For this study, we examined the relationship between the digital economy and labour share from the perspective of industrial heterogeneity. To analyse the digital economy's impact on labour share, we introduced a digital economy into a framework concerning labour share. We then built a mathematical model describing the influencing mechanism of the digital economy on labour share. We generated data from Chinese listed enterprises (n=3778) from 2007 to 2019 and applied a two-way fixed effects model to scrutinise the data. The results show that (1) the digital economy affects labour share through three countervailing forces: the productivity improvement effect, factor-biased effect, and scale return change effect; (2) the labour share would change to -0.12%, 0.36%, and -0.48% through the productivity improvement effect, factor-biased effect, and scale return change effect, respectively, with a 0.1% increase in the digital economy, indicating that the labour-biased effect is the main component of the increase in labour share, and the scale return effect is the primary source of the decline in labour share; (3) a phenomenon similar to the digital divide exists in the factor-biased and scale return change effects for heterogeneous industries. Theoretically and empirically, this study contributes to the existing findings and offers useful managerial insights.

According to an industry white paper released by the China Academy of Information and Communications Technology (CAICT), in the context of a new technological revolution, innovation and knowledge accumulation mostly occur in digital technology, and the digital economy has become a vital part of the global economy. The scale of the digital economy of 47 counties in 2020 was $32.6 trillion, accounting for 43.7% of total gross domestic product (GDP). The US, China, and Germany ranked first to third with scales of $13.6, $5.4, and $2.54 trillion, respectively. Since the digital economy has become a crucial driving force for global development and the rapid growth of the digital economy in the post-COVID-19 era, promoting digital transformation has become a critical strategy for the future development of countries worldwide. For instance, in China's 14th Five-Year Plan, the proportion of the added value of core digital economy industries in GDP is listed as one of 20 economic and social development indicators, and should reach 10% by 2025. Europe released ‘Europe's digital decade: Digital targets for 2030’, which indicates that 75% of European Union (EU) companies will be using cloud/artificial intelligence (AI)/big data, and more than 90% of small and medium-sized enterprises (SMEs) should reach at least a basic level of digital intensity by 2030.

Since 2000s, a succession of new information and communication technologies (ICTs) has diffused and underpinned economic change (Bukht & Heeks, 2017). With the swift expansion of the digital economy, digital technology has transformed production in sectors ranging from agriculture to manufacturing to services. In this process, the digital economy can also be understood as a disruption of existing economic processes and the emergence of new economic processes, systems and sectors (Dahlman et al., 2016; Bukht & Heeks, 2017). Digital technology—including AI, big data analysis, the Internet of Things (IoT), and robots—has greatly influenced the auto, chemical, and retail industries, among other sectors. In this process of digital transformation, the labour market is also undergoing profound changes—such as machines replacing manual mechanisms and algorithms replacing humans—that have become increasingly apparent. It is noticeable that the marginalisation of developing country workers within any strengthening of digital labour driven from and for the global North (Martin et al., 2016).

The development of the global digital economy shows that it occupies an important position and is experiencing fast growth. We investigated the relationship between the digital economy and labour share in China from the standpoint of industrial heterogeneity. The research method used is also applicable to relevant studies conducted in other countries.

The remainder of this paper is organised as follows. Section 2 contains the literature review. Section 3 outlines a mathematical model to analyse the influencing mechanism of the digital economy on labour share and presents the hypothesis. Section 4 covers the methodology. Section 5 illustrates data from Chinese listed enterprises (n=3778) from 2007 to 2019; we applied a two-way fixed effects model to analyse the data. Section 6 addresses the implications and conclusions.

Literature reviewCurrently, the rapid spread of the digital economy has attracted the attention of scholars, some of whom have explored the digital economy's influence on the economy at the macro level. For example, Veselovsky et al. (2018) examined financial, tax, information, communication, infrastructural, technological, and organisational mechanisms of innovative activity promotion in conditions of transition to a digital economy. Some scholars have studied how enterprises should face the digital economy at the micro level Sebastian et al. (2020). described how a big old company can combine customer engagement and digitised solutions to navigate its digital transformation. In addition, scholars have investigated the social changes brought about by the development of the digital economy. For example, Iivari et al. (2020)) scrutinised the digital transformation of the basic education of the young generation initiated by the COVID-19 pandemic and discovered a variety of digital divides.

In contrast to the emerging research on the digital economy, research on the labour share in economics has a long history. In the famous ‘Kaldor's Stylised Facts’, proposed by Kaldor (1961): ‘The steadiness in the share of wages’ is generally accepted as the fifth fact. In recent decades, many researchers have identified a decline in the labour share of GDP (Blanchard et al., 1997; Elsby et al., 2013; Karabarbounis & Neiman, 2014; Piketty, 2018; Autor et al., 2020). However, some documents claim that the fall in the labour share of GDP is due to measurement issues (Elsby et al., 2013; Bridgman, 2018; Rognlie, 2016; Koh et al., 2020; Smith et al., 2019).

Based on the measurement of labour share, scholars have also examined the influencing factors of the labour share, which can be divided into three perspectives: (1) Research explaining the change in labour share from the angle of knowledge and innovation. Acemoglu (2003) developed a model to trace the relationship between capital-augmenting technical change and labour share change along a transition path. (2) Research explaining the change in labour share from the standpoint of institutions Blanchard and Giavazzi (2003). showed that labour market regulation determines workers’ bargaining power and discussed the effects of deregulation on labour share Fichtenbaum (2009., 2011) supported the idea that the decline in unionisation is an important factor in explaining the drop in labour share. (3) Research on factors influencing the labour share from the perspective of global trade Böckerman and Maliranta (2012). stated that increased international trade eliminates enterprises with low productivity, improves the overall labour productivity of the industry involved, and ultimately reduces the labour share.

According to the abovementioned literature, the research on the digital economy and the labour share marks the continuity of research on the labour share from the view of knowledge and innovation against the background of digital transformation. Regarding the relationship between the digital economy and the labour market, the existing literature mostly refers to changes in the labour market caused by the development of technology in the digital economy. For example, Acemoglu (2019) analysed the impact of the application of robots on labour demand and labour income, and found that every robot added nationwide in the manufacturing industry would replace 3.3 workers on average and reduce wages by approximately 0.4%. The use of robots has directly led to a decline in the incomes of low- and middle-skilled workers, exacerbating income inequality Abdurakhmanova et al. (2020). incorporated the level of development of the digital economy into the measurement index of the human capital market. Ballestar et al. (2021)demonstrated the existence of long-term productivity-augmenting and labour-reducing effects as a result of implementing automation technologies in Spanish manufacturing firms. Some scholars believe that with the rise of the digital economy, the impact of AI on labour demand represents a structural change, which chiefly plays a supporting role in work and will increase the number of jobs (Korinek & Stiglitz, 2017; Acemoglu & Restrepo, 2019; Agrawal et al., 2019).

The limitations of the existing literature on the digital economy and labour share are manifested in three aspects. First, most relevant research focuses on specific applications of the digital economy, such as AI and the platform economy, which are not comprehensive enough. Second, the hypothesis of the digital economy is usually so strong that conclusions differ across studies. For example, when AI is assumed to be an automatic mode of production, the application of AI is a process of capital replacing labour, which results in a decrease in the labour share (Zeira, 1998; Benzell et al., 2015; Acemoglu & Restrepo, 2018). When AI is assumed to be a factor-biased technology, the effect on the labour share depends on the substitution elasticity of capital and labour (Graetz & Michaels, 2018; Bessen, 2019; Nordhaus, 2021). Third, existing empirical assessments typically rely on industry or macro data, which may easily lead to missing variables and obscure heterogeneity among firms.

Our contribution is threefold: (1) Including the digital economy into the analytical framework of the labour share expands the understanding of the influencing factors of labour share from the micro level, and enriches the existing research on the labour share and the digital economy. (2) From the three channels of the productivity improvement effect, the factor-biased effect, and the scale return change effect, we describe the influencing mechanism of the digital transformation on the labour share. (3) By comparing heterogeneous industries, we identified a phenomenon similar to the digital divide in the factor-biased effect and the scale return change effect; this provides microcosmic empirical evidence for formulating reasonable digital economy development policies.

