In this paper, we explain the analytics of a particular type of mechanism of open innovation (OI), namely the management of non-pecuniary exchange of information, and address the relationship between intellectual property rights (IPRs), particularly patent rights, and OI using a static game-theoretic setting of research and development (R&D) competition. We develop a duopoly model in which for-profit firms can contribute to downstream improvements to be made by a diverse community of inventors, workers and users of technology by creating knowledge spillovers which the development community employs as an input for its innovative efforts. Although a money market for R&D information does not exist, the commercial firms may appropriate an indirect return on innovative efforts. The degree of spillover information is determined endogenously, and equilibria with voluntary revealing may arise in our theoretical model. We show that, surprisingly perhaps, a rise in the strength of patent protection induces the free sharing and dissemination of technological information and other contributions to the OI development of innovations. Conversely, a fall in the strength of the patent system induces the exercise of traditional IPRs by innovative firms to protect their intellectual assets.

We need to explain the involvement of commercial firms in open innovation (OI) in several industries using a variety of technologies. OI is defined by Chesbrough and Borgers (2014) as “a distributed innovation process based on purposively managed knowledge flows across organizational boundaries, using pecuniary and non-pecuniary mechanisms in line with the organization's business model.” Economists need a better understanding of the incentives of intellectual property holders to initiate and participate in the development of OI. The new innovation model OI can relate to intellectual property rights (IPRs). IPRs, if properly managed, can be an enabling mechanism for innovation, as an instrument to promote the open exchange of knowledge (Arora, 1995).

In economic sectors in which innovation occur rapidly and is incremental and cumulative by nature, the patent system may produce complex overlapping property rights and patent ticket problems (Shapiro, 2000). In the software industry, for instance, innovation tends to be highly incremental and cumulative, in which case, essential licensing for using a new innovation is more likely to involve many patents. Patents, which are important traditional IPRs, create a temporary right to exclude others from using an invention. In such circumstances, the transaction costs of negotiating licenses with many different patentees are fairly high and therefore the allocation of property rights does affect economic efficiency in the marketplace. Free and open development of software has the potential to eliminate such patent ticket problems, which constitutes a major threat to innovation (Isaac & Park, 2004). François Letellier advocates the idea that open source software is one of the most advanced forms of OI.

In this paper, we explain the analytics of a particular type of mechanism of OI, namely the management of non-pecuniary exchange of information, and draw conclusions concerning the relationship between IPRs and OI. IPR management under OI recognizes the value of knowledge exchange to increase the rate of innovation. We consider some economic incentives that help explain OI using a simple research and development (R&D) duopoly framework. Game-theoretic aspects of R&D competition are possibly important in understanding OI incentives.

We identify several research gaps in previous game-theoretic literature, specifically on the relationships between the strength of IPRs, the innovation incentives of the OI community, and the exercise of traditional IPRs by commercial firms. There are two research questions that haven’t been properly addressed yet. First, previous studies haven’t widely investigated if, when, and how weak appropriability conditions in the upstream industry might enhance innovation incentives and efforts in the development community of individual developers, customers and users of technology. The other question that hasn’t been properly attended is if, when, and how a fall in the strength of IPRs might induce the exercise of traditional IPRs by commercial firms to protect their intellectual assets. We describe how we purpose to fill in the existing literature next.

Here we address the relationship between IPRs, particularly patent rights, and OI using a static game-theoretic setting of R&D competition. We present arguments for the proposition that patent rights complement OI rather than undermine it. The management of proprietary knowledge, in particular the managerial decision by a pro-profit competing firm, at the free revelation and dissemination of technological knowledge stage, to initiate and participate in OI projects depends on how strong IPR institutions are in protecting new inventions.

We show that, surprisingly perhaps, a rise in the strength of patent protection increases the benefits to innovation in the OI sector, and so it induces the free sharing and dissemination of technological information and other contributions to the OI development of innovations. The OI communities and commercial firms have therefore (at least) a reason to use the IPR institutions in place to protect their innovation system. Conversely, a fall in the strength of the patent system decreases the protection rights against misappropriation by individual inventors, workers, the rival firm and other users of the technology and hinders the insurance that firms’ innovations remain free and open, and so it induces the exercise of traditional IPRs by innovative firms to protect their intellectual assets.

The rest of the paper is organized as follows. In “Literature review” section, as a backdrop for the current research, we briefly review the literature on open innovation and open source software. We present a theoretical model in “The model” section, and establish a number of analytical results in “Equilibrium results” section. In “Conclusion” section, we offer some concluding remarks, particularly on the role of IPRs to promote innovation by OI communities.

