Optimal growth requires pro-growth institutions and culture. In an optimal growth pattern, institutions and culture facilitate entrepreneurship and innovation. In contrast, if the development and coevolution of institutions and culture are distorted, growth can become permanently stagnant, with a distorted creative destruction process causing weak entrepreneurship and innovation activity. Policymakers should therefore plan and implement pro-growth structural changes to institutions and culture that account for their coevolution process. Otherwise, imported growth (i.e., incoming capital flows or innovation) must be relied upon to form an exogenous pro-growth prototype that promotes growth, entrepreneurship, and innovation.

Un patrón de crecimiento óptimo require de unas instituciones y cultura partidarias del crecimiento. En un patrón de crecimiento óptimo se facilitan el emprendimiento y la innovación. Por el contrario, la aparición de distorsiones en la coevolución de las instituciones y la cultura puede causar un patrón de crecimiento de estancamiento permanente, con un proceso de destrucción creativa que daría lugar a un emprendimiento e innovación débiles. En cuanto a las políticas, deberían centrarse en la planificación e implementación de cambios estructurales en materia cultural y en las instituciones que favorezcan el crecimiento teniendo en cuenta su proceso de coevolución. De lo contrario, debemos depender de la importación de crecimiento (flujos de capital entrante o innovación extranjera en el país), creando un prototipo pro-crecimiento pero exógeno que podría promover el crecimiento, el emprendimiento y la innovación.

The function of economies depends heavily on the interconnection of prevailing institutions and preferences. When institutions and culture are activated in an optimal growth pattern, innovation and entrepreneurship are facilitated. Conversely, in case of (a) distortions in the development of institutions and culture and (b) distortions in their coevolution, growth stagnation can appear, causing strong and permanent distortions in entrepreneurship and innovation.

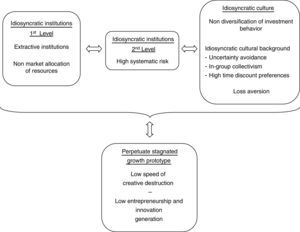

Within an evolutionary concept, two distinct and initial characteristics can seriously distort the optimal function of economies and how they generate innovations: extractive institutions and non-market mechanisms for resource allocation. This paper aims to prove that two characteristics, along with the coevolution of institutions and culture, cause additional effects on institutions (generating systematic risk) and culture (such as for lack of diversification of investment behavior and idiosyncratic cultural traits consistent with uncertainty avoidance, in-group collectivism, high discount preferences and loss aversion). Those second and third round effects maintain the initial distorting forces. In other words, extracting institutions and non-market mechanisms of resource allocation maintain their influence together with the systematic risk and idiosyncratic culture. Thus, an endogenous and perpetual deviation of the optimal pattern is generated, which can be characterized as a stagnated growth prototype that negatively affects the creative destruction process. This prototype thus performs poorly in terms of entrepreneurship and innovation. The most common way (but not the only one) of breaking up this stagnated prototype is through importing growth (i.e., capital inflows or innovation), but those requirements are not included in the interests of the present paper.

Firstly, in the second section, the optimum growth paradigm from the innovation perspective is presented, together with the Schumpeterian perspective on institutions and culture. In the third section, the endogeneity and the institutions-culture nexus are presented. In the fourth section, the influences – related to institutions – that lead to deviations from the optimal pattern are presented. Meanwhile, in the fifth section, the relevant influences related to culture are analyzed. In the sixth section, the concept of coevolution of institutions and culture is presented, while the stagnated growth prototype is described in seventh section. The paper ends with conclusions.

The optimum paradigm and the Schumpeterian perspective on institutions and cultureWalras (1874) developed a general equilibrium model concerning the micro-foundations of price formation. The basic assumptions of the Walrasian paradigm are: (a) the existence of perfect competition, (b) resource allocation is Pareto optimal, (c) the existence of institutions that foster economic growth, (d) the absence of systematic risk, and (e) the growth preferences of individuals and firms (i.e., growth oriented cultural background dimensions) are non-idiosyncratic. The key assumption of perfect competition in conjunction with Pareto's optimal allocation of resources in the Walrasian paradigm (an assumption that generally exists in the neoclassical prototype) ensures a specific context of behavior and preferences, thus forming the way in which economic institutions function. Simultaneously, under perfect information conditions, markets clear smoothly and without transaction costs due to the complete contracting assumption.