Theoretical analysis and hypothesisBasic settingsIn the basic case, the production function of the enterprise is set in the C-D form for the simplicity of the model, as shown in Eq. (1):

In Eq. (1), Y is the output, A is total factor productivity (TFP), K is capital, L is the labour force, and α and β are coefficients of capital and the labour force respectively,αK+αL=1. We assumed that returns to scale would be variable; θ is the coefficient of returns to scale.

Mechanism analysis of the digital economy's effect on production functionThe change in the labour share is, in essence, a problem of income distribution in the production process. Therefore, the digital economy's impact on the labour share is not a direct influence, but a change in the labour share by influencing the production process and thereby income distribution. Hence, this section first examines how the digital economy affects the production function. Common digital economies include e-commerce, Industry 4.0, the algorithmic economy, precision agriculture, the platform economy, the gig economy, digital services, information services, software and information technology consulting, telecommunications, and hardware manufacturing. Based on a summary of existing common forms of the digital economy, the digital economy primarily affects the production function through the following three channels:

(1) Improving enterprise productivity

Research on the relationship between the digital economy and enterprise productivity is a long-standing problem. Early economists continued to argue about the ‘productivity paradox’, as Solow (1987) asserted, according to which computers have changed society's productive activities in ways that have not increased productivity. However, with the progress of digital technology and economic growth, scholars have come to agree that the digital economy can help improve companies’ productivity. For example, Mokyr (2014), Aeppel (2015) claimed that productivity slowdowns are related to underestimating the contribution of the digital economy. Specifically, the digital economy boosts enterprise productivity in three ways.

First, development of the digital economy promotes technological progress and innovation (Bertschek et al., 2013). This situation often manifests in the combination of the digital economy and traditional industries to form a new sector with fresh characteristics. Precision agriculture is one example; it is a combination of the digital economy and traditional agriculture. Compared with traditional agriculture, precision agriculture can adjust the input level and cultivation methods according to the soil and growth conditions of products, and formulate corresponding production goals to accurately manage agricultural production and effectively enhance agricultural productivity.

Second, the development of the digital economy will reduce economic costs and increase the speed of factor flow (Goldfarb & Tucker, 2019). For instance, in e-commerce, enterprises can apply the digital economy to sales and the management process, and then transfer the process of product storage, transportation, and sales online so as to timely master the production process, improve the rate of capital flow, and thereby increase an enterprise's productivity. In addition, the labour force can grasp the employment situation of different industries and regions through timely updated data, which helps solve the problems of frictional undertakings and structural unemployment to a certain extent. By improving the flow speed of labour factors, a company's productivity can also be enhanced.

Third, the development of the digital economy facilitates the flow of information and increases enterprises’ organization capability (Bharadwaj, 2000). Information can flow freely and efficiently with carriers of digitalisation, which reduce intermediate consumption in the production process and improve the data integration ability and technology diffusion level, thus improving companies’ productivity. Studies such as that of Torrisi and Gambardella, who examined mobile phone penetration and Internet usage, indicate that increased data mobility has a long-term impact on productivity.

In sum, the digital economy boosts companies’ productivity, and this relationship can be expressed by Formula (2) where the variable Digital represents the level of the digital economy's development.

(2) Changing the factor input structure

The digital economy's impact on enterprise production mode is significant. Just as the first industrial revolution realised the transformation from manual work to mechanised production, the digital economy has also transformed the combination of labour and capital factors, which in turn has a significant influence on companies’ production processes. ‘Industry 4.0’ is one of the transformation directions of the manufacturing industry under the development of the digital economy. The concept of ‘Industry 4.0’ was put forward by Germany and is also known as the ‘Fourth Industrial Revolution’. It chiefly refers to the deep integration of the manufacturing industry with information and intelligent technologies to realise the construction of an intelligent, interconnected system of production services for large functional industries. Acemoglu et al. (2014, 2018) pointed out that the development of the digital economy will cultivate intelligent and automated production, which may have a substitution effect on labour; that is, it could reduce the demand for labour and further lower income earned from labour.

The digital economy changes the output elasticity of the different factors in companies’ production process. Therefore, based on the digital economy's effect on the factor input structure, the digital economy can be divided into two situations: a capital-biased digital economy and a labour-biased digital economy.

A labour-biased digital economy means that its development of the digital economy increases the demand of enterprises or industries for labour. This situation usually emerges in the consumer services sector. For instance, before the emergence of e-commerce, consumers chose to buy commodities in local wholesale markets or shopping malls. In these circumstances, the number of merchants is normally restricted by entry costs and the number of shop facades. However, in e-commerce, merchants no longer have a demand for shop space, and the entry cost of opening a shop is close to zero. Hence, compared to the traditional consumer service industry, the demand for the labour force in e-commerce is significantly higher. As such, we regard this situation to have a labour-biased digital economy; its mathematical expression is presented in Eq. (3).

A capital-biased digital economy means that its development of the digital economy increases the demand of enterprises or industries for capital. This scenario is fairly common in life and often manifests as the replacement of the labour force by machines, such as the replacement of some workers by the development and popularisation of intelligent robot applications in the manufacturing industry, and the replacement of tellers by ATM machines in the service industry. Thus, we regard this situation as a capital-biased digital economy; its mathematical expression is displayed in Eq. (4).

(3) Changing returns to scale

The traditional view is that the digital economy has network externalities; as such, the digital economy can successfully improve companies’ scale return level. Metcalfe's Law states that the value of a communications network is proportional to the square of the number of its users. Users tend to flock to a few platforms when using a variety of web services which is likely to lead to the phenomenon of ‘natural monopoly’ in the digital market and the formation of ‘winner-takes-all’. This situation can be reflected in the platform economy, the software services industry, and other sectors. An example of this scenario is an online food-ordering platform that provides ordering channels and distribution services. The users of the platform include restaurant owners and consumers. In the process of consuming food and drinks, the greater the number of restaurant owners, the wider the range of consumer choices, which in turn will attract more consumers. The larger the number of consumers, the larger the consumer market of restaurant operators, which will attract more restaurant operators. This shows the characteristics of increasing returns to scale.

However, for the market as a whole, and for most companies in this market, the ascension of the digital economy will make its business turn to online, thus facing the competition with the head enterprise in the relevant field. Given the lack of a consumer-scale advantage, no matter how much capital is invested, it is difficult to achieve scale growth, which will eventually lead to decreasing returns to scale. As a result, industry sales will increasingly concentrate in a small number of superstar firms, the industries that are becoming more concentrated will exhibit faster growth of productivity (Autor et al., 2020). Reality demonstrates this point: After several years of competition and development, only a few large companies are left in the platform economy and software services industry. This underscores the characteristics of an oligopoly. For example, Windows in the operating system software industry, Facebook and WeChat on social platforms, and Uber and Didi on taxi-hailing platforms. For other companies in this industry, owing to the lack of advantages in user scale, there is a large gap between their network externalities and leading enterprises’. Thus, it is difficult to obtain benefits from scale expansion, which manifests as decreasing returns to scale. Hence, we believe that the digital economy itself with network externality will affect the return to scale in the process of enterprise production, and for a few head enterprises in the same industry, the digital economy will increase the return to scale. However, for most companies from the same industry, the improvement of the digital economy will decrease the return to scale. The overall relationship is outlined in (5):

Mechanism analysis of the digital economy's effect on labour shareAccording to the first-order conditions of the labour force, the income of labour force w can be obtained as seen in Eq. (6), where mc is the product's marginal cost.

