency and quality of information | 9.5% | 9.5% | 81.0% | 4 | 4.00 | 0.894 |

| Allows recording and updating of entity's fixed assets | 9.5% | 23.8% | 66.7% | 4 | 4.00 | 1.049 |

| Verifies the implementation of plans and policies made at a higher level | 4.8% | 14.3% | 80.9% | 4 | 3.95 | 0.740 |

| Prevents misappropriation of resources | 9.5% | 23.8% | 66.7% | 4 | 3.95 | 1.024 |

Notes: Scale [1] nothing important – [5] extremely important. In this table, <3 represents the scales [1] – nothing important and [2] – little important, 3 represents the scale [3] – important, and >3 represents the scales [4] – very important and [5] – extremely important.

It can be verified that most respondents in Bragança considered internal control financial information to be important in their decision-making because it contributes to be improvement of the reliability of financial information (4.48) and allows for reliable information to be prepared opportunely (4.24). With a lower mean, but still at higher levels on the scale, internal control is important for internal decision-making because it verifies the implementation of plans and policies made at a higher level and prevents misappropriation of resources (3.95).

Again the Mann–Whitney test was used to examine whether the groups studied differ in central tendency as to the importance attributed to internal control. The empirical analysis indicated that the two groups are similar, although exceptions relating to two situations are verified (Table 6).

Importance of internal control by the decision-makers groups.

| Description | Sample (n=21) | Technical decision-makers | Policy decision-makers | Sig. | ||

| Mean (n=14) | Std. deviation | Mean (n=7) | Std. deviation | |||

| Contributes to improve financial reporting reliability | 4.48 | 4.43 | 0.852 | 4.57 | 0.535 | 0.898 |

| Allows reliable financial information to be opportunely prepared | 4.24 | 4.07 | 0.829 | 4.57 | 0.787 | 0.133 |

| Prevents fraud, crimes, errors and omissions | 4.24 | 4.21 | 1.051 | 4.29 | 0.951 | 0.902 |

| Validates financial information | 4.19 | 4.14 | 0.770 | 4.29 | 0.488 | 0.821 |

| Ensures legality and regularity of operations | 4.19 | 4.21 | 0.802 | 4.14 | 0.378 | 0.498 |

| Ensures accuracy and integrity of accounting records | 4.05 | 4.14 | 0.864 | 3.86 | 0.690 | 0.307 |

| Allows safeguarding of assets | 4.05 | 3.93 | 0.997 | 4.29 | 0.951 | 0.428 |

| Allows a true and fair view of financial statements | 4.00 | 4.07 | 0.829 | 3.86 | 0.900 | 0.576 |

| Contributes to improve management efficiency and quality of information | 4.00 | 4.21 | 0.893 | 3.57 | 0.787 | 0.072* |

| Allows recording and updating of entity's fixed assets | 4.00 | 3.86 | 1.099 | 4.29 | 0.951 | 0.386 |

| Verifies the implementation of plans and policies made at a higher level | 3.95 | 4.14 | 0.770 | 3.57 | 0.535 | 0.039** |

| Prevents resources misappropriation | 3.95 | 4.14 | 1.099 | 3.57 | 0.787 | 0.148 |

Abbreviation: Sig., significance of the Mann–Whitney test.

For the significance levels of 0.1 and 0.05, it appears that the group of technical decision-makers considered internal control significantly more important for internal decision-making than the policy decision-makers, as it ‘contributes to improving management efficiency and quality of information’ and ‘verifies the implementation of plans and policies made at a higher level’, respectively. These reasons seem adequate to the functions they perform as operational decision-makers.

Regarding the way the municipality of Bragança discloses the financial reporting, given its importance for internal decision-making, most respondents believed that the municipality discloses updated information (an average of 4.10) (Table 7). Most respondents also considered that the available financial information makes possible to confirm and correct previous assessments, is sufficient and is provided in a timely pace.

Opportunity of the financial reporting information.

| Description | Frequencies | Statistics | ||||

| <3 | 3 | >3 | Median | Mean (n=21) | Std. deviation | |

| Is the financial information provided updated? | – | 14.3% | 85.7% | 4 | 4.10 | 0.625 |

| Does the financial information made available allow for the confirmation and correction of previous assessments? | 4.8% | 33.3% | 61.9% | 4 | 3.76 | 0.995 |

| Is the financial information enough? | – | 42.9% | 57.1% | 4 | 3.71 | 0.717 |

| Is the financial information prepared and made available on time? | 4.7% | 42.9% | 52.4% | 4 | 3.62 | 0.805 |

| Does the financial information satisfy the generality of your needs? | 4.8% | 38.1% | 57.1% | 4 | 3.57 | 0.676 |