The Walrasian paradigm rejects interactive relations between agents. Pricing cannot incorporate the information available, since some aspects of transactions are not expressed in enforceable contracts (Bowles & Gintis, 2000). Additionally, the role of entrepreneurship and innovation in the Walrasian paradigm is very weak. Thus, a Schumpeterian framework is needed to locate the emergence of innovation and entrepreneurship.

Schumpeter (1921, 1939) based his analysis on the existence of a perfectly competitive economy, presenting a stationary equilibrium and thus, a perfect competitive equilibrium, without profits, interest rates, savings, investments and unintentional unemployment. However, since this is a capitalistic economy, it does not stand still. Innovation is the element that causes imbalance and simultaneously causes an economy to evolve. According to Schumpeter, balance is a concept introduced to explain the imbalance caused by innovation (Schumpeter, 1939). Transition into dynamic economic growth is explained in this way, and is disconnected from productive factor growth. The Schumpeterian growth model is based on three main ideas (Aghion, Ufuk, & Howitt, 2015): (i) it is about growth generated by innovations; (ii) innovations result from entrepreneurial investments that are themselves motivated by the prospects of monopoly rents; and (iii) innovations replace old technologies. In other words, growth involves creative destruction.

According to Schumpeter, institutions also play a key role. He considers them responsible for the emergence of certain behaviors, such that they can partly be seen as the crystallization of individuals’ behaviors (Festré & Garrouste, 2008: 379). Schumpeter (1934: 60–61) also stated that “economic sociology deals with institutions,” and so contrasts with economic theory, which deals with purely economic phenomena and mechanisms. In the Schumpeterian competition scheme, innovation plays a key role in economic change through increasing the efficiency of the economic and institutional structure (Ulgen, 2011). Furthermore, Swedberg (2002: 250) argued that for Schumpeter, institutions are necessary to vigorous capitalism.

Additionally, Schumpeter assumed that the preferences of societies are generally incomplete, and that learning, experience, innovation, and social environment mold the desires of society. Schumpeter deals with how preferences are determined and concludes that we resolve ignorance regarding our enjoyment of specific outcomes by using not only our past experiences, but also the revealed preferences of other similar but more experienced consumers (Jonsson, 1994). In the field of consumer behaviors and preferences, Schumpeter adopts a categorical attitude, according to which producers’ behaviors and activities are important because they have the strength to influence and change consumers’ preferences (Croitoru, 2012).

Risk obviously prevails in the context of Schumpeterian analysis since the likelihood of an innovation being successful is not predictable. Therefore, the existence of non-systematic risk conditions is considered important, given that risk determines the possibility of innovation success. According to Smaga (2014), risk is part of Schumpeterian creative destruction and allows the elimination of inefficient institutions. To the extent that risk does not destabilize the whole economic system, weak institutions should be subject to resolution or allowed to fail. Thus non-systematic risk is essential for activating entrepreneurship provided it can be diversified and can coexist with low systematic risk.

Endogeneity and the institutions/culture nexusThe above optimal growth pattern cannot often be met. We consider idiosyncratic institutions to be one of the most significant reasons for deviations from the optimal pattern.

There are two basic questions to be answered before studying the distorted patterns. The first one refers to the endogeneity or exogeneity of institutions and culture evolution, while the second one refers to the causality and the impact direction between institutions and culture. More precisely, the first question regards the initial creation of the distorted prototype. The second question regards the impact priority between institutions and culture.

