This paper studies the asset side market discipline effect in Mexico, whether borrowers pay higher interest rates (price¿based mechanism) to high¿quality banks, and consequently, whether borrowers discipline their banks. Borrowers continuously require credit and they choose large banks because their lending activity is trustworthy (a refinancing¿solvency motive). In addition, borrowers prefer banks with lower loan losses to signal their creditworthiness to other stakeholders (a certification¿signaling motive). Using a sample of 37 banks over the years 2008 to 2012 and a dynamic panel model, we found evidence in favor of these motives through a price¿based mechanism, that is, the Mexican borrowers are willing to pay higher rates to larger banks with higher capital ratios and reserves for loan losses, or lower nonperforming loans. As a result, the Mexican banks face market discipline induced by borrowers, albeit this discipline is absent in retail and largest banks.

El artículo estudia el efecto de la disciplina de mercado desde el lado de los activos en México, si los prestatarios pagan tasas de interés más altas (mecanismo basado en precio) a bancos de alta calidad, y consecuentemente, si los prestatarios disciplinan sus bancos. Los prestatarios continuamente requieren crédito y prefieren bancos grandes porque su actividad prestamista es confiable (un motivo de refinanciamiento¿solvencia). También los prestatarios prefieren bancos con menores pérdidas crediticias para señalizar su solvencia a otros prestamistas (un motivo de certificación¿señalización). Con una muestra de 37 bancos durante el periodo 2008 a 2012 y un modelo con datos de panel dinámico, se encontró evidencia a favor de dichos motivos a través de un mecanismo basado en precio, es decir, los prestatarios mexicanos están dispuestos a pagar tasas más altas a bancos más grandes, con mayores ratios de capital y reservas para pérdidas crediticias, o con carteras vencidas más bajas. Como resultado, los bancos mexicanos enfrentan disciplina de mercado inducida por los prestatarios, aunque esta disciplina está ausente en bancos de consumo y en los más grandes.

1. Introduction

The banking system is a key component of any modern economy, and it is a determinant of the process of economic growth and development. The real estate sector immedia¿ tely suffers when the financial sector has problems and in a globalized world this chaos is transcended quickly among countries. Due to the financial and banking crisis the economists have studied which factors influence in the soundness of the banks. With an international perspective, the recommendations of the Basel Committee have a special influence on the management of the banks. The Committee points out three Pillars for better performance: 1) Minimum Capital Requirements, 2) Supervisory Review Process, and 3) Market Discipline or Disclosure Requirements (Basel Committee on Banking Supervision, 2006). Nevertheless, we are still suffering from the banking crisis and expensive state rescues.

This paper relates to the Third Pillar of Basel, in which the liability side of market discipline effect has been well investigated. The major findings suggest that the depositors monitor their banks, albeit this discipline has been diminished by the introduction of deposit insurance. In banking markets, with information asymmetry problems, the recommendation for policymakers is to improve the disclosed information of the banks as it allows for accurate decision making, and the depositors can discipline their banks.

On the other side, the asset market discipline effect has been little studied. For that reason, this paper is motivated by the following question: do borrowers pay higher interest rates to high¿quality banks? If the answer is positive, it means that the banks are partially disciplined by borrowers. Kim et al. (2005) explored a similar question in Norway. They found positive evidence for a certification¿signaling motive: borrowers choose banks with lower loan losses because they want to signal their creditworthiness to other stakeholders. Theoretically, the borrowers also have a refinancing¿solvency motive: borrowers prefer high¿quality banks with more assets and higher capital ratios because they continuously need credit, and it is better to request this credit from high¿quality banks because their lending activity is trustworthy. Thus, banks grant credits to economic agents and monitor them, but borrowers are also interested in keeping an eye on the banks.

Mexico was chosen as the most suitable country for exploring this research question because its banking system has only been privatized relatively recently (in 1991) and unfortunately its people had already experienced a financial crisis in 1994-1995. Furthermore, its banks were bailed out in 1997. As a part of the liberalization of the economy and globalization, in the beginning of the 1990s the Mexican government privatized the commercial banks that it had expropriated in 1982 (due to debt crisis), but the result was a financial crisis and the collapse of the banking system. Consequently, Mexico rescued the banks that it had just privatized. The Mexican government reformed the accoun¿ ting rules and reorganized the country's deposit insurance system, where bank deposits were insured by a Trust Fund (the Fund for the Protection of Bank Savings, known by its Spanish acronym, FOBAPROA, which was replaced in 1999 by the Bank Savings Protection Institute, known by its acronym, IPAB).1 To modernize the Mexican banks (as a political speech) the last 15 years of this procedure have been accompanied by strong foreign investment, especially from American and Spanish banks. However, these banks have been criticized because they are risk averse and make fewer loans to household and business enterprises (Haber, 2005).

In this context, the results of this investigation can support the intention of the Mexican policymakers to promote disclosure of banking information. The findings can also help to understand the market discipline in other countries. The rest of the paper is organized as follows: section 2 briefly discusses the theoretical relationship between banks, depositors, borrowers and market discipline, with special attention on the asset side effect, empirical studies and the major findings for Mexico; section 3 describes the data sets, a sample of 37 Mexican banks for the period of 2008-2012; section 4 specifies an econometric model (dynamic panel) and it reports and discusses the results. Finally, conclusions and proposals for future research are outlined.

2. Brief review of literature

After the financial crisis in the 1980s and 1990s, and with the current financial crisis (which usually included the banking crisis), economists, bankers and international orga¿ nizations remarked the need to understand the determinants of stability in the banking system. In this context, the Basel principles play an important role, and among other deter¿ minants, the literature highlights the Third Pillar of Basel: Market Discipline.2

In a wide sense, market discipline is the performance of the market mechanism, which is studied in the well known model of supply and demand. Nevertheless, in the banking literature, market discipline is usually understood as the capability of bank creditors to discipline banks "that engage in excessive risk¿taking, by demanding higher interest rates or by withdrawing their deposits" (Demirgüç¿Kunt and Huizinga, 1999, p. 8).3 Maybe, due to this definition, the liability side of market discipline effect has been extensively studied in the banking literature (see for example, Calomiris and Kahn 1991; Park, 1995; Rochet and Tirole, 1996; Park and Peristiani, 1998; Flannery, 1998; Caprio and Honohan, 2004; Flannery and Nikolova, 2004).