| Is the financial information made available immediately after being requested? | 4.8% | 47.6% | 47.6% | 3 | 3.52 | 0.928 |

| Is the financial information presented in a useful format? | 4.8% | 47.6% | 47.6% | 3 | 3.52 | 0.928 |

| Does the financial information available allow the evaluation of past, present and future events? | 14.4% | 57.1% | 28.5% | 3 | 3.19 | 0.928 |

| Is the financial information easy to read? | 28.6% | 33.3% | 38.1% | 3 | 3.05 | 1.322 |

| Is the financial information easily understood? | 28.6% | 33.3% | 38.1% | 3 | 3.05 | 1.322 |

| Is there any delay between the occurrence of an event and the arrival of information to you? | 33.3% | 33.3% | 33.4% | 3 | 3.00 | 1.000 |

Notes: Scale [1] never – [5] always. In this table, <3 represents the scales [1] – never and [2] – rarely, 3 represents the scale [3] – sometimes, and > 3 represents the scales [4] – almost always and [5] – always.

While checking whether the two groups of decision-makers differed in central tendency as to opportunity of the financial information for internal decision-making, the Mann–Whitney test findings indicate that the two groups are generically similar, although there are exceptions concerning three aspects (Table 8). For a significance level of 0.1, it appears that the group of technical decision-makers in the municipality of Bragança considered financial reporting information significantly more opportune than the policy decision-makers, due to the fact that the information available allows correcting and confirming previous assessments, and it is easy to read and understand.

Opportunity of the financial reporting information by decision-makers groups.

| Description | Sample N=21 | Technical decision-makers | Policy decision-makers | Sig. | ||

| Mean (n=14) | Std. deviation | Mean (n=7) | Std. deviation | |||

| Is the financial information provided updated? | 4.10 | 4.07 | 0.730 | 4.14 | 0.378 | 0.863 |

| Does the financial information made available allow confirming and correcting previous assessments? | 3.76 | 4.07 | 0.829 | 3.14 | 1.069 | 0.064a |

| Is the financial information enough? | 3.71 | 3.86 | 0.770 | 3.43 | 0.535 | 0.223 |

| Is the financial information prepared and made available on time? | 3.62 | 3.79 | 0.820 | 3.29 | 0.756 | 0.245 |

| Does the financial information satisfy the generality of your needs? | 3.57 | 3.64 | 0.745 | 3.43 | 0.535 | 0.405 |

| Is the financial information made available immediately after requirement? | 3.52 | 3.50 | 1.019 | 3.57 | 0.787 | 0.936 |

| Is the financial information presented in a useful format? | 3.52 | 3.64 | 1.082 | 3.29 | 0.488 | 0.242 |

| Does the financial information available allow evaluating past, present and future events? | 3.19 | 3.43 | 0.938 | 2.71 | 0.756 | 0.114 |

| Is the financial information easy to read? | 3.05 | 3.43 | 1.158 | 2.29 | 1.380 | 0.091a |

| Is the financial information easily understood? | 3.05 | 3.43 | 1.158 | 2.29 | 1.380 | 0.091a |

| Is there any delay between the occurrence of an event and the arrival of information to you? | 3.00 | 3.14 | 1.099 | 2.71 | 0.756 | 0.311 |

Abbreviation: Sig., significance of the Mann–Whitney test.

The current municipalities’ financial reporting model in Portugal results from modifications in the Local Government accounting and reporting system set by POCAL in 1999. This paper, based on an exploratory study in the municipality of Bragança, provides the initial research about the usefulness of that reporting for municipalities’ internal decision-making, additionally providing the perceptions of both policy and technical decision-makers. Their perceptions are also considered regarding the importance of internal control and opportunity of the financial reporting information.

Main findings showed that the available financial reporting model did not judge the most appropriate to deliver information for internal decision-making in the municipality of Bragança. Decision-makers considered that the financial reporting model might become more adequate if, on the one hand, the number of reported financial statements (accounting documents) would be reduced and, on the other hand, cost accounting statements as well as budgetary, economic-financial and patrimonial indicators would be included.

Results additionally showed that the internal users have considered as very important the different types of internal control that financial information is subjected to. The great majority of respondents in Bragança believed, for their internal decision-making that internal control is important because it contributes to improving the reliability of financial information and allows for information to be prepared on time, hence pointing to a relationship between internal control, information opportunity and financial reporting adequacy. In what regards the importance of internal control that financial information is subjected to, both groups of decision-makers (technical and policy decision-makers) in general, assigned it the same level of importance, except for the fact that technical decision-makers gave more importance to internal control because it allows for the improvement of management effectiveness and information quality, as well as enables the verification of the accomplishment of plans and policies made at a higher level. Regarding the degree of disclosure opportunity of financial information by the municipality of Bragança, all in all the study found that both type of decision-makers were satisfied.