Literature reviewThis section briefly reviews the literature linking open innovation and open source software, the latter being an increasingly popular example of open innovation. There are at least two main themes in the existing literature on open innovation and open source software that economists have tried to explain: Why do firms release their source code to form an open source project? How could people collaborate for free and produce as a result of collaborative practices valuable information goods? Open innovation theories may be especially applicable for examining how firms have been able to benefit from the opportunities provided by open source, and why firms would contribute resources to projects that will benefit others.

The term ‘open innovation’ was introduced in 2003 by Henry Chesbrough. Open innovation is the “use of purposively inflows and outflows of knowledge to accelerate internal innovation and expand the market for external use of innovation” (Chesbrough, 2006). There are two important types of open innovation, depending on the directions of knowledge flows across the boundary of the firm: outside-in (or inbound) and inside-out (or outbound). A third type of open innovation, the so-called coupled open innovation, links outside-in and inside-out, and involves combining knowledge inflows and outflows between firms or agents (Gassmann & Enkel, 2004). The inside-out and coupled types are the less explored and understood by academic researchers and industry practice.

There are two flavors of open innovation (Euchner, 2010). Open-source innovation, the other definition of open innovation, builds on the concept of open-source software. The research of von Hippel on open and distributed processes innovation establishes the importance of user innovation using an example of open-source software (von Hippel, 2005). The treatment of intellectual property and control of the direction of innovation are the distinguishing factors of the two open innovation approaches. Open-source innovation redefines the firm itself, by requiring that firms take a modified view of intellectual property, by opening intellectual property, and shift the locus of control of the innovation process closer to the user community. This difference in open innovation definitions reflects a schism that has arisen in open-source software itself. There is a strong disagreement between the “free software” people and the “open software” people within the open-source software community (Chesbrough, 2012). However, this difference is more a matter of emphasis regarding the locus of and motive for innovation. User innovation and open innovation are two major distributed processes of innovation, both challenging the dominant view of technological innovation for most of the 20th century, that is, the closed innovation model (Bogers & West, 2012).

Following an open innovation approach, firms can use open source as an ongoing source of external innovation, or to spin off technologies that cannot be internally commercialized by the firm, while they can contribute and combine efforts to use open source too (West & Gallagher, 2006). Firms involved in open source software often make investments that will be shared with rivals. Innovation strategies firms employ include pooled product development, spinouts, selling complements and attracting donated complements. Firms can also use a broad range of knowledge sources for a firm's innovation, including customers, academics and rivals. An open innovation approach presents to managers of commercial firms three challenges: Maximizing returns to internal innovation, incorporating external innovation, and motivating the generation and contribution of external knowledge. The last challenge involves a paradox: Why would firms contribute resources, including intellectual property, to open source projects that will benefit others, including their rivals?

Open source includes both an intellectual property strategy and a development methodology (West & O’Mahony, 2005). Open source refers to a specific set of software licenses approved by the non-profit open source initiative (OSI). Since the open source definition was drafted in 1998, the OSI has approved over fifty licenses that meet the requirements of an open source license (OSI, 2004). It also refers to a development methodology where a community of programmers collaborates to produce software using virtual tools and the Internet. There are two models of community building: the model of a community-founded project, which is the most familiar model of open source development, and, more recently, the sponsored model. Major technical infrastructures are required to enable collaborative software development among the sponsor's programmers and the external community. Open source software differs from proprietary software in two important ways: in its intellectual property strategy and in its production process.

From a legal standpoint, the open source movement and proprietary software treat the source code of software differently. Programmers feel comfortable contributing to open source because they are assured of the right to make copies of the program and distribute those copies, as well as the right to make improvements to the program (Perens, 1999). Volunteers and the companies are only able to cooperate because of the rights that come with open source. The free source software movement also has argued that free source software projects lead to better software, and also requires that software remain free perpetually (West & Dedrick, 2005). The free software contains intellectual property restrictions intended to force sharing of any derivative works. These movements grew out the interests of programmers to write better software for their own purposes. The open source movement has focused on gaining widespread adoption of free and open source software by businesses.