The economists in particular have studied the links between market discipline (liability side), regulation, supervision, deposit insurance and transparency. We expect that market discipline complements regulation and supervision, and also that transparency provides agents with more information to monitor their banks.4 In addition, deposit insurance can stabilize economies by limiting bank runs, but its relationship with the market discipline involves a meticulous discussion. Nowadays, explicitly or implicitly, many countries guarantee bank debt, which can reduce agents' motivation to monitor their banks. There is evidence showing that in the presence of explicit deposit insurance the market discipline has been diminished depending on the credibility of the system (Demirgüç¿Kunt and Huizinga, 1999; 2004; Hosono et al., 2004; Ioannidou and de Dreu, 2006; Karas et al., 2010). A general accepted conclusion is that creditors monitor banks, but the degree to which they do so differs across deposit insurance schemes and countries.

In Mexico, Martinez¿Peria and Schmukler (2001, see Table V, p. 1041) found evidence of the presence of the market discipline liability side effect, particularly in the post¿crisis period. The authors employed a regression analysis, covering a period of 1991 to 1996, where the dependent variables are the growth of the deposits and the implicit interest rate on deposits, and the main explanatory variables are measures of bank risk: capital adequacy, asset quality, management, earnings, and liquidity (known as the CAMEL rating system). Furthermore, the authors found that deposit insurance did not diminish the extent of market discipline. It means that the discipline is supported particularly by depositors, for whom the state guarantees are insufficient or unrealistic.

Hosono et al. (2004, see Table A1, p. 60) found mixed evidence of market discipline in Mexico. Over the regression covering the period of 1992¿2002, they found a positive significant influence of bank's liquidity on the interest rate of deposits, but usually it is expected that banks with liquid assets are safer. For that reason they may pay lower interest rates on deposits. On the contrary, they found evidence of market discipline because more efficient and larger banks pay lower rates.

On the other hand, the asset side market discipline effect has been briefly studied in the banking literature. Allen et al. (2011)5 developed a theoretical model in which the discipline also comes from the asset side. The authors argue that in recent years the banks have been choosing capital ratios above regulatory minimums because of market discipline. Although this does not mean that they were well capitalized. Allen et al. (2011, p. 984) point out that "when credit markets are competitive, market discipline coming from the asset side induces banks to hold positive levels of capital as a way of committing to monitor and attract borrowers". In particular, their model considers the case when the banks operate in a perfectly competitive loan market, but it is extensive to study other market structures, with or without deposit insurance, and it compares market and regulatory solutions. It is noteworthy that the model has an asset side incentive to hold capital, since the market equilibrium entails a combination of capital and loan rate that maximizes borrower surplus.

As an empirical implication "the model suggests that greater credit market competition increases capital holdings as it introduces market discipline from the asset side... Banks that are more involved in monitoring¿intensive lending should be more capitalized. Similarly, firms for which monitoring adds the most value should prefer to borrow from banks with high capital" (p. 986). In other words, banks with a large amount of capital are more attractive for borrowers, and greater monitoring is desirable from the borrower's perspective. "Market discipline is imposed from the asset side as both the loan rate and the bank's capital are used to provide banks with monitoring incentives" (p. 991). Borrowers prefer lower interest rates and large amounts of capital, and banks prefer the opposite.

Fischer et al. (2012), in line with Allen et al. (2011), investigate whether banks charge higher loan spreads due to these high capital ratios. Their findings show positive evidence (they used 21,053 American syndicated loans agreements undertaken by public and non¿financial listed companies during the period of 1993¿2007). Fang (2005) also found that reputable investment banks charge higher fees. On the contrary, Hubbard et al. (2002), Steffen and Wahrenburg (2008) and Santos and Winton (2009) found that banks with low capital ratios charge higher loan rates than well capitalized banks, particularly to small firms. This result is consistent with the theoretical models of Boot et al. (1993) and Diamond and Rajan (2000), in which the banks transmit the cost of funds and extract more rents from bank¿dependent firms with low cash flow.6

Similarly, Cook et al. (2003) and Kim et al. (2005) examine whether borrowers pay higher rates to high¿quality banks, in accordance with the literature on reputational signaling.7 Cook et al. (2003) explore a certification¿signaling motive: whether borrowers prefer higher reputation banks to signal their creditworthiness to other stakeholders, theoretically banks have the best information about the economic conditions of the borrowers and their projects. In order for a bank to grant a loan, first it must thoroughly investigate the borrower and then mitigate the asymmetric information. The outsiders can make decisions based on decisions of the bankers.8

Cook et al. (2003) developed a regression analysis based on a sample of 635 American credit arrangements from 1986 to l994. The explained variable is the rate spread over LIBOR and the explanatory variables are the lender's Standard and Poor's senior debt rating, the lender's size (natural log of assets), and other borrower's characteristics and financial environment. The findings show positive evidence for the certification¿signaling motive.

Kim et al. (2005) explore the certification¿signaling motive, and a refinancing¿solvency motive: whether borrowers prefer high quality banks (well capitalized and diversified, with a good solvency and size) because they can need credit in the future, and whether it is better to obtain credit from a bank that already knows the borrower, because this bank will be able to extend credit and new loans rapidly, particularly in the event of financial distress.9

If borrowers pay a premium to get this certification and refinancing, it means that banks face market discipline induced by borrowers. To explore these hypotheses Kim et al. (2005) elaborated a model in which the dependent variable is the spread of interest rates on credit lines over the money market rate. And the main explanatory variables, indicating the quality of a bank, are the capital ratio, loan losses, and size. But, the model includes other independent variables like geographic location, market concentration and time dummies for macroeconomic effects. The authors used a panel of annual data covering Norwegian banks between 1993 and 1998 (after the banking crisis in Norway). The sample includes a maximum of 121 banks in 1998 and a minimum of 108 in 1994, counting small local savings banks and large nationwide banks, from 19 counties.