Labour share S can be expressed as the ratio of labour income to total enterprise income:

In this study, the market is considered to be an imperfect competitive market. Enterprises can gain profits by changing the price P; the cost is c, and the markup m is the ratio of product price P to marginal cost mc, m=Pmc>1. In combination with Eq. (7), the simplified form of the labour share can be derived, as displayed in Eq. (8):

Furthermore, we internalised the markup m, referring to the mathematical model constructed by Melitz and Ottaviano (2008), and found a positive correlation between the addition rate and enterprise productivity, namely, ∂m∂A>0. According to this conclusion, the enterprise's output-profit ratio is set as δ in this study. According to the setting of Huang et al., 2016, assumingm(A)=δA(KαLβ)θ, substituting it into Eq. (8), Eq. (9) can be obtained:

As mentioned above, the digital economy can boost productivity, modify production modes, and change returns to scale in companies’ production process. Combining with Eq. (9), the partial differential equation of labour share in the digital economy can be derived as shown in Eq. (10):

In sum, we broke down the digital economy's influence on labour share into three effects: productivity improvement, factor-biased, and scale return change. The digital economy's precise impact on the labour share depends on the sum of these three effects. Hypothesis 1 is as follows:

H1 The digital economy's influence on the labour share is not constantly positive or negative, but depends on the joint impact of the productivity promotion effect, the factor-biased effect, and the scale return change effect.

To further determine how the digital economy would change the labour share, we examined the productivity improvement effect, the factor-biased effect, and the scale return change effect.

(1) Improvement in productivity

The function expression of productivity improvement effect is outlined in Eq. (11)

Based on Eq. (11), we can see that the positive productivity improvement effect would reduce the share of labour income, ∂S∂A∂A∂Digital<0. This means that while the digital economy of enterprises improves their productivity, the subsequent increase in the markup of enterprises does not lead to an increase in labour share.

H2a The digital economy reduces the labour share through the productivity promotion effect. (2) Factor-biased effects

The functional expressions of the factor-biased effect are displayed in Formula (12):

Eq. (12) reveals the labour factor-biased effect. We can see that the increase oflnKL would lead to the increase of ∂S∂αL∂αL∂Digital. Thus, when the type of enterprise shifts from labour to capital-intensive, the role of a labour-biased digital economy in enhancing the labour share would be improved accordingly. This situation is similar to the phenomenon of the ‘digital divide’1: In the process of labour-biased digital transformation, the labour share of capital-intensive industries increased more apparently than in labour-intensive industries. Based on this, we derived Hypothesis 2.2.

H2b The labour- (capital-) biased digital economy increases the labour share of capital- (labour-) intensive companies more than labour- (capital) intensive enterprises. (3) Scale return change effect:

The functional expression of the scale return change effect is given by Eq. (13):

Eq. (14) represents the scale return change effect. We noted that the positive and negative form of Eq. (12) depends on 1θ−αKlnk−αLlnk. When θ<1αKlnk+αLlnk,∂S∂θ∂θ∂Digital>0, because ∂θ∂Digital<0, the decrease in scale return level caused by the digital economy would lead to a decrease in the labour share. Enterprises tend to have decreasing returns to scale to satisfy the condition of θ<1αKlnk+αLlnk; this means that enterprises tend to have decreasing returns to scale. Therefore, for companies with lower returns to scale, the digital economy tends to reduce their labour share through the scale return change effect. For businesses with higher scale returns, digital economy technologies tend to increase their labour share through the scale return change effect. This means that with the development of the digital economy, the labour share of companies with different scale remuneration levels may be further differentiated, also showing the characteristics of the ‘digital divide’. Based on the above analysis, Hypothesis 2.3 can be obtained:

H2c The digital economy's influence on the labour share through the scale return change effect is related to the level of return on the scale of enterprises. The digital economy would reduce (increase) the labour share through the scale return change effect when the company's return to scale level is low (high).

Based on the above analysis and conclusions, Hypothesis 2 can be derived:

H2 The digital economy profoundly changes its production process. The labour share can be changed through the productivity improvement effect, the factor-biased effect, and the scale return change effect, among which a phenomenon similar to the digital divide exists in the factor-biased effect and the scale return change effect across heterogeneous industries.

We primarily obtained the financial data of listed companies from the CSMAR database. Since detailed information on the intangible assets of listed companies in China began to be disclosed in 2007, we selected listed companies (n=3778) from 2007 to 2019 including 32984 observations as the research sample.

Measurement of the main variablesLabour share(1) Measurement method

The key of the measurement of labour share is how to divide the income of the self-employed owners into labour income and capital income (Kruger, 1999; Golin, 2002). Since the samples selected in this paper are chiefly Chinese listed enterprises with relatively complete accounting system. It is easily to distinguish between labour income and capital income according to financial data. Therefore, we used ‘cash paid to employees/total income of the company’ to determine the labour share of the listed enterprises.

In addition to calculating the labour share at the micro level, we computed the change in labour share at the macro level. At the macro level, the labour share is calculated by the decomposition of GDP under the income approach of China's National Bureau of Statistics, and the calculation formula is ‘labour income/GDP by income’.

(2) Measurement results

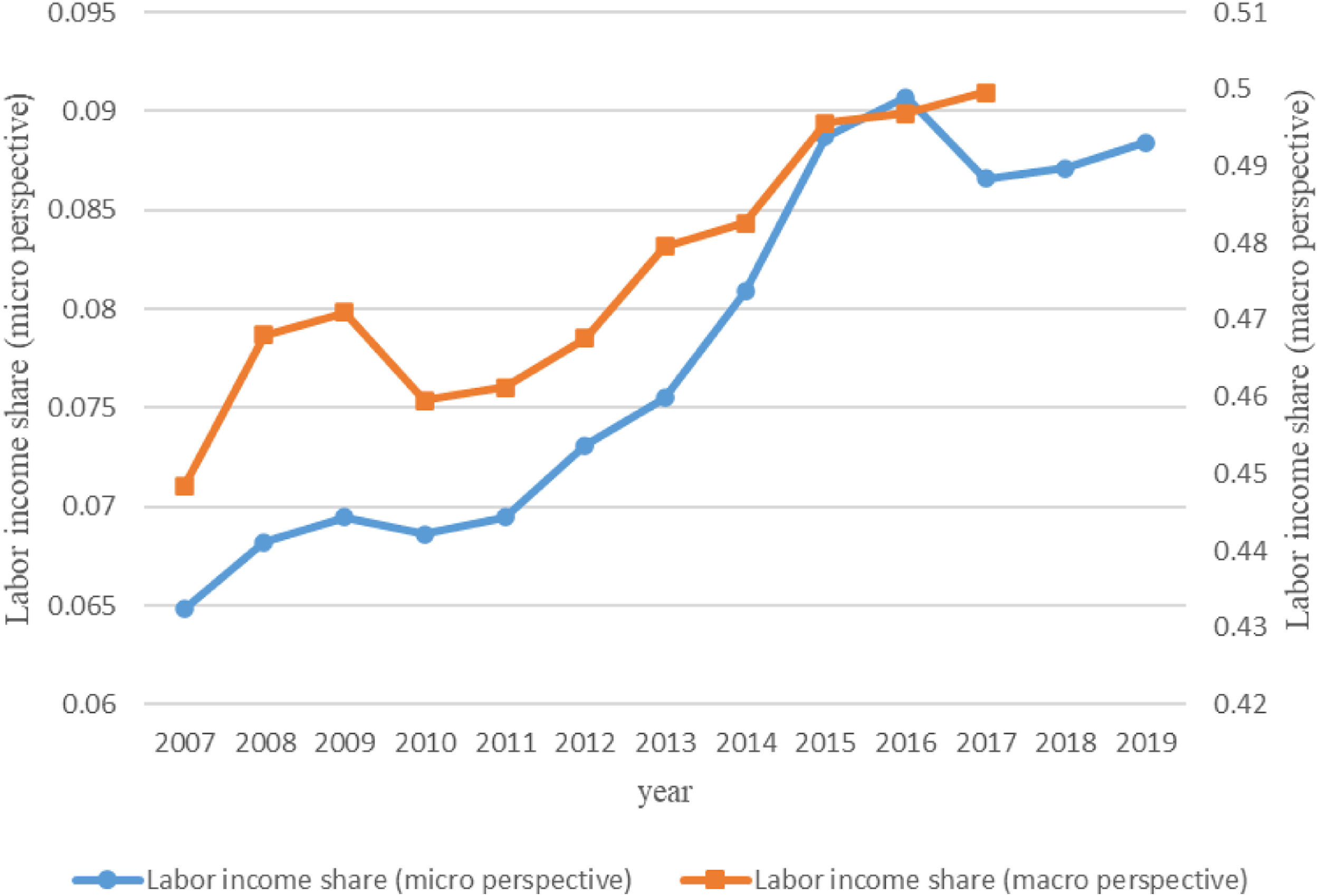

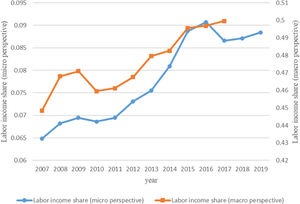

Fig. 1 outlines the changes in the labour share at the micro and macro levels in China.