The collaborative open source production process is another difference between open source software and proprietary software development contributions. Levine and Prietula (2003) define open collaboration as any system of innovation relying on interacting participants in the creation of a product of economic value who are loosely coordinated. Patterns of collaboration, innovation and production were observed initially in open source software, but can now be found in user-to-user forums and online communities, among many other instances. The open source software development is characterized by being geographically distributed, where programmers work in arbitrary locations, and coordinate their activity by means of emails. Despite the weakening of traditional methods of coordinating work, open source software development has produced software of high quality. To explain how this has happened, Mockus, Fielding, and Herbsleb (2002) examined how work was distributed within the development community in two major projects, the Apache web server and the Mozilla browser. They concluded that the software development was controlled by a small group of programmers, but they received occasional error correction from a much larger group of developer-user contributors.

In spite of important differences between open source and proprietary software, for-profit firms have sought to obtain the benefits of open source by releasing their proprietary source code to create new open source projects. West (2003) identifies two reasons why firms release their source code to an open source project in its design phase: to win adoption, or to gain development assistance on non-critical areas. One of the earliest sponsored projects was found in 1998 when Netscape formed the Mozilla project. Ongoing sponsorship can reduce ambiguity and provide structure to keep the project going forward. Potential contributors can more easily find their role as there is clearly someone in charge. This is just one way to motivate external users to adopt the technology. As to mature sponsored projects, an example of ongoing proprietary control can be found in “partly open” models such as Microsoft's Shared Source. The company retains full control of its development but may be successful in attracting contributors from users.

The modelHere we describe a static one-shot game of disclosure and dissemination of technological information to accelerate the rate of innovate, which allow us to consider a number of strategic aspects on the relationship between the strength of IPRs and the initiation and participation of pro-profit firms in OI projects.

We assume that there are two pro-profit firms producing a final homogenous good, which have separately engaged in in-house R&D in order to improve their own production technology. By have been sinking a given R&D cost, firm i(j), i, j=1, 2, i≠j, has produced technological innovations xi(xj), which can be used to reduce its marginal production cost by the amount xi(xj). Commercial firms i and j have sought patent protection in order to safeguard their intellectual assets. IPRs are not necessarily perfect, and so a fraction β∈[0, 1] of initial innovations xi(xj) of firm i(j) were placed in the public domain. Parameter β reflects the extent of involuntary knowledge spillovers from a firm to its rival firm and individual inventors, workers and other users of the technology. It is exogenously determined by the strength of IPR institutions to preclude the misappropriation of proprietary knowledge, and the ability of firms to keep their knowledge secret.

The manager of each pro-profit firm has to decide how to use its proprietary technology, specifically portion 1−β of new technology which is actually protected by IPRs and thus can effectively be controlled by its legal owner. A firm's choices are restricted to the control of non-monetary exchanges of technological information. A firm may decide to keep its proprietary technology and use it in its production process. However, patented or copyrighted technology can also be free and open. Thus we assume away pecuniary rewards tied to prices of patent selling or direct flows of licensing revenue. It is not an option for a firm to commercialize new technology, say by licensing the use of one's technology to an external partner in return for a royalty or a fee.

Commercial firms may decide to initiate and contribute to OI. Different innovators and partners contribute resources to OI development without claiming any revenue-generating patent rights. Individual inventors, experienced workers and sophisticated users of technology improve the innovations of commercial firms. The productivity effect ρ>0 of the joint production of innovation by firms and individuals is owing to an extensive prior knowledge base and a stock of solved technical problems. Follow-on innovations in the OI development tend to be creative combinations of prior knowledge available and previous known techniques.

OI projects do not renounce use of IPR institutions. IPRs and technology licensing help protect the intangible assets of the OI community against misappropriation and misrepresentation. Technology licensing contracts granting use of technology with restrictions and copyright laws are not perfectly enforced, and so a fraction 1−β of improvements of initial innovations made by external partners are not kept within the OI community. In OI projects, disclosure of original technology is readily available and further modifications of technology remain free and open. Improvements of the technology by the OI community are unrestricted but the dissemination of improvements is restricted to keep them within the OI community.

We model two alternative ways of firms controlling non-monetary exchanges of technological information from inside the firm out and from outside the firm in. The first version of the model is the integrated management model of inflows and outflows of knowledge where each firm i has a single control variable of external information flows, αi∈[0, 1]. The second version is the separated management model of external information flows in which each firm chooses simultaneous the extent of inflows (i˜) and outflows (o˜) of knowledge, αi(i˜)∈[0,1] and αi(o˜)∈[0,1], respectively. Readily available disclosure of initial innovations and free distribution of incremental innovations implies that firms choose α=1 in the first version of the model, and α(o˜)=α(i˜)=1 in the second one.