With two¿stage least square (to instrument with its own lag the independent control variable ratio of materials and wage cost to loans outstanding), Kim et al. (2005) found that the coefficients of the variables relating to banks' future lending capacity (capital ratio and size) are not significant. As a result they did not find evidence for the refinancing hypothesis. Norwegian borrowers do not care about bank characteristics indicating the grade that a bank will be able to stay behind its borrowers to extend loans in the future. But, the coefficient of loan loss provision is significant, that is, borrowers care about the quality of a bank's loan portfolio supporting the certification hypothesis. "Borrowers' appreciation of banks with low loss provisions serves as an important disciplinary device, inducing banks to avoid losses" (p. 694).

There are various papers studying whether borrowers (usually syndicated loans undertaken by firms) pay higher rates to high¿quality banks, but it appears that Kim et al. (2005) is the only existing work empirically exploring and interpreting this nexus as evidence of the asset side market discipline effect. Therefore, this paper contributes to the empirical literature in two ways. First, it employs panel data in a dynamic model with a GMM estimator (generalized method of moments). Second, the econometric test includes a sample of Mexican banks that had been not studied before.

3. Data

Mexican banks are required to disclose their financial statements to the Central Bank of Mexico (CBM) and this information is available on its web site. The data used in this investigation are drawn from the National Banking and Securities Commission (known by its Spanish acronym, CNBV). This agency oversees Mexican banks. The analysis is based upon data recorded on a monthly or quarterly basis over the period December, 2008 to March, 2012, covering 37 banks (Mexico currently has 42 banks in operation, but the complete statistics for 5 investment banks were unavailable).

The original panel data of banks is unbalanced because some banks were removed, merged or founded. Nevertheless, the econometric tests of this paper only analyze banks in operation during the complete period. This time period was chosen for study because after the banking crisis the financial agents learned the importance of the market discipline, a wake¿up call as proposed by Martinez¿Peria and Schmukler (2001), and the recent financial crisis in USA and Europe, where large banks were bailed out by their governments. This reminded us that the banks can fail.

As is suggested by Kim et al. (2005), the interest rate on credit works through a price¿based discipline mechanism. It allows us to explore whether borrowers are willing to pay a higher rate because of high¿quality characteristics of the banks. But, in the data here this interest rate is not available, and the 12 month implicit interest rate (PRICE) has been employed as a proxy, i.e., the amount of income due to credit divided by the amount of credit. A similar strategy is frequently used in the literature on the liability side of market discipline effect.10

The explanatory variables are capital ratio (CAPITALR) defined as capital divided by assets, bank's size (SIZE) defined as total assets, reserve for loan losses (RESERVE) defined as the balance at quarter end of provisions for possible credit losses divided by the nonperforming loans, and nonperforming loans divided by total loans, expressed as a percentage (DOUBTFUL). Higher values of CAPITALR, SIZE and RESERVE, and lower values of DOUBTFUL presumably indicate high¿quality banks for borrowers.

