The COVID-19 pandemic has led to an unprecedented situation, with incalculable health, social, and economic consequences. At the start of the outbreak, the financial markets collapsed, although not all sectors suffered equally. The gaming and eSports industry is one of those that has suffered the least from the fall in the markets. Millions of people locked up at home, bored, stressed, and anguished, gave gaming and eSports companies growing prominence throughout the first half of 2020. This prominence has elicited interest in analyzing which variables can influence the returns in an industry in better financial health than many others. Using a logit–probit model, this research aims to analyze the relationship between financial (VIX, S&P GSCI Gold Index) and social (worldwide daily variation in total deaths from COVID-19 and worldwide Google attention on coronavirus) variables and the returns offered by the video game and eSports exchange traded fund (ESPO). The results show that the influence of social variables is weaker than the influence of financial variables. There is a significant inverse relationship between market volatility and ESPO returns and a highly significant relationship between ESPO returns and gold returns. While the relationship of ESPO returns with worldwide Google attention on coronavirus is significant, the relationship with worldwide daily variation in total deaths from COVID-19 is not. The conclusions of the study are discussed at the end of the paper.

The COVID-19 pandemic has forced governments around the planet to restrict mobility and enforce social distancing measures to stop the spread of the virus (Anderson, Heesterbeek, Klinkenberg, & Hollingsworth, 2020; Wilder-Smith, Chiew, & Lee, 2020). Since March 2020, billions of people have been confined to their homes for weeks and even months on end. Quarantine measures, travel restrictions, the cancelation of social events, and the closure of public services continue in force in many countries. The health, economic, and social consequences have been enormous, and all indications suggest that the situation may worsen in the second half of 2020. It is not the first time that a virus has affected humanity, but this pandemic is unprecedented for two key reasons. The first is the growing interconnectivity between people, goods, information, knowledge, and the like; the second is the widespread use of information and communication technologies (ICTs) and the implications of this use in relation to the creation/transmission of information/knowledge and forms of interpersonal relationships.

Although ICTs were already a disruptive factor before the pandemic, since the COVID-19 outbreak, the disruptive approach of new ICT-based business models has been further accentuated, with both positive and negative aspects. On the one hand, ICTs can be thought of as a savior because they are the basis of most of the strategies recommended by the World Health Organization (2020). ICTs enable the instant, reliable dissemination of knowledge to broad sectors of the global population; give researchers the means to collaborate on a global scale in the race to develop a common strategy to fight the virus; make it possible to work, research, and study remotely; help maintain social contact and thus reduce the psychological impacts of isolation; and provide access to entertainment and guides for physical exercise. On the other hand, the use of ICT also involves several risks, including spending long periods on online activities such as gambling, pornography, video games, social media, and shopping, which can lead to serious risks of disorderly and addictive behaviors (Fineberg et al., 2018; Vismara et al., 2020); causing distress and significant deterioration of the personal, family, social, educational, or occupational spheres; and generating multiple adverse impacts such as social isolation, physical inactivity, decreased psychological well-being, and interpersonal conflict (Rumpf et al., 2018; Saunders et al., 2017; World Health Organization, 2019).

Through a wide variety of channels (social media, news websites, etc.), ICTs have been used to distribute information on the COVID-19 outbreak, as well as the recommended prevention measures. Other related information on work, economic, and social issues, and even on creating social awareness, has also been distributed using innovative platforms as part of other virtual reality tools initially oriented to different purposes such as video games and eSports. They have become ideal tools for communication and collaborative tasks thanks to their ability to gather people together in the same virtual space, helping improve efficiency and team performance and reducing costs and environmental impacts (Javaid et al., 2020). They have also played an important role in reducing the enormous pressure caused by the COVID-19 pandemic as a form of gaming and entertainment. There are several reasons for the importance of ICTs. One of the most important reasons, along with the need to reduce the anxiety and stress due to the situation, is the urgent need to stay connected with others, albeit virtually. In particular, eSports have acted as a true tonic for both users and companies. Faced with the cancelation of numerous sporting events or the surreal “new normal” under which very few sports have continued, users have found eSports to be a way to reduce their stress and live experiences like those they would have enjoyed before the pandemic. For clubs and content-generating companies, eSports have been an effective solution to alleviate the losses caused by the pandemic, a way to respond to people’s needs, and an effective way to remain present in the lives and hearts of fans.