In this paper, we do not address the motivations of the OI community at large to improve and develop initial innovations, and we assume that the costs of individual members of the OI in the innovation process are zero. In some cases, namely the software industry, important individual participants in FO development seemed to contribute in response to altruistic and intrinsic motivations. Typically in FO development, users of technologies were actively involved in the innovation process (von Hippel, 1988). Incremental innovations can be made at low cost by the users of the technology, which may have a substantial higher private valuation.

External knowledge is complementary to the technological knowledge resulting from R&D activities which take place within the borders of the firm. The identification and assessment of complementarity and usefulness of bits of knowledge become therefore unnecessary. Firms do no need to incur in search and opportunity costs, that is, costs of interacting with other firms and agents to select those firms and agents with whom technological communication and cooperation can take place.

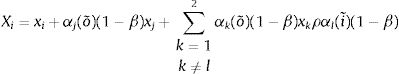

Firm i's effective cost reduction due to technological change in the part which is determined by firms’ control of information exchanges is, in the first version of the model, given by

and, in the second version, given byThese expressions do not show additive terms of firm i's technological progressiveness which are exclusively dependent upon exogenous factors β, xi, xj and ρ. This procedure seems appropriate given that our analysis is about how firm management of inflows and outflows of proprietary knowledge can increase innovation.The additive terms of Eqs. (1) and (2) capture the idea that each commercial firm and external partners of the OI community are working on complementary innovations which, together improve the production technology of the final homogeneous good and so can be employed production activities to reduce the marginal cost of each firm. The multiplicative terms xkρ of these equations, which are preceded by the summation sign, represent the notion that OI development is a creative combination of heterogeneous knowledge and builds both on new inventions and prior knowledge. These last terms are common to every Xi, i=1, 2, which is an indication of the symmetric treatment in terms of benefits given to initiators and contributors to OI projects.

A firm's level of profit gross of innovation cost should influence how much contribution to external innovative partners, that is, how much disclosure of innovations or dissemination of follow-on inventions the firm chooses to do. Firm management controls the inflow and outflow of technological information in order to maximize operational profits and assure the maximum economic rent extraction possible by the firm.

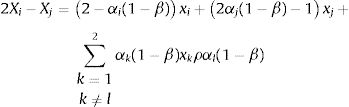

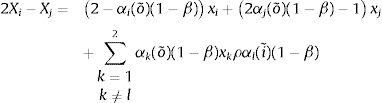

Duopolists i and j compete a la Cournot in the final product market. Thus firm i's operational profit is an increasing function of the following difference between effective firms’ R&D efforts:

in the first version of the model, and in the second version,We also ignore the additive terms of the differences of firms’ effective cost reductions that are uniquely dependent on factors exogenous to the industry where firms i and j operate.Equilibrium resultsIn this section we derive sufficient and necessary requirements for equilibria in the duopoly game of revelation and dissemination of technological information. Either expression (3) or (4) of the objective of firm i=1, 2 is a linear function of both firms’ control variables of information exchanges, and so we should look for corner solutions in the derivation of equilibrium results in each version of our model.

We begin to establish the sufficient and necessary conditions for an equilibrium where both firms i and j initiate and contribute to OI. Innovative development is considered to be OI only if original innovations are readily available from commercial firms and their subsequent modifications by the diverse community of individual inventors, workers and users of technology are freely redistributable.

In equilibrium, αi=αj=1 if xi=xj>0 and

in the first version of the model, or αi(o˜)=αj(o˜)=αi(i˜)=αj(i˜)=1 if xi>0, xj>0 andin the second one. Given the exclusiveness of complementary innovation in the industry, α(i˜)=1 is always an equilibrium strategy in the second version of the model.Non-pecuniary rewards can motive initiation and participation of commercial firms in OI projects if productivity effect ρ is high enough. In OI, initial innovations are fully disclosed and follow-on incremental inventions are freely redistributed in the OI development.

A necessary condition for the innovation process to take place in the OI sector, given the degree of innovativeness ρ of the OI community, is that IPR protection 1−β should be strong enough so that appropriation of the value that is being created by innovative firms and compliance with technology licenses that permit proprietary modifications but require that modifications remain free and open are a real possibility.

The restriction of strategy choice to once-and-for-all commitments to disclosure and dissemination, αi, i=1, 2, makes the selection of strategies of full-commitment to OI comparatively more likely to occur in equilibrium. It is clear from the comparison between inequalities (5) and (6) that the equilibrium requirement imposed on ρ in the first version of the model is more stringent than the one in the second version, as critical ρ is higher in the first version of the model.