The fact that this research was conducted as a pilot study creates some limitations.

Since it regards to one municipality, generalisations cannot be made to conclude about the financial reporting model in Local Government in Portugal. However, the survey is expected to be extended to all Portuguese municipalities, seeking to target a larger sample, hence enabling for more comprehensive and conclusive results, maybe closer to those findings in other international empirical studies.

Nevertheless, this first experience in Bragança allowed identifying improvements in the questionnaire, here used at an experimental stage. It also allowed realising that this quantitative study, even at a large scale, does not capture per se an in-depth understanding of the subject phenomena. Thus, a different approach such as qualitative case study research might have to be complementarily used to shed further light on the issue.

See also IPSASB's document conceptual framework for general purpose financial reporting by public sector entities – an exposure draft 1 (IFAC-IPSASB, 2010).

The usefulness of financial statements is impaired if they are not made available to users within a reasonable period after the reporting date. An entity should be in a position to issue its financial statements within six months of the reporting date (IFAC-IPSASB, 2011a, IPSAS 1, §69).

Information is relevant to users if it might be used to support in evaluating past, present or future or on the confirmation or correction of past assessments. In order to be relevant, information must also be timely (IFAC-IPSASB, 2011a, IPSAS 1, Appendix A).

Dixon, Coy, and Tower (1991) in the case of universities, and Smith and Coy (1999) in the case of municipalities, both in New Zealand, found a positive correlation between information quality and the opportunity of financial reporting.

Law-decree 54-A/99, February 22 – POCAL (Plano Oficial de Contabilidade das Autarquias Locais).

‘Patrimonial accounting’ is the term adopted to designate financial accounting within the Local Government integrated accounting system. The designation is due to the fact that a ‘patrimonial’ perspective prevails, since public domain assets (legally neither saleable nor possible to have mortgages) are recognised in the balance sheet and the subsystem must allow property control and management.

For Portuguese municipalities, in an internal decision-making context, specifically for the decision of approving the annual accounts, Carvalho, Fernandes, Camões, and Jorge (2008) found that both the executive and the deliberative bodies considered budgetary cash-based information more useful than accrual-based economic and financial information.

For this purpose, see Gomes, Carvalho, and Fernandes (2009).

This statement compares receipts and payments from budget accomplishment and treasury operations; cash balance of the previous year is included as receipt. It also highlights the cash balance to the following year.

Order accounts statement discloses the entity's responsibilities and rights that need to be controlled, inasmuch as they might become effective in the future, thus having possible financial and patrimonial consequences, e.g. warranties by and for the municipality.

This statement, linked to the Cash Flow Statement, discloses the receipts and payments each entity does on behalf of third parties, hence not considered budgetary operations.

For example, acquisitions of assets should be performed according to the Multi-annual Investment Plan and based on the deliberations of the executive body, through external requests or equivalent document, issued by designated those responsible, after verification of compliance to legal standards, namely in respect of supply and public works contracts; purchases are made by designated those responsible to make purchases, with based on external request or contract, after verification compliance to legal rules, namely, on the assumption of budgetary commitments, tender and contracts.

Carvalho et al. (2008) conducted a study based on reading official Minutes of meetings approving the annual accounts. They only focused on records from both Municipal Chamber and Municipal Assembly of Portuguese municipalities, and on the decision of approving the annual accounts, thus not considering a more general study about the usefulness of financial information for other internal users and decision-makers.

The issues dealt in this paper were extracted from a more extensive questionnaire, which covers other aspects, namely financial and management information needs and the usefulness of POCAL financial and budgetary statements.

These positions were established in Bragança municipality's hierarchical formal structure.

The Likert scale was adopted in studies such as those by Tayib et al. (1999), Mack (2004), Yamamoto (2008), Andriani et al. (2010) and Kober et al. (2010).

Fisher test is a powerful nonparametric test when it is necessary to compare two independent samples of small size in regard to a dichotomous nominal variable grouped in tables of contingence 2 by 2 (Marôco, 2010). Thus, the Fisher test tests H0: «There are no differences between the samples relatively to the distribution of the variable classes» and H1: «There are significant differences between groups or populations from which samples were taken» and for any p-value lower than or equal to a given probability of type I error, the null hypothesis is rejected. In this case, for p-value lower than or equal to 0.05 the null hypothesis was rejected.

For the items tested, the results of the Fisher test (1-tailed) revealed statistically significant in ManyDocs (p<0.044), ContFinStat (p<0.025), LayoutInf (p<0.025), StatementsCC (p<0.041), DelPrep (p<0.025), and AccountingBases (p<0.035).