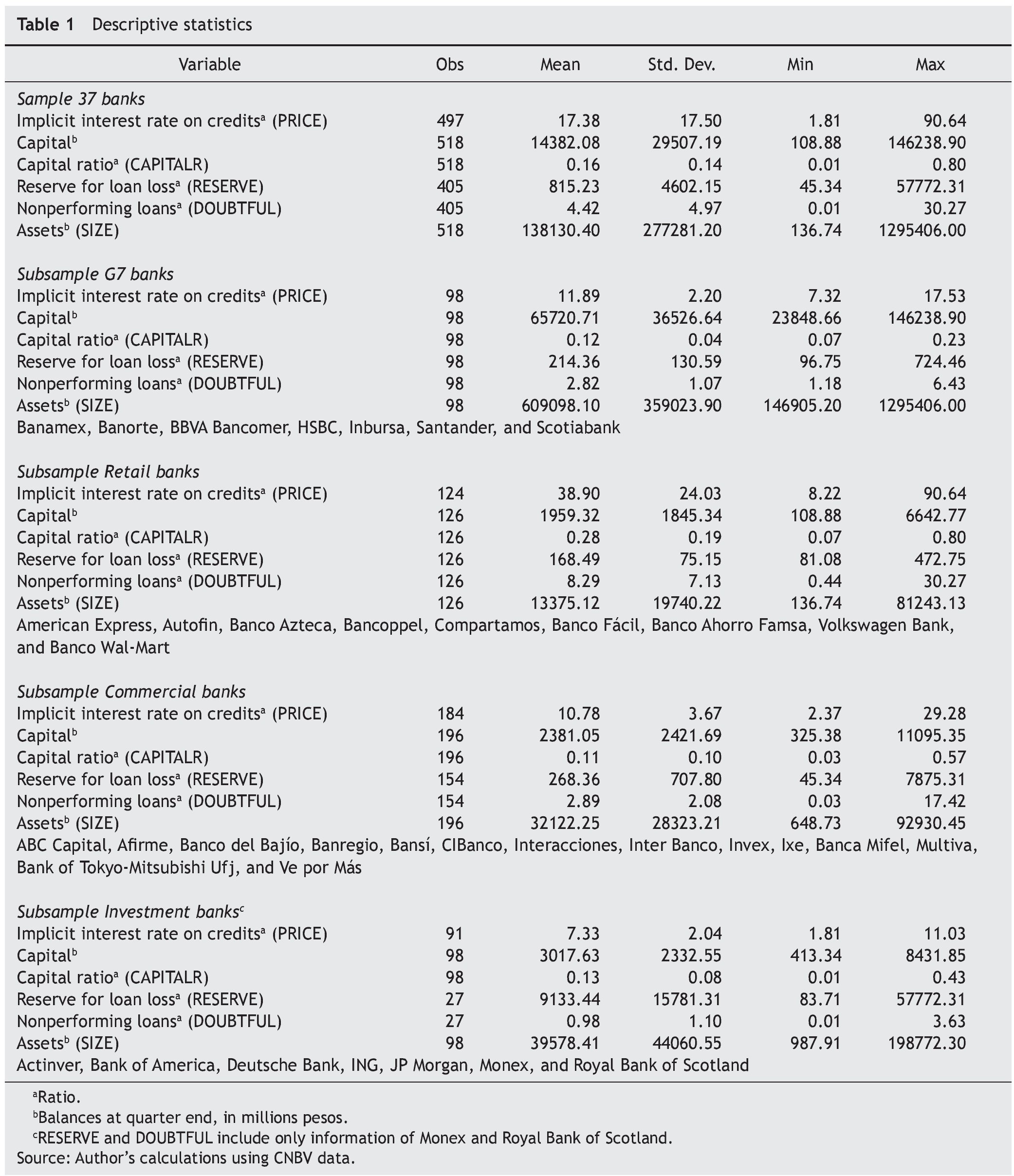

As a first step the data removing outliers (possibly due to reporting or recording errors) has been reviewed. Table 1 summarizes descriptive statistics. Mexican banks have presence over all Mexican regions, but they are different, with a large dispersion of their characteristics. For example, in the period of analysis we have a bank reporting capital of 108 million Mexican pesos and total assets of 136 million (Banco Facil) and banks reporting capital of 146,238 million pesos (Banamex) and total assets of 1,295,406 million pesos (BBVA Bancomer). For that reason four subsamples have been included in the analysis, to take into account these differences and the nature of the banks, following the classification of the CBM. The first subsample contains 7 of the largest banks (G7), they are usually a cutoff point in the reports of the CBM and they control around 80% of the assets in the banking system at the end of the first quarter of 2012. The second subsample includes 9 retail banks, which specialize in transactions with consumers. The third subsample includes 14 commercial banks with typical activities, but smaller than the G7. And finally, the fourth subsample contains 7 investment banks, working in the issuance of securities.

In the full sample (37 banks), as is expected, the retail banks show the highest implicit interest rate (PRICE), the mean being 38.9%, but Banco Azteca, for example, borrowed funds up to 90%. The lower implicit interest rate corresponds to the investment banks at 7.3%, the commercial banks borrowed at 10.8% and the G7 at 11.9%.

On the average the capital ratio (CAPITALR) of the Mexican banks is 0.16, the maximum is 0.80, and the minimum is 0.01, where the retail banks present the highest ratios (the mean is 0.28). The overall mean RESERVE is 815 points, with a range of 45 to 57772, where the investment banks present the highest values, but these maximum values must be treated with caution because information was found on RESERVE for two investment banks only (The Royal Bank of Scotland and Monex). The overall mean DOUBTFUL is 4.4%, with a range of 0.01% to 30.2%, where the maximum values correspond to the retail banks.