According to the trend of the labour share in Fig. 1, we can draw two basic conclusions. First, since 2007, China's labour share has shown a significant upward trend. Second, the variation trend of the labour share at the micro and macro levels is fairly consistent. Since 2007, based on the listed companies, to obtain a labour share, the labour share is calculated based on the income method, and its upward trend is relatively consistent. Therefore, the method of this article, ‘payment to workers/revenue’, used to measure the labour share of listed companies in China, has high reliability.

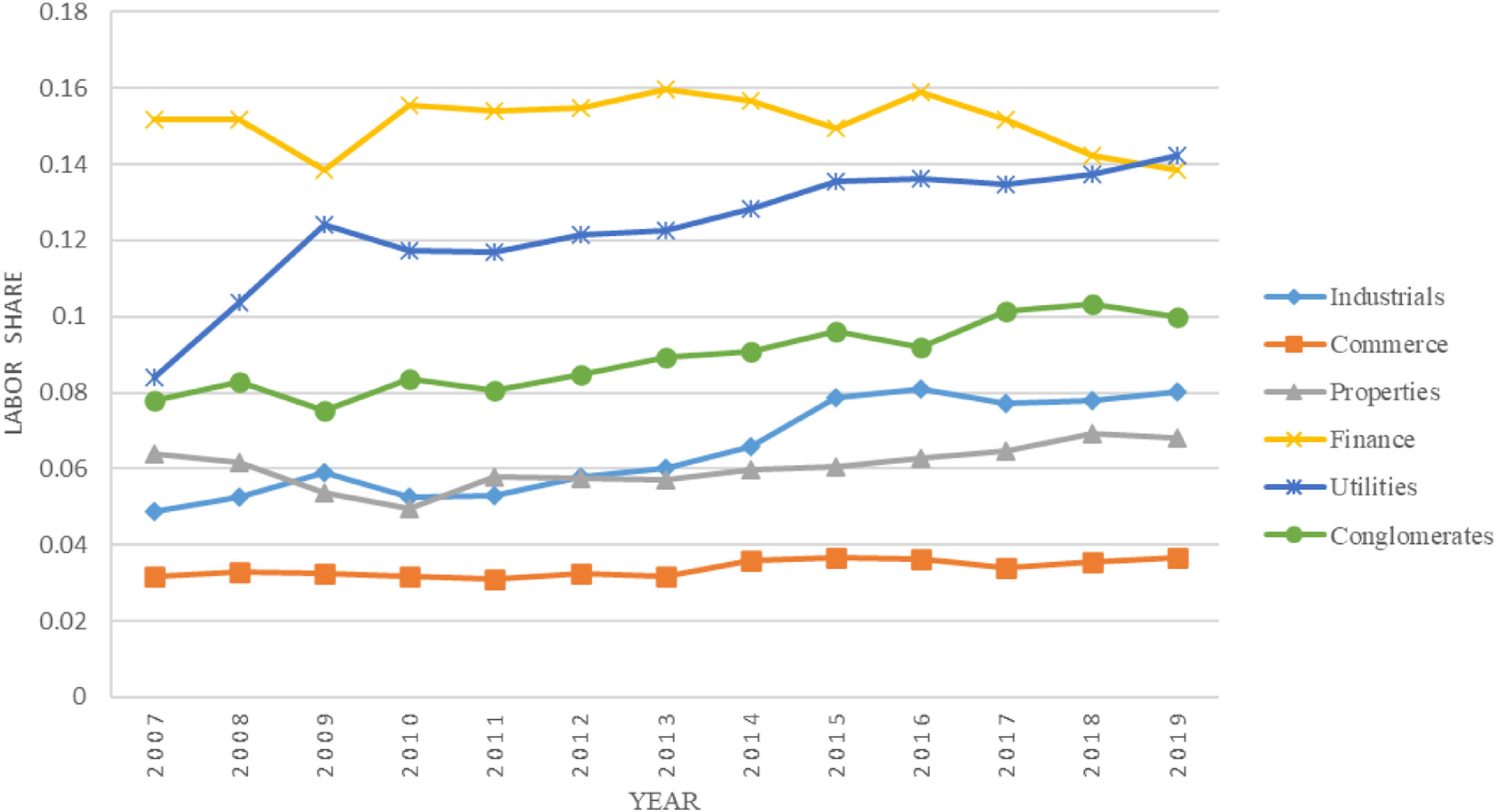

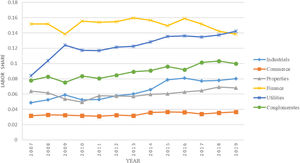

Next, we computed the labour share of all the listed enterprises in the sample. Since there is a ‘digital divide’ (as Hypothesis 2 stated) among different industries, we divided the listed enterprises in the sample into six sectors: industry, commerce, properties, finance, utilities, and conglomerates. The labour share changes for the six industries are shown in Fig. 2.

According to the labour share trend in Fig. 2, we can make the following conclusions: The financial industry has the highest labour share, ranking first until 2018. The share of labour increases the fastest in industry and utilities. Commerce has the lowest labour share and has come in last place since 2007.

The digital economy(1) Measurement methods

In this study, by referring to the method of Fan & Hong-xia (2019), we selected the proportion of digital economy-related items in the year-end intangible asset details, disclosed in the appendices of the financial reports of Chinese listed companies regarding the added value of total intangible assets, as proxy variables. Among them, intangible assets related to the digital economy are primarily intangible assets such as ‘software’, ‘network’, ‘client’, ‘digital’, ‘intelligence’ and ‘management system’. The specific calculation formula is shown in (15).

digitalirepresents the proxy variable employed to measure the digital economy level of listed company I. IA_digitali denotes the initial total amount of digital economy-related items in the intangible assets of listed company i, and IAi refers to the initial total amount of intangible assets of listed company i.(2) Measurement results