The possible situation in which an economy prevails at an optimal pattern and then it is transformed to an idiosyncratic one does exist but is not discussed in the present paper. The present paper accepts an a priori pre-existence of the initial institutions conditions of extractive nature and non-market allocation of resources. All other kinds of developments arise as endogenous reflections of this particular initial pre-existing condition. Historically, the first created economies – most of them appeared in the 17th and 18th century – which were byproducts of colonial presence (Africa and Latin America) (Acemoglu & Robinson, 2012) can be considered as good examples of the deviated pattern we analyze in this paper. The same is valid for the sovereign generated peripheral countries of Europe and Latin America, almost at the same time periods.

The relationship between Institutions and Culture is an extremely interesting issue for the international literature (Alesina & Giuliano, 2015; Bisin & Verdier, 2001; Bowles, 1998). The conclusions of that research state that there exists a two-way influence. However, since, the initial assumption of the present paper is the pre-existence of the particular idiosyncratic institutions, we accept the coevolution of institutions and culture as a second round effect.

Deviations from the optimal pattern: the case of institutionsAcemoglu and Robinson (2012) point out that what matters most in why some economies fail and others succeed in not only the factors identified by earlier authors, such as economic policies, geography, culture, or value systems, but also rather in institutions, specifically the political institutions that determine economic institutions. Economic institutions most strongly affect all kinds of human relations, whether political, social or economic (North, 1990).

Institutions are classified as “extractive” when they impede economic growth, and as “inclusive” when they promote it (Acemoglu & Robinson, 2012). In societies with extractive institutions, entrepreneurship is obstructed, systematic risk is increased and market functioning and efficiency are hampered.

In case of recession or negative economic impacts, extractive institutions are expected to generate distorted influences on the creative destruction process. More precisely, under recession conditions, existing production structures are discredited. This fact, together with the existence of institutions that prevent the formation of new production structures (i.e., failed bankruptcy procedures), preserves failed production prototypes and results in these problematic situations becoming perpetual. In other words, failed businesses live longer and the emergence of new businesses is not accelerated. The consequence is that the production of innovation is slowed and the economy experiences increased systematic risk since diversification does not work.

The theory of the firm (Coase, 1937) introduces the notion that markets and firms (hierarchies) are two alternative institutional forms that govern transactions. Coase (1937) argues that firms may replace markets when the costs of internal transactions within an organization are lower than those of market transactions. For Coase (1937), transaction costs add inefficiencies to the market. Williamson defines transaction costs as the “costs of running the economic system” (Williamson, 1985).

Williamson (1973), in “Market and Hierarchies”, argues that a hierarchy exists “mainly because of uncertainty and opportunism, though bounded rationality is involved as well. It exists when true underlying circumstances relevant to the transaction, or related set of transactions, are known to one or more parties but cannot be costlessly discerned by or displayed for others”. When hierarchies are spread along the whole range of economic activities, they increase uncertainty and, conceptually, systematic risk. Moreover, transaction costs deprive the real economy of resources and are not conducive to optimal resource allocation. High transaction costs lead to market failures and limit efficient resource utilization, increasing the likelihood of systematic risk. Therefore, hierarchies and transaction costs distort resource allocation and increase systematic risk. Also, in free markets – as already mentioned – transaction costs are zero and market exchanges occur in a competitive environment. In general, any effort to integrate transaction costs in mainstream economics – based on the general equilibrium framework – involves working outside the equilibrium framework (Williamson, 1981).

Factors that enhance the formation of idiosyncratic institutions (hierarchies and high transaction costs) are coordination failures, information asymmetries and evolution path dependence. Coordination failures occur when the actions of an individual (or a firm) generate externalities that affect other members of an economic system. Consequently, externalities that are not taken into account bear economic costs, leading the economy toward an equilibrium point that deviates by the Canonical Pattern. Another crucial point is the fact that information asymmetries in turn affect resource allocation within an economy and make it difficult to reach market efficiency. Moreover, the elimination of such information asymmetries requires contract between assignor and assignee, which creates an additional operating expense for the economy.

The prevalence of hierarchical structures in the production process creates obstacles to the orientation of available resources to more productive destinations, making it difficult for economies to adapt or slowing their adaptation to the creative destruction that is essential to economic renaissance.