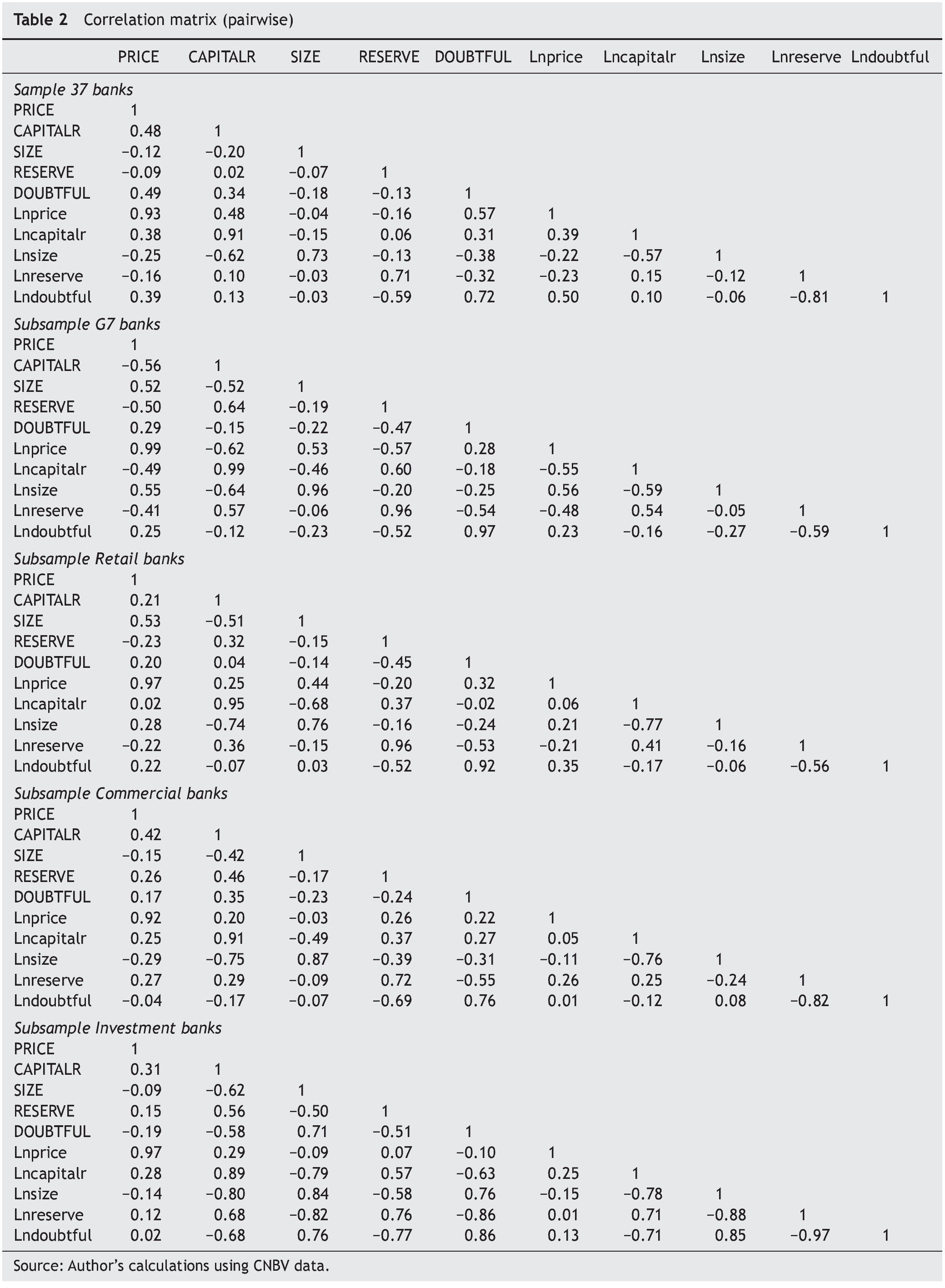

Table 2 shows the correlation matrix of the main variables employed in the econometric models in the next section (the variables measured in logarithms - Ln have been included). In general, the coefficients of correlation suggest a low relationship between the variables (these increased in logarithmic terms). On the one hand, these findings imply that econometric models will not have multicollinearity problems. But, in logarithmic terms a high correlation between RESERVE and DOUBTFUL was found. It is noteworthy that these indicators capture a similar characteristic but in the opposite direction. On the other hand, the low correlations between dependent and independent variables are not good news for the hypothesis of market discipline asset side effect.

4. Empirical model

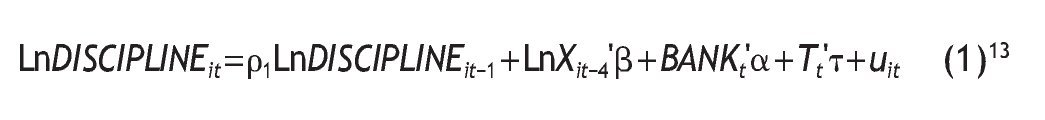

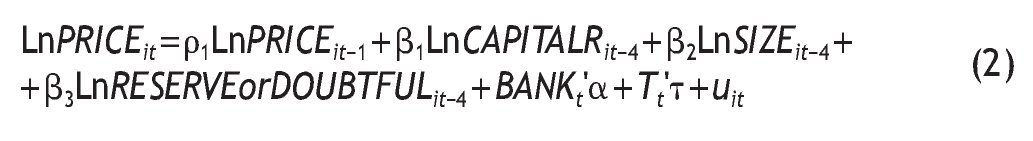

After revising different econometric methodologies, and because previous econometric tests for market discipline employed the dependent variable as regressor, the best option is believed to be to test the presence of the asset side market discipline effect as the dynamic SYS GMM estimator, developed by Blundell and Bond (1998).11 This is because it uses a consistent estimate of the variance-covariance matrix, thus relaxing the assumptions of independence and homoscedasticity, and correcting problems of second-order serial correlation. The model is in levels, it allows for lagged values of the dependent variable to be entered as regressors, and it provides a better control of endogeneity for all explanatory variables because it uses lags of variables like instruments (in first differences and levels).12 In addition, the explanatory variables are entered with a one¿year lag and in logarithms getting elasticity coefficients and linearity, see Model [1]. Note the use of the reduced-form specification extensively employed in the literature to test the liability side of market discipline effect. As Park (1995, p. 504) points out "ideally, we need to estimate a simultaneous equation model specifying demand and supply schedules. Identifying such structural¿form equations is difficult due to the lack of exogenous variables that strongly affect either the supply or just the demand". But this approach is not based on supply and demand; but rather on the refinancing¿solvency and certification¿signaling motives.

Lags of the independent variables have been used to prevent simultaneity and to account for the fact that the information is available to the borrowers with a certain delay. Nonetheless, it is important to notice that the dynamic SYS GMM estimator already prevents simultaneity and reverse causality. In this model it is assumed that the error term is not serially correlated, particularly, there is not a second order serial correlation and Sargan's over¿identification test is employed to validate the instruments.

DISCIPLINE is the indicator of the price discipline mechanism (PRICE), X is a vector of explanatory variables: CAPITALR, SIZE, RESERVE and DOUBTFUL. But because of multicollinearity problems between RESERVE and DOUBTFUL they are included separately in the models. BANK is a dichotomous variable for each type of bank (G7, Commercial and Investment), where retail banks are the basic group, thus the model controls for bank characteristics and markets. T is a dummy variable for periods controlling the effects of unspecified macroeconomic and financial market conditions, which are assumed constant across banks.14

The fundamental hypothesis of interest is that DISCIPLINE depends positively upon the level of CAPITALR, SIZE (refinancing¿solvency motive) and RESERVE, also it depends inversely upon the level of DOUBTFUL (certification¿signaling motive), which is interpreted as evidence of market discipline induced by borrowers. Consequently, the empirical results are robust for different indicators and samples of banks.

4.1. Price-based discipline mechanism

Model (2) shows the transformation of the Model (1) to examine the price-based discipline mechanism. The dependent variable is the implicit interest rate on credits (PRICE).