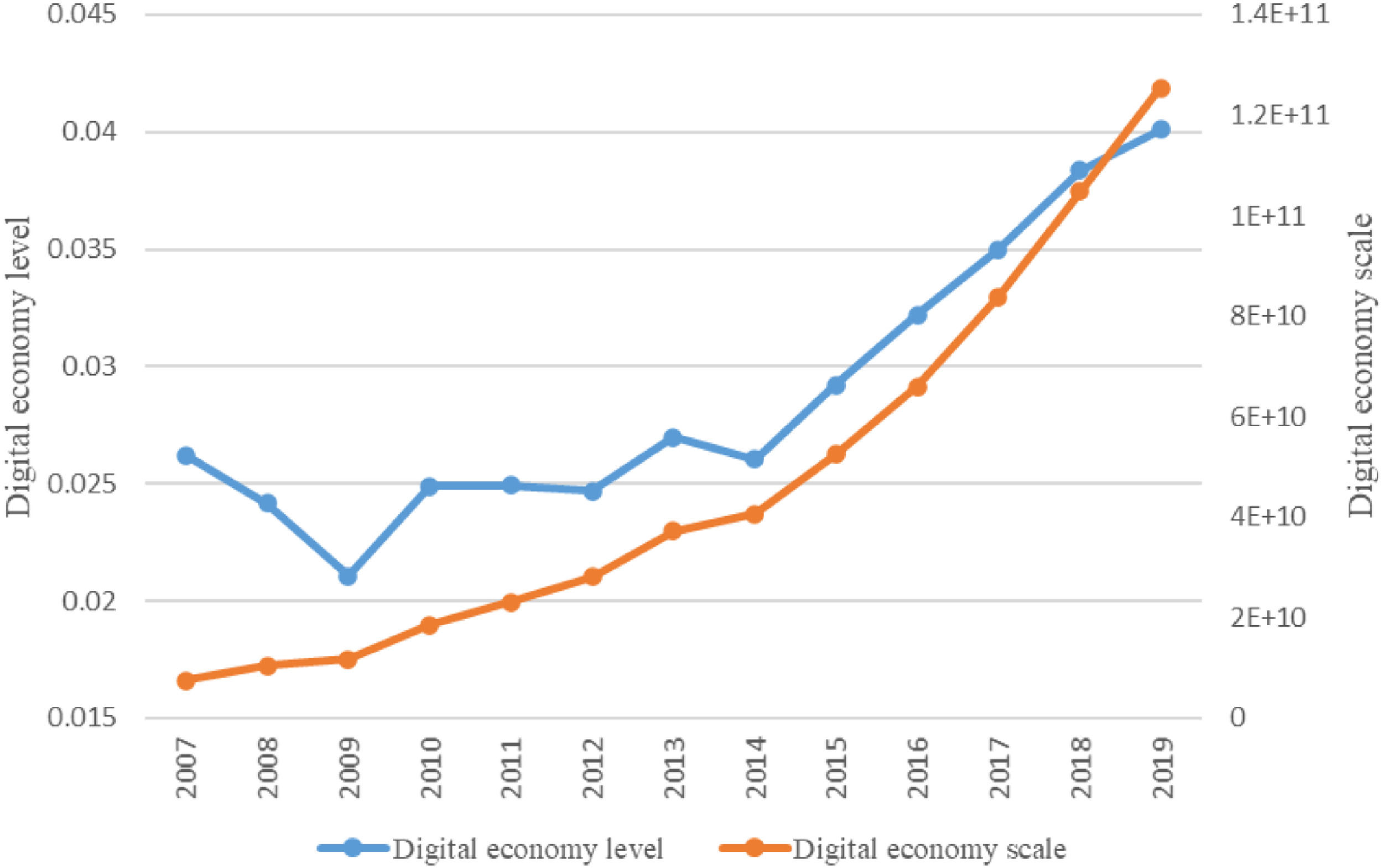

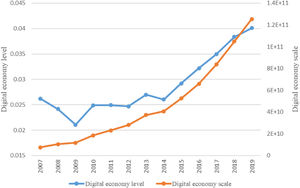

Based on the relevant data of Chinese listed companies, we calculated the changes in proxy variables to determine the level of the digital economy and the size of the digital economy in Chinese listed companies from 2007 to 2019. The results are shown in Fig. 3.

According to the trends of the digital economy level and the digital economy scale in Fig. 3, we can see that the digital economy level of Chinese listed companies has been on the rise since 2007; this upward trend has been especially apparent since 2014. From 2007 to 2019, the digital economy of Chinese listed companies grew at an average annual rate of 3.60%, and the digital economy of Chinese listed companies grew at an average annual rate of 26.38% (without considering price adjustments). Among them, the digital economy level of Chinese listed enterprises showed more rapid growth after 2014, and the average annual growth rate of the digital economy level of Chinese listed enterprises reached 9.00% from 2014 to 2019.

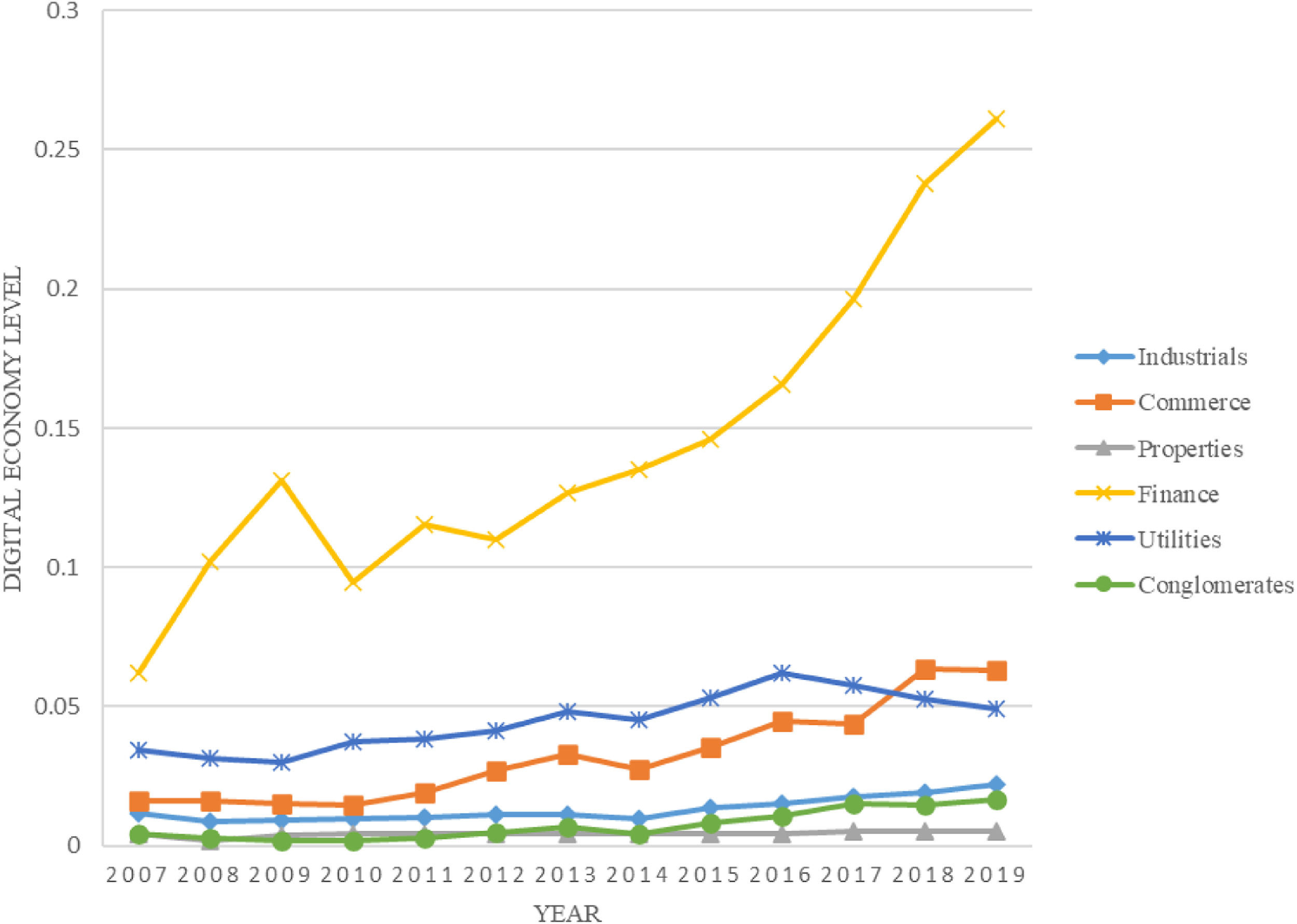

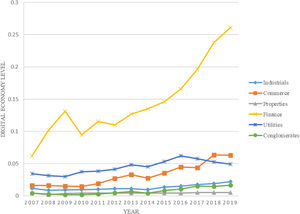

Further, we divided the listed enterprises into six industries. The outcomes of comparison are presented in Fig. 4.