In relation to evolution path dependence, we assume that history still plays a decisive role in various everyday aspects of human existence, such as preferences, decisions and behaviors. However, it is interesting to understand how preferences are formed and, especially, the extent to which they are evolution path dependent. In so far as preferences are formed by initial experiences, later preferences are path dependent (Hoeffler, Ariely, & West, 2006). The factors that govern how previous experiences affect people's later preferences can be sought in drive anchoring and adjustment mechanisms (Chapman & Johnson, 1999; Strack & Mussweiler, 1997).

Evolution path dependence demonstrates the problem of economic science and more specifically the classical economics problem of efficient market functioning. However, in most cases, institutions cannot ensure property rights and economic governance. Both property rights and the manner in which an economy functions result from a path dependent procedure with elements of historical legacy. Based on this concept, the existence of high systematic risk is favored in societies with historical aspects that distort the property rights network. Additionally, distortion of property rights creates disincentives to proceeding with business initiatives and generally limits market efficiency.

Deviations from the optimal pattern: the case of cultureThe concepts of culture and preferences illustrate how members of a society react to everyday concerns. “Culture is defined as a set of shared values, beliefs and expected behaviors” (Hayton, Gerard, & Zahra, 2002). The cultural characteristics of societies reflect psychological social stereotypes that have been created over time and are prior human constructs to current transactions and institutions (Petrakis & Kostis, 2013). Cultural background is conceptualized as a set of “shared knowledge” consisting of (a) taught thought procedures, (b) belief, behavior and value constructs and (c) underlying theories of the physical and social worlds. Thus, cultural background is constituted by cultural syndromes that can be considered intermediate mental constructions that originate from the distant past and connect it with the present (Hong, 2009). The concept of preferences works similarly to that of culture. As defined by Bowles (1998, 2004): “Preferences are reasons for behavior, that is, attributes of individuals – other than beliefs and capacities – that account for the actions they take in a given situation”. Preferences are assisted by three district procedures which include: (a) a list of preferences, (b) rules of ordering and (c) the criteria of optimal choices. These procedures are posited at the final stages of an action preparation and are required for action implementation. Thus, they are bearing all the influences from culture and beliefs. In this paper, when we refer to preferences, we imply all the influences that are exercised by culture and beliefs as well. Although there are economists that assume the exogeneity of preferences (Fehr & Hoff, 2011), it is now accepted that preferences are endogenous in nature. However, there are external influences originated by geographical, biological origin, etc. Bowles (2004) argues for the endogeneity of preferences with respect to institutions as a means to determine the effects of human incentives in the formation of institutions.

The contradictions in the deviations refer to three sub-groups of preferences and behaviors: (a) investment behavior, (b) cultural treats and behavior and (c) loss aversion behavior.

Non-diversification idiosyncratic investment behaviorDiversification is also important to the economy, since diversification of investment and production is essential to economic growth. This statement has been much analyzed in the economic literature. Nobel laureate Simon Kuznets (1971) suggests that national economic growth can be defined as a long-term rise in capacity to supply increasingly diverse economic goods to the population. This argument is further empowered by Grossman and Helpman (1992), who claim that for an economy to grow, it must produce an ever-increasing quantity, quality and variety of goods and services.

An economy is diversified when it has incomes from many different sources that are not directly related to one another (Shayah, 2015). If national income depends on the production of one product, the national standard of living can fluctuate with the price of that product. Imbs and Wacziarg (2003) show the pattern of sectoral diversification along the development path, indicating that countries first diversify, in the sense that economic activity is spread relatively equally across sectors, but relatively late in the development process they start specializing again.

Osakwe (2007) finds a more specific effect of product diversification connecting diversification with risk. He points out that policymakers in developing countries are interested in diversifying their production and export structure to reduce vulnerability to external shocks. This is in line with Ramey and Ramey (1995), who note that more diversified economies are less volatile in terms of outputs, while lower output volatility is associated with higher economic growth. Owner-managers often employ a diversification strategy to reduce the risks related to employment and reputation, since they can decrease firm financial risk by diversifying into unrelated activities (Amihud & Lev, 1981). Furthermore, intra-industry product diversification engenders a trade-off between potential risks of exceeding reasonable capacity to effectively offer diverse products and the possible demand externalities generated by offering a broad range of products (Kang, Lee, & Huh, 2010). Ballivian and Sickles (1994) investigate the relationship between risk-avoidance behavior and economic jointness in a multioutput technology, and notice that diversification in production can have several explanations, such as jointness, cost complementarities and risk-avoidance.