The debate between those who are for and against the use of these technologies on the basis of their positive and negative effects has been rekindled. Outside this debate, gaming and eSports companies have continued to generate new and ever more innovative content and useful products and services to meet the growing needs created by the pandemic. While the moderate use of online games may be beneficial during this pandemic, it may also highlight vulnerabilities that can be exploited by industries that see opportunities to promote their products (King & Gaming Industry Response Consortium, 2018). The gaming industry must adopt an approach that minimizes harm and follows responsible practices (Loh, Deegan, & Inglis, 2015). For all kinds of businesses, but particularly for online gaming, the profitability–sustainability dilemma is strong. These are not the ends of a continuum in which one wins at the expense of the other but two dimensions that should fit each other perfectly. Despite the huge market downturn at the beginning of the pandemic, which also affected companies in the gaming and eSports sector, the returns of these companies seem to be slightly higher than those of companies in other sectors. Therefore, gaming and eSports is an interesting topic for study for at least three reasons. First, the necessary changes in the health, social, and economic spheres require urgent advances in the gaming and eSports context. Second, it was already a disruptive sector before the pandemic and has become more disruptive during the pandemic. Third, its financial behavior differs from that of other sectors, both before and during the pandemic, and foreseeably after the pandemic. These reasons have encouraged deeper analysis of the returns of the gaming and eSports industry, the circumstances in which they are generated, and the variables that can influence them in the context of the COVID-19 pandemic. Both financial and social variables are considered in this study. Using a logit–probit model, this study examines the influence of the Chicago Board Options Exchange (CBOE) Volatility Index (VIX), the S&P GSCI Gold Index, the worldwide daily variation in total deaths from COVID-19, and the worldwide Google attention on coronavirus on the daily returns of ESPO, a gaming and eSports exchange traded fund (ETF).

The structure of the paper is as follows. Section 2 presents the conceptual framework and the hypotheses of the study. Section 3 sets out the methodology used in the study. Section 4 presents the main results and findings. Section 5 provides the discussion of the results. Finally, Section 6 highlights the main conclusions and explores the scope for future research.

Theoretical frameworkICT and gamingCoronavirus disease, first identified in December 2019 in Wuhan, China, has spread rapidly. It was declared a global pandemic on March 11, 2020, by the World Health Organization. In response to this global crisis, the governments of many countries have announced several measures aimed at halting the negative effects of the pandemic. For example, social distancing involves creating and maintaining a safe distance between individuals and reducing the number of times individuals come into close contact with each other (Abel & McQueen, 2020). The implementation of this measure has led to the temporary closure of educational and childcare institutions and cultural and entertainment venues (clubs, cinemas, theatres, museums, sports stadiums, etc.). Social distancing has promoted staying at home and self-isolation, limiting people’s free movement. Stress, anxiety, and the desire to alleviate a depressed mood has increased the use of ICTs such as TV, online gambling platforms, and video games. For example, coinciding with the initial stay-at-home directives, U.S.-based telecommunications provider Verizon reported a 75% increase in online gaming activity (Shanley, 2020). Live streaming platforms such as YouTube Gaming and Twitch reported a 10% increase in audiences. Steam, a leading game distributor, reported more than 20 million users, the highest number of active users in its 16-year history (Stephen, 2020).

In the pandemic, the gaming and eSports industry seems to have found the right ingredients to flourish. However, the debate over its potential positive and negative effects on people’s health has not been resolved. Although several authors criticize the use of video games and their side effects such as obesity, decreased sleep time, motor coordination, vision, and musculoskeletal health (Foti, Eaton, Lowry, & McKnight-Ely, 2011; Straker, Abbott, Collins, & Campbell, 2014), other authors argue that their effects depend only on the content of the video games. While violent video games can increase aggressive and deviant behaviors, prosocial video games can promote positive social interactions and the development of social skills (Greitemeyer & Mügge, 2014). Referring to the “next level” of computer games, several authors argue that in addition to being feasible, attractive, and fun, active video games (AGVs) are an effective means of increasing general levels of physical activity and ultimately improving people’s health, especially if they spend a lot of time at home (Williams & Ayres, 2020).

eSportsProfessional collective sports have not escaped the negative effects of the COVID-19 pandemic. Numerous major league games and sporting events have had to be suspended or postponed, while live audiences have been limited or canceled. This situation has been especially serious for some sports such as professional soccer and basketball due to the large amount of money involved and the large numbers of people they need to function, including not only players but also coaches, technical teams, and fans.

“Play apart together” seems to be a mandatory requirement as well as an insurmountable restriction for sports clubs, mainly those in the most important leagues in the world. Therefore, these leagues have been forced to rethink their business purpose almost from scratch. Without spectators filling the stadiums, the magic of sports disappears and with it the lucrative broadcasting agreements, succulent sponsorship deals, and benefits from merchandising. Encouraged by the role that ICTs now play and will continue to play in the future, sports organizations have opened up to the eSports model. For example, they have begun to create parallel leagues or online sporting events (e.g., the STAY and PLAY Cup with the eSports soccer game FIFA 20, the NBA2K basketball game, and the eNASCAR I Racing Pro Invitational Series Race racing game). The reason is the need to find innovative ways of compensating for the loss of attention and income if new limitations or restrictions are set on holding face-to-face sporting events.