The results of comparison in Fig. 4 indicate that the improvement in China's digital economy level is mostly reflected in the enhancement in the digital economy of finance and commerce. In terms of the absolute level, the digital economy level of finance was 0.261 in 2019, while that of commerce was 0.063, the first and second in six categories. From the perspective of relative changes, from 2007 to 2019, the digital economy level of finance rose from 0.062 to 0.261, while that of commerce increased from 0.016 to 0.063, both of which were at the forefront of the rise.

Technological progressWe used the LP method to estimate the TFP of Chinese listed companies (Levinsohn & Petrin, 2003). The LP method measures the micro-economy TFP of a control function method, and its core idea is to place the company's intermediate inputs as a proxy variable of productivity, assuming that companies will be based on the current condition of productivity of intermediates in decision-making, thus effectively solving the Solow Residual Method of biased problems at the same time. In this study, the log value of the TFP level of Chinese listed companies was expressed by lntfp.

Output elasticityTo calculate the output elasticity of labour and capital factors, the transcendental logarithmic function is set, as seen in Eq. (16):

In Eq. (16), Y represents the operating income of enterprise i in t, K denotes the capital stock, L refers to the number of people in the labour force, and t refers to the year. The estimation results for the parameters are listed in Table 1.

Parameter estimation results of production function.

According to the parameter estimation outcomes in Table 1, the output elasticities of capital factor K and labour factor L can be computed respectively. The calculation formulas are presented in Eqs. (17) and (18):

Based on the calculation outcomes of Eqs. (17) and (18), the output elasticity of labour factor L and capital factor K relative to the return to scale can be obtained, as shown in Eqs. (19) and (20).

The return to scale coefficientGrounded in the estimation outcomes of the transcendental logarithmic production function of Chinese listed companies, the return to scale level of listed companies can also be calculated, as outlined in Eq. (21):

Measurement of the control variablesAccording to the existing literature on the factors that may affect the labour share (Dinlersoz & Wolf, 2018; Mingjin & Ying, 2021), we set the following control variables:

(1) Enterprise scale: This is measured by the operating income of the listed enterprises.

(2) Labour productivity: This is measured by the ratio of operating income to the labour force of the listed enterprises.

(3) Whether a company is state-owned: To judge the equity ownership of a listed enterprise, if it is state-owned, this variable is ‘1’; if it is private or foreign-funded, this variable is ‘0’.

(4) Financing constraints: This is measured by the asset-liability ratio of the listed enterprises.

(5) Year of operation: This is measured by subtracting the year of opening and adding 1.

(6) Board independence: This is measured by the ratio of the number of independent directors to the number of directors.

We selected a two-way fixed effects model to test our theoretical hypothesis because the F-test and Hausman test revealed that both time and fixed effects should be considered. We constructed Model (22) to verify Hypothesis 1, and we examined whether the digital economy would directly affect the share of labour income.

We built models (23), (24), and (25) to verify Hypothesis 2. We investigated whether the digital economy would profoundly change the production process and labour income share through the productivity improvement effect, the factor-biased effect, and the scale return change effect.

Among them, shareit represents the labour share, digitalit denotes the level of the digital economy, lntfpit refers to technological progress, lamdalit indicates the output elasticity of labour factors relative to scale return, RTSit signifies returns to scale, and μiand μj refer to individual fixed effects and practice fixed effects, respectively.

Hypothesis testingThe digital economy and the labour shareWe first tested Hypothesis 1 based on Model (22) to observe whether the digital economy would directly affect the labour share. The sample data include 32,984 observations from all listed companies in China from 2007 to 2019. The results are shown in Column (1) of Table 3, where the regression coefficient of digitalt fails to pass the significance test, indicating that the level of the digital economy does not directly affect the labour share, which adequately verifies Hypothesis 1.

Additionally, the regression coefficient of tfpt is significantly negative at the 10% confidence level, that of lamdalt is significantly positive at the 1% confidence level, and that of RTSt is significantly positive at the 1% confidence level. These results suggest that the level of productivity, labour output elasticity, and returns to scale would directly affect the labour share. In terms of the overall sample, higher productivity leads to lower productivity, higher labour output elasticity leads to a higher labour share, and higher scale return levels lead to a lower labour share. Therefore, if the relationship between the digital economy and productivity, labour output elasticity, and scale return level can be verified, the digital economy's influence on the labour share can be broken down into productivity promotion effects, factor-biased effects, and scale return change effects.

For the above consideration, based on the full sample data, we used models (23), (24) and (25) to test the digital economy's influence on technological progress, the output elasticity of the labour factors, and return to scale. The results are shown in columns (2), (3), and (4) of Table 2. The findings imply that the regression coefficients of digitalt all pass the significance test of the 1% level, and the outcomes of R^2 indicate that they all obtain a good fitting degree. In terms of the overall sample, the higher the level of the digital economy, the higher the level of productivity. Moreover, the higher the flexibility of labour output, and the lower the level of return to scale. Thus, Hypothesis 1 of this study has been confirmed: The digital economy's influence on the labour share is not constantly positive or negative, but depends on the joint impact of the productivity promotion effect, the factor-biased effect, and the scale return change effect.

Empirical test of the impact of digital economy on labor share.

Hypothesis 2 holds that the digital economy would profoundly change the production process and alter the labour share through the productivity improvement effect, the factor-biased effect, and the scale return change effect, among which a phenomenon similar to the digital divide exists in the factor-biased effect and the scale return change effect across heterogeneous industries. Hence, to fully verify Hypothesis 2, we conducted sector-specific regression based on models (22) to (25). We divided the sample data into industry, commerce, properties, finance, utilities, and conglomerates. The regression outcomes are depicted in Table 4 through 7 Table 4. reveals the impact of the digital economy level on productivity in each sector Table 5. tests the impact of the digital economy level on labour output elasticity in each sector Table 6. presents the impact of the digital economy level on the scale return level in each sector Table 7. tests the impact of productivity, labour output elasticity, and returns to scale on the labour share.

Table 3 examines the impact of the digital economy levels on productivity in each sector. The regression coefficients of the digital economy level on productivity in Table 3 are 0.017, 0.023, and 0.028 in (1), (3), and (5) respectively, all of which pass the significance test at the 5% level. The findings indicate that China's digital economy mostly promotes the productivity improvement of industry, properties, and utilities, but does not significantly improve the productivity of commerce, finance, and conglomerates. Combined with the regression outcomes of the total sample in Table 2, the above results suggest that the improvement in the Chinese digital economy has a driving effect on productivity, but this driving effect is chiefly reflected in secondary sectors. Among industry, properties, and utilities, both industry and utilities belong to secondary sectors, as does construction, which is the central component of properties.

Industrial comparative analysis of the impact of digital economy on technological progress.

Table 4 tests the impact of the digital economy level on labour output elasticity in each sector. In (1) through (6) in Table 4, the coefficients of the digital economy level on the elasticity of labour output are 0.033, 0.059, 0.049, 0.064, 0.057, and 0.100, respectively, all of which pass the significance test of 5%. The results show that China's digital economy is labour-biased, promoting the improvement of the elasticity of labour output in various sectors such as industry, commerce, properties, finance, utilities, and conglomerates sectors.

Industrial comparative analysis of digital economy affecting the output elasticity of labor factors.

Table 5 tests the impact of the digital economy level on returns to scale in various sectors. The regression coefficients of the digital economy level on productivity in (1), (3) and (5) in Table 5 are -0.014, -0.015 and -0.020 respectively, all passing the significance test at the 1% level. The results indicate that China's digital economy reduces the returns to scale of industry, properties, and utilities, but does not significantly inhibit the returns to scale of commerce, finance, and conglomerates. Combined with the regression outcomes of the total sample in Table 2, the above findings signal that the improvement of China's digital economy reduces companies’ return to scale level, but this impact is chiefly reflected in the secondary sectors.

Industrial comparative analysis of the impact of digital economy on scale return level.

Table 6 tests the impact of productivity, labour output elasticity, and return to scale on the labour income share.

Industry comparative analysis of impact path of labor share.