Additionally, systematic risk can be mitigated by diversification. Montgomery and Singh (1984) as well as Bettis and Mahajan (1985) associate the concept of diversification strategy with the level of systematic risk, expressed through systematic risk beta (taken as a proxy for market risk), and conclude that diversification increases corporate returns and decreases systematic risk. Additionally, it is argued that firms can significantly minimize their risk by diversifying into similar businesses rather than into identical or very different businesses (Lubatkin & Chatterjee, 1994).

Economies that do not diversify their investment plans and production are more vulnerable to external shocks and lack easy escape routes in response to economic downturns or other external shocks. In contrast, economies that diversify their investment plans and production are sufficiently protected against external shocks or economic downturns. Diversification thus enables economies to maintain the speed of creative destruction and associated innovation.

The idiosyncratic cultural background and loss aversionIdiosyncratic/stagnated cultural background can be characterized by the existence of specific forces that act in a peculiar manner forming individual preferences. Persistent high systematic risk leads to the formation of an idiosyncratic cultural background. This kind of cultural background may be represented through the analysis of three dimensions: (a) uncertainty avoidance, (b) in-group collectivism and (c) high time discount preferences.

Given that decisions are made by agents, systematic risk affects particular characteristics of the cultural background. Human behavior is defined by interaction between individuals and their external environment, generally leading to the formation of personality traits, beliefs and perceptions.

Uncertainty avoidance refers to a lack of social tolerance for uncertainty and doubt. The existence of risk and uncertainty entails that estimates about the future cannot be fully reliable, since there is insufficient information to be creditworthy in attributing the probabilities of the realization of the various results (Petrakis, 2014).

Everyday stimuli form individual's reaction and behavior mechanisms. Similarly, risk perception (Brehmer, 1987) and risk judgments are associated with a cognitive process of processing available information (Kahneman & Tversky, 2000). Events and their consequences are important to our perceptions of risk (Drottz-Sjöberg, 1991; Sjoberg, 2000).

The prevalence of high economic risks leads individuals to protect themselves against risk by demonstrating uncertainty avoidance behaviors. Besides the obvious source of risk perception, there is a belief that risk is a social phenomenon that cannot be examined individually (Boholm, 1996). As risk perception is not formed in a social vacuum, one cannot account for how people perceive risk without considering the social context. Risk perception is a social and cultural phenomenon (Douglas, 1978) that is not dominated exclusively by particular human personality characteristics, needs or preferences.

Acceptance of uncertainty and rate of innovation are negatively correlated (Hofstede, 1980; Shane, 1993, 1995). Willingness to assume entrepreneurial risk, long-term planning and acceptance of changes are basically cultural traits that are boosting innovation (Rothwell & Wissema, 1986). Cultures that reward creativity and motivate their members to achieve personal progress tend to record better innovation results. Furthermore, culture can be seen as a long-term strategic instrument for innovation and competitiveness (Petrakis, Kostis, & Valsamis, 2015). Restated, in risk-avoiding societies, low implementation of creative destruction is expected, since such societies avoid engaging in failed and inefficient activities.

The second dimension refers to in-group collectivism. People have a group mindset and look after the benefit of the group, often suppressing their personal achievements for the interests of the group (Petrakis, 2014). In-group collectivism can be seen essentially as individuals’ resistance to join a group for feelings of safety, for protection against uncertainty, or to ensure access to material resources and social support (Triandis, Bontempo, Villareal, Asai, & Lucca, 1988).