Although there is no commonly accepted definition, eSports usually refers to “organized professional competition enabled by digital technologies in the context of electronic games” (Ke & Wagner, 2020, p.1). Guaranteeing organized competition (much like traditional sports), eSports eliminate the health risks due to physical contact. This feature makes eSports a very attractive extension of sports during crises such as the COVID-19 pandemic. Who would not enjoy the innovative experience of competing with or seeing how others compete with Leo Messi, James Harden, or Lewis Hamilton from their living rooms? Another important question is the impact on athletes and their professional careers. However, addressing this question is not the aim of this paper.

The virtual nature of eSports brings into question the concept and meaning of sport. ESports make physical differences between individuals irrelevant, challenging the principle of physical strength on which most traditional sports are based (Arkenberg, Dyke, Tengberg, & Baltuskonis, 2018). This feature could in turn influence the understanding of sports skills. If e-skills are the new sports objectives in the future, sports organizations must also rethink and clarify what they understand by brand innovation, as well as other considerations. Digital transformation has emerged as the most important strategy for sports brand innovation in recent years. For example, access to competitive entertainment has gradually shifted from television to the Internet. Furthermore, technological innovation of content generation also provides a wide range of new opportunities that should be carefully analyzed, especially in relation to the desirable viewing experience offered by traditional sports. Streaming platforms, which allow viewers to see video gameplay in real-time, have become important in recent times. Hence, sports organizations are trying to incorporate streaming in their digital marketing strategies as a way to influence consumers’ product purchase decisions (Pearson, 2014), facilitate brand engagement by allowing consumers to create new content and socialize around it (Tuten & Solomon, 2015), and blur the boundaries between consumers and producers (Bauer & Gegenhuber, 2015). ESports should not be merely considered as a brand extension of traditional sports but rather as a powerful source of disruption that can force the brand innovation of sports organizations.

Novelty, boredom, and hungry audiences locked up at home have pushed eSports to higher prominence during the COVID-19 lockdown. However, it is unclear whether the eSports trend will last and, if so, for how long. In the short term, the extension of sports to eSports could follow two possible scenarios. The least likely is a slowdown or even the reversal of this extension after the COVID-19 pandemic. The most likely is a source of disruption in sports brand innovation.

ESPOAn exchange traded fund (ETF) is a security that tracks a portfolio of stocks in the ETF’s benchmark index (Mohamad, Jaafar, & Goddard, 2016). ETFs can act as investment tools characterized by low transaction costs and high intraday liquidity. Furthermore, ETFs can satisfy high-frequency demand for trading (Ben-David, Franzoni, & Moussawi, 2018). Although the aim of ETFs is not to replace conventional index funds, they are new investment vehicles that offer new features that are unavailable in conventional funds. The advantages of ETFs affect both investors and markets because they promote price competition and offer additional new service and product features (Agapova, 2011).

Early research on ETFs focused on analyzing the role of regulation, highlighting that regulation that prevents competition between market centers is not optimal, especially for certain sectors (Boehmer & Boehmer, 2003; Nguyen, Van Ness, & Van Ness, 2007). Later, most research on ETFs focused on their role as financial products. Several authors have investigated the effective relationship between benchmark indices and their ETFs (Aber, Li, & Can, 2009), concluding in some cases that there are tracking errors (Johnson, 2009) due to market frictions that can result in ETF performance that deviates significantly from the benchmark to which investors seek exposure (Tsalikis & Papadopoulos, 2019). Recent research has also studied the effect of ETFs on asset prices (Da & Shive, 2018; Dedi & Yavas, 2016), considering ETF ownership as a defining variable (Israeli, Lee, & Sridharan, 2017; Agarwal, Hanouna, Moussawi, & Stahel, 2018; Evans, Moussawi, Pagano, & Sedunov, 2018), and the relationship between ETFs’ objectives, returns, and volatility (Leippold, Su, & Ziegler, 2015; Malamud, 2015; Shank & Vianna, 2016).