In columns (1) and (2) of Table 6, the regression coefficients of productivity on the labour income share are -0.152 and -0.163, respectively, both of which pass the significance test at the 5% level. The results suggest that increases in productivity reduce the labour income share, and this negative impact is mostly reflected in industry and commerce. Combined with the regression outcomes in Table 4, we can verify Hypothesis 2a: The digital economy would reduce the labour share through the productivity promotion effect.

In columns (1) through (6) of Table 6, the regression coefficients of labour output elasticity on the labour income share are 0.524, 0.209, 1.309, 1.897, 0.874, and 0.650, respectively, all of which pass the significance test at the 5% level. The results imply that an increase in labour output elasticity promotes an increase in the labour share in industry, commerce, properties, finance, utilities, conglomerates sectors, and other industries. Among all of them, properties and finance are capital-intensive, with coefficients of 1.309 and 1.897, respectively, ranking first and second among the six sectors. Commerce is a labour-intensive sector with a coefficient of 0.209, ranking last among the six areas. Combined with the previous conclusion that China's digital economy is labour-biased, we can verify Hypothesis 2b: The labour- (capital-) biased digital economy increases the labour share of capital- (labour-) intensive companies more than labour- (capital) intensive enterprises.

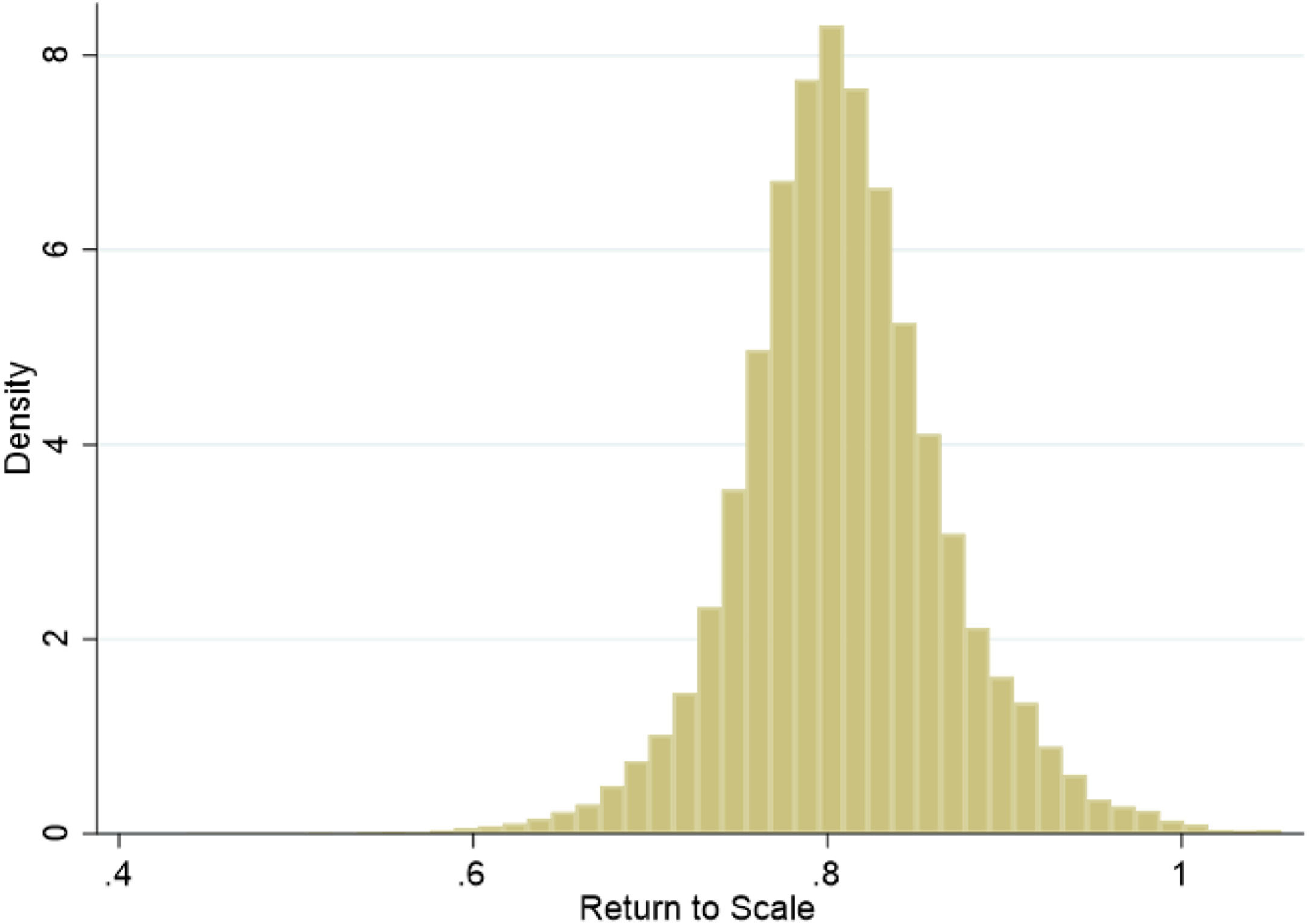

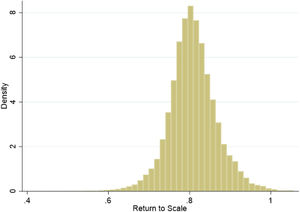

The regression coefficients of the scale remuneration level on the labour income share in columns (1) through (6) in Table 7 are 2.053, 1.079, 4.847, 6.458, 3.441, and 2.939, respectively, all of which pass the significance test at the 5% level. The results indicate that the improvement in scale returns promotes an increase in the labour share in industry, commerce, properties, finance, utilities, conglomerates sectors, and other industries. Combined with the regression outcomes in Table 6, we can conclude that the digital economy reduces the labour income share through the return to scale effect. Further analysis of the returns to scale of listed companies in China shows (as seen in Fig. 5) that returns to scale of listed companies in China are mostly lower than 1, underlining the characteristics of diminishing returns to scale. Therefore, we can verify Hypothesis 2c: The digital economy's influence on the labour share through the scale return change effect is related to the level of return on the scale of enterprises. The digital economy would reduce (increase) the labour share through the scale return change effect when the company's return to scale level is low (high).

Robustness test excluding enterprises with a digital economy level of 0 in the sample period.