These findings agree with the results of earlier game-theoretic literature in that, when the choice between revealing and secrecy is endogenous, revealing may be preferable to secrecy in equilibrium (Henkel, 2004). In a duopoly model of product quality, Henkel found that equilibria with both firms opting to reveal exist for low intensity of competition and medium to high heterogeneity of technology need. In addition, an open regime with compulsory revealing can lead to higher product quality and higher profits than a proprietary regime with no revealing.

Now we establish the requirements for equilibria when the OI and IPR sectors of innovation co-exist. The first equilibrium of this sort is αi=0, αj=1 in the first version of the model, αi(o˜)=0, αj(o˜)=1 and αi(i˜)=αj(i˜)=1 in the second one if xi>0, xj=0 and

The same equilibrium requirement imposed on the critical level of the productivity effect ρ of co-creation of innovation is derived in both versions of our model.

In equilibrium, firm i holds on to its property rights to appropriate the value that it has created through innovations and firm j is willing to take part in the OI development of those innovations. This outcome is more likely to be take place in the economy the weaker IPRs are, that is, the higher β is, which may seem somewhat odd.

Apparently, this result runs against the presumption of conventional intellectual property arguments to foster innovation. The traditional economic justification of IPRs such as patents is that they improve social welfare by providing the necessary incentives for innovation.

Multiple equilibria are possible depending on the expectations held by each competing firm. Thus there is an IPR equilibrium αi=αj=0 in the first version of the model for any β, xi, xj and ρ. In the second version, an IPR equilibrium αi(o˜)=αj(o˜)=0 and αi(i˜)=αj(i˜)=1 exists if xi>0, xj>0 and inequality (7) holds. There is another equilibrium of co-existence of OI e IPRs, for another set of parameters, in the second version of the model: αi(o˜)=0, αj(o˜)=1 and αi(i˜)=αj(i˜)=1 if xi=0, xj>0 and inequality (6) is satisfied.

ConclusionThis section presents the main conclusions arising from our simple model and concerning with how IPRs can relate to OI. There a number of remarks on the role of IPRs such as patents to foster innovation that can be made when IPR management strategies available to commercial firms are either enforcing the legal right given by a patent to an inventor or patent owner to exclude others from commercially exploiting the invention or initiating and participating in OI projects.

We have shown that IPRs, properly managed can enhance OI most likely under strong IPR regimes. Equilibrium behavior of commercial firms in OI projects is more likely to emerge when the enforcement of IPR rights is strong. As a result, and taking a dynamic perspective, scarce resources in a given economic sector or industry should be diverted from the proprietary sector to the OI sector of innovation. Moreover, equilibrium behavior in OI projects is more likely to be observed under the first version of the model than under the second one. Each firm's full commitment to OI projects, from start to finish, by taking a unique decision on the level of information exchange from inside the firm out and from outside the firm in, possibly gives the firm an advantage to undertake OI projects and accelerates its rate of innovation.

However, OI development, if selected in equilibrium together with the enforcement of traditional IPRs, could be possible under weak IPRs too. Weak IPR protection should be of no major concern for commercial firms planning to engage in closed innovation when the option of OI is available to them. The idea that weak IPR protection could successfully foster innovation may seem odd. Closed innovation refers to an earlier innovation model in which R&D is realized within the boundaries of the firm. The paradigm of closed innovation holds the view that the generation and distribution of innovation requires control by innovative firms if there is to be successful innovation.

We now present a discussion of the study limitations and implications for future research. Business models have no explicit role to play in our theoretical model, as it was set up using a ‘copy-left’ approach to coordinate the contributions made by individual developers and users of technology. Open innovation processes combine internal and external ideas together into platforms and systems. These processes employ business models to define the requirements for these platforms and systems. A successful platform requires a business model that induces developers and customers to join the platform. Furthermore, the capital that firms may require to scale their innovations and subsequent improvements made by the OI community was not a question addressed in the model. From an open innovation perspective, firms contribute resources and donate intellectual property to open source projects while exploiting the common benefits of all contributors to make the technology more attractive and to facilitate the sale of related products.

Open-source innovation approaches need business models that can succeed in a more open world. Firms are increasingly defining new strategies for exploiting the principles of open innovation in a changing world. Future research should attend to the development of models for the strategic management of open innovation. It would be worth examining the ways in which the community contributions can add value to the firm, and the causal mechanisms linking managerial decisions to achieving an ongoing supply of external innovations and finding ways to appropriate value from those innovations for enhancing the firm performance.