This study uses the VanEck Vectors Video Gaming and eSports ETF (ESPO). This video game and eSports ETF has performed well in 2020, and its success seems to be well founded (until mid-July 2020, investors added $214 million to ESPO). In fact, ESPO is now the largest ETF in volume of assets under management ($483.89 million) in the gaming and eSports sector. ESPO seeks to track the performance of the MVIS Global Video Gaming and eSports Index (MVESPO). This index is a rules-based, modified capitalization-weighted, float-adjusted index whose objective is to give investors a means of tracking the overall performance of companies involved in video gaming and eSports (Lydon, 2020). The strong positioning of gaming and eSports companies in the market has led investors to keep gaming-focused ETFs among their investment preferences. Although technological innovation and the rise of the games as a service (GaaS) model highlights the viability of investing in ETFs such as ESPO, there is a need for more research on ETF returns and the variables that can influence these returns, especially in the current context of the COVID-19 pandemic. This study aims to analyze the relationship of the returns of ESPO with financial (VIX and S&P GSCI Gold Index) and social (worldwide daily variation in total deaths from COVID-19 and worldwide Google attention on coronavirus) variables.

Study variablesCBOE volatility indexThe CBOE Volatility Index (VIX) was introduced by the Chicago Board Options Exchange in 1993. It was designed to measure the market’s aggregate expectation of future 30-day volatility (Chow, Jiang, & Li, 2014). VIX is estimated out of the trading prices of the options written on equity index (Shaikh & Padhi, 2015) and does not require a specific model, only current option prices (Britten-Jones & Neuberger, 2000; Jiang & Tian, 2005). Accordingly, VIX is a simple and broadly used index (often dubbed the “fear index”) that provides theoretical and empirical support for decisions taken by CBOE. The COVID-19 pandemic has increased volatility expectations substantially and has caused a major drop in the S&P500, the Dow Jones, and markets around the world, without exception. There was an increase of almost 580% in the VIX in April with respect to its January levels (Adrian & Natalucci, 2020).

Several authors have questioned the utility of the VIX index, arguing that it can underestimate true volatility by increasing estimation error during periods of turbulence (Bongiovanni, Vincentiis, & Isaia, 2016; Chow et al., 2014). Other authors have even developed new volatility measures such as a newspaper-based Equity Market Volatility (EMV) tracker, whose movements are very close to VIX (Baker, Bloom, Davis, & Kost, 2019), and a global fear index (GFI) for the COVID-19 pandemic (Salisu & Akanni, 2020). Despite these reservations, the VIX continues to be the only source of reliable data on market volatility in real time. As such, it is considered a leading barometer of market volatility with great predictability on stock markets (Wang, 2019; Yun, 2020; Zhu, Liu, Wang, Wei, & Wei, 2019). COVID-19 has created great uncertainty at all levels, and market volatility has skyrocketed. The need to use a reliable measure of volatility led to the choice of the VIX in this study. Thus, this study analyzes the influence of market volatility on the returns of ESPO. The following hypothesis is proposed: H1 – The Chicago Board Options Exchange Volatility Index negatively and significantly influences ESPO returns.

Gold returnsAlthough it is no longer a primary form of currency in the developed world, gold remains a popular investment for a number of reasons: liquidity, value retention, hedging against inflation, diversification, universal desirability as an investment, and use as an input. In situations such as the COVID-19 crisis where there are periods of great political upheaval, stock market crashes, high inflation rates, and losses of value of national currencies, gold offers an ideal investment option. Even in opposite situations where an increase in the price of gold is not expected, the mere demand for products that use it as an input can encourage investment. Moreover, gold is an asset that maintains its value, so a passive purchase-and-hold investment strategy can be a good form of investment.

Previous research has analyzed the behavior of gold as a safe haven and helps justify its use in this study. Baur and Lucey (2010) conducted an empirical study to analyze the relationship between U.S., UK, and German stock and bond returns and gold returns. They concluded that gold can act as a safe haven in extreme stock market conditions. Along the same lines, Baur and McDermott (2010) distinguished between a weak and strong form of safe haven and argued that gold can act as a stabilizing force for the financial system by reducing losses in the face of extreme negative market shocks. They found that gold acted as a strong safe haven for most developed markets during the peak of the previous July 2007 financial crisis. Recently, Ji, Zhang, and Zhao (2020) empirically showed that in the early stage of the COVID-19 outbreak, gold and soybean commodity futures were used as safe haven assets.

Considering the special circumstances surrounding the COVID-19 pandemic, together with the special characteristics and financial evolution of the gaming and eSports industry, this research analyzes whether the returns of ESPO could encourage investors to consider it a potential safe haven. To date, no research has analyzed the relationship between gaming and eSports ETF returns and gold returns. Therefore, the following hypothesis is proposed: H2 – The S&P GSCI Gold Index positively and significantly influences ESPO returns.