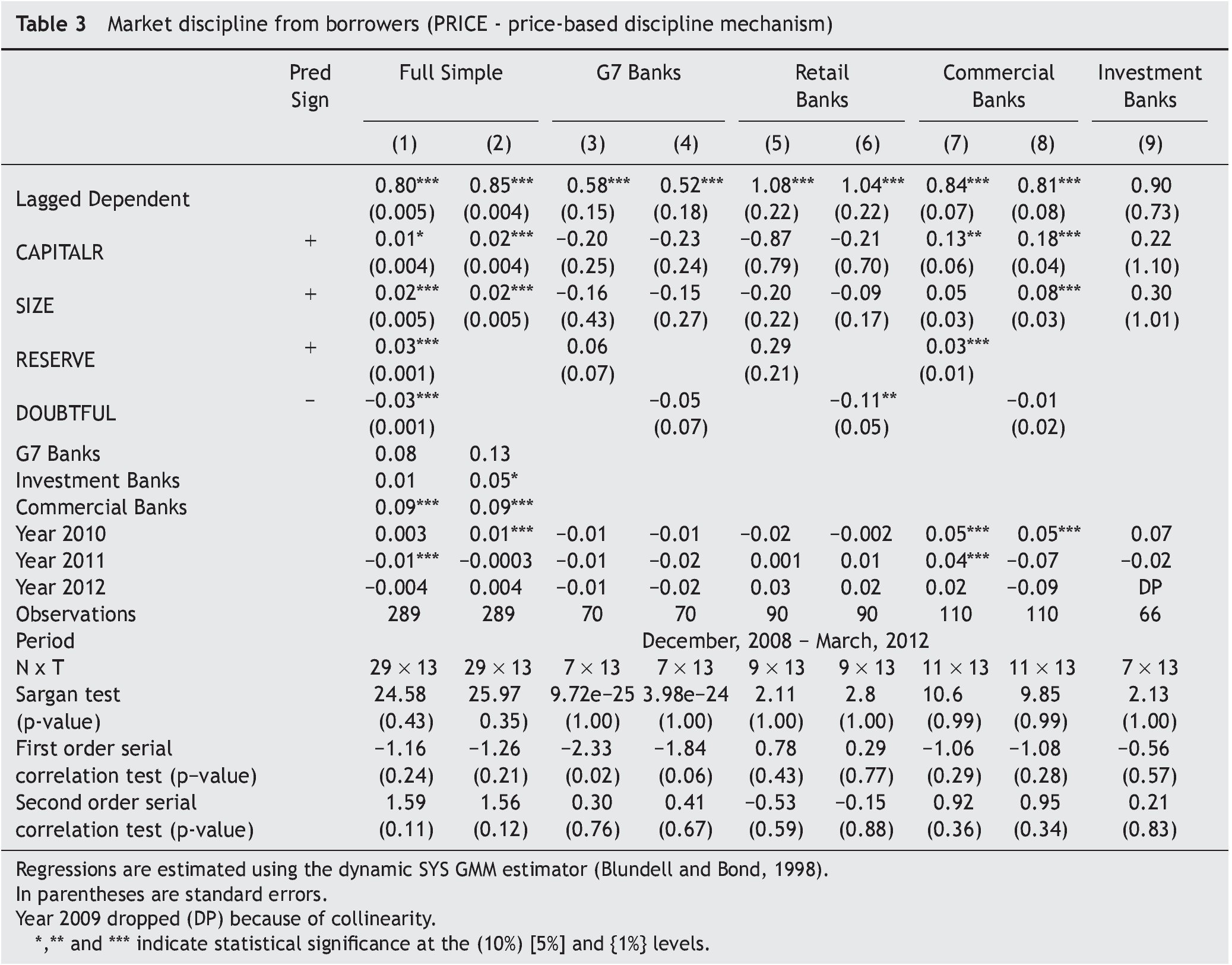

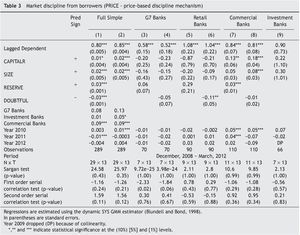

Table 3 summarizes the main results. In columns there are results of the full sample and subsamples, with pair columns showing estimations substituting RESERVE by DOUBTFUL (due to multicollinearity). The explanatory variables are in rows. It is noteworthy that the dynamic panel is justified, because in general the dependent variables as regressors show statistically significant coefficients. All reported estimations pass both the Sargan and the second order serial correlation tests at conventional significance levels.

In the full sample (including 29 banks because of data limitations of some banks, especially investment banks) we found that capital ratio (CAPITALR) and total assets (SIZE) were entered with positive and statistically significant coefficients at the 10% and 1% levels, respectively. Column (1) RESERVE and column (2) DOUBTFUL were also entered with statistically significant coefficients at the 1% level and with the expected sign. These findings suggest that in Mexico we have an asset side market discipline effect through price¿based mechanism. A borrower comparing all the banks in the system is willing to pay a higher rate to a high¿quality bank. Borrowers take into account the capital ratios and the bank's size, thus indicating that the refinancing¿solvency motive is relevant for Mexican borrowers. Furthermore, the borrower's choice also depends on loan losses. In other words, borrowers prefer banks with higher reserves for loan losses, or banks with lower nonperforming loans in accor¿ dance with the certification¿signaling motive.

Nevertheless, the dichotomous variables for type of bank, particularly the commercial banks, show some positive and statistically significant coefficients, it means that in relation with the retails banks these other banks have a larger effect on implicit interest rate (as we already expected, because retail banks show higher implicit interest rates, see Table 1), besides, it implies that the result may be biased by some kinds of banks, in particular by the retail or commercial banks. As a consequence, in the analysis of the subsamples we found some mixed results.

First, the full sample and the subsample of commercial banks present similar results. Second, notice that in the subsample of retail banks, although DOUBTFUL enters with statistically significant coefficient at the 5% level and with the expected sign (column 6), in general the model lack significant relations, that is, for a borrower comparing among retail banks nothing is matter. Third, in the subsample of 7 largest banks (G7) the refinancing and certification motives are irrelevant, in other words, these motives lost sense if we are comparing only the largest banks.

Unfortunately, I did not find information to elaborate the indicator RESERVE and DOUBTFUL for 5 investment banks; therefore in the column (9) I present a model including only capital ratios and bank's size as key explanatory variables. The findings for the investment banks do not support the refinancing¿solvency motive, and it is not possible to argue that the Mexican investment banks with higher capital ratios charge higher or lower interest rates.

Finally, it is interesting to notice that the implicit interest rate (PRICE) has been diminished (significant and negative coefficient of the time dummy in 2011), this could be a response to the crisis in USA and in Europe during the last 4 years. But, this is not necessarily the case in the subsample of commercial banks (time dummies show significance and positive coefficients in 2010 and 2011).

5. Conclusions

Market discipline plays a key role for the stability of the banking system and for the performance of the entire economy. The banking literature focuses on the liability side of market discipline effect and the main findings suggest that the depositors monitor their banks requiring higher interest rates from risky banks or withdrawing their deposits from banks with a low¿quality. In general, the introduction of deposit insurance improved the trust of the agents in the banking system, but it also diminished the liability side of market discipline effect.