In contrast, privacy and innovation potential are positively correlated, since the more freely an individual can express their opinions, the greater the possibility of exploring new ideas (Barnett, 1953). Individualistic societies tend to encourage their members to express their opinions and provide the freedom necessary for creativity. Furthermore, weak links among members of individualistic societies promote easier information dissemination relative to collectivist societies, whose members utilize information at the intragroup level and prevent its dissemination. Mental attributes such as independence, achievement and innovation encouragement are commonly found among individuals inhabiting individualistic societies (Shane, 1992).

Finally, the third dimension of idiosyncratic cultural background, high time discount preferences concern the preference of the members of a society for evaluating the present more highly than the future. Generally, time occupies the core of the cultural background and is responsible for shaping behaviors and perspectives. Individuals make predictions based on the knowledge, perceptions and beliefs that they form during their lives and by partaking in social groups (Nurmi, 1989). In an uncertain and high-risk environment, members of society tend to be cautious about their future decisions, and seek to delay the commitment of resources and effort. When such individuals are oriented toward the present rather than future, innovation is prevented. Innovations require long-term thinking and planning since they rarely yield short-term benefits. Consequently, societies that are more oriented to the present are not interested in innovations after an external shock or economic downturn. Such societies exhibit destruction together with an absence of creativity. Thus, creative destruction slows down in such societies.

Loss aversion assertion (Kahneman & Tversky, 1979) – one of the elements of the prospect theory (Tversky & Kahneman, 1991) – implies that people are twice as sensitive to risks as to gains. That is, the absolute subjective value of a specific loss exceeds the absolute subjective value of an equivalent gain (Ert & Erev, 2010).

The main point here is that loss aversion behavior can be inflated by high systematic risk levels and idiosyncratic/stagnated cultural background. Several studies examine loss aversion in choices among high stakes (hypothetical) gambles (Abdellaoui, Bleichrodt, & Haridon, 2008; Abdellaoui, Bleichrodt, & Paraschiv, 2007). The results are consistent with loss aversion, but could not be differentiated from mere risk aversion, which is typically observed in decisions that involve high stakes (Holt & Laury, 2002).

Breuer, Riesener, and Salzmann (2014) suggest that individualism, which is linked to overconfidence and excessive optimism, significantly and positively affects financial risk aversion. They find evidence consistent with low levels of individualism being important in explaining the limited participation puzzle. Furthermore, Chan and Saqib (2013) posit that loss aversion attenuates under time pressure. More precisely, they point out that, relative to the situation without time constraints, people under time pressure no longer consider the hedonic impact of losses to exceed that of gains, but instead see the two as roughly equal. This is because people consider time a resource, meaning the loss of time under time pressure is a loss of a resource, placing them on the locally convex portion of the value function. From this point, the hedonic impact of any further loss diminishes relative to decisions based on the status quo. In other words, loss aversion attenuates.

Brennan and Lo (2011) point out that when reproductive risk is systematic (i.e., correlated among individuals within a given generation), some seemingly irrational behaviors, such as probability matching and loss aversion, become evolutionarily dominant.

In loss-averse societies people tend to strongly prefer avoiding losses to acquiring gains, and thus do not engage in long-term risky innovations. Under these circumstances the adjustment involved in creative destruction is slow.

The coevolution of institutions and culture in a stagnated growth prototypeIn contrast to the Walrasian paradigm, the evolutionary paradigm is based on three key components: (a) structures of social interactions, (b) agent's behavior and culture, and (c) technology. It is based on a diversified and more realistic concept, which is an evolutionary process of preferences, behaviors and economic institutions.

The major issue is whether culture evolves in a manner that matches institutions. Institutions should be compatible with preferences. Otherwise, they will be unable to support their cause, leading to conflicts where institutions and culture do not match.

Roland (2004) classifies institutions into two categories based on their evolution velocity: fast-moving institutions (political institutions) and slow-moving institutions (culture, norms and stereotypes). Endogenous interactions among institutions and preferences and their coevolution are important during economic evolution (Tabellini, 2008).

It is difficult to understand how institutions coexist with preferences because institutions are endogenously selected by individuals and because institutions and preferences coevolve (Aghion, Algan, Cahuc, & Shleifer, 2010; Tabellini, 2008).