Google attentionHandling information today necessarily means searching online sources (Desamparados Blazquez, 2018). The Internet allows everyone to express their opinions in different ways, so companies are attentive to any type of reaction expressed online. Variables such as Google attention have emerged, with proposals for different ways to measure it. To overcome the drawbacks of previous measurement tools, Ginsberg et al. (2009) proposed the search volume index (SVI) as a direct proxy of investors’ Google attention. The SVI displays the daily search intensity for a selected keyword. Thus, Google Trends expresses the absolute number of searches in relation to the total number of searches during a certain period of interest (Arora, McKee, & Stuckler, 2019). Because it is less sophisticated than others, a key advantage of this proxy is that it tends to attract the attention of more people (Peng & Xiong, 2006; Vozlyublennaia, 2014). Its basic operating principle is that people can react to certain stimuli only when these stimuli are able to capture their attention (Barber & Odean, 2008). SVI provides more valid, fundamental, and timely information than other measures (Da, Engelberg, & Gao, 2011) and acts as a dynamic proxy because it provides the possibility of building a larger database capable of reflecting accurate information from particular users and raises awareness of a problem among different groups of people. Thus, SVI can act as a prosocial tool, motivating people to behave in a certain way. When combined with the extensive reach of technologies, this behavior can have a huge impact at all levels. For example, the behavior of people in relation to an issue (i.e., COVID-19 plus eSports) can be modified (i.e., enhanced or limited) through social norm campaigns. The outcome must be carefully analyzed because the change might depend on several other variables such as previous related behavior (Schultz, Nolan, Cialdini, Goldstein, & Griskevicius, 2007).

This study used a “coronavirus” SVI as a measure of the worldwide Google attention on the COVID-19 pandemic. The level of concern of Internet users measured through their trends and query patterns using Google Trends was employed. A variable of these characteristics is very interesting for at least two reasons: it can give an idea of global awareness of the COVID-19 pandemic, and it can influence many other variables such as returns on ESPO. To date, no study has explored this relationship. Therefore, the following hypothesis is proposed: H3 – Worldwide Google attention on coronavirus negatively and significantly influences ESPO returns.

Total deathsThe enormous complexity of a problem as huge as the current pandemic stems from the fact that its implications and negative effects are numerous and interrelated. What began as a health crisis has led to an economic and social crisis, which has led again to a health crisis that will surely lead to an even bigger economic and social crisis. The death toll around the world is staggering (844,000 as of August 31, 2020), and it seems that it will continue to rise in the coming months. Although at first it seemed that older people were much more vulnerable to COVID-19, the average age of victims has fallen, and regardless of age, not all people react in the same way to the virus.

Little is known about the virus—how it appeared, how it is transmitted, what the real health consequences are, how to immunize individuals and groups to the virus, and so on. At such a time, one of the few objective figures that can be used as a barometer of its serious effects is the number of deaths. Another matter is whether the metrics used by each country are comparable. While the metrics are not uniform (perhaps this will only be the case at the end of the pandemic), the number of deaths provided by official institutions seems to be an objective and valid source of data for studies. Recent research has analyzed the relationship between the daily confirmed cases and deaths from COVID-19 and stock market returns, showing an inverse relationship between the two variables (Ashraf, 2020). Other authors have suggested that the significant deterioration of market liquidity and stability during the first few months of the pandemic is associated with the increase in the number of confirmed cases and deaths (Baig, Butt, Haroon, & Rizvi, 2020). Using the 20 worst-hit countries in terms of reported cases and deaths, other authors have shown that since the emergence of the pandemic, health news searches can act as a good predictor of stock returns (Salisu & Vo, 2020). To date, no study has analyzed the influence of the worldwide daily variation in total deaths from COVID-19 on the returns of ESPO. Therefore, the following hypothesis is proposed: H4 – The worldwide daily variation in total deaths from COVID-19 negatively and significantly influences ESPO returns.

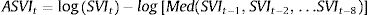

MethodData and variablesA data set was built to test the study hypotheses. The data set included the daily returns of the VanEck Vectors Video Gaming and eSports ETF (ESPO), the VIX, and the S&P GSCI Gold Index, as well as the worldwide daily variation in total deaths from COVID-19 and the worldwide Google attention on coronavirus. Financial data were downloaded from Investing.com, and social data (total deaths from COVID-19) were downloaded from ourworldindata.org. To measure Google attention, the abnormal SVI for the search term “coronavirus” was used. The abnormal SVI was calculated following the method described by Da et al. (2011) as the logarithm of the SVI for the current day minus the logarithm of the median SVI over the previous eight days.