On the contrary, the asset side market discipline effect has been little studied. Theoretically the borrowers also need high¿quality banks. On the one hand, borrowers have a refinancing¿solvency motive, that is to say, borrowers need credit now and in the future, and it is better and less costly to obtain this credit from high¿quality banks, from larger banks with higher capital ratios. This is because these banks imply solvency, a more diversified portfolio and low possibilities to reduce the lending activity. On the other hand, borrowers have a certification¿signaling motive to choose high¿quality banks, with larger reserves for loan losses and lower overdue loans, because this represents the ability of the bank to take on risks correctly and to exert corporate governance, which is a good signal for other stakeholders.

Borrowers paying higher interest rates to high¿quality banks indicate the presence of the asset side market discipline effect through a price¿based mechanism. In Norway, Kim et al. (2005) found evidence in favor of the certification motive only. In this paper the price-based discipline mechanism in Mexico has been examined, with an analysis of 37 banks in a dynamic panel model. The findings suggest that borrowers care about bank's size and capital ratios; they are willing to pay a higher rate to a bank exhibiting these high¿quality characteristics (in favor of the refinancing¿solvency motive), and they also prefer banks with higher reserves for loan losses or lower nonperforming loans (in favor of the certification¿signaling motive). As a consequence, one can argue that the Mexican borrowers discipline their banks through a price¿based discipline mechanism. But, the retail banks escape to this discipline, for a borrower (consumer) comparing among retail banks the refinancing and certification motives have no significance. Also, the 7 largest banks (G7) do not face this market discipline effect, on contrary the smaller commercial banks support the hypothesis. About investments banks it is difficult to pronounce a judgment due to data limitations.

The recommendation for policymakers is to enhance disclosure requirements in accordance with the Third Pillar of Basel towards more refined indicators of information, because both depositors and borrowers may use this information to monitor the banking system.

Future research for Mexico must attempt to investigate the price¿based discipline mechanism in more depth, using data that directly captures the interest rate on credits. Likewise, it is necessary to explore other control and instrumental variables, to test differences by type of borrower and analysis or conduct surveys based on data provided by the borrowers. Lastly, it is important to recognize that the structure of the market is relevant. Therefore we need to discuss what kind of market we are analyzing, what is offered and demanded in this market and whether the price of this service (or good) is a market price or is an administered price.

Acknowledgements

The theoretical analysis was implemented in the framework of the Basic Research Program of the National Research University "Higher School of Economics", Moscow, Russia in 2012. The author wishes to thank Maria Semenova, Carlos Curiel, Manlio Castillo and Noemi Levy for their comments.

1. IPAB provides limited insurance, around 1.9 million Mexican pesos per depositor and bank in July 2012 On the contrary, FOBAPROA implicitly protected 100% of deposits.

2. Detragiache and Demirgüç¿Kunt (2010) did not find support for the hypothesis that better compliance with Basel principles results in sounder banks.

3. A third mechanism to discipline banks from the liability side is the maturity shifts of the deposit (Murata and Hori, 2006; Semenova, 2007).

4. Nevertheless, Semenova (2012) did not find evidence on the positive effect of transparency on market discipline.

5. The first version of the work of Allen et al. (2011) was presented in 2005 as a working paper in the Center for Financial Studies.

6. It is interesting to note that in an analysis of the same period (1987¿1992), the findings of Fischer et al. (2012) coincide with Hubbard et al. (2002).

7. Chemmanur and Fulghieri (1994) study the reputation of the banks, and they developed a theoretical model in which entrepreneurs are willing to pay a higher interest rate to borrow from reputable banks, due to a refinancing motive.

8. For a thorough discussion of certification motive, the reader may refer to Booth and Smith (1986), James (1987), Lummer and McConnell (1989) and Billett et al. (1995).

9. For further discussion about refinancing motive, see Sharpe (1990), Chemmanur and Fulghieri (1994), and Detragiache et al. (2000).

10. It is important to recognize that in the presence of imperfect information the price¿based mechanism might be biased (Park, 1995; Park and Peristiani, 1998).

11. At the start of the research models such as those in the work of Kim et al. (2005) were analyzed with random and fixed effects using the lags of the explanatory variables as instruments, but only the dependent variable as regressor showed significance. These results were interpreted as bad instrumental variables. As a result it was necessary to employ a dynamic model. Consequently, in order to resolve this dilemma a first option was the DIF GMM developed by Arellano and Bond (1991), a model into first differences. But, at present we have few observations and many individuals, as a result of the econometric literature, suggest the use of the estimator of Blundell and Bond (1998) adding moment conditions and instruments with the model in levels.

12. We allow a maximum of 2 lags to be used as instruments to maintain a sensible relationship between the number of cross-sectional observations and the number of over¿identifying restrictions. This can help to avoid the over¿fitting biases that are sometimes associated with using all the available moment conditions.

13. The coefficients represent short¿run effects; the long¿run effects can be derived by dividing each of the coefficients by 1-ρ1 (the coefficient of the lagged dependent variable).

14. Kim et al. (2005) included a Gini coefficient of the explanatory variables denoting the variability of the banks in the system. In the Mexican case it is not necessary, the dispersion and variability among banks is evident ¿ see Table 1. Besides, if we include these Gini coefficients we are inducing collinearity. Therefore, these kinds of independent variables were not included. Moreover, Kim et al. (2005) included an index of bank concentration, but this indicator was not included so as to avoid collinearity and due to the fact that this effect is already captured by the variable SIZE as well as in the analysis of the subsamples.

Received July 30, 2012; accepted November 14, 2012

E¿mail address:beno09@yahoo.com

References

Allen, F., Carletti, E., Marquez, R., 2011. Credit market competition and capital regulation. The Review of Financial Studies 23, 983-1018.

Arellano, M., Bond, S., 1991. Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies 58, 277¿297.