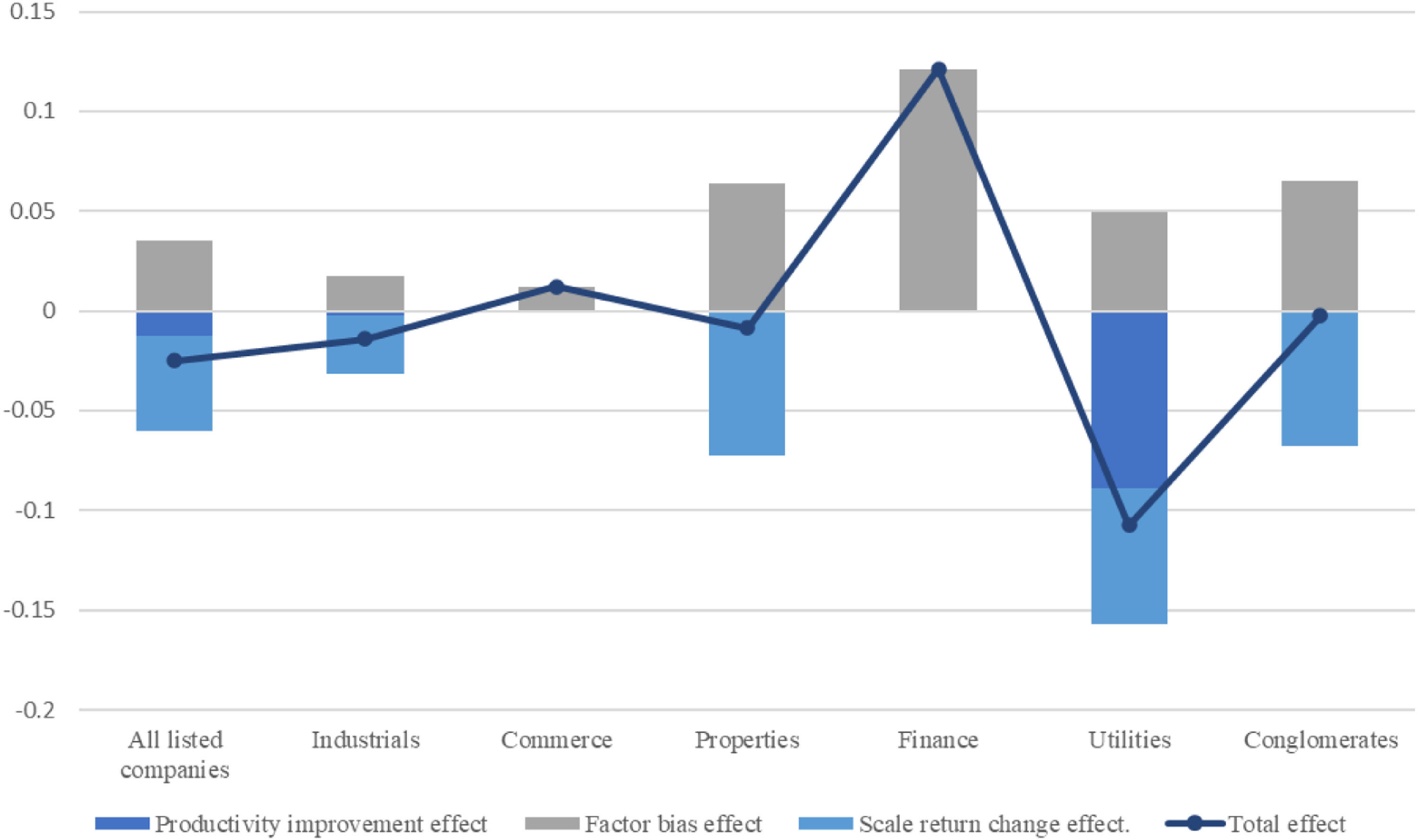

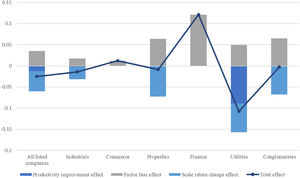

In sum, our empirical findings verify Hypothesis 2: The digital economy would profoundly change the production process. The labour share can be changed through the productivity improvement effect, the factor-biased effect, and the scale return change effect, among which a phenomenon similar to the digital divide exists in the factor-biased effect and the scale return change effect across heterogeneous industries. After establishing Hypothesis 2 (which we fully validated), we became able to more vividly describe the ‘digital divide’ in the process of the digital economy affecting the labour share in heterogeneous industries. We combined the regression results in tables 2 through 6 to draw Fig. 6, highlighting the productivity promotion effect, the factor-biased effect, the scale return change effect, and total effect of the digital economy on the labour share across heterogeneous industries.

We can draw the following conclusions from Fig. 6: (1) From the overall effect of the digital economy on the labour income share, the improvement of the digital economy reduces the labour income share of Chinese listed companies, but in commerce and finance, the improvement of the digital economy drives an increase in the labour income share. (2) The productivity improvement effect mainly exists in secondary sectors such as industry and (public) utilities. (3) A factor-biased effect exists in all industries and is the chief component promoting the increase in the labour income share. The factor-biased effect of capital-intensive sectors, such as finance and properties, is significantly higher than that of labour-intensive sectors such as commerce. (4) The return to scale effect is the primary source of labour remuneration share decline, mostly in industry, properties, (public) utilities, and conglomerates.

Robustness testSince the digital economy level of some enterprises remains at 0 during the sample period, this may be because the changes in the digital economy level of these enterprises are not reflected in the changes in relevant intangible assets, which may affect our regression results. To eliminate such interference, we removed enterprises with a constant digital economy level of 0 in the sample period to further enhance the credibility of our findings. The regression outcomes are displayed in Table 7. Considering the limitations on length for the article, we have only presented the results of the robustness test for the overall sample. Please note, the outcomes of the robustness tests for various industries are consistent with the previous conclusions. Readers can obtain this information from the author if they are interested.

After excluding enterprises with a digital economy level of 0 in the sample period, the digital economy level has no direct effect on the labour income share, but reduces the labour income share through the productivity improvement effect and scale return change effect, and increases the labour income share through the factor-biased effect. This is consistent with the previous conclusions.

ConclusionsIn the context of a new technological revolution, innovation and knowledge accumulation mainly occur in digital technology. Research on the digital economy and the labour share represents the continuity of research on the labour share from the perspective of knowledge and innovation in the context of digital transformation. We performed this study to investigate the relationship between the digital economy and the labour share from the angle of industrial heterogeneity.

Our findings show that: (1) The digital economy affects the labour share through three countervailing forces: the productivity improvement effect, the factor biased effect, and the scale return change effect. (2) The labour share would change to -0.12 %, 0.36 %, and -0.48% through the productivity improvement effect, the factor-biased effect, and the scale return change effect, respectively, with a 0.1% increase in the digital economy, showing that the labour-biased effect is the chief component of the increase in labour share, and the scale return effect is the primary source of the decline in the labour share. (3) A phenomenon similar to the digital divide exists in the factor-biased and scale return change effects across heterogeneous industries.

This study confirms that the digital economy is one of the important influencing factors of the labour income share based on theoretical and empirical evidence. This study enriches the literature on the functions and economic consequences of the digital economy, helps to deepen the understanding of the digital economy's role, and offers evidence for the labour share issue at the micro level.

According to the above conclusions, we offer the following policy implications:

(1) This study shows that the development of the digital economy reduces the share of the labour income through the productivity improvement effect. However, this does not mean that the digital economy should be restrained to increase the labour share. In the process of promoting the digital economy's growth, the government should on the one hand strengthen employment security policies and raise workers’ basic wages. On the other hand, the digital economy should be fully utilised to form new industries to provide workers with new employment opportunities.

(2) Enterprises should select digital technologies based on their factor-intensive type. Digital technology includes AI, big data analysis, e-commerce, IoT, and a series of technological applications. Based on the digital economy's effect on the factor input structure, the digital economy can be divided into two situations: a capital-biased digital economy and a labour-biased digital economy. To increase the share of labour income, a labour-biased digital economy is more adaptive for capital-intensive enterprises, and capital-biased digital economies are more adaptive for labour-intensive enterprises. It is also necessary for regional governments to form industrial divisions and make digital transformation strategies based on their industrial characteristics to avoid inefficient policies caused by the digital divide.

(3) The agglomeration effect should be utilised instead of indulging in the phenomenon of ‘winners take all’ against the background of the digital economy. With the improvement of the digital economy level, the difference in network externalities between enterprises will often lead to ‘the strong becoming stronger and the weak becoming weaker’. The leading enterprises can maintain their monopoly by means of unfair competition such as ‘choose one from two’, data abuse, and algorithm discrimination. As a result, the development of the digital economy only improves the scale level of a few leading companies, but reduces the scale return level of most enterprises, ultimately reducing the labour share. Thus, the government should promote the improvement and implementation of anti-monopoly measures to avoid the encroachment of a few leading enterprises into the production space of other companies. Further, the government can establish industrial clusters suitable for the development of SMEs to fully exploit the agglomeration effect.

This study analyses the influencing mechanism of the digital economy on the labour share from the perspective of heterogeneous firms. From the angle of industrial spill over, there is still room for further expansion. In particular, given the upstream and downstream relationship of the industrial chain under realistic situations, the inter-industry spill over effect in the process of the digital economy affecting the labour share can be discussed from the standpoint of industrial networks to deepen our conclusions.

This word originated from the Transfer of Power, published by the famous American futurist Toffler in 1990. He believed that the digital divide was the gap in information and electronic technology, which caused a division between developed countries and less developed nations, or among different groups within countries.