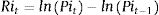

where log SVIt is the logarithm of SVI for day t, and logMed(SVIt-1,SVIt-2,…SVIt-8) is the logarithm of the median value of the SVI over the previous eight days.The daily returns of ESPO and the other indices were calculated following the method described by Campbell et al. (1997, p.11):

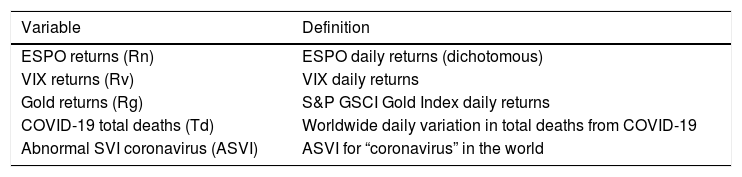

where Pit is the closing price of the company stock or index i at time t.A daily data set was obtained with 114 observations from January 29 to July 10, 2020. Table 1 shows a description of the variables used in the analysis.

Variable descriptions.

| Variable | Definition |

|---|---|

| ESPO returns (Rn) | ESPO daily returns (dichotomous) |

| VIX returns (Rv) | VIX daily returns |

| Gold returns (Rg) | S&P GSCI Gold Index daily returns |

| COVID-19 total deaths (Td) | Worldwide daily variation in total deaths from COVID-19 |

| Abnormal SVI coronavirus (ASVI) | ASVI for “coronavirus” in the world |

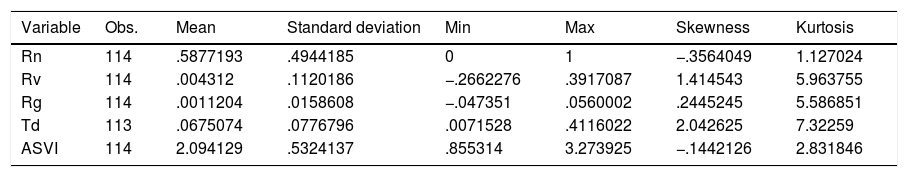

Table 2 shows the descriptive statistics of the variables included in the data set. The statistics show that the analyzed period had high volatility due to the COVID-19 pandemic. It also shows that gold behaved as a safe haven during the period (positive mean and low standard deviation). ESPO returns are represented by a dichotomous variable, where 1 represents positive or zero returns, and 0 represents negative returns.

Descriptive statistics.

| Variable | Obs. | Mean | Standard deviation | Min | Max | Skewness | Kurtosis |

|---|---|---|---|---|---|---|---|

| Rn | 114 | .5877193 | .4944185 | 0 | 1 | −.3564049 | 1.127024 |

| Rv | 114 | .004312 | .1120186 | −.2662276 | .3917087 | 1.414543 | 5.963755 |

| Rg | 114 | .0011204 | .0158608 | −.047351 | .0560002 | .2445245 | 5.586851 |

| Td | 113 | .0675074 | .0776796 | .0071528 | .4116022 | 2.042625 | 7.32259 |

| ASVI | 114 | 2.094129 | .5324137 | .855314 | 3.273925 | −.1442126 | 2.831846 |

The effects of the financial and social study variables on ESPO returns during the first six months of 2020 were tested using a logit–probit model. The following model was proposed:

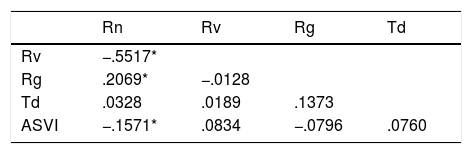

where Rnit represents the daily returns of ESPO, Rvit represents the daily returns of the VIX, Rgit represents the daily returns of the S&P GSCI Gold Index, Tdit is the daily variation in the worldwide total deaths from COVID-19, and ASVI represents the worldwide daily Google attention on COVID-19.ResultsTable 3 shows the correlations between the variables considered in the study. VIX returns have a negative and significant correlation with ESPO returns, suggesting that when volatility increases, ESPO returns decrease. The significant correlation between gold returns and ESPO returns suggests that both variables follow a similar trend. Regarding the social variables, while the worldwide daily variation in total deaths from COVID-19 shows a positive but non-significant correlation with ESPO returns, worldwide Google attention on coronavirus shows a negative and significant correlation, suggesting that when Google attention on coronavirus increases, ESPO returns decrease, and vice versa.