Basel Committee on Banking Supervision, 2006. International convergence of capital measurement and capital standards: A revised framework comprehensive version. Bank for International Settlements. Available at: http://www.bis.org/publ/bcbs 128.pdf [accessed 27 Nov 2012].

Billett, M.T., Flannery, M.J., Garfinkel, J.A., 1995. The effect of lender identity on a borrowing firm's equity return. The Journalof Finance 50, 699¿718.

Blundell, R., Bond, S., 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87, 115-133.

Boot, A.W.A., Greenbaum, S.I., Thakor, A.V., 1993. Reputation and discretion in financial contracting. American Economic Review 83, 1165¿1183.

Booth, J.R., Smith, R.L., 1986. Capital raising, underwriting, and the certification hypothesis. Journal of Financial Economics 15, 261¿281.

Calomiris, C.W., Kahn, C.M., 1991. The role of demandable debt in structuring optimal banking arrangements. American Economic Review 81: 397-513.

Caprio, G., Honohan, P., 2004. Can the unsophisticated market provide discipline? World Bank Research Working Paper No. 3363.

Chemmanur, T.J., Fulghieri, P., 1994. Reputation, renegotiation and the choice between bank loans and publicly traded debt. Review of Financial Studies 7 (3), 475¿506.

Cook, D.O., Schellorn, C.D., Spellman, L.J., 2003. Lender certi fi¿ cation premiums, Journal of Banking and Finance 27, 1561¿1579.

Demirgüç¿Kunt, A., Huizinga, H., 1999. Market Discipline and financial safety net design. CEPR Discussion Paper No. 2311.

Demirgüç¿Kunt, A., Huizinga, H., 2004. Market discipline and deposit insurance. Journal of Monetary Economics 51, 375-399.

Detragiache, E., Demirgüç¿Kunt, A., 2010. Basel core principles and bank risk: Does compliance matter? IMF Working Paper WP/10/81.

Detragiache, E., Garella, P., Guiso, L., 2000. Multiple versus single banking relationships: Theory and evidence. Journal of Finance 55, 1133¿1161.

Diamond, D.W., Rajan, R.G., 2000. A theory of bank capital. Journal of Finance 55, 2331¿2365.

Fang, L.H., 2005. Investment bank reputation and the price and quality of underwriting services. Journal of Finance 60, 2729¿2761.

Fischer, M., Mattes, J., Steffen, S., 2012. Bank Capital ratios, competition and loan spreads. Working paper available at: SSRN: http://ssrn.com/abstract=1483717 or http://dx.doi. org/10.2139/ssrn.1483717 [accessed 27 Nov 2012].

Flannery, M., Nikolova, S., 2004. Market discipline of U.S. financial firms: Recent evidence and research issues. In: Hunter, W.C., Kaufman, G.G., Borio, C., Tsatsaronis, K. (Eds.), Market discipline across countries and industries. MIT Press, Cambridge, MA, pp. 87-100.

Flannery, M.J., 1998. Using market information in prudential bank supervision: A review of the U.S. empirical evidence. Journal of Money, Credit, and Banking 30, 273¿305.

Haber, S., 2005. Mexico's experiments with bank privatization and liberalization, 1991¿2003. Journal of Banking and Finance 29, 2325-2353.

Hosono, K., Iwaki, H., Tsuru, K., 2004. Bank regulation and market discipline around the world. RIETI Discussion Paper Series 04-E-031.

Hubbard, R.G., Kuttner, K.N., Palia, D.N., 2002. Are there bank effects in borrowers' costs of funds? Evidence from a matched sample of borrowers and banks. Journal of Business 75, 559-581.

Ioannidou, V., de Dreu, J., 2006. The impact of explicit deposit insurance on market discipline. CentER Discussion Paper No. 2006¿05.

James, C., 1987. Some evidence on the uniqueness of bank loans. Journal of Financial Economics 19, 217-235.

Karas, A., Pyle, W., Schoors, K., 2010. The effect of deposit insurance on market discipline: Evidence from a natural experiment on deposit flows. BOFIT Discussion Papers 8/2010.

Kim, M., Kristiansen, E., Vale, B., 2005. Endogenous product differentiation in credit markets: What do borrowers pay for? Journal of Banking and Finance 29, 681¿699.

Lummer, S., McConnell, J., 1989. Further evidence on the bank lending process and the capital market response to bank loan agreements. Journal of Financial Economics 25, 99¿122.

Martinez¿Peria, M., Schmukler, S., 2001. Do depositors punish banks for bad behavior? Market discipline, deposit insurance, and banking crises. Journal of Finance 56, 1029¿1051.

Murata, K., Hori, M., 2006. Do small depositors exit from bad banks? Evidence from small financial institutions in Japan. Japanese Economic Review 57, 260¿278.

Park, S., 1995. Market Discipline by depositors evidence from reduced form equations. Quarterly Review of Economics and Finance 35, 397-513.

Park, S., Peristiani, S., 1998. Market discipline by thrift depositors. Journal of Money, Credit and Banking 30, 337¿363.

Rochet, J.C., Tirole, J., 1996. Interbank lending and systemic risk. Journal of Money, Credit, and Banking 28, 733¿762.

Santos, J.A.C., Winton, A., 2009. Bank capital, borrower power, and loan rates. AFA 2010 Atlanta Meetings Paper available at SSRN: http://ssrn.com/abstract=1343897 or http://dx.doi.org/10.2139/ ssrn.1343897 [accessed 27 Nov 2012].

Semenova, M., 2012. Market discipline and banking system transparency: Do we need more information? Journal of Banking Regulation 13, 231¿238.

Semenova, M., 2007. How depositors discipline banks: The case of Russia. Economics Education and Research Consortium Working Paper no. 07/02.

Sharpe, S.A., 1990. Asymmetric information, bank lending, and implicit contracts: A stylized model of customer relationships. Journal of Finance 35, 1069¿1087.

Steffen, S., Wahrenburg, M., 2008. Syndicated loans, lending relationships, and the business cycle. Working paper, Goethe University Frankfurt.