The perpetuating stagnated growth prototypeThe occurrence of new institutions is associated with cultural innovation (Bowles, 2009). However, such institutions usually result from many complex processes, which are not performed jointly, but are individual in terms of time and space. The adoption of new preferences is a process that reflects changes in human behavior that result from various influences on individuals (Bowles, 1998). Complementarity in the development of both culture and institutions is necessary for the long-term survival of institutions.

In the above analysis, the evolution of social preferences structure is very important because it makes small “original” differences prevalent and perpetual. Thus, population is constantly in a situation where influences from the past affect individual culture and institutional evolution. However, the coevolution of culture and institutions is not synchronized in most cases. Incompatibility may be affected by time course, for example where institutions reach an equilibrium that is compatible with equilibrium preferences, but this occurs so when preferences have been modified, and vice versa. However, incompatibility may also result from incomplete transformation of preferences into institutions that may occur for many reasons (such as ineffective political process or hidden preferences).

Summarizing, the two distinct characteristics, namely extractive institutions and non-market mechanisms of resource allocation, have been shown to have second round effects on institutions (generation of systematic risk) and preferences (lack of diversification in investment behavior and idiosyncratic cultural background). The formation of the second round idiosyncratic institutions and culture perpetuates the existence of extractive institutions and non-market mechanisms of resource allocation. Thus, a stagnated growth prototype is generated and prevails with low performance on entrepreneurship and innovation, and the economic prototype can stagnate when creative destruction slows and is characterized by low innovation performance.

This stagnated growth prototype has no endogenous energy to overcome the barriers to growth. Institutions always affect preferences and vice versa, through the coevolution pattern they follow, which can survive for a long time (Fig. 1). When a stagnated growth prototype prevails in an economy, it can experience long periods of stagnation. These periods of stagnation can be interrupted by waves of imported growth (incoming capital and innovation) which can generate growth episodes. The specific requirements are not examined in this paper.

Conclusions and policy implicationsSome basic issues that concern the evolution of institutions and culture have been highlighted in this paper. The ultimate goal of this paper was to describe what we referred to as the perpetuating stagnated growth prototype – i.e. the economic model that does not place institutions and culture that promote innovations.

The stagnated growth prototype described in this paper is a general definition of a deviation from the optimal pattern, in which idiosyncratic institutions and culture are generated. However, it is not the only possible form of deviation from optimality. In any case, deviations from the optimal pattern affect the speed of adjustment of the creative destruction process and hence the innovation performance.

The stagnated growth pattern alters the core of Schumpeter's thoughts about the role of creative destruction.

Concerns about growth policy should be devoted to the extent to which we can reach a growth performance pattern with endogenous ability to generate growth. Consequently, attention should be redirected to the planning and implementation of pro-growth structural changes with reference to institutions and culture that would take into account their coevolution process. Otherwise, we must rely on the importation of growth (i.e., inwards capital flows or incoming innovation), forming an exogenous pro-growth prototype that promotes growth, entrepreneurship and innovations.

The question is how a stagnated growth pattern can be transformed into an exogenous pro-growth pattern (optimal growth pattern) that can promote innovation and growth. Do we have to cure the sources of the generation of the deviations from that canonical growth pattern or should we impose policies that will directly change existing institutions and culture? From one perspective, the question concerning the causes of the deviations from that canonical growth pattern is meaningless since no one can reverse the path dependence evolution. Thus, what we can do is change the current state of institutions. However, according to the coevolution principle, institutions should change with the culture status. However, culture changes at various speeds under specific circumstances even though generally cultural change is a long-term process. But arguments exist that culture can change significantly after major economic shocks. Therefore, the question is how institutions and culture can simultaneously change. Although clarity exists regarding the optimal direction and means of institutional change, no clear idea exists regarding how culture should change during institutional change. Thus an institution-culture low growth trap can be avoided. However, achieving such a transformation is a much more difficult task that requires detailed elaboration, something that can be analyzed in future research.