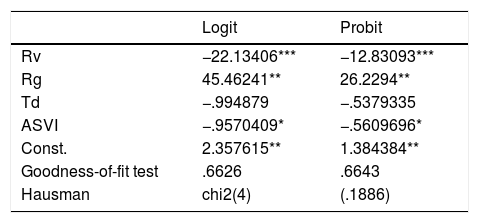

Table 4 shows the results of the logit–probit model. The results are quite similar for both models. These results confirm the results of the correlation analysis. Specifically, ESPO returns have an inverse relationship with VIX returns, which supports H1, and ESPO returns follow the trend of gold returns, which supports H2. The higher coefficient obtained for gold returns suggests that gold exerts a greater influence on ESPO returns than market volatility. Regarding the social variables, the worldwide daily variation in total deaths has an inverse relationship with ESPO returns. This relationship is not significant, so H3 is rejected. Worldwide Google attention on coronavirus influences ESPO returns negatively and significantly, suggesting that when Google attention increases, ESPO returns decrease. This result supports H4. The coefficients of social variables are lower than those of the financial variables, suggesting that their impact on ESPO returns is also lower than the impact exerted by gold or VIX returns. The Hosmer-Lemeshow test (Hosmer & Lemeshow, 1980; Hosmer, Lemeshow, & Klar, 1988; Hosmer, Lemeshow, & Sturdivant, 2013) was performed to calculate the goodness-of-fit of both models. Hausman’s test was performed to identify the best model, with the logit model performing best. Furthermore, the Wald test was performed to test the statistical significance of each coefficient in the models. All variables were significant (p value=.0000).

Logit–probit estimation results.

| Logit | Probit | |

|---|---|---|

| Rv | −22.13406*** | −12.83093*** |

| Rg | 45.46241** | 26.2294** |

| Td | −.994879 | −.5379335 |

| ASVI | −.9570409* | −.5609696* |

| Const. | 2.357615** | 1.384384** |

| Goodness-of-fit test | .6626 | .6643 |

| Hausman | chi2(4) | (.1886) |

*** Significant at 1% level; ** significant at 5% level; * significant at 10% level.

The COVID-19 pandemic has placed companies, individuals, and markets in an unprecedented situation. Given this uncertain context, the aim of this study was to analyze the influence of financial (VIX and S&P GSCI Gold Index) and social (worldwide daily variation in total deaths from COVID-19 and worldwide Google attention on coronavirus) variables on the returns of ESPO. The results are extremely revealing, regardless of whether each variable is considered separately or whether they are all considered together.

The coronavirus outbreak has disrupted the economy and social life, and markets have fallen as a result. Economies around the world have been seriously affected in terms of their GDP growth because the lockdown measures altered supply and demand, millions of people could not work, schools were closed, and thousands of restaurants and other businesses also had to be closed. As a result, global financial markets experienced extreme volatility, and companies and investors were forced to analyze the myriad effects of the virus. Triggered by the COVID-19 outbreak, all stock markets collapsed and experienced extraordinary levels of volatility. The gaming sector also felt this effect, leading to a significant decrease in the returns on ETFs such as ESPO. In general, ETFs simply follow the market and do not consider whether the asset (stock, bond, currency, raw material, etc.) is good or bad. Therefore, a downtrend in the market implies a downtrend in ETFs. The results of this study, in line with previous research (Dedi & Yavas, 2016; López-Cabarcos, Piñeiro-Chousa, & Pérez-Pico, 2017; Qadan, Kliger, & Chen, 2019), reveal a significant inverse relationship between market volatility and the returns of ESPO, suggesting that high levels of market volatility lead to low levels of ESPO returns, and vice versa. Nevertheless, the decline of gaming and eSports ETFs was less than that of ETFs related to other sectors. This fact has encouraged some investors who, despite having been forced to analyze all market movements carefully across different positions, have found a valid investment option in the gaming and eSports sector. The uncertainty over the evolution of the pandemic and the coming months calls for much more research about how market volatility can affect gaming and eSports ETFs, as well as whether there are different aspects in relation to ETFs in other sectors.

Unsurprisingly, the results also show that the relationship between ESPO returns and gold returns during the analyzed period is strong and significant. Although the COVID-19 pandemic is an unprecedented worldwide health crisis, financial markets have already experienced similar crises in the past. Based on their experience, investors have found it advisable to incorporate safe haven assets in their portfolios with the aim of mitigating the effects of these unexpected risks (known as “black swans”). Although gold generally performs well during market sell-offs due to its traditional role as a safe haven, it has still been affected by the global stock market crash. However, although this asset has suffered volatility during the clearing of the markets due to the coronavirus outbreak, it has experienced less intense peaks than other risk assets, and more importantly, it has quickly recovered in price. In mid-April 2020, gold reached the trading peaks of 2012, while the S&P 500 remained at the low values of mid-March 2020. Using a sporting analogy, just as a football team cannot play only with forwards; investors’ portfolios must also have “defenders.” The problem at the beginning of the COVID-19 outbreak was that the defensive market became very expensive, and few defensive assets were available.

In sum, the difficulty to predict the consequences of the COVID-19 pandemic has led investors to expand their portfolios by including safe assets capable of behaving differently to others in times of stress. Although it is not necessarily the time to increase exposure only to safe haven assets, it seems reasonable to invest in at least some of these assets. Except for risk-loving investors, the rule of diversification can be helpful now because it is the approach that best adapts to changing markets. One approach could be to focus on safe assets as well as assets that are less safe but that are very attractive and have good valuations, such as short-term bonds of companies with good credit quality or ETFs in sectors where positive returns can be expected (e.g., gaming and eSports). This reasoning explains why gold returns and ESPO returns had such similar trends in the first half of 2020. Seemingly, the markets will continue to suffer new episodes of volatility and uncertainty, and neither growth nor inflation expectations will change much in the short term. Therefore, it seems sensible to continue buying assets that provide portfolios with a safe haven or buffer.

Both social variables have an inverse relationship with ESPO returns, suggesting that an increase in either of the social variables leads to a decrease in ESPO returns. While the relationship with worldwide Google attention on coronavirus is significant, the relationship with the worldwide daily variation in total deaths from COVID-19 is not. The search intensity for coronavirus reveals people’s fears about the virus’s health consequences, as well as concerns about work, social, and economic issues. During the first few months of the pandemic, worldwide Google attention on COVID-19 was huge. The uncertainty about almost everything led people to search for reliable information online. This search created more uncertainty, stress, and anguish. Mental health was also severely affected during the toughest months of the pandemic, and there was a significant increase in anxiety and depression rates. It seems logical that the periods that could be spent on leisure and enjoyment activities such as gaming and eSports might have been devoted to searching for information on a very serious problem, with multiple consequences for everyone. Assuming the relationship between online activity and company returns, this situation would have led to a decrease in the returns of companies and consequently the ETFs in this sector. This situation might have occurred at the beginning of the outbreak, but in the near future, it is reasonable to expect the situation to change completely. The reason is that information about the pandemic has improved, and people have become used to living in this situation. Hence, to avoid increasing anguish, stress, or anxiety levels derived from the situation, together with the need to spend more time at home, people have to find escape routes that make them happy and remind them how their lives were before the pandemic. Much more research is needed to clarify the new life habits during and after the pandemic and, specifically, the variables that can induce or, where appropriate, hinder the use of gaming and eSports platforms. The other social variable, worldwide total deaths from COVID-19, is not significant, suggesting that, despite its inverse relationship, this variable does not seem to be related to the returns of ESPO.

Jointly these results imply that the influence of the social variables is weaker than the influence of the financial variables on the returns of ESPO. While the results for the financial variables are understandable considering market movements, the results for the social variables reveal a weak relationship with ESPO returns. If this assertion is the case, a simplistic conclusion would be that the gaming and eSports sector seems to have a promising future, and gaming and eSports ETFs seem to be a solid investment option. In other words, the gaming and eSports sector is here to stay.

ConclusionsGaming and eSports do not seem to be a passing craze, and the industry has grown, even during the COVID-19 outbreak. It is important to understand how this sector works because everything indicates that there will be major changes in the short term. It is reasonable to expect these changes to occur, regardless of the evolution of the pandemic. That is, this sector suffered great disruption before and during the COVID-19 outbreak, and everything indicates that it will also experience disruption after the pandemic. How and how much these changes will affect companies, investors, and people must be thoroughly analyzed.

The effects and implications for this sector have usually been analyzed from the point of view of users and investors rather than the point of view of companies. For example, the increasing use of video games and eSports is generating huge amounts of data on people’s preferences, abilities, skills, strengths, weaknesses, and the like. If correctly analyzed with ICT applications such as machine learning or artificial intelligence, these data can provide valuable insight. The more interesting the virtual world becomes for users, the more data will be generated, which can later be used in many ways. At this point, certain questions arise, such as will the artificial become real, or what are the implications of the real-artificial-real transition (Sheth, 2020)? In the first instance, machine learning and artificial intelligence can capture user data to perfect video games and take them to the next level. Correcting imperfections and emulating traditional leisure activities are priorities to meet needs such as promoting friendship, increasing physical activity, facilitating team building, and promoting family integration. Knowledge can act as an input for new and more refined knowledge based on innovation and the use of new technological developments. As innovation is considered the primary driving force of progress and prosperity (Ferreira & Teixeira, 2019), the aim is to create a smart future to increase people’s quality of life (Lee & Trimi, 2018). At this moment, it is unknown what the further steps will be.

Declarations of interestNone.

FundingThis research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.